UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (FEE REQUIRED)

For the fiscal year ended December 31, 2015

o TRANSACTION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED)

For the transaction period from ________ to ________

Commission file number 000-50385

GrowLife, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

90-0821083

(I.R.S. Employer Identification No.)

|

500 Union Street, Suite 810, Seattle, WA 98101

(Address of principal executive offices and zip code)

(866) 781-5559

(Registrant’s telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes o No

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

ý

|

| |

|

|

|

(Do not check if a smaller reporting company)

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes ý No

As of June 30, 2015 (the last business day of our most recently completed second fiscal quarter), based upon the last reported trade on that date, the aggregate market value of the voting and non-voting common equity held by non-affiliates (for this purpose, all outstanding and issued common stock minus stock held by the officers, directors and known holders of 10% or more of the Company’s common stock) was $16,793,431.

As of April 14, 2016 there were 1,099,143,981 shares of the issuer’s common stock, $0.0001 par value per share, outstanding, excluding 15,000,000 shares recorded as contingently redeemable common stock.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

The following discussion, in addition to the other information contained in this report, should be considered carefully in evaluating us and our prospects. This report (including without limitation the following factors that may affect operating results) contains forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended ("Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act") regarding us and our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this report. Additionally, statements concerning future matters such as revenue projections, projected profitability, growth strategies, development of new products, enhancements or technologies, possible changes in legislation and other statements regarding matters that are not historical are forward-looking statements.

Forward-looking statements in this report reflect the good faith judgment of our management and the statements are based on facts and factors as we currently know them. Forward-looking statements are subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, those discussed below and in "Management's Discussion and Analysis of Financial Condition and Results of Operations" as well as those discussed elsewhere in this report. Readers are urged not to place undue reliance on these forward-looking statements which speak only as of the date of this report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report.

| |

|

Page

|

|

|

|

4 |

| |

|

|

|

|

|

4 |

| |

|

|

|

|

|

9 |

| |

|

|

|

|

|

18 |

| |

|

|

|

|

|

18 |

| |

|

|

|

|

|

19 |

| |

|

|

|

|

|

20 |

| |

|

|

|

|

|

21 |

| |

|

|

|

|

|

21 |

| |

|

|

|

|

|

24 |

| |

|

|

|

|

|

24 |

| |

|

|

|

|

|

30 |

| |

|

|

|

|

|

30 |

| |

|

|

|

|

|

30 |

| |

|

|

|

|

|

30 |

| |

|

|

|

|

|

31 |

| |

|

|

|

|

|

32 |

| |

|

|

|

|

|

32 |

| |

|

|

|

|

|

35 |

| |

|

|

|

|

|

43 |

| |

|

|

|

|

|

44 |

| |

|

|

|

|

|

47 |

| |

|

|

|

|

|

49 |

| |

|

|

|

|

|

49 |

| |

|

|

| |

|

54 |

ITEM 1. DESCRIPTION OF BUSINESS

THE COMPANY AND OUR BUSINESS

GrowLife, Inc. (“GrowLife” or the “Company”) was incorporated under the laws of the State of Delaware and is headquartered in Seattle, Washington. We were founded in 2012 with the Closing of the Agreement and Plan of Merger with SGT Merger Corporation. We have authorized common stock of 3,000,000,000 shares at $0.0001 par value and 10,000,000 shares of preferred stock with a par value of $0.0001 were authorized by the shareholders. In addition, on October 21, 2015 we issued 150,000 Series B Preferred Stock at a stated value equal to $10.00 per share that is convertible into our common stock. On October 21, 2015, we also issued 51 shares of Series C Preferred Stock at $0.0001 par value per share.

Our goal of becoming the nation’s largest cultivation facility service provider for the production of organics, herbs and greens and plant-based medicines has not changed. Our mission is to best serve more cultivators in the design, build-out, expansion and maintenance of their facilities with products of high quality, exceptional value and competitive price. Through knowledgeable representatives, regional centers and its e-commerce website, GrowLife provides essential and hard-to-find goods including media (i.e., farming soil), industry-leading hydroponics equipment, organic plant nutrients, and thousands more products to specialty grow operations across the United States.

We primarily sell through our wholly owned subsidiary, GrowLife Hydroponics, Inc. In addition to the promotion and sales of GrowLife owned brands, GrowLife companies distribute and sell over 3,000 products through its e-commerce distribution channel, Greners.com, and through our regional retail storefronts. GrowLife and its business units are organized and directed to operate strictly in accordance with all applicable state and federal laws.

Resumed Trading of our Common Stock

On February 18, 2016, our common stock resumed unsolicited quotation on the OTC Bulletin Board after receiving clearance from the Financial Industry Regulatory Authority (“FINRA”) on our Form 15c2-11. We are currently taking the appropriate steps to uplist to the OTCQB Exchange and resume priced quotations with market makers as soon as it is able.

Overcoming Company Challenges

We grew through a series of acquisitions in 2012 and 2013 leading to seven retail stores. In 2013 we expected to grow through the following three key initiatives (i) expanding to 30 retail stores at an expected average annual revenue of $1.25 million with 12 stores in 2014 resulting in sales of $15 million; (ii) educating the investment community of the demand for indoor growing equipment from the cannabis industry; and (iii) engaging a joint venture investor willing to provide financial resources for acquisitions and strategic investments. The three initiatives were expected to help position us as the leading supplier and participating investor to the emerging cannabis industry and were therefore announced and allocated resources with those goals in mind.

The retail expansion plan, starting in July 2013, was expected to maintain the pre-acquisition revenue pace of GrowLife Hydroponics’ earlier purchase of Rocky Mountain Hydroponics, LLC, a Colorado limited liability company (“RMC”), and Evergreen Garden Center, LLC, a Maine limited liability company (“EGC”), and generate sales of $5.5 million in 2013. For several reasons, GrowLife Hydroponics achieved 2013 revenue of $4.8 million. In addition, GrowLife Hydroponics opened two more stores in Plaistow, New Hampshire and Peabody, Massachusetts. This seven store expansion across five states exposed three issues with the retail expansion plan: (i) the cost of inventory, integration and ramp up in offsetting revenue was under-estimated; (ii) the laws, policies and resulting customer purchase process across the five states varied greatly and lowered the expected economies of scale benefit; and (iii) the increasing competitive hydroponic supplier market, stemming from manufacturers selling directly to cultivators, lowered expected operating margins. The lack of financial resources to offset the operating losses from the retail expansion initiative necessitated a change of our plans.

An education initiative was formed where GrowLife engaged Grass Roots Research and Distribution, Inc., a market research and marketing firm, to study our 2013 plan, the emerging growth of the cannabis industry and estimate the possible financial impact to GrowLife and its valuation. Sets of reports were published and supported with GrowLife press releases to educate the new industry and generate greater awareness of GrowLife. While this initiative proved successful in 2013, we ceased to engage Grass Roots in 2014, after we changed our business strategy.

The third investor initiative was formed in November 2013, through the Organic Growth International, LLC (“OGI”), a joint venture, between GrowLife and CANX USA LLC (“CANX”). CANX would provide the financial resources for OGI to facilitate acquisitions and strategic investments. GrowLife issued warrants for 240 million GrowLife shares to CANX and CANX would provide up to $40 million in mutually agreed upon investments, $1 million in a convertible note and a $1.3 million commitment towards the GrowLife Infrastructure Funding & Technology (“GIFT”) program. GrowLife received the $1 million as a convertible note in December 2013, received the $1.3 million commitment but not executed and by January 2014 OGI had Letters of Intent with four investment and acquisition transactions valued at $96 million. Before the deals could close, the SEC put a trading halt on our stock on April 10, 2014, which resulted in the withdrawal of all transactions. The business disruption from the trading halt and the resulting class action and derivative lawsuits ceased further investments with the OGI joint venture.

Starting in June 2014 we focused on cost reductions with minimal revenue loss as our focus. The primary reduction in operating costs came from (i) streamlining non-profitable personnel, lowering expenses by replacing the Woodland Hills, California headquarters with that of Seattle, Washington that serves more people at a lower cost; (ii) closing the unprofitable Peabody, Massachusetts, Woodland Hills, California and Plaistow, New Hampshire stores and Boulder, Colorado; (iii) relocating the Greners.com e-commerce operation from Santa Rosa, California to the Vail, Colorado store until a new Denver facility is set up; (iv) reducing full-time employees from 46 to 8 as of December 31, 2015; and (v) closing the Phototron subsidiary in California. While transition costs were paid out, the repurposing of company resources is expected to reduce our operating expenses and allows for greater market reach and efficiencies.

However, the challenges of operating a public company under the strains grey market trading and lawsuits, as well as limited access to investment capital kept the company lean. We also chose to convert inventory into cash. This reduced our inventory level from approximately $1.8 million during 2014 to $400,000 as of December 31, 2015 and lowered our gross margins to 14.8% for the year ended December 31, 2015. This conscientious decision was made to help us transition through this period. Also, we reduced our general and administrative expenses from approximately $7.9 million for the year ended December 31, 2014 to $2.7 million for the year ended December 31, 2015.

We remain focused on hiring the best people to expand our direct sales personnel. These personnel are knowledgeable in using the most progressive growing technologies that fit our customer’s needs. Whether they are small-scale local cultivation facilities or large-scale regional cultivators, our customer service team recommends smart medium, cost-effective lighting and ventilation, and the right nutrients that are best suited for the crop objective. Our knowledge layer is strategic for the evolution of the indoor growing industry. Unlike an outdoor superstore, GrowLife serves the specialty cultivation business as indoor crops are designed to deliver multiple grow cycles with greater quality and yield not available in outdoor agriculture. Technologies will be available to provide our customers with a way to further tune their ordering process and crop development using their own experience.

Customer Insights

GrowLife has the unique advantage of working with many cultivators of all sizes across most states that have differing laws and policies for indoor growing. This advantage has given us insights into our customers changing needs. During the last twelve months we have seen a dramatic change in many key areas that required us to adjust our strategies even faster than expected. For example, we expected the retail business to be eclipsed by e-commerce and direct sales combined, however, we now see that each one is surpassing retail sales. While localized, on-hand inventory has a benefit to most cultivators; price, by far, is driving most purchasing decisions. Simply putting up an e-commerce website without a presence in the retail and direct channels is not enough to engage the leading suppliers. Therefore, it remains critical that GrowLife continues to execute its multi-channel strategy, albeit at a different composition.

The driving force behind the customer’s pricing pressure is not that cultivators are greedily seeking to increase their profits or capitalize on the expected commoditization of growing equipment and supplies. Instead, cultivators are quickly adjusting their business models to make a profit. Also, the innovation of optimized indoor growing equipment and supplies is keeping them from becoming a commodity. Indoor cultivation business models, whether they are organic fruits and vegetables or cannabis, have been based on supplying a premium priced crop to serve increasing demand. The dynamics where most of the volume produced is based on supplying a premium crop that is saturating premium demand means that the premium price will drop. Almost two years ago, a 1/8 of an ounce of premium cannabis was selling for about $70. Today, the same crop in the same market sells for less than half that price and the surplus that is being sold in the non-premium market is selling for about 25% of the price; in some cases, for less. Source: bloomberg.com/news/articles/2015-06-22/this-survey-says-that-marijuana-prices-are-crashing-in-Colorado.

Our observations from customers reveal that the more sophisticated cultivators have made the business model adjust and most new cultivators have not distinguished the new price elasticity of demand. In the chart below, the demand line (green) for high grade intersected supply line (red) to define an equilibrium price point. As new cultivators entered the market they assumed that demand would increase for high grade and create what we call a phantom demand (gray) so that the increase in overall supply would lead to an increase in price (Pp). However, many reports support that the increase in supply stayed aligned with the original demand (green) and has led to the lower new price (Pn). The overall increase in demand that is commonly mentioned is not for high grade but for commercial grade, which is used for edibles and a less sophisticated palate. Source: narcoticnews.com/drug-prices/marijuana/

The cost of indoor growing, which included equipment, supplies, water, electricity, housing and skilled labor, requires capital. The risk and limited supply of the capital demanded a higher cost for the cannabis market than that of common fruits and vegetables. The cultivator has found themselves needing to pay more from their crop than expected and needing to sell at close to last year’s prices to achieve a reasonable return. Many customers have indicated that they were prepared to accept a 20-30% drop in selling price, but a 50% drop has created business challenges.

Another unanticipated issue is the separation of dispensaries (cannabis retailers) from the cultivation process. Cultivators now must market their crop to dispensaries that make higher margins, but have many supplier choices. This is leading to the segmentation between boutique premiums versus large commercial grade operations. Thus, the business model adjustments those cultivators are going through. Premium growers seek to scale in order to cover expenses and commercial grade cultivators must decrease prices or introduce quality production to win over dispensaries.

We are working with cultivators of all sizes, across all states at different stages; all of which are seeking to lower operating costs. Since resources such as water and electricity are limited and expensive, we help cultivators get more with less. Vertical farming has become a real and practical cultivation process for volume where a 20-by-30 square foot room that normally houses about 150 plants can now grow over 550 plants, almost three times more. Specially designed vertical lighting with 360-degree coverage and using 35% less power now delivers the necessary light with less heat, thus lowering the HVAC power demand. Finally, specially designed pots automatically control both watering and drainage efficiently. We have both the expertise and supplier relationships to help cultivators scale up with configurations like these.

Market Size and Growth

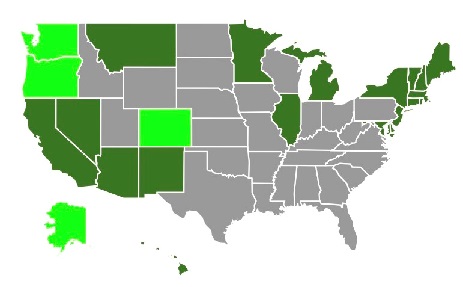

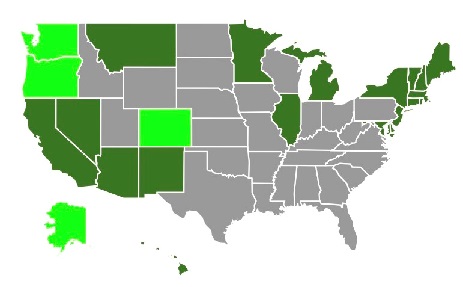

As the states across the country approve medicinal cannabis usage, with different THC and CBD compositions, cultivators purchase equipment and supplies from GrowLife and similar indoor growing supply companies.Therefore, as the cannabis market grows so does the revenue growth opportunity for us. Researchers from The ArcView Group, a cannabis industry investment and research firm based in Oakland, California, found that the U.S. market for cannabis grew 74 percent in 2014 to $2.7 billion, up from $1.5 billion in 2013. Today, 23 states plus Washington, DC have legalized cannabis for medical use and four states plus Washington, DC have passed recreational use into law.

We serve a new, yet sophisticated community of commercial and urban cultivators growing specialty crops including organics, greens and plant-based medicines. Unlike the traditional agricultural industry, these cultivators use innovative indoor growing techniques to produce specialty crops in highly controlled environments. This enables them to produce crops at higher yields without having to compromise quality - regardless of the season or weather and drought conditions.

Indoor growing techniques have primarily been used to cultivate plant-based medicines. Plant-based medicines often require high-degree of regulation and controls including government compliance, security, and crop consistency, making indoor growing techniques a preferred method. Cultivators of plant-based medicines often make a significant investment to design and build-out their facilities. They look to work with companies such as GrowLife who understand their specific needs, and can help mitigate risks that could jeopardize their crops.

The ArcView report indicates that plant-based medicines are the fastest-growing market in the U.S., and conservatively predicts the market could be worth more than $10 billion within five years. Several industry pundits including Dr. Sanjay Gupta of CNN believe that plant-based medicines may even displace prescription pain medication by providing patients with a safer, more affordable alternative.

Indoor growing techniques, however, are not limited to plant-based medicines. Vertical farms producing organic fruits and vegetables are beginning to emerge in the market due to a rising shortage of farmland, and environmental vulnerabilities including drought, other severe weather conditions and insect pests. Indoor growing techniques enables cultivators to grow crops all-year-round in urban areas, and take up less ground while minimizing environmental risks. Indoor growing techniques typically require a more significant upfront investment to design and build-out these facilities, than traditional farmlands. If new innovations lower the costs for indoor growing, and the costs to operate traditional farmlands continue to rise, then indoor growing techniques may be a compelling alternative for the broader agricultural industry.

Strategy

Our goal is to become the nation’s largest cultivation facility service provider for the production of organics, herbs and greens and plant-based medicines. We intend to achieve our goal by (i) expanding our nationwide, multi-channel sales network presence, (ii) offering the best terms for the full range of build-out equipment and consumable supplies, and (iii) deliver superior, innovative products exclusively.

First, we provide distribution through retail, e-commerce and direct sales to have national coverage and serve cultivators of all sizes. Each channel offers varying pricing for differing benefits. Retail sells at list price by offering inventory convenience, e-commerce provides the lowest price without requiring local inventory, and direct sales delivers the best bid price for high-volume purchasers. Additional points of service may be added through existing distribution locations and services. This may be done in several manners such as a value-added reseller program that reaches hundreds of cultivator-centric locations or with collations with other resellers.

Second, we serve the needs of all size cultivators and each one’s unique formulation. We provide thousands of varieties of supplies from dozens of vendors and distributors. More importantly is our experience of knowing which products to recommend under each customer’s circumstance. Growing operations seeking expansion may also qualify for leasing terms by one of our financing partner.

And third, our experience with hundreds of customers allows us to determine specific product needs and sources to test new designs. Lights, pesticides, nutrients, extraction and growing systems are some examples of products that GrowLife has obtained exclusive access to purchase and distribute. Popular name branded products are seeking to be part of the GrowLife Company in many forms. In exchange, we can market their products in a unique manner over generic products.

Our company will expand on these strategies until it serves all the indoor cultivators throughout the country. Once a customer is engaged, we will gradually expand their purchasing market share by providing greater economic benefit to the customers who buy more products from GrowLife than from other suppliers.

Key Market Priorities

Demand for indoor growing equipment is currently high due to legalization of plant-based medicines, primarily cannabis, which is mainly due to equipment purchases for build-out and repeated consumables. This demand is projected to continue to grow as a result of the supporting state laws in 23 states and the District of Columbia. Continued innovation in more efficient build-out technologies along with larger and consolidated cultivation facilities will further expand market demand for our products and services.

We expect for the market to continue to segment into urban farmers serving groups of individuals, community cultivators, and large-scale cultivation facilities across the states. Each segment will be optimized to different distribution channels that we currently provide. Our volume purchasing will allow us to obtain the best prices and maximize both our revenues and gross margins.

The nature of the cannabis industry’s inefficiencies due to the lack of interstate commerce imposed by the Federal government has segmented the market opportunities by State laws, population and demand. Currently, Colorado laws and population demand make it the most progressive and top market in the industry. We have elected to have a major retail presence in Colorado with our direct sales team and centralized our national e-commerce operations. We are currently reaching most of the legal states using both direct sales and seek to re-introduce GrowLife eco products to other hydroponic retailers.

Employees

Starting in 2014 and as of December 31, 2015, we reduced our manpower count from 46 to 8 by leveraging our resources across many areas. All company operations are continually reviewed for growth opportunities and direct sales along with GrowLife eco, a premium line of eco-friendly products, is planned to enable the Company to expand its coverage in a cost-effective manner.

As of March 30, 2016, we had one full-time employee and one consultant at our Seattle, Washington office. Marco Hegyi, our President, is based in Seattle, Washington. Mark E. Scott, our consulting CFO, is based out of in Seattle, Washington. In addition, we have 7 employees located throughout the United States who operate our e-commerce, direct sales and retail businesses. None of our employees is subject to a collective bargaining agreement or represented by a trade or labor union. We believe that we have a good relationship with our employees.

We remain focused on hiring the best people to expand our direct sales personnel. These personnel are knowledgeable in using the most progressive growing technologies that fit our customer’s needs. Whether they are small-scale local cultivation facilities or large-scale regional cultivators, our customer service team recommends smart medium, cost-effective lighting and ventilation, and the right nutrients that are best suited for the crop objective. Our knowledge layer is strategic for the evolution of the indoor growing industry. Unlike an outdoor superstore, GrowLife serves the specialty cultivation business as indoor crops are designed to deliver multiple grow cycles with greater quality and yield not available in outdoor agriculture. Technologies will be available to provide our customers with a way to further tune their ordering process and crop development using their own experience.

Key Partners

Our key customers varying by state and are expected to be more defined as the company moves from its retail walk-in purchasing sales strategy to serving cultivation facilities directly and under predictable purchasing contracts.

Our key suppliers include distributors such as HydroFarm, Urban Horticultural Supply and Sunlight Supply to product-specific suppliers. All the products purchased and resold are applicable to indoor growing for organics, greens, and plant-based medicines.

Competition

Certain large commercial cultivators have found themselves willing to assume their own equipment support by buying large volume purchased directly from certain suppliers and distributors such as Sunlight Supplies, HydroFarm, and UHS. Other key competitors on the retail side consist of local and regional hydroponic resellers of indoor growing equipment. On the e-commerce business, GrowersHouse.com, Hydrobuilder.com, HorticultureSource.com and smaller online resellers using Amazon and eBay e-commerce market systems.

Intellectual Property and Proprietary Rights

Our intellectual property consists of brands and their related trademarks and websites, customer lists and affiliations, product know-how and technology, and marketing intangibles.

Our other intellectual property is primarily in the form of trademarks and domain names. We also hold rights to more than 30 website addresses related to our business including websites that are actively used in our day-to-day business such as www.growlifeinc.com, www.growlifeeco.com, www.stealthgrow.com, and www.greners.com.

We have a policy of entering into confidentiality and non-disclosure agreements with our employees and some of our vendors and customers as necessary.

Government Regulation

Currently, there are twenty-three states plus the District of Columbia that have laws and/or regulation that recognize in one form or another legitimate medical uses for cannabis and consumer use of cannabis in connection with medical treatment. About a dozen other states are considering legislation to similar effect. There are currently four states that allow recreational use of cannabis. As of the date of this writing, the policy and regulations of the Federal government and its agencies is that cannabis has no medical benefit and a range of activities including cultivation and use of cannabis for personal use is prohibited on the basis of federal law and may or may not be permitted on the basis of state law. Active enforcement of the current federal regulatory position on cannabis on a regional or national basis may directly and adversely affect the willingness of customers of GrowLife to invest in or buy products from GrowLife. Active enforcement of the current federal regulatory position on cannabis may thus indirectly and adversely affect revenues and profits of the GrowLife companies.

All this being said, many reports show that the majority of the American public is in favor of making medical cannabis available as a controlled substance to those patients who need it. The need and consumption will then require cultivators to continue to provide safe and compliant crops to consumers. The cultivators will then need to build facilities and use consumable products, which GrowLife provides.

THE COMPANY’S COMMON STOCK

Our common stock trades on the OTC Bulletin Board under the symbol “PHOT.” While the company’s common stock is currently traded without a market maker, its stock does trade directly between buyers and sellers. The Company is currently taking the appropriate steps to uplist to the OTCQB Exchange and resume priced quotations with market makers as soon as it is able.

PRIMARY RISKS AND UNCERTAINTIES

We are exposed to various risks related to legal proceedings, our need for additional financing, the sale of significant numbers of our shares, the potential adjustment in the exercise price of our convertible debentures and a volatile market price for our common stock. These risks and uncertainties are discussed in more detail below in Part I, Item 1A.

WEBSITE ACCESS TO UNITED STATES SECURITIES AND EXCHANGE COMMISSION REPORTS

We file annual and quarterly reports, proxy statements and other information with the Securities and Exchange Commission ("SEC"). You may read and copy any document we file at the SEC's Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. The SEC maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information concerning filers. We also maintain a web site at http://www.growlifeinc.com that provides additional information about our Company and links to documents we file with the SEC. The Company's charters for the Audit Committee, the Compensation Committee, and the Nominating Committee; and the Code of Conduct & Ethics are also available on our website. The information on our website is not part of this Form 10-K.

There are certain inherent risks which will have an effect on the Company’s development in the future and the most significant risks and uncertainties known and identified by our management are described below.

Risks Related to Our Business

Risks associated with our funding from TCA Global Credit Master Fund, LP (“TCA”).

On July 9, 2015, we closed a Securities Purchase Agreement and related agreements with TCA Global Credit Master Fund LP, an accredited investor, whereby we agreed to sell and TCA agreed to purchase up to $3,000,000 of senior secured convertible, redeemable debentures, of which $700,000 was purchased on July 9, 2015 and up to $2,300,000 may be purchased in additional closings. The closing of the Transaction occurred on July 9, 2015.

On August 6, 2015, we closed a Securities Purchase Agreement and related agreements with TCA Global Credit Master Fund LP, whereby we agreed to sell and TCA agreed to purchase a $100,000 senior secured convertible redeemable debenture and we agreed to issue and sell to TCA, from time to time, and TCA agreed to purchase from us up to $3,000,000 of the Company’s common stock pursuant to a Committed Equity Facility. The closing of the Transaction occurred on August 6, 2015.

On October 27, 2015, we entered into an Amended and Restated Securities Purchase Agreement and related agreements with TCA Global Credit Master Fund LP whereby we agreed to sell, and TCA agreed to purchase $350,000 of senior secured convertible, redeemable debentures. We previously entered into a Securities Purchase Agreement dated as of April 30, 2015 and effective as of July 9, 2015 to purchase up to $3,000,000 in Debentures. As of October 27, 2015, we sold $1,050,000 in Debentures to TCA and up to $1,950,000 in Debentures remains for sale by us. The closing of the transaction occurred on October 27, 2015. In addition, TCA has advanced us an additional $100,000 for a total of $1,150.000. Also, on October 21, 2015 we issued 150,000 Series B Preferred Stock at a stated value equal to $10.00 per share to TCA that is convertible into our common stock. On October 21, 2015, we also issued 51 shares of Series C Preferred Stock at $0.0001 par value per share to TCA that is not convertible into our common stock. In the event of a default under the Amended and Restated TCA Transaction Documents, TCA can exercise voting control over our common stock with their Series C Preferred Stock voting rights

As of April 14, 2016, we are in default on our repayment obligations in our Agreements with TCA and owe TCA approximately $254,000 in principal and interest payments. We are working to resolve these issues.

Failure to operate in accordance with the Agreements with TCA could result in the cancellation of these agreements, result in foreclosure on our assets in event of default and would have a material adverse effect on our business, results of operations or financial condition.

Suspension of trading of the Company’s securities.

On April 10, 2014, we received notice from the SEC that trading of the Company’s common stock on the OTCBB was to be suspended from April 10, 2014 through April 24, 2014. The SEC issued its order pursuant to Section 12(k) of the Securities Exchange Act of 1934. According to the notice received by us from the SEC: “It appears to the Securities and Exchange Commission that the public interest and the protection of investors require a suspension of trading in the securities of GrowLife, Inc. because of concerns regarding the accuracy and adequacy of information in the marketplace and potentially manipulative transactions in GrowLife’s common stock.” To date, the Company has not received notice from the SEC that it is being formally investigated.

On February 18, 2016, our common stock resumed unsolicited quotation on the OTC Bulletin Board after receiving clearance from the Financial Industry Regulatory Authority (“FINRA”) on our Form 15c2-11. We are currently taking the appropriate steps to uplist to the OTCQB Exchange and resume priced quotations with market makers as soon as it is able.

The suspension of trading eliminated our market makers, resulted in our trading on the grey sheets, resulted in legal proceedings and restricted our access to capital. This action had a material adverse effect on our business, financial condition and results of operations. If we are unable to obtain additional financing when it is needed, we will need to restructure our operations, and divest all or a portion of our business.

SEC charges outsiders with manipulating our securities.

On August 5, 2014, the SEC charged four promoters with ties to the Pacific Northwest for manipulating our securities. The SEC alleged that the four promoters bought inexpensive shares of thinly traded penny stock companies on the open market and conducted pre-arranged, manipulative matched orders and wash trades to create the illusion of an active market in these stocks. They then sold their shares in coordination with aggressive third party promotional campaigns that urged investors to buy the stocks because the prices were on the verge of rising substantially. This action has had a material adverse effect on our business, financial condition and results of operations. If we are unable to obtain additional financing when it is needed, we will need to restructure our operations, and divest all or a portion of our business.

On July 9, 2015, the SEC entered into settlements with two of the promoters. In connection with the settlement of their SEC action, the two men are liable for disgorgement of approximately $2.1 million and $306,000 in illicit profits, respectively. Earlier this year the two men were also sentenced to five and three years in prison, respectively, for their participation in the scheme.

We are involved in Legal Proceedings.

We are involved in the disputes and legal proceedings as discussed in this Form 10-K. In addition, as a public company, we are also potentially susceptible to litigation, such as claims asserting violations of securities laws. Any such claims, with or without merit, if not resolved, could be time-consuming and result in costly litigation. There can be no assurance that an adverse result in any future proceeding would not have a potentially material adverse on our business, results of operations or financial condition.

Our Joint Venture Agreement with CANX USA, LLC is important to our operations.

On July 10, 2014, we closed a Waiver and Modification Agreement, Amended and Restated Joint Venture Agreement, Secured Credit Facility and Secured Convertible Note with CANX, and Logic Works LLC, a lender and shareholder of the Company. The Agreements require the filing of a registration statement on Form S-1 within 10 days of the filing of our Form 10-Q for the period ended June 30, 2014. Due to our grey sheet trading status and other issues, we did not file the registration statement.

Previously, we entered into a Joint Venture Agreement with CANX USA LLC, a Nevada limited liability company. Under the terms of the Joint Venture Agreement, the Company and CANX formed Organic Growth International, LLC (“OGI”), a Nevada limited liability company, for the purpose of expanding the Company’s operations in its current retail hydroponic businesses and in other synergistic business verticals and facilitating additional funding for commercially financeable transactions of up to $40,000,000. In connection with the closing of the Agreement, CANX agreed to provide a commitment for funding in the amount of $1,300,000 for a GrowLife Infrastructure Funding Technology program transaction and provided additional funding under a 7% Convertible Note instrument for $1,000,000, including $500,000 each from Logic Works and China West III Investments LLC, entities that are unaffiliated with CANX and operate as separate legal entities. We initially owned a non-dilutive 45% share of OGI and we may acquire a controlling share of OGI as provided in the Joint Venture Agreement. In accordance with the Joint Venture Agreement, the Company and CANX entered into a Warrant Agreement whereby the Company delivered to CANX a warrant to purchase 140,000,000 shares of the Company common stock at a maximum strike price of $0.033 per share. Also in accordance with the Joint Venture Agreement, we issued an additional warrant to purchase 100,000,000 shares of our common stock at a maximum strike price of $0.033 per share on February 7, 2014.

On April 10, 2014, as a result of the suspension in the trading of our securities, we went into default on our 7% Convertible Notes Payable for $500,000 each from Logic Works and China West III. As a result, we accrued interest on these notes at the default rate of 24% per annum. Furthermore, as a result of being in default on these notes, the Holders could have, at their sole discretion, called these notes.

Waiver and Modification Agreement

We entered into a Waiver and Modification Agreement dated June 25, 2014 with Logic Works LLC whereby the 7% Convertible Note with Logic Works dated December 20, 2013 was modified to provide for (i) a waiver of the default under the 7% Convertible Note; (ii) a conversion price which is the lesser of (A) $0.025 or (B) twenty percent (20%) of the average of the three (3) lowest daily VWAPs occurring during the twenty (20) consecutive Trading Days immediately preceding the applicable Conversion Date on which the Holder elects to convert all or part of this Note; (iii) the filing of a registration statement on Form S-1 within 10 days of the filing of the Company’s Form 10-Q for the period ended June 30, 2014; and (iv) continuing interest of 24% per annum. China West III converted its Note into common stock on June 4, 2014. Due to our grey sheet trading status and other issues, we did not file the registration statement.

Amended and Restated Joint Venture Agreement

We entered into an Amended and Restated Joint Venture Agreement dated July 1, 2014 with CANX whereby the Joint Venture Agreement dated November 19, 2013 was modified to provide for (i) up to $12,000,000 in conditional financing subject to review by GrowLife and approval by OGI for business growth development opportunities in the legal cannabis industry for up to six months, subject to extension; (ii) up to $10,000,000 in working capital loans, with each loaning requiring approval in advance by CANX; (iii) confirmed that the five year warrants, subject to extension, at $0.033 per share for the purchase of 140,000,000 and 100,000,000 were fully earned and were not considered compensation for tax purposes by the Company; (iv) granted CANX five year warrants, subject to extension, to purchase 300,000,000 shares of common stock at the fair market price of $0.033 per share as determined by an independent appraisal; (v) warrants as defined in the Agreement related to the achievement of OGI milestones; (vi) a four year term, subject to adjustment and (vi) the filing of a registration statement on Form S-1 within 10 days of the filing of our Form 10-Q for the period ended June 30, 2014. Due to our grey sheet trading status and other issues, we did not file the registration statement.

Secured Convertible Note and Secured Credit Facility

We entered into a Secured Convertible Note and Secured Credit Facility dated June 25, 2014 with Logic Works whereby Logic Works agreed to provide up to $500,000 in funding. Each funding requires approval in advance by Logic Works, provides for interest at 6% with a default interest of 24% per annum and requires repayment by June 26, 2016. The Note is convertible into our common stock at the lesser of $0.007 or (B) 20% of the average of the three (3) lowest daily VWAPs occurring during the 20 consecutive Trading Days immediately preceding the applicable conversion date on which Logic Works elects to convert all or part of this 6% Convertible Note, subject to adjustment as provided in the Note. The 6% Convertible Note is collateralized by our assets. We also agreed to file a registration statement on Form S-1 within 10 days of the filing of our Form 10-Q for the three months ended June 30, 2014 and have the registration statement declared effective within ninety days of the filing of our Form 10-Q for the three months ended June 30, 2014. Due to our grey sheet trading status and other issues, we did not file the registration statement.

On July 10, 2014, we closed a Waiver and Modification Agreement, Amended and Restated Joint Venture Agreement, Secured Credit Facility and Secured Convertible Note with CANX, and Logic Works LLC, a lender and shareholder of the Company. As of December 31, 2015, we have borrowed $350,000 under the Secured Convertible Note and Secured Credit Facility dated June 25, 2014 with Logic Works.

Failure to operate in accordance with the Agreements with CANX could result in the cancellation of these agreements, result in foreclosure on our assets in event of default and would have a material adverse effect on our business, results of operations or financial condition.

Our proposed business is dependent on laws pertaining to the marijuana industry.

Continued development of the marijuana industry is dependent upon continued legislative authorization of the use and cultivation of marijuana at the state level. Any number of factors could slow or halt progress in this area. Further, progress, while encouraging, is not assured. While there may be ample public support for legislative action, numerous factors impact the legislative process. Any one of these factors could slow or halt use of marijuana, which would negatively impact our proposed business.

As of November 30, 2015, 23 states and the District of Columbia allow its citizens to use medical marijuana. Additionally, 4 states have legalized cannabis for adult use. The state laws are in conflict with the federal Controlled Substances Act, which makes marijuana use and possession illegal on a national level. The Obama administration has effectively stated that it is not an efficient use of resources to direct law federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws allowing the use and distribution of medical marijuana. However, there is no guarantee that the administration will not change its stated policy regarding the low-priority enforcement of federal laws. Additionally, any new administration that follows could change this policy and decide to enforce the federal laws strongly. Any such change in the federal government’s enforcement of current federal laws could cause significant financial damage to us and its shareholders.

Further, while we do not harvest, distribute or sell marijuana, by supplying products to growers of marijuana, we could be deemed to be participating in marijuana cultivation, which remains illegal under federal law, and exposes us to potential criminal liability, with the additional risk that our business could be subject to civil forfeiture proceedings.

The marijuana industry faces strong opposition.

It is believed by many that large, well-funded businesses may have a strong economic opposition to the marijuana industry. We believe that the pharmaceutical industry clearly does not want to cede control of any product that could generate significant revenue. For example, medical marijuana will likely adversely impact the existing market for the current “marijuana pill” sold by mainstream pharmaceutical companies. Further, the medical marijuana industry could face a material threat from the pharmaceutical industry, should marijuana displace other drugs or encroach upon the pharmaceutical industry’s products. The pharmaceutical industry is well funded with a strong and experienced lobby that eclipses the funding of the medical marijuana movement. Any inroads the pharmaceutical industry could make in halting or impeding the marijuana industry harm our business, prospects, results of operation and financial condition.

Marijuana remains illegal under Federal law.

Marijuana is a Schedule-I controlled substance and is illegal under federal law. Even in those states in which the use of marijuana has been legalized, its use remains a violation of federal law. Since federal law criminalizing the use of marijuana preempts state laws that legalize its use, strict enforcement of federal law regarding marijuana would harm our business, prospects, results of operation and financial condition.

Raising additional capital to implement our business plan and pay our debts will cause dilution to our existing stockholders, require us to restructure our operations, and divest all or a portion of our business.

We need additional financing to implement our business plan and to service our ongoing operations and pay our current debts. There can be no assurance that we will be able to secure any needed funding, or that if such funding is available, the terms or conditions would be acceptable to us.

If we raise additional capital through borrowing or other debt financing, we may incur substantial interest expense. Sales of additional equity securities will dilute on a pro rata basis the percentage ownership of all holders of common stock. When we raise more equity capital in the future, it will result in substantial dilution to our current stockholders.

If we are unable to obtain additional financing when it is needed, we will need to restructure our operations, and divest all or a portion of our business.

We were in default on our convertible notes payable.

On April 10, 2014, as a result of the SEC suspension in the trading of our securities, we went into default on our 6% Senior Secured Convertible Notes Payable and our 7% Convertible Notes Payable. As a result, we accrued interest on these notes at the default rate of 12% and 24% per annum, respectively. Furthermore, as a result of being in default on these notes, the Holders could have, at their sole discretion, called these notes.

During July 2014, we reached settlement agreements with our holders of the 7% Convertible Notes Payable and we are not in default under any of our convertible notes payable. We are accruing interest at the interest rate in the settlement agreements. Any default could have a significant adverse effect on our cash flows and should we be unsuccessful in negotiating an extension or other modification, we may have to restructure our operations, divest all or a portion of its business, or file for bankruptcy.

Closing of bank accounts could have a material adverse effect on our business, financial condition and/or results of operations.

As a result of the regulatory environment, we have experienced the closing of several of our bank accounts since March 2014. We have been able to open other bank accounts. However, we may have other banking accounts closed. These factors impact management and could have a material adverse effect on our business, financial condition and/or results of operations.

Federal regulation and enforcement may adversely affect the implementation of medical marijuana laws and regulations may negatively impact our revenues and profits.

Currently, there are twenty three states plus the District of Columbia that have laws and/or regulation that recognize in one form or another legitimate medical uses for cannabis and consumer use of cannabis in connection with medical treatment. Many other states are considering legislation to similar effect. As of the date of this writing, the policy and regulations of the Federal government and its agencies is that cannabis has no medical benefit and a range of activities including cultivation and use of cannabis for personal use is prohibited on the basis of federal law and may or may not be permitted on the basis of state law. Active enforcement of the current federal regulatory position on cannabis on a regional or national basis may directly and adversely affect the willingness of customers of GrowLife to invest in or buy products from GrowLife that may be used in connection with cannabis. Active enforcement of the current federal regulatory position on cannabis may thus indirectly and adversely affect revenues and profits of the GrowLife companies.

Our history of net losses has raised substantial doubt regarding our ability to continue as a going concern. If we do not continue as a going concern, investors could lose their entire investment.

Our history of net losses has raised substantial doubt about our ability to continue as a going concern, and as a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements as of and for the year ended December 31, 2015 and 2014 with respect to this uncertainty. Accordingly, our ability to continue as a going concern will require us to seek alternative financing to fund our operations. This going concern opinion could materially limit our ability to raise additional funds through the issuance of new debt or equity securities or otherwise. Future reports on our financial statements may include an explanatory paragraph with respect to our ability to continue as a going concern.

We have a history of operating losses and there can be no assurance that we can again achieve or maintain profitability.

We have experienced net losses since inception. As of December 31, 2015, we had an accumulated deficit of $116.7 million. There can be no assurance that we will achieve or maintain profitability.

We are subject to corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements, could adversely affect our business.

We must comply with corporate governance requirements under the Sarbanes-Oxley Act of 2002 and the Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010, as well as additional rules and regulations currently in place and that may be subsequently adopted by the SEC and the Public Company Accounting Oversight Board. These laws, rules, and regulations continue to evolve and may become increasingly stringent in the future. We are required to include management’s report on internal controls as part of our annual report pursuant to Section 404 of the Sarbanes-Oxley Act. We strive to continuously evaluate and improve our control structure to help ensure that we comply with Section 404 of the Sarbanes-Oxley Act. The financial cost of compliance with these laws, rules, and regulations is expected to remain substantial.

We cannot assure you that we will be able to fully comply with these laws, rules, and regulations that address corporate governance, internal control reporting, and similar matters. Failure to comply with these laws, rules and regulations could materially adversely affect our reputation, financial condition, and the value of our securities.

Our management has concluded that we have material weaknesses in our internal controls over financial reporting and that our disclosure controls and procedures are not effective.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of a company's annual or interim financial statements will not be prevented or detected on a timely basis. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of the company's financial reporting. During the review of our financial statements for the year ended December 31, 2015, our management identified material weaknesses in our internal control over financial reporting. If these weaknesses continue, investors could lose confidence in the accuracy and completeness of our financial reports and other disclosures.

Our inability to effectively manage our growth could harm our business and materially and adversely affect our operating results and financial condition.

Our strategy envisions growing our business. We plan to expand our product, sales, administrative and marketing organizations. Any growth in or expansion of our business is likely to continue to place a strain on our management and administrative resources, infrastructure and systems. As with other growing businesses, we expect that we will need to further refine and expand our business development capabilities, our systems and processes and our access to financing sources. We also will need to hire, train, supervise and manage new and retain contributing employees. These processes are time consuming and expensive, will increase management responsibilities and will divert management attention. We cannot assure you that we will be able to:

| |

●

|

expand our products effectively or efficiently or in a timely manner;

|

| |

●

|

allocate our human resources optimally;

|

| |

●

|

meet our capital needs;

|

| |

●

|

identify and hire qualified employees or retain valued employees; or

|

| |

●

|

incorporate effectively the components of any business or product line that we may acquire in our effort to achieve growth.

|

Our inability or failure to manage our growth and expansion effectively could harm our business and materially and adversely affect our operating results and financial condition.

Our operating results may fluctuate significantly based on customer acceptance of our products. As a result, period-to-period comparisons of our results of operations are unlikely to provide a good indication of our future performance. Management expects that we will experience substantial variations in our net sales and operating results from quarter to quarter due to customer acceptance of our products. If customers don’t accept our products, our sales and revenues will decline, resulting in a reduction in our operating income.

Customer interest for our products could also be impacted by the timing of our introduction of new products. If our competitors introduce new products around the same time that we issue new products, and if such competing products are superior to our own, customers’ desire for our products could decrease, resulting in a decrease in our sales and revenues. To the extent that we introduce new products and customers decide not to migrate to our new products from our older products, our revenues could be negatively impacted due to the loss of revenue from those customers. In the event that our newer products do not sell as well as our older products, we could also experience a reduction in our revenues and operating income.

As a result of fluctuations in our revenue and operating expenses that may occur, management believes that period-to-period comparisons of our results of operations are unlikely to provide a good indication of our future performance.

If we do not successfully generate additional products and services, or if such products and services are developed but not successfully commercialized, we could lose revenue opportunities.

Our future success depends, in part, on our ability to expand our product and service offerings. To that end we have engaged in the process of identifying new product opportunities to provide additional products and related services to our customers. The process of identifying and commercializing new products is complex and uncertain, and if we fail to accurately predict customers’ changing needs and emerging technological trends our business could be harmed. We may have to commit significant resources to commercializing new products before knowing whether our investments will result in products the market will accept. Furthermore, we may not execute successfully on commercializing those products because of errors in product planning or timing, technical hurdles that we fail to overcome in a timely fashion, or a lack of appropriate resources. This could result in competitors providing those solutions before we do and a reduction in net sales and earnings.

The success of new products depends on several factors, including proper new product definition, timely completion and introduction of these products, differentiation of new products from those of our competitors, and market acceptance of these products. There can be no assurance that we will successfully identify new product opportunities, develop and bring new products to market in a timely manner, or achieve market acceptance of our products or that products and technologies developed by others will not render our products or technologies obsolete or noncompetitive.

Our future success depends on our ability to grow and expand our customer base. Our failure to achieve such growth or expansion could materially harm our business.

To date, our revenue growth has been derived primarily from the sale of our products and through the purchase of existing businesses. Our success and the planned growth and expansion of our business depend on us achieving greater and broader acceptance of our products and expanding our customer base. There can be no assurance that customers will purchase our products or that we will continue to expand our customer base. If we are unable to effectively market or expand our product offerings, we will be unable to grow and expand our business or implement our business strategy. This could materially impair our ability to increase sales and revenue and materially and adversely affect our margins, which could harm our business and cause our stock price to decline.

If we incur substantial liability from litigation, complaints, or enforcement actions resulting from misconduct by our distributors, our financial condition could suffer. We will require that our distributors comply with applicable law and with our policies and procedures. Although we will use various means to address misconduct by our distributors, including maintaining these policies and procedures to govern the conduct of our distributors and conducting training seminars, it will still be difficult to detect and correct all instances of misconduct. Violations of applicable law or our policies and procedures by our distributors could lead to litigation, formal or informal complaints, enforcement actions, and inquiries by various federal, state, or foreign regulatory authorities against us and/or our distributors. Litigation, complaints, and enforcement actions involving us and our distributors could consume considerable amounts of financial and other corporate resources, which could have a negative impact on our sales, revenue, profitability and growth prospects. As we are currently in the process of implementing our direct sales distributor program, we have not been, and are not currently, subject to any material litigation, complaint or enforcement action regarding distributor misconduct by any federal, state or foreign regulatory authority.

Our future manufacturers could fail to fulfill our orders for products, which would disrupt our business, increase our costs, harm our reputation and potentially cause us to lose our market.

We may depend on contract manufacturers in the future to produce our products. These manufacturers could fail to produce products to our specifications or in a workmanlike manner and may not deliver the units on a timely basis. Our manufacturers may also have to obtain inventories of the necessary parts and tools for production. Any change in manufacturers to resolve production issues could disrupt our ability to fulfill orders. Any change in manufacturers to resolve production issues could also disrupt our business due to delays in finding new manufacturers, providing specifications and testing initial production. Such disruptions in our business and/or delays in fulfilling orders would harm our reputation and would potentially cause us to lose our market.

Our inability to effectively protect our intellectual property would adversely affect our ability to compete effectively, our revenue, our financial condition and our results of operations.

We may be unable to obtain intellectual property rights to effectively protect our business. Our ability to compete effectively may be affected by the nature and breadth of our intellectual property rights. While we intend to defend against any threats to our intellectual property rights, there can be no assurance that any such actions will adequately protect our interests. If we are unable to secure intellectual property rights to effectively protect our technology, our revenue and earnings, financial condition, and/or results of operations would be adversely affected.

We may also rely on nondisclosure and non-competition agreements to protect portions of our technology. There can be no assurance that these agreements will not be breached, that we will have adequate remedies for any breach, that third parties will not otherwise gain access to our trade secrets or proprietary knowledge, or that third parties will not independently develop the technology.

We do not warrant any opinion as to non-infringement of any patent, trademark, or copyright by us or any of our affiliates, providers, or distributors. Nor do we warrant any opinion as to invalidity of any third-party patent or unpatentability of any third-party pending patent application.

Our industry is highly competitive and we have less capital and resources than many of our competitors, which may give them an advantage in developing and marketing products similar to ours or make our products obsolete.

We are involved in a highly competitive industry where we may compete with numerous other companies who offer alternative methods or approaches, may have far greater resources, more experience, and personnel perhaps more qualified than we do. Such resources may give our competitors an advantage in developing and marketing products similar to ours or products that make our products obsolete. There can be no assurance that we will be able to successfully compete against these other entities.

Transfers of our securities may be restricted by virtue of state securities “blue sky” laws, which prohibit trading absent compliance with individual state laws. These restrictions may make it difficult or impossible to sell shares in those states.

Transfers of our common stock may be restricted under the securities or securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as "blue sky" laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities held by many of our stockholders have not been registered for resale under the blue sky laws of any state, the holders of such shares and persons who desire to purchase them should be aware that there may be significant state blue sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. These restrictions may prohibit the secondary trading of our common stock. Investors should consider the secondary market for our securities to be a limited one.

We are dependent on key personnel and we are default under Employment and Consulting Agreements

Our success depends to a significant degree upon the continued contributions of key management and other personnel, some of whom could be difficult to replace. We do not maintain key man life insurance covering our officers except for Marco Hegyi, our President. We are in default under the Employment Agreement with Mr. Hegyi and the Consulting Agreement with Mr. Scott.

Our success will depend on the performance of our officers and key management and other personnel, our ability to retain and motivate our officers, our ability to integrate new officers and key management and other personnel into our operations, and the ability of all personnel to work together effectively as a team. Our failure to retain and recruit officers and other key personnel could have a material adverse effect on our business, financial condition and results of operations.

We have limited insurance.

We have no directors’ and officers’ liability insurance and limited commercial liability insurance policies. Any significant claims would have a material adverse effect on our business, financial condition and results of operations.

Risks Related to our Common Stock

CANX, Logic Works and China West and TCA could have significant influence over matters submitted to stockholders for approval.

CANX, Logic Works and China West

As of December 31, 2015, CANX, Logic Works and China West in the aggregate hold shares representing approximately 53.9% of our common stock on a fully-converted basis and could be considered a control group for purposes of SEC rules. However, their agreements limit their ownership to 4.99% individually and each of the parties disclaims its status as a control group or a beneficial owner due to the fact that their beneficial ownership is limited to 4.99% per their agreements. Beneficial ownership includes shares over which an individual or entity has investment or voting power and includes shares that could be issued upon the exercise of options and warrants within 60 days after the date of determination. If these persons were to choose to act together, they would be able to significantly influence all matters submitted to our stockholders for approval, as well as our officers, directors, management and affairs. For example, these persons, if they choose to act together, could significantly influence the election of directors and approval of any merger, consolidation or sale of all or substantially all of our assets. This concentration of voting power could delay or prevent an acquisition of us on terms that other stockholders may desire.

TCA

On July 9, 2015, we closed a Securities Purchase Agreement and related agreements with TCA Global Credit Master Fund LP, an accredited investor, whereby we agreed to sell and TCA agreed to purchase up to $3,000,000 of senior secured convertible, redeemable debentures, of which $700,000 was purchased on July 9, 2015 and up to $2,300,000 may be purchased in additional closings. The closing of the Transaction occurred on July 9, 2015.

On August 6, 2015, we closed a Securities Purchase Agreement and related agreements with TCA Global Credit Master Fund LP, whereby we agreed to sell and TCA agreed to purchase a $100,000 senior secured convertible redeemable debenture and we agreed to issue and sell to TCA, from time to time, and TCA agreed to purchase from us up to $3,000,000 of the Company’s common stock pursuant to a Committed Equity Facility. The closing of the Transaction occurred on August 6, 2015.

On October 27, 2015, we entered into an Amended and Restated Securities Purchase Agreement and related agreements with TCA Global Credit Master Fund LP whereby we agreed to sell, and TCA agreed to purchase $350,000 of senior secured convertible, redeemable debentures. We previously entered into a Securities Purchase Agreement dated as of April 30, 2015 and effective as of July 9, 2015 to purchase up to $3,000,000 in Debentures. As of October 27, 2015, we sold $1,050,000 in Debentures to TCA and up to $1,950,000 in Debentures remains for sale by us. The closing of the transaction occurred on October 27, 2015. In addition, TCA has advanced us an additional $100,000 for a total of $1,150.000. In addition, on October 21, 2015 we issued 150,000 Series B Preferred Stock at a stated value equal to $10.00 per share to TCA that is convertible into our common stock. On October 21, 2015, we also issued 51 shares of Series C Preferred Stock at $0.0001 par value per share to TCA that is not convertible into our common stock. In the event of a default under the Amended and Restated TCA Transaction Documents, TCA can exercise voting control over our common stock with their Series C Preferred Stock voting rights

As of April 14, 2016, we are in default on our repayment obligations in our Agreements with TCA and owe TCA approximately $254,000 in principal and interest payments. We are working to resolve these issues.

TCA is able to significantly influence all matters submitted to our stockholders for approval, as well as our officers, directors, management and affairs. For example, these persons, if they choose to act together, could significantly influence the election of directors and approval of any merger, consolidation or sale of all or substantially all of our assets. This concentration of voting power could delay or prevent an acquisition of us on terms that other stockholders may desire.

Trading in our stock is limited by the lack of market makers and the SEC’s penny stock regulations.

On April 10, 2014, as a result of the SEC suspension in the trading of our securities, we lost all market makers and traded on the grey market of OTCBB. Until we complied with FINRA Rule 15c2-11, we traded on the grey market, which has limited quotations and marketability of securities. Holders of our common stock found it more difficult to dispose of, or to obtain accurate quotations as to the market value of, our common stock, and the market value of our common stock declined.

On February 18, 2016, our common stock resumed unsolicited quotation on the OTC Bulletin Board after receiving clearance from the Financial Industry Regulatory Authority (“FINRA”) on our Form 15c2-11. We are currently taking the appropriate steps to uplist to the OTCQB Exchange and resume priced quotations with market makers as soon as it is able.

Our stock is categorized as a penny stock The SEC has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than US$ 5.00 per share or an exercise price of less than US$ 5.00 per share, subject to certain exclusions (e.g., net tangible assets in excess of $2,000,000 or average revenue of at least $6,000,000 for the last three years). The penny stock rules impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Finally, broker-dealers may not handle penny stocks under $0.10 per share.

These disclosure requirements reduce the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules would affect the ability of broker-dealers to trade our securities if we become subject to them in the future. The penny stock rules also could discourage investor interest in and limit the marketability of our common stock to future investors, resulting in limited ability for investors to sell their shares.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.