Exhibit 99.1

RECENT DEVELOPMENTS

The information in this Form 6-K supplements the information contained in the Bank’s Form 20-F. To the extent that the information included in this Form 6-K differs from the information set forth in the Form 20-F, you should rely on the information below.

RISK FACTORS

You should carefully consider the following risk factors, and the risk factors set forth under “Item 3. Key Information—D. Risk Factors” in our Form 20-F, which should be read in conjunction with all the other information presented in this Form 6-K and in our Form 20-F. The risks and uncertainties described below are not the only ones that we face. Additional risks and uncertainties that we do not know about or that we currently think are immaterial may also impair our business operations. Any of the following risks, if they actually occur, could materially and adversely affect our business, results of operations, prospects and financial condition.

Our growth and profitability depend on the level of economic activity in Chile.

As reported in our Form 20-F, our core business and transactions are with customers doing business in Chile. Accordingly, our ability to grow our business volumes and results of operations, as well as enhance our financial condition, in general, depends on the dynamics of the Chilean economy and specific macroeconomic variables such as inflation, unemployment, interest rates, consumption and investment. During 2020, the local economy was severely affected by the impact of the COVID-19 pandemic on overall activity, primarily as a result of the long-lasting lockdowns imposed by the Chilean Government in order to control the spread of the virus across the country, which translated into: (i) a spike in unemployment from 7.1% in December 2019 to a peak of 12.3% in the three-month period between August 2020 and October 2020, which decreased to 10.3% in December 2020, (ii) a 7.5% decline in private consumption, caused by the sharp decrease in disposable income and mobility restrictions, and (iii) a contraction of 11.5% in investment spending (gross fixed capital formation), since many investment projects were postponed in light of both uncertainty on the economic outlook, social distancing measures and lockdowns that impacted diverse economic sectors. These trends were mainly present in the second and third quarters of 2020, when the gross domestic product (“GDP”) declined 11.7% on average. However, by the end of the third quarter of 2020, economic activity began to recover as quarantines were lifted and certain industries, like construction, restaurants and manufacturing, returned to more normal activity. Likewise, household spending experienced some recovery based on the fiscal aid package implemented by the Ministry of Finance that resulted in direct money transfers for individuals and the two pension fund withdrawals approved by the Chilean Congress. Accordingly, in the fourth quarter of 2020, the local economy recovered to levels experienced in 2019, by advancing 0.01%. These trends resulted in an annual GDP contraction of 5.8% in 2020. In the first nine months of 2021, the Chilean economy began to show signs of a strong recovery, given both the low comparison base during same period in 2020 and a significant rebound in private consumption. According to figures reported by the Banco Central de Chile (the “Central Bank”), GDP recorded an expansion of 11.6% in the nine months ended September 30, 2021 as compared to the same period in 2020, primarily driven by household spending, which increased 21.9% as a result of significant support measures for individuals that began in 2020, such as direct money transfers from the Chilean Government and the positive effect of three withdrawals from pension funds on disposable income of individuals. Furthermore, most of the mobility restrictions imposed in 2020 were gradually lifted in 2021, as a significant part of the population became fully vaccinated and contagion rates decreased steadily, which supported the reactivation of diverse industries, particularly those associated with retail, mass consumption and services. Thus, as of September 30, 2021, the Chilean economy recovered to a pre-pandemic GDP level. In terms of investment in infrastructure, machinery and equipment, overall capital expenditures grew 8.5% in the nine months ended September 30, 2021 as compared the same period in 2020. Similarly, government spending expanded 11.0% in the nine months ended September 30, 2021, when compared to the same period in 2020, fostered by increasing social demands from the Chilean population and efforts deployed by the current administration in order to deal with the effects of the COVID-19 pandemic. Furthermore, the dynamics that boosted household consumption and, to a lesser extent, investment, together with constrained inventories, led the Chilean balance of trade (defined as exports minus imports) to become negative in the nine months ended September 30, 2021, as reported by the Central Bank.

Although the effects of the COVID-19 pandemic on the local economy and most relevant economies worldwide, such as China, the United States and main European countries, have mostly subsided or significantly improved and the worldwide vaccination process is in progress, it is not clear that new infection waves will not arise, given the appearance of continued or new virus mutations. In connection with this, we cannot assure you that the dynamics displayed by the Chilean economy in the nine months ended September 30, 2021 will remain or that the economic growth of the Chilean key international partners will improve or return to pre-COVID-19 levels. Also, given the social developments prompted by the COVID-19 pandemic and the impacts of the COVID-19 outbreak in Chile, we cannot rule out that the Chilean economy could severely decelerate, stagnate or even fall into recession in 2022, which could have a subsequent adverse effect on our business growth and the business growth of the Chilean banking industry in general.

Therefore, we cannot assure you that the local economy will grow in the coming years, as it has in the past, or that developments affecting the Chilean economy and the local banking industry will not materially affect our business, financial condition or results of operations. For more information, see “Item 5. Operating and Financial Review and Prospects—Operating Results—Impact of COVID-19 in 2020,” “Item 3. Key Information—Risk Factors—COVID-19 or any other pandemic disease and health events will affect both the global and the Chilean economy, our business or results of operations and could affect our financial condition” and “Item 5. Operating and Financial Review and Prospects—Trend Information—Impact of COVID-19,” in our Form 20-F.

Our results of operations are affected by interest rate volatility and inflation.

As reported in our Form 20-F, our results of operations depend greatly on our net interest income, which represented 68.4% of our total operating revenues in the nine months ended September 30, 2021. Changes in nominal interest rates and inflation could affect the interest rates earned on our interest-earning assets differently from the interest rates paid on our interest-bearing liabilities, resulting in net income reduction. Inflation and interest rates are sensitive to several factors beyond our control, including the Central Bank’s monetary policy, deregulation of the Chilean financial sector, local and international economic developments and political conditions, among other factors. In addition, changes in interest rates affect securities and other investments or assets that are recorded at fair value and are therefore exposed to potential negative fair value adjustments. Any volatility in interest rates could have a material adverse effect on our financial condition and results of operations. Also, real negative interest rates could negatively impact our ability to raise funding for our operations, particularly for short-term maturities, which could result in higher funding costs and lower net interest margin.

The average annual short-term nominal interest rate in Chile for 90 to 360 day deposits received by Chilean financial institutions was 2.97% in 2018, 2.72% in 2019 and 0.86% in 2020. The average long-term nominal interest rate based on the interest rate of the five-year bonds traded in the secondary market, issued by both the Central Bank and the Chilean Government, was 4.07% in 2018, 3.31% in 2019 and 1.94% in 2020. In the nine months ended September 30, 2021, interest rates began to steadily increase in Chile, particularly for longer maturities, based on various factors, including: (i) pension funds withdrawals that severely impacted the pricing of financial assets, (ii) expectations of higher inflation, and (iii) political uncertainty. Thus, in the nine months ended September 30, 2021 interest rates paid by Chilean banks on 90 to 360 day deposits averaged 0.83% based on an interest rate that averaged 2.52% in September 2021. In the months of October 2021 and November 2021 (through November 18, 2021) rates paid by Chilean banks on 90 to 360 day deposits averaged 3.59% and 4.24%, respectively. Similarly, in the nine months ended September 30, 2021, interest rates of the Central Bank’s five-year Chilean peso denominated bonds averaged 2.78%, with an average rate of 4.83% for the month of September 2021. Furthermore, in the months of October 2021 and November 2021 (through November 18, 2021) interest rates of the Central Bank’s five-year Chilean peso denominated bonds averaged 5.97% and 5.63%, respectively.

2

Inflation in Chile has been moderate in recent years, especially in comparison with periods of high inflation experienced in the 1980s and 1990s. High levels of inflation in Chile could adversely affect the Chilean economy, consumer purchasing power, household consumption and investment in machinery and equipment and, therefore, the demand for financing and our business. The annual inflation rate (as measured by annual changes in the Consumer Price Index (“CPI”) and as reported by the Chilean National Institute of Statistics) during the last five years and the first ten months of 2021 was:

| Year | Inflation (CPI Variation) |

|||

| 2016 | 2.7 | % | ||

| 2017 | 2.3 | |||

| 2018 | 2.6 | |||

| 2019 | 3.0 | |||

| 2020 | 3.0 | |||

| 2021 (through October 31, latest available data) | 5.8 | % | ||

Source: Chilean National Institute of Statistics

Although we benefit from a higher than expected inflation rate in Chile due to the structure of our assets and liabilities (we have a significant net asset position indexed to the inflation rate), significant changes in inflation with respect to current levels could adversely affect our results of operations and, therefore, the value of our securities.

Inflation and measures taken by the Central Bank to control inflation may adversely affect the Chilean economy, the banking business and results of operations and financial condition. In recent months, inflation has increased more than expected in Chile. Although we currently benefit from this increase due to our net asset structural position denominated in UF, we cannot assure you that our business, financial condition and results of operations will not be negatively impacted by increased and persistent levels of inflation in the future.

The measures adopted by the Central Bank in the past to control inflation have included the increase of the monetary policy interest rate, which has resulted in restricting demand and offer for loans while negatively affecting economic growth through constrained household spending and capital expenditures. In the nine months ended September 30, 2021, the Central Bank has increased the monetary policy rate from 0.5% to 0.75% in July, to 1.5% in August and to 2.75% in October 2021. Furthermore, the Central Bank has announced its intention to continue withdrawing the monetary stimulus by leading the monetary interest rate to neutral levels in the short-term, suggesting that further increases should take place in the remainder of 2021 and 2022. Since our liabilities generally re-price faster than our assets, sudden and sequential increases in short-term rates could affect our net interest margin.

For more information, see “Item 3. Key Information—Risk Factors—Risks Relating to our ADSs— Developments in international financial markets may adversely affect the market price of the ADSs and shares,” “Item 3. Key Information—Risk Factors—Risks Relating to our ADSs— COVID-19 or any other pandemic disease and health events will affect both the global and the Chilean economy, our business or results of operations and could affect our financial condition,” “Item 5. Operating and Financial Review and Prospects—Operating Results—Overview—Inflation” and “Item 5. Operating and Financial Review and Prospects—Operating Results—Overview—Interest Rates” in our Form 20-F.

Market turmoil could result in material negative adjustments to the fair value of our financial assets, which could translate into a material effect on our results of operations or financial condition.

As reported in our Form 20-F, over the last decade worldwide financial markets have been subject to stress that has resulted in sharp temporary changes in interest rates and credit spreads, including the effects of the COVID-19 pandemic, all of which has affected the worldwide and the local financial market. We have material exposures to debt securities issued by the Chilean Government and the Central Bank and other fixed-income investments in securities issued by local and foreign issuers. All of these are booked at fair value with direct impact on our profit and loss statement or in other comprehensive income. Therefore, these positions expose us to potential negative fair value adjustments in the short or medium term and to impairments in the long term, due to dramatic and unexpected changes in short- or long-term local and foreign interest rates and credit spreads. Any of these factors could have a material adverse effect on our results of operations and financial condition.

3

In the nine months ended September 30, 2021, the Chilean financial market has been affected by local forces including, but not limited to: (i) three pension fund withdrawals approved by the Chilean Congress to assist individuals in the context of the COVID-19 pandemic, (ii) expectations of higher inflation, and (iii) the political uncertainty associated with the run-off presidential election to be held on December 19, 2021. Also, in an effort to control inflation, the Central Bank increased the monetary policy rate three times between July and October 2021 from 0.5% to 2.75%, which could be the beginning of a tightening cycle that is expected to continue over the next year. These factors resulted in significant increases for nominal and real interest rates through the whole yield curve. For instance, the interest rates paid by Chilean banks on 90 to 360 day deposits increased from 0.40% in December 2020 to 4.24% in November 2021 (through November 18, 2021), while interest rates of the Central Bank’s five-year Chilean peso denominated bonds increased from 1.58% in December 2020 to 5.63% in November 2021 (through November 18, 2021). All of these factors have negatively impacted the market value of financial assets for the entire industry and us, including available-for-sale instruments. As of September 30, 2021, our available-for-sale portfolio amounted to Ch$ 3,440,313 million, which are mostly concentrated in bonds issued by the Central Bank and the Chilean Government. The approval of a fourth pension fund withdrawal and increased uncertainty on the second and final round of the presidential election to be held in December 2021 could cause further increases in short- and long-term local interest rates, which could continue impacting the economic value of our available-for-sale portfolio.

See also “Item 3. Key Information—Risk Factors—Risks Relating to our ADSs— Developments in international financial markets may adversely affect the market price of the ADSs and shares” and “Item 3. Key Information—Risk Factors—Risks Relating to our ADSs— COVID-19 or any other pandemic disease and health events will affect both the global and the Chilean economy, our business or results of operations and could affect our financial condition,” in our Form 20-F.

Any downgrade in Chile’s or our credit rating could increase our cost of funding, affecting our interest margins, results of operations and profitability.

As reported in our Form 20-F, our credit ratings determine the cost and the terms upon which we are able to obtain funding in the ordinary course of business. Rating agencies regularly evaluate us by taking into account diverse factors, including our financial strength, the business environment and the economic backdrop in which we operate. Thus, methodologies used by rating agencies evaluate Chile’s sovereign debt ratings when determining our ratings. During 2020, Standard & Poor’s Ratings Service (“S&P”) and Moody’s Investors Service (“Moody’s”) did not change Chile’s sovereign credit rating, which were maintained at A+ and A1, respectively, with negative outlooks. However, Fitch Ratings Service (“Fitch”) changed Chile’s sovereign credit rating from A to A-, with stable outlook. Also, S&P maintained its outlook on Chile’s sovereign credit rating as negative, whereas in August 2020 and October 2020, Moody’s and Fitch, respectively, revised the outlook for Chile’s sovereign credit rating from stable to negative and from negative to stable, respectively. Following these actions, on March 24, 2021, S&P downgraded Chile’s sovereign credit rating from A+ to A, while modifying the credit outlook from negative to stable in September 2021. The credit action taken by S&P was founded in the expected negative effects due to the COVID-19 pandemic and the effects of increasing social pressures that may lead the government to incur further social expenses and increase Chile’s current fiscal deficit in the long-run. Given the credit action taken by S&P on Chile’s sovereign credit rating, this rating agency also downgraded four local banks (excluding us) by one notch, while maintaining the negative outlook for the whole banking industry (including us), with the exception of Banco Estado (a state-owned bank) that received a stable outlook. In June 2021, S&P improved the outlook for two banks from negative to stable, excluding us.

As of the date of this report, S&P and Moody’s maintained our credit rating for unsecured long-term debt at levels of A and A1, respectively, both with a negative credit outlook (downgraded from the stable outlook in April 2020) due to the effects of the COVID-19 pandemic on the Chilean economy and banking activity, in conjunction with the slowdown evidenced by the Chilean economy since the social turmoil in October 2019. While Chile’s current long-term debt credit ratings remain investment grade, these credit ratings may deteriorate further and adversely affect our credit rating.

4

Any downgrade in our debt credit ratings could result in higher borrowing costs for us, while requiring us to post additional collateral or take other actions under some of our derivative and other contracts, and could limit our access to capital markets. All of these factors could adversely impact our commercial business by affecting our ability to: (i) sell or market our products, (ii) obtain long-term debt and engage in derivatives transactions, (iii) retain customers who need minimum ratings thresholds to operate with us, (iv) maintain derivative contracts that require us to have a minimum credit rating and (v) enter into new derivative contracts, which could impact our market risk profile, among other effects. Any of these factors could have an adverse effect on our liquidity, results of operations and financial condition.

Due to (i) the volatility in the financial markets and concerns about the soundness of developed and emerging economies, (ii) the still unpredictable impacts or lagged effects of the COVID-19 pandemic on the global and the local economies, and (iii) potential changes to be introduced in the fiscal policy or long-term government spending by the current or future government administrations in Chile, we cannot assure you that rating agencies will maintain our and Chile’s sovereign debt current ratings and outlooks.

Restrictions imposed by regulations may constrain our operations and thereby adversely affect our financial condition and results of operations.

In addition to the bills mentioned in our Form 20-F, related to loans and credit products, new bills have been introduced recently by members of the Chilean Congress. Some of these new bills, if enacted, may increase the costs of our consumer loan and mortgage products by setting higher mandatory protections for customers. Furthermore, one of these bills introduces additional requirements to judicially exercise rights attained to mortgage loan collaterals; others may limit our capacity to gather detailed information throughout our risk evaluation process by, for instance, setting higher privacy standards. Since most of these bills are currently at early stages in the Chilean Congress, there is no certainty whether any or all of them will be further discussed or not, and as to when or how these bills could change the current regulatory framework if approved. Therefore, we cannot determine or assure you whether they will materially affect our business and, in turn, our financial condition and results of operations in the future.

From the taxation perspective, in September 2021 the Chilean Government sent to Congress for discussion a bill to reduce or eliminate certain tax exemptions in order to obtain additional resources to finance certain changes to the Chilean pension system. This proposed bill includes repealing tax exemptions for capital gains on stocks and mutual funds complying with certain requirements, proposing to tax capital gains in accordance with the general tax regime (corporate taxes —semi-integrated system or SME— plus personal taxes). As of the date of this report, there is no certainty whether this legislation will pass or if the proposed draft will be modified. Therefore we cannot yet determine or rule out whether this legislation, if passed, could have a material impact on us in the future or not, including (i) a decrease in fee income from stock trading carried out by our Securities Brokerage or Mutual Funds subsidiaries, and (ii) lower traded volume of our shares in Chile, among other factors. For more information on current tax regulation (Law No. 21,210), please see “Item 4—Information on the Company—Regulation and Supervision—Amendments to the Reform that Modified the Chilean Tax System” and “Item 10—Additional information—Taxation—Chilean Tax Considerations” in our Form 20-F.

In August 2021, Law No. 21,365 was enacted, regulating interchange fees in the payment card market in Chile. An autonomous and technical committee was created to determine, on a periodic basis, the fees or rates to be charged by payment card issuers such as banks (“Interchange Rates”) to the operating companies (acquirers). The technical committee is comprised of four members, each appointed by the following institutions: the Central Bank; the CMF; the Office of National Economic Prosecution (Fiscalía Nacional Económica); and the Ministry of Finance. This committee has six months to announce the first transitory limits and, afterwards, Interchange Rates will be reset every three years. Given the uncertainty regarding the limits on Interchange Rates that could be determined by this technical committee, we cannot yet assure whether this new regulation will or will not have a negative impact on the banking industry and on our results of operations.

5

Changes in regulations may also cause us to face increased compliance costs and limitations on our ability to pursue certain business opportunities and provide certain products and services. As some banking laws and regulations have been recently adopted, the way they are applied to the operations of financial institutions is still evolving. We cannot generally assure that laws or regulations will be adopted, enforced or interpreted in a manner that will not have a material adverse effect on our business and results of operations

Modifications to reserve requirements may affect our growth capacity and margins.

As reported in our Form 20-F, according to Chilean banking regulation, demand deposits and time deposits are subject to reserve requirements of 9.0% and 3.6% (with terms of less than one year), respectively. However, the Central Bank is entitled to require banks to maintain reserves of up to 40.0% for demand deposits and up to 20.0% for time deposits, to the extent needed for monetary policy purposes. In addition, if the aggregate balance of demand deposits and other demand accounts (e.g., deposits in current accounts, other demand deposits or obligations payable on demand and incurred in the ordinary course of business, saving deposits that allow unconditional withdrawals that bear a stated maturity, and other deposits payable immediately unconditionally) held by a bank exceeds 2.5 times its regulatory capital, that bank is required to set a technical reserve equivalent to the full amount of the excess. In this regard, as part of the implementation of Basel III, the new regulation set by the General Banking Act establishes that systemically important banks could be subject to stricter technical reserve requirements since the threshold of 2.5 times the regulatory capital could be reduced to 1.5 times. Conditions to set this additional requirement are part of the powers of the Comisión para el Mercado Financiero (the “Chilean Financial Market Commission,” or the “CMF”), although the decision to impose such additional requirement must be agreed with the Central Bank. On March 31, 2021, the CMF announced that six local banks (including us) were designated as systemically important banks. However, as of the date of this report, we have not received notice about the amount of additional capital requirements or the systemic buffer that will be imposed on us.

We cannot assure you that we will not be subject to such requirement in the future, which in turn could impact our capacity to afford balance sheet growth and could have a material adverse effect on our net interest margin.

COVID-19 or any other pandemic disease and health events will affect both the global and the Chilean economy, our business or results of operations and could affect our financial condition.

As mentioned in our Form 20-F, since the first cases of COVID-19 were detected in Chile during March 2020, the Chilean Government has taken various measures in order to prepare for and safeguard the country from a mass contagion and to contain and control the spread of COVID-19. In March 2020, the Chilean Government declared a state of catastrophe in the entire country, which restricted freedom of movement and gathering. During the state of catastrophe partial or total lockdowns with varying levels of severity and length took place in most of Chile’s regions, particularly during the second and the third quarters of 2020, which covered approximately 60% of the Chilean population in the peak of the pandemic. In the fourth quarter of 2020, the level of contagion decreased significantly and lockdowns started to be lifted. Likewise, vaccination started by the end of 2020 and continued throughout 2021. Notwithstanding this, a second wave of contagion appeared by mid-March 2021, which caused the Chilean Government to implement total lockdown for some neighbourhoods and restrict some economic activities. The contagion rate began to decrease as a greater portion of the target population became vaccinated, which led the Chilean Government to end the state of catastrophe on September 30, 2021. By mid-October, however, the contagion rate began to gradually increase, although health authorities have discarded a new contagion wave, given the high rate of vaccination. As of September 30, 2021, approximately 80% of the target population had received at least one dose of the vaccine and approximately 74% of the target population had been fully vaccinated, including individuals that have received a third booster dose. The Ministry of Health defines “target population” as (1) critical population (i.e. individuals exposed to infection due to their work or functions); (2) healthy population (i.e. individuals between the ages of 18 and 59); and (3) population at risk (i.e. individuals with an increased risk of experiencing grave morbidity, sequels or death due to COVID-19 by reason of age or pre-existing conditions). The Chilean Government has also begun vaccinating children under 18 years of age and is currently rolling out the booster shot. Moreover, on September 6, 2021 the Public Health Institute (Instituto de Salud Pública) granted the necessary emergency approval for the vaccination of children between 6 and 12 years of age.

6

With the end of the state of catastrophe, the Chilean Government modified the restriction program named “step-by-step”, which had been in effect since March 2020. The new program includes five stages ranging from total restriction (lockdown) to advanced opening, depending on many factors, including the number of new cases per capita in a specific area, size of vulnerable population and access to health services. Depending on these factors, the health authority may impose new restrictions or advance to full reopening. Also, in order to promote vaccination, in November 2021 the Ministry of Health launched a new mobility pass, which will be required for individuals 12 years and older in order to have freedom for mobility while frequenting certain locations such as restaurants, cinema, stadiums, among others. Likewise, based on advances in vaccination, Chile has gradually begun to reopen its borders, enabling vaccinated foreigners to visit the country without major restrictions.

Vaccinations appear to be effective in slowing down the spread of COVID-19, while preventing an increase in the death toll. Also, the slow of the spread is also a factor contributing to the reactivation of the Chilean economy throughout 2021 as reflected by a GDP expansion of 11.6% in the nine months ended September 30, 2021, as compared to the same period in 2020. GDP growth has been mainly fostered by the significant increase of household spending and, to a lesser extent, by an increase in overall capital expenditures. The household spending has been driven by support measures for individuals including (i) direct money transfers (Emergency Income for the Family or Ingreso Familiar de Emergencia – “IFE”) ) from the Chilean Government, which considers monthly income for the months June, July, and August 2021, amounting to approximately U.S.$8,700 million according to Chilean Government, and then decreasing amounts for the months of September through December 2021, and (ii) three withdrawals from pension funds amounting to U.S.$47.3 billion as of November 22, 2021 (latest available date) plus one withdrawal from life annuities (rentas vitalicias) from life insurance companies, amounting to U.S.$1.1 billion as of November 19, 2021 (latest available date), as approved by the Chilean Congress, resulting in enhanced disposable income for individuals.

Also, the Chilean Government has provided support lending for microentrepreneurs, SMEs and middle market companies through its program of collateral funds (FOGAPE) by launching FOGAPE COVID and FOGAPE Reactiva Programs. To do this, in April 2020 the Chilean Government increased the amount of collateral funds by U.S.$3 billion, in order to facilitate their access to funding from banks. This FOGAPE COVID program guaranteed from 60% to 85% of the total amount borrowed by a company from the applicable banks depending on a company’s size (measured as annual turnover), which reduced the banks’ credit risk exposure. As the FOGAPE COVID program concluded in 2020, in February 2021, it was supplemented with the FOGAPE Reactiva Program, which was aimed at supporting microentrepreneurs, SMEs and middle market beyond working capital loans as the FOGAPE COVID program did, by also contemplating long-term funding for investment projects and debt restructuring. Thus, as of December 31, 2020, we had granted Ch$1,888,856 million in secured loans associated with the FOGAPE COVID program, and as of September 30, 2021, we had granted Ch$1,234,501 million in secured loans associated with the FOGAPE Reactiva Program. Notwithstanding the fact that we have received guarantees from the Chilean Government through its program of collateral funds for a portion of these loans, if customers holding these loans default, or they fail to timely comply with their payment obligations, this will result in higher levels of non-performing loans and require additional levels of provisions for loan losses. Also, under FOGAPE programs all other loans formerly granted to a customer from the applicable bank from which such customer receives FOGAPE loans were granted a six-month grace period. If customers default on these non-FOGAPE obligations when such grace period ends, this could also result in higher levels of non-performing loans and, therefore, in greater provisions for loan losses.

As new variants of the COVID-19 virus continue to arise all over the world, the long-term impacts of the COVID-19 pandemic are still uncertain, and it is hard to predict the duration of the pandemic and its effects on the global and Chilean economy and on our business. In this regard, we cannot assure you that the Chilean Government will not reinstate or impose new mobility restrictions if the contagion rate increases once again beyond reasonable levels, which is uncertain and cannot be predicted. For more information about the current status of COVID-19 in Chile, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below and “Item 5. Operating and Financial Review and Prospects—Trend Information” in our Form 20-F.

7

Our business growth, asset quality and profitability may be affected by political, legal and economic uncertainty, as well as social developments and the drafting of a new constitution in Chile.

As mentioned in our Form 20-F, our operations are highly dependent on the Chilean political and social environment, as most of our customers and borrowers do business in Chile. Thus, our results of operations could be negatively impacted by unfavorable political and diplomatic developments, social instability or unrest, as well as dramatic changes in public policies, including expropriation, nationalization, international ownership legislation, interest rate caps and tax policy.

In response to the social unrest which occurred in Chile in October 2019, the Chilean Government announced a social agenda intended to increase basic pensions, expand social health coverage, and reduce and stabilize tariffs for some public services, such as public transportation and electricity. To fund these initiatives, the Chilean Government and the opposition reached an agreement regarding a new tax reform that was passed by the Chilean Congress and enacted on January 29, 2020. See “Item 5. Operating and Financial Review and Prospects—Operating Results—Income Tax and Item 10. Additional Information—Taxation—Chilean Tax Considerations” in our Form 20-F. Further, in November 2019, the majority of the local political parties agreed on a process to draft a new constitution that will replace the current one dating from 1980. The referendum to vote for a new constitution was carried out in October 2020, in which the choice for a new constitution obtained 78% of the votes and 79% of voters determined that a convention entirely comprised of citizens (the “Constitutional Convention”), instead of citizens and members of the Chilean Congress, will draft the new constitution. In May 2021, the participants of the Constitutional Convention were elected by the Chilean voters, with an overall majority of left-wing members, and the convention initiated its functions. Each new article of the Constitution will have to be approved by two thirds of the Constitutional Convention, a rule that was ratified in September 2021 by the convention itself. The Constitutional Convention will have approximately one year from May 2021 to complete the draft of the new constitution. An exit referendum with compulsory participation will then be held to approve or reject the new constitution. Notwithstanding the above, protests and demonstrations resumed in the beginning of 2021 and in October 2021, though more subdued than those experienced in October 2019.

The long-term effects of the social unrest are difficult to predict, but could include slower economic growth and higher unemployment rates, which could adversely affect our profitability and prospects. For example, an increase in the unemployment rate beyond what we predicted, or for a longer period than predicted, could diminish demand for loans and decrease our customers’ payment capacity to repay loans, increasing expected credit losses. Overall, we cannot assure you that the social unrest will decrease in Chile in the near future, and therefore, we can offer no assurance that it will not have a negative impact on economic growth, the overall Chilean business environment and our results of operations and financial condition.

Likewise, we cannot assure that any new constitution proposed by the Constitutional Convention, if finally approved by Chilean voters in a referendum, will not affect economic growth, the overall business sentiment, the banking business and, as a consequence, our results of operations or financial condition.

Similarly, presidential elections were held on November 21, 2021, with a run-off set for December 19, 2021. The two candidates receiving the highest majority of the votes in the election held on November 21, 2021 were Jose Antonio Kast, of the right-wing Frente Social Cristiano coalition, and Gabriel Boric, of the left-wing Apruebo Dignidad coalition. The winning candidate will take office for a four-year term beginning March 2022, being uncertain whether the Constitutional Convention will shorten this term, if a new constitution is approved in a referendum. In addition, during the elections of November 21, 2021, the whole Chamber of Deputies and half of the Senate were renewed, as well as all regional counselors (consejeros regionales). The Senate, composed of 50 senators is now comprised of 25 senators from right-wing parties, 23 senators from left-wing parties and two independent senators. The Chamber of Deputies, is composed of 155 deputies, of which 79 deputies are from left-wing parties, 68 deputies are from right-wing parties and eight deputies are independent or members of non-traditional parties. Since the final result of the presidential election is uncertain, we cannot assure you that the elected government will not impose or promote severe modifications to the existing economic and social policy framework in Chile or have a majority in the Chilean Congress to enable it to enact legislation, all of which could translate into higher uncertainty, deteriorated business sentiment and consumer confidence, lower or negative economic growth among other effects, all of which could negatively affect our results of operations and financial condition.

8

Reforms to labor and pension laws as well as labor strikes or slowdowns could adversely affect our results of operations.

In relation to labor law, in addition to the information provided in Item 3. Key Information—D. Risk Factors in our Form 20-F, during the last few months, new bills have been introduced by members of the Chilean Congress on this matter. Among these, one bill aims to gradually reduce the maximum working hours to 38 per week within the fifth year of its enactment, while precluding employers from reducing wages. Another bill seeks to increase the participation of employees in a companies’ profits. These proposed legislations, if approved and enacted, could translate into higher ongoing labor costs, which may have an adverse effect on our results of operations and our financial condition in the future.

With regard to pensions, as of the date of this report, uncertainty on the future of the Chilean pension system remains, since the Chilean Government has not been able to reach an agreement with the Chilean Congress to address an increase in the amount of pensions received by Chilean pensioners. However, it seems probable that regardless of which political coalition comes into power in March 2022, the new government will seek to introduce reforms to the Chilean pension system, which currently relies on individual capitalization. The proposals associated with the government programs of the coalitions that were voted to be included in the run-off for December 2021 include, but are not limited to: (i) replacing current private pension fund managers with a state-owned single manager, (ii) transitioning from individual capitalization to a collective pension system, (iii) reinforcing the current solidarity pillar while maintaining individual capitalization, and (iv) some initiatives in between. Based on these proposals it is not clear that pension funds will continue to operate under the current investment drivers and, therefore, we cannot assure you that the demand for both the long-term fixed-income securities we issue as debt to finance our operations and/or our shares of common stock will continue in the future as in the past, which could lead us to seek for alternative sources of funding in Chile and abroad.

Further, a fourth extraordinary withdrawal from the pension funds is currently under discussion by the Chilean Congress. As mentioned in our Form 20-F, since the pension fund managers usually invest a portion of the funds in certain debt instruments (for instance, bonds and time deposits), including those issued by all Chilean banks, including us, if the amount of funds available in the pension funds system continues to decrease, we will not be able to raise funds from pension fund managers as in the past. As a result, there would be further restrictions to our access to long-term financing, compelling us to seek alternative funding sources, which may bear more expensive interest rates and include higher transactional costs, and, as a consequence, may have an adverse effect on our net interest margin and hence results of operations and financial condition in the long term.

9

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

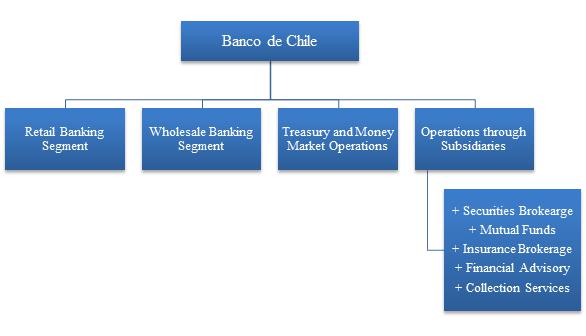

The following discussion of Banco de Chile’s results of operations for the nine months ended September 30, 2021 and 2020 should be read in conjunction with (i) our Form 20-F and, in particular, with “Item 4. Information on the Company–B. Business Overview” and “Item 5. Operating and Financial Overview and Prospects” therein, and (ii) our unaudited interim condensed consolidated financial statements as of September 30, 2021 and for the nine months ended September 30, 2021 and 2020 (the “Unaudited Financial Statements”), which are being furnished to the SEC as Exhibit 99.2 to this Form 6-K. The terms “Banco de Chile,” “the Bank,” “we,” “us” and “our” refer to Banco de Chile together with its subsidiaries, unless otherwise specified.

The Unaudited Financial Statements were prepared in accordance with Chilean Generally Accepted Accounting Principles (“Chilean GAAP”) as issued by the CMF. These Unaudited Financial Statements differ in some respects from our financial statements prepared in accordance with International Financial Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and included in our Form 20-F. See “Differences between IFRS and Chilean Bank GAAP” below and Note 41 to our Unaudited Financial Statements.

Trends and Factors Affecting Our Results of Operations

Developments in the Chilean Economy

Overview

In the first nine months of 2021, the Chilean economy began to show signs of a strong recovery, given both the low comparison base posed by the first nine months of 2020 and, more importantly, real economic growth, particularly steered by a boost in private consumption. According to figures reported by the Central Bank, GDP increased 11.6% in the first nine months of 2021 as compared to the first nine months of 2020, which was primarily driven by household spending increasing 21.9% in the first nine months of 2021, principally as a result of extraordinary support measures for individuals adopted by both the Chilean Government, in the form of direct money transfers, and the Chilean Congress, by approving three withdrawals from pension funds, all of which had a significant impact on liquidity and disposable income of individuals. Also, throughout the same period, most of the long-lasting mobility restrictions were gradually lifted as a significant part of the population became fully vaccinated and contagion rates decreased steadily, reactivating diverse industries, particularly those associated with retail, mass consumption and services. Based on these trends, as of September 30, 2021, the Chilean economy had already surpassed its pre-pandemic GDP level. On the investment side (particularly investment in infrastructure, machinery and equipment), overall capital expenditures also improved as depicted by the 8.5% growth in gross fixed capital formation. Similarly, government spending also expanded 11.0% in the nine months ended September 30, 2021 when compared to the same period in 2020, which has primarily been fostered by increasing social demands from the Chilean population and efforts deployed by the current administration in order to deal with the effects of the COVID-19 pandemic. On the other hand, given the dynamics that boosted household consumption and investment, constrained inventories led the Chilean balance of trade (defined as exports minus imports) to become negative in 2021.

10

Inflation

In the past, Chile has experienced high levels of inflation that affected private consumption, consumer sentiment, financial conditions and the results of various companies. Nevertheless, since the 1990s, inflation has been maintained under control through responsible monetary policy carried out by an independent Central Bank and the adoption of a successful inflation target policy. Thus, in Chile inflation is correlated to both local economic dynamics and external factors. In 2020, in spite of the significant impact of the COVID-19 pandemic on household spending and unemployment rates as a result of the lockdowns determined by Chilean health authorities, the CPI recorded a 12-month increase of 3.0%, which was equivalent to the target defined by the Central Bank for long-term inflation. This moderate increase was the consequence of deflationary pressures caused by both the impacts of the COVID-19 pandemic on household spending and the appreciation of the Chilean peso by the end of the year, both of which were more than offset by the temporary shortfall of certain products during the peak of the COVID-19 pandemic, as many economic sectors were restricted or suspended. In the first nine months of 2021, instead, the deflationary pressures seen in 2020 turned into inflationary forces, based on, among other things: (i) the sharp increase in individuals’ disposable income as a consequence of direct money transfers from the Chilean Government to support families when some mobility restrictions were still in place, (ii) the approval of three withdrawals from pension funds for a total amount of U.S.$47.3 billion as of November 22, 2021 (latest available date) plus one withdrawal from life annuities (rentas vitalicias) from life insurance companies, amounting to U.S.$1.1 billion as of November 19, 2021 (latest available date), and (iii) a significant depreciation of the Chilean peso against the U.S. dollar that amounted to 14.0% between December 31, 2020 and September 30, 2021, as compared to a depreciation of 4.3% between December 31, 2019 and September 30, 2020, as reported by Bloomberg. Whereas the depreciation of the Chilean peso impacted on the final price in Chilean pesos of imported goods or services dependent on imported goods, the effect of increased disposable income associated with support measures deployed by both the Chilean Government and the Chilean Congress had a second-round effect related to an aggregate supply that is not able to adapt instantaneously to changes on the demand for goods, pushing prices up. As a consequence of these factors, in the nine months ended September 30, 2021 the Chilean CPI index increased 4.4% and 5.3% in the twelve months ended September 30, 2021. In October 2021, the latest available date, the CPI index recorded a monthly increase of 1.34%, which resulted in an accumulated increase of 5.81% in the ten months ended October 31, 2021 and 6.02% in the twelve months ended October 31, 2021. Inflation has continued to be steered by liquidity levels among individuals that lingers in above average levels, political uncertainty associated to the run-off of the presidential election and global inflationary pressures, such as those caused by the increase in the price of oil, which has promoted household consumption in an environment where the offer of services and products has not yet adjusted to the increased demand.

Interest Rates

Interest rates earned and paid on our assets and liabilities reflect in part, inflation and expectations regarding future inflation, shifts in short-term interest rates related to the Central Bank’s monetary policies and movements in long-term real rates. The Central Bank manages short-term interest rates in order to achieve its long-term inflation target and provide the economy with financial stability.

According to information published by the Central Bank, the average annual short term nominal interest rate, based on the rate paid by Chilean financial institutions for 90 to 360 days Chilean peso denominated deposits, was 2.97% in 2018, 2.72% in 2019 and 0.86% in 2020. The average annual long-term nominal interest rate, based on the interest rate of the five-year Chilean peso denominated bonds in the secondary market, issued by both the Central Bank and the Chilean Government, was 4.07% in 2018, 3.31% in 2019 and 1.93% in 2020. In the nine months ended September 30, 2021, rates paid by Chilean banks on 90 to 360 day deposits averaged 0.83% based on an interest rate that averaged 2.52% in September 2021. In the months of October 2021 and November 2021 (through November 18, 2021) rates paid by Chilean banks on 90 to 360 day deposits averaged 3.59% and 4.24%, respectively. Within the same timeframe, rates of the Central Bank’s five-year Chilean peso denominated bonds averaged 2.78%. The trend adopted by interest rates in the nine-month period ended September 30, 2021 is a result of different dynamics. For short-term interest rates, the low interest rate levels were a direct result of the monetary stimulus deployed by the Central Bank once the COVID-19 outbreak took place in Chile in March 2020, taking the monetary interest rate from 1.75% to 0.5%, by carrying out two consecutive reductions of 0.75% and 0.5% in March and April 2020, respectively. The monetary policy interest rate remained at 0.5% until July 2021, when the Chilean Central Bank implemented a 25 basis point increment, which was supplemented with a 0.75% increase in August 2021 and a further 1.25% increase in October 2021, taking the monetary policy interest rate to 2.75%, in order to control inflationary pressures. As of November 18, 2021, the monetary policy interest rate remained at 2.75%. As for long-term interest rates, there has been a sharp increase in the local market, mainly attributable to the effect of: (i) pension fund withdrawals on the pricing of fixed-income securities, as pension funds have experienced significant liquidation of fixed-income positions to afford such withdrawals, (ii) expectations of higher inflation in the near future and (iii) political uncertainty associated with the presidential election that will define the administration that will take office in March 2022. As a result, according to the Central Bank, the interest rate of the five-year Chilean peso denominated bonds in the secondary market, issued by both the Central Bank and the Chilean Government, has increased from 1.58% in December 2020 to 4.83% in September 2021, 5.97% in October 2021 and 5.63% in November 2021 (through November 18, 2021).

11

Foreign Currency Exchange Rates

A portion of our assets and liabilities are denominated in foreign currencies, principally U.S. dollars. In the past, we have maintained and may continue to maintain gaps between the balances of such assets and liabilities. This gap includes assets and liabilities denominated in foreign currencies and assets and liabilities denominated in Chilean pesos that contain repayment terms linked to changes in foreign currency exchange rates. However, we generally offset this gap by taking hedging derivative positions that neutralize the effect of exchange rate volatility and/or foreign interest rates. Because foreign currency denominated assets and liabilities, as well as interest earned or paid on such assets and liabilities and gains (losses) realized upon the sale of such assets, are translated into pesos in preparing our financial statements, our reported income is affected by changes in the value of the peso with respect to foreign currencies, primarily the U.S. dollar. Adjustments to U.S. dollar-indexed assets are reflected as adjustments in net interest earnings and offset results in our foreign exchange position.

The relative value of the Chilean peso against the U.S. dollar and other currencies can be affected by several global and domestic factors, such as: (i) the evolution of the price of copper, which represents more than half of total Chilean exports, and therefore has a significant impact in terms of trade and offers of foreign currency in Chile, (ii) potential capital outflows from a further diversification of local investors overseas, (iii) potential capital inflows from the issuance of debt denominated in foreign currency by local companies and the Republic of Chile overseas, (iv) a higher fiscal deficit that potentially impacts long-term fiscal sustainability, and (v) higher political uncertainty resulting from the ongoing constitutional process, the run-off of the presidential election and the policies to be implemented by the next government. Based on the combination of these factors, the Chilean peso has depreciated approximately 14% against the U.S. dollar during 2021. However, since it is not possible to isolate the effects of these factors, we cannot assure you how developments in the local or the global economy can further affect the depreciation or appreciation of the Chilean peso in the future.

See “Item 3. Key Information—Selected Financial Data—Exchange Rates” and Item 3. Key Information—Risk Factors—Risks Relating to Chile—Currency fluctuations could adversely affect the value of our ADSs and any distributions on the ADSs” in our Form 20-F.

Impacts of COVID-19 in Nine-Month Period ended September 30, 2021

For information regarding the impacts of COVID-19 on our results of operations and financial condition in 2020, please see “Item 5. Operating and Financial Review and Prospects—Operating Results—Impacts of COVID-19 in 2020 in our Form 20-F.

In terms of the direct effect on our results of operations and financial condition in the nine months ended September 30, 2021, our performance continued to reflect the dynamics experienced by the local economy and the local banking system, as a consequence of GDP expansion that has been particularly the result of boosting household spending, mobility restrictions that began to be lifted as a result of improved sanitary conditions and unseen levels of liquidity among individuals. Therefore, the main drivers supporting our performance in the first nine months of 2021 are as follows:

| ● | Our loan portfolio began to gradually recover in 2021, in line with improvements from a sanitary perspective, such as the end of total lockdowns and the reopening of diverse economic activities, particularly those involving social interaction. Nonetheless, during the nine months ended September 30, 2021, most of the loan growth continued to be driven by low margin lending products, such as residential mortgage and commercial loans, while consumer loans started to display positive growth only in the third quarter of 2021. Overall, our loan book increased 5.7% in the nine months ended September 30, 2021, when compared to the same period in 2020. The expansion of the loan portfolio has been mainly due to: (i) a steady upward trend in residential mortgage loans growing 9.5% in the nine months ended September 2021, as compared to the same period in 2020, given the decoupling of this lending product from economic drivers due to a demand for housing that remained strong in the nine months ended September 30, 2021, which coupled with the effect of pension fund withdrawals on individuals’ disposable income that allowed them to finance part of the home value, (ii) commercial loans increasing 4.5% in the same period, mainly due to specific lending operations in the third quarter of 2021 in line with a moderate reactivation of investment expenditures postponed during the COVID-19 pandemic, and (iii) a growth of 2.1% in consumer loans, which represents the first positive 12-month change since December 2019, while reflecting trends revealed by the Central Bank in terms of a more dynamic demand for personal banking loans and a persistent easing of offer conditions as economic activity continues to rebound. |

12

| ● | From the funding point of view, as nominal interest rates, particularly in shorter terms, remained at low levels throughout 2021, the contribution of our non-interest bearing demand deposits to our cost of funds continued to be negatively affected, since a scenario of low interest rates reduces the competitive advantage associated with holding demand deposit balances. The average balances of demand deposits increased by 35.2% in the nine months ended September 30, 2021, when compared to the same period in 2020. The increase in demand deposits was mainly attributable to the excess of liquidity among individuals due to non-recurrent factors, such as direct money transfers from the Chilean Government and the approval of three pension fund withdrawals. This trend in demand deposits coupled with mid-term financing provided by the Central Bank bearing the monetary policy interest rate (0.5%). In 2020, we raised Ch$3,110,600 million from the Central Bank and we made an additional request for Ch$1,237,800 million in the nine months ended September 30, 2021 bearing the same rate. Based on these drivers, in the nine months ended September 30, 2021, we carried out a few long-term bond placements while continuing to replace time deposits held by wholesale counterparties. As a result, demand deposits became our main source of funding. |

| ● | In terms of results, in the nine months ended September 30, 2021, our net income was Ch$509,105 million, representing a 51.1% increase when compared to the Ch$336,824 million recorded in the same period in 2020. The main drivers of this change were improvements in both provisions for loan losses and net interest income. Provisions for loan losses recorded a sharp decrease of approximately 40.7%, in spite of the increase of Ch$113,000 million in additional allowances established in the nine months ended September 30, 2021 when compared to the same period of 2020, reflecting an overall improvement in the payment behavior of our customers, particularly in the retail banking segment, as a result of the liquidity surplus observed in the Chilean economy. The lower risk expenses coupled with an increase of 8.5% in net interest income, which was primarily attributable to the effect of increased inflation on the contribution of our structural UF net asset exposure. However, this was, to some extent, offset by lower interest earned on our balance sheet due to interest rates that have remained, for almost two years, at the lowest levels seen in the past decade, following the downturn caused by the COVID-19 pandemic, all of which resulted in the repricing of both assets and liabilities, while negatively impacting growth of higher interest rate lending products, such as consumer loans. These positive factors were, to some degree, offset by: (i) higher income tax associated with a greater amount of income before income tax in the nine months ended September 30, 2021, when compared to the same period in 2020, (ii) a moderate increase of 1.5% in operating expenses within the same period of time, mainly attributable to the low comparison base that represented the nine months ended September 30, 2020, when mobility restrictions were in place and commercial activity was severely affected for that reason, (iii) other income (loss) net decreasing 6.9% in the nine months ended September 30, 2021, when compared to the same period in 2020, primarily due to decreased performance of our treasury business caused by the high comparison base represented by the nine months ended September 30, 2020, when interest rates declined sharply in response to the monetary actions taken by the Central Banks in Chile and abroad to cope with the economic effects of the COVID-19 outbreak, benefiting our trading and investment portfolios in 2020, which was partly offset by higher benefits from Counterparty Value Adjustments for derivatives (“CVA”) in the nine months ended September 30, 2021 as compared to the same period in 2020, (iv) decreased fee-based income by 1.4%, mainly attributable to a high comparison base given that in 2020 we recognized a significant part of the upfront fee received from our alliance with an international insurance company, since most of the portfolios of life and non-life products had been migrated by the end of 2020, which was partly offset by both higher fee income from transactional services, in light of an increasing volume of transactions in 2021, as mobility gradually returned to mid-term levels, and also higher fees from mutual funds management, as investors began to move from fixed-income funds to equity funds. |

13

| ● | From the capital adequacy perspective, however, we continued to maintain a sound equity base in the nine months ended September 30, 2021. The moderate increase of our balance sheet has resulted in an increase of 3.7% in risk-weighted assets in the nine months ended September 30, 2021, when compared to the same period in 2020. Along with this, in the nine months ended September 30, 2021, we have continued to bolster our equity base, as a result of: (i) the retention of Ch$242,837 million from the net distributable income recorded in 2020, an amount that is composed of both a capitalization rate of 40% (60% pay-out ratio) and the effect of inflation on our shareholders’ equity, (ii) a higher net income generated in the nine months ended September 30, 2021, when compared to the same period in 2020, by Ch$116,097 million (after deducting the amount set aside for dividends), and (iii) an improvement in cumulative other comprehensive income of Ch$50,871 million in the nine months ended September 30, 2021, as compared to the same period in 2020, which stemmed primarily from the increase in local long-term interest rates during 2021 that oppositely affected the fair value adjustment of derivatives held for hedge accounting purposes and the fair value of available-for-sale securities. Based on these trends, our total capital ratio improved to 16.5% as of September 30, 2021 from 15.0% as of September 30, 2020. Similarly, our common equity Tier 1 ratio improved from 11.6% to 12.4% within the same period. These ratios compare favorably to those displayed by our main peers as of September 30, 2021 (latest available information). For more information, please see “Business Overview—Competition” below in this Form 6-K. |

Likewise, as part of our commitment to our customers and Chile, we implemented the National Support Plan (“Plan Nacional de Apoyo”) for individuals and SME customers. This plan supported our customers by reducing their financial burden during a specific time period of three to six months by: (i) postponing monthly installments of both residential mortgage and consumer loans, (ii) giving our customers certain facilities to pay their monthly credit card bill, (iii) providing our SME customers with special financing in the form of credits, and (iv) keeping our firm commitment to our SME providers by settling their invoices before ten days. As of December 31, 2020, we had rescheduled Ch$414,155 million of installments of consumer, mortgage and commercial loans and Ch$147,918 million related to credit card loans. Additionally, we continue aiding our customers by means of the special support program for small, medium and large companies associated with the FOGAPE-COVID (government-guaranteed) loan program promoted by the Chilean Government in 2020, in order to assist these kinds of borrowers. During 2020, we granted Ch$1,888,856 million in these types of secured loans. In February 2021, the Chilean Government created a new support program named FOGAPE-REACTIVA program, which was aimed at achieving a prompt economic recovery by promoting borrowing from banks to SMEs and middle market companies to finance working capital, investment projects and debt restructuring. As of September 30, 2021 we had granted Ch$1,234,501 million in loans related to this program. Also, throughout 2021, we have rescheduled mortgage installments for an amount of Ch$7,275 million.

For more information regarding potential economic or regulatory factors that could affect our results of operations or financial condition, see “Item 3. Key Information—Risk Factors— COVID-19 or any other pandemic disease and health events will affect both the global and the Chilean economy, our business or results of operations and could affect our financial condition” and “Item 5. Operating and Financial Review and Prospects—Trend Information in our Form 20-F.

14

Critical Accounting Policies

Please see Note 1 to our Unaudited Financial Statements included in this Form 6-K as Exhibit 99.2.

Differences between IFRS and Chilean GAAP

Chilean GAAP, as prescribed by the Compendio de Normas Contables para Bancos (the “Compendium of Accounting Standards”, the “Compendium” or “CNCB”), differs in certain respects from IFRS as issued by the IASB. See Note 41 to our Unaudited Financial Statements.

The main differences that should be considered by an investor are the following:

Loan loss allowances

The main difference between Chilean GAAP and IFRS 9 regarding loan loss allowances is that loan loss allowances under Chilean GAAP are calculated using expected loss models based on specific guidelines set by the CMF, which in turn are based on an expected losses approach. Additionally, with Board approval, a bank would be allowed to establish additional provisions to protect themselves from the risk of non-predictable economical fluctuations that could affect the macro-economic environment or a specific economic sector. Under IFRS 9 “Financial instruments,” allowances for loan losses are calculated based on the “expected credit loss” model. The CMF has not yet adopted IFRS 9 for banks and therefore the Bank has adjusted the Unaudited Financial Statements to fully comply with IFRS standards. The most significant impact of IFRS 9 on the Bank’s financial statements arises from the new impairment requirements. As a result of these accounting policies differences, our net income under IFRS was Ch$181,494 million higher than our internally reported net income for the nine months ended September 30, 2021. The impact on equity was Ch$409,672 million higher than our internally reported equity as of September 30, 2021.

Provisions for country risk and for contingent loan risk

Under Chilean GAAP, the Bank provisions for country risk cover the risk taken when holding or committing resources with any foreign country. These allowances are established according to country risk classifications established by the CMF and therefore are not in accordance with IFRS as issued by the IASB. Our Unaudited Financial Statements have been adjusted accordingly.

Under Chilean GAAP, the Bank has established allowances related to the undrawn available credit lines and contingent loans in accordance with the CMF. With the adoption of IFRS 9, provisions for contingent loans are calculated based on expected credit loss. The Bank has adjusted its Unaudited Financial Statements accordingly.

These differences do not materially impact our financial statements.

Business Combination

Under internal reporting policies, our merger with Citibank Chile was accounted for under the pooling of interest method, while under IFRS, and for external financial reporting purposes, the merger of the two banks was accounted for as a business combination in which we were the acquirer as required by IFRS 3 “Business Combinations.” Under IFRS 3, we recognized all acquired net assets at fair value as determined at the acquisition date, as well as the goodwill resulting from the purchase price consideration in excess of net assets recognized. We have adjusted our Unaudited Financial Statements accordingly.

Provision for mandatory dividends

Chilean banks are required to distribute at least 30% of their net income to shareholders unless the shareholders unanimously approve the retention of profits. A bank may, however, be prohibited from distributing to shareholders even this 30% of its net income if such distribution would cause the bank to violate certain statutory capital requirements. In accordance with internal reporting policies, we record a minimum dividend allowance of at least 60% of the period’s net distributable income, as permitted by the CMF. Under IFRS, only the portion of dividends that is required to be distributed by Chilean Law must be recorded, i.e., 30% as required by Chilean Corporations Law. This accounting difference does not lead to differences in net income. Given this adjustment, the equity under IFRS was Ch$73,404 million higher than our internally reported equity as of September 30, 2021.

15

Assets Received in Lieu of Payment

The Compendium of Accounting Standards requires that the assets received in lieu of payments are measured at historical cost or fair value, less cost to sell, if lower, on a portfolio basis and written off if not sold after a certain period of time in accordance with specific guidelines established by the CMF. Under IFRS, these assets are deemed non-current assets held for sale and their accounting treatment is set by IFRS 5 “Non-Current Assets Held for Sale and Discontinued Operations.” In accordance with IFRS 5 these assets are measured at historical cost or fair value, less cost to sell, if lower. Accordingly, under IFRS these assets are not written off unless they were impaired. We have adjusted our Unaudited Financial Statements accordingly.

Suspension of Income Recognition on Accrual Basis

In accordance with the Compendium of Accounting Standards, financial institutions must suspend recognition of income on an accrual basis in their statements of income for certain loans included in the impaired portfolio. IFRS 9 and IAS 39 did not allow the suspension of accrual of interest on financial assets for which an impairment loss has been determined. As of January 1, 2018, the Bank adopted IFRS 9. Under IFRS 9, interest income is calculated by applying the effective interest rate to the gross carrying amount of financial assets, except for financial assets that have subsequently become credit-impaired (or “Stage 3”), for which interest revenue is calculated by applying the effective interest rate to their amortized cost (i.e., net of expected credit losses provision). Off-balance interests are recorded as interest income only if the Bank receives the related payments. This difference does not materially impact our Unaudited Financial Statements.

Deferred taxes

The Bank records, when appropriate, deferred tax assets and liabilities for the estimated future tax effects attributable to differences between the carrying amount of assets and liabilities and their tax bases. All of the aforementioned differences had an impact on deferred taxes, which resulted in net income under IFRS that was Ch$53,010 million lower than our internally reported net income for the nine months ended September 30, 2021.

16

In the table below is a reconciliation as of and for the nine months ended September 30, 2021 of the Bank’s Chilean GAAP statement of financial position and income statement to IFRS.

| As of September 30, 2021 | ||||||||||||||||

| Chilean GAAP | Adjustment | Reclassification | Total IFRS | |||||||||||||

| ASSETS | MCh$ | MCh$ | MCh$ | MCh$ | ||||||||||||

| Cash and deposits in banks | 3,099,335 | - | - | 3,099,335 | ||||||||||||

| Cash items in process of collection | 410,644 | - | (250,011 | ) | 160,633 | |||||||||||

| Financial assets held for trading (trading investments) | 3,141,762 | - | - | 3,141,762 | ||||||||||||

| Investments under resale agreements | 76,496 | - | - | 76,496 | ||||||||||||

| Financial derivative contracts | 2,844,672 | - | - | 2,844,672 | ||||||||||||

| Interbank loans, net | 2,017,505 | 497 | - | 2,018,002 | ||||||||||||

| Loans and account receivable at amortized cost (Loans and accounts receivables from customers, net) | 32,404,479 | (36,074 | ) | - | 32,368,405 | |||||||||||

| Financial assets at fair value through OCI (Available for sale investments) | 3,440,313 | 4,241 | 2,244 | 3,446,798 | ||||||||||||

| Held to maturity investments | 302,532 | - | - | 302,532 | ||||||||||||

| Investments in associates and other companies | 48,088 | - | (2,244 | ) | 45,844 | |||||||||||

| Intangible assets | 68,401 | 33,410 | - | 101,811 | ||||||||||||

| Property, plant, and equipment | 223,688 | - | - | 223,688 | ||||||||||||

| Right of use assets | 103,224 | - | - | 103,224 | ||||||||||||

| Investments properties | - | - | 12,566 | 12,566 | ||||||||||||

| Current taxes | 671 | - | (671 | ) | - | |||||||||||

| Deferred taxes | 387,291 | (119,600 | ) | - | 267,691 | |||||||||||

| Other assets | 649,322 | 706 | (23,108 | ) | 626,920 | |||||||||||

| TOTAL ASSETS | 49,218,423 | (116,820 | ) | (261,224 | ) | 48,840,379 | ||||||||||

| LIABILITIES | ||||||||||||||||

| Deposits and other demand liabilities | 17,607,258 | - | - | 17,607,258 | ||||||||||||

| Cash items in process of being cleared | 337,560 | - | (250,011 | ) | 87,549 | |||||||||||

| Obligations under repurchase agreements | 111,438 | - | - | 111,438 | ||||||||||||

| Time deposits and other time liabilities | 8,972,204 | - | - | 8,972,204 | ||||||||||||

| Financial derivative contracts | 2,644,144 | 196 | - | 2,644,340 | ||||||||||||

| Interbank borrowing | 4,814,758 | - | - | 4,814,758 | ||||||||||||

| Issued debt instruments | 8,758,172 | - | - | 8,758,172 | ||||||||||||

| Other financial liabilities | 259,116 | - | - | 259,116 | ||||||||||||

| Obligations for lease contracts | 99,013 | - | - | 99,013 | ||||||||||||

| Current taxes | 82,930 | - | (671 | ) | 82,259 | |||||||||||

| Deferred taxes | - | - | - | - | ||||||||||||

| Provisions | 882,161 | (526,362 | ) | (108,006 | ) | 247,793 | ||||||||||

| Employee benefits | - | - | 108,006 | 108,006 | ||||||||||||

| Other liabilities | 608,030 | - | (10,542 | ) | 597,488 | |||||||||||

| TOTAL LIABILITIES | 45,176,784 | (526,166 | ) | (261,224 | ) | 44,389,394 | ||||||||||

| EQUITY | ||||||||||||||||

| Attributable to the equity holders of the Bank | ||||||||||||||||

| Capital | 2,418,833 | - | - | 2,418,833 | ||||||||||||

| Reserves | 703,571 | 172,655 | 27,800 | 904,026 | ||||||||||||

| Valuation adjustments | (19,214 | ) | 11,615 | - | (7,599 | ) | ||||||||||

| Retained earnings | ||||||||||||||||

| Retained earnings from prior years | 655,478 | 8,345 | (27,800 | ) | 636,023 | |||||||||||

| Income for the period | 509,104 | 143,327 | - | 652,431 | ||||||||||||

| Minus: Provision for mandatory dividends | (226,135 | ) | 73,404 | - | (152,731 | ) | ||||||||||

| Non-controlling interest | 2 | - | - | 2 | ||||||||||||

| TOTAL EQUITY | 4,041,639 | 409,346 | - | 4,450,985 | ||||||||||||

| TOTAL LIABILITIES AND EQUITY | 49,218,423 | (116,820 | ) | (261,224 | ) | 48,840,379 | ||||||||||

17

| For the nine months ended September 30, 2021 | ||||||||||||||||

| Chilean GAAP | Adjustment | Reclassification | Total IFRS | |||||||||||||

| MCh$ | MCh$ | MCh$ | MCh$ | |||||||||||||

| OPERATING INCOME | ||||||||||||||||

| Interest income | 1,515,435 | 2,370 | 390 | 1,518,195 | ||||||||||||

| Interest expense | (470,917 | ) | - | - | (470,917 | ) | ||||||||||

| Net interest income | 1,044,518 | 2,370 | 390 | 1,047,278 | ||||||||||||

| Fee and commission income | 427,087 | - | - | 427,087 | ||||||||||||

| Fee and commission expense | (85,882 | ) | - | - | (85,882 | ) | ||||||||||

| Net fee and commission income | 341,205 | - | - | 341,205 | ||||||||||||

| Net income (expense) from financial operations | 129,802 | 468 | - | 130,270 | ||||||||||||

| Net foreign exchange gain | (15,239 | ) | - | - | (15,239 | ) | ||||||||||

| Other operating income | 25,720 | (1,278 | ) | - | 24,442 | |||||||||||

| Net operating profit before provision for loan losses | 1,526,006 | 1,560 | 390 | 1,527,956 | ||||||||||||

| Provision for loan losses | (223,781 | ) | 190,200 | - | (33,581 | ) | ||||||||||

| NET OPERATING INCOME | 1,302,225 | 191,760 | 390 | 1,494,375 | ||||||||||||

| Personnel salaries and expenses | (335,929 | ) | - | - | (335,929 | ) | ||||||||||

| Administrative expenses | (241,193 | ) | - | - | (241,193 | ) | ||||||||||

| Depreciation and amortization | (57,003 | ) | - | - | (57,003 | ) | ||||||||||

| Impairment of property, plant, and equipment | (3 | ) | - | - | (3 | ) | ||||||||||

| Other operating expenses | (26,178 | ) | 4,577 | - | (21,601 | ) | ||||||||||

| Total operating expenses | (660,306 | ) | 4,577 | - | (655,729 | ) | ||||||||||

| OPERATING INCOME | 641,919 | 196,337 | 390 | 838,646 | ||||||||||||

| Income from investments in associates and other companies | (2,848 | ) | - | (390 | ) | (3,238 | ) | |||||||||