| Name of Fund: |

| Fund Address: | 100 Bellevue Parkway, Wilmington, DE 19809 |

|

DECEMBER 31, 2022 |

2022 Annual Report | ||

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Total Cumulative Distributions for the Fiscal Period |

% Breakdown of the Total Cumulative Distributions for the Fiscal Period |

|||||||||||||||||||||||||||||||||||||||||||||

Trust Name |

Net Income |

Net Realized Capital Gains Short-Term |

Net Realized Capital Gains Long-Term |

Return of Capital |

(a) |

Total Per Common Share |

Net Income |

Net Realized Capital Gains Short-Term |

Net Realized Capital Gains Long-Term |

Return of Capital |

Total Per Common Share |

|||||||||||||||||||||||||||||||||||

BHK |

$ | 0.656210 | $ | — | $ | — | $ | 0.164390 | $ | 0.820600 | 80 | % | — | % | — | % | 20 | % | 100% | |||||||||||||||||||||||||||

HYT |

0.581882 | — | — | 0.275018 | 0.856900 | 68 | — | — | 32 | 100 | ||||||||||||||||||||||||||||||||||||

BTZ |

0.768465 | — | — | 0.154435 | 0.922900 | 83 | — | — | 17 | 100 | ||||||||||||||||||||||||||||||||||||

BGT |

0.751900 | — | — | — | 0.751900 | 100 | — | — | — | 100 | ||||||||||||||||||||||||||||||||||||

(a) |

Each Trust estimates that it has distributed more than its net income and net realized capital gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with “yield” or “income.” When distributions exceed total return performance, the difference will reduce a Trust’s net asset value per share. |

Exchange Symbol |

Amount Per Common Share | |

BHK |

$ 0.0746 | |

HYT |

0.0779 | |

BTZ |

0.0839 | |

BGT |

0.0781 | |

2 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Total Returns as of December 31, 2022 | ||||

6-Month |

12-Month | |||

U.S. large cap equities (S&P 500 ® Index) |

2.31% | (18.11)% | ||

U.S. small cap equities (Russell 2000 ® Index) |

3.91 | (20.44) | ||

International equities (MSCI Europe, Australasia, Far East Index) |

6.36 | (14.45) | ||

Emerging market equities (MSCI Emerging Markets Index) |

(2.99) | (20.09) | ||

3-month Treasury bills(ICE BofA 3-Month U.S. Treasury Bill Index) |

1.32 | 1.47 | ||

U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index) |

(5.58) | (16.28) | ||

U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index) |

(2.97) | (13.01) | ||

Tax-exempt municipal bonds(Bloomberg Municipal Bond Index) |

0.50 | (8.53) | ||

U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) |

3.50 | (11.18) | ||

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||

T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

3 |

Page | ||

| 2 | ||

| 3 | ||

Annual Report: |

||

| 5 | ||

| 5 | ||

| 6 | ||

Financial Statements: |

||

| 18 | ||

| 132 | ||

| 134 | ||

| 135 | ||

| 137 | ||

| 139 | ||

| 143 | ||

| 158 | ||

| 159 | ||

| 160 | ||

| 170 | ||

| 175 | ||

| 176 | ||

| 179 | ||

| 183 |

4 |

T H E B E N E F I T S A N D R I S K S O F L E V E R A G I N G / D E R I V A T I V E F I N A N C I A L I N S T R U M E N T S |

5 |

Trust Summary as of December 31, 2022 |

BlackRock Core Bond Trust (BHK) |

Symbol on New York Stock Exchange |

BHK | |

Initial Offering Date |

November 27, 2001 | |

Current Distribution Rate on Closing Market Price as of December 31, 2022 ($10.38) (a) |

8.62% | |

Current Monthly Distribution per Common Share (b) |

$0.0746 | |

Current Annualized Distribution per Common Share (b) |

$0.8952 | |

Leverage as of December 31, 2022 (c) |

40% | |

(a) |

Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. |

(b) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

(c) |

Represents reverse repurchase agreements as a percentage of total managed assets, which is the total assets of the Trust (including any assets attributable to any borrowings) minus the sum of its liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

12/31/22 |

12/31/21 |

Change |

High |

Low |

||||||||||||||||

Closing Market Price |

$ | 10.38 | $ | 16.51 | (37.13 | )% | $ | 16.51 | $ | 9.56 | ||||||||||

Net Asset Value |

10.89 | 15.47 | (29.61 | ) | 15.47 | 10.31 | ||||||||||||||

(a) |

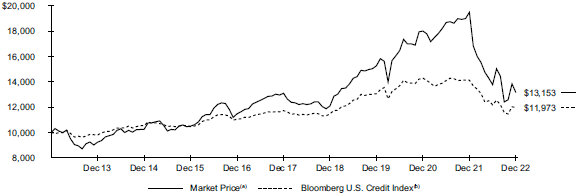

Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

(b) |

An index that measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate and government related bond markets. It is composed of the US Corporate Index and a non-corporate component that includes foreign agencies, sovereigns, supranationals and local authorities. |

6 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Trust Summary as of December 31, 2022 (continued) |

BlackRock Core Bond Trust (BHK) |

| Average Annual Total Returns | ||||||||||||||

1 Year |

5 Years |

10 Years |

||||||||||||

Trust at NAV (a)(b) |

(24.44 | )% | (0.09 | )% | 3.02 | % | ||||||||

Trust at Market Price (a)(b) |

(32.52 | ) | 0.09 | 2.78 | ||||||||||

Bloomberg U.S. Credit Index |

(15.26 | ) | 0.42 | 1.82 | ||||||||||

Reference Benchmark (c) |

(17.07 | ) | 0.33 | 2.02 | ||||||||||

Bloomberg U.S. Long Government/Credit Index (d) |

(27.09 | ) | (1.21 | ) | 1.57 | |||||||||

Bloomberg Intermediate Credit Index (e) |

(9.10 | ) | 1.08 | 1.76 | ||||||||||

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index (f) |

(11.18 | ) | 2.30 | 4.03 | ||||||||||

Bloomberg CMBS, Eligible for U.S. Aggregate Index (g) |

(10.91 | ) | 0.77 | 1.55 | ||||||||||

Bloomberg MBS Index (h) |

(11.81 | ) | (0.53 | ) | 0.74 | |||||||||

Bloomberg ABS Index (i) |

(4.30 | ) | 1.18 | 1.23 | ||||||||||

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Trust’s use of leverage. |

(b) |

The Trust moved from a premium to NAV to a discount during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

(c) |

The Reference Benchmark is comprised of the Bloomberg U.S. Long Government/Credit Index (40%); Bloomberg Intermediate Credit Index (24%); Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index (16%); Bloomberg CMBS, Eligible for U.S. Aggregate Index (8%); Bloomberg MBS Index (8%); and Bloomberg ABS Index (4%). The Reference Benchmark’s index content and weightings may have varied over past periods. |

(d) |

An unmanaged index that is the long component of the Bloomberg U.S. Government/Credit Index. It includes publicly issued U.S. Treasury debt, U.S. government agency debt, taxable debt issued by U.S. states and territories and their political subdivisions, debt issued by U.S. and non-U.S. corporations, non-U.S. government debt and supranational debt. |

(e) |

An unmanaged index that is the intermediate component of the Bloomberg U.S. Credit Index. The Bloomberg U.S. Credit Index includes publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements. |

(f) |

An unmanaged index comprised of issuers that meet the following criteria: at least $150 million par value outstanding; maximum credit rating of Ba1; at least one year to maturity; and no issuer represents more than 2% of the index. |

(g) |

An unmanaged index that is the CMBS component of the Bloomberg U.S. Aggregate Index. |

(h) |

An unmanaged index is a market value-weighted index, which covers the mortgage-backed securities component of the Bloomberg U.S. Aggregate Bond Index. It is comprised of agency mortgage-backed pass-through securities of the Government National Mortgage Association (Ginnie Mae), the Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (Freddie Mac) with a minimum $150 million par amount outstanding and a weighted-average maturity of at least 1 year. The index includes reinvestment of income. |

(i) |

An unmanaged index that is the asset-backed securities component of the Bloomberg U.S. Aggregate Index. |

T R U S T S U M M A R Y |

7 |

Trust Summary as of December 31, 2022 (continued) |

BlackRock Core Bond Trust (BHK) |

Asset Type (a) |

12/31/22 | |

Corporate Bonds |

43.6% | |

U.S. Treasury Obligations |

16.9 | |

U.S. Government Sponsored Agency Securities |

15.1 | |

Asset-Backed Securities |

8.0 | |

Non-Agency Mortgage-Backed Securities |

6.8 | |

Preferred Securities |

3.7 | |

Floating Rate Loan Interests |

2.3 | |

Municipal Bonds |

2.0 | |

Foreign Agency Obligations |

1.6 | |

Credit Rating (a)(b) |

12/31/22 | |||||

AAA/Aaa (c) |

38.1% | |||||

AA/Aa |

2.9 | |||||

A |

9.3 | |||||

BBB/Baa |

23.0 | |||||

BB/Ba |

10.6 | |||||

B |

8.7 | |||||

CCC/Caa |

2.5 | |||||

CC |

0.2 | |||||

C |

— (d) | |||||

D |

— (d) | |||||

N/R (e) |

4.7 | |||||

(a) |

Excludes short-term securities. |

(b) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(c) |

The investment adviser evaluates the credit quality of not-rated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuer. Using this approach, the investment adviser has deemed U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations as AAA/Aaa. |

(d) |

Rounds to less than 0.1%. |

(e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of December 31, 2022, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of the Trust’s total investments. |

8 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Trust Summary as of December 31, 2022 |

BlackRock Corporate High Yield Fund, Inc. (HYT) |

Symbol on New York Stock Exchange |

HYT | |

Initial Offering Date |

May 30, 2003 | |

Current Distribution Rate on Closing Market Price as of December 31, 2022 ($8.74) (a) |

10.70% | |

Current Monthly Distribution per Common Share (b) |

$0.0779 | |

Current Annualized Distribution per Common Share (b) |

$0.9348 | |

Leverage as of December 31, 2022 (c) |

29% |

(a) |

Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. |

(b) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

(c) |

Represents bank borrowings outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowings), minus the sum of liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

12/31/22 |

12/31/21 |

Change |

High |

Low |

||||||||||||||||

Closing Market Price |

$ | 8.74 | $ | 12.34 | (29.17 | )% | $ | 12.34 | $ | 8.15 | ||||||||||

Net Asset Value |

9.25 | 11.99 | (22.85 | ) | 11.99 | 9.03 | ||||||||||||||

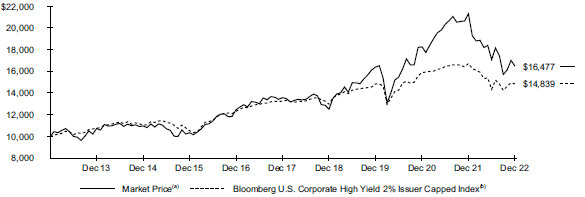

(a) |

Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

(b) |

An unmanaged index comprised of issues that meet the following criteria: at least $150 million par value outstanding; maximum credit rating of Ba1; at least one year to maturity; and no issuer represents more than 2% of the index. |

T R U S T S U M M A R Y |

9 |

Trust Summary as of December 31, 2022 (continued) |

BlackRock Corporate High Yield Fund, Inc. (HYT) |

| Average Annual Total Returns | ||||||||||||

1 Year |

5 Years |

10 Years |

||||||||||

Trust at NAV (a)(b) |

(15.71 | )% | 2.92 | % | 5.53 | % | ||||||

Trust at Market Price (a)(b) |

(22.62 | ) | 3.97 | 5.12 | ||||||||

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index |

(11.18 | ) | 2.30 | 4.03 | ||||||||

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Trust’s use of leverage. |

(b) |

The Trust moved from a premium to NAV to a discount during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

10 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Trust Summary as of December 31, 2022 (continued) |

BlackRock Corporate High Yield Fund, Inc. (HYT) |

Asset Type (a) |

12/31/22 | |

Corporate Bonds |

86.4% | |

Floating Rate Loan Interests |

11.4 | |

Preferred Securities |

1.6 | |

Other* |

0.6 | |

Credit Rating (a)(b) |

12/31/22 | |||||

A |

0.8% | |||||

BBB/Baa |

12.5 | |||||

BB/Ba |

35.5 | |||||

B |

38.4 | |||||

CCC/Caa |

10.3 | |||||

CC |

— (c) | |||||

C |

— (c) | |||||

N/R |

2.5 | |||||

(a) |

Excludes short-term securities. |

(b) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(c) |

Rounds to less than 0.1%. |

| * | Includes one or more investment categories that individually represents less than 1.0% of the Trust’s total investments. Please refer to the Consolidated Schedule of Investments for details. |

T R U S T S U M M A R Y |

11 |

Trust Summary as of December 31, 2022 |

BlackRock Credit Allocation Income Trust (BTZ) |

Symbol on New York Stock Exchange |

BTZ | |

Initial Offering Date |

December 27, 2006 | |

Current Distribution Rate on Closing Market Price as of December 31, 2022 ($10.10) (a) |

9.97% | |

Current Monthly Distribution per Common Share (b) |

$0.0839 | |

Current Annualized Distribution per Common Share (b) |

$1.0068 | |

Leverage as of December 31, 2022 (c) |

36% | |

(a) |

Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. |

(b) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

(c) |

Represents reverse repurchase agreements as a percentage of total managed assets, which is the total assets of the Trust (including any assets attributable to any borrowings) minus the sum of its liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

12/31/22 |

12/31/21 |

Change |

High |

Low |

||||||||||||||||

Closing Market Price |

$ | 10.10 | $ | 15.05 | (32.89 | )% | $ | 15.05 | $ | 9.37 | ||||||||||

Net Asset Value |

11.19 | 15.10 | (25.89 | ) | 15.10 | 10.56 | ||||||||||||||

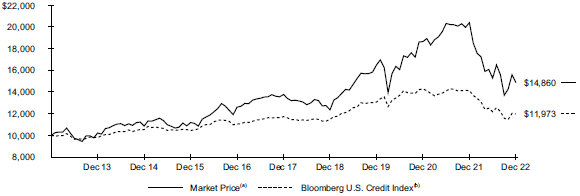

(a) |

Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

(b) |

An index that measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate and government related bond markets. It is composed of the US Corporate Index and a non-corporate component that includes foreign agencies, sovereigns, supranationals and local authorities. |

12 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Trust Summary as of December 31, 2022 (continued) |

BlackRock Credit Allocation Income Trust (BTZ) |

| Average Annual Total Returns | ||||||||||||

1 Year |

5 Years |

10 Years |

||||||||||

Trust at NAV (a)(b) |

(19.50 | )% | 1.54 | % | 4.00 | % | ||||||

Trust at Market Price (a)(b) |

(27.10 | ) | 1.53 | 4.04 | ||||||||

Reference Benchmark (c) |

(13.72 | ) | 1.20 | 2.83 | ||||||||

Bloomberg U.S. Credit Index |

(15.26 | ) | 0.42 | 1.82 | ||||||||

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index (d) |

(11.18 | ) | 2.30 | 4.03 | ||||||||

Bloomberg USD Capital Securities Index (e) |

(13.84 | ) | 1.35 | 3.49 | ||||||||

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Trust’s use of leverage. |

(b) |

The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

(c) |

The Reference Benchmark is comprised of the Bloomberg U.S. Credit Index (50.36%), the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index (29.93%), and the Bloomberg USD Capital Securities Index (19.71%). |

(d) |

An unmanaged index comprised of issuers that meet the following criteria: at least $150 million par value outstanding; maximum credit rating of Ba1; at least one year to maturity; and no issuer represents more than 2% of the index. |

(e) |

An unmanaged index that tracks fixed-rate, investment grade capital securities denominated in USD. |

T R U S T S U M M A R Y |

13 |

Trust Summary as of December 31, 2022 (continued) |

BlackRock Credit Allocation Income Trust (BTZ) |

Asset Type (a) |

12/31/22 | |

Corporate Bonds |

69.8% | |

Preferred Securities |

11.1 | |

Asset-Backed Securities |

9.0 | |

Floating Rate Loan Interests |

4.1 | |

U.S. Government Sponsored Agency Securities |

3.9 | |

Foreign Agency Obligations |

1.5 | |

Other* |

0.6 | |

Credit Rating (a)(b) |

12/31/22 | |||||

AAA/Aaa (c) |

7.9% | |||||

AA/Aa |

2.7 | |||||

A |

11.2 | |||||

BBB/Baa |

40.0 | |||||

BB/Ba |

19.8 | |||||

B |

14.2 | |||||

CCC/Caa |

3.1 | |||||

C |

— (d) | |||||

N/R (e) |

1.1 | |||||

(a) |

Excludes short-term securities. |

(b) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(c) |

Includes U.S. Government Sponsored Agency Securities which are deemed AAA/Aaa by the investment adviser. |

(d) |

Rounds to less than 0.1%. |

(e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of December 31, 2022, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of the Trust’s total investments. |

| * | Includes one or more investment categories that individually represents less than 1.0% of the Trusts’ net assets. Please refer to the Schedule of Investments for details. |

14 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Trust Summary as of December 31, 2022 |

BlackRock Floating Rate Income Trust (BGT) |

Symbol on New York Stock Exchange |

BGT | |

Initial Offering Date |

August 30, 2004 | |

Current Distribution Rate on Closing Market Price as of December 31, 2022 ($10.94) (a) |

8.57% | |

Current Monthly Distribution per Common Share (b) |

$0.0781 | |

Current Annualized Distribution per Common Share (b) |

$0.9372 | |

Leverage as of December 31, 2022 (c) |

25% | |

(a) |

Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

(b) |

The distribution rate is not constant and is subject to change. |

(c) |

Represents bank borrowings outstanding as a percentage of total managed assets, which is the total assets of the Fund (including any assets attributable to borrowings), minus the sum of liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

12/31/22 |

12/31/21 |

Change |

High |

Low |

||||||||||||||||

Closing Market Price |

$ | 10.94 | $ | 13.99 | (21.80 | )% | $ | 14.13 | $ | 10.60 | ||||||||||

Net Asset Value |

12.43 | 13.44 | (7.51 | ) | 13.57 | 12.03 | ||||||||||||||

(a) |

Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

(b) |

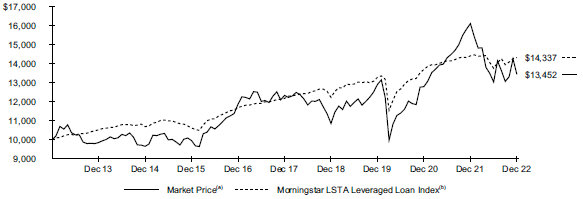

Morningstar LSTA Leveraged Loan Index (formerly S&P ® /LSTA Leveraged Loan Index), an unmanaged market value-weighted index designed to measure the performance of the U.S. leveraged loan market based upon market weightings, spreads and interest payments. |

T R U S T S U M M A R Y |

15 |

Trust Summary as of December 31, 2022 (continued) |

BlackRock Floating Rate Income Trust (BGT) |

| Average Annual Total Returns | ||||||||||||

1 Year |

5 Years |

10 Years |

||||||||||

Trust at NAV (a)(b) |

(1.32 | )% | 3.74 | % | 4.74 | % | ||||||

Trust at Market Price (a)(b) |

(16.56 | ) | 1.74 | 3.01 | ||||||||

Morningstar LSTA Leveraged Loan Index |

(0.60 | ) | 3.31 | 3.67 | ||||||||

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Trust’s use of leverage. |

(b) |

The Trust moved from a premium to NAV to a discount during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

16 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Trust Summary as of December 31, 2022 (continued) |

BlackRock Floating Rate Income Trust (BGT) |

Asset Type (a) |

12/31/22 | |

Floating Rate Loan Interests |

97.9% | |

Corporate Bonds |

1.7 | |

Other* |

0.4 | |

Credit Rating (a)(b) |

12/31/22 | |

BBB/Baa |

5.1% | |

BB/Ba |

25.6 | |

B |

61.6 | |

CCC/Caa |

5.8 | |

C |

— (c) | |

N/R |

1.9 | |

(a) |

Excludes short-term securities. |

(b) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(c) |

Rounds to less than 0.1% of total investments. |

| * | Includes one or more investment categories that individually represents less than 1.0% of the Trust’s total investments. Please refer to the Schedule of Investments for details. |

T R U S T S U M M A R Y |

17 |

Schedule of Investments December 31, 2022 |

BlackRock Core Bond Trust (BHK) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||||||

Asset-Backed Securities |

||||||||||||

522 Funding CLO Ltd. (a)(b) |

||||||||||||

Series 2019-4A, Class CR, (3 mo. LIBOR US + 2.40%), 6.64%, 04/20/30 |

USD | 500 | $ | 476,062 | ||||||||

Series 2019-4A, Class DR, (3 mo. LIBOR US + 3.65%), 7.89%, 04/20/30 |

600 | 544,368 | ||||||||||

AGL CLO 3 Ltd., Series 2020-3A, Class D, (3 mo. LIBOR US + 3.30%), 7.38%, 01/15/33 (a)(b) |

250 | 223,255 | ||||||||||

ALM Ltd., Series 2020-1A, Class D, (3 mo. LIBOR US + 6.00%), 10.08%, 10/15/29 (a)(b) |

285 | 248,259 | ||||||||||

AMMC CLO 20 Ltd., Series 2017-20A, Class AR, (3 mo. LIBOR US + 0.87%), 4.95%, 04/17/29 (a)(b) |

373 | 370,699 | ||||||||||

Anchorage Capital CLO Ltd. (a)(b) |

||||||||||||

Series 2013-1A, Class A2R, (3 mo. LIBOR US + 1.65%), 5.59%, 10/13/30 |

380 | 370,894 | ||||||||||

Series 2013-1A, Class CR, (3 mo. LIBOR US + 3.20%), 7.14%, 10/13/30 |

720 | 673,663 | ||||||||||

Apidos CLO XXII, Series 2015-22A, Class CR, (3 mo. LIBOR US + 2.95%), 7.19%, 04/20/31 (a)(b) |

250 | 233,967 | ||||||||||

Apidos CLO XXIV, Series 2016-24A, Class A1AL, (3 mo. LIBOR US + 0.95%), 5.19%, 10/20/30 (a)(b) |

500 | 490,250 | ||||||||||

Apidos CLO XXVI, Series 2017-26A, Class A1AR, (3 mo. LIBOR US + 0.90%), 5.09%, 07/18/29 (a)(b) |

1,090 | 1,076,564 | ||||||||||

Apidos CLO XXVII, Series 2017-27A, Class A1R, (3 mo. LIBOR US + 0.93%), 5.01%, 07/17/30 (a)(b) |

250 | 247,141 | ||||||||||

ASSURANT CLO I Ltd., Series 2017-1A, Class CR, (3 mo. LIBOR US + 2.15%), 6.39%, 10/20/34 (a)(b) |

500 | 457,186 | ||||||||||

Bain Capital Credit CLO Ltd. (a)(b) |

||||||||||||

Series 2021-3A, Class D, (3 mo. LIBOR US + 3.10%), 7.42%, 07/24/34 |

250 | 224,592 | ||||||||||

Series 2021-5A, Class B, (3 mo. LIBOR US + 1.65%), 5.97%, 10/23/34 |

500 | 477,264 | ||||||||||

Barings CLO Ltd., Series 2017-1A, Class D, 7.79%, 07/18/29 |

250 | 237,314 | ||||||||||

Benefit Street Partners CLO II Ltd., Series 2013-IIA, Class A1R2, (3 mo. LIBOR US + 0.87%), 4.95%, 07/15/29 (a)(b) |

267 | 264,864 | ||||||||||

Birch Grove CLO 3 Ltd., Series 2021-3A, Class D1, (3 mo. LIBOR US + 3.20%), 7.43%, 01/19/35 (a)(b) |

250 | 226,413 | ||||||||||

Birch Grove CLO Ltd., Series 19A, Class DR, (3 mo. LIBOR US + 3.35%), 8.12%, 06/15/31 (a)(b) |

1,000 | 941,549 | ||||||||||

BlueMountain CLO XXVIII Ltd., Series 2021-28A, Class D, (3 mo. LIBOR US + 2.90%), 6.98%, 04/15/34 (a)(b) |

500 | 454,783 | ||||||||||

Buttermilk Park CLO Ltd., Series 2018-1A, Class D, (3 mo. LIBOR US + 3.10%), 7.18%, 10/15/31 (a)(b) |

250 | 220,951 | ||||||||||

Canyon Capital CLO Ltd. (a)(b) |

||||||||||||

Series 2016-1A, Class CR, (3 mo. LIBOR US + 1.90%), 5.98%, 07/15/31 |

250 | 234,598 | ||||||||||

Series 2021-2A, Class D, (3 mo. LIBOR US + 3.35%), 7.43%, 04/15/34 |

500 | 460,893 | ||||||||||

Carlyle Global Market Strategies CLO Ltd. (a)(b) |

||||||||||||

Series 2013-1A, Class A1RR, (3 mo. LIBOR US + 0.95%), 5.60%, 08/14/30 |

247 | 244,358 | ||||||||||

Series 2013-1A, Class CR, (3 mo. LIBOR US + 3.35%), 8.00%, 08/14/30 |

1,000 | 902,476 | ||||||||||

Carlyle U.S. CLO Ltd., Series 2022-6A, Class C, 8.60%, 10/25/34 |

250 | 249,632 | ||||||||||

CarVal CLO II Ltd., Series 2019-1A, Class DR, (3 mo. LIBOR US + 3.20%), 7.44%, 04/20/32 (a)(b) |

500 | 470,032 | ||||||||||

Security |

Par (000) |

Value |

||||||||||

Asset-Backed Securities (continued) |

||||||||||||

CarVal CLO III Ltd., Series 2019-2A, Class E, (3 mo. LIBOR US + 6.44%), 10.68%, 07/20/32 (a)(b) |

USD | 500 | $ | 432,980 | ||||||||

CarVal CLO VC Ltd., Series 2021-2A, Class D, (3 mo. LIBOR US + 3.25%), 7.33%, 10/15/34 (a)(b) |

250 | 229,744 | ||||||||||

CBAM Ltd., Series 2017-1A, Class C, (3 mo. LIBOR US + 2.40%), 6.64%, 07/20/30 (a)(b) |

350 | 332,943 | ||||||||||

Cedar Funding IX CLO Ltd. (a)(b) |

||||||||||||

Series 2018-9A, Class A1, (3 mo. LIBOR US + 0.98%), 5.22%, 04/20/31 |

250 | 246,432 | ||||||||||

Series 2018-9A, Class D, (3 mo. LIBOR US + 2.60%), 6.84%, 04/20/31 |

250 | 233,203 | ||||||||||

Cedar Funding VII CLO Ltd., Series 2018-7A, Class A1, (3 mo. LIBOR US + 1.00%), 5.24%, 01/20/31 (a)(b) |

500 | 493,840 | ||||||||||

Cedar Funding X CLO Ltd., Series 2019-10A, Class BR, (3 mo. LIBOR US + 1.60%), 5.84%, 10/20/32 (a)(b) |

930 | 899,606 | ||||||||||

Cedar Funding XIV CLO Ltd., Series 2021-14A, Class B, (3 mo. LIBOR US + 1.60%), 5.68%, 07/15/33 (a)(b) |

500 | 483,433 | ||||||||||

CIFC Funding I Ltd. (a)(b) |

||||||||||||

Series 2019-1A, Class DR, (3 mo. LIBOR US + 3.10%), 7.34%, 04/20/32 |

500 | 473,933 | ||||||||||

Series 2020-1A, Class DR, (3 mo. LIBOR US + 3.10%), 7.18%, 07/15/36 |

500 | 467,075 | ||||||||||

CIFC Funding II Ltd., Series 2017-2A, Class AR, (3 mo. LIBOR US + 0.95%), 5.19%, 04/20/30 (a)(b) |

497 | 491,018 | ||||||||||

CIFC Funding III Ltd., Series 2015-3A, Class AR, (3 mo. LIBOR US + 0.87%), 5.10%, 04/19/29 (a)(b) |

241 | 238,092 | ||||||||||

CIFC Funding IV Ltd., Series 2017-4A, Class A1R, (3 mo. LIBOR US + 0.95%), 5.27%, 10/24/30 (a)(b) |

500 | 494,549 | ||||||||||

CIFC Funding Ltd. (a)(b) |

||||||||||||

Series 2013-1A, Class CR, (3 mo. LIBOR US + 3.55%), 7.63%, 07/16/30 |

500 | 445,641 | ||||||||||

Series 2014-2RA, Class B1, (3 mo. LIBOR US + 2.80%), 7.12%, 04/24/30 |

750 | 700,171 | ||||||||||

Series 2014-3A, Class BR2, (3 mo. LIBOR US + 1.80%), 6.12%, 10/22/31 |

250 | 242,041 | ||||||||||

Series 2015-1A, Class ARR, (3 mo. LIBOR US + 1.11%), 5.43%, 01/22/31 |

1,000 | 986,993 | ||||||||||

CIFC Funding VII Ltd. |

||||||||||||

Series 2022-7A, Class C, 8.06%, 10/22/35 |

500 | 497,207 | ||||||||||

Series 2022-7A, Class D, 9.56%, 10/22/35 |

600 | 587,136 | ||||||||||

CWHEQ Revolving Home Equity Loan Trust, Series 2006-I, Class 1A, (1 mo. LIBOR US + 0.14%), 4.46%, 01/15/37 (a) |

1,167 | 1,071,509 | ||||||||||

Dewolf Park CLO Ltd., Series 2017-1A, Class DR, (3 mo. LIBOR US + 2.85%), 6.93%, 10/15/30 (a)(b) |

280 | 249,861 | ||||||||||

Dryden 106 CLO Ltd., 8.46%, 10/15/35 |

500 | 496,928 | ||||||||||

Dryden 37 Senior Loan Fund, Series 2015-37A, Class AR, (3 mo. LIBOR US + 1.10%), 5.18%, 01/15/31 (a)(b) |

250 | 246,717 | ||||||||||

Dryden 50 Senior Loan Fund, Series 2017-50A, Class B, (3 mo. LIBOR US + 1.65%), 5.73%, 07/15/30 (a)(b) |

250 | 241,900 | ||||||||||

Dryden 53 CLO Ltd., Series 2017-53A, Class B, (3 mo. LIBOR US + 1.40%), 5.48%, 01/15/31 (a)(b) |

1,320 | 1,274,761 | ||||||||||

Dryden 64 CLO Ltd., Series 2018-64A, Class D, (3 mo. LIBOR US + 2.65%), 6.84%, 04/18/31 (a)(b) |

1,250 | 1,153,890 | ||||||||||

18 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Schedule of Investments (continued) December 31, 2022 |

BlackRock Core Bond Trust (BHK) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||||||

Asset-Backed Securities (continued) |

||||||||||||

Dryden 78 CLO Ltd., Series 2020-78A, Class D, (3 mo. LIBOR US + 3.00%), 7.08%, 04/17/33 (a)(b) |

USD | 250 | $ | 228,392 | ||||||||

Dryden XXVIII Senior Loan Fund (a)(b) |

||||||||||||

Series 2013-28A, Class A1LR, (3 mo. LIBOR US + 1.20%), 5.81%, 08/15/30 |

250 | 247,995 | ||||||||||

Series 2013-28A, Class B1LR, (3 mo. LIBOR US + 3.15%), 7.76%, 08/15/30 |

1,000 | 936,880 | ||||||||||

Eaton Vance CLO Ltd., Series 2015-1A, Class A2R, (3 mo. LIBOR US + 1.25%), 5.49%, 01/20/30 (a)(b) |

1,000 | 966,129 | ||||||||||

EDvestinU Private Education Loan Issue No. 3 LLC, Series 2021-A, Class B, 3.50%, 11/25/50 (b) |

110 | 85,226 | ||||||||||

Elmwood CLO 21 Ltd., Series 2022-8A, Class C, 8.42%, 11/20/35 |

500 | 497,026 | ||||||||||

Elmwood CLO IV Ltd., Series 2020-1A, Class B, (3 mo. LIBOR US + 1.70%), 5.78%, 04/15/33 (a)(b) |

250 | 241,375 | ||||||||||

Elmwood CLO V Ltd., Series 2020-2A, Class CR, (3 mo. LIBOR US + 2.00%), 6.24%, 10/20/34 (a)(b) |

436 | 406,624 | ||||||||||

Elmwood CLO VI Ltd., Series 2020-3A, Class BR, (3 mo. LIBOR US + 1.65%), 5.89%, 10/20/34 (a)(b) |

250 | 241,383 | ||||||||||

Fairstone Financial Issuance Trust I, Series 2020-1A, Class C, 5.16%, 10/20/39 (b) |

CAD | 170 | 113,525 | |||||||||

Galaxy XX CLO Ltd., Series 2015-20A, Class CR, (3 mo. LIBOR US + 1.75%), 5.99%, 04/20/31 (a)(b) |

USD | 250 | 235,605 | |||||||||

Galaxy XXIII CLO Ltd., Series 2017-23A, Class AR, (3 mo. LIBOR US + 0.87%), 5.19%, 04/24/29 (a)(b) |

465 | 460,628 | ||||||||||

Galaxy XXVII CLO Ltd., Series 2018-27A, Class A, (3 mo. LIBOR US + 1.02%), 5.66%, 05/16/31 (a)(b) |

2,000 | 1,972,115 | ||||||||||

Generate CLO 2 Ltd., Series 2A, Class AR, (3 mo. LIBOR US + 1.15%), 5.47%, 01/22/31 (a)(b) |

250 | 246,920 | ||||||||||

Generate CLO 3 Ltd., Series 3A, Class DR, (3 mo. LIBOR US + 3.60%), 7.84%, 10/20/29 (a)(b) |

1,750 | 1,599,701 | ||||||||||

Generate CLO 4 Ltd., Series 4A, Class DR, (3 mo. LIBOR US + 3.15%), 7.39%, 04/20/32 (a)(b) |

1,500 | 1,383,408 | ||||||||||

Generate CLO 6 Ltd., Series 6A, Class DR, (3 mo. LIBOR US + 3.50%), 7.82%, 01/22/35 (a)(b) |

750 | 664,406 | ||||||||||

GoldenTree Loan Management U.S. CLO 3 Ltd., Series 2018-3A, Class B1, (3 mo. LIBOR US + 1.55%), 5.79%, 04/20/30 (a)(b) |

250 | 243,139 | ||||||||||

GoldenTree Loan Management U.S. CLO 4 Ltd., Series 2019-5A, Class BR, (3 mo. LIBOR US + 1.60%), 5.92%, 04/24/31 (a)(b) |

500 | 488,571 | ||||||||||

GoldenTree Loan Opportunities IX Ltd., Series 2014- 9A, Class BR2, (3 mo. LIBOR US + 1.60%), 6.01%, 10/29/29 (a)(b) |

1,500 | 1,465,345 | ||||||||||

GoldenTree Loan Opportunities X Ltd., Series 2015- 10A, Class DR, (3 mo. LIBOR US + 3.05%), 7.29%, 07/20/31 (a)(b) |

250 | 235,452 | ||||||||||

Golub Capital Partners CLO 55B Ltd., Series 2021- 55A, Class E, (3 mo. LIBOR US + 6.56%), 10.80%, 07/20/34 (a)(b) |

250 | 220,129 | ||||||||||

Grippen Park CLO Ltd., Series 2017-1A, Class D, (3 mo. LIBOR US + 3.30%), 7.54%, 01/20/30 (a)(b) |

250 | 231,506 | ||||||||||

Gulf Stream Meridian 1 Ltd., Series 2020-IA, Class E, (3 mo. LIBOR US + 6.45%), 10.53%, 04/15/33 (a)(b) . |

500 | 433,479 | ||||||||||

Highbridge Loan Management, Series 3A-2014, Class CR, (3 mo. LIBOR US + 3.60%), 7.79%, 07/18/29 (a)(b) |

1,000 | 894,660 | ||||||||||

Jay Park CLO Ltd., Series 2016-1A, Class CR, (3 mo. LIBOR US + 2.65%), 6.89%, 10/20/27 (a)(b) |

500 | 473,622 | ||||||||||

Security |

Par (000) |

Value |

||||||||||

Asset-Backed Securities (continued) |

||||||||||||

Litigation Fee Residual, 4.00%, 10/30/27 (c) |

USD | 918 | $ | 877,906 | ||||||||

Long Beach Mortgage Loan Trust, Series 2006-8, Class 2A4, (1 mo. LIBOR US + 0.48%), 4.87%, 09/25/36 (a) |

6,188 | 1,737,763 | ||||||||||

Madison Park Funding LXII Ltd., Series 2022-62A, Class A1, (3 mo. SOFR + 2.25%), 4.76%, 07/17/33 (a)(b) |

760 | 756,320 | ||||||||||

Madison Park Funding XVII Ltd., Series 2015-17A, Class DR, (3 mo. LIBOR US + 3.60%), 7.88%, 07/21/30 (a)(b) |

1,000 | 938,554 | ||||||||||

Madison Park Funding XXIII Ltd. (a)(b) |

||||||||||||

Series 2017-23A, Class AR, (3 mo. LIBOR US + 0.97%), 5.33%, 07/27/31 |

1,000 | 987,920 | ||||||||||

Series 2017-23A, Class CR, (3 mo. LIBOR US + 2.00%), 6.36%, 07/27/31 |

600 | 572,090 | ||||||||||

Madison Park Funding XXV Ltd. (a)(b) |

||||||||||||

Series 2017-25A, Class A1R, (3 mo. LIBOR US + 0.97%), 5.33%, 04/25/29 |

1,478 | 1,456,821 | ||||||||||

Series 2017-25A, Class A2R, (3 mo. LIBOR US + 1.65%), 6.01%, 04/25/29 |

250 | 242,678 | ||||||||||

Madison Park Funding XXXI Ltd., Series 2018-31A, Class D, (3 mo. LIBOR US + 3.00%), 7.32%, 01/23/31 (a)(b) |

625 | 588,297 | ||||||||||

Madison Park Funding XXXIV Ltd., Series 2019-34A, Class DR, (3 mo. LIBOR US + 3.35%), 7.71%, 04/25/32 (a)(b) |

250 | 238,349 | ||||||||||

Madison Park Funding XXXVIII Ltd., Series 2021- 38A, Class C, (3 mo. LIBOR US + 1.90%), 5.98%, 07/17/34 (a)(b) |

250 | 230,252 | ||||||||||

Marble Point CLO XVII Ltd., Series 2020-1A, Class D, (3 mo. LIBOR US + 3.75%), 7.99%, 04/20/33 (a)(b) |

250 | 223,364 | ||||||||||

Marble Point CLO XXIII Ltd., Series 2021-4A, Class D1, (3 mo. LIBOR US + 3.65%), 7.97%, 01/22/35 (a)(b) |

250 | 227,808 | ||||||||||

Mariner Finance Issuance Trust, Series 2022-AA, Class A, 6.45%, 10/20/37 |

515 | 511,358 | ||||||||||

Navient Private Education Refi Loan Trust (b) |

||||||||||||

Series 2021-DA, Class C, 3.48%, 04/15/60 |

770 | 645,265 | ||||||||||

Series 2021-DA, Class D, 4.00%, 04/15/60 |

440 | 372,571 | ||||||||||

Nelnet Student Loan Trust (b) |

||||||||||||

Series 2021-A, Class D, 4.93%, 04/20/62 |

460 | 375,588 | ||||||||||

Series 2021-BA, Class B, 2.68%, 04/20/62 |

1,983 | 1,574,961 | ||||||||||

Neuberger Berman CLO XXII Ltd., Series 2016-22A, Class BR, (3 mo. LIBOR US + 1.65%), 5.73%, 10/17/30 (a)(b) |

250 | 242,578 | ||||||||||

Neuberger Berman Loan Advisers CLO 37 Ltd., Series 2020-37A, Class CR, (3 mo. LIBOR US + 1.80%), 6.04%, 07/20/31 (a)(b) |

1,163 | 1,099,600 | ||||||||||

Neuberger Berman Loan Advisers NBLA CLO 52 Ltd., Series 2022-52A, Class D, 10.33%, 10/24/35 (c) |

568 | 568,000 | ||||||||||

OCP CLO Ltd. (a)(b) |

||||||||||||

Series 2015-9A, Class BR2, (3 mo. SOFR + 1.75%), 5.61%, 01/15/33 |

250 | 239,990 | ||||||||||

Series 2017-13A, Class A1AR, (3 mo. LIBOR US + 0.96%), 5.04%, 07/15/30 |

1,000 | 986,840 | ||||||||||

Series 2017-14A, Class A2, (3 mo. LIBOR US + 1.50%), 6.18%, 11/20/30 |

1,320 | 1,278,872 | ||||||||||

Octagon 54 Ltd., Series 2021-1A, Class D, (3 mo. LIBOR US + 3.05%), 7.13%, 07/15/34 (a)(b) |

250 | 231,309 | ||||||||||

S C H E D U L E O F I N V E S T M E N T S |

19 |

Schedule of Investments (continued) December 31, 2022 |

BlackRock Core Bond Trust (BHK) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||||||

Asset-Backed Securities (continued) |

||||||||||||

Octagon Investment Partners XV Ltd., Series 2013- 1A, Class A1RR, (3 mo. LIBOR US + 0.97%), 5.20%, 07/19/30 (a)(b) |

USD | 2,880 | $ | 2,842,498 | ||||||||

Octagon Investment Partners XVII Ltd., Series 2013- 1A, Class BR2, (3 mo. LIBOR US + 1.40%), 5.76%, 01/25/31 (a)(b) |

500 | 481,883 | ||||||||||

Octagon Investment Partners XXI Ltd., Series 2014- 1A, Class AAR3, (3 mo. LIBOR US + 1.00%), 5.65%, 02/14/31 (a)(b) |

250 | 245,298 | ||||||||||

Octagon Investment Partners XXII Ltd., Series 2014- 1A, Class DRR, (3 mo. LIBOR US + 2.75%), 7.07%, 01/22/30 (a)(b) |

500 | 441,109 | ||||||||||

OneMain Financial Issuance Trust, Series 2020-1A, Class A, 3.84%, 05/14/32 (b) |

900 | 893,614 | ||||||||||

OZLM VIII Ltd., Series 2014-8A, Class CRR, (3 mo. LIBOR US + 3.15%), 7.23%, 10/17/29 (a)(b) |

875 | 805,253 | ||||||||||

OZLM XXI Ltd., Series 2017-21A, Class C, (3 mo. LIBOR US + 2.67%), 6.91%, 01/20/31 (a)(b) |

1,000 | 874,845 | ||||||||||

Palmer Square CLO Ltd. |

||||||||||||

Series 2013-2A, Class A2R3, (3 mo. LIBOR US + 1.50%), 5.73%, 10/17/31 (a)(b) |

250 | 241,171 | ||||||||||

Series 2015-2A, Class CR2, (3 mo. LIBOR US + 2.75%), 6.99%, 07/20/30 (a)(b) |

250 | 230,260 | ||||||||||

Series 2020-3A, Class A2R, (3 mo. LIBOR US + 1.60%), 6.21%, 11/15/31 (a)(b) |

250 | 241,842 | ||||||||||

Series 2022-4A, Class C, 8.07%, 10/20/35 |

1,000 | 995,427 | ||||||||||

Palmer Square Loan Funding Ltd. (a)(b) |

||||||||||||

Series 2020-1A, Class C, (3 mo. LIBOR US + 2.50%), 7.18%, 02/20/28 |

250 | 244,049 | ||||||||||

Series 2021-1A, Class A1, (3 mo. LIBOR US + 0.90%), 5.14%, 04/20/29 |

142 | 140,555 | ||||||||||

Series 2021-2A, Class A1, (3 mo. LIBOR US + 0.80%), 5.48%, 05/20/29 |

169 | 166,039 | ||||||||||

Series 2021-3A, Class A1, (3 mo. LIBOR US + 0.80%), 5.04%, 07/20/29 |

569 | 561,189 | ||||||||||

Park Avenue Institutional Advisers CLO Ltd., Series 2017-1A, Class DR, (3 mo. LIBOR US + 6.81%), 11.46%, 02/14/34 (a)(b) |

1,300 | 1,111,899 | ||||||||||

PPM CLO 2 Ltd., Series 2019-2A, Class DR, (3 mo. LIBOR US + 3.40%), 7.63%, 04/16/32 (a)(b) |

250 | 229,033 | ||||||||||

Prodigy Finance DAC, Series 2021-1A, Class C, (1 mo. LIBOR US + 3.75%), 8.14%, 07/25/51 (a)(b) |

250 | 245,682 | ||||||||||

Rad CLO 3 Ltd., Series 2019-3A, Class DR, (3 mo. LIBOR US + 2.75%), 6.83%, 04/15/32 (a)(b) |

400 | 368,056 | ||||||||||

Regatta XI Funding Ltd., Series 2018-1A, Class D, (3 mo. LIBOR US + 2.85%), 6.93%, 07/17/31 (a)(b) |

370 | 345,791 | ||||||||||

Regional Management Issuance Trust, Series 2021-A, Class A, 6.57%, 11/17/32 |

200 | 201,111 | ||||||||||

Republic Finance Issuance Trust, Series 2020-A, Class C, 4.05%, 11/20/30 (b) |

240 | 217,912 | ||||||||||

Romark CLO Ltd., Series 2017-1A, Class B, (3 mo. LIBOR US + 2.15%), 6.47%, 10/23/30 (a)(b) |

500 | 477,624 | ||||||||||

Shackleton CLO Ltd., Series 2015-7RA, Class C, (3 mo. LIBOR US + 2.35%), 6.43%, 07/15/31 (a)(b) |

250 | 234,705 | ||||||||||

SMB Private Education Loan Trust (b) |

||||||||||||

Series 2021-C, Class C, 3.00%, 01/15/53 (c) |

190 | 158,572 | ||||||||||

Series 2021-C, Class D, 3.93%, 01/15/53 |

160 | 141,530 | ||||||||||

Sterling Coofs Trust (c) |

||||||||||||

Series 2004-1, Class A, 2.36%, 04/15/29 |

776 | 8,296 | ||||||||||

Security |

Par (000) |

Value |

||||||||||

Asset-Backed Securities (continued) |

||||||||||||

Sterling Coofs Trust (c) (continued) |

||||||||||||

Series 2004-2, Class Note, 2.08%, 03/30/30 (b) |

USD | 721 | $ | 7,207 | ||||||||

Structured Asset Securities Corp. Pass-Through Certificates, Series 2002-AL1, Class A2, 3.45%, 02/25/32 |

67 | 61,308 | ||||||||||

TCW CLO Ltd., Series 2020-1A, Class DRR, (3 mo. LIBOR US + 3.40%), 7.64%, 04/20/34 (a)(b) |

250 | 227,852 | ||||||||||

TICP CLO I-2 Ltd., Series 2018-IA, Class C, (3 mo. LIBOR US + 3.04%), 7.37%, 04/26/28 (a)(b) |

500 | 481,299 | ||||||||||

TICP CLO IX Ltd., Series 2017-9A, Class D, (3 mo. LIBOR US + 2.90%), 7.14%, 01/20/31 (a)(b) |

500 | 474,596 | ||||||||||

TICP CLO XV Ltd., Series 2020-15A, Class D, (3 mo. LIBOR US + 3.15%), 7.39%, 04/20/33 (a)(b) |

250 | 231,815 | ||||||||||

Trestles CLO Ltd. (a)(b) |

||||||||||||

Series 2017-1A, Class B1R, (3 mo. LIBOR US + 1.75%), 6.11%, 04/25/32 |

1,750 | 1,616,266 | ||||||||||

Series 2017-1A, Class CR, (3 mo. LIBOR US + 2.90%), 7.26%, 04/25/32 |

250 | 232,319 | ||||||||||

Trimaran CAVU Ltd. |

||||||||||||

Series 2019-2A, Class C, (3 mo. LIBOR US + 4.72%), 8.91%, 11/26/32 (a)(b) |

500 | 463,069 | ||||||||||

Series 2021-2A, Class D1, (3 mo. LIBOR US + 3.25%), 7.61%, 10/25/34 (a)(b) |

500 | 453,243 | ||||||||||

Series 2022-2A, Class D, 10.47%, 01/20/36 |

400 | 396,319 | ||||||||||

Unique Pub Finance Co. PLC, Series N, 6.46%, 03/30/32 (d) |

GBP | 100 | 120,901 | |||||||||

Voya CLO Ltd. |

||||||||||||

Series 2014-2A, Class A1RR, (3 mo. LIBOR US + 1.02%), 5.10%, 04/17/30 (a)(b) |

USD | 237 | 233,539 | |||||||||

Series 2017-2A, Class A2AR, (3 mo. LIBOR US + 1.65%), 5.73%, 06/07/30 (a)(b) |

250 | 242,376 | ||||||||||

Series 2017-4A, Class A1, (3 mo. LIBOR US + 1.13%), 5.21%, 10/15/30 (a)(b) |

250 | 246,896 | ||||||||||

Series 2018-2A, Class A2, (3 mo. LIBOR US + 1.25%), 5.33%, 07/15/31 (a)(b) |

1,000 | 961,165 | ||||||||||

Series 2022-4A, Class C, 8.24%, 10/20/33 |

1,000 | 996,564 | ||||||||||

Whetstone Park CLO Ltd., Series 2021-1A, Classs 1A, (3 mo. LIBOR US + 1.60%), 5.84%, 01/20/35 (a)(b) |

725 | 693,318 | ||||||||||

Whitebox CLO I Ltd., Series 2019-1A, Class CR, (3 mo. LIBOR US + 3.05%), 7.37%, 07/24/32 (a)(b) |

500 | 464,754 | ||||||||||

Whitebox CLO II Ltd., Series 2020-2A, Class DR, (3 mo. LIBOR US + 3.35%), 7.67%, 10/24/34 (a)(b) |

500 | 453,309 | ||||||||||

Whitebox CLO III Ltd. (a)(b) |

||||||||||||

Series 2021-3A, Class D, (3 mo. LIBOR US + 3.35%), 7.43%, 10/15/34 |

250 | 233,839 | ||||||||||

Series 2021-3A, Class E, (3 mo. LIBOR US + 6.85%), 10.93%, 10/15/34 |

250 | 227,048 | ||||||||||

York CLO 1 Ltd. (a)(b) |

||||||||||||

Series 2014-1A, Class CRR, (3 mo. LIBOR US + 2.10%), 6.42%, 10/22/29 |

250 | 241,100 | ||||||||||

Series 2014-1A, Class DRR, (3 mo. LIBOR US + 3.01%), 7.33%, 10/22/29 |

250 | 237,110 | ||||||||||

Total Asset-Backed Securities — 13.7% (Cost: $84,705,242) |

80,294,380 | |||||||||||

20 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Schedule of Investments (continued) December 31, 2022 |

BlackRock Core Bond Trust (BHK) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||||||

Corporate Bonds |

||||||||||||

Advertising Agencies — 0.1% |

||||||||||||

Interpublic Group of Cos., Inc., 5.40%, 10/01/48 |

USD | 500 | $ | 456,893 | ||||||||

Aerospace & Defense — 2.5% |

||||||||||||

Amsted Industries, Inc., 5.63%, 07/01/27 (b) |

30 | 28,460 | ||||||||||

Boeing Co. |

||||||||||||

2.95%, 02/01/30 |

800 | 677,538 | ||||||||||

5.15%, 05/01/30 |

1,140 | 1,112,229 | ||||||||||

3.63%, 02/01/31 |

69 | 60,456 | ||||||||||

Bombardier, Inc. (b) |

||||||||||||

7.50%, 03/15/25 |

35 | 34,661 | ||||||||||

7.13%, 06/15/26 (e) |

846 | 820,801 | ||||||||||

7.88%, 04/15/27 (e) |

395 | 383,140 | ||||||||||

6.00%, 02/15/28 (e) |

667 | 616,788 | ||||||||||

7.45%, 05/01/34 |

100 | 100,000 | ||||||||||

Eaton Corp., 4.15%, 11/02/42 |

500 | 427,290 | ||||||||||

F-Brasile SpA/F-Brasile U.S. LLC, Series XR, 7.38%, 08/15/26 (b) |

200 | 163,500 | ||||||||||

General Electric Co., 6.15%, 08/07/37 |

2,150 | 2,197,819 | ||||||||||

Lockheed Martin Corp., 4.09%, 09/15/52 (e) |

1,410 | 1,180,824 | ||||||||||

Northrop Grumman Corp., 3.85%, 04/15/45 |

350 | 279,149 | ||||||||||

Raytheon Technologies Corp., 2.38%, 03/15/32 |

1,000 | 809,816 | ||||||||||

Rolls-Royce PLC, 5.75%, 10/15/27 (b) |

1,000 | 952,500 | ||||||||||

Spirit AeroSystems, Inc. |

||||||||||||

7.50%, 04/15/25 (b) |

22 | 21,740 | ||||||||||

9.38%, 11/30/29 |

329 | 346,338 | ||||||||||

TransDigm, Inc. |

||||||||||||

8.00%, 12/15/25 (b) |

130 | 131,923 | ||||||||||

6.25%, 03/15/26 (b)(e) |

3,355 | 3,308,667 | ||||||||||

6.38%, 06/15/26 |

31 | 30,162 | ||||||||||

7.50%, 03/15/27 |

71 | 70,248 | ||||||||||

4.63%, 01/15/29 |

393 | 345,553 | ||||||||||

4.88%, 05/01/29 (e) |

203 | 177,067 | ||||||||||

Triumph Group, Inc., 8.88%, 06/01/24 (b) |

509 | 517,907 | ||||||||||

| 14,794,576 | ||||||||||||

Airlines — 1.5% |

||||||||||||

Air Canada, 3.88%, 08/15/26 (b)(e) |

324 | 286,977 | ||||||||||

Allegiant Travel Co., 7.25%, 08/15/27 (b) |

80 | 76,093 | ||||||||||

American Airlines Pass-Through Trust |

||||||||||||

Series 2013-2, Class A, 4.95%, 07/15/24 |

759 | 757,934 | ||||||||||

Series 2015-2, Class A, 4.00%, 03/22/29 |

1,038 | 843,028 | ||||||||||

Series 2015-2, Class AA, 3.60%, 03/22/29 |

1,038 | 931,183 | ||||||||||

American Airlines, Inc., 11.75%, 07/15/25 (b) |

325 | 348,595 | ||||||||||

American Airlines, Inc./AAdvantage Loyalty IP Ltd. (b) |

||||||||||||

5.50%, 04/20/26 |

179 | 171,876 | ||||||||||

5.75%, 04/20/29 |

677 | 619,050 | ||||||||||

Avianca Midco 2 PLC, 9.00%, 12/01/28 (b) |

150 | 109,774 | ||||||||||

Delta Air Lines, Inc./SkyMiles IP Ltd., 4.75%, 10/20/28 (b) |

6 | 5,321 | ||||||||||

Deutsche Lufthansa AG, 2.88%, 05/16/27 (d) |

EUR | 100 | 92,862 | |||||||||

Gol Finance SA, 7.00%, 01/31/25 (b) |

USD | 200 | 87,038 | |||||||||

Hawaiian Brand Intellectual Property Ltd./HawaiianMiles Loyalty Ltd., 5.75%, 01/20/26 (b) |

168 | 152,040 | ||||||||||

Mileage Plus Holdings LLC/Mileage Plus Intellectual Property Assets Ltd., 6.50%, 06/20/27 (b) |

740 | 735,958 | ||||||||||

United Airlines Pass-Through Trust |

||||||||||||

Series 2013-1, Class A, 4.30%, 02/15/27 |

2,413 | 2,244,070 | ||||||||||

Series 2020-1, Class A, 5.88%, 10/15/27 |

379 | 374,052 | ||||||||||

Security |

Par (000) |

Value |

||||||||||

Airlines (continued) |

||||||||||||

United Airlines Pass-Through Trust (continued) |

||||||||||||

Series 2020-1, Class B, 4.88%, 01/15/26 |

USD | 27 | $ | 25,373 | ||||||||

United Airlines, Inc. (b) |

||||||||||||

4.38%, 04/15/26 (e) |

423 | 392,090 | ||||||||||

4.63%, 04/15/29 |

627 | 545,926 | ||||||||||

| 8,799,240 | ||||||||||||

Auto Components — 0.6% |

||||||||||||

Aptiv PLC, 4.40%, 10/01/46 |

465 | 344,204 | ||||||||||

Clarios Global LP, 6.75%, 05/15/25 (b) |

154 | 154,356 | ||||||||||

Clarios Global LP/Clarios U.S. Finance Co. (b) |

||||||||||||

6.25%, 05/15/26 |

743 | 726,284 | ||||||||||

8.50%, 05/15/27 |

1,774 | 1,732,305 | ||||||||||

Dealer Tire LLC/DT Issuer LLC, 8.00%, 02/01/28 (b) |

111 | 97,666 | ||||||||||

Goodyear Tire & Rubber Co. |

||||||||||||

5.00%, 07/15/29 |

78 | 65,064 | ||||||||||

5.63%, 04/30/33 |

81 | 66,120 | ||||||||||

ZF Finance GmbH, 3.75%, 09/21/28 (d) |

EUR | 100 | 89,732 | |||||||||

| 3,275,731 | ||||||||||||

Automobiles — 1.4% |

||||||||||||

Asbury Automotive Group, Inc. |

||||||||||||

4.50%, 03/01/28 |

USD | 18 | 15,847 | |||||||||

4.75%, 03/01/30 |

84 | 70,254 | ||||||||||

5.00%, 02/15/32 (b) |

106 | 87,206 | ||||||||||

Constellation Automotive Financing PLC, 4.88%, 07/15/27 (d) |

GBP | 100 | 78,788 | |||||||||

Ford Motor Co. |

||||||||||||

0.00%, 03/15/26 (f) |

USD | 216 | 203,796 | |||||||||

4.35%, 12/08/26 |

7 | 6,638 | ||||||||||

3.25%, 02/12/32 (e) |

420 | 314,976 | ||||||||||

6.10%, 08/19/32 (e) |

126 | 116,343 | ||||||||||

4.75%, 01/15/43 |

2,000 | 1,435,586 | ||||||||||

Ford Motor Credit Co. LLC |

||||||||||||

4.69%, 06/09/25 |

200 | 190,293 | ||||||||||

4.39%, 01/08/26 |

200 | 186,292 | ||||||||||

2.70%, 08/10/26 |

200 | 173,680 | ||||||||||

4.95%, 05/28/27 (e) |

401 | 374,093 | ||||||||||

4.13%, 08/17/27 |

200 | 179,000 | ||||||||||

2.90%, 02/16/28 (e) |

200 | 165,184 | ||||||||||

3.63%, 06/17/31 |

300 | 235,667 | ||||||||||

General Motors Co. |

||||||||||||

5.40%, 10/15/29 |

414 | 395,079 | ||||||||||

5.60%, 10/15/32 |

69 | 64,101 | ||||||||||

6.25%, 10/02/43 (e) |

2,506 | 2,316,868 | ||||||||||

General Motors Financial Co., Inc., 4.25%, 05/15/23 |

807 | 803,662 | ||||||||||

Group 1 Automotive, Inc., 4.00%, 08/15/28 (b) |

30 | 25,393 | ||||||||||

Ken Garff Automotive LLC, 4.88%, 09/15/28 (b) |

82 | 68,595 | ||||||||||

LCM Investments Holdings II LLC, 4.88%, 05/01/29 (b) . |

182 | 145,744 | ||||||||||

Lithia Motors, Inc., 3.88%, 06/01/29 (b) |

89 | 73,168 | ||||||||||

MajorDrive Holdings IV LLC, 6.38%, 06/01/29 (b) |

120 | 89,543 | ||||||||||

Penske Automotive Group, Inc. |

||||||||||||

3.50%, 09/01/25 |

29 | 26,914 | ||||||||||

3.75%, 06/15/29 |

46 | 37,336 | ||||||||||

RCI Banque SA, (5 year EUR Swap + 2.85%), 2.63%, 02/18/30 (a)(d) |

EUR | 100 | 95,116 | |||||||||

Wabash National Corp., 4.50%, 10/15/28 (b) |

USD | 149 | 126,886 | |||||||||

| 8,102,048 | ||||||||||||

S C H E D U L E O F I N V E S T M E N T S |

21 |

Schedule of Investments (continued) December 31, 2022 |

BlackRock Core Bond Trust (BHK) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||||||

Banks — 1.1% |

||||||||||||

Banco Bilbao Vizcaya Argentaria SA, (5 year USD Swap + 3.87%), 6.13% (a)(g) |

USD | 2,000 | $ | 1,702,859 | ||||||||

Bangkok Bank PCL, (5 year CMT + 4.73%), 5.00% |

200 | 189,350 | ||||||||||

Bank Negara Indonesia Persero Tbk PT, 3.75%, 03/30/26 (d) |

252 | 229,348 | ||||||||||

Bank of Communications Co. Ltd., (5 year CMT + 3.35%), 3.80% (a)(d)(g) |

518 | 494,690 | ||||||||||

Grupo Aval Ltd., 4.38%, 02/04/30 (b) |

200 | 161,600 | ||||||||||

Krung Thai Bank PCL, (5 year CMT + 3.53%), 4.40% (a)(d)(g) |

252 | 224,563 | ||||||||||

NBK Tier 1 Ltd., (6 year CMT + 2.88%), 3.63% (a)(b)(g) |

209 | 181,935 | ||||||||||

Northern Trust Corp., 6.13%, 11/02/32 |

160 | 168,711 | ||||||||||

PNC Financial Services Group, Inc., 6.04%, 10/28/33 |

132 | 137,425 | ||||||||||

Standard Chartered PLC, (5 year USD ICE Swap + 1.97%), 4.87%, 03/15/33 (a)(b) |

500 | 440,469 | ||||||||||

SVB Financial Group, Series D, (5 year CMT + 3.07%), 4.25% (a)(g) |

1,275 | 836,462 | ||||||||||

Wells Fargo & Co. |

||||||||||||

3.90%, 05/01/45 |

2,250 | 1,733,030 | ||||||||||

Series BB, (5 year CMT + 3.45%), 3.90% (a)(g) |

245 | 214,440 | ||||||||||

| 6,714,882 | ||||||||||||

Beverages — 1.4% |

||||||||||||

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide, Inc., 4.90%, 02/01/46 (e) |

4,600 | 4,181,746 | ||||||||||

ARD Finance SA, (6.50% Cash or 7.25% PIK), 6.50%, 06/30/27 (b)(h) |

701 | 487,568 | ||||||||||

Ardagh Metal Packaging Finance USA LLC/Ardagh Metal Packaging Finance PLC (b) |

||||||||||||

6.00%, 06/15/27 |

372 | 364,168 | ||||||||||

3.25%, 09/01/28 |

200 | 169,889 | ||||||||||

4.00%, 09/01/29 |

1,466 | 1,161,845 | ||||||||||

Ball Corp. |

||||||||||||

5.25%, 07/01/25 |

12 | 11,843 | ||||||||||

2.88%, 08/15/30 |

25 | 19,953 | ||||||||||

3.13%, 09/15/31 (e) |

254 | 203,995 | ||||||||||

Crown Americas LLC, 5.25%, 04/01/30 (b) |

91 | 86,042 | ||||||||||

Crown Cork & Seal Co., Inc., 7.38%, 12/15/26 |

23 | 23,679 | ||||||||||

Mauser Packaging Solutions Holding Co., 5.50%, 04/15/24 (b) |

431 | 419,082 | ||||||||||

Silgan Holdings, Inc., 4.13%, 02/01/28 |

25 | 23,129 | ||||||||||

Trivium Packaging Finance BV (b) |

||||||||||||

5.50%, 08/15/26 |

505 | 463,053 | ||||||||||

8.50%, 08/15/27 |

738 | 677,133 | ||||||||||

| 8,293,125 | ||||||||||||

Biotechnology — 0.5% |

||||||||||||

Amgen, Inc. |

||||||||||||

4.20%, 03/01/33 |

1,000 | 925,128 | ||||||||||

4.40%, 05/01/45 |

500 | 418,910 | ||||||||||

Baxalta, Inc., 5.25%, 06/23/45 |

500 | 477,787 | ||||||||||

Cidron Aida Finco SARL, 5.00%, 04/01/28 (d) |

EUR | 100 | 91,256 | |||||||||

Gilead Sciences, Inc., 4.80%, 04/01/44 |

USD | 1,000 | 916,997 | |||||||||

| 2,830,078 | ||||||||||||

Building Materials (b) — 0.3% |

||||||||||||

Camelot Return Merger Sub, Inc., 8.75%, 08/01/28 |

146 | 133,974 | ||||||||||

Jeld-Wen, Inc., 6.25%, 05/15/25 |

98 | 91,664 | ||||||||||

Masonite International Corp. |

||||||||||||

Class C, 5.38%, 02/01/28 |

17 | 15,718 | ||||||||||

Class C, 3.50%, 02/15/30 |

145 | 117,294 | ||||||||||

Security |

Par (000) |

Value |

||||||||||

Building Materials (continued) |

||||||||||||

New Enterprise Stone & Lime Co., Inc. |

||||||||||||

5.25%, 07/15/28 |

USD | 55 | $ | 48,839 | ||||||||

9.75%, 07/15/28 |

26 | 24,023 | ||||||||||

Smyrna Ready Mix Concrete LLC, 6.00%, 11/01/28 |

509 | 455,402 | ||||||||||

Standard Industries, Inc. |

||||||||||||

5.00%, 02/15/27 |

25 | 23,068 | ||||||||||

4.75%, 01/15/28 |

62 | 55,793 | ||||||||||

4.38%, 07/15/30 |

550 | 448,209 | ||||||||||

3.38%, 01/15/31 |

64 | 48,160 | ||||||||||

Summit Materials LLC/Summit Materials Finance Corp., 5.25%, 01/15/29 |

117 | 108,930 | ||||||||||

| 1,571,074 | ||||||||||||

Building Products — 1.0% |

||||||||||||

Advanced Drainage Systems, Inc. (b) |

||||||||||||

5.00%, 09/30/27 |

202 | 188,365 | ||||||||||

6.38%, 06/15/30 |

513 | 498,462 | ||||||||||

Beacon Roofing Supply, Inc., 4.13%, 05/15/29 (b) |

86 | 71,465 | ||||||||||

Foundation Building Materials, Inc., 6.00%, 03/01/29 (b) |

63 | 47,168 | ||||||||||

GYP Holdings III Corp., 4.63%, 05/01/29 (b) |

159 | 129,818 | ||||||||||

Home Depot, Inc., 5.88%, 12/16/36 |

1,660 | 1,775,230 | ||||||||||

LBM Acquisition LLC, 6.25%, 01/15/29 (b) |

25 | 15,909 | ||||||||||

Lowe’s Cos., Inc. |

||||||||||||

5.00%, 04/15/33 (e) |

1,000 | 976,211 | ||||||||||

4.38%, 09/15/45 |

1,000 | 821,791 | ||||||||||

Specialty Building Products Holdings LLC/SBP Finance Corp., 6.38%, 09/30/26 (b) |

56 | 45,089 | ||||||||||

SRS Distribution, Inc. (b) |

||||||||||||

4.63%, 07/01/28 |

362 | 320,902 | ||||||||||

6.13%, 07/01/29 |

340 | 274,897 | ||||||||||

6.00%, 12/01/29 (e) |

423 | 336,646 | ||||||||||

White Cap Buyer LLC, 6.88%, 10/15/28 (b)(e) |

644 | 557,066 | ||||||||||

White Cap Parent LLC, (8.25% PIK), 8.25%, 03/15/26 (b)(h) |

142 | 122,758 | ||||||||||

| 6,181,777 | ||||||||||||

Capital Markets — 1.7% |

||||||||||||

Blackstone Private Credit Fund |

||||||||||||

7.05%, 09/29/25 (b) |

56 | 55,556 | ||||||||||

3.25%, 03/15/27 |

53 | 44,624 | ||||||||||

Charles Schwab Corp., Series H, (10 year CMT + 3.08%), 4.00% (a)(e)(g) |

5,195 | 4,142,753 | ||||||||||

Compass Group Diversified Holdings LLC, 5.25%, 04/15/29 (b)(e) |

129 | 110,397 | ||||||||||

FMR LLC, 4.95%, 02/01/33 (b) |

2,300 | 2,133,966 | ||||||||||

GLP Capital LP/GLP Financing II, Inc., 3.25%, 01/15/32 |

379 | 302,967 | ||||||||||

Icahn Enterprises LP/Icahn Enterprises Finance Corp. |

||||||||||||

4.75%, 09/15/24 |

112 | 107,380 | ||||||||||

6.25%, 05/15/26 |

101 | 97,051 | ||||||||||

5.25%, 05/15/27 |

356 | 325,954 | ||||||||||

4.38%, 02/01/29 |

207 | 175,050 | ||||||||||

NFP Corp. (b) |

||||||||||||

4.88%, 08/15/28 (e) |

658 | 560,153 | ||||||||||

6.88%, 08/15/28 (e) |

1,270 | 1,046,834 | ||||||||||

7.50%, 10/01/30 |

74 | 69,588 | ||||||||||

Owl Rock Capital Corp. |

||||||||||||

3.75%, 07/22/25 |

129 | 119,184 | ||||||||||

4.25%, 01/15/26 |

12 | 11,016 | ||||||||||

3.40%, 07/15/26 |

46 | 40,165 | ||||||||||

22 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Schedule of Investments (continued) December 31, 2022 |

BlackRock Core Bond Trust (BHK) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||||||

Capital Markets (continued) |

||||||||||||

Owl Rock Core Income Corp. |

||||||||||||

3.13%, 09/23/26 |

USD | 31 | $ | 26,380 | ||||||||

7.75%, 09/16/27 (b) |

215 | 214,304 | ||||||||||

Raymond James Financial, Inc., 4.95%, 07/15/46 |

400 | 355,609 | ||||||||||

SURA Asset Management SA, 4.88%, 04/17/24 (d) |

178 | 176,665 | ||||||||||

| 10,115,596 | ||||||||||||

Chemicals — 1.2% |

||||||||||||

Air Liquide Finance SA, 3.50%, 09/27/46 (b) |

360 | 274,299 | ||||||||||

Alpek SAB de CV, 3.25%, 02/25/31 (b) |

200 | 166,163 | ||||||||||

Ashland LLC, 3.38%, 09/01/31 (b) |

186 | 148,664 | ||||||||||

Avient Corp., 7.13%, 08/01/30 (b) |

116 | 113,394 | ||||||||||

Axalta Coating Systems LLC, 3.38%, 02/15/29 (b) |

498 | 410,932 | ||||||||||

Axalta Coating Systems LLC/Axalta Coating Systems Dutch Holding B BV, 4.75%, 06/15/27 (b)(e) |

242 | 223,705 | ||||||||||

Braskem Idesa SAPI, 6.99%, 02/20/32 (b) |

200 | 142,500 | ||||||||||

Celanese U.S. Holdings LLC, 6.17%, 07/15/27 |

190 | 187,402 | ||||||||||

Diamond BC BV, 4.63%, 10/01/29 (b) |

428 | 343,470 | ||||||||||

Element Solutions, Inc., 3.88%, 09/01/28 (b)(e) |

1,211 | 1,029,350 | ||||||||||

Equate Petrochemical BV, 4.25%, 11/03/26 (d) |

200 | 190,850 | ||||||||||

HB Fuller Co., 4.25%, 10/15/28 |

74 | 65,490 | ||||||||||

Herens Holdco SARL, 4.75%, 05/15/28 (b) |

400 | 298,964 | ||||||||||

Illuminate Buyer LLC/Illuminate Holdings IV, Inc., 9.00%, 07/01/28 (b) |

230 | 192,562 | ||||||||||

Ingevity Corp., 3.88%, 11/01/28 (b) |

57 | 49,012 | ||||||||||

Kobe U.S. Midco 2, Inc., (9.25% Cash or 10.00% PIK), 9.25%, 11/01/26 (b)(h) |

176 | 123,200 | ||||||||||

LSF11 A5 HoldCo LLC, 6.63%, 10/15/29 (b) |

76 | 62,784 | ||||||||||

Minerals Technologies, Inc., 5.00%, 07/01/28 (b) |

114 | 101,528 | ||||||||||

Monitchem HoldCo 3 SA, 5.25%, 03/15/25 (d) |

EUR | 100 | 102,619 | |||||||||

NOVA Chemicals Corp., 4.88%, 06/01/24 (b) |

USD | 41 | 39,667 | |||||||||

Sasol Financing USA LLC, 6.50%, 09/27/28 |

200 | 180,725 | ||||||||||

SCIL IV LLC/SCIL USA Holdings LLC, 5.38%, 11/01/26 (b)(e) |

200 | 169,500 | ||||||||||

Scotts Miracle-Gro Co. |

||||||||||||

4.00%, 04/01/31 |

122 | 93,201 | ||||||||||

4.38%, 02/01/32 |

18 | 13,567 | ||||||||||

Sherwin-Williams Co., 4.50%, 06/01/47 |

350 | 293,714 | ||||||||||

SK Invictus Intermediate II Sarl, 5.00%, 10/30/29 (b) |

372 | 305,040 | ||||||||||

WESCO Distribution, Inc. (b) |

||||||||||||

7.13%, 06/15/25 |

117 | 118,464 | ||||||||||

7.25%, 06/15/28 (e) |

590 | 597,655 | ||||||||||

WR Grace Holdings LLC (b) |

||||||||||||

5.63%, 10/01/24 |

21 | 20,685 | ||||||||||

4.88%, 06/15/27 |

105 | 93,044 | ||||||||||

5.63%, 08/15/29 (e) |

987 | 796,776 | ||||||||||

| 6,948,926 | ||||||||||||

Commercial Services & Supplies — 0.4% |

||||||||||||

ADT Security Corp. (b) |

||||||||||||

4.13%, 08/01/29 |

19 | 16,192 | ||||||||||

4.88%, 07/15/32 |

29 | 24,645 | ||||||||||

Albion Financing 1 SARL/Aggreko Holdings, Inc., 6.13%, 10/15/26 (b) |

200 | 178,362 | ||||||||||

APX Group, Inc. (b) |

||||||||||||

6.75%, 02/15/27 |

123 | 118,394 | ||||||||||

5.75%, 07/15/29 |

181 | 149,902 | ||||||||||

Avis Budget Car Rental LLC/Avis Budget Finance, Inc., 5.38%, 03/01/29 (b)(e) |

26 | 22,241 | ||||||||||

Security |

Par (000) |

Value |

||||||||||

Commercial Services & Supplies (continued) |

||||||||||||

BCP V Modular Services Finance II PLC, 4.75%, 11/30/28 (d) |

EUR | 100 | $ | 89,383 | ||||||||

Fortress Transportation & Infrastructure Investors LLC (b) |

||||||||||||

6.50%, 10/01/25 |

USD | 38 | 35,728 | |||||||||

5.50%, 05/01/28 (e) |

194 | 165,503 | ||||||||||

Herc Holdings, Inc., 5.50%, 07/15/27 (b)(e) |

164 | 152,971 | ||||||||||

Hertz Corp. (b) |

||||||||||||

4.63%, 12/01/26 |

85 | 71,187 | ||||||||||

5.00%, 12/01/29 |

70 | 53,102 | ||||||||||

Metis Merger Sub LLC, 6.50%, 05/15/29 (b) |

82 | 68,838 | ||||||||||

NESCO Holdings II, Inc., 5.50%, 04/15/29 (b) |

146 | 127,750 | ||||||||||

Prime Security Services Borrower LLC/Prime Finance, Inc. (b) |

||||||||||||

5.75%, 04/15/26 |

118 | 113,575 | ||||||||||

6.25%, 01/15/28 (e) |

172 | 156,547 | ||||||||||

Sotheby’s/Bidfair Holdings, Inc., 5.88%, 06/01/29 (b) |

400 | 335,880 | ||||||||||

United Rentals North America, Inc., 5.25%, 01/15/30 |

40 | 37,583 | ||||||||||

Williams Scotsman International, Inc. (b) |

||||||||||||

6.13%, 06/15/25 |

175 | 173,250 | ||||||||||

4.63%, 08/15/28 |

146 | 131,765 | ||||||||||

| 2,222,798 | ||||||||||||

Communications Equipment — 0.3% |

||||||||||||

Ciena Corp., 4.00%, 01/31/30 (b) |

71 | 62,488 | ||||||||||

CommScope Technologies LLC, 6.00%, 06/15/25 (b)(e) . |

530 | 482,300 | ||||||||||

CommScope, Inc. (b) |

||||||||||||

8.25%, 03/01/27 |

96 | 74,400 | ||||||||||

7.13%, 07/01/28 |

171 | 122,242 | ||||||||||

4.75%, 09/01/29 |

355 | 286,201 | ||||||||||

Nokia OYJ |

||||||||||||

4.38%, 06/12/27 |

31 | 29,266 | ||||||||||

6.63%, 05/15/39 |

88 | 83,526 | ||||||||||

Viasat, Inc. (b) |

||||||||||||

5.63%, 09/15/25 |

169 | 156,796 | ||||||||||

6.50%, 07/15/28 |

35 | 26,258 | ||||||||||

Viavi Solutions, Inc., 3.75%, 10/01/29 (b) |

237 | 199,188 | ||||||||||

| 1,522,665 | ||||||||||||

Construction & Engineering — 0.7% |

||||||||||||

ITR Concession Co. LLC, 4.20%, 07/15/25 (b) |

4,000 | 3,847,614 | ||||||||||

Construction Materials (b) — 0.0% |

||||||||||||

American Builders & Contractors Supply Co., Inc. |

||||||||||||

4.00%, 01/15/28 |

63 | 56,208 | ||||||||||

3.88%, 11/15/29 |

46 | 37,603 | ||||||||||

BCPE Empire Holdings, Inc., 7.63%, 05/01/27 |

74 | 66,362 | ||||||||||

H&E Equipment Services, Inc., 3.88%, 12/15/28 |

37 | 31,516 | ||||||||||

Resideo Funding, Inc., 4.00%, 09/01/29 |

42 | 33,959 | ||||||||||

| 225,648 | ||||||||||||

Consumer Discretionary — 0.7% |

||||||||||||

APi Group DE, Inc. (b) |

||||||||||||

4.13%, 07/15/29 |

89 | 73,765 | ||||||||||

4.75%, 10/15/29 |

68 | 58,946 | ||||||||||

Carnival Corp. (b) |

||||||||||||

10.50%, 02/01/26 |

387 | 388,842 | ||||||||||

7.63%, 03/01/26 |

48 | 38,045 | ||||||||||

5.75%, 03/01/27 |

711 | 507,682 | ||||||||||

9.88%, 08/01/27 |

223 | 210,735 | ||||||||||

4.00%, 08/01/28 |

447 | 364,488 | ||||||||||

6.00%, 05/01/29 (e) |

342 | 227,903 | ||||||||||

S C H E D U L E O F I N V E S T M E N T S |

23 |

Schedule of Investments (continued) December 31, 2022 |

BlackRock Core Bond Trust (BHK) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||||||

Consumer Discretionary (continued) |

||||||||||||

Carnival Holdings Bermuda Ltd., 10.38%, 05/01/28 (b)(e) |

USD | 224 | $ | 229,961 | ||||||||

CoreLogic, Inc., 4.50%, 05/01/28 (b) |

350 | 268,520 | ||||||||||

Legends Hospitality Holding Co. LLC/Legends Hospitality Co.-Issuer, Inc., 5.00%, 02/01/26 (b) |

60 | 53,400 | ||||||||||

Life Time, Inc. (b) |

||||||||||||

5.75%, 01/15/26 |

174 | 161,907 | ||||||||||

8.00%, 04/15/26 |

146 | 131,400 | ||||||||||

Lindblad Expeditions LLC, 6.75%, 02/15/27 (b) |

208 | 188,691 | ||||||||||

NCL Corp. Ltd. (b) |

||||||||||||

5.88%, 03/15/26 |

156 | 122,533 | ||||||||||

7.75%, 02/15/29 |

74 | 55,688 | ||||||||||

NCL Finance Ltd., 6.13%, 03/15/28 (b) |

177 | 130,665 | ||||||||||

Royal Caribbean Cruises Ltd. (b) |

||||||||||||

11.50%, 06/01/25 |

82 | 87,945 | ||||||||||

5.50%, 08/31/26 |

61 | 51,316 | ||||||||||

5.38%, 07/15/27 |

138 | 111,739 | ||||||||||

11.63%, 08/15/27 |

124 | 124,525 | ||||||||||

5.50%, 04/01/28 |

89 | 71,026 | ||||||||||

8.25%, 01/15/29 |

136 | 136,340 | ||||||||||

9.25%, 01/15/29 (e) |

186 | 191,134 | ||||||||||

Techem Verwaltungsgesellschaft 674 mbH, 6.00%, 07/30/26 (d) |

EUR | 88 | 88,267 | |||||||||

Viking Ocean Cruises Ship VII Ltd., 5.63%, 02/15/29 (b) |

USD | 39 | 31,395 | |||||||||

| 4,106,858 | ||||||||||||

Consumer Finance — 0.9% |

||||||||||||

American Express Co., (5 year CMT + 2.85%), 3.55% (a)(g) |

500 | 410,750 | ||||||||||

Block, Inc., 3.50%, 06/01/31 |

1,275 | 1,017,354 | ||||||||||

Discover Financial Services, 6.70%, 11/29/32 |

65 | 66,071 | ||||||||||

Global Payments, Inc. |

||||||||||||

4.95%, 08/15/27 |

70 | 67,900 | ||||||||||

3.20%, 08/15/29 |

400 | 340,021 | ||||||||||

2.90%, 05/15/30 |

408 | 334,302 | ||||||||||

5.40%, 08/15/32 |

172 | 163,804 | ||||||||||

HealthEquity, Inc., 4.50%, 10/01/29 (b) |

288 | 251,683 | ||||||||||

MPH Acquisition Holdings LLC, 5.50%, 09/01/28 (b)(e) |

139 | 108,434 | ||||||||||

Navient Corp. |

||||||||||||

7.25%, 09/25/23 |

28 | 27,977 | ||||||||||

6.13%, 03/25/24 |

51 | 49,961 | ||||||||||

5.88%, 10/25/24 |

39 | 37,734 | ||||||||||

5.50%, 03/15/29 |

30 | 24,480 | ||||||||||

OneMain Finance Corp. |

||||||||||||

7.13%, 03/15/26 (e) |

150 | 142,632 | ||||||||||

3.50%, 01/15/27 |

206 | 170,562 | ||||||||||

6.63%, 01/15/28 |

165 | 151,937 | ||||||||||

5.38%, 11/15/29 |

42 | 34,352 | ||||||||||

4.00%, 09/15/30 |

74 | 55,214 | ||||||||||

Sabre Global, Inc. (b) |

||||||||||||

9.25%, 04/15/25 |

99 | 98,617 | ||||||||||

7.38%, 09/01/25 |

64 | 61,507 | ||||||||||

11.25%, 12/15/27 |

64 | 65,902 | ||||||||||

Shift4 Payments LLC/Shift4 Payments Finance Sub, Inc., 4.63%, 11/01/26 (b) |

314 | 296,664 | ||||||||||

Shift4 Payments, Inc., 0.00%, 12/15/25 (f) |

112 | 110,950 | ||||||||||

Security |

Par (000) |

Value |

||||||||||

Consumer Finance (continued) |

||||||||||||

SLM Corp., 3.13%, 11/02/26 |

USD | 117 | $ | 99,503 | ||||||||

Verscend Escrow Corp., 9.75%, 08/15/26 (b)(e) |

1,355 | 1,327,507 | ||||||||||

| 5,515,818 | ||||||||||||

Containers & Packaging — 0.4% |

||||||||||||

Clydesdale Acquisition Holdings, Inc. (b) |

||||||||||||

6.63%, 04/15/29 |

591 | 561,894 | ||||||||||

8.75%, 04/15/30 |

382 | 326,981 | ||||||||||

Graphic Packaging International LLC (b) |

||||||||||||

4.75%, 07/15/27 |

53 | 49,886 | ||||||||||

3.50%, 03/15/28 |

11 | 9,573 | ||||||||||

International Paper Co., 6.00%, 11/15/41 |

870 | 867,207 | ||||||||||

Klabin Austria GmbH, 3.20%, 01/12/31 (b) |

200 | 161,000 | ||||||||||

LABL, Inc., 5.88%, 11/01/28 (b) |

176 | 153,344 | ||||||||||

Sealed Air Corp., 4.00%, 12/01/27 (b) |

49 | 44,450 | ||||||||||

Suzano Austria GmbH, 3.75%, 01/15/31 |

80 | 66,790 | ||||||||||

| 2,241,125 | ||||||||||||

Diversified Consumer Services — 0.8% |

||||||||||||

Allied Universal Holdco LLC/Allied Universal Finance Corp. (b)(e) |

||||||||||||

6.63%, 07/15/26 |

719 | 657,885 | ||||||||||

9.75%, 07/15/27 |

200 | 174,000 | ||||||||||

6.00%, 06/01/29 |

939 | 681,488 | ||||||||||

Allied Universal Holdco LLC/Allied Universal Finance Corp./Atlas Luxco 4 SARL, 4.63%, 06/01/28 (b) |

1,241 | 1,014,804 | ||||||||||

Clarivate Science Holdings Corp. (b) |

||||||||||||

3.88%, 07/01/28 |

815 | 706,113 | ||||||||||

4.88%, 07/01/29 (e) |