1.01

Item 5.02(f) Compensatory Arrangements of Certain Officers.

On April 29, 2024, the Compensation Committee of the Board of Directors of Gold Resource Corporation (the “Company”) evaluated and determined the annual short-term incentive plan (“STIP”) amounts earned under the Executive Management Bonus Plan for each of the named executive officers for fiscal year ended December 31, 2023. The 2023 STIP was paid at 59.1% of target based on the achievement of certain pre-determined performance goals as discussed in the “2023 STIP” section of the Company’s proxy statement filed with the Securities and Exchange Commission on April 29, 2024 (the “2023 Proxy Statement”). To conserve the Company’s cash reserves, the 2023 STIP payments to the Company’s named executive officers were made in the form of restricted stock units (“RSUs”) in lieu of cash, with the number of RSUs calculated by dividing each named executive officer’s 2023 STIP amount by the 20-day volume weighted average price of the Company’s common stock as of the grant date, equal to $0.5607 per share. The RSUs were granted to the named executive officers on April 29, 2024 and vest in three equal installments on each of January 1, 2025, January 1, 2026 and January 1, 2027.

The 2023 STIP amounts awarded to each named executive officer, as well as the number of RSUs granted in respect thereof, are set forth in the table below:

| | | | |

Executive | | 2023 STIP Amount | | Number of RSUs Granted |

Allen J. Palmiere | | $175,591 | | 313,165 |

Chet Holyoak (1) | | $56,757 | | 101,225 |

Kimberly C. Perry (1) | | - | | - |

Alberto Reyes | | $80,642 | | 143,824 |

| (1) | Ms. Perry departed the Company on August 2, 2023 and was replaced by Mr. Holyoak as Interim Chief Financial Officer. |

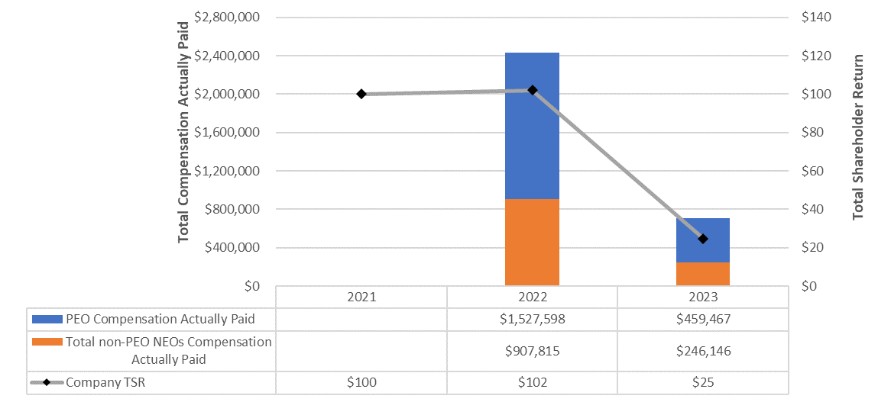

In accordance with Item 5.02(f) of Form 8-K, the Company is providing a revised Summary Compensation Table, the Pay Versus Performance Table, and the Summary Compensation Table Total versus Compensation Actually Paid Reconciliation Table as reported in the 2023 Proxy Statement to include each named executive officer’s final STIP amounts and total compensation amounts for the fiscal year 2023.

Summary Compensation Table

The following table contains revised total compensation amounts of the Company’s named executive officers for the fiscal year ended December 31, 2023 as reported in the 2023 Proxy Statement:

| | | | | | | | | |

| | | | | | | Non-Equity | | |

Name and | | | | | Stock | Option | Incentive | All Other | |

Principal | Position | Year | Salary | Bonus | Awards | Awards | Award | Compensation | Total |

| | | | | | | | | |

Allen J. Palmiere | CEO, President and Director | 2023 | $495,000 | - | $339,255 | - | $175,591 | - | $1,009,846 |

Chet Holyoak | Chief Financial | 2023 | $209,500 | - | $33,795 | - | $56,757 | $7,788 | $307,840 |

Kimberly C. Perry | Chief Financial | 2023 | $242,884 | - | $157,351 | - | - | $196,582 | $596,817 |

Alberto Reyes | Chief Operating | 2023 | $341,000 | $50,000 | $162,596 | - | $80,642 | - | $634,238 |