S-K 1300 Technical Report Summary on the

Don David Gold Mine Project, Oaxaca, Mexico

Report prepared for: |

| Report Date: |

GOLD RESOURCE CORPORATION | | March 2, 2023 |

| | |

Report prepared by: | | Effective Date: |

Rodrigo Simidu, P. Eng. | | December 31, 2022 |

Marcelo Zangrandi, B. Geo Patrick Frenette, P. Eng. Christian Laroche, P. Eng | | |

| | |

| | |

| | | Page No |

|---|---|---|---|

1 | |||

| 1 | ||

| 1 | ||

| 3 | ||

| 3 | ||

| 4 | ||

| 4 | ||

| 5 | ||

| 5 | ||

| 6 | ||

| 6 | ||

| 8 | ||

| 9 | ||

| 10 | ||

| 10 | ||

| 11 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 12 | ||

| 12 | ||

13 | |||

| 13 | ||

| 13 | ||

| 13 | ||

| 13 | ||

| 14 | ||

15 | |||

| 15 | ||

| 18 | ||

| 18 | ||

| 19 | ||

| 19 | ||

| 19 | ||

| 19 | ||

Accessibility, Climate, Local Resources, Infrastructure and Physiography | 19 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 20 | ||

| 21 | ||

| 21 | ||

22 | |||

| 22 | ||

| 22 | ||

| 22 | ||

| 22 | ||

24 | |||

| 24 | ||

| 27 | ||

| | | Page No |

|---|---|---|---|

| 27 | ||

| 34 | ||

| 40 | ||

| 41 | ||

42 | |||

| 42 | ||

| 42 | ||

| 49 | ||

| 50 | ||

| 73 | ||

| 73 | ||

| 73 | ||

74 | |||

| 74 | ||

| 74 | ||

| 75 | ||

| 77 | ||

| 78 | ||

| 80 | ||

81 | |||

| 81 | ||

| 81 | ||

| 81 | ||

82 | |||

| 82 | ||

| 83 | ||

| 83 | ||

| 83 | ||

| 84 | ||

| 90 | ||

| 90 | ||

| 91 | ||

| 91 | ||

92 | |||

| 92 | ||

| 93 | ||

| 94 | ||

| 126 | ||

| 130 | ||

| 140 | ||

141 | |||

| 141 | ||

| 141 | ||

| 141 | ||

| 141 | ||

| 143 | ||

| 145 | ||

| 145 | ||

| 149 | ||

| 150 | ||

| 151 | ||

| 151 | ||

| | | Page No |

|---|---|---|---|

153 | |||

| 153 | ||

| 153 | ||

| 154 | ||

| 155 | ||

| 161 | ||

| 162 | ||

169 | |||

| 169 | ||

| 173 | ||

| 173 | ||

| 175 | ||

| 177 | ||

187 | |||

| 187 | ||

| 187 | ||

| 188 | ||

| 188 | ||

| 188 | ||

| 188 | ||

| 189 | ||

| 190 | ||

| 191 | ||

| 192 | ||

| 192 | ||

193 | |||

| 193 | ||

| 193 | ||

| 193 | ||

| 193 | ||

| 194 | ||

196 | |||

| 196 | ||

| 199 | ||

| 199 | ||

| 200 | ||

| 202 | ||

| 203 | ||

| 204 | ||

| 205 | ||

206 | |||

| 206 | ||

| 206 | ||

208 | |||

| 208 | ||

| 210 | ||

211 | |||

| 211 | ||

| 211 | ||

211 | |||

| | | Page No |

|---|---|---|---|

212 | |||

| 212 | ||

| 212 | ||

| 213 | ||

| 215 | ||

| 215 | ||

| 216 | ||

| 216 | ||

| 217 | ||

| 218 | ||

| 218 | ||

| 219 | ||

| Environmental studies, permitting, social and community impact | 219 | |

| 219 | ||

| 220 | ||

| 220 | ||

221 | |||

| 221 | ||

| 221 | ||

| 221 | ||

| 221 | ||

| 223 | ||

| 223 | ||

224 | |||

227 | |||

GOLD RESOURCE CORPORATION (NYSE American: GORO) is a registrant with the United States Securities and Exchange Commission (“SEC”). GORO must report its exploration results, Mineral Resources, and Mineral Reserves using the mining disclosure standards of Subpart 229.1300 of Regulation S-K Disclosure by Registrants Engaged in Mining Operations (“SK1300”).

This report is a Technical Report Summary (“Technical Report”) in accordance with the SEC SK1300 for Don David Gold Mexico S.A. de C.V. (“DDGM” or “Don David Gold Mine” or “Don David Mine” the “Project”), a wholly-owned subsidiary of Gold Resource Corporation (“GRC”). DDGM is an underground gold, silver, and base-metal production stage property with exploration prospects in Oaxaca, Mexico. This report supports the historical, scientific, and technical information concerning the Project effective as of December 31, 2022. This report does not purport to reflect new information regarding the Project arising after such date.

DDGM adopted SK1300 standards for the December 31, 2021 Technical Report. The adoption applied a new methodology focused on geological interpretations, improved grade estimation, better variable anisotropy, channel sampling, and improved ore control models. This approach creates greater confidence in the reliability of the Mineral Resources and Mineral Reserves. Gold and silver ounces are reported in troy ounces converted using 31.1035 grams per troy ounce. Unless otherwise stated, all currency is in U.S. dollars (“$”).

The Qualified Persons (“QPs”) preparing this report are mining industry professionals and specialists trained in diverse technical backgrounds, including but not limited to geology, exploration, environmental, cost estimation, and mineral economics. A QP defined under SEC SK1300 instructions is a mineral industry professional with at least five years of relevant work experience in the type of mineralization and deposit like DDGM and an eligible member or licensee in good standing of a recognized professional organization.

By their education, experience, and professional association, the following individuals are considered QPs for this report and are members in good standing of relevant professional institutions/organizations. As noted below, three of the QPs are employees of GRC, and therefore, such individuals are not independent of DDGM.

1

Table 1.1 Summary of QP Qualifications

QP NAME & BIOGRAPHY | SITE VISIT | RESPONSIBLE SECTIONS |

Rodrigo Simidu, P. Eng. (GRC employee) | ||

Mr. Rodrigo Simidu graduated with a degree in Mining Engineering from University of Sao Paulo, Brazil, in 2008. He is a Professional Engineer (P. Eng.) registered with Engineers & Geoscientists British Columbia (EGBC). Mr. Simidu has over 14 years of practical experience as a mining engineer in several mining methods for hard rock mines, with a strong background in mine planning. He is currently the principal mining Engineer for GRC, and his relevant experience includes operational, planning, corporate technical support, and consulting in Canada, USA, Mexico, Australia, South Africa, and Ghana. Prior to joining GRC, Mr. Simidu was a Manager, Mine Planning at Worley, a global engineering company. | Multiple times in 2022; most recently on November 22,2022. | 1, 2, 3, 4, 5, 12, 13, 15, 16, 17, 20, 21, 22, 23, 24, 25 |

Marcelo Zangrandi, B. Geo (AMBA employee) | ||

Mr. Marcelo Zangrandi holds a Bachelor´s degree in Geology from Universidad Nacional de San Juan (1998) and a graduate’s degree in Geostatistical Evaluation of Ore Deposits from Universidad e Chile (2012). He is a Professional Geologist (B.Geologist) registered with the Australian Institute of Geoscientists (AIG). Mr. Zangrandi has over 23 years of practical experience in the mining industry and related research (geostatistics), mostly in exploration projects, open pit and underground mines, with gold, silver and copper, among other commodities. He is senior geologist of AMBA Consultoria Ltda. (“AMBA”), a Brazilian consulting company. He has held various roles in geological exploration and mine operations, from the greenfield exploration to the resource estimation, mainly at Snowden Consulting (Brazil) and Barrick Gold (Argentina, Chile and Dominican Republic). | November 30, 2021 for ten (10) days, March 3 and November 16, 2022. | 1, 6, 7, 8, 9, 11, 21, 22, 23, 24, 25 |

Patrick Frenette, P. Eng. (GRC employee) | ||

Mr. Patrick Frenette graduated with a degree in Mining Engineering from Ecole Polytechnique de Montreal in 2001. He also holds a Master’s in Rock Mechanics (2003) and a Master’s in Business Administration (2021). Mr. Frenette has over 19 years of experience in open pit and underground operations as well as in consulting where he worked for different projects in Canada, USA and Mexico for companies such has Cambior, Agnico Eagle, Osisko, Canadian Malartic, InnovExplo and Wesdome. He is currently the Vice-President of Technical Services for GRC. Prior to joining GRC, he was Director of Operational Support for Osisko Development. He is a Professional Engineer and a member in good standing of Ordre des Ingénieurs du Québec (OIQ), Professional Engineers of Ontario (PEO) and Engineers & Geoscientists of British Columbia (EGBC). | May 12-15, 2022, September 21-24, 2022 | 18 and 19 |

Christian Laroche, P. Eng. (GRC employee) | ||

Mr. Christian Laroche graduate from Laval University in Metallurgical Engineering. He is registered at Ordre Ingénieur du Québec (OIQ) and at Engineer and Geoscientists of British-Columbia (EGBC). Mr. Laroche work as Process Engineer for BBA an engineer consultant and as Corporate Director of Metallurgy for Compagnie Minière Osisko. He spent 8 years as Director of Metallurgy for Osisko Gold Royalty and 3 years as Vice-President Metallurgy for Falco Resources. He is now GRC Technical Service Director of Metallurgy since 2022. | Multiple times in 2022 and most recently January 17 – 23, 2023 | 10 and 14 |

2

Technical data and information used in the preparation of this report also included some documents prepared by third-party contractors. The authors sourced information from referenced documents as cited in the text and listed in the References section of this report.

1.3Property Description, Location, and Ownership

At our Don David Gold Mine, we currently have 100% interest in six properties, including two Production Stage Properties and four Exploration Stage Properties, located in Oaxaca, Mexico, along the San Jose structural corridor. The project is in the Sierra Madre Sur Mountains of southern Mexico, in the southwestern part of the State of Oaxaca. The project is a significant precious and base metals epithermal deposit positioned along a major paved highway approximately 120 kilometers (km) southeast of Oaxaca City, the capital city of the State of Oaxaca. Because of their proximity and relatively integrated operations, we refer collectively to the six properties as the Don David Gold Mine. The two Production Stage Properties are the only two of the six properties that make up the Don David Gold Mine that we consider to be independently material at this time. As of December 31, 2021, DDGM controlled twenty-nine (29) mining concessions in Oaxaca State totaling 55,119 hectares, as well as permits necessary to sustain mining operations. Expiration dates associated with the Project concessions range from March 4, 2023, to November 7, 2066.

Table 1.2 Summary of DDGM Properties

DDGM PROJECTS | SEC STAGE | DEPOSITS | VEIN SYSTEMS | |||||

Arista Project | Producing | Arista | Arista Three Sisters | |||||

Alta Gracia Project | Producing | Alta Gracia | Mirador | |||||

Rey | Exploration | |||||||

Chamizo | Exploration | |||||||

Margaritas | Exploration | |||||||

Fuego | Exploration | | ||||||

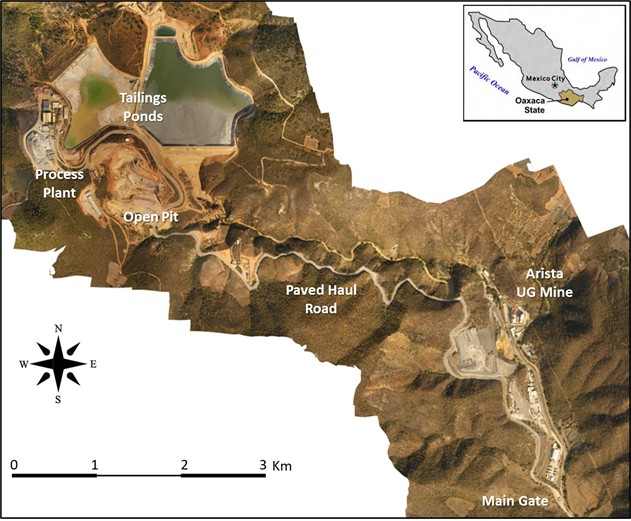

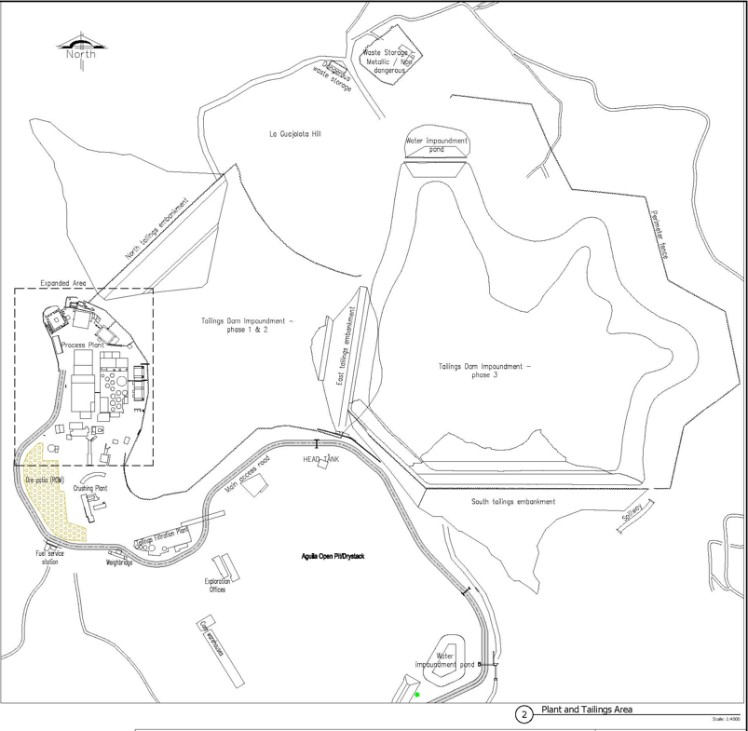

The Arista Project is a production stage property with a relatively small surface infrastructure consisting of a processing plant made up of an 1,800 tonnes per day (“tpd”) flotation plant, 250 tpd leaching plant, electrical power station (connected to the national electric power grid), water storage facilities, paste plant, filtration plant and dry stack facilities, stockpiles, and workshop facilities, all connected by sealed and unsealed roads. Additional structures located at the property include offices, dining halls, laboratory, core logging, and core storage warehouses. The tailings facilities are located approximately 500 meters to the northeast of the flotation plant.

DDGM must pay surface rights for concessions to the Mexican government to maintain its interest in the DDGM concessions. In 2022, DDGM satisfied these concessions' investment and assessment work requirements based on its work programs and past work completed. The annual concession tax paid for the mining concessions controlled by DDGM in 2022 was $1.0 million. DDGM concession payments are in good standing.

DDGM has established surface rights agreements with several neighboring communities. The most significant agreement is with the San Pedro Totolapam Ejido, and the individuals impacted by current and proposed operations, which allow disturbance of the surface, where necessary, for DDGM's exploration activities and mining operations.

The Arista and Alta Gracia Projects are in the regional Tlacolula mining district in Oaxaca, Mexico’s southwestern part. According to the Mexican Geological Survey, the Servicio Geologico Mexicano (SGM) mining activity was initiated in the early 1880s in the Tlacolula mining district, producing some 300,000 ounces of gold and silver from an ore shoot of the La Leona mine. However, no separate reported amounts of production were reported for each metal. SGM says that in 1892 two smelters were built and operated (Magdalena Teitipac and O'Kelly) near the village of Tlacolula for processing ores from the Alta Gracia, La Soledad, San Ignacio y Anexas, La Leona, La Victoria, and San Rafael silver mines. Subsequently, in 1911, Mr. Sken Sanders investigated the Totolapam mining region with a particular interest in the Margaritas mine. Most of these historical mines are within DDGM's mining concessions.

3

While the DDGM Arista and Alta Gracia Projects are in the smaller mining subdistricts of San Jose de Gracia and Alta Gracia, respectively, only small-scale artisanal mining was historically conducted in these areas' subdistricts. No reliable production records exist for the historic production performed in the area.

In 1998 and 1999, Arista Project concessions were leased to Apex Silver Corporation (Apex). Apex carried out an exploration program involving geologic mapping, surface sampling, and an eleven (11) hole reverse circulation (RC) drilling program (1,242 m) into the flat-lying vein, manto-style deposit (“Manto Vein”).

GRC has carried out a continuous exploration program since 2003. This exploration has included an aggressive program of surface and underground drilling. Mining of the Arista Project began in 2010, underground mining commenced in 2011, and underground Switchback vein system mining began in 2017.

Since the commencement of production from the Don David Gold Mine in 2010, DDGM has produced 358,685 ounces of gold and 24,753,618 ounces of silver from the 5,532,682 tonnes shipped to the DDGM Processing Facility. In addition, 15,318 tonnes of copper, 64,515 tonnes of lead, and 176,821 tonnes of zinc are produced from the plant.

1.5Geology Setting, Mineralization, and Deposit

The DDGM area is predominantly comprised of volcanic rocks of presumed Miocene age, which overlay and intrude into basement rocks consisting of marine sediments. This district's gold and silver mineralization is related to a volcanogenic system and is considered epithermal in character. The DDGM mineralization occurs as structurally controlled epithermal deposits in veins and stockwork zones. It consists of concentrations of sulfides containing gold, silver, lead, copper, and zinc. Primary sulfide mineralization consists of pyrite, galena, sphalerite, chalcopyrite, and different minor amounts of argentite and silver sulfosalts. The mineralization is associated with gangue minerals such as quartz, calcite, and other minor elements.

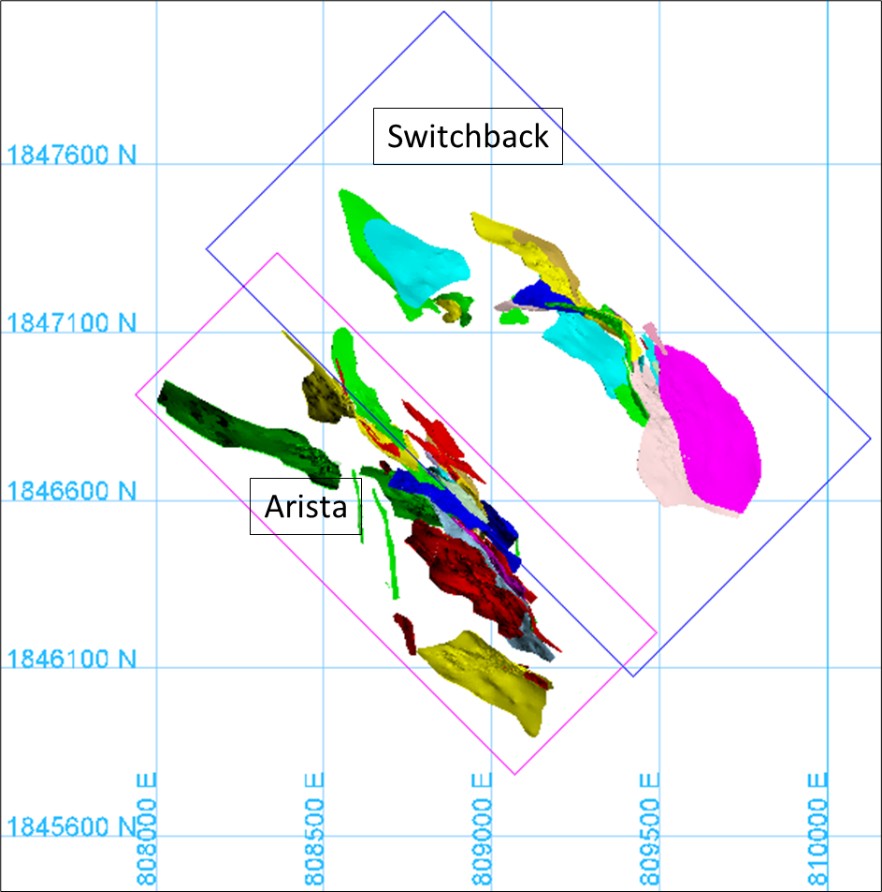

DDGM exploration efforts have been mainly focused on the Arista Project, which contains the Manto vein, Arista, and Switchback vein deposits, and includes the significant Arista, Baja, and Soledad veins as well as multiple ancillary structures. The principal hosts of mineralization are the Arista and Switchback vein systems, known from drilling and underground workings in the Arista underground mine. The Switchback deposit is approximately 500 m northeast of the Arista deposit. Both vein systems are andesitic host rocks, rhyolite dikes, and structural contacts with the basement sedimentary rocks. The mineralization in these systems is intermediate sulfidation with precious and base metals at economic grades. Both vein systems trend north-westerly; although locally, vein orientations can range from north-south to east-west.

The second zone of interest is the Alta Gracia property, where low sulfidation epithermal, predominantly silver mineralized, veins are hosted in andesitic and rhyolitic rocks; this property has been investigated by drilling and surface and underground mapping of historical and recent workings. The Mirador and Independencia vein systems, which DDGM has mined, are one of several predominantly northeast trending vein systems on the property.

Other mineralized zones and properties have been investigated, including some preliminary drilling in areas such as Escondida, Chacal, and Salina Blanca on the Arista Project and the Margaritas and Rey properties. The Margaritas and Rey properties host low sulfidation epithermal veins with volcanic associations.

The Don David Gold Mine properties include several mining sub-districts that had minimal exploration by modern methods before DDGM activity. DDGM acquired its Oaxaca mining concessions in 2003 and began exploring the Manto Vein, including drilling. Commencing in 2005, DDGM has carried out a continuous drilling program on other historical mine targets. The 2007 drill program included the discovery of the Arista vein and was the last time RC drilling was used. Since 2007 the continuous drilling programs have used wireline core drilling with 2.5 inches or 63.5-millimeter (mm) and 1.875 inches or 47.6 mm (“HQ and NQ”) core diameters. Underground drilling began in 2011. In 2013 step-out drilling from underground stations in the Arista underground mine identified the first intersections of the Switchback vein system. Drill programs have targeted other zones of interest in the Arista mine and epithermal vein systems on the Alta Gracia, Margaritas, and Rey projects. The Arista mine is located close to its south-eastern limit.

DDGM continues the development of an aggressive exploration program along the 55 km corridor that includes extensive surface and underground drilling, along with underground mine development, such as access ramps, drifts, and crosscuts into the Arista, Switchback, and Alta Gracia vein systems. Exploration techniques include geophysics (airborne and ground), stream, soil and rock geochemistry, mapping, petrographic and fluid inclusion studies, and drilling. These activities have identified multiple exploration targets. Exploration has focused on the Arista and Alta Gracia zones due to proximity and ease of access to the DDGM processing facilities. Exploration drilling (core and RC) by DDGM through the end of December 2022

4

amounts to 1,792 drill holes totaling 460,288 meters. The 2022 district exploration work program included 182 underground drill holes with 34,829 meters of diamond drill core produced, requiring an expenditure of $5.8 million. One geotechnical hole was also drilled (273 meters), as well as 31 production drill holes (1,527 meters). Exploration mine development in 2022 totaled 1,132 meters at a total cost of $3.1 million. Other district surface exploration work required an expenditure of $1.0 million.

Drill core is logged, sampled, and stored at the on-site exploration facilities within the DDGM operational site, using standard industry practices. All pulps, and selected coarse reject material, are recovered from an external laboratory and also stored in the DDGM exploration storage facilities.

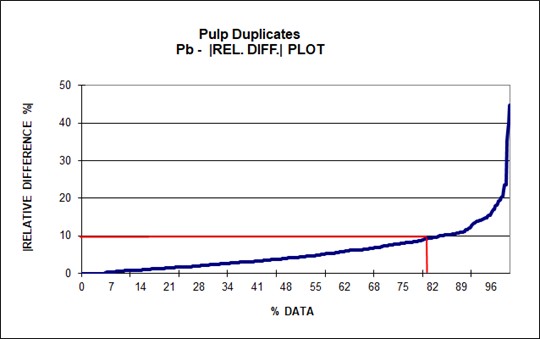

Since 2006 exploration samples have been analyzed by ALS Global (ALS) at their ISO/IEC 17025:2017 accredited laboratory in Vancouver, Canada, with sample preparation at their Guadalajara laboratory in Mexico.

All exploration samples are subject to strict quality assurance and quality control (“QAQC”) protocols that include inserting certified reference materials (standards and blanks) and duplicate sampling. Mine channel samples and narrow diameter production core are assayed at the laboratory located at the DDGM processing facilities.

The DDGM staff follow stringent procedures for data storage and validation, performing verification of data on an ongoing basis. Preliminary validation of the database was last performed by the DDGM database manager in September 2022. The on-site database has a series of automated import, export, and validation tools to minimize potential errors. Any inconsistencies are corrected during the validation process before being handed over for final review and validation. The QP visited the site in July 2021 and March 2022 to review data collection storage and undertake validation. The data verification procedures performed by the QP involved the following:

1.8Mineral Processing and Metallurgical Testing

ALS's metallurgical testing in 2014, 2018, and more recently in 2020 and 2022 supports the DDGM processing methodology. As exploration continues, additional metallurgical testing will be required if the constituents of the ore should change.

Deleterious elements in the concentrate products are predominantly non-liberated sulfide and non-sulfide gangue, apart from Cadmium and Silica within the Zinc concentrate.

Metallurgical recoveries at the DDGM processing facility for ore produced from the Arista mine averaged 83.9% during 2022 for gold (up from 81.3% in 2021), 92% for silver (down from 92.5% in 2021), 75.6% for copper (decrease from 79.9% in 2021), 75.4% for lead (decrease from 80.3% in 2021), and 83.7% for zinc (up from 81.7% in 2021).

The DDGM processing facility has a good body of metallurgical information comprising historic testing supported by the studies completed by ALS. The metallurgical samples tested, and the ore presently treated in the plant represent the material included in the life-of-mine (“LOM”) plan regarding grade and metallurgical response.

5

Construction of the filtration plant was completed in Q1 2022, at which time filtered tailings containing ~14% moisture was deposited and compacted in the depleted open pit.

1.9Commodity Price Projections

For the purpose of estimating the Mineral Reserves and Mineral Resources in this report, the QP utilized prices based on conservative estimates (“Resource & Reserve Price Deck”) which closely approximates the low price for the metal price for 2022 as per published exchanges. Comex for gold and silver; LME for copper, lead and zinc.

The prices were subsequently compared to the actual 2022 closing spot price, as per published exchange, to ensure the price deck was still considered as reasonably conservative estimates for the Mineral Reserves & Mineral Resources. As noted below in Table 1.3, the price used to estimate the Mineral Reserves and Mineral Resources was modestly higher than the low price for each metal for 2022 but was below the closing price of the metal at year-end.

Table 1.3 Mineral Reserves and Mineral Resources Metal Price Assumptions

Metal | Measure | Mineral R&R Price | 2022 Low Price | Approximation % | 2022 Closing Price | Mineral R&R Price Conservative |

Gold Price | Ounce | $1,650 | $1,623 | +2% | $1,820 | Yes |

Silver Price | Ounce | $20.00 | $17.55 | +14% | $23.86 | Yes |

Copper Price | Pound | $3.40 | $3.17 | +7% | $3.80 | Yes |

Lead Price | Pound | $0.90 | $0.80 | +12% | $1.06 | Yes |

Zinc Price | Pound | $1.35 | $1.22 | +10% | $1.37 | Yes |

For the Economic Analysis, the QP utilized the median consensus prices for each of the five years starting 2023 through 2027 as provided by the Bank of Montreal on December 1, 2022. The median price was based on the price estimates contributed by 38 participating financial institutions. The 2027 consensus was used for the remaining life of mine. The Economic Analysis Price Deck is set forth in the below Table 1.4:

Table 1.4 Economic Analysis Metal Price Assumptions

Metal | Measure | 2023 | 2024 | 2025 | 2026 | 2027 |

Gold Price | Ounce | $1,750 | $1,750 | $1,700 | $1,700 | $1,650 |

Silver Price | Ounce | $22.00 | $22.00 | $22.40 | $22.18 | $21.75 |

Copper Price | Pound | $3.50 | $3.75 | $3.75 | $3.82 | $3.59 |

Lead Price | Pound | $0.91 | $0.92 | $0.92 | $0.92 | $0.92 |

Zinc Price | Pound | $1.39 | $1.30 | $1.25 | $1.20 | $1.20 |

The actual metal prices can change, either positively or negatively, from the assumptions above. If the assumed metal prices are not realized, this could have a negative impact on the operation’s financial outcome. At the same time, higher than predicted metal prices could have a positive impact. Gold equivalencies are determined by taking the price for gold and silver and converting them to gold equivalent ratio for the respective remaining life of mine periods (average is 77.7 silver: 1 gold).

1.10Mineral Resources Estimates

The modeling and estimation of Mineral Resources presented herein are based on technical data and information available as of December 31, 2022 (Drilling database close September 30, 2022). DDGM models and estimates Mineral Resources from available technical details before generating Mineral Reserves.

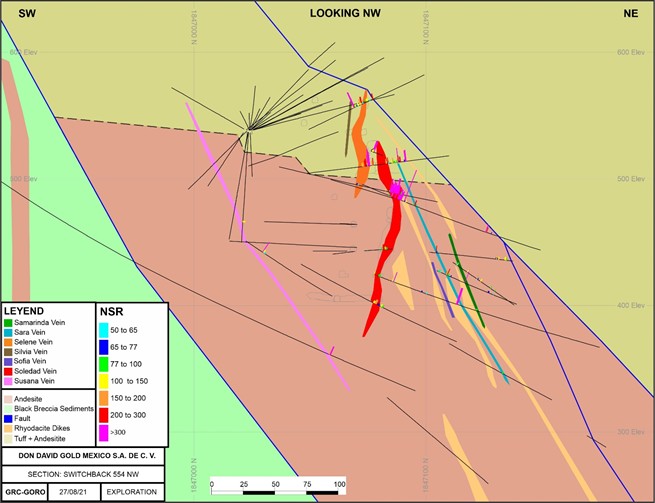

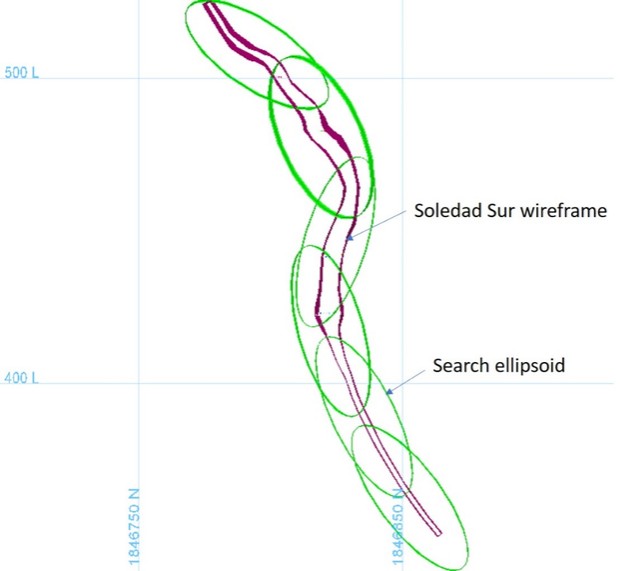

Marcelo Zangrandi, from AMBA Consultoria Ltda. (“AMBA”) completed the Mineral Resource estimate using Vulcan software. Wireframes for geology and mineralization were constructed by DDGM geology staff using Leapfrog Geo, based on underground mappings, assay results, lithological information from drill holes, and structural data. The model incorporates all significant vein systems identified to date: a total of 31 veins were interpreted and modeled for the Switchback system, 45 veins for the Arista system, and 14 veins for the Alta Gracia system. Assays were composited to 1 m lengths and capped to various levels based on exploratory data analysis for each vein. Wireframes were filled with blocks of 10 m by 1 m by 10 m (x,y,z),, which were sub-celled at wireframe boundaries (minimum sub-celling size 2.5 by 0.5 m by 2.5 m, x,y,z). Block grades were interpolated using ordinary kriging (OK) interpolation algorithm. Block estimates were validated using industry-standard validation techniques. Classification of blocks used information distance-based criteria related to the spatial continuity of mineralization. Satisfying adequate minimum mining size continuity criteria and using a breakeven net smelter return (NSR)

6

cutoff grade of $80 per tonne for the Arista mine (Arista and Switchback vein systems) and a gold equivalent (AuEq) of 2.35 grams per tonne (g/t) for the Alta Gracia deposit (See Section 12.7 for more discussion on cutoff grade).

A summary of the Don David Gold Mine Mineral Resources, exclusive of Mineral Reserves, for the Arista mine, is shown in Table 1.5. Table 1.6 shows the Mineral Resources for the Alta Gracia deposit. NSR cutoff values for the Mineral Resources were established using a zinc price of $1.35/pound (lb), a lead price of $0.90/lb, a copper price of $3.40/lb, a silver price of $20.00/ounce (oz) and a gold price of $1,650/oz.

Mineral Resources have been classified under the definitions for Mineral Resources in SK1300, which are consistent with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (CIM (2014) definitions).

Table 1.5 Don David Gold Mine (Arista Mine) - Summary of Gold, Silver and Base Metal Mineral Resources, exclusive of Mineral Reserves at December 31, 2022

Category | Resources | |||||||||||

Amount | Grades | Cutoff grade | Metallurgical Recovery (%) | |||||||||

Ktonne | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | $/tonne | Au | Ag | Cu | Pb | Zn | |

Measured mineral resources | 259 | 1.70 | 153 | 0.38 | 1.36 | 3.95 | 80 | 81.6 | 90.8 | 71.2 | 70.4 | 84.2 |

Indicated mineral resources | 1,240 | 1.19 | 121 | 0.29 | 1.14 | 3.17 | 80 | 81.6 | 90.8 | 71.2 | 70.4 | 84.2 |

Measured + Indicated mineral resources | 1,499 | 1.27 | 126 | 0.31 | 1.18 | 3.30 | 80 | 81.6 | 90.8 | 71.2 | 70.4 | 84.2 |

Inferred mineral resources | 1,916 | 0.80 | 111 | 0.25 | 1.18 | 3.03 | 80 | 81.6 | 90.8 | 71.2 | 70.4 | 84.2 |

Table 1.6 Don David Gold Mine (Alta Gracia Mine) - Summary of Gold, Silver and Base Metal Mineral Resources, exclusive of Mineral Reserves at December 31, 2022

Category | Resources | |||||||||||

Amount | Grades | Cutoff grade | Metallurgical Recovery (%) | |||||||||

Ktonne | Au (g/t) | Ag (g/t) | - | - | - | AuEq/tonne | Au | Ag | Cu | Pb | Zn | |

Measured mineral resources | 24 | 0.81 | 368 | - | - | - | 2.35 | 85.0 | 72.0 | - | - | - |

Indicated mineral resources | 90 | 0.61 | 327 | - | - | - | 2.35 | 85.0 | 72.0 | - | - | - |

Measured + Indicated mineral resources | 114 | 0.65 | 336 | - | - | - | 2.35 | 85.0 | 72.0 | - | - | - |

Inferred mineral resources | 148 | 0.62 | 296 | - | - | - | 2.35 | 85.0 | 72.0 | - | - | - |

7

Notes on Mineral Resources:

| 6. | Mining, processing, and overhead costs were based on 2022 actual costs for the Don David Gold Mine and consider cost improvements made in the fourth quarter of 2022. |

1.11Mineral Reserves Estimates

The Arista and Alta Gracia underground mine Mineral Reserve estimates follow standard industry practices, considering Measured and Indicated Mineral Resources. Only these categories have sufficient geological confidence to be considered Mineral Reserves. Subject to the application of modifying factors, Measured Resources may become Proven Reserves, and Indicated Resources may become Probable Reserves. Mineral Reserves are reconciled quarterly against production to validate dilution and recovery factors. The reserve estimate is based on technical data and information available as of December 31, 2022.

Mineral Reserve are classified as Proven and Probable (“P&P”). The mine designs include all modifying factors and must meet cutoff grade requirements to be deemed feasible and economical for extraction.

DDGM uses a breakeven NSR cutoff grade, considering actual metal prices, total mining, milling, general administration, smelting/refining costs, and plant recoveries for P&P Reserve estimations. The cutoff grade calculation does not include either exploration or capital costs, and the average operating costs used for reserve calculations are net of base metal credits and royalty payments. Plant recoveries used are the average of actual recoveries reported by the plant during the twelve months of 2022.

The 2022 breakeven NSR cutoff grade for the Arista underground mine is based on a $80/t NSR. Gold, silver, copper, lead, and zinc metal price assumptions established in Section 1.9 were utilized to calculate the NSR value. No appreciable amounts of base metals are present in the veins identified to date at the Alta Gracia property; therefore, a breakeven cutoff grade using gold and silver only was used. The breakeven cutoff grade used for the Alta Gracia Project, including the Mirador underground mine, P&P mineral reserves, was 2.35 g/t AuEq.

The P&P Mineral Reserves for the Don David Gold Mine as of December 31, 2022, are summarized in Table 1.7.

8

Table 1.7 David Gold Mine – Summary of Gold, Silver and Base Metal Mineral Reserves

at December 31, 2022(1) (4)

Description | Amount | Grades | Cutoff Grade | Metallurgical Recovery (%) | ||||||||||||||||||||||||||||||||||

Arista | KTonne | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | $/tonne | Au | Ag | Cu | Pb | Zn | ||||||||||||||||||||||||||

Proven Mineral Reserves | 237 | 2.34 | 146 | 0.4 | 1.6 | 4.1 | 80 | 81.6 | 90.8 | 71.2 | 70.4 | 84.2 | ||||||||||||||||||||||||||

Probable Mineral Reserves | 1,120 | 0.92 | 83 | 0.2 | 0.8 | 2.8 | 80 | 81.6 | 90.8 | 71.2 | 70.4 | 84.2 | ||||||||||||||||||||||||||

Arista Mine Total | 1,357 | 1.17 | 94 | 0.3 | 1.0 | 3.0 | | | | | | | ||||||||||||||||||||||||||

Alta Gracia | KTonne | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | AuEq/tonne | Au | Ag | Cu | Pb | Zn | ||||||||||||||||||||||||||

Proven Mineral Reserves | 3 | 0.85 | 392 | - | - | - | 2.35 | 85.0 | 72.0 | - | - | - | ||||||||||||||||||||||||||

Probable Mineral Reserves | 51 | 0.27 | 169 | - | - | - | 2.35 | 85.0 | 72.0 | - | - | - | ||||||||||||||||||||||||||

Mirador Mine Total | 54 | 0.30 | 181 | - | - | - | |

| |

| |

| ||||||||||||||||||||||||||

Don David Mine Total | 1,411 | 1.14 | 97 | | | | |

| |

| |

| ||||||||||||||||||||||||||

Notes on Mineral Reserves in Table 1.7:

During 2010, DDGM began developing an underground mine to access the Arista and Baja veins, part of the Arista vein system. The underground mine is approximately three km from the DDGM processing facilities. In March 2011, DDGM began transitioning to processing the underground mineralization. Conventional drill and blast methods are currently used to extract ore from the Arista underground mine. There are two main mining methods used in the Arista underground mine: 1) overhand mechanized cut and fill (“CAF”) and 2) long-hole open stopping (“LHOS”) with delayed fill.

Since commercial production was declared at the Don David Gold Mine on July 1, 2010, through December 31, 2022, the plant has processed a total of 5,532,682 tonnes of open pit and underground ore to recover 358,685 ounces of gold and 24,753,618 ounces of silver.

9

This Technical Report concludes that:

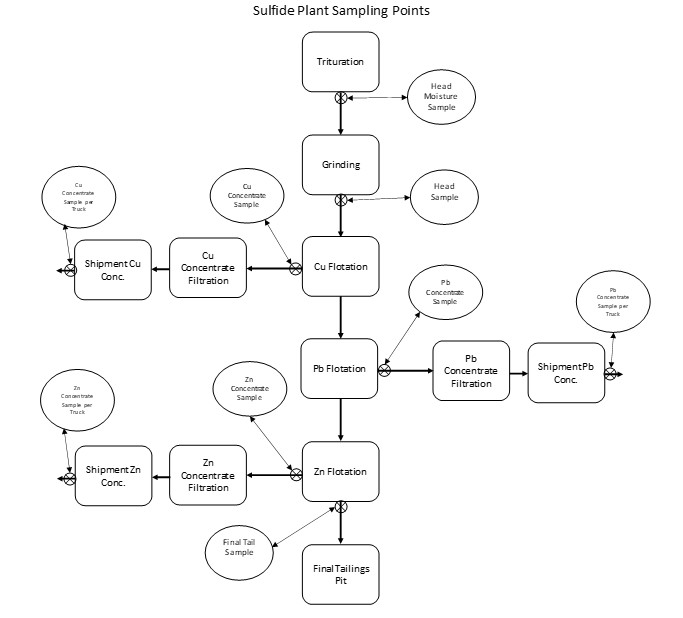

1.13Processing and Recovery Methods

During 2009 and 2010, DDGM constructed a processing plant and infrastructure at the Arista mine. The processing plant has a differential flotation section capable of processing polymetallic ores and producing up to three (3) separate concentrate products for sale and an agitated leach circuit capable of producing gold and silver doré for purchase. The DDGM mill's flotation circuit has undergone modifications in the circuit, higher capacity pumps and extra floatation cells that increased name plate capacity to 2,000 tpd (1,800 sulfides and 200 oxides). There is no indication that the characteristics of the material planned for mining will change, and therefore the recovery assumptions applied for future mining are considered reasonable for the LOM.

All material mine and process infrastructure and supporting facilities are included in the current general layout to ensure that they meet the needs of the mine plan and production rate and notes that:

10

1.15Market Studies and Contracts

Since the operation commenced commercial production in July 2010, a corporate decision was made to sell the concentrate on the open market. All commercial terms entered between the buyer and DDGM are confidential but are considered within standard industry norms.

The information provided by GRC on marketing, contracts, metal price projections, and exchange rate forecasts is consistent with the information publicly available and within industry norms.

1.16 | Environmental Studies, Permitting and Plans, Negotiations, or Agreements with Local Individuals or Groups. |

In connection with mining, milling, and exploration activities, DDGM is subject to all Mexican federal, state, and local laws and regulations governing the protection of the environment. Laws and regulations include the protection of air and water quality, hazardous waste management, mine reclamation and the protection of endangered or threatened species. Additional areas of environmental consideration for mining companies, including DDGM, include but are not limited to, acid rock drainage, cyanide containment and handling, contamination of water sources, dust, and noise.

All mining and environmental activities in México are regulated by the Dirección General de Minas (“DGM”) and by the Secretaría de Medio Ambiente y Recursos Naturales (“SEMARNAT”) from México City, under the corresponding laws and regulations. The environmental impact and risk relating to atmosphere emissions and hazardous waste produced and treated operate under a unique environmental license (“Licencia Ambiental Unica” or “LAU”). This environmental license is issued after approval by the Evaluación del Impacto Ambiental (“EIA”). Special permits are also required for new developments such as expansions, tailings dams, etc. DDGM is also required to obtain various permits for surface and underground water use including waste-water discharge. The permissions are granted by the Comisión Nacional del Agua (“CONAGUA”), the administrative, technical advisory commission of SEMARNAT. CONAGUA administers national waters, manages and controls the country's hydrological system, and promotes social development.

DDGM is required to prepare a mine closure plan for the possible future abandonment of the Arista and Alta Gracia Mines. Golder has prepared a mine closure plan and reclamation budgets. The total estimated closure and reclamation cost for the Arista Mine according to the information provided in 2022 amounts to $10.56 million (excluding taxes). This amount was calculated with the assumptions of the technical information available at the moment at the time of assessment. The total estimated closure and reclamation cost for the Alta Gracia Mine amounts to $0.6 million and is unchanged from last year since no operations were performed during 2022.

1.17Capital and Operating Costs

The support for capital and operating costs is based on realized costs, quotations, and estimates in 2022 dollars. The estimated capital and operating costs are to a feasibility level of accuracy (15%) and include a contingency of 3%. No inflation factors or changes to exchange rates have been used in the economic projections.

Total Don David Gold Mine LOM capital expenditures, including mine closure costs, are estimated to be $48.7 million, before contingency.

Operating costs are estimated based on an evaluation of actual historical and current expenditures for labor, consumables, and established DDGM contracts. The operating costs have a fixed and variable component and are estimated at $139/t before contingency. The total operating costs are based on applying the estimated unit costs to the estimated total ore tonnes of 2.6 million tonnes to be processed over the six (6) year remaining life of mine (“LOM”).

The capital and operating costs estimated for the Don David Gold Mine are reasonable based on industry-standard practices, actual costs observed for 2022 and cost cutting measures implements in Q4 2022.

11

The Don David Gold Mine has a six-year LOM given the Mineral Reserves and Mineral Resources (excluding inferred material) as described in this Report. Assumptions underlying the determination of Free Cash Flow and Net Present Value (“NPV”) include:

Based on Mineral Reserves and Mineral Resources, excluding 25% measured and indicated and 100% inferred material, after estimated taxes, the free cash flow is estimated at $77.4 million, and the NPV is estimated at $64.4 million.

1.19Interpretations and Conclusions

This Technical Report represents the most accurate interpretation of the Mineral Resource and Mineral Reserve available as of the effective date. The conversion of Mineral Resources to Mineral Reserves was undertaken using industry-recognized methods and estimated operational costs, capital costs, and plant performance data. Likewise, the processing facilities and related infrastructure are appropriately designed to convert the minerals into a saleable product. Thus, it is considered to be representative of future operating conditions. This Technical Report has been prepared with the latest environmental and closure cost requirements. DDGM has obtained, or is in the process of applying for, the required Environmental Impact Studies and permits to continue operating in accordance with Mexican Laws and Regulations.

Recommendations for the next phase of work have been broken into those related to ongoing exploration activities and those related to additional technical studies focused on operational improvements. A detailed list of recommendations is described in the "Recommendations" section. Recommended work programs are independent and can be conducted concurrently unless otherwise stated.

12

This Report was prepared for Gold Resource Corporation (GRC) as a Technical Report in accordance with SEC SK1300 for the Don David Gold Mine, a wholly owned subsidiary of GRC. DDGM is an underground gold, silver, and base-metal production and exploration stage property in Oaxaca, Mexico.

The Report contains estimates of Mineral Reserves and Mineral Resources for the Project, effective as of December 31, 2022, prepared following SK1300, which estimates supersede and replace the corresponding estimates of Mineral Reserves and Mineral Resources for the Project contained in the DDGM Technical Report in accordance with SEC SK1300 and the GRC Form 10-K on December 31, 2021. The quality of information, conclusions, and calculations contained herein are consistent with the level of effort by the QPs, based on

A QP defined by SEC SK1300 instructions is a mineral industry professional with at least five years of relevant work experience in the type of mineralization and deposit like DDGM and is an eligible member or licensee in good standing of a recognized professional organization. The QPs preparing this Technical Report are specialists in geology, exploration, mineral resource, mineral reserve estimation and classification, underground and surface mining, geotechnical, environmental, permitting, metallurgical testing, mineral processing, processing design, capital and operating cost estimation, and mineral economics. See section 1.2 for additional details on the QPs for this Technical Report. Technical data and information used in this Report's preparation include documents prepared by third-party contractors. The authors sourced information from referenced documents as cited in the text and listed in the References section of this Technical Report.

The effective date of this Report is December 31, 2022.

DDGM has previously filed technical reports on the Don David Gold Mine, listed in chronological order:

13

2.5Information Sources and References

The primary information source referenced in this Report is the 2021 Technical Report:

The QPs also used the other reports and documents noted in Section 24 "References" in preparing this Report.

The metric system for weights and units has been used throughout this Report. Mass is reported in metric tons (“tonnes or t”) consisting of 1,000 kilograms per tonne. Gold and silver are reported as grams per tonne (“g/t”). Copper, lead, and zinc is reported as percentages (“%”).

Gold and silver ounces are reported in troy ounces converted using 31.1035 grams per troy ounce. Unless otherwise stated, all currency is in U.S. dollars (“$”).

14

3.PROPERTY DESCRIPTION AND LOCATION

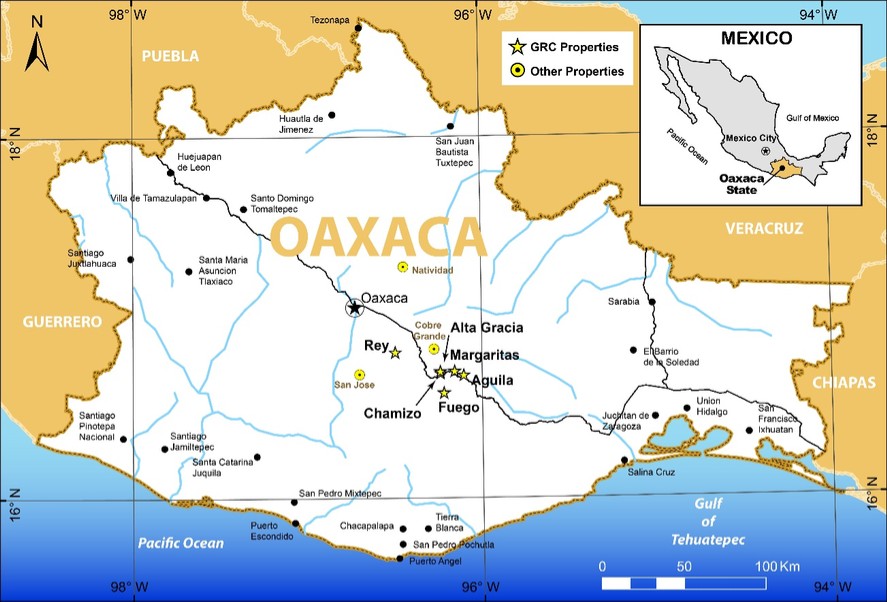

The Project is comprised of six properties. The Arista and Alta Gracia Projects are located in southern Mexico’s Sierra Madre del Sur Mountains, in the central part of the State of Oaxaca (Figure 3.1). The projects are along a paved highway approximately 90 to 120 km southeast of the capital city of Oaxaca. Oaxaca has daily passenger airline service to Mexico City, Guadalajara, and Houston, Texas, USA. They are serviced by Xoxocotlan International airport. The approximate center of the project area is N16.68°, W96.17° (Figure 3.1). The Rey, Chamizo, Margaritas and Fuego properties are exploration-stage properties within the Project.

Figure 3.1 General Location of Properties Comprising the Don David Mine

DDGM currently holds an interest in twenty-nine (29) mining concessions in Oaxaca State totaling 55,119 hectares (Table 3.1; Figure 3.2). Expiration dates associated with the Don David Mine mining concessions range from October 29, 2052, to February 22, 2073.

15

Table 3.1 Mining Concessions Owned by Don David Gold Mexico, S.A. de C.V.

Number | Concession Name | Title Number | Hectares | Term of Mining Concession | |

From | To | ||||

1 | MINA DEL AIRE | 158272 | 72.0000 | 3/5/1973 | 2/22/2073 |

2 | EL AGUILA | 222844 | 899.0610 | 9/9/2004 | 9/8/2054 |

3 | LA TEHUANA | 210029 | 925.0000 | 8/31/1999 | 8/30/2049 |

4 | EL CHACAL | 232628 | 375.0000 | 9/26/2008 | 9/25/2058 |

5 | EL PILON | 232629 | 1,070.3463 | 9/26/2008 | 9/25/2058 |

6 | PITAYO FRACCIÓN 1 | 231124 | 429.6269 | 1/17/2008 | 1/16/2058 |

7 | PITAYO FRACCIÓN 2 | 231125 | 22.0481 | 1/17/2008 | 1/16/2058 |

8 | PITAYO FRACCIÓN 3 | 231126 | 113.3089 | 1/17/2008 | 1/16/2058 |

9 | PITAYO FRACCIÓN 4 | 231127 | 2.8205 | 1/17/2008 | 1/16/2058 |

10 | EL TALAJE | 231128 | 1,015.9512 | 1/17/2008 | 1/16/2058 |

11 | LA HERRADURA | 231129 | 3,628.8500 | 1/17/2008 | 1/16/2058 |

12 | DAVID FRACCIÓN 1 | 232851 | 625.5930 | 10/30/2008 | 10/29/2052 |

13 | DAVID FRACCIÓN 2 | 232852 | 920.7610 | 10/30/2008 | 10/29/2052 |

14 | SAN LUIS | 233124 | 2,820.0691 | 12/12/2008 | 12/11/2052 |

15 | EL COYOTE | 235802 | 2,799.5484 | 3/12/2010 | 2/11/2060 |

16 | EL ZORRITO | 235332 | 8,836.4199 | 11/12/2009 | 11/11/2059 |

17 | LA CURVA | 235803 | 1,940.2815 | 3/12/2010 | 2/11/2060 |

18 | EL CHAMIZO | 238374 | 17,897.537 | 9/23/2011 | 9/22/2061 |

19 | ZOPI | 238875 | 504.0000 | 11/8/2011 | 11/7/2061 |

20 | LA REYNA | 225401 | 692.0000 | 8/31/2005 | 8/30/2055 |

21 | EL REY | 225373 | 172.0000 | 8/26/2005 | 8/25/2055 |

22 | EL VIRREY | 226269 | 36.0000 | 12/2/2005 | 12/1/2055 |

23 | EL MARQUEZ | 234213 | 1,434.8932 | 6/5/2009 | 6/4/2059 |

24 | SAN MIGUEL FRACCIÓN 2 | 241818 | 1,122.8379 | 3/27/2013 | 3/26/2063 |

25 | SAN PEDRO FRACCIÓN 1 | 233694 | 2,554.0000 | 3/30/2009 | 2/23/2054 |

26 | SAN PEDRO FRACCIÓN 2 | 233693 | 1,860.2110 | 3/30/2009 | 2/23/2054 |

27 | EL AGUILA III | 242686 | 2,250.0000 | 12/16/2013 | 12/16/2063 |

28 | CORRECAMINOS | 244389 | 97.8110 | 8/25/2015 | 8/24/2065 |

29 | TLACUACHE | 245147 | 1.0396 | 11/8/2016 | 11/7/2066 |

Total | 55,119.015 |

|

| ||

16

Figure 3.2 Don David Mine Concessions (concession numbers are listed in Table 3.1)

Mineral rights in Mexico belong to the Mexican federal government and are administered according to Article 27 of the Mexican Constitution. Concessions grant the right to explore and exploit all minerals found in the ground. All mining concessions comprising the Don David Gold Mine are exploitation concessions, which may be granted or transferred to Mexican citizens and corporations. Mexican subsidiaries of GRC hold the leases or concessions. Exploitation concessions have a term of 50 years and can be renewed for another 50 years. Maintenance of concessions requires the semi-annual payment of mining duties (due in January and July). The submission of confirmation of work reports on a calendar year basis. The confirmation of work reports is required to be filed in May for the preceding calendar year. The number of mining duties and annual assessment are set by regulation and may increase over the life of the concession and include periodic adjustments for inflation. Mining concessions are registered at the Public Registry of Mining in Mexico City and regional offices in Mexico.

Mexican mining law does not require payment of finder’s fees or royalties to the government, except for a discovery premium connected with national mineral reserves, concessions, and claims or allotments contracted directly from the Mexican Geological Survey. None of the claims held by DDGM’s subsidiaries are under any such discovery premium regime.

DDGM must pay surface rights for concessions to the Mexican government to maintain its interest in the DDGM mining concessions, which are paid twice annually (January and July). The annual 2022 concession surface rights tax paid for the mining concessions controlled by DDGM was $1.0 million; all payments have been met and are current.

In 2022, DDGM satisfied the investment and assessment work requirements based on its annual work programs and past work completed. DDGM concession payments are in good standing.

17

Table 3.2 Don David Gold Mine Concession Maintenance Fees by Property

|

| TOTAL NUMBER OF CONCESSIONS |

| TOTAL SIZE |

| ACQUISITION DATE RANGE |

| 2022 MAINTENANCE FEES PAID | |

| | | (in hectares) * | | | | | ||

Production Stage Properties: | | | | | | | | ||

Arista | | 18 | | 24,372 | | 2002 to 2016 | | $ | 421,953 |

Alta Gracia | | 3 | | 5,175 | | 2008 | | | 95,587 |

Subtotal | | | | 29,547 | | | | $ | 517,540 |

Exploration Stage Properties: | | | | | | | | ||

Rey | | 4 | | 2,335 | | 2002 to 2009 | | $ | 43,126 |

Chamizo | | 2 | | 19,758 | | 2011 to 2013 | | | 364,928 |

Las Margaritas | | 1 | | 925 | | 2002 | | | 17,085 |

Fuego | | 1 | | 2,554 | | 2013 | | | 47,173 |

Subtotal | | | | 25,572 | | | | | 472,312 |

Total: | | | | 55,119 | | | | $ | 989,852 |

In 2013, the Mexican federal government enacted a tax reform package effective January 1, 2014. There were several significant changes in the Mexican tax reform package. The planned corporate income tax rate reductions (29% in 2014, 28% thereafter) were repealed. The corporate tax rate remains at 30%. The tax base for income tax was amplified, considering certain limitations on deductions. The business flat tax (IETU) that was effective from 2008 to 2013 was repealed in 2014. A special mining royalty tax of 7.5% was applied to net profits from a property concession holder from the sale or transfer of extraction-related activities. Net profits for this royalty are determined, including the calculation of general taxable income with the exceptions for deductions for investments in fixed assets and interest. Effective in 2021, deductions for surface right mining concession paid were no longer allowed. In addition, owners of mining concessions are required to pay an additional extraordinary 0.5% royalty fee on gross revenue derived from the sale of gold, silver, and/or platinum. A further 10% withholding tax on dividend distributions was introduced. However, the tax treaty between the US and Mexico to avoid double taxation reduces this withholding tax to 5%.

In this Technical Report, all Mineral Resources and Mineral Reserves mining concessions are controlled by DDGM. Further, DDGM has secured and maintained the necessary permits for the Don David Gold Mine’s exploration, development, and production.

On October 14, 2002, DDGM leased its first three mining concessions from a former consultant to the company. These concessions are El Aguila, Mina Del Aire, and La Tehuana, totaling 1,896 hectares. The El Aguila and Mina Del Aire concessions are now part of DDGM's Arista Mine, and the La Tehuana concession comprises the Margaritas property.

The lease agreement with the former consultant is subject to a 4% net smelter return royalty where production is sold in the form of gold/silver doré and 5% for production sold in concentrate form. Subject to meeting minimum exploration requirements, there is no expiration term for the Lease. DDGM may terminate the Lease at any time upon written notice to the Lessor, and the Lessor may terminate it if DDGM fails to fulfill any of its obligations, which primarily consist of paying the appropriate royalty to the Lessor.

In 2010, DDGM subsequently acquired, at no additional cost, two additional concessions from the former consultant: El Chacal and El Pilon, totaling 1,445 hectares, each is subject to a 2% royalty to the consultant but are not subject to the Lease.

DDGM has since filed for and received additional concessions for the Project that total an additional 45,029 hectares referred to as: El Pitayo Fracción 1 to 4, El Talaje, El Coyote, El Zorrito, San Luis, La Curva, La Herradura, David Fracción 1 and 2, El Chamizo, Zopi, San Miguel Fracción 2, El Aguila III, Correcaminos and Tlacuache. These additional concessions are not part of the concessions leased or acquired from DDGM’s former consultant.

18

The Don David Gold Mine also includes the Rey property, which adjoins DDGM's El Chamizo concession on the west side. These concessions are Rey, El Virrey, La Reyna, and El Marquez. DDGM acquired the El Virrey concession from the former consultant, and it is subject to a 2% net smelter return royalty payable to the consultant. DDGM obtained the remaining concessions by staking claims and filing for concessions with the Mexican government. These concessions total 2,335 hectares.

In March 2013, DDGM acquired the San Pedro Fracción 1 and San Pedro Fracción 2 concessions from Almaden Minerals Ltd. (Almaden), subject to a 2% net smelter return royalty. The San Pedro Fracción 1 concession consists of 2,554 hectares and is located south of DDGM’s Alta Gracia and El Chamizo properties. The San Pedro Fracción 2 concession consists of 1,860 hectares and is surrounded by DDGM's El Chamizo concession and will be included as part of the El Chamizo property. Any future production from the San Pedro Fracción 1 and San Pedro Fracción 2 concession is subject to Almaden's 2% net smelter return royalty.

DDGM is required to prepare a mine closure plan for the possible future abandonment of the Arista and Alta Gracia Projects. Golder has prepared a Mine Closure Plan and Reclamation Budgets for the Arista Mine. The closure cost estimate includes funds covering the tailings ponds, waste rock stockpiles ("tepetateras"), and securing and cleaning up the other surface and underground mine facilities. The total estimated closure and reclamation cost for the Arista Mine is estimated to be $10.6 million. Golder prepared its report in December 2022. The total estimated closure and reclamation cost for the Alta Gracia Project is estimated to be 11.3 million Mexican Pesos (MXP), which is equal to about $0.6 million.

See Section 17 (Environmental Studies, Permitting and Social or Community Impact) for additional information on the environmental regulation of the Project.

DDGM has obtained, or is in the process of applying for, the required Environmental Impact Studies and permits to continue operating in accordance with Mexican Laws and Regulations.

3.6Other Significant Factors and Risks

We are not aware of other significant factors and risks that may affect access, title or right, or ability to perform work at the mine.

In the opinion of the QPs:

The information discussed in this section supports the declaration of Mineral Resources, Mineral Reserves and the development of a mine plan with accompanying financial analysis.

19

4ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND, PHYSIOGRAPHY

DDGM’s primary operations are located near San José de Gracia village, within the Municipality of San Pedro Totolapam. The Municipality of San Pedro Totolapam is located in the Region of the Central Valleys, 89 km southeast of the city of Oaxaca, and is part of the District of Tlacolula. Access to the project area from the city of Oaxaca is by the paved federal highway 190, which passes through the village of San José de Gracia.

The Don David Gold Mine is approximately 4 km northwest of the village of San José de Gracia. Gravel and paved roads have been constructed from the village to the mine and mill sites, supporting adequate property access by small and large vehicles.

The Alta Gracia Project is approximately 20 km northeast of San Pedro Totolapam, the seat of the municipal government. Access to the project is by a gravel road that departs the paved highway approximately 13 km east of San Pedro Totolapam. The haulage distance by road from Alta Gracia to the DDGM Processing Facility, where the ore is processed, is about 32 km.

The climate of the DDGM area is temperate, semi-dry, and warm to hot. Most rainfall occurs in the summer months (June – August), and the annual average precipitation in the project area is approximately 400 mm, with significant fluctuations occurring. The recent average yearly temperature on the mine site is 22 degrees centigrade (°C); measurements at the Totolapam station from 1975 to 2008 showed an annual average of 24.2°C. Minimum yearly temperatures generally occur in January, while maximum temperatures typically occur in March through May; the yearly temperature range is generally between 9°C and 33°C. Mining operations are conducted on a year-round basis.

4.3Topography, Elevation, And Vegetation

The Don David Gold Mine is in the state of Oaxaca in southern Mexico, which is bordered by the states of Puebla, Veracruz, Chiapas, and Guerrero, with the Pacific Ocean to the south. The DDGM project areas are in the physiographic sub-province of Tierras Altas de Oaxaca, part of the Sierra Madre del Sur physiographic province, in the south-western part of Mexico.

Oaxaca has one of the most rugged terrains in Mexico, with mountain ranges that abruptly transition into the sea. Oaxaca has several mountain chains with elevations varying from sea level to more than 3,700 meters above sea level. Between these mountains are primarily narrow valleys, canyons, and ravines. The mountains are formed mainly by the convergence of the Sierra Madre del Sur, Sierra Madre de Oaxaca and Sierra Atravesada into what is called the Oaxaca Complex (Complejo Oaxaqueño).

The Arista and Alta Gracia projects of the Don David Gold Mine are located within San Pedro Totolapam. The municipality's surface is irrigated by the Rio Grande, with many tributary rivers also irrigating other project areas; most watercourses (arroyos) are dry throughout most of the year. The elevations range from 660 meters above sea level (masl) to 2,480 masl in GSRs project areas; somewhat lower in the Arista and Alta Gracia projects (up to 1,680 masl). The area is rugged with generally steep slopes, up to 30°, although more vertical cliffs are also present. The area is very rocky with thorn bushes and stunted deciduous temperate vegetation typical of dry savannah climates; locally, cacti, both columnar and candlestick types, are a prominent vegetation feature. Subsistence farming occurs in the area, and the main agricultural crop is agave cacti cultivated to produce mezcal.

All mine, process infrastructure, and supporting facilities are included in the current general layout to ensure that they meet the needs of the mine plan and production rate.

The Don David Gold Mine is 114 km, or two hours by road from Oaxaca City, the main service center for the operation, with good year-round access. A workforce familiar with mining and the necessary support facilities is present in the region. The company provides transportation to and from their local home bases. The San Jose de Gracia village supplies some of the crew for the mine, while other workers come from Oaxaca City or nearby villages.

The processing plant has a differential flotation circuit capable of processing polymetallic ores and producing up to three separate concentrate products for sale and an agitated leach circuit capable of producing gold and silver doré for purchase. The DDGM mill flotation circuit and agitated leach processing capacities provide for a nominal 2,000 tpd.

A flotation tailings impoundment was constructed in a valley just below the process plant site.

20

The impoundment is double lined with the first liner made of clay and synthetic material that acts as a leak prevention system with an effective absorption equal to ~ 3 meters of clay.

The second liner is a welded High-Density Polyethylene (HDPE), which was a permitting requirement. The method of subsequent embankment construction to obtain total capacity was upstream.

Construction of a filtration plant and dry stack facility commenced in September 2020 and was completed in early 2022. The filtration plant and existing paste plant (commissioned in October 2019) will handle 100% of future tailings production.

DDGM has several permitted waste-rock disposal areas at the Arista and Alta Gracia projects. These waste disposal areas were designed mainly as valley fill sites.

Up until 2018, diesel generators mainly provided power at the site. In 2019, DDGM successfully connected a power line to its Arista Mine from the Mexican Federal Electricity Commission’s (Comisión Federal de Electricidad or CFE) power grid. Before this connection, the project operated 100% from electricity generated from more expensive and higher-emission diesel fuel. The mine and plant can remain operational using the diesel generators maintained for backup use. In 2021, there was an increase in power consumption due to ventilation and dewatering pumps requiring the installation of capacitors that improved and stabilized the power supply. In 2021, DDGM also initiated conversations with CFE to expand the load delivered to stabilize the energy supply. In 2022, the capacitors were installed and commissioned and CFE expanded the load delivered to attend to the higher demand on site.

Water requirements to process ore are primarily sourced from water pumped to the surface from the underground mine dewatering system. Previously, some water was sourced from the local river for which payment was made to the National Water Commission (Comisión Nacional del Agua, or CONAGUA); however, this consumption is now minimal, and river water is only used for the camp facilities. DDGM has the necessary permits to discharge underground mine water at the surface. Water in the tailings facility is recycled to the DDGM processing plant, and the excess water pumped from the underground workings is discharged at the surface into decantation ponds. Water sampling from rivers and creeks is conducted regularly and sent to an external laboratory for analysis.

All process buildings and offices for operating the mine have been constructed. Camp facilities are in the village of San Jose de Gracia.

Plan drawings and more detailed information regarding the property infrastructure are provided in the Project Infrastructure section of this report.

4.5Sufficiency of Surface Rights

This report's mineral resources and mineral reserves are located on mining concessions controlled by DDGM. The mine's processing facility and supporting infrastructure are within the area of surface rights and mineral tenure owned by the Don David Gold Mine.

It is the opinion of the QPs that there are sufficient mineral tenure and surface rights to support the LOM mining operations due to the following:

21

The Arista and Alta Gracia Projects are in the regional Tlacolula mining district in Oaxaca, Mexico’s southwestern part. According to the Mexican Geological Survey, the Servicio Geologico Mexicano (SGM) mining activity was initiated in the early 1880s in the Tlacolula mining district, producing some 300,000 ounces of gold and silver from an ore shoot of the La Leona mine. However, no separate amounts of production were reported for each metal. SGM states that in 1892 two smelters were built and operated (Magdalena Teitipac and O’Kelly) near the village of Tlacolula for processing ores from the Alta Gracia La Soledad, San Ignacio y Anexas, La Leona, La Victoria, and San Rafael silver mines. Subsequently, in 1911, Mr. Sken Sanders investigated the Totolapam mining region with a particular interest in the Margaritas mine. Most of these historical mines are situated within DDGM’s mining concessions.

The Arista and Alta Gracia projects are in the smaller mining sub-districts of San Jose de Gracia and Alta Gracia, respectively. Only small-scale artisanal mining has been historically conducted in these districts. No reliable production records exist for the historic production performed in the Arista and Alta Gracia Project areas.

The Arista Project mining district had been inactive since the 1950s and the Alta Gracia mining district since the 1980s until Apex Silver Corporation in the 1990s. Subsequently, GRC initiated geologic reconnaissance through its Mexican subsidiaries in search of precious metal deposits.

DDGM currently holds an interest in twenty-nine (29) mining concessions in Oaxaca State, totaling 55,119 hectares. Expiration dates associated with the DDGM mining concessions range from March 4, 2023 to November 7, 2066.

GRC has carried out a continuous drilling program since 2003 when the company took control of the Arista project mining concessions, now part of GRC’s Don David Gold Mine. GRC continues the development of an aggressive exploration program that includes underground mine development, such as access ramps, drifts, and crosscuts into the Arista, Switchback, and Alta Gracia vein systems.

In the 1940s, exploration audits were mined into the Manto Vein, but the results of this activity were not reported. In the 1980s, mining took place on the Alta Gracia property; again, no information on exploration activity is available.

In 1998 - 1999, before GRC’s involvement, several DDGM concessions were leased to Apex Silver Corporation (Apex). Apex conducted an exploration program involving geologic mapping, surface sampling, and an 11-hole RC drilling program (1,242 m) into the shallow dipping vein, manto-style deposit.

GRC exploration and drilling activities are discussed in the relevant sections in this document.

5.3.Prior Mineral Resources and Mineral Reserves

All previously reported Mineral Resource and Mineral Reserve estimates are regarded as prior estimates and are superseded by the current Mineral Resources and Mineral Reserves presented in this Report.

The Arista and Alta Gracia Projects are in the smaller mining sub-districts of San Jose de Gracia and Alta Gracia, respectively. Historically, only small-scale artisanal mining has been conducted in these districts. No reliable production records exist for the historic production conducted in the Arista and Alta Gracia Project areas. Both are accessed from the Arista mine workings of the Don David Gold Mine. Mining of the Arista deposit was initiated in 2010. The mining of the Switchback deposit began in 2017.

Since the commencement of production from the Don David Gold Mine in 2010, DDGM has produced 358,685 ounces of gold and 24,753,618 ounces of silver from the 5,532,682 tonnes shipped to the DDGM Processing Facility (Table 5.1). In addition, 15,318 tonnes of copper, 64,515 tonnes of lead, and 176,821 tonnes of zinc have been produced from the plant.

22

Table 5.1 Don David Mine Production 2010 through 2022

YEAR | MILLED | GOLD | SILVER | COPPER | LEAD | ZINC |

TONNES | OZ | OZ | TONNES | TONNES | TONNES | |

2010 | 166,237 | 10,493 | 111,316 | 0 | 0 | 0 |

2011 | 214,215 | 21,586 | 2,180,309 | 620 | 1,840 | 3,730 |

2012 | 282,120 | 34,417 | 2,996,743 | 986 | 3,374 | 9,115 |

2013 | 316,270 | 33,942 | 3,032,841 | 926 | 2,742 | 7,452 |

2014 | 375,623 | 35,552 | 3,297,204 | 1,254 | 4,555 | 13,195 |

2015 | 413,626 | 29,644 | 2,506,337 | 1,310 | 4,174 | 13,900 |

2016 | 450,221 | 27,628 | 1,857,658 | 1,035 | 4,049 | 14,302 |

2017 | 449,177 | 28,117 | 1,773,263 | 1,141 | 5,365 | 16,301 |

2018 | 611,670 | 26,838 | 1,672,034 | 1,652 | 7,280 | 19,808 |

2019 | 693,173 | 29,435 | 1,722,852 | 1,859 | 9,202 | 23,683 |

2020 | 565,346 | 20,473 | 1,189,366 | 1,593 | 7,725 | 19,696 |

2021 | 501,978 | 26,438 | 1,200,291 | 1,506 | 7,544 | 17,696 |

2022 | 493,026 | 34,122 | 1,213,404 | 1,436 | 6,665 | 17,943 |

Totals | 5,532,682 | 358,685 | 24,753,618 | 15,318 | 64,515 | 176,821 |

23

6.GEOLOGICAL SETTING AND MINERALIZATION AND DEPOSIT

The regional geology of the Don David Mine is dominated by volcanic rocks of presumed Miocene age that vary in composition from rhyolitic to andesitic, which occur as flows, tuffs, agglomerates, and ignimbrites, as well as intrusive units. These units overly and intrude basement rocks consisting of marine sediments.

The Don David Mine includes mineral deposits over a 55-km NW–SE mineralized trend, which is hosted by volcanic, sedimentary, igneous, and metamorphic rocks ranging in age from Cenozoic to Cretaceous. The regional geology is contained within the Cuicateco, or Juarez, tectonostratigraphic terrane. The Juarez terrane is a west-dipping, fault-bounded prism of variably deformed Jurassic and Cretaceous arc-volcanic and oceanic rocks. The Cenozoic volcanism and subsequent structural overprint are interpreted to be related to subduction along the predominantly convergent southern Mexico plate boundary (Figure 6.1)

Figure 6.2 shows the regional geology for the Don David Mine area taken from SGM (formerly the CRM; Sánchez Rojas et al., 2000). Figure 6.3 shows the stratigraphic column for rock units shown in Figures 6.2 and 6.4 corresponding to DDGM’s local geologic investigations.

Figure 6.1 Map of Oaxaca State showing tectonostratigraphic terranes

Figure 6.1: Shows approximate location of the Cenozoic (Tertiary) volcanic units.

24

Figure 6.2 Don David Mine Local Geology Showing DDGM Concession Boundaries

Figure 6.2: Concession boundaries in yellow (Geology after Sánchez Rojas et al., 2000; map insert from INEGI 2019).

25

The Don David Mine is underlain by thick sequences of andesitic to rhyolitic volcanic and volcaniclastic rocks, with intercalated minor sedimentary units, of presumed Miocene age (Ferrusquía-Villafranca and McDowell, 1991). The youngest volcanic units may be of the Pliocene age. Multiple, predominantly rhyolitic volcanic domes at various scales have been identified within the district. It is suspected that non-vented domes also occur. These units are unconformably underlain by a basement of Cretaceous marine, locally calcareous sediments.

Figure 6.2 shows the regional geology for the Don David Mine area taken from SGM (formerly the CRM; Sánchez Rojas et al., 2000). Figure 6.3 shows the stratigraphic column for rock units shown in Figures 6.2 and 6.4, corresponding to DDGM’s local geologic investigations.

Figure 6.4 Geologic Map of the Arista Project and Arista Underground Mine Area

Figure 6.4: Map highlights prominent structures and exploration prospects or mines

Multiple volcanic domes of various scales dominate the Don David Mine area, and it is suspected that non-vented intrusive domes are also present. These volcanogenic features overly, and are intruded into, a pre-volcanic basement of sedimentary rocks. Gold, silver, and base metal mineralization in this district is related to the volcanogenic system and is considered epithermal in character.

A semi-detailed regional geologic map of the area at a scale of 1:5000 was initiated in 2007 by DDGM’s on-site geologic staff (Figure 6.4). The information recorded includes lithology, structural, alteration zone features, and hand sample locations. Data

27

based on aerial photographic interpretation and field data were incorporated into the geologic map, continually updated based on new observations.

The Don David Mine Arista property is underlain by a Cretaceous sedimentary lithic sequence, composed of fine-grained sandstones intercalated with shale, siltstone, and calcareous rocks; these have been identified in outcrops on the central part of the Arista Project area surrounding the Cerro Colorado peak and in drill hole intercepts (Figure 6.4). Younger andesitic to rhyolitic volcanic and volcaniclastic units, intrusive dikes, and small stocks of granitic to granodiorite composition crop out within the area and have been intercepted in drill holes. The intrusive rocks may be associated with structural conditions favorable for subsequent deposition of mineralization along dikes, faults, and breccia zones and be related to possible replacement and skarn deposits in good contact zones with the sedimentary sequence.

The mineralized structures appear to be associated with a trans-tensional structural system intersecting an interpreted Cenozoic-aged volcanic “caldera.”

The stratigraphy of the Arista Project area can be divided into a Cretaceous basement and overlying Tertiary units, as shown in Figure 6.4. The Cretaceous units are composed of rocks of sedimentary origin, weakly to moderately metamorphosed and often intensely deformed. These rocks are unconformably overlain by the Cenozoic units comprised mainly of subaerial volcanic rocks. The rocks of the Cenozoic cover have experienced only extensional deformation and, in some places, are gently tilted. The Cenozoic-aged rocks correspond to a period of tectonism accompanied by volcanism, sedimentation, and intrusive magmatic activity associated with the NNE subduction of the Guadalupe plate under southern Mexico (Morán-Zenteno et al., 1999). According to geologic investigations by DDGM’s on-site staff and numerous consultants, the predominant rocks identified within the Arista Project area include volcanic rocks of intermediate to acid composition (andesite to rhyolite).

Below is a summary of the central stratigraphic units determined by the GRC geologists.

Rocks of Cretaceous Age:

Rocks of Cenozoic Age:

The Cenozoic units consist of a series of volcanoclastic deposits interbedded with volcanic rocks of andesitic composition (volcano-sedimentary series) overlain by a succession of andesitic to rhyolitic volcanic rocks occurring as flows, tuffs, ignimbrites, and agglomerates; the units have been classified as follows:

28

Intrusive Rocks:

Other Rocks of Quaternary Age:

The youngest rocks identified in the Arista Project area include surficial deposits of alluvium, colluvium, and gravel as products of weathering of the surrounding pre-existing units. Locally and particularly near Salina Blanca, active travertine deposition occurs due to infiltration and deposition of carbonate-bearing water, which may indicate a dynamic hydrothermal system and dissolution of carbonate sedimentary rocks.

The Arista Project shows a complex structural system with numerous lineaments and geologic structures; many were first identified on satellite images and aerial photographs and later verified during field observations and drilling. Figure 6.4 highlights the prominent structures discussed below.

The identified structures have been used to define a possible regional transtensional wrench-fault system determined by relative movements and inter-relations between the various individual structures. A transpressional system has also been proposed. The most significant regional structures within the Arista Project area are summarized as follows:

29

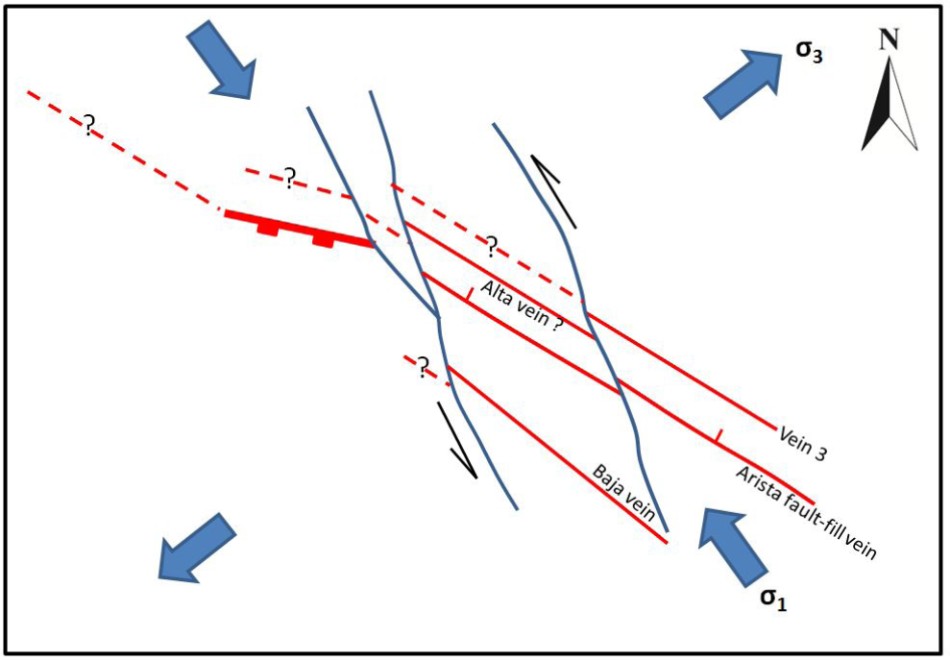

A detailed structural examination from underground mine workings, surface exposures, and drill core intercepts (in the regional regime context) provides evidence of transtensional-wrench faulting as the dominant structural control at the Arista Project. Consultants of SRK (Canada) performed site visits and subsequent desktop studies at the mine project in 2012 and 2013, examining the kinematics and overall structural system (Vos et al., 2012; Couture, 2012; Kramer and Couture 2013). Their conclusions support previous conceptual models and are summarized below (Figures 6.5 and 6.6):

30

Late structural events are suspected of playing a significant role in the current configuration of vein positions (Figure 6.6) with the most prominent trend-oriented 340-350° (sinistral strike-slip, +/- oblique thrust). Many veins, including Baja, exhibit internal deformation (multiphase concurrent with mineralization and post mineralization), and several veins and splays, including Arista and Vein 3, are suspected of having been juxtaposed side-by-side by the post mineralizing events, such that an artificial thickening of veins results from transposition or “stacking.” To support this interpretation, evidence has been documented on measurable fault surfaces exposed in the upper levels of current mine workings on the Arista fault vein, Vein 3, and Baja vein. Likewise, bonanza grades have been attributed to these intersecting structural sites.

Figure 6.5 Simplified Early Structural Framework Arista System

Figure 6.5: Highlights observed fault-vein geometries for the Arista mine, inset photo illustrates outcrop expression of dilation jog as favorable sites for vein/mineralization. (mod. from Vos et al., 2012)

31

Figure 6.6 Generalized Late Structural Framework Arista System

Figure 6.6: Shows post-mineralization deformation of the Arista vein system (mod. from Vos et al., 2012)

A consultant geologist performed additional structural work in 2018 (Hohbach, 2018) on the Switchback vein system, where similar transposition features are also seen in the principal veins. Hohbach identified four main mineralized structural orientations, which are, from oldest to youngest:

Hohbach also identified several preferred post-mineralization orientations, namely: FN0°, F60°, F90° (which can be confused with the mineralized set and can have notable offsets), and F325-330°, which can manifest as significant fault zones with significant gouge thicknesses. All can have fault gouge and show minimal mineral alteration.

Most of the mineralized orientations correlate to directions identified by SRK for the Arista vein system.

Since April 2010, DDGM’s on-site geologic staff has reviewed available information and conducted geological reconnaissance and semi-detailed surface and underground geological mapping on the Alta Gracia property (Figure 6.7). The recorded

32

information included lithology, structural, alteration zone features, and hand sample locations. Previous information based on aerial photographic interpretation and field data were incorporated in the geologic map.

The sedimentary and volcanic units mapped at Alta Gracia are like those observed at the Arista project. Known vein occurrences are mainly hosted in andesitic and rhyolitic units of the Cenozoic age.

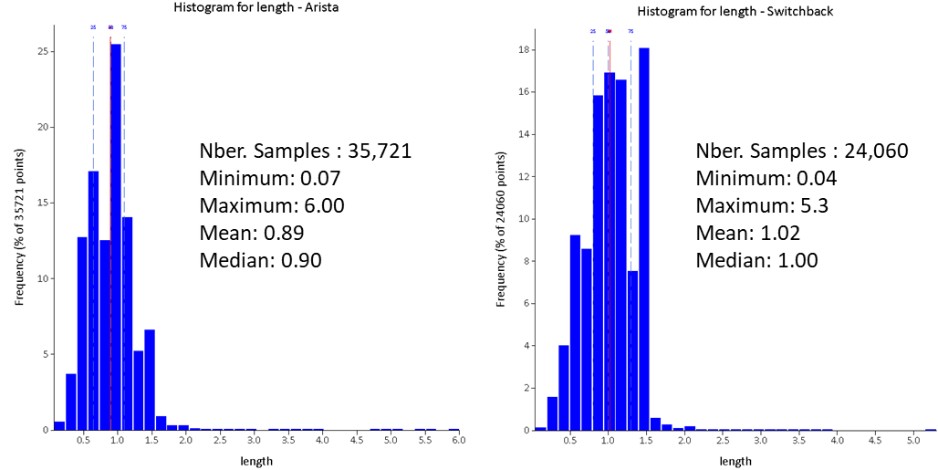

The rock units mapped on the Alta Gracia Project can be divided as follows: