Exhibit 99.2

Unaudited Financial Statements of Aquila Resources Inc.

as of and for the nine months ended September 30, 2021

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in United States Dollars, unless otherwise stated)

(Unaudited)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021

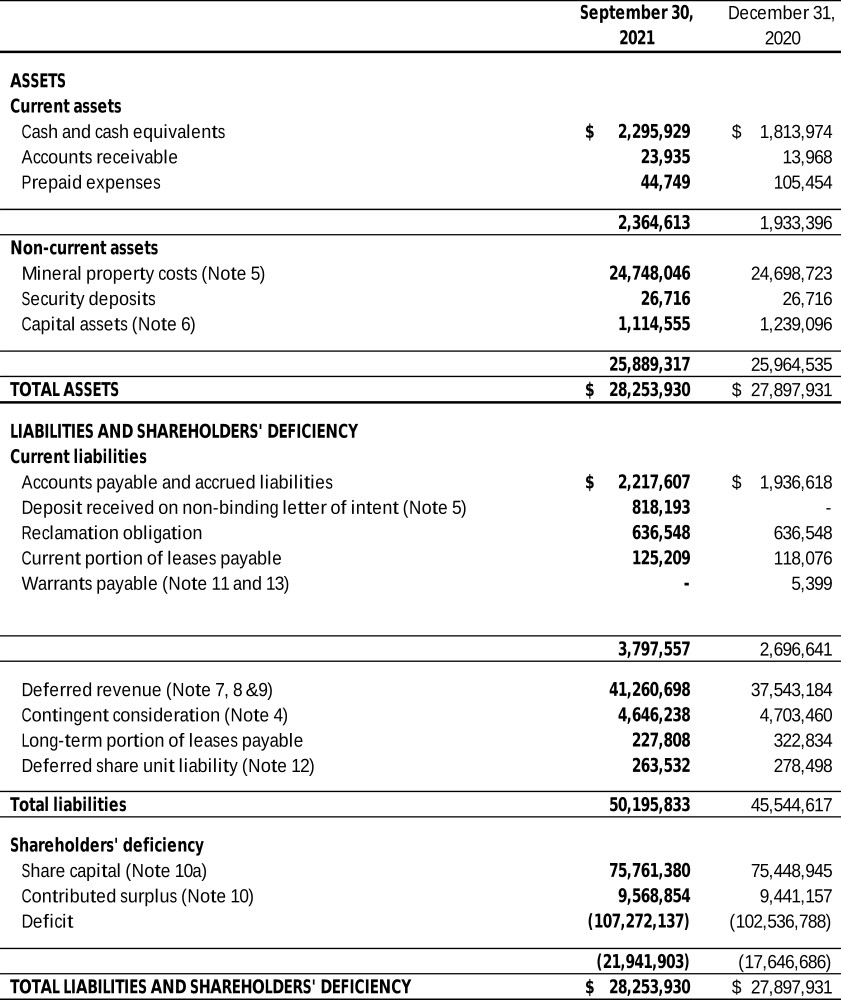

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

As at September 30, 2021 and December 31, 2020

(Unaudited, expressed in United States Dollars)

The accompanying notes are an integral part of these interim financial statements.

Nature of operations and going concern (Note 1)

Commitments related to project spending (Note 6)

2

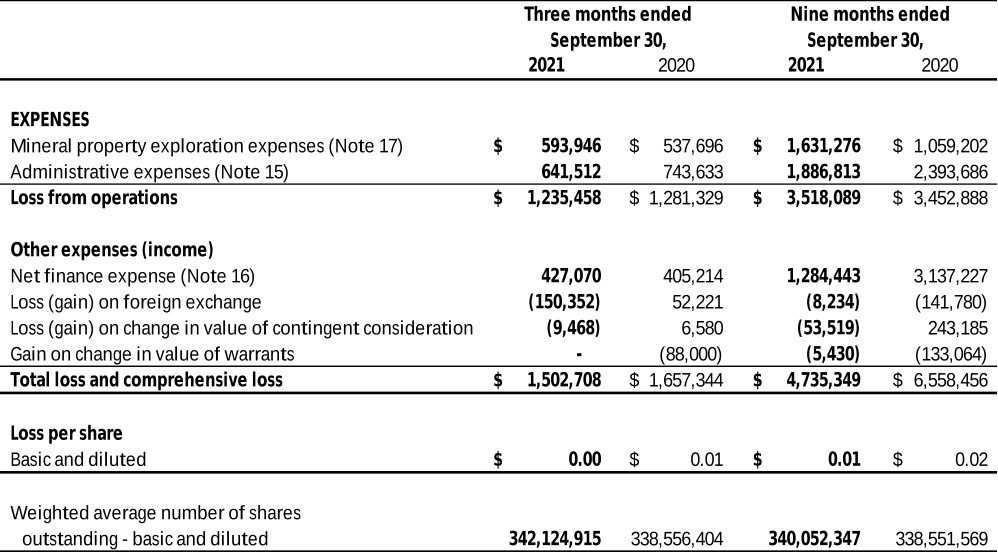

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF NET LOSS AND COMPREHENSIVE LOSS

For the three and nine months ended September 30, 2021 and 2020

(Unaudited, expressed in United States Dollars, except number of shares)

The accompanying notes are an integral part of these interim financial statements.

3

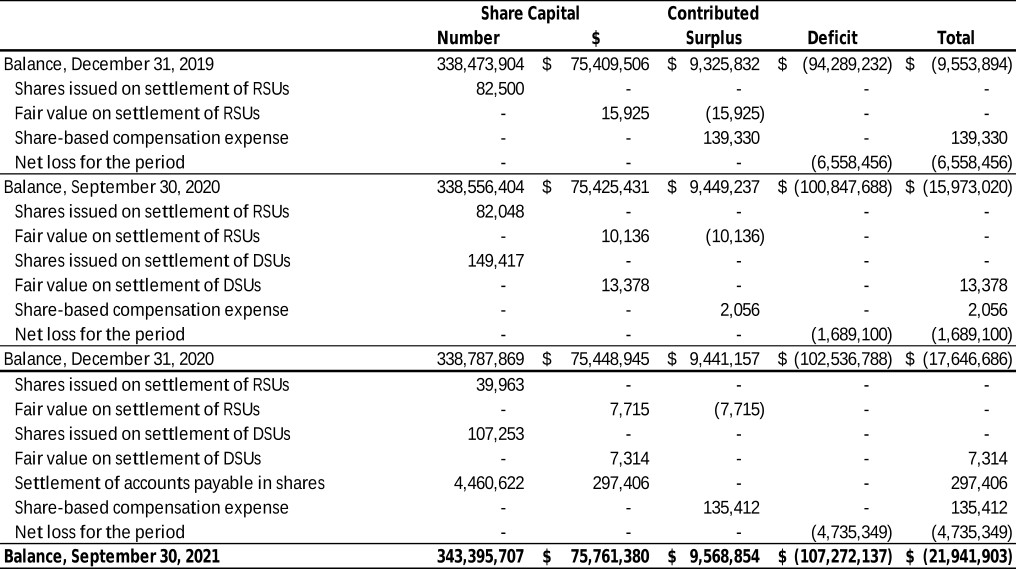

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

As at September 30, 2021 and 2020

(Unaudited, expressed in United States Dollars)

The accompanying notes are an integral part of these interim financial statements.

4

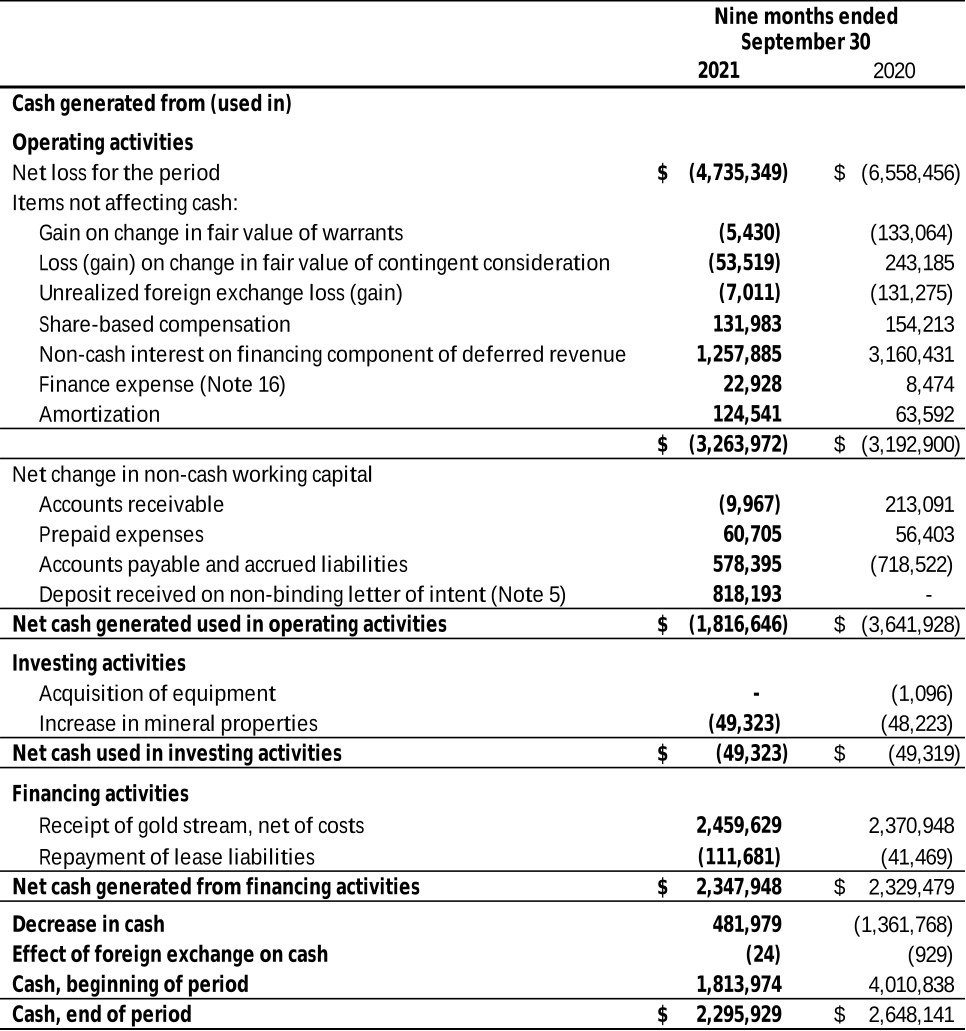

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASHFLOWS

For the nine months ended September 30, 2021 and 2020

(Unaudited, expressed in United States Dollars)

The accompanying notes are an integral part of these interim financial statements.

5

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

| 1. | Nature of Operations and Going Concern |

Aquila Resources Inc. (the “Company” or “Aquila”) is in the business of exploring for and developing mineral properties. Substantially all of the Company’s efforts are devoted to these activities.

Aquila was incorporated in the Province of Ontario and is listed on the Toronto Stock Exchange under the symbol “AQA”. The Company’s head office address is 141 Adelaide Street West, Suite 520, Toronto, Ontario, Canada, M5H 3L5.

The Company’s primary investment is the Back Forty Joint Venture LLC (“BFJV”). This investment holds a property for which a Feasibility Study was released in August 2018. In July 2012 HudBay Minerals Inc. ("HudBay"), which had the controlling interest in the BFJV, suspended its exploration and evaluation activities at the Back Forty Project. In November 2013, Aquila signed a definitive agreement with HudBay to take control and 100% ownership of the BFJV. These transactions were completed in January 2014.

The business of mining and exploration for minerals involves a high degree of risk and there can be no assurance that current exploration and development programs will result in profitable mining operations. The recoverability of the carrying value of exploration properties and the Company’s continued existence is dependent upon the preservation of its interest in the underlying properties, the discovery of economically recoverable reserves, the achievement of profitable operations, and the ability of the Company to raise financing, or alternatively upon the Company’s ability to dispose of its interests on an advantageous basis.

Although the Company has taken steps to verify title to the properties in which it has an interest, in accordance with industry standards for the current stage of exploration of such properties, these procedures do not guarantee the Company's title. Property title may be subject to government licensing requirements or regulations, unregistered prior agreements, undetected defects, unregistered claims, native land claims, and non-compliance with regulatory and environmental requirements.

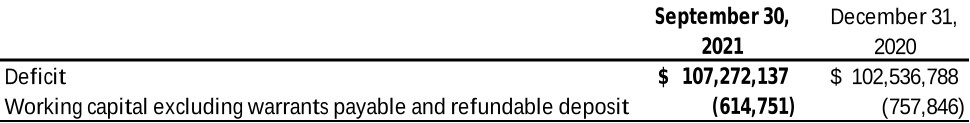

Details of deficit and working capital (current assets less current liabilities excluding warrants payable and the deposit received on the non-binding letter of intent) of the Company are as follows:

The Company has no operating cash flow from a producing mine and therefore must utilize its current cash reserves, income from short term investments and deposits, and other financing transactions to maintain its capacity to meet working capital requirements and planned corporate expenditures, as well as to fund the development of Back Forty and other exploration activities. The Company currently has negative working capital as shown above. It is not possible to predict whether adequate financing will be available in the future on acceptable terms. Although the Company has been successful in the past to obtain financing, there can be no assurances that the steps management is taking, and will continue to take, will be successful in future reporting periods or that such financing will be on terms advantageous to the Company. These conditions indicate that material uncertainty exists that raise a substantial doubt on the Company’s ability to continue as a going concern

6

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

. Changes in future conditions could require a material write down of carrying values and an inability to meet its obligations as they fall due.

These unaudited condensed interim consolidated financial statements (“the interim financial statements”) have been prepared on the basis that Aquila is a going concern in accordance with International Financial Reporting Standards (“IFRS”) on a going concern basis. Accordingly, they do not give effect to adjustments that would be necessary should the Company be unable to continue as a going concern and therefore be required to realize its assets and liquidate its liabilities and commitments in other than the normal course of business and at amounts different from those in the accompanying consolidated financial statements. Such adjustments could be material. It is not possible to predict whether the Company will be able to raise adequate financing or to ultimately attain profitable levels of operations. In addition, the Company has taken steps to organize financing for the Company in the short term and have plans for funding options through the development phase of the mine. However, there can be no assurance over the ability to execute on such financing transactions.

| 2. | Accounting Policies |

Statement of Compliance

These interim financial statements have been prepared in accordance with International Accounting Standard 34, Interim Financial Reporting. Accordingly, they do not include all of the information required for full annual financial statements required by IFRS as issued by the International Accounting Standards Board (“IASB”) and interpretations issued by the International Financial Reporting Interpretations Committee. These interim financial statements should be read in conjunction with the Company's audited consolidated financial statements for the year ended December 31, 2020.

These consolidated financial statements were authorized for issuance by the Board of Directors of the Company on November 11, 2021.

Basis of Preparation and Presentation

The accounting policies adopted are consistent with those of the previous financial year and corresponding interim reporting period, except as noted below in Significant Accounting Policies.

In the preparation of these interim financial statements, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the period. Actual results could differ from these estimates. The significant estimates and assumptions are consistent with these disclosed in the Company’s audited consolidated financial statements for the year ended December 31, 2020 except for deferred share units (Note 12), warrants (Note 13) and contingent consideration (Note 4) where estimates have been updated to reflect current market conditions.

Basis of Consolidation

These interim financial statements include the accounts of the Company and all of its subsidiaries. Subsidiaries are entities controlled by the Company. Control exists when the Company has the power to govern the financial and operating policies of an entity so as to obtain variable benefits from its power over the entity’s activities.

7

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

Subsidiaries are included in the consolidated financial results of the Company from the effective date of acquisition of control up to the effective date of disposal or loss of control. The Company’s principal subsidiaries are: Aquila Resources USA Inc. and Aquila Michigan Inc. (previously known as HudBay Michigan Inc.), which are based in Michigan USA. All inter-company balances and transactions have been eliminated.

These interim financial statements are expressed in United States Dollars, except those amounts denoted C$ which are in Canadian Dollars. The United States dollar is the functional and reporting currency of the Company and its subsidiaries’ operations. Monetary assets and liabilities denominated in foreign currencies are translated into United States dollars at exchange rates in effect at the statement of financial position date. Non-monetary assets and liabilities are translated at historical exchange rates. Revenues and expenses are translated at the rate at the time of the transaction. Any resulting gain or loss is recorded in the consolidated statement of loss and comprehensive loss.

| 3. | Critical Accounting Estimates and Judgments |

Areas of judgment that have the most significant effect on the amounts recognized in the interim financial statements are disclosed in Note 3 of the Company’s consolidated financial statements for the year ended December 31, 2020. There have been no significant changes to the areas of estimation and judgement during the nine months ended September 30, 2021.

| 4. | Contingent Consideration |

On December 30, 2013, the shareholders approved the acquisition of 100% of the shares of HudBay Michigan Inc. (“HMI”), a subsidiary of HudBay Minerals Inc. (“HudBay”), effectively giving Aquila 100% ownership in the Back Forty Project (the “HMI Acquisition”). Pursuant to the HMI Acquisition, HudBay’s 51% interest in the Back Forty Project was acquired in consideration for the issuance of common shares of Aquila, future milestone payments tied to the development of the Back Forty Project and a 1% net smelter return royalty on production from certain land parcels in the project.

The contingent consideration is composed of the following:

| a) | Fair value of future instalments is based on C$9 million tied to development of the Back Forty project as follows: |

| (i) | C$3 million payable on completion of any form of financing for purposes including the commencement of construction of Back Forty (up to 50% of the C$3 million can be paid, at Aquila’s option in Aquila shares with the balance payable in cash); |

| (ii) | C$2 million payable in cash 90 days after the commencement of commercial production; |

| (iii) | C$2 million payable in cash 270 days after the commencement of commercial production, and; |

| (iv) | C$2 million payable in cash 540 days after the commencement of commercial production. |

8

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

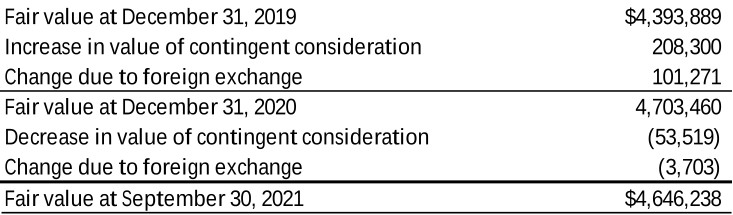

For the nine months ended September 30, 2021, a time value of money calculation was utilized to value the contingent consideration. Each milestone payment was assessed separately. Key risks including permitting, feasibility study, commercial production and timing were each assigned a probability weighting based on the likelihood of occurrence. U.S. Department of the Treasury bond yields ranging from 0.09% to 0.98% were used as the risk-free rate. The milestone payments are estimated to commence in 2022 with commercial production starting in 2025. When performing a sensitivity analysis, a 10% change in each of the probabilities, will impact the fair value of the contingent consideration by an estimated $1,239,100 to $1,417,500. If another key assumption, being the commencement of the milestone payments and the commencement of production, were pushed by one year to 2023 and 2026, respectively, the combined impact on fair value would increase by an estimated $79,000.

The fair value of the contingent consideration is as follows:

| 5. | Mineral Property Costs |

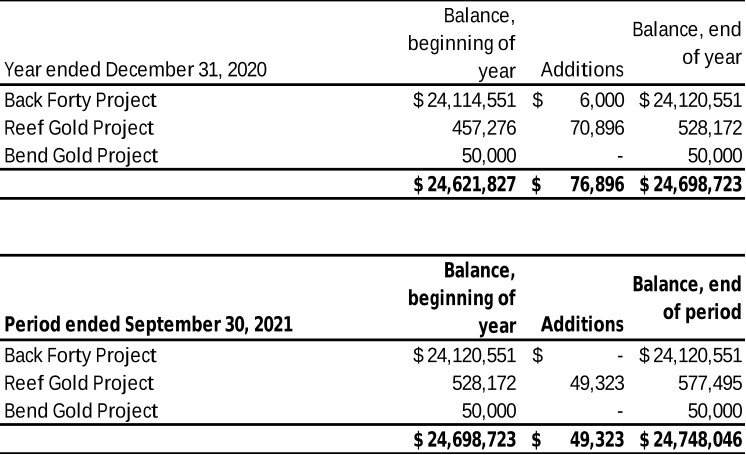

Total accumulated deferred mineral property costs are detailed as follows:

9

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

Back Forty Project

The Back Forty Project (the “Project”) controls surface and mineral rights which are owned or held under lease or option by BFJV. Some lands are subject to net smelter royalties varying from 1% to 3.5%, with certain lands subject to a 2% - 7% state royalty, which under state law can be renegotiated, at the option of Aquila.

In May 2021, the Company determined not to proceed with its appeal and withdrew its application for a Wetlands Permit. The Feasibility Study team is focused on a Project design seeking to avoid direct impacts to wetlands. Even if a Wetlands Permit is required, Aquila expects that it will be able to secure a re-issued permit from the Department of Environment, Great Lakes, and Energy (“EGLE”) based on the fieldwork already completed under the existing Wetlands Permit and progress on the groundwater modeling that would be used to support any estimates of indirect wetland impacts.

In addition, the Company determined not to proceed with the contested case of the amended Mining Permit and withdrew its application for the permit. As the amended Mining Permit only contemplates the open pit portion of the Project, there is no benefit to continuing to dedicate resources to a permit under which the Company does not plan to proceed. Following the completion of the Feasibility Study, the Company will apply for a Mining Permit that reflects the optimized design, including the underground mine plan. Should a Wetlands Permit and Dam Safety Permit be required, the Company will submit applications for these permits concurrent with the Mining Permit application. A key benefit of this approach is that it should facilitate a consolidated review process and, compared to a sequential process, compress the timeline to permit issuances.

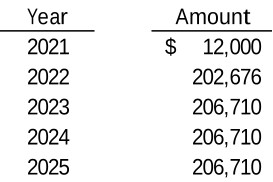

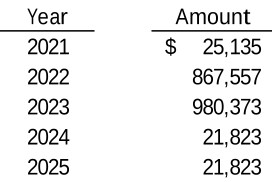

Estimated lease, option and property acquisition costs related to the Back Forty Project for 2021 to 2025, for which the Company is materially liable, are as follows:

Reef Gold Project

The Company entered into a series of agreements with private landholders in Marathon County, Wisconsin for the optioning of surface and mineral rights. The agreements consist of mining leases and exploration agreements with an option to purchase. These agreements have terms from 2 to 20 years up to 2031. A variable net smelter royalty up to 2% is payable in the event of mineral production on the property.

On June 1, 2021, Aquila announced that it had entered into a non-binding letter of intent (the “LOI”) to sell its interest in the Bend and Reef exploration properties located in Wisconsin, USA to a private company (“Newco”)

10

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

(the “Transaction”). Subject to necessary approvals, Newco intends to list on the TSX Venture Exchange concurrent with the closing of the Transaction. Total consideration of C$7,000,000 payable to Aquila will consist of cash consideration of C$3,000,000, of which C$1,000,000 was immediately advanced as a deposit and shares in Newco with an estimated value on completion of the go-public transaction of C$4,000,000. The deposit is currently recorded as a payable in the Statement of Financial Position. In the event the Transaction does not close, the Company will return the Deposit in shares of Aquila (subject to the receipt of all necessary approvals of the Toronto Stock Exchange) or in cash, depending on the circumstances.

On October 5, 2021 the Company announced that it has closed the previously announced Transaction to sell its Bend and Reef properties in Wisconsin to Green Light Metals Inc. (“GL”). Total consideration of C$7,000,000 payable to Aquila consists of:

| ● | Upfront cash consideration of C$2.1 million, of which C$1 million was advanced as a deposit upon the execution of the letter of intent with respect to the Transaction in June 2021 and the remaining C$1.1 million was paid at closing; and |

| ● | A non-interest bearing promissory note (“Promissory Note”) of GL in the principal amount of C$4.9 million. The Promissory Note shall become due and payable by GL on the earlier of: (i) December 31, 2022 (the “Maturity Date”); or (ii) immediately prior to the completion of an initial public offering or other transaction that results in the shares of GL (or of a successor entity) being listed on a stock exchange as freely tradeable securities (a “Go-Public Transaction”). |

If the Promissory Note becomes due and payable on a Go-Public Transaction, then the Promissory Note shall be satisfied by way of:

| ● | C$900,000 in cash; and |

| ● | The issuance of that number of GL shares equal to $4 million divided by the price per share at which GL shares are issued in the Go-Public Transaction financing. |

If GL does not complete a Go-Public Transaction prior to the Maturity Date, then the Promissory Note shall be satisfied by way of the issuance of that number of GL shares equal to C$4.9 million divided by the price per share at which GL issued shares in its most recently completed financing prior to the Maturity Date.

In connection with the Transaction, GL and Aquila also entered into an investor rights agreement pursuant to which, among other things, Aquila received the right to participate in future equity financings completed by GL as well as nomination rights in respect of one member of GL’s board of directors, in each case subject to Aquila continuing to maintain a specified ongoing ownership interest in GL.

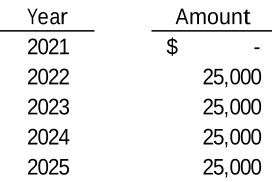

Estimated lease and/or option costs related to the Reef Project for 2021 to 2025, which are at the Company’s option, are as follows:

11

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

Bend

In May 2019, Aquila entered into a long-term mineral lease agreement with a party that owns the mineral rights on a portion of the Bend deposit.

Estimated lease and/or option costs related to Bend for 2021 to 2025, which are at the Company’s option, are as follows:

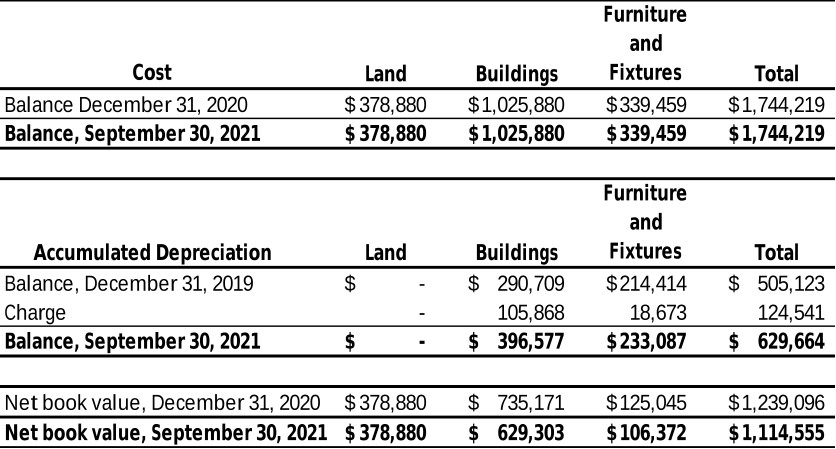

| 6. | Capital Assets |

12

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

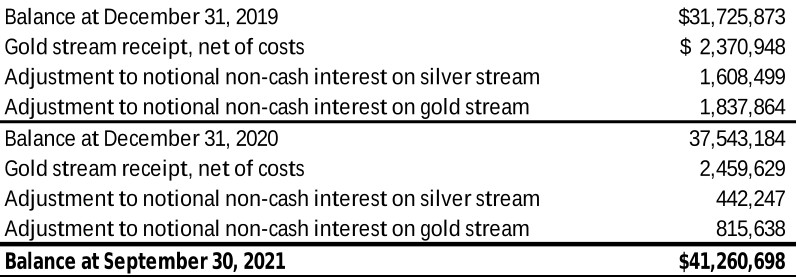

| 7. | Deferred Revenue |

As at September 30, 2021, a breakdown of the deferred revenue is as follows:

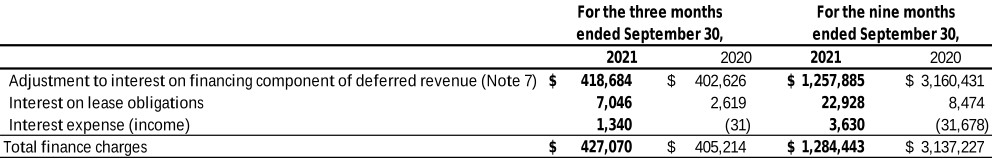

Under IFRS 15, the stream arrangements are considered to have significant financing components on which an implied interest rate is accrued and added to deferred revenue, to be amortized once the stream begins to be paid down. Under these rules, the Company reports a notional non-cash interest expense each quarter based on the implied interest rate at the time that the stream arrangement is consummated, and a corresponding amount is added to deferred revenue. This interest accrual is not a contractual obligation but is intended to allocate the cost of the stream financing over the period it is outstanding. This accrual is a non-cash item and is shown as such on the statement of cash flows. Upon commencement of production, deferred revenue including the accrued interest will be brought into revenue over the life of mine.

These adjustments to the non-cash interest are made on a quarterly basis. The significant financing component is adjusted for timing in receipt of payments and timing for estimated production as well as changes in the long-term commodity price estimates. In the current quarter, no adjustments were made. Adjustments will continue to take place as the Company continues to refine its production plans and the timing of receipt of payments is known.

| 8. | Osisko Financing and Streaming Agreement |

In November 2017, the Company completed a financing transaction with Osisko Bermuda Limited (“OBL”), a wholly owned subsidiary of Osisko Gold Royalties Ltd (TSX & NYSE: OR) (“Osisko”), pursuant to which OBL agreed to commit approximately $55 million to Aquila through a gold stream purchase agreement. In June 2020, the Company amended its agreement with OBL, reducing the deposit owing from $40 million to $35 million, adjusting payment milestones as well as adjusting certain milestone dates under the gold stream and silver stream to align the streams with the current project development timeline.

On March 11, 2021, Aquila announced that it entered into definitive agreements (the “2021 Stream Agreement Amendments”) with OBL to amend certain terms of the Gold Stream and Silver Stream in order to provide additional flexibility. Under the terms of the 2021 Stream Agreement Amendments, OBL agreed to adjust certain

13

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

milestone dates under the Gold Stream and the Silver Stream to align the streams with the current project development timeline. OBL immediately advanced $100,000 of the remaining deposit under the Gold Stream.

On August 16, 2021, Aquila announced that OGR agreed to immediately release $2.4 million (the “Fourth Deposit”) to the Company under the Gold Stream. The Fourth Deposit will be used for the continued advancement of the Back Forty Project Optimized Feasibility Study and demonstrates OGR’s strong support for the Back Forty Project.

Under the Gold Stream, the Fourth Deposit was to be released once Aquila completed an equity financing of not less than $6 million (the “Equity Financing Condition”). Pursuant to an agreement dated August 15, 2021, the Equity Financing Condition has been deferred and must now be satisfied as a condition to the release of the fifth deposit of $5 million (the “Fifth Deposit”). The other conditions for the release of the Fifth Deposit remain the same, being the completion of the Back Forty Feasibility Study and the successful resolution of the permitting process with respect to permits required for the development or operation of the Back Forty Project. The final deposit of $25 million continues to be payable pro rata with drawdowns under a senior construction facility for the Back Forty Project.

The Company agreed to eliminate the change of control provision, which previously allowed an acquiror of control over the Back Forty Project the option to forgo the final payment of $25 million and reduce the Stream Percentage and Tail Percentage to 11% and 5.5%, respectively.

| a) | Gold Stream |

Concurrent with the Strategic Investment, the parties have also entered into a Gold Purchase Agreement (the “Stream Agreement”), whereby OBL will provide the Company with staged payments totaling $50 million, payable as follows:

| ● | $7.5 million was received on closing of the Stream Agreement; |

| ● | $7.5 million upon receipt by Aquila of all material permits required for the development and operation of the Project, and receipt of a positive feasibility study: These funds were received in October 2018; |

| ● | $2.5 million was received on closing of the Stream Amendments in June 2020; |

| ● | $0.1 million was advanced on closing of the Stream Amendments in March 2021; |

| ● | $2.4 million was advanced in August 2021; |

| ● | $5 million upon the completion of the optimized Feasibility Study and the successful resolution of the permitting process with respect to permits required for the development or operation of the Back Forty Project; and |

| ● | $25 million upon the first drawdown of an appropriate project debt finance facility. |

The $20.0 million received from OBL is shown as deferred revenue on the statement of financial position, net of transaction costs and capital commitment fees. The remaining $30 million is payable in three instalments and is subject to the completion of certain milestones and the satisfaction of certain other conditions. Therefore, it is not reflected on the statement of financial position at this time. OBL has been provided a general security agreement over the subsidiaries of Aquila that are directly involved with development of the Back Forty project.

Under the terms of the Stream Agreement, OBL will purchase 18.5% of the refined gold from the Project (the “Stream Percentage”) until the Company has delivered 105,000 ounces of gold (the “Production Threshold”).

14

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

Upon satisfaction of the Production Threshold, the Stream Percentage will be reduced to 9.25% of the refined gold (the “Tail Percentage”). In exchange for the refined gold delivered under the Stream Agreement, OBL will pay the Company ongoing payments equal to 30% of the spot price of gold on the day of delivery, subject to a maximum payment of $600 per ounce.

The initial term of the agreement is for 40 years, automatically renewable for the successive 10 year periods.

The agreement is subject to certain operating and financial covenants, which are in good standing as of September 30, 2021.

| b) | Transaction costs |

Transactions costs for this transaction have been offset against the deferred revenue balance.

| 9. | Orion Financing and Streaming Agreement |

In March 2015, the Company closed a financing transaction with Orion that included an equity private placement and a silver purchase agreement for total cash payments of $20.75 million. In July 2017, Orion sold a royalty portfolio to Osisko Gold Royalties Ltd. which included the Company’s Back Forty silver stream. In June 2020, the Company amended certain terms of its silver stream agreement with Osisko, specifically increasing the percentage of silver purchased under the stream from 75% to 85%.

| a) | Equity Private Placement |

In connection with the private placement completed in March 2015, Orion also has the right to participate in any future equity or equity-linked financings to maintain its ownership level in Aquila. In connection with the private placement, Orion received the right to nominate one individual to the board of directors of Aquila for 24 months and thereafter for such time as Orion owns at least 10 per cent of the outstanding common shares. At September 30, 2021, Orion held 28.2% of the common shares of the Company (December 31, 2020 – 28.6%).

| b) | Silver Stream |

Under the terms of the amended silver purchase agreement, Osisko has agreed to purchase up to 85 per cent of the total silver produced from the Back Forty project at $4 per ounce. A total of $17.25 million has been advanced and is shown as deferred revenue on the Statement of Financial Position as at June 30, 2021. An additional $653,692 was added to the value of the deferred revenue on the partial exercise of the Orion warrants. In 2016, the silver purchase agreement was amended to reduce the deposit owing by $639,000. Where the market price of silver is greater than $4, the difference realized from the sale of the silver will be applied against any deposit received from Osisko.

The initial term of the agreement is for 40 years, automatically renewable for the successive 10 year periods.

The agreement is subject to certain operating and financial covenants, which are in good standing as of September 30, 2021.

15

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

| 10. | Share Capital |

| a) | Authorized |

Unlimited number of common shares.

Issued and outstanding:

16

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

| iii) | During the nine months ended September 30, 2021, the Company settled accounts payable totaling $297,406 in exchange for 4,460,622 shares. |

| b) | Stock-option plan and share-based compensation: |

The Company maintains an Equity Incentive Plan (the "Plan") for the benefit of directors, officers, employees, consultants and other service providers of the Company and its subsidiaries in order to assist the Company in attracting, retaining, and motivating such persons by providing them with the opportunity, through stock options to acquire an increased interest in the Company. Under the Plan, options may be granted for a term not exceeding ten years. The number of common shares reserved for issue under the Plan will not exceed 10% of the number of then outstanding common shares nor may the number of common shares reserved for issuance to insiders must not exceed 10% of the then outstanding common shares. The exercise price of an option may not be lower than the closing price of the common shares on the TSX, subject to applicable discounts, on the business day immediately before the date the option is granted. The options are non-transferable and non-assignable.

17

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

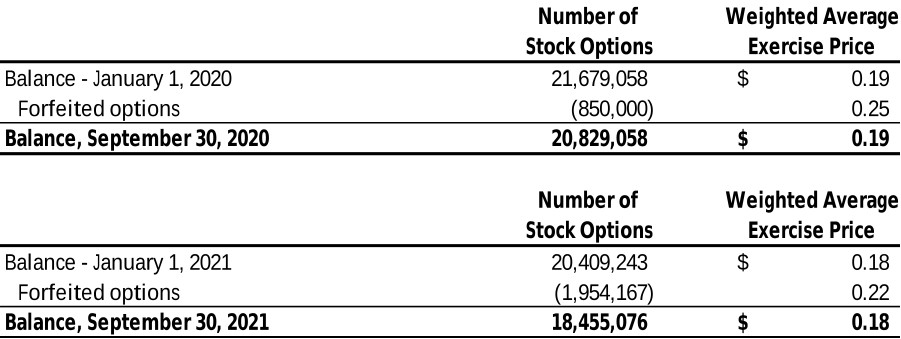

A summary of the Company's stock option, and changes during the period ended September 30, 2021 are presented below:

As at September 30, 2021, common share stock options held by directors, officers, employees and consultants are as follows:

* Issued under plan of arrangement.

18

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

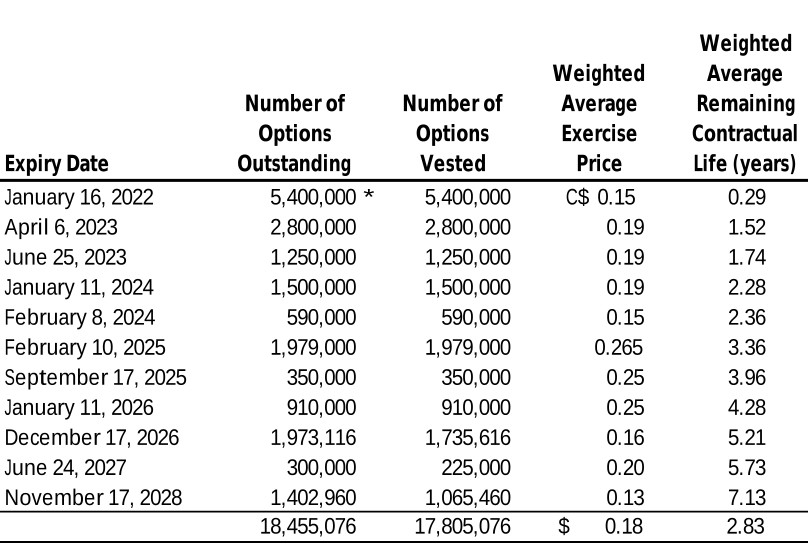

| c) | Restricted share unit plan: |

The Company introduced maintains a restricted share unit plan (“the RSU plan”) for the benefit of officers and employees of the Company and its subsidiaries in order to assist the Company in attracting, retaining, and motivating such persons by providing them with the opportunity, through restricted share units to acquire an increased interest in the Company. Under the RSU plan, units are granted at the discretion of the Board of Directors who have the authority to determine the vesting terms. On the settlement date, each RSU is redeemable for one common share of the Company or subject to the approval of the plan administrator, a cash payment. It is the intention of the Board of Directors to settle all RSUs in common shares. The number of common shares reserved for issue under the Plan cannot exceed 10% of the number of then outstanding common shares nor may the number of common shares reserved for issuance to insiders exceed 10% of the then outstanding common shares.

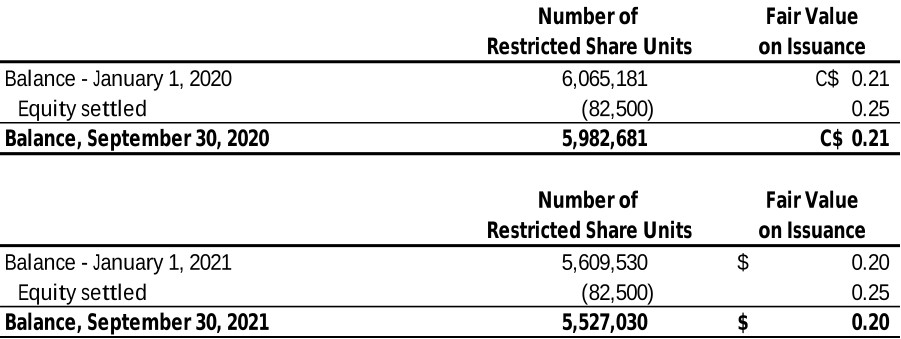

| 11. | Warrants |

The movements in the number of outstanding share purchase warrants for the period ended September 30, 2021 are as follows:

There are no warrants issued and outstanding as at September 30, 2021.

19

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

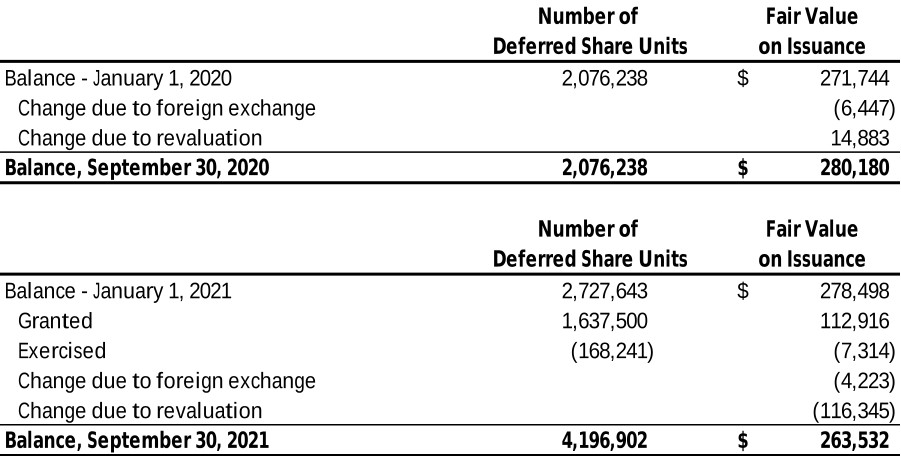

| 12. | Deferred Share Units Liability |

The Company maintains a deferred share unit plan (“the DSU plan”) for the benefit of directors and officers of the Company and its subsidiaries in order to assist the Company in attracting, retaining, and motivating such persons by providing them with the opportunity, through restricted share units to acquire an increased interest in the Company. Under the DSU plan, units are granted at the discretion of board of directors who have the authority to determine the vesting terms. Directors can elect to receive up to 100% of their compensation in DSUs. On the settlement date, each DSU is redeemable for one common share of the Company. The number of common shares reserved for issue under the Plan cannot exceed 10% of the number of then outstanding common shares nor may the number of common shares reserved for issuance to insiders exceed 10% of the then outstanding common shares.

During the period ended September 30, 2021, 2,727,643 units were issued to directors in lieu of receiving director fees in cash. A charge of $112,916 was recorded to share based compensation with the offset recorded as DSU liability.

20

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

| 13. | Derivative Liabilities |

During the period ended September 30, 2021, no equity offerings were completed whereby any warrants or broker warrants were issued with exercise prices denominated in Canadian dollars (December 31, 2020 – no warrants were issued in Canadian dollars). Where the warrants have an exercise price denominated in a currency which is different from the functional currency of the Company (US dollar), the warrants are treated as a financial liability. Broker warrants are accounted as equity. The Company’s share purchase warrants are classified and accounted for as a financial liability at fair value with changes in fair value recognized in net earnings. The warrant derivative liability is classified as level 2 in the fair value hierarchy. As of September 30, 2021, the Company had no warrants outstanding (December 31, 2020 – 12,293,269) which are classified and accounted for as a financial liability. The Company uses the Black-Scholes Option Pricing Model to estimate the fair value of the Canadian dollar denominated warrants. See note 11 for further information.

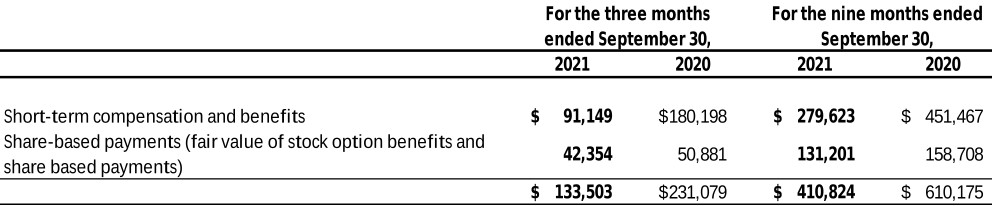

| 14. | Related Party Transactions |

In accordance with IAS 24, key management personnel are those persons having authority and responsibility for planning, directing and controlling the activities of the Company, directly or indirectly, including any directors (executive and non-executive) of the Company. The remuneration of directors and key executives is determined by the nomination, compensation and governance committee of the Board of Directors. During the period ended September 30, 2021, director’s fees, professional fees and other compensation of directors and key management personnel were as follows:

During the three and nine months ended September 30, 2021, the Company had expenditures in the amount of $26,984 (September 30, 2020 – $30,189) and $84,278 (September 30, 2020 - $86,540) for shared office costs paid to a partnership in which one of the Company’s directors is an owner. Beginning in March 2021, the Company has satisfied these shared office costs through the issuance of shares.

21

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

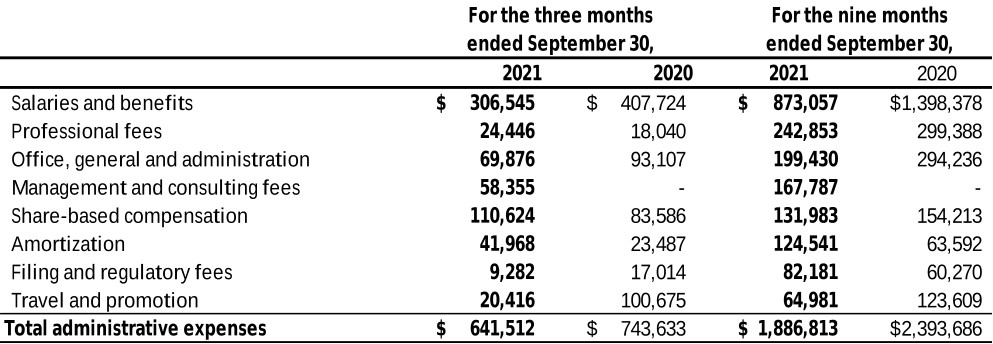

| 15. | Administrative Expenses |

| 16. | Finance Charges |

| 17. | Financial Risk Management |

In the normal course of business, the Company is exposed to a number of financial risks that can affect its operating performance. These risks are: credit risk, liquidity risk and market risk. The Company’s overall risk management program and prudent business practices seek to minimize any potential adverse effects on the Company’s financial performance.

The interim financial statements do not include all financial risk management information and disclosures required in the annual financial statements. They should be read in conjunction with the annual consolidated financial statements as at December 31, 2019. There have been no changes in the risk management or in any risk management policies since year end, except as noted below:

The rapid spread of the COVID-19 virus, which was declared by the World Health Organization to be a pandemic on March 11, 2020, and actions taken globally in response to COVID-19, have significantly disrupted business activities throughout the world. The Company's business relies, to a certain extent, on free movement of goods, services, and capital within Canada and the United States, which has been significantly restricted as a result of the COVID-19 pandemic. The Company took certain measures including temporary layoffs, temporary salary reductions and temporarily suspending all permitting activities in an effort to conserve funds.

22

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS For the three and nine months ended September 30, 2021 and 2020 (Unaudited, expressed in United States Dollars, unless otherwise stated) |

Since the outbreak of COVID-19 in March 2020, the Company has focused its efforts to safeguard the health and well-being of its employees, consultants and community members to ensure their safety during the global COVID-19 pandemic. To help slow the spread of COVID-19, the Company’s employees are working remotely, abiding by local and national guidance in place in Canada and the United States related to social distancing and restrictions on travel outside of the home.

During this time, the Company has progressed with advancing the Back Forty project without significant delays despite the impact of COVID-19. However, given the highly uncertain and evolving nature of the global environment caused by the outbreak of COVID-19, the Company is not able to reliably estimate the duration and severity of this pandemic including the potential impact it may have on the review and approval process of the Dam Safety Permit and any other impacts on the Company’s operating and financial results.

Given the ongoing and dynamic nature of the circumstances surrounding COVID-19, it is difficult to predict how significant the impact of COVID-19, including any responses to it, will be on the economy and the Company’s business in particular, or for how long any disruptions are likely to continue. The extent of such impact will depend on future developments, which are highly uncertain, rapidly evolving and difficult to predict, including new information which may emerge concerning the severity of COVID-19 and additional actions which may be taken to contain COVID-19, as well as the timing of the re-opening of the economy in Canada and the United States. Such further developments could have a material adverse effect on the Company's business, financial condition, results of operations and cash flows.

| 18. | Acquisition by Gold Resources Corporation |

On September 7, 2021, Aquila announced the entering into of a binding letter agreement (the “Letter Agreement”) with Gold Resource Corporation (“GORO”) (NYSE American: GORO) setting out certain key terms of a proposed acquisition by GORO of all the issued and outstanding common shares of Aquila by way of a plan of arrangement under the Business Corporations Act (Ontario) (the “Transaction”). Pursuant to the Transaction, GORO will acquire all the issued and outstanding Aquila shares for 0.0399 of a GORO share per Aquila share (the “Exchange Ratio”). Based upon the 20-day volume-weighted average price (“VWAP”) of GORO’s shares on the NYSE American stock exchange on September 3, 2021, being the last trading day prior to the date of the Letter Agreement, the Exchange Ratio represents a 29% premium to the 20-day VWAP of Aquila’s shares on the Toronto Stock Exchange as of such date. The Exchange Ratio represents consideration of C$0.09 per Aquila share (the “Per Share Price”), reflecting a premium of 12.5%, based upon the closing prices of the Aquila shares and the GORO shares on September 3, 2021.

On October 6, 2021, Aquila announced that it entered into a definitive arrangement agreement (the “Arrangement Agreement”) with GORO in connection with the Transaction. The Transaction requires the approval of (i) 66⅔ percent of the votes cast by Aquila shareholders and (ii) a simple majority of the votes cast by the minority shareholders (excluding shareholders whose votes are required to be excluded pursuant to Multilateral Instrument 61 – 101) at a special meeting of shareholders (the “Aquila Shareholder Meeting”). The Aquila Shareholder Meeting is scheduled to be held on November 17, 2021. Each of Orion Mine Finance and Hudbay Minerals Inc., which hold 28.2% and 10.4%, respectively, of the issued and outstanding Aquila shares, has entered into a voting support agreement with GORO pursuant to which they have agreed to vote their Aquila shares in favour of the Transaction. In addition, all of the directors and officers of Aquila holding approximately 1.9% of the issued and outstanding Aquila shares in aggregate have also executed a voting support agreement.

23