As filed with the Securities and Exchange Commission on November 10, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Lloyds Banking Group plc

(Exact Name of Registrant as Specified in Its Charter)

Scotland

(State or Other Jurisdiction of Incorporation or Organization)

6029

(Primary Standard Industrial Classification Code Number)

Not Applicable

(I.R.S. Employer Identification No.)

25 Gresham Street

London EC2V 7HN

United Kingdom

Tel. No.: 011-44-207-626-1500

(Address and Telephone Number of Registrant’s Principal Executive Offices)

Adriana Maestas

Chief Legal Officer

North America

Lloyds Bank Corporate Markets

1095 Avenue of the Americas

New York, New York 10036

United States

Tel. No.: 212-930-5007

(Name, Address and Telephone Number of Agent for Service)

Please send copies of all communications to:

|

John W. Banes DAVIS POLK & WARDWELL LLP 450 Lexington Avenue New York, New York 10017 United States Tel. No.: 212-450-4000 |

Diana Billik ALLEN & OVERY LLP 52 avenue Hoche CS 90005 75379 Paris Cedex 08, France Tel. No.: +33 (0)1 40 06 5400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its

Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price per Unit(1) |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) |

| Fixed Rate Reset Subordinated Debt Securities due 2046 with a call date in 2041 (the “New Notes”) | $750,000,000 | 100% | $750,000,000 | $ 69,525.00 |

| (1) | The securities being registered hereby are offered in exchange for the securities described in this prospectus. The registration fee has been computed based on the face value of the securities pursuant to Rule 457 under the Securities Act. |

| (2) | Calculated using a registration fee rate of $92.70 per million. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus may change. We may not complete the exchange offer and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer is not permitted.

PRELIMINARY PROSPECTUS, DATED NOVEMBER 10, 2021

Lloyds Banking Group plc

Offer to Exchange

Fixed Rate Reset Subordinated Debt Securities due 2046 with a call date in 2041 (“New Notes”)

plus (if applicable) the relevant Cash Consideration Amount (as defined herein), plus a cash payment for any accrued and unpaid dividends or interest (as the case may be), plus (if applicable) cash amounts in lieu of any fractional New Notes

for

certain Existing Securities listed in the table below

| THE EXCHANGE OFFER (as defined below) will expire AT 11:59 P.M., NEW YORK CITY TIME, ON december 9, 2021 (such time and date, as the same may be extended, THE “EXPIRATION DEADLINE”). EXISTING SECURITIES (AS DEFINED BELOW) TENDERED PURSUANT TO THE EXCHANGE OFFER MAY BE WITHDRAWN AT ANY TIME PRIOR TO THE EXPIRATION DEADLINE (such time and date, as the same may be extended, the “Withdrawal deadline”), BUT NOT thereafter. IN ADDITION, IF NOT PREVIOUSLY RETURNED, YOU MAY WITHDRAW EXISTING SECURITIES THAT YOU TENDER THAT ARE NOT ACCEPTED BY US FOR EXCHANGE AFTER THE EXPIRATION OF 40 BUSINESS DAYS FOLLOWING COMMENCEMENT OF THE EXCHANGE OFFER. |

Lloyds Banking Group plc (“LBG”) is offering to exchange, on the terms and conditions described in this prospectus, Fixed Rate Reset Subordinated Debt Securities due 2046 with a call date in 2041 (the “New Notes”), to be issued by LBG plus (if applicable) the relevant Cash Consideration Amount, plus accrued and unpaid dividends or interest (as the case may be) in cash, plus (if applicable) cash amounts in lieu of any fractional New Notes, for:

(1) any and all of the outstanding American Depositary Shares (“ADSs”) representing LBG’s 6.413% Non-Cumulative Fixed to Floating Rate Preference Shares (the “Series 1 Preference Shares”), ADSs representing LBG’s 6.657% Non-Cumulative Fixed to Floating Rate Preference Shares (the “Series 2 Preference Shares” and, collectively with the Series 1 Preference Shares, the “Preference Shares”) and 6.00% Subordinated Notes due 2033 issued by HBOS plc (the “Series 1 Existing Subordinated Notes”) (the “Any and All Offer”), and

(2) up to the Cap Amount (as defined below) of LBG’s 4.582% Subordinated Debt Securities due 2025 (the “Series 3 Existing Subordinated Notes”) and LBG’s 4.500% Fixed Rate Subordinated Debt Securities due 2024 (the “Series 2 Existing Subordinated Notes” and, collectively with the Series 1 Existing Subordinated Notes and Series 3 Existing Subordinated Notes, the “Existing Subordinated Notes”) (the “Capped Offer” and, together with the Any and All Offer, the “Exchange Offer”).

The Series 1 Existing Subordinated Notes and the Preference Shares are collectively referred to as the “Any and All Offer Securities” and the Series 2 Existing Subordinated Notes and the Series 3 Existing Subordinated Notes are collectively referred to herein as the “Capped Offer Notes”. The Preference Shares and the Existing Subordinated Notes are collectively referred to herein as the “Existing Securities”. The Exchange Offer is being made upon the terms and subject to the conditions set forth in this prospectus (as it may be amended or supplemented from time to time, the “prospectus”).

The following table sets forth certain terms of the Exchange Offer:

iii

|

Title of Security |

Issuer |

ISIN/CUSIP |

Principal Amount Outstanding |

Call Date |

Exchange Priority(1) |

Reference |

Maturity Date |

Minimum Denominations / Integral multiples |

Bloomberg Reference Page(2) |

Fixed |

Cash Consideration Amount(3) |

Hypothetical Total Exchange Consideration(4) |

| Any and All Offer | ||||||||||||

| ADSs representing 6.413% Non-Cumulative Fixed to Floating Rate Preference Shares |

LBG | 144A: US539439AC38 / 539439AC3 Reg S: USG5533WAA56 / G5533WAA5 |

$374,810,000 | October 1, 2035 | N/A | 1.250% U.S. Treasury Notes due August | N/A |

$100,000/ $1,000 |

FIT1 | +107 | $146.00 | $1,449.81 |

| ADSs representing 6.657% Non-Cumulative Fixed to Floating Rate Preference Shares |

LBG |

144A: US539439AF68 / 539439AF6

Reg S:

US539439AE93 / 539439AE9

|

$434,350,000 | May 21, 2037 | N/A | 1.750% U.S. Treasury Notes due August 15, 2041 | N/A |

$100,000/ $1,000 |

FIT1 | +83 | $110.00 | $1,496.46 |

| 6.00% Subordinated Notes due 2033 |

HBOS plc

|

144A: US4041A2AF14 / 4041A2AF1 Reg S: US4041A3AG79 / 4041A3AG7 |

$466,113,000 | N/A | N/A | 1.250% U.S. Treasury Notes due August 15, 2031 | November 1, 2033 |

$1,000/ $1,000 |

FIT1 | +100 | $145.00 | $1,362.74 |

| Capped Offer | ||||||||||||

| 4.500% Fixed Rate Subordinated Debt Securities due 2024 | LBG | US53944YAA10 / 53944YAA1 | $1,000,000,000 | N/A | 1 | 0.750% U.S. Treasury Notes due November 15, 2024 | November 4, 2024 |

$200,000/ $1,000 |

FIT1 | +50 | $0.00 | $1,092.88 |

| 4.582% Subordinated Debt Securities due 2025 | LBG | US539439AM10 / 539439AM1 | $1,327,685,000 | N/A | 2 | 1.125% U.S. Treasury Notes due October 31, 2026 | December 10, 2025 |

$200,000/ $1,000 |

FIT1 | +50 | $0.00 | $1,115.48 |

| (1) | The aggregate principal amount of the Capped Offer Notes of each series that are accepted for exchange pursuant to the Capped Offer will be based on the order of Exchange Priority for such series as set forth in the table above, subject to the Cap Amount and proration arrangements applicable to the Capped Offer. See “The Exchange Offer – Terms of the Exchange Offer – Capped Offer – Acceptance of Existing Securities; Exchange Priority; Proration” for more details. |

| (2) | The applicable page on Bloomberg from which the Dealer Managers (as defined below) will quote the bid-side prices of the applicable Reference UST Security for the purposes of determining the Reference UST Yield. |

| (3) | Per $1,000 principal amount of Existing Securities accepted for exchange pursuant to the Exchange Offer. The Cash Consideration Amount is already included in the Total Exchange Consideration calculated from the applicable Fixed Spread. |

| (4) | Hypothetical Total Exchange Consideration per $1,000 principal amount of Existing Securities as of 6:00 a.m., New York City time, on November 9, 2021 assuming a Settlement Date on December 14, 2021. See Annex C for a hypothetical pricing example for calculation of the Total Exchange Consideration. The Total Exchange Consideration includes both the Cash Consideration Amount and the New Notes Exchange Consideration. (as defined below). |

The following table sets forth certain terms of the New Notes:

|

Title of Series |

Benchmark Security |

Bloomberg Reference Page |

Spread to Benchmark Security |

Optional Redemption Date |

Maturity Date |

Reset Coupon |

Reset Date |

Issue Price | |

| Fixed Rate Reset Subordinated Debt Securities due 2046 with a call date in 2041 | 1.750% U.S. Treasury Notes due August 15, 2041 | FIT1 | +150 bps | From (and including) September 14, 2041 to (and including) December 14, 2041 | December 14, 2046 | 5-year US Treasury Rate +1.50% |

December 14, 2041 | 100% | |

The aggregate principal amount of the Capped Offer Notes of each series that are accepted for exchange will be based on the order of Exchange Priority for such series as set forth in the table above, subject to the Cap Amount and proration arrangements applicable to the Capped Offer. The Cap Amount is a principal amount of Capped Offer Notes that would result in a principal amount of $750,000,000 of the New Notes (the “Maximum Capped Offer New Notes Size”) being issued pursuant to the Exchange Offer (after taking into account the principal amount of the New Notes to be issued pursuant to the Any and All Offer). In case the principal amount of the Any and All Offer Securities accepted pursuant to the Any and All Offer is such that the principal amount of the New Notes to be issued pursuant to the Any and All Offer is equal to or exceeds $750,000,000, all

iv

validly tendered Any and All Offer Securities will be accepted in full and no Capped Offer Notes will be accepted pursuant to the Capped Offer. See also “The Exchange Offer – Terms of the Exchange Offer – Capped Offer – Acceptance of Existing Securities; Exchange Priority; Proration”.

The Exchange Offer is subject to a minimum new issue size of at least $500,000,000 in aggregate principal amount of New Notes being issued in exchange for Existing Securities validly tendered pursuant to the Exchange Offer (the “Minimum New Issue Size”). The Exchange Offer is also subject to certain other conditions set out under “The Exchange Offer—Terms of the Exchange Offer—Exchange Offer Conditions”.

The New Notes will be delivered on the Settlement Date, expected to be on or around December 14, 2021, unless the Expiration Deadline is extended. We will not deliver fractional New Notes pursuant to the Exchange Offer. Instead, each tendering holder of Existing Securities that are accepted for exchange will receive a cash amount in lieu of any fractional New Notes that a tendering holder of Existing Securities would have otherwise been entitled to receive. Any cash amounts payable pursuant to the Exchange Offer will be rounded to the nearest U.S.$0.01, with U.S.$0.005, being rounded upwards.

The Offeror may extend, re-open, amend, limit, waive any condition of, or terminate the Exchange Offer at any time (subject to applicable law and as provided in this prospectus). Details of any such extension, re-opening, amendment, limitation, waiver (if permitted) or termination will be announced wherever applicable as provided in this prospectus as soon as reasonably practicable after the relevant decision is made. For more information, see “The Exchange Offer”.

Questions and requests for assistance in connection with (i) the Exchange Offer may be directed to the Dealer Managers and (ii) the delivery of Exchange Instructions (as defined herein) may be directed to Lucid Issuer Services Limited (the “Exchange Agent”), as applicable, the contact details for whom are on the back cover page of this prospectus.

We expect to apply to list the New Notes on the New York Stock Exchange in accordance with its rules.

Before deciding whether to exchange your Existing Securities for New Notes, you are encouraged to read and carefully consider this prospectus (including the documents incorporated by reference herein) in its entirety. See “Risk Factors” beginning on page 12 for a discussion of risk factors that you should consider prior to deciding whether to tender your Existing Securities in the Exchange Offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Exchange Offer or the securities to be issued in the Exchange Offer or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Global Coordinators and Joint Lead Dealer Managers

| BofA Securities | Credit Suisse | Lloyds Securities |

The date of this prospectus is , 2021

v

Page

Prospectus

| About this Prospectus | vi |

| Important Notices | vii |

| Incorporation of Information by Reference | ix |

| Forward-Looking Statements | ix |

| Important Information | x |

| Enforceability of Civil Liabilities | x |

| Prospectus Summary | 1 |

| Risk Factors | 12 |

| Use of Proceeds and Rationale of the Exchange Offer | 23 |

| Capitalization of the Group | 24 |

| Market Information and Dividend Policy | 25 |

| The Exchange Offer | 28 |

| Description of the New Notes | 44 |

| Comparison of Certain Material Terms of the Preference Shares and the New Notes | 59 |

| Comparison of Certain Material Terms of the Series 1 Existing Subordinated Notes and the New Notes | 82 |

| Comparison of Certain Material Terms of the Capped Offer Notes and the New Notes | 102 |

| Taxation Considerations | 126 |

| Certain Benefit Plan Investor Considerations | 135 |

| Validity of the New Notes | 137 |

| Experts | 137 |

| Index to Financial Statements | 137 |

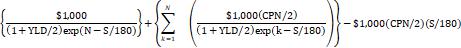

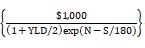

| Annex A—Formula to Determine the Total Exchange Consideration and New Notes Exchange Consideration | 138 |

| Annex B—Formula to Determine the Interest Rate on New Notes | 139 |

| Annex C—Hypothetical Calculation of Total Exchange Consideration and New Notes Exchange Consideration | 140 |

| Annex D—Hypothetical Calculation of the Interest Rate Applicable to the New Notes | 142 |

You should rely only on the information contained or incorporated by reference in this prospectus (including any free writing prospectus issued or authorized by us). Neither we nor the Dealer Managers have authorized anyone to provide you with additional, different or inconsistent information. We are not, and the Dealer Managers are not, making an offer of these securities in any state or jurisdiction where the offer is not permitted. You should assume that the information contained in this prospectus and the documents incorporated by reference herein is accurate only as of their respective dates.

About this Prospectus

In this prospectus, we use the following terms:

| · | “we”, “us”, “our”, “the Issuer”, “LBG” and “Lloyds Banking Group” mean Lloyds Banking Group plc; |

| · | “Group” means Lloyds Banking Group plc together with its subsidiaries and associated undertakings; |

| · | “SEC” refers to the Securities and Exchange Commission; |

| · | “pound sterling”, “pence”, “£” and “p” refer to the currency of the United Kingdom; |

| · | “U.S. dollars”, “$” and “cents” refer to the currency of the United States; |

| · | “euro”, “€” and “euro cents” refer to the currency of the member states of the European Union (the “EU”) that have adopted the single currency in accordance with the treaty establishing the European Community, as amended; and |

| · | “U.K.” means the United Kingdom. |

vi

Important Notices

If a holder decides to tender Existing Securities pursuant to the Exchange Offer, the holder must arrange for a Direct Participant (as defined below) to electronically transmit an electronic tender instruction (each a “Tender Instruction”) through DTC’s Automated Tender Offer Program (“ATOP”), for which the transaction will be eligible (holders are not required to submit a letter of transmittal to tender their Existing Securities pursuant to the Exchange Offer). If a holder holds Existing Securities through either Euroclear Bank S.A./N.V. (“Euroclear”) or Clearstream Banking, société anonyme (“Clearstream” and, together with DTC and Euroclear, the “Clearing Systems” and each a “Clearing System”) and decides to tender Existing Securities pursuant to the Exchange Offer, the holder must arrange for the relevant accountholder to submit an electronic tender and blocking instruction in the form specified in the form of notice to be sent to accountholders by each of Euroclear and Clearstream on or about the date of this prospectus informing accountholders of the procedures to be followed in order to participate in the Exchange Offer. Euroclear and Clearstream will arrange for the relevant instructions to be submitted through ATOP. See “The Exchange Offer—Procedures for Participating in the Exchange Offer”.

If you are a beneficial owner of Existing Securities that are held by or registered in the name of a bank, broker, custodian or other nominee, and you wish to participate in the Exchange Offer, you must promptly contact your bank, broker, custodian or other nominee to instruct it to tender your Existing Securities, to agree to the terms of the Exchange Offer and to cause the timely transmission of an Exchange Instruction on your behalf to the Exchange Agent. You are urged to instruct your bank, broker, custodian or other nominee at least five Business Days prior to the Expiration Deadline in order to allow adequate processing time for your instruction.

The Exchange Offer is subject to certain jurisdictional restrictions. See “The Exchange Offer—Certain Matters Relating to Non-U.S. Jurisdictions”. This document does not constitute a “prospectus” for the purposes of Regulation (EU) 2017/1129 (the “Prospectus Regulation”) or the U.K. Prospectus Regulation (as defined herein) and no such prospectus is required for the issue of the New Notes.

Existing Securities can be tendered in the Exchange Offer only in accordance with the procedures described in “The Exchange Offer—Procedures for Participating in the Exchange Offer”. Holders who do not participate in the Exchange Offer, or whose Existing Securities are not accepted for purchase, will continue to hold their Existing Securities.

Holders must comply with all laws that apply to them in any place in which they possess this prospectus. Holders must also obtain any consents or approvals that they need in order to tender their Existing Securities. None of LBG, the Dealer Managers or the Exchange Agent (or any of their respective directors, employees or affiliates) is responsible for holders’ compliance with these legal requirements. See “The Exchange Offer—Certain Matters Relating to Non-U.S. Jurisdictions”. The applicable provisions of the U.K. Financial Services and Markets Act 2000 must be complied with in respect of anything done in relation to the Exchange Offer in, from or otherwise involving the United Kingdom.

See “Taxation Considerations” for a description of material United Kingdom tax and United States federal income tax considerations that should be considered carefully in evaluating the Exchange Offer.

Unless the context otherwise requires, all references in this prospectus to a “holder” or “holder of the Existing Securities” include:

| (a) | each person who is shown in the records of DTC as a holder of the Existing Securities (also referred to as “Direct Participants” and each a “Direct Participant”); |

| (b) | any broker, dealer, commercial bank, trust company or other nominee or custodian who holds Existing Securities; and |

| (c) | each beneficial owner of Existing Securities holding such Existing Securities, directly or indirectly, in accounts in the name of a Direct Participant acting on the beneficial owner’s behalf, |

except that for the purposes of the exchange of Existing Securities pursuant to the Exchange Offer and the payment of any cash payments, to the extent the beneficial owner of the relevant Existing Securities is not a Direct Participant, the relevant New Notes and any cash payments will only be delivered and paid to the relevant Direct

vii

Participant and the delivery of such New Notes and payment of cash payments to such Direct Participant will satisfy any obligations of LBG, the Exchange Agent and DTC in respect of the exchange of such Existing Securities.

The Offeror is not providing for guaranteed delivery procedures and therefore you must allow sufficient time for the necessary tender procedures to be completed during normal business hours of the Clearing Systems prior to the Expiration Deadline. Tenders received by the Exchange Agent after the Expiration Deadline will be disregarded and of no effect.

LBG is incorporating by reference into this document important business and financial information that is not included in or delivered with this document. This information is available without charge to security holders upon written or oral request. Requests should be directed to:

Lloyds Banking Group

25 Gresham Street

London EC2V 7HN

United Kingdom

Telephone Number: +44 207 626 1500

In order to ensure timely delivery of such documents, holders must request this information no later than five Business Days before the date they must make their investment decision. Accordingly, any request for information should be made by 11:59 p.m., New York City time, on December 1, 2021 to ensure timely delivery of the documents prior to the Expiration Deadline.

See “Risk Factors”, beginning on page 12 for a description of certain factors relating to a decision to tender your Existing Securities in the Exchange Offer, including information about our business.

The terms of the New Notes will be substantially different from those of the Existing Securities. In addition to differences in financial terms, which include, among others, the interest rate and payment dates, the terms of the New Notes differ in respect of maturity, optional redemption dates, ranking (in the case of Preference Shares) and the issuer (in the case of the Series 1 Existing Subordinated Notes). Investors should carefully consider these differences in addition to those described under “Comparison of Certain Material Terms of the Preference Shares and the New Notes”, “Comparison of Certain Material Terms of the Series 1 Existing Subordinated Notes and the New Notes” and “Comparison of Certain Material Terms of the Capped Offer Notes and the New Notes” in deciding whether to tender Existing Securities for exchange in connection with the Exchange Offer.

None of the Offeror, the Dealer Managers or any of their respective representatives are making any representation to you regarding the legality of participation in the Exchange Offer by you under applicable investment or similar laws. You should consult with your own advisors as to legal, tax, business, financial and related aspects of a decision whether to tender your Existing Securities in the Exchange Offer.

All references in this prospectus to a “cash payment” or “cash payments” payable on the Settlement Date of the Exchange Offer with respect to a series of Existing Securities include (i) if applicable, the Cash Consideration Amount, (ii) all accrued and unpaid interest payments or dividend payments, as the case may be, on such series of Existing Securities from and including the latest interest payment date or dividend payment date, as the case may be, for such series of Existing Securities through, but not including, the Settlement Date, and (iii) if applicable, any cash amounts in lieu of any fractional New Notes that a tendering holder of Existing Securities would have otherwise been entitled to receive. Any cash amounts payable pursuant to the Exchange Offer will be rounded to the nearest U.S.$0.01, with U.S.$0.005, being rounded upwards.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to the exchange of Existing Securities for New Notes include all cash payments made in connection with the exchange of such Existing Securities for New Notes.

The New Notes will be available initially only in book-entry form, represented in one or more global securities registered in the name of a nominee of The Depository Trust Company (“DTC”). You will hold beneficial interests in the New Notes through DTC and its direct and indirect participants, including Euroclear and Clearstream, and DTC and its direct and indirect participants will record your beneficial interest on their books.

viii

We intend to apply to list the New Notes on the New York Stock Exchange in accordance with its rules.

Incorporation of Information by Reference

We file annual, semi-annual and special reports and other information with the Securities and Exchange Commission. The SEC’s website, at http://www.sec.gov, contains, free of charge, reports and other information in electronic form that we have filed. You may also request a copy of any filings referred to below (excluding exhibits) at no cost, by contacting us at 25 Gresham Street, London EC2V 7HN, United Kingdom, telephone +44 207 626 1500.

The SEC allows us to incorporate by reference much of the information that we file with them. This means:

| · | incorporated documents are considered part of this prospectus; |

| · | we can disclose important information to you by referring you to these documents; and |

| · | information that we file with the SEC will automatically update and supersede this prospectus. |

We incorporate by reference (i) LBG’s Annual Report on Form 20-F for the fiscal year ended December 31, 2020 filed with the SEC on February 26, 2021, (ii) LBG’s report on Form 6-K filed with the SEC on July 29, 2021 announcing its interim report, which includes the unaudited consolidated half-year results for the half-year ended 30 June 2021; (iii) LBG’s report on Form 6-K filed with the SEC on October 28, 2021 announcing its interim results for the nine months ended September 30, 2021; and (iv) LBG’s report on Form 6-K filed with the SEC on October 28, 2021 disclosing the Group’s capitalization and indebtedness on a consolidated basis as at September 30, 2021.

We have also filed with the SEC a Tender Offer Statement on Schedule TO (the “Schedule TO”), pursuant to Section 13(e) of the Exchange Act and Rule 13e-4 thereunder, furnishing certain information with respect to the Offer. The Schedule TO, together with any exhibits and any amendments thereto, may be examined and copies may be obtained at the same places and in the same manner as set forth above.

Forward-Looking Statements

From time to time, we may make statements, both written and oral, regarding assumptions, projections, expectations, intentions or beliefs about future events. Words such as ‘believes’, ‘anticipates’, ‘estimates’, ‘expects’, ‘intends’, ‘aims’, ‘potential’, ‘will’, ‘would’, ‘could’, ‘considered’, ‘likely’, ‘estimate’ and variations of these words and similar future or conditional expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend upon circumstances that will or may occur in the future. We caution that these statements may and often do vary materially from actual results. Accordingly, we cannot assure you that actual results will not differ materially from those expressed or implied by the forward-looking statements. You should read the sections entitled “Risk Factors” in this prospectus and “Forward-Looking Statements” in our Annual Report on Form 20-F for the year ended December 31, 2020, which is incorporated by reference herein.

In light of these risks, uncertainties and assumptions, forward-looking events discussed in this prospectus or any information incorporated by reference, might not occur. The forward-looking statements contained in this prospectus speak only as of the date of this prospectus. We undertake to publicly update, to the extent required by U.S. federal securities laws, any forward-looking statement to reflect certain events or circumstances after such dates or to reflect the occurrence of unanticipated events.

Important Information

MiFID II product governance / Professional investors and eligible counterparties only target market – Solely for the purposes of the manufacturer’s product approval process, the target market assessment in respect of the New Notes, taking into account the five categories referred to in item 18 of the Guidelines published by ESMA on 5 February 2018 has led to the conclusion that: (i) the target market for the New Notes is eligible counterparties

ix

and professional clients only, each as defined in Directive 2014/65/EU (as amended, “MiFID II”); and (ii) all channels for distribution of the New Notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the New Notes (a “distributor”) should take into consideration the manufacturers’ target market assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the New Notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

U.K. MiFIR product governance – Solely for the purposes of the manufacturer’s product approval process, the target market assessment in respect of the New Notes has led to the conclusion that: (i) the target market for the New Notes is only eligible counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook, and professional clients, as defined in Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“U.K. MiFIR”); and (ii) all channels for distribution of the New Notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the New Notes (a “distributor”) should take into consideration the manufacturers’ target market assessment; however, a distributor subject to the FCA Handbook Product Intervention and Product Governance Sourcebook is responsible for undertaking its own target market assessment in respect of the New Notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

EU PRIIPs Regulation / Prohibition of sales to EEA retail investors – The New Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of MiFID II; or (ii) a customer within the meaning of the Insurance Distribution Directive (EU) 2016/97 (as amended or superseded, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II. Consequently no key information document required by Regulation (EU) No 1286/2014 (as amended the “EU PRIIPs Regulation”) for offering or selling the New Notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the New Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the EU PRIIPs Regulation.

U.K. PRIIPs Regulation / Prohibition of sales to U.K. retail investors – The New Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the U.K. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018, as amended (“EUWA”) (the “U.K. Prospectus Regulation”); or (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000, as amended (“FSMA”) and any rules or regulations made under the FSMA to implement the Insurance Distribution Directive, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law by virtue of the EUWA. Consequently, no key information document required by Regulation (EU) No 1286/2014 as it forms part of domestic law by virtue of the EUWA (the “U.K. PRIIPs Regulation”) for offering or selling the New Notes or otherwise making them available to retail investors in the U.K. has been prepared and therefore offering or selling the New Notes or otherwise making them available to any retail investor in the U.K. may be unlawful under the U.K. PRIIPs Regulation.

x

Enforceability of Civil Liabilities

LBG is a public limited company incorporated and registered in Scotland. All of LBG’s directors and executive officers, and certain experts named in this prospectus, reside outside the United States. All or a substantial portion of LBG’s assets and the assets of those non-resident persons are located outside the United States. As a result, it may not be possible for investors (i) to effect service of process within the United States upon LBG or those persons or (ii) to enforce against LBG or those persons judgments obtained in U.S. courts predicated upon the civil liability provisions of the federal securities laws of the United States. We have been advised by our Scottish counsel, CMS Cameron McKenna Nabarro Olswang LLP (as to Scots law) that, both in original actions and in actions for the enforcement of judgments of U.S. courts, there is doubt as to whether civil liabilities predicated solely upon the U.S. federal securities laws are enforceable in Scotland.

xi

Prospectus Summary

The following is a summary of this prospectus and should be read as an introduction to, and in conjunction with, the remainder of this prospectus and any documents incorporated by reference therein. You should base your investment decision on a consideration of this prospectus and any documents incorporated by reference therein, as a whole. Words and expressions defined in “Description of the New Notes” below shall have the same meanings in this summary.

The Issuer

Lloyds Banking Group plc was incorporated as a public limited company and registered in Scotland under the U.K. Companies Act 1985 on October 21, 1985 (registration number 95000). Lloyds Banking Group plc’s registered office is at The Mound, Edinburgh EH1 1YZ, Scotland, U.K. and its principal executive offices in England, U.K. are located at 25 Gresham Street, London EC2V 7HN, United Kingdom, telephone number +44 (0) 20 7626 1500. LBG maintains a website at www.lloydsbankinggroup.com. The reference to our website is an inactive textual reference only, and information contained therein or connected thereto is not incorporated into this prospectus or the registration statement of which it forms a part.

The following summary contains selected information about the Exchange Offer. It is provided solely for your convenience. This summary is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus. For a more detailed description of the Exchange Offer, see “The Exchange Offer”.

| The Offeror |

Lloyds Banking Group plc |

| Purpose of the Exchange Offer |

From January 1, 2022, LBG will update the regulatory classification of its preference shares to classify any remaining outstanding preference shares as ineligible for regulatory capital purposes. The legal ranking of the U.S. dollar preference shares will remain unchanged.

This update to the future regulatory classification follows the ‘Dear CFO’ letter sent by the Prudential Regulation Authority to all major U.K. deposit takers dated November 16, 2020 requesting all firms to take steps to remediate the prudential treatment of legacy instruments. The Group’s updated capital instruments report as at December 31, 2021 will be published in February 2022 together with the Group’s full year results for 2021. The Group reserves the right to review such classification in the future, to the extent permitted by applicable law and regulation.

LBG is also undertaking the Exchange Offer in order to provide the holders of the Existing Securities with an opportunity to exchange their Existing Securities for the relevant Total Exchange Consideration consisting of New Notes and, where applicable, a Cash Consideration Amount. The voluntary Exchange Offer is part of the Group’s continuous review and management of its outstanding capital base, maintaining a prudent approach to the management of the Group’s capital position. Preference Shares which are not validly exchanged and accepted for purchase pursuant to the Exchange Offer will remain outstanding after completion of the Exchange Offer and shall remain subject to their existing terms and conditions.

LBG has launched, separately and concurrently with the launch of the Exchange Offer, a liability management exercise in respect of three series of sterling preference shares issued by LBG. |

1

| The Exchange Offer | LBG is offering to exchange, on the terms and conditions described in this prospectus, New Notes, plus (i) (if applicable) the Cash Consideration Amount, (ii) accrued and unpaid dividends or interest (as the case may be) in cash, and (iii) (if applicable) cash amounts in lieu of any fractional New Notes for (1) any and all of the Any and All Offer Securities and (2) up to the Cap Amount of the Capped Offer Notes. |

| Securities Offered | Fixed Rate Reset Subordinated Debt Securities due 2046 with a call date in 2041 (the “New Notes”) to be issued by LBG, which will be registered under the Securities Act. See “Description of the New Notes”. |

| Existing Securities | Preference Shares and Existing Subordinated Notes |

| Preference Shares |

· American Depositary Shares representing 6.413% Non-Cumulative Fixed to Floating Rate Preference Shares (ISIN 144A US539439AC38 and Reg S USG5533WAA56); and

· American Depositary Shares representing 6.657% Non-Cumulative Fixed to Floating Rate Preference Shares (ISIN 144A US539439AF68 and Reg S US539439AE93). |

| Existing Subordinated Notes |

· 6.00% Subordinated Notes due 2033 (ISIN 144A US4041A2AF14 and Reg S US4041A3AG79) issued by HBOS plc;

· 4.500% Fixed Rate Subordinated Debt Securities due 2024 (ISIN US53944YAA10) issued by LBG; and

· 4.582% Subordinated Debt Securities due 2025 (ISIN US539439AM10) issued by LBG. |

| Cap Amount | The Cap Amount is a principal amount of Capped Offer Notes that would result in a principal amount of $750,000,000 of the New Notes being issued pursuant to the Exchange Offer (after taking into account the principal amount of the New Notes to be issued pursuant to the Any and All Offer). In case the principal amount of the Any and All Offer Securities accepted pursuant to the Any and All Offer is such that the principal amount of the New Notes to be issued pursuant to the Any and All Offer is equal to or exceeds $750,000,000, all validly tendered Any and All Offer Securities will be accepted in full and no Capped Offer Notes will be accepted pursuant to the Capped Offer. |

2

| Exchange Priority |

There will be no priority of acceptance in the Any and All Offer.

The order, on a series by series basis, in which tenders of Capped Offer Notes will be accepted in the Capped Offer, is set out in the table on the front cover page of this prospectus. |

| Exchange Offer Period | From the commencement of the Exchange Offer on November 10, 2021 to the Expiration Deadline, which is expected to be 11:59 p.m., New York City time, on December 9, 2021, subject to extension. |

| Withdrawal Rights |

If you decide to tender your Existing Securities in the Exchange Offer, you may withdraw them at any time prior to 11:59 p.m. New York City time on December 9, 2021. Holders may not rescind their withdrawal of tenders of Existing Securities, and any Existing Securities properly withdrawn will thereafter be deemed not validly tendered for purposes of the Exchange Offer. Properly withdrawn Existing Securities may, however, be re-tendered again by following the procedures described herein at any time prior to the Expiration Deadline.

In addition, if not previously returned, you may withdraw Existing Securities that you tender that are not accepted by us for exchange after the expiration of 40 Business Days following the commencement of the Exchange Offer. |

| Total Exchange Consideration |

The Total Exchange Consideration for each Series of Existing Securities will be calculated as set out herein with reference to the sum of (i) the rate on the relevant Reference UST Security at the Pricing Time plus (ii) the relevant Fixed Spread.

The Total Exchange Consideration will consist of the Cash Consideration Amount (if applicable) and the New Notes Exchange Consideration. The New Notes Exchange Consideration will be equal to the Total Exchange Consideration minus the Cash Consideration Amount (if applicable). |

| Accrued Interest / Accrued Dividends | Holders whose Existing Securities are accepted in the Exchange Offer will receive payment in cash of an amount equal to the accrued and unpaid interest or dividends, as applicable, if any, in respect of such Existing Securities, as applicable, from the last interest or dividend payment date, as applicable, for such securities to, but not including, the applicable Settlement Date. |

| Fractional Entitlements | No fractional New Notes will be delivered pursuant to the Exchange Offer. Instead, each tendering holder of Existing Securities that are accepted for exchange will receive a cash amount in lieu of any fractional New Notes that a tendering holder of Existing Securities would have otherwise been entitled to receive. Any cash amounts payable pursuant to the Exchange Offer will be rounded to the nearest U.S.$0.01, with U.S.$0.005, being rounded upwards. |

3

| Conditions of the Exchange Offer | The Exchange Offer is subject to a Minimum New Issue Size of at least $500,000,000 in aggregate principal amount of New Notes being issued in exchange for Existing Securities validly tendered pursuant to the Exchange Offer. The Exchange Offer is also subject to the satisfaction or waiver of certain other conditions, which are set forth in “The Exchange Offer—Terms of the Exchange Offer—Exchange Offer Conditions”. |

| Amendment of Terms of the Exchange Offer | Subject to applicable laws and as provided herein, the Offeror may extend, re-open, amend, limit, waive any condition of, or terminate the Exchange Offer at any time. Details of any such extension, re-opening, amendment, limitation, waiver (if permitted) or termination will be announced wherever applicable as provided in this prospectus as soon as reasonably practicable after the relevant decision is made. |

| Settlement Date | The New Notes plus the cash payment for any accrued and unpaid interest, (including, if applicable, cash amounts in lieu of any fractional New Notes) and the Cash Consideration Amount (if applicable) will be delivered on the Settlement Date, which is expected to be on or around December 14, 2021. Any cash amounts payable pursuant to the Exchange Offer will be rounded to the nearest U.S.$0.01, with U.S.$0.005, being rounded upwards. |

| Offer Restrictions | The Exchange Offer is subject to certain offer restrictions. See “The Exchange Offer—Certain Matters Relating to Non-U.S. Jurisdictions”. |

| Use of Proceeds | LBG will not receive any proceeds from the issuance of the New Notes in the Exchange Offer. |

| Dealer Managers |

The Global Coordinators and Joint Lead Dealer Managers for the Exchange Offer are BofA Securities, Inc., Credit Suisse Securities (USA) LLC and Lloyds Securities Inc.

Lloyds Securities Inc. is an affiliate of LBG. Any participation in the Exchange Offer by Lloyds Securities Inc. will be made in compliance with applicable provisions of Rule 5121 of the Financial Industry Regulatory Authority, Inc. |

| Exchange Agent | Lucid Issuer Services Limited. |

| Brokerage Commission | No brokerage commissions are payable by the holders to the Offeror, the Dealer Managers or the Exchange Agent. If your Existing Securities are held through a broker or other nominee that tenders the Existing Securities on your behalf, such broker or other nominee may charge you a commission for doing so. You should consult with your broker or nominee to determine whether any charges will apply. |

4

| No Recommendation | None of the Offeror, the Dealer Managers or the Exchange Agent (or any of their respective directors, employees or affiliates) is providing holders of Existing Securities with any legal, business, tax or other advice in the prospectus, nor is making any recommendation as to whether or not holders should tender any Existing Securities in the Exchange Offer or refrain from tendering any Existing Securities, and none of them has authorized any person to make any such recommendation. Holders should consult their own advisers as needed to assist them in making an investment decision. |

| Further Information |

If you have questions about the terms of the Exchange Offer, please contact your bank, broker or professional investment advisor, or you may contact the Dealer Managers. If you have questions regarding the procedures for tendering your Existing Securities, please contact the Exchange Agent. The Exchange Agent’s and Dealer Managers’ contact details are set forth on the back cover page of this prospectus.

As required by the Securities Act, we have filed a registration statement relating to the Exchange Offer with the SEC. This document is a part of that registration statement, which includes additional information. |

|

U.S. Federal Income Tax Considerations |

The exchange of Existing Securities of any series for New Notes will be a taxable transaction for U.S. federal income tax purposes. For a discussion of material U.S. federal income tax considerations of the Exchange Offer applicable to holders of Existing Securities, see “Taxation Considerations—Material U.S. Federal Income Tax Considerations”. |

The New Notes

| Issuer | Lloyds Banking Group plc |

| Securities | Fixed Rate Reset Subordinated Debt Securities due 2046 with a call date in 2041 |

| Issue Date | December 14, 2021 |

| Maturity | We will pay the New Notes at 100% of their principal amount plus accrued interest (and additional amounts, if any) on December 14, 2046, subject to any early redemption as described in “Description of the New Notes—Optional Redemption”, “Description of the New Notes—Tax Redemption” and “Description of the Notes Notes—Capital Disqualification Event Redemption”. |

5

| Interest Rate | Interest will accrue on the New Notes from (and including) the Issue Date to (but excluding) the Reset Date, at a rate per annum equal to (a) the yield, rounded to three decimal places when expressed as a percentage and calculated by the Dealer Managers in accordance with standard market practice, that corresponds to the bid-side price of 1.750% U.S. Treasury Notes due August 15, 2041 as of the Pricing Time as displayed on the Bloomberg Government Pricing Monitor page FIT1 (or any recognized quotation source selected by LBG in its sole discretion if such quotation report is not available or is manifestly erroneous) plus (b) a fixed spread of 150 basis points, and (2) from (and including) the Reset Date to (but excluding) the Maturity Date, at a rate per annum calculated by the Calculation Agent on the Reset Determination Date as being equal to the sum of the applicable U.S. Treasury Rate and 1.50%, such sum being converted to a semi-annual rate in accordance with market convention (rounded to three decimal places, with 0.0005 rounded down). |

| Reset Date | December 14, 2041 |

| Interest Payment Dates | June 14 and December 14 in each year, commencing on June 14, 2022 to (and including) the Maturity Date. |

| Regular Record Dates | 15 calendar days immediately preceding the related Interest Payment Date, as applicable, whether or not a Business Day. |

| Business Day Convention | Following, unadjusted |

| Day Count Basis | 30/360 (in case of an incomplete month, based on actual number of days elapsed in such period) |

| Ranking |

The New Notes will constitute our direct, unconditional, unsecured, unguaranteed and subordinated obligations ranking pari passu without any preference among themselves and ranking junior in right of payment to the claims of any existing and future unsecured and unsubordinated indebtedness of LBG. In a winding up or in the event that an administrator has been appointed in respect of us and notice has been given that it intends to declare and distribute a dividend, all amounts due in respect of or arising under (including any damages awarded for breach of any obligations under) the New Notes will be subordinated to, and subject in right of payment to the prior payment in full of, all claims of all Senior Creditors.

The rights and claims of the holders of the New Notes shall rank at least pari passu with the claims of holders of all obligations of LBG which constitute, or would but for any applicable limitation on the amount of such capital constitute, Tier 2 Capital of LBG and in priority to (1) the claims of holders of all obligations of LBG which constitute Tier 1 Capital of LBG, (2) the claims of holders of all undated or perpetual subordinated obligations of LBG and (3) the claims of holders of all share capital of LBG.

In addition, because we are a holding company, our rights to participate in the assets of any subsidiary if it is liquidated will be subject to the prior claims of its creditors, including in the case of bank subsidiaries, their depositors, except to the extent that we may be a creditor with recognized claims against the subsidiary. See also “Risk Factors— The New Notes are obligations exclusively of LBG and LBG is structurally subordinated to the creditors of its subsidiaries.” |

6

| Agreement with Respect to the Exercise of U.K. Bail-in Power |

Notwithstanding any other agreements, arrangements, or understandings between us and any holder or beneficial owner of the New Notes by acquiring or holding the New Notes, each holder (including each beneficial owner) of the New Notes acknowledges, accepts, agrees to be bound by and consents to the exercise of any U.K. bail-in power (as defined below) by the relevant U.K. resolution authority that may result in (i) the reduction or cancellation of all, or a portion, of the principal amount of, or interest on, the New Notes; (ii) the conversion of all, or a portion, of the principal amount of, or interest on, the New Notes into shares or other securities or other obligations of LBG or another person (and the issue to or conferral on the holder of such shares, securities or obligations), including by means of amendment, modification or variation of the terms of the New Notes; and/or (iii) the amendment or alteration of the maturity of the New Notes, or amendment of the amount of interest due on the New Notes, or the dates on which interest becomes payable, including by suspending payment for a temporary period; any U.K. bail-in power may be exercised by means of variation of the terms of the New Notes solely to give effect to the exercise by the relevant U.K. resolution authority of such U.K. bail-in power. With respect to (i), (ii) and (iii) above, references to principal and interest shall include payments of principal and interest that have become due and payable (including principal that has become due and payable at the maturity date), but which have not been paid, prior to the exercise of any U.K. bail-in power. Each holder and each beneficial owner of the New Notes further acknowledges and agrees that the rights of the holders and/or beneficial owners under the New Notes are subject to, and will be varied, if necessary, solely to give effect to, the exercise of any U.K. bail-in power by the relevant U.K. resolution authority.

For these purposes, a “U.K. bail-in power” is any write-down and/or conversion power existing from time to time under any laws, regulations, rules or requirements relating to the resolution of banks, banking group companies, credit institutions and/or investment firms incorporated in the |

7

|

United Kingdom in effect and applicable in the United Kingdom to us and the Group, including but not limited to any such laws, regulations, rules or requirements which are implemented, adopted or enacted in the United Kingdom within the context of the U.K. resolution regime under the Banking Act as the same has been or may be amended from time to time (whether pursuant to the Banking Reform Act 2013, secondary legislation or otherwise), pursuant to which obligations of a bank, banking group company, credit institution or investment firm or any of its affiliates can be reduced, cancelled, amended, transferred and/or converted into shares or other securities or obligations of the obligor or any other person (or suspended for a temporary period) or pursuant to which any right in a contract governing such obligations may be deemed to have been exercised (and a reference to the “relevant U.K. resolution authority” is to any authority with the ability to exercise a U.K. bail-in power).

According to the principles contained in the Banking Act, we expect that the relevant U.K. resolution authority would exercise its U.K. bail-in power in respect of the New Notes having regard to the hierarchy of creditor claims and that the holder or beneficial owner of the New Notes would be treated equally in respect of the exercise of the U.K. bail-in power with all other claims that would rank pari passu with the New Notes upon an insolvency of LBG.

No repayment of the principal amount of the New Notes or payment of interest on the New Notes shall become due and payable after the exercise of any U.K. bail-in power by the relevant U.K. resolution authority unless, at the time that such repayment or payment, respectively, is scheduled to become due, such repayment or payment would be permitted to be made by us under the laws and regulations of the United Kingdom applicable to us or other members of the Group. See also “Risk Factors—Under the terms of the New Notes, you will agree to be bound by and consent to the exercise of any U.K. bail-in power by the relevant U.K. resolution authority.”

Neither a reduction or cancellation, in part or in full, of the principal amount of, or interest on, the New Notes or the conversion thereof into another security or obligation of LBG or another person, as a result of the exercise of the U.K. bail-in power by the relevant U.K. resolution authority with respect to LBG, nor the exercise of the U.K. bail-in power by the relevant U.K. resolution authority with respect to the New Notes will be a default or an event of default for any purpose.

LBG’s obligations to indemnify the Trustee in accordance with the Section 6.07 of the Subordinated Indenture shall survive the exercise of the U.K. bail-in power by the relevant U.K. resolution authority with respect to the New Notes.

For a discussion of certain risk factors relating to the U.K. bail-in power, see “Risk Factors—Risks relating to the New Notes”. |

8

| Repayment of Principal and Payment of Interest After Exercise of U.K. Bail-in Power | No repayment of the principal amount of the New Notes or payment of interest on the New Notes shall become due and payable after the exercise of any U.K. bail-in power by the relevant U.K. resolution authority unless, at the time that such repayment or payment, respectively, is scheduled to become due, such repayment or payment would be permitted to be made by us under the laws and regulations of the United Kingdom applicable to us or other members of the Group. |

| Additional Issuances | We may, without the consent of the holders of the New Notes, issue additional notes having the same ranking and same interest rate, maturity date, redemption terms and other terms as the New Notes described in this prospectus except for the price to the public, issue date and first Interest Payment Date, provided however that such additional notes that form part of the same series as the New Notes must be fungible with the outstanding New Notes for U.S. federal income tax purposes. Any such additional notes, together with the New Notes offered by this prospectus, will constitute a single series of securities under the Indenture. There is no limitation on the amount of New Notes or other debt securities that we may issue under the Indenture. |

| Tax Redemption | If certain changes in certain tax laws or regulations of the United Kingdom has occurred that, among other things, impose certain withholding taxes or other deductions on the payments in respect of the New Notes, results in certain tax liability or results in certain other consequences including in treatment of the New Notes, LBG may, subject to the satisfaction of the conditions described under “Description of the New Notes—Conditions to Redemption, Purchase, Substitution or Variation”, redeem the New Notes, in whole but not in part, at any time, at 100% of their principal amount, together with any Accrued Interest to, but excluding, the date fixed for redemption. See “Description of the New Notes—Tax Redemption” for more information. |

9

| Capital Disqualification Event Redemption |

We may redeem the New Notes, in whole but not in part, at any time, upon not less than 30 calendar days’ nor more than 60 calendar days’ notice to the holders of the New Notes, if, at any time immediately prior to the giving of the notice, a Capital Disqualification Event has occurred. “Capital Disqualification Event” shall be deemed to have occurred if at any time LBG determines that there is a change (which has occurred or which the Relevant Regulator considers to be sufficiently certain) in the regulatory classification of the New Notes which becomes effective after the Issue Date and that results, or would be likely to result, in the entire principal amount of the New Notes being excluded from the Tier 2 Capital of LBG and/or the Group (other than as a result of any applicable limitation on the amount of such capital).

In the event of such a redemption, the redemption price of the New Notes will be 100% of their principal amount together with any accrued but unpaid interest to, but excluding, the date fixed for redemption. See “Description of the New Notes—Capital Disqualification of Event Redemption” for more information. Any right of redemption will be subject to the conditions set forth under “Description of the New Notes—Conditions to Redemption, Purchase, Substitution or Variation”. |

| Substitution or Variation | If a Capital Disqualification Event (described above) has occurred and is continuing, then LBG may, subject to “Description of the New Notes —Conditions to Redemption, Purchase, Substitution or Variation”, but without any requirement for the consent or approval of the holders of the New Notes, at any time (whether before, on or following the Reset Date) either substitute all (but not some only) of the New Notes for, or vary the terms of the New Notes so that they remain or, as appropriate, become, Compliant Securities (as defined below), and the Trustee shall (subject to the below) agree to such substitution or variation. Upon the expiry of such notice, LBG shall either vary the terms of or substitute the New Notes, as the case may be. |

| Purchases of the New Notes | We may at any time, and from time to time, purchase New Notes in the open market or by tender or by private agreement in any manner and at any price or at differing prices. New Notes purchased or otherwise acquired by us may be (i) held, (ii) resold or (iii) at our sole discretion, surrendered to the Trustee for cancellation (in which case all New Notes so surrendered will forthwith be cancelled in accordance with applicable law and thereafter may not be re-issued or resold). Any such purchases will be subject to the conditions set forth under “Description of the New Notes —Conditions to Redemption, Purchase, Substitution or Variation”. |

10

| Book-Entry Issuance, Settlement and Clearance |

Book-entry interests in the New Notes will be issued in minimum denominations of $200,000 and in integral multiples of $1,000 in excess thereof. The New Notes shall initially be represented by one or more global securities in registered form, without coupons attached, and will be deposited with DTC, and will be registered in the name of such depositary or its nominee.

Beneficial interests in the global debt securities will be shown on, and transfers thereof will be effected only through, the book-entry records maintained by DTC and its direct and indirect participants, including, as applicable, Euroclear and Clearstream, Luxembourg. |

| Listing and Trading | We intend to apply to list the New Notes on the New York Stock Exchange. |

| Trustee, Paying Agent and Calculation Agent | The Bank of New York Mellon, a banking corporation duly organized and existing under the laws of the state of New York, acting through its London branch, having its corporate trust office at One Canada Square, London E14 5AL, United Kingdom, will act as the Trustee and will act as initial Paying Agent, and The Bank of New York Mellon, acting through its London branch, will act as Calculation Agent for the New Notes. |

|

Subordinated Debt Security Registrar

|

The Bank of New York Mellon SA/NV, Dublin Branch. |

| Governing Law | The Subordinated Indenture (as defined below), the Ninth Supplemental Indenture (as defined below) and the New Notes are governed by, and construed in accordance with, the laws of the State of New York, except for the subordination and waiver of set-off provisions relating to the New Notes which are governed by and construed in accordance with the laws of Scotland. |

11

Risk Factors

Prospective investors should consider carefully the risk factors incorporated by reference into this prospectus and as set out below as well as the other information set out elsewhere in this prospectus (including any other documents incorporated by reference herein) and reach their own views prior to making any investment decision with respect to the New Notes.

Set out below and incorporated by reference herein are certain risk factors that could have a material adverse effect on our business, operations, financial condition or prospects, and cause our future results to be materially different from expected results. Our results could also be affected by competition and other factors. These factors should not be regarded as a complete and comprehensive statement of all potential risks and uncertainties we face. We have described only those risks relating to our operations or an investment in the New Notes that we consider to be material. There may be additional risks that we currently consider not to be material or of which we are not currently aware, and any of these risks could have the effects set forth below. All of these factors are contingencies that may or may not occur and we are not in a position to express a view on the likelihood of any such contingency occurring. Investors should note that they bear our solvency risk. Each of the risks highlighted below could have a material adverse effect on the amount of principal and interest that investors will receive in respect of the New Notes. In addition, each of the highlighted risks could adversely affect the trading price of the New Notes or the rights of investors under the New Notes and, as a result, investors could lose some or all of their investment. You should consult your own financial, tax and legal advisers regarding the risks of an investment in the New Notes.

We believe that the factors described below as relating to the New Notes represent the principal risks inherent in investing in New Notes, but we may be unable to pay interest, principal or other amounts on or in connection with the New Notes for other reasons and we do not represent that the statements below regarding the risks of holding the New Notes are exhaustive. Prospective investors should also read the detailed information set out elsewhere in this prospectus (including any documents deemed to be incorporated by reference herein) and reach their own views prior to making any investment decision.

Risks relating to LBG and the Group

For a description of the risks associated with LBG and the Group, see the section entitled “Risk Factors” of LBG’s Annual Report on Form 20-F for the fiscal year ended December 31, 2020, which is incorporated by reference herein.

Risks relating to the Exchange Offer

The trading markets for the Existing Securities may be adversely affected by the Exchange Offer.

The trading markets for the Existing Securities that remain outstanding following the completion of the Exchange Offer may be characterized by significantly lower levels of liquidity than before the Exchange Offer. Such outstanding Existing Securities may command a lower price than a comparable issue of securities with greater market liquidity. A reduced market value may also make the trading price of the remaining Existing Securities more volatile. As a result, the market price for the Existing Securities that remain outstanding after the completion of the Exchange Offer may be materially and adversely affected as a result of the Exchange Offer.

Some or all series of Existing Securities may not be actively traded. Quotations for securities that are not widely traded, such as the Existing Securities, may differ from actual trading prices and should be viewed as approximations. Investors are urged to contact their brokers with respect to current market prices for the Existing Securities.

There are significant differences between the Existing Securities and the New Notes.

The terms of the New Notes will be substantially different from those of the Existing Securities. In addition to differences in financial terms which include, among others, the coupon and payment dates, the terms of the New Notes differ in respect of maturity, redemption dates, redemption prices, interest rate reset and, in the case of Preference Shares, ranking. In addition, the issuer of the Series 1 Existing Subordinated Notes was HBOS plc, not LBG.

12

Investors should carefully consider the differences described under “Comparison of Certain Material Terms of the Preference Shares and the New Notes”, “Comparison of Certain Material Terms of the Series 1 Existing Subordinated Notes and the New Notes” and “Comparison of Certain Material Terms of the Capped Offer Notes and the New Notes” in deciding whether to tender Existing Securities for exchange in connection with the Exchange Offer.

Existing Securities may be acquired by the Offeror or its affiliates other than through the Exchange Offer in the future.

From time to time in the future, to the extent permitted by applicable law, the Offeror or its affiliates may acquire Existing Securities that remain outstanding, whether or not the Exchange Offer is consummated, through tender offers, exchange offers or otherwise, upon such terms and at such prices as it may determine, which may be more or less than the price to be paid pursuant to the Exchange Offer and could be for cash or other consideration. There can be no assurance as to which, if any, of these alternatives (or combinations thereof) LBG or its affiliates may pursue.

Legality of purchase.

None of LBG, the Dealer Managers or any of their respective affiliates has or assumes responsibility for the lawfulness of the acquisition of the New Notes by a prospective investor of the New Notes, whether under the laws of the jurisdiction of its incorporation or the jurisdiction in which it operates (if different), or for compliance by that prospective investor with any law, regulation or regulatory policy applicable to it.

Failure by a holder to comply with the procedures for participating in the Exchange Offer may result in the holder being excluded from participation.

Holders are responsible for complying with all of the procedures for submitting Exchange Instructions pursuant to the terms of this prospectus. In particular, holders should note that only one Exchange Instruction may be submitted by or on behalf of a beneficial owner in respect of a particular series of Existing Securities. Multiple Exchange Instructions submitted by or on behalf of a beneficial owner in respect of any one series of Existing Securities will be invalid and may be rejected by the relevant Offeror. None of LBG, the Dealer Managers or the Exchange Agent assumes any responsibility for informing holders of irregularities with respect to Exchange Instructions from such holders.

LBG may not accept all Existing Securities validly tendered for exchange in the Capped Offer.

In the case of the Capped Offer, LBG will, if it accepts any tenders, accept tenders of Capped Offer Notes (subject to the Exchange Priority) in an aggregate principal amount that will result in LBG issuing New Notes (after taking into account the New Notes to be issued pursuant to the Any and All Offer) in an aggregate principal amount that is no greater than the Maximum Capped Offer New Notes Size, unless such limit is increased, decreased or waived, subject to applicable law. Depending on the aggregate principal amount of Existing Securities validly tendered in the Exchange Offer, LBG may have to accept Existing Securities in accordance with the Exchange Priority and may have to prorate or reject certain of the Capped Offer Notes tendered in the Capped Offer. See “The Exchange Offer—Terms of the Exchange Offer—Acceptance of Existing Securities; Exchange Priority; Proration”. If the acceptances in the Any and All Offer would lead to issuing New Notes in an amount that is greater than the Maximum Capped Offer New Notes Size, all validly tendered Any and All Offer Securities will be accepted in full and no Capped Offer Notes will be accepted by the LBG. The Offeror reserves the right at its absolute discretion, but is under no obligation, to increase, decrease or waive the Cap Amount at any time, subject to compliance with applicable law.

Subject to applicable law, tenders of Existing Securities may be rejected by LBG, and LBG is not under any obligation to holders to furnish any reason or justification for refusing to accept a tender of Existing Securities. For example, Existing Securities may be rejected if the Exchange Offer is terminated, if the Exchange Offer does not comply with the relevant requirements of a particular jurisdiction, if any of the conditions to the Exchange Offer are not met, or for other reasons.

13

The consummation of the Exchange Offer is subject to certain conditions, including a Minimum New Issue Size Condition, and may not occur or may be delayed. Failure to complete any Exchange Offer could negatively affect the price of the Existing Securities subject to the Exchange Offer.

LBG is not obligated to complete the Exchange Offer. Several conditions must be satisfied or waived in order to complete the Exchange Offer, including among others, that there has been no change or development that, in the reasonable judgment of LBG, may materially reduce the anticipated benefits of the Exchange Offer or that has had or could reasonably be expected to have, an adverse effect on LBG, its business, condition (financial or otherwise) or prospects, or the market for the New Notes. See “The Exchange Offer—Exchange Offer Conditions.” In addition, the Exchange Offer is subject to the condition that the Minimum New Issue Size is satisfied, meaning that a sufficient number of Existing Securities are validly tendered pursuant to the Exchange Offer, such that at least $500,000,000 aggregate principal amount of the New Notes will be issued by LBG.

The foregoing conditions may not be satisfied, and if not satisfied or waived, the Exchange Offer may not occur or may be delayed. LBG may also extend or otherwise amend the Exchange Offer at its sole discretion. Even if the Exchange Offer is completed, it may not be completed on the schedule described in this prospectus or any subsequent notices of extension. Accordingly, holders of Existing Securities participating in the Exchange Offer may have to wait longer than expected to receive their New Notes, during which time those holders of Existing Securities will not be able to effect transfers of their Existing Securities tendered in the Exchange Offer. In addition, if an Exchange Offer is not completed or is delayed, the market price of the applicable Existing Securities may decline to the extent that the current market price of the Existing Securities reflects a market assumption that the Exchange Offer has been or will be completed.

The Exchange Offer may be extended, reopened, amended, limited, terminated or withdrawn at any time, subject to applicable law, and any such action may adversely affect any perceived benefits of the Exchange Offer.

Completion of the Exchange Offer is conditioned upon the satisfaction or waiver of the conditions to the Exchange Offer set out herein. In addition, subject as provided herein, the Offeror may, subject to applicable law, extend, re-open, amend, terminate or withdraw the Exchange Offer at any time prior to the announcement of whether it accepts valid tenders of Existing Securities. For details, see “The Exchange Offer—Amendment and Termination”.

Submitting an Exchange Instruction will restrict a holder’s ability to transfer its Existing Securities.

When considering whether to participate in the Exchange Offer, holders should take into account that restrictions on the transfer of Existing Securities by holders will apply from the time of submission of an Exchange Instruction to DTC. A holder will, on submitting an Exchange Instruction to DTC, agree that its Existing Securities will be blocked in the relevant account in DTC from the date the Exchange Instruction is submitted to DTC until the earlier of (i) the time of settlement on the Settlement Date and (ii) the date of any termination of the Exchange Offer (including where such Existing Securities are not accepted by the Offeror for exchange) or on which the Exchange Instruction is withdrawn, in the circumstances in which such withdrawal is permitted.

A failure of a holder or beneficial owner to consult its own advisors may result in it suffering adverse tax, accounting, financial or legal consequences.