CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities Offered

|

Maximum Aggregate

Offering Price

|

Amount of Registration

Fee (1)

|

|

Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033

|

$3,000,000.00

|

$409.20

|

|

Guarantee of Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033

|

–

|

(2)

|

|

Total

|

$3,000,000.00

|

$409.20

|

|

(1)

|

Calculated in accordance with Rule 457(r)

|

|

(2)

|

Pursuant to Rule 457(n), no separate fee is payable with respect to the guarantee

|

|

Pricing Supplement No. 46

(To Prospectus Supplement dated June 7, 2013

and Prospectus dated June 7, 2013)

|

Filed Pursuant to Rule 424(b)(5)

Registration Nos. 333-189150 and 333-189150-01

September 24, 2013

|

US $3,000,000*

Lloyds Bank plc

fully and unconditionally guaranteed by Lloyds Banking Group plc

Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033

Medium-Term Notes, Series A

As further described below, subject to our redemption right, after the first year of the term of the Notes, interest will accrue quarterly on the Notes at a per annum rate that is determined by multiplying (a) the product of the applicable Multiplier and the applicable CMS30/CMS2 Spread (subject to the Minimum Interest Rate of 0.00% and the Maximum Interest Rate of 10.00%) by (b) a fraction equal to the number of Accrual Days determined for such Floating Rate Interest Period divided by the total number of calendar days in such Floating Rate Interest Period.

|

SUMMARY TERMS

|

|||

|

Issuer:

|

Lloyds Bank plc

|

||

|

Guarantor:

|

Lloyds Banking Group plc. The Notes are fully and unconditionally guaranteed by the Guarantor. The Guarantees will constitute the Guarantor’s direct, unconditional, unsecured and unsubordinated obligations ranking pari passu with all of the Guarantor’s other outstanding unsecured and unsubordinated obligations, present and future, except such obligations as are preferred by operation of law.

|

||

|

Aggregate Principal Amount:

|

$3,000,000. May be increased prior to the Issue Date but we are not required to do so.

|

||

|

Stated Principal Amount:

|

$1,000 per note

|

||

|

Notes:

|

Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033, Medium-Term Notes, Series A (each a “Note” and collectively, “the Notes”)

|

||

|

Payment at Maturity:

|

100% repayment of principal, plus any accrued and unpaid interest, at maturity or upon early redemption. Repayment of principal at maturity, or upon early redemption, if applicable, and all payments of interest are subject to the creditworthiness of Lloyds Bank plc, as the Issuer, and Lloyds Banking Group plc, as the Guarantor of the Issuer’s obligations under the Notes.

|

||

|

Issue Price:

|

At variable prices

|

||

|

Denominations:

|

Minimum denominations of $1,000 and multiples of $1,000 thereafter

|

||

|

Trade Date(s):

|

September 24, 2013

|

||

|

Issue Date:

|

October 17, 2013

|

||

|

Maturity Date:

|

October 17, 2033, subject to redemption at the option of the Issuer (as set forth below)

|

||

|

Interest Rate:

|

From and including the Issue Date to but excluding October 17, 2014: 10.00% per annum (the “Fixed Interest Rate”)

From and including October 17, 2014 to but excluding the Maturity Date or Early Redemption Date (as defined below), if applicable:

For each Interest Period commencing on or after October 17, 2014 (each such Interest Period, a “Floating Rate Interest Period”), the applicable Interest Rate (each such Interest Rate, a “Floating Interest Rate”) will be equal to the product of (x) the applicable Multiplier (as such term is defined below) multiplied by the applicable CMS30/CMS2 Spread (as defined below), subject to the Minimum Interest Rate and the Maximum Interest Rate (as defined below) and (y) N/ACT; where

“N” = the total number of calendar days in the applicable Floating Rate Interest Period with respect to which the Index Closing Value is greater than or equal to the Index Reference Level (as defined below) (each such day, an “Accrual Day”); and

“ACT” = the total number of calendar days in the applicable Floating Rate Interest Period.

If, with respect to any Floating Rate Interest Period, the CMS30/CMS2 Spread is less than or equal to zero on the related Interest Determination Date (as defined below), no interest will accrue in respect of that Floating Rate Interest Period. If, with respect to any calendar day in any Floating Rate Interest Period, the Index Closing Value is less than the Index Reference Level, no interest will accrue in respect of such calendar day.

|

||

|

Multiplier:

|

From and including October 17, 2014 to but excluding October 17, 2018: 4.00

From and including October 17, 2018 to but excluding October 17, 2023: 5.00

From and including October 17, 2023 to but excluding October 17, 2038: 6.00

From and including October 17, 2028 to but excluding October 17, 2033: 7.00

|

||

|

Maximum Interest Rate:

|

10.00% per annum

|

||

|

Minimum Interest Rate:

|

0.00% per annum

|

||

|

Interest Payment Dates:

|

Quarterly, payable in arrears on the 17th day of each January, April, July and October, commencing on (and including) January 17, 2014, and ending on the Maturity Date or the Early Redemption Date, if applicable. If any Interest Payment Date is not a Business Day (as defined below), interest will be paid on the following Business Day, and interest on that payment will not accrue during the period from and after the originally scheduled Interest Payment Date.

|

||

|

CMS30/CMS2 Spread:

|

With respect to any Floating Rate Interest Period, CMS30 (as defined below) for such Floating Rate Interest Period minus CMS2 (as defined below) for such Floating Rate Interest Period pursuant to the provisions set forth under “Additional Provisions—CMS30/CMS2 Spread” herein.

|

||

|

Index:

|

The S&P 500® Index, determined pursuant to the provisions set forth under “Additional Provisions— Index: The S&P 500® Index herein.

|

||

|

Index Closing Value:

|

The daily closing value of the Index. Please see “Additional Provisions—Index: The S&P 500® Index—Index Closing Value” herein.

|

||

|

Index Reference Level:

|

A number equal to 70.00% of the Index Closing Value with respect to October 11, 2013.

|

||

|

Estimated Value:

|

The Issuer’s estimated value of the Notes as of the Trade Date is approximately $908.40 per $1,000 principal amount of Notes, which is less than the Issue Price of the Notes. We may sell additional Notes after the date of this pricing supplement, with issue prices and commissions different from the amounts set forth below, in which case the estimated value of the Notes on the date any additional Notes are traded may vary from the estimated value set forth above, because of changes in prevailing market conditions and other variables we use to derive the estimated value of the Notes. However the Issuer’s estimated value of the Notes on any subsequent Trade Date will not be lower than $878.40 per $1,000 principal amount of Notes. Please see “Issuer’s Estimated Value of the Notes” on page PS-1 and “Risk Factors” beginning on page PS-4 below.

|

||

|

(Summary Terms continued on following page)

|

|||

|

Commissions and issue price:

|

Price to Public (1) (2) (3)

|

Selling Agent’s Commission (3)

|

Proceeds to Lloyds Bank plc

|

|

Per Note

|

At variable prices

|

$35.00

|

$965.00

|

|

Total

|

At variable prices

|

$105,000.00

|

$2,895,000.00

|

* May be increased prior to the Issue Date but we are not required to do so.

Investing in the Notes involves significant risks. See “Risk Factors” beginning on page S-2 of the prospectus supplement and “Risk Factors” beginning on page PS-4 below.

The Notes are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

None of the Securities and Exchange Commission, any state securities commission or any other regulatory body has approved or disapproved of these Notes or passed upon the adequacy or accuracy of this pricing supplement, the accompanying prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

(1) The Notes will be offered from time to time in one or more negotiated transactions at varying prices to be determined at the time of each sale, which may be at prevailing market prices, at prices related to such prevailing prices, or at negotiated prices; provided, however, that such price will not be less than $970.00 per $1,000.00 principal amount of the notes or more than $1,000.00 per $1,000.00 principal amount of the Notes. See “Risk Factors —Yield Risk—The price you pay for the Notes may be higher than the prices other investors pay for the Notes” on page PS-4 of this pricing supplement.

(2) The proceeds you might expect to receive if you were able to resell the Notes on the Issue Date are expected to be less than the price you paid for the notes. This is because the price you paid for the Notes includes the Selling Agent’s commission set forth above and also reflects certain hedging costs associated with the Notes. For additional information, see “Risk Factors— Market Risk—The Issuer’s estimated value of the Notes on the Trade Date is less than the Issue Price of the Notes” on page PS-5 of this pricing supplement. The price you will pay for the Notes also does not include fees that you may be charged if you buy the Notes through your registered investment adviser for managed fee-based accounts.

(3) The Selling Agent will receive commissions from the Issuer of up to $35.00 per $1,000.00 principal amount of the Notes, or up to $105,000.00 of the Aggregate Principal Amount of the Notes, and may retain all or a portion of these commissions or use all or a portion of these commissions to pay selling concessions or fees to other dealers. See “Supplemental Plan of Distribution” on page PS-13 of this pricing supplement.

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

|

(Summary Terms continued from previous page)

|

|||

|

CUSIP / ISIN:

|

5394E8CB3 / US5394E8CB30

|

||

|

Redemption at the Option of the Issuer:

|

We may redeem all, but not less than all, of the Notes at the Redemption Price set forth below, on any Interest Payment Date occurring on or after October 17, 2018, provided we give at least 5 Business Days’ prior written notice to each holder of Notes, the trustee and The Depository Trust Company (“DTC”). If we exercise our redemption option, the Interest Payment Date on which we so exercise it will be referred to as the “Early Redemption Date,” which shall be the date the Redemption Price will become due and payable and on which payments of interest will cease to accrue. If any Early Redemption Date is not a Business Day, the Notes may be redeemed on the following Business Day, and interest will not accrue during the period from and after the originally scheduled Early Redemption Date.

|

||

|

Redemption Price:

|

If we exercise our redemption option, you will be entitled to receive on the Early Redemption Date 100% of the principal amount together with any accrued and unpaid interest to, but excluding, the Early Redemption Date.

|

||

|

Interest Periods:

|

Each period from and including the most recent Interest Payment Date (or the Issue Date, in the case of the first Interest Period) to, but excluding, the following Interest Payment Date (or the Maturity Date or Early Redemption Date, as applicable, in the case of the final Interest Period). Interest Period end dates will not be adjusted in the event that the last day in an Interest Period is not a Business Day.

|

||

|

Day-Count Convention:

|

Actual/Actual

|

||

|

Business Day:

|

Any day, other than a Saturday or Sunday, that is a day on which commercial banks are generally open for business in New York City and London

|

||

|

Ranking:

|

The Notes will constitute our direct, unconditional, unsecured and unsubordinated obligations ranking pari passu, without any preference among themselves, with all our other outstanding unsecured and unsubordinated obligations, present and future, except such obligations as are preferred by operation of law.

|

||

|

Tax Redemption:

|

Following the occurrence of one or more changes in tax law that would require the Issuer or the Guarantor to pay additional amounts and in other limited circumstances as described under “Description of the Notes and the Guarantees—Redemption for Tax Reasons” in the prospectus supplement and “Description of Debt Securities—Redemption” in the prospectus, the Issuer may redeem all, but not fewer than all, of the Notes at any time prior to maturity.

|

||

|

Miscellaneous

|

|||

|

Listing:

|

None

|

Governing Law:

|

New York

|

|

Settlement and Clearance:

|

DTC; Book-entry

|

Specified Currency:

|

U.S. dollars

|

|

Trustee and Paying Agent:

|

The Bank of New York Mellon, acting through its London Branch

|

||

|

Selling Agent:

|

Morgan Stanley & Co. LLC

|

Calculation Agent:

|

Morgan Stanley Capital Services LLC

|

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

ISSUER’S ESTIMATED VALUE OF THE NOTES

Our estimated value of the Notes is derived from our pricing and valuation models, using various market inputs and assumptions such as expected levels and volatility of interest rates, levels of price and volatility of any notional assets referenced by the Notes, or any futures, options, or swaps related to such notional assets, and our internal funding rate, which is determined primarily based on our market-based yield curve, adjusted to account for our funding needs and objectives for the period matching the term of the Notes. Our internal funding rate, which is a theoretical borrowing rate based on variables such as market benchmarks, our appetite for borrowing, and our existing obligations coming to maturity, is typically lower than the rate we would pay when we issue conventional debt securities on equivalent terms and our implied borrowing rate derived from the levels at which our conventional debt securities would trade in the secondary market. The use of our internal funding rate will generally result in the Notes having economic terms that are less favorable to you than if such economic terms were instead based on the levels at which our conventional debt securities trade in the secondary market. The inclusion of the Selling Agent’s commission and the estimated cost of hedging our obligations under the Notes in the Issue Price of the Notes also results in the Notes having less favorable economic terms than would otherwise be the case. Our pricing models rely on market information available to us at the time of our calculation, and on certain assumptions about future events, which may prove to be incorrect. Because our pricing models, market inputs, and assumptions may differ from those used by other issuers, and because funding rates used to value similar notes by other issuers may vary materially from the rates used by us (even among issuers with similar creditworthiness), our estimated value may not be comparable to estimated values of similar notes of other issuers.

Our estimated value of the Notes on the Trade Date is less than the Issue Price of the Notes. The difference between the Issue Price of the Notes and our estimated value of the Notes results from several factors, including the inclusion in the Issue Price of the Selling Agent’s commissions and the cost of our hedging our obligations under the Notes with a counterparty that is an affiliate of the Selling Agent. Such hedging cost includes our counterparty’s expected cost of providing such hedge, as well as the projected profit expected to be realized in consideration for structuring the Notes and for assuming the risks inherent in providing such hedge.

Our estimated value of the Notes on the Trade Date does not represent a minimum or maximum at which we or our affiliates, or the Selling Agent or any of its affiliates, might be willing to purchase your Notes in the secondary market at any time. The price at which any party would be willing to purchase the Notes in the secondary market, absent changes in market conditions or our creditworthiness, will generally be lower than the estimated value on the Trade Date, because such price would take into account our secondary market credit spreads as well as the bid-offer spread that such party would be expected to charge.

If we decide to sell additional Notes after the Trade Date and prior to the Issue Date, each as specified on the cover of this pricing supplement, our estimated value of the Notes on any such subsequent Trade Date may vary from the estimated value set forth above, because of changes in prevailing market conditions and other variables we use to derive the estimated value of the Notes. However the Issuer’s estimated value of the Notes on any subsequent Trade Date will not be lower than $878.40 per $1,000 principal amount of Notes.

PS-1

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

About this Pricing Supplement

Unless otherwise defined herein, terms used in this pricing supplement are defined in the accompanying prospectus supplement or in the accompanying prospectus. As used in this pricing supplement:

|

|

·

|

“we,” “us,” “our,” the “Issuer” and “Lloyds Bank” mean Lloyds Bank plc;

|

|

|

·

|

“LBG” and the “Guarantor” mean Lloyds Banking Group plc;

|

|

|

·

|

“Notes” refers to the Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033, Medium-Term Notes, Series A, together with the related Guarantee, unless the context requires otherwise; and

|

|

|

·

|

“SEC” refers to the Securities and Exchange Commission.

|

LBG and Lloyds Bank have filed a registration statement (including a prospectus) with the SEC for the offering to which this pricing supplement relates. Before you invest, you should read this pricing supplement together with the accompanying prospectus dated June 7, 2013 (the “prospectus”) in that registration statement and other documents, including the more detailed information contained in the accompanying prospectus supplement dated June 7, 2013 (the “prospectus supplement”), that LBG and Lloyds Bank have filed with the SEC for more complete information about Lloyds Bank and LBG and this offering.

This pricing supplement, together with the prospectus supplement and prospectus, contains the terms of the Notes and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, fact sheets, brochures or other educational materials of ours.

If the information in this pricing supplement differs from the information contained in the prospectus supplement or the prospectus, you should rely on the information in this pricing supplement.

You may access these documents for free by visiting EDGAR on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

|

|

·

|

the prospectus supplement dated June 7, 2013 and the prospectus dated June 7, 2013 can be accessed at the following hyperlink:

|

Our Central Index Key, or CIK, on the SEC website is 1167831.

Alternatively, LBG, Lloyds Bank, the Selling Agent, any underwriter or any dealer participating in the offering will arrange to send you the prospectus, prospectus supplement and pricing supplement if you request them by calling your Selling Agent’s sales representative, such dealer or toll free 1-888-227-2275 (Extension 2-3430). A copy of these documents may also be obtained from the Selling Agent by writing to them at 1585 Broadway, New York, New York 10036 or by calling the Selling Agent at (866) 477-4776.

You should rely only on the information provided or incorporated by reference in this pricing supplement, the prospectus supplement and the prospectus. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information that others may give you. We and the Selling Agent are offering to sell the Notes and seeking offers to buy the Notes only in jurisdictions where it is lawful to do so. This pricing supplement, the prospectus supplement and the prospectus are current only as of their respective dates.

PS-2

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

Additional Provisions

CMS30/CMS2 Spread

The 30-Year Constant Maturity Swap Rate (which we refer to as “CMS30”) is, on any day, the fixed rate of interest payable on an interest rate swap with a 30-year maturity as reported on Reuters Page ISDAFIX1 or any successor page thereto at 11:00 a.m. New York City time on that day; provided that for the determination of CMS30 for any calendar day, the “CMS reference determination date” shall be that calendar day unless that calendar day is not a U.S. government securities business day, in which case the CMS30 level shall be the CMS30 level on the immediately preceding U.S. government securities business day. This rate is one of the market-accepted indicators of longer-term interest rates.

The 2-Year Constant Maturity Swap Rate (which we refer to as “CMS2”) is, on any day, the fixed rate of interest payable on an interest rate swap with a 2-year maturity as reported on Reuters Page ISDAFIX1 or any successor page thereto at 11:00 a.m. New York City time on that day; provided that for the determination of CMS2 for any calendar day, the “CMS reference determination date” shall be that calendar day unless that calendar day is not a U.S. government securities business day, in which case the CMS2 level shall be the CMS2 level on the immediately preceding U.S. government securities business day. This rate is one of the market-accepted indicators of shorter-term interest rates.

An interest rate swap rate, at any given time, generally indicates the fixed rate of interest (paid semi-annually) that a counterparty in the swaps market would have to pay for a given maturity, in order to receive a floating rate (paid quarterly) equal to 3-month LIBOR for that same maturity.

“US government securities business day” means any day except for a Saturday, Sunday or a day on which The Securities Industry and Financial Markets Association (or any successor thereto) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

For the purpose of determining the level of the CMS30/CMS2 Spread applicable to a Floating Rate Interest Period, the CMS30/CMS2 Spread will be determined with reference to the day (such day, the “Interest Determination Date”) that is two (2) U.S. government securities business days prior to the first day of such Floating Rate Interest Period. A “U.S. government securities business day” is any day except for a Saturday, Sunday or a day on which The Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

CMS Rate Fallback Provisions

If CMS30 or CMS2 is not displayed by 11:00 a.m. New York City time on the Reuters Screen ISDAFIX1 Page on any day on which the level of the CMS reference index must be determined, the rate for such day will be determined on the basis of the mid-market semi-annual swap rate quotations to the Calculation Agent provided by five leading swap dealers in the New York City interbank market (the “Reference Banks”) at approximately 11:00 a.m., New York City time, on such day, and, for this purpose, the mid-market semi-annual swap rate means the mean of the bid and offered rates for the semi-annual fixed leg, calculated on a 30/360 day count basis, of a fixed-for-floating U.S. Dollar interest rate swap transaction with a term equal to the applicable 30 year or 2 year maturity commencing on such day and in a representative amount with an acknowledged dealer of good credit in the swap market, where the floating leg, calculated on an actual/360 day count basis, is equivalent to USD-LIBOR-BBA with a designated maturity of three months. The Calculation Agent will request the principal New York City office of each of the Reference Banks to provide a quotation of its rate. If at least three quotations are provided, the rate for that day will be the arithmetic mean of the quotations, eliminating the highest quotation (or, in the event of equality, one of the highest) and the lowest quotation (or, in the event of equality, one of the lowest). If fewer than three quotations are provided as requested, the rate will be determined by the Calculation Agent in good faith and in a commercially reasonable manner.

Index: The S&P 500® Index

The S&P 500® Index, which is calculated, maintained and published by Standard & Poor’s, a Division of The McGraw-Hill Companies, Inc., consists of 500 component stocks selected to provide a performance benchmark for the U.S. equity markets. The calculation of the S&P 500 Index is based on the relative value of the float-adjusted aggregate market capitalization of the 500 component companies as of a particular time as compared to the aggregate average market capitalization of 500 similar companies during the base period of the years 1941 through 1943. The S&P 500 Index is described under “Annex A—The S&P 500® Index” in this pricing supplement.

Index Closing Value

For any day in a Floating Rate Interest Period (subject to the “Index Cutoff” described below), the Index Closing Value will equal the closing value of the Index as published on Bloomberg under ticker symbol “SPX,” or in the case of any successor index (such index, a “Successor Index”), the Bloomberg ticker symbol for such Successor Index, at the regular weekday close of trading on that calendar day, as determined by the Calculation Agent; provided that, if a Market Disruption Event with respect to the Index occurs on any day in a Floating Rate Interest Period or if any such day in a Floating Rate Interest Period is not an Index Business Day, the closing value of the Index with respect to such day will be the closing value of the Index on the immediately preceding Index Business Day on which no Market Disruption Event has occurred. In certain circumstances, the Index Closing Value will be based on the alternate calculation of the Index described under “Annex A—The S&P 500® Index—Discontinuance of the S&P 500® Index; Alteration of Method of Calculation.”

Index Cutoff

The Index Closing Value with respect to each day from and including the fifth Index Business Day prior to the related Interest Payment Date for any Floating Rate Interest Period (each such fifth day, an “Index Cutoff Date”) to but excluding such related Interest Payment Date shall be equal to the Index Closing Value in effect on the relevant Index Cutoff Date.

“Index Business Day” means a day, as determined by the Calculation Agent, on which trading is generally conducted on each of the relevant exchange(s) for the Index, other than a day on which trading on such exchange(s) is scheduled to close prior to the time of the posting of its regular final weekday closing price.

PS-3

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

“Relevant exchange” means the primary exchange(s) or market(s) of trading for (i) any security then included in the Index, or any Successor Index, and (ii) futures or options contracts related to the Index or any Successor Index or to any security then included in the Index or any Successor Index.

For more information regarding Market Disruption Events with respect to the Index, discontinuance of the Index and alteration of the method of calculation, see “Annex A—The S&P 500® Index—Market Disruption Event” and “—Discontinuance of the S&P 500® Index; Alteration of Method of Calculation” herein.

PS-4

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

RISK FACTORS

Your investment in the Notes involves significant risks. Your decision to purchase the Notes should be made only after carefully considering the risks of an investment in the Notes, including those discussed below and in the section entitled “Risk Factors” beginning on page S-2 of the prospectus supplement, with your advisers in light of your particular circumstances. The Notes are not an appropriate investment for you if you are not knowledgeable about significant elements of the Notes or financial matters in general. We also urge you to consult with your investment, legal, accounting, tax, and other advisers before you invest in the Notes.

Issuer Risk

The credit risk of Lloyds Bank and LBG and their credit ratings and credit spreads may adversely affect the value of the Notes.

You are dependent on Lloyds Bank’s ability to pay all amounts due on the Notes, and therefore you are subject to the credit risk of Lloyds Bank and to changes in the market’s view of Lloyds Bank’s creditworthiness. In addition, because the Notes are fully and unconditionally guaranteed by Lloyds Bank’s parent company, LBG, you are also dependent on the credit risk of LBG in the event that Lloyds Bank fails to make any payment or delivery required by the terms of the Notes. If Lloyds Bank and LBG were to default on their respective payment obligations, you may not receive any amounts owed to you under the Notes and you could lose your entire investment. The credit ratings of Lloyds Bank and LBG are an assessment by rating agencies of their ability to pay their obligations, including those under the Notes. Any actual or anticipated decline in Lloyds Bank’s and LBG’s credit ratings, or increase in the credit spreads charged by the market for taking credit risk, is likely to adversely affect the value of the Notes. However, because the return on the Notes is dependent upon factors in addition to Lloyds Bank’s and LBG’s credit ratings, an improvement in their credit ratings will not necessarily increase the value of the Notes and will not reduce market risk and other investment risks related to the Notes.

Yield Risk

After the first year of their term, the Notes are subject to interest payment risk based on the applicable CMS30/CMS2 Spread and the Index Closing Value.

After the first year of the term of the Notes, if the applicable CMS30/CMS2 Spread is zero or less than zero or the Index Closing Values are below the Index Reference Level for an extended period of time, we will not pay any interest on the Notes in respect of such periods of time, and the value of the Notes will decrease. It is also possible that the applicable CMS30/CMS2 Spread in respect of a Floating Rate Interest Period will be so low, or that the Index Closing Values will be below the Index Reference Level for so many days during any Floating Rate Interest Period that the interest payment for such Floating Rate Interest Period will be less than the amount that would be paid on an ordinary debt security of Lloyds Bank of comparable maturity and may be zero. To the extent that the applicable CMS30/CMS2 Spread is close to, at or below zero, or that the Index Closing Values are close to, at or below the Index Reference Level, the market value of the Notes may decrease and you may receive substantially less than 100% of the Issue Price if you wish to sell your Notes at such time.

The interest you can earn on the Notes is capped.

The interest you earn on the Notes will never exceed the Maximum Interest Rate of 10.00% per annum for any Floating Rate Interest Period, regardless of the extent to which CMS30 is greater than CMS2, or the Index Closing Values are greater than the Index Reference Level. The interest you receive on the Notes may be less than the return you could earn on other investments.

The Index Closing Value for any day from and including the fifth Index Business Day prior to the Interest Payment Date of a Floating Rate Interest Period will be the Index Closing Value for such fifth Index Business Day.

Because the Index Closing Value with respect to each day from and including the fifth Index Business Day prior to the related Interest Payment Date for any Floating Rate Interest Period (each such fifth day, an “Index Cutoff Date”) to but excluding such related Interest Payment Date will be equal to the Index Closing Value in effect on the relevant Index Cutoff Date, if the Index Closing Value on that Index Business Day is less than the Index Reference Level, you will not receive any interest with respect to the days from and including the Index Cutoff Date to but excluding the relevant Interest Payment Date, even if the Index Closing Value as actually determined on any of those days were to be greater than or equal to the Index Reference Level.

The historical performance of the CMS30/CMS2 Spread and the Index are not an indication of future performance.

Historical performance of the CMS30/CMS2 Spread and the Index should not be taken as indications of their future performance during the term of the Notes. Changes in the levels of the CMS30/CMS2 Spread and the Index will affect the value of the Notes, but it is impossible to predict whether such levels will rise or fall.

The price you pay for the Notes may be higher than the prices other investors pay for the Notes.

The Selling Agent proposes to offer the Notes from time to time for sale to investors in one or more negotiated transactions, or otherwise, at prevailing market prices at the time of sale, at prices related to then-prevailing prices, at negotiated prices, or otherwise. Accordingly, there is a risk that the price you pay for your Notes will be higher than the prices other investors pay for their Notes based on the date and time you made your purchase, from whom you purchased the Notes, any related transaction cost, whether you hold your Notes in a brokerage account, a fiduciary or fee-based account or another type of account and other market factors.

The Notes will be subject to early redemption at our option.

We may redeem the Notes prior to the Maturity Date on any quarterly Interest Payment Date, beginning on October 17, 2018. If you intend to purchase the Notes, you must be willing to have your Notes redeemed early. We are generally more likely to redeem the Notes during periods when we expect that interest will accrue on the Notes at a rate that is greater than that which we would pay on our traditional interest-bearing deposits or debt securities having a maturity equal to the remaining term of the Notes. In contrast, we are generally less likely to redeem the Notes during periods when we expect interest to accrue on the Notes at a rate that is less than that which we would pay on those instruments. In addition, we

PS-5

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

have the right to redeem the Notes in the event of certain tax events as described under “Description of the Notes and the Guarantees—Redemption for Tax Reasons” in the prospectus supplement and “Description of Debt Securities—Redemption” in the prospectus. If we redeem the Notes prior to the Maturity Date, accrued interest will be paid on the Notes until such early redemption, but you will not receive any future interest payments from the Notes redeemed and you may be unable to reinvest your proceeds from the redemption in an investment with a return that is as high as the return on the Notes would have been if they had not been redeemed.

Market Risk

The value of the Notes prior to maturity, the CMS30/CMS2 Spread and the Index Closing Value will be influenced by many unpredictable factors, and the value of the Notes may be less than the price you paid for the Notes.

The value of the Notes will be affected by a number of factors that may either offset or magnify each other, including, but not limited to: (i) changes in the level of the CMS30/CMS2 Spread, (ii) changes in the level of the Index Closing Value, (iii) volatility of the CMS30/CMS2 Spread, (iv) volatility of the Index, (v) changes in interest and yield rates, (vi) geopolitical conditions and economic, financial, political and regulatory or judicial events that affect the securities comprising the Index, or equity markets generally, and that may affect the Index, (vii) time remaining to maturity, (viii) the supply and demand for the Notes in the secondary market, if any; and (ix) the actual or perceived creditworthiness of Lloyds Bank, as the Issuer of the Notes, and LBG, as the Guarantor of Lloyds Bank’s obligations under the Notes, including actual or anticipated downgrades in LBG’s or Lloyds Bank’s credit ratings.

In particular, to the extent that, during the term of the Notes, the CMS30/CMS2 Spread is close to, at, or below zero or the Index Closing Values are close to, at, or less than the Index Reference Level, the value of the Notes may decrease and you may receive substantially less than 100% of the price you paid for your Notes if you wish to sell your Notes at such time.

Some or all of these factors will influence the price that you will receive if you sell your Notes prior to the Maturity Date or the Early Redemption Date in the secondary market, if any.

If you sell your Notes before the Maturity Date or the Early Redemption Date, the price that you receive may be less, and may be substantially less, than the price you paid for your Notes.

The Issuer’s estimated value of the Notes on the Trade Date is less than the Issue Price of the Notes.

Our estimated value of the Notes on the Trade Date is less than the Issue Price of the Notes. The difference between the Issue Price of the Notes and our estimated value of the Notes results from several factors, including the inclusion in the Issue Price of the Selling Agent’s commissions and the cost of our hedging our obligations under the Notes with a counterparty that is an affiliate of the Selling Agent. Such hedging cost includes our counterparty’s expected cost of providing such hedge, as well as the projected profit expected to be realized in consideration for structuring the Notes and for assuming the risks inherent in providing such hedge.

Our estimated value of the Notes is determined by reference to an internal funding rate and our pricing models. Our internal funding rate, which is a borrowing rate based on variables such as market benchmarks, our appetite for borrowing, and our existing obligations coming to maturity, is typically lower than the rate we would pay when we issue conventional debt securities on equivalent terms and our implied borrowing rate derived from the levels at which our conventional debt securities would trade in the secondary market. The use of our internal funding rate will generally result in the Notes having economic terms that are less favorable to you than if such economic terms were instead based on the levels at which our conventional debt securities trade in the secondary market. The inclusion of the Selling Agent’s commission and the estimated cost of hedging our obligations under the Notes in the Issue Price of the Notes also results in the Notes having less favorable economic terms than would otherwise be the case. Our pricing models rely on market information available to us at the time of our calculation, and on certain assumptions about future events, which may prove to be incorrect. Because our pricing models, market inputs, and assumptions may differ from those used by other issuers, and because funding rates used to value similar notes by other issuers may vary materially from the rates used by us (even among issuers with similar creditworthiness), our estimated value may not be comparable to estimated values of similar notes of other issuers.

Assuming no changes in market conditions and other relevant factors, the price you may receive for your Notes in secondary market transactions would generally be lower than both the Issue Price of the Notes and our estimated value of the Notes on the Trade Date.

While the payments on the Notes are based on the full principal amount of your Notes, our estimated value of the Notes on the Trade Date (as disclosed on the cover of this pricing supplement) is less than the Issue Price of the Notes. In addition, our estimated value of the Notes on the Trade Date does not represent the price at which any party, including us and our affiliates, and the Selling Agent and its affiliates, would be willing to purchase your Notes in the secondary market, if any, at any time. Assuming no changes in market conditions, our creditworthiness or other relevant factors, the price, if any, at which any party would be willing to purchase the Notes from you in secondary market transactions, if at all, would generally be lower than both the Issue Price and our estimated value of the Notes on the Trade Date, because the secondary market price would take into account our secondary market credit spreads as well as the bid offer spread that any such party would be expected to charge.

Liquidity Risk

The Notes will not be listed or displayed on any securities exchange or quotation system, and there may be little or no secondary market for the Notes.

The Notes will not have an established trading market when issued, and the Notes will not be listed or displayed on any securities exchange or quotation system; accordingly, there may be little or no secondary market for the Notes and, as such, information regarding independent market pricing for the Notes may be very limited or non-existent. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Notes easily. We, the Selling Agent and/or its affiliates may purchase and sell the Notes from time to time in the secondary market, but we, the Selling Agent and/or its affiliates are not obligated to do so. If we, the Selling Agent and/or its affiliates make such a market in the Notes, we, the Selling Agent and/or any such affiliate may stop doing so at any time and for any reason without notice. Because other dealers are not likely to make a secondary market for the Notes, the prices at which you may be able to trade your Notes will probably depend on the price, if any, at which we, the Selling Agent and/or its affiliates may be willing to buy the Notes. It is expected that transaction costs in any secondary market would

PS-6

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

be high and, as a result, the difference between bid and asked prices for your Notes would be significant. Accordingly, you should be willing to hold the Notes until the Maturity Date, and you may incur a loss if you sell the Notes prior to the Maturity Date or the Early Redemption Date, as applicable. In addition, the Selling Agent may, at any time, hold unsold inventory which may inhibit the development of a secondary market for the Notes.

Index-Specific Risk Factors

Adjustments to the Index could adversely affect the value of the Notes.

The publisher of the Index can add, delete or substitute the stocks comprising the Index (each, an “Index Component Stock”), and can make other methodological changes required by certain events relating to the Index Component Stocks, such as stock dividends, stock splits, spin-offs, rights offerings and extraordinary dividends, that could change the value of the Index. Any of these actions could adversely affect the value of the Notes. The publisher of the Index may discontinue or suspend calculation or publication of the Index at any time. In these circumstances, the Calculation Agent will have the sole discretion to substitute a Successor Index that is comparable to the discontinued Index. The Calculation Agent could have an economic interest that is different than that of investors in the Notes insofar as, for example, the Calculation Agent is not precluded from considering indices that are calculated and published by the Calculation Agent or any of its affiliates. If the Calculation Agent determines that there is no appropriate Successor Index, on any day on which the Index Closing Value is to be determined, the Index Closing Value for such day will be based on the stocks comprising the discontinued index at the time of such discontinuance, without rebalancing or substitution, computed by the Calculation Agent, in accordance with the formula for calculating the Index Closing Value last in effect prior to discontinuance of the Index.

You have no shareholder rights.

As an investor in the Notes, you will not have voting rights, rights to receive dividends or other distributions or any other rights with respect to the stocks that underlie the Index.

Investing in the Notes is not equivalent to investing in the Index or the stocks comprising the Index.

Investing in the Notes is not equivalent to investing in the Index or its component stocks.

Hedging and trading activity by the Calculation Agent and its affiliates could potentially adversely affect the level of the Index.

The Calculation Agent and other of its affiliates will carry out hedging activities related to the Notes (and possibly to other instruments linked to the Index or its component stocks), including trading in the Index Component Stocks as well as in other instruments related to the Index or the Index Component Stocks. The Calculation Agent and some of its other subsidiaries also trade in the Index Component Stocks and other financial instruments related to the Index on a regular basis as part of their general broker-dealer and other businesses. Any of these hedging or trading activities on or prior to the day the Notes are priced for initial sale to the public could potentially decrease the Index Closing Value, thus increasing the risk that the Index Closing Value will be less than the Index Reference Level during the term of the Notes.

Conflicts of Interest

There are potential conflicts of interest between investors in the Notes and us and our affiliates and the Selling Agent and its affiliates.

We and our affiliates and the Selling Agent and its affiliates play a variety of roles in connection with the issuance of the Notes, including acting as Calculation Agent and hedging our obligations under the Notes. Trading activities related to interest rate movements, including short-term and long-term interest rate swaps and other instruments that may affect interest rates, have been entered into or may be entered into on behalf of us, our affiliates, the Selling Agent, its affiliates or their respective customers, that are not for the account of the investors in the Notes or on their behalf. In particular, as described below under “Use of Proceeds; Hedging,” we, the Selling Agent and/or its affiliates may hedge our obligations under the Notes by purchasing securities, futures, options or other derivative instruments with returns linked or related to changes in the levels of CMS30, CMS2, and/or the Index and its component securities, and we may adjust these hedges by, among other things, purchasing or selling securities, futures, options or other derivative instruments at any time. These trading activities may present a conflict between the investors’ interests in the Notes and the interests we, our affiliates and the Selling Agent and its affiliates will have in each of their respective proprietary accounts and in facilitating transactions, including block trades and options and other derivatives transactions, for their respective customers and in accounts under each of their respective management. These trading activities, if they influence the levels of CMS30, CMS2, and/or the Index or any other factor that may affect the amount of interest that may be paid on any Interest Payment Date for any Floating Rate Interest Period, could be adverse to your interests as an investor in the Notes. It is possible that we, the Selling Agent and/or its affiliates could receive substantial returns from these hedging activities while the value of the Notes declines.

There are potential conflicts of interest between investors in the Notes and the Calculation Agent.

As Calculation Agent for your Notes, Morgan Stanley Capital Services LLC, an affiliate of the Selling Agent, will have discretion in making certain determinations that affect your Notes, including with respect to the CMS30/CMS2 Spread, the Index Closing Value, the occurrence or non-occurrence of Market Disruption Events and the selection of a Successor Index or calculation of the Index Closing Value in the event of a discontinuance of the Index, may adversely affect any payments you may receive in respect of the Notes. The exercise of this discretion by Morgan Stanley Capital Services LLC could adversely affect the value of your Notes and may present a conflict of interest between the investors’ interests in the Notes and the interests of Morgan Stanley Capital Services LLC. We may change the Calculation Agent at any time without notice to you.

We and our affiliates and the Selling Agent and its affiliates have published or may in the future publish reports, express opinions or provide recommendations and engage in other transactions that could adversely affect the value of the Notes.

We and our affiliates and the Selling Agent and its affiliates have published or may in the future publish reports from time to time on financial markets and other matters that may influence the value of the Notes or express opinions or provide recommendations that are inconsistent with purchasing or holding the Notes. Any such reports, opinions or recommendations may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the merits of investing in the Notes.

PS-7

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

We and the Selling Agent or any of its affiliates also may issue, underwrite or assist unaffiliated entities in the issuance or underwriting of other securities or financial instruments that may have features similar to those of the Notes, including similar rates of interest or maturities. By introducing competing products into the marketplace in this manner, we and the Selling Agent or its affiliates could adversely affect the value of the Notes.

Suitability of Investment

The Notes may not be a suitable investment for you under certain circumstances.

The Notes may not be a suitable investment for you, if, among other things:

|

|

·

|

you are unwilling to forgo guaranteed market interest rates for the term of the Notes;

|

|

|

·

|

you believe that the CMS30/CMS2 Spread will be equal to or below zero, or that the Index Closing Values will be below the Index Reference Level, for significant periods of time during the term of the Notes;

|

|

|

·

|

you are unable to accept the risk that the Notes may pay interest at a very low rate or even zero interest in respect of any Interest Payment Date for any Floating Rate Interest Period;

|

|

|

·

|

you seek assurances that there will be a liquid market if and when you want to sell the Notes prior to maturity;

|

|

|

·

|

you are unwilling to accept the risk that the Notes may be redeemed prior to maturity, and are unwilling or unable to accept the risk that you may be unable to reinvest the proceeds of such redemption in an investment with a return that is as high as the return on the Notes would have been if they had not been redeemed; or

|

|

|

·

|

you are unwilling or are unable to assume the credit risk associated with Lloyds Bank, as the Issuer of the Notes, and LBG, as the Guarantor of the Issuer’s obligations under the Notes.

|

PS-8

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

HYPOTHETICAL INTEREST RATE AND INTEREST PAYMENT CALCULATIONS

As described above, the Notes will pay interest in respect of each Floating Rate Interest Period with respect to which the CMS30/CMS2 Spread is greater than 0.00%, for each day of such Floating Rate Interest Period on which the closing level of the S&P 500® Index is greater than or equal to the Index Reference Level. The following illustrates the process by which the interest rate and interest payment amount are determined.

Interest Rate Calculation

Step 1: Determine whether interest will accrue with respect to a Floating Rate Interest Period.

For each Floating Rate Interest Period, the CMS30/CMS2 Spread is calculated in respect of such period by reference to CMS30 and CMS2 on the Interest Determination Date. If the applicable CMS30/CMS2 Spread is equal to or less than zero, no interest will accrue in respect of such Floating Rate Interest Period. See “Risk Factors—After the first year of their term, the Notes are subject to interest payment risk based on the applicable CMS30/CMS2 Spread and the Index Closing Value.”

Step 2: If the CMS30/CMS2 Spread with respect to any Floating Rate Interest Period is greater than 0.00%, determine the number of days in that Floating Rate Interest Period with respect to which the Index Closing Value was greater than or equal to the Index Reference Level.

For each Floating Rate Interest Period, the Index Closing Value is determined with respect to each day of such Floating Rate Interest Period (subject to the Index Cutoff). For each calendar day in a Floating Rate Interest Period with respect to which the Index Closing Value is greater than or equal to the Index Reference Level (each such day, an “Accrual Day”), interest will accrue if the CMS30/CMS2 Spread with respect to such Floating Rate Interest Period is greater than 0.00%. However, if on any calendar day in a Floating Rate Interest Period the Index Closing Value is less than the Index Reference Level, no interest will accrue with respect to that day.

Step 3: Calculate the per annum interest rate for the relevant Interest Payment Date.

For each Floating Rate Interest Period, the per annum rate payable is determined by multiplying (a) the product of the applicable Multiplier and the applicable CMS30/CMS2 Spread (subject to the Minimum Interest Rate and the Maximum Interest Rate) by (b) a fraction equal to the number of Accrual Days determined for such Floating Rate Interest Period divided by the total number of calendar days in such Floating Rate Interest Period.

Step 4: Calculate the interest payment amount payable for the relevant Interest Payment Date.

For each Floating Rate Interest Period, once the Calculation Agent has determined the applicable per annum interest rate, the Calculation Agent will calculate the effective rate for that Floating Rate Interest Period by multiplying such rate by the applicable day-count fraction. The resulting effective rate is then multiplied by the relevant principal amount of the Notes to determine the actual interest amount payable on the related Interest Payment Date. No adjustments to the amount of interest calculated will be made in the event an Interest Payment Date is not a Business Day.

PS-9

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

Example Interest Rate Calculations

The table below presents examples of hypothetical interest that would accrue on the Notes during any Floating Rate Interest Period. The examples below are for purposes of illustration only. The examples of the hypothetical interest rate that would accrue on the Notes are based on the applicable Multiplier, the CMS30/CMS2 Spread on the applicable Interest Determination Date and on the total number of calendar days in a Floating Rate Interest Period with respect to which the Index Closing Value of the S&P 500® Index is greater than or equal to the Index Reference Level.

The actual interest payments in respect of any Floating Rate Interest Period, if any, will depend on the actual level of the applicable CMS30/CMS2 Spread on each Interest Determination Date and the Index Closing Value of the S&P 500® Index on each day during each Floating Rate Interest Period. The applicable interest rate for each Floating Rate Interest Period will be determined on a per annum basis but will apply only to that Floating Rate Interest Period. The table assumes that the interest payment period contains 90 calendar days and that the applicable Multiplier is 4.00. The examples below are for purposes of illustration only.

|

CMS30/CMS2 Spread

|

4.00 * CMS30/

CMS2 Spread

|

4.00 * Spread subj. to Min/Max Interest Rates

|

Hypothetical Floating Interest Rate*

|

||||||

|

Number of Accrual Days with respect to which the Index Closing Value of the S&P 500® Index

is greater than or equal to the Index Reference Level.

|

|||||||||

|

0

|

10

|

20

|

30

|

50

|

75

|

90

|

|||

|

-2.60%

|

-10.40%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-2.40%

|

-9.60%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-2.20%

|

-8.80%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-2.00%

|

-8.00%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-1.80%

|

-7.20%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-1.60%

|

-6.40%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-1.40%

|

-5.60%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-1.20%

|

-4.80%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-1.00%

|

-4.00%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-0.80%

|

-3.20%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-0.60%

|

-2.40%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-0.40%

|

-1.60%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

-0.20%

|

-0.80%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

0.00%

|

0.00%

|

0.00%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

0.0000%

|

|

0.20%

|

0.80%

|

0.80%

|

0.0000%

|

0.0889%

|

0.1778%

|

0.2667%

|

0.4444%

|

0.6667%

|

0.8000%

|

|

0.40%

|

1.60%

|

1.60%

|

0.0000%

|

0.1778%

|

0.3556%

|

0.5333%

|

0.8889%

|

1.3333%

|

1.6000%

|

|

0.60%

|

2.40%

|

2.40%

|

0.0000%

|

0.2667%

|

0.5333%

|

0.8000%

|

1.3333%

|

2.0000%

|

2.4000%

|

|

0.80%

|

3.20%

|

3.20%

|

0.0000%

|

0.3556%

|

0.7111%

|

1.0667%

|

1.7778%

|

2.6667%

|

3.2000%

|

|

1.00%

|

4.00%

|

4.00%

|

0.0000%

|

0.4444%

|

0.8889%

|

1.3333%

|

2.2222%

|

3.3333%

|

4.0000%

|

|

1.20%

|

4.80%

|

4.80%

|

0.0000%

|

0.5333%

|

1.0667%

|

1.6000%

|

2.6667%

|

4.0000%

|

4.8000%

|

|

1.40%

|

5.60%

|

5.60%

|

0.0000%

|

0.6222%

|

1.2444%

|

1.8667%

|

3.1111%

|

4.6667%

|

5.6000%

|

|

1.60%

|

6.40%

|

6.40%

|

0.0000%

|

0.7111%

|

1.4222%

|

2.1333%

|

3.5556%

|

5.3333%

|

6.4000%

|

|

1.80%

|

7.20%

|

7.20%

|

0.0000%

|

0.8000%

|

1.6000%

|

2.4000%

|

4.0000%

|

6.0000%

|

7.2000%

|

|

2.00%

|

8.00%

|

8.00%

|

0.0000%

|

0.8889%

|

1.7778%

|

2.6667%

|

4.4444%

|

6.6667%

|

8.0000%

|

|

2.20%

|

8.80%

|

8.80%

|

0.0000%

|

0.9778%

|

1.9556%

|

2.9333%

|

4.8889%

|

7.3333%

|

8.8000%

|

|

2.50%

|

10.00%

|

10.00%

|

0.0000%

|

1.1111%

|

2.2222%

|

3.3333%

|

5.5556%

|

8.3333%

|

10.0000%

|

|

2.60%

|

10.40%

|

10.00%

|

0.0000%

|

1.1111%

|

2.2222%

|

3.3333%

|

5.5556%

|

8.3333%

|

10.0000%

|

|

2.80%

|

11.20%

|

10.00%

|

0.0000%

|

1.1111%

|

2.2222%

|

3.3333%

|

5.5556%

|

8.3333%

|

10.0000%

|

|

3.00%

|

12.00%

|

10.00%

|

0.0000%

|

1.1111%

|

2.2222%

|

3.3333%

|

5.5556%

|

8.3333%

|

10.0000%

|

* The Floating Interest Rate is determined by multiplying (a) the product of the applicable Multiplier and the applicable CMS30/CMS2 Spread (subject to the Minimum Interest Rate and the Maximum Interest Rate) by (b) a fraction equal to the number of Accrual Days determined for such Floating Rate Interest Period divided by the total number of calendar days in such Floating Rate Interest Period.

If CMS30 is less than or equal to CMS2 on the applicable Interest Determination Date, the per annum interest rate applicable to such Floating Rate Interest Period will be the Minimum Interest Rate of 0.00% and no interest will accrue on the Notes for such Floating Rate Interest Period regardless of the total number of calendar days in the Floating Rate Interest Period with respect to which the Index Closing Value of the S&P 500® Index is greater than or equal to the Index Reference Level.

PS-10

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

Historical Information

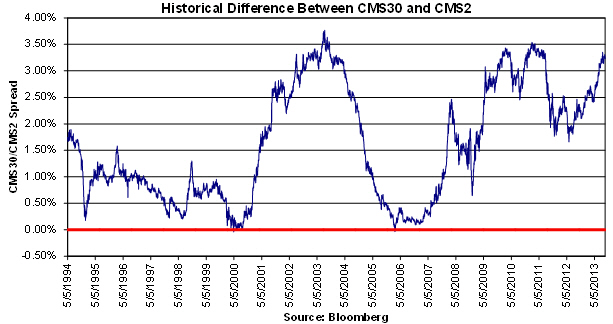

We have provided the following historical information to help you evaluate the behavior of the CMS30/CMS2 Spread in various periods. The historical difference between CMS30 and CMS2 should not be taken as an indication of the future difference between CMS30 and CMS2 or the performance of the Notes. Fluctuations in the CMS Rates and interest rate trends that have occurred in the past are not necessarily indicative of fluctuations that may occur in the future, which may be wider or narrower than those that have occurred historically.

The following table shows historical month-end values for the CMS30/CMS2 Spread from January 2008 through September 23, 2013 based on the values for CMS30 and CMS2 as published by Bloomberg L.P. (“Bloomberg”). The graph below shows historical daily differences between the CMS Rates from May 5, 1994 through September 23, 2013 based on the CMS Rates as published by Bloomberg L.P. We do not make any representation or warranty as to the accuracy or completeness of the historical data in the table and graph below. The Calculation Agent will determine the actual interest rate on the Notes for any Floating Rate Interest Period by reference to the values of CMS30 and CMS2 as published on the ISDAFIX1 Page.

Historical Difference between CMS30 and CMS2 (1)

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

|

January

|

1.97550%

|

1.75000%

|

3.28200%

|

3.51850%

|

2.12700%

|

2.57300%

|

|

February

|

2.34400%

|

1.78600%

|

3.35650%

|

3.41050%

|

2.23250%

|

2.56430%

|

|

March

|

2.22700%

|

1.85700%

|

3.32550%

|

3.28300%

|

2.45750%

|

2.57650%

|

|

April

|

1.69600%

|

2.16650%

|

3.08900%

|

3.38600%

|

2.27450%

|

2.46190%

|

|

May

|

1.65150%

|

2.69700%

|

2.81050%

|

3.31950%

|

1.75550%

|

2.75640%

|

|

June

|

1.41950%

|

2.66600%

|

2.72200%

|

3.37250%

|

1.95280%

|

2.93820%

|

|

July

|

1.58800%

|

2.70400%

|

2.98000%

|

3.21750%

|

1.90050%

|

3.14110%

|

|

August

|

1.50200%

|

2.75400%

|

2.48400%

|

2.76300%

|

2.06910%

|

3.15460%

|

|

September

|

1.25800%

|

2.65000%

|

2.74200%

|

2.11900%

|

2.24400%

|

3.22650% (2)

|

|

October

|

1.71800%

|

2.89650%

|

3.13350%

|

2.34900%

|

2.20950%

|

|

|

November

|

0.95150%

|

3.01700%

|

3.05420%

|

2.06160%

|

2.20950%

|

|

|

December

|

1.22300%

|

3.11930%

|

3.30130%

|

1.88950%

|

2.41150%

|

____________________

|

(1)

|

The Floating Interest Rate is determined by multiplying (a) the product of the applicable Multiplier and the applicable CMS30/CMS2 Spread (subject to the Minimum Interest Rate and the Maximum Interest Rate) by (b) a fraction equal to the number of Accrual Days determined for such Floating Rate Interest Period divided by the total number of calendar days in such Floating Rate Interest Period.

|

|

(2)

|

As measured on September 23, 2013.

|

PS-11

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

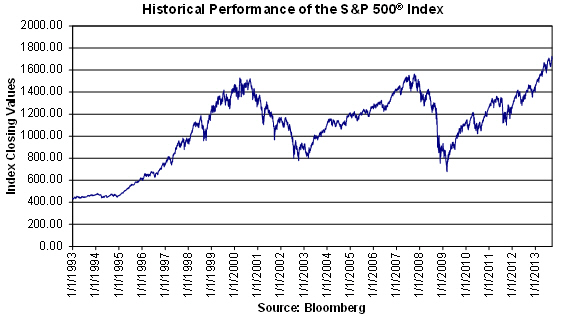

The Index

The following table sets forth the published high and low Index Closing Values, as well as end-of-quarter Index Closing Values, for each quarter in the period from January 1, 2008 through September 23, 2013. The graph following the table sets forth the Index Closing Values from January 1, 1993 through September 23, 2013. The Index Closing Value for September 23, 2013 was 1,701.84. We obtained the information in the table below from Bloomberg, without independent verification. The historical values of the Index should not be taken as an indication of future performance, and no assurance can be given as to the level of the Index on any calendar day during the term of the Notes.

|

Index Closing Value

|

High

|

Low

|

Period End

|

|

2008

|

|||

|

First Quarter

|

1,447.16

|

1,273.37

|

1,322.70

|

|

Second Quarter

|

1,426.63

|

1,278.38

|

1,280.00

|

|

Third Quarter

|

1,305.32

|

1,106.39

|

1,166.36

|

|

Fourth Quarter

|

1,161.06

|

752.44

|

903.25

|

|

2009

|

|||

|

First Quarter

|

934.70

|

676.53

|

797.87

|

|

Second Quarter

|

946.21

|

811.08

|

919.32

|

|

Third Quarter

|

1,071.66

|

879.13

|

1,057.08

|

|

Fourth Quarter

|

1,127.78

|

1,025.21

|

1,115.10

|

|

2010

|

|||

|

First Quarter

|

1,174.17

|

1,056.74

|

1,169.43

|

|

Second Quarter

|

1,217.28

|

1,030.71

|

1,030.71

|

|

Third Quarter

|

1,148.67

|

1,022.58

|

1,141.20

|

|

Fourth Quarter

|

1,259.78

|

1,137.03

|

1,257.64

|

|

2011

|

|||

|

First Quarter

|

1,343.01

|

1,256.88

|

1,325.83

|

|

Second Quarter

|

1,363.61

|

1,265.42

|

1,320.64

|

|

Third Quarter

|

1,353.22

|

1,119.46

|

1,131.42

|

|

Fourth Quarter

|

1,285.09

|

1,099.23

|

1,257.60

|

|

2012

|

|||

|

First Quarter

|

1,416.51

|

1,277.06

|

1,408.47

|

|

Second Quarter

|

1,419.04

|

1,278.04

|

1,362.16

|

|

Third Quarter

|

1,465.77

|

1,334.76

|

1,440.67

|

|

Fourth Quarter

|

1,461.40

|

1,353.33

|

1,426.19

|

|

2013

|

|||

|

First Quarter

|

1,569.19

|

1,457.15

|

1,569.19

|

|

Second Quarter

|

1,669.16

|

1,541.61

|

1,606.28

|

|

Third Quarter (through September 23, 2013)

|

1,725.52

|

1,614.08

|

1,701.84

|

PS-12

| Senior Callable Fixed to Floating Rate Notes Linked to the S&P 500® Index and the Difference Between CMS30 and CMS2 due October 17, 2033 |

|

TAX CONSEQUENCES

You should review carefully the section in the prospectus supplement entitled “U.S. Federal Income Tax Consequences.” We intend to treat the Notes as “contingent payment debt instruments” for U.S. federal income tax purposes, as described under “—Notes Treated as Contingent Payment Debt Instruments” in that section. Because the Notes will be offered to initial purchasers at varying prices, it is expected that the “issue price” of the Notes for U.S. federal income tax purposes will be uncertain. We currently intend to treat the issue price as $1,000 for each $1,000 principal amount Note, and the remainder of this discussion so assumes, unless otherwise indicated. Our intended treatment will affect the amounts you will be required to include in income for U.S. federal income tax purposes. You should consult your tax adviser regarding the uncertainty with respect to the Notes’ issue price, including the tax consequences to you if the actual issue price of the Notes for U.S. federal income tax purposes is not $1,000 per Note.

Assuming that our treatment of the Notes as contingent payment debt instruments is correct, regardless of your method of accounting for U.S. federal income tax purposes, you generally will be required to accrue taxable interest income in each year on a constant yield to maturity basis at the “comparable yield,” as determined by us, with certain adjustments in each year to reflect the difference, if any, between the actual and the projected amounts of the interest payments on the Notes in that year. Any income recognized upon a sale or exchange of a Note (including early redemption or redemption at maturity) will be treated as interest income for U.S. federal income tax purposes.

After the Issue Date, you may obtain the comparable yield and the projected payment schedule by contacting Lloyds Investor Relations at investor.relations@finance.lloydsbanking.com. Neither the comparable yield nor the projected payment schedule constitutes a representation by us regarding the actual interest payments that we will make on the Notes.

If you purchase Notes for an amount that is different from their issue price, you will be required to account for this difference, generally by allocating it reasonably among projected payments on the Notes or daily portions of interest that you are required to accrue with respect to the Notes and treating these allocations as adjustments to your income when the payment is made or the interest accrues. You should consult your tax adviser regarding the treatment of the difference between your basis in your Notes and their issue price.