| Pricing supplement No. 404AI To prospectus dated October 10, 2006, prospectus supplement dated November 13, 2006 and product supplement AI dated May 28, 2008 |

Registration Statement No. 333-137902 Dated May 30, 2008; Rule 424(b)(2) |

| Deutsche Bank AG, London Branch $2,000,000 Return Enhanced Notes Linked to an Equally Weighted Basket of 18 Basket Stocks due December 3, 2009† |

General

| • | The notes are designed for investors who seek a return of four times the appreciation of an equally weighted basket of 18 common stocks up to a Maximum Total Return on the notes of 24.40% at maturity. Investors should be willing to forgo interest and dividend payments and, if the Basket declines, be willing to lose some or all of their initial investment. |

| • |

Senior unsecured obligations of Deutsche Bank AG, London Branch maturing December 3, 2009†. |

| • | Minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof. |

| • | The notes priced on May 30, 2008 (the “Pricing Date”) and are expected to settle three business days later on June 4, 2008. |

Key Terms

| Issuer: | Deutsche Bank AG, London Branch | |

| Rating: | Moody’s Investors Service Ltd has assigned a rating of Aa1 and Standard & Poor’s has assigned a rating of AA to notes, such as the securities offered hereby, issued under Deutsche Bank AG’s Global Notes Program, Series A.†† | |

| Basket: | The Basket consists of 18 common stocks (each, a “Basket Stock” and collectively, the “Basket Stocks”). The Basket Stocks and the Bloomberg ticker symbol, the Stock Weighting and the Initial Share Price of each Basket Stock are set forth under “The Basket” on page PS-1 of this pricing supplement. | |

| Participation Rate: | 400% | |

| Payment at Maturity: | If the Basket Closing Level is greater than the Starting Basket Level, you will receive a cash payment that provides you with a return per $1,000 face amount note equal to the Basket Return multiplied by the Participation Rate of 400%, subject to the Maximum Total Return on the notes of 24.40%. If the Basket Return is more than 6.10%, you will receive the Maximum Total Return on the notes of 24.40%, which entitles you to a maximum payment at maturity of $1,244 for every $1,000 face amount that you hold. Accordingly, if the Basket Return is positive, your payment at maturity per $1,000 face amount will be calculated as follows, subject to the Maximum Total Return: $1,000 + ($1,000 x Basket Return x 400%) | |

| Your investment will be fully exposed to any decline in the Basket. If the Basket Closing Level declines from the Starting Basket Level, you will lose 1% of the face amount of your notes for every 1% that the Basket declines beyond the Starting Basket Level. Accordingly, if the Basket Return is negative, your payment at maturity per $1,000 face amount will be calculated as follows: | ||

| $1,000 + ($1,000 x Basket Return) | ||

| You will lose some or all of your investment at maturity if the Basket Closing Level declines from the Starting Basket Level. | ||

| Basket Return: | Basket Closing Level – Starting Basket Level | |

| Starting Basket Level | ||

| Starting Basket Level: | 100 | |

| Basket Closing Level: | On the Final Valuation Date, the Basket Closing Level will be calculated as follows: 100 x [1 + the sum of the Stock Returns of each Basket Stock on the Final Valuation Date x (1/18)] | |

| Stock Return: | With respect to each Basket Stock, on the Final Valuation Date: Final Share Price – Initial Share Price

Initial Share Price | |

| Initial Share Price: | With respect to each Basket Stock, the closing price of one share of such Basket Stock on the Pricing Date. The Initial Share Price of each Basket Stock is set forth under “The Basket” on page PS-1 of this pricing supplement. | |

| Final Share Price: | With respect to each Basket Stock, on the Final Valuation Date, the closing price of one share of such Basket Stock on such day times the Stock Adjustment Factor for such Basket Stock on such day. | |

| Stock Adjustment Factor: |

With respect to each Basket Stock, 1.0 on the Pricing Date and subject to adjustment under certain circumstances. See “Description of Securities — Payment at Maturity” and “Description of Securities — Anti-Dilution Adjustments” in the accompanying product supplement AI for further information. | |

| Final Valuation Date†: | November 30, 2009 | |

| Maturity Date†: | December 3, 2009 | |

| CUSIP: | 2515A0 LM3 | |

| ISIN | US2515A0LM35 |

† Subject to postponement in the event of a market disruption event and as described under “Description of Notes — Payment at Maturity” in the accompanying product supplement AI.

†† A credit rating is not a recommendation to buy, sell, or hold the securities, and may be subject to revision or withdrawal at any time by the assigning rating agency. Each credit rating should be evaluated independently of any other credit rating. Any rating assigned to notes issued under Deutsche Bank AG’s Global Notes Program, Series A does not enhance, affect or address the likely performance of the securities other than the ability of the Issuer to meet its obligations.

Investing in the Return Enhanced Notes involves a number of risks. See “Risk Factors” beginning on page 14 of the accompanying product supplement AI and “Selected Risk Considerations” beginning on page PS-4 of this pricing supplement.

Deutsche Bank AG has filed a registration statement (including a prospectus) with the Securities and Exchange Commission, or SEC, for the offering to which this term sheet relates. Before you invest, you should read the prospectus in that registration statement and the other documents relating to this offering that Deutsche Bank AG has filed with the SEC for more complete information about Deutsche Bank AG and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Deutsche Bank AG, any agent or any dealer participating in this offering will arrange to send you the prospectus, prospectus supplement, product supplement, addendum to the product supplement and this term sheet if you so request by calling toll-free 1-800-311-4409.

You may revoke your offer to purchase the notes at any time prior to the time at which we accept such offer by notifying the applicable agent. We reserve the right to change the terms of, or reject any offer to purchase, the notes prior to their issuance. We will notify you in the event of any changes to the terms of the notes, and you will be asked to accept such changes in connection with your purchase of any notes. You may also choose to reject such changes, in which case we may reject your offer to purchase the notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying prospectus supplements and prospectus. Any representation to the contrary is a criminal offense.

| Price to Public | Discounts and Commissions(1) | Proceeds to Us | ||||

| Per note |

$1,000.00 | $0.00 | $1,000.00 | |||

| Total |

$2,000,000.00 | $0.00 | $2,000,000.00 |

(1) For more detailed information about discounts and commissions, please see “Underwriting” beginning on page PS-16 of this pricing supplement.

The notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities Offered | Maximum Aggregate Offering Price |

Amount of Registration Fee | ||

| Notes | $2,000,000.00 | $78.60 |

| Deutsche Bank Securities | Deutsche Bank Trust Company Americas |

Additional Terms Specific to the Notes

| • | You should read this pricing supplement together with the prospectus dated October 10, 2006, as supplemented by the prospectus supplement dated November 13, 2006 relating to our Series A global notes of which these notes are a part, and the more detailed information contained in product supplement AI dated May 28, 2008. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website): |

| • | Product supplement AI dated May 28, 2008: |

http://www.sec.gov/Archives/edgar/data/1159508/000119312508123536/d424b21.pdf

| • | Prospectus supplement dated November 13, 2006: |

http://www.sec.gov/Archives/edgar/data/1159508/000119312506233129/d424b3.htm

| • | Prospectus dated October 10, 2006: |

http://www.sec.gov/Archives/edgar/data/1159508/000095012306012432/u50845fv3asr.htm

| • | Our Central Index Key, or CIK, on the SEC website is 0001159508. As used in this pricing supplement, “we,” “us” or “our” refers to Deutsche Bank AG, including, as the context requires, acting through one of its branches. |

| • | This pricing supplement, together with the documents listed above, contains the terms of the notes and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the accompanying product supplement, as the notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisers before deciding to invest in the notes. |

The Basket

The Basket Stocks and the Bloomberg ticker symbol, the Stock Weighting and the Initial Share Price of each Basket Stock are set forth below:

| Ticker Symbol (US) |

Basket Stock |

Exchange | Stock Weighting |

Initial Share Price | ||||

| AXP |

American Express Company |

NYSE | 1/18 | 46.35 | ||||

| BRK/B |

Berkshire Hathaway, Inc. |

NYSE | 1/18 | 4498.00 | ||||

| CAH |

Cardinal Health, Inc. |

NYSE | 1/18 | 56.54 | ||||

| CL |

Colgate Palmolive Company |

NYSE | 1/18 | 74.36 | ||||

| ESRX |

Express Scripts, Inc. |

NasdaqGS | 1/18 | 72.11 | ||||

| FDX |

Fedex Corporation |

NYSE | 1/18 | 91.71 | ||||

| GE |

General Electric Co. |

NYSE | 1/18 | 30.72 | ||||

| GS |

Goldman Sachs Group, Inc. |

NYSE | 1/18 | 176.41 | ||||

| HD |

The Home Depot, Inc. |

NYSE | 1/18 | 27.36 | ||||

| JNJ |

Johnson & Johnson |

NYSE | 1/18 | 66.74 | ||||

| MCO |

Moody’s Corporation |

NYSE | 1/18 | 37.08 | ||||

| MMM |

3M Co. |

NYSE | 1/18 | 77.56 | ||||

| PEP |

Pepsico, Inc. |

NYSE | 1/18 | 68.30 | ||||

| PG |

Procter & Gamble Co. |

NYSE | 1/18 | 66.05 | ||||

| UTX |

United Technologies Corp |

NYSE | 1/18 | 71.04 | ||||

| WAG |

Walgreen Co. |

NYSE | 1/18 | 36.02 | ||||

| WMT |

Wal-Mart Stores, Inc. |

NYSE | 1/18 | 57.74 | ||||

| WU |

Western Union Co. |

NYSE | 1/18 | 23.64 |

PS-1

What Is the Total Return on the Notes at Maturity Assuming a Range of Performance for the Basket?

The following table illustrates the hypothetical total return at maturity on the notes. The “total return” as used in this pricing supplement is the number, expressed as a percentage, that results from comparing the payment at maturity per $1,000 face amount to $1,000. The hypothetical total returns reflect the Maximum Total Return on the notes of 24.40%. The hypothetical total returns set forth below are for illustrative purposes only and may not be the actual total returns applicable to a purchaser of the notes. The numbers appearing in the following table and examples have been rounded for ease of analysis.

| Basket Closing Level |

Basket Return | Total Return | ||

| 180.00 | 80.00% | 24.40% | ||

| 165.00 | 65.00% | 24.40% | ||

| 150.00 | 50.00% | 24.40% | ||

| 140.00 | 40.00% | 24.40% | ||

| 130.00 | 30.00% | 24.40% | ||

| 120.00 | 20.00% | 24.40% | ||

| 110.00 | 10.00% | 24.40% | ||

| 106.10 | 6.10% | 24.40% | ||

| 105.00 | 5.00% | 20.00% | ||

| 102.50 | 2.50% | 10.00% | ||

| 101.00 | 1.00% | 4.00% | ||

| 100.00 | 0.00% | 0.00% | ||

| 95.00 | -5.00% | -5.00% | ||

| 90.00 | -10.00% | -10.00% | ||

| 85.00 | -15.00% | -15.00% | ||

| 80.00 | -20.00% | -20.00% | ||

| 70.00 | -30.00% | -30.00% | ||

| 60.00 | -40.00% | -40.00% | ||

| 50.00 | -50.00% | -50.00% | ||

| 40.00 | -60.00% | -60.00% | ||

| 30.00 | -70.00% | -70.00% | ||

| 20.00 | -80.00% | -80.00% | ||

| 10.00 | -90.00% | -90.00% | ||

| 0.00 | -100.00% | -100.00% |

Hypothetical Examples of Amounts Payable at Maturity

The following examples illustrate how the total returns set forth in the table above are calculated.

Example 1: The level of the Basket increases from a Starting Basket Level of 100 to a Basket Closing Level of 105. Because the Basket Closing Level of 105 is greater than the Starting Basket Level of 100 and the Basket Return of 5% multiplied by 4 does not exceed the Maximum Total Return of 24.40%, the investor receives a payment at maturity of $1,200 per $1,000 face amount, calculated as follows:

$1,000 + ($1,000 x 20%) = $1,200

Example 2: The level of the Basket increases from the Starting Basket Level of 100 to a Basket Closing Level of 110. Because the Basket Closing Level of 110 is greater than the Starting Basket Level of 100 and the Basket Return of 10% multiplied by 4 exceeds the Maximum Total Return of 24.40%, the investor receives a payment at maturity of $1,244 per $1,000 face amount, the maximum payment on the notes, calculated as follows:

$1,000 + ($1,000 x 24.40%) = $1,244

Example 3: The level of the Basket decreases from a Starting Basket Level of 100 to a Basket Closing Level of 80. Because the Basket Closing Level of 80 is less than the Starting Basket Level of 100, the Basket Return is negative and the investor receives a payment at maturity of $800 per $1,000 face amount, calculated as follows:

$1,000 + ($1,000 x -20%) = $800

PS-2

Selected Purchase Considerations

| • | APPRECIATION POTENTIAL — The notes provide the opportunity to enhance equity returns by multiplying a positive Basket Return by four, up to the hypothetical Maximum Total Return on the notes of 24.40%, or $1,244 for every $1,000 face amount. Because the notes are our senior unsecured obligations, payment of any amount at maturity is subject to our ability to pay our obligations as they become due. |

| • | RETURN LINKED TO AN EQUALLY WEIGHTED BASKET OF 18 BASKET STOCKS — The return on the notes is linked to the performance of an equally weighted Basket, which consists of 18 Basket Stocks. These Basket Stocks are the common stocks of American Express, Berkshire Hathaway, Cardinal Health, Colgate Palmolive, Express Scripts, Fedex Corporation, General Electric, Goldman Sachs Group, Home Depot, Johnson & Johnson, Moody’s Corporation, 3M Co., Pepsico, Procter & Gamble, United Technologies Corp, Walgreen Co., WalMart Stores and Western Union. |

| • | CERTAIN TAX CONSEQUENCES — You should review carefully the section of the accompanying product supplement entitled “Certain U.S. Federal Income Tax Consequences,” which contains the opinion of our special tax counsel, Davis Polk & Wardwell, with respect to the tax consequences of an investment in the notes. Although the tax consequences of an investment in the notes are uncertain, based on that opinion we believe it is reasonable under current law to treat the notes as prepaid financial contracts for U.S. federal income tax purposes. Under this treatment, you should not be required to recognize taxable income prior to the maturity of your notes, other than pursuant to a sale or exchange, and your gain or loss on the notes should be long-term capital gain or loss if you hold the notes for more than one year. |

If the Internal Revenue Service (the “IRS”) were successful in asserting an alternative treatment for the notes, the timing and/or character of income on the notes might differ materially and adversely. We do not plan to request a ruling from the IRS, and no assurance can be given that the IRS or a court will agree with the tax treatment described in this pricing supplement and the accompanying product supplement. On December 7, 2007, the Department of the Treasury (“Treasury”) and the IRS released a notice requesting comments on the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments, such as the notes. The notice focuses in particular on whether to require holders of these instruments to accrue income over the term of their investment. It also asks for comments on a number of related topics, including the character of income or loss with respect to these instruments; the relevance of factors such as the nature of the underlying property to which the instruments are linked; the degree, if any, to which income (including any mandated accruals) realized by non-U.S. holders should be subject to withholding tax; and whether these instruments are or should be subject to the “constructive ownership” regime, which very generally can operate to recharacterize certain long-term capital gain as ordinary income that is subject to an interest charge. While the notice requests comments on appropriate transition rules and effective dates, any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the notes, possibly with retroactive effect.

Under current law, the United Kingdom will not impose withholding tax on payments made with respect to the notes.

For a discussion of certain German tax considerations relating to the notes, you should refer to the section in the accompanying prospectus supplement entitled “Taxation by Germany of Non-Resident Holders.”

We do not provide any advice on tax matters. Both U.S. and non-U.S. holders should consult their tax advisers regarding all aspects of the U.S. federal tax consequences of investing in the notes (including possible alternative treatments and the issues presented by the December 7, 2007 notice), as well as any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

PS-3

Selected Risk Considerations

An investment in the notes involves significant risks. Investing in the notes is not equivalent to investing directly in the Basket Stocks. These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement AI dated May 28, 2008.

| • | YOUR INVESTMENT IN THE NOTES MAY RESULT IN A LOSS — The notes do not guarantee any return of your investment. The return on the notes at maturity is linked to the performance of the Basket and will depend on whether, and the extent to which, the Basket Return is positive or negative. Your investment will be fully exposed to any decline in the Basket Closing Level, as compared to the Starting Basket Level. |

| • | YOUR MAXIMUM GAIN ON THE NOTES IS LIMITED TO THE MAXIMUM TOTAL RETURN — If the Basket Closing Level is greater than the Starting Basket Level, for each $1,000 face amount, you will receive at maturity $1,000 plus an additional amount that will not exceed the Maximum Return of 24.40% on the $1,000 face amount, regardless of the appreciation in the Basket, which may be significant. |

| • | CHANGES IN THE VALUE OF THE BASKET STOCKS MAY OFFSET EACH OTHER — The notes are linked to a weighted Basket consisting of 18 Basket Stocks. Price movements in the Basket Stocks may not correlate with each other. At a time when the value of some of the Basket Stocks increase, the value of other Basket Stocks may not increase as much or may even decline in value. Therefore, in calculating the Basket Closing Level, increases in the value of some of the Basket Stocks may be moderated, or more than offset, by lesser increases or declines in the value of the other Basket Stocks. |

| • | NO OWNERSHIP RIGHTS IN THE BASKET STOCKS — As a holder of the notes, you will not have any ownership interest or rights in any of the Basket Stocks, such as voting rights or dividend payments. In addition, the issuers of the Basket Stocks will not have any obligation to consider your interests as a holder of the notes in taking any corporate action that might affect the value of the relevant Basket Stocks and the notes. |

| • | NO AFFILIATION WITH THE BASKET STOCK ISSUERS — We are not affiliated with the issuers of the Basket Stocks. We assume no responsibility for the adequacy of the information about the Basket Stock issuers contained in this pricing supplement. You should make your own investigation into the Basket Stocks and their issuers. We are not responsible for the Basket Stock issuers’ public disclosure of information, whether contained in SEC filings or otherwise. |

| • | CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE NOTES PRIOR TO MATURITY — While the payment at maturity, if any, described in this pricing supplement is based on the full face amount of your notes, the original issue price of the notes includes the agent’s commission and the estimated cost of hedging our obligations under the notes through one or more of our affiliates. As a result, the price, if any, at which Deutsche Bank, will be willing to purchase notes from you in secondary market transactions, if at all, will likely be lower than the original issue price, and any sale prior to the maturity date could result in a substantial loss to you. The notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your notes to maturity. |

| • | LACK OF LIQUIDITY — The notes will not be listed on any securities exchange. Deutsche Bank Securities Inc. intends to offer to purchase the notes in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes easily. Because other dealers are not likely to make a secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on the price, if any, at which Deutsche Bank Securities Inc. may be willing to buy the notes. |

| • | POTENTIAL CONFLICTS — We and our affiliates play a variety of roles in connection with the issuance of the notes, including acting as calculation agent. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the notes. We and/or our affiliates may also currently or from time to time engage in |

PS-4

| business with the Basket Stock issuers, including extending loans to, or making equity investments in, such Basket Stock issuer(s) or providing advisory services to such Basket Stock issuer(s). In addition, one or more of our affiliates may publish research reports or otherwise express opinions with respect to the Basket Stock issuers and these reports may or may not recommend that investors buy or hold the Basket Stock(s). As a prospective purchaser of the notes, you should undertake an independent investigation of the applicable Basket Stock issuer that in your judgment is appropriate to make an informed decision with respect to an investment in the notes. |

| • | HEDGING AND TRADING IN THE BASKET STOCKS — While the notes are outstanding, we or any of our affiliates may carry out hedging activities related to the notes, including in the Basket Stocks or instruments related to one or more of the Basket Stocks. We or our affiliates may also trade in the Basket Stocks or instruments related to either or both of the Basket Stocks from time to time. Any of these hedging or trading activities as of the Pricing Date and during the term of the notes could adversely affect our payment to you at maturity. |

| • | ANTI-DILUTION PROTECTION IS LIMITED — The calculation agent will make adjustments to the Stock Adjustment Factor for each Basket Stock to reflect certain events affecting such Basket Stock. However, the calculation agent will not make an adjustment in response to all events that could affect the Basket Stocks. If an event occurs that does not require the calculation agent to make an adjustment, the value of the notes may be materially and adversely affected. See “Description of Securities — Anti-Dilution Adjustments” in the accompanying product supplement AI for further information. |

| • | MANY ECONOMIC AND MARKET FACTORS WILL INFLUENCE THE VALUE OF THE NOTES — In addition to the closing price of the Basket Stock on any day, the value of the notes will be affected by a number of economic and market factors that may either offset or magnify each other, including: |

| • | the expected volatility in the Basket Stocks; |

| • | the time to maturity of the notes; |

| • | the dividend rates paid on the Basket Stocks; |

| • | interest and yield rates in the market generally; |

| • | a variety of economic, financial, political, regulatory or judicial events; |

| • | the occurrence of certain events affecting the issuer(s) of the Basket Stock(s) that may or may not require an adjustment to the Stock Adjustment Factor, including a merger or acquisition; and |

| • | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

| • | THE U.S. FEDERAL INCOME TAX CONSEQUENCES OF AN INVESTMENT IN THE NOTES ARE UNCLEAR — There is no direct legal authority regarding the proper U.S. federal income tax treatment of the notes, and we do not plan to request a ruling from the IRS. Consequently, significant aspects of the tax treatment of the notes are uncertain, and no assurance can be given that the IRS or a court will agree with the treatment described herein. If the IRS were successful in asserting an alternative treatment for the notes, the timing and/or character of income thereon might differ materially and adversely from the description herein. As described above under “Certain Tax Consequences,” on December 7, 2007, Treasury and the IRS released a notice requesting comments on the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments, such as the notes. Any Treasury regulations or other guidance promulgated after consideration of these comments could materially and adversely affect the tax consequences of an investment in the notes, possibly with retroactive effect. Both U.S. and non-U.S. holders should review carefully the section of the accompanying product supplement entitled “Certain U.S. Federal Income Tax Consequences,” and consult their tax advisers regarding the U.S. federal income tax consequences of an investment in the notes (including possible alternative treatments and the issues presented by the December 7, 2007 notice), as well as any tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction. |

PS-5

The Basket Stocks

Public Information

All information contained herein on the Basket Stocks and on the Basket Stock issuers is derived from publicly available sources and is provided for informational purposes only. Companies with securities registered under the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, are required to periodically file certain financial and other information specified by the SEC. Information provided to or filed with the SEC by a Basket Stock issuer pursuant to the Exchange Act can be located by reference to the SEC file number provided below and can be accessed through www.sec.gov. We do not make any representation that these publicly available documents are accurate or complete. See “Underlying Stock or Basket Stock” beginning on page 52 of the accompanying product supplement AI for more information.

Historical Information of the Basket Stocks and the Basket

The graphs contained in this pricing supplement set forth the historical performance of the Basket Stocks as well as the Basket as a whole based on the weekly closing prices (in U.S. dollars) of the Basket Stocks through May 30, 2008. The graph of the historical Basket performance assumes the Basket Closing Level on May 30, 2008 was 100 and the Stock Weightings were as specified under “The Basket” in this pricing supplement. We obtained the closing prices and other market information in this pricing supplement from Bloomberg Financial Markets, without independent verification. The closing prices and this other information may be adjusted by Bloomberg Financial Markets for corporate actions such as public offerings, mergers and acquisitions, spin-offs, delistings and bankruptcy. We make no representation or warranty as to the accuracy or completeness of the information obtained from Bloomberg Financial Markets.

Since the commencement of trading of each Basket Stock, the price of such Basket Stocks has experienced significant fluctuations. The historical performance of each Basket Stock and the historical performance of the Basket should not be taken as an indication of future performance, and no assurance can be given as to the closing prices of each Basket Stock or the levels of the Basket during the term of the notes. We cannot give you assurance that the performance of each Basket Stock will result in the return of any of your initial investment. We make no representation as to the amount of dividends, if any, that each Basket Stock issuer will pay in the future. In any event, as an investor in the notes, you will not be entitled to receive dividends, if any, that may be payable on each Basket Stock.

American Express Company (“AXP”)

According to its publicly available filings with the SEC, American Express, together with its consolidated subsidiaries, is a leading global payments and travel company. Its principal products and services are charge and credit payment card products and travel-related services offered to consumers and businesses around the world. American Express is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of American Express in the accompanying product supplement AI. American Express’ SEC file number is 001-07657.

PS-6

Historical Information of the Common Stock of American Express

The following graph sets forth the historical performance of the common stock of American Express based on the weekly closing price (in U.S. dollars) of the common stock of American Express from January 1, 2000 through May 30, 2008. The closing price of the common stock of American Express on May 30, 2008 was $46.35.

Berkshire Hathaway, Inc. (“BRK/B”)

According to its publicly available filings with the SEC, Berkshire Hathaway is a holding company owning subsidiaries engaged in a number of diverse business activities. The most important of these are insurance businesses conducted on both a primary basis and a reinsurance basis. Berkshire Hathaway is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Berkshire Hathaway in the accompanying product supplement AI. Berkshire Hathaway’s SEC file number is 001-14905.

Historical Information of the Common Stock of Berkshire Hathaway

The following graph sets forth the historical performance of the common stock of Berkshire Hathaway based on the weekly closing price (in U.S. dollars) of the common stock of Berkshire Hathaway from January 1, 2000 through May 30, 2008. The closing price of the common stock of Berkshire Hathaway on May 30, 2008 was $4498.00.

PS-7

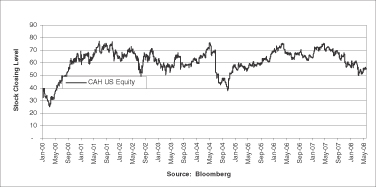

Cardinal Health, Inc. (“CAH”)

According to its publicly available filings with the SEC, Cardinal Health is a leading provider of products and services that improve the safety and productivity of healthcare. As of June 30, 2006, the Company conducted its business within the following four reportable segments: Pharmaceutical Distribution and Provider Services; Medical Products and Services; Pharmaceutical Technologies and Services; and Clinical Technologies and Services. Cardinal Health is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Cardinal Health in the accompanying product supplement AI. Cardinal Health’s SEC file number is 001-11373.

Historical Information of the Common Stock of Cardinal Health

The following graph sets forth the historical performance of the common stock of Cardinal Health based on the weekly closing price (in U.S. dollars) of the common stock of Cardinal Health from January 1, 2000 through May 30, 2008. The closing price of the common stock of Cardinal Health on May 30, 2008 was $56.54.

Colgate Palmolive Company (“CL”)

According to its publicly available filings with the SEC, Colgate Palmolive (together with its subsidiaries) is a leading consumer products company whose products are marketed in over 200 countries and territories throughout the world. Colgate Palmolive is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Colgate Palmolive in the accompanying product supplement AI. Colgate Palmolive’s SEC file number is 001-00644.

Historical Information of the Common Stock of Colgate Palmolive

The following graph sets forth the historical performance of the common stock of Colgate Palmolive based on the weekly closing price (in U.S. dollars) of the common stock of Colgate Palmolive from January 1, 2000 through May 30, 2008. The closing price of the common stock of Colgate Palmolive on May 30, 2008 was $74.36.

PS-8

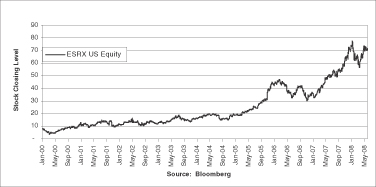

Express Scripts, Inc. (“ESRX”)

According to its publicly available filings with the SEC, Express Scripts is one of the largest Pharmacy Benefit Management companies in North America, which combine retail pharmacy claims processing, formulary management and home delivery pharmacy services to create an integrated product offering to manage the prescription drug benefit for payors. Express Scripts provides a range of services to its clients, which include HMOs, health insurers, third-party administrators, employers, union-sponsored benefit plans, workers’ compensation plans and government health programs. Express Scripts is listed on the NasdaqGS, which we refer to as the Relevant Exchange for purposes of Express Scripts in the accompanying product supplement AI. Express Scripts’ SEC file number is 000-20199.

Historical Information of the Common Stock of Express Scripts

The following graph sets forth the historical performance of the common stock of Express Scripts based on the weekly closing price (in U.S. dollars) of the common stock of Express Scripts from January 1, 2000 through May 30, 2008. The closing price of the common stock of Express Scripts on May 30, 2008 was $72.11.

Fedex Corporation (“FDX”)

According to its publicly available filings with the SEC, Fedex provides a broad portfolio of transportation, e-commerce and business services through companies that compete collectively, operate independently and manage collaboratively, under the FedEx brand. These companies are included in four reportable business segments: Fedex Express, Fedex Ground, Fedex Freight and Fedex Kinko’s. Fedex is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Fedex in the accompanying product supplement AI. Fedex’s SEC file number is 001-15829.

Historical Information of the Common Stock of Fedex

The following graph sets forth the historical performance of the common stock of Fedex based on the weekly closing price (in U.S. dollars) of the common stock of Fedex from January 1, 2000 through May 30, 2008. The closing price of the common stock of Fedex on May 30, 2008 was $91.71.

PS-9

General Electric Co. (“GE”)

According to its publicly available filings with the SEC, General Electric is one of the largest and most diversified technology, media, and financial services corporations in the world. Its products and services range from aircraft engines, power generation, water processing, and security technology to medical imaging, business and consumer financing, media content and industrial products. General Electric serves customers in more than 100 countries and employs more than 300,000 people worldwide. General Electric is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of General Electric in the accompanying product supplement AI. General Electric’s SEC file number is 001-00035.

Historical Information of the Common Stock of General Electric

The following graph sets forth the historical performance of the common stock of General Electric based on the weekly closing price (in U.S. dollars) of the common stock of General Electric from January 1, 2000 through May 30, 2008. The closing price of the common stock of General Electric on May 30, 2008 was $30.72.

Goldman Sachs Group, Inc.(“GS”)

According to its publicly available filings with the SEC, Goldman Sachs Group is a leading global investment banking, securities and investment management firm that provides a wide range of services worldwide to a substantial and diversified client base that includes corporations, financial institutions, governments and high-net-worth individuals. Goldman Sachs Group is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Goldman Sachs Group in the accompanying product supplement AI. Goldman Sachs Group’s SEC file number is 001-14965.

Historical Information of the Common Stock of Goldman Sachs Group

The following graph sets forth the historical performance of the common stock of Goldman Sachs Group based on the weekly closing price (in U.S. dollars) of the common stock of Goldman Sachs Group from January 1, 2000 through May 30, 2008. The closing price of the common stock of Goldman Sachs Group on May 30, 2008 was $176.41.

PS-10

Home Depot, Inc. (“HD”)

According to its publicly available filings with the SEC, Home Depot is the world’s largest home improvement retailer and the second largest retailer in the United States, based on net sales for the fiscal year ended February 3, 2008. As of the end of fiscal 2007, Home Depot was operating 2,234 stores, most of which are The Home Depot stores, which sell a wide assortment of building materials, home improvement and lawn and garden products and provide a number of services. Home Depot is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Home Depot in the accompanying product supplement AI. Home Depot’s SEC file number is 001-08207.

Historical Information of the Common Stock of Home Depot

The following graph sets forth the historical performance of the common stock of Home Depot based on the weekly closing price (in U.S. dollars) of the common stock of Home Depot from January 1, 2000 through May 30, 2008. The closing price of the common stock of Home Depot on May 30, 2008 was $27.36.

Johnson & Johnson (“JNJ”)

According to its publicly available filings with the SEC, Johnson & Johnson and its subsidiaries have approximately 119,200 employees worldwide engaged in the research and development, manufacture and sale of a broad range of products in the health care field. Johnson & Johnson is a holding company, which has more than 250 operating companies conducting business in virtually all countries of the world. Johnson & Johnson’s primary focus has been on products related to human health and well-being. Johnson & Johnson is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Johnson & Johnson in the accompanying product supplement AI. Johnson & Johnson’s SEC file number is 001-03215.

Historical Information of the Common Stock of Johnson & Johnson

The following graph sets forth the historical performance of the common stock of Johnson & Johnson based on the weekly closing price (in U.S. dollars) of the common stock of Johnson & Johnson from January 1, 2000 through May 30, 2008. The closing price of the common stock of Johnson & Johnson on May 30, 2008 was $66.74.

PS-11

Moody’s Corporation (“MCO”)

According to its publicly available filings with the SEC, Moody’s is a provider of (i) credit ratings and related research, data and analytical tools, (ii) quantitative credit risk measures, risk scoring software and credit portfolio management solutions and (iii) beginning in January 2008, fixed income pricing data and valuation models. Moody’s employs approximately 3,600 people worldwide and maintains offices in 27 countries. Moody’s is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Moody’s in the accompanying product supplement AI. Moody’s SEC file number is 001-14037.

Historical Information of the Common Stock of Moody’s

The following graph sets forth the historical performance of the common stock of Moody’s based on the weekly closing price (in U.S. dollars) of the common stock of Moody’s from January 1, 2000 through May 30, 2008. The closing price of the common stock of Moody’s on May 30, 2008 was $37.08.

3M Company (“MMM”)

According to its publicly available filings with the SEC, 3M is a diversified technology company with a global presence in the following businesses: industrial and transportation; health care; display and graphics; consumer and office; safety, security and protection services; and electro and communications. Most 3M products involve expertise in product development, manufacturing and marketing, and are subject to competition from products manufactured and sold by other technologically oriented companies. 3M is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of 3M Co. in the accompanying product supplement AI. 3M’s SEC file number is 001-03285.

Historical Information of the Common Stock of 3M

The following graph sets forth the historical performance of the common stock of 3M based on the weekly closing price (in U.S. dollars) of the common stock of 3M from January 1, 2000 through May 30, 2008. The closing price of the common stock of 3M on May 30, 2008 was $77.56.

PS-12

Pepsico, Inc. (“PEP”)

According to its publicly available filings with the SEC, Pepsico is a leading global snack and beverage company. Pepsico manufactures, markets and sells a variety of salty, convenient, sweet and grain-based snacks, carbonated and non-carbonated beverages and foods. Pepsico is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Pepsico in the accompanying product supplement AI. Pepsico’s SEC file number is 001-01183.

Historical Information of the Common Stock of Pepsico

The following graph sets forth the historical performance of the common stock of Pepsico based on the weekly closing price (in U.S. dollars) of the common stock of Pepsico from January 1, 2000 through May 30, 2008. The closing price of the common stock of Pepsico on May 30, 2008 was $68.30.

Procter & Gamble Company (“PG”)

According to its publicly available filings with the SEC, Procter & Gamble is focused on providing branded consumer goods products. In fiscal year 2007, the company was organized into three Global Business Units: Beauty and Health; Household Care; and Gillette GBU. The company’s products are sold in over 180 countries around the world primarily through mass merchandisers, grocery stores, membership club stores and drug stores. Procter & Gamble is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Procter & Gamble in the accompanying product supplement AI. Procter & Gamble’s SEC file number is 001-00434.

Historical Information of the Common Stock of Procter & Gamble

The following graph sets forth the historical performance of the common stock of Procter & Gamble based on the weekly closing price (in U.S. dollars) of the common stock of Procter & Gamble from January 1, 2000 through May 30, 2008. The closing price of the common stock of Procter & Gamble on May 30, 2008 was $66.05.

PS-13

United Technologies Corporation (“UTX”)

According to its publicly available filings with the SEC, United Technologies provides high technology products and services to the building systems and aerospace industries worldwide. Its operating units include businesses with operations throughout the world. United Technologies is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of United Technologies in the accompanying product supplement AI. United Technologies’ SEC file number is 001-00812.

Historical Information of the Common Stock of United Technologies

The following graph sets forth the historical performance of the common stock of United Technologies based on the weekly closing price (in U.S. dollars) of the common stock of United Technologies from January 1, 2000 through May 30, 2008. The closing price of the common stock of United Technologies on May 30, 2008 was $71.04.

Walgreen Company (“WAG”)

According to its publicly available filings with the SEC, Walgreen is the nation’s largest drugstore chain (based on sales). The total number of locations as of August 31, 2007 was 5,997 located in 48 states and Puerto Rico. Walgreen is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Walgreen in the accompanying product supplement AI. Walgreen’s SEC file number is 001-00604.

Historical Information of the Common Stock of Walgreen

The following graph sets forth the historical performance of the common stock of Walgreen based on the weekly closing price (in U.S. dollars) of the common stock of Walgreen from January 1, 2000 through May 30, 2008. The closing price of the common stock of Walgreen on May 30, 2008 was $36.02.

PS-14

Wal-Mart Stores, Inc. (“WMT”)

According to its publicly available filings with the SEC, Wal-Mart Stores operates retail stores in various formats around the world. Its operations comprise three business segments: Wal-Mart Stores, Sam’s Club and International. The Wal-Mart Stores segment is the largest segment of the business, accounting for 64.0% of its fiscal 2008 net sales. Wal-Mart Stores is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Wal-Mart Stores in the accompanying product supplement AI. Wal-Mart Stores’ SEC file number is 001-06991.

Historical Information of the Common Stock of Wal-Mart Stores

The following graph sets forth the historical performance of the common stock of Wal-Mart Stores based on the weekly closing price (in U.S. dollars) of the common stock of Wal-Mart Stores from January 1, 2000 through May 30, 2008. The closing price of the common stock of Wal-Mart Stores on May 30, 2008 was $57.74.

Western Union Company (“WU”)

According to its publicly available filings with the SEC, Western Union is a leader in global money transfer, providing people with fast, reliable and convenient ways to send money around the world, pay bills and purchase money orders. Its services are available through a network of over 335,000 agent locations in more than 200 countries and territories. Western Union is listed on the NYSE, which we refer to as the Relevant Exchange for purposes of Western Union in the accompanying product supplement AI. Western Union’s SEC file number is 001-32903.

Historical Information of the Common Stock of Western Union

The following graph sets forth the historical performance of the common stock of Western Union based on the weekly closing price (in U.S. dollars) of the common stock of Western Union from September 20, 2006 through May 30, 2008. The closing price of the common stock of Western Union on May 30, 2008 was $23.64.

PS-15

Historical Information of the Basket

The following graph sets forth the historical performance of the Basket based on the weekly Basket Closing Level from January 1, 2000 through May 30, 2008. The following graph assumes the Basket Closing Level on May 30, 2008 was 100 and the Stock Weightings were as specified under “The Basket” in this pricing supplement.

Supplemental Underwriting Information

Deutsche Bank Securities Inc. and Deutsche Bank Trust Company Americas, acting as agents for Deutsche Bank AG, will not receive a commission in connection with the sale of the notes. Deutsche Bank Securities Inc. and other agents may pay referral fees to other broker-dealers of up to 0.05% or $0.50 per $1,000 note face amount. Deutsche Bank Securities Inc. may pay custodial fees to other broker-dealers of up to 0.05% or $0.50 per $1,000 note face amount. See “Underwriting” in the accompanying product supplement.

Settlement

We expect to deliver the notes against payment for the notes on the settlement date indicated above, which may be a date that is greater than three business days following the Trade Date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in three business days, unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to transact in notes that are to be issued more than three business days after the Trade Date will be required to specify alternative settlement arrangements to prevent a failed settlement.

PS-16