UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| [X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2018

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ____________ to ____________

Commission File Number: 000-33167

KIWA BIO-TECH PRODUCTS GROUP CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 77-0632186 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

3200 Guasti Road, Suite #100, Ontario, California |

91761 | |

| (Address of principal executive offices) | (Zip Code) |

(909) 456-8828

(Registrant’s telephone number, including area code)

3200 Guasti Road, Suite #100

Ontario, CA 91761

(Former address)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) | Emerging growth company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

As of August 14, 2018, the Company had 16,637,017 shares of common stock, $0.001 par value, issued and outstanding.

Table of contents

| 2 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| June 30, 2018 | December 31, 2017 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 5,081,590 | $ | 1,083,539 | ||||

| Accounts receivable | 6,993,742 | 28,620 | ||||||

| Prepaid expenses | 3,118,208 | 2,474,272 | ||||||

| Rent deposits and other receivables | 456,287 | 44,423 | ||||||

| Advance to suppliers | 6,097,017 | 12,660,793 | ||||||

| Due from related parties - non-trade | 23,472 | 19,017 | ||||||

| Inventory | 1,705,748 | 2,745,991 | ||||||

| Deferred cost of goods sold | 5,108,997 | 16,726 | ||||||

| Total current assets | 28,585,061 | 19,073,381 | ||||||

| OTHER ASSETS | ||||||||

| Property, plant and equipment - net | 63,810 | 90,500 | ||||||

| Rent deposits-non-current | 74,006 | 72,631 | ||||||

| Deposit for Long-Term Investment | 755,466 | 768,074 | ||||||

| Total non-current assets | 893,282 | 931,205 | ||||||

| Total assets | $ | 29,478,343 | $ | 20,004,586 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 880,333 | $ | 1,800,614 | ||||

| Advances from customers | 597,123 | 543,581 | ||||||

| Due to related parties-non-trade | 527,785 | 320,199 | ||||||

| Convertible notes payable, net of discount of $0 and $1,977 at June 30, 2018 and December 31, 2017, respectively. | 258,655 | 273,200 | ||||||

| Derivative liabilities | 45,562 | 247,933 | ||||||

| Notes payable | 360,000 | 360,000 | ||||||

| Salaries payable | 487,113 | 291,401 | ||||||

| Taxes payable | 1,967,908 | 1,142,973 | ||||||

| Interest payable | 1,855,737 | 1,756,275 | ||||||

| Other payables and accruals | 2,846,309 | 2,108,873 | ||||||

| Deferred revenue | 6,993,742 | 28,620 | ||||||

| Total current liabilities | 16,820,267 | 8,873,669 | ||||||

| Convertible note payable – non-current, net of discount of $243,522 and $384,799 at June 30, 2018 and December 31, 2017, respectively. | 587,490 | 460,082 | ||||||

| Total Liabilities | 17,407,757 | 9,333,751 | ||||||

| Stockholders’ equity | ||||||||

| Preferred stock - $0.001 par value, Authorized 20,000,000 shares. Series A - Issued and outstanding 500,000 and 500,000 shares at June 30, 2018, 2018 and December 31, 2017, respectively; Series B - Issued and outstanding 811,148 and 811,148 shares at June 30, 2018 and December 31, 2017, respectively. | 1,311 | 1,311 | ||||||

| Common stock - $0.001 per value. Authorized 100,000,000 shares. Issued and outstanding 16,637,017 and 15,202,965 shares at June 30, 2018, and December 31, 2017, respectively. | 16,578 | 15,203 | ||||||

| Additional paid-in capital | 26,717,774 | 24,455,291 | ||||||

| Statutory Reserve | 458,334 | 458,334 | ||||||

| Accumulated deficit | (15,165,480 | ) | (14,583,080 | ) | ||||

| Accumulated other comprehensive income | 42,069 | 323,776 | ||||||

| Total stockholders’ equity | 12,070,586 | 10,670,835 | ||||||

| Total liabilities and stockholders’ equity | $ | 29,478,343 | $ | 20,004,586 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 3 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| (As Restated) | (As Restated) | |||||||||||||||

| Revenue | $ | 5,334,830 | $ | - | $ | 14,086,221 | $ | - | ||||||||

| Cost of goods sold | (3,873,502 | ) | - | (10,180,066 | ) | - | ||||||||||

| Gross Profit | 1,461,328 | - | 3,906,155 | - | ||||||||||||

| Operating expenses | ||||||||||||||||

| Selling expense | 161,256 | 54,232 | 345,567 | 90,485 | ||||||||||||

| Research and development | 39,230 | 36,433 | 78,543 | 72,724 | ||||||||||||

| General and administrative | 1,514,298 | 625,275 | 3,079,028 | 1,033,437 | ||||||||||||

| Total operating expenses | 1,714,784 | 715,940 | 3,503,138 | 1,196,646 | ||||||||||||

| Operating income (loss) | (253,456 | ) | (715,940 | ) | 403,017 | (1,196,646 | ) | |||||||||

| Other income/(expense), net | ||||||||||||||||

| Change in fair value of derivative liabilities | 72,433 | (6,561 | ) | 202,371 | (6,561 | ) | ||||||||||

| Interest expense | (152,564 | ) | (125,341 | ) | (307,927 | ) | (187,131 | ) | ||||||||

| Other income/(expense) | - | 800 | (905 | ) | 800 | |||||||||||

| Exchange gain (loss) | 56,285 | (16,903 | ) | 18,253 | (17,075 | ) | ||||||||||

| Total other income/(expense), net | (23,846 | ) | (148,005 | ) | (88,208 | ) | (209,967 | ) | ||||||||

| Income (loss) from continuing operations before income taxes | (277,302 | ) | (863,945 | ) | 314,809 | (1,406,613 | ) | |||||||||

| (Provision) benefit for income taxes | ||||||||||||||||

| Current | (358,066 | ) | (379,973 | ) | (897,209 | ) | (599,022 | ) | ||||||||

| Deferred | - | 427,798 | - | 698,243 | ||||||||||||

| Total (provision) benefit for income taxes | (358,066 | ) | 47,825 | (897,209 | ) | 99,221 | ||||||||||

| Income (loss) from continuing operations | (635,368 | ) | (816,120 | ) | (582,400 | ) | (1,307,392 | ) | ||||||||

| Income from discontinued operations, net of taxes | - | 4,511,384 | - | 4,512,182 | ||||||||||||

| Net income (loss) | (635,368 | ) | 3,695,264 | (582,400 | ) | 3,204,790 | ||||||||||

| Other comprehensive income (loss) | ||||||||||||||||

| Foreign currency translation adjustment | (781,013 | ) | 78,689 | (281,707 | ) | 43,418 | ||||||||||

| Total comprehensive income (loss) | $ | (1,416,381 | ) | $ | 3,773,953 | $ | (864,107 | ) | $ | 3,248,208 | ||||||

| Earnings per share – Basic: | ||||||||||||||||

| Loss from continuing operations | (0.04 | ) | (0.08 | ) | (0.04 | ) | (0.14 | ) | ||||||||

| Discontinued operations | - | 0.46 | - | 0.48 | ||||||||||||

| Net Income (loss) | $ | (0.04 | ) | $ | 0.38 | $ | (0.04 | ) | $ | 0.34 | ||||||

| Earnings per share – Diluted: | ||||||||||||||||

| Loss from continuing operations | (0.04 | ) | (0.07 | ) | (0.04 | ) | (0.10 | ) | ||||||||

| Discontinued operations | - | 0.41 | - | 0.39 | ||||||||||||

| Net Income (loss) | (0.04 | ) | 0.34 | (0.04 | ) | 0.29 | ||||||||||

| Weighted average number of common shares outstanding - basic | 16,479,316 | 9,823,223 | 16,201,020 | 9,450,561 | ||||||||||||

| Weighted average number of common shares outstanding - diluted | 16,497,316 | 10,972,147 | 16,201,020 | 11,437,817 | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 4 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Six Months Ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| (As Restated) | ||||||||

| Cash flows from continuing operating activities: | ||||||||

| Net income (loss) | $ | (582,400 | ) | $ | 3,204,790 | |||

| Income from discontinued operations, net of taxes | - | (4,512,182 | ) | |||||

| Net income (loss) from continuing operations | (582,400 | ) | (1,307,392 | ) | ||||

| Adjustments to reconcile net income to net cash used in continuing operating activities: | ||||||||

| Depreciation | 20,451 | 17,787 | ||||||

| Accrued interest | 307,927 | 186,649 | ||||||

| Stock compensation expense | 1,276,269 | 310,506 | ||||||

| Employee benefits | - | 102,743 | ||||||

| (Gain) loss on derivative liabilities | (202,371 | ) | 6,561 | |||||

| Deferred income tax | - | (698,243 | ) | |||||

| Changes in continuing operating assets and liabilities: | ||||||||

| Accounts receivable | (7,241,877 | ) | (8,164,649 | ) | ||||

| Prepaid expenses | 36,793 | (48,374 | ) | |||||

| Rent deposit and other receivables | (431,569 | ) | (117,586 | ) | ||||

| Advance to suppliers | 6,608,056 | 660,523 | ||||||

| Due from related party – non-trade | (4,957 | ) | - | |||||

| Due from related party – trade | - | 206,253 | ||||||

| Inventory | 1,034,641 | - | ||||||

| Deferred cost of goods sold | (5,294,537 | ) | (6,034,924 | ) | ||||

| Accounts payable | (926,055 | ) | 3,556,354 | |||||

| Salary payable | 203,670 | 70,383 | ||||||

| Taxes payable | 877,180 | 187,896 | ||||||

| Advances from customers | 64,943 | (13,018 | ) | |||||

| Other payables and accruals | 770,480 | (83,312 | ) | |||||

| Deferred revenue | 7,241,877 | 8,827,897 | ||||||

| Net cash provided by (used in) continuing operating activities | 3,758,521 | (2,333,946 | ) | |||||

| Net cash used in discontinued operations | - | - | ||||||

| Net cash provided by (used in) operating activities | 3,758,521 | (2,333,946 | ) | |||||

| Cash flows from investing activities: | ||||||||

| Purchase of property, plant and equipment | (3,488 | ) | (2,333 | ) | ||||

| Payment of deposit for long-term investment | - | (145,449 | ) | |||||

| Net cash used in investing activities | (3,488 | ) | (147,782 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Borrowings from related parties, net | 209,111 | 17,000 | ||||||

| Proceeds from sale of common stock | 235,600 | 1,481,508 | ||||||

| Proceeds from convertible notes | - | 955,955 | ||||||

| Net cash provided by financing activities | 444,711 | 2,454,463 | ||||||

| Effect of exchange rate change | (201,693 | ) | 85,350 | |||||

| Cash and cash equivalents: | ||||||||

| Net increase | 3,998,051 | 58,085 | ||||||

| Balance at beginning of period | 1,083,539 | 13,469 | ||||||

| Balance at end of period | $ | 5,081,590 | $ | 71,554 | ||||

| Non-cash financing activities: | ||||||||

| Issuance of common stock for consulting services | $ | 1,942,050 | $ | 41,396 | ||||

| Issuance of common stock for financing related services | $ | - | $ | 138,501 | ||||

| Supplemental Disclosures of Cash Flow Information: | ||||||||

| Cash paid for interest | $ | - | $ | - | ||||

| Cash paid for income taxes | $ | - | $ | 444,331 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 5 |

KIWA BIO-TECH PRODUCTS GROUP CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

1. Description of Business and Organization

Organization

Kiwa Bio-Tech Products Group Corporation (“the Company”) is the result of a share exchange transaction accomplished on March 12, 2004 between the shareholders of Kiwa Bio-Tech Products Group Ltd. (“Kiwa BVI”), a company originally organized under the laws of the British Virgin Islands on June 5, 2002 and Tintic Gold Mining Company (“Tintic”), a corporation originally incorporated in the state of Utah on June 14, 1933 to perform mining operations in Utah. The share exchange resulted in a change of control of Tintic, with former Kiwa BVI stockholders owning approximately 89% of Tintic on a fully diluted basis and Kiwa BVI surviving as a wholly-owned subsidiary of Tintic. Subsequent to the share exchange transaction, Tintic changed its name to Kiwa Bio-Tech Products Group Corporation. On July 21, 2004, the Company completed its reincorporation in the State of Delaware. On March 8, 2017, we completed our reincorporation in the State of Nevada.

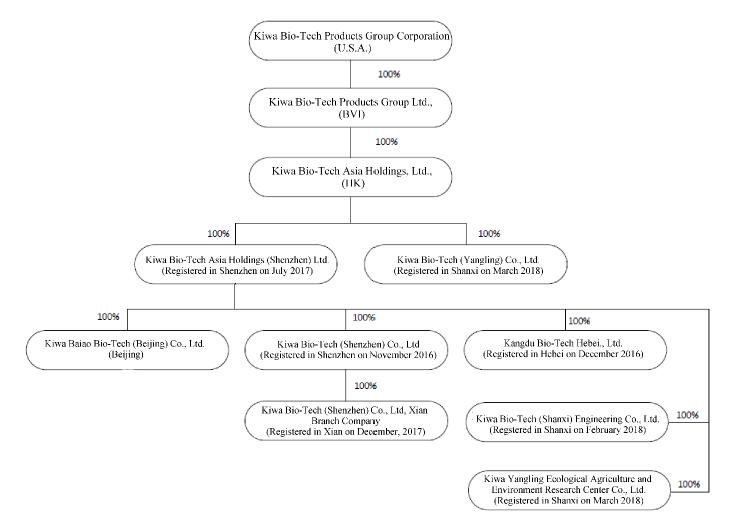

The Company operates through a series of subsidiaries in the Peoples Republic of China as detailed in the following Organizational Chart. The Company had previously operated its business through its subsidiaries Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Kiwa Shandong”) and Tianjin Kiwa Feed Co., Ltd. (“Kiwa Tianjin”). Kiwa Tianjin was dissolved on July, 11, 2012. On February 11, 2017, the Company entered an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) to transfer all of shareholders’ right, title and interest in Kiwa Shandong to the Transferee for RMB1.00. On April 12, 2017, the government processing of transfer has been completed. Currently, the Company mainly operates its business through its subsidiaries Kiwa Baiao Bio-Tech (Beijing) Co., Ltd. (“Kiwa Beijing”), Kiwa Bio-Tech Products (Shenzhen) Co., Ltd. (“Kiwa Shenzhen”), which was incorporated in China in November 2016, Kiwa Bio-Tech Products (Hebei) Co., Ltd. (“Kiwa Hebei”), which was incorporated in China in December 2016, and Kiwa Bio-Tech Products (Shenzhen) Co., Ltd. Xian Branch Company, (“Kiwa Xian”), which was incorporated in China in December 2017. Kiwa Beijing was acquired from a group of unrelated third parties in January 2016 together with its holding company HK Baina Group Holding Company for approximately $34,000 (RMB 220,000) and renamed to Kiwa Baiao Bio-Tech (Beijing) Co., Ltd. from Oriental Baina Co., Ltd. in February 2016. HK Baina Group Holding Company and Oriental Baina Co., Ltd. have no operations prior to the acquisition and the purchase price was initially recorded as goodwill and fully impaired at the year-end of 2016. In July 2017, the Company established Kiwa Bio-Tech Asia Holding (Shenzhen) Ltd. (“Kiwa Asia”) to be the direct holding company of Kiwa Beijing, Kiwa Shenzhen, Kiwa Xian and Kiwa Hebei. The Company established Inner Mongolia Jing Nong Investment & Management, Ltd. (“Kiwa Jing Nong”) in August 2017. The Company established Kiwa Bio-Tech (Shanxi) Engineering Co., Ltd. (“Kiwa Shanxi”) in February 2018. The Company established Kiwa Bio-Tech (Yangling) Co., Ltd. (“Kiwa Yangling”) and Kiwa Yangling Ecological Agriculture and Environment Research Center Co., Ltd. (“Kiwa R&D Center”) in March 2018.

| 6 |

Business

The Company develops, manufactures, distributes and markets innovative, cost-effective and environmentally safe bio-technological products for agricultural use. Our products are designed to enhance the quality of human life by increasing the value, quality and productivity of crops and decreasing the negative environmental impact of chemicals and other wastes.

2. Restatements of June 30, 2017 consolidated financial statements

| 1) | Consolidated statements of operations and comprehensive income (loss) for the three months ended June 30, 2017: |

The unaudited consolidated condensed statements of operations and comprehensive income (loss) for three months ended June 30, 2017 contain restatements related to the following:

| a) | Revenue of $5,682,108 and cost of goods sold of $3,970,915 were being deferred as the Company considers the revenue recognition criteria are not met as of June 30, 2017 and therefore defers the revenue and cost of goods sold until payments were collected; | |

| b) | Recognition of the relative fair value of beneficial conversion feature (“BCF”) $45,094 into additional paid in capital and debt discount and amortize value over the term of the convertible notes issued on January 17, 2017 with amortization of debt discount of $11,243 for the three months ended June 30, 2017; |

| 7 |

Recognition of derivative liability from conversion feature of convertible note of $569,784 into debt discount and amortize value over the term of the convertible notes issued on May 9, 2017 with amortization of debt discount of $41,177 for the three months ended June 30, 2017;

| c) | Issuance of common stock for financing related services of $38,744 were reversed from G&A expenses and net against additional paid-in-capital as they were directly incremental to the financing transaction; | |

| d) | Tax effect of $427,798 and foreign currency translation effect of $11,221 as a result of the above restatements; | |

| e) | Recognition of exchange loss of $1,979 resulted from disposal gain of discontinued operations of $4,511,384. The Company executed an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) on February 11, 2017 whereby the Company transferred all of its right, title and interest in Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Shandong”) to the Transferee for the RMB 1.00. The government approval and processing of the transaction was completed on April 12, 2017. This transaction was considered as completed and effective on April 12, 2017; | |

f)

|

Recognition of the derivative liability and change in fair value of derivative liability of $ 6,561 for fair value of the conversion option of convertible notes issued on May 9, 2017 for the three months ended June 30, 2017; | |

g) |

Recognition of California state income tax refund of $800 for the three months ended June 30, 2017; | |

| h) | Recognition of exchange gain of $16,903 for the convertible notes which was issued by using foreign currency (RMB) and recorded by using U.S. dollar quarterly. |

The impact of these restatements on the three months ended June 30, 2017 unaudited condensed consolidated statements of operations and comprehensive income (loss) is reflected in the following:

Statement of operations and comprehensive income (loss) amounts for the three months ended June 30, 2017:

| As previously reported | Restatement | As restated | ||||||||||

| Revenue | $ | 5,682,108 | $ | (5,682,108 | ) | $ | - | |||||

| Cost of goods sold | 3,970,915 | (3,970,915 | ) | - | ||||||||

| Gross profit | 1,711,193 | (1,711,193 | ) | - | ||||||||

| Operating expenses: | ||||||||||||

| Research and development | 36,433 | - | 36,433 | |||||||||

| Selling expenses | 54,232 | - | 54,232 | |||||||||

| General and administrative | 664,019 | (38,744 | ) | 625,275 | ||||||||

| Total operating expenses | 754,684 | (38,744 | ) | 715,940 | ||||||||

| Operating Income (loss) | 956,509 | (1,672,449 | ) | (715,940 | ) | |||||||

| Other income/(expense), net | ||||||||||||

| Change in fair value of derivative liabilities | - | (6,561 | ) | (6,561 | ) | |||||||

| Interest expense | (72,921 | ) | (52,420 | ) | (125,341 | ) | ||||||

| Other income/(expense) | - | 800 | 800 | |||||||||

| Exchange loss | - | (16,903 | ) | (16,903 | ) | |||||||

| Total other income/(expense), net | (72,921 | ) | (75,084 | ) | (148,005 | ) | ||||||

| Income (loss) from continuing operations before income taxes | 883,588 | (1,747,533 | ) | (863,945 | ) | |||||||

| (Provision) benefit for income taxes | ||||||||||||

| Current | (379,973 | ) | - | (379,973 | ) | |||||||

| Deferred | - | 427,798 | 427,798 | |||||||||

| Total (provision) benefit for income taxes | (379,973 | ) | 427,798 | 47,825 | ||||||||

| Income (loss) from continuing operations | 503,615 | (1,319,735 | ) | (816,120 | ) | |||||||

| Income from discontinued operations, net of taxes | 4,513,363 | (1,979 | ) | 4,511,384 | ||||||||

| Net income (loss) | 5,016,978 | (1,321,714 | ) | 3,695,264 | ||||||||

| Other comprehensive income (loss) | ||||||||||||

| Foreign currency translation adjustment | 89,910 | (11,221 | ) | 78,689 | ||||||||

| Total comprehensive income (loss) | $ | 5,106,888 | $ | (1,332,935 | ) | $ | 3,773,953 | |||||

| Earnings (loss) per share - Basic: | ||||||||||||

| Income (loss) from continuing operations | $ | 0.05 | $ | (0.13 | ) | $ | (0.08 | ) | ||||

| Discontinued operations | 0.46 | - | 0.46 | |||||||||

| Net income (loss) | $ | 0.51 | $ | (0.13 | ) | $ | 0.38 | |||||

| Earnings per share - Diluted: | ||||||||||||

| Income (loss) from continuing operations | $ | 0.05 | $ | (0.12 | ) | $ | (0.07 | ) | ||||

| Discontinued operations | 0.40 | 0.01 | 0.41 | |||||||||

| Net income (loss) | $ | 0.45 | $ | (0.11 | ) | $ | 0.34 | |||||

| Weighted average number of common shares outstanding - basic | 9,865,031 | (41,808 | ) | 9,823,223 | ||||||||

| Weighted average number of common shares outstanding - diluted | 11,360,700 | (388,553 | ) | 10,972,147 | ||||||||

| 8 |

| 2) | Consolidated statements of operations and comprehensive income (loss) and statements of cash flows for the six months ended June 30, 2017: |

The unaudited consolidated condensed statements of operations and comprehensive income (loss) and statements of cash flow for six months ended June 30, 2017 contain restatements related to the following:

| a) | Revenue of $8,827,897 and cost of goods sold of $6,034,924 were being deferred as the Company considers the revenue recognition criteria are not met as of June 30, 2017 and therefore defers the revenue and cost of goods sold until payments were collected; | |

| b) | Recognition of the relative fair value of beneficial conversion feature (“BCF”) $45,094 into additional paid in capital and debt discount and amortize value over the term of the convertible notes issued on January 17, 2017 with amortization of debt discount of $21,710 for the six months ended June 30, 2017; | |

Recognition of derivative liability from conversion feature of convertible note of $569,784 into debt discount and amortize value over the term of the convertible notes issued on May 9, 2017 with amortization of debt discount of $41,177 for the six months ended June 30, 2017; | ||

| c) | Issuance of common stock for financing related services of $61,959 were reversed from G&A expenses and net against additional paid-in-capital as they were directly incremental to the financing transaction; |

| 9 |

| d) | Tax effect of $698,243 and foreign currency translation effect of $14,149 as a result of the above restatements; | |

| e) | Recognition of exchange loss of $1,979 resulted from disposal of discontinued operations gain of $4,512,182 with the respective reclassification of $254,098 of accounts payable, $539,014 of salary payable, $508,107 of taxes payable, $102,651 of other payable, $1,061,367 of due to related party-trade, $1,672,666 of loan payable, $258,213 of construction cost payable changes for the six months ended June 30, 2017 in the statement of cash flow. The Company executed an Equity Transfer Agreement with Dian Shi Cheng Jing (Beijing) Technology Co. (“Transferee”) on February 11, 2017 whereby the Company transferred all of its right, title and interest in Kiwa Bio-Tech Products (Shandong) Co., Ltd. (“Shandong”) to the Transferee for the RMB 1.00. The government approval and processing of the transaction was completed on April 12, 2017. This transaction was considered as completed and effective on April 12, 2017; | |

f)

|

Recognition of the derivative liability and change in fair value of derivative liability of $ 6,561 for fair value of the conversion option of convertible notes issued on May 9, 2017 for the six months ended June 30, 2017; | |

g) |

Recognition of California state income tax refund of $800 for the six months ended June 30, 2017; | |

h)

|

Recognition of exchange gain of $17,075 for the convertible notes which was issued by using foreign currency (RMB) and recorded by using U.S. dollar quarterly. | |

| i) | Reclassification of $206,254 of change in other receivables to change in due from related party in the consolidated statement of cash flow as the Company previously presented the balance of $1,329,166 and $1,522,434 due from Kangtan Gerui (Beijing) Bio-Tech Co, Ltd (“Gerui”), which Ms. Feng Li, a member of the Company’s board of directors and shareholder of the Company (Ms. Li held approximately 12.93% of the Company’s Common Stock and 50% of the Company’s Series A Preferred Stock), is also a 23% shareholder of Gerui, as other receivables - third party as of June 30, 2017 and December 31, 2016, respectively; | |

| j) | Reclassification of prepaid expenses to advance to suppliers of $75,000 as of June 30, 2017. |

| 10 |

The impact of these restatements on the six months ended June 30, 2017 unaudited consolidated condensed statements of operations and comprehensive income (loss) and statements of cash flows is reflected in the following:

Statement of operations and comprehensive income (loss) amounts for the six months ended June 30, 2017:

| As previously reported | Restatement | As restated | ||||||||||

| Revenue | $ | 8,827,897 | $ | (8,827,897 | ) | $ | - | |||||

| Cost of goods sold | 6,034,924 | (6,034,924 | ) | - | ||||||||

| Gross profit | 2,792,973 | (2,792,973 | ) | - | ||||||||

| Operating expenses: | ||||||||||||

| Research and development | 72,724 | - | 72,724 | |||||||||

| Selling expenses | 90,485 | - | 90,485 | |||||||||

| General and administrative | 1,095,396 | (61,959 | ) | 1,033,437 | ||||||||

| Total operating expenses | 1,258,605 | (61,959 | ) | 1,196,646 | ||||||||

| Operating Income (loss) | 1,534,368 | (2,731,014 | ) | (1,196,646 | ) | |||||||

| Other income/(expense), net | ||||||||||||

| Change in fair value of derivative liabilities | - | (6,561 | ) | (6,561 | ) | |||||||

| Interest expense | (124,244 | ) | (62,887 | ) | (187,131 | ) | ||||||

| Other income/(expense) | - | 800 | 800 | |||||||||

| Exchange loss | - | (17,075 | ) | (17,075 | ) | |||||||

| Total other income/(expense), net | (124,244 | ) | (85,723 | ) | (209,967 | ) | ||||||

| Income (loss) from continuing operations before income taxes | 1,410,124 | (2,816,737 | ) | (1,406,613 | ) | |||||||

| (Provision) benefit for income taxes | ||||||||||||

| Current | (599,022 | ) | - | (599,022 | ) | |||||||

| Deferred | - | 698,243 | 698,243 | |||||||||

| Total (provision) benefit for income taxes | (599,022 | ) | 698,243 | 99,221 | ||||||||

| Income (loss) from continuing operations | 811,102 | (2,118,494 | ) | (1,307,392 | ) | |||||||

| Income from discontinued operations, net of taxes | 4,514,161 | (1,979 | ) | 4,512,182 | ||||||||

| Net income (loss) | 5,325,263 | (2,120,473 | ) | 3,204,790 | ||||||||

| Other comprehensive income (loss) | ||||||||||||

| Foreign currency translation adjustment | 57,567 | (14,149 | ) | 43,418 | ||||||||

| Total comprehensive income (loss) | $ | 5,382,830 | $ | (2,134,622 | ) | $ | 3,248,208 | |||||

| Earnings (loss) per share - Basic: | ||||||||||||

| Income (loss) from continuing operations | $ | 0.09 | $ | (0.23 | ) | $ | (0.14 | ) | ||||

| Discontinued operations | 0.47 | 0.01 | 0.48 | |||||||||

| Net income (loss) | $ | 0.56 | $ | (0.22 | ) | $ | 0.34 | |||||

| Earnings per share - Diluted: | ||||||||||||

| Income (loss) from continuing operations | $ | 0.08 | $ | (0.18 | ) | $ | (0.10 | ) | ||||

| Discontinued operations | 0.41 | (0.02 | ) | 0.39 | ||||||||

| Net income (loss) | $ | 0.49 | $ | (0.20 | ) | $ | 0.29 | |||||

| Weighted average number of common shares outstanding - basic | 9,564,506 | (113,945 | ) | 9,450,561 | ||||||||

| Weighted average number of common shares outstanding - diluted | 11,033,303 | 404,514 | 11,437,817 | |||||||||

| 11 |

Statement of cash flows amounts for the six months ended June 30, 2017:

| As previously reported | Restatement/ Reclassification | As restated | ||||||||||

| Cash flows from continuing operating activities: | ||||||||||||

| Net income (loss) | $ | 5,325,262 | $ | (2,120,472 | ) | $ | 3,204,790 | |||||

| Loss from discontinued operations, net of taxes | - | (4,512,182 | ) | (4,512,182 | ) | |||||||

| Net income (loss) from continuing operations | 5,325,262 | (6,632,654 | ) | (1,307,392 | ) | |||||||

| Adjustments to reconcile net income (loss) to net cash used in continuing operating activities: | ||||||||||||

| Depreciation | 17,787 | - | 17,787 | |||||||||

| Accrued interest | 124,301 | 62,348 | 186,649 | |||||||||

| Employee benefits | 102,743 | - | 102,743 | |||||||||

| Stock compensation expense | 372,465 | (61,959 | ) | 310,506 | ||||||||

| Loss on derivative liabilities | - | 6,561 | 6,561 | |||||||||

| Deferred income tax | - | (698,243 | ) | (698,243 | ) | |||||||

| Changes in continuing operating assets and liabilities: | ||||||||||||

| Accounts receivable | (8,164,649 | ) | - | (8,164,649 | ) | |||||||

| Prepaid expenses | 26,626 | (75,000 | ) | (48,374 | ) | |||||||

| Rent deposit and other receivables | 88,668 | (206,254 | ) | (117,586 | ) | |||||||

| Advance to suppliers | 585,523 | 75,000 | 660,523 | |||||||||

| Due from related parties-trade | - | 206,253 | 206,253 | |||||||||

| Deferred cost of goods sold | - | (6,034,924 | ) | (6,034,924 | ) | |||||||

| Accounts payable | 3,302,256 | 254,098 | 3,556,354 | |||||||||

| Salary payable | (468,631 | ) | 539,014 | 70,383 | ||||||||

| Taxes payable | (320,211 | ) | 508,107 | 187,896 | ||||||||

| Advances from customers | (13,018 | ) | - | (13,018 | ) | |||||||

| Other payables and accruals | (185,963 | ) | 102,651 | (83,312 | ) | |||||||

| Due to related party-trade | (1,061,367 | ) | 1,061,367 | - | ||||||||

| Loan payable | (1,672,666 | ) | 1,672,666 | - | ||||||||

| Construction cost payable | (258,213 | ) | 258,213 | - | ||||||||

| Deferred revenue | - | 8,827,897 | 8,827,897 | |||||||||

| Net cash used in continuing operating activities | (2,199,087 | ) | (134,859 | ) | (2,333,946 | ) | ||||||

| Net cash used in discontinued operations | - | - | - | |||||||||

| Net cash used in operating activities | (2,199,087 | ) | (134,859 | ) | (2,333,946 | ) | ||||||

| Cash flows from investing activities: | ||||||||||||

| Purchase of property, plant and equipment | (2,333 | ) | - | (2,333 | ) | |||||||

| Investment in subsidiary | (145,449 | ) | - | (145,449 | ) | |||||||

| Net cash used in investing activities | (147,782 | ) | - | (147,782 | ) | |||||||

| Cash flows from financing activities: | ||||||||||||

| Working capital borrowed from related parties, net of payments to related parties | 17,000 | - | 17,000 | |||||||||

| Proceeds from sale of common stock | 1,481,508 | - | 1,481,508 | |||||||||

| Proceeds from convertible note | 955,955 | - | 955,955 | |||||||||

| Net cash provided by financing activities | 2,454,463 | - | 2,454,463 | |||||||||

| Effect of exchange rate change | (49,509 | ) | 134,859 | 85,350 | ||||||||

| Cash and cash equivalents: | ||||||||||||

| Net increase | 58,085 | - | 58,085 | |||||||||

| Balance at beginning of period | 13,469 | - | 13,469 | |||||||||

| Balance at end of period | $ | 71,554 | $ | - | $ | 71,554 | ||||||

| Non-cash financing activities: | ||||||||||||

| Issuance of common stock for consulting service | $ | 179,897 | $ | (138,501 | ) | $ | 41,396 | |||||

| Issuance of common stock for financing related service | $ | - | $ | 138,501 | $ | 138,501 | ||||||

| Supplemental Disclosures of Cash flow Information: | ||||||||||||

| Cash paid for interest | $ | - | $ | - | $ | - | ||||||

| Cash paid for income taxes | $ | 411,846 | $ | 32,485 | $ | 444,331 | ||||||

| 12 |

3. Summaries of Significant Accounting Policies

Basis of presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for information pursuant to the rules and regulations of the Securities Exchange Commission (“SEC”).

In the opinion of management, all adjustments, consisting only of normal recurring adjustments, considered necessary to give a fair presentation have been included. Interim results are not necessarily indicative of results of a full year. The information in this Form 10-Q should be read in conjunction with information included in the annual report for the fiscal year ended December 31, 2017 on Form 10-K filed with the SEC on June 30, 2018.

Principle of Consolidation

These consolidated unaudited condensed financial statements include the financial statements of the Company and its wholly-owned subsidiaries, Kiwa BVI, Hong Kong Baina Group Holding Company, Kiwa Beijing, Kiwa Shandong, Kiwa Shenzhen, Kiwa Hebei, Kiwa Asia, Kiwa Yangling, Kiwa Shanxi, Kiwa R&D Center and Kiwa Jing Nong. All significant inter-company balances or transactions are eliminated on consolidation.

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant accounting estimates include the valuation of securities issued, derivative liabilities, deferred tax assets and related valuation allowance.

Certain of our estimates, including evaluating the collectability of accounts receivable and the fair market value of long-lived assets, could be affected by external conditions, including those unique to our industry, and general economic conditions. It is possible that these external factors could have an effect on our estimates that could cause actual results to differ from our estimates. We re-evaluate all of our accounting estimates annually based on these conditions and record adjustments when necessary.

Cash and Cash Equivalents

Cash and cash equivalents consist of all cash balances and highly liquid investments with an original maturity of three months or less. Because of the short maturity of these investments, the carrying amounts approximate their fair value. Restricted cash is excluded from cash and cash equivalents.

Accounts receivable and allowance for doubtful accounts

Accounts receivable represent customer accounts receivables. The Company provides an allowance for doubtful accounts equal to the estimated uncollectible amounts. The Company’s estimate is based on historical collection experience, the economic environment, trends in the microbial fertilizer industry, and a review of the current status of trade accounts receivable. Management reviews its accounts receivable each reporting period to determine if the allowance for doubtful accounts is adequate. Such allowances, if any, would be recorded in the period the impairment is identified. It is reasonably possible that the Company’s estimate of the allowance for doubtful accounts will change. Uncollectible accounts receivable are charged against the allowance for doubtful accounts when all reasonable efforts to collect the amounts due have been exhausted.

Inventory

Inventories are stated at the lower of cost, determined on the weighted average method, and net realizable value. Work in progress and finished goods are composed of direct materials, direct labor and a portion of manufacturing overhead. Net realizable value is the estimated based on selling price in the ordinary course of business, less estimated costs to complete and dispose.

| 13 |

Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Gains or losses on disposals are reflected as gain or loss in the year of disposal. The cost of improvements that extend the life of property, plant and equipment are capitalized. These capitalized costs may include structural improvements, equipment and fixtures. All ordinary repair and maintenance costs are expensed as incurred. Depreciation for financial reporting purposes is provided using the straight-line method over the estimated useful lives of the assets as follows:

| Useful Life | ||||

| (In years) | ||||

| Buildings | 30 - 35 | |||

| Machinery and equipment | 5 - 10 | |||

| Automobiles | 8 | |||

| Office equipment | 2 - 5 | |||

| Computer software | 3 | |||

| Leasehold improvement | The shorter of the lease term and useful life | |||

Impairment of Long-Lived Assets

The Company’s long-lived assets consist of property, plant and equipment. The Company evaluates its investment in long-lived assets, including property and equipment, for recoverability whenever events or changes in circumstances indicate the net carrying amount may not be recoverable. It is possible that these assets could become impaired as a result of legal factors, market conditions, operational performance indicators, technological or other industry changes. If circumstances require a long-lived asset or asset group to be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by that asset or asset group to its carrying value. If the carrying value of the long-lived asset or asset group is not recoverable on an undiscounted cash flow basis, an impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques, including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary.

Financial Instruments

The Company analyzes all financial instruments with features of both liabilities and equity under FASB Accounting Standards Codification (“ASC”) Topic 480 “Distinguishing Liabilities from Equity” and FASB ASC Topic 815 “Derivatives and Hedging”.

Embedded conversion features of convertible debentures not considered to be derivative instruments

The embedded conversion features of convertible debentures not considered to be derivative instruments provide for a rate of conversion that is below market value. Such feature is normally characterized as a “beneficial conversion feature” (“BCF”). The relative fair values of the BCF were recorded as discounts from the face amount of the respective debt instrument. The Company amortized the discount using the straight-line method which approximates the effective interest method through maturity of such instruments.

Embedded conversion features of convertible debentures that are classified as derivative liabilities

The embedded conversion features of convertible debentures that are classified as derivative liabilities are recorded at fair value as a discount from the face amount of the respective debt instrument. The discount is being amortized to interest expense over the life of the note using the straight-line method, which approximates the effective interest method. These instruments are accounted for as derivative liabilities and marked-to-market each reporting period. The change in the value of the derivative liabilities is charged against or credited to income in the captioned “change in fair value of derivative liabilities” in the accompanying consolidated statements of operations and comprehensive income.

| 14 |

Fair Value of Financial Instruments

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value with U.S. GAAP and expands disclosures about fair value measurements.

To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| ● | Level 1: quoted market prices available in active markets for identical assets or liabilities as of the reporting date. | |

| ● | Level 2: pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. | |

| ● | Level 3: Pricing inputs that are generally observable inputs and not corroborated by market data. |

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The carrying amount of the Company’s financial assets and liabilities, such as cash and cash equivalent, prepaid expenses, accounts payable and accrued expenses, approximate their fair value because of the short maturity of those instruments. Derivative instruments are carried at fair value, estimated using the Black Scholes Merton model.

Transactions involving related parties cannot be presumed to be carried out on an arm’s-length basis, as the requisite conditions of competitive, free-market dealings may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions were consummated on terms equivalent to those that prevail in arm’s-length transactions unless such representations can be substantiated.

It is not however practical to determine the fair value of advances from stockholders, if any, due to their related party nature.

Revenue Recognition

On January 1, 2018 we adopted Accounting Standards Update (“ASU”) 2014-09 Revenue from Contracts with Customers (FASB ASC Topic 606) using the modified retrospective method for contracts that were not completed as of January 1, 2018. This did not result in an adjustment to the retained earnings upon adoption of this new guidance as the Company’s revenue was recognized based on the amount of consideration we expect to receive in exchange for satisfying the performance obligations.

The core principle underlying the revenue recognition ASU is that the Company will recognize revenue to represent the transfer of goods and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in such exchange. This will require the Company to identify contractual performance obligations and determine whether revenue should be recognized at a point in time or over time, based on when control of goods and services transfers to a customer. The Company’s revenue streams are recognized at a point in time.

| 15 |

The ASU requires the use of a new five-step model to recognize revenue from customer contracts. The five-step model requires that the Company (i) identify the contract with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies the performance obligation. The application of the five-step model to the revenue streams compared to the prior guidance did not result in significant changes in the way the Company records its revenue. Upon adoption, the Company evaluated its revenue recognition policy for all revenue streams within the scope of the ASU under previous standards and using the five-step model under the new guidance and confirmed that there were no differences in the pattern of revenue recognition.

The Company continues to derive its revenues from sales contracts with its customers with revenues being recognized upon delivery of products. Persuasive evidence of an arrangement is demonstrated via sales contract and invoice; and the sales price to the customer is fixed upon acceptance of the sales contract and there is no separate sales rebate, discount, or volume incentive. The Company recognizes revenue when title and ownership of the goods are transferred upon shipment to the customer by the Company to consider control of goods are transferred to its customer and collectability of payment is reasonably assured. The Company’s revenues are recognized at a point in time after all performance obligations are satisfied.

The Company’s customers are mainly agricultural cooperative company and distributors who then resell the Company’s products to individual farmers. Because the crop growing cycle usually takes approximately 3 to 9 months in the agricultural industry, for some co-ops and distributors, it will take approximately similar time frame of 3 to 9 months for farmers to harvest crops and to realize profits to repay them. As a result, for the sales contracts with these customers, the collectability of payment is highly dependent on the successful harvest of corps and the customers’ ability to collect money from farmers. The Company deemed the collectability of payment may not be reasonably assured until after the Company get paid. Collectability is a necessary condition for the contract to be accounted for to meet the criteria of the first step “identifying the contract with the customer” under the new revenue guidance in ASC 606. As a result, these sales contracts are not considered a contract under ASC 606, thus the shipments under these contracts are not recognized as revenue until all criteria for “identifying the contract with the customer” and revenue recognition are met using the five-step model.

Deferred Revenue and Deferred Cost of Goods Sold

Deferred revenue and deferred cost of goods sold result from transactions where the Company has shipped product for which all revenue recognition criteria under the five-step model have not yet been met. Though these contracts are not considered a contract under ASC 606, they are legally enforceable, and the Company has an unconditional and immediate right to payment after the Company has shipped products, therefore, the Company recognizes a receivable and a corresponding deferred revenue upon shipment. Deferred cost of goods sold includes direct inventory costs. Once all revenue recognition criteria under the five-step model have been met, the deferred revenues and associated cost of goods sold are recognized.

Income Taxes

The Company accounts for income taxes under the provisions of FASB ASC Topic 740, “Income Tax,” which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Deferred tax assets and liabilities are recognized for the future tax consequence attributable to the difference between the tax bases of assets and liabilities and their reported amounts in the financial statements. Deferred tax assets and liabilities are measured using the enacted tax rate expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company establishes a valuation when it is more likely than not that the assets will not be recovered.

| 16 |

FASB ASC Topic 740-10, “Accounting for Uncertainty in Income Taxes,” defines uncertainty in income taxes and the evaluation of a tax position as a two-step process. The first step is to determine whether it is more likely than not that a tax position will be sustained upon examination, including the resolution of any related appeals or litigation based on the technical merits of that position. The second step is to measure a tax position that meets the more-likely-than-not threshold to determine the amount of benefit to be recognized in the financial statements. A tax position is measured at the largest amount of benefit that is greater than 50 percent likelihood of being realized upon ultimate settlement. Tax positions that previously failed to meet the more-likely-than-not recognition threshold should be recognized in the first subsequent period in which the threshold is met. Previously recognized tax positions that no longer meet the more-likely-than-not criteria should be de-recognized in the first subsequent financial reporting period in which the threshold is no longer met. Penalties and interest incurred related to underpayment of income tax are classified as income tax expense in the period incurred. United States federal, state and local income tax returns prior to 2015 are not subject to examination by any applicable tax authorities. PRC tax returns filed for 2015, 2016 and 2017 are subject to examination by any applicable tax authorities.

Stock Based Compensation

The Company accounts for share-based compensation awards to employees in accordance with FASB ASC Topic 718, “Compensation – Stock Compensation”, which requires that share-based payment transactions with employees be measured based on the grant-date fair value of the equity instrument issued and recognized as compensation expense over the requisite service period. The Company records stock-based compensation expense at fair value on the grant date and recognizes the expense over the employee’s requisite service period. The Company’s expected volatility assumption is based on the historical volatility of Company’s stock. The expected life assumption is primarily based on historical exercise patterns and employee post-vesting termination behavior. The risk-free interest rate for the expected term of the option is based on the U.S. Treasury yield curve in effect at the time of grant. The expected dividend yield is based on the Company’s current and expected dividend policy.

The Company accounts for share-based compensation awards to non-employees in accordance with FASB ASC Topic 718 and FASB ASC Subtopic 505-50, “Equity-Based Payments to Non-employees”. Under FASB ASC Topic 718 and FASB ASC Subtopic 505-50, stock compensation granted to non-employees has been determined as the fair value of the consideration received or the fair value of equity instrument issued, whichever is more reliably measured and is recognized as an expense as the goods or services are received.

Foreign Currency Translation and Other Comprehensive Income

The Company uses United States dollars (“US Dollar” or “US$” or “$”) for financial reporting purposes. However, the Company maintains the books and records in its functional currency, Chinese Renminbi (“RMB”) and Hong Kong Dollar (“HKD”), being the functional currency of the economic environment in which its operations are conducted. In general, the Company translates its assets and liabilities into U.S. dollars using the applicable exchange rates prevailing at the balance sheet date, and the statement of comprehensive loss and the statement of cash flow are translated at average exchange rates during the reporting period. Equity accounts are translated at historical rates. Adjustments resulting from the translation of the Company’s financial statements are recorded as accumulated other comprehensive income.

Other comprehensive income for the three and six months ended June 30, 2018 and 2017 represented foreign currency translation adjustments and were included in the unaudited condensed consolidated statements of operations and comprehensive income.

The exchange rates used to translate amounts in RMB into U.S. Dollars for the purposes of preparing the unaudited condensed consolidated financial statements were as follows:

| As of June 30, 2018 | As of December 31, 2017 | |||||||

| Balance sheet items, except for equity accounts | 6.61843 | 6.5098 | ||||||

| 17 |

| Three months ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Items in the statements of comprehensive income | 6.3726 | 6.8619 | ||||||

| Six months ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Items in the statements of comprehensive income | 6.3659 | 6.8753 | ||||||

The exchange rates used to translate amounts in HKD into U.S. Dollars for the purposes of preparing the consolidated financial statements were as follows:

| As of June 30, 2018 | As of December 31, 2017 | |||||||

| Balance sheet items, except for equity accounts | 7.8465 | 7.8149 | ||||||

| Three months ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Items in the statements of comprehensive income | 7.8476 | 7.7855 | ||||||

| Six months ended June 30, | ||||||||

| 2018 | 2017 | |||||||

| Items in the statements of comprehensive income | 7.8372 | 7.7728 | ||||||

Earnings Per Common Share

Net income per common share is computed pursuant to section 260-10-45 of the FASB Accounting Standards Codification. Basic net income per common share is computed by dividing net income by the weighted average number of common shares outstanding during the period.

Diluted net income per common share is computed by dividing net income by the weighted average number of shares of common stock and potentially outstanding shares of common stock during the period to reflect the potential dilution that could occur from common shares issuable through contingent shares issuance arrangement, stock options or warrants. Common stock equivalents having an anti-dilutive effect on earnings per share are excluded from the calculation of diluted earnings per share.

Commitments and Contingencies

The Company follows subtopic 450-20 of the FASB Accounting Standards Codification to report accounting for contingencies. Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unassured claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or unassured claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s consolidated financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe, based upon information available at this time that these matters will have a material adverse effect on the Company’s financial position, results of operations or cash flows.

| 18 |

Cash Flow Reporting

The Company adopted paragraph 230-10-45-24 of the FASB Accounting Standards Codification for cash flows reporting, classifies cash receipts and payments according to whether they stem from operating, investing, or financing activities and provides definitions of each category, and uses the indirect or reconciliation method (“Indirect method”) as defined by paragraph 230-10-45-25 of the FASB Accounting Standards Codification to report net cash flow from operating activities by adjusting net income to reconcile it to net cash flow from operating activities by removing the effects of :

(a) all deferrals of past operating cash receipts and payments and all accruals of expected future operating cash receipts and payments;

(b) all items that are included in net income that do not affect operating cash receipts and payments.

The Company reports the reporting currency equivalent of foreign currency cash flows, using the current exchange rate at the time of the cash flows and the effect of exchange rate changes on cash held in foreign currencies is reported as a separate item in the reconciliation of beginning and ending balances of cash and cash equivalents and separately provides information about investing and financing activities not resulting in cash receipts or payments in the period pursuant to paragraph 830-230-45-1 of the FASB Accounting Standards Codification.

Recent Accounting Pronouncements

In February 2016, the FASB issued Accounting Standards Update No. 2016-02 (ASU 2016-02), Leases (Topic 842). ASU 2016-02 requires a lessee to record a right-of-use asset and a corresponding lease liability, initially measured at the present value of the lease payments, on the balance sheet for all leases with terms longer than 12 months, as well as the disclosure of key information about leasing arrangements. ASU 2016-02 requires recognition in the statement of operations of a single lease cost, calculated so that the cost of the lease is allocated over the lease term. ASU 2016-02 requires classification of all cash payments within operating activities in the statement of cash flows. Disclosures are required to provide the amount, timing and uncertainty of cash flows arising from leases. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. Early application is permitted. In July 2018, the FASB issued ASU 2018-10, Codification Improvements to Topic 842, Leases. The Company has not yet evaluated the impact of the adoption of ASU 2016-02 on the Company’s unaudited condensed consolidated financial statement presentation or disclosures.

In January 2017, the FASB issued ASU 2017-01, “Business Combinations (Topic 805): Clarifying the Definition of a Business.” The amendments in this guidance are clarifying the definition of a business to assist entities when determining whether an integrated set of assets and activities meets the definition of a business. The update provides that when substantially all the fair value of the assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. The guidance is effective for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. The adoption of this new guidance is not expected to have a material impact on our unaudited condensed consolidated financial statements.

In January 2017, the FASB issued ASU 2017-04—Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment. The amendments in this guidance to eliminate the requirement to calculate the implied fair value of goodwill to measure goodwill impairment charge (Step 2). As a result, an impairment charge will equal the amount by which a reporting unit’s carrying amount exceeds its fair value, not to exceed the amount of goodwill allocated to the reporting unit. An entity still has the option to perform the qualitative assessment for a reporting unit to determine if the quantitative impairment test is necessary. The amendment should be applied on a prospective basis. The guidance is effective for goodwill impairment tests in fiscal years beginning after December 15, 2019. Early adoption is permitted for goodwill impairment tests performed after January 1, 2017. The impact of this guidance for the Company will depend on the outcomes of future goodwill impairment tests.

In May 2017, the FASB issued Accounting Standards Update No. 2017-09 (ASU 2017-09), Compensation — Stock Compensation (Topic 718) Scope of Modification Accounting. The amendments in ASU 2017-09 provide guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting in Topic 718. The adoption of ASU 2017-09 which will become effective for annual periods beginning after December 15, 2017 and for interim periods within those annual periods, is not expected to have any impact on the Company’s unaudited condensed consolidated financial statement presentation or disclosures.

| 19 |

In July 2017, the FASB issued Accounting Standards Update No. 2017-11 (ASU 2017-11), Earnings Per Share (Topic 260); Distinguishing Liabilities from Equity (Topic 480); Derivatives and Hedging (Topic 815): (Part I) Accounting for Certain Financial Instruments with Down Round Features, (Part II) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception. The amendments in ASU 2017-11 change the classification analysis of certain equity-linked financial instruments (or embedded features) with down round features. When determining whether certain financial instruments should be classified as liabilities or equity instruments, a down round feature no longer precludes equity classification when assessing whether the instrument is indexed to an entity’s own stock. The adoption of ASU 2017-11 which will become effective for annual periods beginning after December 15, 2018 and for interim periods within those annual periods. The Company elected to early adopt ASU 2017-11 when preparing these unaudited condensed consolidated financial statements and no effect on the Company’s unaudited condensed consolidated financial statements.

In February 2018, the FASB issued Accounting Standards Update No. 2018-02 (ASU 2018-02), Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income. The amendments in this Update affect any entity that is required to apply the provisions of Topic 220, Income Statement – Reporting Comprehensive Income, and has items of other comprehensive income for which the related tax effects are presented in other comprehensive income as required by GAAP. The amendments in this Update are effective for all entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption of the amendments in this Update is permitted, including adoption in any interim period, (1) for public business entities for reporting periods for which financial statements have not yet been issued and (2) for all other entities for reporting periods for which financial statements have not yet been made available for issuance. The amendments in this Update should be applied either in the period of adoption or retrospectively to each period (or periods) in which the effect of the change in the U.S. federal corporate income tax rate in the Tax Cuts and Jobs Act is recognized. The Company does not believe the adoption of this ASU would have a material effect on the Company’s unaudited condensed consolidated financial statements.

Management does not believe that any other recently issued, but not yet effective, authoritative guidance, if currently adopted, would have a material impact on the Company’s unaudited condensed consolidated financial statement presentation or disclosures.

4. Accounts Receivable, net

As of June 30, 2018 and December 31, 2017, we had $6,993,742 and $28,620, respectively, of accounts receivable from the Company’s customers. The Company’s current payment terms on these customers are ranging typically from 60 days to 9 months after receipts of the goods depending on the creditworthiness of these customers. These customers are either agricultural cooperative company or distributors who then resell the Company’s products to individual farmers.

The Company’s provision on allowance for doubtful accounts is based on historical collection experience, the economic environment, trends in the microbial fertilizer industry, and a review of the current status of trade accounts receivable and come up with an aging allowance method. Currently, the Company provides a provision of 1%-6% of the allowance for doubtful accounts for accounts receivable balance that are more than 180 days old but less than one year old, 50% of the allowance for doubtful accounts for accounts receivable from one to one and half years old, 100% of the allowance for doubtful accounts for accounts receivable beyond one and half years old, plus additional amount as necessary, which the Company’s collection department had determined the collection of the full amount is remote with the approval from its management to provide a 100% provision allowance for doubtful accounts. The Company’s management has continued to evaluate the reasonableness of the valuation allowance policy and update it if necessary.

| 20 |

Accounts receivable consisted of the following:

| June 30, 2018 | December 31, 2017 | |||||||

| Accounts receivable | $ | 6,993,742 | $ | 83,860 | ||||

| Less: Allowance for doubtful accounts | - | (55,240 | ) | |||||

| Accounts receivable, net | $ | 6,993,742 | $ | 28,620 | ||||

5. Prepaid Expense

Prepaid expenses consisted of the following:

| Notes | June 30, 2018 | December 31, 2017 | ||||||||||

| Prepaid office rent | $ | 20,244 | $ | 41,487 | ||||||||

| Prepaid license Fee (for fertilizer) | - | 26,115 | ||||||||||

| Prepaid government filing expense | 12,000 | 5,000 | ||||||||||

| Prepaid consulting expenses | (1) | 3,065,863 | 2,392,273 | |||||||||

| Others | 20,121 | 9,397 | ||||||||||

| Total | $ | 3,118,208 | $ | 2,474,272 | ||||||||

(1) Prepaid consulting expense for issuance of common stock for prepaid services. Pursuant to the indemnification terms of the services agreements, the Company has the rights to demand the full services being accomplished as scheduled during the service period and to enforce the consultants to pay pro-rata penalties if the consultants do not fulfill the contract services within the services periods. As of June 30, 2018, the Company evaluated the performance of the consultants and concluded all the contracts were on schedule of delivery. The company amortized the consulting fee over the service periods per agreements based on the progress of services delivered. For the three months ended June 30, 2018 and 2017, the amortization of consulting expense was $679,925 and $152,652, respectively. For the six months ended June 30, 2018 and 2017, the amortization of consulting expense was $1,268,460 and $309,702, respectively.

6. Advance to suppliers

Advance to suppliers are mainly funds deposited for future raw material purchases. As a common practice in China’s agriculture industry, many of these vendors require a certain amount to be deposited with them as a guarantee that the Company will complete its purchases on a timely basis as well as securing the current agreed upon purchase price. Since the Company anticipates the price of raw materials is on the rise in 2018, it entered large amount of purchase agreements with its major raw materials supplier and made prepayments in advance of securing a lower purchase price and timely delivery. As of June 30, 2018 and December 31, 2017, such advance to suppliers was $6,097,017 and $12,660,793, respectively.

7. Inventory

Inventory consisted of the following:

| June 30, 2018 | December 31, 2017 | |||||||

| Raw materials | $ | 1,411,271 | $ | 2,745,991 | ||||

| Finished goods | 261,381 | - | ||||||

| Packing materials | 33,096 | - | ||||||

| Total | $ | 1,705,748 | $ | 2,745,991 | ||||

| 21 |

8. Property, Plant and Equipment

Property, plant and equipment, net consisted of the following:

| June 30, 2018 | December 31, 2017 | |||||||

| Property, Plant and Equipment | ||||||||

| Office equipment | $ | 17,581 | $ | 15,899 | ||||

| Furniture | 24,444 | 23,331 | ||||||

| Leasehold improvement | 90,105 | 91,609 | ||||||

| Construction in progress | 26,290 | 26,729 | ||||||

| Others | 665 | 1,106 | ||||||

| Property, plant and equipment - total | $ | 159,085 | $ | 158,674 | ||||

| Less: accumulated depreciation | (95,275 | ) | (68,174 | ) | ||||

| Property, plant and equipment - net | $ | 63,810 | $ | 90,500 | ||||

Depreciation expense was $4,817 and $8,318 for the three months ended June 30, 2018 and 2017, and $20,451 and $17,787 for the six months ended June 30, 2018 and 2017, respectively.

9. Deposit for Long-Term Investment

On June 8, 2017, Kiwa Hebei entered an equity purchase agreement with the shareholders of Yantai Peng Hao New Materials Technology Co. Ltd. (“Peng Hao”) to acquire 100% interest in Peng Hao for approximately RMB 15,000,000 (approximately US$ 2.3 million). As of June 30, 2018, Kiwa Hebei has made deposit payment of RMB 5,000,000 (approximately $0.8 million). Due to certain administrative approval process from the Chinese government, the closing of the equity purchase agreement has been delayed. RMB 6,500,000 (approximately $1.0 million) will be paid upon completion of the land use rights ownership transfer and RMB 3,500,000 (approximately $0.5 million) will be paid upon completion of the business licenses transfer. The Company estimated the completion of the transfer will be sometime in March 2019.

10. Salaries payable

| June 30, 2018 | December 31, 2017 | |||||||

| Ms. Yvonne Wang (“Ms. Wang”) | $ | 217,000 | $ | 175,000 | ||||

| Other Employees | 270,113 | 116,401 | ||||||

| Total | $ | 487,113 | $ | 291,401 | ||||

No salary was paid to Ms. Wang since December 2015. The Company expects to be in negotiations with Ms. Wang to settle these obligations.

11. Related Party Transactions

Due from related parties – non-trade

Amounts due from related parties consisted of the following as of June 30, 2018 and December 31, 2017:

| Item | Nature | Notes | June 30, 2018 | December 31, 2017 | ||||||||

| Mr. Wei Li | Non-trade | (1) | 19,017 | |||||||||

| Xiaoqiang Yu | Non-trade | (2) | 23,472 | |||||||||

| Total | $ | 23,472 | $ | 19,017 | ||||||||

(1) Mr. Wei Li

During the year ended December 31, 2017, Mr. Wei Li, the former chairman and CEO, founder and major shareholder of the Company, obtained a cash advance from the Company for operational purpose . The balance was repaid in March 2018.

(2) Xiaoqiang Yu

During the three months ended June 30, 2018, Mr. Xiaoqiang Yu, the general manager of the operations division of the Company, obtained a cash advance from the Company for operational purpose.

| 22 |

Due to related parties– non-trade

Amounts due to related parties consisted of the following as of June 30, 2018 and December 31, 2017:

| Item | Nature | Notes | June 30, 2018 | December 31, 2017 | ||||||||

| Ms. Wang | Non-trade | (1) | 490,012 | 320,199 | ||||||||

| Ms. Feng Li (“Ms. Li”) | Non-trade | (2) | 37,773 | - | ||||||||

| Total amount due to related parties | $ | 527,785 | $ | 320,199 | ||||||||

(1) Ms. Wang

Effective November 20, 2015, the Company appointed Ms. Wang as the Chairman of the Board and effective August 11, 2016, the Company’s Board of Directors has assigned Ms. Wang the additional titles of Acting President, Acting Chief Executive Officer and Acting Chief Financial Officer. On April 15, 2018, Ms. Wang turned over the Acting Chief Financial Officer to her successor.

During the six months ended June 30, 2018 and 2017, Ms. Wang paid various expenses on behalf of the Company. As of June 30, 2018 and December 31, 2017, the amount due to Ms. Wang was $490,012 and $320,199, respectively.

(2) Ms. Feng Li

Ms. Feng Li is a member of the Company’s board of directors and shareholder of the Company. Ms. Li held approximately 20% of the Company’s Common Stock and 50% of the Company’s Series A Preferred Stock. Ms. Feng Li paid various expenses on behalf of the Company. As of June 30, 2018 and December 31, 2017, the amount due to Ms. Feng Li was $37,773 and $0, respectively.

12. Convertible Notes Payable

Convertible notes payable consisted of the following:

| June 30, 2018 | December 31, 2017 | |||||||

| 6% secured convertible notes – FirsTrust Group Inc. (1) | $ | 107,562 | $ | 121,562 | ||||

| 15% convertible notes- Mr. Geng Liu (1) | 151,093 | 153,615 | ||||||

| 15% convertible notes- Mr. Junwei Zheng (2) | 831,012 | 844,881 | ||||||

| Less: notes discount | (243,522 | ) | (386,776 | ) | ||||

| Convertible notes payable - total | 846,145 | 733,282 | ||||||

| Non-current | (587,490 | ) | (460,082 | ) | ||||

| Current | $ | 258,655 | $ | 273,200 | ||||

| 23 |

(1) Convertible Notes Payable - Current

Convertible notes payable - current consists of $107,562 of 6% secured convertible notes issued to FirsTrust Group Inc. on June 29, 2006 and $151,093 (face amount $151,093 net of discount of $0) of 15% convertible note issued to Mr. Geng Liu on January 17, 2017.

6% secured convertible notes – FirsTrust Group Inc.

On June 29, 2006, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with six institutional investors (collectively, the “Purchasers”) for the issuance and sale of 6% secured convertible notes, due three years from the date of issuance, in the aggregate principal amount of $2,450,000 (the “6% Convertible Notes”), convertible into shares of the Company’s common stock.

On August 12, 2013, the Company, entered into a Settlement Agreement and Release (the “Release”) with the holders (the “Holders”) of the “6% Convertible Notes” in the aggregate principal amount of $2,000,000. Pursuant to the terms of the Release, the Company paid the Holders $75,000 for a full release, including the forgiveness of past defaults of unpaid principal amounts, interests and penalties. During the course of the time, certain notes had been converted as well. On March 18, 2008, FirsTrust Group, Inc. (“FirsTrust”) purchased the three remaining 6% Convertible Notes, totaling $168,000 ($59,100, $50,400 and $59,100 respectively), from Nite Capital, one of the six institutional investors which purchased a total of $300,000 of the Note in three tranches ($105,000, $90,000, $105,000 respectively), for a cash payment of $100,000. After the Release and conversion, FirsTrust is the only holder of the outstanding 6% Convertible Note with outstanding principal amount of $150,250.

On June 29, 2009, the 6% Notes were due. The Company informed the Purchasers of its inability to repay the outstanding balance on the due date. Therefore, the 6% Notes are in default and the default interest rate of 15% per annum is being charged on the 6% Notes.