UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10503

Name of Fund: BlackRock New York Municipal 2018 Term Trust (BLH)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock New York Municipal 2018 Term Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 12/31/2013

Date of reporting period: 12/31/2013

Item 1 – Report to Stockholders

| ANNUAL REPORT |  |

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Table of Contents

| Page | ||||||

Dear Shareholder |

3 | |||||

Annual Report: |

||||||

Municipal Market Overview |

4 | |||||

The

Benefits and Risks of Leveraging |

5 | |||||

Trust Summaries |

6 | |||||

Financial Statements: |

||||||

Schedules of Investments |

12 | |||||

Statements of Assets and Liabilities |

22 | |||||

Statements of Operations |

23 | |||||

Statements of Changes in Net Assets |

24 | |||||

Financial Highlights |

25 | |||||

Notes to Financial Statements |

28 | |||||

Report of Independent Registered Public Accounting Firm |

35 | |||||

Automatic Dividend Reinvestment Plan |

36 | |||||

Officers and Trustees |

37 | |||||

Additional Information |

40 |

| 2 | ANNUAL REPORT | DECEMBER 31, 2013 |

| Dear Shareholder |

President, BlackRock Advisors, LLC

|

| “While monetary policy was the main driving force behind the rally in risk assets, it was also the main culprit for the bouts of volatility during the year.” |

President, BlackRock Advisors, LLC

Total Returns as of December 31, 2013

| 6-month | 12-month | |||||||||

US

large cap equities (S&P 500® Index) |

16.31 | % | 32.39 | % | ||||||

US

small cap equities (Russell 2000® Index) |

19.82 | 38.82 | ||||||||

International equities (MSCI Europe, Australasia, Far East Index) |

17.94 | 22.78 | ||||||||

Emerging market equities (MSCI Emerging Markets Index) |

7.70 | (2.60 | ) | |||||||

3-month Treasury bill (BofA Merrill Lynch 3-Month US Treasury Bill Index) |

0.03 | 0.07 | ||||||||

US

Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index) |

(3.10 | ) | (7.83 | ) | ||||||

US

investment grade bonds (Barclays US Aggregate Bond Index) |

0.43 | (2.02 | ) | |||||||

Tax-exempt municipal bonds (S&P Municipal Bond Index) |

0.00 | (2.55 | ) | |||||||

US

high yield bonds (Barclays US Corporate High Yield 2% Issuer Capped Index) |

5.94 | 7.44 | ||||||||

THIS PAGE NOT PART OF YOUR FUND

REPORT |

3 |

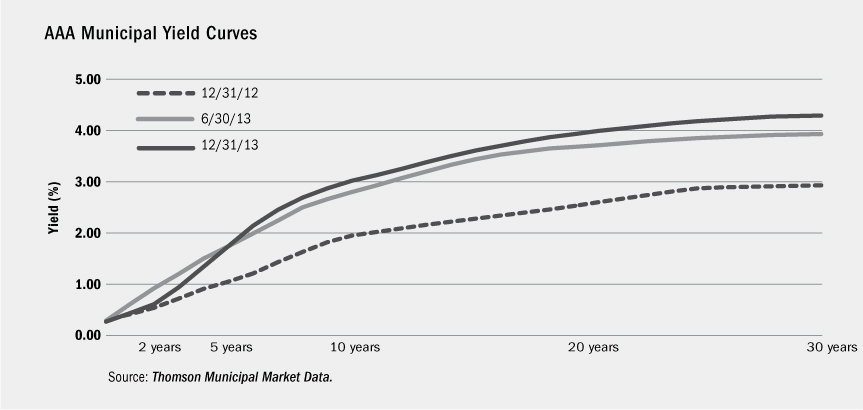

| Municipal Market Overview |

For the Reporting Period Ended December 31, 2013

|

S&P Municipal Bond Index Total Returns as of December 31, 2013 6 months: 0.00% 12 months: (2.55)% |

| 4 | ANNUAL REPORT | DECEMBER 31, 2013 |

| The Benefits and Risks of Leveraging |

| |

|

Percent of Economic Leverage |

||||

BJZ |

21 | % | ||||

BPK

|

23 | % | ||||

BLH |

23 | % | ||||

| ANNUAL REPORT | DECEMBER 31, 2013 | 5 |

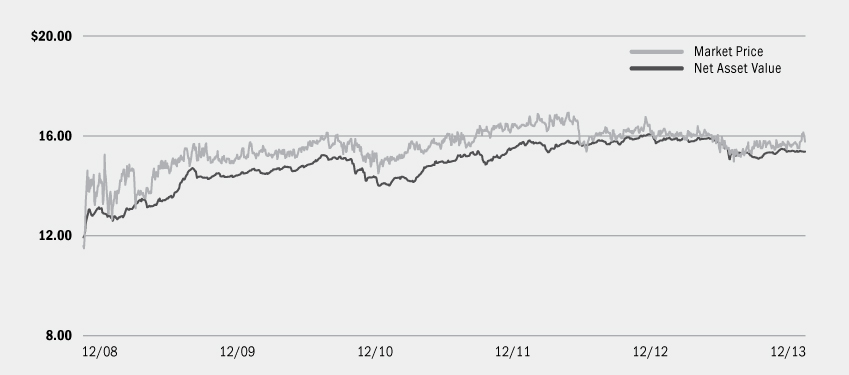

| Trust Summary as of December 31, 2013 | BlackRock California

Municipal 2018 Term Trust |

Trust Overview

Performance

• |

For the 12 months ended December 31, 2013, the Trust returned 1.21% based on market price and 1.07% based on NAV. The Trust’s peer group of closed-end funds in the Lipper California Municipal Debt Funds category posted an average return of (11.17)% based on market price and (5.70)% based on NAV for the same period. All returns reflect reinvestment of dividends. The Trust’s premium to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion pertains to performance based on NAV. |

• |

During the period, the Trust benefited from income generated on its fully invested portfolio of tax-exempt municipal bonds and its exposure to pre-refunded bonds. The Trust is scheduled to mature on or about December 31, 2018 and thus holds securities that will mature close to that date. The Trust’s shorter maturity profile was an advantage in comparison to its Lipper category peers that typically hold longer-dated issues as rate increases were significantly larger further out on the yield curve, driving prices lower on longer-dated issues. |

• |

The Trust’s duration (sensitivity to interest rate movements) and exposure to zero-coupon bonds were detractors from performance in the rising interest rate environment. The Trust’s exposure to Puerto Rico debt also detracted from results as credit spreads on Puerto Rico bonds widened materially during the period due to investors’ lack of confidence and a weak local economy. However, it is important to note that the Trust held only a small exposure to non-escrowed Puerto Rico securities and these positions were eliminated during the period. Therefore, the impact of the deterioration in Puerto Rico bond prices on Trust performance was minimal. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

Trust Information

Symbol on New York Stock Exchange (“NYSE”) |

BJZ |

|||||

Initial Offering Date |

October 26, 2001 |

|||||

Termination Date (on or about) |

December 31, 2018 |

|||||

Yield on Closing Market Price as of December 31, 2013 ($15.77)1 |

3.90% |

|||||

Tax

Equivalent Yield2 |

7.95% |

|||||

Current Monthly Distribution per Common Share3 |

$0.0513 |

|||||

Current Annualized Distribution per Common Share3 |

$0.6156 |

|||||

Economic Leverage as of December 31, 20134 |

21% |

|||||

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal and state tax rate of 50.93%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents Preferred Shares as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to Preferred Shares, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 5. |

| 6 | ANNUAL REPORT | DECEMBER 31, 2013 |

| BlackRock California

Municipal 2018 Term Trust |

Market Price and Net Asset Value Per Share Summary

| |

12/31/13 |

|

12/31/12 |

|

Change |

|

High |

|

Low |

|||||||||||||

Market Price |

$ | 15.77 | $ | 16.21 | (2.71 | )% | $ | 16.49 | $ | 14.97 | ||||||||||||

Net Asset Value |

$ | 15.36 | $ | 15.81 | (2.85 | )% | $ | 15.92 | $ | 15.06 | ||||||||||||

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Long-Term Investments

| Sector Allocation |

|

12/31/13 |

|

12/31/12 |

||||||

County/City/Special District/School District |

22 | % | 25 | % | ||||||

Transportation |

21 | 17 | ||||||||

Utilities |

20 | 18 | ||||||||

State |

11 | 12 | ||||||||

Health |

9 | 13 | ||||||||

Corporate |

8 | 8 | ||||||||

Education |

7 | 5 | ||||||||

Housing |

2 | 2 | ||||||||

| Credit Quality

Allocation1 |

|

12/31/13 |

|

12/31/12 |

||||||

AAA/Aaa |

2 | % | 2 | % | ||||||

AA/Aa |

62 | 47 | ||||||||

A |

31 | 27 | ||||||||

BBB/Baa |

5 | 19 | ||||||||

Not Rated |

— | 5 | 2 | |||||||

| 1 | Using the higher of Standard & Poor’s (”S&P”) or Moody’s Investors Service (“Moody’s”) ratings. |

| 2 | The investment advisor has deemed certain of these securities to be of investment grade quality. As of December 31, 2012, the market value of these securities was $3,063,184, representing 2% of the Trust’s long-term investments. |

| Call/Maturity

Schedule3 |

||||||||

Calendar Year Ended December 31, |

||||||||

2014 |

28 | % | ||||||

2015 |

— | |||||||

2016 |

— | |||||||

2017 |

3 | |||||||

2018 |

33 | |||||||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| ANNUAL REPORT | DECEMBER 31, 2013 | 7 |

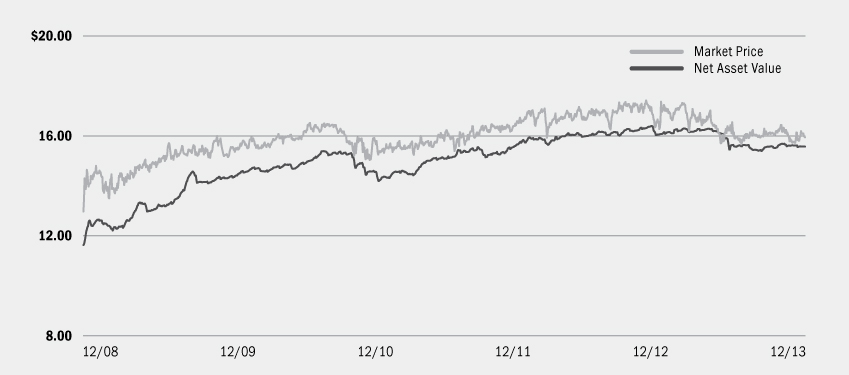

| Trust Summary as of December 31, 2013 | BlackRock Municipal 2018

Term Trust |

Trust Overview

Performance

• |

For the 12 months ended December 31, 2013, the Trust returned 0.88% based on market price and 1.55% based on NAV. The Trust’s peer group of closed-end funds in the Lipper Intermediate Municipal Debt Funds category posted an average return of (7.05)% based on market price and (3.21)% based on NAV for the same period. All returns reflect reinvestment of dividends. The Trust’s premium to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion pertains to performance based on NAV. |

• |

During the period, the Trust benefited from income generated on its fully invested portfolio of tax-exempt municipal bonds and its exposure to pre-refunded bonds. The Trust is scheduled to mature on or about December 31, 2018 and thus holds securities that will mature close to that date. The Trust’s shorter maturity profile was an advantage in comparison to its Lipper category peers that typically hold longer-dated issues as rate increases were significantly larger further out on the yield curve, driving prices lower on longer-dated issues. |

• |

The Trust’s duration (sensitivity to interest rate movements) and exposure to zero-coupon bonds were detractors from performance in the rising interest rate environment. The Trust’s exposure to Puerto Rico debt also detracted from results as credit spreads on Puerto Rico bonds widened materially during the period due to investors’ lack of confidence and a weak local economy. However, it is important to note that the Trust held only a small exposure to Puerto Rico securities and these positions were eliminated during the period. Therefore, the impact of the deterioration in Puerto Rico bond prices on Trust performance was minimal. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

Trust Information

Symbol on NYSE |

BPK |

|||||

Initial Offering Date |

October 26, 2001 |

|||||

Termination Date (on or about) |

December 31, 2018 |

|||||

Yield on Closing Market Price as of December 31, 2013 ($15.94)1 |

4.59% |

|||||

Tax

Equivalent Yield2 |

8.11% |

|||||

Current Monthly Distribution per Common Share3 |

$0.061 |

|||||

Current Annualized Distribution per Common Share3 |

$0.732 |

|||||

Economic Leverage as of December 31, 20134 |

23% |

|||||

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal tax rate of 43.4%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents Preferred Shares and TOBs as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to Preferred Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 5. |

| 8 | ANNUAL REPORT | DECEMBER 31, 2013 |

| BlackRock Municipal 2018

Term Trust |

Market Price and Net Asset Value Per Share Summary

| |

12/31/13 |

|

12/31/12 |

|

Change |

|

High |

|

Low |

|||||||||||||

Market Price |

$ | 15.94 | $ | 16.56 | (3.74 | )% | $ | 17.39 | $ | 15.58 | ||||||||||||

Net Asset Value |

$ | 15.57 | $ | 16.07 | (3.11 | )% | $ | 16.30 | $ | 15.39 | ||||||||||||

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Long-Term Investments

| Sector Allocation |

|

12/31/13 |

|

12/31/12 |

||||||

County/City/Special District/School District |

17 | % | 17 | % | ||||||

Corporate |

16 | 18 | ||||||||

Transportation |

15 | 13 | ||||||||

State |

14 | 13 | ||||||||

Utilities |

12 | 11 | ||||||||

Housing |

10 | 10 | ||||||||

Health |

9 | 11 | ||||||||

Tobacco |

4 | 5 | ||||||||

Education |

3 | 2 | ||||||||

| Credit Quality

Allocation1 |

|

12/31/13 |

|

12/31/12 |

||||||

AAA/Aaa |

15 | % | 13 | % | ||||||

AA/Aa |

18 | 26 | ||||||||

A |

37 | 28 | ||||||||

BBB/Baa |

19 | 23 | ||||||||

BB/Ba |

3 | 3 | ||||||||

B |

1 | 2 | ||||||||

Not Rated2 |

7 | 5 | ||||||||

| 1 | Using the higher of S&P’s or Moody’s ratings. |

| 2 | The investment advisor has deemed certain of these securities to be of investment grade quality. As of December 31, 2013 and December 31, 2012, the market value of these securities was $3,110,215, representing less than 1%, and $5,352,592, representing 1%, respectively, of the Trust’s long-term investments. |

| Call/Maturity

Schedule3 |

||||||||

Calendar Year Ended December 31, |

||||||||

2014 |

3 | % | ||||||

2015 |

10 | |||||||

2016 |

7 | |||||||

2017 |

6 | |||||||

2018 |

45 | |||||||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| ANNUAL REPORT | DECEMBER 31, 2013 | 9 |

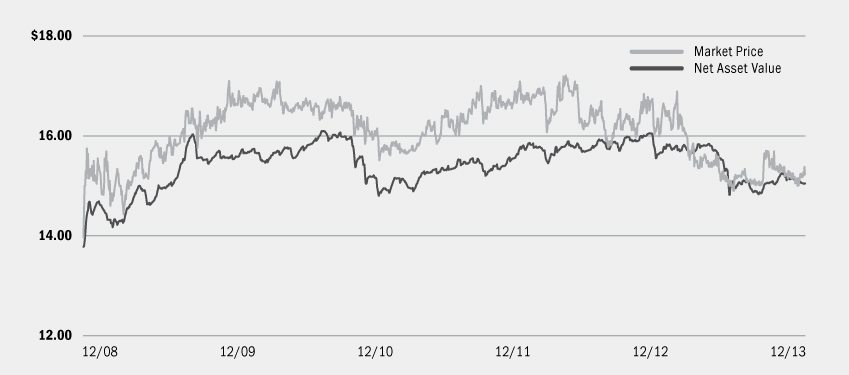

| Trust Summary as of December 31, 2013 | BlackRock New York

Municipal 2018 Term Trust |

Trust Overview

Performance

• |

For the 12 months ended December 31, 2013, the Trust returned (1.55)% based on market price and (0.36)% based on NAV. The Trust’s peer group of closed-end funds in the Lipper New York Municipal Debt Funds category posted an average return of (13.67)% based on market price and (6.92)% based on NAV for the same period. All returns reflect reinvestment of dividends. The Trust’s premium to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion pertains to performance based on NAV. |

• |

During the period, the Trust’s duration (sensitivity to interest rate movements) and exposure to zero-coupon bonds were detractors from performance in the rising interest rate environment. The Trust’s exposure to Puerto Rico debt also detracted from results as credit spreads on Puerto Rico bonds widened materially during the period due to investors’ lack of confidence and a weak local economy. However, it is important to note that the Trust held only a small exposure to Puerto Rico securities and these positions were eliminated during the period. Therefore, the impact of the deterioration in Puerto Rico bond prices on Trust performance was minimal. |

• |

The Trust benefited from income generated on its fully invested portfolio of tax-exempt municipal bonds and its exposure to pre-refunded bonds. The Trust is scheduled to mature on or about December 31, 2018 and thus holds securities that will mature close to that date. The Trust’s shorter maturity profile was an advantage in comparison to its Lipper category peers that typically hold longer-dated issues as rate increases were significantly larger further out on the yield curve, driving prices lower on longer-dated issues. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

Trust Information

Symbol on NYSE |

BLH |

|||||

Initial Offering Date |

October 26, 2001 |

|||||

Termination Date (on or about) |

December 31, 2018 |

|||||

Yield on Closing Market Price as of December 31, 2013 ($15.23)1 |

3.57% |

|||||

Tax

Equivalent Yield2 |

7.24% |

|||||

Current Monthly Distribution per Common Share3 |

$0.0453 |

|||||

Current Annualized Distribution per Common Share3 |

$0.5436 |

|||||

Economic Leverage as of December 31, 20134 |

23% |

|||||

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal and state tax rate of 50.67%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents Preferred Shares as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to Preferred Shares, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging on page 5. |

| 10 | ANNUAL REPORT | DECEMBER 31, 2013 |

| BlackRock New York

Municipal 2018 Term Trust |

Market Price and Net Asset Value Per Share Summary

| |

12/31/13 |

|

12/31/12 |

|

Change |

|

High |

|

Low |

|||||||||||||

Market Price |

$ | 15.23 | $ | 16.05 | (5.11 | )% | $ | 16.94 | $ | 14.90 | ||||||||||||

Net Asset Value |

$ | 15.05 | $ | 15.67 | (3.96 | )% | $ | 15.84 | $ | 14.82 | ||||||||||||

Market Price and Net Asset Value History For the Past Five Years

Overview of the Trust’s Long-Term Investments

| Sector Allocation |

|

12/31/13 |

|

12/31/12 |

||||||

County/City/Special District/School District |

39 | % | 35 | % | ||||||

Transportation |

20 | 16 | ||||||||

Education |

13 | 17 | ||||||||

Housing |

9 | 3 | ||||||||

State |

7 | 13 | ||||||||

Utilities |

6 | 8 | ||||||||

Health |

5 | 6 | ||||||||

Corporate |

1 | 2 | ||||||||

| Credit Quality

Allocation1 |

|

12/31/13 |

|

12/31/12 |

||||||

AAA/Aaa |

15 | % | 18 | % | ||||||

AA/Aa |

51 | 47 | ||||||||

A |

21 | 18 | ||||||||

BBB/Baa |

11 | 6 | ||||||||

Not Rated |

2 | 11 | 2 | |||||||

| 1 | Using the higher of S&P’s or Moody’s ratings. |

| 2 | The investment advisor has deemed certain of these securities to be of investment grade quality. As of December 31, 2012, the market value of these securities was $2,008,600, representing 2% of the Trust’s long-term investments. |

| Call/Maturity

Schedule3 |

||||||||

Calendar Year Ended December 31, |

||||||||

2014 |

4 | % | ||||||

2015 |

8 | |||||||

2016 |

2 | |||||||

2017 |

2 | |||||||

2018 |

54 | |||||||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| ANNUAL REPORT | DECEMBER 31, 2013 | 11 |

| Schedule of Investments December 31, 2013 | BlackRock California

Municipal 2018 Term Trust (BJZ) (Percentages shown are based on Net Assets) |

| Municipal Bonds |

Par (000) |

Value | |||||||||

California — 114.9% |

|||||||||||

Corporate — 8.8% |

|||||||||||

California Pollution Control Financing Authority, RB, Mandatory Put Bonds, AMT (a): |

|||||||||||

Republic Services, Inc. Project, Series B, 5.25%, 6/01/23 |

$ | 2,020 | $ | 2,148,654 | |||||||

Waste Management, Inc. Project, Series A, 5.13%, 7/01/31 |

4,000 | 4,054,160 | |||||||||

California Pollution Control Financing Authority, Refunding RB: |

|||||||||||

Mandatory Put Bonds, Republic Services, Inc. Project, Series C, AMT, 5.25%, 6/01/23 (a) |

2,030 | 2,159,291 | |||||||||

San Diego Gas & Electric, Series A, 5.90%, 6/01/14 |

345 | 353,038 | |||||||||

| 8,715,143 | |||||||||||

County/City/Special District/School District — 25.5% |

|||||||||||

City & County of San Francisco California, GO, Refunding, Series R-1, 5.00%, 6/15/18 |

1,700 | 1,991,873 | |||||||||

City of Vista California, COP, Refunding, Community Projects (NPFGC): |

|||||||||||

5.00%, 5/01/19 |

1,000 | 1,085,480 | |||||||||

4.75%, 5/01/21 |

1,115 | 1,173,058 | |||||||||

County of San Bernardino California, Special Tax Bonds, Community Facilities District No. 2002-1: |

|||||||||||

5.35%, 9/01/17 |

105 | 106,533 | |||||||||

5.50%, 9/01/18 |

245 | 248,459 | |||||||||

Fontana Public Finance Authority California, Refunding, Tax Allocation Bonds, North Fontana Redevelopment Project, Series A (AGM), 5.25%,

9/01/18 |

3,395 | 3,398,633 | |||||||||

Irvine Unified School District California, Refunding, Special Tax Bonds, Community Facilities District No. 86-1 (AGM), 5.25%,

9/01/18 |

5,000 | 5,680,450 | |||||||||

Lathrop Financing Authority, RB, Water Supply Project, 5.80%, 6/01/21 |

470 | 472,688 | |||||||||

Lodi Unified School District, GO, Refunding (AGM), 4.00%, 8/01/18 |

1,000 | 1,107,730 | |||||||||

Los

Angeles Community College District California, GO, Election of 2001, Series E-1, 4.00%, 8/01/18 |

200 | 225,644 | |||||||||

Los

Angeles Unified School District California, GO: |

|||||||||||

Election of 2004, Series H (AGM), 5.00%, 7/01/18 |

600 | 682,344 | |||||||||

Series I, 5.00%, 7/01/20 |

2,000 | 2,338,880 | |||||||||

| Municipal Bonds |

Par (000) |

Value | |||||||||

California (continued) |

|||||||||||

County/City/Special District/School District (concluded) |

|||||||||||

Los

Banos Unified School District, GO, Election of 2008 (AGM), 5.00%, 8/01/18 |

$ | 475 | $ | 541,733 | |||||||

San

Marcos Unified School District, GO, CAB (b): |

|||||||||||

0.00%, 8/01/17 |

385 | 363,367 | |||||||||

0.00%, 8/01/18 |

500 | 454,890 | |||||||||

Santa Clara Unified School District, GO, Election of 2004, Series A, 5.00%, 7/01/18 |

1,690 | 1,978,601 | |||||||||

Stockton East Water District, COP, Refunding, Series B (NPFGC), 0.00%, 4/01/19 (b) |

4,590 | 3,379,250 | |||||||||

| 25,229,613 | |||||||||||

Education — 7.8% |

|||||||||||

California State Public Works Board, Refunding RB, Trustees of the California State University, Series A, 5.00%, 10/01/17 |

2,415 | 2,423,622 | |||||||||

University of California, Refunding RB: |

|||||||||||

General, Series AB, 5.00%, 5/15/19 |

2,500 | 2,956,900 | |||||||||

Series S, 5.00%, 5/15/18 |

2,000 | 2,339,660 | |||||||||

| 7,720,182 | |||||||||||

Health — 11.1% |

|||||||||||

ABAG Finance Authority for Nonprofit Corps., RB, San Diego Hospital Association, Series C, 5.38%, 3/01/21 |

2,100 | 2,113,083 | |||||||||

California Health Facilities Financing Authority, RB: |

|||||||||||

Scripps Health, Series A, 5.00%, 10/01/18 |

750 | 873,818 | |||||||||

Sutter Health, Series B, 5.00%, 8/15/19 |

1,430 | 1,682,023 | |||||||||

California Health Facilities Financing Authority, Refunding RB, Sutter Health, Series D, 5.00%, 8/15/18 |

515 | 600,536 | |||||||||

California Statewide Communities Development Authority, RB, Kaiser Permanente, Series E-1, 5.00%, 4/01/44 (a) |

4,700 | 5,317,627 | |||||||||

California Statewide Communities Development Authority, Refunding RB, Episcopal Communities & Services, 5.00%, 5/15/18 |

300 | 333,912 | |||||||||

| 10,920,999 | |||||||||||

Housing — 2.5% |

|||||||||||

California HFA, RB, Series A (Fannie Mae): |

|||||||||||

3.20%, 8/01/18 |

805 | 847,955 | |||||||||

3.50%, 2/01/19 |

1,580 | 1,662,966 | |||||||||

| 2,510,921 | |||||||||||

Portfolio Abbreviations

To simplify the listings of portfolio holdings in the Schedules of Investments, the names and descriptions of many of the securities have been

abbreviated according to the following list: |

AGC AGM AMBAC AMT ARB CAB COP EDA Fannie Mae GO HDA |

Assured Guarantee Corp. Assured Guaranty Municipal Corp. American Municipal Bond Assurance Corp. Alternative Minimum Tax (subject to) Airport Revenue Bonds Capital Appreciation Bonds Certificates of Participation Economic Development Authority Federal National Mortgage Association General Obligation Bonds Housing Development Authority |

HFA LRB IDA IDB ISD NPFGC PSF-GTD Radian RB S/F SONYMA |

Housing Finance Agency Lease Revenue Bonds Industrial Development Authority Industrial Development Board Independent School District National Public Finance Guarantee Corp. Permanent School Fund Guaranteed Radian Guaranty, Inc. Revenue Bonds Single-Family State of New York Mortgage Agency |

| 12 | ANNUAL REPORT | DECEMBER 31, 2013 |

| Schedule of Investments (continued) | BlackRock California

Municipal 2018 Term Trust (BJZ) (Percentages shown are based on Net Assets) |

| Municipal Bonds |

Par (000) |

Value | |||||||||

California (continued) |

|||||||||||

State — 11.7% |

|||||||||||

California State Public Works Board, Refunding RB, California Community Colleges, Series A, 5.00%, 12/01/17 |

$ | 2,020 | $ | 2,027,211 | |||||||

State of California, GO, Refunding: |

|||||||||||

5.00%, 9/01/18 |

3,400 | 3,965,386 | |||||||||

5.00%, 11/01/20 |

20 | 20,078 | |||||||||

Series A, 5.00%, 7/01/18 |

720 | 842,954 | |||||||||

Various Purpose, 5.25%, 10/01/22 |

4,000 | 4,692,120 | |||||||||

Veterans, Series BZ, AMT (NPFGC), 5.35%, 12/01/21 |

10 | 10,012 | |||||||||

| 11,557,761 | |||||||||||

Transportation — 24.3% |

|||||||||||

City of Long Beach California, RB, Series A, 5.00%, 5/15/18 |

500 | 583,515 | |||||||||

Foothill-Eastern Transportation Corridor Agency California, Refunding RB, CAB, 0.00%, 2/01/14 (b)(c) |

20,000 | 13,268,800 | |||||||||

Los

Angeles Department of Airports, Refunding RB, Senior, Los Angeles International Airport, Series A, 4.50%, 5/15/19 |

3,420 | 3,923,150 | |||||||||

Port of Oakland California, Refunding RB, Series O, AMT: |

|||||||||||

5.00%, 5/01/18 |

2,500 | 2,826,875 | |||||||||

5.00%, 5/01/19 |

3,000 | 3,391,500 | |||||||||

| 23,993,840 | |||||||||||

Utilities — 23.2% |

|||||||||||

California State Department of Water Resources, Refunding RB: |

|||||||||||

Power Supply, Series H, 5.00%, 5/01/22 |

3,500 | 4,011,840 | |||||||||

Series L, 5.00%, 5/01/19 |

2,000 | 2,362,040 | |||||||||

Series N, 5.00%, 5/01/19 |

3,500 | 4,133,570 | |||||||||

City of San Francisco California Public Utilities Commission Water Revenue, Refunding RB, Series D, 3.00%, 11/01/18 |

2,000 | 2,164,540 | |||||||||

Contra Costa Water Authority, Refunding RB, California Water Treatment, Series A, 3.00%, 10/01/18 |

900 | 972,171 | |||||||||

County of Los Angeles California Sanitation Districts Financing Authority, Refunding RB, Series A, 3.00%, 10/01/18 |

3,000 | 3,247,800 | |||||||||

Cucamonga Valley Water District, Refunding RB, Series A (AGM): |

|||||||||||

4.00%, 9/01/18 |

325 | 363,181 | |||||||||

3.00%, 9/01/19 |

375 | 397,797 | |||||||||

4.00%, 9/01/19 |

325 | 362,898 | |||||||||

Los

Angeles Department of Water & Power, RB, Series B, 5.00%, 7/01/18 |

600 | 702,750 | |||||||||

Los

Angeles Department of Water & Power, Refunding RB, Power System, Series A, 5.00%, 7/01/19 |

2,500 | 2,970,450 | |||||||||

| Municipal Bonds |

Par (000) |

Value | |||||||||

California (concluded) |

|||||||||||

Utilities (concluded) |

|||||||||||

Sacramento Municipal Utility District, Refunding RB, Series X, 5.00%, 8/15/18 |

$ | 400 | $ | 467,660 | |||||||

Southern California Public Power Authority, Refunding RB, Canyon Power, Series A, 4.00%, 7/01/18 |

685 | 763,042 | |||||||||

| 22,919,739 | |||||||||||

Total Municipal Bonds in California |

113,568,198 | ||||||||||

Guam — 0.3% |

|||||||||||

Utility — 0.3% |

|||||||||||

Guam Power Authority, Refunding RB, Series A (AGM), 5.00%, 10/01/19 |

240 | 271,524 | |||||||||

Puerto Rico — 0.6% |

|||||||||||

State — 0.0% |

|||||||||||

Puerto Rico Public Buildings Authority, Refunding RB, Government Facilities, Series C, 5.75%, 7/01/19

(d) |

5 | 6,106 | |||||||||

Transportation — 0.6% |

|||||||||||

Puerto Rico Highway & Transportation Authority, Refunding RB, Series Z (AGM), 6.00%, 7/01/18

(d) |

535 | 635,494 | |||||||||

Total Municipal Bonds in Puerto Rico |

641,600 | ||||||||||

US Virgin Islands — 0.9% |

|||||||||||

State — 0.9% |

|||||||||||

Virgin Islands Public Finance Authority, RB, Senior Lien, Matching Fund Loan Note, Series A (c): |

|||||||||||

5.25%, 10/01/14 |

360 | 373,601 | |||||||||

5.25%, 10/01/14 |

455 | 472,190 | |||||||||

Total Municipal Bonds in US Virgin Islands |

845,791 | ||||||||||

Total Long-Term Investments (Cost — $111,180,197) — 116.7% |

115,327,113 | ||||||||||

Short-Term Securities |

Shares | ||||||||||

BIF California Municipal Money Fund, 0.00% (e)(f) |

9,303,179 |

9,303,179 | |||||||||

Total Short-Term Securities (Cost — $9,303,179) — 9.4% |

9,303,179 | ||||||||||

Total Investments (Cost — $120,483,376) — 126.1% |

124,630,292 | ||||||||||

Other Assets Less Liabilities — 1.1% |

1,061,735 | ||||||||||

Preferred Shares, at Redemption Value — (27.2%) |

(26,850,072 | ) | |||||||||

Net Assets Applicable to Common Shares — 100.0% |

$ | 98,841,955 | |||||||||

| ANNUAL REPORT | DECEMBER 31, 2013 | 13 |

| Schedule of Investments (concluded) | BlackRock California

Municipal 2018 Term Trust (BJZ) |

Notes to Schedule of Investments

| (a) | Variable rate security. Rate shown is as of report date. |

|||

| (b) | Zero-coupon bond. |

|||

| (c) | US government securities, held in escrow, are used to pay interest on this security, as well as to retire the bond in full at the

date indicated, typically at a premium to par. |

|||

| (d) | Security is collateralized by municipal or US Treasury obligations. |

|||

| (e) | Investments in issuers considered to be an affiliate of the Trust during the year ended December 31, 2013, for purposes of Section

2(a)(3) of the 1940 Act, as amended, were as follows: |

| Affiliate |

Shares Held at December 31, 2012 |

Net Activity |

Shares Held at December 31, 2013 |

Income |

| BIF California Municipal Money Fund | 6,482,117 | 2,821,062 | 9,303,179 | $10,730 |

| (f) | Represents the current yield as of report date. |

|||

| • | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation

techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| • | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Trust has the

ability to access |

|||

| • | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets

that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are

observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and

default rates) or other market-corroborated inputs) |

|||

| • | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are

not available (including the Trust’s own assumptions used in determining the fair value of investments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1

measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair

value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value

hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is

significant to the fair value measurement in its entirety. |

||||

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In

accordance with the Trust’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of

the beginning of the reporting period. The categorization of a value determined for investments is based on the pricing transparency of the investment

and is not necessarily an indication of the risks associated with investing in those securities. For information about the Trust’s policy

regarding valuation of investments, please refer to Note 2 of the Notes to Financial Statements. |

||||

The following table summarizes the Trust’s investments categorized in the disclosure hierarchy as of December 31,

2013: |

| |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

||||||||||

Assets: |

||||||||||||||||||

Investments: |

||||||||||||||||||

Long-Term Investments1 |

— | $ | 115,327,113 | — | $ | 115,327,113 | ||||||||||||

Short-Term Securities |

$ | 9,303,179 | — | — | 9,303,179 | |||||||||||||

Total |

$ | 9,303,179 | $ | 115,327,113 | — | $ | 124,630,292 | |||||||||||

| 1 | See above Schedule of Investments for values in each sector. |

The carrying amount for certain of the Trust’s assets approximates fair value for financial statement purposes. As of December 31, 2013, cash of $423 is categorized as Level 1 within the disclosure hierarchy.

There were no transfers between levels during the year ended December 31, 2013.

| 14 | ANNUAL REPORT | DECEMBER 31, 2013 |

| Schedule of Investments December 31, 2013 | BlackRock Municipal 2018

Term Trust (BPK) (Percentages shown are based on Net Assets) |

| Municipal Bonds |

|

Par (000) |

|

Value |

||||||

Alabama — 0.6% |

||||||||||

Alabama 21st Century Authority, Refunding RB, Series A, 5.00%, 6/01/18 |

$ | 500 | $ | 563,095 | ||||||

Courtland Alabama IDB, Refunding RB, International Paper Co. Projects, Series A, 4.75%, 5/01/17 |

1,000 | 1,021,250 | ||||||||

| 1,584,345 | ||||||||||

Arizona — 2.2% |

||||||||||

Phoenix Civic Improvement Corp., RB, Junior Lien, Series A, 5.00%, 7/01/21 |

4,660 | 5,363,147 | ||||||||

California — 10.4% |

||||||||||

California Health Facilities Financing Authority, RB, Sutter Health, Series B, 5.00%, 8/15/19 |

2,570 | 3,022,937 | ||||||||

California Pollution Control Financing Authority, RB, Waste Management, Inc. Project, Series C, AMT, 5.13%, 11/01/23 (a) |

6,500 | 6,695,130 | ||||||||

California Pollution Control Financing Authority, Refunding RB, Mandatory Put Bonds, Republic Services, Inc. Project, Series C, AMT, 5.25%,

6/01/23 (a) |

4,055 | 4,313,263 | ||||||||

California State Department of Water Resources, Refunding RB, Power Supply, Series L, 5.00%, 5/01/18 |

5,000 | 5,839,200 | ||||||||

Los

Angeles Regional Airports Improvement Corp., Refunding RB, Facilities Lease, LAXFuel Corp., AMT: |

||||||||||

5.00%, 1/01/17 |

450 | 498,132 | ||||||||

5.00%, 1/01/18 |

930 | 1,045,506 | ||||||||

Los

Angeles Unified School District California, GO, Series I, 5.00%, 7/01/20 |

3,750 | 4,385,400 | ||||||||

| 25,799,568 | ||||||||||

Colorado — 4.8% |

||||||||||

Colorado Health Facilities Authority, Refunding RB, Evangelical Lutheran Good Samaritan Society Project: |

||||||||||

4.00%, 12/01/17 |

515 | 550,396 | ||||||||

4.00%, 12/01/18 |

540 | 575,219 | ||||||||

Colorado Housing & Finance Authority, RB, Disposal, Waste Management, Inc. Project, AMT, 5.70%, 7/01/18 |

5,000 | 5,478,300 | ||||||||

Park Creek Metropolitan District Colorado, Refunding RB, Senior Limited Property Tax, 5.25%, 12/01/20 |

5,010 | 5,265,059 | ||||||||

| 11,868,974 | ||||||||||

Florida — 4.0% |

||||||||||

County of Broward Airport System Revenue Florida, Refunding RB, Series P-1, AMT, 5.00%, 10/01/18 |

3,930 | 4,436,774 | ||||||||

County of Broward School Board Florida, COP, Series A (AGM), 5.25%, 7/01/22 |

1,250 | 1,406,100 | ||||||||

County of Miami-Dade Florida, Refunding RB, Series A, AMT, 5.00%, 10/01/18 |

2,000 | 2,263,220 | ||||||||

Pine Island Community Development District, RB, 5.30%, 11/01/10 |

400 | 156,236 | ||||||||

Stevens Plantation Community Development District, Special Assessment Bonds, Series B, 1.00%, 12/31/49 |

2,270 | 1,689,379 | ||||||||

| 9,951,709 | ||||||||||

| Municipal Bonds |

|

Par (000) |

|

Value |

||||||

Guam — 0.3% |

||||||||||

Guam Power Authority, Refunding RB, Series A (AGM), 5.00%, 10/01/19 |

$ | 620 | $ | 701,437 | ||||||

Hawaii — 0.2% |

||||||||||

Hawaii State Department of Budget & Finance, Refunding RB, Special Purpose Senior Living Revenue, 5.00%,

11/15/18 |

370 | 406,871 | ||||||||

Illinois — 13.5% |

||||||||||

City of Chicago Illinois, RB, General Airport, Third Lien, Series A (AMBAC): |

||||||||||

5.00%, 1/01/19 |

5,000 | 5,351,750 | ||||||||

5.00%, 1/01/20 |

3,000 | 3,211,050 | ||||||||

Illinois Finance Authority, Refunding RB, Central DuPage Health, Series B, 5.00%, 11/01/18 |

2,290 | 2,621,523 | ||||||||

Illinois Sports Facilities Authority, RB, State Tax Supported (AMBAC): |

||||||||||

5.35%, 6/15/19 |

1,885 | 1,983,152 | ||||||||

5.40%, 6/15/20 |

1,985 | 2,078,255 | ||||||||

5.45%, 6/15/21 |

2,090 | 2,179,034 | ||||||||

Railsplitter Tobacco Settlement Authority, RB, 5.00%, 6/01/18 |

10,000 | 11,293,500 | ||||||||

State of Illinois, RB, Build Illinois, Series B: |

||||||||||

5.00%, 6/15/18 (b) |

355 | 414,388 | ||||||||

Unrefunded Balance, 5.00%, 6/15/18 |

1,645 | 1,883,443 | ||||||||

State of Illinois Toll Highway Authority, RB, Senior Priority, Series A (AGM), 5.00%, 7/01/15 (c) |

2,250 | 2,408,513 | ||||||||

| 33,424,608 | ||||||||||

Indiana — 3.0% |

||||||||||

City of Vincennes Indiana, Refunding RB, Southwest Indiana Regional Youth Village, 6.25%, 1/01/24 |

2,975 | 1,740,464 | ||||||||

Indiana Finance Authority, RB, Ohio River Bridges East End Crossing Project, Series B, AMT, 5.00%, 1/01/19 |

1,715 | 1,826,406 | ||||||||

Indiana State Municipal Power Agency, Refunding RB, Series A, 5.00%, 1/01/19 |

875 | 1,014,213 | ||||||||

Indianapolis Airport Authority, Refunding RB, Special Facilities, FedEx Corp. Project, AMT, 5.10%, 1/15/17 |

2,500 | 2,753,825 | ||||||||

| 7,334,908 | ||||||||||

Iowa — 1.4% |

||||||||||

Iowa Finance Authority, Refunding RB, Midwestern Disaster Area, Iowa Fertilizer Co. Project, 5.00%,

12/01/19 |

3,720 | 3,570,754 | ||||||||

Kansas — 1.2% |

||||||||||

Kansas Development Finance Authority, Refunding RB, Adventist Health, 5.00%, 11/15/18 |

2,500 | 2,893,675 | ||||||||

Kentucky — 3.5% |

||||||||||

County of Kenton Kentucky School District Finance Corp., Refunding RB, 2.50%, 6/01/18 |

3,210 | 3,328,256 | ||||||||

County of Louisville & Jefferson Kentucky Metropolitan Government, Refunding RB, Catholic Health Initiatives, Series A, 5.00%,

12/01/18 |

1,755 | 2,017,460 | ||||||||

Kentucky Housing Corp., RB, Series C, AMT, 4.63%, 7/01/22 |

3,195 | 3,243,245 | ||||||||

| 8,588,961 | ||||||||||

Louisiana — 0.2% |

||||||||||

Louisiana Public Facilities Authority, RB, Department of Public Safety, Fire Marshal’s Headquarter

Project (NPFGC), 5.88%, 6/15/14 |

475 | 486,576 | ||||||||

| ANNUAL REPORT | DECEMBER 31, 2013 | 15 |

| Schedule of Investments (continued) | BlackRock Municipal 2018

Term Trust (BPK) (Percentages shown are based on Net Assets) |

| Municipal Bonds |

|

Par (000) |

|

Value | ||||||

Maryland — 3.5% |

||||||||||

Maryland Health & Higher Educational Facilities Authority, Refunding RB: |

||||||||||

Charlestown Community, 5.00%, 1/01/19 |

$ | 1,685 | $ | 1,815,234 | ||||||

University of Maryland Medical System, 5.00%, 7/01/18 |

1,000 | 1,135,410 | ||||||||

Maryland State Transportation Authority, Refunding RB, Baltimore/Washington Thurgood Marshall Airport Project, Series B, AMT, 5.00%,

3/01/19 |

5,000 | 5,673,350 | ||||||||

| 8,623,994 | ||||||||||

Massachusetts — 0.1% |

||||||||||

State of Massachusetts Water Pollution Abatement Trust, Refunding RB, MWRA Program, Sub-Series A, 6.00%,

8/01/23 |

135 | 135,630 | ||||||||

Michigan — 3.0% |

||||||||||

Detroit Water and Sewerage Department, Refunding RB, Sewage Disposal System, Senior Lien, Series A (AGM), 5.00%, 7/01/18 |

3,000 | 3,004,800 | ||||||||

Kalamazoo Hospital Finance Authority, Refunding RB, Bronson Methodist Hospital (AGM), 5.00%, 5/15/18 |

2,025 | 2,296,391 | ||||||||

Michigan State Hospital Finance Authority, Refunding RB, Oakwood Obligation Group, Series A, 5.00%, 7/15/18 |

1,000 | 1,091,970 | ||||||||

Michigan State Housing Development Authority, Refunding RB, Series B, 4.15%, 4/01/18 |

1,000 | 1,076,820 | ||||||||

| 7,469,981 | ||||||||||

Mississippi — 4.1% |

||||||||||

County of Lowndes Mississippi, Refunding RB, Solid Waste Disposal & Pollution Control, Weyerhaeuser Co.

Project, Series A, 6.80%, 4/01/22 |

9,000 | 10,180,710 | ||||||||

Missouri — 0.8% |

||||||||||

City of Kansas City Missouri, Refunding ARB, AMT, Series A, 5.00%, 9/01/18 |

1,750 | 1,978,795 | ||||||||

Multi-State — 5.9% |

||||||||||

Centerline Equity Issuer Trust, 6.80%, 10/31/52 (d)(e) |

14,000 | 14,632,940 | ||||||||

Nebraska — 1.7% |

||||||||||

Central Plains Energy Project Nebraska, RB, Gas Project (Project No. 3), 5.00%, 9/01/17 |

2,330 | 2,569,874 | ||||||||

Public Power Generation Agency, RB, Whelan Energy Center, Series 2-A (AGC), 5.00%, 1/01/18 |

1,500 | 1,652,055 | ||||||||

| 4,221,929 | ||||||||||

Nevada — 4.3% |

||||||||||

City of Las Vegas Nevada, Special Assessment Bonds, Summerlin Area, 5.35%, 6/01/17 |

985 | 1,009,812 | ||||||||

County of Clark Nevada, Refunding, Special Assessment Bonds, Improvement District No. 142, Mountain’s Edge, 4.00%, 8/01/18 |

4,235 | 4,224,370 | ||||||||

Director of the State of Nevada Department of Business & Industry, RB, Mandatory Put Bonds, Republic Services, Inc. Project, AMT, 5.63%,

12/01/26 (a) |

5,120 | 5,540,813 | ||||||||

| 10,774,995 | ||||||||||

| Municipal Bonds |

|

Par (000) |

|

Value | ||||||

New Jersey — 14.0% |

||||||||||

New

Jersey EDA, RB, Continental Airlines, Inc. Project, AMT, 7.20%, 11/15/30 (a) |

$ | 4,250 | $ | 4,249,447 | ||||||

New

Jersey EDA, Refunding RB, Cigarette Tax Revenue, 5.00%, 6/15/18 |

5,000 | 5,558,250 | ||||||||

New

Jersey EDA, Refunding, Special Assessment Bonds, Kapkowski Road Landfill Project, 5.50%, 4/01/16 |

5,440 | 5,635,514 | ||||||||

New

Jersey Educational Facilities Authority, RB, Seton Hall University, Series D, 5.00%, 7/01/18 |

320 | 365,264 | ||||||||

New

Jersey Educational Facilities Authority, Refunding RB, University of Medicine & Dentistry, Series B, 6.25%, 12/01/18 (b) |

2,500 | 3,086,350 | ||||||||

New

Jersey Health Care Facilities Financing Authority, Refunding RB: |

||||||||||

AHS Hospital Corp., 5.00%, 7/01/18 |

850 | 968,651 | ||||||||

AtlantiCare Regional Medical Center, 5.00%, 7/01/20 |

1,500 | 1,617,615 | ||||||||

Barnabas Health, Series A, 5.00%, 7/01/18 |

2,000 | 2,232,320 | ||||||||

New

Jersey State Housing & Mortgage Finance Agency, Refunding RB, S/F Housing, Series T, AMT, 4.55%, 10/01/22 |

2,185 | 2,221,337 | ||||||||

New

Jersey State Turnpike Authority, Refunding RB, Series G, 5.00%, 1/01/18 |

1,350 | 1,544,643 | ||||||||

New

Jersey Transportation Trust Fund Authority, RB, Series B, 5.00%, 6/15/18 |

2,000 | 2,299,280 | ||||||||

Newark Housing Authority, RB, South Ward Police Facility (AGC), 4.50%, 12/01/18 |

4,450 | 4,952,138 | ||||||||

| 34,730,809 | ||||||||||

New York — 8.0% |

||||||||||

City of New York, GO, Sub-Series F-1: |

||||||||||

5.00%, 9/01/15 (c) |

7,365 | 7,937,850 | ||||||||

Unrefunded Balance, 5.00%, 9/01/18 |

135 | 145,092 | ||||||||

Metropolitan Transportation Authority, Refunding RB, Series A, 5.00%, 11/15/18 |

1,000 | 1,165,250 | ||||||||

New

York State Dormitory Authority, RB, General Purpose, Series A, 5.00%, 3/15/18 |

8,000 | 9,244,240 | ||||||||

Port Authority of New York & New Jersey, ARB, JFK International Air Terminal LLC Project, 5.00%, 12/01/20 |

1,200 | 1,290,600 | ||||||||

| 19,783,032 | ||||||||||

North Carolina — 2.8% |

||||||||||

North Carolina Eastern Municipal Power Agency, Refunding RB, Series B, 4.00%, 1/01/18 |

3,865 | 4,265,684 | ||||||||

North Carolina HFA, Refunding RB, Series 28-A, AMT, 4.65%, 7/01/23 |

2,645 | 2,679,729 | ||||||||

| 6,945,413 | ||||||||||

Ohio — 1.4% |

||||||||||

State of Ohio, GO, Refunding, Higher Education, Series B, 5.00%, 8/01/18 |

3,000 | 3,504,630 | ||||||||

Oklahoma — 0.6% |

||||||||||

County of Canadian Educational Facilities Authority, RB, Mustang Public Schools Project, 4.00%, 9/01/18 |

1,000 | 1,092,670 | ||||||||

County of Oklahoma Finance Authority, Refunding RB, Epworth Villa Project, Series A: |

||||||||||

2.25%, 4/01/14 |

175 | 174,454 | ||||||||

2.50%, 4/01/15 |

175 | 172,326 | ||||||||

| 1,439,450 | ||||||||||

| 16 | ANNUAL REPORT | DECEMBER 31, 2013 |

| Schedule of Investments (continued) | BlackRock Municipal 2018

Term Trust (BPK) (Percentages shown are based on Net Assets) |

| Municipal Bonds |

|

Par (000) |

|

Value | |||||||

Pennsylvania — 4.5% |

|||||||||||

County of Cumberland Municipal Authority Pennsylvania, Refunding RB, Diakon Lutheran, 5.75%, 1/01/19 |

$ | 2,375 | $ | 2,703,344 | |||||||

Lancaster Industrial Development Authority, Refunding RB, Garden Spot Village Project: |

|||||||||||

5.00%, 5/01/16 |

300 | 321,216 | |||||||||

5.00%, 5/01/17 |

1,175 | 1,261,727 | |||||||||

Pennsylvania Economic Development Financing Authority, Refunding RB, Amtrak Project, Series A, AMT, 3.00%, 11/01/18 |

1,000 | 1,021,960 | |||||||||

Pennsylvania Higher Educational Facilities Authority, RB, Shippensburg University Student Services, Inc., Student Housing

Project: |

|||||||||||

4.00%, 10/01/17 |

275 | 286,660 | |||||||||

4.00%, 10/01/18 |

560 | 580,322 | |||||||||

Pennsylvania Higher Educational Facilities Authority, Refunding RB, Drexel University, Series A, 5.00%, 5/01/18 |

1,000 | 1,143,000 | |||||||||

Pennsylvania IDA, Refunding RB, Economic Development, 5.00%, 7/01/18 |

1,500 | 1,717,770 | |||||||||

Pennsylvania Turnpike Commission, RB, Sub-Series A (AGC), 5.00%, 6/01/22 |

1,000 | 1,089,680 | |||||||||

State Public School Building Authority, RB, Community College of Allegheny County Project (AGM), 5.00%, 7/15/18 |

900 | 1,031,256 | |||||||||

| 11,156,935 | |||||||||||

Texas — 15.5% |

|||||||||||

Alliance Airport Authority Texas, Refunding RB, FedEx Corp. Project, AMT, 4.85%, 4/01/21 |

2,000 | 2,078,220 | |||||||||

Birdville ISD Texas, GO, Refunding, CAB (PSF-GTD) (f): |

|||||||||||

0.00%, 2/15/18 |

1,615 | 1,523,349 | |||||||||

0.00%, 2/15/19 |

1,815 | 1,645,152 | |||||||||

0.00%, 2/15/20 |

2,625 | 2,282,963 | |||||||||

0.00%, 2/15/21 |

2,500 | 2,073,525 | |||||||||

Central Texas Regional Mobility Authority, Refunding RB, Senior Lien: |

|||||||||||

5.75%, 1/01/18 |

750 | 821,565 | |||||||||

5.75%, 1/01/19 |

750 | 819,960 | |||||||||

City of Dallas Texas, Refunding RB, Civic Center Convention Complex (AGC), 5.00%, 8/15/21 |

2,500 | 2,754,050 | |||||||||

City of Houston Texas, Refunding RB, Sub Lien, Series B, 5.00%, 7/01/18 |

1,000 | 1,148,930 | |||||||||

Love Field Airport Modernization Corp., RB, Southwest Airlines Co., Love Field Modernization Program Project, AMT, 5.00%,

11/01/18 |

5,000 | 5,358,200 | |||||||||

Lower Colorado River Authority, Refunding RB, LCRA Transmission, Series B, 5.00%, 5/15/18 |

5,000 | 5,741,050 | |||||||||

New

Hope Cultural Education Facilities Corp., RB, CHF-Stephenville LLC Tarleton State University Project, Series A: |

|||||||||||

4.00%, 4/01/17 |

160 | 167,238 | |||||||||

4.00%, 4/01/18 |

280 | 291,085 | |||||||||

North Texas Tollway Authority, Refunding RB, Series C: |

|||||||||||

5.00%, 1/01/19 |

2,215 | 2,491,499 | |||||||||

5.25%, 1/01/20 |

4,000 | 4,468,120 | |||||||||

Texas Municipal Gas Acquisition & Supply Corp. III, RB, 5.00%, 12/15/18 |

4,360 | 4,774,723 | |||||||||

| 38,439,629 | |||||||||||

| Municipal Bonds |

|

Par (000) |

|

Value | |||||||

US Virgin Islands — 0.4% |

|||||||||||

Virgin Islands Public Finance Authority, Refunding RB, Senior Lien, Series B, 5.00%,

10/01/18 |

$ | 1,000 | $ | 1,110,790 | |||||||

Virginia — 1.9% |

|||||||||||

City of Norfolk Virginia, Refunding RB, Water Revenue, 5.00%, 11/01/18 |

1,230 | 1,441,191 | |||||||||

Hanover County EDA, Refunding RB, Residential Care Facility, Covenant Woods, Series A, 3.00%, 7/01/14 |

415 | 413,186 | |||||||||

Virginia HDA, Refunding RB, Sub-Series E-2, AMT, 4.38%, 10/01/19 |

2,750 | 2,797,355 | |||||||||

| 4,651,732 | |||||||||||

Washington — 0.2% |

|||||||||||

Washington Health Care Facilities Authority, Refunding RB, Providence Health & Services, Series B,

5.00%, 10/01/18 |

500 | 578,925 | |||||||||

Wisconsin — 1.9% |

|||||||||||

City of Franklin Wisconsin, RB, Waste Management, Inc. Project, AMT, 4.95%, 4/01/16 |

1,990 | 2,087,928 | |||||||||

State of Wisconsin, Refunding RB, Series A, 5.00%, 5/01/18 |

1,000 | 1,156,490 | |||||||||

Wisconsin Health & Educational Facilities Authority, Refunding RB, Froedtert & Community Health, Inc., 5.00%, 4/01/19 |

1,265 | 1,457,659 | |||||||||

| 4,702,077 | |||||||||||

Total Municipal Bonds — 119.9% |

297,037,929 | ||||||||||

Municipal Bonds Transferred to Tender Option Bond Trusts (g) — 2.2% |

|||||||||||

Illinois — 2.2% |

|||||||||||

City of Chicago Illinois Waterworks, Refunding RB, Second Lien (AGM), 5.00%, 11/01/20 |

5,000 | 5,467,250 | |||||||||

Total Long-Term Investments (Cost — $289,122,564) — 122.1% |

302,505,179 | ||||||||||

Short-Term Securities |

Shares | ||||||||||

FFI Institutional Tax-Exempt Fund, 0.03% (h)(i) |

10,765,381 | 10,765,381 | |||||||||

Total Short-Term Securities (Cost — $10,765,381) — 4.4% |

10,765,381 | ||||||||||

Total Investments (Cost — $299,887,945) — 126.5% |

313,270,560 | ||||||||||

Other Assets Less Liabilities — 3.0% |

7,411,036 | ||||||||||

Liability for TOB Trust Certificates, Including Interest Expense and Fees Payable — (1.5%) |

(3,751,247 | ) | |||||||||

Preferred Shares, at Redemption Value — (28.0%) |

(69,251,216 | ) | |||||||||

Net Assets Applicable to Common Shares — 100.0% |

$ | 247,679,133 | |||||||||

| ANNUAL REPORT | DECEMBER 31, 2013 | 17 |

| Schedule of Investments (concluded) | BlackRock Municipal 2018

Term Trust (BPK) |

Notes to Schedule of Investments

| (a) | Variable rate security. Rate shown is as of report date. |

|||

| (b) | Security is collateralized by municipal or US Treasury obligations. |

|||

| (c) | US government securities, held in escrow, are used to pay interest on this security, as well as to retire the bond in full at the

date indicated, typically at a premium to par. |

|||

| (d) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold

in transactions exempt from registration to qualified institutional investors. |

|||

| (e) | Represents a beneficial interest in a trust. The collateral deposited into the trust is federally tax-exempt revenue bonds issued by

various state or local governments, or their respective agencies or authorities. The security is subject to remarketing prior to its stated

maturity. |

|||

| (f) | Zero-coupon bond. |

|||

| (g) | Represent bonds transferred to a TOB. In exchange the Trust acquired residual interest certificates. These bonds serve as collateral

in a financing transaction. See Note 3 of the Notes to Financial Statements for details of municipal bonds transferred to TOBs. |

|||

| (h) | Investments in issuers considered to be an affiliate of the Trust during the year ended December 31, 2013, for purposes of Section

2(a)(3) of the 1940 Act, as amended, were as follows: |

| Affiliate |

Shares Held at December 31, 2012 |

Net Activity |

Shares Held at December 31, 2013 |

Income |

| FFI Institutional Tax-Exempt Fund | 26,827,828 | (16,062,447) | 10,765,381 | $1,684 |

| (i) | Represents the current yield as of report date. |

|||

| • | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation

techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| • | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Trust has the

ability to access |

|||

| • | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets

that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are

observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and

default rates) or other market-corroborated inputs) |

|||

| • | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are

not available (including the Trust’s own assumptions used in determining the fair value of investments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1

measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair

value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value

hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is

significant to the fair value measurement in its entirety. |

||||

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In

accordance with the Trust’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of

the beginning of the reporting period. The categorization of a value determined for investments is based on the pricing transparency of the investment

and is not necessarily an indication of the risks associated with investing in those securities. For information about the Trust’s policy

regarding valuation of investments, please refer to Note 2 of the Notes to Financial Statements. |

||||

The following table summarizes the Trust’s investments categorized in the disclosure hierarchy as of December 31,

2013: |

| |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

||||||||||

Assets: |

||||||||||||||||||

Investments: |

||||||||||||||||||

Long-Term Investments1 |

— | $ | 302,505,179 | — | $ | 302,505,179 | ||||||||||||

Short-Term Securities |

$ | 10,765,381 | — | — | 10,765,381 | |||||||||||||

Total |

$ | 10,765,381 | $ | 302,505,179 | — | $ | 313,270,560 | |||||||||||

| 1 | See above Schedule of Investments for values in each state or political subdivision. |

The carrying amount for certain of the Trust’s liabilities approximates fair value for financial statement purposes. As of December 31, 2013, TOB trust certificates of $(3,750,000) are categorized as Level 2 within the disclosure hierarchy.

There were no transfers between levels during the year ended December 31, 2013.

| 18 | ANNUAL REPORT | DECEMBER 31, 2013 |

| Schedule of Investments December 31, 2013 | BlackRock New York

Municipal 2018 Term Trust (BLH) (Percentages shown are based on Net Assets) |

| Municipal Bonds |

Par (000) |

Value | |||||||||

New York — 127.6% |

|||||||||||

Corporate — 1.7% |

|||||||||||

Port Authority of New York & New Jersey, RB, Continental Airlines, Inc. and Eastern Air Lines, Inc.,

Project, LaGuardia Airport, AMT, 9.13%, 12/01/15 |

$ | 920 | $ | 939,357 | |||||||

County/City/Special District/School District — 50.3% |

|||||||||||

City of New York New York, GO: |

|||||||||||

Series M, 5.00%, 4/01/15 (a) |

1,060 | 1,122,593 | |||||||||

Series M, 5.00%, 4/01/23 |

330 | 348,064 | |||||||||

Sub-Series G-1, 5.00%, 4/01/18 |

5,000 | 5,733,450 | |||||||||

Sub-Series H-2, 5.00%, 6/01/20 |

3,470 | 4,009,307 | |||||||||

City of New York New York Transitional Finance Authority, RB, Fiscal 2008, Series S-1, 5.00%, 1/15/23 |

1,400 | 1,532,664 | |||||||||

City of New York New York Transitional Finance Authority, Refunding RB, Future Tax Secured, Series B, 5.00%, 2/01/20 |

2,000 | 2,329,840 | |||||||||

City of Rochester New York, GO, Refunding, Series I, 4.00%, 8/15/18 |

2,500 | 2,781,975 | |||||||||

New

York State, GO, Series E: |

|||||||||||

5.00%, 12/15/18 |

1,000 | 1,182,310 | |||||||||

5.00%, 12/15/20 |

2,000 | 2,374,820 | |||||||||

New

York State Dormitory Authority, RB: |

|||||||||||

General Purpose, Series E, 5.00%, 8/15/19 |

1,500 | 1,761,060 | |||||||||

State University Dormitory Facilities, Series A, 5.00%, 7/01/18 |

1,045 | 1,206,536 | |||||||||

New

York State Dormitory Authority, Refunding RB, 3rd General Resolution, State University Educational Facilities, Series A, 4.00%,

5/15/18 |

1,000 | 1,109,170 | |||||||||

New

York State Urban Development Corp., Refunding RB, Series D, 5.50%, 1/01/19 |

750 | 884,873 | |||||||||

Owego Apalachin Central School District, GO, Refunding (AGM), 4.00%, 6/15/18 |

1,015 | 1,117,738 | |||||||||

| 27,494,400 | |||||||||||

Education — 16.4% |

|||||||||||

Albany Industrial Development Agency, RB, New Covenant Charter School Project, Series A, 7.00%, 5/01/25 (b)(c) |

450 | 67,496 | |||||||||

City of Troy New York, RB, Rensselaer Polytechnic, Series B, 5.00%, 9/01/18 |

1,000 | 1,148,840 | |||||||||

New

York State Dormitory Authority, LRB, State University Dormitory Facilities, Series A, 5.00%, 7/01/21 |

250 | 289,157 | |||||||||

New

York State Dormitory Authority, RB: |

|||||||||||

Mental Health Services, 5.00%, 8/15/18 |

1,020 | 1,176,519 | |||||||||

Pratt Institute, Series C (AGC), 5.00%, 7/01/19 |

600 | 688,590 | |||||||||

School Districts Financing Program, Series C, 4.00%, 10/01/18 |

535 | 588,842 | |||||||||

University of Rochester, Series A, 5.00%, 7/01/21 |

1,155 | 1,294,362 | |||||||||

New

York State Dormitory Authority, Refunding RB: |

|||||||||||

Mental Health Services, 5.00%, 8/15/18 (d) |

5 | 5,869 | |||||||||

Teachers College, Series A, 5.00%, 7/01/17 |

200 | 227,078 | |||||||||

Teachers College, Series A, 5.00%, 7/01/18 |

250 | 288,055 | |||||||||

Yeshiva University, 5.00%, 9/01/27 |

2,000 | 2,059,160 | |||||||||

| Municipal Bonds |

Par (000) |

Value | |||||||||

New York (continued) |

|||||||||||

Education (concluded) |

|||||||||||

Yonkers Industrial Development Agency New York, RB, Sarah Lawrence College Project, Series A: |

|||||||||||

5.00%, 6/01/18 |

$ | 600 | $ | 672,654 | |||||||

5.00%, 6/01/19 |

400 | 449,816 | |||||||||

| 8,956,438 | |||||||||||

Health — 7.2% |

|||||||||||

New

York State Dormitory Authority, Refunding RB, Miriam Osborn Memorial Home, 2.50%, 7/01/18 |

1,890 | 1,912,548 | |||||||||

Orange County Industrial Development Agency, Refunding RB, St. Luke’s Hospital Newburgh New York Project, Series A (Radian), 5.38%,

12/01/21 |

2,000 | 2,008,560 | |||||||||

| 3,921,108 | |||||||||||

Housing — 11.2% |

|||||||||||

New

York Mortgage Agency, Refunding RB, AMT, 4.50%, 10/01/20 |

4,110 | 4,174,404 | |||||||||

New

York State Dormitory Authority, Refunding RB, Series A: |

|||||||||||

North Shore Long Island Jewish, 5.00%, 5/01/18 |

615 | 700,356 | |||||||||

North Shore Long Island Jewish, 4.00%, 5/01/19 |

250 | 271,955 | |||||||||

North Shore Long Island Jewish, 5.00%, 5/01/19 |

650 | 739,583 | |||||||||

State University Educational Facilities, 5.88%, 5/15/17 |

125 | 140,501 | |||||||||

New

York State HFA, RB, Affordable Housing, Series E (SONYMA), 1.50%, 5/01/18 |

120 | 118,973 | |||||||||

| 6,145,772 | |||||||||||

State — 8.5% |

|||||||||||

Monroe County Industrial Development Agency, RB, Rochester Schools Modernization Project, Series A, 5.00%, 5/01/18 |

1,000 | 1,149,340 | |||||||||

New

York State Dormitory Authority, RB, Series A, 5.00%, 3/15/18 |

2,000 | 2,311,060 | |||||||||

New

York State Dormitory Authority, Refunding LRB, Municipal Health Facilities, 4.00%, 5/15/18 |

550 | 605,864 | |||||||||

New

York State Urban Development Corp., RB, State Personal Income Tax, Series A-1, 5.00%, 12/15/22 |

500 | 568,910 | |||||||||

| 4,635,174 | |||||||||||

Transportation — 25.4% |

|||||||||||

Metropolitan Transportation Authority, Refunding RB: |

|||||||||||

Series A, 5.00%, 11/15/18 |

1,000 | 1,165,250 | |||||||||

Series C, 4.00%, 11/15/16 |

1,000 | 1,093,600 | |||||||||

Series C, 5.00%, 11/15/17 |

1,000 | 1,147,240 | |||||||||

Series C, 5.00%, 11/15/18 |

1,965 | 2,274,684 | |||||||||

New

York State Thruway Authority, RB, Transportation, Series A, 5.00%, 3/15/20 |

1,750 | 2,012,552 | |||||||||

New

York State Thruway Authority, Refunding RB, Series I, 5.00%, 1/01/18 |

1,300 | 1,486,888 | |||||||||

Port Authority of New York & New Jersey, RB, JFK International Air Terminal, 5.00%, 12/01/20 |

300 | 322,650 | |||||||||

Port Authority of New York & New Jersey, Refunding RB, 178th Series, AMT, 5.00%, 12/01/18 |

900 | 1,040,256 | |||||||||

| ANNUAL REPORT | DECEMBER 31, 2013 | 19 |

| Schedule of Investments (continued) | BlackRock New York

Municipal 2018 Term Trust (BLH) (Percentages shown are based on Net Assets) |

| Municipal Bonds |

Par (000) |

Value | |||||||||

New York (concluded) |

|||||||||||

Transportation (concluded) |

|||||||||||

Triborough Bridge & Tunnel Authority, Refunding RB, Series B, 4.00%, 11/15/18 |

$ | 3,000 | $ | 3,361,980 | |||||||

| 13,905,100 | |||||||||||

Utilities — 6.9% |

|||||||||||

Long Island Power Authority, Refunding RB, Series A, 5.25%, 4/01/21 |

1,000 | 1,098,650 | |||||||||

New

York City Municipal Water Finance Authority, Refunding RB, Water & Sewer System, 2nd General Resolution, Fiscal 2012, Series FF, 5.00%,

6/15/20 |

2,000 | 2,345,060 | |||||||||

Upper Mohawk Valley Regional Water Finance Authority, Refunding RB, Water System, 4.00%, 4/01/18 |

300 | 328,047 | |||||||||

| 3,771,757 | |||||||||||

Total Municipal Bonds in New York |

69,769,106 | ||||||||||

| Municipal Bonds |

Par (000) |

Value | |||||||||

Guam — 0.3% |

|||||||||||

Utility — 0.3% |

|||||||||||

Guam Power Authority, Refunding RB, Series A (AGM), 5.00%, 10/01/19 |

$ | 140 | $ | 158,389 | |||||||

Total Long-Term Investments ($68,726,125) — 127.9% |

69,927,495 | ||||||||||

Short-Term Securities |

Shares | ||||||||||

BIF New York Municipal Money Fund, 0.00% (e)(f) |

545,734 |

545,734 | |||||||||

Total Short-Term Securities (Cost — $545,734) — 1.0% |

545,734 | ||||||||||

Total Investments (Cost — $69,271,859) — 128.9% |

70,473,229 | ||||||||||

Other Assets Less Liabilities — 1.1% |

619,079 | ||||||||||

Preferred Shares, at Redemption Value — (30.0%) |

(16,425,356 | ) | |||||||||

Net Assets Applicable to Common Shares — 100.0% |

$ | 54,666,952 | |||||||||

Notes to Schedule of Investments

| (a) | US government securities, held in escrow, are used to pay interest on this security, as well as to retire the bond in full at the

date indicated, typically at a premium to par. |

|||

| (b) | Non-income producing security. |

|||

| (c) | Issuer filed for bankruptcy and/or is in default of principal and/or interest payments. |

|||

| (d) | Security is collateralized by municipal or US Treasury obligations. |

|||

| (e) | Investments in issuers considered to be an affiliate of the Trust during the year ended December 31, 2013, for purposes of Section

2(a)(3) of the 1940 Act, as amended, were as follows: |

| Affiliate |

Shares Held at December 31, 2012 |

Net Activity |

Shares Held at December 31, 2013 |

Income |

| BIF New York Municipal Money Fund | 577,963 | (32,229) | 545,734 | $6 |

| (f) | Represents the current yield as of report date. |

|||

| • | Fair Value Measurements — Various inputs are used in determining the fair value of investments. These inputs to valuation

techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes as follows: |

| • | Level 1 — unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Trust has the

ability to access |

|||

| • | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets

that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are

observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and

default rates) or other market-corroborated inputs) |

|||

| • | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are

not available (including the Trust’s own assumptions used in determining the fair value of investments) |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1

measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair

value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value

hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is

significant to the fair value measurement in its entirety. |

||||

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In

accordance with the Trust’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of

the beginning of the reporting period. The categorization of a value determined for investments is based on the pricing transparency of the investment

and is not necessarily an indication of the risks associated with investing in those securities. For information about the Trust’s policy

regarding valuation of investments, please refer to Note 2 of the Notes to Financial Statements. |

| 20 | ANNUAL REPORT | DECEMBER 31, 2013 |

| Schedule of Investments (concluded) | BlackRock New York

Municipal 2018 Term Trust (BLH) |

The following table summarizes the Trust’s investments categorized in the disclosure hierarchy as of December 31, 2013:

| |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

||||||||||

Assets: |

||||||||||||||||||

Investments: |

||||||||||||||||||

Long-Term Investments1 |

— | $ | 69,927,495 | — | $ | 69,927,495 | ||||||||||||

Short-Term Securities |

$ | 545,734 | — | — | 545,734 | |||||||||||||

Total |

$ | 545,734 | $ | 69,927,495 | — | $ | 70,473,229 | |||||||||||

| 1 | See above Schedule of Investments for values in each sector. |

There were no transfers between levels during the year ended December 31, 2013.

| ANNUAL REPORT | DECEMBER 31, 2013 | 21 |

| Statements of Assets and Liabilities |

| December 31, 2013 | BlackRock California Municipal 2018 Term Trust (BJZ) |

BlackRock Municipal 2018 Term Trust (BPK) |

BlackRock New York Municipal 2018 Term Trust (BLH) |

||||||||||||

Assets |

|||||||||||||||

Investments at value — unaffiliated1 |

$ | 115,327,113 | $ | 302,505,179 | $ | 69,927,495 | |||||||||

Investments at value — affiliated2 |

9,303,179 | 10,765,381 | 545,734 | ||||||||||||

Cash |

423 | — | — | ||||||||||||

Interest receivable |

1,132,466 | 3,624,338 | 707,797 | ||||||||||||

Investments sold receivable |

45,638 | 1,430,000 | — | ||||||||||||

Prepaid expenses |

10,091 | 19,261 | 7,858 | ||||||||||||

Prepaid redemption of Preferred Shares |

— | 2,625,000 | — | ||||||||||||

Total assets |

125,818,910 | 320,969,159 | 71,188,884 | ||||||||||||

Accrued Liabilities |

|||||||||||||||

Investment advisory fees payable |

44,947 | 108,920 | 24,174 | ||||||||||||

Officer’s and Trustees’ fees payable |

13,213 | 47,382 | 9,358 | ||||||||||||

Income dividends payable — Common Shares |

10,851 | 51,926 | 4,684 | ||||||||||||

Interest expense and fees payable |

— | 1,247 | — | ||||||||||||

Other accrued expenses payable |

57,872 | 79,335 | 58,360 | ||||||||||||

Total accrued liabilities |

126,883 | 288,810 | 96,576 | ||||||||||||

Other Liabilities |

|||||||||||||||

TOB trust certificates |

— | 3,750,000 | — | ||||||||||||

Total liabilities |

126,883 | 4,038,810 | 96,576 | ||||||||||||

Preferred Shares at Redemption Value |

|||||||||||||||

$25,000 per share liquidation preference, plus unpaid dividends3 |

26,850,072 | 69,251,216 | 16,425,356 | ||||||||||||

Net Assets Applicable to Common Shareholders |

$ | 98,841,955 | $ | 247,679,133 | $ | 54,666,952 | |||||||||

Net Assets Applicable to Common Shareholders Consist

of |

|||||||||||||||

Paid-in capital4 |

$ | 92,305,843 | $ | 232,793,378 | $ | 52,684,382 | |||||||||

Undistributed net investment income |

3,456,626 | 10,485,817 | 1,360,947 | ||||||||||||

Accumulated net realized loss |

(1,067,430 | ) | (8,982,677 | ) | (579,747 | ) | |||||||||

Net unrealized appreciation/depreciation |

4,146,916 | 13,382,615 | 1,201,370 | ||||||||||||

Net Assets Applicable to Common Shareholders |

$ | 98,841,955 | $ | 247,679,133 | $ | 54,666,952 | |||||||||

Net asset value per Common Share |

$ | 15.36 | $ | 15.57 | $ | 15.05 | |||||||||

1 Investments at cost — unaffiliated |

$ | 111,180,197 | $ | 289,122,564 | $ | 68,726,125 | |||||||||

2 Investments at cost — affiliated |

$ | 9,303,179 | $ | 10,765,381 | $ | 545,734 | |||||||||

3 Preferred Shares outstanding, unlimited number of shares authorized, par value $0.001 per share

|

1,074 | 2,770 | 657 | ||||||||||||

4 Common Shares outstanding, unlimited number of shares authorized, par value $0.001 per share

|

6,433,028 | 15,908,028 | 3,633,028 | ||||||||||||

| 22 | ANNUAL REPORT | DECEMBER 31, 2013 |

| Statements of Operations |

| Year Ended December 31, 2013 | BlackRock California Municipal 2018 Term Trust (BJZ) |

BlackRock Municipal 2018 Term Trust (BPK) |

BlackRock New York Municipal 2018 Term Trust (BLH) |

||||||||||||

Investment Income |

|||||||||||||||

Interest |

$ | 4,731,920 | $ | 13,355,363 | $ | 2,113,110 | |||||||||