UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number 001-32335

_________________________

(Exact name of registrant as specified in its charter)

___________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Zip Code) | ||||||||

| (Address of principal executive offices) | ||||||||

(858 ) 794-8889

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

Securities registered under Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Accelerated filer | Non-accelerated filer | Smaller reporting company | Emerging growth company | ||||||||||||||

| ☒ | ☐ | ☐ | |||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ | |||||||||||||||||

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2022 was approximately $5.1 billion based on the closing price on the NASDAQ Global Select Market reported for such date. Shares of common stock held by each officer and director and by each person who is known to own 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of outstanding shares of the registrant’s common stock, par value $0.001 per share, was 135,366,862 as of February 14, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be filed subsequent to the date hereof with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 2023 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report.

HALOZYME THERAPEUTICS, INC.

INDEX

| Page | |||||||||||

| Item 1. | |||||||||||

| Item 1A. | |||||||||||

| Item 1B. | |||||||||||

| Item 2. | |||||||||||

| Item 3. | |||||||||||

| Item 4. | |||||||||||

| Item 5. | |||||||||||

| Item 6. | |||||||||||

| Item 7. | |||||||||||

| Item 7A. | |||||||||||

| Item 8. | |||||||||||

| Item 9. | |||||||||||

| Item 9A. | |||||||||||

| Item 9B. | |||||||||||

| Item 9C. | |||||||||||

| Item 10. | |||||||||||

| Item 11. | |||||||||||

| Item 12. | |||||||||||

| Item 13. | |||||||||||

| Item 14. | |||||||||||

| Item 15. | |||||||||||

| Item 16. | |||||||||||

3

Summary of Risk Factors

Our business is subject to a number of risks and uncertainties, including those described in the section labeled “Risk Factors” in “Part I, Item 2, Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Quarterly Report. These risks include the following:

Risks Related To Our Business

•If our partnered or proprietary product candidates do not receive and maintain regulatory approvals, or if approvals are not obtained in a timely manner, such failure or delay would substantially impair our ability to generate revenues.

•Use of our partnered or proprietary products and product candidates could be associated with adverse events or product recalls.

•If our contract manufacturers or vendors are unable or unwilling for any reason to manufacture and supply to us bulk rHuPH20 or other raw materials, reagents, components or devices in the quantity and quality required by us or our partners for use in the production of Hylenex or other proprietary or partnered products and product candidates, our and our partners’ product development or commercialization efforts could be delayed or suspended and our business results of operations and our collaborations could be harmed.

•We rely on third parties to perform necessary services for our products including services related to the distribution, invoicing, rebates and contract administration, co-pay program administration, sample distribution and administration, storage and transportation of our products. If anything should impede their ability to meet their commitments this could impact our business performance.

•If we or any party to a key collaboration agreement fail to perform material obligations under such agreement, or if a key collaboration agreement, is terminated for any reason, our business could suffer.

•Hylenex and our partners’ ENHANZE® products and product candidates rely on the rHuPH20 enzyme, and any adverse development regarding rHuPH20 could substantially impact multiple areas of our business, including current and potential ENHANZE collaborations, as well as any proprietary programs.

•Our business strategy is focused on growth of our ENHANZE technology, our auto-injector technology, our commercial products and potential growth through acquisition. Currently, ENHANZE is the largest revenue driver and as a result there is a risk for potential negative impact from adverse developments. Future expansion of our strategic focus to additional applications of our ENHANZE technology or by acquiring new technologies may require the use of additional resources, result in increased expense and ultimately may not be successful.

•Our partnered or proprietary product candidates may not receive regulatory approvals or their development may be delayed for a variety of reasons, including delayed or unsuccessful clinical trials, regulatory requirements or safety concerns. If we or our partners fail to obtain, or have delays in obtaining, regulatory approvals for any product candidates, our business, financial condition and results of operations may be materially adversely affected or delayed.

•Our third-party partners are responsible for providing certain proprietary materials that are essential components of our partnered products and product candidates, and any failure to supply these materials could delay the development and commercialization efforts for these partnered products and product candidates and/or harm our collaborations. Our partners are also responsible for distributing and commercializing their products, and any failure to successfully commercialize their products could materially adversely affect our revenues.

•If we or our partners fail to comply with regulatory requirements applicable to promotion, sale and manufacturing of approved products, regulatory agencies may take action against us or them, which could harm our business.

•Failure to successfully integrate the Antares business, or failure of the Antares business to perform could adversely impact our future business and operations.

4

•Business interruptions resulting from pandemics or similar public health crises could cause a disruption of the development of our and our partnered product candidates and commercialization of our approved and our partnered products, impede our ability to supply bulk rHuPH20 to our ENHANZE partners or procure and sell our proprietary products and otherwise adversely impact our business and results of operations.

•We may need to raise additional capital in the future and there can be no assurance that we will be able to obtain such funds.

•We currently have significant debt and expect to incur additional debt. Failure by us to fulfill our obligations under the applicable debt agreements may cause repayment obligations to accelerate.

•The conditional conversion feature of the Convertible Notes, if triggered, may adversely affect our financial condition and operating results.

•Conversion of our Convertible Notes may dilute the ownership interest of existing stockholders or may otherwise depress the price of our common stock.

•If proprietary or partnered product candidates are approved for commercialization but do not gain market acceptance resulting in commercial performance below that which was expected or projected, our business may suffer.

•Our ability to license our ENHANZE and device technologies to our partners depends on the validity of our patents and other proprietary rights.

•Developing, manufacturing and marketing pharmaceutical products for human use involves significant product liability risks for which we may have insufficient insurance coverage.

•If our partners do not achieve projected development, clinical, or regulatory goals in the timeframes publicly announced or otherwise expected, the commercialization of our partners products may be delayed and, as a result, , our business, financial condition, and results of operations may be adversely affected or delayed.

•Future acquisitions could disrupt our business and impact our financial condition.

•Our effective tax rate may fluctuate, and we may incur obligations in tax jurisdictions in excess of accrued amounts.

Risks Related To Ownership of Our Common Stock

•Our stock price is subject to significant volatility.

•Future transactions where we raise capital may negatively affect our stock price.

•Anti-takeover provisions in our charter documents, the Indentures and Delaware law may make an acquisition of us more difficult.

Risks Related to Our Industry

•Our or our partnered products must receive regulatory approval before they can be sold, and compliance with the extensive government regulations is expensive and time consuming and may result in the delay or cancellation of our or our partnered product sales, introductions or modifications.

•Because some of our and our partners’ products and product candidates are considered to be drug/device combination products, the approval and post-approval requirements that we and they are required to comply with can be more complex.

•We may be subject, directly or indirectly, to various broad federal and state healthcare laws. If we are unable to comply, or have not fully complied, with such laws, we could face civil, criminal and administrative penalties, damages, monetary fines, disgorgement, possible exclusion from participation in Medicare, Medicaid and other federal healthcare programs, contractual damages, reputational harm, diminished profits and future earnings and curtailment or restructuring of our operations, any of which could adversely affect our ability to operate.

5

•We may be required to initiate or defend against legal proceedings related to intellectual property rights, which may result in substantial expense, delay and/or cessation of certain development and commercialization of our products.

•We may incur significant liability if it is determined that we are promoting or have in the past promoted the “off-label” use of drugs or medical devices, or otherwise promoted or marketed approved products in a manner inconsistent with the FDA’s requirements.

•For certain of our products, we and our independent contractors, distributors, prescribers, and dispensers are required to comply with regulatory requirements related to controlled substances, which will require the expenditure of additional time and will incur additional expenses to maintain compliance and may subject us to additional penalties for noncompliance, which could inhibit successful commercialization.

•Patent protection for biotechnology inventions and for inventions generally is subject to significant scrutiny. If patent laws or the interpretation of patent laws change, our business may be adversely impacted because we may lose the ability to enforce our intellectual property rights against competitors who develop and commercialize products based on our discoveries.

•If third-party reimbursement and customer contracts are not available, our proprietary and our partnered products may not be accepted in the market resulting in commercial performance below that which was expected or projected.

•The rising cost of healthcare and related pharmaceutical product pricing has led to cost containment pressures from third-party payers as well as changes in federal coverage and reimbursement policies and practices that could cause us and our partners to sell our products at lower prices, and impact access to our and our partners’ products, resulting in less revenue to us.

•We face competition and rapid technological change that could result in the development of products by others that are competitive with our proprietary and partnered products, including those under development.

General Risks

•If we are unable to attract, hire and retain key personnel our business could be negatively affected.

•Our operations might be interrupted by the occurrence of a natural disaster or other catastrophic event.

•Cyberattacks, security breaches or system breakdowns may disrupt our operations and harm our operating results and reputation.

6

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the “safe harbor” provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. All statements, other than statements of historical fact, included herein, including without limitation those regarding our future product development and regulatory events and goals, product collaborations, our business intentions and financial estimates and anticipated results, are, or may be deemed to be, forward-looking statements. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “think,” “may,” “could,” “will,” “would,” “should,” “continue,” “potential,” “likely,” “opportunity,” “project” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Annual Report. Additionally, statements concerning future matters such as the development or regulatory approval of new partner products, enhancements of existing products or technologies, timing and success of the launch of new products by us and our partners, third party performance under key collaboration agreements, the ability to successfully integrate Antares Pharma, Inc. into our business, the ability of our bulk drug and device part manufacturers to provide adequate supply for our partners, revenue, expense, cash burn levels and our ability to make timely repayments of debt, anticipated amounts and timing of share repurchases, anticipated profitability and expected trends and other statements regarding our plans and matters that are not historical are forward-looking statements.

Although forward-looking statements in this Annual Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation those discussed under the heading “Risk Factors” in Part I, Item 1A below, as well as those discussed elsewhere in this Annual Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report. Readers are urged to carefully review and consider the various disclosures made in this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

References to “Halozyme,” “the Company,” “we,” “us,” and “our” refer to Halozyme Therapeutics, Inc. and its wholly owned subsidiary, Halozyme, Inc., Antares Pharma Inc., and Antares Pharma Inc.’s wholly-owned subsidiaries, Antares Pharma IPL AG and Antares Pharma AG. References to “Notes” refer to the Notes to Consolidated Financial Statements included herein (refer to Part II, Item 8).

PART I

7

Item 1.Business

Overview

Halozyme Therapeutics, Inc. is a biopharma technology platform company that provides innovative and disruptive solutions with the goal of improving the patient experience and potentially outcomes.

Our proprietary enzyme, rHuPH20, is used to facilitate the subcutaneous (“SC”) delivery of injected drugs and fluids. We license our technology to biopharmaceutical companies to collaboratively develop products that combine our ENHANZE® drug delivery technology (“ENHANZE”) with the partners’ proprietary compounds.

Our first commercially approved product, Hylenex® recombinant (“Hylenex”), and our ENHANZE partners’ approved products and product candidates are based on rHuPH20, our patented recombinant human hyaluronidase enzyme. rHuPH20 is the active ingredient in Hylenex, that works by breaking down hyaluronan (“HA”), a naturally occurring carbohydrate that is a major component of the extracellular matrix of the SC space. This temporarily reduces the barrier to bulk fluid flow allowing for improved and more rapid SC delivery of high dose, high volume injectable biologics, such as monoclonal antibodies and other large therapeutic molecules, as well as small molecules and fluids. We refer to the application of rHuPH20 to facilitate the delivery of other drugs or fluids as ENHANZE. We license the ENHANZE technology to form collaborations with biopharmaceutical companies that develop or market drugs requiring or benefiting from injection via the SC route of administration. In the development of proprietary intravenous (“IV”) drugs combined with our ENHANZE technology, data have been generated supporting the potential for ENHANZE to reduce patient treatment burden as a result of shorter duration of SC administration with ENHANZE compared to IV administration. ENHANZE may enable fixed-dose SC dosing compared to weight-based dosing typically required for IV administration, extend the dosing interval for drugs that are already administered subcutaneously and potentially allow for lower rates of infusion related reactions. ENHANZE may enable more flexible treatment options such as home administration by a healthcare professional or potentially the patient or caregiver. Lastly, certain proprietary drugs co-formulated with ENHANZE have been granted additional exclusivity, extending the patent life of the product beyond the patent expiry of the proprietary IV drug.

We currently have ENHANZE collaborations and licensing agreements with F. Hoffmann-La Roche, Ltd. and Hoffmann-La Roche, Inc. (“Roche”), Takeda Pharmaceuticals International AG and Baxalta US Inc (“Takeda”), Pfizer Inc. (“Pfizer”), Janssen Biotech, Inc. (“Janssen”), AbbVie, Inc. (“AbbVie”), Eli Lilly and Company (“Lilly”), Bristol-Myers Squibb Company (“BMS”), Alexion Pharma International Operations Unlimited Company (an indirect wholly owned subsidiary of AstraZeneca PLC)(“Alexion”), argenx BVBA (“argenx”), Horizon Therapeutics plc. (“Horizon”), ViiV Healthcare (the global specialist HIV Company majority owned by GlaxoSmithKline) (“ViiV”) and Chugai Pharmaceutical Co, Ltd (“Chugai”). In addition to receiving upfront licensing fees from our ENHANZE collaborations, we are entitled to receive event and sales-based milestone payments, revenues from the sale of bulk rHuPH20 and royalties from commercial sales of approved partner products co-formulated with ENHANZE. We currently receive royalties from three of these collaborations, including royalties from sales of one product from the Takeda collaboration, three products from the Roche collaboration and one product from the Janssen collaboration. Future potential revenues from ENHANZE collaborations and from the sales and/or royalties of our approved products will depend on the ability of our partners, in some areas supported by Halozyme, to develop, manufacture, secure and maintain regulatory approvals for approved products and product candidates and commercialize product candidates.

Through our recent acquisition of Antares Pharma, Inc. (“Antares”), we also develop, manufacture and commercialize, for ourselves or with our partners, drug-device combination products using our advanced auto-injector technologies. Also as a result of our acquisition of Antares, our commercial portfolio of proprietary products includes XYOSTED®, TLANDO® and NOCDURNA®. We have commercialized auto-injector products with several pharmaceutical companies including Teva Pharmaceutical Industries, Ltd. (“Teva”), Covis Group S.a.r.l. (“Covis”) and Otter Pharmaceuticals, LLC (“Otter”). We have development programs including auto-injectors with Idorsia Pharmaceuticals Ltd. (“Idorsia”) and Pfizer.

Our principal offices and research facilities are located at 12390 El Camino Real, San Diego, CA 92130. Our telephone number is (858) 794-8889 and our e-mail address is info@halozyme.com. Our website address is www.halozyme.com. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this Annual Report on Form 10-K. Our periodic and current reports that we filed with the SEC are available on our website at www.halozyme.com, free of charge, as soon as reasonably practicable after we have electronically filed such material with, or furnished them to, the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports.

8

Our Technology

rHuPH20 can be applied as a drug delivery platform to increase dispersion and absorption of other injected drugs and fluids, potentially reducing treatment burden. For example, rHuPH20 has been used to convert drugs that must be delivered intravenously into SC injections or to reduce the number of SC injections needed for effective therapy. When ENHANZE technology is applied subcutaneously, the rHuPH20 acts locally and transiently, with a tissue half-life of less than 30 minutes. HA at the local site reconstitutes its normal density within two days and, therefore, the effect of rHuPH20 on the architecture of the SC space is temporary.

Through our recent acquisition of Antares, our technology also includes pressure-assisted auto-injector technology. The pressure-assisted auto-injector technology is a form of parenteral drug delivery that continues to gain acceptance and demand among the medical and patient community. Encompassing a variety of sizes and designs, our technology operates by using pressure to force the drug, in solution or suspension, through the skin and deposits the drug into the SC or intramuscular tissue. We have designed disposable, pressure-assisted auto-injector devices to address acute and chronic medical needs, such as rheumatoid arthritis and psoriasis, allergic reactions, migraine headaches, testosterone deficiency and maternal health. Our current platforms include the VIBEX® and the VIBEX® QuickShot® disposable pressure-assisted auto-injection systems, the Vai™ auto-injector and disposable pen injection systems. Our auto-injectors offer a does capacity ranging from 0.5 mL to 2.25 mL. They are designed for speed and patient comfort and accommodate for highly viscous drug products. They are customizable for fill volumes and needle lengths to meet our partners’ needs for reliability requirements, including for emergency use applications.

Our Strategy

We are a leader in converting IV biologics to SC delivery and extending the dosing interval of SC drugs, using our commercially-validated ENHANZE technology. Our ENHANZE technology also has the potential for SC delivery of small molecules, including those developed as long-acting injectables and other therapies that might benefit from larger dose/larger volume SC delivery. We collaborate with leading pharmaceutical and biotechnology companies to help them develop products that combine our ENHANZE technology with their proprietary compounds. We target large, attractive markets, where ENHANZE-enabled SC delivery has the potential to deliver competitive differentiation and other important benefits to our partners, such as larger injection volumes administered rapidly, extended dosing intervals, and reduced treatment burden and healthcare costs. In addition, ENHANZE has been demonstrated to enable the combination of two therapeutic antibodies in a single injection, as well as the development of new co-formulation intellectual property. We leverage our strategic, technical, regulatory and alliance management skills in support of our partners' efforts to develop new subcutaneously delivered products. We currently have twelve collaborations with five currently approved products and additional product candidates in development using our ENHANZE technology. We intend to work with our existing partners to expand our collaborations to add new targets and develop targets and product candidates under the terms of the operative collaboration agreements. We will also continue our efforts to enter into new collaborations to derive additional revenue from our proprietary technology.

We also support leading pharmaceutical companies by assisting in the development of, and supplying, auto-injector devices and auto-injector drug combination products. We leverage our engineering, regulatory and manufacturing skills to support our partners’ plans. We intend to extend the range of auto-injectors available to current and new partners, initiating development of a high volume auto-injector, and further extend the number of partners by gaining more partners for the current auto-injectors.

9

Product and Product Candidates

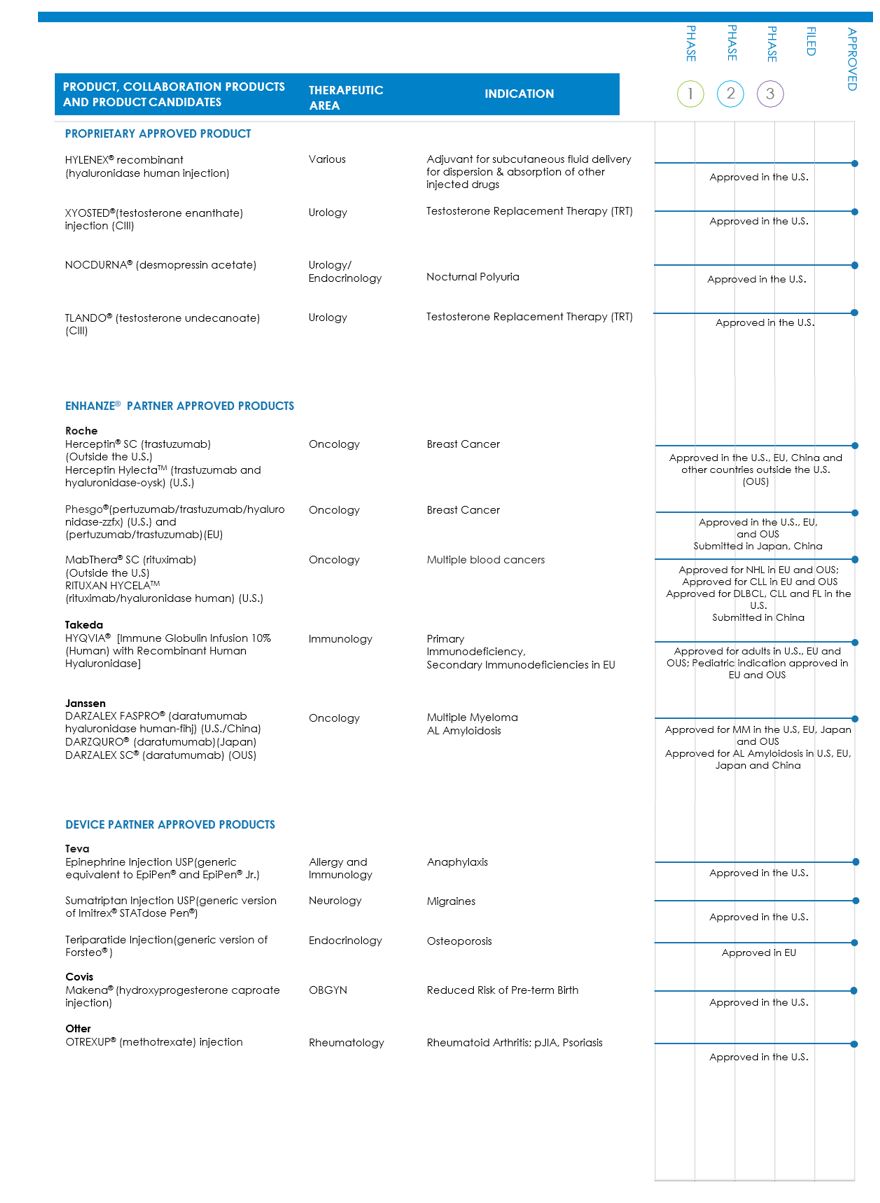

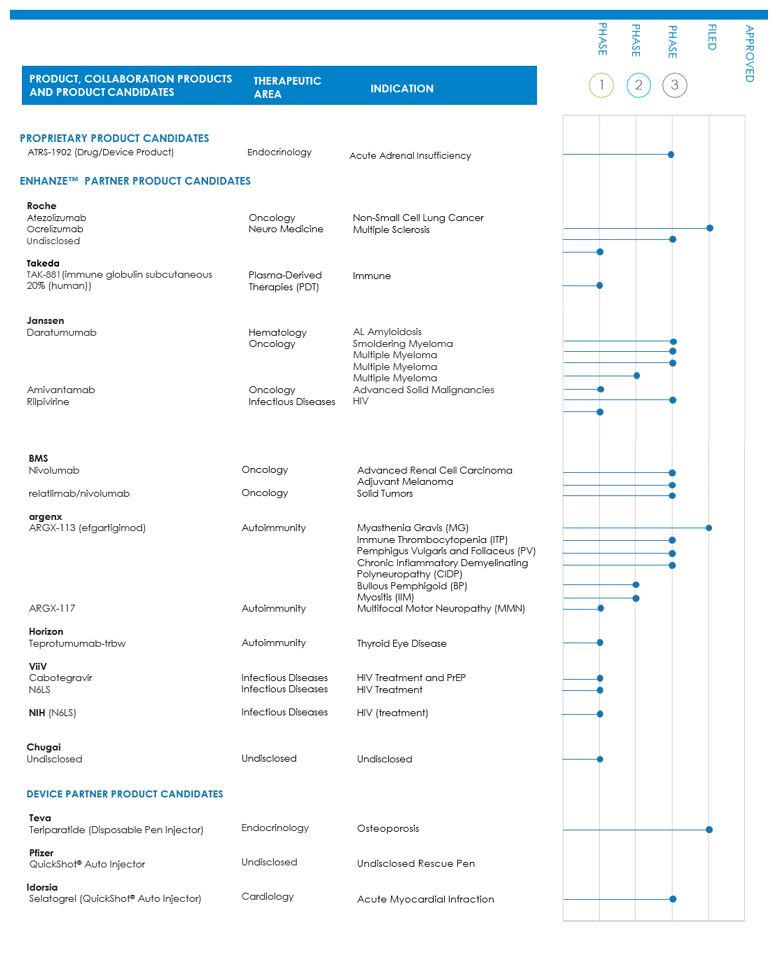

The following table summarizes our marketed proprietary products and product candidates under development and our marketed partnered products and product candidates under development with our partners:

10

11

Proprietary Products and Product Candidates

Hylenex Recombinant (hyaluronidase human injection)

We market and sell Hylenex recombinant which is a formulation of rHuPH20 that facilitates SC administration for achieving hydration, increases the dispersion and absorption of other injected drugs and, in SC urography, to improve resorption of radiopaque agents. Hylenex recombinant is currently the number one prescribed branded hyaluronidase.

XYOSTED (testosterone enanthate) Injection

We market and sell in the U.S. our proprietary product XYOSTED injection for SC administration of testosterone replacement therapy (“TRT”) in adult males for conditions associated with a deficiency or absence of endogenous testosterone (primary or hypogonadism). XYOSTED is the only FDA-approved SC testosterone enanthate product for once-weekly, at-home self-administration and is approved and marketed in three dosage strengths, 50 mg, 75 mg and 100 mg. Safety and efficacy of XYOSTED in males less than 18 years old have not been established.

NOCDURNA (desmopressin acetate) Sublingual Tablets

We market and sell NOCDURNA in the U.S., which is the first and only sublingual tablet indicated for the treatment of nocturia due to nocturnal polyuria (“NP”) in adults who awaken at least two times per night to urinate. In the NOCDURNA clinical trials, NP was defined as night-time urine production exceeding one-third of the 24-hour urine production. NOCDURNA is a sublingual tablet, marketed in two dosage strengths, that dissolves quickly under the tongue without water and has been shown in clinical studies to reduce nighttime urination by nearly one-half (in patients who average three nighttime bathroom visits.) We license NOCDURNA from Ferring. In October 2022, we sent a notice to Ferring that we are terminating the NOCDURNA license agreement with an effective termination date in October 2023.

TLANDO (testosterone undecanoate) Oral Formulation

TLANDO is a twice daily oral formulation of testosterone indicated for testosterone replacement therapy in adult males for conditions associated with a deficiency or absence of endogenous testosterone (primary or hypogonadotropic hypogonadism). TLANDO was granted FDA approval in March 2022. In June 2022, we announced the commercial launch of TLANDO. Safety and efficacy of TLANDO in males less than 18 years old have not been established.

ATRS - 1902

We have an ongoing program to develop a proprietary drug device combination product for the endocrinology market, for patients who require additional supplemental hydrocortisone, identified as ATRS-1902. The development program uses a novel proprietary auto-injector platform to deliver a liquid stable formulation of hydrocortisone.

In June 2021, we submitted an IND application with the FDA for the initiation of a Phase 1 clinical study of ATRS-1902 for adrenal crisis rescue. The IND application includes the protocol for an initial clinical study to compare the pharmacokinetic profile of our novel formulation of hydrocortisone versus Solu-Cortef®, which is an anti-inflammatory glucocorticoid and is the current standard of care for the management of acute adrenal crises.

In July 2021, the FDA accepted our IND for ATRS-1902 enabling us to initiate our Phase 1 clinical study. The Phase 1 clinical study, designed to evaluate the safety, tolerability and pharmacokinetics (“PK”) of a liquid stable formulation of hydrocortisone, was initiated in September 2021. The study was a cross-over design to establish the PK profile of ATRS-1902 (100 mg) compared to Solu-Cortef (100 mg), the reference-listed drug, in 32 healthy adults.

In January 2022, we announced the positive results from the Phase 1 clinical study and were granted Fast Track designation by the FDA. The positive results supported the advancement of our ATRS-1902 development program to a pivotal study for the treatment of acute adrenal insufficiency using our Vai novel proprietary rescue pen platform to deliver a liquid stable formulation of hydrocortisone.

Partnered Products

ENHANZE Collaborations

Roche Collaboration

In December 2006, we and Roche entered into a collaboration and license agreement under which Roche obtained a worldwide license to develop and commercialize product combinations of rHuPH20 and up to twelve Roche target compounds (the Roche Collaboration). Under this agreement, Roche elected a total of eight targets, two of which are exclusive.

12

In September 2013, Roche launched a SC formulation of Herceptin (trastuzumab) (Herceptin® SC) in Europe for the treatment of patients with HER2-positive breast cancer followed by launches in additional countries. This formulation utilizes our ENHANZE technology and is administered in two to five minutes, compared to 30 to 90 minutes with the standard IV form. In September 2018, we announced that Roche received approval from Health Canada for Herceptin SC for the treatment of patients with HER2-positive breast cancer. In February 2019, we announced that Roche received approval from the U.S. Food and Drug Administration (“FDA”) for Herceptin SC under the brand name Herceptin Hylecta™ (trastuzumab and hyaluronidase-oysk). In April 2019, Roche made Herceptin Hylecta available in the U.S. In October 2022, Roche Pharmaceuticals China announced the approval of Herceptin in China for the treatment of patients with early-stage and metastatic HER2-positive breast cancer.

In June 2020, the FDA approved the fixed-dose combination of Perjeta® (pertuzumab) and Herceptin for SC injection (Phesgo™) utilizing ENHANZE technology for the treatment of patients with HER2-positive breast cancer. In December 2020, the European Commission (“EC”) also approved Phesgo for the treatment of patients with early and metastatic HER2-positive breast cancer. In July 2022, Roche submitted the Initial Marketing Application (“IMA”) for the fixed-dose combination of Perjeta (pertuzumab) and Herceptin for SC injection (Phesgo) to Center for Drug Evaluation (“CDE”) in China. In September 2022, Chugai Pharmaceutical Co., Ltd. (a Member of the Roche Group) announced the submission of a new NDA in Japan for fixed-dose SC combination of pertuzumab and trastuzumab (same monoclonal antibodies as in Perjeta and Herceptin) with ENHANZE. This application is based on data from two clinical studies including the results from the global Phase 3 FeDeriCa study in patients with HER2-positive breast cancer.

In June 2014, Roche launched MabThera® SC in Europe for the treatment of patients with common forms of non-Hodgkin lymphoma (NHL) followed by launches in additional countries. This formulation utilizes our ENHANZE technology and is administered in approximately five minutes compared to the approximately 1.5 to 4 hour IV infusion. In May 2016, Roche announced that the European Medicines Agency (“EMA”) approved Mabthera SC to treat patients with chronic lymphocytic leukemia (“CLL”). In June 2017, the FDA approved Genentech’s RITUXAN HYCELA®, a combination of rituximab using ENHANZE technology (approved and marketed under the MabThera SC brand in countries outside the U.S. and Canada), for CLL and two types of NHL, follicular lymphoma and diffuse large B-cell lymphoma. In March 2018, Health Canada approved a combination of rituximab and rHuPH20 (approved and marketed under the brand name RITUXAN® SC) for patients with CLL. In November 2022, Roche submitted the IMA for Mabthera SC to CDE in China.

In September 2017, we entered into an agreement with Roche to develop and commercialize one additional exclusive target using ENHANZE technology. The upfront license payment may be followed by event-based payments subject to Roche’s achievement of specified development, regulatory and sales-based milestones. In addition, Roche will pay royalties to us if products under the collaboration are commercialized.

In October 2018, we entered into an agreement with Roche for the right to develop and commercialize one additional exclusive target and an option to select two additional targets within four years using ENHANZE technology. The upfront license payment may be followed by event-based payments subject to Roche’s achievement of specified development, regulatory and sales-based milestones. In addition, Roche will pay royalties to us if products under the collaboration are commercialized. Roche subsequently returned the rights for the first exclusive target.

In December 2018, Roche initiated a Phase 1b/2 study in patients with non-small cell lung cancer for TECENTRIQ® (atezolizumab) using ENHANZE technology. In December 2020, Roche initiated a Phase 3 study in patients with non-small cell lung cancer (NSCLC) for TECENTRIQ using ENHANZE technology. In August 2022, Roche announced that the Phase 3 study met its co-primary endpoints, showing non-inferior levels of Tecentriq in the blood (pharmacokinetics), when injected subcutaneously, compared with IV infusion, in cancer immunotherapy-naïve patients with advanced or metastatic NSCLC for whom prior platinum therapy has failed. The safety profile of the SC formulation was consistent with that of IV Tecentriq. In November 2022, Roche submitted a Biologics License Application (“BLA”) to the FDA and a Marketing Authorization Application (“MAA”) to the EMA for SC formulation of Tecentriq (atezolizumab) with ENHANZE across all approved indications of IV Tecentriq. In January 2023, FDA accepted the BLA for the SC formulation of Tecentriq with the official PDUFA goal date of September 15, 2023.

In August 2019, Roche initiated a Phase 1 study evaluating OCREVUS® (ocrelizumab) with ENHANZE technology in subjects with multiple sclerosis. In April 2022, Roche initiated a Phase 3 study evaluating OCREVUS with ENHANZE technology in subjects with multiple sclerosis.

In October 2019, Roche nominated a new undisclosed exclusive target to be studied using ENHANZE technology. In November 2021, Roche initiated a Phase 1 study with the undisclosed target and ENHANZE.

13

Takeda Collaboration

In September 2007, we and Takeda entered into a collaboration and license agreement under which Takeda obtained a worldwide, exclusive license to develop and commercialize product combinations of rHuPH20 with GAMMAGARD LIQUID (HYQVIA®) (the Takeda Collaboration). HYQVIA is indicated for the treatment of primary immunodeficiency disorders associated with defects in the immune system.

In May 2013, the EC granted Takeda marketing authorization in all European Union (“EU”) Member States for the use of HYQVIA (solution for SC use) as replacement therapy for adult patients with primary and secondary immunodeficiencies. Takeda launched HYQVIA in the first EU country in July 2013 and has continued to launch in additional countries.

In September 2014, HYQVIA was approved by the FDA for treatment of adult patients with primary immunodeficiency in the U.S. HYQVIA is the first SC immune globulin (IG) treatment approved for adult primary immunodeficiency patients with a dosing regimen requiring only one infusion up to once per month (every three to four weeks) and one injection site per infusion in most patients, to deliver a full therapeutic dose of IG.

In May 2016, Takeda announced that HYQVIA received a marketing authorization from the EC for a pediatric indication, which was launched in Europe to treat primary and certain secondary immunodeficiencies. In September 2020, Takeda announced that the EMA approved a label update for HYQVIA broadening its use and making it the first and only facilitated SC immunoglobulin replacement therapy in adults, adolescents and children with an expanded range of secondary immunodeficiencies (SID).

In October 2021, Takeda initiated a Phase 1 single-dose, single-center, open-label, three-arm study to assess the tolerability and safety of immune globulin SC (human), 20% solution with ENHANZE (TAK-881) at various infusion rates in healthy adult subjects.

In July 2022, Takeda announced positive topline results from pivotal Phase 3 trial evaluating HYQVIA, for maintenance treatment of chronic inflammatory demyelinating polyradiculoneuropathy (CIDP), and Takeda confirmed its intention to submit regulatory applications in the United States and European Union in its fiscal year 2022. In July 2022, Takeda filed a supplemental Biologics License Application (sBLA) for the potential expanded use of HYQVIA for pediatric indication for primary immunodeficiency.

Pfizer Collaboration

In December 2012, we and Pfizer entered into a collaboration and license agreement, under which Pfizer has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with Pfizer proprietary biologics in primary care and specialty care indications. Pfizer has elected five targets and has returned two targets.

Janssen Collaboration

In December 2014, we and Janssen entered into a collaboration and license agreement, under which Janssen has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with Janssen proprietary biologics directed to up to five targets. Targets may be selected on an exclusive basis. Janssen has elected CD38 as the first target on an exclusive basis. Janssen has initiated several Phase 3 studies, Phase 2 studies and Phase 1 studies of DARZALEX® (daratumumab), directed at CD38, using ENHANZE technology in patients with amyloidosis, smoldering myeloma and multiple myeloma.

In February 2019, Janssen’s development partner, Genmab, announced positive Phase 3 trial results from the COLUMBA study evaluating SC DARZALEX in comparison to IV DARZALEX in patients with relapsed or refractory multiple myeloma. DARZALEX SC® (utilizing ENHANZE technology) was found to be non-inferior to DARZALEX IV with regard the co-primary endpoints of Overall Response Rate and Maximum Trough concentration. In May 2020, we announced that Janssen received US FDA approval and launched the commercial sale of DARZALEX FASPRO® in four regimens across five indications in multiple myeloma patients, including newly diagnosed, transplant-ineligible patients as well as relapsed or refractory patients. As a fixed-dose formulation, DARZALEX FASPRO can be administered over three to five minutes, significantly less time than DARZALEX IV which requires multi-hour infusions. In June 2020, we announced that Janssen received European marketing authorization and launched the commercial sale of DARZALEX SC utilizing ENHANZE in the EU. Subsequent to these approvals, Janssen received several additional regulatory approvals for additional indications and patient populations in US, EU, Japan and China. Beginning with the US, in January 2021, Janssen received FDA approval for DARZALEX FASPRO in combination with bortezomib, thalidomide, and dexamethasone in newly diagnosed multiple myeloma patients who are eligible for autologous stem cell transplant. In January 2021, Janssen received accelerated approval from the FDA for DARZALEX FASPRO in combination with bortezomib, cyclophosphamide and dexamethasone (D-VCd) for the treatment of adult patients with newly diagnosed AL amyloidosis (not recommended for the treatment of patients with AL amyloidosis who have NYHA Class IIIB or Class IV cardiac disease or Mayo Stage IIIB outside of controlled clinical trials). In July 2021, Janssen received FDA approval for DARZALEX FASPRO in combination with pomalidomide and dexamethasone

14

(D-Pd) for patients with multiple myeloma after first or subsequent relapse. In July 2021, Janssen received FDA approval for DARZALEX FASPRO in combination with D-Pd for patients with multiple myeloma after first or subsequent relapse. In November 2021, Janssen received FDA approval for DARZALEX FASPRO in combination with Kyprolis® (carfilzomib) and dexamethasone for patients with relapsed or refractory multiple myeloma who have received one to three prior lines of therapy. In the EU, in June 2021, we announced that Janssen received marketing authorization from the EC for DARZALEX SC in two new indications, in combination with D-VCd in newly diagnosed adult patients with AL amyloidosis and in combination with D-Pd in adult patients with relapsed or refractory multiple myeloma. In Japan in March 2021, Janssen announced approval from Japan’s Ministry of Health, Labour and Welfare (MHLW) for the SC formulation of DARZALEX (known as DARZQURO) in Japan for the treatment of multiple myeloma, and in May 2021 Janssen commenced commercial sale in Japan. In August 2021, Janssen received approval of DARZQURO for systemic AL amyloidosis in Japan. In China in October 2021, Janssen’s DARZALEX FASPRO was approved by the China National Medical Products Administration (NMPA) for the treatment of primary light chain amyloidosis, in combination with D-VCd in newly diagnosed patients.

In December 2019, Janssen elected EGFR and cMET as a bispecific antibody (amivantamab) target on an exclusive basis, which is being studied in solid tumors. In November 2020, Janssen initiated a Phase 1 study of amivantamab and ENHANZE. In September 2022, Janssen initiated a Phase 3 study of lazertinib and amivantamab with ENHANZE in patients with epidermal growth factor receptor (EGFR)-mutated advanced or metastatic non-small cell lung cancer (PALOMA-3). In November 2022, Janssen initiated a Phase 2 study of amivantamab with ENHANZE in multiple regimens in patients with advanced or metastatic solid tumors including epidermal growth factor receptor (EGFR)-mutated non-small cell lung cancer (PALOMA-2).

In July 2021, Janssen elected the target HIV reverse transcriptase limited to non-nucleoside reverse transcriptase inhibitors. In December 2021, Janssen initiated a Phase 1 clinical trial combining rilpivirine and ENHANZE. Janssen and ViiV are exploring the possibility of an ultra-long acting version of CABENUVA using ENHANZE.

AbbVie Collaboration

In June 2015, we and AbbVie entered into a collaboration and license agreement, under which AbbVie has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with AbbVie proprietary biologics directed to up to nine targets. Targets may be selected on an exclusive basis. AbbVie elected one target on an exclusive basis, TNF alpha, for which it has discontinued development and returned the target.

Lilly Collaboration

In December 2015, we and Lilly entered into a collaboration and license agreement, under which Lilly has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with Lilly proprietary biologics. Lilly currently has the right to select up to three targets. Targets may be selected on an exclusive basis. Lilly has elected two targets on an exclusive basis and one target on a semi-exclusive basis.

BMS Collaboration

In September 2017, we and BMS entered into a collaboration and license agreement, which became effective in November 2017, under which BMS had the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with BMS products directed at up to eleven targets. Targets may be selected on an exclusive basis or non-exclusive basis. BMS has designated multiple immuno-oncology targets including programmed death 1 (PD-1) and has an option to select 3 additional targets by November 2024. In October 2019, BMS initiated a Phase 1 study of relatlimab, an anti-LAG 3 antibody, in combination with nivolumab using ENHANZE technology. In May 2021, BMS initiated a Phase 3 of nivolumab using ENHANZE technology, for patients with advanced or metastatic clear cell renal cell carcinoma (CheckMate-67T), leveraging data and insights from Phase 1/2 CA209-8KX study in patients with solid tumors. In June 2022, BMS nominated a new undisclosed target. In August 2022, BMS initiated a Phase 3 trial to compare the drug levels of nivolumab with ENHANZE administered subcutaneously vs IV administration in participants with melanoma following complete resection (CheckMate-6GE). BMS plans to initiate a Phase 3 trial in early 2023 to demonstrate the drug exposure levels of nivolumab and relatlimab fixed-dose combination with ENHANZE is not inferior than intravenous administration in participants with previously untreated metastatic or unresectable melanoma (RELATIVITY-127).

Alexion Collaboration

In December 2017, we and Alexion entered into a collaboration and license agreement, under which Alexion has the worldwide license to develop and commercialize products combining our rHuPH20 enzyme with Alexion’s portfolio of products directed at up to four exclusive targets and has access to utilize ENHANZE with up to three exclusive targets.

argenx Collaboration

In February 2019, we and argenx entered into an agreement for the right to develop and commercialize one exclusive target, the human neonatal Fc receptor FcRn, which includes argenx's lead asset efgartigimod (ARGX-113), and an option to select two additional targets using ENHANZE technology. In May 2019, argenx nominated a second target to be studied using

15

ENHANZE technology, a human complement factor C2 associated with the product candidate ARGX-117, which is being developed to treat severe autoimmune diseases in Multifocal Motor Neuropathy (MMN). In October 2020, we and argenx entered into an agreement to expand the collaboration relationship. Under the newly announced expansion, argenx gained the ability to exclusively access our ENHANZE technology for three additional targets for a total of up to six targets under the existing and newly expanded collaboration.

In July 2019, argenx dosed the first subject in a phase 1 clinical trial evaluating the safety, pharmacokinetics and pharmacodynamics of efgartigimod (ARGX-113), using ENHANZE technology. In December 2019, argenx reported that based on data from the phase 1 study and internal company analysis, a one minute injection administered every 2 weeks may be possible. In December 2020, argenx initiated a Phase 3 study of ARGX-113 using ENHANZE technology for patients with immune thrombocytopenia (ITP), an immune disorder in which the blood does not clot normally. In January 2021, argenx initiated a Phase 3 study of ARGX-113 using ENHANZE technology in pemphigus vulgaris and foliaceus (PV), a rare autoimmune disease that causes painful blisters on the skin and mucous membranes. In February 2021, argenx initiated a Phase 3 study of ARGX-113 using ENHANZE technology for patients with chronic inflammatory demyelinating polyneuropathy (CIDP) and initiated a Phase 3 study of ARGX-113 using ENHANZE technology in myasthenia gravis (MG), an autoimmune disorder of the musculoskeletal system caused by IgG autoantibodies. In December 2021, argenx announced the FDA approval of efgartigimod (VYVGARTTM) for the treatment of generalized myasthenia gravis for the IV dosing regimen. In March 2022, argenx announced that data from argenx’s phase 3 ADAPT-SC study evaluating SC efgartigimod (1000mg efgartigimod-PH20) for the treatment of generalized myasthenia gravis (gMG) achieved the primary endpoint of total IgG reduction from baseline at day 29, demonstrating statistical non-inferiority to VYVGART (efgartigimod alfa-fcab) IV formulation in gMG patients. In June 2022, argenx initiated a study, BALLAD, evaluating Efgartigimod with ENHANZE in bullous pemphigoid. In September 2022, argenx announced the submission of a BLA to the US FDA for SC efgartigimod for the treatment of adults with gMG. In November 2022, argenx announced the acceptance of the BLA application for SC efgartigimod in gMG with a priority review and a Prescription Drug User Free Act (“PDUFA”) date of March 20, 2023. In January 2023, argenx announced the review time was extended by the FDA to June 20, 2023 to allow the FDA sufficient time to review. Argenx has also submitted a marketing authorization application to the European Medicines Agency for SC efgartigimod for the treatment of adults with gMG with an anticipated regulatory approval decision in the fourth quarter of 2023.

Horizon Collaboration

In November 2020, we and Horizon entered into a global collaboration and license agreement that gives Horizon exclusive access to ENHANZE technology for SC formulation of medicines targeting IGF-1R. Horizon intends to use ENHANZE to develop a SC formulation of TEPEZZA® (teprotumumab-trbw), indicated for the treatment of thyroid eye disease, a serious, progressive and vision-threatening rare autoimmune disease, potentially shortening drug administration time, reducing healthcare practitioner time and offering additional flexibility and convenience for patients. In March 2021, Horizon completed dosing in a Phase 1 study exploring the SC formulation of TEPEZZA. The trial was a small, single-dose Phase 1 pharmacokinetic trial which included evaluation of ENHANZE technology for a SC formulation. In March 2022, Horizon announced the completion of a Phase 1 trial for the TEPEZZA SC program.

ViiV Healthcare Collaboration

In June 2021, we entered into a global collaboration and license agreement with ViiV. The license gives ViiV exclusive access to our ENHANZE technology for four specific small and large molecule targets for the treatment and prevention of HIV. These targets are integrase inhibitors, reverse transcriptase inhibitors limited to nucleoside reverse transcriptase inhibitors (NRTI) and nucleoside reverse transcriptase translocation inhibitors (NRTTIs), capsid inhibitors and broadly neutralising monoclonal antibodies (bNAbs), that bind to the gp120 CD4 binding site. In December 2021, ViiV initiated enrollment of a Phase 1 study to evaluate cabotegravir administered subcutaneously with ENHANZE. In February 2022, ViiV initiated enrollment of a Phase 1 study to evaluate the safety and pharmacokinetics of N6LS, a broadly neutralizing antibody, administered subcutaneously with ENHANZE technology. In June 2022, ViiV initiated enrollment of a Phase 1 single dose escalation study to evaluate pharmacokinetics, safety and tolerability of long-acting cabotegravir administered subcutaneously with ENHANZE technology.

Chugai Collaboration

In March 2022, we entered into a global collaboration and license agreement with Chugai Pharmaceutical Co., Ltd. The license gives Chugai exclusive access to ENHANZE drug delivery technology for an undisclosed target. Chugai intends to explore the potential use of ENHANZE for a Chugai drug candidate. In May 2022, Chugai initiated a Phase 1 study to evaluate the pharmacokinetics, pharmacodynamics, and safety of targeted antibody administered subcutaneously with ENHANZE.

NIH CRADA

In June 2019, we announced a Cooperative Research and Development Agreement (“CRADA”) with the National Institute of Allergy and Infectious Diseases’ Vaccine Research Center (VRC), part of National Institute of Health (NIH),

16

enabling the VRC’s use of ENHANZE technology to develop SC formulations of VRC07-523LS and N6LS broadly neutralizing antibodies (bnAbs) against HIV for HIV treatment. In April 2021, we were notified that the first patient was dosed with N6LS and rHuPH20 in VRC 609 Phase 1 dose-escalation study to evaluate safety, tolerability, and pharmacokinetics of N6LS using ENHANZE technology. In October 2022, the VRC 609 Phase 1 study was completed.

CAPRISA

In September 2020, we entered into a collaboration with the Centre for the AIDS Programme of Research in South Africa (CAPRISA), a non-profit company, to evaluate safety, tolerability and pharmacokinetics of a human monoclonal antibody (CAP256V2LS) in HIV-negative and HIV-positive women in South Africa. In October 2020, we were notified that the first patient was dosed with CAP256V2LS and rHuPH20 in CAPRISA 012B Phase 1 dose-escalation study to evaluate safety, tolerability, and pharmacokinetics of CAP256V2LS alone and in combination with VRC07-523LS using ENHANZE technology. In January 2021, we were notified the first patient was dosed with CAP256V2LS and rHuPH20 in combination with VRC07-523LS and rHuPH20 in CAPRISA 012B Phase 1 study. VRC07-523LS broadly neutralizing antibody was supplied by the NIH/VRC under a research collaboration with CAPRISA. In June 2022, we received final study reports for CAPRISA 012B Phase 1 study and concluded our collaboration with CAPRISA.

Device and Other Drug Product Collaborations

Teva License, Development and Supply Agreements

In July 2006, we entered into an exclusive license, development and supply agreement with Teva for an epinephrine auto- injector product to be marketed in the U.S. and Canada. Pursuant to the agreement, Teva is obligated to purchase all of its delivery device requirements from us. We received an upfront cash payment and a milestone payment upon FDA product approval. We also receive a negotiated purchase price for each device sold, as well as royalties on Teva’s commercial sales of the product. The agreement will continue until the expiration of the last to expire patent that is filed no later than 12 months after FDA approval. We have multiple patents that have been granted by the United States Patent and Trademark Office (“USPTO”) that cover this product, the latest of which will expire in 2033. We have and plan to continue to file patent applications covering this product. We are the exclusive supplier of the device, which we developed, for Teva’s generic Epinephrine Injection USP products, indicated for emergency treatment of severe allergic reactions including those that are life threatening (anaphylaxis) in adults and certain pediatric patients. Teva’s Epinephrine Injection, utilizing our patented VIBEX® injection technology, was approved by the FDA as a generic drug product with an AB rating, meaning that it is therapeutically equivalent to the branded products EpiPen® and EpiPen Jr® and therefore, subject to state law, substitutable at the pharmacy. We supply the device and Teva is responsible for the drug, assembly and packaging, distribution and commercialization of the finished product, for which we also receive royalties on Teva’s net sales.

In December 2007, we entered into a license, development and supply agreement with Teva under which we developed and will supply a disposable pen injector for two therapeutic products: exenatide and teriparatide. Under the agreement, we received an upfront payment and development milestones, and are entitled to receive royalties on net product sales by Teva in territories where commercialized. On February 25, 2022, Teva notified us that it was terminating the exenatide program and related agreement due to a lack of commercial viability. The termination was effective August 23, 2022.

We are the exclusive supplier of the multi-dose pen, which we developed, used in Teva’s generic teriparatide injection product. In 2020, Teva launched Teriparatide Injection, the generic version of Eli Lilly’s branded product Forsteo® featuring our multi-dose pen platform, for commercial sale in several countries outside of the U.S. Under an exclusive development, license and supply agreement with Teva, we are responsible for the manufacturing and supply of the multi-dose pen used in Teva’s generic teriparatide product and Teva is responsible for the sale and distribution of the product. We are compensated for devices sold to Teva and we are entitled to receive royalties on net product sales by Teva in the territories.

In November 2012, we entered into a license, supply and distribution agreement with Teva for an auto-injector product containing sumatriptan for the treatment of migraines. Teva is responsible for the manufacture, supply, commercialization and distribution of the drug, and Halozyme is responsible for the manufacture and supply of the device and assembly and packaging of the finished product. We are compensated at cost for product shipment to Teva and Teva distributes the product in the U.S. Teva also received an option for distribution rights in other territories. In addition, net profits are shared equally between Halozyme and Teva. The term of the agreement continues seven years from commercial launch, which was in June 2016, with automatic one-year renewals unless terminated sooner by either party in accordance with the terms of the agreement.

Covis Agreements

In September 2014, we entered into a development and license agreement with Covis, to develop and supply a SC auto-injector system for use with Makena, a progestin drug (hydroxyprogesterone caproate) indicated to reduce the risk of preterm birth in women pregnant with one baby and who spontaneously delivered one preterm baby in the past. Under the agreement, we were granted an exclusive, worldwide, royalty-bearing license, with the right to sublicense, to certain intellectual property rights, including know-how, patents and trademarks. Covis is responsible for the clinical development and preparation,

17

submission and maintenance of all regulatory applications, and is responsible for the manufacture and supply of the drug to be used in the product, and to market, distribute and sell the product.

In March 2018, we entered into a manufacturing agreement with Covis for the exclusive supply of the device, a variation of our VIBEX QuickShot SC auto-injector developed by us, and fully assembled and packaged final finished product of the Makena SC auto-injector. We receive a contracted price per unit on each product manufactured and royalties based on net sales of products commencing on product launch in a particular country.

In October 2020, Covis received notice that the FDA proposed to withdraw approval of Makena (hydroxyprogesterone caproate injection). Covis requested a public hearing in an effort to maintain patient access to Makena as a treatment option to reduce pre-term birth. In October 2022 the hearing resulted in the FDA Advisory Committee recommending that Makena should not remain on the market.

Pfizer Agreement

In August 2018, we entered into a development agreement with Pfizer to jointly develop a combination drug device rescue pen utilizing the QuickShot auto-injector and an undisclosed Pfizer drug. We are continuing to evaluate the next steps for this program.

Idorsia Agreement

In November 2019, we entered into a global agreement with Idorsia to develop a novel, drug-device product containing selatogrel. A new chemical entity selatogrel is being developed for the treatment of a suspected acute myocardial infarction (AMI) in adult patients with a history of AMI. Idorsia will pay for the development of the combination product and will be responsible for applying for and obtaining global regulatory approvals for the product. The parties intend to enter into a separate commercial license and supply agreement pursuant to which Antares will provide fully assembled and labelled product to Idorsia at cost plus mark-up. Idorsia will then be responsible for global commercialization of the product, pending FDA or foreign approval. Halozyme will be entitled to receive royalties on net sales of the commercial product.

Ferring Agreement

In October 2020, we entered into an exclusive license and commercial supply agreement with Ferring for the marketed product NOCDURNA (desmopressin acetate) in the U.S. Under the terms of the license agreement, we paid Ferring an upfront payment of $5.0 million upon execution and paid an additional $2.5 million on October 1, 2021. Ferring is eligible for tiered royalties and additional commercial milestone payments potentially totaling up to $17.5 million based on our net sales of NOCDURNA in the U.S. In October 2022, we sent a notice to Ferring that we are terminating the NOCDURNA license agreement with an effective termination date in October 2023.

Lipocine Agreement

In October 2021, we entered into an exclusive license agreement with Lipocine for the product TLANDO (testosterone undecanoate) in the U.S. In June 2022, we announced the commercial launch of TLANDO. Under the terms of the license agreement, we paid Lipocine an upfront payment of $11.0 million. Lipocine is eligible for additional milestone payments up to $10.0 million and tiered royalty and commercial milestones based on net sales of TLANDO in the U.S. We will be responsible for the manufacturing and commercialization of TLANDO.

Otter Agreement

In December 2021, we entered into a supply agreement with Otter to manufacture the VIBEX auto-injection system device, designed and developed to incorporate a pre-filled syringe for delivery of methotrexate, assemble, package, label and supply the final OTREXUP product and related samples to Otter at cost plus mark-up. Otter is responsible for manufacturing, formulation and testing of methotrexate and the corresponding pre-filled syringe for assembly with the device manufactured by us, along with the commercialization and distribution of OTREXUP. OTREXUP is a SC methotrexate injection for once weekly self-administration with an easy-to-use, single dose, disposable auto-injector, indicated for adults with severe active rheumatoid arthritis (“RA”), children with active polyarticular juvenile idiopathic arthritis and adults with severe recalcitrant psoriasis. Further, we entered into a license agreement with Otter in which we granted Otter a worldwide, exclusive, fully paid-up license to certain patents relating to OTREXUP that may also relate to our other products for Otter to commercialize and otherwise exploit OTREXUP in the field as defined in the license agreement.

For a further discussion of the collaboration agreements, refer to Note 2, Summary of Significant Accounting Policies - Revenues under Collaborative Agreements.

Patents and Intellectual Proprietary Rights

Patents and other intellectual proprietary rights are essential to our business. Our success will depend in part on our ability to obtain patent protection for our inventions, to preserve our trade secrets and to operate without infringing the proprietary

18

rights of third parties. Our strategy is to actively pursue patent protection in the U.S. and certain foreign jurisdictions for technology that we believe to be proprietary to us and that offers us a potential competitive advantage.

Halozyme Patent Portfolio

Our Halozyme patent portfolio includes patents in the U.S., Europe and other countries in the world and we also have numerous pending patent applications. In general, patents have a term of 20 years from the application filing date or earlier claimed priority date. Our issued patents will expire between 2023 and 2039. We continue to file and prosecute patent applications to strengthen and grow our patent portfolio pertaining to our recombinant human hyaluronidase and other drugs and drug delivery devices, which cover primarily compositions of matter, formulations, methods of use and devices. We have multiple patents and patent applications throughout the world pertaining to our recombinant human hyaluronidase and methods of use and manufacture, including an issued U.S. patent which expires in 2027 and an issued European patent which expires in 2024, which we believe cover the products and product candidates under our existing collaborations and Hylenex recombinant. In addition, we have, under prosecution throughout the world, multiple patent applications that relate specifically to individual product candidates under development, the expiration of which can only be definitely determined upon maturation into our issued patents. We believe our patent filings represent a barrier to entry for potential competitors looking to utilize these hyaluronidases.

Other Proprietary Rights

In addition to patents, we rely on trade secrets, proprietary know-how, regulatory exclusivities and continuing technological innovation to protect our products and technologies. We protect our trade secrets, proprietary know-how and innovation, in part, by maintaining physical security of our sites and electronic security of our information technology systems and utilizing confidentiality and proprietary information agreements. Our policy is to require our employees, directors, consultants, advisors, partners, outside scientific partners and sponsored researchers, other advisors and other individuals and entities to execute confidentiality agreements upon the start of employment, consulting or other contractual relationships with us. These agreements provide that all confidential information developed or made known to the individual or entity during the course of the relationship is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of employees and some other parties, the agreements provide that all discoveries and inventions conceived by the individual will be our exclusive property. In certain instances, partners with which we have entered into development agreements may have rights to certain technology developed in connection with such agreements. Despite the use of these agreements and our efforts to protect our intellectual property, there is a risk of unauthorized use or disclosure of information. Furthermore, our trade secrets may otherwise become known to, or underlying technology may be independently developed by, our competitors.

We also file trademark applications to protect the names of our products and product candidates. These applications may not mature to registration and may be challenged by third parties. We are pursuing trademark protection in a number of different countries around the world.

Research and Development Activities

Our research and development expenses consist primarily of costs associated with the product development, quality and regulatory work required to maintain the ENHANZE platform, expenses associated with testing of new auto-injectors, activities and support for our partners in their development and manufacturing of product candidates performed on behalf of our partners, compensation and other expenses for research and development personnel, supplies and materials, facility costs and amortization and depreciation. We charge all research and development expenses to operations as they are incurred. Prior to our November 2019 restructuring, our research and development activities were primarily focused on the development of PEGPH20.

Manufacturing

ENHANZE

We do not have our own manufacturing facility for our product and our partners’ products and product candidates, or the capability to package our products. We have engaged third parties to manufacture bulk rHuPH20 and Hylenex.

19

We have existing supply agreements with contract manufacturing organizations Avid Bioservices, Inc. (Avid) and Catalent Indiana LLC (Catalent) to produce supplies of bulk rHuPH20. These manufacturers each produce bulk rHuPH20 under current Good Manufacturing Practices (cGMP) for clinical and commercial uses. Catalent currently produces bulk rHuPH20 for use in Hylenex and collaboration product candidates. Avid currently produces bulk rHuPH20 for use in collaboration products. We rely on their ability to successfully manufacture these batches according to product specifications. It is important for our business for Catalent and Avid to (i) retain their status as cGMP-approved manufacturing facilities; (ii) successfully scale up bulk rHuPH20 production; and/or (iii) manufacture the bulk rHuPH20 required by us and our partners for use in our proprietary and collaboration products and product candidates. In addition to supply obligations, Avid and Catalent will also provide support for data and information used in the chemistry, manufacturing and controls sections for FDA and other regulatory filings.

We have a commercial manufacturing and supply agreement with Patheon Manufacturing Services, LLC (Patheon) under which Patheon will provide the final fill and finishing steps in the production process of Hylenex recombinant.

Devices

We also use third parties to manufacture our auto-injector technology products and product candidates, including the products and related components we supply to our partners. For our products and product candidates, we verify that they are manufactured in accordance with FDA’s cGMPs for drug products and FDA’s current Quality System Regulations (“QSRs”) for medical devices and equivalent provisions in the EU and elsewhere, which are required as part of the overall obligations necessary, in the EU for instance, to obtain a CE-mark. We enter into quality agreements with our third-party manufacturers which require compliance with cGMPs, QSRs and foreign equivalents, to the extent applicable. We use third-party service providers to assemble and package our products and product candidates under our direction. We monitor and evaluate manufacturers and suppliers to assess compliance with regulatory requirements and our internal quality standards and benchmarks. We perform quality reviews of manufacturing for all of our product candidates and products, and quality releases for all of our product candidates and products that we sponsor or commercialize.

We use third-party manufacturers to manufacture and supply certain components, drugs, final assembly and finished product. Below is a summary of our key production, manufacturing, assembly and packaging arrangements with third-party manufacturers for products commercialized by us and our partners:

•Phillips-Medisize Corporation (“Phillips”), an international outsource provider of design and manufacturing services, produces commercial quantities of components of our QuickShot auto-injector device for XYOSTED, our QuickShot auto-injector device for the Makena product with Covis, and our VIBEX epinephrine auto-injector product with Teva.

•ComDel Innovation, Inc. (“ComDel”), a domestic provider of integrated solutions for product development, tooling, and manufacturing, produces commercial quantities of components for the VIBEX sumatriptan auto-injector product and for the teriparatide pen product with Teva.

•Jabil Healthcare, an international manufacturing development company produces commercial quantities of components of our VIBEX auto-injector device for the OTREXUP product for Otter and the VIBEX epinephrine auto-injector product with Teva.

•Fresenius Kabi supplies commercial quantities of pre-filled syringes of testosterone for XYOSTED.

•Sharp Corporation (“Sharp”), an international contract packaging company, assembles and packages XYOSTED, Sumatriptan Injection USP and the Makena auto-injector products, and the OTREXUP auto-injector product for Otter.

•Pfizer supplies the active pharmaceutical ingredient (“API”) for TLANDO.

•NextPharma, an international pharmaceutical manufacturing company, supplies the bulk capsule product for TLANDO.

•PCI Pharma Services (“PCI”), an international contract packaging company, bottles and packages TLANDO.

Sales, Marketing and Distribution

We have two teams of sales specialists, one that provide hospital and surgery center customers with the information needed to obtain formulary approval for, and support utilization of, Hylenex recombinant and one that supports the promotion of our testosterone products XYOSTED and TLANDO. Our commercial activities also include marketing and related services and commercial support services such as commercial operations, managed markets and commercial analytics. We also employ third-party vendors, such as advertising agencies, market research firms and suppliers of marketing and other sales support related services to assist with our commercial activities.

20

We sell XYOSTED, TLANDO and Hylenex recombinant in the U.S. to wholesale pharmaceutical distributors, who sell Hylenex to hospitals and XYOSTED and TLANDO to other end-user customers. We engage Integrated Commercialization Solutions (ICS), a division of AmerisourceBergen Specialty Group, a subsidiary of AmerisourceBergen, to act as our exclusive distributor for commercial shipment and distribution of Hylenex recombinant to our customers in the United States. We also contract with numerous wholesale distributors, including Cardinal, McKesson Corporation (“McKesson”) and AmerisourceBergen Corporation to distribute our other proprietary products (including XYOSTED and TLANDO) to retail pharmacies as well as the Veterans Administration and other governmental agencies

In addition to shipping and distribution services, these distributors and third-party logistics provider, Cardinal Health 105, Inc., also known as Specialty Pharmaceutical Services (“Cardinal”) provide us with other key services related to logistics, warehousing, returns and inventory management, sales reports, contract administration and chargebacks processing and accounts receivable management. We also use a division of Cardinal for sample administration. In addition, we utilize these third parties to perform various other services for us relating to regulatory monitoring, including call center management, adverse event reporting, safety database management and other product maintenance services. In exchange for these services, we pay fees to certain distributors based on a percentage of wholesale acquisition cost. We have also contracted with several specialty pharmacies to support fulfillment of certain prescriptions. In addition, we use third parties to perform various other services for us relating to regulatory monitoring, including adverse event reporting, safety database management and other product maintenance services.

Competition