10-Q

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2015

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-32335

___________________________

HALOZYME THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

___________________________

|

| | |

Delaware | | 88-0488686 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

11388 Sorrento Valley Road, San Diego, CA | | 92121 |

(Address of principal executive offices) | | (Zip Code) |

(858) 794-8889

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | |

Large accelerated filer ý | Accelerated filer ¨ | | Non-accelerated filer ¨ | Smaller reporting company ¨ |

| | | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The number of outstanding shares of the registrant’s common stock, par value $0.001 per share, was 128,014,034 as of November 2, 2015.

HALOZYME THERAPEUTICS, INC.

INDEX

|

| | | | |

| | | Page | |

| |

Item 1. | | | | |

| | | | |

| | | | |

| Three and Nine Months Ended September 30, 2015 and 2014 | | | |

| September 30, 2015 and 2014 | | | |

| | | | |

Item 2. | | | | |

Item 3. | | | | |

Item 4. | | | | |

| |

| |

Item 1. | | | | |

Item 1A. | | | | |

Item 2. | | | | |

Item 3. | | | | |

Item 4. | | | | |

Item 5. | | | | |

Item 6. | | | | |

| | | | |

PART I — FINANCIAL INFORMATION

| |

Item 1. | Financial Statements |

HALOZYME THERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | | |

| | September 30,

2015 | | December 31,

2014 |

ASSETS | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 71,514 |

| | $ | 61,389 |

|

Marketable securities, available-for-sale | | 52,204 |

| | 74,234 |

|

Accounts receivable, net | | 8,392 |

| | 9,149 |

|

Inventories | | 11,101 |

| | 6,406 |

|

Prepaid expenses and other assets | | 9,879 |

| | 10,143 |

|

Total current assets | | 153,090 |

| | 161,321 |

|

Property and equipment, net | | 2,686 |

| | 2,951 |

|

Prepaid expenses and other assets | | 2,458 |

| | 1,205 |

|

Restricted cash | | 500 |

| | 500 |

|

Total assets | | $ | 158,734 |

| | $ | 165,977 |

|

| | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

Current liabilities: | | | | |

Accounts payable | | $ | 4,437 |

| | $ | 3,003 |

|

Accrued expenses | | 18,926 |

| | 13,961 |

|

Deferred revenue, current portion | | 5,789 |

| | 7,367 |

|

Current portion of long-term debt, net | | 15,699 |

| | — |

|

Total current liabilities | | 44,851 |

| | 24,331 |

|

Deferred revenue, net of current portion | | 44,244 |

| | 47,267 |

|

Long-term debt, net | | 34,094 |

| | 49,860 |

|

Other long-term liabilities | | 3,746 |

| | 3,167 |

|

Commitments and contingencies (Note 9) | |

| |

|

Stockholders’ equity: | | | | |

Preferred stock - $0.001 par value; 20,000 shares authorized; no shares issued and outstanding | | — |

| | — |

|

Common stock - $0.001 par value; 200,000 shares authorized; 127,811 and 125,721 shares issued and outstanding at September 30, 2015 and December 31, 2014, respectively | | 128 |

| | 126 |

|

Additional paid-in capital | | 518,647 |

| | 491,694 |

|

Accumulated other comprehensive loss | | — |

| | (41 | ) |

Accumulated deficit | | (486,976 | ) | | (450,427 | ) |

Total stockholders’ equity | | 31,799 |

| | 41,352 |

|

Total liabilities and stockholders’ equity | | $ | 158,734 |

| | $ | 165,977 |

|

See accompanying notes to condensed consolidated financial statements.

HALOZYME THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share amounts)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Revenues: | | | | | | | | |

Product sales, net | | $ | 10,301 |

| | $ | 9,617 |

| | $ | 32,503 |

| | $ | 27,679 |

|

Royalties | | 8,274 |

| | 2,895 |

| | 21,431 |

| | 5,382 |

|

Revenues under collaborative agreements | | 2,205 |

| | 2,094 |

| | 28,896 |

| | 11,896 |

|

Total revenues | | 20,780 |

| | 14,606 |

| | 82,830 |

| | 44,957 |

|

Operating expenses: | | | | | | | | |

Cost of product sales | | 6,180 |

| | 5,141 |

| | 20,818 |

| | 16,585 |

|

Research and development | | 27,611 |

| | 19,904 |

| | 65,490 |

| | 59,968 |

|

Selling, general and administrative | | 10,226 |

| | 8,587 |

| | 29,439 |

| | 27,589 |

|

Total operating expenses | | 44,017 |

| | 33,632 |

| | 115,747 |

| | 104,142 |

|

Operating loss | | (23,237 | ) | | (19,026 | ) | | (32,917 | ) | | (59,185 | ) |

Other income (expense): | | | | | | | | |

Investment and other income, net | | 78 |

| | 122 |

| | 267 |

| | 287 |

|

Interest expense | | (1,301 | ) | | (1,376 | ) | | (3,899 | ) | | (4,203 | ) |

Net loss | | $ | (24,460 | ) | | $ | (20,280 | ) | | $ | (36,549 | ) | | $ | (63,101 | ) |

| | | | | | | | |

Net loss per share:

| | | | | | | | |

Basic and diluted | | $ | (0.19 | ) | | $ | (0.16 | ) | | $ | (0.29 | ) | | $ | (0.52 | ) |

| | | | | | | | |

Shares used in computing net loss per share: | | | | | | | | |

Basic and diluted | | 126,921 |

| | 124,041 |

| | 126,127 |

| | 122,157 |

|

See accompanying notes to condensed consolidated financial statements.

HALOZYME THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

(In thousands)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Net loss | | $ | (24,460 | ) | | $ | (20,280 | ) | | $ | (36,549 | ) | | $ | (63,101 | ) |

Other comprehensive income (loss): | | | | | | | | |

Unrealized gain (loss) on marketable securities | | 40 |

| | (49 | ) | | 41 |

| | (63 | ) |

Total comprehensive loss | | $ | (24,420 | ) | | $ | (20,329 | ) | | $ | (36,508 | ) | | $ | (63,164 | ) |

See accompanying notes to condensed consolidated financial statements.

HALOZYME THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

|

| | | | | | | | |

| | Nine Months Ended

September 30, |

| |

| | 2015 | | 2014 |

Operating activities: | | | | |

Net loss | | $ | (36,549 | ) | | $ | (63,101 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

Share-based compensation | | 15,588 |

| | 11,065 |

|

Depreciation and amortization | | 1,218 |

| | 1,304 |

|

Non-cash interest expense | | 885 |

| | 1,610 |

|

Amortization of premiums on marketable securities, net | | 699 |

| | 1,062 |

|

Changes in operating assets and liabilities: | | | | |

Accounts receivable, net | | 757 |

| | 822 |

|

Inventories | | (4,695 | ) | | (746 | ) |

Prepaid expenses and other assets | | (1,000 | ) | | 98 |

|

Accounts payable and accrued expenses | | 6,011 |

| | 1,693 |

|

Deferred revenue | | (4,600 | ) | | (418 | ) |

Other liabilities | | (200 | ) | | 32 |

|

Net cash used in operating activities | | (21,886 | ) | | (46,579 | ) |

Investing activities: | | | | |

Purchases of marketable securities | | (46,360 | ) | | (89,117 | ) |

Proceeds from maturities of marketable securities | | 67,730 |

| | 43,816 |

|

Purchases of property and equipment | | (726 | ) | | (1,132 | ) |

Net cash provided by (used in) investing activities | | 20,644 |

| | (46,433 | ) |

Financing activities: | | | | |

Proceeds from issuance of common stock under equity incentive plans, net | | 11,367 |

| | 4,317 |

|

Proceeds from issuance of common stock, net | | — |

| | 107,713 |

|

Net cash provided by financing activities | | 11,367 |

| | 112,030 |

|

Net increase in cash and cash equivalents | | 10,125 |

| | 19,018 |

|

Cash and cash equivalents at beginning of period | | 61,389 |

| | 27,357 |

|

Cash and cash equivalents at end of period | | $ | 71,514 |

| | $ | 46,375 |

|

See accompanying notes to condensed consolidated financial statements.

HALOZYME THERAPEUTICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Organization and Business

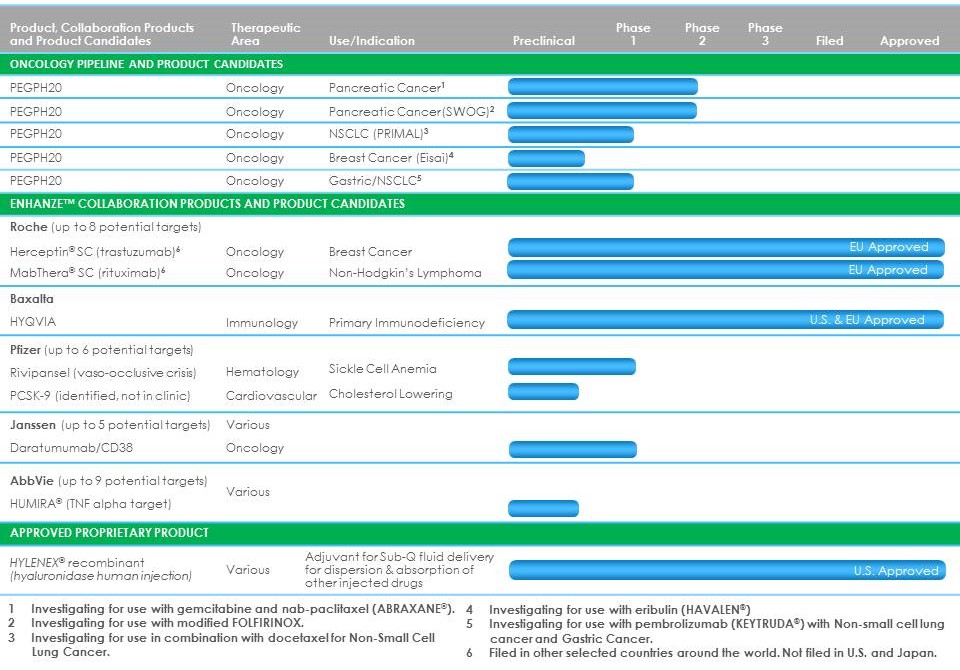

Halozyme Therapeutics, Inc. is a biotechnology company focused on developing and commercializing novel oncology therapies. We are seeking to translate our unique knowledge of the tumor microenvironment to create therapies that have the potential to improve cancer patient survival. Our research primarily focuses on human enzymes that alter the extracellular matrix and tumor microenvironment. The extracellular matrix is a complex matrix of proteins and carbohydrates surrounding the cell that provides structural support in tissues and orchestrates many important biological activities, including cell migration, signaling and survival. Over many years, we have developed unique technology and scientific expertise enabling us to pursue this target-rich environment for the development of therapies.

Our proprietary enzymes are used to facilitate the delivery of injected drugs and fluids, potentially enhancing the efficacy and the convenience of other drugs or can be used to alter tissue structures for potential clinical benefit. We have chosen to exploit our technology and expertise in a balanced way to modulate both risk and spend by: (1) developing our own proprietary products in therapeutic areas with significant unmet medical needs, with a focus on oncology, and (2) licensing our technology to biopharmaceutical companies to collaboratively develop products which combine our technology with the collaborators’ proprietary compounds.

The majority of our approved product and product candidates are based on rHuPH20, our patented recombinant human hyaluronidase enzyme. rHuPH20 temporarily breaks down hyaluronan (or “HA”), a naturally occurring complex carbohydrate that is a major component of the extracellular matrix in tissues throughout the body such as skin and cartilage. We believe this temporary degradation creates an opportunistic window for the improved subcutaneous delivery of injectable biologics, such as monoclonal antibodies and other large therapeutic molecules, as well as small molecules and fluids. We refer to the application of rHuPH20 to facilitate the delivery of other drugs or fluids as Enhanze™ technology. rHuPH20 is also the active ingredient in our first commercially approved product, Hylenex® recombinant.

Our proprietary development pipeline consists primarily of clinical stage product candidates in oncology. Our lead oncology program is PEGPH20 (PEGylated recombinant human hyaluronidase), a new molecular entity, under development for the systemic treatment of tumors that accumulate HA. When HA accumulates in a tumor, it can cause higher pressure in the tumor, reducing blood flow into the tumor and with that, reduced access of cancer therapies to the tumor. PEGPH20 works by temporarily degrading HA surrounding cancer cells resulting in reduced pressure and increased blood flow to the cancer with increased amounts of anticancer treatments administered concomitantly gaining access to the tumor. We are currently in Phase 2 clinical testing for PEGPH20 in metastatic pancreatic cancer (Study 109-202), in Phase 1b clinical testing in non-small cell lung cancer (Study 107-201), and in Phase 1b clinical testing in non-small cell lung cancer and gastric cancer (Study 107-101).

Regarding Enhanze, we currently have collaborations with F. Hoffmann-La Roche, Ltd. and Hoffmann-La Roche, Inc. (“Roche”), Baxter Healthcare Corporation (predecessor to Baxalta Incorporated) (“Baxalta”), Pfizer Inc. (“Pfizer”), Janssen Biotech, Inc. (“Janssen”), and AbbVie, Inc. (“AbbVie”), with one product approved in the U.S. and three products approved for marketing in Europe from which we are receiving royalties and several others at various stages of development.

Except where specifically noted or the context otherwise requires, references to “Halozyme,” “the Company,” “we,” “our,” and “us” in these notes to condensed consolidated financial statements refer to Halozyme Therapeutics, Inc. and its wholly owned subsidiary, Halozyme, Inc., and Halozyme, Inc.’s wholly owned subsidiary, Halozyme Holdings Ltd.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying interim unaudited condensed consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”) and with the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) related to a quarterly report on Form 10-Q. Accordingly, they do not include all of the information and disclosures required by U.S. GAAP for a complete set of financial statements. These interim unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on March 2, 2015. The unaudited financial information for the interim periods presented herein reflects all adjustments which, in the opinion of management, are necessary for a fair presentation of the financial condition and results of operations for the periods presented, with such adjustments consisting only of normal recurring adjustments. Operating results for interim periods are not necessarily indicative of the operating results for an entire fiscal year.

The accompanying condensed consolidated financial statements include the accounts of Halozyme Therapeutics, Inc. and its wholly owned subsidiary, Halozyme, Inc., and Halozyme, Inc.’s wholly owned subsidiary, Halozyme Holdings Ltd. All intercompany accounts and transactions have been eliminated.

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in our consolidated financial statements and accompanying notes. On an ongoing basis, we evaluate our estimates and judgments, which are based on historical and anticipated results and trends and on various other assumptions that management believes to be reasonable under the circumstances. By their nature, estimates are subject to an inherent degree of uncertainty and, as such, actual results may differ from management’s estimates.

Adoption and Pending Adoption of Recent Accounting Pronouncements

In July 2013, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2013-11, Income Taxes (Topic 740), Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists (“ASU 2013-11”). The provisions of ASU 2013-11 require entities to present unrecognized tax benefits as a decrease in a net operating loss, similar tax loss or tax credit carryforward if certain criteria are met. The determination of whether a deferred tax asset is available is based on the unrecognized tax benefit and the deferred tax asset that exists at the reporting date and presumes disallowance of the tax position at the reporting date. The guidance eliminates the diversity in practice in the presentation of unrecognized tax benefits but does not alter the way in which entities assess deferred tax assets for realizability. ASU 2013-11 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2014. ASU 2013-11 is applied prospectively to unrecognized tax benefits that exist at the effective date. The adoption of ASU 2013-11 did not have a material impact on our consolidated financial position or results of operations.

In May 2014, the FASB issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (“ASU 2014-09”). ASU 2014-09 will eliminate transaction-specific and industry-specific revenue recognition guidance under current U.S. GAAP and replace it with a principle-based approach for determining revenue recognition. ASU 2014-09 will require that companies recognize revenue based on the value of transferred goods or services as they occur in the contract. ASU 2014-09 also will require additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract. ASU 2014-09 is effective for our annual reporting beginning on January 1, 2018. Entities can transition to the standard either retrospectively or as a cumulative-effect adjustment as of the date of adoption. We have not yet selected a transition method and we are currently evaluating the effect that the updated standard will have on our consolidated financial statements and related disclosures.

In August 2014, the FASB issued Accounting Standards Update No. 2014-15, Presentation of Financial Statements — Going Concern (“ASU 2014-15”). The provisions of ASU 2014-15 provide that in connection with preparing financial statements for each annual and interim reporting period, an entity’s management should evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the entity’s ability to continue as a going concern within one year after the date that the financial statements are issued (or within one year after the date that the financial statements are available to be issued when applicable). ASU 2014-15 is effective for the annual reporting period ending after December 15, 2016, and for annual and interim periods thereafter. Early adoption is permitted. The adoption of ASU 2014-15 is not expected to have a material impact on our consolidated financial position or results of operations.

In April 2015, the FASB issued Accounting Standards Update No. 2015-03, Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs (“ASU 2015-03”). ASU 2015-03 requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from that debt liability, consistent with the presentation of a debt discount. The recognition and measurement guidance for debt issuance costs is not affected by ASU 2015-03. ASU 2015-03 is effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Early application is permitted. The adoption of ASU 2015-03 is not expected to have a material impact on our consolidated financial position or results of operations.

In July 2015, the FASB issued Accounting Standards Update No. 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory (“ASU 2015-11”). ASU 2015-11 requires that for entities that measure inventory using the first-in, first-out method, inventory should be measured at the lower of cost and net realizable value. Topic 330, Inventory, currently requires an entity to measure inventory at the lower of cost or market. Market could be replacement cost, net realizable value, or net realizable value less an approximately normal profit margin. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. ASU 2015-11 is effective for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years. The amendments should be applied prospectively with earlier application permitted as of the beginning of an interim or annual reporting period. The adoption of ASU 2015-11 is not expected to have a material impact on our consolidated financial position or results of operations.

Cash Equivalents and Marketable Securities

Cash equivalents consist of highly liquid investments, readily convertible to cash, that mature within ninety days or less from the date of purchase. Our cash equivalents consist of money market funds.

Marketable securities are investments with original maturities of more than ninety days from the date of purchase that are specifically identified to fund current operations. Marketable securities are considered available-for-sale. These investments are classified as current assets, even though the stated maturity date may be one year or more beyond the current balance sheet date which reflects management’s intention to use the proceeds from the sale of these investments to fund our operations, as necessary. Such available-for-sale investments are carried at fair value with unrealized gains and losses recorded in other comprehensive gain (loss) and included as a separate component of stockholders’ equity. The cost of marketable securities is adjusted for amortization of premiums or accretion of discounts to maturity, and such amortization or accretion is included in investment and other income, net in the condensed consolidated statements of operations. We use the specific identification method for calculating realized gains and losses on marketable securities sold. Realized gains and losses and declines in value judged to be other-than-temporary on marketable securities, if any, are included in investment and other income, net in the condensed consolidated statements of operations.

Restricted Cash

Under the terms of the leases of our facilities, we are required to maintain letters of credit as security deposits during the terms of such leases. At September 30, 2015 and December 31, 2014, restricted cash of $0.5 million was pledged as collateral for the letters of credit.

Fair Value of Financial Instruments

The authoritative guidance for fair value measurements establishes a three tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include: Level 1, defined as observable inputs such as quoted prices in active markets; Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

Our financial instruments include cash equivalents, available-for-sale marketable securities, accounts receivable, prepaid expenses, accounts payable, accrued expenses and long-term debt. Fair value estimates of these instruments are made at a specific point in time, based on relevant market information. These estimates may be subjective in nature and involve uncertainties and matters of significant judgment and therefore cannot be determined with precision. The carrying amount of cash equivalents, accounts receivable, prepaid expenses, accounts payable and accrued expenses are generally considered to be representative of their respective fair values because of the short-term nature of those instruments. Further, based on the borrowing rates currently available for loans with similar terms, we believe the fair value of long-term debt approximates its carrying value.

Available-for-sale marketable securities consist of corporate debt securities, commercial paper and certificates of deposit and were measured at fair value using Level 2 inputs. Level 2 financial instruments are valued using market prices on less active markets and proprietary pricing valuation models with observable inputs, including interest rates, yield curves, maturity dates, issue dates, settlement dates, reported trades, broker-dealer quotes, issue spreads, benchmark securities or other market related data. We obtain the fair value of Level 2 financial instruments from our investment manager, who obtains these fair values from a third-party pricing source. We validate the fair values of Level 2 financial instruments provided by our investment manager by comparing these fair values to a third-party pricing source.

The following table summarizes, by major financial instrument type, our cash equivalents and marketable securities that are measured at fair value on a recurring basis and are categorized using the fair value hierarchy (in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2015 | | December 31, 2014 |

| | Level 1 | | Level 2 | | Total estimated fair value | | Level 1 | | Level 2 | | Total estimated fair value |

Cash equivalents: | | | | | | | | | | | | |

Money market funds | | $ | 67,561 |

| | $ | — |

| | $ | 67,561 |

| | $ | 42,685 |

| | $ | — |

| | $ | 42,685 |

|

| | | | | | | | | | | | |

Available-for-sale marketable securities: | | | | | | | | | | | | |

Corporate debt securities | | — |

| | 52,204 |

| | 52,204 |

| | — |

| | 74,234 |

| | 74,234 |

|

| | $ | 67,561 |

| | $ | 52,204 |

| | $ | 119,765 |

| | $ | 42,685 |

| | $ | 74,234 |

| | $ | 116,919 |

|

There were no transfers between Level 1 and Level 2 of the fair value hierarchy in the three and nine months ended September 30, 2015. We have no financial instruments that were classified within Level 3 as of September 30, 2015 and December 31, 2014.

Inventories

Inventories are stated at lower of cost or market. Cost is determined on a first-in, first-out basis. Inventories are reviewed periodically for potential excess, dated or obsolete status. Management evaluates the carrying value of inventories on a regular basis, taking into account such factors as historical and anticipated future sales compared to quantities on hand, the price we expect to obtain for products in their respective markets compared with historical cost and the remaining shelf life of goods on hand.

Prior to receiving marketing approval from the U.S. Food and Drug Administration (“FDA”) or comparable regulatory agencies in foreign countries, costs related to purchases of bulk rHuPH20 and raw materials used in the manufacturing of the product candidates are recorded as research and development expense. All direct manufacturing costs incurred after receiving marketing approval are capitalized as inventory. Inventories used in clinical trials are expensed at the time the inventories are packaged for the clinical trials.

As of September 30, 2015 and December 31, 2014, inventories consisted of $1.7 million and $3.0 million of Hylenex recombinant inventory, respectively, and $9.4 million and $3.4 million of bulk rHuPH20 inventory, respectively.

Revenue Recognition

We generate revenues from product sales and payments received under collaborative agreements. Collaborative agreement payments may include nonrefundable fees at the inception of the agreements, license fees, milestone and event-based payments for specific achievements designated in the collaborative agreements, reimbursements of research and development services and supply of bulk rHuPH20, and/or royalties on sales of products resulting from collaborative arrangements.

We recognize revenue in accordance with the authoritative guidance for revenue recognition. We recognize revenue when all of the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred or services have been rendered; (3) the seller’s price to the buyer is fixed or determinable; and (4) collectibility is reasonably assured.

Product Sales, Net

Hylenex Recombinant

We sell Hylenex recombinant in the U.S. to wholesale pharmaceutical distributors, who sell the product to hospitals and other end-user customers. Sales to wholesalers provide for selling prices that are fixed on the date of sale, although we offer discounts to certain group purchasing organizations (“GPOs”), hospitals and government programs. The wholesalers take title to the product, bear the risk of loss of ownership and have economic substance to the inventory. Further, we have no significant obligations for future performance to generate pull-through sales.

We have developed sufficient historical experience and data to reasonably estimate future returns and chargebacks of Hylenex recombinant. As a result, we recognize Hylenex recombinant product sales and related cost of product sales at the time title transfers to the wholesalers.

Upon recognition of revenue from product sales of Hylenex recombinant, we record certain sales reserves and allowances as a reduction to gross revenue. These reserves and allowances include:

| |

• | Product Returns. We allow the wholesalers to return product that is damaged or received in error. In addition, we accept unused product to be returned beginning six months prior to and ending twelve months following product |

expiration. Our estimates for expected returns of expired products are based primarily on an ongoing analysis of historical return patterns.

| |

• | Distribution Fees. The distribution fees, based on contractually determined rates, arise from contractual agreements we have with certain wholesalers for distribution services they provide with respect to Hylenex recombinant. These fees are generally a fixed percentage of the price of the product purchased by the wholesalers. |

| |

• | Prompt Payment Discounts. We offer cash discounts to certain wholesalers as an incentive to meet certain payment terms. We estimate prompt payment discounts based on contractual terms, historical utilization rates, as available, and our expectations regarding future utilization rates. |

| |

• | Other Discounts and Fees. We provide discounts to end-user members of certain GPOs under collective purchasing contracts between us and the GPOs. We also provide discounts to certain hospitals, who are members of the GPOs, with which we do not have contracts. The end-user members purchase products from the wholesalers at a contracted discounted price, and the wholesalers then charge back to us the difference between the current retail price and the price the end-users paid for the product. We also incur GPO administrative service fees for these transactions. In addition, we provide predetermined discounts under certain government programs. Our estimate for these chargebacks and fees takes into consideration contractual terms, historical utilization rates, as available, and our expectations regarding future utilization rates. |

Allowances for product returns and chargebacks are based on amounts owed or to be claimed on the related sales. We believe that our estimated product returns for Hylenex recombinant requires a high degree of judgment and is subject to change based on our experience and certain quantitative and qualitative factors. In order to develop a methodology to reliably estimate future returns and provide a basis for recognizing revenue on sales to wholesale distributors, we analyzed many factors, including, without limitation: (1) actual Hylenex recombinant product return history, taking into account product expiration dating at the time of shipment, (2) re-order activities of the wholesalers as well as their customers and (3) levels of inventory in the wholesale channel. We have monitored actual return history on an individual product lot basis since product launch. We consider the dating of product at the time of shipment into the distribution channel and changes in the estimated levels of inventory within the distribution channel to estimate our exposure to returned product. We also consider historical chargebacks activity and current contract prices to estimate our exposure to returned product. Based on such data, we believe we have the information needed to reasonably estimate product returns and chargebacks.

We recognize product sales allowances as a reduction of product sales in the same period the related revenue is recognized. Because of the shelf life of Hylenex recombinant and our lengthy return period, there may be a significant period of time between when the product is shipped and when we issue credits on returned product. If actual results differ from our estimates, we will be required to make adjustments to these allowances in the future, which could have an effect on product sales revenue and earnings in the period of adjustments.

Bulk rHuPH20

Subsequent to receiving marketing approval from the FDA or comparable regulatory agencies in foreign countries, sales of bulk rHuPH20 for use in collaboration commercial products are recognized as product sales when the materials have met all the specifications required for the customer’s acceptance and title and risk of loss have transferred to the customer. Following the receipt of FDA approval of Baxalta’s HYQVIA® in September 2014 and European marketing approvals of Roche’s Herceptin SC product in August 2013 and MabThera® SC product in March 2014 and Baxalta’s HYQVIA product in May 2013, revenue from the sales of bulk rHuPH20 for these collaboration products has been recognized as product sales. For the three months ended September 30, 2015 and 2014, we recognized product sales of bulk rHuPH20 for Roche collaboration products in the amount of $4.7 million and $5.8 million, respectively, and for Baxalta collaboration products in the amount of $1.6 million and zero, respectively. For the nine months ended September 30, 2015 and 2014, we recognized product sales of bulk rHuPH20 for Roche

collaboration products in the amount of $17.0 million and $17.7 million, respectively, and for Baxalta collaboration products in the amount of $3.1 million and zero, respectively.

Revenues under Collaborative Agreements

We have license and collaboration agreements under which the collaborators obtained worldwide rights for the use of our proprietary rHuPH20 enzyme in the development and commercialization of the collaborators’ biologic compounds. The collaborative agreements contain multiple elements including nonrefundable payments at the inception of the arrangement, license fees, exclusivity fees, payments based on achievement of specified milestones or events designated in the collaborative agreements, annual maintenance fees, reimbursements of research and development services, payments for supply of bulk rHuPH20 by the collaborator and/or royalties on sales of products resulting from collaborative agreements. We analyze each element of our collaborative agreements and consider a variety of factors in determining the appropriate method of revenue recognition of each element.

In order to account for the multiple-element arrangements, we identify the deliverables included within the agreement and evaluate which deliverables represent units of accounting. Analyzing the arrangement to identify deliverables requires the use of judgment, and each deliverable may be an obligation to deliver services, a right or license to use an asset, or another performance obligation. The deliverables under our collaborative agreements include (i) the license to our rHuPH20 technology, (ii) at the collaborator’s request, research and development services which are reimbursed at contractually determined rates, and (iii) at the collaborator’s request, supply of bulk rHuPH20 which is reimbursed at our cost plus a margin. A delivered item is considered a separate unit of accounting when the delivered item has value to the collaborator on a standalone basis based on the consideration of the relevant facts and circumstances for each arrangement. Factors considered in this determination include the research capabilities of the collaborator and the availability of research expertise in this field in the general marketplace.

Consideration we receive under collaboration agreements is allocated at the inception of the agreement to all identified units of accounting based on their relative selling price. The relative selling price for each deliverable is determined using vendor specific objective evidence (“VSOE”) of selling price or third-party evidence of selling price if VSOE does not exist. If neither VSOE nor third-party evidence of selling price exists, we use our best estimate of the selling price for the deliverable. The amount of allocable consideration is limited to amounts that are not contingent upon the delivery of additional items or meeting other specified performance conditions. The consideration received is allocated among the separate units of accounting, and the applicable revenue recognition criteria are applied to each of the separate units. Changes in the allocation of the sales price between delivered and undelivered elements can impact the timing of revenue recognition but do not change the total revenue recognized under any agreement.

Nonrefundable upfront license fee payments are recognized upon delivery of the license if (i) facts and circumstances dictate that the license has standalone value from the undelivered items, which generally include research and development services and the manufacture of bulk rHuPH20, (ii) the relative selling price allocation of the license is equal to or exceeds the upfront license fee, (iii) persuasive evidence of an arrangement exists, (iv) our price to the collaborator is fixed or determinable and (v) collectibility is reasonably assured. Upfront license fee payments are deferred if facts and circumstances dictate that the license does not have standalone value. The determination of the length of the period over which to defer revenue is subject to judgment and estimation and can have an impact on the amount of revenue recognized in a given period.

Certain of our collaborative agreements provide for milestone payments upon achievement of development and regulatory events and/or specified sales volumes of commercialized products by the collaborator. We account for milestone payments in accordance with the provisions of ASU No. 2010-17, Revenue Recognition - Milestone Method (“Milestone Method of Accounting”). We recognize consideration that is contingent upon the achievement of a milestone in its entirety as revenue in the period in which the milestone is achieved only if the milestone is substantive in its entirety. A milestone is considered substantive when it meets all of the following criteria:

| |

1. | The consideration is commensurate with either the entity’s performance to achieve the milestone or the enhancement of the value of the delivered item(s) as a result of a specific outcome resulting from the entity’s performance to achieve the milestone; |

| |

2. | The consideration relates solely to past performance; and |

| |

3. | The consideration is reasonable relative to all of the deliverables and payment terms within the arrangement. |

A milestone is defined as an event (i) that can only be achieved based in whole or in part on either the entity’s performance or on the occurrence of a specific outcome resulting from the entity’s performance, (ii) for which there is substantive uncertainty at the date the arrangement is entered into that the event will be achieved and (iii) that would result in additional payments being due to the vendor.

Reimbursements of research and development services are recognized as revenue during the period in which the services are performed as long as there is persuasive evidence of an arrangement, the fee is fixed or determinable and collection of the related receivable is reasonably assured. Revenue from the manufacture of bulk rHuPH20 is recognized when the materials have met all specifications required for the collaborator’s acceptance and title and risk of loss have transferred to the collaborator. We do not directly control when any collaborator will request research and development services or supply of bulk rHuPH20; therefore, we cannot predict when we will recognize revenues in connection with research and development services and supply of bulk rHuPH20.

Since we receive royalty reports 60 days after quarter end, royalty revenue from sales of collaboration products by our collaborators is recognized in the quarter following the quarter in which the corresponding sales occurred.

The collaborative agreements typically provide the collaborators the right to terminate such agreement in whole or on a product-by-product or target-by-target basis at any time upon 30 to 90 days prior written notice to us. There are no performance, cancellation, termination or refund provisions in any of our collaborative agreements that contain material financial consequences to us.

Refer to Note 4, Collaborative Agreements, for further discussion on our collaborative agreements.

Cost of Product Sales

Cost of product sales consists primarily of raw materials, third-party manufacturing costs, fill and finish costs, freight costs, internal costs and manufacturing overhead associated with the production of Hylenex recombinant and bulk rHuPH20 for use in approved collaboration products. Cost of product sales also consists of the write-down of excess, dated and obsolete inventories and the write-off of inventories that do not meet certain product specifications, if any.

Research and Development Expenses

Research and development expenses include salaries and benefits, facilities and other overhead expenses, external clinical trial expenses, research related manufacturing services, contract services and other outside expenses. Research and development expenses are charged to operations as incurred when these expenditures relate to our research and development efforts and have no alternative future uses. After receiving approval from the FDA or comparable regulatory agencies in foreign countries for a product, costs related to purchases and manufacturing of bulk rHuPH20 for such product are capitalized as inventory. The manufacturing costs of bulk rHuPH20 for the collaboration products, Herceptin SC, MabThera SC and HYQVIA, incurred after the receipt of marketing approvals are capitalized as inventory.

We are obligated to make upfront payments upon execution of certain research and development agreements. Advance payments, including nonrefundable amounts, for goods or services that will be used or rendered for future research and development activities are deferred and capitalized. Such amounts are recognized as expense as the related goods are delivered or the related services are performed or such time when we do not expect the goods to be delivered or services to be performed.

Milestone payments that we make in connection with in-licensed technology for a particular research and development project that have no alternative future uses (in other research and development projects or otherwise) and therefore no separate economic value are expensed as research and development costs at the time the costs are incurred. We currently have no in-licensed technologies that have alternative future uses in research and development projects or otherwise.

Clinical Trial Expenses

Payments in connection with our clinical trials are often made under contracts with multiple contract research organizations that conduct and manage clinical trials on our behalf. The financial terms of these agreements are subject to negotiation and vary from contract to contract and may result in uneven payment flows. Generally, these agreements set forth the scope of work to be performed at a fixed fee, unit price or on a time and materials basis. Payments under these contracts depend on factors such as the successful enrollment or treatment of patients or the completion of other clinical trial milestones.

Expenses related to clinical trials are accrued based on our estimates and/or representations from service providers regarding work performed, including actual level of patient enrollment, completion of patient studies and progress of the clinical trials. Other incidental costs related to patient enrollment or treatment are accrued when reasonably certain. If the contracted amounts are modified (for instance, as a result of changes in the clinical trial protocol or scope of work to be performed), we modify our accruals accordingly on a prospective basis. Revisions in the scope of a contract are charged to expense in the period in which the facts that give rise to the revision become reasonably certain. Historically, we have had no changes in clinical trial expense accruals that had a material impact on our consolidated results of operations or financial position.

Share-Based Compensation

We record compensation expense associated with stock options, restricted stock awards (“RSAs”), restricted stock units (“RSUs”), and RSUs with performance conditions (“PRSUs”) in accordance with the authoritative guidance for stock-based compensation. The cost of employee services received in exchange for an award of an equity instrument is measured at the grant date, based on the estimated fair value of the award, and is recognized as expense on a straight-line basis, net of estimated forfeitures, over the requisite service period of the award. Share-based compensation expense recognized during the period is based on the value of the portion of share-based payment awards that is ultimately expected to vest during the period. Share-based compensation expense for an award with a performance condition is recognized when the achievement of such performance condition is determined to be probable. If the outcome of such performance condition is not determined to be probable or is not met, no compensation expense is recognized and any previously recognized compensation expense is reversed. Share-based compensation expense recognition is based on awards ultimately expected to vest and is reduced for estimated forfeitures. The authoritative guidance requires forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates.

Net Loss Per Share

Basic net loss per common share is computed by dividing net loss for the period by the weighted average number of common shares outstanding during the period, without consideration for common stock equivalents. Outstanding stock options, unvested RSAs, unvested RSUs and unvested PRSUs are considered common stock equivalents and are only included in the calculation of diluted earnings per common share when net income is reported and their effect is dilutive. For the three and nine months ended September 30, 2015 and 2014, approximately 9.6 million and 9.8 million shares, respectively, of outstanding stock options, unvested RSAs, unvested RSUs and unvested PRSUs were excluded from the calculation of diluted net loss per common share because a net loss was reported in each of these periods and therefore their effect was anti-dilutive.

Segment Information

We operate our business in one segment, which includes all activities related to the research, development and commercialization of our proprietary enzymes. This segment also includes revenues and expenses related to (i) research and development and bulk rHuPH20 manufacturing activities conducted under our collaborative agreements with third parties and (ii) product sales of Hylenex recombinant. The chief operating decision-maker reviews the operating results on an aggregate basis and manages the operations as a single operating segment.

3. Marketable Securities

Available-for-sale marketable securities consisted of the following (in thousands):

|

| | | | | | | | | | | | | | | | | |

| | September 30, 2015 |

| | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Estimated Fair Value |

Corporate debt securities | | $ | 52,204 |

| | $ | 16 |

| | $ | (16 | ) | | $ | 52,204 |

|

|

| | | | | | | | | | | | | | | | |

| | December 31, 2014 |

| | Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Estimated Fair Value |

Corporate debt securities | | $ | 74,275 |

| | $ | 2 |

| | $ | (43 | ) | | $ | 74,234 |

|

As of September 30, 2015, $43.1 million of our available-for-sale marketable securities were scheduled to mature within the next 12 months. As of September 30, 2015, we had 11 available-for-sale marketable securities in a gross unrealized loss position, all of which had been in such position for less than twelve months. Based on our review of these marketable securities, we believe there were no other-than-temporary impairments on these marketable securities as of September 30, 2015 because we do not intend to sell these marketable securities prior to maturity and it is not more likely than not that we will be required to sell these marketable securities before the recovery of their amortized cost basis.

4. Collaborative Agreements

Roche Collaboration

In December 2006, we and Roche entered into a collaboration and license agreement, under which Roche obtained a worldwide, exclusive license to develop and commercialize product combinations of rHuPH20 and up to thirteen Roche target compounds (the “Roche Collaboration”). As of September 30, 2015, Roche has elected a total of five targets, two of which are exclusive, and retains the option to develop and commercialize rHuPH20 with three additional targets, provided that Roche continues to pay annual maintenance fees to us. In August 2013, Roche received European marketing approval for its collaboration product, Herceptin SC, for the treatment of patients with HER2-positive breast cancer and launched Herceptin SC in the European Union (“EU”) in September 2013.

In March 2014, Roche received European marketing approval for its collaboration product, MabThera SC, for the treatment of patients with common forms of non-Hodgkin lymphoma (“NHL”). In June 2014, Roche launched MabThera SC in the EU which triggered a $5.0 million sales-based payment to us for the achievement of the first commercial sale pursuant to the terms of the Roche Collaboration.

Roche assumes all development, manufacturing, clinical, regulatory, sales and marketing costs under the Roche Collaboration, while we are responsible for the supply of bulk rHuPH20. We are entitled to receive reimbursements for providing research and development services and supplying bulk rHuPH20 to Roche at its request.

Under the terms of the Roche Collaboration, Roche pays us a royalty on each product commercialized under the agreement consisting of a mid-single digit percent of the net sales of such product. Unless terminated earlier in accordance with its terms, the Roche Collaboration continues in effect until the expiration of Roche’s obligation to pay royalties. Roche has the obligation to pay royalties to us with respect to each product commercialized in each country, during the period equal to the longer of: (a) the duration of any valid claim of our patents covering rHuPH20 or other specified patents developed under the Roche Collaboration which valid claim covers the product in such country or (b) ten years following the date of the first commercial sale of such product in such country.

As of September 30, 2015, we have received $78.3 million from Roche, excluding royalties and reimbursements for providing research and development services and supplying bulk rHuPH20. The amounts received consisted of a $20.0 million upfront license fee payment for the application of rHuPH20 to the initial three Roche exclusive targets, $22.3 million in connection with Roche’s election of two additional exclusive targets and annual license maintenance fees for the right to designate the remaining targets as exclusive targets, $13.0 million in clinical development milestone payments, $8.0 million in regulatory milestone payments and $15.0 million in sales-based payments. Due to our continuing involvement obligations (for example, support activities associated with rHuPH20), revenues from the upfront payment, exclusive designation fees, annual license maintenance fees and sales-based payments were deferred and are being amortized over the remaining term of the Roche Collaboration.

For the three months ended September 30, 2015 and 2014, we recognized approximately $0.9 million and $0.8 million of Roche deferred revenues as revenues under collaborative agreements. For the nine months ended September 30, 2015 and 2014, we recognized approximately $2.5 million and $7.3 million, respectively, of Roche deferred revenues as revenues under collaborative agreements. Roche deferred revenues were approximately $40.3 million and $42.7 million as of September 30, 2015 and December 31, 2014, respectively.

Baxalta Collaboration

In September 2007, we and Baxalta entered into a collaboration and license agreement, under which Baxalta obtained a worldwide, exclusive license to develop and commercialize HYQVIA, a combination of Baxalta’s current product GAMMAGARD LIQUID™ and our patented rHuPH20 enzyme (the “Baxalta Collaboration”). In May 2013, the European Commission granted Baxalta marketing authorization in all EU Member States for the use of HYQVIA (solution for subcutaneous use), a combination of GAMMAGARD LIQUID and rHuPH20 in dual vial units, as replacement therapy for adult patients with primary and secondary immunodeficiencies. Baxalta launched HYQVIA in the EU in July 2013. In September 2014, the FDA approved HYQVIA for treatment of adult patients with primary immunodeficiency. In October 2014, Baxalta announced the launch and first shipments of HYQVIA in the U.S.

The Baxalta Collaboration is applicable to both kit and formulation combinations. Baxalta assumes all development, manufacturing, clinical, regulatory, sales and marketing costs under the Baxalta Collaboration, while we are responsible for the supply of bulk rHuPH20. We perform research and development activities and supply bulk rHuPH20 at the request of Baxalta, and are reimbursed by Baxalta under the terms of the Baxalta Collaboration. In addition, Baxalta has certain product development and commercialization obligations in major markets identified in the Baxalta Collaboration.

Unless terminated earlier in accordance with its terms, the Baxalta Collaboration continues in effect until the expiration of Baxalta’s obligation to pay royalties to us. Baxalta has the obligation to pay royalties, with respect to each product commercialized in each country, during the period equal to the longer of: (a) the duration of any valid claim of our patents covering rHuPH20 or other specified patents developed under the Baxalta Collaboration which valid claim covers the product in such country or (b) ten years following the date of the first commercial sale of such product in such country.

As of September 30, 2015, we have received $17.0 million under the Baxalta Collaboration, excluding royalties and reimbursements for providing research and development services and supplying bulk rHuPH20. The amounts received consisted of a $10.0 million upfront license fee payment, a $3.0 million regulatory milestone payment and a $4.0 million sales-based payment. Baxalta pays us a royalty on HYQVIA consisting of a mid-single digit percent of the net sales of such product. Due to our continuing involvement obligations (for example, support activities associated with rHuPH20 enzyme), the upfront license fee and sales-based payments were deferred and are being recognized over the term of the Baxalta Collaboration.

For both the three months ended September 30, 2015 and 2014, we recognized approximately $0.2 million of Baxalta deferred revenues as revenues under collaborative agreements. For both the nine months ended September 30, 2015 and 2014, we recognized approximately $0.6 million of Baxalta deferred revenues as revenues under collaborative agreements. For the three and nine months ended September 30, 2015, we recognized approximately $0.6 million and $1.2 million, respectively, of deferred revenues relating to manufacturing prepayments received from Baxalta. No such deferred revenues were recognized in the corresponding periods in 2014. Baxalta deferred revenues related to collaborative agreements and manufacturing prepayments totaled approximately $9.7 million and $10.9 million as of September 30, 2015 and December 31, 2014, respectively.

Other Collaborations

In June 2015, we and AbbVie, Inc. (“AbbVie”) entered into a collaboration and license agreement, under which AbbVie has the worldwide license to develop and commercialize products combining our patented rHuPH20 enzyme with AbbVie proprietary biologics directed at up to nine targets (the “AbbVie Collaboration”). Targets, once selected, will be on an exclusive, global basis. As of September 30, 2015, we have received a $23.0 million payment for the license fee of one specified exclusive target, TNF alpha. AbbVie has announced plans to develop rHuPH20 with HUMIRA® (adalimumab) which may allow reduced number of induction injections and deliver additional performance benefits. AbbVie has the right to elect up to eight additional targets for additional fees. The upfront license payment may be followed by event-based payments subject to AbbVie’s achievement of specified development, regulatory and sales-based milestones. In addition, AbbVie will pay tiered royalties if products under the collaboration are commercialized. Unless terminated earlier in accordance with its terms, the AbbVie Collaboration continues in effect until the later of: (i) expiration of the last to expire of the valid claims of our patents covering rHuPH20 or other specified patents developed under the collaboration which valid claim covers a product developed under the collaboration, and (ii) expiration of the last to expire royalty term for a product developed under the collaboration. The royalty term of a product developed under

the AbbVie Collaboration, with respect to each country, consists of the period equal to the longer of: (a) the duration of any valid claim of our patents covering rHuPH20 or other specified patents developed under the collaboration which valid claim covers the product in such country or (b) ten years following the date of the first commercial sale of such product in such country. AbbVie may terminate the agreement prior to expiration for any reason in its entirety or on a target-by-target basis upon 90 days prior written notice to us. Upon any such termination, the license granted to AbbVie (in total or with respect to the terminated target, as applicable) will terminate provided, however, that in the event of expiration of the agreement, the licenses granted will become perpetual, non-exclusive and fully paid.

In December 2014, we and Janssen entered into a collaboration and license agreement, under which Janssen has the worldwide license to develop and commercialize products combining our patented rHuPH20 enzyme with Janssen proprietary biologics directed at up to five targets (the “Janssen Collaboration”). Targets, once selected, will be on an exclusive, global basis. As of September 30, 2015, we have received a $15.0 million payment for the license fee of one specified exclusive target, CD38. Janssen has the right to elect four additional targets in the future upon payment of additional fees. Unless terminated earlier in accordance with its terms, the Janssen Collaboration continues in effect until the later of (i) expiration of the last to expire of the valid claims of our patents covering rHuPH20 or other specified patents developed under the collaboration which valid claim covers a product developed under the collaboration, and (ii) expiration of the last to expire royalty term for a product developed under the collaboration. The royalty term of a product developed under the Janssen Collaboration, with respect to each country, consists of the period equal to the longer of: (a) the duration of any valid claim of our patents covering rHuPH20 or other specified patents developed under the collaboration which valid claim covers the product in such country or (b) ten years following the date of the first commercial sale of such product in such country. Janssen may terminate the agreement prior to expiration for any reason in its entirety or on a target-by-target basis upon 90 days prior written notice to us. Upon any such termination, the license granted to Janssen (in total or with respect to the terminated target, as applicable) will terminate provided, however, that in the event of expiration of the agreement, the licenses granted will become perpetual, non-exclusive and fully paid. In November 2015, Janssen initiated dosing in a Phase 1b clinical trial of a subcutaneous formulation of rHuPH20 and daratumumab, a human monoclonal antibody that targets CD38 on the surface of multiple myeloma cells.

In December 2012, we and Pfizer entered into a collaboration and license agreement, under which Pfizer has the worldwide license to develop and commercialize products combining our patented rHuPH20 enzyme with Pfizer proprietary biologics directed at up to six targets (the “Pfizer Collaboration”). Targets may be selected on an exclusive or non-exclusive basis. As of September 30, 2015, we have received $11.0 million in upfront and license fee payments for the licenses to four specified exclusive targets. One of the targets is proprotein convertase subtilisin/kexin type 9, also known as PCSK9. Pfizer is also developing Rivipansel directed to another target under the collaboration to treat vaso-occlusive crisis in individuals with sickle cell disease. Pfizer has the right to elect two additional targets in the future upon payment of additional fees. Unless terminated earlier in accordance with its terms, the Pfizer Collaboration continues in effect until the later of (i) expiration of the last to expire of the valid claims of our patents covering rHuPH20 or other specified patents developed under the collaboration which valid claim covers a product developed under the collaboration, and (ii) expiration of the last to expire royalty term for a product developed under the collaboration. The royalty term of a product developed under the Pfizer Collaboration, with respect to each country, consists of the period equal to the longer of: (a) the duration of any valid claim of our patents covering rHuPH20 or other specified patents developed under the collaboration which valid claim covers the product in such country or (b) ten years following the date of the first commercial sale of such product in such country. Pfizer may terminate the agreement prior to expiration for any reason in its entirety or on a target-by-target basis upon 30 days prior written notice to us. Upon any such termination, the license granted to Pfizer (in total or with respect to the terminated target, as applicable) will terminate, provided, however, that in the event of expiration of the agreement, the licenses granted will become perpetual, non-exclusive and fully paid. In October 2015, Pfizer initiated dosing in a Phase 1 clinical trial for a subcutaneous formulation of Rivipansel, triggering a $1.0 million milestone payment.

At the inception of the Pfizer, Janssen and AbbVie arrangements, we identified the deliverables in each arrangement to include the license, research and development services and supply of bulk rHuPH20. We have determined that the license, research and development services and supply of bulk rHuPH20 individually represent separate units of accounting, because each deliverable has standalone value. The estimated selling prices for these units of accounting were determined based on market conditions, the terms of comparable collaborative arrangements for similar technology in the pharmaceutical and biotech industry and entity-

specific factors such as the terms of our previous collaborative agreements, our pricing practices and pricing objectives. The arrangement consideration was allocated to the deliverables based on the relative selling price method and the nature of the research and development services to be performed for the collaborator.

The amount allocable to the delivered unit or units of accounting is limited to the amount that is not contingent upon the delivery of additional items or meeting other specified performance conditions (non-contingent amount). As such, we excluded from the allocable arrangement consideration the event-based payments, milestone payments, annual exclusivity fees and royalties regardless of the probability of receipt. Based on the results of our analysis, we allocated the $11.0 million license fees from Pfizer, the $15.0 million upfront license fee from Janssen and the $23.0 million upfront license fee from AbbVie to the license fee deliverable under each of the arrangements. We determined that the upfront payments were earned upon the granting of the worldwide, exclusive right to our technology to the collaborators in these arrangements. As a result, we recognized the $11.0 million license fees under the Pfizer Collaboration, the $15.0 million upfront license fee under the Janssen Collaboration and the $23.0 million upfront license fee under the AbbVie Collaboration as revenues under collaborative agreements in the period when such license fees were earned. There were no revenues recognized related to event-based payments or milestone payments under these collaborations for the three and nine months ended September 30, 2015 and 2014.

The collaborators are each solely responsible for the development, manufacturing and marketing of any products resulting from their respective collaborations. We are entitled to receive payments for research and development services and supply of bulk rHuPH20 to these collaborators if requested by such collaborator. We recognize amounts allocated to research and development services as revenues under collaborative agreements as the related services are performed. We recognize amounts allocated to the sales of bulk rHuPH20 as revenues under collaborative agreements when such bulk rHuPH20 has met all required specifications by the collaborators and the related title and risk of loss and damages have passed to the collaborators. We cannot predict the timing of delivery of research and development services and bulk rHuPH20 as they are at the collaborators’ requests.

Pursuant to the terms of our collaboration agreements with Roche and Pfizer, certain future payments meet the definition of a milestone in accordance with the Milestone Method of Accounting. We are entitled to receive additional milestone payments for the successful development of the elected targets in the aggregate of up to approximately $55.0 million upon achievement of specified clinical development milestone events and up to approximately $12.0 million upon achievement of specified regulatory milestone events in connection with specified regulatory filings and receipt of marketing approvals.

5. Certain Balance Sheet Items

Accounts receivable, net consisted of the following (in thousands):

|

| | | | | | | | |

| | September 30,

2015 | | December 31,

2014 |

Accounts receivable from product sales to collaborators | | $ | 5,463 |

| | $ | 6,361 |

|

Accounts receivable from other product sales | | 2,433 |

| | 2,133 |

|

Accounts receivable from revenues under collaborative agreements | | 1,230 |

| | 1,266 |

|

Subtotal | | 9,126 |

| | 9,760 |

|

Allowance for distribution fees and discounts | | (734 | ) | | (611 | ) |

Total accounts receivable, net | | $ | 8,392 |

| | $ | 9,149 |

|

Inventories consisted of the following (in thousands):

|

| | | | | | | | |

| | September 30,

2015 | | December 31,

2014 |

Raw materials | | $ | 467 |

| | $ | 553 |

|

Work-in-process | | 9,494 |

| | 5,207 |

|

Finished goods | | 1,140 |

| | 646 |

|

Total inventories | | $ | 11,101 |

| | $ | 6,406 |

|

Prepaid expenses and other assets consisted of the following (in thousands):

|

| | | | | | | | |

| | September 30,

2015 | | December 31,

2014 |

Prepaid manufacturing expenses | | $ | 7,181 |

| | $ | 6,339 |

|

Prepaid research and development expenses | | 3,120 |

| | 2,380 |

|

Other prepaid expenses | | 1,516 |

| | 1,094 |

|

Other assets | | 520 |

| | 1,535 |

|

Total prepaid expenses and other assets | | 12,337 |

| | 11,348 |

|

Less long-term portion | | 2,458 |

| | 1,205 |

|

Total prepaid expenses and other assets, current | | $ | 9,879 |

| | $ | 10,143 |

|

Property and equipment, net consisted of the following (in thousands):

|

| | | | | | | | |

| | September 30,

2015 | | December 31,

2014 |

Research equipment | | $ | 9,142 |

| | $ | 8,474 |

|

Computer and office equipment | | 1,973 |

| | 2,178 |

|

Leasehold improvements | | 1,554 |

| | 1,518 |

|

Subtotal | | 12,669 |

| | 12,170 |

|

Accumulated depreciation and amortization | | (9,983 | ) | | (9,219 | ) |

Property and equipment, net | | $ | 2,686 |

| | $ | 2,951 |

|

Depreciation and amortization expense totaled approximately $0.4 million for both of the three months ended September 30, 2015 and 2014, and approximately $1.2 million and $1.3 million for the nine months ended September 30, 2015 and 2014, respectively.

Accrued expenses consisted of the following (in thousands):

|

| | | | | | | | |

| | September 30,

2015 | | December 31,

2014 |

Accrued outsourced research and development expenses | | $ | 7,017 |

| | $ | 4,383 |

|

Accrued compensation and payroll taxes | | 5,614 |

| | 5,923 |

|

Accrued outsourced manufacturing expenses | | 3,914 |

| | 2,112 |

|

Other accrued expenses | | 3,060 |

| | 2,023 |

|

Total accrued expenses | | 19,605 |

| | 14,441 |

|

Less long-term accrued outsourced research and development expenses | | 679 |

| | 480 |

|

Total accrued expenses, current | | $ | 18,926 |

| | $ | 13,961 |

|

Long-term accrued outsourced research and development is included in other long-term liabilities in the condensed consolidated balance sheets.

Deferred revenue consisted of the following (in thousands):

|

| | | | | | | | |

| | September 30,

2015 | | December 31,

2014 |

Collaborative agreements | | $ | 49,455 |

| | $ | 53,479 |

|

Product sales | | 578 |

| | 1,155 |

|

Total deferred revenue | | 50,033 |

| | 54,634 |

|

Less current portion | | 5,789 |

| | 7,367 |

|

Deferred revenue, net of current portion | | $ | 44,244 |

| | $ | 47,267 |

|

6. Long-Term Debt, Net

In December 2013, we entered into an Amended and Restated Loan and Security Agreement (the “Loan Agreement”) with Oxford Finance LLC (“Oxford”) and Silicon Valley Bank (“SVB”) (collectively, the “Lenders”), amending and restating in its entirety our original loan agreement with the Lenders, dated December 2012. The Loan Agreement provided for an additional $20 million principal amount of new term loan, bringing the total term loan balance to $50 million. The proceeds are to be used for working capital and general business requirements. The amended term loan facility matures on January 1, 2018.

In January 2015, we entered into the second amendment to the Loan Agreement with the Lenders, amending and restating the loan repayment schedules of the Loan Agreement. The amended and restated term loan repayment schedule provides for interest only payments through January 2016, followed by consecutive equal monthly payments of principal and interest in arrears starting in February 2016 and continuing through the previously established maturity date of January 1, 2018. Consistent with the original loan, the Loan Agreement provides for a 7.55% interest rate on the term loan and a final interest payment equal to 8.5% of the original principal amount, or $4.25 million, which is due when the term loan becomes due or upon the prepayment of the facility. We have the option to prepay the outstanding balance of the term loan in full, subject to a prepayment fee of 1% to 3% depending upon when the prepayment occurs.

In connection with the term loan, the debt offering costs have been recorded as a debt discount in our condensed consolidated balance sheets which, together with the final payment and fixed interest rate payments, are being amortized and recorded as interest expense throughout the life of the term loan using the effective interest rate method.

The amended term loan is secured by substantially all of the assets of the Company and our subsidiary, Halozyme, Inc., except that the collateral does not include any equity interests in Halozyme, Inc., any of our intellectual property (including all licensing, collaboration and similar agreements relating thereto), and certain other excluded assets. The Loan Agreement contains customary representations, warranties and covenants by us, which covenants limit our ability to convey, sell, lease, transfer, assign or otherwise dispose of certain of our assets; engage in any business other than the businesses currently engaged in by us or reasonably related thereto; liquidate or dissolve; make certain management changes; undergo certain change of control events; create, incur, assume, or be liable with respect to certain indebtedness; grant certain liens; pay dividends and make certain other restricted payments; make certain investments; make payments on any subordinated debt; and enter into transactions with any of our affiliates outside of the ordinary course of business or permit our subsidiaries to do the same. In addition, subject to certain exceptions, we are required to maintain with SVB our primary deposit accounts, securities accounts and commodities, and to do the same for our subsidiary, Halozyme, Inc.

The Loan Agreement also contains customary indemnification obligations and customary events of default, including, among other things, our failure to fulfill certain of our obligations under the Loan Agreement and the occurrence of a material adverse change which is defined as a material adverse change in our business, operations, or condition (financial or otherwise), a material impairment of the prospect of repayment of any portion of the loan, or a material impairment in the perfection or priority of lender’s lien in the collateral or in the value of such collateral. In the event of default by us under the Loan Agreement, the Lenders would be entitled to exercise their remedies thereunder, including the right to accelerate the debt, upon which we may be required to repay all amounts then outstanding under the Loan Agreement, which could harm our financial condition.

As of September 30, 2015, we were in compliance with all material covenants under the Loan Agreement and there was no material adverse change in our business, operations or financial condition.

Interest expense, including amortization of the debt discount, related to the long-term debt totaled approximately $1.3 million and $1.4 million for the three months ended September 30, 2015 and 2014, respectively. Interest expense, including amortization of the debt discount, related to the long-term debt totaled approximately $3.9 million and $4.2 million for the nine months ended September 30, 2015 and 2014, respectively. Accrued interest, which is included in accrued expenses and other long-term liabilities, was $2.9 million and $2.0 million as of September 30, 2015 and December 31, 2014, respectively.

7. Share-based Compensation

Total share-based compensation expense related to all of our share-based awards was allocated as follows (in thousands):

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Research and development | | $ | 2,269 |

| | $ | 2,295 |

| | $ | 7,268 |

| | $ | 5,735 |

|

Selling, general and administrative | | 3,284 |