PART I

ITEM 1. BUSINESS

Our Organization

China HGS Real Estate Inc. (the “Company” or “China HGS,” “we”, “our”, “us”), formerly known as China Agro Sciences Corp., is a corporation organized under the laws of the State of Florida.

HGS Investment is a Delaware corporation and owns 100% of the equity interest in Shaanxi HGS Management and Consulting Co., Ltd. (“Shaanxi HGS”), a wholly owned foreign entity incorporated under the laws of the People’s Republic of China (“PRC” or “China”).

China HGS does not conduct any substantive operations of its own. Instead, through its subsidiary, Shaanxi HGS, it entered into certain exclusive contractual agreements with Shaanxi Guangsha Investment and Development Group Co., Ltd. (“Guangsha”). Pursuant to these agreements, Shaanxi HGS is obligated to absorb a majority of the risk of loss from Guangsha’s activities and entitles Shaanxi HGS to receive a majority of Guangsha’s expected residual returns. In addition, Guangsha’s shareholders have pledged their equity interest in Guangsha to Shaanxi HGS, irrevocably granted Shaanxi HGS an exclusive option to purchase, to the extent permitted under PRC Law, all or part of the equity interests in Guangsha and agreed to entrust all the rights to exercise their voting power to the person(s) appointed by Shaanxi HGS.

Our Company engages in real estate development, primarily in the construction and sale of residential apartments, car parks and commercial properties.

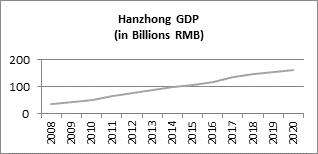

Guangsha was organized in August 1995 as a limited liability company under the laws of the PRC. Guangsha is headquartered in the city of Hanzhong, Shaanxi Province. Guangsha is engaged in developing large scale and high quality commercial and residential projects, including multi-layer apartment buildings, sub-high-rise apartment buildings, high-rise apartment buildings, and office buildings.

Our corporate structure as of September 30, 2021 is set forth below:

2