UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x |

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended October 31, 2016

or

| o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 333-68008

PHARMACYTE BIOTECH, INC.

(Exact name of registrant as specified in its

charter)

| Nevada |

62-1772151 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

23046 Avenida de la Carlota, Suite 600, Laguna

Hills, CA 92653

(Address of principal executive offices)

(917) 595-2850

(Registrant’s telephone number, including

area code)

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes x

No o

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months

(or for such shorter period that the registrant was required to submit and post such files). Yes x

No o

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| |

|

|

|

| Large accelerated filer |

o |

Accelerated filer |

x |

| Non-accelerated filer |

o |

Smaller reporting company |

o |

| (Do not check if a smaller reporting company) |

|

|

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of December 2, 2016, registrant had 849,904,665

outstanding shares of common stock, with a par value of $0.0001 per share.

PHARMACYTE BIOTECH, INC.

INDEX TO QUARTERLY REPORT ON FORM 10-Q

FOR THE THREE AND SIX MONTHS ENDED OCTOBER

31, 2016

| |

|

Page |

| PART I. |

FINANCIAL INFORMATION |

|

| |

|

|

| Item 1. |

Condensed Consolidated Financial Statements |

3 |

| |

| |

Condensed Consolidated Balance Sheets as of October 31, 2016 and April 30, 2016 (Unaudited) |

3 |

| |

| |

Condensed Consolidated Statements of Operations for the Three Months and Six Months Ended October 31, 2016 and 2015 (Unaudited) |

4 |

| |

|

|

| |

Condensed Consolidated Statements of Comprehensive Loss for the Three Months and Six Months Ended October 31, 2016 and 2015 (Unaudited) |

5 |

| |

|

|

| |

Condensed Consolidated Statements of Cash Flows for the Three Months and Six Months Ended October 31, 2016 and 2015 (Unaudited) |

6 |

| |

| |

Notes to Condensed Consolidated Financial Statements (Unaudited) |

7 |

| |

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

22 |

| |

| Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

26 |

| |

|

|

| Item 4. |

Controls and Procedures |

26 |

| |

|

|

| PART II. |

OTHER INFORMATION |

|

| |

|

|

| Item 1. |

Legal Proceedings |

28 |

| |

|

|

| Item 1A. |

Risk Factors |

28 |

| |

|

|

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

28 |

| |

|

|

| Item 3. |

Defaults Upon Senior Securities |

28 |

| |

|

|

| Item 4. |

Mine Safety Disclosures |

28 |

| |

|

|

| Item 5. |

Other Information |

28 |

| |

|

|

| Item 6. |

Exhibits |

29 |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

PHARMACYTE BIOTECH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | |

October 31, | | |

April 30, | |

| | |

2016 | | |

2016 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 1,551,610 | | |

$ | 1,920,825 | |

| Prepaid expenses and other current assets | |

| 51,112 | | |

| 110,026 | |

| Total current assets | |

| 1,602,722 | | |

| 2,030,851 | |

| | |

| | | |

| | |

| Other assets: | |

| | | |

| | |

| Intangibles | |

| 3,549,427 | | |

| 3,549,427 | |

| Investment in SG Austria | |

| 1,572,193 | | |

| 1,572,193 | |

| Other assets | |

| 7,372 | | |

| 7,854 | |

| Total other assets | |

| 5,128,992 | | |

| 5,129,474 | |

| | |

| | | |

| | |

| Total Assets | |

$ | 6,731,714 | | |

$ | 7,160,325 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 300,896 | | |

$ | 336,009 | |

| Accrued expenses | |

| 148,094 | | |

| 151,630 | |

| License agreement obligation | |

| – | | |

| 150,000 | |

| Total current liabilities | |

| 448,990 | | |

| 637,639 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 448,990 | | |

| 637,639 | |

| | |

| | | |

| | |

| Commitments and Contingencies (Notes 7 and 9) | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Common stock, authorized 1,490,000,000 shares, $0.0001 par value, 849,154,665 and 781,233,338 shares issued and outstanding as of October 31, 2016 and April 30, 2016, respectively | |

| 84,916 | | |

| 78,127 | |

| Additional paid in capital | |

| 92,894,298 | | |

| 91,135,370 | |

| Accumulated deficit | |

| (86,698,134 | ) | |

| (84,691,617 | ) |

| Accumulated other comprehensive income | |

| 1,644 | | |

| 806 | |

| Total stockholders' equity | |

| 6,282,724 | | |

| 6,522,686 | |

| | |

| | | |

| | |

| Total Liabilities and Stockholders' Equity | |

$ | 6,731,714 | | |

$ | 7,160,325 | |

See accompanying notes to condensed consolidated

financial statements.

PHARMACYTE BIOTECH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | |

Three Months Ended October 31, | | |

Six Months Ended October 31, | |

| | |

2016 | | |

2015 | | |

2016 | | |

2015 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | – | | |

$ | – | | |

$ | – | | |

$ | – | |

| Cost of revenue | |

| – | | |

| – | | |

| – | | |

| – | |

| Gross margin | |

| – | | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development costs | |

| 253,768 | | |

| 439,711 | | |

| 428,772 | | |

| 595,389 | |

| Compensation expense | |

| 491,472 | | |

| 400,507 | | |

| 906,478 | | |

| 848,077 | |

| Director fees | |

| 9,000 | | |

| 9,000 | | |

| 18,000 | | |

| 27,000 | |

| Legal and professional | |

| 56,760 | | |

| 57,988 | | |

| 234,765 | | |

| 183,063 | |

| General and administrative | |

| 163,195 | | |

| 728,612 | | |

| 417,577 | | |

| 1,496,600 | |

| Total operating expenses | |

| 974,195 | | |

| 1,635,818 | | |

| 2,005,592 | | |

| 3,150,129 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (974,195 | ) | |

| (1,635,818 | ) | |

| (2,005,592 | ) | |

| (3,150,129 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| – | | |

| 430 | | |

| – | | |

| 335 | |

| Interest expense | |

| (356 | ) | |

| (194 | ) | |

| (925 | ) | |

| (826 | ) |

| Total other income (expense), net | |

| (356 | ) | |

| 236 | | |

| (925 | ) | |

| (491 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (974,551 | ) | |

$ | (1,635,582 | ) | |

$ | (2,006,517 | ) | |

$ | (3,150,620 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per share | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| Weighted average shares outstanding basic and diluted | |

| 848,910,100 | | |

| 745,357,022 | | |

| 818,540,900 | | |

| 741,637,252 | |

See accompanying notes to condensed consolidated

financial statements.

PHARMACYTE BIOTECH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

LOSS

(UNAUDITED)

| | |

Three Months Ended October 31, | | |

Six Months Ended October 31, | |

| | |

2016 | | |

2015 | | |

2016 | | |

2015 | |

| | |

| | |

| | |

| | |

| |

| Net Loss | |

$ | (974,551 | ) | |

$ | (1,635,582 | ) | |

$ | (2,006,517 | ) | |

$ | (3,150,620 | ) |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation | |

| (390 | ) | |

| (34 | ) | |

| (1,644 | ) | |

| 1,587 | |

| Other comprehensive income (loss) | |

| (390 | ) | |

| (34 | ) | |

| (1,644 | ) | |

| 1,587 | |

| Comprehensive loss | |

$ | (974,941 | ) | |

$ | (1,635,616 | ) | |

$ | (2,008,161 | ) | |

$ | (3,149,033 | ) |

See accompanying notes to condensed consolidated

financial statements.

PHARMACYTE BIOTECH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS

(UNAUDITED)

| | |

Six Months Ended October 31, | |

| | |

2016 | | |

2015 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (2,006,517 | ) | |

$ | (3,150,620 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock issued for services | |

| 38,500 | | |

| 333,216 | |

| Stock issued for compensation | |

| 143,760 | | |

| 254,040 | |

| Stock based compensation – options | |

| 340,236 | | |

| 287,928 | |

| Stock based compensation – warrants | |

| – | | |

| 679,930 | |

| Change in assets and liabilities: | |

| | | |

| | |

| Increase (decrease) in prepaid expenses and other current assets | |

| 59,396 | | |

| (80,500 | ) |

| Decrease in accounts payable | |

| (35,113 | ) | |

| (69,491 | ) |

| Increase (decrease) in accrued expenses | |

| (3,536 | ) | |

| 29,130 | |

| Decrease in license agreement obligation | |

| (150,000 | ) | |

| (400,000 | ) |

| Net cash used in operating activities | |

| (1,613,274 | ) | |

| (2,116,367 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Net cash provided by (used in) investing activities | |

| – | | |

| – | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from sale of common stock | |

| 1,243,221 | | |

| 1,728,935 | |

| Net cash provided by financing activities | |

| 1,243,221 | | |

| 1,728,935 | |

| | |

| | | |

| | |

| Effect of currency rate exchange on cash | |

| 838 | | |

| 125 | |

| | |

| | | |

| | |

| Net decrease in cash | |

| (369,215 | ) | |

| (387,307 | ) |

| | |

| | | |

| | |

| Cash at beginning of the period | |

| 1,920,825 | | |

| 2,699,737 | |

| Cash at end of the period | |

$ | 1,551,610 | | |

$ | 2,312,430 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flows information: | |

| | | |

| | |

| Cash paid during the period for interest | |

$ | 925 | | |

$ | 826 | |

See accompanying notes to condensed consolidated

financial statements.

PHARMACYTE BIOTECH,

INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(UNAUDITED)

NOTE 1 – NATURE OF BUSINESS

Overview

PharmaCyte Biotech, Inc. (“Company”)

is a clinical stage biotechnology company focused on developing and preparing to commercialize treatments for cancer and diabetes

based upon a proprietary cellulose-based live cell encapsulation technology known as “Cell-in-a-Box®.”

The Cell-in-a-Box® technology will be used as a platform upon which treatments for several types of cancer, including

advanced, inoperable pancreatic cancer, and diabetes will be developed.

The Company is developing therapies for pancreatic

and other solid cancerous tumors involving the encapsulation of live cells placed in the body to enable the delivery of cancer-killing

drugs at the source of the cancer. In addition, the Company is developing a therapy for Type 1 diabetes and insulin-dependent Type

2 diabetes based upon the encapsulation of a human cell line genetically engineered to produce, store and secrete insulin at levels

in proportion to the levels of blood sugar in the human body using the Cell-in-a-Box® technology. The Company is

also examining ways to exploit the benefits of the Cell-in-a-Box® technology to develop therapies for cancer based

upon the constituents of the Cannabis plant, known as “cannabinoids.”

Cancer Therapy

Targeted Chemotherapy

The Company is using the Cell-in-a-Box®

technology to develop a therapy for solid cancerous tumors through targeted chemotherapy. For example, for pancreatic cancer

the Company is encapsulating genetically engineered live human cells that produce an enzyme designed to convert the prodrug ifosfamide

into its cancer-killing form. The capsules containing these cells will be implanted in a patient in the blood supply as near as

possible to the tumor. The cancer prodrug ifosfamide will then be given intravenously at one-third the normal dose. In this way,

the ifosfamide will be converted at the site of the tumor instead of in the liver where it is normally converted. The Company believes

placement of the Cell-in-a-Box® capsules near the tumor enables the production of optimal concentrations of the

“cancer-killing” form of ifosfamide at the site of the tumor. The cancer-killing metabolite of ifosfamide has a short

half-life, which the Company believes will result in little to no collateral damage to other organs in the body. In an earlier

Phase 1/2 clinical trial which used ifosfamide at one-third the normal dose with the Cell-in-a-Box® technology,

this targeted chemotherapy not only reduced the tumor size but also generally resulted in no obvious adverse side effects attributed

to this therapy.

Pancreatic Cancer Therapy

The Company is developing a therapy for pancreatic

cancer to address a critical unmet medical need. This need exists for patients with advanced pancreatic cancer whose tumors are

locally advanced, non-metastatic and inoperable but no longer respond to Abraxane® plus gemcitabine, the current

standard of care for advanced pancreatic cancer. These patients have no effective treatment alternative once their tumors no longer

respond to this combination therapy.

Although several therapies have been tried

in this situation, the most commonly used is believed to be the combination of the cancer chemotherapy drug capecitabine plus radiation

(“CRT”). However, the results of a Phase 3 clinical trial were recently reported in the Journal of the American Medical

Association. This clinical trial addressed whether CRT is more effective than chemotherapy alone. In patients with locally advanced,

inoperable pancreatic cancer whose tumors no longer responded to gemcitabine or gemcitabine plus erlotinib (standard initial therapies

at the time the clinical trial was conducted) patients were treated with the same chemotherapy or with CRT. In both cases CRT was

not meaningfully more effective than chemotherapy alone.

Subject to United States Food and Drug

Administration (“FDA”) approval, the Company plans to commence a Phase 2b clinical trial. A Pre-Investigational

New Drug (“Pre-IND”) meeting with the Center for Biologics Evaluation and Research (“CBER”) of the

FDA has been granted by the FDA, although no assurance can be given as to when the meeting will be held or whether the FDA

will approve the Company’s Investigational New Drug Application (“IND”). The trial is designed to show that

the Company’s Cell-in-a-Box® plus low-dose ifosfamide therapy can serve as an effective and safe

consolidation chemotherapy for patients whose tumors no longer respond after four to six months of therapy with

Abraxane® plus gemcitabine. The trial will take place in the United States (“U.S.”) with study sites in Europe.

Translational Drug Development (“TD2”) will conduct the trial in the U.S. Clinical

Network Services (“CNS”) will conduct the trial in Europe in alliance with TD2. TD2 will be responsible for

clinical development plans, program analysis, medical writing, clinical management and database development.

Malignant Ascites Fluid Therapy

The Company is also developing a therapy to

delay the production and accumulation of malignant ascites fluid that results from all abdominal tumors. Malignant ascites fluid

is secreted by abdominal tumors into the abdomen after the tumor reaches a certain stage of growth. This fluid contains cancer

cells that can seed and form new tumors throughout the abdomen. This fluid accumulates in the abdominal cavity, causing swelling

of the abdomen, severe breathing difficulties and extreme pain.

Malignant ascites fluid must be surgically

removed on a periodic basis. This is painful and costly. There is no therapy that prevents or delays the production and accumulation

of malignant ascites fluid. The Company has been involved in a series of preclinical studies at TD2 to determine if the combination

of Cell-in-a-Box® encapsulated cells plus ifosfamide can delay the production and accumulation of malignant ascites

fluid. If successful, the Company plans to conduct a clinical trial in the U.S. with additional study sites in Europe. TD2 will

conduct the trial in the U.S., and CNS will conduct the trial in Europe in alliance with TD2. The Company plans to start a clinical

trial in 2017 if the results of its preclinical studies support the trial and the Company receive FDA approval to do so.

Diabetes Therapy

Diabetes

Diabetes is caused by insufficient availability

of, or resistance to, insulin. Insulin is produced by the islet cells of the pancreas. Its function is to assist in the transport

of sugar (glucose) in the blood to the inside of most types of cells in the body where it is used as a source of energy for those

cells. In Type 1 diabetes the islet cells of the pancreas (the body’s insulin-producing cells) have been destroyed - usually

by an autoimmune reaction. Type 1 diabetics require daily insulin administration through injection or through the use of an insulin

pump. In Type 2 diabetes the body does not use insulin properly. This means the body has become resistant to insulin. Type 2 diabetes

can generally be controlled by diet and exercise in its early stages. As time goes by, it may be necessary to use antidiabetic

drugs to control the disease. However, over time these too may lose their effectiveness. Thus, even Type 2 diabetics may become

insulin-dependent.

Bio-Artificial Pancreas for Diabetes

The Company plans to develop a therapy for

Type 1 diabetes and insulin-dependent Type 2 diabetes. The Company is developing a therapy that involves encapsulation of human

liver cells that have been genetically engineered to produce, store insulin and release insulin on demand at levels in proportion

to the levels of blood sugar (glucose) in the human body. The encapsulation will be done using the Cell-in-a-Box®

technology.

In October 2014, the Company obtained from

the University of Technology Sydney (“UTS”) in Australia an exclusive, worldwide license (“Melligen Cell License

Agreement”) to use insulin-producing genetically engineered human cells developed by UTS to treat Type 1 diabetes and insulin-dependent

Type 2 diabetes. These cells, named “Melligen,” have already been tested in mice and shown to produce insulin in direct

proportion to the amount of glucose in their surroundings. When Melligen cells were transplanted into immunosuppressed diabetic

mice, the blood glucose levels of the mice became normal. In other words, the Melligen cells reversed the diabetic condition.

Austrianova Singapore Pte Ltd (“Austrianova”)

has already successfully encapsulated live pig pancreatic islet insulin-producing cells using the Cell-in-a-Box®

technology and then implanted these encapsulated cells in diabetic rats. Soon after the capsules were implanted, the rats’

blood glucose levels normalized and remained normal throughout the study period of approximately six months. No immune system suppressing

drugs were needed. Thus, the preclinical proof of principle for a bio-artificial pancreas has already been established using Cell-in-a-Box®

capsules containing pig pancreatic insulin-producing cells in a rat model of Type 1 diabetes.

In June 2013, the Company acquired from Austrianova

an exclusive, worldwide license to use the Cell-in-a-Box® technology for the development of a treatment for diabetes

and the use of Austrianova’s Cell-in-a-Box® trademark and its associated technology (“Diabetes Licensing

Agreement”). The Company believes that encapsulating the Melligen cells using the Cell-in-a-Box® technology

has numerous advantages over encapsulation of cells with other materials, such as alginate. Since the capsules are composed largely

of cellulose (a bio-inert material in the human body), the Cell-in-a-Box® capsules are robust. This allows them

to remain intact for long periods of time in the body, all the while protecting the cells inside them from immune system attack.

Moreover, in prior studies, these capsules and the cells inside them have not caused any immune or inflammatory responses like

those seen with alginate-encapsulated cells.

Cannabis Therapy

The Company plans to use Cannabis to

develop therapies for two of the deadliest forms of cancer – brain and pancreatic. We also plan to focus initially on developing

specific therapies based on carefully chosen molecules rather than using complex Cannabis extracts. Targeted cannabinoid-based

chemotherapy utilizing our Cell-in-a-Box® technology offers a “green” approach to treating solid-tumor

malignancies.

It is believed that the constituents of the

Cannabis plant (cannabinoids) inhibit or prevent the growth and spread of tumors or malignant

cells. The chemical and biochemical processes involved in the interaction of cannabinoids with live cell encapsulation provides

the opportunity to develop “green” approaches to treating cancers, such as pancreatic, brain, breast and prostate,

among others. The Company believes that it is in a unique position among medical Cannabis pharmaceutical companies to develop

cannabinoid-based therapies utilizing the Cell-in-a-Box® live cell encapsulation technology as the platform.

In May 2014, the Company entered into a Research

Agreement with the State of Colorado, acting on behalf of the Board of Trustees of the University of Northern Colorado. The goal

of the ongoing research is to develop methods for the identification, separation and quantification of constitutes of Cannabis

(some of which are prodrugs) that may be used in combination with the Cell-in-a-Box® technology to treat cancer.

Initial studies have been undertaken using cannabinoid-like model compounds to identify the appropriate cell type that can convert

the selected cannabinoid prodrugs into metabolites with anticancer activity. Once identified, the genetically modified cells that

will produce the appropriate enzyme to convert that prodrug will be encapsulated using the Company’s Cell-in-a-Box®

technology. The encapsulated cells and cannabinoid prodrugs identified by these studies will then be combined and used for future

studies to evaluate their anticancer effectiveness.

Company Background and Material Agreements

The Company is a Nevada corporation incorporated

in 1996. In 2013, it restructured its operations in an effort to focus on biotechnology. The restructuring resulted in the Company

focusing all of its efforts upon the development of a novel, effective and safe way to treat cancer and diabetes. On January 6,

2015, the Company changed its name from Nuvilex, Inc. to PharmaCyte Biotech, Inc. to better reflect the nature of its business.

In 2011, the Company entered into an Asset

Purchase Agreement (“SG Austria APA”) with SG Austria Pte. Ltd. (“SG Austria”) to purchase 100% of the

assets and liabilities of SG Austria. As a result, Austrianova and Bio Blue Bird AG ("Bio Blue Bird"), then wholly-owned

subsidiaries of SG Austria, were to become wholly-owned subsidiaries of the Company on the condition that the Company pay SG Austria

$2.5 million and 100,000,000 shares of the Company’s common stock. The Company was to receive 100,000 shares of common stock

of Austrianova and nine bearer shares of Bio Blue Bird representing 100% of the ownership of Bio Blue Bird.

Through two addenda to the SG Austria APA,

the closing date of the SG Austria APA was extended twice by agreement between the parties.

In June 2013, the Company and SG Austria entered

into a Third Addendum to the SG Austria APA (“Third Addendum”). The Third Addendum changed materially the transaction

contemplated by the SG Austria APA. Under the Third Addendum, the Company acquired 100% of the equity interests in Bio Blue Bird

and received a 14.5% equity interest in SG Austria. In addition, the Company received nine bearer shares of Bio Blue Bird to reflect

its 100% ownership of Bio Blue Bird. The Company paid: (i) $500,000 to retire all outstanding debt of Bio Blue Bird; and (ii) $1.0

million to SG Austria. The Company also paid SG Austria $1,572,193 in exchange for the 14.5% equity interest of SG Austria. The

Third Addendum required SG Austria to return the 100,000,000 shares of the Company’s common stock held by SG Austria and

for the Company to return the 100,000 shares of common stock of Austrianova the Company held.

Effective as of the same date of the Third

Addendum, the parties entered into a Clarification Agreement to the Third Addendum (“Clarification Agreement”) to clarify

and include certain language that was inadvertently left out of the Third Addendum. Among other things, the Clarification Agreement

confirmed that the Third Addendum granted the Company an exclusive, worldwide license to use, with a right to sublicense, the Cell-in-a-Box®

technology for the development of treatments for cancer and use of Austrianova’s Cell-in-a-Box® trademark

and its associated technology.

Bio Blue Bird licensed certain types of genetically

modified human cells (“Cells”) from Bavarian Nordic A/S (“Bavarian Nordic”) and GSF-Forschungszentrum für

Umwelt u. Gesundheit GmbH (collectively, “Bavarian Nordic/GSF”) pursuant to a License Agreement (“Bavarian Nordic/GSF

License Agreement”) to develop a therapy for cancer using encapsulated Cells. The licensed rights to the Cells pertain to

the countries in which Bavarian Nordic/GSF obtained patent protection. Hence, facilitated by the acquisition of Bio Blue Bird,

the Third Addendum and the Clarification Agreement provide the Company with an exclusive, worldwide license to use the Cell-in-a-Box®

technology and trademark for the development of a therapy for cancer using the Cells.

In June 2013, the Company entered into the

Diabetes Licensing Agreement. The Company paid Austrianova $2.0 million to secure this license.

In October 2014, the Company entered into the

Melligen Cell License Agreement (defined below). The Company is in the process of developing a therapy for diabetes by encapsulating

the Melligen cells using the Cell-in-a-Box® technology.

In December 2014, the Company acquired from

Austrianova an exclusive, worldwide license to use the Cell-in-a-Box® technology in combination with genetically

modified non-stem cell lines which are designed to activate cannabinoid prodrug molecules for development of treatments for diseases

and their related symptoms and the use of the Cell-in-a-Box® trademark for this technology (“Cannabis Licensing

Agreement”).

In July 2016, the Company entered into a Binding

Memorandum of Understanding with Austrianova (“Austrianova MOU”). Pursuant to the Austrianova MOU, Austrianova will

actively work to seek an investment partner or partners who will finance clinical trials and further develop products for the therapies

for cancer, in exchange for which we, Austrianova and any future investment partner or partners will each receive a share of the

net revenue of applicable products in designated territories.

Effective October 1, 2016, the parties

amended the Bavarian Nordic/GSF License Agreement to include the right to import, reflect ownership and notification of improvements,

clarify which provisions survive expiration or termination of the Bavarian Nordic/GSF License Agreement, to provide rights to Bio

Blue Bird to the clinical data after expiration of the licensed patent rights and to change the notice address and recipients of

Bio Blue Bird.

NOTE 2 – LIQUIDITY AND MANAGEMENT

PLANS

Liquidity

The Company's condensed consolidated financial

statements are prepared using accounting principles generally accepted in the United States (“U.S. GAAP”) applicable

to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business.

As of October 31, 2016, the Company had an accumulated deficit of $86,698,134 and incurred a net loss for the six months ended

October 31, 2016 of $2,006,517.

During the six months ended October 31,

2016, approximately $1.3 million of funding was provided by investors to maintain and expand the Company’s operations.

The remaining challenges, beyond the regulatory and clinical aspects, include accessing funding for the Company to cover its

future cash flow needs. During the six months ended October 31, 2016, the Company acquired funds through the Company’s

S-3 Registration Statement pursuant to which its exclusive placement agent, Chardan Capital Markets, LLC

(“Chardan”), sold shares of common stock “at-the-market” or in negotiated block trades in a program

which is structured to provide up to $50 million dollars to the Company less certain commissions.

The Company requires substantial additional

capital to finance its planned business operations and expects to incur operating losses in future periods due to the expenses

related to the Company’s core businesses. The Company has not realized material revenue since it commenced doing business

in the biotechnology sector, and there can be no assurance that it will be successful in generating revenues in the future in this

sector. The Company believes that cash as of October 31, 2016, any sales of unregistered shares of its common stock and any public

offerings of common stock the Company may engage in will provide sufficient capital to meet its capital requirements and to fund

its operations through October 31, 2017. However, the Company’s ability to raise additional capital is limited by its inability

to use a short form registration statement on Form S-3. As of the date of this Report, the Company does not meet the eligibility

requirements in order for it to be able to conduct a primary offering of its common stock under Form S-3 or to file a new Registration

Statement on Form S-3. The Company may be able to regain the use of Form S-3 if it meets one or both of the eligibility criteria,

including: (i) the aggregate market value of the Company’s common stock held by non-affiliates exceeds $75 million; or (ii)

the common stock is listed and registered on a national securities exchange.

If the Company is not able to raise substantial

additional capital in a timely manner, the Company may not be able to commence or complete its planned clinical trials and preclinical

studies.

The Company will continue to be dependent on

outside capital to fund its research and operating expenditures for the foreseeable future. If the Company fails to generate positive

cash flows or fails to obtain additional capital when required, the Company may need to modify, delay or abandon some or all of

its business plans.

Management Goal and Strategies to Implement

The Company’s goal is to become an industry-leading

biotechnology company using the Cell-in-a-Box® technology as a platform upon which therapies for cancer and diabetes

are developed and obtain marketing approval for these therapies from regulatory agencies in the U.S., the European Union, Australia

and Canada.

The Company’s strategies to achieve this

goal consist of the following:

| |

· |

The completion of clinical trials in locally advanced, inoperable non-metastatic pancreatic cancer and its associated pain; |

| |

· |

The completion of preclinical studies and clinical trials that will demonstrate the effectiveness of the Company’s cancer therapy in reducing the production and accumulation of malignant ascites fluid in the abdomen that is characteristic of pancreatic and other abdominal cancers; |

| |

· |

The completion of preclinical studies and clinical trials that involve the encapsulation of the Melligen cells using the Cell-in-a-Box® technology to develop a treatment for Type 1 diabetes and insulin-dependent Type 2 diabetes; |

| |

· |

The enhancement of the Company’s ability to expand into the biotechnology arena through further research and partnering agreements in cancer and diabetes; |

| |

· |

The acquisition of contracts that generate revenue or provide research and development capital utilizing the Company’s sublicensing rights; |

| |

· |

The further development of uses of the Cell-in-a-Box® technology platform through contracts, licensing agreements and joint ventures with other companies; and |

| |

|

|

| |

· |

The completion of testing, expansion and marketing of existing and newly derived product candidates. |

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

General

The accompanying condensed consolidated financial

statements as of October 31, 2016 and for the three and six months ended October 31, 2016 and 2015 are unaudited. These unaudited

condensed consolidated financial statements have been prepared in accordance with U.S. GAAP for interim financial information and

are presented in accordance with the requirements of Regulation S-X of the Securities and Exchange Commission (“SEC”) and

with the instructions to Form 10-Q. Accordingly, they do not include all the information and footnotes required by U.S. GAAP for

complete condensed consolidated financial statements.

In the opinion of management, all adjustments

(consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for

the three and six months ended October 31, 2016 are not necessarily indicative of the results that may be expected for the fiscal

year ending April 30, 2017. The unaudited condensed consolidated financial statements should be read in conjunction with the audited

consolidated financial statements as of and for the fiscal year ended April 30, 2016 and footnotes thereto included in the Annual

Report on Form 10-K of the Company filed with the SEC on July 29, 2016.

The condensed consolidated balance sheet as

of October 31, 2016 contained herein has been derived from the audited consolidated financial statements as of April 30, 2016,

but does not include all disclosures required by U.S. GAAP.

Principles of Consolidation and Basis of

Presentation

The condensed consolidated financial statements

include the accounts of the Company and its wholly owned subsidiaries. The Company operates independently and through four wholly-owned

subsidiaries: (i) Bio Blue Bird; (ii) PharmaCyte Biotech Europe Limited; (iii) PharmaCyte Biotech Australia Pty. Ltd.; and (iv) Viridis

Biotech, Inc. and are prepared in accordance with U.S. GAAP and the rules and regulations of the SEC. Intercompany balances and

transactions are eliminated. The Company’s 14.5% investment in SG Austria is presented on the cost method of accounting.

Use of Estimates

The preparation of financial statements in

accordance with U.S. GAAP requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities,

disclosure of contingent assets and liabilities known to exist as of the date the financial statements are published and the reported

amounts of revenues and expenses during the reporting period. On an ongoing basis, the Company evaluates these estimates including

those related to fair values of financial instruments, intangible assets, fair value of stock-based awards, income taxes and contingent

liabilities, among others. Uncertainties with respect to such estimates and assumptions are inherent in the preparation of the

Company’s consolidated financial statements; accordingly, it is possible that the actual results could differ from these

estimates and assumptions, which could have a material effect on the reported amounts of the Company’s consolidated financial

position and results of operations.

Intangible Assets

The Financial Accounting Standards Board ("FASB")

standard on goodwill and other intangible assets prescribes a two-step process for impairment testing of goodwill and indefinite-lived

intangibles, which is performed annually, as well as when an event triggering impairment may have occurred. The first step tests

for impairment, while the second step, if necessary, measures the impairment. The Company has elected to perform its annual analysis

at the end of its reporting year.

The Company’s intangible assets are licensing

agreements related to the Cell-in-a-Box® technology for $1,549,427 and diabetes license for $2,000,0000 for an aggregate

total of $3,549,427.

These intangible assets have an indefinite

life; therefore, they are not amortizable.

The Company concluded that there was no impairment

of the carrying value of the intangibles for the six months ended October 31, 2016.

Impairment of Long-Lived Assets

The Company evaluates long-lived assets for

impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be fully recoverable.

If the estimated future cash flows (undiscounted and without interest charges) from the use of an asset are less than carrying

value, a write-down would be recorded to reduce the related asset to its estimated fair value. No impairment was identified or

recorded during the six months ended October 31, 2016.

Fair Value of Financial Instruments

For certain of the Company’s non-derivative

financial instruments, including cash, accounts payable and accrued expenses, the carrying amount approximates fair value due to

the short-term maturities of these instruments.

Accounting Standards Codification ("ASC")

Topic 820, “Fair Value Measurements and Disclosures,” requires disclosure of the fair value of financial instruments

held by the Company. ASC Topic 825, “Financial Instruments,” defines fair value, and establishes a three-level valuation

hierarchy for disclosures of fair value measurement that enhances disclosure requirements for fair value measures. The carrying

amounts reported in the consolidated balance sheets for current liabilities qualify as financial instruments and are a reasonable

estimate of their fair values because of the short period of time between the origination of such instruments and their expected

realization and their current market rate of interest. The three levels of valuation hierarchy are defined as follows:

| |

· |

Level 1. Observable inputs such as quoted prices in active markets; |

| |

· |

Level 2. Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and |

| |

· |

Level 3. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions. |

The Company adopted ASC subtopic 820-10, Fair

Value Measurements and Disclosures and Accounting Standards Codification subtopic 825-10, Financial Instruments, which permits

entities to choose to measure many financial instruments and certain other items at fair value. Neither of these statements had

an impact on the Company's financial position, results of operations or cash flows. The carrying value of cash, accounts payable

and accrued expenses, as reflected in the consolidated balance sheets, approximate fair value because of the short-term maturity

of these instruments.

Income Taxes

Deferred taxes are calculated using the liability

method whereby deferred tax assets are recognized for deductible temporary differences and operating loss and tax credit carry

forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences

between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation

allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will

not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date

of enactment.

A valuation allowance is provided for deferred

income tax assets when, in management’s judgment, based upon currently available information and other factors, it is more

likely than not that all or a portion of such deferred income tax assets will not be realized. The determination of the need for

a valuation allowance is based on an on-going evaluation of current information including, among other things, historical operating

results, estimates of future earnings in different taxing jurisdictions and the expected timing of the reversals of temporary differences.

The Company believes the determination to record a valuation allowance to reduce a deferred income tax asset is a significant accounting

estimate because it is based, among other things, on an estimate of future taxable income in the U.S. and certain other jurisdictions,

which is susceptible to change and may or may not occur, and because the impact of adjusting a valuation allowance may be material.

In determining when to release the valuation allowance established against the Company’s net deferred income tax assets,

the Company considers all available evidence, both positive and negative. Consistent with the Company’s policy, and because

of the Company’s history of operating losses, the Company does not currently recognize the benefit of all of its deferred

tax assets, including tax loss carry forwards, that may be used to offset future taxable income. The Company continually assesses

its ability to generate sufficient taxable income during future periods in which deferred tax assets may be realized. If and when

the Company believes it is more likely than not that it will recover its deferred tax assets, the Company will reverse the valuation

allowance as an income tax benefit in the statements of operations.

The Company accounts for its uncertain tax

positions in accordance with U.S. GAAP. The purpose of this method is to clarify accounting for uncertain tax positions recognized.

The U.S. GAAP method of accounting for uncertain tax positions utilizes a two-step approach to evaluate tax positions. Step one,

recognition, requires evaluation of the tax position to determine if based solely on technical merits it is more likely than not

to be sustained upon examination. Step two, measurement, is addressed only if a position is more likely than not to be sustained.

In step two, the tax benefit is measured as the largest amount of benefit, determined on a cumulative probability basis, which

is more likely than not to be realized upon ultimate settlement with tax authorities. If a position does not meet the more likely

than not threshold for recognition in step one, no benefit is recorded until the first subsequent period in which the more likely

than not standard is met, the issue is resolved with the taxing authority or the statute of limitations expires. Positions previously

recognized are derecognized when the Company subsequently determines the position no longer is more likely than not to be sustained.

Evaluation of tax positions, their technical merits and measurements using cumulative probability are highly subjective management

estimates. Actual results could differ materially from these estimates.

Research and Development

Research and development expenses consist of

costs incurred for direct and overhead-related research expenses and are expensed as incurred. Costs to acquire technologies, including

licenses, that are utilized in research and development and that have no alternative future use are expensed when incurred. Technology

developed for use in the Company’s product candidates is expensed as incurred until technological feasibility has been established.

Under the Cannabis Licensing Agreement, the

Company acquired from Austrianova an exclusive, world-wide license to use the Cell-in-a-Box® trademark and its associated

technology with genetically modified non-stem cell lines which are designed to activate cannabinoids to develop therapies involving

Cannabis.

Under the Cannabis Licensing Agreement, the

Company is required to pay Austrianova an Upfront Payment (defined in Note 4) of $2,000,000. The Company has the right to make

periodic monthly partial payments of the Upfront Payment in amounts to be agreed upon between the parties prior to each such payment

being made. Under the Cannabis Licensing Agreement, the Company was required to pay the Upfront Payment in full by no later than

June 30, 2016, and such obligation has been paid in full. As of October 31, 2016, the Company has paid Austrianova $2.0 million

of the Upfront Payment. The $2 million cost of the license has been recorded as research and development costs.

Research and development costs for the three

and six months ended October 31, 2016 and 2015 were $253,768, $439,711, $428,772, and $595,389, respectively.

Stock-Based Compensation

The Company recognizes stock-based compensation

expense for only those awards ultimately expected to vest on a straight-line basis over the requisite service period of the award,

net of an estimated forfeiture rate. The Company estimates the fair value of stock options using a Black-Scholes-Merton valuation

model, which requires the input of highly subjective assumptions, including the option's expected term and stock price volatility.

In addition, judgment is also required in estimating the number of stock-based awards that are expected to be forfeited. Forfeitures

are estimated based on historical experience at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures

differ from those estimates. The assumptions used in calculating the fair value of share-based payment awards represent management's

best estimates, but these estimates involve inherent uncertainties and the application of management's judgment. As a result, if

factors change and the Company uses different assumptions, its stock-based compensation expense could be materially different in

the future.

Concentration of Credit Risk

The Company has no significant off-balance-sheet

concentrations of credit risk such as foreign exchange contracts, options contracts or other foreign hedging arrangements. The

Company maintains most of its cash balance at a financial institution located in California. Accounts at this institution are insured

by the Federal Deposit Insurance Corporation up to $250,000. Uninsured balances aggregated approximately $1,302,000 and $1,656,000

at October 31, 2016 and April 30, 2016, respectively. The Company has not experienced any losses in such accounts, and management

believes it is not exposed to any significant credit risk on cash.

Foreign Currency Translation

The Company translates the financial statements

of its foreign subsidiary from the local (functional) currencies to U.S. dollars in accordance with FASB ASC 830, Foreign Currency

Matters. All assets and liabilities of the Company’s foreign subsidiaries are translated at year-end exchange rates,

while revenue and expenses are translated at average exchange rates prevailing during the year. Adjustments for foreign currency

translation fluctuations are excluded from net loss and are included in other comprehensive income. Gains and losses on short-term

intercompany foreign currency transactions are recognized as incurred.

Recent Accounting Pronouncements

ASU No. 2015-07, Fair Value Measurement

(Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) ("ASU

2015-07"), was issued in May 2015. This ASU removes the requirement to categorize within the fair value hierarchy table investments

without readily determinable fair values in entities that elect to measure fair value using net asset value per share (“NAV”)

or its equivalent. ASU 2015-07 requires that these investments continue to be shown in the fair value disclosure in order

to allow the disclosure to reconcile to the investment amount presented in the balance sheet. The Company’s prospective

adoption of this ASU did not have a material impact on its consolidated financial statements.

ASU No. 2014-15, “Presentation of

Financial Statements – Going Concern”, Subtopic 205-40, “Disclosure of Uncertainties about an Entity’s

Ability to Continue as a Going Concern.” The amendments in this ASU apply to all entities and require management

to assess an entity’s ability to continue as a going concern by incorporating and expanding upon certain principles that

are currently in U.S. auditing standards. Specifically, the amendments: (i) provide a definition of the term “substantial

doubt”; (ii) require an evaluation every reporting period including interim periods; (iii) provide principles for considering

the mitigating effect of management’s plans; (iv) require certain disclosures when substantial doubt is alleviated as a result

of consideration of management’s plans; (v) require an express statement and other disclosures when substantial doubt

is not alleviated; and (vi) require an assessment for a period of one year after the date that the financial statements are issued

or available to be issued. The amendments in this update are effective for the annual period ending after December 15, 2016. For

annual periods and interim periods thereafter, early application is permitted. The Company is currently evaluating the impact this

guidance will have on its consolidated financial position and results of operations.

ASU No. 2016-09, Compensation—Stock

Compensation, includes several areas of simplification to stock compensation including simplifications to the accounting for

income taxes, classification of excess tax benefits on the Statement of Cash Flows and forfeitures. ASU 2016-09 is effective for

annual reporting periods beginning after December 15, 2016. An entity that elects early adoption must adopt all of the amendments

in the same period. We did not early adopt ASU 2016-09 as of and for the period ended October 31, 2016. The Company is still

evaluating the effect of this update.

In May 2014, the FASB issued Accounting

Standards Update (“ASU”) No. 2014-09 "Revenue from Contracts with Customers" (“Topic

606”). Topic 606 supersedes the revenue recognition requirements in Topic 605, “Revenue

Recognition”, including most industry-specific revenue recognition guidance throughout the Industry Topics of the

Codification. In addition, the amendments create a new Subtopic 340-40, “Other Assets and Deferred

Costs—Contracts with Customers”. In summary, the core principle of Topic 606 is that an entity recognizes

revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to

which the entity expects to be entitled in exchange for those goods or services. For a public entity, the amendments in this

Update are effective for annual reporting periods beginning after December 15, 2016, including interim periods within that

reporting period; early application is not permitted. The Company is currently evaluating the impact this guidance will have

on its consolidated financial position and consolidated statement of operations. In August 2015, the FASB issued ASU No.

2015-14, Revenue with Customers – Deferral of the Effective Date, as an amendment to ASU No. 2014-09, which

defers the effective date of ASU No. 2014-09 by one year.

ASU No. 2016-01, Recognition and Measurement

of Financial Assets and Financial Liabilities, eliminates the requirement to disclose the methods and significant assumptions

used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost on the balance

sheet. The standard also clarifies the need to evaluate a valuation allowance on a deferred tax asset related to available-for-sale

securities in combination with other deferred tax assets. ASU 2016-01 is effective for annual reporting periods beginning after

December 15, 2017. The adoption of this standard is not expected to have a material impact on the Company’s consolidated

financial statements.

ASU No. 2016-02, Leases, allows the

recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under previous US

GAAP. The classification criteria for distinguishing between finance leases and operating leases are substantially similar to the

classification criteria for distinguishing between capital leases and operating leases in the previous leases guidance. The Update

2016-02 is effective for annual reporting periods beginning after December 15, 2018 and early adoption is permitted. The Company

is still evaluating the effect of this update.

NOTE 4 – LICENSE AGREEMENT OBLIGATION

The Company entered into a licensing agreement

for a license to use the Cell-in-a-Box® technology to develop therapies involving Cannabis for a total amount

of $2,000,000 “Upfront Payment” for the license (see Note 8). As of October 31, 2016, the Company’s license agreement

obligation was paid in full. As of April 30, 2016, the Company’s license obligation was $150,000.

NOTE 5 – COMMON STOCK TRANSACTIONS

The Company issued 3,600,000 shares of common

stock to officers as part of their compensation agreements in the year ended April 30, 2015. These shares vest on a quarterly basis

over a twelve-month period. During the three and six months ended October 31, 2015, 900,000 and 1,800,000 shares vested and the

Company recorded a non-cash compensation expense of $80,010 and $190,530, respectively.

The Company issued 1,200,000 shares of common

stock to an employee as part of an employee agreement in the year ended April 30, 2015. These shares vest on a quarterly basis

over a twelve-month period. During the three and six months ended October 31, 2015, 300,000 and 600,000 shares vested and the Company

recorded a non-cash expense of $26,670 and $63,510, respectively.

The Company awarded 3,600,000 shares of common

stock to officers as part of their compensation agreements for 2016. These shares vest on a quarterly basis over a twelve-month

period and are subject to their continuing service under the agreements. During the three and six months ended October 31, 2016,

900,000 and 1,800,000 shares vested and the Company recorded a non-cash compensation expense in the amount of $53,910 and $107,820,

respectively.

The Company awarded 1,200,000 shares of common

stock to an employee as part of his compensation agreement for 2016. These shares vest on a quarterly basis over a twelve-month

period and are subject to the employee providing services under the agreement. During the three and six months ended October 31,

2016, 300,000 and 600,000 shares vested and the Company recorded a non-cash compensation expense in the amount of $17,970 and $35,940,

respectively.

During the six months ended October 31, 2016,

the Company issued 600,000 shares of common stock to a consultant. These shares vest on a quarterly basis over a twelve-month period

and are subject to the consultant providing services under the agreement. During the three and six months ended October 31, 2016,

150,000 and 300,000 shares vested and the Company recorded a non-cash expense in the amount of $8,550 and $17,100, respectively.

During the six months ended October 31, 2016,

the Company issued 500,000 shares of common stock to two consultants. The terms of the agreements are for twelve months each. The

shares vested upon issuance and the Company recorded a non-cash compensation expense in the amount of $21,400 for the three and

six months ended October 31, 2016.

All shares were issued without registration

under the Securities Act of 1933, as amended (“Securities Act”), in reliance upon the exemption afforded by Section

4(a)(2) of the Securities Act.

On October 28, 2014, the Company’s Registration

on Form S-3 was declared effective by the Commission for a public offering of up to $50 million on a “shelf offering”

basis. During the six months ended October 31, 2016 and 2015, the Company sold and issued approximately 66.8 and 14.7 million shares

of common stock, respectively, at prices ranging from $0.02 to $0.16 per share. Net of underwriting discounts, legal, accounting

and other offering expenses, the Company received proceeds of approximately $1.3 and $1.7 million from the sale of these shares

for the six months ended October 31, 2016 and 2015, respectively. The Company has filed a prospectus supplement for an “at-the-market”

offering with an investment bank as sales agent. As of October 31, 2016, the Company did not meet the eligibility requirements

in order for it to be able to conduct a primary offering of its common stock under Form S-3 or to file a new Registration Statement

on Form S-3. See Note 2 for additional information.

A summary of the Company’s non-vested

restricted stock activity and related weighted average grant date fair value information for the six months ended October 31, 2016

are as follows:

| | | |

Shares | | |

Weighted Average Grant Date Fair Value | |

| Non-vested, at April 30, 2016 | | |

| 3,600,000 | | |

$ | 0.06 | |

| Granted | | |

| 1,100,000 | | |

| 0.05 | |

| Vested | | |

| (3,200,000 | ) | |

| 0.06 | |

| Forfeited | | |

| – | | |

| – | |

| Non-vested, at October 31, 2016 | | |

| 1,500,000 | | |

$ | 0.06 | |

| | | | |

| | | |

| | |

NOTE 6 – STOCK OPTIONS AND WARRANTS

Stock Options

As of October 31, 2016, the Company had outstanding

stock options held by its directors, officers, an employee, (“employee options”) and a consultant, (“non-employee

options”) that were issued pursuant to compensation, director and consultant agreements.

During the six months ended October 31, 2016

and 2015, the Company granted 13,100,000 and zero non-employee options, respectively. The non-employee options granted during the

six months ended October 31, 2016 consist of 600,000 guaranteed options and 12,500,000 non-guaranteed performance based options.

There were no employee options granted during the six months ended October 31, 2016 and 2015, respectively.

The fair value of the non-employee options

was estimated using the Black-Scholes-Merton option-pricing model, based on the following weighted average assumptions:

| | |

Six Months Ended October 31, | |

| | |

2016 | | |

2015 | |

| Risk-free interest rate | |

| 1.31% | | |

| – | |

| Expected volatility | |

| 105% | | |

| – | |

| Expected lives (years) | |

| 5.0 | | |

| – | |

| Expected dividend yield | |

| 0.00% | | |

| – | |

The Company’s computation of expected

volatility is based on the historical daily volatility of its publicly traded stock. For stock option grants issued during three

and six months ended October 31, 2016 and 2015, the Company used a calculated volatility for each grant. For employee options,

the Company lacks adequate information about the exercise behavior at this time and has determined the expected term assumption

under the simplified method provided for under ASC 718, which averages the contractual term of the Company’s stock options

of five years with a typical vesting term of one year. For non-employee options, the Company used the contract term of five years

to estimate the expected term as guided under ASC 505. The dividend yield assumption of zero is based upon the fact the Company

has never paid cash dividends and presently has no intention of paying cash dividends. The risk-free interest rate used for each

grant is equal to the U.S. Treasury rates in effect at the time of the grant for instruments with a similar expected life.

Non-employee option grants that do not vest

immediately upon grant are recorded as an expense over the vesting period. At the end of each financial reporting period, the value

of these options, as calculated using the Black-Scholes-Merton option-pricing model, is determined, and compensation expense recognized

or recovered during the period is adjusted accordingly. During the three and six months ended October 31, 2016, the values to account

for the measurement on these vesting dates were approximately $0.04 and $0.04, respectively. As a result, the amount of the future

compensation expense is subject to adjustment until the common stock options are fully vested.

A summary of the Company’s stock option

activity and related information for the six months ended October 31, 2016 are shown below:

| | |

Options | | |

Weighted Average Exercise Price | | |

Weighted Average Grant Date Fair Value per Share | |

| Outstanding, April 30, 2016 | |

| 68,050,000 | | |

$ | 0.13 | | |

$ | 0.09 | |

| Issued | |

| 13,100,000 | | |

| 0.07 | | |

| 0.04 | |

| Exercised | |

| – | | |

| | | |

| | |

| Total Outstanding, October 31, 2016 | |

| 81,150,000 | | |

| 0.11 | | |

| 0.09 | |

| Total Exercisable, October 31, 2016 | |

| 65,750,000 | | |

| 0.13 | | |

| – | |

| Total Vested and expected to vest as of October 31, 2016 | |

| 68,650,000 | | |

$ | 0.13 | | |

| – | |

The Company recorded $164,363 and $142,962

of stock-based compensation expense related to the issuance of employee options in exchange for services during the three ended

October 31, 2016 and 2015, respectively, and $328,726 and $285,924 during the six months ended October 31, 2016 and 2015, respectively.

As of October 31, 2016 and 2015, there remained $109,576 and $238,266, respectively, of unrecognized compensation expense related

to unvested employee options granted, to be recognized as expense over a weighted-average period of approximately one year. The

non-vested employee options vest at 1,300,000 per month and are expected to be fully vested on December 31, 2016.

The Company recorded $5,760, $11,510, zero

and zero of stock-based compensation expense related to the issuance of non-employee options in exchange for services during the

three and six months ended October 31, 2016 and 2015, respectively. The non-vested non-employee guaranteed options vest at 50,000

per month and are expected to be fully vested on April 30, 2017.

The following table summarizes ranges of outstanding

stock options by exercise price at October 31, 2016:

| | |

Exercise Price | |

| Exercise Price | |

$ | 0.19 | | |

$ | 0.11 | | |

$ | 0.18 | | |

$ | 0.063 | | |

$ | 0.069 | |

| Number of Options Outstanding | |

| 25,000,000 | | |

| 27,200,000 | | |

| 250,000 | | |

| 15,600,000 | | |

| 13,100,000 | |

| Weighted Average Remaining Contractual Life (years) of Outstanding Options | |

| 2.92 | | |

| 3.17 | | |

| 3.47 | | |

| 4.17 | | |

| 4.50 | |

| Weighted Average Exercise Price | |

$ | 0.19 | | |

$ | 0.11 | | |

$ | 0.18 | | |

$ | 0.063 | | |

$ | 0.069 | |

| Number of Options Exercisable | |

| 25,000,000 | | |

| 27,200,000 | | |

| 250,000 | | |

| 13,000,000 | | |

| 300,000 | |

| Weighted Average Exercise Price of Exercisable Options | |

$ | 0.19 | | |

$ | 0.11 | | |

$ | 0.18 | | |

$ | 0.063 | | |

$ | 0.069 | |

The aggregate intrinsic value of outstanding

options as of October 31, 2016 was approximately $0. This represents options whose exercise price was less than the closing fair

market value of the Company’s common stock on October 31, 2016 of approximately $0.04 per share.

Warrants

The warrants issued by the Company are classified

as equity. The fair value of the warrants was recorded as additional-paid-in-capital, and no further adjustments are made.

For stock warrants paid in consideration of

services rendered by non-employees, the Company recognizes consulting expense in accordance with the requirements of ASC 505-50

and ASC 505, as amended.

A summary of the Company’s warrant activity

and related information for the three and six months ended October 31, 2016 are shown below:

| | | |

Warrants | | |

Weighted Average Exercise Price | |

| Outstanding, April 30, 2016 | | |

| 84,969,908 | | |

$ | 0.16 | |

| Issued | | |

| – | | |

| – | |

| Expired | | |

| – | | |

| – | |

| Total Outstanding, October 31, 2016 | | |

| 84,969,908 | | |

| 0.16 | |

| Total Exercisable, October 31, 2016 | | |

| 84,969,908 | | |

$ | 0.16 | |

| | | | |

| | | |

| | |

The following table summarizes additional

information concerning warrants outstanding and exercisable at October 31, 2016:

| Range of Exercise Prices |

|

Number of Warrant Shares Exercisable at 10/31/2016 |

|

|

Weighted Average Remaining Contractual Life |

|

|

Weighted Average Exercise Price |

|

| $0.075, $0.11, $0.12, $0.18 and $0.25 |

|

|

84,969,908 |

|

|

|

2.05 |

|

|

$ |

0.16 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Five Year Term - $0.075 |

|

|

1,056,000 |

|

|

|

0.94 |

|

|

|

|

|

| Five Year Term - $0.12 |

|

|

35,347,508 |

|

|

|

2.66 |

|

|

|

|

|

| Five Year Term - $0.18 |

|

|

19,811,200 |

|

|

|

1.16 |

|

|

|

|

|

| Five Year Term - $0.25 |

|

|

18,755,200 |

|

|

|

1.18 |

|

|

|

|

|

| Five Year Term - $0.11 |

|

|

10,000,000 |

|

|

|

3.39 |

|

|

|

|

|

| |

|

|

84,969,908 |

|

|

|

|

|

|

|

|

|

NOTE 7 – LEGAL PROCEEDINGS

The Company is not currently a party to any

pending legal proceedings, material or otherwise. There are no legal proceedings to which any property of the Company is subject.

However, in the past the Company has been the subject of litigation, claims and assessments arising out of matters occurring in

its normal business operations. In the opinion of management, none of these had a material adverse effect on the Company’s

unaudited condensed consolidated financial position, operations and cash flows presented in this Quarterly Report on Form 10-Q.

NOTE 8 – RELATED PARTY TRANSACTIONS

The Company had the following related party

transactions.

The Company owns 14.5% of the equity in SG

Austria and is reported on the cost method of accounting. SG Austria has two subsidiaries: (i) Austrianova; and (ii) Austrianova

Thailand Ltd. The Company purchased products from these subsidiaries in the approximate amounts of $95,073 and $155,255 in the

three months ended October 31, 2016 and 2015, respectively, and $144,843 and $202,942 in the six months ended October 31, 2016

and 2015, respectively.

In April 2014, the Company entered into a consulting

agreement with Vin-de-Bona Trading Company Pte. Ltd. (“Vin-de-Bona”) pursuant to which Vin-de-Bona agreed to provide

professional consulting services to the Company. Vin-de-Bona is owned by Prof. Walter H. Günzburg and Dr. Brian Salmons. The

term of the agreement is for 12 months, automatically renewable for successive 12 month terms. After the initial term, either party

can terminate the agreement by giving the other party 30 days’ written notice before the effective date of termination. The

amounts paid for the three months ended October 31, 2016 and 2015 are approximately $13,910 and $8,740, respectively, and the amounts

paid for the six months ended October 31, 2016 and 2015 are approximately $41,705 and $18,885, respectively.

Under the Cannabis Licensing Agreement, the

Company acquired from Austrianova an exclusive, world-wide license to use the Cell-in-a-Box® trademark and its associated

technology with genetically modified non-stem cell lines which are designed to activate cannabinoids to develop therapies involving

Cannabis.

Under the Cannabis Licensing Agreement, the

Company is required to pay Austrianova an Upfront Payment of $2,000,000. The Company has the right to make periodic monthly partial

payments of the Upfront Payment in amounts to be agreed upon between the parties prior to each such payment being made. Under

the Cannabis Licensing Agreement, as amended, the Upfront Payments must be paid in full by no later than June 30, 2016. As of

October 31, 2016 and 2015, the Company has paid Austrianova $2.0 million and $1.4 million of the Upfront Payment, respectively.

With the exception of Thomas Liquard, the Board

has determined that none of the Company’s directors satisfies the definition of Independent Director as established in the

NASDAQ Marketplace Rules. Mr. Liquard has been determined by the Board to be an Independent Director.

NOTE 9 – COMMITMENTS AND CONTINGENCIES

The Company acquires assets still in development

and enters into research and development arrangements with third parties that often require milestone and royalty payments to the

third party contingent upon the occurrence of certain future events linked to the success of the asset in development. Milestone

payments may be required, contingent upon the successful achievement of an important point in the development life-cycle of the

pharmaceutical product (e.g., approval of the product for marketing by a regulatory agency). If required by the license agreements,

the Company may have to make royalty payments based upon a percentage of the sales of the pharmaceutical products in the event

that regulatory approval for marketing is obtained.

Office Lease

The Company formerly leased office space at

12510 Prosperity Drive, Suite 310, Silver Spring, Maryland 20904. The term of the lease expired on July 31, 2016 and was extended

to August 31, 2016 at the same amount of monthly rent.

The Company entered into a new office lease

agreement effective on September 1, 2016. The term of the lease is twelve months. The leased premises are located at 23046 Avenida

de la Carlota, Suite 600, Laguna Hills, California 92653.

Rent expense for these offices for the three

and six months ended October 31, 2016 and 2015 were $9,577 and $17,114, respectively, and were $23,429 and $29,612 for the six

months ended October 31, 2016 and 2015, respectively.

The following table summarizes the Company’s

aggregate future minimum lease payments required under the operating lease as of October 31, 2016.

| Period ending, October 31, |

|

Amount |

|

| |

|

|

|

| 2017 |

|

$ |

18,430 |

|

| 2018 |

|

|

12,007 |

|

| |

|

$ |

30,437 |

|

License Agreements

The Third Addendum

The Third Addendum requires the Company to

make future royalty and milestone payments as follows:

| |

· |

Two percent royalty on all gross sales received by the Company or its affiliates; |

| |

· |

Ten percent royalty on gross revenues received by the Company or its affiliates from any sublicense or right to use the patents or the licenses granted by the Company or its affiliates; |

| |

· |

Milestone payments of $100,000 due 30 days after enrollment of the first human patient in the first clinical trial for each product; $300,000 due 30 days after enrollment of the first human patient in the first Phase 3 clinical trial for each product; and $800,000 due 60 days after having a marketing application approved by the applicable regulatory authority for each product; and |

| |

· |

Milestone payments of $50,000 due 30 days after enrollment of the first veterinary patient in the first trial for each product and $300,000 due 60 days after having a marketing application approved by the applicable regulatory authority for each veterinary product. |

In addition, the parties to the Third Addendum

entered into a Manufacturing Framework Agreement pursuant to which the Company is required to pay a fee for producing the final

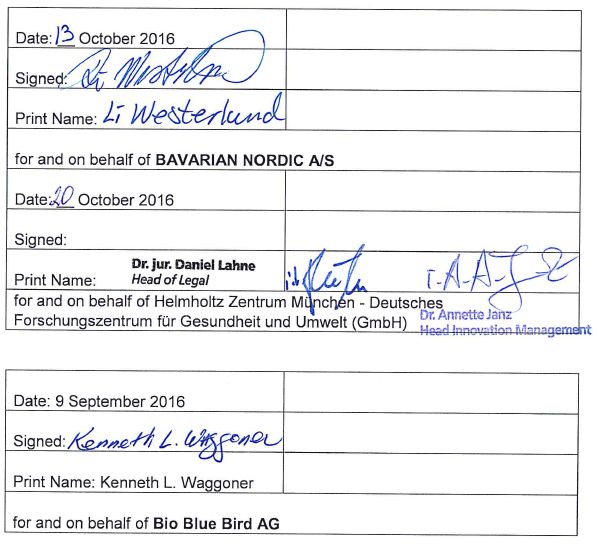

encapsulated cell product of $647 per vial of 300 capsules after production with a minimum purchased batch size of 400 vials of