Table of Contents

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

W. R. BERKLEY CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

Table of Contents

W. R. BERKLEY CORPORATION

475 Steamboat Road

Greenwich, Connecticut 06830

Tel: (203) 629-3000 • www.berkley.com

To our fellow shareholders:

Your vote is important to us, and on behalf of our Board of Directors, we encourage you to cast your ballot on the items discussed in the Proxy Statement using the attached proxy card or by voting via telephone or online.

While 2020 was a year like no other, it was another year of strong performance by our Company in many ways. Our focus on risk-adjusted return continued, but our efforts for much of the year centered on issues surrounding the COVID-19 pandemic and its economic impact. These events affected our employees, customers and communities alike. Our employees demonstrated incredible professional and personal resiliency and continued to support the communities where we live and work by volunteering their time and skills and contributing to worthy causes. Amidst it all, we responsibly grew our business while rewarding shareholders with 10.5% growth in book value per share before share repurchases and dividends. We are proud of not only what we achieved, but also how we accomplished it.

We were able to produce these results because W. R. Berkley Corporation is a company with a long-term perspective, a commitment to managing the insurance cycle and an acute awareness of the potential impact of unforeseen risks. This focus comes about because together, our Board of Directors and our employees are the Company’s largest shareholders and have been for many years.

We actively consider environmental, social and governance (ESG) matters, including the impact of climate change, the need for diversity and inclusion, and the importance of our employee’s professional growth through education and training. Understanding of and sensitivity to these issues makes our business and our communities better for all our stakeholders. We continue to invest heavily in developing the behaviors and processes that foster innovation at all levels of our organization to enhance our value to our clients and customers and to prepare our employees for the future.

As we look forward to the remainder of 2021 and beyond, we are optimistic about every aspect of our enterprise. Our Company is built to succeed in periods of uncertainty through a constant evaluation of risk and reward in all aspects of our business, and to excel in all phases of market activity. We are well positioned for the current improving economic times.

Direct communication with our independent shareholders remains extremely strong and we look forward to continuing this important dialogue with you, our fellow owners. The resiliency, courage and commitment of our people continue to inspire us, and we thank them for their constant efforts. Their dedication to our values will allow us the opportunity to continue delivering superior risk-adjusted returns and growth in shareholder value in a manner that we can all be proud of for years to come.

Sincerely,

|

| |

| William R. Berkley | W. Robert Berkley, Jr. | |

| Executive Chairman | President and Chief Executive Officer | |

“Always do right. This will gratify some people and astonish the rest.”

— Mark Twain

Table of Contents

W. R. BERKLEY CORPORATION

475 Steamboat Road

Greenwich, Connecticut 06830

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 15, 2021

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of W. R. Berkley Corporation (the “Company”) will be held online through an audio-only webcast at www.virtualshareholdermeeting.com/WRB2021 on Tuesday, June 15, 2021 at 1:30 p.m. for the following purposes:

| (1) | To elect as directors to serve until their successors are duly elected and qualified the five nominees named in the accompanying proxy statement; |

| (2) | To approve an increase in the number of shares reserved under the W. R. Berkley Corporation 2009 Directors Stock Plan (as amended and restated, the “Directors Stock Plan”); |

| (3) | To consider and cast a non-binding advisory vote on a resolution approving the compensation of the Company’s named executive officers pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission, or “say-on-pay” vote; |

| (4) | To ratify the appointment of KPMG LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2021; and |

| (5) | To consider and act upon any other matters which may properly come before the Annual Meeting or any adjournment thereof. |

In accordance with the Company’s By-Laws, the Company’s Board of Directors has fixed the close of business on April 19, 2021 as the date for determining stockholders of record entitled to receive notice of, and to vote at, the Annual Meeting.

Due to COVID-19-related public health restrictions and for the safety and well-being of our stockholders, the Annual Meeting will be conducted online through an audio-only webcast at www.virtualshareholdermeeting.com/WRB2021. The accompanying Proxy Statement contains information about participating in the Annual Meeting. There will be no physical location for the Annual Meeting. As always, we encourage you to vote your shares prior to the Annual Meeting.

By Order of the Board of Directors,

PHILIP S. WELT

Executive Vice President – General Counsel and Secretary

Dated: April 27, 2021

Table of Contents

Table of Contents

|

|

|

65

|

| |

|

|

||||

|

Discussion of Risk and Compensation Plans

|

|

66

|

| |

|

|

||||

|

|

|

67

|

| |

|

|

||||

|

|

|

68

|

| |

|

|

||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 72 | ||||

| 72 | ||||

| 73 | ||||

| 76 | ||||

| 77 | ||||

| 78 | ||||

|

|

|

79

|

| |

|

|

||||

|

|

|

80

|

| |

|

|

||||

| 80 | ||||

|

Principal Stockholders and Ownership by Directors and Executive Officers

|

|

81

|

| |

|

|

||||

|

Other Matters to Come Before the Meeting

|

|

84

|

| |

|

|

||||

|

|

|

85

|

| |

|

|

||||

|

Outstanding Stock and Voting Rights

|

|

92

|

| |

|

|

||||

|

Stockholder Nominations for Board Membership and Other Proposals

|

|

93

|

| |

|

|

||||

|

Annex A: Forward-Looking Statements

|

|

A-1

|

| |

|

|

|

B-1

|

| |

|

|

||||

Table of Contents

|

|

W. R. BERKLEY CORPORATION PROXY STATEMENT

|

|||||||

|

ANNUAL MEETING OF STOCKHOLDERS June 15, 2021 |

||||||||

Your proxy is being solicited on behalf of the Board of Directors of W. R. Berkley Corporation (the “Company”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) and at any adjournment thereof. On April 27, 2021, we began mailing to stockholders of record either a Notice of Internet Availability of Proxy Materials (“Notice”) or this proxy statement and proxy card and the Company’s Annual Report for the year ended December 31, 2020.

2021 Annual Meeting of Stockholders

|

| Date and Time: |

Tuesday, June 15, 2021 at 1:30 p.m. |

| Location: |

Online through an audio-only webcast at www.virtualshareholdermeeting.com/WRB2021 |

| Record Date: |

April 19, 2021 |

|

Proposal

|

Discussion Beginning on Page

|

Vote Required to Adopt Proposal

|

Board Recommendation

|

Broker Discretionary Voting Allowed

|

Effect of Abstentions

|

Effect of Broker Non-Votes

| ||||||

|

1. Election of five directors

|

10 |

Majority of the votes cast at the Annual Meeting (i.e., more shares voted “FOR” election than “AGAINST” election)

|

FOR

|

No

|

No effect

|

No effect

| ||||||

|

2. Increase in shares reserved under Directors Stock Plan |

17 |

The vote of the holders of a majority of the stock having voting power present in person or represented by proxy at the Annual Meeting

|

FOR |

No |

Same effect as a vote against |

No effect | ||||||

|

3. Non-binding advisory vote to approve the 2020 compensation of our named executive officers |

20 |

The vote of the holders of a majority of the stock having voting power present in person or represented by proxy at the Annual Meeting

|

FOR |

No |

Same effect as a vote against |

No effect | ||||||

|

4. Ratification of appointment of independent registered public accounting firm for 2021 |

22 |

The vote of the holders of a majority of the stock having voting power present in person or represented by proxy at the Annual Meeting

|

FOR |

Yes |

Same effect as a vote against |

Not applicable | ||||||

In order for business to be conducted, a quorum of a majority of our common stock outstanding and entitled to vote must be present either in person or by proxy at the Annual Meeting. Abstentions and broker non-votes are included in determining whether a quorum is present. The effects of abstentions and broker non-votes on the matters to be voted on are described in the table above.

| 2021 Proxy Statement | 1 |

Table of Contents

ALIGNMENT WITH STOCKHOLDER INTERESTS

|

LONG-TERM VALUE CREATION

|

|

Performance

|

Governance

|

Alignment

| ||||||

|

MANAGEMENT AND THE BOARD OF DIRECTORS ARE FOCUSED ON LONG-TERM VALUE CREATION |

CORPORATE GOVERNANCE IS ALIGNED WITH LONG-TERM PERSPECTIVE |

COMPENSATION PROGRAMS ARE DESIGNED TO ALIGN INTERESTS WITH STOCKHOLDERS | ||||||

|

✓Superior risk-adjusted underwriting results Pages 3, 6, 58

✓Above average risk-adjusted investment returns Pages 3, 7, 9, 58

✓Prudent capital management Pages 3, 58

✓Disciplined cycle management is key to long-term success Pages 3, 5

✓Grow when pricing is strong and reduce volume when prices are inadequate Pages 3, 5

✓Effectively manage volatility, including from catastrophic events Pages 6, 7, 58

✓Pursue strategies to build value for the future Pages 7-8

✓Our long term return on equity (“ROE”) and total value creation have consistently outperformed the industry and our peers Pages 7, 9, 54, 58

✓Our total value creation over the last 20 years has been achieved with significantly less volatility than peers Page 7

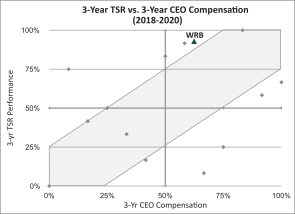

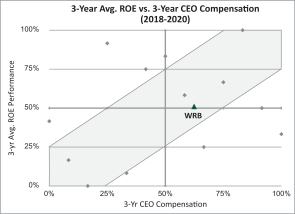

✓Our three-year average Total Shareholder Return ranks in the 94th percentile of our peers Page 54

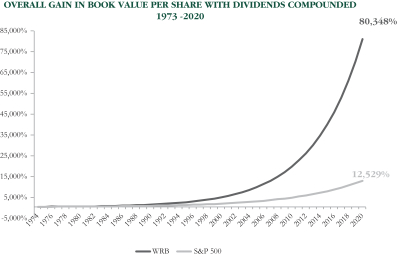

✓Average annual gain in book value per share (with dividends included) since 1974 of 16.7% has outpaced the S&P 500® Index by 4.0 points Page 9 |

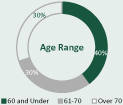

✓80% independent directors Pages 10, 25

✓Board members bring diverse backgrounds, skills, experience and perspectives Pages 12-16, 29-30

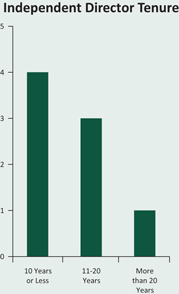

✓Diversified tenure of directors balances Board refreshment with benefit of overseeing the full insurance cycle

✓38% of independent Board members refreshed in the last 4 years Page 33

✓Separate Executive Chairman and Chief Executive Officer Pages 24, 31

✓Independent lead who presides at executive sessions of the Board rotates among the Chair of the Audit Committee, the Chair of the Compensation Committee and any non-management members of the Executive Committee Pages 31-32

✓Significant required stock ownership by NEOs and directors. Shares held

until separation from service. Prohibition on pledging shares used to satisfy ownership requirements.

✓Directors and executive officers as a group own 22.4% of the Company’s stock as of April 19, 2021 Page 82

✓Board oversight of Enterprise Risk Management with ERM management committee that regularly reports to the Board Page 34

✓Boardoversight of Environmental, Social and Governance with ESG management committee that regularly reports to the Board Pages 36-37

✓Board oversight of human capital management and corporate culture Pages 38-39 |

✓CEO and other NEOs compensation are 91% and 83%, respectively, performance based and at-risk

✓66% of CEO and 58% of NEO compensation are long-term and subject to clawback Page 42

✓NEOs do not receive any shares from vested Restricted Stock Unit awards until separation from service

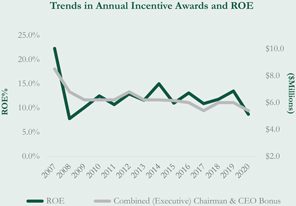

✓Annualcash incentive awards are performance-based and non-formulaic to discourage short-term oriented behavior that can hurt long-term performance in our industry Pages 43, 45, 47

✓Determination of the NEOs’ annual cash incentive awards is based on financial performance for the current year, financial performance compared to peers, and contributions to long-term value creation Pages 47, 49, 57

✓100% of long-term compensation, and 70% of CEO’s incentive compensation, is formulaic Page 42

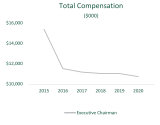

✓Executive Chairman’s compensation reflects his active role in strategy and investments and his instrumental role in the strategy and investment opportunities that have generated significant realized gains Page 56

✓CEO compensation is well-aligned with performance, as the Company’s performance ranks in the top quartile of our peers Page 54

✓Compensation peer group comprised of relevant industry peers Page 53 | ||||||

|

FUNDAMENTAL UNDERSTANDING THAT PROPERTY CASUALTY INSURANCE IS A LONG-TERM AND CYCLICAL BUSINESS

|

| 2 | W. R. Berkley Corporation |

Table of Contents

|

8.7% |

$2.81 | $35.49 | ||

|

Return on Stockholders’ Equity averaged 11.4% over the past 5 years. |

Net Income Per Diluted Share |

Book Value Per Share grew 67.5% over the past 5 years before dividends and share repurchases. |

Our Company demonstrated remarkable resiliency in 2020, with good financial performance despite many challenges. Improvement in our accident-year combined ratio, excluding catastrophes, and strong alternative investment performance, including realized capital gains, contributed to an 8.7% return on equity. These results included $340 million of catastrophe losses, including losses related to the COVID-19 pandemic, and the impact of unprecedentedly low interest rates and difficult economic conditions. Book value per share grew 10.5% before dividends and share repurchases.

|

94.9% |

$8.1B | $7.3B | ||

|

Combined Ratio |

Total Revenues |

Net Premiums Written |

Net premiums written grew by nearly 6% in 2020 despite a contracting economy as a result of the COVID-19 pandemic. Growth was fueled by accelerating rate increases in all lines of business, except workers’ compensation. Our underwriting continued to outperform with a combined ratio that was 4.4 points better than the property casualty insurance industry’s 99.3%.

Appropriately managing the insurance pricing cycle has been critical to our long-term success. We maintain underwriting discipline during the softer parts of the cycle by targeting areas of the market that we believe have greater return potential, while de-emphasizing less attractive sectors. Our results also benefited from our continued focus on terms and conditions, attachment points and limits, and our risk selection, as well as expense management. Our strategy positions us well for expansion in improving rate environments, such as we are currently experiencing.

Our financial performance allowed us to reward our stockholders by returning approximately 81% of net income through ordinary dividends and share repurchases, while still growing reported book value per share by 7.2%.

| 2021 Proxy Statement | 3 |

Table of Contents

Berkley is committed to promoting environmental, social and governance initiatives throughout its organization. In 2020 Berkley continued to advance these initiatives as an extension of its core guiding principle that “Everything Counts, Everyone Matters®”.

COVID-19 Response

In response to the unprecedented challenges raised by the COVID-19 pandemic, Berkley endeavored to meet the needs of its various stakeholders, including its employees, customers and communities.

Our Employees:

We implemented our business continuity plans at our 50+ operating units around the world and seamlessly transitioned to working from home. As importantly, we took steps to support the physical and mental well-being of our employees through innovative outreach programs.

Our Customers:

Berkley operating units embraced their roles as experts in risk management and mitigation to provide valuable advice for customers in navigating the unprecedented challenges presented by the COVID-19 pandemic.

Our Communities:

We sponsored corporate matching programs focused on food insecurity, children’s assistance and general COVID-19 relief efforts and we supported our employees who volunteered their time and skills to assist those most affected by the COVID-19 pandemic.

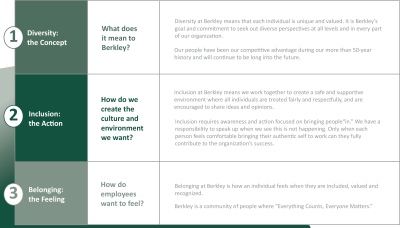

Advancing Diversity and Inclusion

|

We value diversity, inclusion and belonging (DIB) in our workforce and believe that it helps foster innovation and creativity by bringing together different perspectives and opinions. In 2020, to strengthen our DIB efforts and build upon the extensive work being done at our operating units in this area, we established a corporate Diversity, Inclusion and Belonging Committee. |

Managing Climate Risk

Managing risks, including those posed by climate change, is important to Berkley’s ability to thrive now and for future generations. The uncertainties posed by climate change provide opportunities for Berkley to support its customers in navigating climate change-influenced weather events. In 2020 we continued to refine our focus on three main areas of climate risk: physical and operational risk, underwriting risk and investment risk. We also updated our analysis and review of the key potential effects of climate change on our business. In addition, we offered loss control services and underwriting incentives to clients to address their needs in connection with weather-related events and climate change.

For more information, see our Sustainability Report on the Investor Relations page of our corporate website.

| 4 | W. R. Berkley Corporation |

Table of Contents

|

INDUSTRY BACKGROUND AND CORPORATE STRATEGY

|

Our Business Must Be Managed with a Long-Term Perspective

|

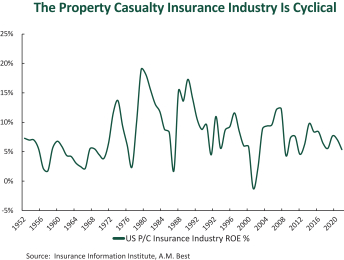

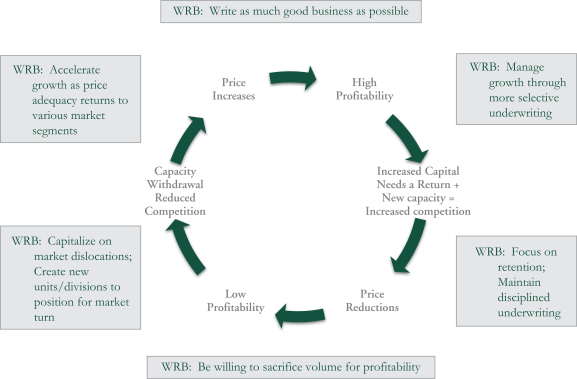

| The property casualty insurance business has historically been cyclical. It can take an extended time for insured losses to be reported, ultimate costs to be determined and final payments to be made, especially for liability claims. The uncertainty of insurers’ ultimate loss costs and fluctuating competitive conditions result in alternating periods of “hard” markets (more profitable for insurers) and “soft” markets (less profitable for insurers). Various lines of property casualty insurance generally improve (or deteriorate) concurrently, but not necessarily at the same pace, and can at times move in different directions. |

|

Because this cyclicality can cause variability in results over time, an insurer’s results should be considered over the entire length of the cycle.

We manage our business to outperform over the full insurance cycle. Managing a property casualty insurance company for the long term requires discipline throughout the cycle, especially in soft markets. Companies that are too aggressive in soft markets can suffer large losses later, while increasing volume in hard markets can lead to profitable growth.

The Classic Insurance Cycle

We will forgo top-line growth when prudent and pursue top-line growth when advantageous to maximize long-term profitability.

| 2021 Proxy Statement | 5 |

Table of Contents

|

INDUSTRY BACKGROUND AND CORPORATE STRATEGY

|

| Losses from large events cause significant volatility in industry results. We seek to maximize returns on a risk-adjusted basis. As a result, our historical catastrophe losses from major industry events have been significantly lower than industry averages. |

|

We manage our business with an appropriate consideration of volatility in analyzing risk.

The lack of volatility in our results has contributed to superior long-term performance.

|

|

|

The graph above on the left shows that our accident year loss ratios have outperformed the property casualty insurance industry for over 10 years. Accident year loss ratios are a key measure of profitability, representing accident year losses as a percent of earned premium. (A lower loss ratio is better.) The graph above on the right shows the impact of catastrophe losses on those loss ratios, and the dramatically less volatility for our Company.

Our outperformance is a result of our disciplined underwriting and risk management.

The cornerstone to long-term success is understanding risk-adjusted return. All returns are not created equal, and we focus on the risks we are taking to achieve our returns and create stockholder value.

| 6 | W. R. Berkley Corporation |

Table of Contents

|

INDUSTRY BACKGROUND AND CORPORATE STRATEGY

|

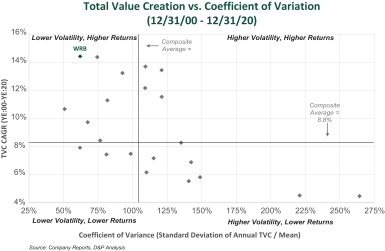

| We seek to maximize returns on a risk-adjusted basis over the long term by limiting volatility in all aspects of our business. Catastrophes are only one source of volatility for property casualty insurance companies. Rising loss costs, social inflation, and changes in the judicial or political climate also can drive volatility. We attempt to address these risks through pricing, terms and conditions, and risk selection and by focusing on products with lower individual policy limits, primarily issuing policies with defined aggregate limits, and attempting to avoid unfavorable or unpredictable political or legal environments. |

| |

| Based on a composite of 27 property and casualty insurers. Excludes companies with coefficients of variation that exceed 275%. Source: Dowling & Partners. |

Over the long term, we have created more value for stockholders with less volatility than most of our peers.

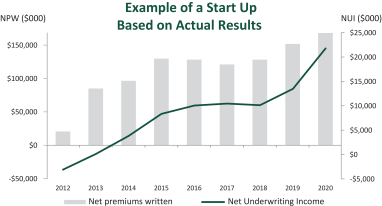

| Strategies that we pursue to create long-term value may result in short-term expenses, but they ultimately benefit long-term ROE and build value for the future. An example is our strategy of starting businesses rather than acquiring them. Costs are expensed as they occur, avoiding the creation of intangible assets. This allows us to build the business in a more controlled way, and develop a culture at each operating unit that is consistent with our values. |

|

We make long-term decisions to enhance long-term ROE and build stockholder value.

| 2021 Proxy Statement | 7 |

Table of Contents

|

INDUSTRY BACKGROUND AND CORPORATE STRATEGY

|

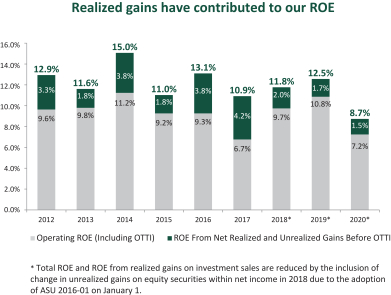

| Investing for capital gains enhances our ROE. Our total-return investment strategy is designed to support our long-term return. In response to the extended low interest rate environment, we have increased our investments in private equity, real estate and other asset classes. These changes have caused us to give up some current investment income, but the gains have ultimately benefited our ROE when viewed over longer periods. |

|

We remain focused on total risk-adjusted return for stockholders.

We continue to have the potential to realize a significant amount of unrealized gains that are not reflected on our balance sheet. For certain of our investments, accounting rules depart from the underlying economics and require us to carry the investments at a value other than fair value. The appreciation in the value of certain of these investments is therefore not fully reflected in our book value until they are sold, and we have the ability to hold these assets during times of market stress.

Net realized gains on investment sales have contributed an average of nearly 3% per year to our ROE over the past 9 years.

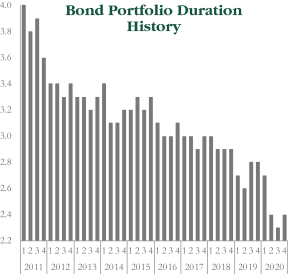

| We maintain a strategic posture with respect to inflation. Because of the extended low interest rate environment and relatively flat yield curve, we shortened the duration of our bond portfolio over the past several years to less than 3 years, while maintaining its high quality with an average rating of AA-. As a result, there has been less volatility in our book value from mark-to-market accounting and we are better able to manage the uncertain interest rate environment. |

|

As investment income is an important component of our economic model, we will continue to position our portfolio to take advantage of opportunities to manage the yield curve as well as the impact of potential inflation.

| 8 | W. R. Berkley Corporation |

Table of Contents

|

INDUSTRY BACKGROUND AND CORPORATE STRATEGY

|

Our Long-Term Perspective Has Driven Superior Stockholder Value Creation

|

| Since our initial public offering, our growth in book value per share with dividends compounded has far outpaced the S&P 500® Index. Our long-term approach to our business and careful risk management have resulted in strong profitability, below average volatility and superior long-term value creation for our stockholders. |

| |

| Note: W. R. Berkley Corporation’s book value per share has been adjusted for stock dividends paid from 1975 to 1983. Stock dividends were 6% in each year from 1975 to 1978, 14% in 1979, and 7% in each year from 1980 to 1983. The Company has paid cash dividends each year since 1976. |

| We have delivered superior returns to stockholders over the past 20 years. The Company’s total stockholder return (“TSR”) over the past 20 years has exceeded by a wide margin the TSR of the S&P 500® Index and the S&P 500® Property & Casualty Insurance Index, as illustrated in the graph to the right. |

| |

| The S&P 500® Property and Casualty Insurance Index consists of Allstate Corporation, Chubb, Ltd., Cincinnati Financial Corporation, Loews Corporation, Progressive Corporation, The Travelers Companies, Inc., and W. R. Berkley Corporation (added Dec. 2019). |

| There is a positive correlation between long-term value creation and long-term total stockholder return, as shown by the accompanying graph. The correlation generally improves over long periods of time. We have been a top performer compared to our compensation peer group over the past 20 years. |

|

| 2021 Proxy Statement | 9 |

Table of Contents

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

Proposal 1: Election of Directors

Our Directors and Director Nominees

|

You are being asked to vote for the election of five directors. Five other directors are continuing in office. Detailed information about each director’s background, skills and areas of expertise can be found beginning on page 12.

| Name

|

Age

|

Director

|

Occupation and Experience

|

Term

|

Independent

|

Committee Memberships

|

Other Public

| |||||||||||||||||||

| AC

|

BEC

|

CC

|

NCGC

|

EC

| ||||||||||||||||||||||

| Director Nominees Standing for Election | ||||||||||||||||||||||||||

| William R. Berkley |

75 | 1967 | Executive Chairman of the Board of the Company |

2024 | No |

|

|

|

|

C | None | |||||||||||||||

| Christopher L. Augostini |

56 | 2012 | Executive Vice President—Business of Emory University |

2024 | Yes | ✓ |

|

|

✓ |

|

None | |||||||||||||||

| Mark E. Brockbank |

69 | 2001 | Former Chief Executive Officer of XL Brockbank Ltd. |

2023 | Yes |

|

|

✓ | ✓ |

|

None | |||||||||||||||

| Mark L. Shapiro |

77 | 1974 | Former Senior Consultant to the Export-Import Bank of the United States; former Managing Director of Schroder & Co. Inc. |

2022 | Yes | C/F | ✓ |

|

✓ | ✓ | None (Boardwalk | |||||||||||||||

| Jonathan Talisman |

61 | 2019 | Founder and managing partner of Capitol Tax Partners |

2024 | Yes | ✓ |

|

|

✓ |

|

None | |||||||||||||||

| Directors Continuing in Office | ||||||||||||||||||||||||||

| W. Robert Berkley, Jr. |

48 | 2001 | President and Chief Executive Officer of the Company |

2022 | No |

|

|

|

|

✓ | None | |||||||||||||||

| Ronald E. Blaylock |

61 | 2001 | Founder and Managing Partner of GenNx360 Capital Partners; founder and former Chairman and Chief Executive Officer of Blaylock & Company, Inc. |

2022 | Yes |

|

✓ | ✓ | ✓ |

|

3 (Pfizer

Inc., | |||||||||||||||

| Mary C. Farrell |

71 | 2006 | President of the Howard Gilman Foundation; former Managing Director at UBS |

2022 | Yes |

|

✓ | C | ✓ | ✓ | None | |||||||||||||||

| Leigh Ann Pusey |

58 | 2018 | Senior Vice President, Corporate Affairs and Communications Eli Lilly and Company |

2022 | Yes |

|

|

✓ | ✓ |

|

None | |||||||||||||||

| María Luisa Ferré |

57 | 2017 | President and Chief Executive Officer of FRG, LLC |

2023 | Yes | ✓ |

|

|

✓ |

|

1 (Popular, | |||||||||||||||

| 10 | W. R. Berkley Corporation |

Table of Contents

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

The Board of Directors, which currently has ten directors, is divided into three classes, each class generally having a term of three years. Each year the term of office of one class expires. This year the term of a class consisting of five directors expires.

The Board of Directors intends that the shares represented by proxy, unless otherwise indicated therein, will be voted for the election of William R. Berkley, Christopher L. Augostini, and Jonathan Talisman as directors to hold office for a term of three years until the Annual Meeting in 2024 and until their respective successors are duly elected and qualified, Mark E. Brockbank as a director to hold office for a term of two years until the Annual Meeting in 2023 and until his successor is duly elected and qualified, and Mark L. Shapiro as a director to hold office for a term of one year until the Annual Meeting in 2022 and until his successor is duly elected and qualified. There are no arrangements or understandings between the nominees for director and any other person pursuant to which the nominees were selected.

The persons designated as proxies reserve full discretion to cast votes for other persons in the event any such nominee is unable to serve. However, the Board of Directors has no reason to believe that any nominee will be unable to serve if elected. The proxies cannot be voted for a greater number of persons than five nominees.

Following the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors unanimously recommends a vote “FOR” all of the nominees for director.

The following table sets forth biographical and other information regarding each nominee and the remaining directors who will continue in office after the Annual Meeting.

| 2021 Proxy Statement | 11 |

Table of Contents

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

Director Nominees Standing for Election

|

William R. Berkley

|

Christopher L. Augostini

|

|||||||||||

|

|

Director Since: 1967 Age: 75 Occupation: Executive Chairman of the Board Expiring Term: 2024 Independent: No Committees: Executive Other Public Company Directorships: None |

|

Director Since: 2012 Age: 56 Occupation: Executive Vice President — Business of Emory University Expiring Term: 2024 Independent: Yes Committees: Audit, Nominating and Corporate Governance Other Public Company Directorships: None |

|||||||||

|

Key Experience: Chairman of the Board since the Company’s formation in 1967 and Executive Chairman since October 2015. He served as Chief Executive Officer from 1967 to October 2015, President and Chief Operating Officer from March 2000 to November 2009 and held such positions at various times from 1967 to 1995. He serves on the Boards or is a Trustee of various charitable and educational organizations, including the W. R. Berkley Corporation Charitable Foundation, and Achievement First, and he is a Trustee Emeritus of the National Parks Conservation Association. He is Chair of the New York University Board of Trustees and has served in various capacities at New York University for almost three decades, including Chairman of the Board of Overseers of the Stern School of Business, and member of the Board of Trustees of the New York University Langone Medical Center, as well as Vice Chairman of the Board of Trustees at New York University. In addition, he has served as Vice Chairman of the Board of Directors of Georgetown University, where he helped create the Berkley Center for Religion, Peace, and World Affairs. He is the father of Mr. Rob Berkley.

Key Qualifications, Attributes or Skills: The founder of the Company, Mr. Wm. Berkley is widely regarded as one of the most distinguished leaders of the insurance industry. He provides the Company with strategic leadership, bringing to the Company’s Board of Directors deep and comprehensive knowledge of, and experience with, the Company and all facets of the insurance and reinsurance businesses. He has significant investment related experience, including oversight and management, since prior to his founding of the Company. His service as Executive Chairman of the Company creates a vital link between management and the Company’s Board of Directors, enabling the Company’s Board of Directors to perform its oversight function with the benefit of management’s insight on the business. In addition, his service on the Board of Directors provides the Company with effective, ethical and responsible leadership.

|

Key Experience: Mr. Augostini has served as Executive Vice President — Business of Emory University since July 2017. Previously, Mr. Augostini was Senior Vice President and Chief Operating Officer of Georgetown University, where previously he served in various positions, including as Chief Financial Officer, from 2000 to 2017; a member of New York City Mayor Rudolph Giuliani’s administration in various capacities, including chief of staff to the deputy mayor for operations, director of intergovernmental affairs, and deputy budget director from 1995 to 2000; an analyst for the New York State General Assembly’s Higher Education Committee and its Ways and Means Committee in the late 1980s and early 1990s. He began his career conducting workforce and economic development research at the Nelson A. Rockefeller Institute of Government, the public policy arm of the State University of New York higher education system. In addition, Mr. Augostini is a member of the Joint Advisory Board of the Georgetown University/Qatar Foundation. He also serves as a member of the Board of Directors of Emory Health Care (EHC), Emory Innovations Inc., Clifton Casualty Insurance Company LTD, the Georgia Chamber of Commerce, Atlanta Midtown Alliance and EMTECH, Inc.

Key Qualifications, Attributes or Skills: Mr. Augostini’s extensive experience at senior levels of both a major university and in government enables him to provide valuable business, leadership and management insights to the Company’s Board of Directors. Mr. Augostini possesses operational, financial, management and investment expertise.

|

|||||||||||

| 12 | W. R. Berkley Corporation |

Table of Contents

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

|

Mark E. Brockbank

|

Mark L. Shapiro

|

|||||||||||

|

|

Director Since: 2001 Age: 69 Occupation: Former Chief Executive Officer of XL Brockbank Ltd. Expiring Term: 2023 Independent: Yes Committees: Compensation, Nominating and Corporate Governance Other Public Company Directorships: None |

|

Director Since: 1974 Age: 77 Occupation: Former Senior Consultant to the Export-Import Bank of the United States; former Managing Director at Schroder & Co. Inc. Expiring Term: 2022 Independent: Yes Committees: Audit (Chair), Business Ethics, Nominating and Corporate Governance, Executive Other Public Company Directorships: None |

|||||||||

|

Key Experience: Mr. Brockbank retired from active employment in November 2000. He served from 1995 to 2000 as Chief Executive of XL Brockbank Ltd., an underwriting management agency at Lloyd’s of London. He was a founder of the predecessor firm of XL Brockbank Ltd. and was a director of XL Brockbank Ltd. from 1983 to 2000. He serves as a director of the International Emerging Film Talent Association, Monaco (IEFTA).

Key Qualifications, Attributes or Skills: Mr. Brockbank’s service as Chief Executive of XL Brockbank Ltd. provides him with valuable entrepreneurial business, leadership and management experience, and particular knowledge of the insurance industry. He also brings significant business acumen to the Company’s Board of Directors, including a strong understanding of insurance and reinsurance risk evaluation, executive compensation and related areas. |

Key Experience: Since September 1998, Mr. Shapiro has been a private investor. From July 1997 through August 1998, Mr. Shapiro was a Senior Consultant to the Export-Import Bank of the United States. Prior thereto, he was a Managing Director in the investment banking firm of Schroder & Co. Inc. He is a trustee of The Greenacre Foundation. Mr. Shapiro was a director of Boardwalk Pipeline Partners, LP until 2018.

Key Qualifications, Attributes or Skills: Mr. Shapiro’s career in investment banking and finance provides valuable broad-based business experience and insights on the Company’s business. In addition, he brings considerable financial expertise to the Board of Directors, providing an understanding of accounting, financial statements and corporate finance. Mr. Shapiro has a professional working knowledge of the Company and its operations since the Company’s initial public offering in 1973, and his extensive service on the Company’s Board of Directors affords him a depth of understanding of the Company’s business, operations and culture.

|

|||||||||||

|

Jonathan Talisman

|

||||||||||||

|

|

Director Since: 2019 Age: 61 Occupation: Founder and managing partner of Capitol Tax Partners Expiring Term: 2024 Independent: Yes Committees: Audit, Nominating and Corporate Governance Other Public Company Directorships: None |

|||||||||||

|

Key Experience: Mr. Talisman is a founder and managing partner of Capitol Tax Partners. Before forming Capitol Tax Partners in 2001, Mr. Talisman served as the Assistant Secretary for Tax Policy at the U.S. Treasury Department during the Clinton Administration. Previously, he had served at the Treasury Department as the Deputy Assistant Secretary for Tax Policy and the Tax Legislative Counsel, as the Chief Democratic Tax Counsel of the Senate Finance Committee and as Legislation Counsel to the Joint Committee on Taxation. Currently, Mr. Talisman serves on the Board of Advisors to the Tax Policy Center and was chair of the Formation of Tax Policy Committee, American Bar Association Tax Section. He also currently serves as an adjunct tax professor at Georgetown University Law Center. He was president of the board of directors at Adventure Theatre Musical Theatre Center for several years.

Key Qualifications, Attributes or Skills: Mr. Talisman’s founding and management of a noted government relations and tax policy firm, coupled with his extensive experience at senior levels of government, have provided him with a solid understanding of accounting, financial statements and tax matters that allow him to offer valuable business, leadership and management insights and expertise to the Company’s Board of Directors. |

||||||||||||

| 2021 Proxy Statement | 13 |

Table of Contents

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

Directors Continuing in Office

|

W. Robert Berkley, Jr.

|

Ronald E. Blaylock

|

|||||||||||

|

|

Director Since: 2001 Age: 48 Occupation: President and Chief Executive Officer Expiring Term: 2022 Independent: No Committees: Executive Other Public Company Directorships: None |

|

Director Since: 2001 Age: 61 Occupation: Founder and Managing Partner of GenNx360 Capital Partners Expiring Term: 2022 Independent: Yes Committees: Business Ethics, Compensation, Nominating and Corporate Governance Other Public Company Directorships: Pfizer Inc., CarMax, Inc., and Advantage Solutions Inc. |

|||||||||

|

Key Experience: President and Chief Executive Officer of the Company since October 2015 and Vice Chairman and President of Berkley International, LLC since May 2002 and April 2008, respectively. President and Chief Operating Officer of the Company from November 2009 to October 2015, Executive Vice President from August 2005 to November 2009, Senior Vice President — Specialty Operations from January 2003 to August 2005, and a variety of positions of increasing responsibility since September 1997. From July 1995 to August 1997, Mr. Rob Berkley was employed in the Corporate Finance Department of Merrill Lynch Investment Company. He serves on the Boards or is a Trustee of various charitable and educational organizations, including the W. R. Berkley Corporation Charitable Foundation. He serves on the Georgetown University Board of Trustees and the Board of Advisors of the McDonough School of Business at Georgetown. He also serves on the boards of Brunswick School and St. John’s University School of Risk Management, Insurance and Actuarial Science; Chairman of the Greenwich Hospital Board of Trustees; American Property Casualty Insurance Association (APCIA) and American Institute for Chartered Property Casualty Underwriters (The Institutes) Boards of Trustees; and is a member of the Yale New Haven Health Systems Investment Committee. He is the son of Mr. William R. Berkley.

Key Qualifications, Attributes or Skills: Mr. Rob Berkley’s substantial experience in all areas of the Company’s operations, as well as his service as a Director (and prior service as Chairman of the Board) of NCCI Holdings, Inc. (the nation’s largest provider of workers’ compensation and employee injury data and statistics), on the Board of Trustees of The Institutes and prior investment banking experience, enable him to bring to the Company’s Board of Directors insightful, working knowledge of the Company’s business and the insurance industry. |

Key Experience: Founder and Managing Partner of GenNx360 Capital Partners, a private equity buyout firm, since 2006. Between 1993 and 2006, Mr. Blaylock was the Founder, Chairman and Chief Executive Officer of Blaylock & Company, Inc., an investment banking firm. Prior to that, he held senior management positions with PaineWebber Group and Citicorp. He currently serves on the Boards of Pfizer, Inc., CarMax, Inc. and Advantage Solutions Inc. He is currently a Trustee of Carnegie Hall and the New York University Stern School of Business, as well as having formerly served on the Board of Trustees of Georgetown University, American Ballet Theater, Covenant House, National Association of Basketball Coaches, Prep for Prep and Inner-City Scholarship Fund.

Key Qualifications, Attributes or Skills: Mr. Blaylock’s founding and management of two financial services companies has provided him with valuable entrepreneurial business, leadership and management experience. As a result, he brings substantial financial expertise to the Company’s Board of Directors. In addition, his experience on the boards of directors of other public companies and non-profit organizations enables him to bring other public company leadership, operational and ESG perspectives and experience to the Company’s Board of Directors.

|

|||||||||||

| 14 | W. R. Berkley Corporation |

Table of Contents

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

|

Mary C. Farrell

|

Leigh Ann Pusey

|

|||||||||||

|

|

Director Since: 2006 Age: 71 Occupation: President of the Howard Gilman Foundation Expiring Term: 2022 Independent: Yes Committees: Business Ethics, Compensation (Chair), Executive, Nominating and Corporate Governance Other Public Company Directorships: None |

|

Director Since: 2018 Age: 58 Occupation: Senior Vice President, Corporate Affairs and Communications, Eli Lilly and Company Expiring Term: 2022 Independent: Yes Committees: Compensation, Nominating and Corporate Governance Other Public Company Directorships: None |

|||||||||

|

Key Experience: Ms. Farrell has served as President of the Howard Gilman Foundation since September 2009, and a Director of Fidelity Strategic Advisor Funds since 2013. Retired in July 2005 from UBS, where she served as a Managing Director, Chief Investment Strategist for UBS Wealth Management USA and Co-Head of UBS Wealth Management Investment Strategy & Research Group. Chairman of the Board of Yale New Haven Hospital and Vice Chairman of Yale New Haven Health System.

Key Qualifications, Attributes or Skills: Ms. Farrell’s career in investment banking, including serving in various leadership roles at UBS, provides valuable business experience and critical insights regarding investments, finance, strategic transactions, and diversity and inclusion. She brings considerable financial expertise to the Company’s Board of Directors, providing an understanding of financial statements, corporate finance, executive compensation and capital markets. |

Key Experience: Senior Vice President, Corporate Affairs and Communications, Eli Lilly and Company since June 2017. She previously served as president and chief executive officer of the American Insurance Association (AIA) from 2009 to June 2017 following several other AIA leadership positions, including chief operating officer and senior vice president for government affairs from 2000 to 2009 and senior vice president of public affairs from 1997 to 2000. From 1995 to 1997, she served as director of communications for the Office of the Speaker of the U.S. House of Representatives, and from 1993 to 1994, she was the deputy director of communications for the Republican National Committee. From 1990 to 1992, Ms. Pusey served as special assistant and then deputy assistant to the president for the White House Office of Public Liaison. She currently serves on the advisory board of The George Washington Graduate School of Political Management and as a board member of The Mind Trust. She previously served on the board of the Insurance Institute for Highway Safety and was a member of the U.S. Chamber of Commerce’s Committee of 100.

Key Qualifications, Attributes or Skills: Ms. Pusey possesses executive leadership experience and a deep understanding of the insurance business and governmental operations as well as management and oversight skills that allow her to make significant contributions to the Company’s Board of Directors. Her experience as a past president and CEO of the AIA enable her to provide thoughtful insight regarding the operations of the Company, including its approach to diversity and inclusion.

|

|||||||||||

| 2021 Proxy Statement | 15 |

Table of Contents

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

|

María Luisa Ferré

|

||||||||||

|

|

Director Since: 2017 Age: 57 Occupation: President and CEO of FRG, LLC Expiring Term: 2023 Independent: Yes Committees: Audit, Nominating and Corporate Governance Other Public Company Directorships: Popular, Inc. |

|||||||||

|

Key Experience: Ms. Ferré has served as President and CEO of FRG, LLC, a diversified family holding company with leading operations in media, real estate, contact centers and distribution in Puerto Rico, the United States and Chile, since 2001. She has been a Member of the Board of Directors of GFR Media, LLC since 2003 and was its Chair from 2006 to February 2016. Ms. Ferré is also the Publisher of El Nuevo Día newspaper and of Primera Hora newspaper since 2006. She has been a member of the Board of Directors of Popular, Inc. since 2004. Ms. Ferré has served as the President and Trustee of The Luis A. Ferré Foundation, Inc. since 2003. She has been the President of the Board of Directors of Multisensory Reading Center of PR, Inc. since 2012, as well as a member of the Latin American Caribbean Fund of The Museum of Modern Art since 2013 and a member of the Board of Directors of the Partnership for Modern Puerto Rico since 2019.

Key Qualifications, Attributes or Skills: Ms. Ferré possesses executive leadership experience and a deep understanding of business operations, ESG and diversity and inclusion issues, as well as management and oversight skills that allow her to make significant contributions to the Company’s Board of Directors. Her deep media and publishing experience enable her to provide thoughtful insight regarding the communication needs of the Company. |

||||||||||

| 16 | W. R. Berkley Corporation |

Table of Contents

|

PROPOSAL 2: INCREASE IN SHARE RESERVE UNDER DIRECTORS STOCK PLAN

|

Proposal 2: Increase in Share Reserve Under Directors Stock Plan

The Board of Directors has unanimously approved an amendment and restatement (the “Amendment and Restatement”) of the Directors Stock Plan increasing the number of shares of the Company’s common stock reserved for issuance thereunder by 150,000 shares, and is now seeking stockholder approval for increasing the shares reserved. Shares granted to directors under the Directors Stock Plan constitutes a substantial portion of their compensation for service as directors.

If the stockholders do not approve this change, the change will not take effect, but the Company may continue to grant awards under the Directors Stock Plan, as otherwise amended and restated, in accordance with the terms and conditions thereof. The key terms and provision of the Directors Stock Plan, including eligibility for participation and the types of awards that may be granted thereunder, are unchanged by the Amendment and Restatement.

Summary of Directors Stock Plan

The following summary of certain provisions of the Directors Stock Plan is qualified in its entirety by reference to its full text, a copy of which is filed with the Securities and Exchange Commission as Annex B to this proxy statement.

Purpose

The Directors Stock Plan provides a means to recruit and retain highly qualified individuals to serve as members of the Board of Directors by allowing the Company to grant shares of its common stock and other stock-based awards to members of the Board of Directors.

Eligibility

Participation in the Directors Stock Plan is limited to members of the Board of Directors. Accordingly, eight non-executive directors and two executive officer directors are eligible to participate in the Directors Stock Plan.

Shares Reserved

Currently, of 300,000 shares of the Company’s common stock previously reserved for issuance under the Directors Stock Plan, 30,392 shares remain reserved for issuance thereunder. If the Amendment and Restatement is approved by our stockholders at the Annual Meeting, an additional 150,000 shares of the Company’s common stock will be reserved for issuance under the Directors Stock Plan. Such shares are authorized but unissued shares or treasury shares. The Board of Directors may adjust the number and kind of shares to which awards are subject, and the automatic grant formula set forth in the Directors Stock Plan, in the event of certain changes in capitalization of the Company, including mergers, reorganizations, recapitalizations, consolidations, stock dividends and splits, spin-offs, split-ups, and certain distributions of cash, securities, or other property. Shares withheld by or delivered to the Company to satisfy the exercise price of options or stock appreciation rights or tax withholding obligations with respect to any award under the Directors Stock Plan will be deemed to have been issued under the Directors Stock Plan and not available for issuance in connection with future awards.

| 2021 Proxy Statement | 17 |

Table of Contents

|

PROPOSAL 2: INCREASE IN SHARE RESERVE UNDER DIRECTORS STOCK PLAN

|

Awards

Automatic Grants: Pursuant to the Directors Stock Plan, currently on the date of each Annual Meeting, each member of the Board of Directors who continues to serve on the Board of Directors following such Annual Meeting will receive an automatic grant of the number of shares determined by dividing $200,000 by the average high and low prices of the Company’s common stock reported on the New York Stock Exchange on the business day immediately prior to the date of the Annual Meeting, rounded up to the next whole share, which will be fully vested on the grant date. Each grantee will have all rights of a stockholder, including the right to receive dividends, with respect to such shares.

Discretionary Awards: Pursuant to the Directors Stock Plan, the Board of Directors is authorized to make discretionary awards to its members which may consist of grants of shares, stock options, restricted stock, restricted stock units, stock appreciation rights, phantom stock, or any other stock-based award. The terms and conditions of each award shall be determined by the Board of Directors and may be set forth in an award agreement.

Effective Date, Administration, Termination and Amendment

The Amendment and Restatement will be effective as of June 1, 2021, provided that the increase in the shares reserved is approved by our stockholders. The Directors Stock Plan will remain administered by the Board of Directors, which will have the authority to: (i) exercise all of the powers granted to it under the Directors Stock Plan, (ii) revise the automatic grant formula set forth in the Directors Stock Plan, (iii) make discretionary awards under the Directors Stock Plan, (iv) construe, interpret and implement the Directors Stock Plan, (v) prescribe, amend, and rescind rules and regulations relating to the Directors Stock Plan, (vi) make all determinations necessary in administering the Directors Stock Plan, and (vii) correct any defect, supply any omission, and reconcile any inconsistency in the Directors Stock Plan. The Board of Directors may amend, suspend or terminate the Directors Stock Plan at any time, provided that any amendment for which stockholder approval is required will not become effective until such approval is obtained.

Federal Income Tax Consequences

The following is a summary of certain U.S. federal income tax consequences of awards made under the Directors Stock Plan, based upon the laws in effect on the effective date of the Amendment and Restatement. The discussion is general in nature and does not take into account a number of considerations that may apply in light of the circumstances of a particular participant under the Directors Stock Plan. The income tax consequences under applicable state and local tax laws may not be the same as under U.S. federal income tax laws.

Non-Qualified Stock Options. A participant will not recognize taxable income at the time of a grant of a non-qualified stock option, and the Company will not be entitled to a tax deduction at such time. A participant will recognize compensation taxable as ordinary income (and be subject to income tax withholding in respect of an employee) upon exercise of a non-qualified stock option equal to the excess of the fair market value of the shares purchased over their exercise price, and the Company generally will be entitled to a corresponding deduction.

Vested Shares. A participant will immediately recognize compensation taxable as ordinary income (and be subject to income tax withholding in respect of an employee) upon grant of an award of vested shares, and

| 18 | W. R. Berkley Corporation |

Table of Contents

|

PROPOSAL 2: INCREASE IN SHARE RESERVE UNDER DIRECTORS STOCK PLAN

|

the Company generally will be entitled to a corresponding deduction. The foregoing general tax discussion is intended for the information of stockholders considering how to vote with respect to this proposal and not as tax guidance to participants in the Directors Stock Plan. Participants are strongly urged to consult their own tax advisors regarding the federal, state, local, foreign and other tax consequences to them of participating in the Directors Stock Plan.

New Plan Benefits

As noted above, at the Company’s 2021 Annual Meeting each continuing member of the Board of Directors will receive an automatic annual grant of shares of common stock under the Directors Stock Plan, in accordance with the automatic grant formula, which is disclosed in the tabular format below. The Board of Directors may also grant additional awards under the Directors Stock Plan in its sole discretion. Because the Company cannot forecast the extent of discretionary awards that may be made in the future, the Company has omitted the tabular disclosure relating to the grant of discretionary awards under the Directors Stock Plan. The following is a summary of grants expected to be made on June 15, 2021:

| Name and Position

|

Dollar Value ($)

|

Number of Units

| ||||||||

|

W. Robert Berkley, Jr. President and Chief Executive Officer

|

$

|

200,000

|

|

|

(1

|

)

| ||||

|

William R. Berkley Executive Chairman of the Board

|

$

|

200,000

|

|

|

(1

|

)

| ||||

|

Executive Group

|

$

|

400,000

|

|

|

(1

|

)

| ||||

|

Non-Executive Director Group

|

$

|

1,600,000

|

|

|

(1

|

)

| ||||

|

Non-Executive Officer Employee Group

|

|

N/A

|

|

|

N/A

|

| ||||

| (1) | The number of shares of common stock expected to be awarded to each member of the Board of Directors on June 15, 2021 is not determinable at this time. The number of shares to be awarded will be determined by dividing $200,000 by the average high and low prices of the Company’s common stock reported on the New York Stock Exchange on the business day immediately prior to June 15, 2021, rounded up to the next whole share. |

The Board of Directors unanimously recommends a vote “FOR” this resolution.

| 2021 Proxy Statement | 19 |

Table of Contents

|

PROPOSAL 3: NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

|

Proposal 3: Non-Binding Advisory Vote on Executive Compensation

We submit to our stockholders this non-binding advisory vote on the compensation of our NEOs, which gives stockholders a mechanism to convey their views about our compensation programs and policies. Although your vote on executive compensation is not binding on the Board of Directors or the Company, the Board of Directors values the views of our stockholders. The Board of Directors and Compensation Committee will review the results of the non-binding vote and consider them in addressing future compensation policies and decisions.

We believe that our executive compensation programs create a strong competitive advantage both for retaining talent and for creating long-term stockholder value. They reflect feedback from our stockholders over the preceding years, align the interests of our NEOs with those of our stockholders, and reward achievement of our strategic objectives. See “Compensation Discussion and Analysis — Executive Compensation Objectives, Philosophy and Design” on pages 45-46.

A substantial majority of our NEOs’ compensation is linked to Company performance and stockholder value over the long term.

| ➣ | Annual cash incentive awards are performance-based and are primarily based on annual ROE, with additional consideration for non-financial goals and value creation items. See pages 47-49 and 57-58. Determination of an NEO’s annual cash incentive compensation award is based on the Company’s financial performance for the current year, the Company’s financial performance compared to peers, and the NEO’s contributions to long-term value creation. Annual cash incentive awards are also non-formulaic. In our industry, a formulaic short-term incentive award can encourage excessive risk taking and imprudent short-term behavior to create near-term payouts at the expense of long-term value creation. Our annual cash incentive plan provides the Compensation Committee with flexibility to respond to market conditions and permits the application of judgment that is necessary to avoid creating incentives for our NEOs to engage in short-term oriented behavior in our industry that is detrimental to long-term value creation. |

| ➣ | RSUs vest based on our ROE performance and use a series of rolling three-year performance periods, with the last period extending five years from the grant date. Additionally, for our NEOs and certain other senior executives, RSU awards include a mandatory deferral feature that delays settlement and delivery of shares until the executive’s separation from service with the Company, which further promotes a long term perspective on performance. RSUs are also subject to recapture (clawed back) if a recipient engages in misconduct during employment or breaches post-employment obligations during the one-year period following separation from the Company. |

| ➣ | Our Long-Term Incentive Plan (“LTIP”) further promotes our long-term approach to compensation incentives, as well as our emphasis on pay for performance, because LTIP awards remain outstanding over a five-year period and deliver targeted value only to the extent that the Company achieves the targeted or greater growth in book value per share. |

| ➣ | Consistent with good corporate governance practices, we do not provide our NEOs with employment agreements or cash severance agreements. |

The non-binding advisory vote on this resolution is not intended to address any specific element of compensation; rather, the vote is intended to provide our stockholders the opportunity to approve, on an

| 20 | W. R. Berkley Corporation |

Table of Contents

|

PROPOSAL 3: NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

|

aggregate basis and in light of our corporate performance, the compensation program for our NEOs as described in this proxy statement. The following resolution is submitted for a stockholder vote at the Annual Meeting:

“RESOLVED, that the stockholders of the Company approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers listed in the 2020 Summary Compensation Table included in the proxy statement for the 2021 Annual Meeting, as such compensation is disclosed pursuant to the compensation disclosure rules of the U.S. Securities and Exchange Commission, including the section titled “Compensation Discussion and Analysis,” as well as the compensation tables and other narrative executive compensation disclosures thereafter.”

The Board of Directors unanimously recommends a vote “FOR” this resolution.

| 2021 Proxy Statement | 21 |

Table of Contents

|

PROPOSAL 4: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm

KPMG LLP (“KPMG”) has been appointed by the Board of Directors as the independent registered public accounting firm to audit the financial statements of the Company for the fiscal year ending December 31, 2021. The appointment of this firm was recommended to the Board of Directors by the Audit Committee. The Board of Directors is submitting this matter to a vote of stockholders in order to ascertain their views. If the appointment of KPMG is not ratified, the Board of Directors will reconsider its action and will appoint auditors for the 2021 fiscal year without further stockholder action. Further, even if the appointment is ratified by stockholder action, the Board of Directors may at any time in the future in its discretion reconsider the appointment without submitting the matter to a vote of stockholders.

It is expected that representatives of KPMG will attend the Annual Meeting, will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate stockholder questions.

Information on KPMG’s fees for 2020 and our pre-approval policy for services provided by the Company’s independent auditors is provided under “Audit and Non-Audit Fees” on page 80.

The Board of Directors unanimously recommends a vote “FOR” the ratification of the appointment of KPMG LLP.

| 22 | W. R. Berkley Corporation |

Table of Contents

|

EXECUTIVE OFFICERS

|

Each executive officer who does not also serve as a director is listed below. The executive officers are elected by the Board of Directors annually and serve at the pleasure of the Board of Directors. There are no arrangements or understandings between the executive officers and any other person pursuant to which the executive officers were selected. The information is provided as of April 19, 2021.

|

Name

|

Age

|

Position

| ||||

|

Richard M. Baio

|

|

52

|

|

Executive Vice President — Chief Financial Officer

| ||

|

Lucille T. Sgaglione

|

|

71

|

|

Executive Vice President

| ||

|

James G. Shiel

|

|

61

|

|

Executive Vice President — Investments

| ||

|

Philip S. Welt

|

|

61

|

|

Executive Vice President — General Counsel and Secretary

| ||

Richard M. Baio has served as Executive Vice President — Chief Financial Officer since February 2019, as Senior Vice President – Chief Financial Officer from May 2016 to January 2019, as Vice President when he joined the Company in May 2009 and as Treasurer from May 2009 to April 2021. He has 30 years of experience in the insurance and financial services industry, having served prior to joining the Company as a director in Merrill Lynch & Co.’s financial institutions investment banking group and as a partner in Ernst & Young’s insurance practice.

Lucille T. Sgaglione has served as Executive Vice President of the Company since December 2015. She joined the Company in 2010 as a Senior Vice President with oversight responsibility for several of the Company’s operating units and has nearly 30 years of senior leadership experience in the commercial property casualty insurance industry.

James G. Shiel has served as Executive Vice President — Investments of the Company since June 2015, Senior Vice President — Investments from January 1997 to June 2015 and Vice President — Investments from January 1992. Since February 1994, Mr. Shiel has been President of Berkley Dean & Company, Inc., a subsidiary of the Company, which he joined in 1987.

Philip S. Welt has served as Executive Vice President — General Counsel since January 2019 and Corporate Secretary since June 2020. Mr. Welt joined the Company in 2004 as vice president – senior counsel and was named executive vice president with oversight responsibility for certain of the Company’s operating units in 2011. Prior to joining the Company, he was an assistant general counsel – mergers and acquisitions at a major international insurer and a corporate associate with the New York law offices of Davis Polk & Wardwell. Mr. Welt is also a certified public accountant and was a senior manager at the accounting firm of Deloitte & Touche.

| 2021 Proxy Statement | 23 |

Table of Contents

|

CORPORATE GOVERNANCE AND BOARD MATTERS

|

Corporate Governance and Board Matters

|

| ✓ | Majority Voting for Directors | |||

| ✓ | Majority of Independent Directors: 8 of 10 | |||

| ✓ | Separate Chairman and CEO | |||

| ✓ | Diversified Tenure of Directors that balances board refreshment with benefit of experience of overseeing the Company over the full insurance cycle | |||

| ✓ | Regular Executive Sessions of Independent Directors with rotating presiding Director that provides for effective checks and balances to ensure the exercise of independent judgment by the Board of Directors | |||

| ✓ | Annual Board and Committee Self-Evaluations | |||

| ✓ | Independent Compensation Consultant Retained by Compensation Committee | |||

| ✓ | Risk Oversight by Full Board and Committees | |||

| ✓ | Enterprise Risk Management Committee: Management committee reports regularly to the Board | |||

| ✓ | Environmental, Social and Governance (ESG) Management committee regularly reports to the Board | |||

| ✓ | Rigorous Stock Ownership Requirements for Executives and Directors | |||

| ✓ | Anti-Hedging Policy | |||

| ✓ | Anti-Pledging Policy for shares satisfying NEOs’ ownership requirement | |||

| ✓ | Mandatory Deferral of Vested RSUs Until Separation from Service | |||

| ✓ | Compensation Clawback for long-term compensation plans | |||

| ✓ | Annual Equity Grant to Directors is a substantial portion of their compensation | |||

| ✓ | Statement of Business Ethics for the Board of Directors and Code of Ethics for Senior Financial Officers | |||

|

|

✓

|

|

Robust Continuing Investor Outreach Program | |

Our Board of Directors is committed to sound and effective corporate governance practices. Accordingly, our Board of Directors has adopted written Corporate Governance Guidelines, which address, among other things:

| ➣ | identification of director candidates; |

| ➣ | director qualification (including independence) standards; |

| ➣ | director responsibilities; |

| 24 | W. R. Berkley Corporation |

Table of Contents

|

CORPORATE GOVERNANCE AND BOARD MATTERS

|

| ➣ | director access to management and independent advisors; |

| ➣ | employee, officer or other interested party communications with non-management members of the Board of Directors; |

| ➣ | director compensation; |

| ➣ | director orientation and continuing education; |

| ➣ | director election procedures; |

| ➣ | management succession; and |

| ➣ | annual performance evaluation of the Board of Directors. |

Our Corporate Governance Guidelines are available on our website at www.berkley.com.

Director Independence and Involvement.

The Board of Directors is currently composed of ten directors, all of whom, other than Messrs. Wm. Berkley and Rob Berkley, have been determined by the Board of Directors (1) to be independent in accordance with applicable New York Stock Exchange (“NYSE”) corporate governance rules and (2) not to have a material relationship with the Company which would impair their independence from management or otherwise compromise their ability to act as an independent director.

The Board of Directors held seven meetings during 2020. Eight of the eleven directors then serving attended 100% of the meetings of the Board of Directors, while three attended between 92% and 94% of such meetings. Each director attended 100% of the meetings of the Board committees on which he or she served. Nine of the eleven directors then serving attended the Company’s 2020 Virtual Annual Meeting.

|

|

| 2021 Proxy Statement | 25 |

Table of Contents

|

CORPORATE GOVERNANCE AND BOARD MATTERS

|

|

The Board of Directors has five standing committees: Audit, Business Ethics, Compensation, Nominating and Corporate Governance and Executive. The charters for the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee are available on our website at www.berkley.com. The table below provides membership and meeting information for each of these committees for 2020.

|

Committees

| ||||||||||

| Audit

|

Business Ethics(1)

|

Compensation

|

Nominating and

|

Executive

| ||||||

| Meetings in 2020 |

9 | 1 | 4 | 2 | None | |||||

| Committee Member | ||||||||||

| Christopher L. Augostini |

M | M | ||||||||

| William R. Berkley |

C | |||||||||

| W. Robert Berkley, Jr. |

M | |||||||||

| Ronald E. Blaylock |

M | M | M | |||||||

| Mark E. Brockbank |

M | M | ||||||||

| Mary C. Farrell(3) |

C | M | ||||||||

| María Luisa Ferré |

M | M | ||||||||

| Jack H. Nusbaum(4) |

M | M | ||||||||

| Leigh Ann Pusey |

M | M | ||||||||

| Mark L. Shapiro |

C/F | M | M | M | ||||||

| Jonathan Talisman |

M | M | ||||||||

| M Member |

C Chair |

F Audit Committee Financial Expert |

| (1) | The chair of the Business Ethics Committee is selected by rotation among the members. |

| (2) | The chair of the Nominating and Corporate Governance Committee is selected by rotation among the chair of the Audit Committee, the chair of the Compensation Committee and the non-management member of the Executive Committee who does not already chair another committee, if any. |

| (3) | Effective February 2021, Ms. Farrell was appointed as a member of each of the Business Ethics Committee and the Executive Committee. |

| (4) | Mr. Nusbaum was a member of the Board for the full fiscal year of 2020 but passed away on January 11, 2021. |

Audit Committee. The Audit Committee, which held nine meetings during 2020, is appointed by the Board of Directors to assist the Board of Directors in monitoring:

| ➣ | the integrity of the financial statements of the Company; |

| ➣ | the independent auditors’ qualifications and independence; |

| ➣ | the performance of the Company’s internal audit function and independent auditors; and |

| ➣ | compliance by the Company with legal and regulatory requirements. |

The Audit Committee has also adopted procedures to receive, retain and treat any complaints received regarding accounting, internal accounting controls or auditing matters and provide for the anonymous, confidential submission of concerns regarding these matters.

| 26 | W. R. Berkley Corporation |

Table of Contents

|

CORPORATE GOVERNANCE AND BOARD MATTERS

|

Each member of the Audit Committee is independent under the rules of the Securities and Exchange Commission (the “SEC”) and the NYSE. The Board of Directors has identified Mr. Shapiro as a current member of the Audit Committee who meets the definition of an “audit committee financial expert” established by the SEC.

The Audit Committee has determined to engage KPMG LLP as the Company’s independent registered public accounting firm for fiscal year 2021 and is recommending that our stockholders ratify this appointment at the Annual Meeting. See Proposal 4, Ratification of Appointment of Independent Registered Public Accounting Firm on page 22 of this proxy statement.

The report of our Audit Committee is found on page 79 of this proxy statement.

Compensation Committee. The Compensation Committee, which held four meetings during 2020, has overall responsibility for discharging the Board of Directors’ responsibilities relating to the compensation of the Company’s senior executive officers and directors.