UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Northborough, Massachusetts

April 10, 2024

Dear Aspen Aerogels, Inc. Stockholder:

You are cordially invited to attend the 2024 annual meeting of stockholders of Aspen Aerogels, Inc. to be held at 9:30 a.m. Eastern Time on Thursday, May 30, 2024. This year’s annual meeting will be conducted solely via live audio webcast on the Internet.

You will be able to attend our annual meeting, vote and submit your questions during the annual meeting by visiting www.virtualshareholdermeeting.com/ASPN2024. You will not be able to attend the annual meeting in person.

Details regarding the meeting, the business to be conducted at the meeting, and information about Aspen Aerogels that you should consider when you vote your shares are described in the accompanying proxy statement.

At the 2024 annual meeting, two persons will be elected to our Board of Directors (the “Board of Directors” or the “Board”). In addition, we ask stockholders to ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024, and to approve, on a non-binding, advisory basis, the compensation of the named executive officers, as disclosed in the accompanying proxy statement for the 2024 annual meeting of stockholders. Our Board of Directors recommends the election of the two nominees to our Board of Directors and a vote in favor of proposals (2) and (3). Such other business will be transacted as may properly come before the annual meeting.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to the majority of our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On or about April 10, 2024, we will send to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our 2024 annual meeting of stockholders and our 2023 annual report to stockholders. The Notice also provides instructions on how to vote online and includes instructions on how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the annual meeting. Whether you plan to attend the annual meeting or not, it is important that you cast your vote. Prior to the annual meeting, you may vote by proxy over the Internet as well as by telephone or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in the proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend. Any stockholder attending the virtual annual meeting may vote online during the annual meeting, even if you already returned a proxy card or voted by proxy over the telephone or the Internet.

Thank you for your continued support of Aspen Aerogels, Inc. We look forward to seeing you at the annual meeting.

Sincerely,

Donald R. Young

President and Chief Executive Officer

Aspen Aerogels, Inc.

30 Forbes Road, Building B

Northborough, Massachusetts 01532

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TIME: 9:30 a.m. Eastern Time

DATE: Thursday, May 30, 2024

ACCESS: www.virtualshareholdermeeting.com/ASPN2024

This year’s annual meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend the annual meeting, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/ASPN2024 and providing relevant information, including the control number included in the Notice of Internet Availability or the proxy card or voting instruction form that you receive. For further information, please see the Important Information About the Annual Meeting and Voting beginning on page 4 of this proxy statement.

PURPOSES:

| 1. | To elect Rebecca B. Blalock and James E. Sweetnam as directors to serve three-year terms expiring in 2027; |

| 2. | To ratify the appointment of KPMG LLP as Aspen Aerogels, Inc.’s independent registered public accounting firm for the fiscal year ending December 31, 2024; |

| 3. | To approve, on a non-binding, advisory basis, the compensation of the named executive officers, as disclosed in our proxy statement for the annual meeting; and |

| 4. | To transact such other business that is properly presented at the annual meeting and any adjournments or postponements thereof. |

WHO MAY VOTE:

You may vote if you were the record owner of Aspen Aerogels, Inc.’s common stock at the close of business on April 3, 2024 (the “Record Date”). A list of registered stockholders as of the close of business on the Record Date will be available at our corporate headquarters for examination by any stockholder for any purpose germane to the annual meeting for a period of 10 days ending on the day before the date of the annual meeting. If you wish to view this list, please contact our Corporate Secretary at Aspen Aerogels, Inc., 30 Forbes Road, Building B, Northborough, Massachusetts 01532.

All stockholders are cordially invited to attend the virtual annual meeting. Whether you plan to attend the annual meeting or not, we urge you to vote by following the instructions in the Notice of Internet Availability of Proxy Materials or proxy materials you received and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the meeting.

By Order of the Board of Directors

Virginia H. Johnson

Chief Legal Officer, General Counsel,

Corporate Secretary & Chief Compliance Officer

Northborough, Massachusetts

April 10, 2024

CREATING VALUE THROUGH TECHNOLOGY, INNOVATION, AND EXECUTION

Dear Stakeholders,

In 2023, we set the stage for significant value creation in our Thermal Barrier and Energy Industrial businesses. Over the past year, teams across Aspen came together to scale business operations, drive innovation, eliminate the capacity constraints in our Energy Industrial business, and increase market adoption of our high-performance thermal barrier solutions. These successful initiatives played a pivotal role in our 2023 financial and operational progress. Our PyroThin® thermal barrier business achieved record annual revenues, reaching an impressive $110 million for the year, nearly doubling the segment’s revenue generation compared to 2022. In addition, we continued to diversify our customer base in this segment, signing contracts with three new major automotive OEMs. Equally impressive, our Energy Industrial business, which faced capacity constraints through the year, still demonstrated year-over-year growth, and exited 2023 with a meaningful backlog of orders to fulfill throughout 2024.

These results bode well for 2024 and beyond and are important indicators of the successful execution of our multi-year strategy to build a profitable growth engine that benefits all stakeholders: employees, customers, suppliers, communities, and investors alike.

2023 Highlights and Recent Business Developments

During the year 2023, the company focused on driving top line growth from both business segments, improving productivity and yields, maintaining careful control of operating expenses, optimizing the timing of capital expenditures, and accelerating on the path to near-term profitability.

| ● | Grew record consolidated revenue 32% year-over-year to $238.7 million. |

| ● | Generated record PyroThin thermal barrier revenue of $110.1 million, up 98% year-over-year. |

| ● | Delivered Energy Industrial revenues of $128.6 million, despite being capacity constrained, and initiated deliveries from our external manufacturing facility. |

| ● | Recorded 2023 gross margins of 24%, with a quarterly progression from 11% in Q1 to 17% in Q2, 23% in Q3, and 35% in Q4. |

| ● | Delivered record company profitability in Q4 2023, where $84.2 million in quarterly revenue enabled gross margins of 35% and operating income of $1.4 million. |

| ● | Secured PyroThin award with Audi, a luxury brand of the Volkswagen Group, to supply a vehicle platform with start of vehicle production expected in 2025. |

| ● | Awarded PyroThin contract from Scania, a commercial vehicle division of the Volkswagen Group, for a commercial truck nameplate with start of production expected in 2024. |

| ● | Announced PyroThin award from The Automotive Cells Company (“ACC”), a battery cell joint-venture between Stellantis N.V., Saft-TotalEnergies, and Mercedes-Benz, to supply the Stellantis STLA Medium vehicle platform with an expected start of production in 2025. |

| ● | Announced the right-timing of our second aerogel manufacturing facility in Statesboro, Georgia to better align with the expected ramp of our EV customers. |

| ● | Completed $75 million registered direct offering of common stock at $12.375 per share in December 2023. |

| ● | Ended the year with cash and equivalents of $139.7 million and believe that we are fully funded to deliver on our near-term operating plans. |

| ● | Invited into the formal due diligence and term sheet negotiation phase by the U.S. Department of Energy (“DOE”) Loan Programs Office (“LPO”) for the company’s pending application seeking a loan pursuant to the DOE LPO’s Advanced Technology Vehicles Manufacturing (“ATVM”) for re-accelerating construction of our Second Aerogel Plant in Statesboro, GA. The DOE’s continued evaluation of the application is not an assurance that the terms and conditions of a term sheet will be consistent with terms proposed by the applicant. The foregoing matters are wholly dependent on the results of DOE review and evaluation, and DOE’s determination whether to proceed. |

| ● | For the second consecutive year, Aspen was awarded a Silver Medal rating from EcoVadis for its overall sustainability scorecard, placing Aspen in the 85th percentile of companies assessed by EcoVadis. |

Amidst the uncertainties of today’s global macroeconomic landscape, our focus on profitability remains top priority. To this point, we are steadfast in managing our fixed cost base, optimizing our current assets, executing against our quoted customer pipeline, and leveraging our supply partner to unlock additional capacity. We are well positioned to capture several industry tailwinds that have unfolded due to the global electrification movement and increasing demands for energy security.

Without our great team here at Aspen, none of this success would be possible. On behalf of the entire management team, I extend our deepest gratitude for your unwavering trust, confidence, and support. We remain committed to upholding the highest ethical standards in our relationships with all stakeholders, striving to exceed your expectations at every turn along the way.

Sincerely,

Donald R. Young

President & Chief Executive Officer

TABLE OF CONTENTS

Aspen Aerogels, Inc.

30 Forbes Road, Building B

Northborough, Massachusetts 01532

PROXY STATEMENT FOR THE ASPEN AEROGELS, INC.

2024 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 30, 2024

This proxy statement, along with the accompanying notice of 2024 annual meeting of stockholders, contains information about the 2024 annual meeting of stockholders of Aspen Aerogels, Inc., including any adjournments or postponements of the annual meeting. We are holding the annual meeting at 9:30 a.m. Eastern Time on Thursday, May 30, 2024. This year’s annual meeting will be conducted solely via live audio webcast on the Internet. You will be able to attend our annual meeting, vote and submit your questions during the annual meeting by visiting www.virtualshareholdermeeting.com/ASPN2024. You will not be able to attend the annual meeting in person.

In this proxy statement, we refer to Aspen Aerogels, Inc. as “Aspen Aerogels,” “the Company,” “we,” “our” and “us.”

This proxy statement relates to the solicitation of proxies by our Board of Directors for use at the annual meeting.

On or about April 10, 2024, we intend to begin sending to our stockholders entitled to vote at the annual meeting the Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement for the 2024 annual meeting of stockholders and our 2023 annual report. Stockholders who have previously requested to receive paper copies of our proxy materials will receive paper copies of the proxy materials instead of a Notice of Internet Availability.

1

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL STOCKHOLDER MEETING TO BE HELD ON MAY 30, 2024

This proxy statement and our 2023 annual report to stockholders are available for viewing, printing and downloading at www.proxyvote.com. In order to view, print or download these materials, please have the 16-digit control number(s) that appears on your notice or proxy card available. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2023 on the website of the Securities and Exchange Commission, or the SEC, at www.sec.gov, or in the “SEC Filings” tab of the “Financials” subsection of the “Investors” section of our website at www.aerogel.com. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, from us, free of charge, by sending a written request to:

Aspen Aerogels, Inc.

Attn: Investor Relations

30 Forbes Road, Building B

Northborough, Massachusetts 01532

Exhibits will be provided upon written request and payment of an appropriate processing fee.

2

CAUTIONARY INFORMATION AND FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements about future events and circumstances. Generally speaking, any statement not based upon historical fact is a forward-looking statement. Forward-looking statements can also be identified by the use of forward-looking or conditional words such as “could,” “should,” “can,” “continue,” “estimate,” “forecast,” “intend,” “look,” “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “remain,” “confident” and “commit” or similar expressions. In particular, statements regarding our plans, strategies, prospects and expectations regarding our business and industry are forward-looking statements. They reflect our expectations, are not guarantees of performance and speak only as of the date of this proxy statement. Except as required by law, we do not undertake to update such forward-looking statements. You should not rely unduly on forward-looking statements. Our business results are subject to a variety of risks, including those that are described in our annual report on Form 10-K for the year ended December 31, 2023 and elsewhere in our filings with the Securities and Exchange Commission. If any of these considerations or risks materialize or intensify, our expectations (or underlying assumptions) may change and our performance may be adversely affected.

Although we include references to our website throughout this proxy statement, information contained on or accessible through our website, including any reports, is not a part of, and is not incorporated by reference into, this proxy statement or any other report or document we file with the SEC. Any reference to our website throughout this proxy statement is intended to be an inactive textual reference only.

3

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

The Board of Directors of Aspen Aerogels is soliciting your proxy to vote at the 2024 Annual Meeting of Stockholders to be held virtually via live audio webcast, on Thursday, May 30, 2024 at 9:30 a.m. Eastern Time and any adjournments or postponements of the meeting, which we refer to as the annual meeting. This proxy statement along with the accompanying Notice of 2024 Annual Meeting of Stockholders summarizes the purposes of the meeting and the information you need to know to vote at the annual meeting.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of Annual Meeting of Stockholders, the proxy card and a copy of our annual report on Form 10-K for the fiscal year ended December 31, 2023 because you owned shares of our common stock on April 3, 2024, or the Record Date. We will commence distribution of the Notice of Internet Availability of Proxy Materials, which we refer to throughout this proxy statement as the Notice, and, if applicable, the proxy materials, to stockholders on or about April 10, 2024.

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the SEC, we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Most stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the annual meeting and help to conserve natural resources. If you received the Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

Why Are You Holding a Virtual Annual Meeting?

Our 2024 Annual Meeting will be held in a virtual meeting format only. We have designed our virtual format to enhance, rather than constrain, stockholder access, participation and communication. For example, the virtual format allows stockholders to communicate with us in advance of, and during, the annual meeting so they can submit questions to our Board of Directors or management, as time permits.

What Happens if There Are Technical Difficulties During the Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual annual meeting, voting at the annual meeting or submitting questions at the annual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Stockholder Meeting login page.

In the event of technical difficulties with the annual meeting, we expect that an announcement will be made on www.virtualshareholdermeeting.com/ASPN2024. If necessary, the announcement will provide updated information regarding the date, time, and location of the annual meeting. Any updated information regarding the annual meeting will also be posted on our Investors website at ir.aerogel.com.

Who Can Vote?

Only stockholders who owned our common stock at the close of business on April 3, 2024 are entitled to vote at the annual meeting. On this Record Date, there were 76,762,124 shares of our common stock outstanding and entitled to vote. Our common stock is our only class of voting stock.

4

If on the Record Date your shares of our common stock were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record.

If on the Record Date your shares were held not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice or proxy materials are being forwarded to you by that organization. You may have also received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting and may vote online during the annual meeting by entering the 16-digit control number included on your Notice, proxy card or the voting instructions that accompanied your proxy materials. If you hold your shares in street name and did not receive a 16-digit control number, please contact your brokerage firm, bank, dealer or other similar organization to obtain a legal proxy to be able to participate in or vote at the meeting.

You do not need to attend the annual meeting to vote your shares. Shares represented by valid proxies, received in time for the annual meeting and not revoked prior to the annual meeting, will be voted at the annual meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the annual meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet or telephone. You may specify whether your shares should be voted FOR or WITHHELD for each nominee for director, and whether your shares should be voted FOR, AGAINST or ABSTAIN with respect to the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with our Board of Directors’ recommendations as noted below. Voting by proxy will not affect your right to attend the annual meeting. If your shares are registered directly in your name through our stock transfer agent, Computershare Trust Company, N.A., or you have stock certificates registered in your name, you may vote:

| ● | By Internet. Follow the instructions included in the Notice or, if you received printed materials, in the proxy card to vote over the Internet. |

| ● | By telephone. If you received a proxy card by mail, you can vote by telephone by following the instructions included in the proxy card. |

| ● | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with our Board of Directors’ recommendations as noted below. |

| ● | During the virtual meeting. If you attend the virtual meeting, you may vote your shares online during the annual meeting by following the instructions on the virtual annual meeting page. |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on May 29, 2024.

5

If your shares are held in “street name” (held in the name of a bank, broker or other nominee), you will receive instructions from the holder of record. You must follow the instructions of the nominee in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The Board of Directors recommends that you vote as follows:

| ● | “FOR” the election of the nominees for director; |

| ● | “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; and |

| ● | “FOR” the non-binding, advisory vote to approve the compensation of the named executive officers, as disclosed in this proxy statement. |

If any other matter is presented at the annual meeting, your proxy provides that your shares will be voted by the proxy holders listed in the proxy in accordance with their best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the annual meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the annual meeting. If you are a stockholder of record, you may change or revoke your proxy in any one of the following ways:

| ● | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy card and submitting it as instructed above; |

| ● | by re-voting by Internet or by telephone as instructed above; |

| ● | by providing written notice to Aspen Aerogels’ Corporate Secretary at 30 Forbes Road, Building B, Northborough, Massachusetts 01532 before the annual meeting that you are revoking your proxy; or |

| ● | by attending the annual meeting and voting virtually. Attending the annual meeting virtually will not in and of itself revoke a previously submitted proxy. |

If your shares are held in “street name” (held in the name of a bank, broker or other nominee), you should follow the instructions provided by your bank, broker or other nominee to change or revoke your proxy.

Your most current vote, whether by telephone, Internet or proxy card, is the vote that will be counted.

What if I Receive More Than One Notice, Proxy Card or Voting Instruction Form?

You may receive more than one Notice, proxy card or voting instruction form if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

6

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the ratification of the appointment of our independent registered public accounting firm (Proposal 2 of this proxy statement) without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the annual meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Your bank, broker or other nominee does not have the ability to vote your uninstructed shares in the election of directors (Proposal 1 of this proxy statement). In addition, your bank, broker or other nominee is prohibited from voting your uninstructed shares on any matters related to our executive compensation (Proposal 3 of this proxy statement). Therefore, if you hold your shares in street name, it is critical that you cast your vote if you want your vote to be counted for Proposals 1 and 3 of this proxy statement.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

| Proposal 1: Elect Directors | The nominees for director who receive the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one of the two nominees. Votes that are withheld will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. | |

| Proposal 2: Ratify Appointment of Independent Registered Public Accounting Firm | The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to ratify the appointment of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to appoint our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2024, the Audit Committee of our Board of Directors (the “Audit Committee”) will reconsider its appointment. | |

| Proposal 3: Approve, on a Non-Binding, Advisory Basis, the Compensation of the Named Executive Officers | The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to approve the advisory vote. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

7

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspectors of Election, representatives of Broadridge Investor Communication Solutions, Inc., examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make on the proxy card or that you otherwise provide.

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the annual meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the annual meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay for the entire cost of soliciting proxies. Our directors and employees are soliciting proxies for the annual meeting from stockholders. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. We have not yet retained, but may retain, a proxy solicitor in conjunction with the annual meeting, and its employees may assist us in the solicitation. We will pay all costs of soliciting proxies, including a fee and reasonable out-of-pocket expenses for the proxy solicitor, if any.

What Constitutes a Quorum for the Annual Meeting?

The presence, at the meeting virtually or by proxy, of the holders of a majority of the voting power of all outstanding shares of our common stock entitled to vote at the annual meeting is necessary to constitute a quorum at the annual meeting. Votes of stockholders of record who are present at the annual meeting virtually or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

How Can I Attend the Annual Meeting?

The annual meeting will be held at 9:30 a.m. Eastern Time on Thursday, May 30, 2024. This year, our annual meeting will be held in a virtual meeting format only.

To attend the virtual annual meeting, go to www.virtualshareholdermeeting.com/ASPN2024 shortly before the meeting time, and follow the instructions for downloading the webcast. You will need the 16-digit control number provided on your proxy card, voting instruction form or Notice in order to attend and to vote and ask questions at the annual meeting. We encourage you to access the annual meeting before the start time of 9:30 a.m. (Eastern Time), on May 30, 2024. Please allow ample time for online check-in, which will begin at 9:15 a.m. (Eastern Time) on May 30, 2024. An annual meeting program containing rules of conduct for the annual meeting will be provided to attendees.

If you are unable to attend the annual meeting, you can view a replay of the webcast at the same webpage for at least six months from the meeting. You need not attend the annual meeting in order to vote.

How Do I Submit a Question at the Annual Meeting?

If you wish to submit a question, you may do so in two ways:

| ● | Before the annual meeting: Once you receive your proxy materials, you may log into www.proxyvote.com and enter your 16-digit control number included on your Notice, proxy card or voting instruction form and follow the prompts to submit a question. You may submit questions through this pre-meeting forum until the start of the meeting. |

| ● | During the annual meeting: Log into the virtual meeting platform at www.virtualshareholdermeeting.com/ASPN2024 to attend the annual meeting, during which you may type your question into the “Ask a Question” field and click “Submit.” You will need the 16-digit control number included on your Notice, proxy card or voting instruction form. |

8

Questions pertinent to annual meeting matters will be answered during the annual meeting, subject to time constraints. If a stockholder has a question about any matter other than those being acted upon at the annual meeting, such question will be addressed following adjournment of the formal business of the annual meeting. Questions may be ruled as out of order if they are, among other things, derogatory, uncivil or otherwise inappropriate, irrelevant to our business or to the business of the annual meeting, related to personal grievances or our material non-public information or substantially duplicative of statements already made. In addition, questions may be grouped by topic by our management with a representative question read aloud and answered. Stockholders will be limited to two questions each. If there are any matters of individual concern to a stockholder and not of general concern to all stockholders, or if a question posed was not otherwise answered, such matters may be raised separately after the annual meeting by contacting Investor Relations at ir@aerogel.com.

Householding of Annual Disclosure Documents

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single Notice or, if applicable, a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our Notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single Notice or, if applicable, a single set of proxy materials this year, but you would prefer to receive your own copy, please contact our transfer agent, Computershare Trust Company, N.A., please contact our transfer agent at Computershare Trust Company, N.A. (for overnight mail delivery: 150 Royall Street, Suite 101, Canton, Massachusetts 02021; for regular mail delivery: P.O. Box 43006, Providence, Rhode Island 02940-3006; by telephone: in the U.S. or Canada, 1-877-373-6374; outside the U.S. or Canada, 1-781-575-2879).

If you do not wish to participate in householding and would like to receive your own Notice or, if applicable, set of Aspen Aerogels proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another Aspen Aerogels stockholder and together both of you would like to receive only a single Notice or, if applicable, set of proxy materials, follow these instructions:

| ● | If your Aspen Aerogels shares are registered in your own name, please contact our transfer agent, Computershare Trust Company, N.A. and inform them of your request using the contact information above. |

| ● | If a broker or other nominee holds your Aspen Aerogels shares, please contact the broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number. |

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We own or have rights to use “Aspen Aerogels,” “Cryogel,” “Pyrogel,” “PyroThin,” the Aspen Aerogels logo and other trademarks, service marks and trade names of Aspen Aerogels appearing in this document. Solely for convenience, the trademarks, service marks and trade names referred to in this document are without the ® and TM symbols, but such references are not intended to indicate, in any way, that the owner thereof will not assert, to the fullest extent under applicable law, such owner’s rights to these trademarks, service marks and trade names.

9

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of the Record Date for (a) the executive officers named in the Summary Compensation Table on page 41 of this proxy statement, (b) each of our current directors and director nominees, (c) all of our current directors and executive officers as a group and (d) each stockholder known by us to own beneficially more than 5% of our common stock.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. We deem shares of common stock that may be acquired by an individual or group within 60 days of the Record Date pursuant to the exercise of options or warrants, conversion of notes, or the vesting of restricted stock units (“RSUs”) to be outstanding for the purpose of computing the percentage ownership of such individual or group, but such shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table.

Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them based on information provided to us by these stockholders. Percentage of ownership is based on 76,762,124 shares of common stock outstanding on the Record Date.

| Shares beneficially owned | ||||||||

| Name of Beneficial Owner | Number | Percentage | ||||||

| Directors and Named Executive Officers: | ||||||||

| Donald R. Young (1) | 1,674,984 | 2.2 | % | |||||

| Ricardo C. Rodriguez (2) | 71,609 | * | ||||||

| Corby C. Whitaker (3) | 300,492 | * | ||||||

| Gregg R. Landes (4) | 324,224 | * | ||||||

| Virginia H. Johnson (5) | 63,096 | * | ||||||

| Rebecca B. Blalock (6) | 134,645 | * | ||||||

| Kathleen M. Kool (7) | 16,155 | * | ||||||

| Steven R. Mitchell (8) | 217,856 | * | ||||||

| Mark L. Noetzel (9) | 177,891 | * | ||||||

| William P. Noglows (10) | 180,315 | * | ||||||

| James E. Sweetnam (11) | 17,563 | * | ||||||

| All directors and current executive officers as a group (13 persons) (12) | 3,276,247 | 4.3 | % | |||||

| Five Percent Stockholders: | ||||||||

| Entities affiliated with Koch Industries, Inc. (13) | 19,732,696 | 24.4 | % | |||||

| BlackRock, Inc. (14) | 4,054,986 | 5.3 | % | |||||

* Represents beneficial ownership of less than 1% of the outstanding shares of our common stock.

| (1) | Consists of 365,446 shares of our common stock (including unvested restricted stock) held by Mr. Young and 1,309,538 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date. |

| (2) | Consists of 27,955 shares of our common stock (including unvested restricted stock) held by Mr. Rodriguez and 43,654 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date. |

| (3) | Consists of 131,533 shares of our common stock (including unvested restricted stock) held by Mr. Whitaker and 168,959 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date. |

| (4) | Consists of 78,239 shares of our common stock (including unvested restricted stock) held by Mr. Landes and 245,985 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date. |

10

| (5) | Consists of 27,794 shares of our common stock (including unvested restricted stock) held by Ms. Johnson and 35,302 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date. |

| (6) | Consists of 61,277 shares of our common stock (including unvested restricted stock) held by Ms. Blalock and 73,368 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date. |

| (7) | Consists of 11,685 shares of our common stock (including unvested restricted stock) held by Ms. Kool and 4,470 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date. |

| (8) | Consists of 134,260 shares of our common stock (including unvested restricted stock) held by Mr. Mitchell and 83,596 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date. |

| (9) | Consists of 119,322 shares of our common stock (including unvested restricted stock) held by Mr. Noetzel and 58,569 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date. |

| (10) | Consists of 76,719 shares of our common stock (including unvested restricted stock) held by Mr. Noglows, 83,596 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date, 10,000 shares of our common stock held by a trust, for the benefit of one of Mr. Noglows’ children, and 10,000 shares of our common stock held by a trust, for the benefit of another one of Mr. Noglows’ children. |

| (11) | Consists of 13,683 shares of our common stock (including unvested restricted stock) held by Mr. Sweetnam and 3,880 shares of our common stock issuable upon the exercise of options exercisable within 60 days following the Record Date. |

| (12) | See the footnotes above. Also includes 52,979 shares of common stock (including unvested restricted stock) and 44,438 shares of common stock issuable upon the exercise of options exercisable within 60 days following the Record Date held by Ms. Pittman and Mr. Schilling. |

| (13) | Consists of 15,780,426 shares held by Wood River Capital, LLC (“Wood River”), which is a subsidiary of SCC Holdings, LLC (“SCC”), and 3,952,270 shares, which may be issuable to Wood River upon the conversion of the Convertible Senior PIK Toggle Notes due 2027 (the “Notes”). SCC is a subsidiary of KIM, LLC (“KIM”). KIM is a subsidiary of Koch Investments Group (“KIG”), which is a subsidiary of Koch Investments Group Holdings, LLC (“KIGH”). KIGH is a subsidiary of Koch Industries, Inc. (“Koch”). These securities may be deemed to be beneficially owned by each of SCC, KIM, KIG, KIGH and Koch by virtue of their indirect beneficial ownership of Wood River. Each of SCC, KIM, KIG, KIGH and Koch disclaims beneficial ownership of the reported securities except to the extent of its pecuniary interest therein. The shares of common stock that may be issuable to Wood River upon conversion of the Notes are deemed to be outstanding for the purpose of computing the percentage ownership of these entities. The addresses of the principal office and principal business of Wood River and Koch is 4111 East 37th Street North, Wichita, Kansas 67220. This information is based on a Form 13D/A filed by Wood River, SCC, KIM, KIG, KIGH, and Koch with the SEC on December 7, 2022, and Form 4 filed by Wood River with the SEC on January 4, 2024. |

| (14) | BlackRock, Inc. is the parent of several subsidiaries that hold the shares listed in the table, none of which beneficially owns more than 5% of the Company’s common stock. Of the shares listed, BlackRock, Inc. has sole voting power with respect to 3,959,053 shares and sole dispositive power with respect to 4,054,986 shares. BlackRock, Inc.’s business address is 50 Hudson Yards, New York, New York 10001. This information is based on a Schedule 13G filed by BlackRock, Inc. with the SEC on January 31, 2024. |

11

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Exchange Act requires our directors, officers, and persons that own more than 10% of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC. To our knowledge, based solely on a review of the copies of such reports and representations that no other reports were required, we believe that all Section 16 filing requirements applicable to our executive officers, directors and greater than 10% stockholders were complied with during the fiscal year ended December 31, 2023, except that a Form 4 filed on January 4, 2024, with a transaction date of December 30, 2023, by Wood River Capital, LLC and Koch Industries, Inc. was filed untimely with respect to paid-in-kind interest on the Convertible Senior PIK Notes held by Wood River Capital, LLC, and that a Form 4 filed on March 7, 2024, for Mr. Young reflected a decrease in 485 shares resulting from prior year dispositions that were, through inadvertent oversight, not previously reported in Mr. Young’s Section 16 filings.

12

MANAGEMENT AND CORPORATE GOVERNANCE

The Board of Directors

Our Restated Certificate of Incorporation, as amended, and Amended and Restated Bylaws provide that our business is to be managed by or under the direction of our Board of Directors. Our Board of Directors is divided into three classes for purposes of election. One class is elected at each annual meeting of stockholders to serve for a three-year term. Our Board of Directors currently consists of seven members classified into three classes as follows: (1) Rebecca B. Blalock and James E. Sweetnam constitute the Class I directors and their current terms will expire at the annual meeting; (2) Kathleen M. Kool, Mark L. Noetzel and William P. Noglows constitute the Class II directors and their current terms will expire at the 2025 annual meeting of stockholders; and (3) Steven R. Mitchell and Donald R. Young constitute the Class III directors and their current terms will expire at the 2026 annual meeting of stockholders.

On March 6, 2024, our Board of Directors accepted the recommendation of the Nominating, Governance and Sustainability Committee of the Board (the “Nominating, Governance and Sustainability Committee”) and voted to nominate Rebecca B. Blalock and James E. Sweetnam for re-election at the annual meeting for a term of three years to serve until the 2027 annual meeting of stockholders, and until their respective successors have been elected and qualified.

Set forth below are the names of those persons nominated for election as directors at the annual meeting and those directors whose terms do not expire this year, their ages as of the Record Date, their positions in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships during the past five years. Additionally, information about the specific experience, qualifications, attributes or skills that led to our Board of Directors’ conclusion at the time of filing of this proxy statement that each person listed should serve as a director is set forth below:

| Name | Age | Position | ||

| Donald R. Young | 66 | President, Chief Executive Officer and Director | ||

| Rebecca B. Blalock | 68 | Director | ||

| Kathleen M. Kool | 52 | Director | ||

| Steven R. Mitchell | 54 | Director | ||

| Mark L. Noetzel | 66 | Director | ||

| William P. Noglows | 66 | Chairperson of the Board | ||

| James E. Sweetnam | 71 | Director |

Donald R. Young has been our President, Chief Executive Officer and a member of our Board of Directors since November 2001. Prior to joining us, Mr. Young worked in the United States and abroad in a broad range of senior operating roles for Cabot Corporation, a leading global specialty chemical company. Prior to Cabot Corporation, Mr. Young worked in the investment business at Fidelity Management & Research. Mr. Young holds a BA from Harvard College and an MBA from Harvard Business School. The Board has concluded that Mr. Young possesses specific attributes that qualify him to serve as a member of our Board of Directors, including the perspective and experience he brings as our Chief Executive Officer, which brings historic knowledge, operational expertise and continuity to our Board of Directors.

Rebecca B. Blalock has served on our Board of Directors since June 2016. Ms. Blalock is a partner at Advisory Capital LLC, which provides strategic consulting in the areas of energy and information technology. She has served in that role since October 2011. From October 2002 to October 2011, Ms. Blalock was Senior Vice President and Chief Information Officer of Southern Company, a Fortune 500 energy company. From 1979 to October 2002, Ms. Blalock served in various positions at Georgia Power and Southern Company Services, which are subsidiaries of Southern Company. Ms. Blalock’s management experience during her tenure at Georgia Power included serving as Vice President of Community and Economic Development from January 2000 to October 2002 and Director, Corporate Communication from February 1996 to February 2000. She currently serves on the Advisory Boards of Valor Ventures LLC and HData LLC. She is also a board member of 1910 Legacy, which is an employee-owned company, and she chairs the nomination and governance committee of this board. She previously served on the Board of Directors of Hannon Armstrong Sustainable Infrastructure Capital, Inc., including on its Compensation Committee from March 15, 2017 until July 31, 2019 and on its Finance and Risk Committee from May 15, 2017 until July 31, 2019. She also serves on the Board of Councilors of The Carter Center and was elected to the State of Georgia’s Humanities Board. Ms. Blalock holds a BBA in Marketing from State University of West Georgia and an MBA in Finance from Mercer University. Ms. Blalock also completed the Program for Management Development (PMD) at Harvard Business School, received a cyber-security certificate from the Georgia Institute of Technology in 2017 and a Cyber Risk Oversight Certificate from the National Association of Corporate Directors in 2018. The Board has concluded that Ms. Blalock possesses specific attributes that qualify her to serve as a member of our Board of Directors, including the strategic insight, expertise and experience she has developed in senior executive management at a Fortune 500 company in the energy industry, particularly with information technology, as well as her experience with the business environment in Georgia. In addition, because Ms. Blalock has served on many boards of directors, the Board has concluded that she has substantial experience regarding how boards can and should effectively oversee and manage companies as well as a significant understanding of governance issues.

13

Kathleen M. Kool has served on our Board of Directors since November 2022. Ms. Kool has served as the President of Impact100 Genesee County, a non-profit organization, since March 2023. Ms. Kool previously served as the CEO of Tide Cleaners, a wholly owned subsidiary of Procter & Gamble (“P&G”), until her retirement in June 2022. Under Ms. Kool’s leadership as CEO, Tide Cleaners grew from 35 to 191 stores and was ranked 76th in Entrepreneur’s Franchise 500 ranking in 2022, marking the third consecutive year in the top 100. During her 27-year tenure at P&G, Ms. Kool served in a variety of executive leadership roles, including CFO of North America Fabric Care, the largest regional business unit at P&G, with over $8 billion in retail sales, and CFO of the Global P&G Professional business. In addition to her extensive business leadership experience, Ms. Kool was a key member of P&G’s award-winning Investor Relations team, partnering with multiple CEOs and leading the communication for the strategy renewal that spanned two $10 billion productivity programs and a more focused portfolio of strategic brands. Additionally, Ms. Kool led numerous acquisitions, integrations, and business expansions, and navigated Tide Cleaners through the COVID-19 pandemic, growing industry share, opening new stores and overseeing expansion to new campuses. Ms. Kool is also a member of the Board of Directors of Digimarc Corporation, where she chairs the Compensation and Talent Management Committee and serves on the Audit and the Governance, Nominating, and Sustainability Committees. Ms. Kool also serves as a board member and Chief Financial Officer of Sonje Ayiti, a non-profit organization. Ms. Kool received her BA, summa cum laude, in Economics from Kalamazoo College and her MBA from Washington University in St. Louis. The Board has concluded that Ms. Kool possesses specific attributes that qualify her to serve as a member of our Board of Directors, including her extensive senior-level management experience in financial reporting and accounting, investor relations, general business operations, complex business integration, corporate governance, and other public company board service.

Steven R. Mitchell has served on our Board of Directors since August 2009. Mr. Mitchell has served as the Chief Executive Officer of Argonaut Private Capital L.P. since July 2016, prior to which he was the managing director of Argonaut Private Equity, LLC, or Argonaut, since November 2004. Prior to joining Argonaut, Mr. Mitchell was a principal in both Radical Incubation and 2929 Entertainment. He currently serves on the boards of directors of several public and privately owned companies, including Stepstone Group; Alkami Technology, Inc.; S&R Compression, LLC; DMB Pacific, LLC; Downing Wellhead Equipment LLC; The Fred Jones Companies, LLC; JAC Holding Enterprises, Inc.; QRC Valve Distributors LLC; SEF Energy, LLC; Mammoth Carbon Products, LLC; MT Group Holdings, LLC; American Cementing, LLC; McNellies Group LLC; Mark Young Construction, LLC; APE-III (JAC) Inc.; Cypress Environmental Partners, LLC; and Petroplex Acidixing, Inc. From 1996 to 1999, Mr. Mitchell was a corporate attorney at Gibson, Dunn & Crutcher LLP. Mr. Mitchell holds a BBA in Marketing from Baylor University and a JD from University of San Diego School of Law. The Board has concluded that Mr. Mitchell possesses specific attributes that qualify him to serve as a member of our Board of Directors, including his experience building, investing in and growing several manufacturing, technology and product companies and his experience with sophisticated transactions as a corporate attorney. In addition, because Mr. Mitchell has served on many boards of directors, the Board has concluded that he has substantial experience regarding how boards can and should effectively oversee and manage companies, and a significant understanding of governance issues.

14

Mark L. Noetzel has served on our Board of Directors since December 2009. Mr. Noetzel has worked as a consultant to a number of public and private companies since May 2009. From July 2019 to May 2021, he was a Managing Director of Akoya Capital Partners, LLC, working in the specialty chemicals segment. From June 2007 to May 2009, Mr. Noetzel was President and Chief Executive Officer of Cilion, Inc., a biofuels company. Prior to joining Cilion in 2007, he had served in several senior positions at BP plc, including Group Vice President, Global Retail, from 2003 until 2007, Group Vice President, B2B Fuels and New Markets, during 2001 and 2002 and Group Vice President, Chemicals, from 1997 until 2001. Prior to those senior management roles with BP plc, Mr. Noetzel served in other management and non-management roles with Amoco Corporation from 1981 until BP acquired Amoco in 1998. Mr. Noetzel served on the board of directors of Axiall Corporation from September 2009 until Axiall was acquired by Westlake Chemical Corporation in August 2016. Mr. Noetzel served as Chairperson of Axiall from January 2010 to March 2016. Mr. Noetzel also previously served on the board of Siluria Technologies Inc., a privately owned technology company, until May 2019 and on the board of Dixie Chemical Company Inc., also privately owned, from September 2017 to November 2018. Mr. Noetzel holds a BA in Political Science from Yale University and an MBA from the Wharton School at University of Pennsylvania. The Board has concluded that Mr. Noetzel possesses specific attributes that qualify him to serve as a member of our Board of Directors, including more than ten years of experience in senior executive management roles with large, international businesses within the chemical and fuel industries and his experience as chairperson of the board of a public company.

William P. Noglows has served on our Board of Directors since our initial public offering in June 2014 and as chairperson of our Board since February 2019, and previously served on our Board of Directors from January 2011 to April 2013. Mr. Noglows served as Chairperson of the Board of CMC Materials, Inc., formerly known as Cabot Microelectronics Corporation, from November 2003 to August 2022 and as President and Chief Executive Officer from November 2003 until December 2014. Mr. Noglows currently serves on the boards of Littelfuse, Inc. and NuMat Technologies, Inc. From 1984 through 2003, Mr. Noglows served in various management positions at Cabot Corporation, culminating in serving as an executive vice president and general manager. Mr. Noglows had previously served as a director of Cabot Microelectronics from December 1999 until April 2002. Mr. Noglows holds a BS in Chemical Engineering from Georgia Institute of Technology. The Board has concluded that Mr. Noglows possesses specific attributes that qualify him to serve as a member and chairperson of our Board of Directors, including his experience as chief executive officer of a leading public company and his expertise in developing technology. In addition, because Mr. Noglows has served on boards of directors of two other public companies, the Board has concluded that he has significant experience regarding how boards can and should effectively oversee and manage companies, and a significant understanding of governance issues.

James E. Sweetnam has served on our Board of Directors since August 2022. Mr. Sweetnam served as President and CEO, and a member of the board, of Dana Corporation, a Fortune 500 world leader in the design and manufacture of driveline components for light, medium and heavy-duty vehicle manufacturers in the automotive, commercial vehicle and off-highway markets. Previously, he served in various roles of increasing responsibility, including as CEO of Truck Group, at Eaton Corporation, a global, diversified power management company, after serving in a variety of other roles at Eaton Corporation. Prior to joining Eaton, Mr. Sweetnam spent 10 years at Cummins Inc., a diesel and natural gas engine designer, manufacturer, and distributor, where he served as VP, Cummins Engine Company and Group Managing Director of Holset Engineering Co. Ltd., a Cummins subsidiary and manufacturer of turbochargers, headquartered in England. Prior to that, he served as President of Cummins Electronics Company. Mr. Sweetnam has also held management positions with Canadian Liquid Air and engineering positions with Air Products and Chemicals in Allentown, Pennsylvania and São Paulo, Brazil. He presently serves on the board of directors of Republic Airways Holdings, Inc., an airline holding corporation, on which he is a member of its audit and finance committee and its nominating and governance committee. He previously served on the board of directors of SunCoke Energy, Inc., including as chair of its nominating and governance committee and chair of its compensation committee. Mr. Sweetnam received his BS in Applied Science and Engineering from the United States Military Academy, West Point, and his MBA from Harvard Business School. The Board has concluded that Mr. Sweetnam possesses specific attributes that qualify him to serve as a member of our Board of Directors, including his extensive senior-level management experience in general business operations, manufacturing and engineering, his automotive industry experience, and his background in international business development, as well as his service on a number of public company boards.

15

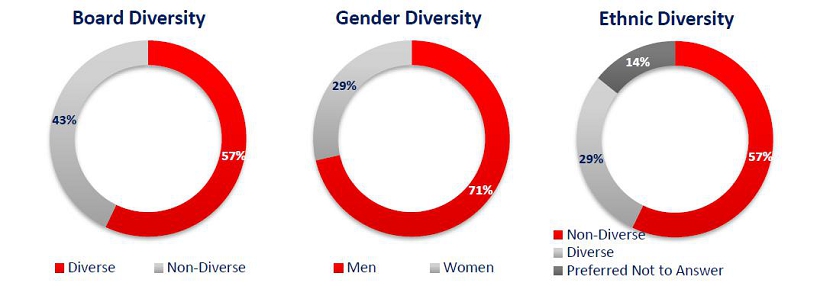

Board of Director Qualifications, Expertise, Attributes and Diversity

In connection with its determination that our current directors should continue to serve on our Board, the Nominating, Governance and Sustainability Committee considered, among other factors, certain skills, expertise and experiences that the Board considers valuable to ensure effective oversight of the Company. During 2023, to better align with the Company’s corporate strategy, each director completed a self-assessment of their skills, expertise and experiences in 25 skills areas across three categories: Industry Experience, Functional Experience and Other Specific Experience. The committee selected a number of categories as “core competencies,” which are summarized in the bullets below. These indicators are intended to be a high-level summary of what the Board views as the core competencies and are not a comprehensive list of each director’s skills or contributions to the Board. The Board believes that the Board possesses these qualifications collectively as a group.

| ● | Manufacturing – Experience scaling up manufacturing significantly and managing large scale projects, including the construction of plants. |

| ● | Other Industry Experience – Experience in the heavy industrial, automotive, energy and/or materials science industry. |

| ● | Strategic Planning and Innovation – Experience setting the mission or vision of a company or function; establishing and implementing the strategic plan to achieve such goals; contributing to transformative innovation, leading to disruptive products and services. |

| ● | Financial / Accounting / Audit – Experience leading or managing the financial function of an enterprise, resulting in proficiency in complex financial management, capital allocation and financial reporting. Experience or expertise in financial accounting and reporting processes or the financial management of a major organization. |

| ● | Information Technology and Cybersecurity – Significant background working in information technology and/or cybersecurity, resulting in knowledge of how to anticipate technological trends, including digital transformation, data governance, information security and development of new business models. Significant expertise and experience in leading information technology and/or cybersecurity functions of an enterprise. |

| ● | Global / International Experience – Experience working within organizations that have a global customer base and/or international presence, lending itself to valuable commercial and cultural perspectives regarding a diverse range of business aspects. |

| ● | Public Company Governance – Experience serving as a director of public company, which enables one to understand the dynamics and operation of a corporate board, the relationship of a public company board to the CEO and other senior management personnel, the legal and regulatory landscape in which public companies must operate, the importance of particular agenda and oversight issues, and how to oversee an ever-changing mix of strategic, operational and compliance-related matters. |

| ● | Leadership Development – Experience leading a significant enterprise, resulting in a practical understanding of organizations, processes, strategic planning and risk management. Demonstrated strengths in developing talent planning succession and driving change and long-term growth. |

| ● | Mergers and Acquisitions – Experience in strategic planning and business development with direct responsibility for and/or overseeing collaborations and deals, including mergers, acquisitions, divestitures, joint ventures and other partnerships, and experience in integrating acquisitions. |

16

Board Diversity

Director Independence

Our Board of Directors has reviewed the materiality of any relationship that each of our directors has with Aspen Aerogels, either directly or indirectly. Based upon this review, our Board has determined that all of our current directors other than Donald R. Young, our President and Chief Executive Officer, are “independent directors” as defined by the New York Stock Exchange. The Board of Directors also determined that Mr. Reilly, who served on the Board during 2023, was independent under the same standard.

Committees of the Board of Directors and Meetings

Meeting Attendance. During the fiscal year ended December 31, 2023, there were eight meetings of our Board of Directors, and the various committees of the Board met a total of 21 times. No director attended fewer than 75% of the total number of meetings of the Board and of committees of the Board on which he or she served during fiscal year 2023. The Board has adopted a policy under which each member of the Board is strongly encouraged but not required to attend each annual meeting of our stockholders. All of our directors attended the annual meeting of our stockholders held in 2023.

Audit Committee. Our Audit Committee met nine times during fiscal year 2023. This committee currently has four members, Kathleen M. Kool (chair), Rebecca B. Blalock, Mark L. Noetzel and James E. Sweetnam. Richard F. Reilly, a former member of our Board of Directors, served as a member and chair of the Audit Committee until June 1, 2023. Our Audit Committee’s role and responsibilities are set forth in the Audit Committee’s written charter and include the authority to retain and terminate the services of our independent registered public accounting firm. In addition, the Audit Committee reviews our annual and quarterly financial statements, considers matters relating to accounting policy and internal controls and reviews the scope of annual audits. All members of the Audit Committee satisfy the current independence standards promulgated by the SEC and by the New York Stock Exchange, as such standards apply specifically to members of audit committees. Our Board of Directors has determined that Ms. Kool is an “audit committee financial expert,” as the SEC has defined that term in Item 407 of Regulation S-K.

In addition to the responsibilities described above, our Audit Committee is authorized to, among other matters:

| ● | appoint and retain the independent registered public accounting firm to conduct the annual audit of our financial statements; |

| ● | review the proposed scope and results of the audit; |

| ● | review accounting and financial controls with the independent registered public accounting firm and our financial and accounting staff; |

17

| ● | review and approve transactions between us and our directors, officers and affiliates; |

| ● | establish and oversee procedures for complaints received by us regarding accounting matters and any other complaints alleging a violation of our Code of Business Conduct and Ethics; |

| ● | oversee internal audit functions; |

| ● | review and evaluate our policies and procedures with respect to risk assessment and enterprise risk management, including cybersecurity; and |

| ● | prepare the report of the Audit Committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

Our Audit Committee meets at least quarterly, typically twice per quarter, and with greater frequency as necessary. The agenda for each meeting is set by the chair of the Audit Committee in consultation with the Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and Corporate Secretary. The Audit Committee meets regularly in executive session. However, from time to time, various members of management, and employees, outside advisors or consultants may be invited by the Audit Committee to make presentations, to provide financial, background information or advice, or to otherwise participate in Audit Committee meetings.

Please also see the report of the Audit Committee set forth elsewhere in this proxy statement.

A copy of the Audit Committee’s written charter is publicly available in the “Investors” section of our website at www.aerogel.com.

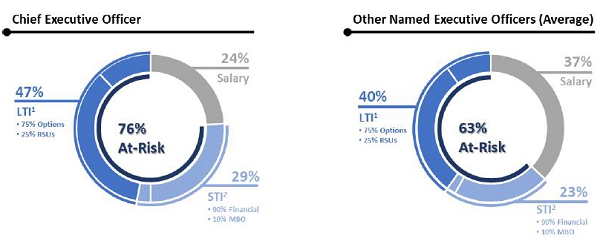

Compensation and Leadership Development Committee. The Compensation and Leadership Development Committee of the Board (the “Compensation Committee”) met eight times during fiscal 2023. This committee currently has four members, Mark L. Noetzel (chair), Steven R. Mitchell, William P. Noglows and James E. Sweetnam. Our Compensation Committee’s role and responsibilities are set forth in its written charter and includes reviewing, approving and making recommendations regarding our compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of the Board of Directors are carried out and that such policies, practices and procedures contribute to our success. Our Compensation Committee also administers our 2023 Equity Incentive Plan (the “2023 Plan”), our employee cash bonus plan and our Compensation Recoupment Policy. The Compensation Committee is responsible for the determination of the compensation of our executive officers other than our Chief Executive Officer. The compensation of our Chief Executive Officer is determined by our Board of Directors upon the recommendation of our Compensation Committee. All members of the Compensation Committee qualify as independent under the definition promulgated by the New York Stock Exchange.

In addition to the responsibilities described above, our Compensation Committee is authorized to, among other matters:

| ● | review and recommend compensation arrangements for management; |

| ● | establish and review general compensation policies with the objective to attract and retain superior talent, to reward individual performance and to achieve our financial goals, as well as to encourage progress in the areas of environmental, social and governance priorities, including employee retention, satisfaction, engagement and attrition rates, and in meeting our stated environmental, social and governance goals and metrics; |

| ● | administer our equity incentive plans; |

| ● | ensure appropriate leadership development and succession planning is in place; |

| ● | oversee the evaluation of management; and |

| ● | if applicable, prepare the report of the Compensation Committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

18

Our Compensation Committee typically meets quarterly and with greater frequency if necessary. The agenda for each meeting is set by the chair of the Compensation Committee in consultation with the Chief Executive Officer, the Corporate Secretary and the Chief Human Resources Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice, or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer does not participate in and is not present during any deliberations or determinations of the Board of Directors or the Compensation Committee regarding his compensation.

The Compensation Committee has the sole authority to obtain, at the expense of the Company, advice and assistance from compensation consultants, legal counsel, experts and other advisors that the Compensation Committee deems advisable in the performance of its duties. The Compensation Committee has the sole authority to approve any such consultants’ or advisors’ fees and other retention terms. The Compensation Committee may select any such consultant, counsel, expert or advisor to the Compensation Committee, only after taking into consideration factors that bear upon the advisor’s independence. The Compensation Committee has engaged Meridian Compensation Partners, LLC (“Meridian”) as its compensation consultant since 2014. The Compensation Committee assessed the independence of Meridian pursuant to SEC and New York Stock Exchange rules and other factors and concluded that Meridian’s work for the Compensation Committee does not raise any conflict of interest nor affect its independence.

Generally, the Compensation Committee’s process involves the establishment of corporate goals and objectives for the current year and determination of compensation levels. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation is conducted by the Compensation Committee, which recommends any adjustments to his compensation levels and arrangements for approval by the Board of Directors. For all executives, as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, total compensation that may become payable to executives in various hypothetical scenarios, executive stock ownership information, Company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels and recommendations of the Compensation Committee’s compensation consultant, if any, including analyses of executive compensation paid at other companies.

For 2023, Meridian assisted the Compensation Committee in fulfilling its responsibilities under its charter, including advising on compensation packages for executive officers, compensation program design and market practices generally. The Compensation Committee authorized Meridian to interact with management on behalf of the Compensation Committee, as needed in connection with advising the Compensation Committee, and Meridian participates in discussions with management and, when appropriate, outside legal counsel with respect to matters under consideration by the Compensation Committee.

A copy of the Compensation Committee’s written charter is publicly available in the “Investors” section of our website at www.aerogel.com.

19