UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————————————

FORM 10-K

———————————————

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2019

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from __________ to __________

Commission File Number 001-38253

(Exact name of registrant as specified in its charter)

———————————————

State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) | |

(Address of principal executive offices, including zip code) | ||

(408 ) 213-3191

(Registrants telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | ||

Non-accelerated filer | ☐ | Smaller reporting company | ||

Emerging growth company | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the registrant on June 28, 2019 (the last business day of the registrant’s most recently completed second fiscal quarter), was approximately $1,492,156,938 based on the closing price of a share of the registrant’s common stock on that date as reported by The NASDAQ Global Market.

As of February 14, 2020, 48,404,973 shares of the registrant’s common stock, $0.001 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the information called for by Part III of this Annual Report on Form 10-K are hereby incorporated by reference where indicated from the definitive proxy statement for the registrant’s annual meeting of stockholders, which will be filed with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year ended December 31, 2019.

FORESCOUT TECHNOLOGIES, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2019

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

Item 16. | ||

3

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “would,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

• | the merger agreement and our proposed acquisition by entities affiliated with Advent International Corporation (“Advent”); |

• | the evolution of the cyberthreat landscape facing enterprises in the United States and other countries; |

• | developments and trends in the domestic and international markets for network security products and related services; |

• | our expectations regarding the size of our target market; |

• | our ability to educate prospective end-customers about our technical capabilities and the use and benefits of our products and to achieve increased market acceptance of our solution; |

• | our beliefs and objectives regarding our prospects and our future results of operations and financial condition; |

• | the effects of increased competition in our target markets and our ability to compete effectively; |

• | our business plan and our ability to manage our growth effectively; |

• | our investment in our sales force and our expectations concerning the productivity and efficiency of our expanding sales force as our sales representatives become more seasoned; |

• | our growth strategy to maintain and extend our technology leadership, expand and diversify our end-customer base, deepen our existing end-customer relationships, and attract and retain highly skilled security professionals; |

• | our ability to enhance our existing products and technologies and develop or acquire new products and technologies; |

• | our plans to attract new end-customers, retain existing end-customers, and increase our annual revenue; |

• | our expectations concerning renewal rates of Software Products subscription contracts, support and maintenance contracts, and software sold as a service (“SaaS”) contracts (collectively known as “term contracts”) with end-customers; |

• | our plans to expand our international operations; |

• | our expectations regarding future acquisitions of, or investments in, complementary companies, services, or technologies; |

• | our ability to continue to generate a significant portion of our revenue from public sector customers; |

• | the effects on our business of evolving information security and data privacy laws and regulations, government export or import controls and any failure to comply with the U.S. Foreign Corrupt Practices Act and similar laws; |

• | our ability to maintain, protect, and enhance our brand and intellectual property; |

4

• | fluctuations in our results of operations and other operating measures; |

• | our expectations regarding changes in our cost of revenue, gross margins, and operating costs and expenses; |

• | our expectations regarding the portions of our revenue represented by license revenue, subscription revenue, and professional services revenue; |

• | our expectations concerning the impact on our results of operations of development of our distribution programs and sales through our channel partners; |

• | the impact on our revenue, gross margin, and profitability of future investments in the enhancement of Forescout eyeSight, Forescout eyeSegment Forescout eyeControl, Forescout eyeExtend, SilentDefense, and SilentDefense Command Center, and expansion of our sales and marketing programs; |

• | the impact of the Tax Cuts and Jobs Act on our business; |

• | our ability to successfully acquire and integrate companies and assets; |

• | sufficiency of our existing liquidity sources to meet our cash needs; and |

• | our potential use of foreign exchange forward contracts to hedge our foreign currency risk and our general use of our foreign currency. |

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, operating results, cash flows, or prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors, including, but not limited to, those described in the section titled “Risk Factors” in Part I, Item 1A and elsewhere in this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K. We cannot assure you that the results, events, and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements. You should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments we may make.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed with the Securities and Exchange Commission as exhibits to this Annual Report on Form 10-K with the understanding that our actual future results, levels of activity, performance, and events and circumstances may be materially different from what we expect.

5

PART I

ITEM 1. BUSINESS

Overview

Forescout Technologies, Inc. (“Forescout”) is the leading provider of device visibility and control solutions. We have pioneered an agentless approach to device visibility and control that provides one of the most comprehensive, real-time identification, classification, assessment and continuous control over the devices, that collectively, comprise an organization’s network. This network extends across the campus information technology (“IT”) devices, the campus Internet of Things (“IoT”) devices, operational technology (“OT”) devices, the data center, and within the third-party cloud. The devices that comprise this vastly heterogeneous and flat (non-segmented) network are continuously monitored for purposes of taking real-time control action when those devices behave in a manner outside of established policies. Through continuous visibility and control over the devices, each of which is an entry point for malware to enter and for corporate and customer information to exit, we protect organizations against the emerging threats that exploit the billions of devices connected to organizations’ networks. Over 40 billion devices will be connected to the Internet by 2023, according to data published by ABI Research*, and a growing percentage of them will be used for business purposes through Enterprise IoT initiatives. In addition, in its Top Strategic IoT Trends and Technologies Through 2023 report (September 2018), Gartner, Inc. estimates that, by 2023, the average CIO will be responsible for more than three times the devices they managed in 2018.**

IoT devices often bring tremendous value to an organization and OT devices are fundamental to an organizations’ infrastructure and revenue generation. As such, the percentage of the network that is comprised of these devices will continue to increase, and, as evidenced by trends emerging in many of our end-customers’ organizations, will actually surpass, in quantity, the number of devices that are secured using the traditional approach of relying on a corporate-installed security software agent. Given that IoT devices, OT devices, and virtual devices within a third-party cloud provider cannot be adequately secured with the traditional approach of relying on a corporate-installed security software agent on those devices, organizations are faced with a major gap in device visibility and lack of control over a significant portion of their network. Also contributing to that gap are the wide varieties of platforms and operating systems on these devices that are something other than Microsoft Windows, UNIX or LINUX operating systems commonly found on traditional corporate-owned, IT managed devices.

The threat landscape is rapidly evolving, and attackers are now leveraging the gap in device visibility to gain access to organizations. New attacks are stealthy, targeted, and pervasive and can target known and unknown software vulnerabilities that can persist undetected inside a network for months. As organizations invest billions of dollars to protect their traditional devices, servers, network infrastructure, mobile systems, and personal computers, attackers are shifting their focus to the less secure IoT and OT devices, which have increased the attack surface within organizations. Attackers use these unsecured devices and a lack of IT control to enter a network and traverse through systems, gathering information before executing an attack. The response to such attacks is often both uncoordinated and manual because existing security systems operate in silos and security teams often lack the ability to share information and coordinate an attack response. Further compounding this issue is the continued trend of IT/OT network convergence, in which previously air-gapped OT networks are physically connected to traditional IT networks, exposing operational technologies and critical infrastructure to potential threats.

Organizations need a new approach to security that gives them the ability to see and control the devices connected to their extended networks. Over the past ten years, Forescout has developed proprietary agentless technology that discovers and classifies IP-based devices in real time as they connect to the network and continuously monitors and assesses their security posture. Our solution supports heterogeneous wired and wireless networks, typically without requiring network modification or upgrades, as well as both virtual and cloud infrastructures, while scaling to meet the needs of globally distributed organizations. We have built an extensive repository of policies that control how devices are expected to behave on the network. When a device deviates from a policy, we can immediately take action. Additionally, we offer integrations with third-party systems that expand upon our visibility and control capabilities and allow us to share contextual device data and deliver automatic policy enforcement between our system and the third-party systems. This is enforcement that neither our solution nor the third-party solution could do individually. Collectively, we refer to this as our orchestration capabilities.

Our solution is sold across two product groups: (i) products for visibility and control capabilities, and (ii) products for orchestration capabilities. Typically, end-customers initially deploy our solution in a portion of their campus IT and IoT network or in a portion of their OT network. Because our solution is agentless and supports heterogeneous network infrastructure, end-

6

*ABI Research, Internet of Everything Market Tracker, QTR 1, 2019.

**Gartner, Inc., Top Strategic IoT Trends and Technologies Through 2023, Nick Jones, September 2018. The Gartner Report(s) described herein, (the "Gartner Report(s)") represent(s) research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. ("Gartner"), and are not representations of fact. Each Gartner Report speaks as of its original publication date (and not as of the date of the Filing and the opinions expressed in the Gartner Report(s) are subject to change without notice.

customers experience rapid deployment of the Forescout platform including compliance assessment of their devices within days. They then apply these detailed visibility insights to various access control policies. Anecdotally, an end-customer might begin in a specific region in their wired or wireless network within their campus IT and IoT network, for example - then expand their usage to cover additional regions and other portions of their network. After end-customers achieve enhanced visibility of and control over their devices, and before they have completed their wall-to-wall deployment in any specific portion of the network, they can deploy new use cases that often leverage our orchestration capabilities on that portion of the network.

We sell into organizations of all sizes, with a focus on those with a large footprint of devices. Our end-customers represent a broad range of industries, including financial services, government, healthcare, technology, manufacturing, services, energy, entertainment, and retail. We target the largest accounts in each industry first to establish reference accounts for that sector. As of December 31, 2019, we have sold to more than 3,700 end-customers in over 90 countries, including 25% of the Global 2000, since our inception, with nearly 80 million devices under management. We utilize a high-touch direct sales force with deep security expertise and strong industry relationships. We sell our products predominantly through a network of value added resellers and systems integrators that provide a broad reach into various segments of the market across geographies.

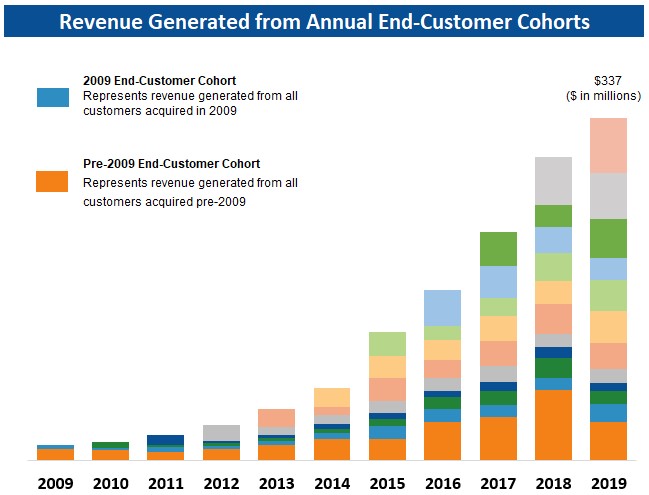

We have experienced rapid growth in recent periods. For the years ended December 31, 2019, 2018, and 2017, our revenue was $336.8 million, $297.7 million, and $224.4 million, respectively, representing year-over-year growth of 13% and 33%, respectively. For the years ended December 31, 2019, 2018, and 2017, our net loss was $118.5 million, $74.8 million, and $80.7 million, respectively.

Proposed Merger

On February 6, 2020, we entered into an Agreement and Plan of Merger (the ”Merger Agreement”) with Ferrari Group Holdings, L.P., a Delaware limited partnership (“Parent”), and Ferrari Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”). Parent and Merger Sub are affiliates of Advent.

The Merger Agreement provides that, subject to the terms and conditions set forth in the Merger Agreement, Merger Sub will merge with and into Forescout (the “Merger”), with Forescout surviving the Merger and becoming a wholly-owned indirect subsidiary of Parent (the “Surviving Corporation”). Under the Merger Agreement, at the effective time of the Merger, each issued and outstanding share of our common stock (except for certain shares specified in the Merger Agreement) will be canceled and automatically converted into the right to receive cash in an amount equal to $33.00, without interest.

Consummation of the Merger is subject to the satisfaction or waiver of customary closing conditions, including (1) approval of the Merger Agreement by our stockholders; (2) the absence of any law or order restraining, enjoining or otherwise prohibiting the Merger; and (3) the expiration or termination of the waiting period under the United States Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and clearance under the antitrust laws of certain non-United States jurisdictions. The Merger is expected to close in the second fiscal quarter of 2020. Upon consummation of the Merger, our common stock will no longer be listed on any public market.

Our Growth Strategy

We intend to execute on the following growth strategies:

• | Expand within our existing end-customers as more devices enter the enterprise and as we expand to new parts of their network. We expect to grow within our end-customer base as more devices come online within the enterprise. Our license revenue and the SaaS portion of our subscription revenue, are directly tied to the number of licensed devices managed by our solution; therefore, we sell more product as more devices come online. End-customers often expand usage of our products as they realize the value and applicability to other areas within an organization. We expect to grow as our end-customers extend their use of our solution across campus IT and IoT portions of the network which are characterized as wired networks and wireless networks (remote and visitor devices), the operational technology portion of the network, the on-premise data center portion of the network, and the portion of their network that is now hosted by a third-party cloud provider. As of December 31, 2019, we had sold products with licenses covering nearly 80 million devices, 19% (or approximately 15 million) of those device licenses were purchased during the year ended December 31, 2019. |

7

• | Grow global end-customer base. We have invested significantly, and plan to continue to invest, in our sales organization to drive new end-customer growth. During the year ended December 31, 2019, we added more than 400 new customers, of which approximately 80 are identified in the list of Global 2000. We now count six of the top 10 financial services companies, five of the top 10 manufacturing companies, numerous large healthcare companies and 12 of the 14 civilian cabinets within the United States federal government as customers that are standardizing with Forescout for device visibility and control. |

• | Increase sales of our eyeExtend family of products. We are seeing strong demand for our eyeExtend family of products as end-customers are realizing the value of the orchestration capabilities enabled with these integration modules. As of December 31, 2019, 31% of our end-customers have purchased at least one product in our eyeExtend family of products, up from 27% as of December 31, 2018. During the year ended December 31, 2019, nearly 40% of product deals included at least one product in our eyeExtend family of products, up from one-third of product deals during the year ended December 31, 2018. As of December 31, 2019, we had a portfolio of over 20 products in our eyeExtend family of products. We have also established an Alliance Partner program that allows us to productize these integrations and leverage joint go-to-market efforts. |

• | Expand our presence in the market by leveraging our ecosystem of channel partners. We will continue to broaden and invest in our value added and system integrator channel partner relationships to increase distribution of our products. We are focused on educating existing partners and investing in sales enablement to expand our market reach through our channel partner network, particularly into mid-market enterprises. |

Our Products

We offer our solution across two product groups: (i) products for visibility and control capabilities and (ii) products for orchestration capabilities.

• | Our products for visibility and control capabilities are comprised of eyeSight, eyeSegment, eyeControl, and SilentDefense. Our eyeSight, eyeSegment, and eyeControl products provide for visibility and control capabilities across the extended enterprise, from campus to data center to hybrid cloud to OT devices, while our SilentDefense product provides for visibility and control capabilities deeper within the OT portion of the network. Our agentless technology discovers, classifies, and assesses IP-based devices. It interrogates the network infrastructure to discover devices immediately as they attempt to connect to the network. Since it does not rely on agents, our end-customers have reported seeing up to 60% more devices on their networks than previously known. After discovering a device, our solution uses a combination of active and non-disruptive passive methods to classify the device based on its type and ownership. Based on its classification, our solution then assesses the device security posture and allows organizations to set policies that establish the specific behavior the device is allowed to have while connected to a network. The connected devices on these vastly heterogeneous and flat (non-segmented) networks are continuously monitored for purposes of taking real-time control action when those devices behave in a manner outside of established policies. Control actions vary, based on our customers’ preferences, and include blocking a device from accessing the network, establishing a Virtual Local Area Network (“VLAN”) that limits access on the network, and sending alerts of non-compliance. |

• | Our products for orchestration capabilities are comprised of our portfolio of eyeExtend products. Our eyeExtend products represent integrations with vendors across nine categories: advanced threat detection, client management tools, enterprise mobility management, endpoint protection, detection and response, IT Systems Management, next-generation firewall, privileged access management, security information and event management and vulnerability assessment. Additionally, end-customers can create their own integrations using our Open Integration Module or utilize our Advanced Compliance Module for security content automation protocol. |

• | Advanced Threat Detection (“ATD”): The combined solution automatically detects indicators of compromise (“IOCs”) and quarantines infected devices, thereby limiting malware propagation and breaking the cyber kill chain. |

• | Client Management Tools (“CMT”): The combined solution provides visibility and control of devices while they’re off the enterprise network. |

8

• | Enterprise Mobility Management (“EMM”): The combined solution facilitates unified security policy management for mobile devices. |

• | Endpoint Protection, Detection and Response (“EPP/EDR”): The combined solution verifies device compliance for functional antivirus, up-to-date signatures, encryption and other endpoint policies and facilitates remediation actions. |

• | IT Service Management (“ITSM”): The combined solution provides up-to-date device properties, classification, configuration and network context to help true-up assets in a configuration management database (“CMDB”), improve asset compliance, and maintain a trusted single-source-of-truth repository for better decision-making. |

• | Next Generation Firewall (“NGFW”): The combined solution uses real-time situational awareness about devices to implement dynamic network segmentation, automate controls for secure access to critical resources and create context-aware security policies within industry-leading next-generation firewalls. |

• | Privileged Access Management (“PAM”): The combined solution provides real-time agentless visibility into undiscovered local privileged accounts and automated responses to threats based on holistic visibility into user activity, device security posture, incident severity, and overall threat exposure. |

• | Security Incidence and Event Management (“SIEM”): The combined solution improves situational awareness and mitigates risks using advanced analytics and comprehensive device information, including IoT classification and assessment context for correlation and incident prioritization. |

• | Vulnerability Assessment (“VA”): The combined solution ensures devices be added to the network for the first time or ones rejoining the network (such as mobile devices) meet defined vulnerability compliance thresholds. Additionally, the solution automates policy-based enforcement actions. |

• | Open Integration Module (“OIM”): Allows end-customers, systems integrators and technology vendors to integrate custom applications, security tools and management systems with our platform. |

• | Advanced Compliance Module for Security Content Automation Protocol (“SCAP”): Automates on-connect and continuous device configuration assessment to comply with standards-based security benchmarks and content published in the SCAP format. |

We offer our solution across two product types: software products and hardware products

• | Our software products include eyeSight, eyeSegment, eyeControl, eyeExtend, SilentDefense, and SilentDefense Command Center (“Software Products”). |

• | Our hardware products include hardware that is sold separately for use with our Software Products and appliances that are embedded with our software (“Hardware Products”). |

We offer our solution across license types and increments

• | Our products are sold with a perpetual license or a subscription license. |

• | End-customers can purchase in license increments of 100 devices, with hardware sold separately based on end-customer deployment requirements. End-customers can manage their deployments of our products in various options which are capable of scaling and managing deployments of up to 2,000,000 devices under a single console. End-customers can purchase our SilentDefense products in license increments that are on a per sensor basis. |

Our Technology

The key technologies underlying our platform have been built from the ground up to address the device visibility and control challenges of today. Our foundational technologies are: (i) agentless data collection, (ii) an adaptive abstraction layer, (iii) a real time and continuous policy engine, and (iv) distributed and scalable architecture. We have invested over ten years of research and development into our technology and believe it represents a significant competitive advantage for us.

9

Agentless data collection. Our software uses a combination of both active and passive methods to discover, classify, and assess devices in an organization’s network. Utilizing active discovery methods, we can poll switches, VPN concentrators, and wireless controllers for a list of connected devices. Using NBT scans and NMAP, or via WMI for deeper inspection of corporate-managed devices, we can inspect workstations running Windows, Mac, or Linux, without the use of agents. We also deploy passive inspection methods that allow our appliances to receive SNMP traps from switches and wireless controllers, monitor a network SPAN port to see network traffic, and leverage information such as TCP window sizes, session information, HTTP traffic, and DHCP information banners as well as NetFlow traffic data. If 802.1x is implemented, our technology can authenticate 802.1x requests to a built-in or external RADIUS server, and authorize network access. In addition, our technology can import external MAC classification data or request LDAP data. Power over Ethernet (PoE) is an additional method available.

Adaptive abstraction layer. Our abstraction layer is able to ingest billions of packets of raw data across a wide array of heterogeneous network systems. We then consolidate this data into a single pane of glass showing our end-customers a real-time depiction of the devices on their networks by type. Our solution does not require vendor-specific network equipment, upgrades of existing infrastructure, or reconfiguration of each switch and switch port to support 802.1x. As organizations adopt virtual and cloud environments, our technology has the flexibility to integrate with hypervisor technologies and cloud platforms.

The abstraction layer adapts to the IT enterprise environment and continuously enriches its information as organizations make more data available. As an example, organizations can choose to consume only NetFlow data, which is only the metadata of the actual network traffic. With this information, our solutions expedite detection of new devices, collects device properties such as IP address and session protocols, and understands which devices are talking to each other. If organizations choose to give our technology full access to their network traffic through a SPAN port, we can build on this and provide very granular information such as MAC address, HTTP user agent, device type, applications in use, and the ability to identify malicious traffic.

Real-time and continuous policy engine. Our policy engine continuously checks devices against a set of policies that control how devices are expected to behave on the network. While other vendor technologies rely on periodic checks, or queries from an operator, our policy engine can do this continuously and in real-time for over two million devices. Our policies are triggered in real-time based on events occurring on a specific device. These can be network admission events, such as plugging into a switch port or change of IP address, authentication events like those received by RADIUS servers or detected by network traffic, changes in device attributes like user, opening/closing of ports, and specific traffic behavior such as how the device is communicating and what protocol it is using.

The policy engine leverages both infrastructure and host-based controls. At the network switch, our technology can change a Virtual Local Area Network (“VLAN”), add an Access Control List (“ACL”), or disable a switch port. At a wireless controller, we can blacklist a MAC address or change the role of a user. In addition, our technology can restrict remote VPN users. At the host, our technology can start and stop applications, update anti-virus security agents, disable peripheral devices, and request end-user acknowledgment. The policy engine applies these policies automatically regardless of a device’s location. As the device moves, the policy engine can follow it within the corporate network, cloud, or data center. We determine the type of infrastructure and, based on policy, apply the appropriate control actions.

Distributed, scalable architecture. Our console uses distributed computing algorithms to virtually consolidate the device information into a single pane of a glass view for the administrator. The algorithms allow the administrator to search for security related information such as users, processes, and services across the entire deployment in real time, and retrieve it in seconds.

Our Services

End-customers typically purchase maintenance and professional services when they purchase one or more of our products. Our support and maintenance contracts typically have a one-year or three-year term, but can be up to five years. We offer a portfolio of professional services and extended support contract options to assist with additional deployment and ongoing advanced technical support.

Maintenance and Support Services

We offer technical maintenance and support for our solution to our end-customers. We provide multiple levels of maintenance and support, including advanced-level support for coverage 24 hours a day, seven days a week on a global basis. Our end-customers receive post-sale support through online portals, email and telephone, managed by a single point of contact.

10

Professional Services

We offer professional services to end-customers to help them design, plan, deploy, and optimize our solution. We also provide training on solution administration and emerging security best practices. Our certified channel partners also provide professional services for our products.

Our Customers

Since our inception, we have sold to more than 3,700 end-customers in over 90 countries, including 25% of the Global 2000, with nearly 80 million devices under management. We sell into all industries and into organizations of all sizes, including corporations and government agencies. Our end-customers generally purchase from distributors and/or VARs.

Sales and Marketing

Sales

We deploy a direct-touch channel-fulfilled strategy. Our customer acquisition sales cycle is typically nine to 24 months, depending on the industry and size and scope of deployment. Our expansion sales cycle is typically three to 12 months, as our customers buy more licenses to cover the additional devices that enter their network after their initial purchase and as we expand into other parts of their network, generally into their other campus environments or beyond campus and into OT, data center and cloud. We have a direct field sales team and a dedicated team focused on managing relationships with our channel partners and working with our channel partners to support our end-customers. We expect to continue to grow our sales headcount in areas of highest demand for our solution. Generally, our sales representatives become more productive the longer they are with us, with limited productivity in their first few quarters as they learn to sell our products and participate in field training, but with increasing productivity as they acquire accounts and as those accounts begin their expansion purchases for additional devices, additional parts of their network and orchestration capabilities. As of December 31, 2019, 38% of our sales representatives have been with us for more than two years, down from 50% as of December 31, 2018.

Our sales team is supported by sales engineers with deep technical expertise who are responsible for pre-sales technical support, solutions engineering for our end-customers, proof of concept work and technical training for our channel partners.

Marketing

Our marketing efforts are focused on building brand reputation and awareness to generate customer demand and build a strong sales pipeline, working in conjunction with our channel partners around the globe. Our team consists of corporate marketing, product marketing, partner marketing, field and digital marketing, account and lead development, operations, social media, public relations, and corporate communications. Marketing activities include demand generation, managing our corporate website and partner portal, trade shows and conferences, press, and analyst relations. Our sales development representatives also qualify sales leads and facilitate face-to-face meetings with potential customers. We actively drive thought leadership and tell our technology story by engaging industry analysts and top journalists at business and trade publications, as well as direct to customers via social media and other digital marketing channels.

Partner Ecosystem

We actively foster and develop our partner ecosystem to find and work with high quality partners who provide our solution to end-customers. Our sales force and strategic alliance group are responsible for cultivating these partnerships to establish new opportunities for delivering our solution to new and existing end-customers.

Channel Partners

We leverage the global breadth and reach of the channel ecosystem, including value-added resellers and distributors, to fulfill orders and sell to our mid-market end-customers. We dedicate significant resources to building in-depth relationships with our channel partners, including marketing, technical, and sales support to assist in jointly sourcing and closing sales opportunities.

Alliances Partners

We have established an Alliance Partner program that allows us to productize technical integrations with third-party security vendors and leverage joint go-to-market efforts.

11

Research and Development

We invest substantial resources in research and development to consistently enhance features and capabilities of our solution. Our research and development teams are located in Tel Aviv, Israel; San Jose, California; Eindhoven, The Netherlands; and Dallas, Texas. We plan to continue to significantly invest in resources to conduct our research and development effort.

Competition

We operate in the intensely competitive security market that is characterized by constant change and innovation. The threat landscape is growing faster than the security market, drawing new providers and new functionality from existing providers to address dynamic threat vectors. We compete with security providers in the following categories:

• | the large networking vendors, Cisco and HP Enterprise Company; and |

• | independent security vendors that offer products that perform some of the functions of our solution. |

The principal competitive factors in our market include:

• | effectiveness; |

• | features and functionality; |

• | global support capabilities; |

• | scalability and overall performance; |

• | time to value; |

• | integration capabilities with heterogeneous network infrastructure and security tools; |

• | brand awareness and reputation; |

• | strength of sales and marketing efforts; |

• | size and scale of organization; |

• | price and total cost of ownership; and |

• | customer return on investment. |

We believe we compete favorably with our competitors on the basis of these factors as a result of the features and performance of our solution, the ease of integration of our products with network infrastructure, and the breadth of our capabilities. However, many of our competitors have substantially greater financial, technical and other resources, greater name recognition, larger sales and marketing budgets, deeper customer relationships, broader distribution, and larger and more mature intellectual property portfolios.

Manufacturing

We outsource the final assembly of the off-the-shelf-Dell-components that comprise the hardware that is sold separately along with our software, or which has our software embedded, to a single third-party contract manufacturer, Arrow Electronics, Inc. (“Arrow”). This approach allows us to reduce our costs by decreasing our manufacturing overhead and inventory and also allows us to adjust more quickly to changing end-customer demand. Arrow assembles our product using design specifications, quality assurance programs and standards that we establish, and it procures components and assembles our products based on our demand forecasts. These forecasts represent our estimates of future demand for our products based on historical trends and analysis from our sales and product management functions as adjusted for overall market conditions.

We have entered into a written agreement with Arrow pursuant to which Arrow provides its contract manufacturing services. This agreement continues in effect until either party terminates, with or without cause, by giving 90 days prior written notice.

12

Seasonality and Backlog

We experience seasonality in our business, with sales generally stronger in our third and fourth fiscal quarters. For this reason, we do not believe that our product backlog at any particular time is meaningful because it is not necessarily indicative of future revenue in any given period as such orders may be rescheduled by our partners without penalty or delayed due to inventory constraints.

Intellectual Property

Our success depends in part upon our ability to protect our core technology and intellectual property. We rely on, among other things, patents, trademarks, copyrights, and trade secret laws, confidentiality safeguards and procedures, and employee non-disclosure and invention assignment agreements to protect our intellectual property rights. We have twelve U.S-issued patents, which expire between July 26, 2028 and December 26, 2037, 28 patent applications pending in the United States, and 21 pending foreign counterpart patent applications in a non-U.S. jurisdiction. We also have 24 issued foreign counterparts of these patents. We also license software from third parties for integration into our products, including open source software and other software available on commercially reasonable terms.

We control access to and use of our proprietary software, technology and other proprietary information through the use of internal and external controls, including contractual protections with employees, contractors, end-customers, and partners, and our software is protected by U.S. and international copyright, patent, and trade secret laws. In addition, we intend to expand our international operations and effective patent, copyright, trademark, and trade secret protection may not be available or may be limited in foreign countries.

See the section titled “Risk Factors—Failure to protect our proprietary technology and intellectual property rights could substantially harm our business and results of operations” for additional information.

Employees

As of December 31, 2019, we had 1,217 employees, including 1,206 full-time employees.

None of our employees are represented by a labor organization or are a party to any collective bargaining arrangement. None of our employees located in France, Spain, Germany and The Netherlands are currently covered by industry-wide collective bargaining agreements. We have never had a work stoppage, and we consider our relationship with our employees to be good.

13

Corporate Information

We were incorporated in Delaware in April 2000. We completed our initial public offering (“IPO”) in October 2017 and our common stock is listed on The NASDAQ Global Market. Our principal executive offices are located at 190 West Tasman Drive, San Jose, California 95134. Our main telephone number is (408) 213-3191.

Several trademarks and trade names appear in this prospectus. “Forescout” and “CounterACT” are the exclusive properties of Forescout Technologies, Inc., are registered with the U.S. Patent and Trademark Office, and may be registered or pending registration in other countries. Other trademarks, service marks, or trade names appearing in this Annual Report on Form 10-K are the property of their respective owners.

Our website address is located at www.forescout.com, and our investor relations website is located at http://investors.forescout.com/investor-relations. Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, are available, free of charge, on our investor relations website as soon as reasonably practicable after we file such material electronically with or furnish it to the Securities and Exchange Commission (the “SEC”). The SEC also maintains a website that contains our SEC filings. The address of the site is www.sec.gov.

We also use our website and the investor relations page on our website as channels of distribution for important company information. Important information, including press releases, analyst presentations and financial information regarding us, as well as corporate governance information, is routinely posted and accessible on our investor relations website and social media. It is possible that the information that we post on social media could be deemed to be material information. Therefore, we encourage investors, the media and others interested in us to review the information we post on U.S. social media channels listed on the investor relations page on our website. Information contained on, or that can be accessed through, our website or social medial sites does not constitute part of this Annual Report on Form 10-K or any other report or document we file with the SEC, and any references to our website and social media sits are intended to be inactive textual references only.

14

ITEM 1A. | RISK FACTORS |

You should carefully consider the following risks and uncertainties described below, together with all of the other information contained in this Annual Report on Form 10-K, including the sections titled “Special Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes. Any of the risks, if realized, could have a material adverse effect on our business, results of operations, prospects, and financial condition, and could cause the trading price of our common stock to decline, which would cause you to lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or deemed to be material by us may impair our operations and performance.

Risks Related to the Merger

The announcement and pendency of our agreement to be acquired by Advent could adversely affect our business.

On February 6, 2020, we announced that we had entered into a definitive agreement to be acquired by entities affiliated with Advent. Uncertainty about the effect of the proposed Merger on our end-customers, employees, partners, and other parties may adversely affect our business. Our employees may experience uncertainty about their roles or seniority following the Merger. There can be no assurance that our employees, including key personnel, can be retained, or that we will be able to attract and retain employees to the same extent that we have previously been able to. Any loss or distraction of such employees could adversely affect our business and operations. In addition, we have diverted, and will continue to divert, significant management resources toward the completion of the Merger, which could adversely affect our business and operations. Parties with which we do business may experience uncertainty associated with the Merger, including with respect to current or future business relationships with us. Uncertainty may cause customers to refrain from doing business with us, which could adversely affect our business, results of operations and financial condition.

The failure to complete the Merger could adversely affect our business.

Consummation of the Merger is subject to several conditions beyond our control that may prevent, delay, or otherwise adversely affect its completion, including our need to obtain stockholder approval of the Merger. If any of these conditions are not satisfied or waived, it is possible that the Merger will not be consummated in the expected time frame (or at all) or that the definitive agreement may be terminated. If the proposed Merger is not completed, the share price of our common stock may decrease to the extent that the current market price of our common stock reflects an assumption that a transaction will be completed. In addition, under circumstances specified in the Merger Agreement, we may be required to pay a termination fee of $55.8 million to Advent. Further, a failed transaction may result in negative publicity and a negative impression of us in the investment community. Any disruption to our business resulting from the announcement and pendency of the transaction and from intensifying competition from our competitors, including any adverse changes in our relationships with our customers, employees, partners and other parties, could continue or accelerate in the event of a failed transaction. There can be no assurance that our business, relationships with other parties, liquidity or financial condition will not be adversely affected, as compared to the condition prior to the announcement of the Merger, if the Merger is not consummated.

While the Merger is pending, we are subject to business uncertainties and contractual restrictions that could harm our operations and the future of our business or result in a loss of employees.

Pursuant to the terms of the Merger Agreement with Advent, we are subject to certain restrictions on the conduct of our business. These restrictions generally require us to conduct our businesses in the ordinary course, consistent with past practice, and subject us to a variety of specified limitations, including the ability in certain cases to enter into material contracts, acquire or dispose of assets, incur indebtedness or incur capital expenditures, until the proposed Merger becomes effective or the Merger Agreement terminates. These restrictions, which are standard for a transaction of this type, may inhibit our ability to take actions outside of the ordinary course of our business that are inconsistent with our past practice but which we may consider advantageous and limit our ability to respond to future business opportunities and industry developments that may arise during such period. The pendency of the Merger may also divert management’s attention and our resources from ongoing business and operations. Our end-customers, employees, partners, and other parties may have uncertainties about the effects of the Merger. In connection

15

with the Merger, it is possible that some customers and other persons with whom we have a business relationship may delay or defer certain business decisions or might decide to seek to terminate, change or renegotiate their relationship with us as a result of the Merger. If any of these effects were to occur, it could materially and adversely impact our business, cash flow, results of operations or financial condition, as well as the market price of our common stock and our perceived Merger value, regardless of whether the Merger is completed. In addition, whether or not the Merger is completed, while it is pending we will continue to incur costs, fees, expenses and charges related to the Merger, which may materially and adversely affect our financial condition.

The Merger Agreement limits our ability to pursue alternatives to the Merger.

The Merger Agreement contains provisions that make it more difficult for us to enter into alternative transactions. The Merger Agreement contains certain provisions that restrict our ability to, among other things, solicit, initiate or knowingly encourage or knowingly facilitate the submission of inquiries, proposals or offers relating to or that would reasonably be expected to lead to any acquisition proposal from a third party. The Merger Agreement also provides that our board of directors will not change its recommendation that our stockholders adopt the Merger Agreement and will not approve any agreement with respect to an acquisition proposal, subject to limited exceptions.

In addition, upon adoption of the Merger Agreement by our stockholders, our right to terminate the Merger Agreement in response to a superior proposal will be eliminated. While we believe these provisions are reasonable, customary and not preclusive of other offers, the provisions might discourage a third party that has an interest in acquiring all or a significant part of us from considering or proposing such acquisition, even if such party were prepared to pay consideration with a higher per-share value than the currently proposed merger consideration. Furthermore, the requirement to pay a termination fee under certain circumstances may result in a third party proposing to pay a lower per-share price to acquire us than it might otherwise have proposed to pay because of the added expense of the $55.8 million termination fee that may become payable by us in certain circumstances.

Litigation may arise in connection with the Merger, which could be costly, prevent consummation of the Merger, divert management’s attention and otherwise materially harm our business.

Regardless of the outcome of any future litigation related to the Merger, such litigation may be time-consuming and expensive and may distract our management from running the day-to-day operations of our business. The litigation costs and diversion of management’s attention and resources to address the claims and counterclaims in any litigation related to the Merger may materially adversely affect our business, results of operations, prospects, and financial condition. If the Merger is not consummated for any reason, litigation could be filed in connection with the failure to consummate the Merger. Any litigation related to the Merger may result in negative publicity or an unfavorable impression of us, which could adversely affect the price of our common stock, impair our ability to recruit or retain employees, damage our relationships with our end-customers, manufacturers and other third-party providers, or otherwise materially harm our operations and financial performance.

Risks Related to Our Business

As a result of recent changes in our market, sales organization, and go-to-market strategy, our ability to forecast our future results of operations and plan for and model future growth is limited and subject to a number of uncertainties.

Although we were founded in 2000 and launched CounterACT in 2006, much of our growth has occurred in recent periods. Our growth reflects a number of macro changes impacting the cyber security market, particularly through the growth of unsecured IoT devices within the campus and on-premise data center portions of organizations’ networks, the emerging awareness that the OT devices represent significant portions of many organizations’ networks that are unsecured and are connected to the IT part of the network and the shift of application payloads from on-premise data centers into third-party cloud providers thus extending the IT part of an organization’s network into a third-party network for which visibility and control over those virtual devices is very limited. To address this demand, we have made substantial investments in our sales force. As a result of these recent changes in our market, sales organization and go-to-market strategies, coupled with our limited operating history, our ability to forecast our future results of operations and plan for and model future growth is limited and subject to a number of uncertainties. We have encountered, and will continue to encounter, risks and uncertainties frequently encountered by rapidly growing companies in developing markets. If our assumptions regarding these risks and uncertainties are incorrect or change in response to developments in the security market, our results of operations and financial results could differ materially from our plans and forecasts. If we are unable to achieve our key objectives, our business and results of operations will be adversely affected and the fair market value of our common stock could decline.

16

Our revenue growth rate in recent periods may not be indicative of our future performance.

Our revenue growth rate in recent periods should not be viewed as an indication of our future performance. For the years ended December 31, 2019, 2018, and 2017 our revenue was $336.8 million, $297.7 million, and $224.4 million, respectively, representing year-over-year growth of 13% and 33%, respectively. We may not achieve similar revenue growth rates in future periods. Factors that could impact our ability to increase our revenue include continued retention and sales to existing end-customers, extending the reach of our sales force footprint, and increasing the efficiency by which our sales force engages our end-customers. If we are unable to maintain consistent revenue or revenue growth, our stock price could experience volatility, and our ability to achieve and maintain profitability could be adversely affected.

In addition, beginning in 2019, we embarked on the first phases of a change in our go-to-market strategy by beginning to transition our business model from licensing our products on a perpetual basis toward term-based licensing and software-as-a-service offerings. Over time, we expect that we will transition further to a subscription license model. This transition may give rise to a number of risks, and if we do not successfully execute this transition, our business and future operating results could be adversely affected. In particular, we generally recognize perpetual license revenues upfront, while we recognize term-based and software-as-a-service offerings ratably over the term of the agreement. At the beginning of each period, we cannot predict the ratio of orders with revenues that will be recognized upfront and those with revenues that will be recognized ratably that we will enter into during the quarter, which makes it difficult for us to predict the amount of revenue we will be able to recognize in any quarter. Our operating margins, cash flows and other operating results and our business model could also be significantly impacted by shifts over time in the relative percentage of term-based licenses and software-as-a-service offerings and the duration of these types of agreements for our offerings. In addition, the size of our licenses and orders varies greatly. A single, large perpetual license order in a given period could distort our operating results, and a decline in larger orders in any given period could adversely affect our revenues and operating results. The timing and size of large orders are often hard to predict in any particular period.

We have a history of losses and may be unable to achieve or maintain profitability in the future.

We have incurred significant net losses in each year since our inception. We may not be able to sustain or increase our growth or achieve profitability in the future or on a consistent basis. We expect our operating expenses to increase over the next several years as we continue to expend substantial financial resources on, among other things, investments in research and development and sales and marketing, and the hiring of additional employees. The return on these investments, if any, will only be realized over time and may not result in increased revenue commensurate with increases in our expenses, or at all.

In addition, as a public company, we have incurred, and will continue to incur, significant accounting, legal, and other expenses that we did not incur as a private company. Achieving profitability will require us to increase revenue, manage our cost structure, and avoid significant liabilities. Revenue growth may slow, revenue may decline, or we may incur significant losses in the future for a number of reasons, including general macroeconomic conditions, increasing competition, a decrease in the growth of the markets in which we operate, the inability to expand our sales force and increase its productivity, or if we fail for any reason to continue to capitalize on growth opportunities. Additionally, we may encounter unforeseen operating expenses, difficulties, complications, delays, and other unknown factors that may result in losses in future periods. If these losses exceed our expectations or our revenue growth expectations are not met in future periods, our financial performance will be harmed and our stock price could decline.

If we are unable to increase sales of our solution to large organizations and government entities, while mitigating the risks associated with serving such end-customers, our business, financial position, and results of operations may suffer.

Our growth strategy is dependent, in part, upon increasing sales of our solution to large organizations and government entities. Sales to large organizations and government entities involve risks that may not be present (or that are present to a lesser extent) with sales to smaller entities. These risks include:

• | increased purchasing power and leverage held by large end-customers in negotiating contractual arrangements with us, including, in certain cases, clauses that provide preferred pricing of configurations with similar specifications; |

• | more stringent or costly requirements imposed upon us in our maintenance and support contracts with such end-customers, including stricter response times and penalties for any failure to meet maintenance and support requirements |

17

(which penalties may include termination of our maintenance and support contracts with such end-customer, or refunds of amounts paid);

• | more complicated and costly implementation processes and network infrastructure; |

• | longer sales cycles and the associated risk that substantial time and resources may be spent on a potential end-customer that ultimately elects not to purchase our products or purchases fewer products than we anticipated; |

• | closer relationships with, and increased dependence upon, large technology companies who offer competitive products and have stronger brand recognition; and |

• | increased pressure for pricing discounts. In addition, because security breaches with respect to larger, high-profile organizations, or government entities are likely to be heavily publicized and because they are more likely to be targeted by cyberattackers, there is increased reputational risk associated with serving such end-customers. |

If we are unable to increase sales of our solution to large organizations and government entities while mitigating the risks associated with serving such end-customers, our business, results of operations, prospects, and financial condition may suffer.

Our business and operations have experienced rapid growth, and if we do not appropriately manage any future growth, or are unable to improve our systems and processes, our results of operations will be harmed.

We have experienced rapid growth over the last several years, which has placed, and will continue to place, significant demands on our management, administrative, operational, and financial infrastructure. As we have grown, we have had to manage an increasingly larger and more complex array of internal systems and processes to scale all aspects of our business in proportion to such rapid growth, including an expanded sales force, additional end-customer service personnel, and a new corporate headquarters, as well as more complex administrative systems related to managing increased headcount, particularly within our sales force. Our success will depend in part upon our ability to manage our growth effectively. To do so, we must continue to increase the productivity of our existing employees, particularly our sales force, and hire, train, and manage new employees as needed.

To manage the domestic and international growth of our operations and personnel, we will need to continue to improve our operational, financial, and management controls, as well as our reporting processes and procedures. In addition, we will need to implement more extensive and integrated financial and business information systems. These additional investments will increase our operating costs, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term. We may not be able to successfully acquire or implement these or other improvements to our systems and processes in an efficient or timely manner, or once implemented, we may discover deficiencies in their capabilities or effectiveness. We may experience difficulties in managing improvements to our systems and processes or in integrating with third-party technology. In addition, our systems and processes may fail to prevent or detect errors, omissions, or fraud. Our failure to improve our systems and processes, or their failure to operate effectively and in the intended manner, may result in the disruption of our current operations and end-customer relationships, our inability to manage the growth of our business, and our inability to accurately forecast and report our revenue, expenses and earnings, any of which may materially harm our business, results of operations, prospects, and financial condition.

If we are unable to increase market awareness of our company and our solution, or fail to successfully promote or protect our brand, our competitive market position and revenue may not continue to grow or may decline.

Market awareness of the value proposition of our solution will be essential to our continued growth and our success. If our marketing efforts are unsuccessful in creating market awareness of our company and our solution, then our business, results of operations, prospects, and financial condition will be adversely affected, and we will not be able to achieve sustained growth.

Moreover, due to the intensely competitive nature of our market, we believe that building and maintaining our brand and reputation is critical to our success and that the importance of positive brand recognition will increase as competition in our market further intensifies. While we believe that we are successfully building a well-established brand and have invested, and expect to continue to invest substantial resources to promote and maintain our brand, both domestically and internationally, there can be no assurances that our brand development strategies will enhance our reputation or brand recognition or lead to increased revenue.

18

Furthermore, an increasing number of independent industry analysts and researchers, such as Gartner, Inc., International Data Corporation, and Forrester Research, Inc., regularly evaluate, compare, and publish reviews regarding the functionality of security products and services, including our solution. The market’s perception of our solution may be significantly influenced by these reviews. We do not have any control over the content of these independent industry analysts and researchers’ reports, and our reputation and brand could be harmed if they publish negative reviews of our solution or do not view us as a market leader. The strength of our brand may also be negatively impacted by the marketing efforts of our competitors, which may include incomplete, inaccurate, and misleading statements about us, or our products and services. If we are unable to maintain a strong brand and reputation, sales to new and existing end-customers could be adversely affected, and our financial performance could be harmed.

We operate in a highly competitive market, with certain competitors having greater resources than we do, and competitive pressures from existing and new companies may adversely impact our business, results of operations, prospects, and financial condition.

The market in which we compete is highly fragmented, intensely competitive, and evolving in response to changes in the threat landscape and corporate network security infrastructures. We expect competition to intensify in the future as existing competitors bundle new and more competitive offerings with their existing products and services, and as new market entrants introduce new products into the security market. This competition could result in increased pricing pressure, reduced profit margins, increased sales and marketing expenses, and our failure to increase, or the loss of, market share, any of which could seriously harm our business, results of operations, prospects, and financial condition. If we do not keep pace with product and technology advances and otherwise keep our products and services competitive, there could be a material and adverse effect on our competitive position, revenue, and prospects for growth.

Our competitors and potential competitors may emulate or integrate features similar to ours into their own products; independent network security vendors that offer products that claim to perform similar functions to our solution; and small and large companies that offer point solutions that compete with some of the features present in our solution. We may also face competition from highly specialized vendors as well as larger vendors that may continue to acquire or bundle their products more effectively as our market grows and IT budgets are increased or created to support next-generation threat protection.

Many of our current and potential competitors have longer operating histories, are substantially larger and have greater financial, technical, research and development, sales and marketing, manufacturing, distribution, and other resources, and greater name recognition. Such competitors also may have well-established relationships with our current and potential end-customers, extensive knowledge of our industry and the market in which we compete and intend to compete, and such competitors may emulate or integrate product features similar to ours into their own products. As a result, our competitors may be able to respond more quickly to new or emerging technologies and changes in customer requirements, or to devote greater resources to the development, marketing, promotion, and sale of their products and services than we can with respect to our products and services. They also may make strategic acquisitions or establish cooperative relationships among themselves or with other providers, thereby increasing their ability to provide a broader suite of products and services, and potentially causing our end-customers to decrease purchases of, or defer purchasing decisions with respect to, our products and services. In addition, some of our larger competitors have substantially broader product offerings and may be able to leverage their relationships with distribution partners and customers based on other products or incorporate functionality into existing products to gain business in a manner that discourages potential end-customers from purchasing our products and services, including by selling at zero or negative margins, product bundling, or offering closed technology solutions. Potential end-customers may also prefer to purchase from their existing vendors rather than a new supplier regardless of product performance or features. Further, to the extent that one of our competitors acquires, or establishes or strengthens a cooperative relationship with, one or more of our channel partners, it could adversely affect our ability to compete. We may be required to make substantial additional investments in research and development and sales and marketing to respond to these competitive pressures, and we may not be able to compete successfully in the future. Any of the foregoing may limit our ability to compete effectively in the market and adversely affect our business, results of operations, prospects, and financial condition.

If we are unable to successfully expand our sales force while maintaining sales productivity, sales of our products, maintenance, and professional services and the growth of our business and financial performance could be harmed.

We continue to be substantially dependent on our sales force to obtain new end-customers and increase sales to existing end-customers, and we plan to continue to grow our sales force in the future. There is significant competition for sales personnel

19

with the skills and technical knowledge that we require. Our ability to achieve significant revenue growth and profitability will depend, in large part, on our success in recruiting, training, and retaining a sufficient number of sales personnel to support our growth, particularly in international markets. New sales representative hires require significant training and may require a lengthy on-boarding process before they achieve adequate levels of productivity. Generally, our sales representatives become more productive the longer they are with us, with limited productivity in their first few quarters as they learn to sell our products and participate in field training.

Our recent hires and planned hires may not become productive as quickly as we expect, or at all, and we may be unable to hire or retain a sufficient number of qualified personnel in the markets where we do business or plan to do business. If we are unable to recruit, train, and retain a sufficient number of productive sales personnel, sales of our products, maintenance, and professional services and the growth of our business would be harmed. Additionally, if our efforts to expand our sales force do not result in increased revenue, our results of operations could be negatively impacted due to increased operating expenses associated with an expanded sales force.

Our end-customers’ purchasing cycles may cause fluctuations in our revenue.

Our business is affected by cyclical fluctuations in end-customer spending patterns, which result in some seasonal trends in the sale of our solution. Revenue in our third and fourth fiscal quarters, particularly in the last two weeks of the fourth quarter, is typically stronger due to the calendar year-end. Our U.S. public sector end-customers typically end their fiscal years during our third quarter, while many of our other end-customers end their fiscal years during our fourth quarter. Our first and second fiscal quarters typically experience lower sales, with aggregate revenue historically significantly lower in our first fiscal quarter when compared to our third and fourth fiscal quarters. Furthermore, our rapid growth rate over recent years may have made these fluctuations more difficult to detect. If our growth rate slows over time, cyclical variations in our operations may become more pronounced, and our business, results of operations, prospects, and financial condition may be adversely affected.

Failure to complete sales or deliver products at the end of the quarter could cause our revenue for the applicable period to fall below expected levels.

As a result of end-customer buying patterns and the efforts of our sales force and channel partners to meet or exceed their quarterly sales objectives, we have historically received a substantial portion of sales orders and generated a substantial portion of revenue during the last few weeks of each fiscal quarter. If recognition of expected revenue is delayed beyond the end of the quarter for any reason, our revenue for that quarter could fall below our expectations and the estimates of analysts, which could adversely impact our business, results of operations, prospects, and financial condition and cause a decline in the trading price of our common stock. The reasons our expected revenue may be delayed include: