Exhibit 13.2

|

TransAlta Corporation |

| Second Quarter Report for 2017 |

Management’s Discussion and Analysis

This Management’s Discussion and Analysis (“MD&A”) contains forward-looking statements. These statements are based on certain estimates and assumptions and involve risks and uncertainties. Actual results may differ materially. See the Forward-Looking Statements section of this MD&A for additional information.

This MD&A should be read in conjunction with the unaudited interim condensed consolidated financial statements of TransAlta Corporation as at and for the three and six months ended June 30, 2017 and 2016, and should also be read in conjunction with the audited annual consolidated financial statements and MD&A contained within our 2016 Annual Integrated Report. In this MD&A, unless the context otherwise requires, “we”, “our”, “us”, the “Corporation”, and “TransAlta” refers to TransAlta Corporation and its subsidiaries. Our condensed consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) International Accounting Standards (“IAS”) 34 Interim Financial Reporting for Canadian publically accountable enterprises as issued by the International Accounting Standards Board (“IASB”) and in effect at June 30, 2017. All tabular amounts in the following discussion are in millions of Canadian dollars unless otherwise noted. This MD&A is dated Aug. 9, 2017. Additional information respecting TransAlta, including its Annual Information Form, is available on SEDAR at www.sedar.com, on EDGAR at www.sec.gov, and on our website at www.transalta.com. Information on or connected to our website is not incorporated by reference herein.

Additional IFRS Measures and Non-IFRS Measures

An additional IFRS measure is a line item, heading, or subtotal that is relevant to an understanding of the financial statements but is not a minimum line item mandated under IFRS, or the presentation of a financial measure that is relevant to an understanding of the financial statements but is not presented elsewhere in the financial statements. We have included line items entitled gross margin and operating income (loss) in our Condensed Consolidated Statements of Earnings (Loss) for the three and six months ended June 30, 2017, and 2016. Presenting these line items provides management and investors with a measurement of ongoing operating performance that is readily comparable from period to period.

We evaluate our performance and the performance of our business segments using a variety of measures. Certain of the financial measures discussed in this MD&A are not defined under IFRS and, therefore, should not be considered in isolation or as an alternative to or to be more meaningful than net earnings attributable to common shareholders or cash flow from operating activities, as determined in accordance with IFRS, when assessing our financial performance or liquidity. These measures may not be comparable to similar measures presented by other issuers and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Earnings before interest, taxes, depreciation, and amortization (“EBITDA”), comparable EBITDA, Funds from Operations (“FFO”), and “Free Cash Flow” (“FCF”) are non-IFRS measures. See the Reconciliation of Non-IFRS Measures and, Discussion of Segmented Comparable Results sections of this MD&A for additional information.

| transalta corporation /Q2 2017 m1 |

Forward-Looking Statements

This MD&A, the documents incorporated herein by reference, and other reports and filings made with securities regulatory authorities include forward-looking statements or information (collectively referred to herein as “forward-looking statements”) within the meaning of applicable securities legislation. Forward-looking statements are presented for general information purposes only and not as specific investment advice. All forward-looking statements are based on our beliefs as well as assumptions based on information available at the time the assumptions were made and on management’s experience and perception of historical trends, current conditions, and expected future developments, as well as other factors deemed appropriate in the circumstances. Forward-looking statements are not facts, but only predictions and generally can be identified by the use of statements that include phrases such as “may”, “will”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “project”, “forecast”, “foresee”, “potential”, “enable”, “continue”, or other comparable terminology. These statements are not guarantees of our future performance and are subject to risks, uncertainties, and other important factors that could cause our actual performance to be materially different from that projected.

In particular, this MD&A contains forward-looking statements pertaining to: our business and anticipated future financial performance; our success in executing on our growth projects; the timing of the construction and commissioning of projects under development, including major projects such as the South Hedland power project, the Brazeau Pumped Storage Project, Kent Hills 3 Wind Project, and the conversion of our Sundance Units 3 to 6 and Keephills Units 1 and 2 from coal-fired generation to gas-fired generation, and their attendant costs and sources of funding; the retirement of Sundance Unit 1 and mothballing of Sundance Unit 2; the changes to capacity and emissions following the conversion to gas generation of Sundance Units 3 to 6 and Keephills Units 1 and 2; spending on growth and sustaining capital and productivity projects; expectations in terms of the cost of operations, capital spending, and maintenance, and the variability of those costs; expected decommissioning costs; the section titled “2017 Outlook”; coal supply constraints for our facilities in Alberta and their impact on our mining costs and power generation at our Sundance coal-fired generating units 1 to 6 and Keephills units 1 to 3; the impact of certain hedges on future reported earnings and cash flows, including future reversals of unrealized gains or losses; expectations relating to the dispositions of assets and the completion of sale transactions; expectations related to future earnings and cash flow from operating and contracting activities (including estimates of full-year 2017 comparable EBITDA, FFO, FCF, and expected sustaining capital expenditures); expectations in respect of financial ratios and targets and the timing associated with meeting such targets (including FFO before interest to adjusted interest coverage, adjusted FFO to adjusted net debt, and adjusted net debt to comparable EBITDA); the Corporation’s plans and strategies relating to repositioning its capital structure and strengthening its balance sheet and the anticipated debt reductions during 2017 and beyond; project Greenlight; expected governmental regulatory regimes, legislation (including the Government of Alberta’s Climate Leadership Plan) and proposed regulations to discontinue over time the use of technologies that our coal-fired plants currently utilize, the expected impact on us and the timing of the implementation of such regimes and regulations, as well as the cost of complying with resulting regulations and laws; the expected results and impact of the Off-Coal Agreement (“OCA”) and Memorandum of Understanding with the Government of Alberta on our business and financial performance; the outcome of discussions with the Government of Canada and the Government of Alberta in relation to potential opportunities for investment in renewable and gas-fired generation; our comparative advantages over our competitors; estimates of fuel supply and demand conditions and the costs of procuring fuel; our share of offer control in the Province of Alberta after the expiry of the Power Purchase Arrangements (“PPAs”) at the end of 2020; the impact of load growth, increased capacity, and natural gas costs on power prices; expectations in respect of generation availability, capacity, and production; expectations regarding the role different energy sources will play in meeting future energy needs, including the impact of the anticipated elimination of current excess system capacity and future growth in Alberta driven by the retirement of coal units over the next 15 years; expected financing of our capital expenditures; the anticipated financial impact of increased carbon prices (including under the existing Specified Gas Emitters Regulation) (“SGER”) in Alberta; expectations in respect of our environmental initiatives; our trading strategies and the risk involved in these strategies; estimates of future tax rates, future tax expense, and the adequacy of tax provisions; accounting estimates; anticipated growth rates in our markets; our expectations regarding the outcome of existing or potential legal and contractual claims, regulatory investigations, and disputes; expectations regarding the renewal of collective bargaining agreements; expectations for the ability to access capital markets on reasonable terms; the estimated impact of changes in interest rates and the value of the Canadian dollar relative to the US dollar, the Australian dollar, and other currencies in which we do business; our exposure to liquidity risk; expectations regarding the impact of the general slowdown in the oil and gas sector; expectations in respect of the global economic environment and growing scrutiny by investors relating to sustainability performance; our credit practices; expected cost savings following the implementation of our efficiency and productivity initiatives; the estimated contribution of Energy Marketing activities to gross margin; expectations relating to the performance of TransAlta Renewables Inc.’s (“TransAlta Renewables”) assets; expectations regarding our continued ownership of common shares of TransAlta Renewables; the refinancing our upcoming debt maturities over the next two years by raising $700 million to $900 million of debt secured by contracted cash flows; expectations regarding our de-leveraging strategy, including applying a portion of our FCF over the next four years to reduce debt; expectations in respect of our community initiatives; impacts of future IFRS standards; and amendments or interpretations by accounting standard setters prior to initial adoption of those standards.

| M2 transalta corporation / Q2 2017 |

Factors that may adversely impact our forward-looking statements include risks relating to: fluctuations in market prices, our ability to contract our generation for prices that will provide expected returns; the regulatory and political environments in the jurisdictions in which we operate; increasingly stringent environmental requirements and changes in, or liabilities under, these requirements; changes in general economic conditions, including interest rates; operational risks involving our facilities, including unplanned outages at such facilities; disruptions in the transmission and distribution of electricity; the effects of weather; disruptions in the source of fuels, water, sun, or wind required to operate our facilities; natural or man-made disasters; the threat of terrorism and cyberattacks and our ability to manage such attacks; equipment failure and our ability to carry out or have completed the repairs in a cost-effective or timely manner; commodity risk management; industry risk and competition; fluctuations in the value of foreign currencies and foreign political risks; the need for additional financing and the ability to access financing at a reasonable cost and on reasonable terms; our ability to fund our growth projects; our ability to maintain our investment grade credit ratings; structural subordination of securities; counterparty credit risk; our ability to recover our losses through our insurance coverage; our provision for income taxes; outcomes of legal, regulatory, and contractual proceedings involving the Corporation; outcomes of investigations and disputes; reliance on key personnel; labour relations matters; development projects and acquisitions, including delays or changes in costs in the construction and commissioning of the South Hedland power project; and the maintenance or adoption of enabling regulatory frameworks or the satisfactory receipt of applicable regulatory approvals for existing and proposed operations and growth initiatives, including as it pertains to coal-to-gas conversions.

The foregoing risk factors, among others, are described in further detail in the Governance and Risk Management section of this MD&A and under the heading “Risk Factors” in our 2017 Annual Information Form for the fiscal year ended Dec. 31, 2016.

Readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements included in this document are made only as of the date hereof and we do not undertake to publicly update these forward-looking statements to reflect new information, future events, or otherwise, except as required by applicable laws. In light of these risks, uncertainties, and assumptions, the forward-looking events might occur to a different extent or at a different time than we have described, or might not occur. We cannot assure that projected results or events will be achieved.

| transalta corporation /Q2 2017 m3 |

Highlights

Consolidated Financial Highlights

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenues | 503 | 492 | 1,081 | 1,060 | ||||||||||||

| Net earnings (loss) attributable to common shareholders | (18 | ) | 6 | (18 | ) | 68 | ||||||||||

| Cash flow from operating activities | 63 | 119 | 344 | 394 | ||||||||||||

| Comparable EBITDA(1) | 268 | 248 | 542 | 527 | ||||||||||||

| FFO(1) | 187 | 175 | 389 | 372 | ||||||||||||

| FCF(1) | 30 | 56 | 125 | 140 | ||||||||||||

| Net earnings (loss) per share attributable to common shareholders, basic and diluted | (0.06 | ) | 0.02 | (0.06 | ) | 0.24 | ||||||||||

| FFO per share(1) | 0.65 | 0.61 | 1.35 | 1.29 | ||||||||||||

| FCF per share(1) | 0.10 | 0.19 | 0.43 | 0.49 | ||||||||||||

| Dividends declared per common share | 0.04 | 0.04 | 0.04 | 0.08 | ||||||||||||

| As at | June 30, 2017 | Dec. 31, 2016 | ||||||

| Total assets | 10,419 | 10,996 | ||||||

| Net debt(2) | 3,709 | 3,893 | ||||||

| Total long-term liabilities | 4,313 | 5,116 | ||||||

Comparable EBITDA was up $20 million for the three months ended June 30, 2017 compared to same period in 2016. During the second quarter, all segments, with the exception of Canadian Coal, delivered better or comparable results over last year. We benefited from favourable mark-to-market gains on economic hedges in US Coal, stronger wind resources in Eastern Canada, and higher levels of water flow at Alberta Hydro. At Canadian Coal, higher fuel costs caused by a higher expected strip ratio and lower planned equipment availability at our mine, and lower prices due to the rolling off of certain hedges, negatively impacted our results.

Comparable EBITDA was up $15 million for the six months ended June 30, 2017 compared to the same period in 2016, mostly due to the settlement of the contract indexation dispute with the Ontario Electricity Financial Corporation (“OEFC”) relating to the Ottawa and Windsor generating facilities, totalling $34 million, at Canadian Gas. At US Coal, favourable mark-to-market on economic hedges that do not qualify for hedge accounting and higher merchant and contracted revenues contributed to higher comparable EBITDA. Energy Marketing was impacted by unusual weather in the Northeast and the Pacific Northwest and delivered below expected performance in the first quarter of 2017. As expected, Canadian Coal was negatively impacted by the rolling off of higher priced hedges and higher mining costs. This was partially offset by the OCA payments.

FFO for the three and six months ended June 30, 2017 was up $12 million and $17 million, respectively, compared to the same periods in 2016, due mostly to higher comparable EBITDA. The timing of sustaining and productivity expenditures and higher distributions paid to subsidiaries’ non-controlling interests negatively impacted our FCF by $26 million and $15 million during the second quarter of 2017 and year-to-date, respectively, compared to the same periods in 2016.

| (1) | These items are not defined under IFRS. Presenting these items from period to period provides management and investors with the ability to evaluate earnings trends more readily in comparison with prior periods’ results. Refer to the Reconciliation of Non-IFRS Measures section of this MD&A for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS. |

| (2) | Net debt includes current portion, amounts due under credit facilities, long-term debt, tax equity, and finance lease obligations, net of cash and the fair value of economic hedging instruments on debt. See the table in the Capital Structure and Liquidity section of this MD&A for more details on the composition of net debt. |

| M4 transalta corporation / Q2 2017 |

Reported net loss attributable to common shareholders for the second quarter of 2017 was $18 million ($0.06 loss per share) compared to $6 million net earnings ($0.02 earnings per share) during the same period in 2016. An impairment charge of $20 million was recognized in the quarter as a result of our decision to early retire Sundance Unit 1 at the end of 2019. Year-to-date, reported net earnings was down $86 million ($0.30 loss per share). Last year, net earnings in the first quarter were positively impacted by lower depreciation due to the reduction of our reclamation obligation at our Centralia mine caused by a higher discount rate. This year, higher depreciation arose due to the shortening of useful lives of Keephills 3, Genesee 3, and to a lesser extent, Sundance Unit 1. Higher earnings attributable to non-controlling interests also negatively impacted net earnings.

Segmented Comparable EBITDA Results

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Comparable EBITDA | ||||||||||||||||

| Canadian Coal | 85 | 93 | 176 | 196 | ||||||||||||

| U.S. Coal | 34 | 18 | 44 | 14 | ||||||||||||

| Canadian Gas | 57 | 56 | 145 | 121 | ||||||||||||

| Australian Gas | 32 | 33 | 63 | 64 | ||||||||||||

| Wind and Solar | 42 | 36 | 110 | 97 | ||||||||||||

| Hydro | 28 | 25 | 42 | 43 | ||||||||||||

| Energy Marketing | 12 | 6 | 8 | 29 | ||||||||||||

| Corporate | (22 | ) | (19 | ) | (46 | ) | (37 | ) | ||||||||

| Total comparable EBITDA | 268 | 248 | 542 | 527 | ||||||||||||

Significant Events

During the first half of the year, we continued to work on strengthening our financial flexibility, improving our operating performance, and progressing our transition to clean power generation through the following initiatives:

| § | On July 24, 2017, TransAlta Renewables entered into a syndicated credit agreement giving TransAlta Renewables access to $500 million in direct borrowings. The agreement is fully committed for four years, expiring in 2021. At the same time, our credit facilities were reduced by a similar amount and also expire in 2021. Our consolidated liquidity will remain unchanged. See the Significant and Subsequent Events section of this MD&A for further details. |

| § | Entered into a long-term contract for the Kent Hills 3 expansion project located in New Brunswick, which is expected to begin construction in the spring of 2018. The 17.25 MW expansion will be funded through a project financing of $240 million to $275 million at Kent Hills. |

| § | Closed the previously announced sale of our 51 per cent interest in the Wintering Hills merchant wind facility for approximately $61 million. The sale provided us with near-term liquidity, increased our financial flexibility, and reduced our merchant exposure in Alberta. |

| § | Achieved commercial operation on our South Hedland power project achieved on July 28, 2017. The project is expected to generate approximately $80 million of comparable EBITDA annually. See the Significant and Subsequent Events section of this MD&A for further details. On July 28, 2017, TransAlta Renewables announced the conversion of the Class B shares we own into common shares on Aug. 1, 2017, and also increased their monthly dividend by approximately 7 per cent. |

| § | Announced the acceleration of our transition to gas and renewables generation with the retirement of Sundance Unit 1, the mothballing of Sundance Unit 2, and the conversion of Sundance Units 3 to 6, and Keephills Units 1 and 2 from coal-fired generation to gas-fired generation between 2021 to 2023. The retirement of Sundance Unit 1 and mothballing of Sundance Unit 2 is not expected to have a material impact on our forecasted cash flow for 2018 and 2019. We received approval to extend the life of Sundance Unit 2 to the end of 2021 on coal. This unit will qualify for the capacity market auctions in the 2019 timeframe. |

| § | Settled the contract indexation dispute with the OEFC. The settlement consisted of a $34 million payment by the OEFC to TransAlta. |

| transalta corporation /Q2 2017 m5 |

Adjusted Availability and Production

Adjusted availability for the three and six months ended June 30, 2017 was 84.0 per cent and 86.2 per cent, respectively, compared to 86.5 per cent and 89.4 per cent for the same periods in 2016. The main causes of the decreases were higher planned outages at Canadian and US Coal, a planned maintenance outage at our Sarnia facility, and Windsor’s cycling conversion project. Lower availability had a minimal impact on our results due to current low prices in Alberta and the Pacific Northwest.

Production for the three and six months ended June 30, 2017 was 7,707 GWh and 16,758 GWh, respectively, compared to 7,899 GWh and 16,766 GWh for the same periods in 2016. The cessation of operations at our Mississauga cogeneration facility effective Jan. 1, 2017 and planned major maintenance at US Coal were the main drivers of the production decrease in the second quarter of 2017. This was partially offset by higher generation from Alberta Hydro and Eastern Wind and stronger customer demand in Australia. On a year-to-date basis, US Coal had higher production compared to 2016 as a result of later economic dispatching in the first quarter due to slightly higher prices in the first quarter of 2017. Higher water resources at Hydro also contributed to higher production in 2017. In accordance with the terms of Mississauga’s new contract with Ontario’s Independent Electricity System Operator (“IESO”), we continue to receive monthly capacity payments from the IESO until Dec. 31, 2018.

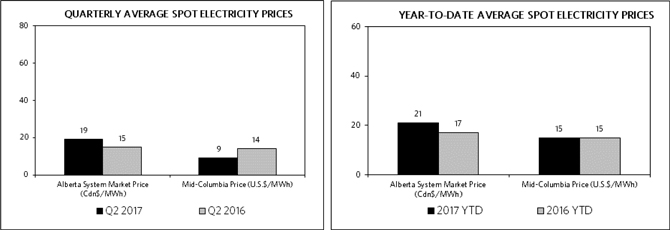

Electricity Prices

The average spot electricity prices for the three and six months ended June 30, 2017 increased compared to the same periods in 2016 in Alberta due to higher environmental levies as compliance costs have increased the marginal cost to producers, while excess water resources during the second quarter of 2017 in the Pacific Northwest caused prices to decline compared to the same period in 2016.

| M6 transalta corporation / Q2 2017 |

Funds from Operations and Free Cash Flow

FFO is an important metric as it provides a proxy for the amount of cash generated from operating activities before changes in working capital, and provides the ability to evaluate cash flow trends more readily in comparison with results from prior periods. FCF is an important metric as it represents the amount of cash generated by our business, before changes in working capital, that is available to invest in growth initiatives, make scheduled principal repayments on debt, repay maturing debt, pay common share dividends, or repurchase common shares. Changes in working capital are excluded so as to not distort FFO and FCF with changes that we consider temporary in nature, reflecting, among other things, the impact of seasonal factors and the timing of capital projects. FFO per share and FCF per share are calculated using the weighted average number of common shares outstanding during the period.

The table below reconciles our cash flow from operating activities to our FFO and FCF.

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Cash flow from operating activities | 63 | 119 | 344 | 394 | ||||||||||||

| Change in non-cash operating working capital balances | 109 | 40 | 14 | (54 | ) | |||||||||||

| Cash flow from operations before changes in working capital | 172 | 159 | 358 | 340 | ||||||||||||

| Adjustments: | ||||||||||||||||

| Decrease in finance lease receivable | 15 | 15 | 30 | 29 | ||||||||||||

| Other | - | 1 | 1 | 3 | ||||||||||||

| FFO | 187 | 175 | 389 | 372 | ||||||||||||

| Deduct: | ||||||||||||||||

| Sustaining capital | (87 | ) | (66 | ) | (133 | ) | (125 | ) | ||||||||

| Productivity capital | (7 | ) | (4 | ) | (9 | ) | (4 | ) | ||||||||

| Dividends paid on preferred shares | (10 | ) | (10 | ) | (20 | ) | (22 | ) | ||||||||

| Distributions paid to subsidiaries' non-controlling interests | (51 | ) | (37 | ) | (98 | ) | (76 | ) | ||||||||

| Other | (2 | ) | (2 | ) | (4 | ) | (5 | ) | ||||||||

| FCF | 30 | 56 | 125 | 140 | ||||||||||||

| Weighted average number of common shares outstanding in the period | 288 | 288 | 288 | 288 | ||||||||||||

| FFO per share | 0.65 | 0.61 | 1.35 | 1.29 | ||||||||||||

| FCF per share | 0.10 | 0.19 | 0.43 | 0.49 | ||||||||||||

| transalta corporation /Q2 2017 m7 |

Comparable EBITDA

EBITDA is a widely adopted valuation metric and an important metric for management that represents our core business profitability. Interest, taxes, and depreciation and amortization are not included, as differences in accounting treatments may distort our core business results. In addition, we reclassify certain transactions to facilitate the discussion on the performance of our business: i) Certain assets we own in Canada and Australia are fully contracted and recorded as finance leases under IFRS. We believe it is more appropriate to reflect the payment we received under the contracts as a capacity payment in our revenues instead of as finance lease income and a decrease in finance lease receivables. We depreciate these assets over their expected lives. ii) We also reclassify the deprecation on our mining equipment from fuel and purchased power to reflect the actual cash cost of our business in our comparable EBITDA. iii) In December 2016, we agreed to terminate our existing arrangement with the IESO relating to our Mississauga cogeneration facility in Ontario and entered into a new Non-Utility Generator Contract (the “NUG Contract”) effective Jan. 1, 2017. Under the new NUG Contract, we receive fixed monthly payments until December 31, 2018 with no delivery obligations. Under IFRS, for our reported results in 2016, as a result of the NUG Contract, we recognized a receivable of $207 million (discounted), a pre-tax gain of approximately $191 million net of costs to mothball the units, and accelerated depreciation of $46 million. In 2017 and 2018, on a comparable basis, we record the payments we receive as revenues as a proxy for operating income, and continue to depreciate the facility until Dec. 31, 2018.

A reconciliation of reported operating

income to EBITDA and comparable EBITDA results for the three and six months ended

June 30, 2017 and 2016, is set out below:

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Operating income | 24 | 41 | 86 | 148 | ||||||||||||

| Depreciation and amortization | 154 | 147 | 297 | 269 | ||||||||||||

| EBITDA | 178 | 188 | 383 | 417 | ||||||||||||

| Comparable reclassifications | ||||||||||||||||

| Finance leases income | 16 | 17 | 32 | 33 | ||||||||||||

| Decrease in finance lease receivables | 15 | 15 | 30 | 29 | ||||||||||||

| Mine depreciation | 19 | 15 | 36 | 30 | ||||||||||||

| Adjustments to earnings to arrive at comparable results: | ||||||||||||||||

| Impacts to revenue associated with certain de-designated and economic hedges | 2 | 13 | 2 | 18 | ||||||||||||

| Impacts associated with Mississauga recontracting(1) | 18 | - | 39 | - | ||||||||||||

| Asset impairment charge | 20 | - | 20 | |||||||||||||

| Comparable EBITDA | 268 | 248 | 542 | 527 | ||||||||||||

| (1) | Impacts associated with Mississauga recontracting for the six months ended June 30, 2017 are as follows: Revenue ($50 million), fuel and purchased power de-designated hedges ($8 million), and Operations, maintenance, and administration ($3 million). |

| M8 transalta corporation / Q2 2017 |

Discussion of Consolidated Financial Results

We evaluate our performance and the performance

of our business segments using a variety of measures. Comparable figures are not defined under IFRS. Refer to the Reconciliation

of Non-IFRS Measures section of this MD&A for further discussion of these items.

Reconciliation of Non-IFRS Measures

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Comparable EBITDA | 268 | 248 | 542 | 527 | ||||||||||||

| Provisions | - | (8 | ) | - | (7 | ) | ||||||||||

| Interest expense | (56 | ) | (57 | ) | (113 | ) | (115 | ) | ||||||||

| Unrealized (gains) losses from risk management activities | (16 | ) | 9 | (21 | ) | 2 | ||||||||||

| Current income tax recovery | (6 | ) | (6 | ) | (12 | ) | (11 | ) | ||||||||

| Decommissioning and restoration costs settled | (3 | ) | (5 | ) | (7 | ) | (8 | ) | ||||||||

| Realized foreign exchange gain (loss) | 3 | - | 6 | (1 | ) | |||||||||||

| Other | (3 | ) | (6 | ) | (6 | ) | (15 | ) | ||||||||

| FFO | 187 | 175 | 389 | 372 | ||||||||||||

| Deduct: | ||||||||||||||||

| Sustaining capital | (87 | ) | (66 | ) | (133 | ) | (125 | ) | ||||||||

| Productivity capital | (7 | ) | (4 | ) | (9 | ) | (4 | ) | ||||||||

| Dividends paid on preferred shares | (10 | ) | (10 | ) | (20 | ) | (22 | ) | ||||||||

| Distributions paid to subsidiaries' non-controlling interests | (51 | ) | (37 | ) | (98 | ) | (76 | ) | ||||||||

| Other | (2 | ) | (2 | ) | (4 | ) | (5 | ) | ||||||||

| FCF | 30 | 56 | 125 | 140 | ||||||||||||

| Weighted average number of common shares outstanding in the period | 288 | 288 | 288 | 288 | ||||||||||||

| FFO per share | 0.65 | 0.61 | 1.35 | 1.29 | ||||||||||||

| FCF per share | 0.10 | 0.19 | 0.43 | 0.49 | ||||||||||||

FCF for the second quarter and year-to-date was down by $26 million and $15 million, respectively, compared to the same periods in 2016, mostly due to the timing of sustaining and productivity capital expenditures and higher distributions to our subsidiaries’ non-controlling interests as a result of the settlement of the indexation dispute for our long-term contracts at Ottawa and Windsor, which are held by TransAlta Cogeneration L.P (“TA Cogen”). Higher comparable EBITDA was offset by higher unrealized mark-to-market gains excluded to arrive at FCF.

Segmented Comparable Results

Each business segment assumes responsibility for its operating results measured to comparable EBITDA. Operating income and gross margin are also useful measures as they provide management and investors with a measurement of operating performance that is readily comparable from period to period.

| transalta corporation /Q2 2017 m9 |

Canadian Coal

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Availability (%) | 84.5 | 85.7 | 84.1 | 86.1 | ||||||||||||

| Contract production (GWh) | 4,430 | 4,335 | 9,400 | 9,254 | ||||||||||||

| Merchant production (GWh) | 920 | 986 | 1,923 | 1,895 | ||||||||||||

| Total production (GWh) | 5,350 | 5,321 | 11,323 | 11,149 | ||||||||||||

| Gross installed capacity (MW) | 3,791 | 3,791 | 3,791 | 3,791 | ||||||||||||

| Revenues | 248 | 229 | 498 | 463 | ||||||||||||

| Fuel and purchased power | 122 | 90 | 244 | 173 | ||||||||||||

| Comparable gross margin | 126 | 139 | 254 | 290 | ||||||||||||

| Operations, maintenance, and administration | 47 | 43 | 91 | 88 | ||||||||||||

| Taxes, other than income taxes | 4 | 3 | 7 | 6 | ||||||||||||

| Net other operating income | (10 | ) | - | (20 | ) | - | ||||||||||

| Comparable EBITDA | 85 | 93 | 176 | 196 | ||||||||||||

| Depreciation and amortization | 96 | 79 | 183 | 155 | ||||||||||||

| Comparable operating income (loss) | (11 | ) | 14 | (7 | ) | 41 | ||||||||||

| Sustaining capital: | ||||||||||||||||

| Routine capital | 5 | 11 | 10 | 13 | ||||||||||||

| Mine capital | 3 | 7 | 6 | 7 | ||||||||||||

| Finance leases | 4 | 3 | 7 | 6 | ||||||||||||

| Planned major maintenance | 17 | 13 | 35 | 50 | ||||||||||||

| Total sustaining capital expenditures | 29 | 34 | 58 | 76 | ||||||||||||

| Productivity capital | 4 | 1 | 5 | 1 | ||||||||||||

| Total sustaining and productivity capital expenditures | 33 | 35 | 63 | 77 | ||||||||||||

Production for the three months ended June 30, 2017 increased 29 GWh compared to the same period in 2016. Lower availability caused by higher outages was offset by lower derates and paid curtailments on contracted assets as a result of slightly higher pricing. Production for the six months ended June 30, 2017 increased 174 GWh compared to the same period in 2016. Lower availability caused by higher planned and unplanned outages was offset by lower paid curtailment on contracted assets and lower levels of economic dispatching on our non-contracted generation as a result of slightly higher prices.

Comparable EBITDA for the three and six months ended June 30, 2017 decreased by $8 million and $20 million, respectively, compared to the same periods in 2016. Revenues for the quarter and year-to-date were positively impacted by the pass through of higher environmental compliance costs to the PPA buyer ($26 million). Lower realized prices on our uncontracted volumes and changes in our mark-to-market positions attributable to long-term financial contracts to economically hedge our future generation partially offset the increase in revenues. As expected, fuel and purchased power was impacted by higher coal costs related to the expected higher strip ratio and availability of equipment at our mine, and higher environmental compliance costs in 2017. Most of our higher environmental compliance costs are passed through to the PPA buyer. For the three and six months ended June 30, 2017, comparable EBITDA also included $10 million and $20 million, respectively, related to OCA payment accruals included in net other operating income. We expect to receive our OCA payment in the third quarter.

| M10 transalta corporation / Q2 2017 |

Depreciation and amortization for the three and six months ended June 30, 2017 increased $17 million and $28 million, respectively, compared to the same periods in 2016, mainly due to shortening of the useful lives of the Keephills 3, Genesee 3, and Sundance 1 facilities and on mine equipment at the Sunhills mine as a result of the Alberta Climate Leadership Plan. See the Accounting Changes section of this MD&A for further details.

Sustaining capital expenditures for the three and six months ended June 30, 2017 were lower by $2 million and $14 million, respectively, compared to the same periods in 2016, when pit stops were executed on our Sundance 1 and 2 units. Productivity capital spending is expected to provide pay back in less than 2 years. See the Corporate Transformation section of this MD&A for further details.

US Coal

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Availability (%) | 18.8 | 68.8 | 36.7 | 84.4 | ||||||||||||

| Adjusted availability (%)(1) | 67.1 | 72.1 | 76.8 | 86.1 | ||||||||||||

| Contract sales volume (GWh) | 915 | 916 | 1,820 | 1,831 | ||||||||||||

| Merchant sales volume (GWh) | - | 186 | 959 | 588 | ||||||||||||

| Purchased power (GWh) | (915 | ) | (923 | ) | (1,967 | ) | (1,868 | ) | ||||||||

| Total production (GWh) | - | 179 | 812 | 551 | ||||||||||||

| Gross installed capacity (MW) | 1,340 | 1,340 | 1,340 | 1,340 | ||||||||||||

| Revenues | 61 | 54 | 149 | 115 | ||||||||||||

| Fuel and purchased power | 15 | 23 | 79 | 75 | ||||||||||||

| Comparable gross margin | 46 | 31 | 70 | 40 | ||||||||||||

| Operations, maintenance, and administration | 11 | 12 | 24 | 24 | ||||||||||||

| Taxes, other than income taxes | 1 | 1 | 2 | 2 | ||||||||||||

| Comparable EBITDA | 34 | 18 | 44 | 14 | ||||||||||||

| Depreciation and amortization | 16 | 27 | 31 | 24 | ||||||||||||

| Comparable operating income (loss) | 18 | (9 | ) | 13 | (10 | ) | ||||||||||

| Sustaining capital: | ||||||||||||||||

| Routine capital | 2 | 1 | 2 | 2 | ||||||||||||

| Finance leases | 1 | 2 | 2 | 2 | ||||||||||||

| Planned major maintenance | 22 | 8 | 27 | 11 | ||||||||||||

| Total sustaining capital expenditures | 25 | 11 | 31 | 15 | ||||||||||||

| Productivity capital | 2 | - | 3 | - | ||||||||||||

| Total sustaining and productivity capital expenditures | 27 | 11 | 34 | 15 | ||||||||||||

Availability for the three and six months ended June 30, 2017 was down compared to 2016 due to a forced outage on Unit 1 in January. Both Units were taken out of service in February as a result of seasonally lower prices in the Pacific Northwest. We performed major maintenance on both units during this time. The lower availability had a nominal impact on our results as our contractual obligations were supplied with less expensive power purchased in the market.

Production was up 261 GWh during the first half of 2017 compared to 2016, due mainly to the timing of economic dispatching in 2017.

| (1) | Adjusted for economic dispatching. |

| transalta corporation /Q2 2017 m11 |

Comparable EBITDA improved by $16 million during the second quarter of 2017 compared to 2016, largely due to favourable impacts of mark-to-market positions on certain forward financial contracts that do not qualify for hedge accounting, higher contracted revenues, lower prices on purchased power, and favourable exchange rates in 2017. Comparable EBITDA improved by $30 million for the first half of 2017 compared to the same period in 2016, due to favourable impacts of mark-to-market positions on certain forward financial contracts that do not qualify for hedge accounting, higher merchant and contracted revenues, and lower prices on purchased power.

Depreciation and amortization for the second quarter of 2017 was lower by $11 million compared to 2016, due to an increase in our decommissioning obligation for the Centralia Mine in the second quarter of 2016. On a year-to-date basis, depreciation and amortization was up $7 million compared to 2016, due to a lower discount rate applied to the decommissioning obligation. As the mine is in the reclamation stage, adjustments to the decommissioning obligation are recognized in earnings.

Sustaining capital expenditures for the three and six months ended June 30, 2017 increased $16 million and $19 million, respectively, due to planned outages executed during the second quarter of 2017. Productivity capital relates to project Greenlight, our Corporate transformation project, which is intended to provide long-term cost savings. See the Strategic Growth and Corporate Transformation section of this MD&A for further details.

Canadian Gas

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Availability (%) | 82.3 | 95.5 | 91.6 | 97.5 | ||||||||||||

| Contract production (GWh) | 379 | 712 | 772 | 1,455 | ||||||||||||

| Merchant production (GWh) | 5 | 66 | 50 | 66 | ||||||||||||

| Total production (GWh) | 384 | 778 | 822 | 1,521 | ||||||||||||

| Gross installed capacity (MW)(1) | 953 | 1,057 | 953 | 1,057 | ||||||||||||

| Revenues | 91 | 105 | 237 | 227 | ||||||||||||

| Fuel and purchased power | 19 | 35 | 62 | 77 | ||||||||||||

| Comparable gross margin | 72 | 70 | 175 | 150 | ||||||||||||

| Operations, maintenance, and administration | 15 | 14 | 29 | 28 | ||||||||||||

| Taxes, other than income taxes | - | - | 1 | 1 | ||||||||||||

| Comparable EBITDA | 57 | 56 | 145 | 121 | ||||||||||||

| Depreciation and amortization | 29 | 27 | 58 | 55 | ||||||||||||

| Comparable operating income | 28 | 29 | 87 | 66 | ||||||||||||

| Sustaining capital: | ||||||||||||||||

| Routine capital | 4 | 2 | 4 | 2 | ||||||||||||

| Planned major maintenance | 16 | - | 19 | 2 | ||||||||||||

| Total sustaining capital | 20 | 2 | 23 | 4 | ||||||||||||

Availability for the three and six months ended June 30, 2017 decreased by 13 per cent and 6 per cent compared to the same periods in 2016, primarily due to a planned major inspection at Sarnia, the base cycling conversion project at Windsor, and an unplanned steam turbine outage at Windsor.

| (1) | Includes production capacity for the Fort Saskatchewan power station, which has been accounted for as a finance lease, the portion of the Poplar Creek facility we continue to own and excludes the Mississauga cogeneration facility, which has been shutdown temporarily due to the recontracting in the fourth quarter of 2016. |

| M12 transalta corporation / Q2 2017 |

Production for the three and six months ended June 30, 2017 decreased by 394 GWh and 699 GWh compared to the same periods in 2016, primarily due to softer markets in Ontario in 2017 and the change in contracts at Mississauga and Windsor at the end of 2016. The Mississauga facility has been temporarily shut down effective Jan. 1, 2017, as we have no delivery obligations under the new agreement. We will continue to receive monthly capacity payments until the end of 2018 under the NUG Contract.

Comparable EBITDA for the six months ended June 30, 2017 increased by $24 million compared to 2016, primarily due to the settlement with OEFC for the retroactive adjustment to price indices at Ottawa and Windsor, partially offset by unfavourable changes in unrealized mark-to-market positions on gas contracts that do not qualify for hedge accounting, and higher labour costs. The Mississauga, Ottawa, and Windsor facilities are owned through our 50.01 per cent interest in TA Cogen.

Depreciation for the three and six months ended June 30, 2017 increased by $2 million and $3 million, respectively, compared to the same periods in 2016. We record the decrease in the finance lease receivable as a comparable increase in depreciation, as this amount, and the finance lease income, is included in comparable revenues as a proxy for capacity revenues for this segment.

Sustaining capital for the three and six months ended June 30, 2017 increased by $18 million and $19 million, respectively, compared to the same periods in 2016, primarily due to the scheduled maintenance at Sarnia and the base cycling conversion project at Windsor to increase its flexibility to respond to market prices.

Australian Gas

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Availability (%) | 93.9 | 94.3 | 91.9 | 92.2 | ||||||||||||

| Contract production (GWh) | 472 | 371 | 870 | 743 | ||||||||||||

| Gross installed capacity (MW)(1) | 425 | 425 | 425 | 425 | ||||||||||||

| Revenues | 42 | 45 | 82 | 87 | ||||||||||||

| Fuel and purchased power | 4 | 6 | 6 | 11 | ||||||||||||

| Comparable gross margin | 38 | 39 | 76 | 76 | ||||||||||||

| Operations, maintenance, and administration | 6 | 6 | 13 | 12 | ||||||||||||

| Comparable EBITDA | 32 | 33 | 63 | 64 | ||||||||||||

| Depreciation and amortization | 8 | 3 | 16 | 8 | ||||||||||||

| Comparable operating income | 24 | 30 | 47 | 56 | ||||||||||||

| Sustaining capital: | ||||||||||||||||

| Routine capital | 2 | - | 2 | 1 | ||||||||||||

| Planned major maintenance | - | 5 | 1 | 5 | ||||||||||||

| Total sustaining capital | 2 | 5 | 3 | 6 | ||||||||||||

Production for the three and six months ended June 30, 2017 increased 101 GWh and 127 GWh, respectively, compared to the same periods in 2016, mostly due to an increase in customer load. Due to the nature of our contracts, the increases did not have a significant financial impact on our results as our contracts are structured as capacity payments with a pass-through of fuel costs.

Comparable EBITDA was consistent across all periods.

| (1) | Includes production capacity for the Solomon power station, which has been accounted for as a finance lease. |

| transalta corporation /Q2 2017 m13 |

Depreciation and amortization for the three and six months ended June 30, 2017 increased by $5 million and $8 million, respectively, compared to the same periods in 2016, due mostly to the advanced start-up of one of the gas turbines at our South Hedland project in late December 2016. The remaining two other gas and steam turbines were completed and the South Hedland power project was fully commissioned on July 28, 2017. See the Significant and Subsequent Events section of this MD&A for further details.

Wind and Solar

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Availability (%) | 96.5 | 95.0 | 96.5 | 95.9 | ||||||||||||

| Contract production (GWh) | 521 | 486 | 1,263 | 1,197 | ||||||||||||

| Merchant production (GWh) | 254 | 245 | 567 | 665 | ||||||||||||

| Total production (GWh) | 775 | 731 | 1,830 | 1,862 | ||||||||||||

| Gross installed capacity (MW) | 1,363 | 1,408 | 1,363 | 1,408 | ||||||||||||

| Revenues | 59 | 55 | 146 | 139 | ||||||||||||

| Fuel and purchased power | 3 | 3 | 8 | 12 | ||||||||||||

| Comparable gross margin | 56 | 52 | 138 | 127 | ||||||||||||

| Operations, maintenance, and administration | 12 | 14 | 24 | 26 | ||||||||||||

| Taxes, other than income taxes | 2 | 2 | 4 | 4 | ||||||||||||

| Comparable EBITDA | 42 | 36 | 110 | 97 | ||||||||||||

| Depreciation and amortization | 28 | 29 | 55 | 59 | ||||||||||||

| Comparable operating income | 14 | 7 | 55 | 38 | ||||||||||||

| Sustaining capital: | ||||||||||||||||

| Routine capital | - | 1 | - | 1 | ||||||||||||

| Planned major maintenance | 2 | 4 | 5 | 6 | ||||||||||||

| Total sustaining capital expenditures | 2 | 5 | 5 | 7 | ||||||||||||

| Productivity capital | - | 3 | - | 3 | ||||||||||||

| Total sustaining and productivity capital expenditures | 2 | 8 | 5 | 10 | ||||||||||||

Production for the three months ended June 30, 2017 increased by 44 GWh compared to same period in 2016, primarily due to higher availability and stronger wind resources, partially offset by sale of the Wintering Hills wind facility in the first quarter of 2017. Production for the six months ended June 30, 2017 decreased by 32 GWh compared to same period in 2016, as stronger wind resources in the first quarter did not fully offset the lost generation from the Wintering Hills wind facility, which was sold in the first quarter of 2017.

Comparable EBITDA for the three and six months ended June 30, 2017 increased by $6 million and $13 million, respectively, compared to the same periods in 2016, primarily due to better generation than last year at our contracted facilities in Eastern Canada and lower operations, maintenance, and administration expenses after renegotiating Long Term Service Agreements with service providers.

Depreciation and amortization was lower by $4 million for the first half of 2017 compared to 2016, primarily due to the disposition of our Wintering Hills merchant wind facility, which closed on March 1, 2017.

| M14 transalta corporation / Q2 2017 |

Hydro

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Contract production (GWh) | 695 | 482 | 1,062 | 899 | ||||||||||||

| Merchant production (GWh) | 31 | 37 | 39 | 41 | ||||||||||||

| Total production (GWh) | 726 | 519 | 1,101 | 940 | ||||||||||||

| Gross installed capacity (MW) | 926 | 926 | 926 | 926 | ||||||||||||

| Revenues | 40 | 38 | 64 | 66 | ||||||||||||

| Fuel and purchased power | 2 | 2 | 3 | 4 | ||||||||||||

| Comparable gross margin | 38 | 36 | 61 | 62 | ||||||||||||

| Operations, maintenance, and administration | 9 | 10 | 17 | 17 | ||||||||||||

| Taxes, other than income taxes | 1 | 1 | 2 | 2 | ||||||||||||

| Comparable EBITDA | 28 | 25 | 42 | 43 | ||||||||||||

| Depreciation and amortization | 9 | 6 | 17 | 13 | ||||||||||||

| Comparable operating income | 19 | 19 | 25 | 30 | ||||||||||||

| Sustaining capital: | ||||||||||||||||

| Routine capital, excluding hydro life extension | 1 | 2 | 3 | 2 | ||||||||||||

| Hydro life extension | - | 3 | - | 6 | ||||||||||||

| Planned major maintenance | 1 | - | 2 | 2 | ||||||||||||

| Total | 2 | 5 | 5 | 10 | ||||||||||||

Production for the three and six months ended June 30, 2017 increased by 207 GWh and 161 GWh, respectively, compared to the same periods in 2016, primarily due to higher water resources from spring run-off in Alberta.

This higher volume of generation positively impacted comparable EBITDA for the three months ended June 30, 2017, which increased by $3 million compared to the same period in 2016. Last year, we recorded a $3 million positive adjustment in the first quarter relating to a prior year metering issues at one of our facilities.

Depreciation for the three and six months ended June 30, 2017 increased by $3 million and $4 million, respectively, compared to the same periods in 2016, primarily due to a higher asset base and the recognition of a decommissioning obligation on transmission lines recently taken out of service. As the lines are not in service, the recognition of the obligation impacts depreciation.

Sustaining capital for the second quarter and year-to-date 2017 decreased $3 million and $5 million, respectively, compared to the same periods in 2016, primarily due to life extension projects at Bighorn and Brazeau last year.

| transalta corporation /Q2 2017 m15 |

Energy Marketing

| 3 months ended June 30 | 6 months ended June 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenues and comparable gross margin | 18 | 11 | 19 | 43 | ||||||||||||

| Operations, maintenance, and administration | 6 | 5 | 11 | 14 | ||||||||||||

| Comparable EBITDA | 12 | 6 | 8 | 29 | ||||||||||||

| Depreciation and amortization | 1 | - | 1 | 1 | ||||||||||||

| Comparable operating income | 11 | 6 | 7 | 28 | ||||||||||||

For the three months ended June 30, 2017, comparable EBITDA exceeded our 2016 results by $6 million due to a return to normal level of gross margin and better performance in certain markets. On a year to date basis, results were lower compared to 2016, due to unfavourable first quarter of 2017 results impacted by warm weather during the winter in the Northeast, significant precipitation in the Pacific Northwest, and reduced margins from our customer business.

Corporate

Our Corporate overhead costs were $4 million and $10 million higher for the three and six months ended June 30, 2017, respectively, compared to the same periods in 2016. Corporate costs in the second quarter include certain costs relating to our corporate transformation that we expect will translate into significant long-term cost savings. See the Strategic Growth and Corporate Transformation section of this MD&A for further details. The first quarter of 2017 also includes the reclassification of incentives for 2016 between our operational segments and our Corporate segment.

Key Financial Ratios

The methodologies and ratios used by rating agencies to assess our credit ratings are not publicly disclosed. We have developed our own definitions of ratios and targets to help evaluate the strength of our financial position. These metrics and ratios are not defined under IFRS, and may not be comparable to those used by other entities or by rating agencies. We are focused on strengthening our financial position and flexibility and aim to meet all our target ranges by 2018.

FFO before Interest to Adjusted Interest Coverage

| As at | June 30, 2017(1) | Dec. 31, 2016 | ||||||

| FFO | 780 | 763 | ||||||

| Add: Interest on debt net of interest income and capitalized interest | 222 | 223 | ||||||

| FFO before interest | 1,002 | 986 | ||||||

| Interest on debt net of interest income | 239 | 239 | ||||||

| Add: 50 per cent of dividends paid on preferred shares | 20 | 21 | ||||||

| Adjusted interest | 259 | 260 | ||||||

| FFO before interest to adjusted interest coverage (times) | 3.9 | 3.8 | ||||||

Our target for FFO before interest to adjusted interest coverage is four to five times. The ratio improved slightly compared to 2016 due to stronger FFO. We expect this metric to improve towards our targeted level as a result of increased comparable EBITDA from operations at our South Hedland power project. See the Significant and Subsequent Events section of this MD&A for further details on South Hedland’s commissioning.

| (1) | Last 12 months. Our target range for FFO in 2017 is $765 million to $820 million. |

| M16 transalta corporation / Q2 2017 |

Adjusted FFO to Adjusted Net Debt

| As at | June 30, 2017 | Dec. 31, 2016 | ||||||

| FFO(1) | 780 | 763 | ||||||

| Less: 50 per cent of dividends paid on preferred shares(1) | (20 | ) | (21 | ) | ||||

| Adjusted FFO(1) | 760 | 742 | ||||||

| Period-end long-term debt(2) | 3,803 | 4,361 | ||||||

| Less: Cash and cash equivalents | (50 | ) | (305 | ) | ||||

| Add: 50 per cent of issued preferred shares | 471 | 471 | ||||||

| Fair value asset of economic hedging instruments on debt(3) | (44 | ) | (163 | ) | ||||

| Adjusted net debt | 4,180 | 4,364 | ||||||

| Adjusted FFO to adjusted net debt (%) | 18.2 | 17.0 | ||||||

Our adjusted FFO to adjusted net debt ratio improved to 18.2 per cent, due to the reduction in our net debt year-to-date and the improvement in FFO. We expect this metric to improve towards our targeted level of 20 to 25 per cent as a result of increased comparable EBITDA from our operations at our South Hedland power project. See the Significant and Subsequent Events section of this MD&A for further details on South Hedland’s commissioning.

Adjusted Net Debt to Comparable EBITDA

| As at | June 30, 2017 | Dec. 31, 2016 | ||||||

| Period-end long-term debt(1) | 3,803 | 4,361 | ||||||

| Less: Cash and cash equivalents | (50 | ) | (305 | ) | ||||

| Add: 50 per cent of issued preferred shares | 471 | 471 | ||||||

| Fair value asset of economic hedging instruments on debt(3) | (44 | ) | (163 | ) | ||||

| Adjusted net debt | 4,180 | 4,364 | ||||||

| Comparable EBITDA | 1,160 | 1,145 | ||||||

| Adjusted net debt to comparable EBITDA (times) | 3.6 | 3.8 | ||||||

As at June 30, 2017 our adjusted net debt to comparable EBITDA ratio improved compared to 2016, mainly due to the significant reduction in our net debt during the year. Our target for adjusted net debt to comparable EBITDA is 3.0 to 3.5 times. We expect this metric to trend towards our targeted level due to the expected increase in comparable EBITDA of approximately $80 million annually from operations at our South Hedland power project. See the Significant and Subsequent Events section of this MD&A for further details on South Hedland’s commissioning.

| (1) | Last 12 months. Our target range for FFO in 2017 is $765 million to $820 million. |

| (2) | Includes finance lease obligations and tax equity financing. |

| (3) | Included in risk management assets and/or liabilities on the condensed consolidated financial statements as at June 30, 2017 and Dec. 31, 2016. During the first quarter of 2017, we discontinued hedge accounting on certain US-denominated debt hedges. The foreign currency derivatives remain in place as economic hedges. See the Financial Instruments section of this MD&A for further details. |

| transalta corporation /Q2 2017 m17 |

Strategic Growth and Corporate Transformation

Kent Hills 3 Wind Project

During the second quarter of 2017, TransAlta Renewables entered into a long-term contract with the New Brunswick Power Corporation for the sale of all power generated by an additional 17.25 MW of capacity to be installed at our Kent Hills wind project.

This is an expansion project of our existing Kent Hills wind project on approximately five to ten acres of Crown land, increasing the total operating capacity of the Kent Hills wind project to approximately 167 MW. As part of the regulatory process, we are submitting an Environmental Impact Assessment to the province of New Brunswick in the third quarter. If environmental approvals are received, we expect to begin the construction phase in the spring of 2018.

Brazeau Hydro Pumped Storage

The Brazeau Hydro Pumped Storage project is an innovative way to generate and shape clean electricity. It will store water that can be used to both generate power when it is needed and store excess power supply when demand is low. When there is excess renewable generation in periods of low demand, water will be pumped from the lower reservoir and stored in the upper reservoir to be used later. When demand is high and generation from other renewables generation is not sufficient, water will flow back through a turbine using gravity to generate clean electricity. The Brazeau Pumped storage project is a focus for us, as it has existing infrastructure that reduces the cost of the project, is situated close to existing transmission infrastructure, and allows for increased renewable development by balancing intermittent generation from wind and solar.

We are currently working to secure a path that will advance our investment in the project and secure a long-term contract for the project. The Brazeau Hydro Pumped Storage project is expected to have new capacity ranging between 600 MW to 900 MW, bringing the total Brazeau facility to 955 – 1,255 MW, post-completion. We estimate an investment in the range of $1.8 billion to $2.5 billion and expect construction to begin upon receipt of a long-term contract and regulatory approvals, between 2020 and 2021, and operations to commence in 2025. This year we are investing $5 million to $10 million to advance the environmental study, work with stakeholders, and execute geotechnical work to help further our design and construction phase.

Corporate Transformation - Project Greenlight

Our major corporate transformation project, called “Greenlight”, is a top priority for us. Driven by engagement from all employees, the intent is to deliver ambitious improvements in every part of our company. Initiatives include increasing revenue, improving generation, reducing operating and maintenance costs, reducing overhead costs and financing costs, and optimizing our capital spend. We expect Greenlight to deliver sustainable pre-tax savings of approximately $50 million to $70 million annually, commencing in 2018. We are on track to achieve our expected annual savings targets. Our internal cost to run these initiatives is expected to be between $10 million to $15 million in 2017.

Significant and Subsequent Events

Commissioning of South Hedland Facility and Conversion of Class B Shares

During, and subsequent to, the quarter, the final stages of construction of our South Hedland Facility, including reliability runs, were completed. The facility achieved commercial operation on July 28, 2017. On Aug. 1, 2017, TransAlta Renewables announced the conversion of the Class B Shares to common shares and an increase in monthly dividend rate by approximately 7 per cent.

On Aug. 1, 2017, Fortescue Metals Group Ltd. (“FMG”) issued a news release indicating that it had notified us that in its view the South Hedland Facility has not yet satisfied the requisite performance criteria under the South Hedland power purchase agreement between FMG and TransAlta. Our view is that all the conditions to establishing that commercial operations have been achieved under the terms of the power purchase agreement with FMG have been satisfied in full.

| M18 transalta corporation / Q2 2017 |

Termination of Solomon Power Purchase Arrangement

On Aug. 1, 2017, we received notice that FMG intends to repurchase the Solomon Power facility from TEC Pipe Pty Ltd., a wholly-owned subsidiary of the Corporation, for approximately US$335 million. FMG is expected to complete its acquisition of the Solomon Power Station in November 2017. We will utilize the proceeds in part to repay the credit facility used to fund the development of the South Hedland power station, for other future growth opportunities, and for general corporate purposes.

TransAlta Renewables Credit Facility

On July 24, 2017, TransAlta Renewables entered into a syndicated credit agreement giving it access to a $500 million committed credit facility. The agreement is fully committed for four years, expiring in 2021. The facility is subject to a number of customary covenants and restrictions in order to maintain access to the funding commitments. In conjunction with the new credit agreement, the existing $350 million credit facility currently provided by TransAlta was cancelled. At the same time, we also extended our credit facility, expiring in 2021 and reduced its credit facility by $500 million to $1 billion in total.

Appointment of Director

On July 13, 2017, the Board of Directors (the “Board”) appointed the Honourable Rona Ambrose to the Board effective July 13, 2017. We believe that Ms. Ambrose’s extensive public policy experience and demonstrated ability to bring people of divergent views together for a common purpose will strengthen our Board. Her experience, along with her Alberta roots, will also help further our strategy of becoming Canada’s leading clean power company through good governance, operational excellence, and growth. Ms. Ambrose was the former Leader of Canada’s Official Opposition in the House of Commons and former leader of the Conservative Party of Canada. She also acted as Minister of the Crown across nine government departments, including serving as Vice Chair of the Treasury Board and Chair of the cabinet committee for public safety, justice and aboriginal issues.

In addition to serving as an independent director, Ms. Ambrose is a Global Fellow at the Wilson Center Canada Institute in Washington, D.C. focusing on key Canada-U.S. bilateral trade and competitiveness issues. We look forward to the contributions of Ms. Ambrose to the Board of Directors.

Balancing Pool PPA Termination Consultation

On July 4, 2017, the Balancing Pool announced its intention to consult with customer representatives regarding the termination of the Alberta PPAs that it holds for Sundance A, Sundance B and Sundance C (the “Sundance PPAs”). It also stated that it considered the termination of the Sundance PPAs to be reasonable.

Under Section 97 of the Electric Utilities Act (Alberta), the Balancing Pool may terminate the PPAs if it:

| § | Consults with representatives of customers and the Minister of Energy about the reasonableness of the termination; |

| § | Gives to the owner of the generating unit to which the PPA applies 6 months’ notice, or any shorter period agreed to by the owner, of its intention to terminate, and; |

| § | Pays the owner or ensures that the owner receives an amount equal to the remaining closing net book value of the generating unit, determined in accordance with the PPA, as if the generating unit had been destroyed, less any insurance proceeds. |

We have 3,770 MW of gross capacity under PPAs, including hydro, representing approximately 23 per cent of the generation capacity in Alberta. If, after meeting the requirements, the Balancing Pool chooses to terminate the Sundance B and C PPAs, we expect to receive approximately $231 million in payment for the net book value of the assets. Proceeds from any termination would be used to reduce outstanding debt, fund growth opportunities, and replace current gross margin from the existing PPAs. The Sundance A PPA expires at the end of 2017 and, as such, it was not included in the Balancing Pool’s initial PPA termination considerations.

Termination of the Sundance PPAs is expected to provide us with increased operational flexibility, including with respect to offer pricing for generation from the affected units, maintenance and turnaround schedules, and the timing of the coal-to-gas conversions.

| transalta corporation /Q2 2017 m19 |

Series C Preferred Share Conversion Results and Rate Reset

On June 16, 2017, the Corporation announced that the minimum election notices received did not meet the requirements required to give effect to the conversion of the Series C Preferred Shares into the Series D Preferred Shares. As a result, none of the Series C Preferred Shares were converted into Series D Preferred Shares on June 30, 2017, and the dividend rate will remain fixed for the subsequent five-year period.

Transition to Clean Power in Alberta and Impairment Charge

On April 19, 2017, we announced our strategy to accelerate our transition to gas and renewables generation. The strategy includes the following steps:

| § | retirement of Sundance Unit 1 effective Jan. 1, 2018; |

| § | mothballing of Sundance Unit 2 effective Jan. 1, 2018, for a period of 2 years; and |

| § | conversion of Sundance Units 3 to 6 and Keephills Units 1 and 2 from coal-fired generation to gas-fired generation in the 2021 to 2023 timeframe, thereby extending the useful lives of these units until the mid-2030's. |

The retirement of Sundance Unit 1 and mothballing of Sundance Unit 2 reflects the limited economic viability of the units upon the expiry of their PPA due to the current oversupplied Alberta power market and low power price environment and is not expected to materially impact our forecasted cash flows for 2018 and 2019.

The benefits of converting coal-fired units to gas-fired generation include:

| § | significantly lowering carbon intensities, emissions, and carbon costs; |

| § | significantly lowering operating and sustaining capital costs; |

| § | increasing operating flexibility; and |

| § | adding between five-to-ten years of economic life to each converted unit. |

Sundance Units 1 and 2

Federal regulations stipulate that all coal plants built before 1975 must cease to operate on coal by the end of 2019, which includes Sundance Units 1 and 2. Given that Sundance Unit 1 will be shut down two years early, the federal Minister of Environment has agreed to extend the life of Sundance Unit 2 from 2019 to 2021. This will provide us with flexibility to respond to the regulatory environment for coal-to-gas conversions and the new upcoming Alberta capacity market.

Sundance Units 1 and 2 collectively comprise 560 MW of the 2,141 MW at the Sundance power plants, which serves as a baseload provider for the Alberta electricity system. The PPA with the Balancing Pool relating to Sundance Units 1 and 2 expires on Dec. 31, 2017.

In the second quarter of 2017, we recognized an impairment loss on Sundance Unit 1 in the amount of $20 million due to our decision to early retire Sundance Unit 1. Previously, we had expected Sundance Unit 1 to operate in the merchant market in 2018 and 2019. The impairment assessment was based on value in use and included the estimated future cash flows expected to be derived from the Unit until its retirement on Jan. 1, 2018. Discounting did not have a material impact.

No change in estimated useful life or separate stand-alone impairment test arose for Sundance Unit 2, as mothballing the Unit maintains our flexibility to operate the Unit beyond the expiry of the PPA to 2021.

Coal-to-Gas Conversions

In December 2016, notice was given by Environment and Climate Change Canada of its intention to amend regulations to phase out coal-fired generation by 2030 while permitting the conversion of boiler units from coal to natural gas fired generation for a period of up to 15 years or until 2045, whichever comes first. These regulations, which will facilitate our proposed coal-to-gas conversions, remain a work-in-progress. We are engaged with the Government of Canada in the development of required regulatory regime.

We are planning the conversion of Sundance Units 3 and 6 and Keephills Units 1 and 2 to gas-fired generation in the 2021 to 2023 timeframe, thereby extending the useful lives of these units until the mid-2030’s. We expect that the capacity of Sundance Units 3 to 6 and Keephills 1 and 2 will not change following conversion, which will result in a reduction of approximately 40 per cent of carbon emissions while maintaining approximately 2,400 MWs in the Alberta power grid.

| M20 transalta corporation / Q2 2017 |

Our total capital commitment for the coal-to-gas conversions is expected to be approximately $300 million, mostly invested between 2021 to 2023. We anticipate funding the conversions with free cash flow at that time. These units are expected to provide low cost capacity and to be competitive in the upcoming capacity market auctions; we expect the first auction to occur in 2019 for 2021 and that Federal and Provincial regulations will be adopted to facilitate coal-to-gas conversions. We continue to be engaged with government in the development of the required regulatory regime. This year, we are committing $3 million to $5 million to advance engineering for the conversion.

Alberta Off-Coal Agreement

On Nov. 24, 2016, we announced that we entered into the OCA with the Government of Alberta on transition payments in exchange for the cessation of coal-fired emissions from the Keephills 3, Genesee 3, and Sheerness coal-fired plants on or before Dec. 31, 2030.

Under the terms of the OCA, we receive annual cash payments on or before July 31 of approximately $39.7 million ($37.2 million, net to the Corporation), commencing Jan. 1, 2017 and terminating at the end of 2030. We recognize the OCA payments evenly throughout the year. Accordingly, during the three and six months ended June 30, 2017, approximately $10 million and $20 million, respectively, was recognized in Net Other Operating Income in the Condensed Consolidated Statement of Earnings. Receipt of the payments is subject to certain terms and conditions. The OCA’s main condition is the cessation of all coal-fired emissions on or before Dec. 31, 2030. The affected plants are not, however, precluded from generating electricity at any time by any method, other than the combustion of coal. We are expecting to receive our first payment under the OCA in the third quarter of 2017.

Mississauga Cogeneration Facility New Contract

On Dec. 22, 2016, we announced that we had signed a NUG Contract with the Independent Electricity System Operator for our Mississauga cogeneration facility. The NUG Contract became effective on Jan. 1, 2017, and in conjunction with the execution of the NUG Contract, we agreed to terminate effective Dec. 31, 2016, the Mississauga cogeneration facility’s pre-existing contract with the Ontario Electricity Financial Corporation, which would have otherwise terminated in December 2018. The NUG Contract provides us stable monthly payments totalling approximately $209 million until Dec. 31, 2018.

Refer to our 2016 Annual MD&A for further information regarding the Mississauga NUG Contract.

Wintering Hills Sale

On March 1, 2017, we closed the previously announced sale of our 51 per cent interest in the Wintering Hills merchant wind facility for approximately $61 million. Proceeds from the sale have been used for general corporate purposes, including reducing our debt and funding future renewables growth.

Credit Ratings Change

We maintain investment grade ratings from three credit rating agencies. Earlier this year, Fitch Ratings reaffirmed our Unsecured Debt rating and Issuer Rating of BBB- and changed their outlook from negative to stable, DBRS Limited changed our Unsecured Debt rating and Medium-Term Notes rating from BBB to BBB (low), the Preferred Shares rating from Pfd-3 to Pfd-3 (low), and Issuer Rating BBB to BBB (low) (changed to stable from negative), and Standard and Poor’s reaffirmed our Unsecured Debt rating and Issuer Rating of BBB- but changed the outlook from stable to negative.

Environmental Regulation Updates

Refer to the Regional Regulation and Compliance discussion in our 2016 Annual MD&A for further details that supplement the recent developments as discussed below.

Alberta

In March 2016, Alberta began development of its renewable energy procurement process design for the Alberta Electric System Operator (“AESO”) to procure a first block of renewable generation projects to be in-service by 2019. On Sept. 14, 2016, the Government of Alberta re-confirmed its commitment to achieve 30 per cent renewables in Alberta’s electricity energy mix by 2030.

In January 2017, the AESO commenced consultation sessions and initiated the process for the development of a capacity market for the Province of Alberta. In May 2017, the AESO published a Straw Alberta market proposal for discussion.

| transalta corporation /Q2 2017 m21 |

The AESO has now assembled five working groups to develop and provide recommendations on the design of Alberta’s capacity market. The groups are comprised of industry stakeholders that are working collaboratively across five design streams for the market. The working groups are tasked with developing their recommendations into papers that will be publicly issued for stakeholder comment. The comments received from the stakeholder process will be considered by the working groups to refine the recommendations. The first paper is planned to be released in September 2017, followed by papers issued in December 2017 and March 2018 and culminating in a final recommendation paper being issued to the AESO in June 2018. The AESO will begin formalizing the capacity market design and implementing it in the second half of 2018 with first procurement expected in second half of 2019, to be effective in 2021 with first capacity contracts awarded at that time.

Ontario

On Feb. 25, 2016, Ontario released draft regulations for its GHG cap-and-trade program that were finalized on May 19, 2016. The regulations became effective Jan. 1, 2017, and will apply to all fossil fuels used for electricity generation. The majority of our gas-fired generation in Ontario will not be significantly impacted by virtue of change-in-law provisions within existing PPAs.

Capital Structure and Liquidity

Our capital structure consists of the following components as shown below:

| June 30, 2017 | Dec. 31, 2016 | |||||||||||||||

| $ | % | $ | % | |||||||||||||

| Recourse debt - CAD debentures | 1,046 | 13 | 1,045 | 12 | ||||||||||||

| Recourse debt - U.S. senior notes | 1,551 | 19 | 2,151 | 25 | ||||||||||||

| Credit facilities | 100 | 1 | - | - | ||||||||||||

| U.S. tax equity financing | 35 | - | 39 | 1 | ||||||||||||

| Other | 14 | - | 15 | - | ||||||||||||

| Less: cash and cash equivalents | (50 | ) | (1 | ) | (305 | ) | (4 | ) | ||||||||

| Less: fair value asset of economic hedging instruments on debt(1) | (44 | ) | (1 | ) | (163 | ) | (2 | ) | ||||||||

| Net recourse debt | 2,652 | 31 | 2,782 | 32 | ||||||||||||

| Non-recourse debt | 992 | 12 | 1,038 | 12 | ||||||||||||

| Finance lease obligations | 65 | 1 | 73 | 1 | ||||||||||||

| Total net debt | 3,709 | 44 | 3,893 | 45 | ||||||||||||

| Non-controlling interests | 1,124 | 14 | 1,152 | 14 | ||||||||||||

| Equity attributable to shareholders | ||||||||||||||||

| Common shares | 3,094 | 37 | 3,094 | 36 | ||||||||||||

| Preferred shares | 942 | 11 | 942 | 11 | ||||||||||||

| Contributed surplus, deficit, and accumulated other comprehensive income | (560 | ) | (6 | ) | (525 | ) | (6 | ) | ||||||||

| Total capital | 8,309 | 100 | 8,556 | 100 | ||||||||||||

We continued down our path of strengthening our financial position during the first half of 2017 and reduced our total net debt by $184 million. We made a scheduled US$400 million US Senior Note repayment. This repayment was hedged with a cross currency swap entered into on issuance of the debt that effectively reduced our Canadian dollar repayment by approximately $107 million.

| (1) | During the first quarter of 2017, we discontinued hedge accounting on certain US-denominated debt hedges. The foreign currency derivatives remain in place as economic hedges. See the Financial Instruments section of this MD&A for further details. |

| M22 transalta corporation / Q2 2017 |

On Jan. 18, 2017, we renewed a US base shelf prospectus that allows for the issuance of up to $2.0 billion aggregate principal amount (or its equivalent in other currencies) of common shares, first preferred shares, warrants, subscription receipts and debt securities from time to time. We also have a Canadian base shelf prospectus, which would allow for the issuance of common shares, first preferred shares, warrants, subscription receipts and debt securities from time to time. The specific terms of any offering of securities is to be determined at the date of issue.

The weakening of the US dollar has decreased our long-term debt balances by $61 million compared to Dec. 31, 2016. Almost all our U.S.-denominated debt is hedged(1) either through financial contracts or net investments in our U.S. operations. During the period, these changes in our U.S.-denominated debt were offset as follows: