|

TransAlta Corporation third quarter report for 2014 |

management’s discussion and analysis

This Management’s Discussion and Analysis

(“MD&A”) contains forward-looking statements. These statements are based on certain estimates and assumptions and

involve risks and uncertainties. Actual results may differ materially. See the

Forward-Looking Statements section of this MD&A for additional information.

This MD&A should be read in conjunction with the unaudited interim condensed consolidated financial statements of TransAlta Corporation as at and for the three and nine months ended Sept. 30, 2014 and 2013, and should also be read in conjunction with the audited consolidated financial statements and MD&A contained within our 2013 Annual Report. In this MD&A, unless the context otherwise requires, ‘we’, ‘our’, ‘us’, the ‘Corporation’, and ‘TransAlta’ refer to TransAlta Corporation and its subsidiaries. The condensed consolidated financial statements have been prepared in accordance with International Financial Reporting Standard (“IFRS”) IAS 34 Interim Financial Reporting. All tabular amounts in the following discussion are in millions of Canadian dollars unless otherwise noted. This MD&A is dated Oct. 29, 2014. Additional information respecting TransAlta, including its Annual Information Form, is available on SEDAR at www.sedar.com.

rESULTS OF OPERATIONS

The results of operations are presented on a consolidated basis and by business segment. We have three business segments: Generation, Energy Trading, and Corporate. For this MD&A, we have further split what is reported as our Generation business segment into the various fuel types to provide additional information to our readers. In this MD&A, the impact of foreign exchange fluctuations on foreign currency denominated transactions and balances is discussed with the relevant Condensed Consolidated Statements of Earnings (Loss) and Condensed Consolidated Statements of Financial Position items. While individual line items in the Condensed Consolidated Statements of Financial Position may be impacted by foreign exchange fluctuations, the net impact of the translation of these items relating to foreign operations to our presentation currency is reflected in Accumulated Other Comprehensive Income (Loss) (“AOCI”) in the equity section of the Condensed Consolidated Statements of Financial Position.

NON-IFRS MEASURES

We evaluate our performance and the performance of our business segments using a variety of measures. Certain of these measures discussed in this MD&A are not defined under IFRS and, therefore, should not be considered in isolation or as an alternative to or to be more meaningful than net earnings attributable to common shareholders or cash flow from operating activities, as determined in accordance with IFRS, when assessing our financial performance or liquidity. These measures may not be comparable to similar measures presented by other issuers and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. See the Funds from Operations and Free Cash Flow, and Earnings and Other Measures on a Comparable Basis, sections of this MD&A for additional information.

highlights

Consolidated Highlights

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | ||||

| 2014 | 2013 | 2014 | 2013 | ||

| Revenues | 639 | 623 | 1,905 | 1,705 | |

| Comparable EBITDA(1) | 212 | 266 | 735 | 781 | |

| Net earnings (loss) attributable to common shareholders | (6) | (9) | (7) | (5) | |

| Comparable net earnings (loss) attributable to common shareholders(1) |

(13) | 39 | 22 | 80 | |

| Funds from operations(1) | 145 | 174 | 537 | 551 | |

| Cash flow from operating activities | 216 | 253 | 546 | 601 | |

| Free cash flow(1) | 33 | 64 | 191 | 235 | |

| Net earnings (loss) per share attributable to common shareholders, basic and diluted |

(0.03) | (0.03) | (0.03) | (0.02) | |

| Comparable net earnings (loss) per share(1) | (0.05) | 0.15 | 0.08 | 0.31 | |

| Funds from operations per share(1) | 0.53 | 0.65 | 1.97 | 2.10 | |

| Free cash flow per share(1) | 0.12 | 0.24 | 0.70 | 0.90 | |

| Dividends paid per common share | 0.18 | 0.29 | 0.65 | 0.87 | |

| As at | Sept. 30, 2014 | Dec. 31, 2013(2) | |||

| Total assets | 9,568 | 9,624 | |||

| Total long-term liabilities | 4,613 | 5,348 | |||

[1]

Financial Highlights

| § | Comparable earnings before interest, taxes,

depreciation, and amortization (“EBITDA”) for the third quarter and year-to-date periods in 2014 totalled $212 million and $735 million, respectively, with strong availability throughout our generation portfolio and continued improved operational performance at Canadian Coal. Third quarter and year-to-date comparable EBITDA decreased $54 million and $46 million, respectively, compared to the same periods in 2013, primarily due to lower prices in Alberta which impacted our assets in the province. Prices in Alberta averaged $56 per megawatt hour (“MWh”) during the nine months ended Sept. 30, 2014, compared to $91 per MWh in the same period in 2013. Hydro assets were further impacted by reduced price volatility and lower water resource. Our strategy of being highly contracted and high availability in Canadian Coal generally limited the impacts of lower prices in Alberta. The third quarter was also impacted by lower trading margins. |

| § | Funds from operations (“FFO”) for the three and nine months ended Sept. 30, 2014 decreased $29 million and $14 million, respectively, compared to the same periods in 2013, primarily due to lower comparable EBITDA, partially offset by higher realized gains from risk management activities and lower current income tax expense. |

| § | These results were in line with our expectations. However, subsequent to Sept. 30, 2014, we have observed weaker than expected prices for the fourth quarter, which impact primarily our Alberta wind and hydro assets. Accordingly, our forecasts for the year are tracking to the lower end of previously disclosed comparable EBITDA and FFO guidance, and expected ranges have been revised accordingly. Revised expected comparable EBITDA for 2014 is between $1,005 million and $1,025 million, and revised expected FFO is between $735 million and $755 million. |

__________________________

(1) These items are not defined under IFRS. Presenting these items from period to period provides management and investors with the ability to evaluate earnings trends more readily in comparison with prior periods’ results. Refer to the Funds from Operations and Free Cash Flow and Earnings and Other Measures on a Comparable Basis sections of this MD&A for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS.

(2) After giving effect to the reclassification described in the Current Accounting Changes section of this MD&A.

| § | Third quarter comparable net loss attributable to common shareholders was $13 million ($0.05 net loss per share) and year-to-date comparable net earnings attributable to common shareholders was $22 million ($0.08 net earnings per share), down from comparable net earnings of $39 million ($0.15 net earnings per share) and $80 million ($0.31 net earnings per share), respectively, due to the decrease in comparable EBITDA and higher non-controlling interests, partially offset by lower income tax expense. |

| § | Reported net loss attributable to common shareholders was $6 million for the third quarter ($0.03 net loss per share) and $7 million year-to-date ($0.03 net loss per share), compared to a net loss of $9 million ($0.03 net loss per share) and $5 million ($0.02 net loss per share) for the same periods in 2013. The difference between comparable and reported net earnings is due to increases in the fair value of future period economic hedges at U.S. Coal, and a larger deferred income tax writedown in 2013. The change in the year-to-date reported net loss was also impacted by a one-time loss on assumption of pension obligations in the prior period. |

Strategic Initiative Highlights

During the quarter we continued to make significant progress to grow our portfolio of highly contracted assets, improve our operating performance, and strengthen our financial condition.

| § | Entered into agreements to build and operate a 150 megawatt (“MW”) combined cycle gas power station in South Hedland, Western Australia. The project is estimated to cost approximately AUD$570 to build. The fully contracted power station is expected to be commissioned and delivering power to customers in the first half of 2017. We expect to receive our permits before the end of 2014, and begin construction during the first quarter of 2015. |

| § | Continued construction with our joint venture partner of an AUD$178 million natural gas pipeline to our Solomon power station. We hold a 43 per cent interest in the joint venture. The project is on schedule and within budget, with expected commencement of commercial operations in early 2015. |

| § | Successfully completed an offering of preferred shares for gross proceeds of $165 million. Proceeds from this transaction will provide flexibility to repay debt maturing early in 2015. |

| § | Continued executing our hydro life extension plan, sustaining our advantage as the first hydro power producer in Alberta. |

Earlier this year we completed the following transactions:

| § | Completed the sale of our 50 per cent ownership of CE Generation LLC (“CE Gen”), the Blackrock Development Project (“Blackrock”), and CalEnergy, LLC (“CalEnergy”) for net proceeds of U.S.$188.5 million. |

| § | Completed a secondary offering of TransAlta Renewables Inc. (“TransAlta Renewables”) shares for proceeds of approximately $129 million, net of offering costs. |

| § | Successfully completed an offering of U.S.$400 million of senior notes, due in June 2017. |

Operational Results

Comparable EBITDA is as follows:

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | |||

| 2014 | 2013 | 2014 | 2013 | |

| Availability (%)(1) | 92.0 | 85.9 | 88.6 | 83.1 |

| Adjusted availability (%)(1),(2) | 92.0 | 85.9 | 89.6 | 86.4 |

| Production (GWh)(1) | 11,445 | 11,088 | 32,795 | 29,842 |

| Comparable EBITDA | ||||

| Generation Segment | ||||

| Canadian Coal | 91 | 95 | 268 | 239 |

| U.S. Coal | 12 | 20 | 43 | 52 |

| Gas | 77 | 75 | 228 | 246 |

| Wind | 26 | 25 | 121 | 121 |

| Hydro | 26 | 50 | 65 | 127 |

| Total Generation Segment | 232 | 265 | 725 | 785 |

| Energy Trading Segment | (3) | 17 | 50 | 41 |

| Corporate Segment | (17) | (16) | (40) | (45) |

| Total comparable EBITDA | 212 | 266 | 735 | 781 |

[2]

| § | Canadian Coal: Comparable EBITDA decreased

slightly to $91 million in the third quarter and increased to $268 million year-to-date, compared to $95 million and $239 million, respectively, for the same periods in 2013. The increase in year-to-date comparable EBITDA is primarily driven by increased availability, from 78.2 per cent during the period in 2013 to 87.6 per cent in 2014. We have also been able to decrease fuel costs per tonne through greater efficiency and productivity. In the third quarter of 2014, the benefits of these improvements have been offset by lower Alberta prices. Our contract profile in Alberta as well as our hedging strategy significantly mitigates the $35 per MWh market price reduction year over year. Sundance Units 1 and 2, which returned to service a year ago, have been performing as planned. |

| § | U.S. Coal: Comparable EBITDA was $12 million in the third quarter and $43 million year-to-date, compared to $20 million and $52 million, respectively, for the same periods in 2013, primarily due to lower volumes of higher-priced hedges. In the third quarter of 2014, we also incurred higher costs than in the same period in 2013 to purchase power during periods of curtailment. In order to mitigate coal supply risks during the winter months, coal has been stockpiled in anticipation of increased rail congestion into 2015. |

| § | Gas: Comparable EBITDA was $77 million in the third quarter and $228 million year-to-date, compared to $75 million and $246 million, respectively, for the same periods in 2013. The decrease in year-to-date comparable EBITDA is primarily due to lower Alberta prices impacting results from the Poplar Creek facility in the second quarter and the effects of the new contract at Ottawa. Increases in third quarter comparable EBITDA are primarily due to increases in fair value of forward purchase and physical gas volumes in Ontario, which is offset by losses in the Energy Trading Segment. |

| § | Wind: Comparable EBITDA was consistent in the third quarter and year-to-date with the same periods in 2013. Production from our Wyoming facility has offset the effects of lower Alberta prices. We have also achieved higher availability through targeted maintenance spend. |

__________________________

(1) Availability and production includes all generating assets (generation operations, finance leases, and equity investments).

(2) Adjusted for economic dispatching at Centralia Thermal.

| § | Hydro: Comparable EBITDA was $26 million in the third quarter and $65 million year-to-date, compared to $50 million and $127 million, respectively, for the same periods in 2013. In 2013, the combination of abundant water resource and high prices had lifted comparable EBITDA. We continue to maintain ample water resource to capture pricing opportunities as they arise. |

| § | Energy Trading Segment: Energy Trading generated a loss of $3 million in the third quarter, down $20 million compared to the third quarter of 2013. Lower commodity price volatility in Alberta and the western U.S. impacted Energy Trading’s ability to generate gross margin. In addition, timing differences related to supplying gas to our Eastern assets negatively impacted our gross margin in the third quarter, which is offset by gains in the Gas results. Year-to-date comparable EBITDA in 2014 was $50 million, up $9 million from $41 million in the same period in 2013 as a result of our ability to optimize our energy marketing assets during extraordinarily volatile market conditions caused by extreme weather events in the northeast during the first quarter of 2014. |

| § | Corporate Segment: Our Corporate Segment incurred similar costs in the third quarter of 2014 of $17 million compared $16 million in 2013. The Corporate Segment incurred costs of $40 million in year-to-date 2014 compared to $45 million in the same period in 2013. The lower costs resulted from a change in the way in which certain overhead cost allocations are made within the organization, partially offset by higher incentive-based compensation. |

AVAILABILITY & PRODUCTION

Availability for the three and nine months ended Sept. 30, 2014 increased compared to the same periods in 2013, primarily due to lower unplanned outages at Canadian Coal.

Production for the three months ended Sept. 30, 2014 increased 357 gigawatt hours (“GWh”) compared to the same period in 2013, primarily due to Sundance Units 1 and 2 returning to service and lower unplanned outages at Canadian Coal, partially offset by higher contract curtailments in Alberta.

For the nine months ended Sept. 30, 2014, production increased 2,953 GWh compared to the same period in 2013, primarily due to Sundance Units 1 and 2 returning to service, lower unplanned outages at Canadian Coal, lower economic dispatching at Centralia Thermal, and the acquisition of Wyoming Wind, partially offset by higher contract curtailments.

Funds from operations AND free cash flow

Presenting non-IFRS measures such as FFO, free cash flow, funds from operations per share, and free cash flow per share from period to period provides management, and investors, with a proxy for the amount of cash generated from operating activities before changes in working capital, and provides the ability to evaluate cash flow trends more readily in comparison with results from prior periods. FFO per share and free cash flow per share are calculated as follows using the weighted average number of common shares outstanding during the period:

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | |||||||

| 2014 | 2013 | 2014 | 2013 | |||||

| Cash flow from operating activities | 216 | 253 | 546 | 601 | ||||

| Impacts associated with California claim | - | - | 33 | - | ||||

| Payment of restructuring costs | - | 1 | - | 5 | ||||

| Non-comparable insurance proceeds | - | - | (6) | - | ||||

| Timing of payments related to assumption of pension obligations |

- | (7) | - | - | ||||

| Decrease in finance lease receivable | 1 | - | 2 | 1 | ||||

| Flood-related maintenance costs | 4 | 4 | 12 | 5 | ||||

| Change in non-cash operating working capital balances | (76) | (77) | (50) | (61) | ||||

| FFO | 145 | 174 | 537 | 551 | ||||

| Deduct: | ||||||||

| Sustaining capital expenditures | (84) | (93) | (255) | (245) | ||||

| Dividends paid on preferred shares | (9) | (9) | (28) | (28) | ||||

| Distributions paid to subsidiaries' non-controlling interests | (19) | (8) | (63) | (43) | ||||

| Free cash flow | 33 | 64 | 191 | 235 | ||||

| Weighted average number of common shares outstanding in the period |

273 | 266 | 272 | 262 | ||||

| FFO per share | 0.53 | 0.65 | 1.97 | 2.10 | ||||

| Free cash flow per share | 0.12 | 0.24 | 0.70 | 0.90 | ||||

A reconciliation of comparable EBITDA to FFO is as follows:

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | |||||||

| 2014 | 2013 | 2014 | 2013 | |||||

| Comparable EBITDA | 212 | 266 | 735 | 781 | ||||

| Realized gains (losses) from risk management activities | 6 | (26) | 16 | (16) | ||||

| Interest expense | (59) | (61) | (178) | (177) | ||||

| Provisions | (4) | 10 | - | 10 | ||||

| Current income tax expense | (7) | (10) | (24) | (36) | ||||

| Realized foreign exchange gain (loss) | (4) | (2) | (3) | 3 | ||||

| Decommissioning and restoration costs settled | (4) | (6) | (11) | (19) | ||||

| Reversal of restructuring charges | - | 1 | - | 3 | ||||

| Payment of restructuring costs | - | 1 | - | 5 | ||||

| Timing of payments related to assumption of pension obligations |

- | (7) | - | - | ||||

| Other non-cash items | 5 | 8 | 2 | (3) | ||||

| FFO | 145 | 174 | 537 | 551 | ||||

FFO for the three months ended Sept. 30,

2014 decreased $29 million compared to the same period in 2013, to

$145 million, primarily due to lower comparable EBITDA. For the nine months ended Sept. 30, 2014, FFO decreased $14 million compared

to the same period in 2013, to $537 million, primarily due to lower comparable EBITDA, partially offset by lower current income

tax expense. Cash interest was consistent for the three and nine month periods in 2014 and 2013.

Free cash flow for the three months ended Sept. 30, 2014 decreased $31 million compared to the same period in 2013 primarily due to the decrease in FFO.

For the nine months ended Sept. 30, 2014, free cash flow decreased $44 million compared to the same period in 2013, to $191 million, primarily due to reduced FFO and higher distributions paid to our subsidiaries’ non-controlling interests as a result of the reduction of our interest in TransAlta Renewables and improved performance at TransAlta Cogeneration L.P. (“TA Cogen”).

significant events

South Hedland Power Project

On July 28, 2014, we announced that we had agreed to build, own, and operate a 150 MW combined cycle gas power station in South Hedland, Western Australia. The project is estimated to cost approximately AUD$570 million to build, including the cost of acquiring existing equipment from Horizon Power. The development has been fully contracted under 25-year Power Purchase Agreements with Horizon Power, a state owned utility company, and The Pilbara Infrastructure Pty Ltd., a wholly owned subsidiary of Fortescue, a mining company. The project may be expanded to accommodate additional customers at later dates. The power station will supply Horizon Power’s customers in the Pilbara region as well as Fortescue’s port operations. IHI Engineering Australia has been selected as the contractor to construct the power station. Relevant work and environmental permits are expected to be received in the fourth quarter of 2014. Teams are preparing for site mobilization. Construction is expected to begin in early 2015 and the power station is expected to be commissioned and delivering power to customers in the first half of 2017.

Australia Natural Gas Pipeline

On Jan. 15, 2014, we announced the formation of an unincorporated joint venture named Fortescue River Gas Pipeline Joint Venture to build, own, and operate an AUD$178 million, 270 kilometer natural gas pipeline from the Dampier to Bunbury Natural Gas Pipeline to our Solomon power station. Usage of the pipeline has been contracted with our Solomon customer under a 20-year agreement. We hold a 43 per cent interest in the joint venture through a wholly owned subsidiary. The project is on schedule and within budget. Construction of the pipeline has begun from both east and west ends, with multiple construction crews working at any one time. As at Sept. 30, 2014, over 40 kilometers of pipe had been welded. In addition to our portion of the pipeline cost, AUD$14 million in plant retrofitting costs are being incurred to allow the Solomon power station to burn gas instead of diesel, which will provide a return over time through increased lease payments.

Sale of Preferred Shares

On Aug. 15, 2014, we completed a public offering of 6.6 million Series G 5.3 per cent Cumulative Redeemable Rate Reset First Preferred Shares, resulting in gross proceeds of $165 million. The proceeds from the offering are being used for general corporate purposes, including the repayment of debt coming due in January 2015.

Sale of CE Gen, Blackrock, and CalEnergy

On June 12, 2014, we completed the previously announced sale of our 50 per cent interest in CE Gen, Blackrock, and CalEnergy to MidAmerican Renewables for gross proceeds of U.S.$200.5 million. The net proceeds were U.S.$188.5 million, after consideration of an equity contribution made by us to CE Gen in May 2014. As a result of the sale, we recognized a pre-tax gain of $1 million in second quarter earnings.

We expect the sale of our 50 per cent interest in the Wailuku Holding Company, LLC (“Wailuku”), announced in February 2014, to close in December 2014.

Secondary Offering of TransAlta Renewables Shares

On April 29, 2014, we completed a secondary offering of 11,950,000 common shares of TransAlta Renewables at a price of $11.40 per common share. As a result of the offering, we received gross proceeds of approximately $136 million (net proceeds of approximately $129 million after issuance costs). The net proceeds from the offering were used to reduce indebtedness, to fund growth, and for general corporate purposes. Following completion of the offering, we own approximately 70.3 per cent of the common shares of TransAlta Renewables.

Fort McMurray Transmission Project

On Jan. 17, 2014, we announced that our strategic partnership with MidAmerican Transmission, TAMA Transmission LP (“TAMA Transmission”), which was formed on May 9, 2013, successfully qualified to participate as a proponent in the Fort McMurray West 500 kilovolt Transmission Project. The Alberta Electric System Operator (“AESO”) announced its selection of a short-list of companies, identifying TAMA Transmission as a participant in the next stage of its competitive process for the project. The AESO has indicated that it intends to select the preferred proponent in December 2014.

California Claim

On May 30, 2014, we announced that our settlement with California utilities, the California Attorney General and certain other parties (“California Parties”) to resolve claims related to the 2000 - 2001 power crisis in the State of California had been approved by the U.S. Federal Energy Regulatory Commission. The settlement provides for the payment by us of U.S.$52 million in two equal payments and a credit of approximately U.S.$97 million for monies owed to us from accounts receivable. The first payment of U.S.$26 million was paid in June 2014 and the second is expected to be made in 2015. During the fourth quarter of 2013, the Corporation accrued for the then expected settlement of these disputes with the California Parties, which resulted in a pre-tax charge to earnings of approximately $56 million. An additional pre-tax charge to 2014 second quarter earnings of $5 million arose as a result of the final settlement.

Proceedings before the Alberta Utilities Commission

On March 21, 2014, the Alberta Market Surveillance Administrator (the “MSA”) filed an application with the Alberta Utilities Commission (the “AUC”) alleging, among other things, that TransAlta manipulated the price of electricity in the Province of Alberta when it took outages at certain of its coal-fired generating units in late 2010 and early 2011. TransAlta has denied the MSA’s allegations in their entirety. The MSA’s application is presently before the AUC. The hearing in relation to the application is currently set to proceed in December 2014.

Senior Notes Offering

On June 3, 2014, we completed an offering

of U.S.$400 million of senior notes, due in June 2017, that carry a coupon rate of

1.90 per cent, payable semi-annually, at an issue price equal to 99.887 per cent of the principal amount of the notes. The net

proceeds from the offering were used to repay borrowings under existing credit facilities and for general corporate purposes.

Sundance Unit 6 Agreement

On Feb. 19, 2014, we reached an agreement with the Power Purchase Arrangement (“PPA”) Buyer related to the dispute on Sundance Unit 6. There were no material impacts to the financial statements as a result of the agreement.

Board of Directors Appointments

During the third quarter of 2014, we announced that Mr. P. Thomas Jenkins, OC, CD and Mr. John. P. Dielwart had been appointed to our Board of Directors, effective Sept. 1 and Oct. 1, 2014, respectively. The appointments are the result of our ongoing process of evaluating the skills and composition of the Board, planning for succession, and aligning the skills of the Board with the strategic direction of the Corporation.

Executive Leadership Team Appointments

On March 18, 2014, we announced three senior leadership appointments that will enhance our objectives of operational excellence from the base business and growth. Brett Gellner was appointed to the role of Chief Investment Officer, responsible for leading all growth aspects of the Corporation. Donald Tremblay joined TransAlta as Chief Financial Officer, effective March 31, 2014, and on July 3, 2014, Wayne Collins joined TransAlta as Executive Vice President, Coal and Mining Operations.

BUSINESS environment

We operate in a variety of business environments to generate electricity, find buyers for the power we generate, and arrange for its transmission. The major markets we operate in are Western Canada, the Western U.S., and Eastern Canada. For a further description of the regions in which we operate as well as the impact of prices of electricity and natural gas upon our financial results, refer to our 2013 Annual MD&A.

Contracted Cash Flows

During the third quarter of 2014, approximately 90 per cent of our consolidated power portfolio was contracted through the use of PPAs and other long-term contracts. We also entered into short-term physical and financial contracts for the remaining volumes, which are primarily for periods of up to five years. The average prices of these contracts for the balance of 2014 are approximately $55 per MWh in Alberta and approximately U.S.$40 per MWh in the Pacific Northwest.

Electricity Prices

Please refer to the Business Environment section of our 2013 Annual MD&A for a full discussion of the spot electricity market and the impact of electricity prices on our business, as well as our strategy to hedge our risks associated with changes in these prices.

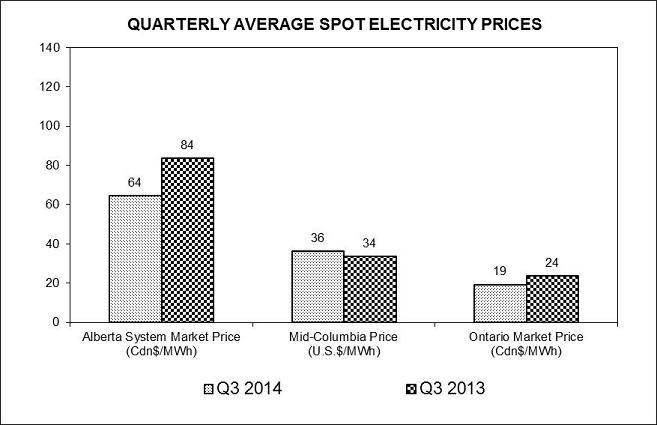

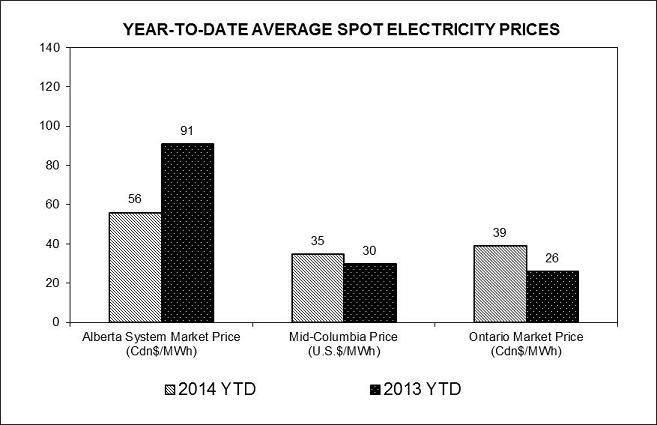

The average spot electricity prices for the three and nine months ended Sept. 30, 2014 and 2013 in our three major markets are shown in the following graphs:

For the three months ended Sept. 30, 2014, average spot prices in Alberta decreased compared to the same period in 2013, primarily due to an increase in supply. Average prices in the Pacific Northwest were consistent with the prior period as increased hydro flows and nuclear availability were offset by higher natural gas prices. Average spot prices in Ontario in the current quarter decreased due to lower demand, as well as increased hydro and renewable generation.

For the nine months ended Sept. 30, 2014, average spot prices in Alberta decreased significantly compared to the same period in 2013, primarily due to an increase in supply. In the Pacific Northwest, average spot prices increased due to higher natural gas prices, particularly in February, partially offset by higher hydro and nuclear production. Average spot prices in Ontario for the nine months ended Sept. 30, 2014 increased compared to the same period in 2013 due to extreme cold weather across the entire northeast during the first quarter, which led to higher natural gas prices and increased demand.

Over the balance of 2014, power prices in Alberta are expected to be lower than 2013 as a result of more baseload generation. However, prices can vary based on supply and weather conditions. In the Pacific Northwest, we expect prices to settle lower than in 2013. Market prices in December 2013 increased as a result of significant cold weather. In Ontario, prices for the balance of the year are expected to be lower than 2013 despite higher natural gas prices due to fewer nuclear unit outages and increased wind capacity compared to 2013. While we did account for lower pricing in our guidance, recent market conditions have been weaker than anticipated and we believe these weak conditions could be sustained through the end of the year.

discussion of segmented results

We have three business segments: Generation, Energy Trading, and Corporate.

Generation: Owns and operates hydro, wind, natural gas-fired and coal-fired facilities, and related mining operations in Canada, the U.S., and Australia. Generation revenues and overall profitability are derived from the availability and production of electricity and steam as well as ancillary services such as system support. Electricity sales generated by our Commercial and Industrial group are assumed to be sourced from TransAlta’s production and have been included in the Generation Segment on a net basis.

The full capacity of the facilities in which we have a share of ownership is 10,144 MW(1)(2). At Sept. 30, 2014, our generating assets had 9,092 MW(1)(2) of gross generating capacity in operation (8,381 MW(1)(2) net ownership interest). The following information excludes assets that were accounted for using the equity method, which are discussed separately within this discussion of the Generation Segment.

The results of the Generation Segment are as follows:

| 3 months ended Sept. 30, 2014 | 3 months ended Sept. 30, 2013(3) | |||||||||

| Reported | Comparable adjustments and reclassifications(4) | Comparable total | Reported | Comparable adjustments and reclassifications(4) | Comparable total | |||||

| Availability (%)(5) | 92.0 | - | 92.0 | 85.7 | - | 85.7 | ||||

| Production (GWh)(5) | 11,445 | - | 11,445 | 10,710 | - | 10,710 | ||||

| Gross installed capacity (MW)(1), (5) | 9,092 | - | 9,092 | 8,668 | - | 8,668 | ||||

| Net installed capacity (MW)(1), (5) | 8,381 | - | 8,381 | 8,073 | - | 8,073 | ||||

| Revenues | 636 | (22) | 614 | 601 | 22 | 623 | ||||

| Fuel and purchased power | 277 | (13) | 264 | 265 | (16) | 249 | ||||

| Gross margin | 359 | (9) | 350 | 336 | 38 | 374 | ||||

| Operations, maintenance, and administration | 113 | (4) | 109 | 103 | (4) | 99 | ||||

| Asset impairment reversals | (1) | 1 | - | (18) | 18 | - | ||||

| Restructuring provision | - | - | - | (1) | 1 | - | ||||

| Taxes, other than income taxes | 6 | - | 6 | 7 | - | 7 | ||||

| Gain on sale of assets | - | - | - | - | (1) | (1) | ||||

| Intersegment cost allocation | 3 | - | 3 | 4 | - | 4 | ||||

| EBITDA | 238 | (6) | 232 | 241 | 24 | 265 | ||||

| Depreciation and amortization | 128 | 13 | 141 | 118 | 17 | 135 | ||||

| Decrease in finance lease receivable | - | 1 | 1 | - | - | - | ||||

| Operating income | 110 | (20) | 90 | 123 | 7 | 130 | ||||

[3]

_______________________________

(1) We measure capacity as net maximum capacity (see Glossary of Key Terms for definition of this and other key terms), which is consistent with industry standards. Capacity figures represent capacity owned and in operation unless otherwise stated. Gross capacity reflects the basis of consolidation of underlying assets, while net capacity deducts capacity attributable to non-controlling interests in these assets.

(2) The Centralia gas plant is currently not in operation. We are currently assessing the generation needs of the region and the financial feasibility of bringing the plant back into operation.

(3) Refer to the Current Accounting Changes section of this MD&A for a description of prior period restatements.

(4) Comparable figures are not defined under IFRS. Refer to the Earnings and Other Measures on a Comparable Basis section of this MD&A for further discussion of these items, including, where applicable, reconciliations to net earnings attributable to common shareholders.

(5) Availability, production, and installed capacity include assets under generation operations and finance leases.

| [4] | 9 months ended Sept. 30, 2014 | 9 months ended Sept. 30, 2013(1) | ||||||||

| Reported | Comparable adjustments and reclassifications(2) | Comparable total | Reported | Comparable adjustments and reclassifications(2) | Comparable total | |||||

| Availability (%)(3) | 88.5 | - | 88.5 | 82.7 | 82.7 | |||||

| Adjusted availability (%)(3), (4) | 89.6 | - | 89.6 | 86.1 | - | 86.1 | ||||

| Production (GWh)(3) | 32,481 | - | 32,481 | 28,678 | - | 28,678 | ||||

| Gross installed capacity (MW)(2), (5) | 9,092 | - | 9,092 | 8,668 | - | 8,668 | ||||

| Net installed capacity (MW)(2), (5) | 8,381 | - | 8,381 | 8,073 | - | 8,073 | ||||

| Revenues | 1,829 | 31 | 1,860 | 1,652 | 95 | 1,747 | ||||

| Fuel and purchased power | 824 | (41) | 783 | 669 | (42) | 627 | ||||

| Gross margin | 1,005 | 72 | 1,077 | 983 | 137 | 1,120 | ||||

| Operations, maintenance, and administration | 329 | (6) | 323 | 308 | (5) | 303 | ||||

| Asset impairment reversals | (1) | 1 | - | (18) | 18 | - | ||||

| Restructuring provision | - | - | - | (2) | 2 | - | ||||

| Taxes, other than income taxes | 20 | - | 20 | 22 | - | 22 | ||||

| Intersegment cost allocation | 10 | - | 10 | 11 | - | 11 | ||||

| Insurance recovery | - | (1) | (1) | - | - | - | ||||

| Gain on sale of assets | - | - | - | - | (1) | (1) | ||||

| EBITDA | 647 | 78 | 725 | 662 | 123 | 785 | ||||

| Depreciation and amortization | 382 | 41 | 423 | 365 | 43 | 408 | ||||

| Decrease in finance lease receivable | - | 2 | 2 | - | 1 | 1 | ||||

| Operating income | 265 | 35 | 300 | 297 | 79 | 376 | ||||

_______________________________

(1) Refer to the Current Accounting Changes section of this MD&A for a description of prior period restatements.

(2) Comparable figures are not defined under IFRS. Refer to the Earnings and Other Measures on a Comparable Basis section of this MD&A for further discussion of these items, including, where applicable, reconciliations to net earnings attributable to common shareholders.

(3) Availability, production, and installed capacity include assets under generation operations and finance leases.

(4) Adjusted for economic dispatching at Centralia Thermal.

(5) We measure capacity as net maximum capacity (see Glossary of Key Terms for definition of this and other key terms), which is consistent with industry standards. Capacity figures represent capacity owned and in operation unless otherwise stated. Gross capacity reflects the basis of consolidation of underlying assets, while net capacity deducts capacity attributable to non-controlling interests in these assets.

Coal: TransAlta owns and operates coal-fired facilities and related mining operations in Canada and the U.S. Coal revenues and overall profitability are derived from the availability and production of electricity. For a full listing of all of our generating assets and the regions in which they operate, refer to the Plant Summary section of our 2013 Annual MD&A.

Canadian Coal

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | |||

| 2014 | 2013 | 2014 | 2013 | |

| Availability (%) | 88.6 | 74.9 | 87.6 | 78.2 |

| Contract production (GWh) | 5,401 | 4,158 | 15,316 | 12,269 |

| Merchant production (GWh) | 999 | 983 | 3,208 | 2,656 |

| Total production (GWh) | 6,400 | 5,141 | 18,524 | 14,925 |

| Gross installed capacity (MW) | 3,771 | 3,491 | 3,771 | 3,491 |

| Net installed capacity (MW) | 3,576 | 3,296 | 3,576 | 3,296 |

| Revenues | 260 | 249 | 750 | 664 |

| Fuel and purchased power | 113 | 101 | 323 | 267 |

| Comparable gross margin(1) | 147 | 148 | 427 | 397 |

| Operations, maintenance, and administration | 52 | 50 | 147 | 147 |

| Taxes, other than income taxes | 3 | 3 | 9 | 9 |

| Gain on sale of assets | - | (1) | - | (1) |

| Intersegment cost allocation | 1 | 1 | 3 | 3 |

| Comparable EBITDA(1) | 91 | 95 | 268 | 239 |

| Depreciation and amortization | 72 | 70 | 216 | 210 |

| Comparable operating income(1) | 19 | 25 | 52 | 29 |

| Sustaining capital expenditures: | ||||

| Routine capital | 13 | 25 | 38 | 44 |

| Mining equipment and land purchases | 19 | 18 | 27 | 38 |

| Finance leases | 3 | 3 | 7 | 7 |

| Planned major maintenance | 17 | 29 | 81 | 88 |

| Total | 52 | 75 | 153 | 177 |

[5]

Production for the three and nine months ended Sept. 30, 2014 increased 1,259 GWh and 3,599 GWh, respectively, compared to the same periods in 2013, primarily due to better availability as a result of the Keephills Unit 1 outage in 2013 and the return to service of Sundance Units 1 and 2. Increases in paid curtailments from our PPA counterparties following lower prices in Alberta have offset impacts on total production. For the balance of 2014, there are no further scheduled planned major maintenance outages on plants we operate.

For the three months ended Sept. 30, 2014, comparable gross margin decreased slightly compared to 2013. We benefited from increased contract production associated with reduced outages compared to the same period in 2013, allowing for increased revenue and contributing to decreasing unit fuel costs. Increases in contract revenue were limited by lower market-based production incentive rates under the terms of the PPAs, due to lower market prices. The effects of spot prices reductions on our merchant production were partially mitigated by our hedging program.

_____________________

(1) Comparable figures are not defined under IFRS. Refer to the Earnings and Other Measures on a Comparable Basis section of this MD&A for further discussion of these items, including, where applicable, reconciliations to net earnings attributable to common shareholders.

For the nine months ended Sept. 30, 2014, comparable gross margin increased by $30 million compared to the same period in 2013, primarily as a result of lower unplanned outages, lower coal costs, and contract price escalations, partially offset by lower Alberta prices. In the first half of 2013, we had to settle financial contracts at high prices due to lower than expected generation during unplanned outages.

For the three and nine months ended Sept. 30, 2014, we have maintained comparable OM&A costs consistent with the same periods in 2013 despite much higher operating capacity with Sundance Units 1 and 2 returning to service. This was achieved through reduced maintenance costs associated with lower unplanned outages and the implementation of an initiative to reduce contract labour, staff overtime work, and material usage.

Depreciation and amortization for the three and nine months ended Sept. 30, 2014 increased compared to the same periods in 2013 due to an increased asset base, primarily related to Sundance Units 1 and 2 returning to service.

For the three and nine months ended Sept. 30, 2014, sustaining capital expenditures decreased $23 million and $24 million, respectively, compared to the same periods in 2013. The reduction is mainly attributable to mining activities, due to completion in 2013 of dragline and shovel major maintenance and to purchases of heavy equipment, in anticipation of production ramp-up to the current levels.

U.S. Coal

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | |||

| 2014 | 2013 | 2014 | 2013 | |

| Availability (%) | 96.9 | 97.6 | 80.3 | 72.7 |

| Adjusted availability (%)(1) | 96.9 | 97.6 | 86.9 | 90.8 |

| Production (GWh) | 2,254 | 2,421 | 4,740 | 4,231 |

| Gross and net installed capacity (MW) | 1,340 | 1,340 | 1,340 | 1,340 |

| Revenues | 109 | 110 | 259 | 233 |

| Fuel and purchased power | 84 | 77 | 176 | 142 |

| Comparable gross margin | 25 | 33 | 83 | 91 |

| Operations, maintenance, and administration | 11 | 11 | 34 | 31 |

| Taxes, other than income taxes | 1 | 1 | 2 | 3 |

| Intersegment cost allocation | 1 | 1 | 4 | 5 |

| Comparable EBITDA | 12 | 20 | 43 | 52 |

| Depreciation and amortization | 13 | 14 | 40 | 41 |

| Comparable operating income (loss) | (1) | 6 | 3 | 11 |

| Sustaining capital expenditures: | ||||

| Routine capital | 2 | 1 | 3 | 5 |

| Planned major maintenance | - | 1 | 9 | 8 |

| Total | 2 | 2 | 12 | 13 |

[6]

For the three months ended Sept. 30, 2014, production decreased 167 GWh compared to the same period in 2013 due to constraints in rail transport of coal and lower availability.

_____________________

(1) Adjusted for economic dispatching.

Production for the nine months ended Sept. 30, 2014 increased 509 GWh compared to the same period in 2013 due to lower economic dispatching as a result of certain months during the period in which higher prices made production more economic. In periods of low market prices, such as during spring runoff, it can be more economic for us to not produce power at Centralia Thermal and purchase power in the market to satisfy our contractual obligations.

For the three and nine months ended Sept. 30, 2014, comparable EBITDA decreased by $8 million and $9 million, respectively, compared to the same periods in 2013, primarily due to compressed margin caused by curtailments from expected constraints in coal supply, lower volumes of higher priced hedges, higher cost of purchased power during periods of market curtailment, and escalation in fuel input costs, partially offset by increased power prices.[7]

Gas: TransAlta owns and operates natural gas-fired facilities in Canada, the U.S., and Australia. Gas revenues and overall profitability are derived from the availability and production of electricity and steam. For a full listing of all of our generating assets and the regions in which they operate, refer to the Plant Summary section of our 2013 Annual MD&A.

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | |||

| 2014 | 2013 | 2014 | 2013 | |

| Availability (%) | 93.7 | 93.1 | 92.9 | 93.7 |

| Production (GWh)(1) | 1,720 | 2,009 | 5,567 | 5,968 |

| Gross installed capacity (MW)(1), (2) | 1,779 | 1,779 | 1,779 | 1,779 |

| Net installed capacity (MW)(1), (2) | 1,618 | 1,618 | 1,618 | 1,618 |

| Revenues | 162 | 167 | 575 | 526 |

| Fuel and purchased power | 60 | 65 | 266 | 202 |

| Comparable gross margin | 102 | 102 | 309 | 324 |

| Operations, maintenance, and administration | 24 | 25 | 77 | 74 |

| Taxes, other than income taxes | - | 1 | 2 | 3 |

| Intersegment cost allocation | 1 | 1 | 2 | 1 |

| Comparable EBITDA | 77 | 75 | 228 | 246 |

| Depreciation and amortization | 28 | 26 | 83 | 80 |

| Decrease in finance lease receivable | 1 | - | 2 | 1 |

| Comparable operating income | 48 | 49 | 143 | 165 |

| Sustaining capital expenditures: | ||||

| Routine capital | 5 | 3 | 13 | 10 |

| Planned major maintenance | 15 | 4 | 39 | 21 |

| Total | 20 | 7 | 52 | 31 |

[8]

Production for the three and nine months ended Sept. 30, 2014 decreased 289 GWh and 401 GWh, respectively, compared to the same periods in 2013, primarily due to the reduced contribution from our Ottawa facility under the terms of the new contract effective Jan. 1, 2014 and the timing of a planned outage.

For the three months ended Sept. 30, 2014, comparable EBITDA was comparable to the same period in 2013, as the effects of lower Alberta prices on our Poplar Creek facility and reduced contribution from our Ottawa facility were offset by mark-to-market gains on certain Ontario gas purchase contracts and stored gas that are used as fuel or for trading purposes. These mark-to-market gains are offset by losses in the Energy Trading Segment.

_____________________

(1) Includes production capacity for Fort Saskatchewan and Solomon power stations, which have been accounted for as finance leases.

(2) The Centralia gas plant is currently not in operation. We are currently assessing the generation needs of the region and the financial feasibility of bringing the plant back into operation.

Comparable EBITDA for the nine months ended Sept. 30, 2014 decreased by $18 million compared to the same period in 2013, primarily due to lower Alberta prices and the reduced contribution from our Ottawa facility under the terms of the contract. Those decreases in comparable EBITDA were partially offset by the benefits achieved through resale of higher priced excess gas during unplanned outages in 2014. The decreased contribution from the Ottawa contract was included in our 2014 full year EBITDA forecast. The new capacity-based contract is consistent with our contracting strategy and its twenty-year duration supports continued investment in the facility.

For the three and nine months ended Sept. 30, 2014, sustaining capital expenditures increased compared to the same periods in 2013, mainly due to an increase in planned major maintenance activities, including outages at Sarnia, Ottawa, and Poplar Creek.

Renewables: TransAlta owns and operates hydro and wind facilities in Canada and the U.S. Renewable revenues and overall profitability are derived from the availability of water and wind resources and the production of electricity, as well as ancillary services such as system support. For a full listing of all of our generating assets and the regions in which they operate, refer to the Plant Summary section of our 2013 Annual MD&A.

Wind

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | |||

| 2014 | 2013 | 2014 | 2013 | |

| Availability (%) | 94.6 | 92.9 | 94.1 | 93.5 |

| Production (GWh) | 532 | 432 | 2,193 | 1,837 |

| Gross installed capacity (MW) | 1,289 | 1,145 | 1,289 | 1,145 |

| Net installed capacity (MW) | 965 | 926 | 965 | 926 |

| Revenues | 43 | 39 | 172 | 165 |

| Fuel and purchased power | 3 | 3 | 10 | 10 |

| Comparable gross margin | 40 | 36 | 162 | 155 |

| Operations, maintenance, and administration | 12 | 9 | 35 | 28 |

| Taxes, other than income taxes | 2 | 1 | 5 | 5 |

| Intersegment cost allocation | - | 1 | 1 | 1 |

| Comparable EBITDA | 26 | 25 | 121 | 121 |

| Depreciation and amortization | 22 | 20 | 66 | 58 |

| Comparable operating income | 4 | 5 | 55 | 63 |

| Sustaining capital expenditures: | ||||

| Routine capital | 1 | - | 2 | 2 |

| Planned major maintenance | 1 | 1 | 5 | 3 |

| Total | 2 | 1 | 7 | 5 |

Production for the three and nine months ended Sept. 30, 2014 increased 100 GWh and 356 GWh, respectively, compared to the same periods in 2013, primarily due to the contribution from recently added facilities and higher wind volumes in Eastern Canada. The increase in availability is associated with our operational improvement strategy focused on higher-priced, contracted facilities.

For the three and nine months ended Sept. 30, 2014, comparable EBITDA was consistent with the same periods in 2013, as increased production offset lower prices in Alberta.

Depreciation and amortization for the three and nine months ended Sept. 30, 2014 increased by $2 million and $8 million, respectively, compared to the same periods in 2013, primarily due to the higher asset based associated with recently added facilities.

Hydro

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | |||

| 2014 | 2013 | 2014 | 2013 | |

| Production (GWh) | 539 | 707 | 1,457 | 1,717 |

| Gross installed capacity (MW) | 913 | 913 | 913 | 913 |

| Net installed capacity (MW) | 882 | 893 | 882 | 893 |

| Revenues | 40 | 58 | 104 | 159 |

| Fuel and purchased power | 4 | 3 | 8 | 6 |

| Comparable gross margin | 36 | 55 | 96 | 153 |

| Operations, maintenance, and administration | 10 | 4 | 30 | 23 |

| Taxes, other than income taxes | - | 1 | 2 | 2 |

| Intersegment cost allocation | - | - | - | 1 |

| Insurance recovery | - | - | (1) | - |

| Comparable EBITDA | 26 | 50 | 65 | 127 |

| Depreciation and amortization | 6 | 5 | 18 | 19 |

| Comparable operating income | 20 | 45 | 47 | 108 |

| Sustaining capital expenditures: | ||||

| Routine capital | 2 | 1 | 13 | 4 |

| Planned major maintenance | 1 | 1 | 1 | 1 |

| Total | 3 | 2 | 14 | 5 |

Production for the three and nine months ended Sept. 30, 2014 decreased 168 GWh and 260 GWh, respectively, compared to the same periods in 2013, due to lower water resource in Western Canada and lower economic incentive to run water. In 2013, water inflows in Western Canada were much higher than normal.

Comparable gross margin decreased by $19 million and $57 million, respectively, for the three and nine months ended Sept. 30, 2014 compared to the same periods in 2013, primarily as a result of lower market pricing in Alberta for power and ancillary services and lower production. Lower prices and low price volatility in Alberta limited our ability to take advantage of our flexibility to produce electricity during higher priced hours.

The $6 million and $7 million increase in OM&A expense during the three and nine months ended Sept. 30, 2014, respectively, compared to the same periods in 2013, is associated primarily with the return to regular maintenance activities after last year’s disruptions from the flood.

For the nine months ended Sept. 30, 2014, the increase in sustaining capital expenditures compared to the same period in 2013 is mainly due to flood recovery expenditures.

Equity Investments

As outlined in the Significant Events section of this MD&A, we completed the sale of our interests in CE Gen and CalEnergy in June 2014. We continue to be the beneficial owner of a 50 per cent interest in Wailuku until the proposed sale closes in December 2014. The Wailuku hydro facility has 10 MW of gross generating capacity (5 MW net ownership interest).

The equity method was used to account for the results of the CE Gen, CalEnergy, and Wailuku joint ventures for the months of January and February 2014, but ceased effective March 1, 2014 with classification of these investments as assets held for sale in compliance with IFRS requirements.

The table below summarizes key operational information adjusted to reflect our interest in these investments:

| 2 months ended | 3 months ended | 9 months ended | ||

| Feb. 28, 2014 | Sept. 30, 2013 | Sept. 30, 2013 | ||

| Availability (%) | 97.1 | 91.5 | 90.1 | |

| Production (GWh): | ||||

| Gas | 127 | 93 | 301 | |

| Renewables | 187 | 285 | 863 | |

| Total production | 314 | 378 | 1,164 | |

Our investment in TAMA Transmission continues to be accounted for using the equity method.

Energy Trading: Derives revenue and earnings from the wholesale marketing and trading of electricity and other energy-related commodities and derivatives. Achieving gross margins, while remaining within Value at Risk (“VaR”) limits, is a key measure of Energy Trading’s activities. Refer to the Value at Risk and Trading Positions discussion in the Risk Management section of our 2013 Annual MD&A for further discussion on VaR.

Energy Trading markets our production through short-term and long-term contracts, ensures cost effective and reliable fuel supply, and seeks to capture margin upside within dynamic market conditions. We leverage our core marketing capabilities by also serving third party customers' energy supply and marketing needs.

Our marketing commitments are backed by our own supply and through the acquisition of third party supply and proprietary marketing assets, such as transmission, transportation, and storage rights. In the course of managing our portfolio, we actively seek to take advantage of our knowledge of physical power and fuel markets to capture incremental arbitrage margins.

All activities are managed within our core markets and within our low to moderate risk profile. Direct marketing of our own generation is reported in the Generation Segment results. All activities indirectly related to our assets and all other marketing activities are reported in the Energy Trading Segment.

For a more in-depth discussion of our Energy Trading activities, refer to the Discussion of Segmented Results section of our 2013 Annual MD&A.

The results of the Energy Trading Segment, with all trading results presented on a net basis, are as follows:

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | |||

| 2014 | 2013 | 2014 | 2013 | |

| Revenues and comparable gross margin | 3 | 22 | 76 | 53 |

| Operations, maintenance, and administration | 9 | 9 | 36 | 23 |

| Intersegment cost allocation | (3) | (4) | (10) | (11) |

| Comparable EBITDA and comparable operating income (loss) | (3) | 17 | 50 | 41 |

For the three months ended Sept. 30, 2014, comparable EBITDA decreased by $20 million compared to the same period in 2013, primarily due to lower commodity price volatility in Alberta and the western U.S. which impacted Energy Trading’s ability to generate gross margin. In addition, timing differences related to supplying gas to our Eastern assets negatively impacted our gross margin in the third quarter, which is offset by gains in the Gas results.

Year-to-date comparable EBITDA increased by $9 million to $50 million as a result of extreme weather events which resulted in unprecedented gas and power commodity price volatility in eastern markets during the first quarter of 2014, which positively impacted our ability to optimize our portfolio of generation, transportation, transmission, and storage assets. We also capitalized on low risk arbitrage opportunities brought about by the extreme market volatility. The increase was partially offset by higher corporate cost allocations and higher performance-based compensation costs driven by the strong results.

We expect the Energy Trading gross margin to remain close to historical levels for the balance of the year.

Corporate: Our Generation and Energy Trading segments are supported by a Corporate group that provides finance, tax, treasury, legal, regulatory, environmental, procurement, health and safety, sustainable development, corporate communications, government and investor relations, information technology, risk management, human resources, internal audit, and other administrative support.

The expenses incurred by the Corporate Segment are as follows:

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | |||

| 2014 | 2013 | 2014 | 2013 | |

| Operations, maintenance, and administration and taxes other than income taxes |

(17) | (16) | (40) | (45) |

| Depreciation and amortization | 7 | 6 | 20 | 17 |

| Comparable operating loss | (24) | (22) | (60) | (62) |

| Sustaining capital expenditures: | ||||

| Routine capital | 5 | 6 | 17 | 14 |

| Total | 5 | 6 | 17 | 14 |

For the three months ended Sept. 30, 2014, OM&A expenses were consistent compared to the same period in 2013.

For the nine months ended Sept. 30, 2014, OM&A expense decreased by $5 million compared to the same period in 2013, primarily due to a change in the way in which certain overhead cost allocations are made within the organization, partially offset by higher incentive-based compensation.

Routine capital expenditures for the nine months ended Sept. 30, 2014 increased compared to the same period in 2013, primarily as a result of an increase in corporate information technology expenditures.

INCOME TAXES

A reconciliation of income taxes and effective tax rates on earnings, excluding non-comparable items, is presented below:

| 3 months ended Sept. 30 | 9 months ended Sept. 30 | ||||

| 2014 | 2013 | 2014 | 2013 | ||

| Earnings before income taxes | 31 | 45 | 90 | 80 | |

| (Income) loss attributable to non-controlling interests | (9) | 3 | (35) | (16) | |

| Equity (income) loss | - | (2) | - | 5 | |

| Impacts associated with certain de-designated and ineffective hedges |

(35) | 11 | (7) | 60 | |

| Asset impairment | (1) | (18) | (1) | (18) | |

| Restructuring provision | - | (1) | - | (3) | |

| Gain on sale of assets | - | - | (1) | (10) | |

| Sundance Units 1 and 2 return to service | - | 15 | - | 15 | |

| Loss on assumption of pension obligations | - | - | - | 29 | |

| Insurance recovery | - | - | (1) | - | |

| California claim | - | - | 5 | - | |

| Foreign exchange loss on California claim | 2 | - | 2 | - | |

| Flood-related maintenance costs, net of insurance recovery | 4 | 4 | 6 | 5 | |

| Earnings (loss) attributable to TransAlta shareholders, excluding non-comparable items, subject to tax |

(8) | 57 | 58 | 147 | |

| Income tax expense (recovery) | 18 | 48 | 33 | 41 | |

| Income tax (expense) recovery related to impacts associated with certain de-designated and ineffective hedges |

(12) | 4 | (2) | 21 | |

| Income tax expense related to asset impairment | - | (5) | - | (5) | |

| Income tax (expense) recovery related to restructuring provision |

- | (1) | - | (1) | |

| Income tax recovery (expense) related to gain on sale of assets |

- | - | 1 | (1) | |

| Income tax recovery related to sale of investment | - | - | 36 | - | |

| Income tax recovery related to Sundance Units 1 and 2 return to service |

- | 4 | - | 4 | |

| Income tax recovery (expense) related to write off of deferred income tax assets |

(12) | (40) | (63) | (40) | |

| Income tax recovery related to loss on assumption of pension obligations |

- | - | - | 7 | |

| Income tax recovery related to California claim | - | - | 1 | - | |

| Income tax recovery related to foreign exchange loss on California claim |

1 | - | 1 | - | |

| Income tax recovery related to flood-related maintenance costs, net of insurance recovery |

1 | 1 | 1 | 1 | |

| Income tax expense (recovery) excluding non-comparable items |

(4) | 11 | 8 | 34 | |

| Effective tax rate on earnings attributable to TransAlta shareholders excluding non-comparable items (%) |

50 | 19 | 14 | 23 | |

The income tax expense excluding non-comparable items for the three and nine months ended Sept. 30, 2014 decreased compared to the same periods in 2013, due to lower comparable earnings and changes in the amount of earnings between the jurisdictions in which pre-tax income is earned.

The effective tax rate on earnings attributable to TransAlta shareholders excluding non-comparable items for the three months ended Sept. 30, 2014 increased compared to the same period in 2013, due to the effect of certain deductions that do not fluctuate with earnings and changes in the amount of earnings between the jurisdictions in which pre-tax income is earned.

For the nine months ended Sept. 30, 2014, the effective tax rate on earnings attributable to TransAlta shareholders excluding non-comparable items decreased compared to the same period in 2013, due to the effect of certain deductions that do not fluctuate with earnings, changes in the amount of earnings between the jurisdictions in which pre-tax income is earned, and the effect of certain prior year amounts that do not fluctuate with earnings.

During the three and nine months ended Sept. 30, 2014, $13 million and $27 million (2013 - $40 million and $40 million), respectively, of deferred income tax assets were written off related to the tax benefits of losses associated with the Corporation’s directly owned U.S. operations. We wrote these assets off as it was no longer considered probable that sufficient taxable income would be available from our directly owned U.S. operations to utilize the underlying tax losses, due to reduced price growth expectations.

NON-CONTROLLING INTERESTS

Net earnings attributable to non-controlling interests for the three and nine months ended Sept. 30, 2014 increased $13 million and $20 million, respectively, compared to the same periods in 2013, primarily due to earnings at TransAlta Renewables, which was formed as a separate public entity in August 2013, and better performance at TA Cogen associated with the deferral of a planned outage to 2015. As outlined in the Significant Events section of this MD&A, we completed a secondary offering of the common shares of TransAlta Renewables on April 29, 2014. As a result, the public share ownership of TransAlta Renewables increased from 19.4 per cent to 29.7 per cent.

Additional IFRS Measures

An additional IFRS measure is a line item, heading, or subtotal that is relevant to an understanding of the financial statements but is not a minimum line item mandated under IFRS, or the presentation of a financial measure that is relevant to an understanding of the financial statements but is not presented elsewhere in the financial statements. We have included line items entitled gross margin and operating income (loss) in our Condensed Consolidated Statements of Earnings (Loss) for the three and nine months ended Sept. 30, 2014 and 2013. Presenting these line items provides management and investors with a measurement of ongoing operating performance that is readily comparable from period to period.

Earnings and other measures on a Comparable Basis

Presenting non-IFRS measures such as earnings on a comparable basis, comparable gross margin, comparable operating income, and comparable EBITDA from period to period provides management and investors with supplemental information to evaluate earnings trends in comparison with results from prior periods. In calculating these items, we exclude the impact related to certain hedges that are either de-designated or deemed ineffective for accounting purposes, as management believes that these transactions are not representative of our business operations and that these are still effective economic hedges. As these gains (losses) have already been recognized in earnings in current or prior periods, future reported earnings will be lower; however, the expected cash flows from these contracts will not change.

Other adjustments to earnings, such as those included in the earnings on a comparable basis calculation, have also been excluded as management believes these transactions are not representative of our business operations. Earnings on a comparable basis per share are calculated using the weighted average common shares outstanding during the period.

Presenting comparable EBITDA from period to period provides management and investors with a proxy for the amount of cash generated from operating activities before net interest expense, non-controlling interests, income taxes, and working capital adjustments.

Comparable operating income and EBITDA also include the earnings from the finance lease facilities that we operate. The finance lease income is used as a proxy for the operating income and EBITDA of these facilities.

A reconciliation of comparable results to reported results for the three months ended Sept. 30, 2014 and 2013 is as follows:

| 3 months ended Sept. 30, 2014 | 3 months ended Sept. 30, 2013(1) | |||||||||||||||

| Reported | Comparable reclassifications | Comparable adjustments | Comparable total | Reported | Comparable reclassifications | Comparable adjustments | Comparable total | |||||||||

| Revenues | 639 | 13 | (2) | (35) | (4) | 617 | 623 | 11 | (2) | 11 | (4) | 645 | ||||

| Fuel and purchased power | 277 | (13) | (3) | - | 264 | 265 | (16) | (3) | - | 249 | ||||||

| Gross margin | 362 | 26 | (35) | 353 | 358 | 27 | 11 | 396 | ||||||||

| Operations, maintenance, and administration | 138 | - | (4) | (5) | 134 | 128 | - | (4) | (5) | 124 | ||||||

| Asset impairment charges (reversals) | (1) | - | 1 | (6) | - | (18) | - | 18 | (6) | - | ||||||

| Restructuring provision | - | - | - | - | (1) | - | 1 | (6) | - | |||||||

| Taxes, other than income taxes | 7 | - | - | 7 | 7 | - | - | 7 | ||||||||

| Insurance recovery | - | - | - | - | - | - | - | - | ||||||||

| Gain on sale of assets | - | - | - | - | - | (1) | (9) | - | (1) | |||||||

| EBITDA | 218 | 26 | (32) | 212 | 242 | 28 | (4) | 266 | ||||||||

| Depreciation and amortization | 135 | 13 | (3) | - | 148 | 124 | 17 | (3),(9) | - | 141 | ||||||

| Decrease in finance lease receivable | - | 1 | (2) | - | 1 | - | - | - | - | |||||||

| Operating income | 83 | 12 | (32) | 63 | 118 | 11 | (4) | 125 | ||||||||

| Finance lease income | 12 | (12) | (2) | - | - | 11 | (11) | (2) | - | - | ||||||

| Foreign exchange gain (loss) | - | - | 2 | (6) | 2 | (6) | - | - | (6) | |||||||

| Sundance Units 1 and 2 return to service | - | - | - | - | (15) | - | 15 | (6) | - | |||||||

| Equity income | - | - | - | - | 2 | - | - | 2 | ||||||||

| Earnings before interest and taxes | 95 | - | (30) | 65 | 110 | - | 11 | 121 | ||||||||

| Net interest expense | 64 | - | - | 64 | 65 | - | - | 65 | ||||||||

| Income tax expense (recovery) | 18 | - | (22) | (7) | (4) | 48 | - | (37) | (10) | 11 | ||||||

| Net earnings (loss) | 13 | - | (8) | 5 | (3) | - | 48 | 45 | ||||||||

| Non-controlling interests | 10 | - | (1) | (8) | 9 | (3) | - | - | (3) | |||||||

| Net earnings (loss) attributable to TransAlta shareholders | 3 | - | (7) | (4) | - | - | 48 | 48 | ||||||||

| Preferred share dividends | 9 | - | - | 9 | 9 | - | - | 9 | ||||||||

| Net earnings (loss) attributable to common shareholders |

(6) | - | (7) | (13) | (9) | - | 48 | 39 | ||||||||

| Weighted average number of common shares outstanding in the period |

273 | 273 | 266 | 266 | ||||||||||||

| Net earnings (loss) per share attributable to common shareholders |

(0.03) | (0.05) | (0.03) | 0.15 | ||||||||||||

____________________

(1) Refer to the Current Accounting Changes section of this MD&A for a description of prior period restatements.

(2) Finance lease income and decrease in finance lease receivable used as a proxy for operating income.

(3) Mine depreciation that is included in fuel and purchased power.

(4) Impacts associated with certain de-designated and ineffective hedges.

(5) Flood-related maintenance costs, net of insurance recoveries.

(6) Non-comparable item.

(7) Writedown of deferred income tax assets and net tax effect of all comparable adjustments.

(8) Non-comparable item attributable to non-controlling interest.

(9) Gain on sale of property, plant and equipment that is included in depreciation.

(10) Net tax effect of all comparable adjustments.

A reconciliation of comparable results to reported results for the nine months ended Sept. 30, 2014 and 2013 is as follows:

| 9 months ended Sept. 30, 2014 | 9 months ended Sept. 30, 2013(1) | |||||||||||||||

| Reported | Comparable reclassifications | Comparable adjustments | Comparable total | Reported | Comparable reclassifications | Comparable adjustments | Comparable total | |||||||||

| Revenues | 1,905 | 38 | (2) | (7) | (5) | 1,936 | 1,705 | 35 | (2) | 60 | (5) | 1,800 | ||||

| Fuel and purchased power | 824 | (41) | (3) | - | 783 | 669 | (42) | (3) | - | 627 | ||||||

| Gross margin | 1,081 | 79 | (7) | 1,153 | 1,036 | 77 | 60 | 1,173 | ||||||||

| Operations, maintenance, and administration | 404 | - | (6) | (6) | 398 | 376 | - | (5) | (6) | 371 | ||||||

| Asset impairment charges (reversals) | (1) | - | 1 | (7) | - | (18) | - | 18 | (7) | - | ||||||

| Restructuring provision | - | - | - | - | (3) | - | 3 | (7) | - | |||||||

| Taxes, other than income taxes | 21 | - | - | 21 | 22 | - | - | 22 | ||||||||

| Insurance recovery | - | (1) | (4) | - | (1) | - | - | - | - | |||||||

| Gain on sale of assets | - | - | - | - | - | (1) | (10) | - | (1) | |||||||

| EBITDA | 657 | 80 | (2) | 735 | 659 | 78 | 44 | 781 | ||||||||

| Depreciation and amortization | 402 | 41 | (3) | - | 443 | 382 | 43 | (3),(10) | - | 425 | ||||||

| Decrease in finance lease receivable | - | 2 | (2) | - | 2 | - | 1 | (2) | - | 1 | ||||||

| Operating income | 255 | 37 | (2) | 290 | 277 | 34 | 44 | 355 | ||||||||

| Finance lease income | 36 | (36) | (2) | - | - | 34 | (34) | (2) | - | - | ||||||

| Foreign exchange gain (loss) | (7) | - | 2 | (7) | (5) | (2) | - | - | (2) | |||||||

| Gain on sale of assets | 1 | - | (1) | (8) | - | 10 | - | (10) | (7) | - | ||||||

| California claim | (5) | - | 5 | (7) | - | - | - | - | - | |||||||

| Sundance Units 1 and 2 return to service | - | - | - | - | (15) | - | 15 | (7) | - | |||||||

| Insurance recovery | 2 | (1) | (4) | (1) | (7) | - | - | - | - | - | ||||||

| Equity loss | - | - | - | - | (5) | - | - | (5) | ||||||||

| Loss on assumption of pension obligations | - | - | - | - | (29) | 29 | (7) | - | ||||||||

| Earnings before interest and taxes | 282 | - | 3 | 285 | 270 | - | 78 | 348 | ||||||||

| Net interest expense | 192 | - | - | 192 | 190 | - | - | 190 | ||||||||

| Income tax expense (recovery) | 33 | - | (25) | (9) | 8 | 41 | - | (7) | (11) | 34 | ||||||

| Net earnings | 57 | - | 28 | 85 | 39 | - | 85 | 124 | ||||||||

| Non-controlling interests | 36 | - | (1) | 35 | 16 | - | - | 16 | ||||||||

| Net earnings attributable to TransAlta shareholders | 21 | - | 29 | 50 | 23 | - | 85 | 108 | ||||||||

| Preferred share dividends | 28 | - | - | 28 | 28 | - | - | 28 | ||||||||

| Net earnings (loss) attributable to common shareholders | (7) | - | 29 | 22 | (5) | - | 85 | 80 | ||||||||

| Weighted average number of common shares outstanding in the period |

272 | 272 | 262 | 262 | ||||||||||||

| Net earnings (loss) per share attributable to common shareholders |

(0.03) | 0.08 | (0.02) | 0.31 | ||||||||||||

____________________

(1) Refer to the Current Accounting Changes section of this MD&A for a description of prior period restatements.

(2) Finance lease income and decrease in finance lease receivable used as a proxy for operating income.

(3) Mine depreciation that is included in fuel and purchased power.

(4) Comparable portion of insurance recovery.

(5) Impacts associated with certain de-designated and ineffective hedges.

(6) Flood-related maintenance costs, net of insurance recoveries.

(7) Non-comparable item.

(8) Gain on sale of CE Gen, Blackrock, and CalEnergy.

(9) Writedown of deferred income tax assets and net tax effect of all comparable adjustments.

(10) Gain on sale of property, plant and equipment that is included in depreciation.

(11) Net tax effects of all comparable adjustments.

financial position

The following chart highlights significant changes in the Condensed Consolidated Statements of Financial Position from Dec. 31, 2013 to Sept. 30, 2014:

| Increase/ | |||

| (Decrease) | Primary factors explaining change | ||

| Cash and cash equivalents | 203 | Timing of receipts and payments, sale of investments, and financing activities | |

| Accounts receivable | (128) | Timing of customer receipts and seasonality of revenues | |

| Prepaid expenses | 20 | Prepayment of annual insurance premiums, royalties, and service agreements | |

| Investments | (192) | Sale of CE Gen | |

| Finance lease receivable (current and long-term) | 13 | Favourable changes in foreign exchange rates | |

| Property, plant, and equipment, net | (31) | Depreciation for the period, partially offset by additions and favourable changes in foreign exchange rates | |

| Deferred income tax assets | (71) | Writedown of deferred income tax asset and changes in temporary differences | |

| Risk management assets (current and long-term)(1) | 130 | Gains on long-term power sale contract | |

| Accounts payable and accrued liabilities | (37) | Timing of payments and accruals, partially offset by higher capital accruals | |

| Dividends payable | (30) | Reduction of quarterly dividend | |

| Long-term debt (including current portion) | (196) | Reduction of borrowings under credit facility and payout on maturity of medium term notes, partially offset by the issuance of senior notes | |

| Decommissioning and other provisions (current and long-term) | 19 | Fluctuations in period end discount rates | |

| Defined benefit obligation and other long-term liabilities |

(15) | Payment related to California claim, partially offset by increase in defined benefit obligation | |

| Deferred income tax liabilities | (31) | Net deferred income tax recovery | |

| Risk management liabilities (current and long-term)(1) |

(23) | Price movements and changes in underlying positions and settlements | |

| Equity attributable to shareholders | 161 | Net earnings for the period, gains on cash flow hedges recognized in other comprehensive income, and preferred shared issued, partially offset by declared dividends | |

| Non-controlling interests | 90 | Sale of additional non-controlling interest in TransAlta Renewables, partially offset by non-controlling interests' portion of net earnings net of distributions |

(1) After giving effect to the $160 million reduction in risk management assets and liabilities as at Dec. 31, 2013, as described in the Current Accounting Changes section of this MD&A.

financial instruments

Refer to Note 19 of the notes to the audited annual consolidated financial statements within our 2013 Annual Report and Note 9 of our unaudited interim condensed consolidated financial statements as at and for the three and nine months ended Sept. 30, 2014 for details on Financial Instruments. Refer to the Risk Management section of our 2013 Annual Report and Note 10 of our unaudited interim condensed consolidated financial statements for further details on our risks and how we manage them. Our risk management profile and practices have not changed materially from Dec. 31, 2013.

Energy Trading may enter into commodity transactions involving non-standard features for which market observable data is not available. These are defined under IFRS as Level III financial instruments. Level III financial instruments are not traded in an active market and fair value is, therefore, developed using valuation models based upon internally developed assumptions or inputs. Our Level III fair values are determined using data such as unit availability, transmission congestion, or demand profiles. Fair values are validated on a quarterly basis by using reasonably possible alternative assumptions as inputs to valuation techniques, and any material differences are disclosed in the notes to the financial statements.

We also have various contracts with terms that extend beyond a liquid trading period. As forward market prices are not available for the full period of these contracts, the value of these contracts must be derived by reference to a forecast that is based on a combination of external and internal fundamental modeling, including discounting. As a result, these contracts are classified in Level III. These contracts are for specified prices with counterparties that we believe to be creditworthy.

At Sept. 30, 2014, total Level III financial instruments had a net asset carrying value of $170 million (Dec. 31, 2013 - $66 million net asset). The increase during the period is attributable primarily to decreased estimated long-term power prices on a long-term power sale contract designated as an all-in-one cash flow hedge, for which changes in fair value are recognized in other comprehensive income.

During the third quarter of 2014, one of our subsidiaries with Australian functional currency became exposed to future payments of JPY5.3 billion for the acquisition of components of property, plant, and equipment over the period to June 2017. The subsidiary’s exposure to foreign exchange fluctuations is hedged using foreign currency forward purchase contracts.

Following the divestiture of CE Gen, Blackrock, and CalEnergy, and the repatriation of proceeds into Canadian funds, we de-designated approximately U.S.$180 million of debt from hedging U.S. net investments. During the third quarter of 2014, we de-designated an additional U.S.$90 million of U.S.-denominated debt hedging other U.S. operations. Prospectively, these tranches of U.S.-denominated debt are being hedged with foreign currency derivative instruments.