|

TransAlta

Corporation first quarter report for 2013 |

management’s discussion and analysis

This Management’s Discussion and Analysis

(“MD&A”) contains forward-looking statements. These statements are based on certain estimates and assumptions and

involve risks and uncertainties. Actual results may differ materially. See the

Forward-Looking Statements section of this MD&A for additional information.

This MD&A should be read in conjunction with unaudited interim condensed consolidated financial statements of TransAlta Corporation as at and for the three months ended March 31, 2013 and 2012, and should also be read in conjunction with the audited consolidated financial statements and MD&A contained within our 2012 Annual Report. In this MD&A, unless the context otherwise requires, ‘we’, ‘our’, ‘us’, the ‘Corporation’ and ‘TransAlta’ refers to TransAlta Corporation and its subsidiaries. The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”). All tabular amounts in the following discussion are in millions of Canadian dollars unless otherwise noted. This MD&A is dated April 22, 2013. Additional information respecting TransAlta, including its Annual Information Form, is available on SEDAR at www.sedar.com.

rESULTS OF OPERATIONS

The results of operations are presented on a consolidated basis and by business segment. We have three business segments: Generation, Energy Trading, and Corporate. In this MD&A, the impact of foreign exchange fluctuations on foreign currency denominated transactions and balances is discussed with the relevant Condensed Consolidated Statements of Earnings (Loss) and Condensed Consolidated Statements of Financial Position items. While individual line items in the Condensed Consolidated Statements of Financial Position may be impacted by foreign exchange fluctuations, the net impact of the translation of these items relating to foreign operations to our presentation currency is reflected in Accumulated Other Comprehensive Income (Loss) (“AOCI”) in the equity section of the Condensed Consolidated Statements of Financial Position.

highlights

Generation Results

|

• |

Comparable gross margins, which doesn’t include finance lease income, decreased $4 million to $363 million quarter over quarter, primarily due to lower contract pricing at Centralia Thermal and higher Alberta coal Power Purchase Arrangement (“PPA”) penalties due to higher prices in Alberta during outages, offset by lower planned outages at the Alberta coal PPA facilities, lower market curtailments, and higher hydro margins. |

|

• |

Total finance lease income increased $9 million in the quarter due to the new Solomon finance lease. |

|

• |

Overall fleet availability was 91.5 per cent compared to 91.7 per cent in 2012. |

|

• |

Production increased 1,203 gigawatt hours (“GWh”) to 10,644 GWh compared to 2012. |

|

• |

Through continued efforts to lower costs and focus on productivity, Operations, Maintenance, and Administration (“OM&A”) costs have been reduced by $7 million to $92 million. |

transalta corporation / Q1 2013 1 |

Energy Trading Results

| • | Energy Trading gross margins were consistent with the prior year at $17 million. |

Financial Highlights

| • | Funds from Operations (“FFO”) increased $3 million to $192 million compared to the prior year. |

| • | Comparable Earnings Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”) increased $15 million in the quarter to $267 million compared to 2012. |

| • | Comparable earnings were $32 million ($0.12 per share), down from $44 million ($0.20 per share) in 2012. The decrease in comparable earnings is primarily due to lower earnings in the Generation Segment driven by a higher comparable inventory writedown and lower tax recoveries, partially offset by OM&A savings. |

| • | Reported net losses attributable to common shareholders were $11 million ($0.04 net loss per share), down from net earnings attributable to common shareholders of $88 million ($0.39 net earnings per share) in 2012. The change is driven by the following non-comparable amounts, net of tax: |

| • | Impact of de-designated hedges $82 million |

| • | Loss on assumption of pension obligations of $22 million |

| • | During the quarter, our New Richmond wind farm was commissioned. |

The following table depicts key financial results and statistical operating data:

| 3 months ended March 31 | |||

| 2013 | 2012 | ||

| Availability (%)(1) | 91.5 | 91.7 | |

| Production (GWh)(1) | 10,644 | 9,441 | |

| Revenues | 540 | 644 | |

| Gross margin(2) | 339 | 469 | |

| Comparable gross margin(3) | 380 | 374 | |

| Operating income(2) | 76 | 171 | |

| Comparable operating income(3) | 128 | 122 | |

| Net earnings (loss) attributable to common shareholders | (11) | 88 | |

| Net earnings (loss) per share attributable to common shareholders, basic and diluted |

(0.04) | 0.39 | |

| Comparable net earnings per share(3) | 0.12 | 0.20 | |

| Comparable EBITDA(3) | 267 | 252 | |

| Funds from operations(3) | 192 | 189 | |

| Funds from operations per share(3) | 0.74 | 0.84 | |

| Cash flow from operating activities | 256 | 183 | |

| Free cash flow(3) | 76 | 10 | |

| Dividends paid per common share | 0.29 | 0.29 | |

(1) Availability and production includes all generating assets (generation operations, finance leases, and equity investments).

(2) These items are Additional IFRS Measures. Refer to the Additional IFRS Measures section of this MD&A for further discussion of these items.

(3) These comparable items are not defined under IFRS. Presenting these items from period to period provides management and investors with the ability to evaluate earnings trends more readily in comparison with prior periods’ results. Refer to the Non-IFRS Measures section of this MD&A for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS

transalta corporation / Q1 2013 2 |

| As at | March 31, 2013 | Dec. 31, 2012 |

| Total assets | 9,357 | 9,462 |

| Total long-term liabilities | 4,749 | 4,729 |

AVAILABILITY & PRODUCTION

Availability for the three months ended March 31, 2013 was 91.5 per cent compared to 91.7 per cent in the first quarter of 2012.

Production for the three months ended March 31, 2013 increased 1,203 GWh compared to the same period in 2012 due to lower economic dispatching at Centralia Thermal, lower planned outages at the Alberta coal PPA facilities, and lower market curtailments, partially offset by higher unplanned outages at the Alberta coal PPA facilities and lower PPA customer demand.

NET EARNINGs attributable to common shareholders

The primary factors contributing to the change in net earnings attributable to common shareholders for the three months ended March 31, 2013 are presented below:

| 3 months ended March 31 | |

| Net earnings attributable to common shareholders, 2012 | 88 |

| Decrease in Generation comparable gross margins | (4) |

| Mark-to-market movements and de-designations - Generation | (126) |

| Decrease in operations, maintenance, and administration costs | 13 |

| Decrease in depreciation and amortization expense | 2 |

| Decrease in gain on sale of assets | (3) |

| Decrease in inventory writedown | 20 |

| Increase in finance lease income | 9 |

| Decrease in equity income | (4) |

| Increase in loss on assumption of pension obligations | (29) |

| Increase in net interest expense | (2) |

| Decrease in income tax expense | 19 |

| Increase in preferred share dividends | (2) |

| Other | 8 |

| Net loss attributable to common shareholders, 2013 | (11) |

Generation comparable gross margins for the three months ended March 31, 2013, excluding the impact of mark-to-market movements, decreased by $4 million compared to the same period in 2012, as there was lower contract pricing at Centralia Thermal and higher Alberta coal PPA penalties due to higher prices in Alberta during outages were largely offset by lower planned outages at the Alberta coal PPA facilities, lower market curtailments, and higher hydro margins.

Mark-to-market movements decreased for the three months ended March 31, 2013 compared to the same period in 2012 due to the recognition of higher mark-to-market gains in 2012 resulting from certain power hedging relationships being deemed ineffective and released from AOCI to net earnings.

OM&A costs for the three months ended March 31, 2013 decreased compared to the same period in 2012 primarily due to lower compensation costs as a result of organizational restructuring in the fourth quarter of 2012 and a continued focus on costs.

transalta corporation / Q1 2013 3 |

Depreciation and amortization expense for the three months ended March 31, 2013 decreased compared to 2012 primarily due to a lower depreciable asset base caused by asset impairments and the change in the economic useful lives of Alberta coal-fired plants resulting from amendments to Canadian federal regulations in 2012, partially offset by an increased asset base through acquiring new assets.

The decrease in the gain on sale of assets in the three months ended March 31, 2013 compared to 2012 is due to the release of a contingent provision on the sale of our Grande Prairie facility in 2012.

Coal inventory has been written down to its net realizable value at our Centralia plant. The writedown in March 2013 is lower compared to the same period in 2012 due to an increase in prices in the Pacific Northwest and a decrease in inventory costs.

Finance lease income for the three months ended March 31, 2013 increased compared to the same period in 2012 due to the acquisition of the Solomon Power station. We began receiving lease payments in the fourth quarter of 2012.

Equity income for the three months ended March 31, 2013 decreased compared to 2012 primarily due to unfavourable pricing and higher planned outages at CE Generation, LLC (“CE Gen”).

During the quarter, we assumed certain pension obligations upon the assumption of operating and management control of the Highvale Mine.

Net interest expense for the three months ended March 31, 2013 increased compared to the same period in 2012 due to higher debt levels.

Income tax expense for the three months

ended March 31, 2013 decreased compared to the same period in 2012 due to lower

pre-tax earnings and an income tax recovery related to an adjustment in the deferred tax rate.

The preferred share dividends for the three months ended March 31, 2013 increased compared to the same period in 2012 due to a higher balance of preferred shares outstanding during 2013.

Funds from operations AND FREE CASH FLOW

FFO for the three months ended March 31, 2013 increased $3 million compared to the same period in 2012 to $192 million after adjusting net earnings for the non-cash impacts from risk management activities.

Free cash flow for the three months ended March 31, 2013 increased $66 million compared to the same period in 2012 due to lower cash dividends paid as a result of increased participation in the Premium DividendTM, Dividend Reinvestment and Optional Common Share Purchase Plan (the “Plan”) and lower sustaining capital expenditures, partially offset by lower net earnings.

transalta corporation / Q1 2013 4 |

significant Events

Keephills Unit 1

On March 26, 2013, we announced that an outage occurred on March 5, 2013 at Unit 1 of our Keephills facility due to a winding failure found in the generator. In response to the event, we gave notice of a High Impact Low Probability event and claimed force majeure relief under the PPA. In the event of a force majeure, we are entitled to continue to receive our PPA capacity payment and are protected under the terms of the PPA from having to pay availability penalties. As a result, we do not expect the outage to have a material financial impact on the Corporation. We are working with the original equipment manufacturer of the generator to safely return the Unit to service, which is currently expected to be in early May of 2013. During the quarter, the PPA Buyer informed us that they will be taking the matter to arbitration.

Centralia Thermal

On July 25, 2012, we announced that we entered into an 11-year agreement to provide electricity from the Centralia Thermal plant to Puget Sound Energy (“PSE”). The agreement was approved, with conditions, by the Washington Utilities and Transportation Commission (“WUTC”) on Jan. 9, 2013. On Jan. 23, 2013, it was announced that PSE had filed a petition for reconsideration of certain conditions within the decision issued by the WUTC. On March 22, 2013, the administrative law judge managing the regulatory hearing process issued two Commission Orders to establish an amended timeline for addressing the petition for reconsideration. The deadline for filing answers to the reconsideration motion is May 30, 2013 and the timeline for a decision on the reconsideration motion is no later than June 28, 2013.

New Richmond

On March 13, 2013, our 68 megawatt (“MW”) New Richmond wind farm began commercial operations. The total cost of the project is still forecasted to be approximately $212 million.

SunHills Mining Limited Partnership

Effective Jan. 17, 2013, we assumed, through our wholly owned SunHills Mining Limited Partnership (“SunHills”), operations and management control of the Highvale Mine from Prairie Mines and Royalty Ltd. (“PMRL”). PMRL employees working at the Highvale Mine were offered employment by SunHills which agreed to assume responsibility for certain pension plan and pension funding obligations, which we had previously funded through the payments made under the PMRL mining contracts. As a result, a pre-tax loss of $29 million was recognized, along with the corresponding liabilities.

We also entered into a related finance lease

for certain mining equipment that was used by PMRL in mining operations. As a result,

$21 million in mining equipment has been capitalized to property, plant and equipment and the related finance lease obligation

recognized. At the end of the lease term, we are eligible to purchase the assets subject to lease, for a nominal amount.

Change in Estimates - Useful Lives

During the three months ended March 31, 2013, management completed a comprehensive review of the estimated useful lives of our hydro assets, having regard for, among other things, our economic life cycle maintenance program and the existing condition of the assets. As a result, depreciation was reduced by $1 million for the three months ended March 31, 2013. Pre-tax depreciation expense is expected to be reduced by $5 million for the year ended Dec. 31, 2013 and by $5 million annually thereafter.

transalta corporation / Q1 2013 5 |

Centralia Coal Inventory Writedown

During the quarter, we recognized a pre-tax

writedown of $14 million related to the coal inventory at our Centralia plant to write the inventory down to its net realizable

value.

BUSINESS environment

We operate in a variety of business environments to generate electricity, find buyers for the power we generate, and arrange for its transmission. The major markets we operate in are Western Canada, the Western United States (“U.S.”), and Eastern Canada. For a further description of the regions in which we operate as well as the impact of prices of electricity and natural gas upon our financial results, refer to our 2012 Annual MD&A.

Contracted Cash Flows

During the first quarter of 2013, approximately 90 per cent of our consolidated power portfolio was contracted through the use of PPAs and other long-term contracts. We also entered into short-term physical and financial contracts for the remaining volumes, which are primarily for periods of up to five years. The average price of these contracts for the balance of 2013 are approximately $60 per megawatt hour (“MWh”) in Alberta and approximately U.S.$40 per MWh in the Pacific Northwest.

transalta corporation / Q1 2013 6 |

Electricity Prices

Please refer to the Business Environment section of our 2012 Annual MD&A for a full discussion of the spot electricity market and the impact of electricity prices on our business, as well as our strategy to hedge our risks associated with changes in these prices.

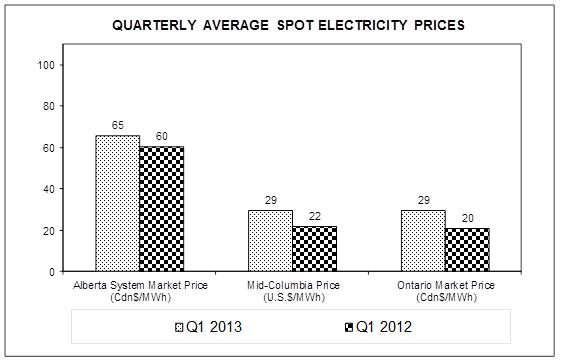

The average spot electricity prices for the three months ended March 31, 2013 and 2012 in our three major markets is shown in the following graph.

For the three months ended March 31, 2013, average spot prices in Alberta increased compared to the same period in 2012 primarily due to overall higher planned and unplanned outages leading to tighter supply and demand conditions. In the Pacific Northwest, average spot prices increased due to higher natural gas prices and lower hydro generation. The average spot prices in Ontario increased compared to 2012 due to higher natural gas prices and stronger weather-driven loads.

In 2013, power prices in Alberta are expected to be lower than 2012 due to fewer planned turnarounds and increased capacity due to additional generation facilities coming online, partially offset by load growth. In the Pacific Northwest, we expect prices to be modestly stronger than in 2012; however, we expect that overall prices will still remain weak due to anticipated low natural gas prices and slow load growth.

transalta corporation / Q1 2013 7 |

Spark Spreads

Please refer to the Business Environment section of our 2012 Annual MD&A for a full discussion of spark spreads and the impact of spark spreads on our business.

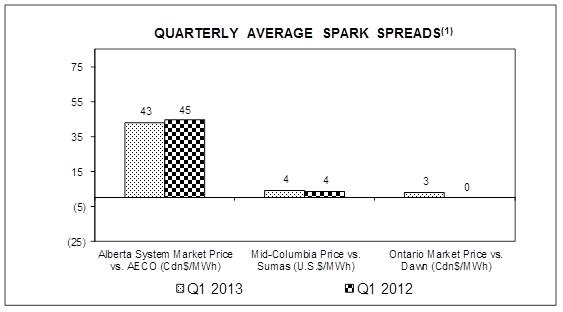

The average spark spreads for the three months ended March 31, 2013 and 2012 in our three major markets is shown in the following graph.

(1) For a 7,000 British Thermal Units per Kilowatt hour heat rate plant.

For the three months ended March 31, 2013, average spark spreads decreased in Alberta compared to the same period in 2012 due to natural gas prices rising faster than power prices. In the Pacific Northwest average spark spreads were consistent with 2012 as power prices and natural gas prices increased at relatively similar rates. For the three months ended March 31, 2013, average spark spreads increased in Ontario compared to the same period in 2012 as a result of power prices increasing more than natural gas prices.

transalta corporation / Q1 2013 8 |

GENERATION: TransAlta owns and operates hydro, wind, natural gas-fired and coal-fired facilities, and related mining operations in Canada, the U.S., and Australia. Generation revenues and overall profitability are derived from the availability and production of electricity and steam as well as ancillary services such as system support. For a full listing of all of our generating assets and the regions in which they operate, refer to the Plant Summary section of our 2012 Annual MD&A.

Generation Operations: During the first quarter of 2013, we began commercial operations at New Richmond, a 68 MW wind farm in Quebec. At March 31, 2013, our generating assets had 8,268 MW of gross generating capacity(2) in operation (7,926 MW net ownership interest) and 560 MW under restoration in the Sundance Units 1 and 2 major project. The following information excludes assets that are accounted for as a finance lease or using the equity method, which are discussed separately within this discussion of the Generation Segment.

The results of Generation Operations are as follows:

|

|

|

2013 |

|

2012 | ||||

|

3 months ended March 31 |

Total |

Comparable |

Comparable |

Per installed |

|

Comparable |

Per installed | |

|

Revenues |

|

523 |

41 |

564 |

31.59 |

|

542 |

30.36 |

|

Fuel and purchased power |

201 |

- |

201 |

11.26 |

|

175 |

9.80 | |

|

Gross margin |

322 |

41 |

363 |

20.33 |

|

367 |

20.55 | |

|

Operations, maintenance, and administration |

92 |

- |

92 |

5.15 |

|

99 |

5.55 | |

|

Depreciation and amortization |

122 |

- |

122 |

6.83 |

|

124 |

6.95 | |

|

Inventory writedown |

14 |

- |

14 |

0.78 |

|

- |

- | |

|

Taxes, other than income taxes |

7 |

- |

7 |

0.39 |

|

7 |

0.39 | |

|

Intersegment cost allocation |

4 |

- |

4 |

0.22 |

|

3 |

0.17 | |

|

Operating income |

83 |

41 |

124 |

6.96 |

|

134 |

7.49 | |

|

Installed capacity (GWh) |

17,856 |

|

17,856 |

|

|

17,851 |

| |

|

Production (GWh) |

10,112 |

|

10,112 |

|

|

8,913 |

| |

|

Availability (%) |

91.6 |

|

91.6 |

|

|

91.6 |

| |

(1) We measure capacity as net maximum capacity (see glossary for definition of this and other key terms), which is consistent with industry standards. Capacity figures represent capacity owned and in operation unless otherwise stated.

(2) Comparable figures are not defined under IFRS. Refer to the Non-IFRS Measures section of this MD&A for further discussion of these items, including, where applicable, reconciliations to net earnings attributable to common shareholders and cash flow from operating activities.

transalta corporation / Q1 2013 9 |

Generation Operations Production and Comparable Gross Margins

Production volumes, comparable revenues, fuel and purchased power expenses, and comparable gross margins based on geographical regions and fuel types are presented below.

|

3 months ended March 31, 2013 |

Production (GWh) |

Installed (GWh) |

Comparable revenues |

Comparable fuel & purchased power |

Comparable |

Comparable revenues per |

Fuel & purchased power per installed MWh |

Comparable |

|

|

|

|

|

|

|

|

|

|

|

Coal |

5,275 |

6,926 |

228 |

94 |

134 |

32.92 |

13.57 |

19.35 |

|

Gas |

668 |

769 |

30 |

7 |

23 |

39.01 |

9.10 |

29.91 |

|

Renewables |

739 |

2,889 |

56 |

3 |

53 |

19.38 |

1.04 |

18.34 |

|

Total Western Canada |

6,682 |

10,584 |

314 |

104 |

210 |

29.67 |

9.83 |

19.84 |

|

|

|

|

|

|

|

|

|

|

|

Gas |

1,001 |

1,619 |

105 |

51 |

54 |

64.85 |

31.50 |

33.35 |

|

Renewables |

425 |

1,573 |

42 |

2 |

40 |

26.70 |

1.27 |

25.43 |

|

Total Eastern Canada |

1,426 |

3,192 |

147 |

53 |

94 |

46.05 |

16.60 |

29.45 |

|

|

|

|

|

|

|

|

|

|

|

Coal |

1,678 |

2,896 |

71 |

31 |

40 |

24.52 |

10.70 |

13.82 |

|

Gas |

326 |

1,184 |

32 |

13 |

19 |

27.03 |

10.98 |

16.05 |

|

Total International |

2,004 |

4,080 |

103 |

44 |

59 |

25.25 |

10.78 |

14.47 |

|

|

|

|

|

|

|

|

|

|

|

|

10,112 |

17,856 |

564 |

201 |

363 |

31.59 |

11.26 |

20.33 |

|

3 months ended March 31, 2012 |

Production (GWh) |

Installed (GWh) |

Comparable revenues |

Fuel & purchased power |

Comparable gross margin |

Comparable revenues per |

Fuel & purchased power per installed MWh |

Comparable |

|

|

|

|

|

|

|

|

|

|

|

Coal |

5,263 |

6,944 |

210 |

81 |

129 |

30.24 |

11.66 |

18.58 |

|

Gas |

704 |

778 |

31 |

6 |

25 |

39.85 |

7.71 |

32.14 |

|

Renewables |

751 |

2,921 |

48 |

3 |

45 |

16.43 |

1.03 |

15.40 |

|

Total Western Canada |

6,718 |

10,643 |

289 |

90 |

199 |

27.15 |

8.46 |

18.69 |

|

|

|

|

|

|

|

|

|

|

|

Gas |

1,003 |

1,638 |

99 |

43 |

56 |

60.44 |

26.25 |

34.19 |

|

Renewables |

460 |

1,444 |

45 |

2 |

43 |

31.16 |

1.39 |

29.77 |

|

Total Eastern Canada |

1,463 |

3,082 |

144 |

45 |

99 |

46.72 |

14.60 |

32.12 |

|

|

|

|

|

|

|

|

|

|

|

Coal |

404 |

2,929 |

82 |

32 |

50 |

28.00 |

10.93 |

17.07 |

|

Gas |

328 |

1,197 |

27 |

8 |

19 |

22.56 |

6.68 |

15.88 |

|

Total International |

732 |

4,126 |

109 |

40 |

69 |

26.42 |

9.69 |

16.73 |

|

|

|

|

|

|

|

|

|

|

|

|

8,913 |

17,851 |

542 |

175 |

367 |

30.36 |

9.80 |

20.55 |

transalta corporation / Q1 2013 10 |

Western Canada

Our Western Canada assets consist of coal, natural gas, hydro, and wind facilities. Refer to the Discussion of Segmented Results section of our 2012 Annual MD&A for further details on our Western Canadian operations.

The primary factors contributing to the change in production for the three months ended March 31, 2013 are presented below:

|

3 months ended | ||

|

|

|

(GWh) |

|

Production, 2012 |

|

6,718 |

|

Higher unplanned outages at the Alberta coal PPA facilities |

|

(356) |

|

Lower PPA customer demand |

|

(108) |

|

Lower production at natural gas-fired facilities |

|

(36) |

|

Lower wind volumes |

|

(8) |

|

Lower hydro volumes |

|

(4) |

|

Lower planned outages at the Alberta coal PPA facilities |

|

283 |

|

Market curtailments |

|

111 |

|

Lower unplanned outages at Genesee Unit 3 |

|

75 |

|

Other |

|

7 |

|

Production, 2013 |

|

6,682 |

The primary factors contributing to the change in comparable gross margin for the three months ended March 31, 2013 are presented below:

|

3 months ended | ||

|

Comparable gross margin, 2012 |

|

199 |

|

Lower planned outages at the Alberta coal PPA facilities |

|

16 |

|

Market curtailments |

|

7 |

|

Higher hydro margins |

|

6 |

|

Lower unplanned outages at Genesee Unit 3 |

|

4 |

|

Pricing, primarily related to hedging and penalties paid under |

|

(11) |

|

Higher unplanned outages at the Alberta coal PPA facilities |

|

(5) |

|

Unfavourable coal pricing |

|

(3) |

|

Other |

|

(3) |

|

Comparable gross margin, 2013 |

|

210 |

transalta corporation / Q1 2013 11 |

Eastern Canada

Our Eastern Canada assets consist of natural gas, hydro, and wind facilities. Refer to the Discussion of Segmented Results section of our 2012 Annual MD&A for further details on our Eastern Canadian operations.

The primary factors contributing to the change in production for the three months ended March 31, 2013 are presented below:

|

3 months ended | ||

|

|

|

(GWh) |

|

Production, 2012 |

|

1,463 |

|

Lower wind volumes |

|

(31) |

|

Unfavourable market conditions at natural gas-fired facilities |

|

(2) |

|

Other |

|

(4) |

|

Production, 2013 |

|

1,426 |

The primary factors contributing to the change in gross margin for the three months ended March 31, 2013 are presented below:

|

3 months ended | ||

|

Gross margin, 2012 |

|

99 |

|

Unfavourable contracted gas input costs |

|

(2) |

|

Lower wind volumes |

|

(2) |

|

Other |

|

(1) |

|

Gross margin, 2013 |

|

94 |

International

Our International assets consist of coal, natural gas, and hydro facilities in various locations in the United States, and natural gas and diesel assets in Australia. Refer to the Discussion of Segmented Results section of our 2012 Annual MD&A for further details on our International operations.

The primary factors contributing to the change in production for the three months ended March 31, 2013 are presented below:

|

3 months ended | ||

|

|

|

(GWh) |

|

Production, 2012 |

|

732 |

|

Lower economic dispatching at Centralia Thermal |

|

1,301 |

|

Higher planned and unplanned outages at Centralia Thermal |

|

(25) |

|

Other |

|

(4) |

|

Production, 2013 |

|

2,004 |

transalta corporation / Q1 2013 12 |

The primary factors contributing to the change in comparable gross margin for the three months ended March 31, 2013 are presented below:

|

3 months ended | ||

|

Comparable gross margin, 2012 |

|

69 |

|

Lower contract pricing, including margins on purchased power |

|

(35) |

|

Coal pricing(1) |

|

23 |

|

Other |

|

2 |

|

Comparable gross margin, 2013 |

|

59 |

During the quarter, we recognized a pre-tax

writedown of $14 million related to the coal inventory at our Centralia plant to write the inventory down to its net realizable

value.

Operations, Maintenance, and Administration Expense

OM&A expenses for the three months ended March 31, 2013 decreased compared to the same period in 2012, primarily due to lower compensation costs as a result of restructuring in the fourth quarter of 2012 and a continued focus on costs.

Depreciation and Amortization Expense

The primary factors contributing to the change in depreciation and amortization expense for the three months ended March 31, 2013 are presented below:

|

3 months ended | ||

|

Depreciation and amortization expense, 2012 |

|

124 |

|

Increase in asset base |

|

7 |

|

Impact of asset impairments |

|

(8) |

|

Change in economic life(2) |

|

(5) |

|

Change in useful lives of hydro assets |

|

(1) |

|

Other |

|

5 |

|

Depreciation and amortization expense, 2013 |

|

122 |

Finance Leases

Solomon

On Sept. 28, 2012, we completed the acquisition from Fortescue Metals Group Ltd. (“Fortescue”) of its 125 MW natural gas-fired and diesel-fired Solomon power station in Western Australia for U.S.$318 million. The facility and associated Power Purchase Agreement (“Agreement”) are accounted for as a finance lease and we began receiving payments under the Agreement in the fourth quarter of 2012. The facility is currently under construction and is expected to be commissioned during the second quarter of 2013.

(1) Coal price includes the impact of the inventory writedown which is not included in gross margin.

(2) As a result of amendments to Canadian federal regulations requiring that coal-fired plants be shut down after a maximum of 50 years of operation. The previous draft regulations proposed shut down after 45 years. The useful lives of these assets were changed in the third quarter of 2012.

transalta corporation / Q1 2013 13 |

Fort Saskatchewan

Fort Saskatchewan is a natural gas-fired facility with a gross generating capacity of 118 MW in operation, of which TransAlta Cogeneration, L.P. has a 60 per cent ownership interest (35 MW net ownership interest). Key operational information adjusted to reflect our interest in the Fort Saskatchewan facility, which we continue to operate, is summarized below:

|

|

|

3 months ended March 31 | |

|

|

|

2013 |

2012 |

|

Availability (%) |

|

104.5 |

102.6 |

|

Production (GWh) |

138 |

137 | |

Availability for the three months ended March 31, 2013 increased compared to the same period in 2012, due to lower unplanned outages.

Production for the three months ended March 31, 2013 is consistent with the same period in 2012.

Total Finance Lease Income

Total finance lease income for the three months ended March 31, 2013 increased $9 million compared to the same period in 2012 due to the payments we began receiving in October 2012 under the Agreement with Fortescue.

Equity Investments

Our interests in the CE Gen and Wailuku River Hydroelectric, L.P. joint ventures are accounted for using the equity method and are comprised of geothermal, natural gas, and hydro facilities in various locations throughout the U.S., with 839 MW of gross generating capacity (390 MW net ownership interest). The table below summarizes key operational information adjusted to reflect our interest in these investments:

|

|

|

3 months ended March 31 | |

|

|

|

2013 |

2012 |

|

Availability (%) |

|

86.9 |

92.9 |

|

Production (GWh) |

|

| |

|

Gas |

|

140 |

91 |

|

Renewables |

254 |

300 | |

|

Total production |

394 |

391 | |

Availability for the three months ended March 31, 2013 decreased compared to the same period in 2012 due to higher planned outages, partially offset by lower unplanned outages.

Production for the three months ended March 31, 2013 increased compared to the same period in 2012 due to lower unplanned outages and higher customer demand, partially offset by higher planned outages.

Equity loss for the three months ended March 31, 2013 was $4 million compared to equity income of nil for the same period in 2012. The decrease is primarily due to unfavourable pricing and higher planned outages.

transalta corporation / Q1 2013 14 |

Since 2001, a significant portion of the CE Gen plants have been operating under modified fixed energy price contracts. Commencing May 1, 2012, the terms of the contracts reverted to a pricing clause that permits the power purchaser to pay their short-run avoided costs (“SRAC”) as the price for power. The SRAC is linked to the price of natural gas. There can be no assurances that prices based on the avoided cost of energy after May 1, 2012 will result in revenues equivalent to those realized under the fixed energy price structure.

ENERGY TRADING: Derives revenue and earnings from the wholesale trading of electricity and other energy-related commodities and derivatives. Achieving gross margins, while remaining within Value at Risk (“VaR”) limits, is a key measure of Energy Trading’s activities. Refer to the Value at Risk and Trading Positions discussion in the Risk Management section of our 2012 Annual MD&A for further discussion on VaR.

Energy Trading utilizes contracts of various durations for the forward purchase and sale of electricity and for the purchase and sale of natural gas and transmission capacity. If the activities are performed on behalf of the Generation Segment, the results of these activities are included in the Generation Segment.

For a more in-depth discussion of our Energy Trading activities, refer to the Discussion of Segmented Results section of our 2012 Annual MD&A.

The results of the Energy Trading Segment, with all trading results presented on a net basis, are as follows:

|

|

3 months ended March 31 | |

|

|

2013 |

2012 |

|

Revenues |

17 |

17 |

|

Fuel and purchased power |

- |

- |

|

Gross margin |

17 |

17 |

|

Operations, maintenance, and administration |

7 |

7 |

|

Intersegment cost allocation |

(4) |

(3) |

|

Operating income |

14 |

13 |

For the three months ended March 31, 2013, Energy Trading gross margins and OM&A expenses are consistent compared to the same period in 2012.

transalta corporation / Q1 2013 15 |

CORPORATE: Our Generation and Energy Trading Segments are supported by a Corporate group that provides finance, tax, treasury, legal, regulatory, environmental, health and safety, sustainable development, corporate communications, government and investor relations, information technology, risk management, human resources, internal audit, and other administrative support.

The expenses incurred by the Corporate Segment are as follows:

|

|

|

3 months ended March 31 | |

|

|

|

2013 |

2012 |

|

Operations, maintenance, and administration |

|

16 |

22 |

|

Depreciation and amortization |

|

5 |

5 |

|

Operating loss |

|

21 |

27 |

OM&A expenses for the three months ended March 31, 2013 decreased compared to the same period in 2012, primarily due to lower compensation costs as a result of restructuring in the fourth quarter of 2012 and a continued focus on costs.

NET INTEREST EXPENSE

The components of net interest expense are shown below:

|

|

|

3 months ended March 31 | |

|

|

|

2013 |

2012 |

|

Interest on debt |

|

60 |

56 |

|

Capitalized interest |

|

(2) |

- |

|

Interest expense |

|

58 |

56 |

|

Accretion of provisions |

|

4 |

4 |

|

Net interest expense |

|

62 |

60 |

The change in net interest expense for the three months ended March 31, 2013, compared to the same period in 2012, is shown below:

|

|

|

|

|

3 months ended March 31 | |

|

Net interest expense, 2012 |

|

|

|

60 |

|

|

Higher capitalized interest |

|

|

|

(2) |

|

|

Unfavourable foreign exchange impacts |

|

|

1 |

| |

|

Higher financing costs |

|

|

|

1 |

|

|

Higher debt levels |

|

|

|

2 |

|

|

Net interest expense, 2013 |

|

|

|

62 |

|

transalta corporation / Q1 2013 16 |

INCOME TAXES

A reconciliation of income taxes and effective tax rates on earnings, excluding non-comparable items, is presented below:

|

|

|

3 months ended March 31 | |

|

|

|

2013 |

2012 |

|

Earnings (loss) before income taxes |

|

(9) |

110 |

|

Income attributable to non-controlling interests |

|

(10) |

(13) |

|

Equity loss |

|

4 |

- |

|

Impacts associated with certain de-designated and |

|

41 |

(85) |

|

Inventory writedown |

|

- |

34 |

|

Gain on sale of assets |

|

- |

(3) |

|

Loss on assumption of pension obligations |

|

29 |

- |

|

Earnings attributable to TransAlta shareholders, |

|

55 |

43 |

|

Income tax expense (recovery) |

|

(17) |

2 |

|

Income tax recovery (expense) related to impacts associated |

|

14 |

(30) |

|

Income tax recovery related to inventory |

|

- |

12 |

|

Income tax expense related to gain on sale of assets |

|

- |

(1) |

|

Income tax recovery related to deferred tax rate adjustment |

|

6 |

- |

|

Income tax recovery related to the resolution of certain |

|

- |

9 |

|

Income tax recovery related to loss on assumption of |

|

7 |

- |

|

Income tax expense (recovery) excluding |

|

10 |

(8) |

| Effective tax rate on earnings (loss) attributable to TransAlta shareholders excluding non-comparable items (%) |

18 | (19) | |

The income tax expense excluding non-comparable items for the three months ended March 31, 2013 increased compared to the same period in 2012 due to higher taxable comparable earnings and the positive resolution of certain comparable tax contingency matters in the prior period.

The effective tax rate on earnings attributable to TransAlta shareholders excluding non-comparable items for the three months ended March 31, 2013 increased compared to the same period in 2012 due to changes in the amount of earnings between the jurisdictions in which pre-tax income is earned, the effect of certain deductions that do not fluctuate with earnings, and due to the positive resolution of certain comparable tax contingency matters in the prior period.

NON-CONTROLLING INTERESTS

Net earnings attributable to non-controlling interests for the three months ended March 31, 2013 was comparable to the same period in 2012.

transalta corporation / Q1 2013 17 |

financial position

The following chart highlights significant

changes in the Condensed Consolidated Statements of Financial Position from

Dec. 31, 2012 to March 31, 2013:

|

|

Increase/ |

|

|

|

|

(Decrease) |

|

Primary factors explaining change |

|

Cash and cash equivalents |

23 |

|

Timing of receipts and payments |

|

Accounts receivable |

(140) |

|

Timing of customer receipts and overall lower revenues |

|

Prepaid expenses |

18 |

|

Prepayment of annual insurance premiums |

|

Property, plant, and equipment, net |

34 |

|

Additions partially offset by depreciation |

|

Deferred income tax assets |

25 |

|

Tax benefits of losses related to the profitability of U.S. operations |

|

Risk management assets (current and long-term) |

(84) |

|

Price movements and changes in underlying positions and settlements |

|

Other assets |

13 |

|

Increase in long-term prepaids |

|

Accounts payable and accrued liabilities |

(45) |

|

Timing of payments and lower capital accruals |

|

Long-term debt (including current portion) |

14 |

|

Unfavourable foreign exchange, partially offset by repayments and decreased borrowings under credit facilities |

|

Finance lease obligation (including current portion) |

21 |

|

Finance lease for certain equipment used in mining operations at the Highvale Mine |

|

Risk management liabilities (current and long-term) |

(51) |

|

Price movements and changes in underlying positions and settlements |

|

Equity attributable to shareholders |

(34) |

|

Net loss for the period and share dividends, partially offset by issuance of common shares |

financial instruments

Refer to Note 13 of the notes to the audited consolidated financial statements within our 2012 Annual Report and Note 11 of our interim condensed consolidated financial statements as at and for the three months ended March 31, 2013 for details on Financial Instruments. Refer to the Risk Management section of our 2012 Annual Report and Note 12 of our interim condensed consolidated financial statements for further details on our risks and how we manage them. Our risk management profile and practices have not changed materially from Dec. 31, 2012.

Energy Trading may enter into commodity

transactions involving non-standard features for which market observable data is not available. These are defined under IFRS as

Level III financial instruments. Level III financial instruments are not traded in an active market and fair value is, therefore,

developed using valuation models based upon internally developed assumptions or inputs. Our

Level III fair values are determined using data such as unit availability, transmission congestion, or demand profiles. Fair values

are validated on a quarterly basis by using reasonably possible alternative assumptions as inputs to valuation techniques, and

any material differences are disclosed in the notes to the financial statements.

We also have various contracts with terms that extend beyond five years. As forward price forecasts are not available for the full period of these contracts, the value of these contracts must be derived by reference to a forecast that is based on a combination of external and internal fundamental modeling, including discounting. As a result, these contracts are classified in Level III. These contracts are for specified prices with counterparties that we believe to be creditworthy.

transalta corporation / Q1 2013 18 |

At March 31, 2013, total Level III financial instruments had a net asset carrying value of $17 million (Dec. 31, 2012 - $31 million net asset).

Certain of our hedging relationships had

previously been de-designated and deemed ineffective for accounting purposes. The hedges were in respect of power production

and the associated gains remain in AOCI until the underlying production occurs or until such time that the production has been

assessed as highly probable not to occur. No gains related to these previously

de-designated hedges were reclassified to earnings during the three months ended March 31, 2013 (March 31, 2012 - $75 million pre-tax

gain).

As at March 31, 2013, cumulative gains of $7 million related to cash flow hedges that were de-designated and no longer meet the criteria for hedge accounting continued to be deferred in AOCI and will be reclassified to net earnings as the forecasted transactions occur or if the forecasted transactions are assessed as highly probable not to occur.

STATEMENTS OF CASH FLOWS

The following charts highlight significant changes in the Condensed Consolidated Statements of Cash Flows for the three months ended March 31, 2013 compared to the same period in 2012:

|

3 months ended March 31 |

2013 |

2012 |

Primary factors explaining change |

|

Cash and cash equivalents, beginning |

27 |

49 |

|

|

Provided by (used in): |

|

|

|

|

Operating activities |

256 |

183 |

Favourable changes in working capital of $83 million partially offset by lower cash earnings of $10 million |

|

|

|

|

|

|

Investing activities |

(150) |

(164) |

Decrease in additions to PP&E and intangibles of $11 million and a net positive cash impact of $8 million related to changes in collateral received from or paid to counterparties, partially offset by an unfavourable change in non-cash investing working capital balances of $7 million and lower proceeds on sale of assets of $3 million |

|

|

|

|

|

|

Financing activities |

(84) |

(37) |

Decrease in borrowings under credit facilities of $73 million partially offset by a decrease in common share cash dividends of $25 million due to dividends reinvested through the dividend reinvestment plan |

|

Translation of foreign currency cash |

1 |

- |

|

|

Cash and cash equivalents, end of period |

50 |

31 |

|

transalta corporation / Q1 2013 19 |

Liquidity and Capital Resources

Liquidity risk arises from our ability to meet general funding needs, engage in trading and hedging activities, and manage the assets, liabilities, and capital structure of the Corporation. Liquidity risk is managed by maintaining sufficient liquid financial resources to fund obligations as they come due in the most cost-effective manner.

Our liquidity needs are met through a variety of sources, including cash generated from operations, borrowings under our long-term credit facilities, and long-term debt or equity issued under our Canadian and U.S. shelf registrations. Our primary uses of funds are operational expenses, capital expenditures, dividends, distributions to non-controlling limited partners, and interest and principal payments on debt securities.

Debt

Long-term debt totalled $4.2 billion as at March 31, 2013 compared to $4.2 billion as at Dec. 31, 2012.

Credit Facilities

At March 31, 2013, we had a total of $2.0 billion (Dec. 31, 2012 - $2.0 billion) of committed credit facilities, of which $0.8 billion (Dec. 31, 2012 - $0.8 billion) is not drawn and is available, subject to customary borrowing conditions. At March 31, 2013, the $1.2 billion (Dec. 31, 2012 - $1.3 billion) of credit utilized under these facilities was comprised of actual drawings of $0.9 billion (Dec. 31, 2012 - $1.0 billion) and letters of credit of $0.3 billion (Dec. 31, 2012 - $0.3 billion). These facilities are comprised of a $1.5 billion committed syndicated bank facility that matures in 2016, with the remainder comprised of bilateral credit facilities, of which $0.3 billion matures in the third quarter of 2013 and $0.2 billion matures in the fourth quarter of 2014. We anticipate renewing these facilities, based on reasonable commercial terms, prior to their maturities.

In addition to the $0.8 billion available under the credit facilities, we also have $48 million of available cash.

Share Capital

On April 22, 2013, we had 262.1 million common shares outstanding, 12.0 million Series A, 11.0 million Series C, and 9.0 million Series E first preferred shares outstanding. At March 31, 2013, we had 258.4 million (Dec. 31, 2012 - 254.7 million) common shares issued and outstanding. At March 31, 2013, we also had 32.0 million (Dec. 31, 2012 - 32.0 million) preferred shares issued and outstanding.

We issue common shares for cash proceeds, on exercise of stock options and other share-based payment plans, or for reinvestment of dividends. During February 2012, we added a Premium DividendTM component to the Plan. Please refer to Note 28 of our audited consolidated financial statements within our 2012 Annual Report for additional information regarding the amendments.

During the three months ended March 31, 2013, 3.7 million (March 31, 2012 - 0.9 million) common shares were issued for $53 million (March 31, 2012 - $20 million), which were comprised of dividends reinvested under the terms of the Plan.

transalta corporation / Q1 2013 20 |

Guarantee Contracts

We have obligations to issue letters of credit and cash collateral to secure potential liabilities to certain parties, including those related to potential environmental obligations, energy trading activities, hedging activities, and purchase obligations. At March 31, 2013, we provided letters of credit totalling $327 million (Dec. 31, 2012 - $336 million) and cash collateral of $17 million (Dec. 31, 2012 - $19 million). These letters of credit and cash collateral secure certain amounts included on our Condensed Consolidated Statements of Financial Position under risk management liabilities and decommissioning and other provisions.

Commitments

During March 2013, the New Richmond wind farm commenced operations and as such, the 15 year long-term service agreement for repairs and maintenance became effective. The future payments over the term of the agreement are approximately $35 million.

climate change and the environment

In Alberta, there are requirements for coal-fired generation units to implement additional air emission controls for oxides of nitrogen (“NOx”), sulphur dioxide (“SO2”), and particulate matter, once they reach the end of their respective PPAs, in most cases at 2020. These regulatory requirements were developed by the province in 2004 as a result of multi-stakeholder discussions under Alberta’s Clean Air Strategic Alliance (“CASA”). However, the release of the federal Greenhouse Gas (“GHG”) regulations may create a potential misalignment between the CASA air pollutant requirements and schedules, and the GHG retirement schedules for older coal plants, which in themselves will result in significant reductions of NOx, SO2, and particulates. We are in discussions with the provincial government to ensure coordination between GHG and air pollutant regulations, such that emission reduction objectives are achieved in the most effective manner while taking into consideration the reliability and cost of Alberta’s generation supply.

On March 27, 2012, the U.S. Environmental Protection Agency (“EPA”) proposed GHG emission standards for future coal-fired power plants. Compliance under the proposed standard will likely be met with fuel switching or clean coal technologies. As this regulatory framework is for new coal-fired plants, we expect no material impact on our existing coal units at Centralia.

In December 2011, the EPA issued national standards for mercury emissions from power plants. Existing sources will have up to four years to comply. We have already voluntarily installed mercury capture technology at our Centralia coal-fired plant, and began full capture operations in early 2012. We have also installed additional technology to further reduce NOx, consistent with the Washington State Bill passed in April 2011.

We continue to make operational improvements and investments to our existing generating facilities to reduce the environmental impact of generating electricity. We installed mercury control equipment at our Alberta Thermal operations in 2010 in order to meet the province’s 70 per cent reduction objectives, and voluntarily at our Centralia coal-fired plant in 2012. Our Keephills Unit 3 plant began operations in September 2011 using supercritical combustion technology to maximize thermal efficiency, as well as SO2 capture and low NOx combustion technology, which is consistent with the technology that is currently in use at Genesee Unit 3. Uprate projects completed at our Keephills and Sundance plants are expected to improve the energy and emissions efficiency of those units.

transalta corporation / Q1 2013 21 |

2013 Outlook

Business Environment

Power Prices

Over the balance of 2013, power prices in Alberta are expected to be lower than in 2012 due to fewer planned turnarounds and increased capacity due to additional generation facilities coming online, partially offset by load growth. In the Pacific Northwest, we expect prices to be modestly stronger than in 2012; however, we expect that overall prices will still remain weak due to low natural gas prices and slow load growth.

Environmental Legislation

The finalization of the federal Canadian GHG regulations for coal-fired power has initiated further activities. We are in discussions with the provincial government to ensure coordination between GHG and air pollutant regulations, such that emission reduction objectives are achieved in the most effective manner while taking into consideration the reliability and cost of Alberta’s generation supply. This may provide additional flexibility to coal-fired generators in meeting the regulatory requirements. For further information on the Canadian GHG regulations, please refer to the Significant Events section of our 2012 Annual MD&A.

In addition, there are ongoing discussions between the federal and provincial governments regarding a national Air Quality Management System for air pollutants. In Alberta’s recently released Clean Air Strategy, the province indicated that its provincial air quality management system will operationalize any national system. Our current outlook is that, for Alberta, provincial regulations will be considered as equivalent to any future national framework.

On Jan. 21, 2013, the Ontario government released a discussion paper for public input on reducing GHG emissions in the province, with the stated intent of developing GHG regulations for all major industrial sectors by 2015. No specific targets or regulatory approaches have yet been proposed.

In the U.S., it is not yet clear how climate change legislation for existing fossil-fuel-based generation will unfold. Additionally, new air pollutant regulations for the power sector are anticipated, but are not expected to directly affect our coal-fired operations in Washington State. TransAlta’s agreement with Washington State, established in April 2011, provides regulatory clarity at the state level regarding an emissions regime related to the Centralia Coal plant until 2025.

Beginning in 2013, direct deliveries of power to the California Independent System Operator will be subject to a compliance obligation established by the California Air Resources Board’s (“CARB”) cap and trade program. As CARB continues to finalize their regulations, we will stay at the forefront of regulatory changes to enable us to remain in compliance with the cap and trade program.

In Australia, the carbon tax implemented in July 2012 remains in place and is due to increase from AUS$23.00 to AUS$24.15 per tonne in July 2013. While TransAlta’s gas-fired operations are subject to the tax, all related costs are flowed to contracted customers.

We continue to closely monitor the progress and risks associated with environmental legislation changes on our future operations.

The siting, construction, and operation of electrical energy facilities requires interaction with many stakeholders. Recently, certain stakeholders have brought actions against government agencies and owners over alleged adverse impacts of wind projects. We are monitoring these claims in order to assess the risk associated with these activities.

transalta corporation / Q1 2013 22 |

Economic Environment

In 2013, we expect slow to moderate growth in Alberta and Australia, and low growth in other markets. We continue to monitor global events and their potential impact on the economy and our supplier and commodity counterparty relationships.

We had no material counterparty losses in the first quarter of 2013. We continue to monitor counterparty credit risk and have established risk management policies to mitigate counterparty risk. We do not anticipate any material change to our existing credit practices and continue to deal primarily with investment grade counterparties.

Operations

Capacity, Production, and Availability

Generating capacity is expected to increase for the remainder of 2013 due to Sundance Units 1 and 2 returning to service. Prior to the effect of any economic dispatching, overall production is expected to increase in 2013 due to lower planned outages, Sundance Units 1 and 2 returning to service, and the completion of the New Richmond wind farm. Overall availability is expected to be in the range of 89 to 90 per cent in 2013 due to lower planned outages across the fleet.

Contracted Cash Flows

Through the use of Alberta PPAs, long-term contracts, and other short-term physical and financial contracts, on average, approximately 75 per cent of our capacity is contracted over the next seven years. On an aggregated portfolio basis, depending on market conditions, we target being up to 90 per cent contracted for the upcoming calendar year. As at the end of the first quarter of 2013, approximately 89 per cent of our 2013 capacity was contracted. The average prices of our short-term physical and financial contracts for the balance of 2013 are approximately $60 per MWh in Alberta and approximately U.S.$40 per MWh in the Pacific Northwest.

Fuel Costs

Mining coal in Alberta is subject to cost increases due to greater overburden removal, inflation, capital investments, and commodity prices. Seasonal variations in coal costs at our Alberta mine are minimized through the application of standard costing. In January 2013, we assumed, through SunHills, operating and management control of the Highvale Mine from PMRL. Coal costs for 2013, on a standard cost basis, are expected to be comparable to 2012 with the assumption of operational and management control offsetting any cost increases mentioned above.

Although we own the Centralia mine in the State of Washington, it is not currently operational. Fuel at Centralia Thermal is purchased from external suppliers in the Powder River Basin and delivered by rail. The delivered cost of fuel per MWh for 2013 is expected to decrease between six to eight per cent.

The value of coal inventories is assessed for impairment at the end of each reporting period. If the inventory is impaired, further charges will be recognized in net earnings. For more information on the inventory impairment charges recorded in 2013, please refer to the Significant Events section of this MD&A.

We purchase natural gas from outside companies coincident with production or have it supplied by our customers, thereby minimizing our risk to changes in prices. The continued success of unconventional gas production in North America could reduce the year-to-year volatility of prices in the near term.

transalta corporation / Q1 2013 23 |

We closely monitor the risks associated with changes in electricity and input fuel prices on our future operations and, where we consider it appropriate, use various physical and financial instruments to hedge our assets and operations from such price risks.

Operations, Maintenance, and Administration Costs

OM&A costs for 2013 are expected to be consistent with 2012 OM&A, with cost savings as a result of organizational restructuring in the fourth quarter offset by additional costs as Sundance Units 1 and 2 are returned to service and the commencement of operations at our New Richmond wind farm.

Energy Trading

Earnings from our Energy Trading Segment are affected by prices in the market, overall strategies adopted, and changes in legislation. We continuously monitor both the market and our exposure in order to maximize earnings while still maintaining an acceptable risk profile. Our target is for Energy Trading to contribute between $40 million and $60 million in gross margin for 2013.

Exposure to Fluctuations in Foreign Currencies

Our strategy is to minimize the impact of fluctuations in the Canadian dollar against the U.S. dollar, Euro, and Australian dollar by offsetting foreign denominated assets with foreign denominated liabilities and by entering into foreign exchange contracts. We also have foreign denominated expenses, including interest charges, which largely offset our net foreign denominated revenues.

Net Interest Expense

Net interest expense for 2013 is not expected to change materially compared to 2012. However, changes in interest rates and in the value of the Canadian dollar relative to the U.S. dollar can affect the amount of net interest expense incurred.

Liquidity and Capital Resources

If there is increased volatility in power and natural gas markets, or if market trading activities increase, we may need additional liquidity in the future. We expect to maintain adequate available liquidity under our committed credit facilities.

Accounting Estimates

A number of our accounting estimates, including those outlined in the Critical Accounting Policies and Estimates section of our 2012 Annual MD&A, are based on the current economic environment and outlook. As a result of the current economic environment, market fluctuations could impact, among other things, future commodity prices, foreign exchange rates, and interest rates, which could, in turn, impact future earnings and the unrealized gains or losses associated with our risk management assets and liabilities and asset valuation for our asset impairment calculations.

Income Taxes

The effective tax rate on earnings excluding non-comparable items for 2013 is expected to be approximately 10 to 15 per cent, which is lower than the statutory tax rate of 25 per cent, due to changes in the amount of earnings between the jurisdictions in which pre-tax income is earned and the effect of certain deductions that do not fluctuate with earnings.

transalta corporation / Q1 2013 24 |

Capital Expenditures

Our major projects are focused on sustaining our current operations and supporting our growth strategy.

Growth and Major Project Expenditures

We have one major project with a targeted completion date of Q4 2013. A summary is outlined below:

|

|

Total Project |

|

2013 |

Target completion |

|

| ||

|

|

Estimated spend |

Spent to date(1) |

|

Estimated spend |

Spent to date(1) |

|

Details | |

|

|

|

|

|

|

|

|

|

|

|

Growth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Richmond |

212 |

216 |

|

15 - 25 |

28 |

Commercial |

|

A 68 MW wind farm in Quebec |

|

|

|

|

|

|

|

|

|

|

|

Major projects |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sundance Units 1 |

190 |

92 |

|

130 - 145 |

48 |

Q4 2013 |

|

Sundance Units 1 and 2 comprising 560 MW of our Sundance power plant |

|

Total major projects and growth |

402 |

308 |

|

145 - 170 |

76 |

|

|

|

The total estimated spend for New Richmond is less than the amount incurred to date due to estimated recoveries to be received in 2013.

Transmission

For the three months ended March 31, 2013, a total of $2 million was spent on transmission projects. The estimated spend for 2013 on transmission projects is $7 million. Transmission projects consist of the major maintenance and reconfiguration of Alberta’s transmission networks to increase capacity of power flow in the lines.

transalta corporation / Q1 2013 25 |

Sustaining Capital and Productivity Expenditures(1)

For 2013, our estimate for total sustaining capital and productivity expenditures, net of any contributions received, is allocated among the following:

|

Category |

Description |

|

|

Expected |

Spent to | ||

|

|

|

|

|

|

|

|

|

|

Routine capital |

Expenditures to maintain our existing generating capacity |

90 - 100 |

15 | ||||

|

Mining equipment and |

Expenditures related to mining equipment and |

40 - 50 |

8 | ||||

|

Planned major maintenance |

Regularly scheduled major maintenance |

165 - 185 |

28 | ||||

|

Total sustaining expenditures |

|

|

|

|

295 - 335 |

51 | |

|

Productivity capital |

Projects to improve power production efficiency |

30 - 50 |

4 | ||||

|

Total sustaining and productivity expenditures |

|

|

325 - 385 |

55 | |||

As a result of assuming the operating and management control of the Highvale Mine, sustaining capital and productivity expenditures for 2013 may be adjusted throughout the year as additional costs are incurred. We are currently assessing the impact that this will have on our 2013 sustaining capital and productivity expenditures. During the quarter, we acquired $21 million of mining equipment under a finance lease.

Our planned major maintenance program relates to regularly scheduled major maintenance activities and includes costs related to inspection, repair and maintenance, and replacement of existing components. It excludes amounts for day-to-day routine maintenance, unplanned maintenance activities, and minor inspections and overhauls, which are expensed as incurred. Details of the 2013 planned major maintenance program are outlined as follows:

|

|

|

|

|

Coal |

Gas and Renewables |

Expected |

Spent |

|

Capitalized |

|

|

|

90 - 105 |

75 - 80 |

165 - 185 |

28 |

|

Expensed |

|

|

|

- |

0 - 5 |

0 - 5 |

- |

|

|

|

|

|

90 - 105 |

75 - 85 |

165 - 190 |

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coal |

Gas and Renewables |

Expected |

Lost |

|

GWh lost |

|

|

|

1,660 - 1,670 |

420 - 430 |

2,080 - 2,100 |

228 |

Financing

Financing for these capital expenditures is expected to be provided by cash flow from operating activities, existing borrowing capacity, reinvested dividends under the Plan, and capital markets. The funds required for committed growth, sustaining capital, and productivity projects are not expected to be significantly impacted by the current economic environment due to the highly contracted nature of our cash flows, our financial position, and the amount of capital available to us under existing committed credit facilities.

([1]) Represents amounts incurred as of March 31, 2013.

transalta corporation / Q1 2013 26 |

accounting changes

Adoption of New or Amended IFRS

On Jan. 1, 2013, we adopted the following new accounting standards that were previously issued by the International Accounting Standards Board (“IASB”):

IFRS 10 Consolidated Financial Statements

IFRS 10 replaces the parts of International Accounting Standard (“IAS”) 27 Consolidated and Separate Financial Statements that deal with consolidated financial statements and Standing Interpretations Committee (“SIC”) Interpretation 12 Consolidation - Special Purpose Entities. IFRS 10 defines the principle of control, establishes control as the basis for determining when entities are to be consolidated, and provides guidance on how to apply the principle of control to identify whether an investor controls an investee. Under IFRS 10, an investor controls an investee when it has all of the following: (i) power over the investee; (ii) exposure, or rights, to variable returns from the investee; and (iii) the ability to affect those returns.

We applied IFRS 10 retrospectively by reassessing whether, on Jan. 1, 2013, we had control of all of our previously consolidated entities. As a result of adopting IFRS 10, no changes arose in the entities we controlled and consolidated.

IFRS 11 Joint Arrangements

IFRS 11 replaces IAS 31 Interests in Joint Ventures and SIC-13 Jointly Controlled Entities – Non-Monetary Contributions by Venturers. IFRS 11 provides for a principles-based approach to the accounting for joint arrangements that requires an entity to recognize its contractual rights and obligations arising from its involvement in joint arrangements. A joint arrangement is an arrangement in which two or more parties have joint control. Under IFRS 11, joint arrangements are classified as either a joint operation or a joint venture, whereas under IAS 31, they were classified as a jointly controlled asset, jointly controlled operation or a jointly controlled entity. IFRS 11 requires the use of the equity method of accounting for interests in joint ventures, whereas IAS 31 permitted a choice of the equity method or proportionate consolidation for jointly controlled entities. Under IFRS 11, for joint operations, each party recognizes its respective share of the assets, liabilities, revenues and expenses of the arrangement, generally resulting in proportionate consolidation accounting.

We applied

IFRS 11 retrospectively by reassessing the type of, and accounting for, each joint arrangement in existence at

Jan. 1, 2013. No significant impacts resulted.

IFRS 12 Disclosure of Interests in Other Entities

IFRS 12 contains enhanced disclosure requirements about an entity’s interests in subsidiaries, joint arrangements, associates, and consolidated and unconsolidated structured entities (special purpose entities). The objective of IFRS 12 is that an entity should disclose information that helps financial statement users evaluate the nature of, and risks associated with, its interests in other entities and the effects of those interests on its financial statements. Disclosures arising from the adoption of IFRS 12 can be found in Notes 7, 10, and 18 of our interim consolidated financial statements.

IFRS 13 Fair Value Measurement

IFRS 13 establishes a single source of guidance for all fair value measurements required by other IFRS, clarifies the definition of fair value, and enhances disclosures about fair value measurements. IFRS 13 applies when other IFRS require or permit fair value measurements or disclosures. IFRS 13 specifies how an entity should measure fair value and disclose fair value information. It does not specify when an entity should measure an asset, a liability, or its own equity instrument at fair value. Our adoption of IFRS 13, prospectively on Jan. 1, 2013, did not have a material financial impact upon the consolidated financial position or results of operations, however, certain new or enhanced disclosures are required and can be found in Note 11 of our interim consolidated financial statements.

transalta corporation / Q1 2013 27 |

IAS 1 Presentation of Financial Statements

Amendments to IAS 1 Presentation of Financial Statements issued in June 2011 were intended to improve the consistency and clarity of the presentation of items of comprehensive income by requiring that items presented in OCI be grouped on the basis of whether they are at some point reclassified from OCI to net earnings or not. The Consolidated Statements of Comprehensive Income (Loss) have been reorganized to comply with the required groupings.

IAS 19 Employee Benefits

Amendments to IAS 19 Employee Benefits are intended to improve the recognition, presentation, and disclosure of defined benefit plans. The amendments require the recognition of changes in defined benefit obligations and in fair value of plan assets when they occur, thus eliminating the “corridor approach” previously permitted. All actuarial gains and losses must be recognized immediately through other comprehensive income and the net pension liability or asset recognized at the full amount of the plan deficit or surplus. Additional changes relate to the presentation, into three components, of changes in defined benefit obligations and plan assets: service cost and net interest cost is recognized in net earnings and remeasurements are recognized in other comprehensive income. The net interest cost introduced in these amendments removes the concept of expected return on plan assets that was previously recognized in net earnings.

We calculate the net interest cost for our defined benefit plans by applying the discount rate at the beginning of the reporting period to the net defined benefit liability at the beginning of the reporting period. An expected return on plan assets is no longer calculated and recognized as part of pension expense. The elimination of the corridor method had no impact as we have, since adoption of IFRS, recognized actuarial gains and losses in OCI in the period in which they occurred.

On adoption, we applied the amendments retrospectively. The impacts as at Dec. 31, 2012 and Jan 1, 2012, respectively, were an increase in the cumulative prior periods’ pre-tax pension expense of $17 million and $11 million ($12 million and $8 million after-tax, respectively), as a result of the application of the net interest cost requirements.

For the three months ended March 31, 2012, OM&A expense increased by $1 million as a result of increased pension expense, Net actuarial losses on defined benefit plans as reported in OCI decreased by $1 million, and basic and diluted net earnings per share attributable to common shareholders decreased by $0.01.

Interpretation 20 Stripping Costs in the Production Phase of a Surface Mine (“IFRIC 20”)