Exhibit 99.1

|

|

|

TransAlta Corporation Annual Report 2013

|

|

|

|

|

|

Table of Contents |

|

|

|

Letter to Shareholders |

1 |

|

|

Map of Operations |

4 |

|

|

Plant Summary |

6 |

|

|

Management’s Discussion and Analysis |

7 |

|

|

Consolidated Financial Statements |

71 |

|

|

Notes to Consolidated Financial Statements |

80 |

|

|

Eleven-Year Financial and Statistical Summary |

150 |

|

|

Shareholder Information |

152 |

|

|

Shareholder Highlights |

154 |

|

|

Corporate Information |

155 |

|

|

Glossary |

156 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Letter to Shareholders |

|

|

Our mission at TransAlta is straightforward: to operate a competitive power generation company committed to serving customers, expanding our business, driving operational excellence and, of course, growing shareholder value.

These business goals must be achieved in the context of the market forces and regulatory environment in which we operate. In 2013, we made significant steps forward in the business. We:

· exceeded our target of serving over 600 megawatts (“MW”) of customers in our Commercial and Industrial business;

· re-contracted over 835 MW of our facilities to provide for long-term cash predictability, which in some cases also extended the lives of those assets;

· added newly operational MWs to our portfolio through the commissioning of our New Richmond wind farm and the return to service of Sundance Units 1 and 2;

· returned our trading business to its historical performance levels within tighter risk parameters;

· created financial flexibility and revealed the underlying value of our renewables assets through the launch of TransAlta Renewables;

· achieved progress with our growth program with the acquisition of wind generation assets in Wyoming and completed the work to construct a pipeline in Western Australia to bring natural gas to our generation facilities. Since January of 2012, we’ve invested or announced approximately $730 million in new growth projects that have added over $80 million in earnings before interest, taxes, depreciation and amortization (“EBITDA”) to our business; and

· achieved cost savings in our corporate organization by downsizing our corporate operations and implementing a shared services approach which were both announced in November of 2012.

While these accomplishments are meaningful, our Canadian coal fleet underperformed and impacted our financial results in a significant way. In addition, profits from our U.S. coal operation declined compared to last year as high priced supply contracts expired and production was sold at lower market prices.

|

|

|

|

|

Letter to Shareholders |

|

|

|

|

2013 comparable EBITDA of $1,023 million is slightly above 2012 levels. Funds from operations of $729 million are below 2012 levels. We were very satisfied with the performance of our gas, hydro, wind, energy marketing and corporate operations as they improved their businesses and met their commitments. Our U.S. coal operation has worked diligently over the past three years, in the face of significantly lower commodity prices, to re-position their plant with a competitive cost structure. We believe they’ve performed extremely well and we now have that plant positioned to add cash flow to TransAlta as prices improve in their market. Our energy marketing operations returned to their normal level of profitability within a tighter risk profile and with the oversight of a strong compliance program. Our Canadian coal operation is now re-doubling its efforts to achieve performance at the level of excellence expected in TransAlta, which will provide increased cash flow in 2014. This work will position those plants for the period when the Power Purchase Arrangements begin to roll off in 2018 providing TransAlta with access to higher market-based prices.

As we concluded 2013, your board and management reflected on all of the actions that were taken over the past two years and those that remain necessary to position TransAlta for the future. Our analysis showed that balance sheet constraints required that we either reduce our growth strategy until 2018 when the Sundance Units 1 and 2 Power Purchase Arrangement expires providing more cash, or take other actions now to provide the financial flexibility needed to sustain growth.

As a result, in February of this year, we took two additional steps to strengthen our financial position. We sold our interests in CE Generation, the Blackrock development project, and Wailuku, and we aligned the dividend to an annualized amount of $0.72 per share. Part of the business, located in California, required cash contributions over the course of the next several years that were not economic in the short term; a good long-term investment but not the right investment for us at this time. Our partner on these assets, MidAmerican, purchased our interest and remains partners with us on gas-fired generation development in Canada and certain transmission projects in Alberta.

|

|

|

|

|

Letter to Shareholders |

|

|

|

|

“We are committed to providing our shareholders with a strong and sustainable dividend while also having the funds necessary to support growth for the future.

We are committed to providing our shareholders with a strong and sustainable dividend while also having the funds necessary to support growth for the future. Both components are necessary to provide quality shareholder returns.

Our first priority in 2014 is to improve the performance of the Canadian coal fleet. Other priorities include:

· growing our gas and renewables businesses in our core markets;

· re-contracting our Ontario and Australia facilities where agreements roll off in the 2016 to 2019 period;

· diversifying our businesses into transmission and gas transportation where feasible; and

· building on our customer base within our trading operations.

While the requirements of regulators in the power industry are constantly changing and becoming more demanding, we aim to meet our priorities within a compliant and operationally excellent work environment.

We thank you for your continued support and we assure you that the management team is committed to executing on its plan to meet your expectations.

Sincerely,

Dawn L. Farrell

President and CEO

Ambassador Gordon Giffin

Chair of the Board of Directors

Plant Summary

|

|

|

|

|

|

|

|

|

Net capacity |

|

|

|

|

|

|

|

|

As of |

|

|

|

Capacity |

|

Ownership |

|

ownership |

|

|

|

Revenue |

|

Contract |

|

|

January 31, 2014 |

|

Facility |

|

(MW)1 |

|

(%) |

|

interest (MW)1,2 |

|

Fuel |

|

source |

|

expiry date |

|

|

Western Canada |

|

Sundance, AB3 |

|

2,141 |

|

100% |

|

2,141 |

|

Coal |

|

Alberta PPA4/Merchant5 |

|

2017-2020 |

|

|

39 Facilities |

|

Keephills, AB |

|

790 |

|

100% |

|

790 |

|

Coal |

|

Alberta PPA/Merchant6 |

|

2020 |

|

|

|

|

Genesee 3, AB |

|

466 |

|

50% |

|

233 |

|

Coal |

|

Merchant |

|

- |

|

|

|

|

Keephills 3, AB |

|

463 |

|

50% |

|

232 |

|

Coal |

|

Merchant |

|

- |

|

|

|

|

Sheerness, AB |

|

780 |

|

25% |

|

195 |

|

Coal |

|

Alberta PPA |

|

2020 |

|

|

|

|

Poplar Creek, AB |

|

356 |

|

100% |

|

356 |

|

Gas |

|

LTC7/Merchant |

|

2023 |

|

|

|

|

Fort Saskatchewan, AB |

|

118 |

|

30% |

|

35 |

|

Gas |

|

LTC |

|

2019 |

|

|

|

|

Brazeau, AB |

|

355 |

|

100% |

|

355 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Big Horn, AB |

|

120 |

|

100% |

|

120 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Spray, AB |

|

103 |

|

100% |

|

103 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Ghost, AB |

|

51 |

|

100% |

|

51 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Rundle, AB |

|

50 |

|

100% |

|

50 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Cascade, AB |

|

36 |

|

100% |

|

36 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Kananaskis, AB |

|

19 |

|

100% |

|

19 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Bearspaw, AB |

|

17 |

|

100% |

|

17 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Pocaterra, AB |

|

15 |

|

100% |

|

15 |

|

Hydro |

|

Merchant |

|

- |

|

|

|

|

Horseshoe, AB |

|

14 |

|

100% |

|

14 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Barrier, AB |

|

13 |

|

100% |

|

13 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Taylor, AB |

|

13 |

|

81% |

|

10 |

|

Hydro |

|

Merchant |

|

- |

|

|

|

|

Interlakes, AB |

|

5 |

|

100% |

|

5 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Belly River, AB |

|

3 |

|

81% |

|

2 |

|

Hydro |

|

Merchant |

|

- |

|

|

|

|

Three Sisters, AB |

|

3 |

|

100% |

|

3 |

|

Hydro |

|

Alberta PPA |

|

2020 |

|

|

|

|

Waterton, AB |

|

3 |

|

81% |

|

2 |

|

Hydro |

|

Merchant |

|

- |

|

|

|

|

St. Mary, AB |

|

2 |

|

81% |

|

2 |

|

Hydro |

|

Merchant |

|

- |

|

|

|

|

Upper Mamquam, BC |

|

25 |

|

81% |

|

20 |

|

Hydro |

|

LTC |

|

2025 |

|

|

|

|

Pingston, BC |

|

45 |

|

40% |

|

18 |

|

Hydro |

|

LTC |

|

2023 |

|

|

|

|

Bone Creek, BC |

|

19 |

|

81% |

|

15 |

|

Hydro |

|

LTC |

|

2031 |

|

|

|

|

Akolkolex, BC |

|

10 |

|

81% |

|

8 |

|

Hydro |

|

LTC |

|

2015 |

|

|

|

|

Summerview 1, AB |

|

70 |

|

81% |

|

57 |

|

Wind |

|

Merchant |

|

- |

|

|

|

|

Summerview 2, AB |

|

66 |

|

81% |

|

53 |

|

Wind |

|

Merchant |

|

- |

|

|

|

|

Ardenville, AB |

|

69 |

|

81% |

|

56 |

|

Wind |

|

Merchant |

|

- |

|

|

|

|

Blue Trail, AB |

|

66 |

|

81% |

|

53 |

|

Wind |

|

Merchant |

|

- |

|

|

|

|

Castle River, AB8 |

|

44 |

|

81% |

|

35 |

|

Wind |

|

Merchant |

|

- |

|

|

|

|

McBride Lake, AB |

|

75 |

|

40% |

|

30 |

|

Wind |

|

LTC |

|

2023 |

|

|

|

|

Soderglen, AB |

|

71 |

|

40% |

|

28 |

|

Wind |

|

Merchant |

|

- |

|

|

|

|

Cowley Ridge, AB |

|

21 |

|

100% |

|

21 |

|

Wind |

|

Merchant |

|

- |

|

|

|

|

Cowley North, AB |

|

20 |

|

81% |

|

16 |

|

Wind |

|

Merchant |

|

- |

|

|

|

|

Sinnott, AB |

|

7 |

|

81% |

|

5 |

|

Wind |

|

Merchant |

|

- |

|

|

|

|

Macleod Flats, AB |

|

3 |

|

81% |

|

2 |

|

Wind |

|

Merchant |

|

- |

|

|

Total Western Canada |

|

|

|

6,546 |

|

|

|

5,219 |

|

|

|

|

|

|

|

|

Eastern Canada |

|

Sarnia, ON |

|

506 |

|

100% |

|

506 |

|

Gas |

|

LTC |

|

2022-2025 |

|

|

16 Facilities |

|

Mississauga, ON |

|

108 |

|

50% |

|

54 |

|

Gas |

|

LTC |

|

2018 |

|

|

|

|

Ottawa, ON |

|

74 |

|

50% |

|

37 |

|

Gas |

|

LTC |

|

2017-2033 |

|

|

|

|

Windsor, ON |

|

68 |

|

50% |

|

34 |

|

Gas |

|

LTC/Merchant |

|

2016 |

|

|

|

|

Ragged Chute, ON |

|

7 |

|

100% |

|

7 |

|

Hydro |

|

Merchant |

|

- |

|

|

|

|

Misema, ON |

|

3 |

|

81% |

|

2 |

|

Hydro |

|

LTC |

|

2027 |

|

|

|

|

Galetta, ON |

|

2 |

|

81% |

|

2 |

|

Hydro |

|

LTC |

|

2030 |

|

|

|

|

Appleton, ON |

|

1 |

|

81% |

|

1 |

|

Hydro |

|

LTC |

|

2030 |

|

|

|

|

Moose Rapids, ON |

|

1 |

|

81% |

|

1 |

|

Hydro |

|

LTC |

|

2030 |

|

|

|

|

Wolfe Island, ON |

|

198 |

|

81% |

|

160 |

|

Wind |

|

LTC |

|

2029 |

|

|

|

|

Melancthon, ON9 |

|

200 |

|

81% |

|

161 |

|

Wind |

|

LTC |

|

2026-2028 |

|

|

|

|

Le Nordais, QC |

|

99 |

|

100% |

|

99 |

|

Wind |

|

LTC |

|

2033 |

|

|

|

|

Kent Hills, NB9 |

|

150 |

|

67% |

|

100 |

|

Wind |

|

LTC |

|

2033-2035 |

|

|

|

|

New Richmond, QC |

|

68 |

|

81% |

|

55 |

|

Wind |

|

Québec PPA |

|

2033 |

|

|

Total Eastern Canada |

|

|

|

1,484 |

|

|

|

1,219 |

|

|

|

|

|

|

|

|

United States |

|

Centralia, WA |

|

1,340 |

|

100% |

|

1,340 |

|

Coal |

|

LTC/Merchant |

|

2025 |

|

|

18 Facilities |

|

Centralia Gas, WA10 |

|

248 |

|

100% |

|

248 |

|

Gas |

|

Merchant |

|

- |

|

|

|

|

Power Resources Inc., TX |

|

212 |

|

50% |

|

106 |

|

Gas |

|

Merchant |

|

- |

|

|

|

|

Saranac, NY |

|

240 |

|

37.5% |

|

90 |

|

Gas |

|

Merchant |

|

- |

|

|

|

|

Yuma, AZ |

|

50 |

|

50% |

|

25 |

|

Gas |

|

LTC |

|

2024 |

|

|

|

|

Skookumchuck, WA |

|

1 |

|

100% |

|

1 |

|

Hydro |

|

LTC |

|

2020 |

|

|

|

|

Wailuku, HI |

|

10 |

|

50% |

|

5 |

|

Hydro |

|

LTC |

|

2023 |

|

|

|

|

Wyoming Wind, WY |

|

144 |

|

81% |

|

116 |

|

Wind |

|

LTC |

|

2028 |

|

|

|

|

Imperial Valley, CA11 |

|

340 |

|

50% |

|

170 |

|

Geothermal |

|

LTC |

|

2016-2039 |

|

|

Total U.S. |

|

|

|

2,585 |

|

|

|

2,101 |

|

|

|

|

|

|

|

|

Australia |

|

Parkeston, WA |

|

110 |

|

50% |

|

55 |

|

Gas |

|

LTC |

|

2016 |

|

|

6 Facilities |

|

Southern Cross, WA12 |

|

245 |

|

100% |

|

245 |

|

Gas/Diesel |

|

LTC |

|

2023 |

|

|

|

|

Solomon Power Station, WA |

|

125 |

|

100% |

|

125 |

|

Gas/Diesel |

|

LTC |

|

2028 |

|

|

Total Australia |

|

|

|

480 |

|

|

|

425 |

|

|

|

|

|

|

|

|

Total |

|

|

|

11,095 |

|

|

|

8,964 |

|

|

|

|

|

|

|

|

1 |

Megawatts are rounded to the nearest whole number; columns may not add due to rounding. |

|

7 |

LTC refers to Long-Term Contract. |

|

2 |

Accounts for TransAlta’s 80.7% ownership of TransAlta Renewables. |

|

8 |

Includes seven individual turbines at other locations. |

|

3 |

Includes a 15 MW uprate on Sundance unit 3; the resulting increased capacity will not be realized until the generator stator is replaced. |

|

9 |

Comprised of two facilities. |

|

|

10 |

The plant is currently not in operation. The Corporation is currently assessing the generation needs of the region and the financial feasibility of bringing the plant back into operation. | ||

|

4 |

PPA refers to Power Purchase Agreement |

| ||

|

5 |

Merchant capacity refers to uprates on unit 4 (53 MW), unit 5 (53 MW), and unit 6 (44 MW). |

|

11 |

Comprised of ten facilities. |

|

6 |

Merchant capacity refers to uprates on unit 1 (12 MW) and unit 2 (12 MW). |

|

12 |

Comprised of four facilities. |

|

|

TransAlta Corporation | 2013 Annual Report |

|

| |

|

Management’s Discussion and Analysis | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table of Contents |

|

|

|

|

|

|

|

|

|

|

|

Highlights |

8 |

|

Financial Instruments |

40 |

|

Business Environment |

10 |

|

Employee Share Ownership |

42 |

|

Strategy |

13 |

|

Employee Future Benefits |

42 |

|

Capability to Deliver Results |

14 |

|

Statements of Cash Flows |

43 |

|

Performance Metrics |

15 |

|

Liquidity and Capital Resources |

44 |

|

Results of Operations |

18 |

|

Unconsolidated Structured Entities or Arrangements |

45 |

|

Significant Events |

18 |

|

Climate Change and the Environment |

45 |

|

Subsequent Events |

24 |

|

Forward-Looking Statements |

48 |

|

Discussion of Segmented Results |

24 |

|

2014 Outlook |

49 |

|

Net Interest Expense |

33 |

|

Risk Management |

53 |

|

Income Taxes |

34 |

|

Critical Accounting Policies and Estimates |

62 |

|

Non-Controlling Interests |

35 |

|

Current Accounting Changes |

67 |

|

Additional IFRS Measures |

35 |

|

Future Accounting Changes |

69 |

|

Non-IFRS Measures |

36 |

|

Selected Quarterly Information |

70 |

|

Financial Position |

40 |

|

Controls and Procedures |

70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with our audited 2013 consolidated financial statements and our 2014 Annual Information Form. Our consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) for Canadian publicly accountable enterprises. All dollar amounts in the following discussion, including the tables, are in millions of Canadian dollars unless otherwise noted. This MD&A is dated Feb. 20, 2014. Additional information respecting TransAlta Corporation (“TransAlta”, “we”, “our”, “us”, or “the Corporation”), including our Annual Information Form, is available on SEDAR at www.sedar.com, on EDGAR at www.sec.gov, and on our website at www.transalta.com. | |

|

|

|

|

|

|

|

TransAlta Corporation | 2013 Annual Report |

|

|

|

|

|

|

|

|

Management’s Discussion and Analysis |

|

Highlights

Strategic Highlights

Financial Flexibility and Positioning for Growth

§ TAMA transmission LP (“TAMA transmission”) successfully qualified to participate as a proponent in the Fort McMurray West 500 kilovolt Transmission Project.

§ Formation of TransAlta Renewables Inc. (“TransAlta Renewables”), creating a vehicle for enhancing TransAlta’s strategy for growth in contracted and operating assets.

Long-Term Stability of Cash Flows

§ Long-term contract extension to supply power to the BHP Billiton Nickel West operations in Western Australia.

§ 50 megawatt (“MW”) long-term contract with the Salt River Project signed by CalEnergy, LLC (“CalEnergy”).

§ 74 MW 20-year long-term power supply contract with the Ontario Power Authority (“OPA”) for our Ottawa facility.

§ 86 MW long-term contract with the City of Riverside signed by CalEnergy.

§ Approval of long-term contract with Puget Sound Energy (“PSE”) at Centralia Thermal.

Growth

§ Announced plans to build and own (TransAlta ownership 43 per cent) a $178 million natural gas pipeline to our Solomon power station.

§ Acquired 144 MW wind farm in Wyoming.

§ Began commercial operations of our 68 MW long-term contracted New Richmond wind farm.

Operational Financial Results

§ Consolidated: Comparable earnings before interest, taxes, depreciation, and amortization (“EBITDA”) for 2013 increased $8 million to $1,023 million. The improvements in the wind, hydro, gas, trading, and corporate segments were partially offset by a decline in comparable EBITDA from our Canadian and U.S. coal operations. Lower realized prices and higher coal costs at Canadian Coal facilities and lower pricing at Centralia Thermal contributed to the bulk of the decline in the coal business in 2013.

§ Canadian Coal: In 2013, comparable EBITDA was $309 million compared to $373 million in 2012 and $273 million in 2011. The main impact to the business in 2013 was lower realized prices, higher penalties, and higher coal costs. We also took over the Highvale Mine in 2012 and needed to expand the mine to be able to deliver coal to all six Sundance units and all three Keephillls units. Planned major maintenance for this business sector has returned to normal levels after a large capital program in 2012 was completed.

§ U.S. Coal: Comparable EBITDA decreased to $66 million in 2013 compared to $148 million in 2012 and $211 million in 2011. The decline in comparable EBITDA is due to weak merchant pricing and expiry of contracts through the 2011 to 2013 period. Lower fuel and purchased power cost in 2013 reflect re-negotiated rail costs, and capital was reduced significantly due to the long period of economic curtailment of these units under low prices.

§ Gas: Comparable EBITDA increased by $15 million to $327 million primarily due to a full year of income from the Solomon power station that was acquired in August 2012, partially offset by higher operations, maintenance, and administration (“OM&A”) costs resulting from higher routine maintenance. Capital expenditures in this business were $58 million, up $9 million compared to 2012, and down $11 million compared to 2011. These are relatively normal run rates for capital for this business.

§ Wind: Comparable EBITDA for wind improved by $29 million in 2013 to $180 million, primarily due to higher prices in the Alberta market and commencement of operations at the New Richmond facility in Québec.

§ Hydro: Comparable EBITDA increased by $20 million to $147 million, primarily due to favourable pricing in the Alberta market.

§ Equity Investments: The geothermal business, which is recorded within equity investments, lost $10 million in 2013 compared to a loss of $15 million in 2012. The reduction of the loss is primarily due to favourable prices in 2013 relative to 2012.

§ Energy Trading Segment: Our Energy Trading business showed an improvement in comparable EBITDA of $74 million in 2013 to $61 million. Tighter risk controls and additional asset optimization capability contributed to the turnaround in this business.

§ Corporate Segment: OM&A improved by $16 million due to savings achieved through the restructuring in 2012.

§ Overall availability, including finance leases and equity investments, was 85.5 per cent compared to 88.4 per cent in 2012. Adjusting for economic dispatching at Centralia Thermal, availability was 87.8 per cent compared to 90.0 per cent in 2012. The decrease is mainly due to higher unplanned outages at the Alberta coal Power Purchase Arrangement (“PPA”) facilities, primarily driven by the Keephills Unit 1 force majeure outage, partially offset by lower planned outages at the Alberta coal facilities.

§ Overall production increased 3,732 gigawatt hours (“GWh”) to 42,482 GWh compared to 2012.

|

|

TransAlta Corporation | 2013 Annual Report |

|

|

Management’s Discussion and Analysis |

Consolidated Highlights

§ Funds from operations (“FFO”) decreased $59 million to $729 million compared to 2012, primarily due to higher cash interest and cash taxes as well as differences in timing of cash proceeds associated with power hedges.

§ Comparable earnings were $81 million ($0.31 per share), down from $117 million ($0.50 per share) in 2012. The decrease in comparable earnings is primarily due to an increase in depreciation and amortization, income taxes, and net interest, partially offset by an increase in comparable EBITDA.

§ Reported net loss attributable to common shareholders was $71 million ($0.27 net loss per share), up from net loss attributable to common shareholders of $615 million ($2.62 net loss per share) in 2012. The change is driven by an increase in comparable EBITDA of $8 million and the following non-comparable amounts, net of tax:

§ Decrease in asset impairment charges of $342 million

§ Decrease in impact of Sundance Units 1 and 2 return to service of $170 million

§ Decrease in impact of writeoff of deferred income tax assets of $141 million

§ Increase in impact of the California claim of $42 million

§ Increase in loss on assumption of pension obligations of $22 million due to the assumption of mining operations at the Highvale Mine and related pension obligations for mine employees

§ Increase in loss on de-designated hedges of $20 million

§ Decrease in restructuring provision of $12 million

§ Decrease in gain on sale of collateral of $11 million

§ We have accrued for a potential settlement with San Diego Gas & Electric Company, the California Attorney General, and other government agencies with a pre-tax impact of U.S.$52 million.

The following table depicts key financial results and statistical operating data:

|

Year ended Dec. 31 |

2013 |

|

2012 |

|

2011 |

|

Availability (%)1 |

85.5 |

|

88.4 |

|

85.4 |

|

Adjusted availability (%)1,2 |

87.8 |

|

90.0 |

|

88.2 |

|

Production (GWh)1 |

42,482 |

|

38,750 |

|

41,012 |

|

Revenues |

2,292 |

|

2,210 |

|

2,618 |

|

Comparable EBITDA3 |

1,023 |

|

1,015 |

|

1,044 |

|

Net earnings (loss) attributable to common shareholders |

(71 |

) |

(615 |

) |

290 |

|

Comparable net earnings attributable to common shareholders3 |

81 |

|

117 |

|

232 |

|

Funds from operations3 |

729 |

|

788 |

|

812 |

|

Cash flow from operating activities |

765 |

|

520 |

|

690 |

|

Free cash flow3 |

295 |

|

258 |

|

417 |

|

Net earnings (loss) per share attributable to common shareholders, basic and diluted |

(0.27 |

) |

(2.62 |

) |

1.31 |

|

Comparable earnings per share3 |

0.31 |

|

0.50 |

|

1.05 |

|

Funds from operations per share3 |

2.76 |

|

3.35 |

|

3.66 |

|

Free cash flow per share3 |

1.12 |

|

1.10 |

|

1.88 |

|

Dividends paid per common share |

1.16 |

|

1.16 |

|

1.16 |

|

As at Dec. 31 |

2013 |

|

2012 |

|

|

|

Total assets |

9,783 |

|

9,503 |

|

|

|

Total long-term liabilities |

5,508 |

|

4,769 |

|

|

1 Availability and production includes all generating assets (generation operations, finance leases, and equity investments).

2 Adjusted for economic dispatching at Centralia Thermal.

3 These comparable items are not defined under IFRS. Presenting these items from period to period provides management and investors with the ability to evaluate earnings trends more readily in comparison with prior periods’ results. Refer to the Non-IFRS Measures section of this MD&A for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS.

|

TransAlta Corporation | 2013 Annual Report |

|

Management’s Discussion and Analysis |

|

Comparable EBITDA is as follows:

|

Year ended Dec. 31 |

|

2013 |

|

2012 |

|

2011 |

|

|

Generation Segment |

|

|

|

|

|

|

|

|

Canadian Coal |

|

309 |

|

373 |

|

273 |

|

|

U.S. Coal |

|

66 |

|

148 |

|

211 |

|

|

Gas |

|

327 |

|

312 |

|

275 |

|

|

Wind |

|

180 |

|

151 |

|

163 |

|

|

Hydro |

|

147 |

|

127 |

|

105 |

|

|

Total Generation Segment |

|

1,029 |

|

1,111 |

|

1,027 |

|

|

Energy Trading Segment |

|

61 |

|

(13 |

) |

101 |

|

|

Corporate Segment |

|

(67 |

) |

(83 |

) |

(84 |

) |

|

Total comparable EBITDA |

|

1,023 |

|

1,015 |

|

1,044 |

|

Business Environment

Overview of the Business

We are a wholesale power generator and marketer with operations in Canada, the United States (“U.S.”), and Australia. We own, operate, and manage a highly contracted and geographically diversified portfolio of assets and use a broad range of generation fuels including coal, natural gas, hydro, wind, and geothermal. During 2013, commercial operations began at our New Richmond wind farm and Sundance Units 1 and 2 were returned to service. We added an additional 628 MW of power to our generation portfolio as a result of these projects, increasing our gross generating capacity1 to 9,046 MW2 (8,453 MW net ownership interest). Please refer to the Significant Events section of this MD&A for more information.

We operate in a variety of markets to generate electricity, find buyers for the power we generate, and arrange for its transmission. The major markets we operate in are Western Canada, the Western U.S., and Eastern Canada. The key characteristics of these markets are described below.

Demand

Demand for electricity, among other things, is a fundamental driver of prices in all of our markets. Economic growth is the main driver of longer-term changes in the demand for electricity. Historically, demand for electricity in all three of our major markets has grown at an average rate of one to three per cent per year. In recent years, demand growth has been weaker in Ontario and the Pacific Northwest due to economic conditions, while Alberta has shown steady growth.

Alberta has seen annual average demand growth of about three per cent over the past three years. Investment in oil sands development is a key driver of electricity demand growth in the province, and several large projects are under way that should bring new demand over the next several years. In the Pacific Northwest and Ontario, demand growth was relatively flat in 2013.

Supply

Reserve margins measure available capacity in a market over and above the capacity needed to meet normal peak demand levels. Falling reserve margins indicate that generation capacity is becoming relatively scarce and results in increased power prices. During 2013, reserve margins in Alberta increased as a result of Sundance Units 1 and 2 returning to service and reserve margins were relatively flat in the Pacific Northwest. In Ontario, reserve margins decreased primarily due to the retirement of coal generation capacity, which was partially offset by the effect of nuclear generating plants returning to service at the end of 2012.

Renewable generation growth has been strong in all regions for the past several years. In 2013, neither Alberta nor the Pacific Northwest increased wind capacity; however, both regions completed small biomass projects. Ontario continues to develop wind and solar capacity through its Feed-in Tariff program and increased renewable capacity by over 1,000 MW in 2013.

1 We measure capacity as net maximum capacity (see glossary for definition of this and other key terms), which is consistent with industry standards. Capacity figures represent capacity owned and in operation unless otherwise stated.

2 All Generation assets excluding equity investments.

|

|

TransAlta Corporation | 2013 Annual Report |

|

|

Management’s Discussion and Analysis |

Transmission

Transmission refers to the bulk delivery system of power and energy between generating units and consumers. In the North American market, we believe investment in transmission capacity has not kept pace with the growth in demand for electricity. Lead times in new transmission infrastructure projects are significant, subject to extensive consultation processes with landowners, and subject to regulatory requirements that can change frequently. As a result, existing generation or additions of generating capacity may not have access to markets until key bulk transmission upgrades and additions are completed.

Alberta

Transmission development in Alberta has not kept pace with growing loads and new generation connections. In 2009, the Government of Alberta declared several transmission projects as being critical, including three major transmission lines that will be completed between late 2013 and early 2015. A fourth major transmission line, consisting of two lines, is the subject of a competitive procurement process, in which TAMA Transmission, a partnership between TransAlta and MidAmerican Transmission, is participating. The Alberta Electric System Operator (“AESO”) announced its selection of a short-list of companies for the first of the two lines, identifying that TAMA Transmission will participate in the next stage of its competitive process for the project. The AESO is expected to start the Request for Proposals (“RFP”) process on the second line in 2015. Although the critical transmission projects should address constraints along major paths, a number of regional transmission lines are currently constrained or are forecast to become constrained in the near future as a result of new connections. In January 2014, the AESO published a new long-term transmission plan and has proposed a number of new transmission facilities to address these regional constraints. Until these projects can be completed, there will continue to be transmission constraints in some regions of the province, particularly southern Alberta, central-eastern Alberta, and Fort McMurray.

Ontario

Ontario has procured significant quantities of generation, in particular renewable generation, but procurement has been limited to prevent significant congestion on Ontario’s transmission system. Several transmission projects in both southwestern and northeastern Ontario have been developed to increase transmission capability and facilitate the procurement of additional generation. The Independent Electricity System Operator’s forecast of constrained generation for the time period from 2013 to 2015 includes minor impacts to generation in southwestern Ontario and significant impacts to generation in northern Ontario. Rapid load growth in the area north of Dryden as well as the potential to develop the mineral-rich area known as the Ring of Fire could require significant transmission expansion. This transmission expansion may be subject to a competitive process.

Environmental Legislation and Technologies

Environmental issues and related legislation have, and will continue to have, an impact upon our business. Since 2007, we have incurred costs as a result of Greenhouse Gas (“GHG”) legislation in Alberta. Please refer to the Climate Change and the Environment section of this MD&A for additional information on the changes to Alberta’s GHG legislation that occurred in 2012. Our exposure to increased costs as a result of environmental legislation in Alberta is mitigated to some extent through change-in-law provisions in our PPAs. We are in discussions with the provincial government to ensure coordination between GHG and air pollutant regulations, such that emission reduction objectives are achieved in the most effective manner while taking into consideration the reliability and cost of Alberta’s generation supply. In the State of Washington, the TransAlta Energy Bill (the “Bill”) was signed into law and provides a framework to transition from coal to other forms of generation. Legislation in other jurisdictions is in various stages of maturity and sophistication.

While TransAlta discontinued its Pioneer carbon capture and storage (“CCS”) project (“Project Pioneer”) in April 2012, the detailed Front-End Engineering Design (“FEED”) study that was completed provided us with a comprehensive analysis of this technology, which should provide ongoing value in the assessment of other carbon control strategies. We also are actively and broadly disseminating the knowledge from Project Pioneer to others who may benefit from it.

|

TransAlta Corporation | 2013 Annual Report |

|

Management’s Discussion and Analysis |

|

Economic Environment

In 2014, we expect slow to moderate growth in all markets. We continue to monitor global events and their potential impact on the economy and our supplier and commodity counterparty relationships.

Contracted Cash Flows

During the year, approximately 90 per cent of our consolidated power portfolio was contracted through the use of PPAs and other long-term contracts. We also entered into short-term physical and financial contracts for the remaining volumes, which are primarily for periods of up to five years. The average prices of these contracts for 2013 were approximately $60 per megawatt hour (“MWh”) in Alberta and approximately U.S.$40 per MWh in the Pacific Northwest.

Electricity Prices

|

|

Spot electricity prices are important to our business as our merchant natural gas, wind, hydro, and thermal facilities are exposed to these prices. Changes in these prices will affect our profitability, economic dispatching, and any contracting strategy. Our Alberta plants, operating under PPAs, receive contracted capacity payments based on targeted availability and will pay penalties or receive payments for production outside targeted availability based upon a rolling 30-day average of spot prices. The PPAs and long-term contracts covering a number of our generating facilities help minimize the impact of spot price changes. |

Spot electricity prices in our markets are driven by customer demand, generator supply, natural gas prices, and the other business environment dynamics discussed above. We monitor these trends in prices, and schedule maintenance, where possible, during times of lower prices.

For the year ended Dec. 31, 2013, average spot prices in Alberta increased compared to 2012, primarily due to tighter supply and demand conditions. In the Pacific Northwest, average spot prices increased due to higher natural gas prices and lower hydro generation. Average spot prices in Ontario for the year ended Dec. 31, 2013 increased compared to 2012 due to higher natural gas prices, which was partially offset by an increase in supply as a result of nuclear generating plants returning to service.

In 2014, power prices in Alberta are expected to be lower than 2013 as a result of more baseload generation and fewer planned maintenance outages across the market. However, prices can vary based on supply and weather conditions. In the Pacific Northwest, we expect prices to settle higher than in 2013 due to marginally higher natural gas prices and an outlook for lower hydro generation compared to 2013.

In 2012, average spot prices in all three markets decreased compared to 2011, partially due to lower natural gas prices. In Alberta, spot prices also decreased as a result of overall higher availability. In the Pacific Northwest, spot prices also decreased as a result of increased wind and hydro generation. Spot prices in Ontario also decreased compared to 2011 due to increased supply resulting from facilities returning to service.

Spark Spreads

|

|

Spark spreads measure the potential profit from generating electricity at current market rates. A spark spread is calculated as the difference between the market price of electricity and its cost of production. The cost of production is comprised of the total cost of fuel and the efficiency, or heat rate, with which the plant converts the fuel source to electricity. For most markets, a standardized plant heat rate is assumed to be 7,000 British Thermal Units (“Btu”) per kilowatt hour (“KWh”).

Spark spreads will also vary between plants due to their design, the geographical region in which they operate, and customer and/or market requirements. The change in the prices of electricity and natural gas, and the resulting spark spreads in our three major markets, affect our operational results. |

|

|

TransAlta Corporation | 2013 Annual Report |

|

|

Management’s Discussion and Analysis |

For the year ended Dec. 31, 2013, average spark spreads increased in Alberta compared to 2012 due to higher power prices driven by tighter supply and demand conditions. In the Pacific Northwest, average spark spreads increased due to higher power prices driven by lower hydro generation. Average spark spreads in Ontario decreased for the year ended Dec. 31, 2013 compared to 2012 as power prices did not rise as rapidly as natural gas prices, largely due to nuclear generating plants returning to service and increased renewables generation.

In 2012, average spark spreads in Alberta decreased compared to 2011 due to lower power prices. In the Pacific Northwest and Ontario, average spark spreads increased as a result of lower natural gas prices compared to 2011. The decrease in natural gas prices was greater than the decrease in spot prices in both the Pacific Northwest and Ontario, causing the spark spread to increase compared to 2011.

Strategy

Our goals are to deliver shareholder value by delivering solid returns through a combination of dividend yield and disciplined growth in cash flow per share, while striving for a low to moderate risk profile, balancing capital allocation, and maintaining financial strength. Our comparable cash flow growth is driven by optimizing and diversifying our existing assets and further expanding our overall portfolio and operations in Canada, the U.S., and Australia. We are focusing on these geographic areas as our expertise, scale, and diversified fuel mix allows us to create expansion opportunities in our core markets. Our strategy to achieve these goals has the following key elements:

Growth Strategy

Our growth strategy is to continue to diversify our asset base in three core markets with a focus on renewables and natural gasfired generation. Furthermore, we are focused on ensuring we replace our coal assets that are scheduled to retire in Alberta and the Pacific Northwest.

During 2013, we executed on our strategy through the commencement of commercial operations at our 68 MW New Richmond wind farm and the acquisition of a 144 MW wind farm in Wyoming through one of our wholly owned subsidiaries. In early 2014 we announced the construction of a new natural gas pipeline in Australia. Please refer to the Significant Events section of this MD&A for more information.

Financial Strategy

Our financial strategy is to maintain a strong financial position and investment grade credit ratings to provide a solid foundation for our long-cycle, capital-intensive, and commodity-sensitive business. A strong financial position and investment grade credit ratings improve our competitiveness by providing greater access to capital markets, lowering our cost of capital compared to that of non-investment grade companies, and enabling us to contract our assets with customers on more favourable commercial terms. We value financial flexibility, which allows us to selectively access the capital markets when conditions are favourable.

Contracting Strategy

In 2013, we continued to see some demand growth in our Alberta market; however, demand in the Pacific Northwest and Ontario remained relatively flat. While we are not immune to lower power prices, the impact of these lower prices is mitigated through our contracting strategy. Currently, approximately 88 per cent of 2014 and approximately 80 per cent of 2015 expected capacity across our fleet is contracted. On an aggregated portfolio basis, depending on market conditions, we target being up to 90 per cent contracted for the upcoming year. This contracting strategy helps protect our cash flow and our financial position through economic cycles.

Operational Strategy

We manage our facilities to achieve stable and predictable operations that are comparatively low cost and balanced with our fleet availability target. Our target for 2014 is to increase productivity and achieve overall fleet availability of 88 to 90 per cent. Over the last three years, our average adjusted availability has been 88.7 per cent, which is slightly below our corporate target.

|

TransAlta Corporation | 2013 Annual Report |

|

Management’s Discussion and Analysis |

|

Capability to Deliver Results

We have the following core competencies and non-capital resources that give us the capability to achieve our corporate objectives. Refer to the Liquidity and Capital Resources section of this MD&A for further discussion of the capital resources available that will assist us in achieving our objectives.

Operational Excellence

We seek to optimize our generating portfolio by owning and managing a mix of relatively low-risk assets and fuels to deliver an acceptable and predictable return. Our strategic focus is primarily on improving base operations, repositioning coal, and diversifying our portfolio.

Financial Strength

We manage our financial position and cash flows to maintain financial strength and flexibility throughout all economic cycles. This financial discipline will continue to be important during 2014. We continue to maintain $2.1 billion in committed credit facilities, and as of Dec. 31, 2013, $0.9 billion was available to us. Our investment grade credit rating, available credit facilities, FFO, manageable debt maturity profile, and access to the capital markets provide us with financial flexibility. As a result, we can be selective if and when we go to the capital markets for funding.

The funding required for our growth strategy is supported by our financial strength. In 2013, we took advantage of favourable capital markets by completing the initial public offering of TransAlta Renewables in August, as well as an offering of $400 million of Canadian medium-term senior notes. Looking forward, we expect continued capital market support for projects that meet our return requirements and risk profile.

Our senior unsecured debt is rated as investment grade, BBB- (stable), Baa3 (stable), and BBB (stable) with Standard and Poor’s (“S&P”), Moody’s Investors Services, and DBRS, respectively. Our preferred shares are rated P-3 and Pfd-3 with S&P and DBRS, respectively.

Participation in the Dividend Reinvestment and Share Purchase (“DRASP”) plan is approximately 30 to 35 per cent.

Disciplined Capital Allocation

We are committed to optimizing the balance between returning capital to shareholders, investing in the base business and growth opportunities, and maintaining a strong financial position.

We continue to selectively grow our diversified generating fleet to increase production and meet future demand requirements, with growth projects that have the ability to meet or exceed our targeted rate of return. During 2013, commercial operations began at our 68 MW New Richmond wind farm, and in early 2014 we announced the construction of a new natural gas pipeline in Australia. We also completed the acquisition of a 144 MW wind farm in Wyoming through one of our wholly owned subsidiaries.

People

Our experienced leadership team is made up of senior business leaders who bring a broad mix of skills in the electricity sector, finance, law, government, regulation, engineering, operations, construction, risk management, and corporate governance. The leadership team’s experience and expertise, our employees’ knowledge and dedication to superior operations, and our entire organization’s knowledge of the energy business, in our opinion, has resulted in a long-term proven track record of financial stability.

|

|

TransAlta Corporation | 2013 Annual Report |

|

|

Management’s Discussion and Analysis |

Performance Metrics

We have key measures that, in our opinion, are critical to evaluating how we are progressing towards meeting our goals. These measures, which include a mix of operational, risk management, and financial metrics, are discussed below.

Availability

|

|

We strive to optimize the availability of our plants throughout the year to meet demand. However, this ability to meet demand is limited by the requirement to shut down for planned maintenance and unplanned outages, as well as by reduced production from derates. Our goal is to minimize these events through regular assessments of our equipment and a comprehensive review of our maintenance plans in order to balance our maintenance costs with optimal availability targets. Over the past three years, we have achieved an average adjusted availability of 88.7 per cent, which was slightly below our long-term target of 89 to 90 per cent. If availability is also adjusted for the force majeure outage at Keephills Unit 1, the average adjusted availability is 89.7 per cent, which is within our long-term target. Our availability in 2013, after adjusting for economic dispatching at Centralia Thermal, was 87.8 per cent (2012 – 90.0 per cent). |

Availability for the year ended Dec. 31, 2013 decreased compared to 2012, primarily due to higher unplanned outages at the Alberta coal PPA facilities, which was largely driven by the Keephills Unit 1 force majeure outage, partially offset by lower planned outages at the Alberta coal PPA facilities.

In 2012, availability increased compared to 2011, primarily due to lower planned and unplanned outages at Centralia Thermal and lower unplanned outages at the Alberta coal PPA facilities, partially offset by higher planned outages at the Alberta coal PPA facilities.

Operating Costs

|

|

Our OM&A costs reflect the operating cost of our facilities. These costs can fluctuate due to the timing and nature of planned maintenance activities. The remainder of OM&A costs reflects the cost of day-to-day operations. Our target is to offset the impact of inflation in our recurring operating costs as much as possible through cost control and targeted productivity initiatives. We measure our ability to maintain productivity on OM&A based on the cost per installed MWh of capacity. |

For the year ended Dec. 31, 2013, OM&A costs per installed MWh were consistent with 2012.

In 2012, OM&A costs per installed MWh decreased compared to 2011, primarily due to lower compensation costs as a result of productivity initiatives and a continued focus on reducing costs.

Cash Flow

We focus our base business on delivering strong cash flows. In addition, our goal is to steadily grow comparable EBITDA and cash flows over the long term through the addition of new assets, recognizing that the amount of growth may fluctuate year over year with the amount of our cash flows from our base business.

|

Year ended Dec. 31 |

2013 |

2012 |

2011 |

|

Comparable EBITDA |

1,023 |

1,015 |

1,044 |

|

Comparable Earnings Per Share (“EPS”) |

0.31 |

0.50 |

1.05 |

|

FFO |

729 |

788 |

812 |

|

FFO per share |

2.76 |

3.35 |

3.66 |

|

Free cash flow |

295 |

258 |

417 |

|

Free cash flow per share |

1.12 |

1.10 |

1.88 |

|

TransAlta Corporation | 2013 Annual Report |

|

Management’s Discussion and Analysis |

|

Sustaining Capital and Productivity Expenditures

We are in a long-cycle, capital-intensive business that requires significant capital expenditures. Our goal is to undertake sustaining capital and productivity expenditures that ensure our facilities operate reliably and safely over a long period of time. Our sustaining capital and productivity expenditures are comprised of four components: (i) routine and mine capital, (ii) planned maintenance, (iii) productivity capital, and (iv) finance lease.

|

|

In 2013, we spent $122 million less on sustaining capital and productivity expenditures compared to 2012, which was made up of $11 million more on routine capital, an increase of $15 million on mine capital, $133 million less on planned maintenance, a decrease of $24 million on productivity, and $9 million more on finance leases. The increase in routine capital was primarily due to the generating rewind at the Keephills facility. Mine capital increased as a result of the purchase of pre-stripping trucks during the year. Planned maintenance decreased, primarily due to fewer planned outages during the year. Productivity expenditures decreased as a result of a reduction in corporate improvement initiatives. The finance leases were for mining equipment that was in use, or committed to, by Prairie Mines and Royalty Ltd. (“PMRL”) for mining operations at our Highvale Mine. |

In 2012, we spent $139 million more on sustaining capital and productivity expenditures compared to 2011, which was made up of $18 million more on routine and mine capital, $102 million more on planned maintenance, and $19 million more on productivity. The increase in routine and mine capital was due to non-turnaround maintenance projects. Planned maintenance increased primarily due to planned outages at Keephills Units 1 and 2 and Sundance Units 3 and 5. A significant part of the expenditures at the Keephills facility relate to more comprehensive planned major maintenance, including significant component replacements that are not expected to be replaced again over the balance of the life of the plant. Productivity increased as a result of costs associated with several corporate improvement initiatives.

Safety

Safety is our top priority with all of our staff, contractors, and visitors. Our objective is to maintain our Injury Frequency Rate (“IFR”), which includes employees and contractors, at less than 1.00 for 2013. Our ultimate goal is to achieve zero injury incidents.

|

Year ended Dec. 31 |

2013 |

2012 |

2011 |

|

IFR |

0.93 |

0.89 |

0.89 |

Investment Grade Ratios

Investment grade ratings support contracting activities and provide better access to capital markets through commodity and credit cycles. We are focused on maintaining a strong financial position and cash flow coverage ratios to support stable investment grade credit ratings.

|

Year ended Dec. 31 |

2013 |

2012 |

2011 |

|

Adjusted cash flow to interest coverage (times)1,2 |

4.0 |

4.4 |

4.4 |

|

Adjusted cash flow to debt (%)1,3 |

16.9 |

19.0 |

20.1 |

|

Debt to comparable EBITDA (times)4 |

4.2 |

4.1 |

3.8 |

1 Adjusted for the impacts associated with the California claim in 2013 and the Sundance Units 1 and 2 arbitration in 2012.

2 Adjusted cash flow to interest coverage is calculated as cash flow from operating activities before changes in working capital plus net interest expense divided by interest on debt less interest income.

3 Adjusted cash flow to debt is calculated as cash flow from operating activities before changes in working capital divided by average total debt less average cash and cash equivalents.

4 Debt to comparable EBITDA is calculated as long-term debt including current portion less cash and cash equivalents divided by comparable EBITDA.

|

|

TransAlta Corporation | 2013 Annual Report |

|

|

Management’s Discussion and Analysis |

Adjusted cash flow to interest coverage decreased in 2013 compared to 2012, primarily due to higher interest on debt. Adjusted cash flow to interest coverage in 2012 was comparable to 2011. Our goal is to maintain this ratio in a range of four to five times.

Adjusted cash flow to debt decreased in 2013 compared to 2012, due to higher average debt levels in 2013. Adjusted cash flow to debt decreased in 2012 compared to 2011 due to higher average debt levels in 2012. Our goal is to maintain this ratio in a range of 20 to 25 per cent.

We have elected to present debt to comparable EBITDA in place of the debt to invested capital ratio. We believe that the EBITDA-based metric is more relevant to the users of the financial statements as it is a more current, cash-based metric, rather than the invested capital metric, which uses historical balances. We also believe that the debt to comparable EBITDA ratio is a more meaningful metric that is consistent with the metrics the rating agencies that cover TransAlta use.

Debt to comparable EBITDA as at Dec. 31, 2013 was comparable to 2012. Debt to comparable EBITDA increased as at Dec. 31, 2012 compared to 2011 due to higher average debt levels and lower comparable EBITDA in 2012. Our goal is to maintain this ratio in a range of four to five times.

At times, and over a short-term period, the credit ratios may be outside of the specified target ranges while we realign the capital structure. During 2013, we took several steps to strengthen our financial position and reduce debt, using the approximate $221 million in gross proceeds from the initial public offering of TransAlta Renewables to pay down debt, and utilizing the proceeds from dividends reinvested under the DRASP plan as a continued source of equity. Participation in the DRASP plan is currently at approximately 35 per cent.

We seek to maintain financial flexibility by using multiple sources of capital to finance capital allocation plans effectively, while maintaining a sufficient level of available liquidity to support contracting and trading activities. Further, financial flexibility allows our commercial team to contract our portfolio with a variety of counterparties on terms and prices that are favourable to our financial results.

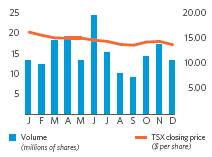

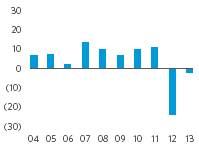

Shareholder Value

Our business model is designed to deliver low to moderate risk-adjusted sustainable returns and maintain financial strength and flexibility, which enhances shareholder value in a capital-intensive, long-cycle, commodity-based business. Our goal is to generate Total Shareholder Returns (“TSR”)1 through a combination of cash flow growth and dividend yield.

The table below shows our historical performance on this measure:

|

Year ended Dec. 31 |

2013 |

2012 |

2011 |

|

TSR (%) |

(3.2) |

(22.5) |

4.9 |

We continue to focus on delivering shareholder returns. Improvements in the business will come from investments in productivity, with a focus on improving the Alberta coal business. We continue to be disciplined in our capital allocation process and are actively seeking growth opportunities in the U.S., Western Australia, and Canada, as demonstrated by the acquisition of the Solomon power station in 2012, the commencement of commercial operations at New Richmond, the Wyoming wind farm acquisition in the U.S., and the announcement of the Australian natural gas pipeline project in 2014. We are focused on delivering cash flow to fund the dividends and growth and maintain investment grade credit ratings.

1 This measure is not defined under IFRS. We evaluate our performance and the performance of our business segments using a variety of measures. This measure is not necessarily comparable to a similarly titled measure of another company. TSR is the total amount returned to investors over a specific holding period and includes capital gains, capital losses, and dividends.

|

TransAlta Corporation | 2013 Annual Report |

|

|

Management’s Discussion and Analysis |

|

Results of Operations

Our results of operations are presented on a consolidated basis and by business segment. We have three business segments: Generation, Energy Trading, and Corporate. For this MD&A, we have further split what is reported as our Generation business segment into the various fuel types to provide additional information to our readers. Some of our accounting policies require management to make estimates or assumptions that in some cases may relate to matters that are inherently uncertain. Some of our critical accounting policies and estimates include: revenue recognition, valuation and useful life of property, plant, and equipment (“PP&E”), financial instruments, decommissioning and restoration provisions, valuation of goodwill, income taxes, and employee future benefits. Refer to the Critical Accounting Policies and Estimates section of this MD&A for further discussion.

In this MD&A, the impact of foreign exchange fluctuations on foreign currency denominated transactions and balances is discussed with the relevant items from the Consolidated Statements of Earnings (Loss) and the Consolidated Statements of Financial Position. While individual line items on the Consolidated Statements of Financial Position may be impacted by foreign exchange fluctuations, the net impact of the translation of individual items relating to foreign operations to our presentation currency is reflected in accumulated other comprehensive income (loss) (“AOCI”) in the equity section of the Consolidated Statements of Financial Position.

Significant Events

Our consolidated financial results include the following significant events:

2013

California Claim

In response to complaints filed by San Diego Gas & Electric Company, the California Attorney General, and other government agencies, the Federal Energy Regulatory Commission (“FERC”) ordered us to refund approximately U.S.$47 million for sales we made in the organized markets of the California Power Exchange, the California Independent System Operator, and the California Department of Water Resources during the 2000 - 2001 period. In addition, the California parties have sought additional refunds that to date have been rejected by FERC. We have established a U.S.$47 million provision to cover any potential refunds. Final rulings are not expected in the near future.

For the year ended Dec. 31, 2013, we accrued for a potential settlement of all outstanding disputes with the California parties, which resulted in a pre-tax charge to earnings of approximately U.S.$52 million.

Eastern Canada Ice Storm

In late December 2013, extreme weather conditions impacted our operations in parts of Ontario and Atlantic Canada, causing icing on turbine blades and consequently requiring us to shut down some of the wind turbines. The impact ranged from 7 to 12 days of downtime at each of the affected facilities, a total of 25.6 GWh of lost production, and approximately $3 million in total lost revenues. Operations at all impacted sites have returned to normal.

Acquisition by TransAlta Renewables

On Dec. 20, 2013, we completed the acquisition, through one of our wholly owned subsidiaries, of a 144 MW wind farm in Wyoming for approximately U.S.$102 million from an affiliate of NextEra Energy Resources, LLC. The wind farm is fully operational and contracted under a long-term PPA until 2028 with an investment grade counterparty. An economic interest in the wind farm was acquired by TransAlta Renewables from the Corporation in consideration for a payment equal to the original purchase price of the acquisition. We have extended a U.S.$102 million loan to TransAlta Renewables to fund the acquisition. Terms of the loan require TransAlta Renewables to repay a minimum of U.S.$45 million of the loan over the first 36 months with free cash flow from operations, and the balance on maturity on Dec. 31, 2018, through a long-term debt refinancing that is expected to be completed in conjunction with other financing needs of TransAlta Renewables.

The acquisition is expected to be accretive to cash flow per share for both the Corporation and TransAlta Renewables.

Senior Notes Offering

On Nov. 25, 2013, we completed an offering of $400 million medium-term senior notes that carry a coupon rate of 5.0 per cent, payable semi-annually, at an issue price equal to 99.516 per cent of the principal amount of the notes. The net proceeds from the offering were used to repay indebtedness, finance our long-term investment plan and growth projects, and for general corporate purposes.

|

|

TransAlta Corporation | 2013 Annual Report |

|

|

Management’s Discussion and Analysis |

Western Australia Contract Extension

On Oct. 30, 2013, we announced a long-term contract extension to supply power to the BHP Billiton Nickel West operations in Western Australia from our Southern Cross Energy facilities (“Southern Cross”). The extension is effective immediately and replaces the previous contract, which was set to expire at the beginning of 2014.

Operating since 1996, Southern Cross has a total installed capacity of 245 MW from the Kambalda, Mt. Keith, Leinster, and Kalgoorlie power stations.

Salt River Project

On Sept. 17, 2013, we announced that CalEnergy, a joint venture with MidAmerican Energy Holdings Company (“MidAmerican”), executed a 50 MW long-term contract for renewable geothermal power with Salt River Project, an Arizona utility, which runs from 2016 to 2039.

Ontario Power Authority

On Aug. 30, 2013, we announced the execution of a new agreement for a 20-year power supply term with the OPA, for our Ottawa gas facility, which is effective January 2014.

Under the new deal the plant will become dispatchable. This will assist in reducing the incidents of surplus baseload generation in the market, while maintaining the ability of the system to reliably produce energy when it is needed.

This new contract will benefit our shareholders by providing long-term stable earnings from this facility and will benefit ratepayers of Ontario by securing attractively priced capacity from this existing facility, reducing the need for new capacity to be built in the future and allowing hospitals in the area to continue to be served with the steam they need for heat and other energy processes, in an environmentally friendly manner.

TransAlta Renewables

On May 28, 2013, we formed a new subsidiary, TransAlta Renewables, to provide investors with the opportunity to invest directly in a highly contracted portfolio of power generation facilities. We retain control over TransAlta Renewables, and therefore we consolidate TransAlta Renewables. As a result, any loans outstanding or transactions between the Corporation and TransAlta Renewables are eliminated on consolidation in our financial statements.

Transfer of Generating Assets

On Aug. 9, 2013, we transferred 28 indirectly owned wind and hydroelectric generating assets to TransAlta Renewables through the sale of all the issued and outstanding shares of two subsidiaries: Canadian Hydro Developers, Inc. (“CHD”) and Western Sustainable Power Inc. As consideration for the transfer, we received: i) 66.7 million common shares of TransAlta Renewables valued at $10 per share for total share consideration of $667 million; ii) a Closing Note receivable in the amount of $187 million; iii) a Short Term Note receivable in the amount of $250 million; iv) an Acquisition Note receivable in the amount of $30 million; and v) an Amortizing Loan receivable in the amount of $200 million.

Initial Public Offering of Common Shares

On July 31, 2013, TransAlta Renewables filed a final prospectus to qualify the distribution of 20.0 million of its common shares, to be issued pursuant to the terms of an underwriting agreement at a price of $10.00 per common share (the “Offering”). TransAlta Renewables granted to the underwriters an option (the “Over-Allotment Option”), exercisable in whole or in part for a period of 30 days following Closing, to purchase, at the Offering price, up to an additional 3.0 million common shares (representing 15 per cent of the common shares offered under the prospectus).

On Aug. 29, 2013, TransAlta Renewables completed the Offering and issued 20.0 million common shares for gross proceeds of $200 million. The net proceeds of the Offering were used by TransAlta Renewables to repay the $187 million Closing Note issued to the Corporation. On Aug. 29, 2013, the underwriters exercised their Over-Allotment Option in part to purchase an additional 2.1 million common shares at the Offering price of $10.00 per common share for gross proceeds of $21 million. TransAlta Renewables used the net proceeds received from the partial exercise of the Over-Allotment Option to repay a portion of the amount outstanding under the Acquisition Note issued to TransAlta. The remaining principal amount of $9 million outstanding under the Acquisition Note after such payment was converted into 0.9 million common shares of TransAlta Renewables on the basis of one common share for each $10.00 owing to the Corporation under the Acquisition Note. After completion of the transactions, we own 92.6 million common shares of TransAlta Renewables, representing an 80.7 per cent ownership interest. In total, we received $207 million in cash consideration net of commissions and expenses.

|

TransAlta Corporation | 2013 Annual Report |

|

|

Management’s Discussion and Analysis |

|

Effective Aug. 9, 2013, the net earnings and total comprehensive income (loss) attributable to the 19.3 per cent divested interest are reflected in net earnings (loss) attributable to non-controlling interests and total comprehensive income (loss) attributable to non-controlling interests, respectively, on the Consolidated Statements of Earnings (Loss) and on the Consolidated Statements of Comprehensive Income (Loss), respectively. The excess of consideration received over the net book value of our divested interest was $4 million and was recorded in retained earnings (deficit). As at Dec. 31, 2013, the net assets attributable to the 19.3 per cent divested interest are reflected in equity attributable to non-controlling interests in the Consolidated Statements of Financial Position.

Update on Hydro Facilities Due to Southern Alberta Flooding

Following extremely high rainfall and flooding during the second quarter in southern Alberta, we continue to safely and efficiently resolve operational challenges related to our hydro systems. Three of the hydro facilities we operate in Alberta in the Bow River Basin continue to be impacted by the flooding events and are currently being repaired. We have assessed any financial impact and continue to believe that we have sufficient insurance coverage for this damage, subject to a $5 million deductible.

City of Riverside

On June 18, 2013, we announced that CalEnergy had executed an 86 MW long-term contract for renewable geothermal power with the City of Riverside which runs from 2016 to 2039. CalEnergy will purchase the power from CE Generation LLC’s (“CE Gen”) portfolio of geothermal generating facilities in California’s Imperial Valley.

Sundance Units 1 and 2 Return to Service