UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

Nexstar Broadcasting Group, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

1) |

Title of each class of securities to which transaction applies: |

|

2) |

Aggregate number of securities to which transaction applies: |

|

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

4) |

Proposed maximum aggregate value of transaction: |

|

5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

1) |

Amount Previously Paid: |

|

2) |

Form, Schedule or Registration Statement No.: |

|

3) |

Filing Party: |

|

4) |

Date Filed: |

2015 Annual Meeting of Stockholders │ Meeting Notice │ Proxy Statement

proxy

YOUR VOTE IS IMPORTANT

NEXSTAR BROADCASTING GROUP, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 11, 2015

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Nexstar Broadcasting Group, Inc. (the “Annual Meeting”) will be held at:

Nexstar Broadcasting Group, Inc.

The Summit

545 E. John Carpenter Freeway

Suite 120

Irving, Texas 75062

Thursday, June 11, 2015

10:00 a.m., Central Daylight Time

The Annual Meeting will be held for the following purposes:

|

1. |

To elect directors to serve as Class III directors for a term of three years. |

|

2. |

To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2015. |

|

3. |

To advise the Board of Directors on the compensation of our Named Executive Officers. |

|

4. |

The approval of our 2015 Long-Term Equity Incentive Plan. |

|

5. |

To transact any other business which may properly come before the meeting. |

Nexstar Broadcasting Group, Inc. is mailing this Proxy Statement and the related proxy on or about May 7, 2015 to its stockholders of record on April 17, 2015. Only stockholders of record at that time are entitled to receive notice of or to vote at the Annual Meeting and any adjournment or postponement thereof. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose germane to the Annual Meeting, at the Annual Meeting and for ten days prior to the Annual Meeting during ordinary business hours at 545 E. John Carpenter Freeway, Suite 700, Irving, Texas 75062.

|

By Order of the Board of Directors |

|

|

|

/s/ Elizabeth Ryder |

|

|

|

Elizabeth Ryder |

|

Secretary |

|

|

|

April 24, 2015 |

IF YOU DO NOT EXPECT TO BE PRESENT AT THIS MEETING AND WISH YOUR SHARES OF COMMON STOCK TO BE VOTED, YOU ARE REQUESTED TO SIGN AND MAIL PROMPTLY THE ENCLOSED PROXY WHICH IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. A RETURN ENVELOPE WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES IS ENCLOSED FOR THAT PURPOSE.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 11, 2015:

The Proxy Statement and the Company’s 2014 Annual Report on Form 10-K are available at https://materials.proxyvote.com/65336K.

PROXY STATEMENT TABLE OF CONTENTS

|

|

1 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

PROPOSAL 2 – RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

5 |

|

|

|

|

|

|

6 |

|

|

|

|

|

|

PROPOSAL 4 – APPROVAL OF THE 2015 LONG-TERM EQUITY INCENTIVE PLAN |

|

7 |

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

31 |

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND OTHER MATTERS |

|

35 |

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

NEXSTAR BROADCASTING GROUP, INC. 2015 LONG-TERM EQUITY INCENTIVE PLAN |

|

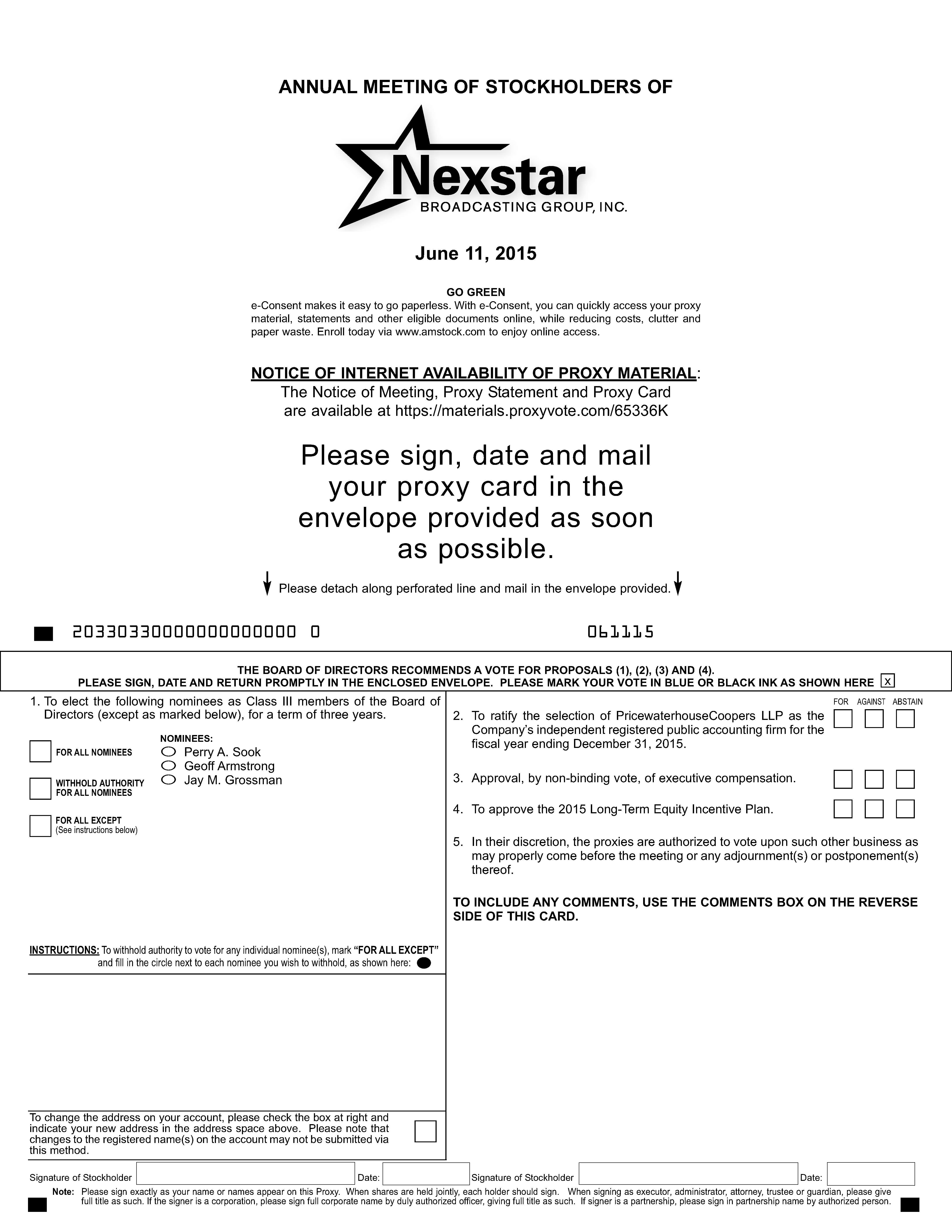

This Proxy Statement is furnished in connection with the solicitation by and on behalf of the Board of Directors of Nexstar Broadcasting Group, Inc., a Delaware corporation (“Nexstar” or the “Company”), of proxies for use at Nexstar’s Annual Meeting of Stockholders to be held, pursuant to the accompanying Notice of Annual Meeting, on Thursday, June 11, 2015 at 10:00 a.m., Central Daylight Time, and at any adjournment or postponement thereof (the “Annual Meeting”). Actions will be taken at the Annual Meeting to (1) elect directors to serve as Class III directors for a term of three years; (2) ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2015; (3) advise the Board of Directors on the compensation of Named Executive Officers; (4) approve our 2015 Long-Term Equity Incentive Plan; and (5) transact any other business which may properly come before the meeting.

Shares of Nexstar common stock, par value $0.01 (“Common Stock”), represented by a properly executed proxy that is received by Nexstar prior to the Annual Meeting, will, unless revoked, be voted as directed in the proxy. If a proxy is signed and returned, but does not specify how the shares represented by the proxy are to be voted, the proxy will be voted (i) FOR the election of the nominees named therein; (ii) FOR PricewaterhouseCoopers LLP as Nexstar’s independent registered public accounting firm in 2015; (iii) FOR the approval, by non-binding vote, of executive compensation; (iv) FOR the approval of the 2015 Long-Term Equity Incentive Plan; and (v) in such manner as the persons named in your proxy card shall decide on any other matters that may properly come before the Annual Meeting.

This Proxy Statement, the accompanying notice and the enclosed proxy card are first being mailed to stockholders on or about May 7, 2015.

Voting Securities

Stockholders of record on April 17, 2015 may vote at the Annual Meeting. On that date, there were 31,291,608 shares of Class A Common Stock outstanding and no shares of Class B Common Stock, Class C Common Stock or Preferred Stock outstanding. The holders of Class A Common Stock are entitled to one vote per share and the holders of Class B Common Stock are entitled to 10 votes per share. Holders of our Class C Common Stock and Preferred Stock have no voting rights. Under the Company’s By-laws, the holders of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting, present in person or represented by proxy, constitute a quorum. Abstentions and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. If you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority under NASDAQ rules to vote your shares on the ratification of PricewaterhouseCoopers LLP even if the broker does not receive voting instructions from you. However, your broker does not have discretionary authority to vote on the election of directors, the approval of executive compensation and the approval of the 2015 Long-Term Equity Incentive Plan without instructions from you, in which case a broker non-vote will occur and your shares will not be voted on these matters.

Voting Instructions

Stockholders of record may vote their proxies by signing, dating and returning the enclosed Proxy Card. If no instructions are indicated, the shares represented by such proxy will be voted according to the recommendations of our Board of Directors. Each proxy that is properly received by Nexstar prior to the Annual Meeting will, unless revoked, be voted in accordance with the instructions given on such proxy. Any stockholder giving a proxy prior to the Annual Meeting has the power to revoke it at any time before it is voted by a written revocation received by the Secretary of Nexstar or by executing and returning a proxy bearing a later date. Any stockholder of record attending the Annual Meeting may vote in person, whether or not a proxy has been previously given, but the mere presence of a stockholder at the Annual Meeting will not constitute revocation of a previously given proxy. In addition, stockholders whose shares of Common Stock are not registered in their own name, including shares held in a brokerage account, will need to obtain a legal proxy from the record holder of such shares to vote in person at the Annual Meeting.

1

Votes Necessary to Approve Proposals

|

• |

Proposal 1: Election of Class III Directors |

The election of directors requires a plurality of the votes cast, and votes may be cast in favor of the nominees or withheld. A plurality means that the nominee receiving the most votes for election to a director position is elected to that position. For the proposal to elect directors, abstentions and broker non-votes will not affect the outcome of such vote, because abstentions and broker non-votes are not treated as votes cast.

|

• |

Proposal 2: Ratification of the Selection of Independent Registered Public Accounting Firm |

The ratification of the selection of our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast at the meeting. Votes may be cast for or against such ratification. Stockholders may also abstain from voting. Abstentions will count in the tabulations of votes cast on this proposal, while broker non-votes are not counted as votes cast or shares voting on this matter and will have no effect on the voting results.

|

• |

Proposal 3: Advisory Vote on the Compensation of our Named Executive Officers |

This vote is advisory only and non-binding to the Board of Directors. The Board of Directors will receive the count of votes cast and expects to consider the results of the vote, along with other relevant factors, in its assessment of executive compensation. Because this vote is advisory only, abstentions and broker non-votes will have no effect on the voting for this matter.

|

• |

Proposal 4: Approval of the 2015 Long-Term Equity Incentive Plan |

The approval of our 2015 Long-Term Equity Incentive Plan requires the affirmative vote of a majority of the votes cast at the meeting. Votes may be cast for or against such ratification. Stockholders may also abstain from voting. Abstentions will count in the tabulations of votes cast on this proposal, while broker non-votes are not counted as votes cast or shares voting on this matter and will have no effect on the voting results.

2

PROPOSAL 1 – ELECTION OF CLASS III DIRECTORS

Our By-laws provide for a classified Board of Directors, divided into three staggered classes – I, II and III. The terms of office for each of these classes are scheduled to expire on the date of our annual stockholders’ meeting in 2016, 2017 and 2015, respectively. At the 2015 Annual Meeting, all of our class III directors are up for election.

Our Board of Directors has nominated Messrs. Perry A. Sook, Geoff Armstrong and Jay M. Grossman as nominees for election as our class III directors. Once elected, each of our class III directors’ terms will expire on the date of our 2018 annual stockholders’ meeting. The persons named in the enclosed proxy will vote to elect as class III directors the nominees named below, unless the proxy is marked otherwise. If a stockholder returns a proxy without contrary instructions, the persons named as proxies therein will vote to elect as Directors the nominees named below.

The Board of Directors recommends a vote FOR the selection of Messrs. Perry A. Sook, Geoff Armstrong and Jay M. Grossman to the Board of Directors.

|

|

|

Principal Occupation and Business Experience |

|

Perry A. Sook |

|

Perry A. Sook has served as Chairman of our Board of Directors, President and Chief Executive Officer and as a Director since our inception in 1996. From 1991 to 1996, Mr. Sook was a principal of Superior Communications Group. Mr. Sook currently serves as a director of the National Association of Broadcasters, the NBC Affiliate Association Board and the Television Bureau of Advertising and serves as Vice Chairman and trustee for the Ohio University Foundation. Previously, Mr. Sook served on the board of Penton Media. Mr. Sook brings to the Board of Directors his demonstrated leadership skills and extensive operating executive experience acquired in several communication and media businesses. He is highly experienced in driving operational excellence, development of innovative technologies and attainment of financial objectives under a variety of economic and competitive conditions. |

3

|

|

|

Principal Occupation and Business Experience |

|

Geoff Armstrong |

|

Geoff Armstrong has served as a Director since November 2003. Mr. Armstrong is Chief Executive Officer of 310 Partners, a private investment firm, and currently serves on the board and as Chairman of the audit committee at SFXii, an entertainment company, beginning in January 2013. From March 1999 through September 2000, Mr. Armstrong was the Chief Financial Officer of AMFM, which was publicly traded on the New York Stock Exchange until it was purchased by Clear Channel Communications in September 2000. From June 1998 to February 1999, Mr. Armstrong was Chief Operating Officer and a director of Capstar Broadcasting Corporation, which merged with AMFM in July 1999. Mr. Armstrong was a founder of SFX Broadcasting, which went public in 1993, and subsequently served as Chief Financial Officer, Chief Operating Officer, and a director until the company was sold in 1998 to AMFM. Mr. Armstrong has served as a director and the chairman of the audit committee of Radio One since June 2001 and May 2002, respectively. Mr. Armstrong has also served on the board of directors of Capstar Broadcasting Corporation, AMFM and SFX Broadcasting. Mr. Armstrong brings to the Board of Directors his extensive experience as the CFO of several publicly traded companies in the broadcast and communications industry, as well as a member of the audit committee of several publicly traded companies. His service on the boards of public companies in diverse industries allows him to offer a broad perspective on corporate governance, risk management and operating issues facing corporations today.

|

|

Jay M. Grossman |

|

Jay M. Grossman has served as a Director since 1997 and was our Vice President and Assistant Secretary from 1997 until March 2002. Mr. Grossman serves as Managing Partner and Co-Chief Executive officer at ABRY Partners, LLC (“ABRY”), which he joined in 1996. Prior to joining ABRY, Mr. Grossman was an investment banker specializing in media and entertainment at Kidder Peabody and at Prudential Securities. Mr. Grossman currently serves as a director (or the equivalent) of several private companies including Hometown Cable, Grande Communications Networks and RCN Telecom Services. Previously, Mr. Grossman served on the board of directors of a wide variety of companies including Atlantic Broadband, Q9 Networks, Sidera Networks, WideOpenWest Holdings, Consolidated Theaters, Country Road Communications, Monitronics International, Caprock Communications, Cyrus One Networks, Executive Health Resources and Hosted Solutions. Mr. Grossman brings to the Board of Directors his ability to provide the insight and perspectives of a former investment banker at one of the world’s largest investment banks. His prior experience with media and entertainment transactions offers a unique viewpoint as a Director. He also oversaw the integration of two middle-market communications companies with differing operations and networks. His service on the boards of several private companies in diverse industries allows him to offer a broad perspective on corporate governance, compensation and operating issues facing corporations today. |

4

PROPOSAL 2 – RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Subject to ratification by the stockholders, the Audit Committee of our Board of Directors has selected the firm of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2015. PricewaterhouseCoopers LLP has served as our independent registered public accounting firm since 1997. If the stockholders do not ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm, the selection of such independent registered public accounting firm will be reconsidered by the Audit Committee.

Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from stockholders.

The Board of Directors believes that the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the year ending December 31, 2015 is in the best interests of the Company and its stockholders and therefore recommends that the stockholders vote FOR this proposal.

5

PROPOSAL 3 – ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Board of Directors is asking stockholders to cast an advisory, non-binding vote on the compensation of our Named Executive Officers, as disclosed in the Compensation Discussion and Analysis section of this Proxy Statement. While this vote is non-binding, the Board of Directors values the opinions of Nexstar’s stockholders and expects to consider the outcome of the vote, along with other relevant factors, when making future compensation decisions.

As described in detail in the Compensation Discussion and Analysis section, the Compensation Committee oversees the program and compensation awarded, adopting changes to the program and awarding compensation as appropriate to reflect Nexstar’s circumstances.

The Board of Directors is asking Nexstar’s stockholders to indicate their support for the compensation of its Named Executive Officers. The Board of Directors believes that the information provided in the Proxy Statement demonstrates that Nexstar’s executive compensation program was designed appropriately and is working to ensure that management’s interests are aligned with its stockholders’ interests to support long-term value creation.

You may vote for or against the following resolution, or you may abstain. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and procedures described in this Proxy Statement.

The Board of Directors believes, based on the analysis and recommendations performed by the Compensation Committee, as discussed in the Compensation Discussion and Analysis section of this Proxy Statement, that it has provided a reasonable compensation structure for the Company’s Named Executive Officers, in order to align their personal interests with that of the Company and to attract and retain their talent. The Board of Directors recommends that the stockholders vote FOR such compensation.

6

PROPOSAL 4 – APPROVAL OF THE 2015 LONG-TERM EQUITY INCENTIVE PLAN

Subject to approval by the stockholders, our Board of Directors, upon the recommendation of the Compensation Committee of the Board of Directors, has approved our 2015 Long-Term Equity Incentive Plan (the “2015 Plan”).

The Board of Directors believes that the approval of the 2015 Plan is in the best interests of the Company and its stockholders and therefore recommends that the stockholders vote FOR this proposal.

The Company believes that incentives and share-based awards focus employees on the objective of creating shareholder value and promoting the success of the Company, and that incentive compensation plans like the proposed 2015 Plan are an important attraction, retention and motivation tool for participants in the plan.

The Company currently maintains one equity compensation plan (the 2012 Plan), which provides for the granting of stock options, stock appreciation rights (“SARs”), restricted stock and performance awards. As of April 10, 2015, options to purchase 2,803,977 shares of the Company’s Class A Common Stock were outstanding and 220,500 restricted stock units were unvested. An additional 16,250 shares of the Company’s Class A Common Stock were available for new award grants under the 2012 Plan.

The Board of Directors approved the 2015 Plan based, in part, on a belief that the number of shares currently available under the 2012 Plan does not give the Company sufficient authority and flexibility to adequately provide for future incentives.

The following is a summary of the significant terms of the 2015 Plan, but does not include all of the provisions of the 2015 Plan. For further information we refer you to the 2015 Plan, a copy of which is attached as Annex A.

Shares Available For Awards

The aggregate number of shares of our Class A Common Stock that may be issued under all stock-based awards made under the 2015 Plan will be 2,500,000 shares.

The Compensation Committee will adjust the number of shares and share limits described above in the case of a stock dividend or other extraordinary distribution, recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase or exchange of shares, issuance of warrants or other rights or other similar corporate transaction or event that affects shares of our Common Stock, in order to prevent dilution or enlargement of the benefits or potential benefits intended to be provided under the 2015 Plan.

The Company intends to file a Registration Statement on Form S-8 relating to the issuance of common stock under the 2015 Long-Term Equity Incentive Plan with the SEC pursuant to the Securities Act of 1933, as amended, as soon as practicable after approval of the 2015 Long-Term Equity Incentive Plan by our stockholders.

Key Terms

Any employee, officer, consultant, independent contractor, advisor or non-employee director providing services to us, who is selected by the Compensation Committee, is eligible to receive an award under the 2015 Plan. As of April 10, 2015, approximately 4,103 employees and 6 non-employee directors were eligible as a class to be selected by the Compensation Committee to receive awards under the 2015 Plan.

Each individual to whom a grant is made under the 2015 Plan will enter into a written agreement with the Company that will contain, among other provisions, vesting requirements, award restrictions and the duration of such restrictions. Unless the Compensation Committee determines otherwise and except in certain occurrences of termination or Change of Control, no award under the 2015 Plan may be exercised and no award restrictions may lapse within 12 months from the date of grant. The Compensation Committee may accelerate vesting in connection with a change of control of the Company.

7

The term of awards may not be longer than 10 years from the date of grant. If an award terminates, is forfeited or is cancelled, shares covered by such award will increase the pool of stock under the 2015 Plan and will again be available to be awarded under the 2015 Plan, except for shares that were used by participant to pay the exercise price of an option or satisfy tax obligation of an exercise or shares subject to a SAR that are not issued upon its exrcise. If a participant’s employment or service as a director terminates during the vesting period for any reason other than death, disability or retirement, all of the participant’s unexercised awards that were vested and exercisable on the date of such termination will remain exercisable for a period of 90 days after the date of such termination, and all of the participant’s unexercised awards that were not vested or exercisable on the date of such termination will be forfeited immediately.

The exercise price of stock options and SARs may not be less than 100% of the fair market value of a share of Common Stock as of the date of grant and, in case of the stock option award to an employee who, at the time of grant, owns more than 10% of the total combined voting power of all classes of stock of the Company, the exercise price of such stock option award may not be less than 110% of the Fair Market Value of a share of Common Stock as of the date of grant.

The Compensation Committee will administer the 2015 Plan and will have full power and authority to determine when and to whom awards will be granted, and the type, amount, form of payment and other terms and conditions of each award, consistent with the provisions of the 2015 Plan.

New Plan Benefits

No awards have been granted, and no specific plans have been made for the grant of future awards, under the 2015 Plan. The grant of any awards under the 2015 Plan will be at the discretion of the Compensation Committee, as will the terms and number of awards to be granted in the future. Since no such determinations regarding the grant of awards have yet been made, the benefits or amounts that will be received by or allocated to the Company’s Named Executive Officers, executive officers as a group, non-employee directors as a group, and all other employees cannot be determined at this time.

Market Price of Shares

The closing price of a share of Common Stock on April 20, 2015 was $57.87.

Types of Awards and Terms and Conditions

The 2015 Plan permits the granting of:

|

· |

stock options (including both incentive and non-qualified stock options); |

|

· |

stock appreciation rights; |

|

· |

restricted stock and restricted stock units (“RSUs”); and |

|

· |

performance awards of cash or stock. |

Stock Options. The holder of an option will be entitled to purchase a number of shares of our Common Stock at a specified exercise price during a specified time period, all as determined by the Compensation Committee. The Compensation Committee may, in its discretion, permit non-qualified stock options to be net exercised.

Stock Appreciation Rights. The holder of a SAR is entitled to receive the excess of the fair market value (calculated as of the exercise date or, at the Compensation Committee’s discretion, as of any time during a specified period before or after the exercise date) of a specified number of shares of our Common Stock over the grant price of the SAR.

Restricted Stock and Restricted Stock Units. The holder of restricted stock will own shares of our Common Stock subject to restrictions imposed by the Compensation Committee (including, for example, restrictions on the right to vote the restricted shares or to receive any dividends with respect to the shares) for a specified time period determined by the Compensation Committee. The holder of restricted stock units will have the right, subject to any restrictions imposed by the Compensation Committee, to receive shares of our Common Stock, or a cash payment equal to the fair market value of those shares, at some future date determined by the Compensation Committee.

8

Performance Awards. The Compensation Committee may grant performance awards under the 2015 Plan. A performance award may be denominated or payable in cash, stock (including restricted stock and restricted stock units), other securities, other awards or other property, and confers on the holder the right to receive payments, in whole or in part, upon the achievement of one or more performance goals during a performance period as established by the Compensation Committee. The performance goals to be achieved during any performance period, the length of any performance period, the amount of any performance award granted, the amount of any payment or transfer to be made pursuant to any performance award and any other terms and conditions of any performance award will be determined by the Compensation Committee.

Non-Employee Director Limitations

The maximum grant date fair value of any award granted to any non-employee director during any calendar year under the 2015 Plan will not exceed $500,000. The $500,000 limit does not include shares of Common Stock granted in lieu of all or any portion of such non-employee director’s cash retainer fees.

Change of Control

If a participant’s services are terminated without cause or other than due to death or disability following a change of control, then all of the participant’s awards (other than performance awards) will become immediately fully vested and, in the case of options and SARs, exercisable for up to the later of 90 days after the date of termination or the expiration date of the award. Furthermore, a participant who has been granted a performance award will earn no less than the portion of the performance award that he would have earned if the applicable performance cycle had terminated on the date of the change of control.

Duration and Termination

No awards may be made after ten years from the earlier of the date of adoption of the 2015 Plan by the Board of Directors, the date of stockholder approval or any earlier date of discontinuation or termination established pursuant to the 2015 Plan. However, awards granted under the 2015 Plan prior to expiration may extend beyond the expiration of the 2015 Plan.

Clawback or Recoupment of Awards

All awards under the 2015 Plan will be subject to forfeiture and/or penalty conditions determined by the Compensation Committee and set forth in the award agreement, including recovery under any law, government regulation or stock exchange listing requirement.

Blackout Periods

Notwithstanding contrary provisions in the 2015 Plan or any award agreement, Nexstar has the authority to establish any “blackout” period that it deems necessary or advisable with respect to any and all awards.

Prohibition on Repricing Awards

Without the approval of our stockholders, the Compensation Committee will not reprice, adjust or amend the exercise price of any options or the grant price of any SAR previously awarded, whether through amendment, cancellation and replacement grant or any other means, except in connection with a stock dividend or other distribution, recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase or exchange of shares, issuance of warrants or other rights or other similar corporate transaction or event that affects shares of our Common Stock, in order to prevent dilution or enlargement of the benefits, or potential benefits intended to be provided under the 2015 Plan.

9

Section 162(m) Limitations

Although the Compensation Committee may consider preserving tax deductibility as one objective in administering the 2015 Plan, that objective will only be one consideration among others, including the ability of the 2015 Plan to support the Company’s strategy and the long-term interests of the Company’s stockholders. As such, the Compensation Committee may authorize awards under the 2015 Plan that are not fully tax deductible under Section 162(m) of the Code. To the extent applicable to U.S.-based executives, Section 162(m) of the Code generally limits to $1,000,000 the amount that a publicly-held corporation is allowed each year to deduct for the compensation paid to each of its Chief Executive Officer and the three other most highly compensated officers other than the principal financial officer. However, “qualified performance-based compensation” is not subject to the $1,000,000 deduction limit. While the Compensation Committee views preserving tax deductibility as an important objective, it believes the primary purpose of the Company’s compensation program is to support its strategy and the long-term interests of its stockholders. Accordingly, the Compensation Committee may authorize awards under the 2015 Plan that are not fully tax deductible under Section 162(m).

The restrictions described below (which will be doubled with respect to any participant during his/her first year of employment) will apply to awards under the 2015 Plan that are intended to qualify as performance-based compensation under Section 162(m) of the Code:

(i) During any fiscal year, the maximum number of shares of Common Stock subject to any award of stock options or SARs, or, with respect to any award of restricted stock or RSUs when the grant or vesting is subject to performance, will be 500,000 per participant per award type;

(ii) During any twelve-month period, the maximum cash payment that may be earned via any cash-based award where the grant or vesting is subject to performance goals will be $10,000,000 per participant; and

(iii) During any twelve-month period, the maximum number of shares of Common Stock subject to any performance award intended to qualify as performance-based compensation that may be earned will be 500,000 shares per participant.

The individual participant limitations described herein are cumulative such that if the shares that have been awarded do not meet the maximum amount described above, the difference between the awarded shares and the maximum amount will carry over to the following twelve-month period or fiscal year, as applicable.

There are no annual individual limitations applicable to awards that are not intended to qualify as performance-based compensation under Section 162(m).

Performance Goals

To the extent permitted under Section 162(m) of the Code, performance goals established for purposes of awards intended to be “performance-based compensation” under Section 162(m) of the Code, will be based on the attainment of certain target levels of, or a specified increase or decrease (as applicable) in one or more of the following: (i) earnings (either in the aggregate or on a per share basis); (ii) operating income or profit; (iii) underwriting income or profit; (iv) profitability ratios; (v) gross income; (vi) net income (before or after taxes); (vii) cash flow (including annual cash flow provided by operations); (viii) gross profit; (ix) gross profit return on investment; (x) gross margin return on investment; (xi) gross margin; (xii) operating margin; (xiii) working capital; (xiv) earnings before interest and taxes; (xv) earnings before or after either, or any combination of, interest, tax, depreciation and amortization; (xvi) return on equity; (xvii) return on assets; (xviii) return on capital; (xix) return on invested capital; (xx) any other return measures; (xxi) net revenues; (xxii) gross revenues; (xxiii) annual net income to shares of Common Stock; (xxiv) revenue growth; (xxv) annual recurring revenues; (xxvi) recurring revenues; (xxvii) license revenues; (xxviii) changes in annual revenue; (xxix) sales or market share; (xxx) total stockholder return, including return on assets, investment, invested capital, and equity (including income applicable to common stockholders or other class or stockholders); (xxxi) share price (including growth measures and total stockholder return or attainment by the shares of a specified value for a specified period of time); (xxxii) economic value added; (xxxiii) operational performance measures; (xxxiv) reduction in expense levels in each case, where applicable, determined either on a Company-wide basis or in respect of any one or more Subsidiaries or business units thereof; (xxxv) specified objectives with regard to limiting the level of increase in all or a portion of the Company’s bank debt or other long-term or short-term public or private debt or other similar financial obligations of the Company, which may be calculated net of cash balances, other offsets and adjustments or a combination thereof as may be established by the Compensation Committee in its sole discretion; (xxxvi) strategic business criteria, consisting of one or more objectives based on meeting specified revenue, market-penetration or business expansion goals, objectively identified project milestones, volume levels,

10

cost targets and goals relating to acquisitions or divestitures; (xxxvii) the fair market value of a share of Common Stock; (xxxviii) the growth in the value of an investment in the Common Stock assuming the reinvestment of dividends; (xxxix) reduction in operating expenses or (xl) book value of assets, book value per share of Common Stock, growth in book value per share of Common Stock or any combination thereof.

With respect to awards that are intended to qualify as “performance-based compensation” under Section 162(m) of the Code, to the extent permitted thereunder, the Compensation Committee may, in its sole discretion, exclude or adjust the impact of an event or occurrence that the Compensation Committee determines should be appropriately excluded or adjusted, including:

(a) restructurings, discontinued operations, extraordinary items or events, and other unusual or non-recurring charges as described in Accounting Standards Codification 225-20, “Extraordinary and Unusual Items,” and management’s discussion and analysis of financial condition and results of operations appearing or incorporated by reference in the Company’s Form 10-K for the applicable year;

(b) an event either not directly related to the operations of the Company or not within the reasonable control of the Company’s management; or

(c) a change in tax law or accounting standards required by generally accepted accounting principles.

Performance goals may also be based upon individual participant performance goals, as determined by the Compensation Committee, in its sole discretion. In addition, awards that are not intended to qualify as “performance-based compensation” under Section 162(m) of the Code may be based on the performance goals set forth herein or on such other performance goals as determined by the Compensation Committee in its sole discretion. Such performance goals may be based upon the attainment of specified levels of Company (or subsidiary, division, other operational unit, administrative department or product category of the Company) performance under one or more of the measures described above relative to the performance of other corporations. With respect to awards that are intended to qualify as “performance-based compensation” under Section 162(m) of the Code, to the extent permitted under Section 162(m) of the Code (including, without limitation, compliance with any requirements for stockholder approval), the Compensation Committee may also:

(a) designate additional business criteria on which the performance goals may be based; or

(b) adjust, modify or amend the aforementioned business criteria.

11

The current directors of the Company are:

|

|

|

Independent |

|

Age |

|

Nexstar Position |

|

Perry A. Sook |

|

|

|

57 |

|

Chairman, President, Chief Executive Officer and Class III Director |

|

Geoff Armstrong |

|

ü |

|

57 |

|

Class III Director |

|

Jay M. Grossman |

|

ü |

|

55 |

|

Class III Director |

|

I. Martin Pompadur |

|

ü |

|

79 |

|

Class II Director |

|

Dennis A. Miller |

|

ü |

|

57 |

|

Class II Director |

|

Lisbeth McNabb |

|

ü |

|

54 |

|

Class I Director |

|

C. Thomas McMillen |

|

ü |

|

62 |

|

Class I Director |

Perry A. Sook – biographical information for Mr. Sook can be found under “Proposal 1 – Election of Class III Directors.”

Geoff Armstrong – biographical information for Mr. Armstrong can be found under “Proposal 1 – Election of Class III Directors.”

Jay M. Grossman – biographical information for Mr. Grossman can be found under “Proposal 1 – Election of Class III Directors.”

I. Martin Pompadur - has served as a Director since November 2003. In June of 1998, Mr. Pompadur joined News Corporation as Executive Vice President of News Corporation, President of News Corporation Eastern and Central Europe and a member of News Corporation’s Executive Management Committee. In January 2000, Mr. Pompadur was appointed Chairman of News Corp Europe. Mr. Pompadur resigned from News Corporation in November 2008. He is currently Global Vice Chairman, Media and Entertainment at Macquarie Capital as well as an advisor to several companies. Prior to joining News Corporation, Mr. Pompadur was President of RP Media Management and held executive positions at several other media companies. Mr. Pompadur currently serves as a director of RP Coffee Ventures, IMAX Corporation and Truli Media Group. Previously, Mr. Pompadur served on the boards of Metan Development Group, News Corporation Europe, Sky Italia, News Out of Home, Balkan Bulgarian, BSkyB, Metromedia International Group, Elong, Seatwave Limited and Linkshare Corporation.

Mr. Pompadur’s qualifications for election to the Board of Directors include his ability to offer a broad international perspective on issues considered by the Board of Directors and his extensive expertise in the media industry.

Dennis A. Miller has served as a Director since February 2014. From 2013 until April 2014, Mr. Miller served as President of Operations for TV Guide Network, a highly distributed entertainment network owned by CBS Corporation and Lionsgate Entertainment Corporation. From 2011 to 2013, Mr. Miller was as an independent consultant to MediaLink and Lionsgate. From 2005 to 2011, Mr. Miller was a General Partner at Spark Capital, a venture fund with an investment focus on the conflux of the media, entertainment and technology industries. Prior to joining Spark Capital, Mr. Miller served as Managing Director for Constellation Ventures, the venture arm of Bear Stearns. His portfolio of investments included CSTV (sold to CBS), TVONE (sold to Comcast and Radio One), Capital IQ (sold to McGraw Hill), and K12, which went public in 2007. Before focusing on venture capital investing, Mr. Miller served as Executive Vice President of Lionsgate, a global entertainment company with motion picture, television, home entertainment and digital media operations, which he joined in 1998. From 1995 to 1998, Mr. Miller was the Executive Vice President of Sony Pictures Entertainment, a global motion picture, television and entertainment production and distribution company. He was Executive Vice President of Turner Network Television from 1991 to 1995, during the cable channel’s early inception. From 1990 to 1995, Mr. Miller was Executive Vice President of Turner Network Television. Mr. Miller began his career as an attorney with Manatt, Phelps, Rothenberg and Phillips in Los Angeles. He holds a Juris Doctorate from Boalt Law School and a B.A. in political science from the University of California at San Diego.

12

Mr. Miller’s qualifications for election to the Board include his over 25 years of knowledge and experience in numerous early-stage and established media, entertainment and technology companies. Mr. Miller currently serves on the board of directors of publicly-traded companies Radio One, Inc. and Canaccord Genuity Group Inc., a leading independent, full-service financial services firm. Previously, Mr. Miller served on the board of Global Eagle Entertainment, Inc.

Lisbeth McNabb has served as a Director since May 2006. In March 2013, Ms. McNabb founded DigiWorksCorp, a Digital and Big Analytics company, for retail, internet, and brand companies. Ms. McNabb is also founder and Chairman of w2wlink.com, a professional women’s online membership community. Ms. McNabb is the former Chief Financial Officer and Chief Revenue Officer of Match.com, an online dating company, where she was employed from March 2005 through 2006. Prior to joining Match.com, Ms. McNabb served as Senior Vice President of Finance and Planning for Sodexo, an on-site food service and facilities management company, from 2000 to 2005 and, previous to that, held innovation, management and strategy leadership roles with PepsiCo Frito-Lay, American Airlines, AT&T and JP Morgan Chase. Ms. McNabb currently serves as a director of non-profit 4Word and is on the advisory boards of Southern Methodist University and the University of Nebraska. Previously, Ms. McNabb served as a director and chair of the audit committee of Tandy Brands and served on the advisory board of American Airlines, the Dallas Chapter of Financial Executives International, the Sammons Art Center and The Family Place.

Ms. McNabb brings to the Board of Directors her leadership skills in entrepreneurial and executive roles in brand, internet and technology companies and extensive strategy, integrated marketing, finance, analytics and operational scaling experience in a wide range of industries and in marketing to women.

C. Thomas McMillen has served as a Director since July 2015. Mr. McMillen served as Timios National Corporation’s (formerly Homeland Security Capital Corporation) Chief Executive Officer and Chairman of the Board since August 2005 and served as its President since July 2011 until his resignation in February 2014. From May 2011 to July 2013, Mr. McMillen served as Chairman of the National Foundation on Fitness, Sports and Nutrition, a Congressionally authorized foundation that Mr. McMillen founded where he currently serves as Treasurer. From 2010 to 2012, Mr. McMillen was the sole member and manager of NVT License Holdings, LLC, (New Vision Television) a Delaware limited liability company, which was the indirect parent and controlling entity of several other limited liability companies which held the Federal Communications Commission licenses for eight full power and two low power television stations in eight different television markets. From April 2007, he has served on the Board of Regents of the University of Maryland System. From December 2004 until January 2007, Mr. McMillen served as the Chairman of Fortress America Acquisition Corporation (now Fortress International Group, Inc., FIGI.PK), and from January 2007 until August 2009, he served as Vice Chairman and director. From October 2007 until October 2009, Mr. McMillen served as Chairman and Co-Chief Executive Officer of Secure America Acquisition Corporation (now Ultimate Escapes, Inc. OTCBB: ULEIQ.PK), and from October 2009 to December 2010 as a director and from November 2009 to December 2010 as Vice Chairman. Ultimate Escapes, Inc. filed for Chapter 11 bankruptcy protection in the United States Bankruptcy Court in Wilmington, Delaware in September 2010. From 1987 through 1993, Mr. McMillen served three consecutive terms in the U.S. House of Representatives representing the 4th Congressional District of Maryland. Mr. McMillen received a Bachelor of Science in Chemistry from the University of Maryland and a Bachelor and Master of Arts from Oxford University as a Rhodes Scholar.

Mr. McMillen’s qualifications to serve as a director include his over 27 years of political, business and sports experience and leadership. During his career, he has been an active investor, principal and board member in companies in the cellular, paging, healthcare, motorcycle, environmental technology, broadcasting, real estate and insurance industries.

13

Committees of the Board of Directors

The Board of Directors currently has three standing committees with the following members:

|

|

|

Compensation |

|

Audit |

|

Nominating |

|

Geoff Armstrong |

|

Chair |

|

ü |

|

|

|

Jay Grossman |

|

ü |

|

|

|

ü |

|

I. Martin Pompadur |

|

|

|

ü |

|

Chair |

|

Dennis A. Miller |

|

ü |

|

|

|

|

|

Lisbeth McNabb |

|

|

|

Chair |

|

|

|

C. Thomas McMillen |

|

|

|

|

|

ü |

Compensation Committee

The Compensation Committee makes all decisions about the compensation of the Chief Executive Officer and also has the authority to review and approve the compensation for the Company’s other executive officers. The primary objectives of the Compensation Committee in determining total compensation (both salary and incentives) of the Company’s executive officers, including the Chief Executive Officer, are (i) to enable the Company to attract and retain highly qualified executives by providing total compensation opportunities with a combination of elements which are at or above competitive opportunities, (ii) to tie executive compensation to the Company’s general performance and specific attainment of long-term strategic goals, and (iii) to provide a long-term incentive for future performance that aligns stockholder interests and executive rewards.

The purpose of the Compensation Committee is to establish compensation policies for Directors and executive officers of Nexstar, approve employment agreements with executive officers of Nexstar, administer Nexstar’s stock option plans and approve grants under the plans and make recommendations regarding any other incentive compensation or equity-based plans. The Compensation Committee met two times during 2014. The Compensation Committee operates under a written charter adopted by the Board of Directors in January 2004. In July 2013, the Board of Directors amended the charter of the Compensation Committee to comprise its members primarily of independent directors in order to comply with the rules and regulations of the NASDAQ Stock Market for an uncontrolled company. A copy of such charter is available through our web site at www.nexstar.tv. The information contained on or accessible through our web site does not constitute a part of this Proxy Statement. All three members of the Compensation Committee are “independent” as that term is defined in the NASDAQ Stock Market Marketplace rules. For more information regarding the Compensation Committee, please refer to the “Compensation Committee Report” in this Proxy Statement.

Audit Committee

The purpose of the Audit Committee is to oversee the quality and integrity of Nexstar’s accounting, internal auditing and financial reporting practices, to perform such other duties as may be required by the Board of Directors, and to oversee Nexstar’s relationship with its independent registered public accounting firm. The Audit Committee met four times during 2014. The members of the Audit Committee are “independent” as that term is defined in the NASDAQ Stock Market Marketplace rules. The Board of Directors has determined that Ms. McNabb, who served as Chair of the Audit Committee in 2014, is an “audit committee financial expert” in accordance with the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”). The Audit Committee operates under a written charter adopted by the Board of Directors in January 2004. A copy of such charter is available through our web site at www.nexstar.tv. For more information regarding the Audit Committee, please refer to the “Audit Committee Report” in this Proxy Statement.

14

Nominating and Corporate Governance Committee

The purpose of the Nominating and Corporate Governance Committee is to identify individuals qualified to serve on Nexstar’s Board of Directors, recommend persons to be nominated by the Board of Directors for election as directors at the annual meeting of stockholders, recommend nominees for any committee of the Board of Directors, develop and recommend to the Board of Directors a set of corporate governance principles applicable to Nexstar and to oversee the evaluation of the Board of Directors and its committees. The Nominating and Corporate Governance Committee operates under a written charter adopted by the Board of Directors in January 2004. In July 2013, the Board of Directors amended the charter of the Nominating and Corporate Governance Committee to comprise its members primarily of independent directors in order to comply with NASDAQ requirements for an uncontrolled company. All three members of the Nominating and Corporate Governance Committee are “independent” as that term is defined in the NASDAQ Stock Market Marketplace rules. A copy of such charter is available through our web site at www.nexstar.tv. The Nominating and Corporate Governance Committee met once during 2014, and its functions were performed through consents or by the full Board of Directors. Our Nominating and Corporate Governance Committee will consider nominees for the Board of Directors (see “Stockholder Proposals for the 2016 Annual Meeting” under “Other Information” in this Proxy Statement).

Additional Information Concerning the Board of Directors

During 2014, the full Board of Directors met four times and each incumbent director attended all of the meetings of the Board of Directors and committees of the Board of Directors on which they serve.

Because fewer than ten non-management stockholders attended our 2014 Annual Meeting of Stockholders in person, the Board of Directors has not adopted a formal policy with regard to director attendance at the annual meeting of stockholders. Mr. Sook attended the 2014 Annual Meeting of Stockholders.

The Board of Directors has not adopted a nominating policy to be used for identifying and evaluating nominees for Director, including Director candidates recommended by stockholders, and has not established any specific minimum qualifications that Director nominees must possess. Instead, the Nominating and Corporate Governance Committee determines the qualifications and skills required to fill a vacancy to complement the existing qualifications and skills, as a vacancy arises in the Board of Directors. However, if it is determined that a nominating policy would be beneficial to Nexstar, the Board of Directors may in the future adopt a nominating policy.

There is no formal policy governing how diversity is considered in the makeup of the Board and the selection of its members. The Nominating and Corporate Governance Committee defines Board diversity broadly to mean that the Board is comprised of individuals with a variety of perspectives, industry experience, personal and professional backgrounds, skills and qualifications. When nominating a Board member, the Nominating and Corporate Governance Committee examines the diversity of the overall board and strives to maintain an appropriate level of diversity with the addition of each new nominee.

Nexstar is not a “controlled company” in accordance with the rules and regulations of the NASDAQ Stock Market. Thus, we are required to maintain a majority of independent Directors on our Board of Directors and to have the compensation of our executive officers and the nomination of Directors be determined by independent Directors.

15

Board of Directors Leadership Structure

Our Board of Directors has the responsibility for selecting the appropriate leadership structure for the Company. In making leadership structure determinations, the Board of Directors considers many factors, including the specific needs of the business and the best interests of the Company’s stockholders. Our current leadership structure is comprised of a combined Chairman of the Board and Chief Executive Officer and Board committees comprised of independent Directors. Although the Board of Directors does not currently have a formal policy, the Board of Directors believes that Mr. Sook’s service in this combined role is in the best interest of both the Company and its stockholders. Mr. Sook has a vast knowledge of television broadcasting and is seen as a leader in this industry. He understands the issues facing the Company and serving in this dual role he is able to effectively focus the Board of Director’s attention on these matters. In his combined capacity, he can speak clearly with one voice in addressing the Company’s various stakeholders such as customers, suppliers, employees and the investing public.

The Board of Directors has, so far, not found a need to designate one of the independent Directors as a “lead independent director” because each independent Director is fully and effectively involved in the activities and issues relevant to the Board of Directors and its committees. The independent Directors have time and again demonstrated the ability to exercise their fiduciary responsibilities in deliberating issues before the Board of Directors and making independent decisions. Under NASDAQ independence rules, our independent Directors are Messrs. Armstrong, Grossman, Pompadur, Miller and McMillen and Ms. McNabb.

Our Board of Directors plays a vital role in managing the risks facing our Company. Through the Audit Committee, the Board of Directors manages potential accounting risk through oversight of disclosure controls and controls surrounding financial reporting. Senior financial executives report to the Audit Committee at each committee meeting on significant financial and accounting matters. In addition, the Audit Committee, in conjunction with senior management, manage the Company’s data risks (including privacy and storage risks). Through the Compensation Committee, the Board of Directors helps manage potential risks associated with our compensation programs by ensuring that they are not structured in a way that encourages executives to take unacceptable risks. The Board of Directors is involved in managing operational risk through the evaluation of potential station acquisitions and significant agreements at Board of Directors meetings and in between meetings, as needed. The Board of Directors confers with our general counsel and outside legal counsel, when necessary, in overseeing legal and regulatory risks.

The Board of Directors adopted a Code of Ethics that applies to our Chief Executive Officer, Chief Financial Officer, the other executive officers and Directors, and persons performing similar functions. The purpose of the Code of Ethics is to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, to promote full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by Nexstar and to promote compliance with all applicable rules and regulations that apply to Nexstar and its officers and directors. The Code of Ethics was filed as an exhibit to Nexstar’s Annual Report for the year ended December 31, 2003 on Form 10-K filed with the SEC on March 31, 2004. The Board of Directors periodically reviews the Code of Ethics for any necessary changes. The Board of Directors performed such a review in 2012 and made no changes to the Code of Ethics.

Compensation Committee Interlocks and Insider Participation

None of our Directors or executive officers served, and we anticipate that no member of our Board of Directors or executive officers will serve, as a member of the board of directors or compensation committee of any other company that has one or more executive officers serving as a member of our Board of Directors.

16

Overview of Compensation and Procedures

Nexstar employees do not receive additional compensation for their services as Directors. Accordingly, Mr. Sook serves on the Board of Directors without additional compensation. Each non-employee director receives compensation of $60,000 per year for their services as a director. The Audit Committee Chairman, the Compensation Committee Chairman and the Nominating and Corporate Governance Committee Chairman receive additional annual compensation of $15,000, $10,000 and $7,500, respectively. Each non-employee director also receives $1,500 for each in-person meeting of the Board of Directors or committee thereof of which they are a member and $750 for each telephonic meeting that they attended. We reimburse our directors for business related travel expenses.

Each class of directors holds office until the applicable meeting of the stockholders of Nexstar for election of their class of Directors and until their successors are elected and qualified. There are no family relationships among Directors or executive officers of Nexstar.

2014 DIRECTOR COMPENSATION TABLE

The following table sets forth information concerning compensation to each of our Directors (excluding the Chief Executive Officer disclosed in the Summary Compensation Table) during the year ended December 31, 2014:

|

|

|

Fees Earned or Paid in Cash

|

|

|

Option Awards(1)

|

|

|

Total ($)

|

|

|||

|

Geoff Armstrong |

|

$ |

80,500 |

|

|

$ |

639,240 |

|

|

$ |

719,740 |

|

|

Jay M. Grossman |

|

|

— |

(2) |

|

|

639,240 |

|

|

|

639,240 |

|

|

I. Martin Pompadur |

|

|

76,500 |

|

|

|

639,240 |

|

|

|

715,740 |

|

|

Dennis A. Miller |

|

|

64,500 |

|

|

|

323,450 |

|

|

|

387,950 |

|

|

C. Thomas McMillen |

|

|

31,500 |

|

|

|

368,850 |

|

|

|

400,350 |

|

|

Lisbeth McNabb |

|

|

83,250 |

|

|

|

639,240 |

|

|

|

722,490 |

|

|

(1) |

Represents the grant date fair value of the awards computed in accordance with FASB Accounting Standards Codification Topic 718. See the Notes to the Company’s Consolidated Financial Statements in our 2014 Annual Report on Form 10-K for a discussion of the assumptions made in the valuation of these awards. The aggregate option awards outstanding for each Director as of December 31, 2014 were as follows (in shares): |

|

|

|

Vested

|

|

|

Unvested

|

|

||

|

Geoff Armstrong |

|

|

5,000 |

|

|

|

20,000 |

|

|

Jay M. Grossman |

|

|

— |

|

|

|

20,000 |

|

|

I. Martin Pompadur |

|

|

1,000 |

|

|

|

20,000 |

|

|

Dennis A. Miller |

|

|

— |

|

|

|

10,000 |

|

|

C. Thomas McMillen |

|

|

— |

|

|

|

10,000 |

|

|

Lisbeth McNabb |

|

|

4,000 |

|

|

|

20,000 |

|

Stock options vest over a range of four to five years and expire ten years from the date of grant.

|

(2) |

Mr. Grossman serves as a Managing Partner of ABRY, our former principal stockholder. In May 2013, ABRY sold the remainder of its common stock holdings in Nexstar and no longer holds an ownership interest in Nexstar. Mr. Grossman is now an independent director under NASDAQ independence rules and will receive compensation in 2015. |

17

The current executive officers of the Company are:

|

|

Age

|

Nexstar Position

|

|

|

Perry A. Sook |

57 |

President, Chief Executive Officer and Director |

|

|

Thomas E. Carter |

56 |

Chief Financial Officer and Executive Vice President |

|

|

Timothy C. Busch |

52 |

Executive Vice President, Co-Chief Operating Officer |

|

|

Brian Jones |

54 |

Executive Vice President, Co-Chief Operating Officer |

|

|

Thomas O’Brien |

54 |

Executive Vice President, Digital Media and Chief Revenue Officer |

|

|

Blake Russell |

44 |

Senior Vice President, Station Operations |

|

|

Elizabeth Ryder |

50 |

Senior Vice President, General Counsel and Secretary |

|

|

Julie Pruett |

53 |

Senior Vice President and Regional Manager |

|

|

William Sally |

57 |

Senior Vice President and Regional Manager |

|

|

Theresa Underwood |

52 |

Senior Vice President and Regional Manager |

|

Perry A. Sook – biographical information for Mr. Sook can be found under “Proposal 1 – Election of Class III Directors.”

Thomas E. Carter has served as our Chief Financial Officer since August 2009. Prior to joining Nexstar, Mr. Carter was Managing Director, Media Telecom Corporate Investment Banking at Banc of America Securities, which he joined in 1985. In this position, he acted as the senior banker responsible for delivering bank products and services including M&A, private and public equity, high-yield debt, fixed income derivatives, syndicated financial products and treasury management for selected clients across the broadcasting, cable, publishing and media industries, including Nexstar. Mr. Carter began his banking career in 1980, serving for five years in various roles in Corporate and International Banking at a predecessor to JPMorgan Chase.

Timothy C. Busch has served as our Executive Vice President and Co-Chief Operating Officer since May 2008. Mr. Busch served as Senior Vice President and Regional Manager from October 2002 to May 2008. Prior to that time, Mr. Busch served as our Vice President and General Manager at WROC (CBS) in Rochester, New York from 2000 to October 2002. Prior to joining Nexstar, Mr. Busch served as General Sales Manager and held various other sales management positions at Gannett-owned WGRZ (NBC) in Buffalo, New York from 1993 to 2000. Prior to that, Mr. Busch held various sales management positions at WGR-AM and FM radio stations in Buffalo. Mr. Busch has served on various boards in the Rochester and Buffalo areas as well as the New York State Broadcasting Association and as the former Chairman of the CBS Affiliate Board. Mr. Busch currently serves on the New York State Broadcasting Association Board of Directors and the Upstate New York Advisory Board for the Federal Reserve Bank of New York.

Brian Jones has served as our Executive Vice President and Co-Chief Operating Officer since May 2008. Mr. Jones served as Senior Vice President and Regional Manager from May 2003 to May 2008. Prior to joining Nexstar, Mr. Jones served as Vice President and General Manager at KTVT (CBS) and KTXA (IND) in Dallas/Fort Worth, Texas from 1995 to 2003. Prior to that, Mr. Jones served in various management, sales and news positions at KTVT, MMT Sales, Inc., KXAS (NBC) in Dallas/Ft. Worth, KLBK (CBS) in Lubbock, Texas and KXAN (NBC) in Austin, Texas. Mr. Jones has served as the Chairman of the FOX Affiliates Board of Governors, Chairman of the Board of the Texas Association of Broadcasters, on the Small Market Advisory Committee of the National Association of Broadcasters and on the Southern Methodist University Journalism Advisory Committee.

18

Thomas O’Brien joined Nexstar in November 2013 as Executive Vice President, Digital Media and Chief Revenue Officer. Mr. O’Brien is responsible for leading Nexstar’s digital media portfolio including the content, product, service and sales teams, development of the Company’s multi-screen strategy, business development and digital investment strategy and the expansion of Nexstar’s overall digital media business portfolio. As the Company’s Chief Revenue Officer, he works closely with Nexstar’s broadcast leadership teams throughout the country to drive holistic revenue growth across the entire Company. Prior to joining Nexstar, Mr. O’Brien served as President and Managing Partner of Prescient Strategy Group, from 2012 to 2013. Prior to that, Mr. O’Brien served as Executive Vice President & Chief Revenue Officer for CNBC, from 2010 to 2012. From 1997 to 2010, Mr. O’Brien served as President and General Manager in the NBC Television Stations Division, serving the Connecticut, Dallas/Ft. Worth and New York markets. Prior to NBC, Mr. O’Brien served in sales management roles at Viacom Broadcasting.

Blake Russell has served as our Senior Vice-President of Station Operations since November 2008. Prior to that, he served as Vice President Marketing and Operations since October 2007. Before that, Mr. Russell served as Vice President and General Manager at KNWA (NBC) and KFTA (FOX) in Ft. Smith/Fayetteville, Arkansas from January 2004 to September 2007 and as our Director of Marketing/Operations at KTAL (NBC) in Shreveport, Louisiana from 2000 to December 2003.

Elizabeth Ryder has served as our Senior Vice President and General Counsel since November 1, 2013, Secretary since January 1, 2013 and Vice President and General Counsel since May 2009. Prior to joining Nexstar, Ms. Ryder served as Vice President—Legal Affairs at First Broadcasting Operating, Inc. Prior to that, Ms. Ryder served as Counsel at the law firm of Drinker Biddle & Reath LLP in Washington, D.C.

Julie Pruett was appointed as the company’s Senior Vice President and Regional Manager of West Region Markets in September 2013. From 1997 through August 2013, Ms. Pruett served as Vice President/General Manager of Nexstar’s KFDX and Mission’s KJTL and KJBO serving the Wichita Falls, Texas and Lawton, Oklahoma, market. From 1989 to 1997, Ms. Pruett served in sales and various management positions at KFDX. Ms. Pruett also worked in the agency side of the business, developing and implementing marketing plans for multiple clients. Altogether, Ms. Pruett has 24 years of experience in the television industry.

William Sally joined Nexstar in September 2013 as a Senior Vice President and Regional Manager. Mr. Sally is responsible in overseeing station operations in 12 television markets in Nexstar's East region including New York, Vermont, Pennsylvania, Indiana, Maryland and Alabama. His responsibilities include generating revenue strategies across Nexstar's multimedia platforms, while evaluating and improving operating efficiencies. Prior to joining Nexstar, Mr. Sally was Vice President and General Manager for Newport Television in Albany at WXXA from May 2008 to December 2012. He held the same position for Smith Broadcasting in Burlington, Vermont, at WFFF from August 1998 to April 2004 and at WFFF and WVNY from April 2004 to April 2008. Mr. Sally also held various management level positions in sales including while in California at KEYT in Santa Barbara from January 1995 to August 1998. He began his television career in 1978 in Utica where he later became Sports Director/Anchor at WKTV.

Theresa Underwood was named Senior Vice President and Regional Manager in April 2015. Ms. Underwood is responsible for overseeing strategic planning and business development of the Company’s broadcast and digital operations in the Northeast. Since 2000, Ms. Underwood has served as Vice President and General Manager of Nexstar-owned WSYR-TV (ABC) and LocalSYR.com serving the Syracuse, NY market. She spent 22 years at WSYR-TV where she held various management level positions. Ms. Underwood first joined Nexstar as VP / General Manager of WSYR-TV in December 2012 when the Company acquired various assets of Newport Television.

19

BENEFICIAL OWNERSHIP OF NEXSTAR COMMON STOCK

The following table sets forth certain information regarding the beneficial ownership of Nexstar’s Common Stock as of April 10, 2015 by (i) those persons known to Nexstar to be the beneficial owners of more than five percent of the outstanding shares of Common Stock of Nexstar, (ii) each Director of Nexstar, (iii) the Named Executive Officers listed in the Summary Compensation Table and (iv) all Directors and executive officers of Nexstar as a group. Under such rules, beneficial ownership includes any shares as to which the entity or individual has sole or shared voting power or investment power and also any shares that the entity or individual had the right to acquire as of June 9, 2015 (60 days after April 10, 2015) through the exercise of any stock option or other right. This information has been furnished by the persons named in the table below or in filings made with the SEC. Where the number of shares set forth below includes shares beneficially owned by spouses and minor children, the named persons disclaim any beneficial interest in the shares so included. As of April 10, 2015, there were no shares issued and outstanding under Nexstar’s Class B Common Stock, Class C Common Stock or Preferred Stock. Unless otherwise indicated, a person’s address is c/o Nexstar Broadcasting Group, Inc., 545 E. John Carpenter Freeway, Suite 700, Irving, Texas 75062.

|

|

|

Class A Common Stock |

|

|||||||||||||

|

Name of Beneficial Owner

|

|

Direct

|

|

|

Vested

|

|

|

Total

|

|

|

%

|

|

||||

|

Beneficial Owners of More Than 5%: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Neuberger Berman Group, LLC(1) |

|

|

3,368,632 |

|

|

|

— |

|

|

|

3,368,632 |

|

|

|

10.8 |

% |

|

MSDC Management, L.P.(2) |

|

|

3,056,793 |

|

|

|

— |

|

|

|

3,056,793 |

|

|

|

9.8 |

% |

|

Luxor Capital Group, LP(3) |

|

|

2,555,987 |

|

|

|

— |

|

|

|

2,555,987 |

|

|

|

8.2 |

% |

|

BlackRock, Inc.(4) |

|

|

2,068,002 |

|

|

|

— |

|

|

|

2,068,002 |

|

|

|

6.6 |

% |

|

Roystone Capital Management LP(5) |

|

|

1,863,000 |

|

|

|

— |

|

|

|

1,863,000 |

|

|

|

6.0 |