UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee

(Name and address of agent for service)

(513)-629-8104

Registrant's telephone number, including area code

Date of fiscal year end: August 31, 2020

Date of reporting period: February 29, 2020

Item 1. Reports to Stockholders.

PMC Funds

PMC Core Fixed Income Fund

Advisor Class Shares: (PMFIX)

Institutional Class Shares: (PMFQX)

PMC Diversified Equity Fund

Advisor Class Shares: (PMDEX)

Institutional Class Shares: (PMDQX)

Semi-Annual Report

February 29, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary or, if you are a direct investor, by calling the Funds at 1-866-762-7338.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Funds, you can call the Funds at 1-866-762-7338. Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary or, if you invest directly, to all PMC Funds you hold.

| 3 | ||||

| 6 | ||||

| 8 | ||||

| 15 | ||||

| SCHEDULE OF OPEN FUTURES CONTRACTS—PMC CORE FIXED INCOME FUND |

37 | |||

| 38 | ||||

| 76 | ||||

| 77 | ||||

| 78 | ||||

| 80 | ||||

| 84 | ||||

| 96 | ||||

| 97 | ||||

PMC Funds

To our Shareholders:

We are pleased to present you with the Semi-Annual Report for the PMC Funds mutual fund family. This report covers the six-month period ended February 29, 2020, as well as the period since the inception of the PMC Funds. The table below presents the performance of the two PMC Funds relative to their respective benchmarks.

The six-month period ended February 29, 2020 was one in which the COVID-19 coronavirus shut down a large portion of the U.S. economy, and wreaked havoc on financial markets. For most of the period, conditions were benign and uneventful, with equity markets rising steadily to record highs on February 19th on the back of an economy that was by most accounts growing resiliently. The unemployment rate had dipped to 3.5% as the economy extended its record expansion to more than 126 months. Interest rates also rose steadily as investors took into account the positive economic data. However, news about how COVID-19 was quickly spreading beyond China forced government leaders to take unprecedented action by requiring non-essential businesses to close, and citizens to shelter-in-place in order to slow the contagion. In an abrupt reversal, equity markets throughout the world went into a tailspin, dropping more than 12% in the final few days of February. Government bond yields also plunged, as investors drove up prices in a rush to the perceived security of safe-haven assets. The 10-year U.S. Treasury yield dropped to 1.15% by the end of February, after trading at 1.65% two weeks earlier, and as high as 1.94% in November 2019.

For its part, the U.S. Federal Open Market Committee (FOMC) was very aggressive in taking action to provide monetary stimulus when the economy began to be shuttered. While the FOMC had not moved by the end of February, the committee did reduce the target federal funds rate twice during the first two weeks of March, first by 0.50%, and then by a whopping 1.00%, bringing the rate to a range of 0%-0.25%. The FOMC also stated that it would take additional action if necessary, although most economists believe it will be hesitant to move rates below 0%.

Policymakers at all levels of government were also quick to mobilize, given the uncertainty of the virus’s spread and the dire predictions of some of the models used to forecast its effects. Many states set forth shelter-in-place rules that effectively closed down large portions of the economy. President Trump tapped Vice President Pence to head the newly established Coronavirus Task Force, which promulgated virus mitigation guidelines, including those related to hygiene and the new concept of social distancing. Congress had not acted by the end of February, but approved three stimulus bills in March amounting to about $6 trillion to help the economy through the uncertainty.

Prior to the economic chaos created by COVID-19, the overall U.S. economy continued to post solid, if unspectacular, results. Real gross domestic product (GDP) grew at an annualized rate of 2.1% in the fourth quarter of 2019. Housing has shown signs of accelerating in recent months, as mortage rates have declined. Inflation has remained benign, and may be less of an issue now with the economy on pause.

Overall, equity markets were little changed over the past six months, but gave up all their gains in the last two weeks of the period. Investors are focused intently on how quickly progress is being made in mitigating the spread of the virus, and policymakers’ plans to begin to open up the economy once again. Within that context, the MSCI World Index Net Return (global all-capitalization) posted a total return of +0.88% for the six months ended February 29, 2020. In the fixed income asset class, bond prices were mixed, with prices of U.S. government securities rising due to the flight-to-quality environment precipitated by COVID-19. However, corporate bonds saw yields rise due to the economic fallout of the shutdown. As such, the Bloomberg Barclays U.S. Aggregate Bond Index, a broad-based index of fixed-income securities, delivered a positive total return of +3.39% over the six months ended February 29, 2020.

3

Total Returns as of February 29, 2020*

*Periods of Less than 1-Year Are Unannualized

| Fund |

Three Months |

Six Months |

One Year |

Five Year |

Ten Year |

Gross Expense Ratio |

||||||||||||||||||

| PMC Diversified Equity Fund (Advisor Class) |

-7.78 | % | -0.99 | % | -1.32 | % | 3.10 | % | 8.00 | % | 0.95 | % | ||||||||||||

| PMC Diversified Equity Fund |

-7.69 | % | -0.82 | % | N/A | N/A | N/A | 0.74 | % | |||||||||||||||

| MSCI World Index Net Return |

-6.28 | % | 0.88 | % | 4.63 | % | 5.88 | % | 8.75 | % | ||||||||||||||

| PMC Core Fixed Income Fund (Advisor Class) |

3.10 | % | 2.86 | % | 10.50 | % | 2.94 | % | 3.65 | % | 1.29 | % | ||||||||||||

| PMC Core Fixed Income Fund |

3.22 | % | 2.99 | % | N/A | N/A | N/A | 1.04 | % | |||||||||||||||

| Bloomberg Barclays U.S. Aggregate Bond Index |

3.69 | % | 3.39 | % | 11.68 | % | 3.58 | % | 3.93 | % | ||||||||||||||

Past performance is no guarantee of future returns. Current performance may be higher or lower than the performance data shown. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please visit the Funds’ website at http://www.investpmc.com/solutions/portfolios or by calling 866-762-7338. Performance results reflect contractual expense subsidies and waivers in effect until December 29, 2020; without these waivers, returns would have been less favorable.

PMC Diversified Equity Fund

The PMC Diversified Equity Fund was launched on August 26, 2009, and provides broad equity asset class exposure. The Fund’s investment objective is long-term capital appreciation, and is managed internally by Envestnet’s Quantitative Research Group (“QRG”). QRG employs its Factor-Enhanced strategies in four different asset class portfolios within the Fund: US Large Cap, US Small Cap, International Developed Markets ADR, and Emerging Markets ADR.

One of the primary drivers of the Fund’s performance is its exposure to the well-known value, momentum and quality asset pricing factors. As discussed in our last annual letter, value-oriented stocks have significantly underperformed the past 36 months, and this has been a contributor to the Fund’s relative performance, as it lagged the benchmark over the six-month period ending February 29, 2020. Over that period the Fund’s Advisor Class shares generated a total return of -0.99%, trailing the +0.88% return of the benchmark MSCI World Index Net Return. The primary driver of the Fund’s performance during the period was the poor aggregate performance of the asset pricing factors toward which the portfolio is tilted. The Fund’s orientation toward value stocks was a key cause of the underperformance relative to the benchmark. Performance was also negatively impacted by having a lower weighted average market capitalization than the index, as stocks of smaller companies underperformed stocks of larger companies. Relative performance was also disadvantaged during the twelve-month period from an underweight to domestic equities relative to European equities, as domestic markets have outperformed international indices. Among the detractors to performance during the period was a modest underweight to the information technology energy sector, and security selection in the info tech, communications services and financials sectors. Slight underweights to energy and financials contributed to performance during the period, as did security selection in the real estate, industrials and materials sectors. As is typically the case, the strategy’s factor orientation resulted in over- or underweights to specific stocks that have a meaningful impact on performance. Over the past six months underweights to well-known companies such as Apple, Inc. (AAPL), Microsoft, Inc. (MSFT), Alphabet, Inc. (GOOG), and Amazon.com, Inc. (AMZN) resulted in underperformance. However, underweights to The Boeing Co. (BA) and The Walt Disney Co. (DIS) benefited performance.

In addition to the risk that the investment strategy employed in the Fund will underperform the benchmark index generally, the primary risks continue to primarily involve systematic risk. Because QRG controls the risk of the portfolio relative to the benchmark, the overall portfolio should track the Fund’s benchmark fairly closely on a relative basis. However, in general market declines the Fund’s fully invested strategy would incur a setback commensurate with the decline in the benchmark.

4

PMC Core Fixed Income Fund

The PMC Core Fixed Income Fund was launched on September 28, 2007, and provides broad exposure to the U.S. fixed income market. The Fund’s investment objective is to provide current income consistent with low volatility of principal, and is sub-advised by two institutional investment managers: Neuberger Berman Investment Advisers, LLC and Schroder Investment Management North America, Inc.

Over the past six months the environment for fixed income securities has been one of declining yields resulting from demand for U.S. Treasury securities as a result of a flight to quality in the midst of the coronavirus pandemic. Against this backdrop, the Fund’s Advisor Class shares generated positive return of 2.86% for the six-month period ending February 29, 2020, trailing the performance of the Bloomberg Barclays U.S. Aggregate Bond Index return of 3.39%. The primary factors positively impacting performance over the past six-month period were security selection within the U.S. Treasury bond and securitized securities segments. The Fund’s aggregate underweight to corporate bonds was a positive contributor during the period. The primary detractors from performance included security selection in the corporate bonds and an overweight to cash.

The primary risks to the strategies employed by the Fund’s sub-advisers remain in place, and exist at both the macro level and in individual security selection. Due to the Fund’s aggregate overweight exposure to credit securities, the Fund remains likely to underperform the benchmark somewhat if the Federal Reserve makes a policy misstep, and Treasury securities consequently rise relative to credits. In addition, if the general level of interest rates rises rapidly, the Fund will not be immune to losses. Similarly, if certain of the individual credits currently owned by the Fund are adversely affected by economic events, the Fund itself will also be affected.

Remarks

As always, we appreciate your continued trust and confidence in the PMC Funds. We will continue to do all we can to ensure that such trust and confidence are well placed and will manage the PMC Funds with that goal clearly in mind.

Brandon R. Thomas

Co-Founder and Chief Investment Officer

Envestnet | PMC

Envestnet Asset Management

The views in this report were those of the Funds’ Investment Adviser and the Investment Sub-Advisers as of the date of this report, and may not reflect their views on the date the report is first published or anytime thereafter. These views are intended to assist the shareholders of the Funds in understanding their investments in the Funds and do not constitute investment advice.

Investments in smaller companies carry greater risk than is customarily associated with larger companies for various reasons such as volatility of earnings and prospects, higher failure rates, and limited markets, product lines or financial resources. Investing overseas involves special risks, including the volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. Income (bond) funds are subject to interest rate risk which is the risk that debt securities in a fund’s portfolio will decline in value because of increases in market interest rates. Please see the prospectus for a complete description of the risks associated with investing in the PMC Funds.

5

PMC FUNDS

(Unaudited)

As a shareholder of the PMC Core Fixed Income Fund or the PMC Diversified Equity Fund (each a “Fund”, and together the “Funds”), you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees, distribution (12b-1) fees (Advisor Class shares only) and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds, and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period.

| Actual | Expenses |

The first lines of the following tables provide information about actual account values and actual expenses. Although the Funds do not charge a sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. Individual Retirement Accounts (“IRA”) will be charged a $15.00 annual maintenance fee. To the extent the Funds invest in shares of exchange-traded funds or other investment companies as part of their investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the direct expenses of the Funds. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the Example. The Example includes, but is not limited to, management fees, distribution (12b-1) fees, fund administration and accounting, custody and transfer agent fees. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| Hypothetical | Example for Comparison Purposes |

The second lines of the tables provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or exchange fees. Therefore, the second lines of the tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value 9/1/19 |

Ending Account Value 2/29/20 |

Expenses Paid During Period 9/1/19-2/29/20* |

||||||||||

| PMC Core Fixed Income Fund–Advisor Class |

||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,028.60 | $ | 5.04 | ||||||

| Hypothetical (5% return before expenses) |

1,000.00 | 1,019.89 | 5.02 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

| Beginning Account Value 9/1/19 |

Ending Account Value 2/29/20 |

Expenses Paid During Period 9/1/19-2/29/20* |

||||||||||

| PMC Core Fixed Income Fund–Institutional Class |

||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,029.90 | $ | 3.79 | ||||||

| Hypothetical (5% return before expenses) |

1,000.00 | 1,021.13 | 3.77 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.75%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

6

| Beginning Account Value 9/1/19 |

Ending Account Value 2/29/20 |

Expenses Paid During Period 9/1/19-2/29/20* |

||||||||||

| PMC Diversified Equity Fund–Advisor Class |

||||||||||||

| Actual |

$ | 1,000.00 | $ | 990.10 | $ | 4.85 | ||||||

| Hypothetical (5% return before expenses) |

1,000.00 | 1,019.99 | 4.92 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.98%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

| Beginning Account Value 9/1/19 |

Ending Account Value 2/29/20 |

Expenses Paid During Period 9/1/19-2/29/20* |

||||||||||

| PMC Diversified Equity Fund–Institutional Class |

||||||||||||

| Actual |

$ | 1,000.00 | $ | 991.80 | $ | 3.47 | ||||||

| Hypothetical (5% return before expenses) |

1,000.00 | 1,021.38 | 3.52 | |||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.70%, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

7

PMC CORE FIXED INCOME FUND (PMFIX, PMFQX)

Investment Highlights (Unaudited)

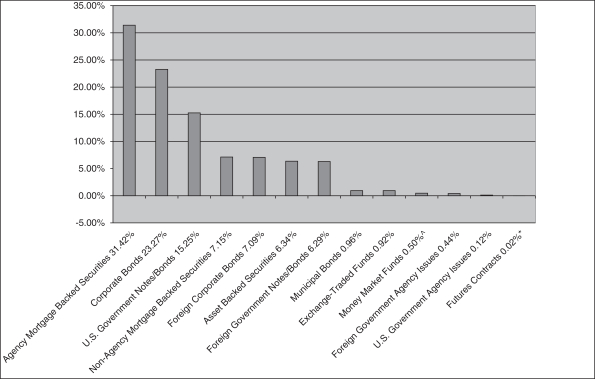

The investment objective of the Fund is to provide current income consistent with low volatility of principal. The Fund’s allocation of portfolio holdings as of February 29, 2020 is shown below.

Allocation of Portfolio Holdings

% of Net assets

| ^ | Excludes securities lending collateral. |

| * | Valued at the net unrealized appreciation (depreciation). |

8

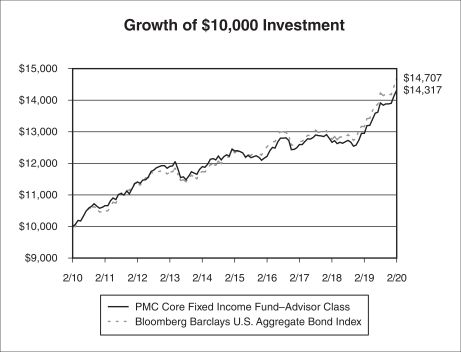

PMC CORE FIXED INCOME FUND–ADVISOR CLASS (PMFIX)

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of February 29, 2020

| PMC Core Fixed Income Fund–Advisor Class |

Bloomberg Barclays U.S. Aggregate Bond Index |

|||||||

| One Year |

10.50 | % | 11.68 | % | ||||

| Five Year |

2.94 | % | 3.58 | % | ||||

| Ten Year |

3.65 | % | 3.93 | % | ||||

| Since Inception (9/28/07) |

4.81 | % | 4.47 | % | ||||

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at (866) PMC-7338.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on February 28, 2010. The graph does not reflect any future performance.

The Bloomberg Barclays U.S. Aggregate Bond Index is an index composed of U.S. securities in Treasury, Government-Related, Corporate and Securitized Sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity and have an outstanding par value of at least $250 million.

One cannot invest directly in an index.

9

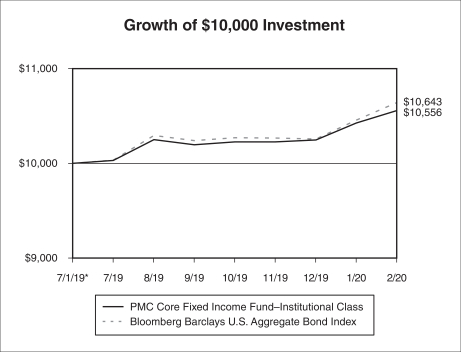

PMC CORE FIXED INCOME FUND–INSTITUTIONAL CLASS (PMFQX)

Investment Highlights (Unaudited) (Continued)

Total Returns as of February 29, 2020

| PMC Core Fixed Income Fund–Institutional Class |

Bloomberg Barclays U.S. Aggregate Bond Index |

|||||||

| Since Inception (7/1/19) |

5.56 | % | 6.43 | % | ||||

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at (866) PMC-7338.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on July 1, 2019, the inception date of the Institutional Class. The graph does not reflect any future performance.

The Bloomberg Barclays U.S. Aggregate Bond Index is an index composed of U.S. securities in Treasury, Government-Related, Corporate and Securitized Sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity and have an outstanding par value of at least $250 million.

One cannot invest directly in an index.

| * | Inception Date |

10

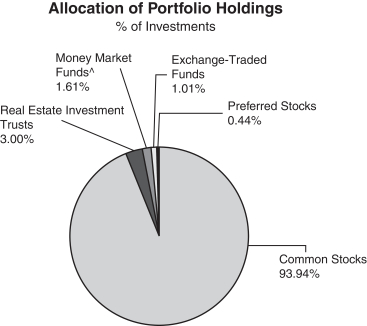

PMC DIVERSIFIED EQUITY FUND (PMDEX, PMDQX)

Investment Highlights (Unaudited)

The investment objective of the Fund is long-term capital appreciation. The Fund’s allocation of portfolio holdings as of February 29, 2020 is shown below.

| ^ | Excludes securities lending collateral. |

11

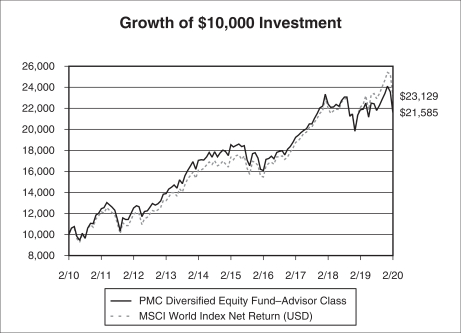

PMC DIVERSIFIED EQUITY FUND–ADVISOR CLASS (PMDEX)

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of February 29, 2020

| PMC Diversified Equity Fund– Advisor Class |

MSCI World Index Net Return |

|||||||

| One Year |

-1.32 | % | 4.63 | % | ||||

| Five Year |

3.10 | % | 5.88 | % | ||||

| Ten Year |

8.00 | % | 8.75 | % | ||||

| Since Inception (8/26/09) |

8.24 | % | 8.82 | % | ||||

On May 25, 2018, Envestnet Asset Management, Inc. (the “Adviser”), the Fund’s investment adviser, assumed all responsibilities for selecting investments in the Fund’s portfolio in connection with a change to the Fund’s investment strategies. The Fund’s performance prior to this date reflects the Fund’s returns achieved when the Adviser actively managed a portion of the Fund’s portfolio and used a “manager of managers” investment strategy by engaging sub-advisers to manage other portions of the Fund’s portfolio.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at (866) PMC-7338.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on February 28, 2010. The graph does not reflect any future performance. On May 25, 2018, the Adviser assumed all responsibilities for selecting investments in the Fund’s portfolio in connection with a change to the Fund’s investment strategies. The Fund’s performance prior to this date reflects the Fund’s returns achieved when the Adviser actively managed a portion of the Fund’s portfolio and used a “manager of managers” investment strategy by engaging sub-advisers to manage other portions of the Fund’s portfolio.

The MSCI World Index Net Return is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Net return indices reinvest dividends after the deduction of taxes, using a tax rate applicable to non-resident investors who do not benefit from table taxation treaties. The MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

One cannot invest directly in an index.

Continued

12

PMC DIVERSIFIED EQUITY FUND–ADVISOR CLASS (PMDEX)

Investment Highlights (Unaudited) (Continued)

13

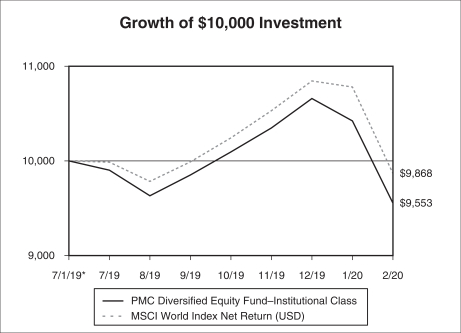

PMC DIVERSIFIED EQUITY FUND–INSTITUTIONAL CLASS (PMDQX)

Investment Highlights (Unaudited) (Continued)

Total Returns as of February 29, 2020

| PMC Diversified Equity Fund– Institutional Class |

MSCI World Index Net Return |

|||||||

| Since Inception (7/1/19) |

-4.47 | % | -1.32 | % | ||||

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at (866) PMC-7338.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on July 1, 2019, the inception date of the Institutional Class. The graph does not reflect any future performance.

The MSCI World Index Net Return is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Net return indices reinvest dividends after the deduction of taxes, using a tax rate applicable to non-resident investors who do not benefit from table taxation treaties. The MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

One cannot invest directly in an index.

| * | Inception Date |

14

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited)

| Principal Amount |

Value |

|||||||

| Asset Backed Securities—6.34% | ||||||||

| AM Capital Funding LLC |

||||||||

| 2018-1, 4.980%, 12/15/2023(b) |

$ | 560,000 | $ | 595,442 | ||||

| Asset Backed Funding Certificates |

||||||||

| 2004-OPT3, 2.407% (1 Month LIBOR USD + 0.780%), 11/25/2033(c) |

276,662 | 273,262 | ||||||

| BlueMountain CLO Ltd. |

||||||||

| 2013-2R, 2.982% (3 Month LIBOR USD + 1.180%), 10/22/2030(b)(c) |

370,000 | 369,852 | ||||||

| CAL Funding III Ltd. |

||||||||

| 2017-1A, 3.620%, 06/25/2042(b) |

713,533 | 715,023 | ||||||

| Carlyle Global Market Strategies |

||||||||

| 2017-1A, 3.119% (3 Month LIBOR USD + 1.300%), 04/20/2031(b)(c) |

1,375,000 | 1,375,000 | ||||||

| Cedar Funding VI CLO Ltd. |

||||||||

| 2016-6A, 2.909% (3 Month LIBOR USD + 1.090%), 10/20/2028(b)(c) |

1,480,000 | 1,477,780 | ||||||

| Centex Home Equity Loan Trust |

||||||||

| 2005-D M3, 2.107% (1 Month LIBOR USD + 0.480%), 10/25/2035(c) |

358,767 | 359,745 | ||||||

| 2005-D M4, 2.237% (1 Month LIBOR USD + 0.610%), 10/25/2035(c) |

390,000 | 390,722 | ||||||

| CIFC Funding Ltd. |

||||||||

| 2017-4, 3.051% (3 Month LIBOR USD + 1.250%), 10/24/2030(b)(c) |

500,000 | 500,050 | ||||||

| Citibank Credit Card Issuance Trust |

||||||||

| 2018-A1, 2.490%, 01/20/2023 |

125,000 | 126,199 | ||||||

| Citigroup Mortgage Loan Trust, Inc. |

||||||||

| 2006-WFHE4, 1.907% (1 Month LIBOR USD + 0.280%), 11/25/2036(c) |

203,171 | 203,089 | ||||||

| CWABS, Inc. |

||||||||

| 2004-5, 2.127% (1 Month LIBOR USD + 0.500%), 10/25/2034(c) |

337,200 | 335,475 | ||||||

| Dewolf Park Clo Ltd. |

||||||||

| 2017-1A, 3.041% (3 Month LIBOR USD + 1.210%), 10/15/2030(b)(c) |

1,700,000 | 1,699,320 | ||||||

| ECAF I Ltd. |

||||||||

| 2015-1A, 3.473%, 06/15/2040(b) |

179,267 | 179,585 | ||||||

| EquiFirst Mortgage Loan Trust |

||||||||

| 2003-2, 2.784% (1 Month LIBOR USD + 1.125%), 09/25/2033(c) |

270,511 | 269,616 | ||||||

| GCAT Trust |

||||||||

| 2019-NQM2, 2.855%, 09/25/2059(b) |

837,877 | 848,977 | ||||||

| 2019-NQM3, 2.686%, 11/25/2059(b)(d) |

542,023 | 550,949 | ||||||

| Goldentree Loan Management US Clo 2 Ltd. |

||||||||

| 2017-2A, 2.969% (3 Month LIBOR USD + 1.150%), 11/28/2030(b)(c) |

1,525,000 | 1,524,390 | ||||||

| Home Equity Mortgage Trust |

||||||||

| 2004-5, 3.227% (1 Month LIBOR USD + 1.600%), 02/25/2035(c) |

5,472 | 5,480 | ||||||

| JP Morgan Mortgage Acquisition Trust |

||||||||

| 2007-CH1, 1.941% (1 Month LIBOR USD + 0.280%), 11/25/2036(c) |

310,000 | 310,262 | ||||||

| Madison Park Funding XVIII Ltd. |

||||||||

| 2015-18, 3.009% (3 Month LIBOR USD + 1.190%), 10/21/2030(b)(c) |

2,000,000 | 2,000,000 | ||||||

| Madison Park Funding XXVI Ltd. |

||||||||

| 2007-26, 2.975% (3 Month LIBOR USD + 1.200%), 07/29/2030(b)(c) |

2,295,000 | 2,295,230 | ||||||

| Navient Student Loan Trust |

||||||||

| 2017-3A, 1.927% (1 Month LIBOR USD + 0.300%), 07/26/2066(b)(c) |

233 | 233 | ||||||

| 2019-7, 2.127% (1 Month LIBOR USD + 0.500%), 01/25/2068(b)(c) |

970,931 | 971,354 | ||||||

| Octagon Investment Partners 30 Ltd. |

||||||||

| 2017-1A, 3.139% (3 Month LIBOR USD + 1.320%), 03/17/2030(b)(c) |

550,000 | 549,945 | ||||||

| Permanent Master Issuer PLC |

||||||||

| 2018-1, 2.211% (3 Month LIBOR USD + 0.380%), 07/15/2058(b)(c) |

187,500 | 187,538 | ||||||

| Popular ABS Mortgage Pass-Through Trust |

||||||||

| 2005-2, 2.181% (1 Month LIBOR USD + 0.260%), 04/25/2035(c) |

29,142 | 29,207 | ||||||

The accompanying notes are an integral part of these financial statements.

15

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| RASC Trust |

||||||||

| 2005-EMX2, 2.277% (1 Month LIBOR USD + 0.650%), 07/25/2035(c) |

$ | 177,357 | $ | 178,859 | ||||

| 2005-KS12, 2.087% (1 Month LIBOR USD + 0.460%), 01/25/2036(c) |

390,000 | 390,099 | ||||||

| Structured Asset Securities Corp. |

||||||||

| 2005-NC1, 2.147% (1 Month LIBOR USD + 0.520%), 02/25/2035(c) |

440,000 | 441,518 | ||||||

| Structured Asset Securities Corp. Mortgage Loan Trust |

||||||||

| 2006-AM1, 1.787% (1 Month LIBOR USD + 0.160%), 04/25/2036(c) |

63 | 63 | ||||||

| TAL Advantage V LLC |

||||||||

| 2014-2A, 3.330%, 05/20/2039(b) |

70,125 | 70,852 | ||||||

| Textainer Marine Containers V Ltd. |

||||||||

| 2017-1A, 3.720%, 05/20/2042(b) |

134,075 | 137,710 | ||||||

| 2017-2A, 3.520%, 06/20/2042(b) |

452,017 | 462,379 | ||||||

| Towd Point Mortgage Trust |

||||||||

| 2015-6, 3.500%, 04/25/2055(b)(d) |

45,103 | 46,275 | ||||||

| 2016-2, 2.750%, 08/25/2055(b)(d) |

46,302 | 47,266 | ||||||

| 2016-3, 2.250%, 04/25/2056(b)(d) |

37,936 | 38,253 | ||||||

| 2017-5, 2.227% (1 Month LIBOR USD + 0.600%), 02/25/2057(b)(c) |

745,430 | 746,321 | ||||||

| 2017-2, 2.750%, 04/25/2057(b)(d) |

257,806 | 262,257 | ||||||

| 2017-3, 2.750%, 06/25/2057(b)(d) |

534,707 | 547,780 | ||||||

| 2017-4, 2.750%, 06/25/2057(b)(d) |

295,969 | 304,507 | ||||||

| Voya CLO Ltd. |

||||||||

| 2014-2A, 0.000% (3 Month LIBOR USD + 1.020%), 04/17/2030(b)(c) |

1,750,000 | 1,749,212 | ||||||

| 2014-2R, 3.086% (3 Month LIBOR USD + 1.250%), 04/17/2030(b)(c) |

1,380,000 | 1,380,000 | ||||||

| Wind River CLO Ltd. |

||||||||

| 2017-2A, 3.049% (3 Month LIBOR USD + 1.230%), 07/20/2030(b)(c) |

1,440,000 | 1,441,872 | ||||||

| Total Asset Backed Securities (Cost $26,165,708) |

26,388,948 | |||||||

| Corporate Bonds—23.27% | ||||||||

| Accommodation—0.03% |

||||||||

| Wynn Las Vegas LLC |

||||||||

| 5.250%, 05/15/2027(b) |

117,000 | 113,636 | ||||||

| Administrative and Support Services—0.12% |

||||||||

| Scientific Games International, Inc. |

||||||||

| 5.000%, 10/15/2025(b) |

492,000 | 494,460 | ||||||

| Ambulatory Health Care Services—0.10% |

||||||||

| Encompass Health Corp. |

||||||||

| 5.750%, 09/15/2025(f) |

420,000 | 436,974 | ||||||

| Beverage and Tobacco Product Manufacturing—1.13% |

||||||||

| Altria Group, Inc. |

||||||||

| 4.400%, 02/14/2026 |

483,000 | 540,820 | ||||||

| 4.800%, 02/14/2029(f) |

721,000 | 824,544 | ||||||

| Anheuser-Busch InBev Worldwide, Inc. |

||||||||

| 4.150%, 01/23/2025 |

1,006,000 | 1,121,887 | ||||||

| 4.600%, 04/15/2048 |

420,000 | 504,934 | ||||||

| 4.750%, 04/15/2058 |

755,000 | 917,671 | ||||||

| 5.800%, 01/23/2059 |

550,000 | 782,365 | ||||||

| 4,692,221 | ||||||||

| Broadcasting (except Internet)—1.44% |

||||||||

| Comcast Corp. |

||||||||

| 3.700%, 04/15/2024 |

595,000 | 646,676 | ||||||

| 3.950%, 10/15/2025 |

838,000 | 939,107 | ||||||

| 3.150%, 02/15/2028 |

1,000,000 | 1,087,062 | ||||||

| 4.950%, 10/15/2058 |

765,000 | 1,051,073 | ||||||

The accompanying notes are an integral part of these financial statements.

16

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| Discovery Communications LLC |

||||||||

| 2.950%, 03/20/2023 |

$ | 1,220,000 | $ | 1,262,277 | ||||

| Fox Corp. |

||||||||

| 5.576%, 01/25/2049(b) |

755,000 | 1,015,401 | ||||||

| 6,001,596 | ||||||||

| Chemical Manufacturing—1.53% |

||||||||

| AbbVie, Inc. |

||||||||

| 3.200%, 11/06/2022 |

45,000 | 46,595 | ||||||

| 2.950%, 11/21/2026(b) |

135,000 | 141,458 | ||||||

| 3.200%, 11/21/2029(b) |

1,713,000 | 1,810,523 | ||||||

| 4.050%, 11/21/2039(b) |

270,000 | 299,598 | ||||||

| 4.700%, 05/14/2045 |

580,000 | 687,360 | ||||||

| 4.250%, 11/21/2049(b) |

775,000 | 880,070 | ||||||

| Bayer US Finance II LLC |

||||||||

| 3.875%, 12/15/2023(b) |

1,840,000 | 1,980,825 | ||||||

| Church & Dwight Co., Inc. |

||||||||

| 2.450%, 08/01/2022(f) |

500,000 | 510,357 | ||||||

| 6,356,786 | ||||||||

| Computer and Electronic Product Manufacturing—0.78% |

||||||||

| Apple, Inc. |

||||||||

| 3.000%, 06/20/2027 |

1,200,000 | 1,300,626 | ||||||

| Dell International LLC |

||||||||

| 5.450%, 06/15/2023(b) |

1,085,000 | 1,196,904 | ||||||

| Microchip Technology, Inc. |

||||||||

| 4.333%, 06/01/2023 |

690,000 | 745,253 | ||||||

| 3,242,783 | ||||||||

| Credit Intermediation and Related Activities—4.22% |

||||||||

| Bank of America Corp. |

||||||||

| 2.738% to 01/23/2021, then 3 Month LIBOR USD + 0.370%, 01/23/2022(a) |

545,000 | 550,648 | ||||||

| 2.456% to 10/22/2024, then 3 Month LIBOR USD + 0.870%, 10/22/2025(a) |

187,000 | 191,843 | ||||||

| 3.705% to 04/24/2027, then 3 Month LIBOR USD + 1.512%, 04/24/2028(a) |

660,000 | 721,221 | ||||||

| 3.970% to 03/05/2028, then 3 Month LIBOR USD + 1.070%, 03/05/2029(a) |

630,000 | 706,296 | ||||||

| 2.884% to 10/22/2029, then 3 Month LIBOR USD + 1.190%, 10/22/2030(a) |

1,418,000 | 1,489,055 | ||||||

| BNP Paribas SA |

||||||||

| 3.052% to 01/13/2030, then SOFR + 1.507%, 01/13/2031(a)(b) |

615,000 | 631,969 | ||||||

| Capital One NA |

||||||||

| 2.150%, 09/06/2022 |

820,000 | 829,964 | ||||||

| Citigroup, Inc. |

||||||||

| 2.700%, 03/30/2021 |

775,000 | 783,272 | ||||||

| 4.050%, 07/30/2022 |

65,000 | 68,616 | ||||||

| 3.200%, 10/21/2026 |

1,095,000 | 1,166,915 | ||||||

| 4.300%, 11/20/2026 |

890,000 | 987,755 | ||||||

| 3.887% to 01/10/2027, then 3 Month LIBOR USD + 1.563%, 01/10/2028(a) |

795,000 | 881,921 | ||||||

| 3.520% to 10/27/2027, then 3 Month LIBOR USD + 1.151%, 10/27/2028(a)(f) |

455,000 | 495,865 | ||||||

| Fifth Third Bancorp |

||||||||

| 3.650%, 01/25/2024 |

703,000 | 753,973 | ||||||

| 2.375%, 01/28/2025 |

1,197,000 | 1,230,314 | ||||||

| General Motors Financial Co., Inc. |

||||||||

| 3.700%, 11/24/2020 |

525,000 | 529,571 | ||||||

| 3.200%, 07/06/2021 |

150,000 | 151,810 | ||||||

| 5.100%, 01/17/2024 |

370,000 | 405,637 | ||||||

The accompanying notes are an integral part of these financial statements.

17

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| JPMorgan Chase & Co. |

||||||||

| 2.700%, 05/18/2023 |

$ | 1,255,000 | $ | 1,302,321 | ||||

| Wells Fargo & Co. |

||||||||

| 3.069%, 01/24/2023 |

645,000 | 661,836 | ||||||

| 2.406% to 10/30/2024, then 3 Month LIBOR USD + 0.825%, 10/30/2025(a) |

2,097,000 | 2,147,612 | ||||||

| 2.572% to 02/11/2030, then 3 Month LIBOR USD + 1.000%, 02/11/2031(a)(f) |

865,000 | 884,186 | ||||||

| 17,572,600 | ||||||||

| Data Processing, Hosting and Related Services—0.12% |

||||||||

| Hewlett Packard Enterprise Co. |

||||||||

| 3.600%, 10/15/2020 |

490,000 | 494,217 | ||||||

| Food and Beverage Stores—0.05% |

||||||||

| Kroger Co. |

||||||||

| 5.400%, 01/15/2049 |

170,000 | 221,097 | ||||||

| Food Manufacturing—0.56% |

||||||||

| Kraft Heinz Foods Co. |

||||||||

| 3.750%, 04/01/2030(b) |

860,000 | 877,102 | ||||||

| 4.625%, 10/01/2039 |

524,000 | 501,387 | ||||||

| 5.000%, 06/04/2042 |

110,000 | 109,785 | ||||||

| 5.200%, 07/15/2045 |

50,000 | 51,478 | ||||||

| 4.875%, 10/01/2049(b)(f) |

790,000 | 780,529 | ||||||

| 2,320,281 | ||||||||

| General Merchandise Stores—0.00% |

||||||||

| JC Penney Corp., Inc. |

||||||||

| 5.650%, 06/01/2020 |

1,000 | 959 | ||||||

| Health and Personal Care Stores—0.47% |

||||||||

| Albertsons Cos LLC / Safeway, Inc. / New Albertsons LP / Albertson’s LLC |

||||||||

| 5.875%, 02/15/2028(b) |

79,000 | 82,251 | ||||||

| CVS Health Corp. |

||||||||

| 4.300%, 03/25/2028 |

1,076,000 | 1,206,400 | ||||||

| 5.050%, 03/25/2048 |

555,000 | 683,437 | ||||||

| 1,972,088 | ||||||||

| Hospitals—0.41% |

||||||||

| Advocate Health & Hospitals Corp. |

||||||||

| 3.829%, 08/15/2028 |

495,000 | 569,548 | ||||||

| CommonSpirit Health |

||||||||

| 3.347%, 10/01/2029 |

445,000 | 473,086 | ||||||

| HCA, Inc. |

||||||||

| 5.250%, 06/15/2049 |

570,000 | 665,516 | ||||||

| 1,708,150 | ||||||||

| Insurance Carriers and Related Activities—0.84% |

||||||||

| American International Group, Inc. |

||||||||

| 3.300%, 03/01/2021 |

674,000 | 683,737 | ||||||

| 3.900%, 04/01/2026 |

646,000 | 715,804 | ||||||

| Equitable Holdings, Inc. |

||||||||

| 4.350%, 04/20/2028 |

1,104,000 | 1,243,080 | ||||||

| 5.000%, 04/20/2048 |

545,000 | 618,342 | ||||||

| UnitedHealth Group, Inc. |

||||||||

| 3.875%, 08/15/2059 |

215,000 | 245,244 | ||||||

| 3,506,207 | ||||||||

The accompanying notes are an integral part of these financial statements.

18

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| Machinery Manufacturing—0.26% |

||||||||

| General Electric Co. |

||||||||

| 3.100%, 01/09/2023 |

$ | 317,000 | $ | 328,963 | ||||

| 5.875%, 01/14/2038 |

590,000 | 768,122 | ||||||

| 1,097,085 | ||||||||

| Merchant Wholesalers, Durable Goods—0.26% |

||||||||

| KLA Corp. |

||||||||

| 3.300%, 03/01/2050 |

250,000 | 246,656 | ||||||

| TransDigm, Inc. |

||||||||

| 6.250%, 03/15/2026(b)(f) |

780,000 | 827,288 | ||||||

| 1,073,944 | ||||||||

| Merchant Wholesalers, Nondurable Goods—0.08% |

||||||||

| Cardinal Health, Inc. |

||||||||

| 3.079%, 06/15/2024 |

305,000 | 318,315 | ||||||

| Motor Vehicle and Parts Dealers—0.22% |

||||||||

| Volkswagen Group of America Finance LLC |

||||||||

| 2.700%, 09/26/2022(b)(f) |

890,000 | 910,826 | ||||||

| Miscellaneous Manufacturing—0.15% |

||||||||

| Boston Scientific Corp. |

||||||||

| 3.450%, 03/01/2024 |

567,000 | 604,617 | ||||||

| Oil and Gas Extraction—1.80% |

||||||||

| Apache Corp. |

||||||||

| 4.375%, 10/15/2028(f) |

945,000 | 995,272 | ||||||

| Concho Resources, Inc. |

||||||||

| 4.875%, 10/01/2047 |

445,000 | 525,035 | ||||||

| EQT Corp. |

||||||||

| 7.000%, 02/01/2030(f) |

2,010,000 | 1,507,500 | ||||||

| Occidental Petroleum Corp. |

||||||||

| 3.200%, 08/15/2026 |

700,000 | 713,427 | ||||||

| 3.500%, 08/15/2029 |

710,000 | 714,893 | ||||||

| 4.300%, 08/15/2039 |

260,000 | 249,873 | ||||||

| Phillips 66 Partners LP |

||||||||

| 3.605%, 02/15/2025 |

95,000 | 101,349 | ||||||

| Plains All American Pipeline LP / PAA Finance Corp. |

||||||||

| 4.650%, 10/15/2025 |

280,000 | 305,088 | ||||||

| 3.550%, 12/15/2029 |

2,420,000 | 2,384,013 | ||||||

| 7,496,450 | ||||||||

| Pipeline Transportation—1.14% |

||||||||

| Energy Transfer Operating LP |

||||||||

| 3.600%, 02/01/2023 |

600,000 | 622,162 | ||||||

| 6.625% to 05/15/2028, then 3 Month LIBOR USD + 4.155%(a)(h) |

785,000 | 701,983 | ||||||

| 3.750%, 05/15/2030 |

961,000 | 976,471 | ||||||

| 7.125% to 05/15/2030, then 5 Year CMT Rate + 5.306%(a)(h) |

1,055,000 | 998,294 | ||||||

| Kinder Morgan Energy Partners LP |

||||||||

| 4.150%, 02/01/2024 |

755,000 | 813,530 | ||||||

| MPLX LP |

||||||||

| 4.700%, 04/15/2048 |

640,000 | 649,421 | ||||||

| 4,761,861 | ||||||||

The accompanying notes are an integral part of these financial statements.

19

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| Professional, Scientific, and Technical Services—0.21% |

||||||||

| International Business Machines Corp. |

||||||||

| 4.250%, 05/15/2049 |

$ | 170,000 | $ | 212,316 | ||||

| Mylan, Inc. |

||||||||

| 4.550%, 04/15/2028(f) |

585,000 | 660,406 | ||||||

| 872,722 | ||||||||

| Publishing Industries (except Internet)—0.06% |

||||||||

| Oracle Corp. |

||||||||

| 4.000%, 07/15/2046 |

205,000 | 244,393 | ||||||

| Real Estate—0.87% |

||||||||

| Boston Properties LP |

||||||||

| 3.400%, 06/21/2029 |

1,362,000 | 1,498,161 | ||||||

| Camden Property Trust |

||||||||

| 3.150%, 07/01/2029 |

275,000 | 299,517 | ||||||

| Digital Realty Trust LP |

||||||||

| 3.950%, 07/01/2022 |

1,010,000 | 1,060,174 | ||||||

| Healthcare Trust of America Holdings LP |

||||||||

| 3.100%, 02/15/2030 |

400,000 | 418,829 | ||||||

| Healthpeak Properties, Inc. |

||||||||

| 3.250%, 07/15/2026 |

335,000 | 361,763 | ||||||

| 3,638,444 | ||||||||

| Rental and Leasing Services—0.69% |

||||||||

| Air Lease Corp. |

||||||||

| 2.300%, 02/01/2025(f) |

655,000 | 655,623 | ||||||

| Ford Motor Credit Co. LLC |

||||||||

| 4.063%, 11/01/2024 |

1,008,000 | 1,024,115 | ||||||

| Synchrony Financial |

||||||||

| 2.850%, 07/25/2022(f) |

1,165,000 | 1,192,136 | ||||||

| 2,871,874 | ||||||||

| Securities, Commodity Contracts, and Other Financial Investments and Related Activities—2.57% |

||||||||

| BAT Capital Corp. |

||||||||

| 2.764%, 08/15/2022 |

790,000 | 811,569 | ||||||

| 3.222%, 08/15/2024 |

297,000 | 312,119 | ||||||

| 3.557%, 08/15/2027 |

320,000 | 335,931 | ||||||

| Goldman Sachs Group, Inc. |

||||||||

| 2.875%, 02/25/2021 |

50,000 | 50,518 | ||||||

| 3.850%, 01/26/2027 |

1,375,000 | 1,511,427 | ||||||

| 3.691% to 06/05/2027, then 3 Month LIBOR USD + 1.510%, 06/05/2028(a) |

590,000 | 645,798 | ||||||

| 3.814% to 04/23/2028, then 3 Month LIBOR USD + 1.158%, 04/23/2029(a) |

640,000 | 706,433 | ||||||

| 4.017% to 10/31/2037, then 3 Month LIBOR USD + 1.373%, 10/31/2038(a) |

250,000 | 284,107 | ||||||

| Morgan Stanley |

||||||||

| 2.750%, 05/19/2022 |

1,000,000 | 1,028,382 | ||||||

| 3.750%, 02/25/2023 |

1,380,000 | 1,466,506 | ||||||

| 3.950%, 04/23/2027 |

935,000 | 1,026,013 | ||||||

| 3.591% to 07/22/2027, then 3 Month LIBOR USD + 1.340%, 07/22/2028(a) |

1,125,000 | 1,231,518 | ||||||

| 3.772% to 01/24/2028, then 3 Month LIBOR USD + 1.140%, 01/24/2029(a) |

875,000 | 972,997 | ||||||

| 5.441% to 12/20/2049, then 3 Month LIBOR USD + 3.610%(a)(h) |

320,000 | 320,722 | ||||||

| 10,704,040 | ||||||||

The accompanying notes are an integral part of these financial statements.

20

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| Support Activities for Mining—0.04% |

||||||||

| Targa Resources Partners LP |

||||||||

| 6.750%, 03/15/2024 |

$ | 150,000 | $ | 153,189 | ||||

| Telecommunications—1.92% |

||||||||

| American Tower Corp. |

||||||||

| 3.700%, 10/15/2049 |

849,000 | 908,987 | ||||||

| AT&T, Inc. |

||||||||

| 3.400%, 05/15/2025 |

345,000 | 367,747 | ||||||

| 4.350%, 06/15/2045(f) |

220,000 | 248,338 | ||||||

| 5.450%, 03/01/2047 |

795,000 | 1,034,490 | ||||||

| 4.500%, 03/09/2048(f) |

545,000 | 625,768 | ||||||

| Charter Communications Operating LLC |

||||||||

| 5.050%, 03/30/2029(f) |

996,000 | 1,155,309 | ||||||

| 4.800%, 03/01/2050 |

545,000 | 589,910 | ||||||

| Crown Castle International Corp. |

||||||||

| 3.200%, 09/01/2024 |

825,000 | 873,208 | ||||||

| 3.800%, 02/15/2028(f) |

700,000 | 769,734 | ||||||

| Verizon Communications, Inc. |

||||||||

| 2.792% (3 Month LIBOR USD + 1.100%), 05/15/2025(c) |

825,000 | 843,765 | ||||||

| 4.016%, 12/03/2029 |

500,000 | 581,257 | ||||||

| 7,998,513 | ||||||||

| Transportation Equipment Manufacturing—0.39% |

||||||||

| General Motors Co. |

||||||||

| 2.542% (3 Month LIBOR USD + 0.800%), 08/07/2020(c) |

1,100,000 | 1,103,180 | ||||||

| United Technologies Corp. |

||||||||

| 3.950%, 08/16/2025 |

480,000 | 537,475 | ||||||

| 1,640,655 | ||||||||

| Utilities—0.81% |

||||||||

| DTE Energy Co. |

||||||||

| 2.529%, 10/01/2024 |

370,000 | 380,432 | ||||||

| 3.400%, 06/15/2029 |

825,000 | 890,427 | ||||||

| Evergy, Inc. |

||||||||

| 2.900%, 09/15/2029 |

780,000 | 806,703 | ||||||

| Kinder Morgan, Inc. |

||||||||

| 5.550%, 06/01/2045(f) |

730,000 | 868,843 | ||||||

| Southern Co. |

||||||||

| 2.950%, 07/01/2023 |

388,000 | 404,422 | ||||||

| 3,350,827 | ||||||||

| Total Corporate Bonds (Cost $91,131,494) |

96,871,810 | |||||||

| Foreign Corporate Bonds—7.09% | ||||||||

| Chemical Manufacturing—0.07% |

||||||||

| Mylan NV |

||||||||

| 3.950%, 06/15/2026 |

260,000 | 282,958 | ||||||

| Computer and Electronic Product Manufacturing—0.21% |

||||||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust |

||||||||

| 4.450%, 10/01/2025 |

800,000 | 882,723 | ||||||

| Credit Intermediation and Related Activities—3.80% |

||||||||

| Banque Federative du Credit Mutuel SA |

||||||||

| 2.700%, 07/20/2022(b)(f) |

1,770,000 | 1,826,906 | ||||||

The accompanying notes are an integral part of these financial statements.

21

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| Barclays Bank PLC |

||||||||

| 10.179%, 06/12/2021(b) |

$ | 1,950,000 | $ | 2,149,739 | ||||

| Barclays PLC |

||||||||

| 3.072% (3 Month LIBOR USD + 1.380%), 05/16/2024(c) |

895,000 | 911,638 | ||||||

| Credit Agricole SA/London |

||||||||

| 2.821% (3 Month LIBOR USD + 1.020%), 04/24/2023(b)(c) |

745,000 | 757,474 | ||||||

| Credit Suisse Group AG |

||||||||

| 2.997% to 12/14/2022, then 3 Month LIBOR USD + 1.200%, 12/14/2023(a)(b) |

1,145,000 | 1,171,738 | ||||||

| 3.869% to 01/12/2028, then 3 Month LIBOR USD + 1.410%, 01/12/2029(a)(b) |

250,000 | 272,072 | ||||||

| HSBC Holdings PLC |

||||||||

| 2.650%, 01/05/2022 |

765,000 | 778,810 | ||||||

| 2.692% (3 Month LIBOR USD + 1.000%), 05/18/2024(c) |

400,000 | 403,684 | ||||||

| 2.633% to 11/07/2024, then 3 Month LIBOR USD + 1.140%, 11/07/2025(a) |

2,017,000 | 2,061,963 | ||||||

| 6.000% to 05/22/2027, then 5 Year Mid Swap Rate USD + 3.746%(a)(h) |

910,000 | 947,160 | ||||||

| Lloyds Banking Group PLC |

||||||||

| 2.438% to 02/05/2025, then 1 Year CMT Rate + 1.000%, 02/05/2026(a) |

970,000 | 984,372 | ||||||

| Royal Bank of Scotland Group PLC |

||||||||

| 6.125%, 12/15/2022 |

835,000 | 911,586 | ||||||

| 3.875%, 09/12/2023 |

835,000 | 887,551 | ||||||

| UBS Group AG |

||||||||

| 2.859% to 08/15/2022, then 3 Month LIBOR USD + 0.954%, 08/15/2023(a)(b) |

500,000 | 512,667 | ||||||

| 4.125%, 09/24/2025(b) |

1,100,000 | 1,227,000 | ||||||

| 15,804,360 | ||||||||

| Food Manufacturing—0.20% |

||||||||

| Grupo Bimbo SAB de CV |

||||||||

| 4.700%, 11/10/2047(b) |

730,000 | 837,379 | ||||||

| Funds, Trusts, and Other Financial Vehicles—0.22% |

||||||||

| Credit Suisse Group Funding Guernsey Ltd. |

||||||||

| 3.800%, 06/09/2023 |

860,000 | 903,750 | ||||||

| Machinery Manufacturing—0.25% |

||||||||

| GE Capital International Funding Co. Unlimited Co. |

||||||||

| 3.373%, 11/15/2025(f) |

963,000 | 1,027,431 | ||||||

| Management of Companies and Enterprises—0.32% |

||||||||

| Bank of Ireland Group PLC |

||||||||

| 4.500%, 11/25/2023(b) |

1,245,000 | 1,348,667 | ||||||

| Merchant Wholesalers, Durable Goods—0.02% |

||||||||

| Johnson Controls International PLC |

||||||||

| 3.900%, 02/14/2026 |

79,000 | 88,161 | ||||||

| Merchant Wholesalers, Nondurable Goods—0.30% |

||||||||

| Allergan Funding SCS |

||||||||

| 3.450%, 03/15/2022 |

1,211,000 | 1,255,035 | ||||||

| Miscellaneous Manufacturing—0.16% |

||||||||

| Shire Acquisitions Investments Ireland DAC |

||||||||

| 2.400%, 09/23/2021 |

675,000 | 684,167 | ||||||

| Oil and Gas Extraction—0.27% |

||||||||

| Canadian Natural Resources Ltd. |

||||||||

| 6.250%, 03/15/2038 |

850,000 | 1,109,675 | ||||||

| Rental and Leasing Services—0.05% |

||||||||

| FLY Leasing Ltd. |

||||||||

| 6.375%, 10/15/2021 |

200,000 | 202,875 | ||||||

The accompanying notes are an integral part of these financial statements.

22

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| Securities, Commodity Contracts, and Other Financial Investments and Related Activities—0.51% |

||||||||

| AIB Group PLC |

||||||||

| 4.263% to 04/10/2024, then 3 Month LIBOR USD + 1.874%, 04/10/2025(a)(b) |

$ | 1,995,000 | $ | 2,131,197 | ||||

| Telecommunications—0.48% |

||||||||

| British Telecommunications PLC |

||||||||

| 3.250%, 11/08/2029(b) |

860,000 | 890,173 | ||||||

| Vodafone Group PLC |

||||||||

| 2.833% (3 Month LIBOR USD + 0.990%), 01/16/2024(c) |

1,095,000 | 1,105,903 | ||||||

| 1,996,076 | ||||||||

| Transportation Services—0.12% |

||||||||

| JSL Europe SA |

||||||||

| 7.750%, 07/26/2024 |

474,000 | 504,376 | ||||||

| Utilities—0.11% |

||||||||

| Engie Energia Chile SA |

||||||||

| 3.400%, 01/28/2030(b) |

450,000 | 453,555 | ||||||

| Total Foreign Corporate Bonds (Cost $28,286,375) |

29,512,385 | |||||||

| Foreign Government Agency Issues—0.44% | ||||||||

| European Investment Bank |

||||||||

| 1.625%, 03/14/2025(f) |

1,780,000 | 1,833,805 | ||||||

| Total Foreign Government Agency Issues (Cost $1,774,660) |

1,833,805 | |||||||

| Foreign Government Notes/Bonds—6.29% | ||||||||

| Abu Dhabi Government International Bond |

||||||||

| 4.125%, 10/11/2047(b) |

610,000 | 737,479 | ||||||

| Angolan Government International Bond |

||||||||

| 9.500%, 11/12/2025(b) |

700,000 | 782,313 | ||||||

| Argentine Republic Government International Bond |

||||||||

| 4.625%, 01/11/2023 |

463,000 | 200,444 | ||||||

| 6.875%, 01/26/2027 |

435,000 | 185,423 | ||||||

| Brazilian Government International Bond |

||||||||

| 2.625%, 01/05/2023 |

760,000 | 771,788 | ||||||

| 5.625%, 02/21/2047 |

220,000 | 263,108 | ||||||

| Colombia Government International Bond |

||||||||

| 4.000%, 02/26/2024 |

390,000 | 415,089 | ||||||

| 3.875%, 04/25/2027 |

150,000 | 161,602 | ||||||

| 3.000%, 01/30/2030 |

1,305,000 | 1,318,716 | ||||||

| 5.200%, 05/15/2049 |

200,000 | 252,187 | ||||||

| Costa Rica Government International Bond |

||||||||

| 7.158%, 03/12/2045 |

995,000 | 1,038,218 | ||||||

| Croatia Government International Bond |

||||||||

| 6.000%, 01/26/2024(b) |

300,000 | 343,472 | ||||||

| Dominican Republic International Bond |

||||||||

| 5.875%, 04/18/2024(b) |

505,000 | 544,352 | ||||||

| 6.875%, 01/29/2026(b) |

360,000 | 410,529 | ||||||

| Guatemala Government Bond |

||||||||

| 4.375%, 06/05/2027(b) |

600,000 | 630,958 | ||||||

| Hungary Government International Bond |

||||||||

| 7.625%, 03/29/2041 |

660,000 | 1,131,084 | ||||||

| Indonesia Government International Bond |

||||||||

| 3.700%, 01/08/2022(b) |

330,000 | 340,494 | ||||||

| 4.350%, 01/08/2027(b) |

350,000 | 388,089 | ||||||

The accompanying notes are an integral part of these financial statements.

23

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| Kazakhstan Government International Bond |

||||||||

| 6.500%, 07/21/2045(b) |

$ | 200,000 | $ | 305,380 | ||||

| Mexico Government International Bond |

||||||||

| 4.150%, 03/28/2027 |

200,000 | 220,052 | ||||||

| 3.250%, 04/16/2030 |

1,785,000 | 1,836,319 | ||||||

| 4.350%, 01/15/2047(f) |

825,000 | 910,334 | ||||||

| Mongolia Government International Bond |

||||||||

| 8.750%, 03/09/2024(b) |

635,000 | 707,287 | ||||||

| Morocco Government International Bond |

||||||||

| 4.250%, 12/11/2022(b) |

475,000 | 500,051 | ||||||

| 5.500%, 12/11/2042(b) |

150,000 | 191,100 | ||||||

| Namibia International Bonds |

||||||||

| 5.250%, 10/29/2025(b)(f) |

785,000 | 810,271 | ||||||

| Nigeria Government International Bond |

||||||||

| 7.875%, 02/16/2032(b) |

535,000 | 540,282 | ||||||

| Oman Government International Bond |

||||||||

| 3.875%, 03/08/2022(b) |

290,000 | 291,834 | ||||||

| 5.375%, 03/08/2027(b) |

350,000 | 349,620 | ||||||

| 6.500%, 03/08/2047(b) |

350,000 | 328,564 | ||||||

| Panama Government International Bond |

||||||||

| 4.500%, 05/15/2047 |

450,000 | 562,363 | ||||||

| Paraguay Government International Bond |

||||||||

| 4.700%, 03/27/2027(b) |

790,000 | 883,107 | ||||||

| Peruvian Government International Bond |

||||||||

| 8.750%, 11/21/2033 |

450,000 | 761,630 | ||||||

| Qatar Government International Bond |

||||||||

| 3.250%, 06/02/2026(b) |

450,000 | 479,052 | ||||||

| 4.625%, 06/02/2046(b) |

360,000 | 449,602 | ||||||

| Republic of South Africa Government International Bond |

||||||||

| 4.875%, 04/14/2026 |

690,000 | 722,293 | ||||||

| 4.850%, 09/27/2027 |

933,000 | 974,985 | ||||||

| 4.300%, 10/12/2028 |

150,000 | 148,613 | ||||||

| 5.000%, 10/12/2046 |

150,000 | 137,685 | ||||||

| Romanian Government International Bond |

||||||||

| 6.125%, 01/22/2044(b) |

665,000 | 888,336 | ||||||

| Saudi Government International Bond |

||||||||

| 4.500%, 10/26/2046(b) |

150,000 | 172,383 | ||||||

| Sri Lanka Government International Bond |

||||||||

| 6.750%, 04/18/2028 (b) |

880,000 | 809,820 | ||||||

| Trinidad & Tobago Government International Bond |

||||||||

| 4.500%, 08/04/2026(b)(f) |

1,030,000 | 1,079,293 | ||||||

| Turkey Government International Bond |

||||||||

| 6.000%, 01/14/2041 |

250,000 | 224,190 | ||||||

| Uruguay Government International Bond |

||||||||

| 4.375%, 01/23/2031(f) |

590,000 | 679,243 | ||||||

| 5.100%, 06/18/2050 |

245,000 | 309,238 | ||||||

| Total Foreign Government Notes/Bonds (Cost $25,375,733) |

26,188,272 | |||||||

| Non-Agency Mortgage Backed Securities—7.15% | ||||||||

| Angel Oak Mortgage Trust |

||||||||

| 2019-6, 2.620%, 11/25/2059(b)(d) |

625,169 | 632,082 | ||||||

| BANK 2019-BNK22 |

||||||||

| 2019-BNK22, 2.978%, 11/15/2062 |

110,000 | 120,158 | ||||||

The accompanying notes are an integral part of these financial statements.

24

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| BANK 2020-BNK25 |

||||||||

| 2020-BNK25, 2.649%, 01/15/2063 |

$ | 1,536,680 | $ | 1,635,430 | ||||

| Benchmark Mortgage Trust |

||||||||

| 2018-B8, 4.232%, 01/15/2052 |

1,690,000 | 1,992,660 | ||||||

| BX Commercial Mortgage Trust |

||||||||

| 2018-IND B, 2.559% (1 Month LIBOR USD + 0.900%), 11/15/2035(b)(c) |

808,500 | 808,965 | ||||||

| 2018-IND C, 2.759% (1 Month LIBOR USD + 1.100%), 11/15/2035(b)(c) |

500,500 | 500,945 | ||||||

| Citigroup Commercial Mortgage Trust |

||||||||

| 2013-GCJ11, 3.732%, 04/10/2046(d) |

455,000 | 480,194 | ||||||

| 2013-GC17, 5.095%, 11/10/2046(d) |

145,000 | 160,569 | ||||||

| 2014-GC25, 0.993%, 10/10/2047(d)(e) |

1,488,013 | 59,657 | ||||||

| 2015-GC27, 1.346%, 02/10/2048(d)(e) |

1,104,469 | 59,820 | ||||||

| 2016-GC36, 3.616%, 02/10/2049 |

200,000 | 221,107 | ||||||

| 2017-C4, 2.121%, 10/12/2050 |

239,847 | 241,301 | ||||||

| 2018-C6, 3.300%, 11/10/2051 |

443,622 | 459,335 | ||||||

| COMM Mortgage Trust |

||||||||

| 2012-CCRE4, 3.251%, 10/15/2045 |

385,000 | 391,388 | ||||||

| 2014-UBS2, 3.472%, 03/10/2047 |

619,354 | 642,430 | ||||||

| 2014-CR16, 0.977%, 04/10/2047(d)(e) |

1,336,766 | 46,488 | ||||||

| 2014-LC15, 1.096%, 04/10/2047(d)(e) |

1,519,403 | 57,455 | ||||||

| 2014-CR17, 0.973%, 05/10/2047(d)(e) |

1,120,818 | 39,157 | ||||||

| 2014-UBS3, 1.078%, 06/10/2047(d)(e) |

911,193 | 36,186 | ||||||

| 2014-UBS6, 0.892%, 12/10/2047(d)(e) |

1,684,703 | 57,839 | ||||||

| 2014-CR21, 3.987%, 12/10/2047 |

281,514 | 308,350 | ||||||

| 2015-LC21, 3.708%, 07/10/2048 |

100,000 | 110,089 | ||||||

| 2015-CR25, 3.759%, 08/10/2048 |

340,000 | 376,814 | ||||||

| 2017-COR2, 2.111%, 09/10/2050 |

172,468 | 173,619 | ||||||

| Connecticut Avenue Securities Trust |

||||||||

| 2019-R07, 2.397% (1 Month LIBOR USD + 0.770%), 10/25/2039(b)(c) |

210,015 | 210,140 | ||||||

| CSAIL Commercial Mortgage Trust |

||||||||

| 2015-C3, 4.103%, 08/15/2048(d) |

350,000 | 376,609 | ||||||

| 2016-C7, 3.502%, 11/15/2049 |

275,000 | 302,235 | ||||||

| 2019-C15, 4.053%, 03/15/2052 |

215,000 | 250,372 | ||||||

| 2015-C2, 0.757%, 06/15/2057(d)(e) |

1,575,832 | 51,554 | ||||||

| Flagstar Mortgage Trust |

||||||||

| 2017-2, 3.500%, 10/25/2047(b)(d) |

1,149,902 | 1,165,169 | ||||||

| FREMF Mortgage Trust |

||||||||

| 2015-K718, 3.541%, 02/25/2048(b)(d) |

580,000 | 596,399 | ||||||

| GS Mortgage Securities Trust |

||||||||

| 2012-GCJ7, 4.740%, 05/10/2045 |

405,000 | 429,191 | ||||||

| 2012-GCJ9, 3.747%, 11/10/2045(b) |

345,000 | 359,459 | ||||||

| 2014-GC18, 1.013%, 01/10/2047(d)(e) |

3,939,478 | 125,231 | ||||||

| 2014-GC26, 0.967%, 11/10/2047(d)(e) |

2,202,417 | 86,949 | ||||||

| 2015-GC32, 3.764%, 07/10/2048 |

105,000 | 116,191 | ||||||

| 2015-GC34, 3.278%, 10/10/2048 |

131,000 | 137,778 | ||||||

| 2015-GS1, 4.420%, 11/10/2048(d) |

205,000 | 216,938 | ||||||

| 2019-GSA1, 3.048%, 11/10/2052 |

430,000 | 467,288 | ||||||

| Impac Secured Assets Trust |

||||||||

| 2006-2, 2.127% (1 Month LIBOR USD + 0.500%), 08/25/2036(c) |

50,000 | 50,133 | ||||||

| JP Morgan Chase Commercial Mortgage Securities Trust |

||||||||

| 2013-LC11, 3.499%, 04/15/2046 |

375,000 | 389,771 | ||||||

| 2011-C5, 5.418%, 08/15/2046(b)(d) |

305,000 | 319,569 | ||||||

| JP Morgan Mortgage Trust |

||||||||

| 2016-3, 3.500%, 10/25/2046(b)(d) |

804,704 | 832,868 | ||||||

The accompanying notes are an integral part of these financial statements.

25

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| 2017-1, 3.500%, 01/25/2047(b)(d) |

$ | 198,731 | $ | 202,376 | ||||

| 2017-2, 3.500%, 05/25/2047(b)(d) |

118,635 | 121,912 | ||||||

| 2017-3, 3.500%, 08/25/2047(b)(d) |

722,994 | 742,718 | ||||||

| 2017-4, 3.500%, 11/25/2048(b)(d) |

654,746 | 669,836 | ||||||

| JP Morgan Trust |

||||||||

| 2015-3, 3.500%, 05/25/2045(b)(d) |

144,417 | 145,809 | ||||||

| JPMBB Commercial Mortgage Securities Trust |

||||||||

| 2015-C31, 3.801%, 08/15/2048 |

320,000 | 354,319 | ||||||

| JPMDB Commercial Mortgage Securities Trust |

||||||||

| 2017-C7, 2.081%, 10/15/2050 |

237,816 | 239,524 | ||||||

| Morgan Stanley Bank of America Merrill Lynch Trust |

||||||||

| 2013-C9, 2.657%, 05/15/2046 |

471,320 | 478,961 | ||||||

| 2015-C24, 3.732%, 05/15/2048 |

220,000 | 242,279 | ||||||

| 2017-C34, 2.109%, 11/18/2052 |

327,740 | 330,027 | ||||||

| Morgan Stanley Capital I Trust |

||||||||

| 2015-MS1, 3.779%, 05/15/2048(d) |

200,000 | 220,262 | ||||||

| New Residential Mortgage Loan Trust |

||||||||

| 2019-NQM5, 2.710%, 11/25/2059(b)(d) |

579,169 | 587,435 | ||||||

| OBX Trust |

||||||||

| 2019-EXP3, 2.527% (1 Month LIBOR USD + 0.900%), 10/25/2059(b)(c) |

369,382 | 370,754 | ||||||

| One Market Plaza Trust |

||||||||

| 2017-1MKT, 4.142%, 02/10/2032(b) |

445,000 | 461,164 | ||||||

| Sequoia Mortgage Trust |

||||||||

| 2015-2, 3.500%, 05/25/2045(b)(d) |

389,385 | 396,085 | ||||||

| 2015-3, 3.500%, 07/25/2045(b)(d) |

473,503 | 480,215 | ||||||

| 2017-2, 3.500%, 02/25/2047(b)(d) |

933,196 | 968,482 | ||||||

| Starwood Mortgage Residential Trust |

||||||||

| 2019-INV1, 2.610%, 09/27/2049(b)(d) |

552,975 | 555,834 | ||||||

| UBS Commercial Mortgage Trust |

||||||||

| 2017-C2, 3.487%, 08/15/2050 |

200,000 | 222,203 | ||||||

| 2017-C4 A1, 2.129%, 10/15/2050 |

135,129 | 135,501 | ||||||

| 2017-C4 A4, 3.563%, 10/15/2050 |

160,500 | 179,485 | ||||||

| 2017-C4, 3.836%, 10/15/2050(d) |

200,000 | 224,453 | ||||||

| 2018-C15, 3.321%, 12/15/2051 |

189,523 | 196,564 | ||||||

| 2018-C14, 3.379%, 12/15/2051 |

716,019 | 740,563 | ||||||

| UBS-Barclays Commercial Mortgage Trust |

||||||||

| 2013-C6, 2.788%, 04/10/2046 |

248,219 | 252,241 | ||||||

| Verus Securitization Trust |

||||||||

| 2019-4, 2.642%, 11/25/2059(b) |

426,022 | 430,739 | ||||||

| 2019-INV1, 3.402%, 12/25/2059(b)(d) |

413,452 | 419,061 | ||||||

| Wells Fargo Commercial Mortgage Trust |

||||||||

| 2012-LC5, 4.142%, 10/15/2045 |

305,000 | 321,420 | ||||||

| 2015-C29, 3.637%, 06/15/2048 |

130,000 | 142,596 | ||||||

| 2016-LC24, 2.942%, 10/15/2049 |

280,000 | 299,756 | ||||||

| 2016-NXS6, 2.918%, 11/15/2049 |

300,000 | 320,692 | ||||||

| 2017-C39, 3.418%, 09/15/2050 |

260,000 | 287,251 | ||||||

| 2017-C40, 2.110%, 10/15/2050 |

150,422 | 151,406 | ||||||

| 2018-C48, 4.302%, 01/15/2052 |

625,000 | 736,894 | ||||||

| 2019-C49, 4.023%, 03/15/2052 |

185,000 | 214,697 | ||||||

| 2016-LC25, 3.640%, 12/15/2059 |

315,000 | 351,342 | ||||||

| WFRBS Commercial Mortgage Trust |

||||||||

| 2014-LC14, 1.208%, 03/15/2047(d)(e) |

883,217 | 33,403 | ||||||

| 2014-C22 XA, 0.808%, 09/15/2057(d)(e) |

3,366,433 | 100,722 | ||||||

| 2014-C22 AS, 4.069%, 09/15/2057(d) |

290,000 | 315,603 | ||||||

| Total Non-Agency Mortgage Backed Securities (Cost $29,331,370) |

29,740,466 | |||||||

The accompanying notes are an integral part of these financial statements.

26

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| Agency Mortgage Backed Securities—31.42% | ||||||||

| Fannie Mae Connecticut Avenue Securities |

||||||||

| 2017-C03, 4.627% (1 Month LIBOR USD + 3.000%), 10/25/2029(c) |

$ | 300,000 | $ | 312,044 | ||||

| 2017-C04, 4.477% (1 Month LIBOR USD + 2.850%), 11/25/2029(c) |

364,000 | 376,368 | ||||||

| 2017-C05, 3.827% (1 Month LIBOR USD + 2.200%), 01/25/2030(c) |

461,510 | 469,773 | ||||||

| 2017-C06, 4.427% (1 Month LIBOR USD + 2.800%), 02/25/2030(c) |

307,761 | 314,993 | ||||||

| 2017-C07, 4.127% (1 Month LIBOR USD + 2.500%), 05/25/2030(c) |

952,462 | 964,857 | ||||||

| 2018-C01, 3.877% (1 Month LIBOR USD + 2.250%), 07/25/2030(c) |

780,000 | 790,304 | ||||||

| 2018-C02, 3.827% (1 Month LIBOR USD + 2.200%), 08/25/2030(c) |

599,411 | 605,852 | ||||||

| Fannie Mae or Freddie Mac |

||||||||

| #TBA, 4.500%, 03/01/2040 |

320,000 | 341,656 | ||||||

| #TBA, 3.000%, 03/15/2043 |

400,000 | 412,062 | ||||||

| Fannie Mae Pool |

||||||||

| 254908, 5.000%, 09/01/2023 |

29,764 | 32,175 | ||||||

| 255320, 5.000%, 07/01/2024 |

5,519 | 5,968 | ||||||

| MA0023, 5.000%, 04/01/2029 |

12,103 | 13,092 | ||||||

| MA0096, 4.500%, 06/01/2029 |

7,154 | 7,732 | ||||||

| AE0205, 5.000%, 03/01/2030 |

12,619 | 13,765 | ||||||

| AB3000, 4.500%, 05/01/2031 |

16,507 | 17,990 | ||||||

| BM3905, 5.000%, 08/01/2031 |

81,590 | 88,197 | ||||||

| 720679, 5.000%, 06/01/2033 |

11,855 | 13,245 | ||||||

| 725027, 5.000%, 11/01/2033 |

7,588 | 8,511 | ||||||

| 888283, 5.000%, 08/01/2034 |

35,656 | 39,983 | ||||||

| 735484, 5.000%, 05/01/2035 |

10,651 | 12,005 | ||||||

| 830722, 5.000%, 07/01/2035 |

31,928 | 35,272 | ||||||

| 735925, 5.000%, 10/01/2035 |

30,524 | 34,548 | ||||||

| 836427, 5.000%, 10/01/2035 |

16,460 | 18,606 | ||||||

| 900527, 6.000%, 09/01/2036 |

1,604 | 1,881 | ||||||

| 915320, 6.000%, 03/01/2037 |

22,106 | 24,732 | ||||||

| 889757, 5.000%, 02/01/2038 |

15,767 | 18,060 | ||||||

| 962343, 5.000%, 03/01/2038 |

17,093 | 19,310 | ||||||

| 929301, 5.000%, 04/01/2038 |

12,147 | 13,699 | ||||||

| 257161, 5.500%, 04/01/2038 |

27,358 | 30,949 | ||||||

| 982126, 5.000%, 05/01/2038 |

33,007 | 37,089 | ||||||

| 889579, 6.000%, 05/01/2038 |

19,725 | 23,207 | ||||||

| 995681, 6.000%, 05/01/2038 |

2,934 | 3,439 | ||||||

| 889533, 5.500%, 06/01/2038 |

25,434 | 29,324 | ||||||

| AB0131, 5.000%, 12/01/2038 |

9,853 | 11,170 | ||||||

| 995245, 5.000%, 01/01/2039 |

31,236 | 35,318 | ||||||

| 995906, 5.000%, 03/01/2039 |

11,405 | 12,917 | ||||||

| BC4575, 5.500%, 04/01/2039 |

46,832 | 52,824 | ||||||

| 995838, 5.500%, 05/01/2039 |

77,138 | 88,876 | ||||||

| AL0070, 5.000%, 07/01/2039 |

18,423 | 20,790 | ||||||

| AD7406, 5.000%, 07/01/2040 |

10,534 | 11,678 | ||||||

| AD9173, 4.000%, 08/01/2040 |

313,266 | 340,343 | ||||||

| AB1389, 4.500%, 08/01/2040 |

67,974 | 75,024 | ||||||

| MA0510, 4.500%, 09/01/2040 |

709 | 782 | ||||||

| AE8714, 3.500%, 11/01/2040 |

32,440 | 34,527 | ||||||

| 890310, 4.500%, 12/01/2040 |

14,813 | 16,349 | ||||||

| AH3952, 4.000%, 01/01/2041 |

185,108 | 201,134 | ||||||

| AL0791, 4.000%, 02/01/2041 |

57,707 | 62,743 | ||||||

| AE0954, 4.500%, 02/01/2041 |

50,870 | 56,144 | ||||||

| AH7196, 4.500%, 03/01/2041 |

485,659 | 535,943 | ||||||

| AL0245, 4.000%, 04/01/2041 |

11,682 | 12,701 | ||||||

The accompanying notes are an integral part of these financial statements.

27

| PMC CORE FIXED INCOME FUND |

Schedule of Investments |

February 29, 2020 (Unaudited) (Continued)

| Principal Amount |

Value |

|||||||

| AL0065, 4.500%, 04/01/2041 |

$ | 23,211 | $ | 25,617 | ||||

| AI1170, 5.000%, 04/01/2041 |

186,009 | 209,360 | ||||||

| AB2817, 5.000%, 04/01/2041 |

12,331 | 13,880 | ||||||

| AL0214, 5.000%, 04/01/2041 |

13,046 | 14,684 | ||||||

| AH7395, 4.500%, 06/01/2041 |

9,245 | 10,203 | ||||||

| AB3194, 4.500%, 06/01/2041 |

21,724 | 23,977 | ||||||

| AI4891, 4.500%, 06/01/2041 |

261,365 | 288,430 | ||||||

| AH1662, 4.500%, 07/01/2041 |

28,257 | 30,782 | ||||||