UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 629-8104

Registrant’s telephone number, including area code

Date of fiscal year end: February 28, 2021

Date of reporting period: August 31, 2020

Item 1. Reports to Stockholders.

Semi-Annual Report

August 31, 2020

Snow Capital Small Cap Value Fund

Class A Shares (SNWAX)

Class C Shares (SNWCX)

Institutional Class Shares (SNWIX)

Snow Capital Long/Short Opportunity Fund

Class A Shares (SNOAX)

Class C Shares (SNOCX)

Institutional Class Shares (SNOIX)

Investment Adviser

Snow Capital Management L.P.

1605 Carmody Court, Suite 300

Sewickley, Pennsylvania 15143

Phone: 1-877-SNOWFND (877-766-9363)

| 3 | ||||

| 14 | ||||

| 17 | ||||

| 23 | ||||

| SCHEDULE OF INVESTMENTS (Snow Capital Long/Short Opportunity Fund) |

27 | |||

| 32 | ||||

| 36 | ||||

| 38 | ||||

| 40 | ||||

| 42 | ||||

| 54 | ||||

| BASIS FOR TRUSTEES’ APPROVAL OF INVESTMENT ADVISORY AGREEMENT |

69 | |||

| 74 | ||||

| 75 | ||||

Amid unparalleled oscillating market action, equity prices, as measured by the S&P 500® Total Return Index, rose by 19.63% for the six-month period ending August 31, 2020.

In the early part of the year, the severity of the COVID-19 pandemic took investors by surprise leading to a rapid selloff in capital assets. In the latter part of the period, government stimulus actions had a large impact on investors’ risk tolerance, accelerating the pace of the recovery in equity returns. While the rebound in the broad markets has been significant, it has been uneven and largely led by a narrow scope of large cap momentum-driven growth companies. Market breadth has also been weak with the largest gainers concentrated in the Technology sector. To illustrate, the Technology heavy Russell 3000® Growth Index returned 35.62%, while the Russell 3000® Value Total Return Index posted a paltry 2.17% return for the same period ended August 31, 2020. As a result, the valuation differential between growth and value, as measured by the Russell Indices, has expanded to historic levels. We expect these divergent return streams to correct as the recovery continues.

While the pace of the recovery has been varied with asymmetrical performance patterns in substyles and large differences in returns between sectors, the broad market has advanced. Overall, our economic outlook remains positive and we expect equity prices to continue to appreciate. Fiscal policy working in tandem with monetary policy should continue to buoy the economy and markets. Currently, legislators are negotiating an additional fiscal relief package that would provide aid to local governments and offer businesses financial protection. The Fed remains highly supportive and emphasized that interest rates are expected to be flat or near zero through the next two to three years. In turn, this is likely to help boost risk asset prices and valuations. The path to recovery also seems to be getting clearer on the employment front. With many businesses continuing to rehire employees following coronavirus lockdowns there have been four consecutive months of job gains. While the current unemployment rate of 8.4% remains well above 3.5% in February - before the pandemic hit - it is still substantially lower than its peak of 14.7% in April. We expect continued improvement in labor to fuel investor sentiment and consumer spending, which should bode well for further increases in equity returns.

In closing, our Funds are populated with companies that we believe are positioned to benefit throughout the economic and market cycle. The firms we

3

own have strong balance sheets, proven management teams, recurring cash flow streams and the flexibility to adapt to the new world post COVID-19. We believe these companies will be able to compound earnings over an extended period through both rising and declining markets. All told, we remain dedicated to delivering strong long-term performance and transparent communications to our shareholders. Thank you for your commitment and loyalty to Snow Capital.

Snow Capital Small Cap Value Fund

How did the Fund perform?

For the six-month period ended August 31, 2020, the Snow Capital Small Cap Value Fund’s Institutional Class Shares recorded a return of 4.51% compared to a return of -3.66% for the Russell 2000® Value Total Return Index.

How is the Fund managed?

We employ a contrarian value process rooted in fundamental investing to build a portfolio of investments. The Snow Capital Small Cap Value Fund typically maintains a portfolio of between 40 and 60 U.S.-listed equities. We weight position sizes based on our assessment of upside potential and near-term catalysts. The Fund draws at least 80% of its investments, at cost, from companies with market capitalizations in the range of the Russell 2000 Value® Total Return Index which, as of August 31, 2020, was between $50 million and $7.3 billion.

Top Positive Contributors to the Fund’s Return

For the six-month period ended August 31, 2020, the Consumer Discretionary, Materials, Health Care, Information Technology, Industrials, Consumer Staples, Energy, and Communication Services sectors added to overall performance. In order of magnitude, the best performing stocks for the six months were:

National General Holdings Corp (NGHC), a specialty personal lines insurance company, was acquired by Allstate (ALL) in July for $3.9 billion, a nearly 70%

4

premium from where it was trading. The deal is expected to close at the end of Q1, 2021. Global leader in aviation services Atlas Air Worldwide Holdings (AAWW) outperformed as demand for air freight increased while capacity on commercial airlines for similar services declined, leading to substantial pricing power. The company was instrumental in transporting personal protective equipment when it was most needed during the spring and should continue to benefit from a tight air freight market and historic demand for e-commerce moving forward. Brinker International (EAT), which operates Chili’s and Maggiano’s restaurants, positively contributed to performance as the company did well to pivot to online and take-away sales amidst the nationwide stay-at-home orders. The company launched the first digital restaurant brand this summer, called “It’s Just Wings”, leveraging their brick-and-mortal assets and partnering with DoorDash to add a brand-new high margin growth channel that investors are excited about. Bloomin’ Brands Inc (BLMN), operator of global restaurant chains including Outback Steakhouse, added to performance during the period as management did well managing the variable costs of the business, preserving cash during the initial lock-down period and quickly resuming sales when they were able to. Both BLMN and EAT used the sudden changes to the operating model to cut costs and emerge as leaner businesses that project a better margin profile moving forward, which led to stock price appreciation as investors extrapolated their results forward. Sporting goods retailer Dick’s Sporting Goods (DKS) outperformed during the period due to strong operating performance led by consumer demand for fitness products, bikes, outdoor goods and golf supplies. The company managed substantial e-commerce demand deftly, with online sales rising nearly 200% during the second quarter.

Top Detractors from the Fund’s Return

For the six-month period ended August 31, 2020, the Financials sector detracted from overall performance. Great Western Bancorp (GWB), a regional bank based in Sioux Falls, South Dakota, fell on weak earnings, deteriorating credit trends and multiple dividend cuts. We maintained a position in the company as of the end of the period because we feel the risk reward profile is favorable given the balance sheet and liquidity ratios, which the banks make publicly available. JetBlue Airways (JBLU) detracted as airline demand has been slow to recover from widespread lockdowns across the country. We

5

believe JBLU is well positioned to rebound as a domestic only, low cost carrier with a homogeneous fleet and the balance sheet strength to weather the downturn. Regional banks Umpqua Holdings (UMPQ), based in Portland, OR, FNB Corp (FNB), based in Pittsburgh, PA, and First Commonwealth Financial Corp (FCF), based in Indiana, PA, bore the brunt of COVID-related macro headwinds during the spring and into the summer with investors expecting rates to remain lower for longer, loan reserves increasing, and uncertainty continuing surrounding individual and small business credit trends. We maintained a position in all three companies as of the end of the period based on each company’s risk reward profile, balance sheet status, and regional outlook in the markets in which they participate. Rules that emerged following the housing crisis in 2008 led to more public disclosure of bank’s capital levels and credit trends, which when evaluated today gives us confidence in the long-term trajectories of the companies.

Were there significant changes to the portfolio?

Compared to the Russell 2000® Value Total Return Index, the Fund holds an above-average weight in the Consumer Discretionary, Financials, Information Technology, and Materials Sectors, and a below-average weight in the Industrials, Health Care, Consumer Staples, Communication Services, and Energy sectors. The Fund maintained a zero percent weighting in the Real Estate and Utilities sectors as of August 31, 2020.

We reduced our exposure to Financials, Consumer Staples, Health Care, and Information Technology and increased our investments in Consumer Discretionary, Industrials, Materials, and Communication Services during the period.

Comments on the Fund’s Five Largest Holdings

Bloomin’ Brands Inc (BLMN)

Bloomin’ Brands (BLMN) owns and operates a chain of casual dining restaurants worldwide, with four different concepts ranging in price point and degree of formality from casual (Outback Steakhouse and Carrabba’s Italian

6

Grill) to upscale casual (Bonefish Grill) and fine dining (Fleming’s Prime Steakhouse & Wine Bar). Macro-consumer sentiment has continued to depress restaurant valuations, with BLMN showcasing a historically favorable risk/reward profile.

BankUnited Inc. (BKU)

BankUnited (BKU) is a bank holding that provides a range of financial products and services including personal, commercial and business banking. Over the years, BankUnited has built out a national or non-geographically focused platform and scaled up its banking operation through several acquisitions. The company is focused on reducing costs and improving efficiencies, increasing its low-cost deposit base and growing the loan portfolio.

Dave & Buster’s Entertainment (PLAY)

Leading owner and operator of high-volume entertainment and dining venues Dave & Buster’s Entertainment (PLAY) offers customers the opportunity to “Eat, Drink, Play, and Watch” all in one location. The company has done well to improve profitability at lower sales volumes, which should translate well when normalized foot traffic returns.

CNO Financial Group (CNO)

CNO Financial Group (CNO) provides life insurance, annuity, and supplemental health insurance products to more than four million customers in the United States through its insurance subsidiaries primarily serving middle-income pre-retirees and retired Americans, which are underserved high growth markets. The company took actions in 2018/2019 to de-risk the investment portfolio, which should enable the management team flexibility looking for yield opportunities in the current environment.

Commercial Metals Company (CMC)

Commercial Metals Company (CMC) manufactures, recycles, and markets rebar and other metal products used in a variety of industries. CMC boasts a low-cost structure, strong free-cash-flow generation, and a disciplined capital allocation strategy that should support the valuation over time. CMC should benefit from any increases in infrastructure spending.

7

Snow Capital Long/Short Opportunity Fund

How did the Fund perform?

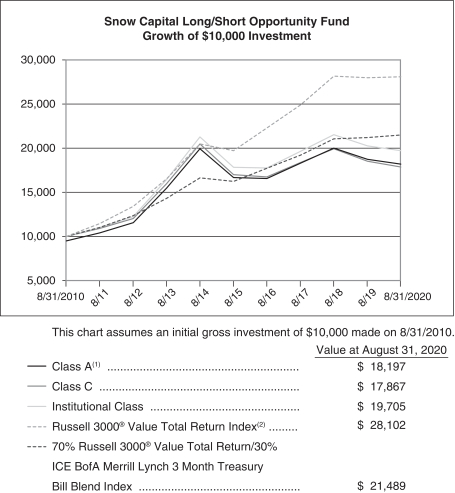

For the six-month period ended August 31, 2020, the Snow Capital Long/Short Opportunity Fund’s Institutional Class Shares recorded a return of -4.48% compared to a return of 2.21% for the blended index of 70% Russell 3000® Value Total Return and 30% ICE BofAML 3-Month T-Bill Index and a return of 2.17% for the Russell 3000 Value Total Return Index.

How is the Fund managed?

The Long/Short Opportunity Fund is an all-cap, contrarian value, liquid alternatives fund that uses a variety of hedging strategies which are designed to reduce the overall volatility of the Fund’s investment portfolio.

The Fund employs a fundamental value philosophy and a disciplined bottom-up investment process to select long equity positions. Thorough reviews are conducted on each company to ensure they are in line with our investment thesis and upside target potential return. The portfolio consists of our highest conviction companies as core holdings, while the Fund simultaneously utilizes various hedging strategies such as short equity positions, long and short options, ETFs, and closed-ended funds. The Fund is managed with a conviction-weighted long portfolio and an opportunistic, research-driven process for our short positioning with the goal of smoothing volatility of investment returns for our shareholders.

Top Positive Contributors to the Fund’s Return

For the six-month period ended August 31, 2020, the Industrials, Health Care, Materials, Consumer Staples, Communication Services, and Information Technology sectors added to overall performance. In order of magnitude, the best performing stocks for the six months were:

FedEx Corp (FDX) outperformed driven by record package volumes as a result of increased e-commerce and delivery trends with people adhering to

8

stay-at-home orders. The company did well to manage costs as package volumes grew, improving profitability as output grew. Rio Tinto PLC (RIO), an international mining company, added to performance as the spot price of iron ore increased throughout the summer of 2020. The increase in commodity spot prices increased profitability due to RIO’s low production costs, while the valuation improved with the company’s strong balance sheet and significant capital return profile. RIO should benefit from a robust recovery in China post-COVID-19. Amgen Inc (AMGN), an independent biotechnology medicines company, added to overall performance after a positive patent ruling alleviated near-term generic competition concerns. Investors rewarded the company for its lower-risk, higher-visibility profile in the biotech space. United Parcel Service (UPS) was also a beneficiary of record package deliveries as a result of the COVID-19 pandemic. Historically a superior operator, UPS did well to leverage elevated volume into increased profitability despite a rise of new logistical challenges brought on by ever shortening delivery windows. Emerson Electric Co (EMR), a designer and manufacturer of electrical software, systems, and services, outperformed due to structural cost cuts that should position the company for a higher profit base during the next cycle.

Top Detractors from the Fund’s Return

For the six-month period ended August 31, 2020, the Consumer Discretionary, Financials, Energy, Real Estate, and Utilities sectors detracted from overall performance.

BankUnited Inc (BKU), a regional bank based in Miami, Florida, detracted from performance due to macro trends of lower-for-longer interest rates and heightened concerns on individual and small business credit trends as a result of the COVID-19 pandemic. BKU holds a relatively large portion of commercial real estate loans and construction and industrial loans, amplifying the macro concerns. Tapestry Inc (TPR), designer and marketer of Coach, Kate Spade, and Stuart Weitzman, detracted on concerns about what demand may look like for their products should the global economy enter a prolonged recession. The Fund maintains a position in the name as we like the steps the company has taken since the downturn, including increased focus on each brand’s core customers, a greater focus on digital efforts and prudent store rationalization. Occidental Petroleum (OXY) fell in early March as macro

9

conditions deteriorated in the oil markets, reducing the spot price of Brent Crude. The Fund promptly exited the position once it became clear oil demand would be lower during the COVID-19 pandemic, as our thesis for the name included higher sustained oil prices over time. OUTFRONT Media (OUT), an out-of-home advertising company including billboards and municipal transit systems, fell in early March as it became clear commuting, and human movement from place-to-place in general, would be restricted for a period of time and perhaps structurally changed going forward. The Fund exited this position during the period. CNO Financial Group (CNO) fell on a general concerned outlook for supplemental health, long-term care, and life insurance companies during the COVID-19 pandemic. Company specific results have been encouraging, including the reinstitution of a share repurchase plan, and the Fund has maintained a position in the company.

Were there significant changes to the portfolio?

Compared to the blended index of 70% Russell 3000® Value Total Return and 30% ICE BofAML 3-Month T-Bill Index, the Fund holds an above-average weight in the Financials, Energy, Consumer Discretionary, Materials, Communication Services, and Health Care sectors, and a below-average weight in the Utilities, Real Estate, Industrials, Consumer Staples, and Information Technology sectors as of August 31, 2020.

We reduced our exposure to Consumer Discretionary, Communication Services, Real Estate, Utilities, Information Technology, and Health Care, and increased our investments in Financials, Industrials, Materials, Consumer Staples, and Energy during the period. As of the end of August, the portfolio held 52 core long positions and was approximately 61% net long.

The purchase and/or sale of short positions, options, exchange-traded funds, or other securities aim to serve as a hedge to our long equity portfolio. We are holding cash as a component of our strategies and to take advantage of any opportunities the market volatility may provide.

10

Comments on the Fund’s Five Largest Holdings

PulteGroup Inc (PHM)

Operating in 23 states led by Texas, Florida, and Arizona, well-balanced homebuilder PulteGroup (PHM) is nicely positioned to benefit from increased demand due to prolonged low interest rates and a continued uptick in first-time homebuyers. The company also provides mortgage financing, title insurance, and other services to homebuyers.

JPMorgan Chase & Co (JPM)

Under the leadership of CEO Jamie Dimon, JPMorgan Chase & Co (JPM) has become a premier money center bank. The company remains focused on capital generation, cost reduction, regulatory compliance and shareholder returns. Credit trends remain benign, loan growth is solid and the balance sheet is well capitalized. The company continues to take share from the competition and strives for a mid-teen return on equity.

FedEx Corp (FDX)

Integrated global delivery company FedEx Corp (FDX) is the world’s largest express transportation provider, operating in more than 220 countries with services ranging from ground small-parcel delivery to global supply chain solutions. The oligopolistic nature of the business FDX operates in creates natural barriers to entry that should enable material pricing power with e-commerce ramping across the world.

Bank of America Corporation (BAC)

One of the largest financial institutions in the U.S., Bank of America Corporation (BAC) may benefit from greater economies of scale and less competition over the long-term. Capital levels have been bolstered and the business model has been simplified under the direction of CEO Brian Moynihan.

PVH Corp (PVH)

Based in New York, New York, PVH Corp (PVH) owns and operates global brands Calvin Klein, Tommy Hilfiger, and Heritage Brands, as well as several

11

third-party brands. The company has diverse sales channels, helping to mitigate changing consumer preferences for consumption and driving customer engagement.

Past performance is not a guarantee of future results.

The views expressed herein are solely the opinions of Snow Capital Management L.P. We make no representations as to their accuracy. This communication is intended for informational purposes only and does not constitute a solicitation to invest money nor a recommendation to buy or sell certain securities. Equity investments are not appropriate for all investors. Individual investment decisions should be discussed with a financial advisor.

Mutual fund investing involves risk. Principal loss is possible. Investments in small- and medium-capitalization companies involve additional risks such as limited liquidity and greater volatility. Investments in foreign securities involve political, economic, and currency risks, greater volatility and differences in accounting methods. The Snow Capital Long/Short Opportunity Fund may invest in debt securities. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. The Snow Capital Long/Short Opportunity Fund may use options or futures contracts which have the risks of unlimited losses and the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of the securities prices, interest rates, and currency exchange rates. Investments in ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a discount to their net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell ETF shares. This investment may not be suitable for all investors.

Earnings growth is not representative of the Fund’s future performance.

12

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. Please refer to the Schedules of Investments in this report for a complete list of Fund holdings.

The S&P 500® Total Return Index is a broad-based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The Russell 2000® Value Total Return Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 3000® Value Total Return Index measures the performance of the broad value segment of the U.S. equity value universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 3000® Growth Index is a market capitalization-weighted index based on the Russell 3000 companies. The Russell 3000 Growth Index includes companies that display signs of above-average growth and high price-to-book ratios.

The blended index of 70% Russell 3000 Value Total Return and 30% ICE BofAML 3-Month T-Bill Index is a weighted blend of the Russell 3000 Value Total Return Index, defined above, and the ICE BofAML 3-Month T-Bill Index, which is an unmanaged index that measures returns of three-month Treasury Bills.

The Russell 2000® Index is comprised of the smallest 2000 companies in the Russell 3000® Index, which represents approximately 98% of the investable U.S. equity market. Indexes are unmanaged. It is not possible to invest directly in an index.

Return on Equity or ROE is calculated as net income divided by common stockholders’ equity.

Market Capitalization is the market price of an entire company, calculated by multiplying the number of shares outstanding by the price per share.

The Snow Capital Family of Funds are distributed by Quasar Distributors, LLC.

13

Expense Example (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (Class A shares only) and redemption fees, and (2) ongoing costs, including management fees, distribution (12b-1) and service fees (Class A and Class C shares only) and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds, and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (3/1/20-8/31/20).

Actual Expenses

The following table provides information about actual account values and actual expenses. If you purchase Class A shares of the Funds you will pay an initial sales charge of 5.25% when you invest. Class A shares are also subject to a contingent deferred sales charge of 0.50% for purchases made at the $1,000,000 breakpoint and are redeemed within twelve months of purchase. A 1.00% contingent deferred sales charge is imposed on Class C shares redeemed within twelve months of purchase. In addition, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 0.50% of the net amount of the redemption if you redeem your shares of the Funds within 30 days of purchase. IRA accounts will be charged a $15.00 annual maintenance fee. To the extent a Fund invests in shares of exchange-traded funds or other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the Example. The Example includes, but is not limited to, management fees, distribution (12b-1) and service fees, fund administration and accounting, custody and transfer agent fees. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

14

Fund Expense Examples (Unaudited)

| Beginning Account Balance 3/1/20 |

Ending Account Balance 8/31/20 |

Expenses Paid During Period 3/1/20- 8/31/20 |

Annualized Expense Ratio |

|||||||||||||

| Based on Actual Fund Returns* |

||||||||||||||||

| Long/Short Opportunity Fund |

||||||||||||||||

| Class A |

$ | 1,000.00 | $ | 954.00 | $ | 10.24 | 2.08 | % | ||||||||

| Class C |

1,000.00 | 950.50 | 13.91 | 2.83 | % | |||||||||||

| Institutional Class |

1,000.00 | 955.20 | 9.02 | 1.83 | % | |||||||||||

| Small Cap Value Fund |

||||||||||||||||

| Class A |

1,000.00 | 1,043.60 | 7.73 | 1.50 | % | |||||||||||

| Class C |

1,000.00 | 1,040.00 | 11.57 | 2.25 | % | |||||||||||

| Institutional Class |

1,000.00 | 1,045.10 | 6.44 | 1.25 | % | |||||||||||

| * | Expenses are equal to each Fund’s annualized expense ratio by class multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period (184), then divided by the number of days in the 12-month period (365). |

Hypothetical Example for Comparison Purposes

The following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the information in this table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

15

| Beginning Account Balance 3/1/20 |

Ending Account Balance 8/31/20 |

Expenses Paid During Period 3/1/20- 8/31/20 |

Annualized Expense Ratio |

|||||||||||||

| Based on Hypothetical 5% Yearly Returns* |

|

|||||||||||||||

| Long/Short Opportunity Fund |

||||||||||||||||

| Class A |

$ | 1,000.00 | $ | 1,014.72 | $ | 10.56 | 2.08 | % | ||||||||

| Class C |

1,000.00 | 1,010.94 | 14.34 | 2.83 | % | |||||||||||

| Institutional Class |

1,000.00 | 1,015.98 | 9.30 | 1.83 | % | |||||||||||

| Small Cap Value Fund |

||||||||||||||||

| Class A |

1,000.00 | 1,017.64 | 7.63 | 1.50 | % | |||||||||||

| Class C |

1,000.00 | 1,013.86 | 11.42 | 2.25 | % | |||||||||||

| Institutional Class |

1,000.00 | 1,018.90 | 6.36 | 1.25 | % | |||||||||||

| * | Expenses are equal to each Fund’s annualized expense ratio by class multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period (184), then divided by the number of days in the 12-month period (365). |

16

Snow Capital Small Cap Value Fund

Investment Highlights (Unaudited)

The investment objective of the Fund is long-term capital appreciation. To achieve its investment objective, under normal market conditions the Fund will invest at least 80% of its net assets, at cost, in equity securities of companies with market capitalizations in the range of the Russell 2000® Value Total Return Index (“small cap companies”). Snow Capital Management L.P. (the “Adviser”) selects equity securities for the Fund using a bottom-up approach that seeks to identify small cap companies that the Adviser believes are undervalued and are likely to experience a rebound in earnings due to an event or series of events that creates a price-to-earnings expansion that leads to higher stock price valuations. The Fund’s allocation of portfolio assets as of August 31, 2020 is shown below.

17

Snow Capital Long/Short Opportunity Fund

Investment Highlights (Unaudited) (Continued)

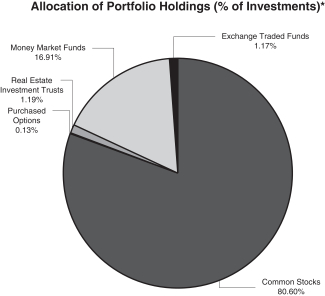

The investment objective of the Fund is long-term capital appreciation and protection of investment principal. The Fund seeks to achieve its investment objective by investing primarily in equity securities that Snow Capital Management L.P. (the “Adviser”), the Fund’s investment adviser, believes are undervalued, selling short equity securities the Adviser believes are overvalued and selling short equity securities to hedge market risk. The Fund may also invest in options, futures contracts and options on futures contracts (collectively, “Derivative Instruments”) as a substitute for a comparable market position in the underlying equity security or to attempt to “hedge” or limit the exposure of the Fund’s position in an equity security. Long and short investments can include common and preferred stocks, convertible securities, shares of other investment companies and ETFs that invest in equity securities. With a long position, the Fund purchases a security outright, while with a short position, the Fund sells a security that it has borrowed. When the Fund sells a security short, it borrows the security from a third party and sells it at the then-current market price. The Fund is then obligated to buy the security on a later date so that it can return the security to the lender. The Fund may invest in securities of companies of any size and is not managed toward sector or industry weights. In addition to domestic securities, the Fund may have up to 25% of its net assets invested directly or indirectly in foreign securities, including investments in emerging markets. The Fund’s allocation of portfolio assets as of August 31, 2020 is shown below.

| * | Short Securities (17.27%); Options Written (1.04%), each as a percent of total net assets. |

18

Snow Capital Family of Funds

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of August 31, 2020(1)

| One Year |

Three Years |

Five Years |

Since Inception (11/30/10) |

|||||||||||||

| Snow Capital Small Cap Value Fund |

||||||||||||||||

| Class A (with sales charge) |

-4.14% | -2.93% | -1.12% | 5.06% | ||||||||||||

| Class A (without sales charge) |

1.18% | -1.17% | -0.04% | 5.64% | ||||||||||||

| Class C (with sales charge) |

-0.57% | -1.90% | -0.79% | 4.86% | ||||||||||||

| Class C (without sales charge) |

0.43% | -1.90% | -0.79% | 4.86% | ||||||||||||

| Institutional Class |

1.47% | -0.91% | 0.21% | 5.91% | ||||||||||||

| Russell 2000® Value Total Return Index |

-6.14% | -1.39% | 4.37% | 7.11% | ||||||||||||

| One Year |

Five Years |

Ten Years |

Since Inception (4/28/06) |

|||||||||||||

| Snow Capital Long/Short Opportunity Fund |

||||||||||||||||

| Class A (with sales charge) |

-8.03% | 0.67% | 6.17% | 3.35% | ||||||||||||

| Class A (without sales charge) |

-2.92% | 1.77% | 6.74% | 3.74% | ||||||||||||

| Class C (with sales charge) |

-4.60% | 1.00% | 5.98% | 2.98% | ||||||||||||

| Class C (without sales charge) |

-3.64% | 1.00% | 5.98% | 2.98% | ||||||||||||

| Institutional Class |

-2.69% | 2.02% | 7.02% | 3.99% | ||||||||||||

| Russell 3000® Value Total Return Index |

0.39% | 7.33% | 10.89% | 6.02% | ||||||||||||

| 70% Russell 3000® Value Total Return / 30% ICE BofA Merrill Lynch 3 Month Treasury Bill Blend Index |

1.38% | 5.75% | 7.95% | 4.85% | ||||||||||||

| (1) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A shares and the applicable contingent deferred sales charge for Class C shares. Returns without sales charges do not reflect the current maximum sales charges. Had the sales charges been included, the returns would have been lower. |

19

Snow Capital Family of Funds

Investment Highlights (Unaudited) (Continued)

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-SNOWFND (877-766-9363). The Funds impose a 0.50% redemption fee on shares held 30 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Short-term performance, in particular, is not a good indication of the Funds’ future performance, and an investment should not be made solely on returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

The returns shown in the table above and the following graphs assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graphs below illustrate performance of a hypothetical investment made in the Funds and a broad- based securities index on each Fund’s inception date. The graphs do not reflect any future performance.

The Russell 2000® Value Total Return Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The Russell 3000® Value Total Return Index measures the performance of the broad value segment of U.S. equity value universe. It includes those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values. The 70% Russell 3000® Value Total Return/30% ICE BofA Merrill Lynch 3 Month Treasury Bill Blend Index consists of 70% Russell 3000® Value Total Return Index and 30% ICE BofA Merrill Lynch 3 Month U.S. Treasury Bill Index. The Russell 3000® Value Total Return Index measures the performance of the broad value segment of U.S. equity value universe. It includes those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values. The ICE BofA Merrill Lynch 3 Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

20

Snow Capital Family of Funds

Investment Highlights (Unaudited) (Continued)

| (1) | Reflects 5.25% initial sales charge. |

21

Snow Capital Family of Funds

Investment Highlights (Unaudited) (Continued)

| (1) | Reflects 5.25% initial sales charge. |

22

Snow Capital Small Cap Value Fund

Schedule of Investments

August 31, 2020 (Unaudited)

| Shares | Value | |||||||

| COMMON STOCKS - 99.99% |

||||||||

| Air Freight & Logistics - 1.41% |

||||||||

| Atlas Air Worldwide Holdings, Inc. (a) |

2,995 | $ | 168,888 | |||||

|

|

|

|||||||

| Airlines - 3.56% |

||||||||

| JetBlue Airways Corp. (a) |

37,025 | 426,528 | ||||||

|

|

|

|||||||

| Auto Components - 2.66% |

||||||||

| Modine Manufacturing Co. (a) |

46,960 | 317,919 | ||||||

|

|

|

|||||||

| Banks - 22.64% |

||||||||

| BankUnited, Inc. |

23,821 | 556,936 | ||||||

| First Commonwealth Financial Corp. |

28,292 | 231,994 | ||||||

| First Horizon National Corp. |

46,231 | 441,506 | ||||||

| FNB Corp. |

59,306 | 444,795 | ||||||

| Great Western Bancorp, Inc. |

7,795 | 108,584 | ||||||

| OFG Bancorp (b) |

14,954 | 192,009 | ||||||

| TCF Financial Corp. |

11,300 | 303,744 | ||||||

| Umpqua Holdings Corp. |

37,786 | 426,226 | ||||||

|

|

|

|||||||

| 2,705,794 | ||||||||

|

|

|

|||||||

| Capital Markets - 0.55% |

||||||||

| Affiliated Managers Group, Inc. |

950 | 65,218 | ||||||

|

|

|

|||||||

| Construction & Engineering - 1.24% |

||||||||

| AECOM (a) |

3,742 | 147,846 | ||||||

|

|

|

|||||||

| Electrical Equipment - 0.48% |

||||||||

| nVent Electric PLC |

3,000 | 57,360 | ||||||

|

|

|

|||||||

| Electronic Equipment, Instruments & Components - 0.48% |

|

|||||||

| II-VI, Inc. (a) |

1,288 | 57,316 | ||||||

|

|

|

|||||||

| Entertainment - 0.51% |

||||||||

| Cinemark Holdings, Inc. (a) |

4,200 | 61,530 | ||||||

|

|

|

|||||||

| Food Products - 1.52% |

||||||||

| Pilgrim’s Pride Corp. (a) |

11,354 | 181,664 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of these financial statements.

23

Snow Capital Small Cap Value Fund

Schedule of Investments (Continued)

August 31, 2020 (Unaudited)

| Shares | Value | |||||||

| Health Care Equipment & Supplies - 1.53% |

||||||||

| Integra LifeSciences Holdings Corp. (a) |

3,836 | $ | 183,322 | |||||

|

|

|

|||||||

| Health Care Providers & Services - 1.58% |

||||||||

| AMN Healthcare Services, Inc. (a) |

3,501 | 188,494 | ||||||

|

|

|

|||||||

| Hotels, Restaurants & Leisure - 16.79% |

||||||||

| Bloomin’ Brands, Inc. |

43,312 | 621,094 | ||||||

| Brinker International, Inc. |

6,682 | 300,957 | ||||||

| Dave & Buster’s Entertainment, Inc. |

33,322 | 554,145 | ||||||

| Norwegian Cruise Line Holdings Ltd. (a)(b) |

3,000 | 51,330 | ||||||

| The Cheesecake Factory, Inc. |

16,260 | 480,158 | ||||||

|

|

|

|||||||

| 2,007,684 | ||||||||

|

|

|

|||||||

| Household Durables - 0.89% |

||||||||

| Taylor Morrison Home Corp. |

4,500 | 105,885 | ||||||

|

|

|

|||||||

| Insurance - 12.34% |

||||||||

| American Equity Investment Life Holding Co. |

18,875 | 451,301 | ||||||

| Argo Group International Holdings Ltd. (b) |

4,700 | 174,558 | ||||||

| CNO Financial Group, Inc. |

32,120 | 523,556 | ||||||

| Lincoln National Corp. |

9,038 | 325,820 | ||||||

|

|

|

|||||||

| 1,475,235 | ||||||||

|

|

|

|||||||

| Metals & Mining - 7.66% |

||||||||

| B2Gold Corp. (b) |

25,340 | 170,792 | ||||||

| Century Aluminum Co. (a) |

13,485 | 133,097 | ||||||

| Commercial Metals Co. |

24,345 | 508,080 | ||||||

| Gold Resource Corp. |

26,070 | 103,759 | ||||||

|

|

|

|||||||

| 915,728 | ||||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels - 2.70% |

||||||||

| Cabot Oil & Gas Corp. |

2,970 | 56,341 | ||||||

| Cimarex Energy Co. |

6,901 | 191,710 | ||||||

| Delek US Holdings, Inc. |

4,765 | 74,953 | ||||||

|

|

|

|||||||

| 323,004 | ||||||||

|

|

|

|||||||

The accompanying notes are an integral part of these financial statements.

24

Snow Capital Small Cap Value Fund

Schedule of Investments (Continued)

August 31, 2020 (Unaudited)

| Shares | Value | |||||||

| Paper & Forest Products - 0.73% |

||||||||

| Domtar Corp. |

3,060 | $ | 87,271 | |||||

|

|

|

|||||||

| Semiconductors & Semiconductor Equipment - 0.97% |

||||||||

| Diodes, Inc. (a) |

2,371 | 115,847 | ||||||

|

|

|

|||||||

| Software - 2.11% |

||||||||

| J2 Global, Inc. (a) |

3,600 | 251,964 | ||||||

|

|

|

|||||||

| Specialty Retail - 7.09% |

||||||||

| American Eagle Outfitters, Inc. |

31,581 | 398,236 | ||||||

| Dick’s Sporting Goods, Inc. |

1,281 | 69,328 | ||||||

| Urban Outfitters, Inc. (a) |

16,125 | 379,583 | ||||||

|

|

|

|||||||

| 847,147 | ||||||||

|

|

|

|||||||

| Technology Hardware, Storage & Peripherals - 6.51% |

||||||||

| NCR Corp. (a) |

15,880 | 324,587 | ||||||

| Super Micro Computer, Inc. (a) |

16,560 | 453,579 | ||||||

|

|

|

|||||||

| 778,166 | ||||||||

|

|

|

|||||||

| Textiles, Apparel & Luxury Goods - 0.50% |

||||||||

| Skechers U.S.A., Inc. - Class A (a) |

1,985 | 59,252 | ||||||

|

|

|

|||||||

| Trading Companies & Distributors - 3.54% |

||||||||

| WESCO International, Inc. (a) |

9,020 | 422,587 | ||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS |

11,951,649 | |||||||

|

|

|

|||||||

| MONEY MARKET FUND - 0.23% |

||||||||

| Fidelity Investment Money Market Funds - Government Portfolio, Institutional Class, 0.010% (c) |

27,861 | 27,861 | ||||||

|

|

|

|||||||

| TOTAL MONEY MARKET FUND |

27,861 | |||||||

|

|

|

|||||||

| Total Investments |

11,979,510 | |||||||

| Liabilities in Excess of Other Assets - (0.22)% |

(25,781 | ) | ||||||

|

|

|

|||||||

| TOTAL NET ASSETS - 100.00% |

$ | 11,953,729 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of these financial statements.

25

Snow Capital Small Cap Value Fund

Schedule of Investments (Continued)

August 31, 2020 (Unaudited)

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | Seven day yield as of August 31, 2020. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services.

The accompanying notes are an integral part of these financial statements.

26

Snow Capital Long/Short Opportunity Fund

Schedule of Investments

August 31, 2020 (Unaudited)

| Shares | Value | |||||||

| COMMON STOCKS - 81.44% |

||||||||

| Air Freight & Logistics - 3.84% |

||||||||

| FedEx Corp. |

10,380 | $ | 2,281,939 | |||||

| United Parcel Service, Inc. - Class B |

4,940 | 808,283 | ||||||

|

|

|

|||||||

| 3,090,222 | ||||||||

|

|

|

|||||||

| Banks - 9.41% |

||||||||

| Bank of America Corp. (a) |

85,920 | 2,211,581 | ||||||

| JPMorgan Chase & Co. (a)(b) |

22,560 | 2,260,287 | ||||||

| Truist Financial Corp. |

40,050 | 1,554,341 | ||||||

| Umpqua Holdings Corp. |

137,678 | 1,553,008 | ||||||

|

|

|

|||||||

| 7,579,217 | ||||||||

|

|

|

|||||||

| Beverages - 1.01% |

||||||||

| Constellation Brands, Inc. - Class A |

4,390 | 809,867 | ||||||

|

|

|

|||||||

| Biotechnology - 4.07% |

||||||||

| Amgen, Inc. (a)(b) |

6,975 | 1,766,906 | ||||||

| Biogen, Inc. (a)(c) |

5,234 | 1,505,508 | ||||||

|

|

|

|||||||

| 3,272,414 | ||||||||

|

|

|

|||||||

| Capital Markets - 1.38% |

||||||||

| The Goldman Sachs Group, Inc. |

5,420 | 1,110,395 | ||||||

|

|

|

|||||||

| Communications Equipment - 1.48% |

||||||||

| Cisco Systems, Inc. (b) |

28,158 | 1,188,831 | ||||||

|

|

|

|||||||

| Consumer Finance - 1.83% |

||||||||

| American Express Co. |

14,505 | 1,473,563 | ||||||

|

|

|

|||||||

| Containers & Packaging - 1.30% |

||||||||

| International Paper Co. |

28,770 | 1,043,488 | ||||||

|

|

|

|||||||

| Diversified Telecommunication Services - 2.95% |

||||||||

| CenturyLink, Inc. (b) |

126,150 | 1,356,112 | ||||||

| Verizon Communications, Inc. (a) |

17,200 | 1,019,444 | ||||||

|

|

|

|||||||

| 2,375,556 | ||||||||

|

|

|

|||||||

| Electric Utilities - 1.34% |

||||||||

| Exelon Corp. (b) |

29,151 | 1,075,963 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of these financial statements.

27

Snow Capital Long/Short Opportunity Fund

Schedule of Investments (Continued)

August 31, 2020 (Unaudited)

| Shares | Value | |||||||

| Electrical Equipment - 2.64% |

||||||||

| Emerson Electric Co. (a)(b) |

18,800 | $ | 1,306,036 | |||||

| nVent Electric PLC |

42,850 | 819,292 | ||||||

|

|

|

|||||||

| 2,125,328 | ||||||||

|

|

|

|||||||

| Entertainment - 1.33% |

||||||||

| The Walt Disney Co. |

8,110 | 1,069,466 | ||||||

|

|

|

|||||||

| Food Products - 2.03% |

||||||||

| Tyson Foods, Inc. - Class A |

25,970 | 1,630,916 | ||||||

|

|

|

|||||||

| Health Care Equipment & Supplies - 0.81% |

||||||||

| Zimmer Biomet Holdings, Inc. |

4,640 | 653,683 | ||||||

|

|

|

|||||||

| Health Care Providers & Services - 3.88% |

||||||||

| Centene Corp. (c) |

27,380 | 1,678,942 | ||||||

| Laboratory Corp. of America Holdings (a)(b)(c) |

8,240 | 1,448,180 | ||||||

|

|

|

|||||||

| 3,127,122 | ||||||||

|

|

|

|||||||

| Hotels, Restaurants & Leisure - 1.55% |

||||||||

| Las Vegas Sands Corp. |

24,650 | 1,250,002 | ||||||

|

|

|

|||||||

| Household Durables - 3.10% |

||||||||

| PulteGroup, Inc. (a)(b) |

56,030 | 2,498,378 | ||||||

|

|

|

|||||||

| Insurance - 8.19% |

||||||||

| Argo Group International Holdings Ltd. (a)(d) |

22,520 | 836,393 | ||||||

| CNO Financial Group, Inc. |

49,570 | 807,991 | ||||||

| Hartford Financial Services Group, Inc. |

37,320 | 1,509,594 | ||||||

| MetLife, Inc. (a) |

47,455 | 1,825,119 | ||||||

| The Travelers Companies, Inc. (a) |

13,890 | 1,611,796 | ||||||

|

|

|

|||||||

| 6,590,893 | ||||||||

|

|

|

|||||||

| Machinery - 1.64% |

||||||||

| Caterpillar, Inc. |

9,265 | 1,318,502 | ||||||

|

|

|

|||||||

| Media - 1.69% |

||||||||

| The Interpublic Group of Cos., Inc. |

76,500 | 1,358,640 | ||||||

|

|

|

|||||||

| Metals & Mining - 3.63% |

||||||||

| B2Gold Corp. (d) |

72,100 | 485,954 | ||||||

The accompanying notes are an integral part of these financial statements.

28

Snow Capital Long/Short Opportunity Fund

Schedule of Investments (Continued)

August 31, 2020 (Unaudited)

| Shares | Value | |||||||

| Commercial Metals Co. |

50,360 | $ | 1,051,013 | |||||

| Rio Tinto PLC - ADR |

22,700 | 1,389,921 | ||||||

|

|

|

|||||||

| 2,926,888 | ||||||||

|

|

|

|||||||

| Multiline Retail - 1.41% |

||||||||

| Kohl’s Corp. |

52,980 | 1,131,653 | ||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels - 7.68% |

||||||||

| BP PLC - ADR |

41,968 | 878,390 | ||||||

| Chevron Corp. (b) |

4,000 | 335,720 | ||||||

| Cimarex Energy Co. |

27,790 | 772,006 | ||||||

| Marathon Petroleum Corp. (a) |

44,760 | 1,587,191 | ||||||

| Pioneer Natural Resources Co. |

8,300 | 862,619 | ||||||

| Suncor Energy, Inc. (d) |

68,140 | 1,092,284 | ||||||

| Valero Energy Corp. |

12,470 | 655,797 | ||||||

|

|

|

|||||||

| 6,184,007 | ||||||||

|

|

|

|||||||

| Pharmaceuticals - 1.99% |

||||||||

| AbbVie, Inc. (a) |

16,744 | 1,603,573 | ||||||

|

|

|

|||||||

| Semiconductors & Semiconductor Equipment - 1.36% |

|

|||||||

| Broadcom, Inc. (b) |

3,160 | 1,096,994 | ||||||

|

|

|

|||||||

| Specialty Retail - 1.23% |

||||||||

| The TJX Cos Inc. |

18,150 | 994,439 | ||||||

|

|

|

|||||||

| Technology Hardware, Storage & Peripherals - 4.18% |

|

|||||||

| NCR Corp. (c) |

84,450 | 1,726,158 | ||||||

| NetApp, Inc. |

34,596 | 1,639,504 | ||||||

|

|

|

|||||||

| 3,365,662 | ||||||||

|

|

|

|||||||

| Textiles, Apparel & Luxury Goods - 4.49% |

||||||||

| PVH Corp. (c) |

34,256 | 1,910,114 | ||||||

| Tapestry, Inc. |

115,790 | 1,705,586 | ||||||

|

|

|

|||||||

| 3,615,700 | ||||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS |

65,561,362 | |||||||

|

|

|

|||||||

The accompanying notes are an integral part of these financial statements.

29

Snow Capital Long/Short Opportunity Fund

Schedule of Investments (Continued)

August 31, 2020 (Unaudited)

| Contracts | Notional Value |

Value | ||||||||||

| PURCHASED OPTIONS - 0.13% |

||||||||||||

| Exchange Traded Call Options - 0.08% |

|

|||||||||||

| CenturyLink, Inc. |

||||||||||||

| Expiration: October, 2020, Exercise Price: $10.000 |

700 | $ | 752,500 | $ | 70,000 | |||||||

|

|

|

|||||||||||

| Exchange Traded Put Options - 0.05% |

|

|||||||||||

| SPDR S&P 500 ETF Trust |

||||||||||||

| Expiration: December, 2020, Exercise Price: $300.000 |

50 | 1,746,550 | 37,800 | |||||||||

|

|

|

|||||||||||

| TOTAL PURCHASED OPTIONS |

107,800 | |||||||||||

|

|

|

|||||||||||

| Shares | ||||||||

| EXCHANGE TRADED FUNDS - 1.18% |

||||||||

| VanEck Vectors Junior Gold Miners ETF |

15,800 | $ | 951,002 | |||||

|

|

|

|||||||

| TOTAL EXCHANGE TRADED FUNDS |

951,002 | |||||||

|

|

|

|||||||

| REAL ESTATE INVESTMENT TRUSTS (REITS) - 1.20% |

|

|||||||

| Mortgage Real Estate Investment Trusts (REITs) - 1.20% |

|

|||||||

| Annaly Capital Management, Inc. |

131,380 | 965,643 | ||||||

|

|

|

|||||||

| TOTAL REAL ESTATE INVESTMENT TRUSTS (REITS) |

965,643 | |||||||

|

|

|

|||||||

| MONEY MARKET FUND - 17.08% |

||||||||

| Fidelity Investments Money Market Funds - Government Portfolio, Institutional Class, 0.010% (e) |

13,752,762 | 13,752,762 | ||||||

|

|

|

|||||||

| TOTAL MONEY MARKET FUND |

13,752,762 | |||||||

|

|

|

|||||||

| Total Investments |

81,338,569 | |||||||

| Liabilities in Excess of Other Assets - (1.03)% |

(829,895 | ) | ||||||

|

|

|

|||||||

| TOTAL NET ASSETS - 100.00% |

$ | 80,508,674 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of these financial statements.

30

Snow Capital Long/Short Opportunity Fund

Schedule of Investments (Continued)

August 31, 2020 (Unaudited)

Percentages are stated as a percent of net assets.

| (a) | All or a portion of this security is pledged as collateral for securities sold short. |

| (b) | All or a portion of this security may be subject to call options written. |

| (c) | Non-income producing security. |

| (d) | Foreign issued security. |

| (e) | Seven day yield as of August 31, 2020. |

Abbreviations:

| ADR | American Depositary Receipt |

| PLC | Public Limited Company. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services.

The accompanying notes are an integral part of these financial statements.

31

Snow Capital Long/Short Opportunity Fund

Schedule of Securities Sold Short

August 31, 2020 (Unaudited)

| Shares | Value | |||||||

| SECURITIES SOLD SHORT - (17.45)% |

||||||||

| COMMON STOCKS - (2.61)% |

||||||||

| Health Care Providers & Services - (0.56)% |

||||||||

| Humana, Inc. |

(1,080 | ) | $ | (448,384 | ) | |||

|

|

|

|||||||

| Insurance - (0.56)% |

||||||||

| Prudential Financial, Inc. |

(6,660 | ) | (451,348 | ) | ||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels - (0.41)% |

||||||||

| Phillips 66 |

(5,650 | ) | (330,356 | ) | ||||

|

|

|

|||||||

| Specialty Retail - (0.54)% |

||||||||

| Foot Locker, Inc. |

(14,270 | ) | (432,809 | ) | ||||

|

|

|

|||||||

| Textiles, Apparel & Luxury Goods - (0.54)% |

||||||||

| VF Corp. |

(6,615 | ) | (434,936 | ) | ||||

|

|

|

|||||||

| TOTAL COMMON STOCKS |

(2,097,833 | ) | ||||||

|

|

|

|||||||

| EXCHANGE TRADED FUNDS - (14.84)% |

||||||||

| Energy Select Sector SPDR Fund |

(10,700 | ) | (381,455 | ) | ||||

| iShares Russell 1000 Value ETF |

(40,010 | ) | (4,877,619 | ) | ||||

| iShares Russell 2000 ETF |

(18,940 | ) | (2,943,844 | ) | ||||

| SPDR S&P 500 ETF Trust |

(10,730 | ) | (3,748,096 | ) | ||||

|

|

|

|||||||

| TOTAL EXCHANGE TRADED FUNDS |

(11,951,014 | ) | ||||||

|

|

|

|||||||

| Total for Shares Sold Short |

$ | (14,048,847 | ) | |||||

|

|

|

|||||||

The accompanying notes are an integral part of these financial statements.

32

Snow Capital Long/Short Opportunity Fund

Schedule of Options Written

August 31, 2020 (Unaudited)

| Contracts | Notional Value |

Value | ||||||||||

| EXCHANGED TRADED CALL OPTIONS |

|

|||||||||||

| Amgen, Inc. |

|

|||||||||||

| Expiration: October, 2020, Exercise Price: $260.00 |

(15 | ) | $ | (379,980 | ) | $ | (11,250 | ) | ||||

| Broadcom, Inc. |

||||||||||||

| Expiration: September, 2020, Exercise Price: $300.00 |

(13 | ) | (451,295 | ) | (65,195 | ) | ||||||

| Chevron Corp. |

|

|||||||||||

| Expiration: September, 2020, Exercise Price: $100.00 |

(40 | ) | (335,720 | ) | (160 | ) | ||||||

| Cisco Systems, Inc. |

|

|||||||||||

| Expiration: September, 2020, Exercise Price: $47.50 |

(85 | ) | (358,870 | ) | (170 | ) | ||||||

| Emerson Electric Co. |

||||||||||||

| Expiration: September, 2020, Exercise Price: $67.50 |

(60 | ) | (416,820 | ) | (19,200 | ) | ||||||

| Exelon Corp. |

||||||||||||

| Expiration: October, 2020, Exercise Price: $40.00 |

(101 | ) | (372,791 | ) | (4,545 | ) | ||||||

| Invesco QQQ Trust Series 1 |

||||||||||||

| Expiration: September, 2020, Exercise Price: $235.00 |

(36 | ) | (1,061,568 | ) | (220,680 | ) | ||||||

| JPMorgan Chase & Co. |

||||||||||||

| Expiration: September, 2020, Exercise Price: $105.00 |

(36 | ) | (360,684 | ) | (5,112 | ) | ||||||

| Laboratory Corp. of America Holdings |

|

|||||||||||

| Expiration: November, 2020, Exercise Price: $190.00 |

(21 | ) | (369,075 | ) | (12,810 | ) | ||||||

| Expiration: February, 2021, Exercise Price: $210.00 |

(41 | ) | (720,575 | ) | (18,450 | ) | ||||||

| PulteGroup, Inc. |

||||||||||||

| Expiration: October, 2020, Exercise Price: $37.00 |

(103 | ) | (459,277 | ) | (84,460 | ) | ||||||

| Expiration: October, 2020, Exercise Price: $40.00 |

(140 | ) | (624,260 | ) | (79,800 | ) | ||||||

The accompanying notes are an integral part of these financial statements.

33

Snow Capital Long/Short Opportunity Fund

Schedule of Options Written (Continued)

August 31, 2020 (Unaudited)

| Contracts | Notional Value |

Value | ||||||||||

| Rio Tinto PLC |

||||||||||||

| Expiration: October, 2020, Exercise Price: $60.00 |

(67 | ) | $ | (410,241 | ) | $ | (23,450 | ) | ||||

| VanEck Vectors Junior Gold Miners ETF |

||||||||||||

| Expiration: January, 2021, Exercise Price: $60.00 |

(100 | ) | (601,900 | ) | (84,500 | ) | ||||||

|

|

|

|||||||||||

| (629,782 | ) | |||||||||||

|

|

|

|||||||||||

| EXCHANGED TRADED PUT OPTIONS |

|

|||||||||||

| Ally Financial, Inc. |

|

|||||||||||

| Expiration: December, 2020, Exercise |

(269 | ) | (615,472 | ) | (10,491 | ) | ||||||

| American Express Co. |

||||||||||||

| Expiration: January, 2021, Exercise |

(45 | ) | (457,155 | ) | (19,800 | ) | ||||||

| Biogen, Inc. |

|

|||||||||||

| Expiration: December, 2020, Exercise |

(18 | ) | (517,752 | ) | (6,300 | ) | ||||||

| Broadcom, Inc. |

|

|||||||||||

| Expiration: September, 2020, Exercise Price: $220.00 |

(23 | ) | (798,445 | ) | (1,035 | ) | ||||||

| CenturyLink, Inc. |

||||||||||||

| Expiration: October, 2020, Exercise |

(700 | ) | (752,500 | ) | (7,350 | ) | ||||||

| Hartford Financial Services Group, Inc. |

||||||||||||

| Expiration: October, 2020, Exercise |

(135 | ) | (546,075 | ) | (3,038 | ) | ||||||

| Honeywell Intl, Inc. |

||||||||||||

| Expiration: September, 2020, Exercise Price: $135.00 |

(40 | ) | (662,200 | ) | (520 | ) | ||||||

| JPMorgan Chase & Co. |

||||||||||||

| Expiration: September, 2020, Exercise |

(57 | ) | (571,083 | ) | (1,140 | ) | ||||||

The accompanying notes are an integral part of these financial statements.

34

Snow Capital Long/Short Opportunity Fund

Schedule of Options Written (Continued)

August 31, 2020 (Unaudited)

| Contracts | Notional Value |

Value | ||||||||||

| Kohl’s Corp. |

|

|||||||||||

| Expiration: January, 2021, Exercise |

(230 | ) | $ | (491,280 | ) | $ | (43,930 | ) | ||||

| Laboratory Corp. of America Holdings |

||||||||||||

| Expiration: February, 2021, Exercise Price: $160.00 |

(25 | ) | (439,375 | ) | (25,750 | ) | ||||||

| NetApp, Inc. |

||||||||||||

| Expiration: March, 2021, Exercise Price: $40.00 |

(101 | ) | (478,639 | ) | (33,835 | ) | ||||||

| Skechers USA, Inc. |

||||||||||||

| Expiration: October, 2020, Exercise |

(168 | ) | (501,480 | ) | (5,040 | ) | ||||||

| Suncor Energy, Inc. |

|

|||||||||||

| Expiration: September, 2020, Exercise |

(270 | ) | (432,810 | ) | (7,020 | ) | ||||||

| The Goldman Sachs Group, Inc. |

|

|||||||||||

| Expiration: January, 2021, Exercise |

(25 | ) | (512,175 | ) | (11,250 | ) | ||||||

| Tyson Foods, Inc. - Class A |

||||||||||||

| Expiration: October, 2020, Exercise |

(88 | ) | (552,640 | ) | (6,160 | ) | ||||||

| Valero Energy Corp. |

||||||||||||

| Expiration: September, 2020, Exercise |

(82 | ) | (431,238 | ) | (27,470 | ) | ||||||

| Zimmer Biomet Holdings, Inc. |

||||||||||||

| Expiration: September, 2020, Exercise |

(43 | ) | (605,784 | ) | (2,451 | ) | ||||||

| Expiration: December, 2020, Exercise |

(40 | ) | (563,520 | ) | (5,160 | ) | ||||||

|

|

|

|||||||||||

| (217,740 | ) | |||||||||||

|

|

|

|||||||||||

| Total Options Written |

$ | (847,522 | ) | |||||||||

|

|

|

|||||||||||

The accompanying notes are an integral part of these financial statements.

35

Snow Capital Family of Funds

Statements of Assets and Liabilities

August 31, 2020 (Unaudited)

| Snow Capital Small Cap Value Fund |

Snow Capital Long/Short Opportunity Fund |

|||||||

| ASSETS |

||||||||

| Investments, at value: (Cost $12,686,794 and $83,202,447, respectively) |

$ | 11,979,510 | $ | 81,338,569 | ||||

| Dividends and interest receivable |

7,884 | 275,672 | ||||||

| Receivable from Adviser |

21,438 | — | ||||||

| Deposits at Broker |

— | 16,403,243 | ||||||

| Other assets |

15,427 | 23,602 | ||||||

|

|

|

|

|

|||||

| TOTAL ASSETS |

12,024,259 | 98,041,086 | ||||||

|

|

|

|

|

|||||

|

|

||||||||

| LIABILITIES |

||||||||

| Short securities, at value (premiums received of $0 and |

— | 14,048,847 | ||||||

| Written options, at value (premiums received of $0 and |

— | 847,522 | ||||||

| Payable for dividends on short positions |

— | 14,362 | ||||||

| Payable for investments purchased |

— | 2,196,363 | ||||||

| Payable for Fund shares redeemed |

9,003 | 233,288 | ||||||

| Payable to affiliates |

26,021 | 48,413 | ||||||

| Payable to Adviser |

— | 51,367 | ||||||

| Payable for distribution fees |

804 | 33,190 | ||||||

| Payable for shareholder servicing fees |

1,463 | 17,729 | ||||||

| Accrued expenses and other liabilities |

33,239 | 41,331 | ||||||

|

|

|

|

|

|||||

| TOTAL LIABILITIES |

70,530 | 17,532,412 | ||||||

|

|

|

|

|

|||||

| NET ASSETS |

$ | 11,953,729 | $ | 80,508,674 | ||||

|

|

|

|

|

|||||

|

|

||||||||

| Net assets consist of: |

||||||||

| Paid-in Capital |

$ | 20,813,114 | $ | 87,636,507 | ||||

| Accumulated deficit |

(8,859,385 | ) | (7,127,833 | ) | ||||

|

|

|

|

|

|||||

| NET ASSETS |

$ | 11,953,729 | $ | 80,508,674 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

36

Snow Capital Family of Funds

Statements of Assets and Liabilities (Continued)

August 31, 2020 (Unaudited)

| COMPUTATION OF NET ASSET VALUE |

Snow Capital Small Cap Value Fund |

Snow Capital Long/Short Opportunity Fund |

||||||

| CLASS A SHARES |

||||||||

| Net assets |

$ | 5,817,650 | $ | 37,548,459 | ||||

| Shares of beneficial interest outstanding (unlimited shares authorized, $0.001 par value) |

211,227 | 1,548,290 | ||||||

| Net asset value, redemption price and offering price per share |

$ | 27.54 | $ | 24.25 | ||||

| Maximum offering price per share (Net asset value per share |

$ | 29.07 | $ | 25.60 | ||||

|

|

||||||||

| CLASS C SHARES |

||||||||

| Net assets |

$ | 1,446,677 | $ | 6,096,197 | ||||

| Shares of beneficial interest outstanding (unlimited shares authorized, $0.001 par value) |

56,819 | 268,941 | ||||||

| Net asset value, redemption price and offering price per share(1) (3) |

$ | 25.46 | $ | 22.67 | ||||

|

|

||||||||

| INSTITUTIONAL CLASS SHARES |

|

|||||||

| Net assets |

$ | 4,689,402 | $ | 36,864,018 | ||||

| Shares of beneficial interest outstanding (unlimited shares authorized, $0.001 par value) |

165,886 | 1,503,010 | ||||||

| Net asset value, redemption price and offering price per share |

$ | 28.27 | $ | 24.53 | ||||

| (1) | If applicable, redemption price per share may be reduced by a 0.50% redemption fee for shares redeemed within thirty days of purchase. |

| (2) | A contingent deferred sales charge (“CDSC”) of 0.50% may be charged on Class A share purchases of $1,000,000 or more that are redeemed within twelve months of purchase and a CDSC of 1.00% may be charged on Class C shares redeemed within twelve months of purchase. |

| (3) | Reflects a maximum sales charge of 5.25%. |

The accompanying notes are an integral part of these financial statements.

37

Snow Capital Family of Funds

For the Six Months Ended August 31, 2020 (Unaudited)

| Snow Capital Small Cap Value Fund |

Snow Capital Long/Short Opportunity Fund |

|||||||

| INVESTMENT INCOME |

||||||||

| Dividend income |

$ | 117,545 | $ | 1,274,169 | ||||

| Interest income |

149 | 19,678 | ||||||

|

|

|

|

|

|||||

| TOTAL INVESTMENT INCOME |

117,694 | 1,293,847 | ||||||

|

|

|

|

|

|||||

| EXPENSES |

||||||||

| Administration fees |

60,925 | 81,214 | ||||||

| Management fees |

56,113 | 332,520 | ||||||

| Transfer agent fees and expenses |

32,489 | 47,612 | ||||||

| Federal and state registration fees |

21,902 | 22,537 | ||||||

| Audit and tax fees |

17,397 | 18,780 | ||||||

| Legal fees |

7,746 | 14,091 | ||||||

| Distribution fees - Class C |

7,033 | 27,869 | ||||||

| Distribution fees - Class A |

6,316 | 47,528 | ||||||

| Chief Compliance Officer fees and expenses |

6,256 | 6,256 | ||||||

| Trustees’ fees and expenses |

5,799 | 5,799 | ||||||

| Custody fees |

4,719 | 7,425 | ||||||

| Reports to shareholders |

2,463 | 13,705 | ||||||

| Shareholder servicing fees - Class C |

2,344 | 9,290 | ||||||

| Accounting expense |

1,193 | 2,202 | ||||||

| Insurance expense |

920 | 920 | ||||||

| Broker fees |

— | 57,077 | ||||||

| Dividends on short positions |

— | 166,541 | ||||||

| Other expenses |

2,291 | 2,653 | ||||||

|

|

|

|

|

|||||

| TOTAL EXPENSES |

235,906 | 864,019 | ||||||

|

|

|

|

|

|||||

| Less waivers and reimbursements by Adviser (Note 4) |

(146,380 | ) | (17,466 | ) | ||||

|

|

|

|

|

|||||

| NET EXPENSES |

89,526 | 846,553 | ||||||

|

|

|

|

|

|||||

| NET INVESTMENT INCOME |

28,168 | 447,294 | ||||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

38

Snow Capital Family of Funds

Statements of Operations (Continued)

For the Six Months Ended August 31, 2020 (Unaudited)

| Snow Capital Small Cap Value Fund |

Snow Capital Long/Short Opportunity Fund |

|||||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS |

||||||||

| Net realized gain (loss) on: |

||||||||

| Investments |

$ | (4,237,626 | ) | $ | (6,586,579 | ) | ||

| Securities sold short |

— | 926,428 | ||||||

| Purchased options |

— | 323,765 | ||||||

| Written options |

— | 785,207 | ||||||

| Net change in unrealized appreciation (depreciation) on: |

||||||||

| Investments |

2,075,005 | (1,237,309 | ) | |||||

| Securities sold short |

— | (2,036,416 | ) | |||||

| Purchased options |

— | (353,226 | ) | |||||

| Written options |

— | 353,619 | ||||||

| Foreign currency translation |

— | 144 | ||||||

|

|

|

|

|

|||||

| NET REALIZED AND UNREALIZED LOSS |

(2,162,621 | ) | (7,824,367 | ) | ||||

|

|

|

|

|

|||||

| NET DECREASE IN NET ASSETS FROM OPERATIONS |

$ | (2,134,453 | ) | $ | (7,377,073 | ) | ||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

39

Snow Capital Family of Funds

Snow Capital Small Cap Value Fund

Statements of Changes in Net Assets

| Six Months Ended August 31, 2020 (Unaudited) |

Year Ended February 29, 2020 |

|||||||

| FROM OPERATIONS |

||||||||

| Net investment income |

$ | 28,168 | $ | 7,932 | ||||

| Net realized loss on: |

||||||||

| Investments |

(4,237,626 | ) | (2,780,526 | ) | ||||

| Net change in unrealized appreciation (depreciation) Investments |

2,075,005 | (1,625,480 | ) | |||||

|

|

|

|

|

|||||

| Decrease in Net Assets from Operations |

(2,134,453 | ) | (4,398,074 | ) | ||||

|

|

|

|

|

|||||

| FROM CAPITAL SHARE TRANSACTIONS |

||||||||

| Proceeds from shares sold - Class A |

577,131 | 579,612 | ||||||

| Proceeds from shares sold - Class C |

5,937 | 118,051 | ||||||

| Proceeds from shares sold - Institutional Class |

192,526 | 1,979,250 | ||||||

| Payments for shares redeemed - Class A |

(3,207,088 | ) | (1,411,323 | ) | ||||

| Payments for shares redeemed - Class C |

(1,177,794 | ) | (1,106,761 | ) | ||||

| Payments for shares redeemed - Institutional Class(1) |

(2,747,929 | ) | (7,395,345 | ) | ||||

|

|

|

|

|

|||||

| Net Decrease from capital share transactions |

(6,357,217 | ) | (7,236,516 | ) | ||||

|

|

|

|

|

|||||

| TOTAL DECREASE IN NET ASSETS |

(8,491,670 | ) | (11,634,590 | ) | ||||

| NET ASSETS |

||||||||

| Beginning of Period |

$ | 20,445,399 | $ | 32,079,989 | ||||

|

|

|

|

|

|||||

| End of Period |

$ | 11,953,729 | $ | 20,445,399 | ||||

|

|

|

|

|

|||||

| (1) | Net of redemption fees of $1 and $105 for the six months ended August 31, 2020 and the year ended February 29, 2020, respectively. |

The accompanying notes are an integral part of these financial statements.

40

Snow Capital Family of Funds

Snow Capital Long/Short Opportunity Fund

Statements of Changes in Net Assets

| Six Months Ended August 31, 2020 (Unaudited) |

Year Ended February 29, 2020 |

|||||||

| FROM OPERATIONS |

||||||||

| Net investment income |

$ | 447,294 | $ | 1,339,307 | ||||

| Net realized gain (loss) on: |

||||||||

| Investments |

(6,586,579 | ) | 3,901,880 | |||||

| Securities sold short |

926,428 | (2,743,121 | ) | |||||

| Purchased options |

323,765 | (172,629 | ) | |||||

| Written options |

785,207 | 1,510,009 | ||||||

| Net change in unrealized appreciation (depreciation) |

||||||||

| Investments |

(1,237,309 | ) | (5,803,715 | ) | ||||

| Securities sold short |

(2,036,416 | ) | 1,758,572 | |||||

| Purchased options |

(353,226 | ) | 276,525 | |||||

| Written options |

353,619 | (661,335 | ) | |||||

| Foreign currency translation |

144 | — | ||||||

|

|

|

|

|

|||||

| Decrease in Net Assets from Operations |

(7,377,073 | ) | (594,507 | ) | ||||

|

|

|

|

|

|||||

| FROM DISTRIBUTIONS |

||||||||

| Net investment income - Class A |

— | (982,205 | ) | |||||

| Net investment income - Class C |

— | (61,228 | ) | |||||

| Net investment income - Institutional Class |

— | (987,581 | ) | |||||

|

|

|

|

|

|||||

| Net decrease in net assets resulting from distributions paid |

— | (2,031,014 | ) | |||||

|

|

|

|

|

|||||

| FROM CAPITAL SHARE TRANSACTIONS |

||||||||

| Proceeds from shares sold - Class A |

1,364,247 | 2,239,996 | ||||||

| Proceeds from shares sold - Class C |

1,200 | 70,625 | ||||||

| Proceeds from shares sold - Institutional Class |

250,279 | 1,927,779 | ||||||

| Net asset value of shares issued to shareholders in payment of distributions declared - Class A |

— | 179,072 | ||||||

| Net asset value of shares issued to shareholders in payment of distributions declared - Class C |

— | 46,095 | ||||||

| Net asset value of shares issued to shareholders in payment of distributions declared - Institutional Class |

— | 816,091 | ||||||