Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 629-8104

Registrant’s telephone number, including area code

Date of fiscal year end: December 31, 2019

Date of reporting period: June 30, 2019

Table of Contents

| Item 1. | Reports to Stockholders. |

Table of Contents

Marketfield Fund

Semi-Annual Report

June 30, 2019

Investment Adviser

Marketfield Asset Management LLC

60 East 42nd Street

36th Floor

New York, New York 10165

www.marketfield.com

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary or, if you are a direct investor, by calling the Fund at 1-800-311-MKTD (6583).

You may elect to receive all future reports in paper free of charge. To request that you continue to receive paper copies of your shareholder reports, you can contact your financial intermediary if you invest through the financial intermediary, or if you invest directly with the Fund, you can call the Fund at 1-800-311-MKTD (6583). Your election to receive reports in paper form will apply to all funds held in your account with your financial intermediary.

Table of Contents

| 1 | ||||

| 6 | ||||

| 8 | ||||

| 11 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 24 | ||||

| 36 | ||||

| 37 | ||||

Table of Contents

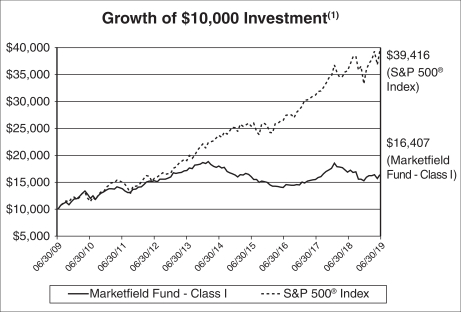

The Class I shares of the Marketfield Fund (the “Fund”) generated a return of 7.60% in the first half of 2019 compared to a 18.54% return by the S&P 500® Index. We believe the U.S./China trade dispute was by far the greatest influence on portfolio performance over the period.

There was little variety across our various exposures with most contributing either small profits or losses towards the overall results. Homebuilding did continue its recovery from 2018 losses and continues to be a core focus for our U.S. exposure. Japan also did somewhat better than during the first quarter, mostly a reflection of single stock exposure within the portfolio.

The performance of commodity related exposure was mixed. The small Energy exposure continues to perform poorly even though oil prices were steady over the six-month period, and although the overall loss was not significant, we have yet to see any reason to engage further with this sector despite a relatively benign pricing environment for crude oil. There were some signs of life in gold, palladium, and iron ore, with stronger metal pricing feeding into the underlying equities and delivering strong gains. Thus, although we are not in a traditional reflationary environment, there are increasing pockets of strength within the commodity complex.

Our large emerging market exposure contributed a small gain, outperforming most broad emerging market indexes which showed a small loss for the six-month period. Within our portfolio, exposure to Russia, Brazil, and Taiwan were the strongest regions, with Chile, Korea and Mainland China were the weakest. Most of the above variances can be linked to sentiment over the trade dispute and the shift in investor flows that dominated the quarter.

On the short side of our portfolio, the NASDAQ 100 hedge hurt performance overall but did decline sharply during the May drawdown. Real Estate shorts contributed a small profit over the six-month period, with gains from office REITs more than covering losses in residential REITs.

Overall, the portfolio remains positioned towards a resumption of global growth that we anticipate will be helped by the considerable easing of global monetary policy and significant decline in global sovereign and credit yields. As we discuss below, although the latter has been viewed as evidence of a slowing global economy, it often leads to a pickup in performance of both data and economically sensitive sectors.

July 11, 2019

Michael Shaoul

Chairman, CEO & Portfolio Manager

Chief Investment Officer’s Report

Recent strength in bond markets is widely cited as a harbinger of impending economic weakness and a rationale for a turn back to easing by the Federal Reserve.

The idea that trends in bond prices carry some special prognostic signal about future economic conditions has gained traction in recent years.

The facts suggest otherwise. Energetic rallies in high-grade bonds (declines in yield) have occurred in the aftermath of weak financial conditions. Bonds had sharp rallies in 1971, 1976, 1980 and 1986, just prior to sharp accelerations in nominal Gross Domestic Product (GDP) and inflation.

1

Table of Contents

Bond market rallies in the 1990s in response to the Mexican financial crisis of 1994-95, the Asian currency crises of 1997-98 and the subsequent demise of Long Term Capital Management in 1998 all occurred on the cusp of accelerations in the economy and equity markets.

During the past two decades, bond yields plunged in the wake of the 2008 global panic and again in 2015-16 following the collapse in oil prices. Both instances set the stage for strong recoveries in activity and risk markets.

The ability of changes in borrowing costs to powerfully influence future economic conditions is often overlooked in citations of bond yields and interest rates as leading economic indicators. Dramatic rises or falls in interest rates across the yield curve produce important, if not determinative, changes in business conditions among sectors that are meaningfully affected by borrowing and refinancing costs.

Interest rate sensitivity in various portions of the overall economy changes from one cycle to the next, resulting in very different points of response to large moves in bond and money markets.

Rising rates in 1984 destroyed the Savings and Loan (S&L) industry and set in motion the final washout in energy markets and activity. Tightening in at the turn of the millennium undermined the entire technology and internet craze, while the subsequent easing set the housing boom in motion and reignited interest in emerging markets.

Price cycles in particular sectors or themes that develop reinforcing credit dynamics act as focal points of risk once interest rate and credit conditions become less accommodative. When margin lending dominated bank credit growth in the late 1920s, stocks were the beneficiaries in the expansion phase and the epicenter of risk once the credit cycle turned. The ensuing calamity metastasized through the banking system, ushering in an economic depression, deflation and a litany of regulation meant to prevent another credit cycle focused on heavily margined public equities.

Trends in government bond prices and other high-grade rates do not predict outcomes in the real economy as much as provoke them. Falling market rates in the absence of crisis do not indicate impending weakness, but do set the stage for more robust activity in parts of the economy that are sensitive to borrowing costs. By contrast, when market rates rise over the course of several quarters, depressive effects will emerge in sectors that have relied on supportive financing conditions.

In the post 2009 monetary cycle, abundant, cheap credit has been a crucial driver of large-scale asset price inflation. Luxury properties, art, equities and private venture capital-backed businesses have been prime beneficiaries. Prices have expanded to unprecedented heights across a far-reaching landscape of investable media.

Little of this shows forth in traditional inflation indices, but consumption goods have, at best, a tertiary sensitivity to monetary conditions. Central banks directly influence asset prices, which, oddly enough, are ignored in their calculations of inflation.

When credit-propelled asset inflations suffer their inevitable reversals, the ensuing deflation can undermine financial stability across capital markets and the banking system without registering any deflationary pressures on the measures that the Federal Reserve relies on to warn of impending deflation. This was the dynamic in 2008.

Credit expansions are built on collateral. Consumption goods are, in large part, insufficiently long-lived to serve as collateral for loans with durations beyond those found in money markets instruments. Credit expansions past the very front of the yield curve rely on long duration assets for collateral backing. Inflationary effects on favored collateral forms occur in a world apart from the main constituents of the indices that measure consumer prices.

2

Table of Contents

Current deflationary risks are concentrated in assets that have enjoyed the monetary inflation of the past decade. As mentioned above, these include luxury property, art, financial assets and start-up businesses backed by venture capital investors. Most of these markets have reached a point at which supply is functionally limitless. Prices are either stagnant or in the early stages of decline.

Deflation in any or all of these sectors will begin to close the gap in relative wealth that has dominated political discourse during the past decade. In that sense, there will be little popular pressure for rescue efforts by official bodies.

As deflation in “elite” asset markets takes hold, goods and services in the real economy look poised for an extensive cycle of absolute and relative expansion.

Every major geopolitical trend is, at present, supportive of inflation in the real economy.

With nominal GDP running at its fastest annual rate of change (5.1%) since the panic of 2008, the Federal Reserve seems intent upon loosening. At the very least they have abandoned the recent tightening bias.

High yield spreads are at the low end of long-term ranges. Flows are strong and high yield financing is widely accessible.

Trade policy in the U.S. is clearly intent on reducing or eliminating supplies of inexpensive imports that compete with more costly domestic production. Immigration as a method of satisfying demand for lower cost service and manual labor has effectively ended, just as domestic labor supplies are exhausted. Shortages are becoming more widespread, and substantial, long-term labor cost inflation is in the cards.

Political restrictions on energy infrastructure and mandated shifts to wind and solar power generation guarantee that residential energy costs will rise considerably over the intermediate term. The effect will be more severe should there be a meaningful disruption of global energy supplies.

Dollar strength has been a crucial factor suppressing inflation in the real economy. Although exchange rates are not officially with the Federal Reserve’s remit, they are well aware that relative variance in monetary policies among major central banks exerts tremendous influence in currency markets. With the President loudly decrying the relative strength of the dollar, the message is doubtlessly clear at the Federal Reserve and in the Treasury Department, the latter of which does have direct responsibility for foreign exchange policy.

With traditional inflation on the horizon, the question of the bond markets arises once more. What special insights does it reflect, and what do its trends foretell?

Not many and not much is the simple answer.

Demand for high-grade bond duration reflects a variety of structural and technical factors that are reactive rather than anticipatory. European investors have been driven out of shorter duration paper by negative deposit and money market rates among highly rated issuers. Managers of enormous pension schemes are focused on liability matching, which requires large allocations to long duration, top quality bonds. Germany is running a fiscal surplus, eliminating an important source of bond supply. Mortgage refinancing in the U.S. has forced a scramble to replace duration lost in pre-paid instruments.

Growing concerns about global economic prospects and the risks of all-out trade conflict has prompted incremental demand for fixed income. That allocation shift has been paralleled by inflows to low volatility, defensive and higher yielding equities, at the expense of more cyclical stocks.

3

Table of Contents

None of these flows are Delphic in their grasp of the future. Money managers receive funds and put them to work in the clearly defined areas to which they are assigned. Bond fund managers buy bonds when flows are positive. If their product is defined as investment grade, they focus their buying there. If they are charged with managing high-yield bonds, those are the instruments that will benefit when they see inflows. The amount of broad discretion to make important allocation shifts among asset types is a minuscule portion of the overall investment business.

Very few people are charged with the task of assessing broad, macroeconomic conditions and altering existing allocation parameters based on their judgment.

Major shifts away from bonds, equities or any subsets thereof take place after a long period of disappointing performance. That is what creates prolonged bottoming processes after unnerving declines. Foresight has little to do with it.

To the extent that equities were traditional harbingers of future fundamental developments, real privileged (now illegal) information was at the heart of the effect. Corporate officers and their advisors were free with actual, firsthand details of how companies were faring long before any formal, public announcements were available. The discipline of technical analysis grew around attempts to identify robust patterns of buying and selling among larger investors who, presumably, were privy to real-time information about company affairs.

Comparable inside facts with the power to move bond markets was and is extremely scarce. Direct knowledge of planned central bank moves before they are made public might have been one avenue within the broad category of early (i.e., illegal) access to government data releases.

At the moment, flows away from traditional savings instruments continue to support a wide range of investment markets. Their absolute and relative performances hold few, if any, insights into prospects for the real economy.

Benign financing conditions continue to support consumer and business activity. Disruptions produced by changes in trade flows and tariffs will, if anything, add to the likelihood of inflationary pressures in certain sectors of the global economy.

We have positioned the portfolio to attempt to benefit under conditions of rising nominal growth and inflation. About half of the assets are invested outside of the dollar sphere. To date, this posture has weighed on our results.

In recent weeks, we have seen the beginnings of stability and recovery in sectors that have suffered in the face of concerns about trade and global economic activity. Rhetorical changes from central bankers have supported our sense that global policy tendencies should remain accommodative long past the point of acceleration in nominal activity and prices.

July 11, 2019

Michael C. Aronstein

President, CIO & Portfolio Manager

The foregoing represents the opinions of the Chairman, CEO & Portfolio Manager and of the President, CIO & Portfolio Manager, respectively, and are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

4

Table of Contents

Definitions:

The S&P 500® Index is a trademark of McGraw Hill Financial Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. The securities holdings and volatility of the Fund differ significantly from the stocks that make up the S&P 500® Index. An investment cannot be made directly into an index.

The NASDAQ 100 Index is a market capitalization weighted index made up of the 100 largest companies listed on the Nasdaq group exchanges.

Duration measures how long it takes, in years, for an investor to be repaid the bond’s price by the bond’s total cash flows.

“Investment grade” refers to bonds that carry low to medium credit risk.

Past performance does not guarantee future results.

The Marketfield Fund is managed by Marketfield Asset Management LLC (the “Adviser”) and distributed by Quasar Distributors, LLC.

Must be preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. Before considering an investment in the Fund, you should understand that you could lose money.

The Fund regularly makes short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may also use options and futures contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates, and currency exchange rates. However, a mutual fund investor’s risk is limited to the amount invested in a fund. Investments in absolute return strategies are not intended to outperform stocks and bonds during strong market rallies. Investments in exchange-traded funds are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact the fund’s ability to sell its shares.

Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks. These risks may be greater for emerging markets. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. Investing in mid-cap stocks may carry more risk than investing in stocks of larger, more well-established companies. This risk is usually greater for longer- term debt securities. Investment by the Fund in lower rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in asset-backed and mortgage-backed securities involve additional risks such as credit risk, prepayment risk, possible illiquidity and default, and increased susceptibility to adverse economic developments. Investing in the Fund involves the risk that the macroeconomic trends identified by portfolio management will not come to fruition and their advantageous duration may not last as long as portfolio management forecasts. The Fund may invest in derivatives, which may increase the volatility of the Fund’s NAV and may result in a loss to the Fund.

5

Table of Contents

MARKETFIELD FUND

(Unaudited)

| Example |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (as applicable), and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from January 1, 2019 to June 30, 2019.

This example illustrates the Fund’s ongoing costs in two ways:

| Actual | Expenses |

The first lines of the following tables provide information about actual account values and actual expenses. If you purchase Class A shares of the Fund you will pay an initial sales charge of up to 5.50% when you invest. A contingent deferred sales charge (“CDSC”) may be imposed on certain redemptions of Class A shares redeemed within twelve months of purchase. Class C shares are subject to a CDSC of 1.00% for shares redeemed within twelve months of purchase. In addition, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. IRA accounts will be charged a $15.00 annual maintenance fee. To the extent the Fund invests in shares of exchange-traded funds or other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example. The example includes, but is not limited to, management fees, fund administration and accounting, custody and transfer agent fees. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the fourth column under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| Hypothetical | Example for Comparison Purposes |

The second lines of the tables below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second lines of the tables are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

6

Table of Contents

MARKETFIELD FUND

Expense Example (continued)

(Unaudited)

| Class A |

||||||||||||

| Beginning Account Value January 1, 2019 |

Ending Account Value June 30, 2019 |

Expenses Paid During Period January 1, 2019 - June 30, 2019* |

||||||||||

| Actual |

$ | 1,000.00 | $ | 1,074.40 | $ | 13.53 | ||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,011.75 | $ | 13.12 | ||||||

| * | Expenses are equal to the Class A shares’ annualized expense ratio of 2.63%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| Class C |

||||||||||||

| Beginning Account Value January 1, 2019 |

Ending Account Value June 30, 2019 |

Expenses Paid During Period January 1, 2019 - June 30, 2019* |

||||||||||

| Actual |

$ | 1,000.00 | $ | 1,070.30 | $ | 17.45 | ||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,007.93 | $ | 16.93 | ||||||

| * | Expenses are equal to the Class C shares’ annualized expense ratio of 3.40%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| Class I |

||||||||||||

| Beginning Account Value January 1, 2019 |

Ending Account Value June 30, 2019 |

Expenses Paid During Period January 1, 2019 - June 30, 2019* |

||||||||||

| Actual |

$ | 1,000.00 | $ | 1,076.00 | $ | 12.20 | ||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,013.04 | $ | 11.83 | ||||||

| * | Expenses are equal to the Class I shares’ annualized expense ratio of 2.37%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| Class R6 |

||||||||||||

| Beginning Account Value January 1, 2019 |

Ending Account Value June 30, 2019 |

Expenses Paid During Period January 1, 2019 - June 30, 2019* |

||||||||||

| Actual |

$ | 1,000.00 | $ | 1,076.70 | $ | 11.74 | ||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,013.49 | $ | 11.38 | ||||||

| * | Expenses are equal to the Class R6 shares’ annualized expense ratio of 2.28%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

7

Table of Contents

MARKETFIELD FUND

(Unaudited)

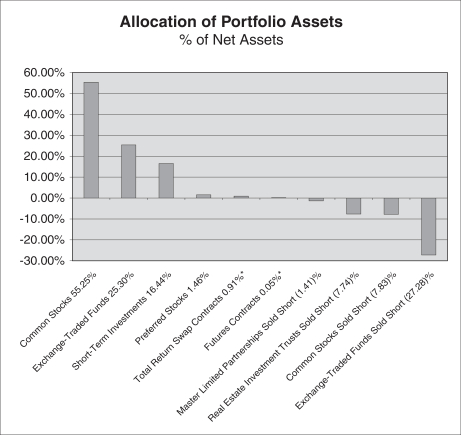

The investment objective of the Fund is capital appreciation. The Fund seeks to achieve its investment objective by allocating the Fund’s assets among investments in equity securities, fixed-income securities, and other investment companies, including exchange-traded funds (“ETFs”), in proportions consistent with Marketfield Asset Management LLC’s (the “Adviser”) evaluation of their expected risks and returns. In making these allocations, the Adviser considers various factors, including macroeconomic conditions, corporate earnings at a macroeconomic level, anticipated inflation and interest rates, consumer risk and the Adviser’s perception of the outlook of the capital markets as a whole. The Adviser may allocate the Fund’s investments between equity securities and fixed-income securities at its discretion, without limitation. The Fund’s allocation of portfolio assets as of June 30, 2019 is shown below.

| * | Valued at the net unrealized appreciation (depreciation). |

8

Table of Contents

MARKETFIELD FUND

Investment Highlights (continued)

(Unaudited)

Average Annual Total Returns as of June 30, 2019

| Class |

Sales Charge |

1 Year |

5 Years |

10 Years |

Since Inception (7/31/2007) |

|||||||||||||||

| Class A(1) |

Maximum 5.5% Initial Sales Charge | With sales charge | -8.40 | % | -3.18 | % | 4.24 | % | 3.50 | % | ||||||||||

| Excluding sales charge |

-3.08 | % | -2.07 | % | 4.83 | % | 3.99 | % | ||||||||||||

| Class C(1) |

Maximum 1% CDSC if Redeemed | With sales charge | -4.81 | % | -2.84 | % | 4.03 | % | 3.20 | % | ||||||||||

| within One Year of Purchase | Excluding sales charge | -3.85 | % | -2.84 | % | 4.03 | % | 3.20 | % | |||||||||||

| Class I(2) |

No Sales Charge | -2.86 | % | -1.85 | % | 5.08 | % | 4.24 | % | |||||||||||

| Class R6(3) |

No Sales Charge | -2.67 | % | -1.70 | % | 5.17 | % | 4.31 | % | |||||||||||

| S&P 500® Index |

10.42 | % | 10.71 | % | 14.70 | % | 8.37 | % | ||||||||||||

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (800) 311-MKTD (6583).

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graph illustrates performance of a hypothetical investment made in the Fund and certain broad-based securities indices on the Fund’s inception date. The graph does not reflect any future performance.

The S&P 500® Index is a broad-based measurement of changes in stock market conditions based on a capitalization-weighted average of 500 leading companies representing all major industries in the U.S. economy. It is not possible to invest directly in an index.

| (1) | Performance figures for Class A and Class C shares, first offered on October 5, 2012, include the historical performance of Class I shares through October 4, 2012 and are adjusted to reflect differences in fees and expenses. Performance data for the classes varies based on differences in their fee and expense structures. The Fund commenced operations on July 31, 2007. Unadjusted, the performance for the newer classes would likely have been different. |

| (2) | Performance figures for Class I shares prior to April 8, 2016 reflect the historical performance of the then-existing shares of the MainStay Marketfield Fund, a series of MainStay Funds Trust (the predecessor to the Fund, which was subject to a different fee structure, and for which the Adviser served as the investment sub-adviser) for periods from October 5, 2012 to April 8, 2016. The performance figures also reflect the historical performance of the then-existing shares of the predecessor fund to the MainStay Marketfield Fund (which was subject to a different fee structure, and for which a predecessor entity to the Adviser served as the investment adviser) for periods prior to October 5, 2012. |

| (3) | Performance figures for Class R6 shares, first offered on June 17, 2013, include the historical performance of Class I shares through June 16, 2013. Performance for Class R6 shares would likely have been different because of differences in certain expenses attributable to each share class. |

9

Table of Contents

MARKETFIELD FUND

Investment Highlights (continued)

(Unaudited)

| (1) | The minimum investment for Class I shares is $25,000 for individual investors. There is no minimum investment for Class I shares for institutional investors. The minimum investment for Class C shares is $2,500. The minimum investment for Class A shares is $2,500. The minimum investment for Class R6 shares is $250,000. |

10

Table of Contents

MARKETFIELD FUND

June 30, 2019 (Unaudited)

| Shares |

Value |

|||||||

| COMMON STOCKS — 55.25% | ||||||||

| Auto Components — 0.31% | ||||||||

| Continental AG(a) |

4,524 | $ | 659,595 | |||||

| Building Products — 1.01% | ||||||||

| TOTO Ltd.(a) |

54,686 | 2,158,224 | ||||||

| Chemicals — 2.67% | ||||||||

| Nutrien Ltd.(a) |

54,404 | 2,908,438 | ||||||

| The Sherwin-Williams Co.(b) |

6,165 | 2,825,358 | ||||||

| 5,733,796 | ||||||||

| Electrical Equipment — 1.23% | ||||||||

| Rockwell Automation, Inc. |

16,062 | 2,631,437 | ||||||

| Electronic Equipment, Instruments & Components — 2.48% | ||||||||

| Keyence Corp.(a) |

8,662 | 5,312,972 | ||||||

| Food & Staples Retailing — 3.00% | ||||||||

| Costco Wholesale Corp. |

24,340 | 6,432,088 | ||||||

| Health Care Equipment & Supplies — 2.19% | ||||||||

| Intuitive Surgical, Inc.(c) |

8,958 | 4,698,919 | ||||||

| Hotels, Restaurants & Leisure — 0.81% | ||||||||

| Dalata Hotel Group PLC(a) |

323,936 | 1,733,076 | ||||||

| Household Durables — 8.87% | ||||||||

| DR Horton, Inc.(b) |

131,471 | 5,670,344 | ||||||

| Lennar Corp. — Class A |

62,039 | 3,006,410 | ||||||

| PulteGroup, Inc. |

161,197 | 5,097,049 | ||||||

| Sony Corp. — ADR(b) |

100,053 | 5,241,777 | ||||||

| 19,015,580 | ||||||||

| Industrial Conglomerates — 2.03% | ||||||||

| Honeywell International, Inc. |

18,384 | 3,209,662 | ||||||

| Siemens AG(a) |

9,580 | 1,139,452 | ||||||

| 4,349,114 | ||||||||

| Machinery — 5.08% | ||||||||

| Caterpillar, Inc.(b) |

25,490 | 3,474,032 | ||||||

| Cummins, Inc.(b) |

23,808 | 4,079,263 | ||||||

| Deere & Co.(b) |

20,187 | 3,345,188 | ||||||

| 10,898,483 | ||||||||

| Metals & Mining — 11.29% | ||||||||

| Barrick Gold Corp.(b) |

293,840 | 4,633,857 | ||||||

| BHP Group Ltd. — ADR |

89,722 | 5,213,745 | ||||||

| Cia de Minas Buenaventura SAA — ADR(b) |

157,512 | 2,625,725 | ||||||

| Grupo Mexico SAB de CV(a) |

1,112,826 | 2,963,864 | ||||||

| MMC Norilsk Nickel PJSC — ADR |

149,381 | 3,392,443 | ||||||

| Southern Copper Corp. |

75,349 | 2,927,309 | ||||||

| Vale SA — ADR |

181,007 | 2,432,734 | ||||||

| 24,189,677 | ||||||||

| Oil, Gas & Consumable Fuels — 1.15% | ||||||||

| Devon Energy Corp. |

86,308 | 2,461,504 | ||||||

The accompanying notes are an integral part of these financial statements.

11

Table of Contents

MARKETFIELD FUND

Schedule of Investments (continued)

June 30, 2019 (Unaudited)

| Shares |

Value |

|||||||

| Real Estate Management & Development — 1.22% | ||||||||

| Cresud SACIF y A — ADR(c) |

97,342 | $ | 1,020,144 | |||||

| The St. Joe Co.(c) |

92,771 | 1,603,083 | ||||||

| 2,623,227 | ||||||||

| Road & Rail — 5.36% | ||||||||

| Norfolk Southern Corp.(b) |

32,281 | 6,434,572 | ||||||

| Union Pacific Corp.(b) |

29,940 | 5,063,153 | ||||||

| 11,497,725 | ||||||||

| Semiconductors & Semiconductor Equipment — 1.42% | ||||||||

| Intel Corp. |

63,529 | 3,041,133 | ||||||

| Software — 2.67% | ||||||||

| Microsoft Corp.(b) |

27,965 | 3,746,191 | ||||||

| Splunk, Inc.(c) |

15,713 | 1,975,910 | ||||||

| 5,722,101 | ||||||||

| Specialty Retail — 2.46% | ||||||||

| Ross Stores, Inc. |

53,220 | 5,275,166 | ||||||

| TOTAL COMMON STOCKS (Cost $74,869,669) |

118,433,817 | |||||||

| PREFERRED STOCKS — 1.46% | ||||||||

| Banks — 1.46% | ||||||||

| Itau Unibanco Holding SA — ADR, 6.615% |

331,844 | 3,125,970 | ||||||

| TOTAL PREFERRED STOCKS (Cost $2,713,929) |

3,125,970 | |||||||

| EXCHANGE-TRADED FUNDS — 25.30% | ||||||||

| iShares MSCI Chile ETF |

68,873 | 2,814,151 | ||||||

| iShares MSCI Emerging Markets ETF(b) |

319,610 | 13,714,465 | ||||||

| iShares MSCI Malaysia ETF(b) |

142,455 | 4,235,187 | ||||||

| iShares MSCI South Korea ETF(b) |

178,090 | 10,662,248 | ||||||

| iShares MSCI Taiwan ETF(b) |

210,383 | 7,354,990 | ||||||

| iShares U.S. Home Construction ETF(b) |

168,994 | 6,458,951 | ||||||

| SPDR S&P Homebuilders ETF(b) |

87,402 | 3,642,915 | ||||||

| SPDR S&P Oil & Gas Exploration & Production ETF(b) |

93,267 | 2,541,526 | ||||||

| VanEck Vectors Russia ETF |

118,641 | 2,803,487 | ||||||

| TOTAL EXCHANGE-TRADED FUNDS (Cost $47,881,486) |

54,227,920 | |||||||

| SHORT-TERM INVESTMENTS — 16.44% | ||||||||

| Money Market Fund — 16.44% | ||||||||

| First American Government Obligations Fund, Class X, 2.285%(d) |

35,241,588 | 35,241,588 | ||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $35,241,588) | 35,241,588 | |||||||

| Total Investments (Cost $160,706,672) — 98.45% | 211,029,295 | |||||||

| Other Assets in Excess of Liabilities — 1.55% |

3,319,101 | |||||||

| TOTAL NET ASSETS — 100.00% | $ | 214,348,396 | ||||||

| (a) | Foreign issued security. |

| (b) | All or a portion of this security is pledged as collateral for securities sold short, swap contracts and future contracts with an aggregate fair value of $81,784,494. |

| (c) | Non-income producing security. |

| (d) | Seven day yield as of June 30, 2019. |

The accompanying notes are an integral part of these financial statements.

12

Table of Contents

MARKETFIELD FUND

Schedule of Investments (continued)

June 30, 2019 (Unaudited)

Abbreviations:

| ADR | American Depositary Receipt | |

| AG | Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e. owned by shareholders. | |

| Ltd. | Limited is a term indicating a company is incorporated and shareholders have limited liability. | |

| PLC | Public Limited Company is a publicly traded company which signifies that shareholders have limited liability. | |

| SA | An abbreciation used by many countries to signify a stock company whereby shareholders have limited liability. | |

| SAB de CV | Sociedad Anonima de Capital Variable is a Spanish term for an SA with variable capital. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

13

Table of Contents

MARKETFIELD FUND

Schedule of Securities Sold Short

June 30, 2019 (Unaudited)

| Shares |

Value |

|||||||

| SECURITIES SOLD SHORT — 44.26% | ||||||||

| COMMON STOCKS — 7.83% | ||||||||

| Banks — 0.86% | ||||||||

| Signature Bank/New York NY |

(15,264 | ) | $ | (1,844,502 | ) | |||

| Capital Markets — 2.70% | ||||||||

| Eaton Vance Corp. |

(25,049 | ) | (1,080,363 | ) | ||||

| Invesco Ltd.(a) |

(25,634 | ) | (524,472 | ) | ||||

| T Rowe Price Group, Inc. |

(7,937 | ) | (870,768 | ) | ||||

| The Goldman Sachs Group, Inc. |

(16,169 | ) | (3,308,178 | ) | ||||

| (5,783,781 | ) | |||||||

| IT Services — 1.95% | ||||||||

| International Business Machines Corp. |

(30,366 | ) | (4,187,471 | ) | ||||

| Wireless Telecommunication Services — 2.32% | ||||||||

| SoftBank Group Corp.(a) |

(103,600 | ) | (4,963,075 | ) | ||||

| TOTAL COMMON STOCKS (Proceeds $16,827,132) |

(16,778,829 | ) | ||||||

| EXCHANGE-TRADED FUNDS — 27.28% | ||||||||

| Consumer Staples Select Sector SPDR Fund |

(232,161 | ) | (13,481,589 | ) | ||||

| Invesco QQQ Trust Series 1 |

(209,891 | ) | (39,195,046 | ) | ||||

| Vanguard Real Estate ETF |

(66,403 | ) | (5,803,622 | ) | ||||

| TOTAL EXCHANGE-TRADED FUNDS (Proceeds $54,444,020) |

(58,480,257 | ) | ||||||

| MASTER LIMITED PARTNERSHIPS — 1.41% | ||||||||

| The Blackstone Group LP |

(67,859 | ) | (3,014,297 | ) | ||||

| TOTAL MASTER LIMITED PARTNERSHIPS (Proceeds $2,150,823) |

(3,014,297 | ) | ||||||

| REAL ESTATE INVESTMENT TRUSTS — 7.74% | ||||||||

| Apartment Investment & Management Co. |

(27,518 | ) | (1,379,202 | ) | ||||

| AvalonBay Communities, Inc. |

(8,417 | ) | (1,710,166 | ) | ||||

| Boston Properties, Inc. |

(26,901 | ) | (3,470,229 | ) | ||||

| Equity Residential |

(26,039 | ) | (1,976,881 | ) | ||||

| Essex Property Trust, Inc. |

(7,533 | ) | (2,199,109 | ) | ||||

| SL Green Realty Corp. |

(35,121 | ) | (2,822,675 | ) | ||||

| Vornado Realty Trust |

(47,336 | ) | (3,034,237 | ) | ||||

| TOTAL REAL ESTATE INVESTMENT TRUSTS (Proceeds $16,374,367) |

(16,592,499 | ) | ||||||

| Total Securities Sold Short (Proceeds $89,796,342) |

$ | (94,865,882 | ) | |||||

| (a) | Foreign issued security. |

The accompanying notes are an integral part of these financial statements.

14

Table of Contents

MARKETFIELD FUND

Schedule of Total Return Swaps(a)

June 30, 2019 (Unaudited)

| Counterparty |

Reference Entity(b) |

Termination Date |

Pay/Receive Total Return on Reference Entity |

Financing Rate |

Payment Frequency |

Notional Amount |

Unrealized Appreciation (Depreciation)(d) |

|||||||||||||||||||

| Long Total Return Swaps | ||||||||||||||||||||||||||

| Bank of America Merrill Lynch |

CSI300 Net Total Return Index |

10/09/2019 | Receive | 1.598 | %(c) | Monthly | $ | 10,594,677 | $ | 1,951,837 | ||||||||||||||||

| Total net unrealized appreciation on total return swaps |

|

$ | 1,951,837 | |||||||||||||||||||||||

| (a) | There were no upfront payments paid or received. |

| (b) | Foreign issued security. |

| (c) | Floating rate, adjusted monthly based on 1 month LIBOR -4.000%. |

| (d) | Based on the net swap value held at each counterparty, unrealized appreciation is a receivable and unrealized depreciation is a payable. Excludes any unrealized appreciation or depreciation of foreign currency. |

Schedule of Open Futures Contracts

June 30, 2019 (Unaudited)

| Number of Contracts |

Expiration Month |

Notional Amount |

Unrealized Appreciation (Depreciation) |

|||||||||||||

| FUTURE CONTRACTS PURCHASED | ||||||||||||||||

| Yen Denominated Nikkei 225 Index Future |

121 | September 2019 | $ | 11,955,224 | $ | 97,740 | ||||||||||

| TOTAL FUTURES CONTRACTS PURCHASED |

|

$ | 97,740 | |||||||||||||

The accompanying notes are an integral part of these financial statements.

15

Table of Contents

MARKETFIELD FUND

| Statement of Assets & Liabilities | ||

| June 30, 2019 (Unaudited) | ||

| Assets | ||||

| Investments in securities, at value (cost $160,706,672) |

$ | 211,029,295 | ||

| Restricted Cash |

17,600 | |||

| Receivables: |

||||

| Investments sold |

899,241 | |||

| Fund shares sold |

4,886 | |||

| Dividends and interest |

461,531 | |||

| Dividend tax reclaim |

408,018 | |||

| Swap dividend and interest receivable |

121,143 | |||

| Unrealized appreciation on open swap contracts |

1,951,837 | |||

| Variation margin on futures contracts |

53,309 | |||

| Deposits at brokers for derivative instruments(1) |

96,245,502 | |||

| Other assets |

26,414 | |||

| Total Assets |

311,218,776 | |||

| Liabilities | ||||

| Securities sold short, at value (proceeds received $89,796,342) |

94,865,882 | |||

| Payables: |

||||

| Investments purchased |

507,049 | |||

| Fund shares redeemed |

769,316 | |||

| To affiliates |

84,534 | |||

| To distributor |

46,297 | |||

| For shareholder servicing fees |

43,357 | |||

| To adviser |

189,952 | |||

| Dividends and interest on short positions |

273,697 | |||

| Accrued expenses and other liabilities |

90,296 | |||

| Total Liabilities |

96,870,380 | |||

| Net Assets | $ | 214,348,396 | ||

| Net assets consist of: |

||||

| Paid-in capital |

585,978,304 | |||

| Accumulated deficit |

(371,629,908 | ) | ||

| Net Assets | $ | 214,348,396 | ||

The accompanying notes are an integral part of these financial statements.

16

Table of Contents

MARKETFIELD FUND

| Statement of Assets & Liabilities (continued) | ||

| June 30, 2019 (Unaudited) | ||

| Class A | ||||

| Net assets |

$40,722,306 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

2,540,159 | |||

| Net asset value, minimum offering, and redemption price per share |

$16.03 | |||

| Maximum offering price per share (net asset value per share divided by 0.945)(2) |

$16.96 | |||

| Class C | ||||

| Net assets |

$47,228,620 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

3,101,927 | |||

| Net asset value, offering, and redemption price per share(3) |

$15.23 | |||

| Class I | ||||

| Net assets |

$124,804,958 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

7,664,874 | |||

| Net asset value, offering, and redemption price per share |

$16.28 | |||

| Class R6 | ||||

| Net assets |

$1,592,512 | |||

| Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) |

97,001 | |||

| Net asset value, offering, and redemption price per share |

$16.42 | |||

| (1) | Serves as collateral for securities sold short and derivative instruments including futures, swaps and options. |

| (2) | Reflects a maximum sales charge of 5.50%. |

| (3) | A contingent deferred sales charge (“CDSC”) of 1.00% may be charged on shares redeemed within twelve months of purchase. |

The accompanying notes are an integral part of these financial statements.

17

Table of Contents

MARKETFIELD FUND

| Statement of Operations | ||

| For the Six Months Ended June 30, 2019 (Unaudited) | ||

| Investment Income | ||||

| Dividend income(1) |

$ | 2,036,369 | ||

| Interest income |

1,539,388 | |||

| Total Investment Income |

3,575,757 | |||

| Expenses | ||||

| Management fees |

1,714,677 | |||

| Dividend expense |

1,003,639 | |||

| Distribution fees — Class C |

194,761 | |||

| Administration and accounting fees |

190,298 | |||

| Transfer agent fees and expenses |

180,141 | |||

| Shareholder servicing fees — Class C |

64,920 | |||

| Distribution fees — Class A |

54,950 | |||

| Reports to shareholders |

42,208 | |||

| Custody fees |

33,024 | |||

| Federal and state registration fees |

29,292 | |||

| Audit and tax fees |

22,082 | |||

| Legal fees |

13,228 | |||

| Trustees’ fees |

6,716 | |||

| Chief Compliance Officer fees |

5,973 | |||

| Pricing fees |

1,051 | |||

| Other expenses |

8,298 | |||

| Total Expenses |

3,565,258 | |||

| Less waivers and reimbursement by Adviser (Note 4) |

(336,974 | ) | ||

| Net Expenses |

3,228,284 | |||

| Net Investment Income | 347,473 | |||

| Realized And Unrealized Gain (Loss) on Investments and Foreign Currency | ||||

| Net realized gain (loss) on: |

||||

| Investments |

16,717,039 | |||

| Futures contracts |

47,002 | |||

| Swap contracts |

287,011 | |||

| Securities sold short |

(1,913,178 | ) | ||

| Foreign currency translations |

(18,810 | ) | ||

| 15,119,064 | ||||

| Net change in unrealized appreciation (depreciation) on: |

||||

| Investments |

13,641,768 | |||

| Futures contracts |

927,901 | |||

| Swap contracts |

2,902,716 | |||

| Securities sold short |

(14,438,767 | ) | ||

| Foreign currency translations |

24,595 | |||

| 3,058,213 | ||||

| Net Realized And Unrealized Gain on Investments and Foreign Currency | 18,177,277 | |||

| Net Increase In Net Assets From Operations | $ | 18,524,750 | ||

| (1) | Net of $79,853 in foreign withholding taxes and issuance fees. |

The accompanying notes are an integral part of these financial statements.

18

Table of Contents

MARKETFIELD FUND

The accompanying notes are an integral part of these financial statements.

19

Table of Contents

MARKETFIELD FUND — CLASS A

| (1) | Per share net investment gain (loss) was calculated using average shares outstanding. |

| (2) | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Based on net asset value, which does not reflect the applicable sales charges. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

| (5) | Expense ratios of expenses to average net assets before waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 2.08% for the six months ended June 30, 2019 and 2.01%, 1.98%, 1.87%, 1.80%, and 1.78% for the years ended December 31, 2018, 2017, 2016, 2015, and 2014, respectively. |

| (6) | Expense ratios of expenses to average net assets after waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.80% for the six months ended June 30, 2019 and 1.80%, 1.80%, 1.83%, 1.80%, and 1.78% for the years ended December 31, 2018, 2017, 2016, 2015, and 2014, respectively. |

| (7) | The net investment gain (loss) ratios include dividend and interest expense on short positions. |

| (8) | Consists of long-term investments only; excludes securities sold short and derivative instruments. |

| (9) | Effective after the close of business on April 8, 2016, Class A shares were subject to an expense limitation cap of 1.80%. |

The accompanying notes are an integral part of these financial statements.

20

Table of Contents

MARKETFIELD FUND — CLASS C

| Financial Highlights (continued) | ||||||||||||||||||||||||

| Per Share Data for a Share Outstanding Throughout Each Year/Period | ||||||||||||||||||||||||

| Six Months Ended June 30, 2019 (Unaudited) |

Year Ended December 31, 2018 |

Year Ended December 31, 2017 |

Year Ended December 31, 2016 |

Year Ended December 31, 2015 |

Year Ended December 31, 2014 |

|||||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 14.22 | $ | 16.56 | $ | 13.80 | $ | 14.43 | $ | 15.89 | $ | 18.30 | ||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||

| Net investment loss(1) |

(0.03 | ) | (0.17 | ) | (0.22 | ) | (0.31 | ) | (0.28 | ) | (0.33 | ) | ||||||||||||

| Net realized and unrealized gain (loss) on investments and foreign currency |

1.04 | (2.17 | ) | 2.98 | (0.32 | ) | (1.18 | ) | (2.08 | ) | ||||||||||||||

| Total from investment operations |

1.01 | (2.34 | ) | 2.76 | (0.63 | ) | (1.46 | ) | (2.41 | ) | ||||||||||||||

| Net Asset Value, End of Period | $ | 15.23 | $ | 14.22 | $ | 16.56 | $ | 13.80 | $ | 14.43 | $ | 15.89 | ||||||||||||

| Total return(2)(3) | 7.03 | % | -14.13 | % | 20.00 | % | -4.37 | % | -9.19 | % | -13.17 | % | ||||||||||||

| Supplemental Data and Ratios: | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$ | 47,229 | $ | 55,958 | $ | 92,518 | $ | 123,651 | $ | 315,894 | $ | 1,003,835 | ||||||||||||

| Ratio of expenses to average net assets:(4) |

||||||||||||||||||||||||

| Before waivers and reimbursements of expenses(5) |

3.66 | % | 3.49 | % | 3.48 | % | 3.65 | % | 3.29 | % | 3.38 | % | ||||||||||||

| After waivers and reimbursements of expenses(6) |

3.40 | % | 3.30 | % | 3.30 | % | 3.59 | %(9) | 3.29 | % | 3.38 | % | ||||||||||||

| Ratio of net investment loss to average net assets:(4)(7) |

||||||||||||||||||||||||

| Before waivers and reimbursements of expenses |

(0.73 | )% | (1.27 | )% | (1.67 | )% | (2.36 | )% | (1.84 | )% | (1.89 | )% | ||||||||||||

| After waivers and reimbursements of expenses |

(0.47 | )% | (1.08 | )% | (1.49 | )% | (2.30 | )% | (1.84 | )% | (1.89 | )% | ||||||||||||

| Portfolio turnover rate(3)(8) |

0 | % | 40 | % | 5 | % | 86 | % | 93 | % | 98 | % | ||||||||||||

| (1) | Per share net investment loss was calculated using average shares outstanding. |

| (2) | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Based on net asset value, which does not reflect the applicable sales charges. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

| (5) | Expense ratios of expenses to average net assets before waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 2.83% for the six months ended June 30, 2019 and 2.76% , 2.75%, 2.65%, 2.57%, and 2.53% for the years ended December 31, 2018, 2017, 2016, 2015, and 2014, respectively. |

| (6) | Expense ratios of expenses to average net assets after waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 2.57% for the six months ended June 30, 2019 and 2.57%, 2.57%, 2.59%, 2.57%, and 2.53% for the years ended December 31, 2018, 2017, 2016, 2015, and 2014, respectively. |

| (7) | The net investment loss ratios include dividend and interest expense on short positions. |

| (8) | Consists of long-term investments only; excludes securities sold short and derivative instruments. |

| (9) | Effective after the close of business on April 8, 2016, Class C shares were subject to an expense limitation cap of 2.57%. |

The accompanying notes are an integral part of these financial statements.

21

Table of Contents

MARKETFIELD FUND — CLASS I

| Financial Highlights (continued) | ||||||||||||||||||||||||

| Per Share Data for a Share Outstanding Throughout Each Year/Period | ||||||||||||||||||||||||

| Six Months Ended June 30, 2019 (Unaudited) |

Year Ended December 31, 2018 |

Year Ended December 31, 2017 |

Year Ended December 31, 2016 |

Year Ended December 31, 2015 |

Year Ended December 31, 2014 |

|||||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 15.14 | $ | 17.44 | $ | 14.39 | $ | 14.89 | $ | 16.24 | $ | 18.51 | ||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||

| Net investment gain (loss)(1) |

0.04 | (0.02 | ) | (0.07 | ) | (0.19 | ) | (0.13 | ) | (0.16 | ) | |||||||||||||

| Net realized and unrealized gain (loss) on investments and foreign currency |

1.10 | (2.28 | ) | 3.12 | (0.31 | ) | (1.22 | ) | (2.11 | ) | ||||||||||||||

| Total from investment operations |

1.14 | (2.30 | ) | 3.05 | (0.50 | ) | (1.35 | ) | (2.27 | ) | ||||||||||||||

| Net Asset Value, End of Period | $ | 16.28 | $ | 15.14 | $ | 17.44 | $ | 14.39 | $ | 14.89 | $ | 16.24 | ||||||||||||

| Total return(2)(3) | 7.60 | % | -13.25 | % | 21.20 | % | -3.36 | % | -8.31 | % | -12.26 | % | ||||||||||||

| Supplemental Data and Ratios: | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$ | 124,805 | $ | 163,260 | $ | 302,439 | $ | 376,791 | $ | 1,698,033 | $ | 7,062,935 | ||||||||||||

| Ratio of expenses to average net assets:(4) |

||||||||||||||||||||||||

| Before waivers and reimbursements of expenses(5) |

2.65 | % | 2.47 | % | 2.48 | % | 2.61 | % | 2.26 | % | 2.39 | % | ||||||||||||

| After waivers and reimbursements of expenses(6) |

2.37 | % | 2.27 | % | 2.30 | % | 2.56 | %(9) | 2.26 | % | 2.39 | % | ||||||||||||

| Ratio of net investment gain (loss) to average net assets:(4)(7) |

||||||||||||||||||||||||

| Before waivers and reimbursements of expenses |

0.26 | % | (0.29 | )% | (0.64 | )% | (1.38 | )% | (0.82 | )% | (0.90 | )% | ||||||||||||

| After waivers and reimbursements of expenses |

0.54 | % | (0.09 | )% | (0.46 | )% | (1.33 | )% | (0.82 | )% | (0.90 | )% | ||||||||||||

| Portfolio turnover rate(3)(8) |

0 | % | 40 | % | 5 | % | 86 | % | 93 | % | 98 | % | ||||||||||||

| (1) | Per share net investment gain (loss) was calculated using average shares outstanding. |

| (2) | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Based on net asset value. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

| (5) | Expense ratios of expenses to average net assets before waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.84% for the six months ended June 30, 2019 and 1.76%, 1.74%, 1.61%, 1.56%, and 1.53% for the years ended December 31, 2018, 2017, 2016, 2015, and 2014, respectively. |

| (6) | Expense ratios of expenses to average net assets after waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.56% for the six months ended June 30, 2019 and 1.56%, 1.56%, 1.56%, 1.56%, and 1.53% for the years ended December 31, 2018, 2017, 2016, 2015, and 2014, respectively. |

| (7) | The net investment gain (loss) ratios include dividend and interest expense on short positions. |

| (8) | Consists of long-term investments only; excludes securities sold short and derivative instruments. |

| (9) | Effective after the close of business on April 8, 2016, Class I shares were subject to an expense limitation cap of 1.56%. |

The accompanying notes are an integral part of these financial statements.

22

Table of Contents

MARKETFIELD FUND — CLASS R6

| Financial Highlights (continued) | ||||||||||||||||||||||||

| Per Share Data for a Share Outstanding Throughout Each Year/Period | ||||||||||||||||||||||||

| Six Months Ended June 30, 2019 (Unaudited) |

Year Ended December 31, 2018 |

Year Ended December 31, 2017 |

Year Ended December 31, 2016 |

Year Ended December 31, 2015 |

Year Ended December 31, 2014 |

|||||||||||||||||||

| Net Asset Value, Beginning of Period | $ | 15.25 | $ | 17.55 | $ | 14.46 | $ | 14.94 | $ | 16.27 | $ | 18.53 | ||||||||||||

| Income (loss) from investment operations: | ||||||||||||||||||||||||

| Net investment gain (loss)(1) |

0.05 | 0.01 | (0.05 | ) | (0.17 | ) | (0.12 | ) | (0.13 | ) | ||||||||||||||

| Net realized and unrealized gain (loss) on investments and foreign currency |

1.12 | (2.31 | ) | 3.14 | (0.31 | ) | (1.21 | ) | (2.13 | ) | ||||||||||||||

| Total from investment operations |

1.17 | (2.30 | ) | 3.09 | (0.48 | ) | (1.33 | ) | (2.26 | ) | ||||||||||||||

| Net Asset Value, End of Period | $ | 16.42 | $ | 15.25 | $ | 17.55 | $ | 14.46 | $ | 14.94 | $ | 16.27 | ||||||||||||

| Total return(2)(3) | 7.67 | % | -13.11 | % | 21.37 | % | -3.21 | % | -8.17 | % | -12.20 | % | ||||||||||||

| Supplemental Data and Ratios: | ||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$ | 1,593 | $ | 1,563 | $ | 2,567 | $ | 2,793 | $ | 5,749 | $ | 6,365 | ||||||||||||

| Ratio of expenses to average net assets:(4) |

||||||||||||||||||||||||

| Before waivers and reimbursements of expenses(5) |

2.69 | % | 2.49 | % | 2.45 | % | 2.64 | % | 2.25 | % | 2.34 | % | ||||||||||||

| After waivers and reimbursements of expenses(6) |

2.28 | % | 2.16 | % | 2.18 | % | 2.55 | %(9) | 2.25 | % | 2.34 | % | ||||||||||||

| Ratio of net investment gain (loss) to average net assets:(4)(7) |

||||||||||||||||||||||||

| Before waivers and reimbursements of expenses |

0.26 | % | (0.28 | )% | (0.62 | )% | (1.33 | )% | (0.78 | )% | (0.75 | )% | ||||||||||||

| After waivers and reimbursements of expenses |

0.67 | % | 0.05 | % | (0.35 | )% | (1.24 | )% | (0.78 | )% | (0.75 | )% | ||||||||||||

| Portfolio turnover rate(3)(8) |

0 | % | 40 | % | 5 | % | 86 | % | 93 | % | 98 | % | ||||||||||||

| (1) | Per share net investment gain (loss) was calculated using average shares outstanding. |

| (2) | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Based on net asset value. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

| (5) | Expense ratios of expenses to average net assets before waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.84% for the six months ended June 30, 2019 and 1.76%, 1.70%, 1.53%, 1.43%, and 1.42% for the years ended December 31, 2018, 2017, 2016, 2015, and 2014, respectively. |

| (6) | Expense ratios of expenses to average net assets after waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.43% for the six months ended June 30, 2019 and 1.43%, 1.43%, 1.44%, 1.43%, and 1.42% for the years ended December 31, 2018, 2017, 2016, 2015, and 2014, respectively. |

| (7) | The net investment gain (loss) ratios include dividend and interest expense on short positions. |

| (8) | Consists of long-term investments only; excludes securities sold short and derivative instruments. |

| (9) | Effective after the close of business on April 8, 2016, Class R6 shares were subject to an expense limitation cap of 1.43%. |

The accompanying notes are an integral part of these financial statements.

23

Table of Contents

MARKETFIELD FUND

June 30, 2019 (Unaudited)

| (1) | Organization |

Trust for Professional Managers (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust dated May 29, 2001. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Marketfield Fund (the “Fund”) represents a distinct series with its own investment objective and policies within the Trust. The investment objective of the Fund is capital appreciation. The Trust may issue an unlimited number of shares of beneficial interest at $0.001 par value. The assets of the Fund are segregated, and a shareholder’s interest is limited to the Fund in which shares are held.

The Fund currently offers four classes of shares. Class I shares commenced operations on July 31, 2007. Class A and Class C shares commenced operations on October 5, 2012. Class R6 shares commenced operations on June 17, 2013. Effective as of the close of business on August 15, 2016, the Fund converted its Investor Class shares into Class A shares of the Fund. Effective as of the close of business on August 15, 2016, the Fund converted its Class R2 and Class P shares into Class I shares of the Fund. Class A shares are subject to an initial maximum sales charge of 5.50% imposed at the time of purchase. The sales charge declines as the amount purchased increases in accordance with the Fund’s prospectus. A contingent deferred sales charge (“CDSC”) of 1.00% may be imposed on certain redemptions of Class A shares made within 12 months of the date of purchase of Class A shares. Class C shares are offered at NAV without an initial sales charge, although a 1.00% CDSC may be imposed on redemptions made within 12 months of the date of purchase of Class C shares. Class I and Class R6 shares are offered at NAV and are not subject to a sales charge. In addition, you generally may elect on a voluntary basis to convert your Class A or Class C shares that are no longer subject to a CDSC into Class A or Class I shares of the Fund, subject to satisfying the eligibility requirements of Class A or Class I shares, as applicable. Class C shares of the Fund automatically convert to Class A shares after 10 years. Also, you generally may elect on a voluntary basis to convert your Class A or Class C shares that are no longer subject to a CDSC, or Class I shares, into Class R6 shares of the Fund, subject to satisfying the eligibility requirements of Class R6 shares. The four classes of shares have the same voting (except for issues that relate solely to one class), dividend, liquidation and other rights, and the same terms and conditions, except that Class C shares are subject to higher distribution and/or service (Rule 12b-1) fee rates than Class A shares under a distribution plan pursuant to Rule 12b-1 under the 1940 Act. Class I and Class R6 shares are not subject to a distribution and/or service (Rule 12b-1) fee.

Pursuant to a reorganization that took place after the close of business on April 8, 2016 (the “Reorganization”), the Fund is the successor to the MainStay Marketfield Fund, a series of MainStay Funds Trust (the “Predecessor Fund”). The Predecessor Fund and the Fund have the same investment objectives and substantially the same strategies and investment policies.

The Fund is an investment company and accordingly follows the investment accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services — Investment Companies.”

| (2) | Significant Accounting Policies |

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of these schedules of investments. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

| (a) | Investment Valuation |

Each security owned by the Fund that is listed on a securities exchange, except securities listed on the NASDAQ Stock Market, LLC (“NASDAQ”), is valued at its last sale price on that exchange on the date as of which assets are valued. Swap agreements, such as credit default swaps, interest rate swaps and currency swaps, are priced by an approved independent pricing service (“Pricing Service”). Forward foreign currency contracts are valued at the mean between the bid and asked prices by Pricing Service. Commodities futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading.

24

Table of Contents

MARKETFIELD FUND

Notes to Financial Statements, continued

June 30, 2019 (Unaudited)

If the security is listed on more than one exchange, the Fund will use the price of the exchange that the Fund generally considers to be the principal exchange on which the security is traded. Portfolio securities listed on NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or on NASDAQ on such day, the security is valued at the mean between the most recent bid and ask prices at the close of the exchange on such day, or the security shall be valued at the latest sales price on the “composite market” for the day such security is being valued. The composite market is defined as a consolidation of the trade information provided by national securities and foreign exchanges and over-the-counter markets as published by a Pricing Service for the day such security is being valued.

If market quotations are not readily available, any security or other asset will be valued at its fair value as determined under fair value pricing procedures approved by the Board of Trustees. These fair value pricing procedures will also be used to price a security when corporate events, events in the securities market and/or world events cause the Adviser to believe that a security’s last sale price may not reflect its actual fair market value. The intended effect of using fair value pricing procedures is to ensure that the Fund’s shares are accurately priced. The Board of Trustees will regularly evaluate whether the Fund’s fair value pricing procedures continue to be appropriate in light of the specific circumstances of the Fund and the quality of prices obtained through the application of such procedures by the Trust’s valuation committee.

Redeemable securities issued by open-end, registered investment companies are valued at the NAVs of such companies for purchase and/or redemption orders placed on that day. If, on a particular day, a share of an investment company is not listed on NASDAQ, such security’s fair value will be determined as described above. All exchange-traded funds are valued at the last reported sale price on the exchange on which the security is principally traded. In the event market quotations are not readily available, such security’s fair value will be determined.

Debt securities, including short-term instruments having a maturity of 60 days or less, are valued at the mean in accordance with prices supplied by a Pricing Service. Pricing Services may use various valuation methodologies such as the mean between the bid and ask prices, matrix pricing method or other analytical pricing models as well as market transactions and dealer quotations. If a price is not available from a Pricing Service, the most recent quotation obtained from one or more broker-dealers known to follow the issue will be obtained. Quotations will be valued at the mean between the bid and the offer. Fixed income securities purchased on a delayed-delivery basis are typically marked to market daily until settlement at the forward settlement date. Any discount or premium is accreted or amortized using the constant yield method until maturity.

Money market funds, demand notes and repurchase agreements are valued at cost. If cost does not represent current market value the securities will be priced at fair value.

Exchange-traded options are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which an option is quoted, thus providing a view across the entire U.S. options marketplace. Specifically, composite pricing looks at the last trades on the exchanges where the options are traded. If there are no trades for the option on a given business day, composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. Over-the-counter (“OTC”) option contracts on securities, currencies and other financial instruments with less than 180 days remaining until their expiration shall be valued at the evaluated price provided by the broker-dealer with which the option was traded. Option contracts on securities, currencies and other financial instruments traded in the OTC market with 180 days or more remaining until their expiration shall be valued at the prices provided by a recognized independent broker-dealer. Futures contracts and options thereon are valued at the last settlement price at the closing of trading on the relevant exchange or board of trade. Futures or options on futures positions for which reliable market quotations are not readily available shall be valued at a price supplied by a Pricing Service.

Swap agreements are generally traded over the counter and are valued by a Pricing Service using observable inputs. If a price provided by a Pricing Service differs from the price provided by an independent dealer by

25

Table of Contents

MARKETFIELD FUND

Notes to Financial Statements, continued

June 30, 2019 (Unaudited)

10% or more or the Adviser otherwise believes that the price provided by the Pricing Service is inaccurately stated, the Adviser shall price the swap using the average of two prices obtained by independent dealers. In the event the Adviser determines the price of a swap in this manner does not represent market value, the fair value of the subject swap shall be determined in accordance with the Trust’s fair value procedures.

FASB Accounting Standards Codification, “Fair Value Measurements” Topic 820 (“ASC 820”), establishes an authoritative definition of fair value and sets out a hierarchy for measuring fair value. ASC 820 requires an entity to evaluate certain factors to determine whether there has been a significant decrease in volume and level of activity for the security such that recent transactions and quoted prices may not be determinative of fair value and further analysis and adjustment may be necessary to estimate fair value. ASC 820 also requires enhanced disclosure regarding the inputs and valuation techniques used to measure fair value in those instances as well as expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

Level 1 — Quoted prices in active markets for identical securities.

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s investments carried at fair value as of June 30, 2019:

| Level 1 |

Level 2 |

Level

3(3) |

Total |

|||||||||||||

| Assets: |

|

|||||||||||||||

| Common Stocks(1) |

$ | 118,433,817 | $ | — | $ | — | $ | 118,433,817 | ||||||||

| Exchange-Traded Funds |

54,227,920 | — | — | 54,227,920 | ||||||||||||

| Preferred Stocks |

3,125,970 | — | — | 3,125,970 | ||||||||||||

| Short-Term Investments |

35,241,588 | — | — | 35,241,588 | ||||||||||||

| Total Assets | $ | 211,029,295 | $ | — | $ | — | $ | 211,029,295 | ||||||||

| Liabilities: |

|

|||||||||||||||

| Securities Sold Short |

|

|||||||||||||||

| Common Stocks(1) |

$ | (16,778,829 | ) | $ | — | $ | — | $ | (16,778,829 | ) | ||||||

| Exchange-Traded Funds |

(58,480,257 | ) | — | — | (58,480,257 | ) | ||||||||||

| Master Limited Partnerships |

(3,014,297 | ) | — | — | (3,014,297 | ) | ||||||||||

| Real Estate Investment Trusts |

(16,592,499 | ) | — | — | (16,592,499 | ) | ||||||||||

| Total Securities Sold Short | (94,865,882 | ) | — | — | (94,865,882 | ) | ||||||||||

| Total Liabilities | $ | (94,865,882 | ) | $ | — | $ | — | $ | (94,865,882 | ) | ||||||

| Other Financial Instruments(2) |

|

|||||||||||||||

| Futures |

$ | 97,740 | $ | — | $ | — | $ | 97,740 | ||||||||

| Swaps |

— | 1,951,837 | — | 1,951,837 | ||||||||||||

| Total Other Financial Instruments | $ | 97,740 | $ | 1,951,837 | $ | — | $ | 2,049,577 | ||||||||

| (1) | See the Schedule of Investments for industry/geographic classifications. |

| (2) | Reflected at the net unrealized appreciation on the contracts held. |

| (3) | The Fund measures Level 3 activity as of the end of each financial reporting period. For the six months ended June 30, 2019, the Fund did not have unobservable inputs (Level 3 securities) used in determining fair value. Therefore, a reconciliation of assets and liabilities in which significant unobservable inputs (Level 3 securities) were used in determining fair value is not applicable. |

26

Table of Contents

MARKETFIELD FUND

Notes to Financial Statements, continued

June 30, 2019 (Unaudited)

| (b) | Foreign Securities and Currency Transactions |

Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not isolate the portion of the results of operations from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Realized foreign exchange gains or losses arising from sales of portfolio securities and sales and maturities of short-term securities are reported within realized gain (loss) on investments. Net unrealized foreign exchange gains and losses arising from changes in the values of investments in securities from fluctuations in exchange rates are reported within unrealized gain (loss) on investments. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currency other than U.S. dollars are disclosed separately.

Investments in foreign securities entail certain risks. There may be a possibility of nationalization or expropriation of assets, confiscatory taxation, political or financial instability, and diplomatic developments that could affect the value of the Fund’s investments in certain foreign countries. Since foreign securities normally are denominated and traded in foreign currencies, the value of the Fund’s assets may be affected favorably or unfavorably by currency exchange rates, currency exchange control regulations, foreign withholding taxes, and restrictions or prohibitions on the repatriation of foreign currencies. There may be less information publicly available about a foreign issuer than about a U.S. issuer, and foreign issuers are not generally subject to accounting, auditing, and financial reporting standards and practices comparable to those in the United States. The securities of some foreign issuers are less liquid and at times more volatile than securities of comparable U.S. issuers.

| (c) | Derivative Instruments |