2024-05-23194011_JensenQualityValueFund_ClassI_TSRAnnual

false

0001141819

N-1A

0001141819

tsr:C000086400Member

2023-06-01

2024-05-31

0001141819

tsr:C000086400Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072427129_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627448_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627373_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627449_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072427131_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627450_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627372_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627451_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627371_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627452_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072927458_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627453_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627396_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627454_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072427134_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627455_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627456_941Member

2024-05-31

0001141819

tsr:C000086400Member

tsr:bench2024072627457_941Member

2024-05-31

0001141819

tsr:C000086400Member

2014-05-31

0001141819

tsr:bench2024072326899_941Member

2014-05-31

0001141819

tsr:C000086400Member

2015-05-31

0001141819

tsr:bench2024072326899_941Member

2015-05-31

0001141819

tsr:C000086400Member

2016-05-31

0001141819

tsr:bench2024072326899_941Member

2016-05-31

0001141819

tsr:C000086400Member

2017-05-31

0001141819

tsr:bench2024072326899_941Member

2017-05-31

0001141819

tsr:C000086400Member

2018-05-31

0001141819

tsr:bench2024072326899_941Member

2018-05-31

0001141819

tsr:C000086400Member

2019-05-31

0001141819

tsr:bench2024072326899_941Member

2019-05-31

0001141819

tsr:C000086400Member

2020-05-31

0001141819

tsr:bench2024072326899_941Member

2020-05-31

0001141819

tsr:C000086400Member

2021-05-31

0001141819

tsr:bench2024072326899_941Member

2021-05-31

0001141819

tsr:C000086400Member

2022-05-31

0001141819

tsr:bench2024072326899_941Member

2022-05-31

0001141819

tsr:C000086400Member

2023-05-31

0001141819

tsr:bench2024072326899_941Member

2023-05-31

0001141819

tsr:bench2024072326899_941Member

2024-05-31

0001141819

tsr:bench2024072326899_941Member

2023-06-01

2024-05-31

0001141819

tsr:C000086400Member

2019-06-01

2024-05-31

0001141819

tsr:bench2024072326899_941Member

2019-06-01

2024-05-31

0001141819

tsr:C000086400Member

2014-06-01

2024-05-31

0001141819

tsr:bench2024072326899_941Member

2014-06-01

2024-05-31

0001141819

2023-06-01

2024-05-31

tsr:Years

iso4217:USD

xbrli:pure

xbrli:shares

iso4217:USD

xbrli:shares

0001141819

tsr:C000086401Member

2023-06-01

2024-05-31

0001141819

tsr:C000086401Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072427129_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627448_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627373_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627449_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072427131_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627450_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627372_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627451_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627371_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627452_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072927458_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627453_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627396_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627454_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072427134_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627455_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627456_942Member

2024-05-31

0001141819

tsr:C000086401Member

tsr:bench2024072627457_942Member

2024-05-31

0001141819

tsr:C000086401Member

2014-05-31

0001141819

tsr:bench2024072326899_942Member

2014-05-31

0001141819

tsr:C000086401Member

2015-05-31

0001141819

tsr:bench2024072326899_942Member

2015-05-31

0001141819

tsr:C000086401Member

2016-05-31

0001141819

tsr:bench2024072326899_942Member

2016-05-31

0001141819

tsr:C000086401Member

2017-05-31

0001141819

tsr:bench2024072326899_942Member

2017-05-31

0001141819

tsr:C000086401Member

2018-05-31

0001141819

tsr:bench2024072326899_942Member

2018-05-31

0001141819

tsr:C000086401Member

2019-05-31

0001141819

tsr:bench2024072326899_942Member

2019-05-31

0001141819

tsr:C000086401Member

2020-05-31

0001141819

tsr:bench2024072326899_942Member

2020-05-31

0001141819

tsr:C000086401Member

2021-05-31

0001141819

tsr:bench2024072326899_942Member

2021-05-31

0001141819

tsr:C000086401Member

2022-05-31

0001141819

tsr:bench2024072326899_942Member

2022-05-31

0001141819

tsr:C000086401Member

2023-05-31

0001141819

tsr:bench2024072326899_942Member

2023-05-31

0001141819

tsr:bench2024072326899_942Member

2024-05-31

0001141819

tsr:bench2024072326899_942Member

2023-06-01

2024-05-31

0001141819

tsr:C000086401Member

2019-06-01

2024-05-31

0001141819

tsr:bench2024072326899_942Member

2019-06-01

2024-05-31

0001141819

tsr:C000086401Member

2014-06-01

2024-05-31

0001141819

tsr:bench2024072326899_942Member

2014-06-01

2024-05-31

0001141819

tsr:C000216771Member

2023-06-01

2024-05-31

0001141819

tsr:C000216771Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072427129_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627448_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627373_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627449_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072427131_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627450_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627372_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627451_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627371_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627452_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072927458_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627453_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627396_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627454_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072427134_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627455_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627456_943Member

2024-05-31

0001141819

tsr:C000216771Member

tsr:bench2024072627457_943Member

2024-05-31

0001141819

tsr:C000216771Member

2020-05-31

0001141819

tsr:bench2024072326899_943Member

2020-05-31

0001141819

tsr:C000216771Member

2021-05-31

0001141819

tsr:bench2024072326899_943Member

2021-05-31

0001141819

tsr:C000216771Member

2022-05-31

0001141819

tsr:bench2024072326899_943Member

2022-05-31

0001141819

tsr:C000216771Member

2023-05-31

0001141819

tsr:bench2024072326899_943Member

2023-05-31

0001141819

tsr:bench2024072326899_943Member

2024-05-31

0001141819

tsr:bench2024072326899_943Member

2023-06-01

2024-05-31

0001141819

tsr:C000216771Member

2020-01-15

2024-05-31

0001141819

tsr:bench2024072326899_943Member

2020-01-15

2024-05-31

0001141819

tsr:C000216770Member

2023-06-01

2024-05-31

0001141819

tsr:C000216770Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072627371_938Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072927460_938Member

2024-05-31

0001141819

tsr:C000216770Member

country:US

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072627373_938Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024071926724_938Member

2024-05-31

0001141819

tsr:C000216770Member

country:GB

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072427131_938Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072927462_938Member

2024-05-31

0001141819

tsr:C000216770Member

country:TW

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072427129_938Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072927463_938Member

2024-05-31

0001141819

tsr:C000216770Member

country:CA

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072627372_938Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072927464_938Member

2024-05-31

0001141819

tsr:C000216770Member

country:IE

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072927458_938Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072927465_938Member

2024-05-31

0001141819

tsr:C000216770Member

country:FR

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072427132_938Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072927466_938Member

2024-05-31

0001141819

tsr:C000216770Member

country:DE

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072427133_938Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072927467_938Member

2024-05-31

0001141819

tsr:C000216770Member

country:NL

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072427134_938Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072927468_938Member

2024-05-31

0001141819

tsr:C000216770Member

country:ES

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072927469_938Member

2024-05-31

0001141819

tsr:C000216770Member

tsr:bench2024072427135_938Member

2024-05-31

0001141819

tsr:C000216770Member

2020-05-31

0001141819

tsr:bench2024072627351_938Member

2020-05-31

0001141819

tsr:C000216770Member

2021-05-31

0001141819

tsr:bench2024072627351_938Member

2021-05-31

0001141819

tsr:C000216770Member

2022-05-31

0001141819

tsr:bench2024072627351_938Member

2022-05-31

0001141819

tsr:C000216770Member

2023-05-31

0001141819

tsr:bench2024072627351_938Member

2023-05-31

0001141819

tsr:bench2024072627351_938Member

2024-05-31

0001141819

tsr:bench2024072627351_938Member

2023-06-01

2024-05-31

0001141819

tsr:C000216770Member

2020-04-15

2024-05-31

0001141819

tsr:bench2024072627351_938Member

2020-04-15

2024-05-31

0001141819

tsr:C000216769Member

2023-06-01

2024-05-31

0001141819

tsr:C000216769Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072627371_939Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927460_939Member

2024-05-31

0001141819

tsr:C000216769Member

country:US

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072627373_939Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927461_939Member

2024-05-31

0001141819

tsr:C000216769Member

country:GB

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072427131_939Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927462_939Member

2024-05-31

0001141819

tsr:C000216769Member

country:TW

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072427129_939Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927463_939Member

2024-05-31

0001141819

tsr:C000216769Member

country:CA

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072627372_939Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927464_939Member

2024-05-31

0001141819

tsr:C000216769Member

country:IE

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927458_939Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927465_939Member

2024-05-31

0001141819

tsr:C000216769Member

country:FR

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072427132_939Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927466_939Member

2024-05-31

0001141819

tsr:C000216769Member

country:DE

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072427133_939Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927467_939Member

2024-05-31

0001141819

tsr:C000216769Member

country:NL

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072427134_939Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927468_939Member

2024-05-31

0001141819

tsr:C000216769Member

country:ES

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072927469_939Member

2024-05-31

0001141819

tsr:C000216769Member

tsr:bench2024072427135_939Member

2024-05-31

0001141819

tsr:C000216769Member

2022-05-31

0001141819

tsr:C000216769Member

2020-05-31

0001141819

tsr:bench2024072627351_939Member

2020-05-31

0001141819

tsr:C000216769Member

2023-05-31

0001141819

tsr:C000216769Member

2021-05-31

0001141819

tsr:bench2024072627351_939Member

2021-05-31

0001141819

tsr:bench2024072627351_939Member

2022-05-31

0001141819

tsr:bench2024072627351_939Member

2023-05-31

0001141819

tsr:bench2024072627351_939Member

2024-05-31

0001141819

tsr:bench2024072627351_939Member

2023-06-01

2024-05-31

0001141819

tsr:C000216769Member

2020-04-15

2024-05-31

0001141819

tsr:bench2024072627351_939Member

2020-04-15

2024-05-31

0001141819

tsr:C000216768Member

2023-06-01

2024-05-31

0001141819

tsr:C000216768Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072627371_940Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927460_940Member

2024-05-31

0001141819

tsr:C000216768Member

country:US

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072627373_940Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927461_940Member

2024-05-31

0001141819

tsr:C000216768Member

country:GB

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072427131_940Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927462_940Member

2024-05-31

0001141819

tsr:C000216768Member

country:TW

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072427129_940Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927463_940Member

2024-05-31

0001141819

tsr:C000216768Member

country:CA

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072627372_940Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927464_940Member

2024-05-31

0001141819

tsr:C000216768Member

country:IE

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927458_940Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927465_940Member

2024-05-31

0001141819

tsr:C000216768Member

country:FR

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072427132_940Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927466_940Member

2024-05-31

0001141819

tsr:C000216768Member

country:DE

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072427133_940Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927467_940Member

2024-05-31

0001141819

tsr:C000216768Member

country:NL

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072427134_940Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927468_940Member

2024-05-31

0001141819

tsr:C000216768Member

country:ES

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072927469_940Member

2024-05-31

0001141819

tsr:C000216768Member

tsr:bench2024072427135_940Member

2024-05-31

0001141819

tsr:C000216768Member

2020-05-31

0001141819

tsr:bench2024072627351_940Member

2020-05-31

0001141819

tsr:C000216768Member

2021-05-31

0001141819

tsr:bench2024072627351_940Member

2021-05-31

0001141819

tsr:C000216768Member

2022-05-31

0001141819

tsr:bench2024072627351_940Member

2022-05-31

0001141819

tsr:C000216768Member

2023-05-31

0001141819

tsr:bench2024072627351_940Member

2023-05-31

0001141819

tsr:bench2024072627351_940Member

2024-05-31

0001141819

tsr:bench2024072627351_940Member

2023-06-01

2024-05-31

0001141819

tsr:C000216768Member

2020-04-15

2024-05-31

0001141819

tsr:bench2024072627351_940Member

2020-04-15

2024-05-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional

Managers

(Exact name of

registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive

offices) (Zip code)

Jay Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent

for service)

(513) 520-5925

Registrant's telephone number, including area code

Date of fiscal year end: May

31, 2024

Date of reporting period: May 31, 2024

Item 1. Reports to Stockholders.

(a)

|

|

|

|

|

Jensen Quality Value Fund

|

|

|

Class I | JNVIX

|

|

Annual Shareholder Report | May 31, 2024

|

This annual shareholder report contains important information about the Jensen Quality Value Fund for the period of June 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$90

|

0.82%

|

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the year ended May 31, 2024, the Fund’s performance relative to the Russell Midcap Total Return Index was aided by an overweight position in the Industrials sector; underweights in the Real Estate and Communications sectors; and specific companies in the Consumer Discretionary, Health Care, Information Technology, and Consumer Staples sectors. Relative performance was hindered by the Fund’s overweight positions in the Consumer Staples and Health Care sectors; underweights in the Financial and Energy Sectors; and specific companies in the Industrials and Financials sectors.

During the period, the strategy continued its high allocation to quality companies, as defined by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to the highest-quality companies — those rated A+, A and A- — averaged 48% of portfolio assets compared to 23% of the Russell Midcap Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor appetite for risk following the U.S. avoidance of a recession and easing concerns over inflation.

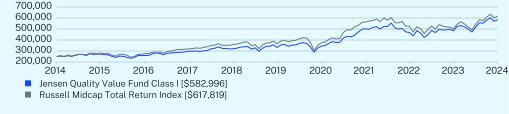

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $250,000 chart reflects a hypothetical $250,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $250,000)

| Jensen Quality Value Fund

|

PAGE 1

|

TSR_AR_89833W519 |

ANNUAL AVERAGE TOTAL RETURN (%)

|

|

|

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I

|

20.45

|

11.94

|

8.84

|

|

Russell Midcap Total Return Index

|

23.11

|

11.07

|

9.47

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

| * |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

KEY FUND STATISTICS (as of May 31, 2024)

|

|

|

Net Assets

|

$196,563,374

|

|

Number of Holdings

|

41

|

|

Net Advisory Fee

|

$1,157,242

|

|

Portfolio Turnover

|

25%

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

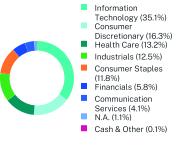

WHAT DID THE FUND INVEST IN? (% of net assets as of May 31, 2024)

|

|

|

Top 10 Issuers

|

|

|

Encompass Health Corp.

|

4.2%

|

|

Broadridge Financial Solutions, Inc.

|

3.8%

|

|

Copart, Inc.

|

3.7%

|

|

Tractor Supply Co.

|

3.6%

|

|

Labcorp Holdings, Inc.

|

3.5%

|

|

Crown Holdings, Inc.

|

3.5%

|

|

Equifax, Inc.

|

3.4%

|

|

Lennox International, Inc.

|

3.4%

|

|

Genuine Parts Co.

|

3.1%

|

|

Kroger Co.

|

3.1%

|

| * |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.jenseninvestment.com/reg-docs/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Jensen Investment Management documents not be householded, please contact Jensen Investment Management at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Jensen Investment Management or your financial intermediary.

| Jensen Quality Value Fund

|

PAGE 2

|

TSR_AR_89833W519 |

25000027167925887829699932119433164334449950227046816548400858299625000028116527563131935135979936552537512456375752556650184461781928.619.615.313.813.14.33.51.8

|

|

|

|

|

Jensen Quality Value Fund

|

|

|

Class J | JNVSX

|

|

Annual Shareholder Report | May 31, 2024

|

This annual shareholder report contains important information about the Jensen Quality Value Fund for the period of June 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class J

|

$116

|

1.05%

|

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the year ended May 31, 2024, the Fund’s performance relative to the Russell Midcap Total Return Index was aided by an overweight position in the Industrials sector; underweights in the Real Estate and Communications sectors; and specific companies in the Consumer Discretionary, Health Care, Information Technology, and Consumer Staples sectors. Relative performance was hindered by the Fund’s overweight positions in the Consumer Staples and Health Care sectors; underweights in the Financial and Energy Sectors; and specific companies in the Industrials and Financials sectors.

During the period, the strategy continued its high allocation to quality companies, as defined by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to the highest-quality companies — those rated A+, A and A- — averaged 48% of portfolio assets compared to 23% of the Russell Midcap Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor appetite for risk following the U.S. avoidance of a recession and easing concerns over inflation.

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Jensen Quality Value Fund

|

PAGE 1

|

TSR_AR_89833W527 |

ANNUAL AVERAGE TOTAL RETURN (%)

|

|

|

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class J

|

20.14

|

11.68

|

8.60

|

|

Russell Midcap Total Return Index

|

23.11

|

11.07

|

9.47

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

| * |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

KEY FUND STATISTICS (as of May 31, 2024)

|

|

|

Net Assets

|

$196,563,374

|

|

Number of Holdings

|

41

|

|

Net Advisory Fee

|

$1,157,242

|

|

Portfolio Turnover

|

25%

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of May 31, 2024)

|

|

|

Top 10 Issuers

|

|

|

Encompass Health Corp.

|

4.2%

|

|

Broadridge Financial Solutions, Inc.

|

3.8%

|

|

Copart, Inc.

|

3.7%

|

|

Tractor Supply Co.

|

3.6%

|

|

Labcorp Holdings, Inc.

|

3.5%

|

|

Crown Holdings, Inc.

|

3.5%

|

|

Equifax, Inc.

|

3.4%

|

|

Lennox International, Inc.

|

3.4%

|

|

Genuine Parts Co.

|

3.1%

|

|

Kroger Co.

|

3.1%

|

| * |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.jenseninvestment.com/reg-docs/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Jensen Investment Management documents not be householded, please contact Jensen Investment Management at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Jensen Investment Management or your financial intermediary.

| Jensen Quality Value Fund

|

PAGE 2

|

TSR_AR_89833W527 |

1000010849103211182012764131331362119801184201899522821100001124711025127741439214621150052255021023200742471328.619.615.313.813.14.33.51.8

|

|

|

|

|

Jensen Quality Value Fund

|

|

|

Class Y | JNVYX

|

|

Annual Shareholder Report | May 31, 2024

|

This annual shareholder report contains important information about the Jensen Quality Value Fund for the period of June 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class Y

|

$88

|

0.80%

|

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the year ended May 31, 2024, the Fund’s performance relative to the Russell Midcap Total Return Index was aided by an overweight position in the Industrials sector; underweights in the Real Estate and Communications sectors; and specific companies in the Consumer Discretionary, Health Care, Information Technology, and Consumer Staples sectors. Relative performance was hindered by the Fund’s overweight positions in the Consumer Staples and Health Care sectors; underweights in the Financial and Energy Sectors; and specific companies in the Industrials and Financials sectors.

During the period, the strategy continued its high allocation to quality companies, as defined by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to the highest-quality companies — those rated A+, A and A- — averaged 48% of portfolio assets compared to 23% of the Russell Midcap Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor appetite for risk following the U.S. avoidance of a recession and easing concerns over inflation.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $1,000,000)

| Jensen Quality Value Fund

|

PAGE 1

|

TSR_AR_89834G877 |

ANNUAL AVERAGE TOTAL RETURN (%)

|

|

|

|

|

1 Year

|

Since Inception

(01/15/2020)

|

|

Class Y

|

20.46

|

10.30

|

|

Russell Midcap Total Return Index

|

23.11

|

8.82

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

| * |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

KEY FUND STATISTICS (as of May 31, 2024)

|

|

|

Net Assets

|

$196,563,374

|

|

Number of Holdings

|

41

|

|

Net Advisory Fee

|

$1,157,242

|

|

Portfolio Turnover

|

25%

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of May 31, 2024)

|

|

|

Top 10 Issuers

|

|

|

Encompass Health Corp.

|

4.2%

|

|

Broadridge Financial Solutions, Inc.

|

3.8%

|

|

Copart, Inc.

|

3.7%

|

|

Tractor Supply Co.

|

3.6%

|

|

Labcorp Holdings, Inc.

|

3.5%

|

|

Crown Holdings, Inc.

|

3.5%

|

|

Equifax, Inc.

|

3.4%

|

|

Lennox International, Inc.

|

3.4%

|

|

Genuine Parts Co.

|

3.1%

|

|

Kroger Co.

|

3.1%

|

| * |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.jenseninvestment.com/reg-docs/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Jensen Investment Management documents not be householded, please contact Jensen Investment Management at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Jensen Investment Management or your financial intermediary.

| Jensen Quality Value Fund

|

PAGE 2

|

TSR_AR_89834G877 |

9075891322579123356112747831535658878761132065112311861175615144729628.619.615.313.813.14.33.51.8

|

|

|

|

|

Jensen Global Quality Growth Fund

|

|

|

Class I | JGQIX

|

|

Annual Shareholder Report | May 31, 2024

|

This annual shareholder report contains important information about the Jensen Global Quality Growth Fund for the period of June 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$108

|

1.02%

|

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the year ended May 31, 2024, relative performance of the Jensen Global Quality Growth Fund to the MSCI ACWI Net Total Return Index was aided by an underweight position in the Communication Services, Real Estate, Utilities and Materials sectors. Relative performance was hindered by the Fund’s overweight position and stock selection in the Consumer Discretionary, Consumer Staples, Health Care, Information Technology and Industrials sectors as well as the Fund’s underweight in the Financials and Energy sectors.

During the period, the strategy continued its high allocation to quality companies, as defined by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to the highest-quality companies — those rated A+, A and A- — averaged 51.71% of portfolio assets compared to 32.72% of the MSCI ACWI Net Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor appetite for risk following the global avoidance of recessions and easing concerns over inflation.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $250,000 chart reflects a hypothetical $250,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $250,000)

| Jensen Global Quality Growth Fund

|

PAGE 1

|

TSR_AR_89834G844 |

ANNUAL AVERAGE TOTAL RETURN (%)

|

|

|

|

|

1 Year

|

Since Inception

(04/15/2020)

|

|

Class I

|

11.33

|

12.60

|

|

MSCI ACWI Net Total Return Index (USD)

|

23.56

|

15.32

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

| * |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

KEY FUND STATISTICS (as of May 31, 2024)

|

|

|

Net Assets

|

$55,610,238

|

|

Number of Holdings

|

33

|

|

Net Advisory Fee

|

$234,128

|

|

Portfolio Turnover

|

12%

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

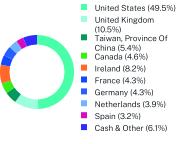

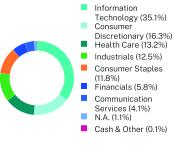

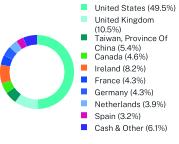

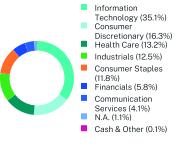

WHAT DID THE FUND INVEST IN? (% of net assets as of May 31, 2024)

|

|

|

Top 10 Issuers

|

|

|

Microsoft Corp.

|

6.8%

|

|

Taiwan Semiconductor Manufacturing Co. Ltd.

|

5.4%

|

|

Alphabet, Inc.

|

5.2%

|

|

Accenture PLC

|

4.4%

|

|

SAP SE

|

4.3%

|

|

Compass Group PLC

|

4.2%

|

|

ASML Holding NV

|

3.9%

|

|

Aon PLC

|

3.8%

|

|

PepsiCo, Inc.

|

3.7%

|

|

Canadian National Railway Co.

|

3.6%

|

| * |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.jenseninvestment.com/reg-docs/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Jensen Investment Management documents not be householded, please contact Jensen Investment Management at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Jensen Investment Management or your financial intermediary.

| Jensen Global Quality Growth Fund

|

PAGE 2

|

TSR_AR_89834G844 |

27025035745034764336636740788427320338752636124336431645013635.116.313.212.511.85.84.11.10.149.510.55.44.68.24.34.33.93.26.1

|

|

|

|

|

Jensen Global Quality Growth Fund

|

|

|

Class J | JGQSX

|

|

Annual Shareholder Report | May 31, 2024

|

This annual shareholder report contains important information about the Jensen Global Quality Growth Fund for the period of June 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class J

|

$132

|

1.25%

|

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the year ended May 31, 2024, relative performance of the Jensen Global Quality Growth Fund to the MSCI ACWI Net Total Return Index was aided by an underweight position in the Communication Services, Real Estate, Utilities and Materials sectors. Relative performance was hindered by the Fund’s overweight position and stock selection in the Consumer Discretionary, Consumer Staples, Health Care, Information Technology and Industrials sectors as well as the Fund’s underweight in the Financials and Energy sectors.

During the period, the strategy continued its high allocation to quality companies, as defined by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to the highest-quality companies — those rated A+, A and A- — averaged 51.71% of portfolio assets compared to 32.72% of the MSCI ACWI Net Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor appetite for risk following the global avoidance of recessions and easing concerns over inflation.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Jensen Global Quality Growth Fund

|

PAGE 1

|

TSR_AR_89834G851 |

ANNUAL AVERAGE TOTAL RETURN (%)

|

|

|

|

|

1 Year

|

Since Inception

(04/15/2020)

|

|

Class J

|

11.09

|

12.35

|

|

MSCI ACWI Net Total Return Index (USD)

|

23.56

|

15.32

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

| * |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

KEY FUND STATISTICS (as of May 31, 2024)

|

|

|

Net Assets

|

$55,610,238

|

|

Number of Holdings

|

33

|

|

Net Advisory Fee

|

$234,128

|

|

Portfolio Turnover

|

12%

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of May 31, 2024)

|

|

|

Top 10 Issuers

|

|

|

Microsoft Corp.

|

6.8%

|

|

Taiwan Semiconductor Manufacturing Co. Ltd.

|

5.4%

|

|

Alphabet, Inc.

|

5.2%

|

|

Accenture PLC

|

4.4%

|

|

SAP SE

|

4.3%

|

|

Compass Group PLC

|

4.2%

|

|

ASML Holding NV

|

3.9%

|

|

Aon PLC

|

3.8%

|

|

PepsiCo, Inc.

|

3.7%

|

|

Canadian National Railway Co.

|

3.6%

|

| * |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.jenseninvestment.com/reg-docs/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Jensen Investment Management documents not be householded, please contact Jensen Investment Management at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Jensen Investment Management or your financial intermediary.

| Jensen Global Quality Growth Fund

|

PAGE 2

|

TSR_AR_89834G851 |

1081014263138321455616170109281550114450145731800535.116.313.212.511.85.84.11.10.149.510.55.44.68.24.34.33.93.26.1

|

|

|

|

|

Jensen Global Quality Growth Fund

|

|

|

Class Y | JGQYX

|

|

Annual Shareholder Report | May 31, 2024

|

This annual shareholder report contains important information about the Jensen Global Quality Growth Fund for the period of June 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class Y

|

$106

|

1.00%

|

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the year ended May 31, 2024, relative performance of the Jensen Global Quality Growth Fund to the MSCI ACWI Net Total Return Index was aided by an underweight position in the Communication Services, Real Estate, Utilities and Materials sectors. Relative performance was hindered by the Fund’s overweight position and stock selection in the Consumer Discretionary, Consumer Staples, Health Care, Information Technology and Industrials sectors as well as the Fund’s underweight in the Financials and Energy sectors.

During the period, the strategy continued its high allocation to quality companies, as defined by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to the highest-quality companies — those rated A+, A and A- — averaged 51.71% of portfolio assets compared to 32.72% of the MSCI ACWI Net Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor appetite for risk following the global avoidance of recessions and easing concerns over inflation.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $1,000,000)

| Jensen Global Quality Growth Fund

|

PAGE 1

|

TSR_AR_89834G869 |

ANNUAL AVERAGE TOTAL RETURN (%)

|

|

|

|

|

1 Year

|

Since Inception

(04/15/2020)

|

|

Class Y

|

11.35

|

12.63

|

|

MSCI ACWI Net Total Return Index (USD)

|

23.56

|

15.32

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

| * |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

KEY FUND STATISTICS (as of May 31, 2024)

|

|

|

Net Assets

|

$55,610,238

|

|

Number of Holdings

|

33

|

|

Net Advisory Fee

|

$234,128

|

|

Portfolio Turnover

|

12%

|

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

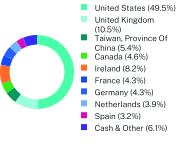

WHAT DID THE FUND INVEST IN? (% of net assets as of May 31, 2024)

|

|

|

Top 10 Issuers

|

|

|

Microsoft Corp.

|

6.8%

|

|

Taiwan Semiconductor Manufacturing Co. Ltd.

|

5.4%

|

|

Alphabet, Inc.

|

5.2%

|

|

Accenture PLC

|

4.4%

|

|

SAP SE

|

4.3%

|

|

Compass Group PLC

|

4.2%

|

|

ASML Holding NV

|

3.9%

|

|

Aon PLC

|

3.8%

|

|

PepsiCo, Inc.

|

3.7%

|

|

Canadian National Railway Co.

|

3.6%

|

| * |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.jenseninvestment.com/reg-docs/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Jensen Investment Management documents not be householded, please contact Jensen Investment Management at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Jensen Investment Management or your financial intermediary.

| Jensen Global Quality Growth Fund

|

PAGE 2

|

TSR_AR_89834G869 |

108100014300051391045146727216337781092813155010514449731457262180054235.116.313.212.511.85.84.11.10.149.510.55.44.68.24.34.33.93.26.1

(b) Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s

principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the

period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period

covered by this report. A copy of the registrant’s Code of Ethics is incorporated by reference to the Registrant’s Form N-CSR

filed on August 6, 2020.

Item 3. Audit Committee Financial

Expert.

The registrant’s board of trustees has determined that there is at

least one audit committee financial expert serving on its audit committee. Dr. Michael Akers is the “audit committee financial expert”

and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR. Dr. Akers holds a Ph.D. in

accountancy and is a professor Emeritus of accounting at Marquette University in Milwaukee, Wisconsin.

Item 4.

Principal Accountant Fees and Services.

The registrant has engaged its principal

accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit

services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by

the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services”

refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax

services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning.

The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related

fees, tax fees and other fees by the principal accountant.

| |

FYE 5/31/2024

|

FYE 5/31/2023 |

| (a) Audit Fees |

$33,200 |

$31,000 |

| (b) Audit-Related Fees |

$0 |

$0 |

| (c) Tax Fees |

$6,000 |

$6,000 |

| (d) All Other Fees |

$0 |

$0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures

that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any

entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company Ltd. applicable

to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| |

FYE 5/31/2024

|

FYE 5/31/2023 |

| Audit-Related Fees |

0% |

0% |

| Tax Fees |

0% |

0% |

| All Other Fees |

0% |

0% |

(f) All of the principal accountant’s hours spent on auditing the

registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected

to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and

any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit

Related Fees |

FYE 5/31/2024 |

FYE 5/31/2023 |

| Registrant |

$0 |

$0 |

| Registrant’s Investment

Adviser |

$36,500 |

$28,000 |

(h) The audit committee of the board of trustees has considered whether

the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal

accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s

independence.

(i) Not applicable.

(j) Not applicable.

Item 5.

Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in

Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6.

Investments.

|

(a) |

Schedule of Investments is included as part of the report to shareholders filed

under Item 7(a) of this Form. |

(b) Not Applicable.

Item 7.

Financial Statements and Financial Highlights for Open-End Investment Companies.

|

|

|

|

|

|

|

|

|

|

|

|

|

Jensen

Quality

Value

Fund |

|

|

Jensen Global

Quality Growth

Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class I Shares |

|

|

Class J Shares |

|

|

Class Y Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

Back to Table of Contents

Jensen

Global Quality Growth Fund

Schedule

of Investments

As

of May 31, 2024

|

|

|

|

|

|

|

|

|

|

COMMON

STOCKS — 96.9%

|

|

|

Canada

— 4.6%

|

|

|

|

|

|

|

|

|

Alimentation

Couche-Tard, Inc. |

|

|

9,230 |

|

|

$ 538,719

|

|

|

Canadian

National Railway Co. |

|

|

15,800 |

|

|

2,011,299

|

|

|

|

|

|

|

|

|

2,550,018

|

|

|

France

— 4.3%

|

|

|

|

|

|

|

|

|

Dassault

Systemes SE |

|

|

18,170 |

|

|

738,462

|

|

|

Hermes

International SCA |

|

|

700 |

|

|

1,661,528

|

|

|

|

|

|

|

|

|

2,399,990

|

|

|

Germany

— 4.3%

|

|

|

|

|

|

|

|

|

SAP

SE |

|

|

13,030 |

|

|

2,376,123

|

|

|

Ireland

— 8.2%

|

|

|

|

|

|

|

|

|

Accenture

PLC - Class A |

|

|

8,680 |

|

|

2,450,277 |

|

|

Aon

PLC |

|

|

7,500

|

|

|

2,112,300 |

|

|

|

|

|

|

|

|

4,562,577

|

|

|

Netherlands

— 3.9%

|

|

|

|

|

|

|

|

|

ASML

Holding NV |

|

|

2,270 |

|

|

2,171,862

|

|

|

Spain

— 3.2%

|

|

|

|

|

|

|

|

|

Amadeus

IT Group SA |

|

|

25,160 |

|

|

1,795,977

|

|

|

Switzerland

— 3.0%

|

|

|

|

|

|

|

|

|

Nestle

SA |

|

|

15,920 |

|

|

1,689,847

|

|

|

Taiwan,

Province Of China — 5.4%

|

|

|

|

|

|

|

|

|

Taiwan

Semiconductor Manufacturing Co. Ltd. - ADR |

|

|

20,040 |

|

|

3,026,842

|

|

|

United

Kingdom — 10.5%

|

|

|

|

|

|

|

|

|

AstraZeneca

PLC |

|

|

12,060 |

|

|

1,874,704

|

|

|

Compass

Group PLC |

|

|

82,070 |

|

|

2,304,200

|

|

|

Diageo

PLC |

|

|

48,590 |

|

|

1,635,888

|

|

|

|

|

|

|

|

|

5,814,792

|

|

|

United

States — 49.5%(a)

|

|

|

|

|

|

|

|

|

Alphabet,

Inc.(b) |

|

|

16,640 |

|

|

2,870,400

|

|

|

Apple,

Inc. - Class A |

|

|

10,220 |

|

|

1,964,795

|

|

|

Automatic

Data Processing, Inc. |

|

|

6,480 |

|

|

1,587,082

|

|

|

Broadridge

Financial Solutions, Inc. |

|

|

4,390 |

|

|

881,380

|

|

|

Equifax,

Inc. |

|

|

5,620 |

|

|

1,300,412

|

|

|

Home

Depot, Inc. |

|

|

2,530 |

|

|

847,221

|

|

|

Intuit,

Inc. |

|

|

2,750 |

|

|

1,585,210

|

|

|

KLA

Corp. |

|

|

1,950 |

|

|

1,481,083

|

|

|

Mastercard,

Inc. - Class A |

|

|

2,560 |

|

|

1,144,499

|

|

|

Microsoft

Corp. |

|

|

9,180 |

|

|

3,810,893

|

|

|

NIKE,

Inc. - Class B |

|

|

10,020 |

|

|

952,401

|

|

|

PepsiCo,

Inc. |

|

|

11,960 |

|

|

2,067,884

|

|

|

Starbucks

Corp. |

|

|

17,840 |

|

|

1,431,125

|

|

|

|

|

|

|

|

|

|

|

The

accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Jensen

Global Quality Growth Fund

Schedule

of Investments

As

of May 31, 2024

|

|

|

|

|

|

|

|

|

|

COMMON

STOCKS (Continued)

|

|

|

United

States (Continued)

|

|

|

Stryker

Corp. |

|

|

3,550 |

|

|

$1,210,870

|

|

|

Texas

Instruments, Inc. |

|

|

5,650 |

|

|

1,101,807

|

|

|

UnitedHealth

Group, Inc. |

|

|

2,600 |

|

|

1,287,962

|

|

|

Verisk

Analytics, Inc. |

|

|

3,790 |

|

|

958,036

|

|

|

Zoetis,

Inc. |

|

|

6,190 |

|

|

1,049,576

|

|

|

|

|

|

|

|

|

27,532,636

|

|

|

TOTAL

COMMON STOCKS

(Cost

$43,326,539) |

|

|

|

|

|

53,920,664

|

|

|

MONEY

MARKET FUNDS — 3.0%

|

|

|

|

|

|

|

|

|

First

American Treasury Obligations Fund -

Class X,

5.22%(c) |

|

|

1,642,089 |

|

|

1,642,089

|

|

|

TOTAL

MONEY MARKET FUNDS

(Cost

$1,642,089) |

|

|

|

|

|

1,642,089

|

|

|

TOTAL

INVESTMENTS — 99.9%

(Cost

$44,968,628) |

|

|

|

|

|

55,562,753

|

|

|

Other

Assets in Excess of Liabilities — 0.1% |

|

|

|

|

|

47,485

|

|

|

TOTAL

NET ASSETS — 100.0% |

|

|

|

|

|

$55,610,238 |

|

|

|

|

|

|

|

|

|

|

ADR

- American Depositary Receipt

NV

- Naamloze Vennootschap

PLC

- Public Limited Company

SA

- Sociedad Anónima

SCA

- Societe en commandite par actions

SE

- Societas Europaea

Percentages

are stated as a percent of net assets.

|

(a)

|

To the extent that

the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is more likely to

be impacted by events or conditions affecting the country or region. |

|

(b)

|

Non-income producing

security. |

|

(c)

|

The rate shown represents

the 7-day effective yield as of May 31, 2024. |

The

accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Jensen

Quality Value Fund

Schedule

of Investments

As

of May 31, 2024

|

|

|

|

|

|

|

|

|

|

COMMON

STOCKS — 98.2%

|

|

|

Automobile

Components — 2.8%

|

|

|

|

|

|

|

|

|

Gentex

Corp. |

|

|

154,820 |

|

|

$ 5,418,700

|

|

|

Building

Products — 3.4%

|

|

|

|

|

|

|

|

|

Lennox

International, Inc. |

|

|

13,280 |

|

|

6,674,528

|

|

|

Capital

Markets — 4.3%

|

|

|

|

|

|

|

|

|

FactSet

Research Systems, Inc. |

|

|

10,750 |

|

|

4,345,795

|

|

|

MSCI,

Inc. |

|

|

8,470 |

|

|

4,194,175

|

|

|

|

|

|

|

|

|

8,539,970

|

|

|

Commercial

Services & Supplies — 3.7%

|

|

|

|

|

|

|

|

|

Copart,

Inc.(a) |

|

|

137,810 |

|

|

7,312,199

|

|

|

Communications

Equipment — 2.3%

|

|

|

|

|

|

|

|

|

F5,

Inc.(a) |

|

|

26,860 |

|

|

4,538,534

|

|

|

Consumer

Staples Distribution & Retail — 3.1%

|

|

|

|

|

|

|

|

|

Kroger

Co. |

|

|

116,730 |

|

|

6,113,150

|

|

|

Containers

& Packaging — 3.5%

|

|

|

|

|

|

|

|

|

Crown

Holdings, Inc. |

|

|

80,820 |

|

|

6,804,236

|

|

|

Distributors

— 4.6%

|

|

|

|

|

|

|

|

|

Genuine

Parts Co. |

|

|

42,590 |

|

|

6,138,923

|

|

|

Pool

Corp. |

|

|

8,240 |

|

|

2,995,652

|

|

|

|

|

|

|

|

|

9,134,575

|

|

|

Electronic

Equipment, Instruments & Components — 5.0%

|

|

|

|

|

|

|

|

|

Amphenol

Corp. - Class A |

|

|

39,360 |

|

|

5,210,083

|

|

|

Keysight

Technologies, Inc.(a) |

|

|

33,220 |

|

|

4,600,306

|

|

|

|

|

|

|

|

|

9,810,389

|

|

|

Food

Products — 7.6%

|

|

|

|

|

|

|

|

|

Campbell

Soup Co. |

|

|

101,670 |

|

|

4,512,114

|

|

|

General

Mills, Inc. |

|

|

75,940 |

|

|

5,220,875

|

|

|

Kellanova |

|

|

86,320 |

|

|

5,208,549

|

|

|

|

|

|

|

|

|

14,941,538

|

|

|

Health

Care Equipment & Supplies — 1.3%

|

|

|

|

|

|

|

|

|

IDEXX

Laboratories, Inc.(a) |

|

|

5,120 |

|

|

2,544,384

|

|

|

Health

Care Providers & Services — 7.7%

|

|

|

|

|

|

|

|

|

Encompass

Health Corp. |

|

|

94,410 |

|

|

8,156,080

|

|

|

Laboratory

Corp. of America Holdings |

|

|

35,690 |

|

|

6,956,338

|

|

|

|

|

|

|

|

|

15,112,418

|

|

|

Health

Care Technology — 1.9%

|

|

|

|

|

|

|

|

|

Veeva

Systems, Inc. - Class A(a) |

|

|

21,230 |

|

|

3,699,328

|

|

|

Household

Products — 3.0%

|

|

|

|

|

|

|

|

|

Church

& Dwight Co., Inc. |

|

|

56,010 |

|

|

5,993,630

|

|

|

|

|

|

|

|

|

|

|

The

accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Jensen

Quality Value Fund

Schedule

of Investments

As

of May 31, 2024

|

|

|

|

|

|

|

|

|

|

COMMON

STOCKS (Continued)

|

|

|

Life

Sciences Tools & Services — 4.4%

|

|

|

|

|

|

|

|

|

Bio-Techne

Corp. |

|

|

52,060 |

|

|

$4,018,512

|

|

|

Charles

River Laboratories International, Inc.(a) |

|

|

15,910 |

|

|

3,316,280

|

|

|

Waters

Corp.(a) |

|

|

4,590 |

|

|

1,417,851

|

|

|

|

|

|

|

|

|

8,752,643

|

|

|

Machinery

— 3.7%

|

|

|

|

|

|

|

|

|

Donaldson

Co., Inc. |

|

|

56,760 |

|

|

4,182,077

|

|

|

Toro

Co. |

|

|

38,740 |

|

|

3,106,560

|

|

|

|

|

|

|

|

|

7,288,637

|

|

|

Professional

Services — 16.2%

|

|

|

|

|

|

|

|

|

Booz

Allen Hamilton Holding Corp. |

|

|

28,380 |

|

|

4,319,720

|

|

|

Broadridge

Financial Solutions, Inc. |

|

|

36,619 |

|

|

7,351,997

|

|

|

Equifax,

Inc. |

|

|

28,940 |

|

|

6,696,426

|

|

|

Genpact

Ltd. |

|

|

166,270 |

|

|

5,496,886

|

|

|

Maximus,

Inc. |

|

|

44,220 |

|

|

3,807,342

|

|

|

Verisk

Analytics, Inc. |

|

|

16,540 |

|

|

4,180,981

|

|

|

|

|

|

|

|

|

31,853,352

|

|

|

Semiconductors

& Semiconductor Equipment — 3.6%

|

|

|

|

|

|

|

|

|

Microchip

Technology, Inc. |

|

|

49,430 |

|

|

4,806,079

|

|

|

ON

Semiconductor Corp.(a) |

|

|

31,030 |

|

|

2,266,431

|

|

|

|

|

|

|

|

|

7,072,510

|

|

|

Software

— 2.2%

|

|

|

|

|

|

|

|

|

Manhattan

Associates, Inc.(a) |

|

|