UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 629-8104

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2021

Date of reporting period: June 30, 2021

Item 1. Reports to Stockholders.

(a)

SEMI-ANNUAL REPORT

JUNE 30, 2021

MINNESOTA MUNICIPAL BOND ETF (MINN)

est. 2021

MAIRS & POWER MINNESOTA MUNICIPAL BOND ETF (unaudited)

To Our Shareholders: June 30, 2021

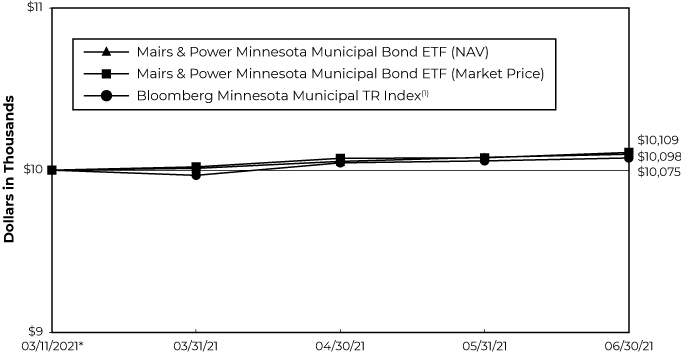

The Mairs & Power Minnesota Municipal Bond ETF (the "Fund") gained 0.86% (NAV) and 0.89% (Market Price) in the second quarter ended June 30, 2021. During the same period, the Bloomberg Minnesota Municipal Total Return (TR) Index, the Fund's benchmark, rose 1.07%. Since inception on March 11, 2021, the Fund was up 0.98% (NAV) and 1.09% (Market Price) while its benchmark has gained 0.75%.

Since launch on March 11, 2021, the Fund has become fully invested as inflows of cash have been prudently put to work. Over one third of money invested was put to work in the new issue market, directly funding Minnesota municipalities.

From a credit perspective, the names in which the Fund is invested have remained strong. The state overall is facing a large surplus as tax collections are running $2.2B ahead of February 2021 estimates. Regardless of the legislature's inability to reach budget deals in a timely manner, we believe that maintaining credit quality should not be an issue. The state has opened up, and Minnesota boasts the 12th lowest unemployment rate in the country.

New bond issuance since the Fund's launch has been in line with historical standards, but there is substantial demand for tax exempt paper as seen through healthy fund flows in municipal bond funds. The supply is not satisfying demand, and issuers have employed coupon structures that we believe would be highly disadvantageous in a rising interest rate environment. We have tended to avoid these coupon structures, instead preferring to invest in higher coupon bonds.

Our weighted average maturity of 11.9 years is slightly short to the benchmark index of 12.5 years while the duration to worst is long of the index as we are investing where we find opportunities at reasonable prices.

Given a relative lack of lower quality deals and the state of the high yield municipal market with the lowest yields on record, we have found fewer areas to invest in lower rated paper. We will continue to be highly selective in the lower than A-rated space, where we only have two holdings currently. The majority of the Fund's portfolio will continue to focus on high credit quality.

Notably, we focused on and will continue to focus on unlimited tax general obligation bonds, which comprise nearly half of the Fund's portfolio given the solid credit structure of these securities. The second largest sector – leases – is a mix of essential purpose lease projects representing a mix of projects including school additions, special education centers, and a county courthouse, among others. We are careful in credit selection and anticipate our preference for essential projects will continue to prevail as we will not sacrifice quality for the sake of additional yield.

Past performance is not a guarantee of future results.

Bloomberg Minnesota Municipal (TR) Index is a market capitalization-weighted index of Minnesota investment-grade bonds with maturities of one year or more. It is not possible to invest directly in an index.

Weighted average maturity is the average time it takes for securities in a portfolio to mature, weighted in proportion to the dollar amount that is invested in the portfolio. Weighted average maturity measures the sensitivity of fixed-income portfolios to interest rate changes.

Duration to Worst is a measure of weighted average expected cash flows based on expected maturity of bonds. This measure can indicate interest rate sensitivity as a higher duration to worst indicates greater sensitivity to moves in interest rates and a lower duration to worst indicates relatively lower sensitivity to a move in interest rates.

1

Mairs & Power Minnesota Municipal Bond ETF

PERFORMANCE INFORMATION (unaudited) June 30, 2021

Investment performance since commencement of operations (through June 30, 2021)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund since commencement of operations.

* Fund commenced investment operation on March 11, 2021.

Average annual total returns for periods ended June 30, 2021

|

3 Months(2) |

Since Commencement of Operations(2)(3) |

||||||||||

|

Mairs & Power Minnesota Municipal Bond ETF (NAV) |

0.86 |

% |

0.98 |

% |

|||||||

|

Mairs & Power Minnesota Municipal Bond ETF (Market Price) |

0.89 |

% |

1.09 |

% |

|||||||

|

Bloomberg Minnesota Municipal TR Index |

1.07 |

% |

0.75 |

% |

|||||||

Performance data quoted represents past performance and does not guarantee future results. All performance information shown includes the reinvestment of dividend and capital gain distributions, but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. For the most recent month-end performance figures, visit the Fund's website at www.mairsandpower.com or call Shareholder Services at (855) 839-2800. Per the Prospectus dated March 3, 2021, the expense ratio for the Fund is 0.39%.

(1) Bloomberg Minnesota Municipal TR Index is a market capitalization – weighted index of Minnesota Investment-grade bonds with maturities of one year or more.

(2) Periods less than one year are not annualized.

(3) Since commencement of operations performance is as of March 11, 2021, which is the offering date of the Fund.

2

Mairs & Power Minnesota Municipal Bond ETF

FUND INFORMATION (unaudited) June 30, 2021

Portfolio Managers

Brent S. Miller, CFA, lead manager since March 11, 2021, Northwestern University, MBA Management & Strategy 2016

Robert W. Thompson, CFA, co-manager since March 11, 2021, University of Minnesota, MBA Finance 1995

General Information

|

Fund Symbol |

MINN |

||||||

|

Net Asset Value (NAV) Per Share |

$ |

25.21 |

|||||

|

Expense Ratio |

0.39 |

% |

|||||

|

Portfolio Turnover Rate (3/11/21 to 6/30/21, not annualized) |

0.00 |

% |

|||||

|

Sales Charge |

None1 |

||||||

|

Fund Inception Year |

2021 |

||||||

Portfolio Composition

Top Ten Portfolio Holdings

(Percent of Total Net Assets) 2

|

State of Minnesota |

9.6 |

% |

|||||

|

Minnesota Higher Education Facilities Authority |

8.6 |

||||||

|

Minneapolis-St Paul Metropolitan Airports Commission |

4.9 |

||||||

|

Minneapolis Special School District No 1 |

4.8 |

||||||

|

Anoka-Hennepin Independent School District No 11 |

4.3 |

||||||

|

Zumbro Education District |

3.7 |

||||||

|

City of Carver MN |

3.6 |

||||||

|

City of Elk River MN Electric Revenue |

3.4 |

||||||

|

City of Elk River MN |

3.0 |

||||||

|

Housing & Redevelopment Authority of The City of St Paul Minnesota |

2.7 |

||||||

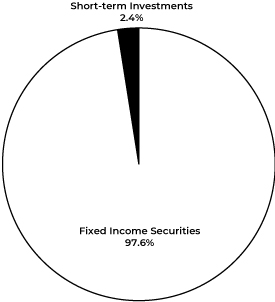

Portfolio Diversification

(Percent of Total Net Assets)

|

Fixed Income Securities 97.6% |

|||||||

|

Municipal Bonds |

97.6 |

% |

|||||

|

Short-term Investments 2.4%3 |

2.4 |

||||||

|

100.0 |

% |

||||||

1 Although the Fund is no-load, investment management fees still apply.

2 All holdings in the Fund's portfolio are subject to change without notice and may or may not represent current or future portfolio composition. The mention of specific securities is not intended as a recommendation or offer for a particular security, nor is it intended to be a solicitation for the purchase or sale of any security.

3 Represents short-term investments and other assets and liabilities (net).

3

Mairs & Power Minnesota Municipal Bond ETF

SCHEDULE OF INVESTMENTS (unaudited) June 30, 2021

|

Par Value |

Security Description |

Fair Value |

|||||||||||||||||

|

FIXED INCOME SECURITIES 97.6% |

|||||||||||||||||||

|

MUNICIPAL BONDS 97.6% |

|||||||||||||||||||

|

$ |

200,000 |

Southern Plains Education Cooperative No 915 |

3.000 |

% |

02/01/26 |

$ |

215,052 |

||||||||||||

| 125,000 |

Housing & Redevelopment Authority of The City of St Paul Minnesota |

3.500 |

% |

09/01/26 |

131,394 |

||||||||||||||

| 250,000 |

Metropolitan Council |

5.000 |

% |

12/01/27 |

317,775 |

||||||||||||||

| 200,000 |

North Branch Independent School District No 138 |

5.000 |

% |

02/01/28 |

246,202 |

||||||||||||||

| 115,000 |

City of Lonsdale MN |

3.000 |

% |

02/01/28 |

130,683 |

||||||||||||||

| 175,000 |

City of Fridley MN |

4.000 |

% |

02/01/28 |

200,445 |

||||||||||||||

| 255,000 |

County of Scott MN |

5.000 |

% |

12/01/28 |

330,009 |

||||||||||||||

| 95,000 |

City of Apple Valley MN |

3.000 |

% |

12/15/28 |

110,273 |

||||||||||||||

| 110,000 |

Minneapolis-St Paul Metropolitan Airports Commission |

5.000 |

% |

01/01/29 |

134,661 |

||||||||||||||

| 85,000 |

City of Apple Valley MN |

3.000 |

% |

12/15/29 |

99,819 |

||||||||||||||

| 180,000 |

Minneapolis-St Paul Metropolitan Airports Commission |

5.000 |

% |

01/01/30 |

232,453 |

||||||||||||||

| 35,000 |

Rocori Area Schools Independent School District No 750 |

4.000 |

% |

02/01/30 |

40,498 |

||||||||||||||

| 185,000 |

City of Hopkins MN |

2.000 |

% |

02/01/30 |

199,527 |

||||||||||||||

| 150,000 |

Rosemount-Apple Valley-Eagan Independent School District No 196 |

1.300 |

% |

04/01/30 |

150,398 |

||||||||||||||

| 200,000 |

City of Minneapolis MN |

2.000 |

% |

12/01/30 |

209,870 |

||||||||||||||

| 150,000 |

County of Hennepin MN |

5.000 |

% |

12/15/30 |

198,488 |

||||||||||||||

| 50,000 |

Pelican Rapids Independent School District No 548 |

2.150 |

% |

02/01/31 |

51,572 |

||||||||||||||

| 130,000 |

St Cloud Housing & Redevelopment Authority |

2.000 |

% |

02/01/31 |

138,573 |

||||||||||||||

| 325,000 |

City of Elk River MN |

3.000 |

% |

02/01/31 |

376,861 |

||||||||||||||

| 275,000 |

Springfield Independent School District No 85 |

3.000 |

% |

02/01/31 |

310,993 |

||||||||||||||

| 65,000 |

Dakota County Community Development Agency |

2.000 |

% |

01/01/32 |

68,695 |

||||||||||||||

| 130,000 |

Minneapolis-St Paul Metropolitan Airports Commission |

5.000 |

% |

01/01/32 |

157,658 |

||||||||||||||

| 195,000 |

City of Carver MN |

3.000 |

% |

02/01/32 |

225,445 |

||||||||||||||

| 200,000 |

Pine City Independent School District No 578 |

2.000 |

% |

04/01/32 |

206,241 |

||||||||||||||

| 365,000 |

City of Elk River MN Electric Revenue |

3.000 |

% |

08/01/32 |

422,959 |

||||||||||||||

| 100,000 |

St Paul Public Library Agency |

3.000 |

% |

10/01/32 |

114,861 |

||||||||||||||

| 75,000 |

Housing & Redevelopment Authority of The City of St Paul Minnesota |

4.000 |

% |

10/01/32 |

85,421 |

||||||||||||||

| 110,000 |

Housing & Redevelopment Authority of The City of St Paul Minnesota |

3.125 |

% |

11/15/32 |

118,218 |

||||||||||||||

| 115,000 |

City of Madelia MN |

2.000 |

% |

02/01/33 |

119,916 |

||||||||||||||

| 160,000 |

St Cloud Housing & Redevelopment Authority |

2.000 |

% |

02/01/33 |

168,885 |

||||||||||||||

| 200,000 |

City of Carver MN |

3.000 |

% |

02/01/33 |

230,465 |

||||||||||||||

| 200,000 |

St Paul Independent School District No 625 |

3.000 |

% |

02/01/33 |

217,641 |

||||||||||||||

| 300,000 |

Hibbing Independent School District No 701 |

3.000 |

% |

03/01/33 |

330,296 |

||||||||||||||

| 300,000 |

City of St Paul MN |

2.000 |

% |

05/01/33 |

315,828 |

||||||||||||||

| 165,000 |

State of Minnesota |

5.000 |

% |

08/01/33 |

216,204 |

||||||||||||||

| 50,000 |

City of Minneapolis MN |

5.000 |

% |

11/15/33 |

62,305 |

||||||||||||||

| 100,000 |

County of Hennepin MN |

5.000 |

% |

12/15/33 |

131,229 |

||||||||||||||

| 125,000 |

Zumbro Education District |

4.000 |

% |

02/01/34 |

147,981 |

||||||||||||||

4

Mairs & Power Minnesota Municipal Bond ETF

SCHEDULE OF INVESTMENTS (unaudited) (continued) June 30, 2021

|

Par Value |

Security Description |

Fair Value |

|||||||||||||||||

| FIXED INCOME SECURITIES (continued) | |||||||||||||||||||

| MUNICIPAL BONDS (continued) | |||||||||||||||||||

|

$ |

100,000 |

City of Corcoran MN |

3.125 |

% |

02/01/34 |

$ |

109,478 |

||||||||||||

| 110,000 |

Shakopee Independent School District No 720 |

3.500 |

% |

02/01/34 |

119,111 |

||||||||||||||

| 215,000 |

State of Minnesota |

5.000 |

% |

08/01/34 |

281,211 |

||||||||||||||

| 70,000 |

Minneapolis-St Paul Metropolitan Airports Commission |

5.000 |

% |

01/01/35 |

89,138 |

||||||||||||||

| 500,000 |

Minneapolis Special School District No 1 |

4.000 |

% |

02/01/36 |

607,841 |

||||||||||||||

| 90,000 |

University of Minnesota |

5.000 |

% |

04/01/36 |

106,875 |

||||||||||||||

| 150,000 |

Minnetonka Independent School District No 276 |

3.000 |

% |

07/01/36 |

166,350 |

||||||||||||||

| 200,000 |

Minnesota Higher Education Facilities Authority |

3.000 |

% |

10/01/36 |

221,407 |

||||||||||||||

| 225,000 |

Fergus Falls Independent School District No 544 |

3.000 |

% |

02/01/37 |

240,543 |

||||||||||||||

| 100,000 |

City of Hanover MN |

3.300 |

% |

02/01/37 |

105,902 |

||||||||||||||

| 130,000 |

Minnesota Higher Education Facilities Authority |

4.000 |

% |

03/01/37 |

158,648 |

||||||||||||||

| 35,000 |

City of Minneapolis MN |

4.000 |

% |

11/15/37 |

40,403 |

||||||||||||||

| 275,000 |

Zumbro Education District |

4.000 |

% |

02/01/38 |

322,300 |

||||||||||||||

| 215,000 |

City of Rochester MN |

4.500 |

% |

11/15/38 |

218,340 |

||||||||||||||

| 275,000 |

County of Wright MN |

3.000 |

% |

12/01/38 |

301,185 |

||||||||||||||

| 335,000 |

State of Minnesota |

5.000 |

% |

08/01/39 |

443,617 |

||||||||||||||

| 20,000 |

County of Wright MN |

3.000 |

% |

12/01/39 |

21,854 |

||||||||||||||

| 200,000 |

State of Minnesota |

5.000 |

% |

08/01/40 |

264,409 |

||||||||||||||

| 400,000 |

Minnesota Higher Education Facilities Authority |

3.000 |

% |

10/01/41 |

442,096 |

||||||||||||||

| 70,000 |

City of Rochester MN |

4.000 |

% |

11/15/41 |

72,066 |

||||||||||||||

| 500,000 |

Anoka-Hennepin Independent School District No 11 |

3.000 |

% |

02/01/43 |

542,575 |

||||||||||||||

| 125,000 |

Minnesota Higher Education Facilities Authority |

3.000 |

% |

03/01/43 |

136,738 |

||||||||||||||

| 105,000 |

Minnesota Higher Education Facilities Authority |

5.000 |

% |

03/01/44 |

126,611 |

||||||||||||||

|

12,304,492 |

|||||||||||||||||||

|

TOTAL FIXED INCOME SECURITIES (cost $12,236,181) |

$ |

12,304,492 |

|||||||||||||||||

|

SHORT-TERM INVESTMENTS 2.9% |

|||||||||||||||||||

| 364,377 |

First American Government Obligations Fund, Class X, 0.026% (a) (cost $364,377) |

$ |

364,377 |

||||||||||||||||

|

TOTAL INVESTMENTS 100.5% (cost $12,600,558) |

$ |

12,668,869 |

|||||||||||||||||

|

OTHER ASSETS AND LIABILITIES (NET) (0.5)% |

(63,350 |

) |

|||||||||||||||||

|

TOTAL NET ASSETS 100.0% |

$ |

12,605,519 |

|||||||||||||||||

(a) The rate quoted is the annualized seven-day effective yield as of June 30, 2021.

See accompanying Notes to Financial Statements.

5

STATEMENTS OF ASSETS AND LIABILITIES (unaudited) June 30, 2021

|

Mairs & Power Minnesota Municipal Bond ETF |

|||||||

|

ASSETS |

|||||||

|

Investments in securities, at fair value*: |

$ |

12,668,869 |

|||||

|

Dividends and interest receivable |

102,655 |

||||||

|

12,771,524 |

|||||||

|

LIABILITIES |

|||||||

|

Payable for securities purchased |

163,854 |

||||||

| Accrued investment management fees (Note 4) |

2,151 |

||||||

|

166,005 |

|||||||

|

NET ASSETS |

$ |

12,605,519 |

|||||

|

NET ASSETS CONSIST OF |

|||||||

|

Paid-in capital |

$ |

12,534,150 |

|||||

|

Total distributable earnings |

71,369 |

||||||

|

TOTAL NET ASSETS |

$ |

12,605,519 |

|||||

|

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) |

500,000 |

||||||

|

Net asset value per share |

$ |

25.21 |

|||||

|

* Cost of investments |

$ |

12,600,558 |

|||||

See accompanying Notes to Financial Statements.

6

STATEMENT OF OPERATIONS (unaudited) Period Ended June 30, 2021 1

|

Mairs & Power Minnesota Municipal Bond ETF |

|||||||

|

INVESTMENT INCOME |

|||||||

|

Income: |

|||||||

|

Interest income |

$ |

30,013 |

|||||

|

TOTAL INCOME |

30,013 |

||||||

|

Expenses: |

|||||||

| Investment management fees (Note 4) |

11,328 |

||||||

|

TOTAL EXPENSES |

11,328 |

||||||

|

NET INVESTMENT INCOME |

18,685 |

||||||

|

REALIZED AND UNREALIZED GAIN |

|||||||

|

Net realized gain (loss) on investments |

- |

||||||

|

Change in net unrealized appreciation on investments |

68,311 |

||||||

|

NET GAIN ON INVESTMENTS |

68,311 |

||||||

|

NET INCREASE IN NET ASSETS FROM OPERATIONS |

$ |

86,996 |

|||||

1 Period from March 11, 2021 (commencement of operations) through June 30, 2021.

See accompanying Notes to Financial Statements.

7

Mairs & Power Minnesota Municipal Bond ETF

STATEMENT OF CHANGES IN NET ASSETS

|

Period Ended June 30, 2021 1 (unaudited) |

|||||||

|

OPERATIONS |

|||||||

|

Net investment income |

$ |

18,685 |

|||||

|

Net realized gain on investments sold |

- |

||||||

|

Net change in unrealized appreciation of investments |

68,311 |

||||||

|

NET INCREASE IN NET ASSETS FROM OPERATIONS |

86,996 |

||||||

|

DISTRIBUTIONS TO SHAREHOLDERS |

(15,627 |

) |

|||||

|

CAPITAL TRANSACTIONS |

|||||||

|

Proceeds from shares sold |

12,534,150 |

||||||

|

INCREASE IN NET ASSETS FROM CAPITAL TRANSACTIONS |

12,534,150 |

||||||

|

TOTAL INCREASE IN NET ASSETS |

12,605,519 |

||||||

|

NET ASSETS |

|||||||

|

Beginning of period |

- |

||||||

|

End of period |

$ |

12,605,519 |

|||||

|

FUND SHARE TRANSACTIONS |

|||||||

|

Shares sold |

500,000 |

||||||

|

NET INCREASE IN FUND SHARES |

500,000 |

||||||

1 Period from March 11, 2021 (commencement of operations) through June 30, 2021.

See accompanying Notes to Financial Statements.

8

NOTES TO THE FINANCIAL STATEMENTS (unaudited) June 30, 2021

Note 1 – Organization

Trust for Professional Managers (the "Trust") was organized as a Delaware statutory trust under a Declaration of Trust dated May 29, 2001. The Trust is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end, management investment company. The Mairs & Power Minnesota Municipal Bond Fund (the "Fund") represents a distinct diversified series with its own investment objective and policies within the Trust. The Fund is an actively-managed exchange-traded fund ("ETF"). The investment objective of the Fund is to seek current income that is exempt from federal and Minnesota state income tax consistent with the preservation of capital. The Trust may issue an unlimited number of shares at a price per share of not less than the net asset value thereof. The assets of the Fund are segregated, and a shareholder's interest is limited to the fund in which shares are held. The Fund commenced operations on March 11, 2021. Costs incurred by the Fund in connection with the organization and the initial public offering of shares were paid by Mairs & Power, Inc. (the "Adviser"), the Fund's investment adviser.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 946 "Financial Services – Investment Companies".

Note 2 – Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America ("GAAP").

Investment Valuation

Each equity security owned by the Fund that is listed on a securities exchange, except for securities listed on the NASDAQ Stock Market LLC ("NASDAQ"), is valued at its last sale price on the exchange on the date as of which assets are valued. When the security is listed on more than one exchange, the Fund will use the price of the exchange that the Fund generally considers to be the principal exchange on which the stock is traded. Fund securities listed on NASDAQ will be valued at the NASDAQ Official Closing Price ("NOCP"), which may not necessarily represent the last sale price. If the NOCP is not available, such securities shall be valued at the last sale price on the day of valuation. If there has been no sale on such exchange or on NASDAQ on such day, the security is valued at (i) the mean between the most recent quoted bid and asked prices at the close of the exchange on such day or (ii) the latest sales price on the Composite Market for the day such security is being valued. "Composite Market" means a consolidation of the trade information provided by national securities and foreign exchanges and over-the- counter markets as published by an approved independent pricing service (a "Pricing Service").

Debt securities, such as U.S. government securities, corporate securities, municipal securities and asset-backed and mortgage-backed securities, including short-term debt instruments having a maturity of 60 days or less, are valued at the mean in accordance with prices supplied by a Pricing Service. Pricing Services may use various valuation methodologies such as the mean between the bid and the asked prices, matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. If a price is not available from a Pricing Service, the most recent quotation obtained from one or more broker-dealers known to follow the issue will be obtained. Quotations will be valued at the mean between the bid and the offer. In the absence of available quotations, the securities will be priced at fair value. Any discount or premium is accreted or amortized over the expected life of the respective security using the constant yield to maturity method. Pricing Services generally value debt securities assuming orderly transactions of an institutional round lot size, but such securities may be held or transactions may be conducted in such securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots.

Money market funds, demand notes and repurchase agreements are valued at cost. If cost does not represent current market value the securities will be priced at fair value.

9

NOTES TO THE FINANCIAL STATEMENTS (unaudited) (continued) June 30, 2021

Note 2 – Significant Accounting Policies (continued)

Investment Valuation (continued)

Redeemable securities issued by open-end, registered investment companies are valued at the net asset values ("NAVs") of such companies for purchase and/or redemption orders placed on that day. If, on a particular day, a share of an investment company is not listed on NASDAQ, such security's fair value will be determined. Money market mutual funds are valued at cost. If cost does not represent current market value the securities will be priced at fair value.

When market quotations are not readily available, any security or other asset is valued at its fair value as determined under procedures approved by the Trust's Board of Trustees. These fair value procedures will also be used to price a security when corporate events, events in the securities market or world events cause the Adviser to believe that a security's last sale price may not reflect its actual fair market value. The intended effect of using fair value pricing procedures is to ensure that the Fund is accurately priced. The Board of Trustees will regularly evaluate whether the Fund's fair value pricing procedures continue to be appropriate in light of the specific circumstances of the Fund and the quality of prices obtained through their application by the Trust's valuation committee.

FASB Accounting Standards Codification, "Fair Value Measurements and Disclosures" Topic 820 ("ASC 820"), establishes an authoritative definition of fair value and sets out a hierarchy for measuring fair value. ASC 820 requires an entity to evaluate certain factors to determine whether there has been a significant decrease in volume and level of activity for the security such that recent transactions and quoted prices may not be determinative of fair value and further analysis and adjustment may be necessary to estimate fair value. ASC 820 also requires enhanced disclosure regarding the inputs and valuation techniques used to measure fair value in those instances as well as expanded disclosure of valuation levels for each class of investments. These inputs are summarized in the three broad levels listed below:

• Level 1 – Quoted prices in active markets for identical securities.

• Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

• Level 3 – Significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund's investments carried at fair value as of June 30, 2021:

|

Level 1 |

$ |

364,377 |

|||||

|

Level 2 |

12,304,492 |

||||||

|

Level 3 |

- |

||||||

|

Total |

$ |

12,668,869 |

|||||

The Fund did not hold any Level 3 securities during the period ended June 30, 2021.

The Fund did not hold any financial derivative instruments during the period ended June 30, 2021.

Federal Income Taxes

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986 (the "Code"), as amended, necessary to qualify as a regulated investment company and to make the requisite distributions of income and capital gains to its shareholders sufficient to relieve it from all or substantially all federal income taxes. Therefore, no federal income tax provision has been provided.

The Fund's Federal income tax returns are subject to examination by the Internal Revenue Service (the "IRS") for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination

10

NOTES TO THE FINANCIAL STATEMENTS (unaudited) (continued) June 30, 2021

Note 2 – Significant Accounting Policies (continued)

Federal Income Taxes (continued)

for an additional fiscal year depending on the jurisdiction. As of and during the period ended June 30, 2021, the Fund did not have a liability for any unrecognized tax benefits.

The Fund recognizes interest and penalties, if any, related to uncertain tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Distributions to Shareholders

The Fund will distribute any net investment income monthly. The Fund will distribute any net realized long- or short-term capital gains, if any, at least annually. Distributions from net realized gains for book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes.

Distributions to shareholders are recorded on the ex-dividend date. The Fund may also pay a special distribution at the end of the calendar year to comply with federal tax requirements. Income and capital gain distributions may differ from GAAP, primarily due to timing differences in the recognition of income, gains and losses by the Funds. To the extent that these differences are attributable to permanent book and tax accounting differences, the components of net assets have been adjusted.

The Fund intends to make distributions that are exempt from federal and Minnesota state income tax, in the form of exempt-interest dividends. However, some of the Fund's distributions other than exempt-interest dividends may be taxed as ordinary income or capital gains (or a combination). The Fund may invest a portion of its assets in securities that generate income that is not exempt from federal income tax or Minnesota state income tax. Income exempt from federal income tax may be subject to state and local income tax. The federal income tax status of all distributions made by the Fund for the preceding year will be reported annually to shareholders.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Share Transactions

The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) divided by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund's shares will not be priced on the days on which the New York Stock Exchange ("NYSE") is closed for trading.

Expenses

Expenses associated with a specific fund in the Trust are charged to that fund. Common expenses are typically allocated evenly between the series of the Trust, or by other equitable means.

Other

Investment transactions are recorded on the trade date. The Fund determines the gain or loss from investment transactions on the identified cost basis by comparing the cost of the security lot sold with the net sales proceeds. Dividend income, less foreign withholding tax, is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends and interest, net of any reclaims, have been provided for in accordance with the Fund's understanding of the applicable country's tax rules and rates. An amortized cost method of valuation may be used with respect to debt obligations with sixty days or less remaining to maturity, unless the Adviser determines in good faith that such method does not represent fair value.

11

NOTES TO THE FINANCIAL STATEMENTS (unaudited) (continued) June 30, 2021

Note 3 – Federal Tax Matters

The Fund commenced operations on March 11, 2021; therefore, there is no tax information as of June 30, 2021.

Note 4 – Investment Adviser

The Trust has an Investment Advisory Agreement (the "Agreement") with the Adviser to furnish investment advisory services to the Fund. Under the terms of the Agreement between the Trust, on behalf of the Fund, and the Adviser, the Fund pays a unified management fee to the Adviser, which is calculated daily and paid monthly, at an annual rate of 0.39% of the Fund's average daily net assets. The Adviser has agreed to pay all expenses of the Fund except the unified management fee paid to the Adviser under the Agreement, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, distribution fees and expenses paid by the Fund under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act.

Note 5 – Distribution Agreement

Foreside Fund Services, LLC (the "Distributor") serves as the Fund's distributor pursuant to a Distribution Services Agreement. The Distributor receives compensation for the statutory underwriting services it provides to the Fund. The Distributor enters into agreements with certain broker-dealers and others that will allow those parties to be "Authorized Participants" and to subscribe for and redeem shares of the Fund. The Distributor will not distribute shares in less than whole Creation Units and does not maintain a secondary market in shares.

Note 6 – Related Party Transactions

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services ("Fund Services" or the "Administrator"), acts as the Fund's administrator under an Administration Agreement. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund's custodian, transfer agent and fund accountant; coordinates the preparation and payment of the Fund's expenses; and reviews the Fund's expense accruals. Fund Services also serves as the fund accountant and transfer agent to the Fund. U.S. Bank N.A (the "Custodian"), an affiliate of Fund Services, serves as the Fund's custodian pursuant to a Custody Agreement. Under the terms of these agreements, the Adviser pays the Fund's administrative, custody and transfer agency fees.

Certain officers of the Fund are also employees of Fund Services. A Trustee of the Trust is affiliated with Fund Services and the Custodian.

The Trust's Chief Compliance Officer is also an employee of Fund Services.

Note 7 – Creation and Redemption Transactions

Shares of the Fund are listed and traded on the Cboe BZX Exchange, Inc. (the "Exchange"). The Fund issues and redeems shares on a continuous basis at NAV only in large blocks of shares called "Creation Units." A Creation Unit generally consists of 10,000 shares. Creation Units are to be issued and redeemed principally in kind for a basket of securities and a balancing cash amount. Shares generally will trade in the secondary market in amounts less than a Creation Unit at market prices that change throughout the day. Market prices for the shares may be different from their NAV. The NAV is determined as of the close of trading (generally, 4:00 p.m. Eastern Time) on each day the NYSE is open for trading. The NAV of the shares of the Fund will be equal to the Fund's total assets minus the Fund's total liabilities divided by the total number of shares outstanding. The NAV that is published will be rounded to the nearest cent; however, for purposes of determining the price of Creation Units, the NAV will be calculated to five decimal places.

12

NOTES TO THE FINANCIAL STATEMENTS (unaudited) (continued) June 30, 2021

Note 7 – Creation and Redemption Transactions (continued)

Only "Authorized Participants" may purchase or redeem shares directly from the Fund. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the shares directly from the Fund. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees. Securities received or delivered in connection with in-kind creates and redeems are valued as of the close of business on the effective date of the creation or redemption.

Creation Unit Transaction Fee

Authorized Participants will be required to pay to the Custodian a fixed transaction fee (the "Creation Transaction Fee") in connection with the issuance of Creation Units. The standard Creation Transaction Fee will be the same regardless of the number of Creation Units purchased by an investor on the applicable Business Day. The Creation Transaction Fee for the Fund is $250.

An additional variable fee of up to a maximum of 2% of the value of the Creation Units subject to the transaction may be imposed for cash purchases, non-standard orders, or partial purchase of Creation Units. For orders comprised entirely of cash, a variable fee of 0.03% of the value of the order will be charged by the Fund. The variable charge is primarily designed to cover additional costs (e.g., brokerage, taxes) involved with buying the securities with cash. The Fund may determine to not charge a variable fee on certain orders when the Adviser has determined that doing so is in the best interests of Fund shareholders.

A creation unit will generally not be issued until the transfer of good title of the deposit securities to the Fund and the payment of any cash amounts have been completed. To the extent contemplated by the applicable participant agreement, Creation Units of the Fund will be issued to such authorized participant notwithstanding the fact that the Fund's deposits have not been received in part or in whole, in reliance on the undertaking of the authorized participant to deliver the missing deposit securities as soon as possible. If the Fund or its agents do not receive all of the deposit securities, or the required cash amounts, by such time, then the order may be deemed rejected and the authorized participant shall be liable to the Fund for losses, if any.

Note 8 – Investment Transactions

The aggregate purchases and sales of securities, excluding short-term investments, creations in-kind and redemptions in-kind for the Fund for the period ended June 30, 2021 were as follows:

| Purchases |

Sales |

||||||

| $ |

12,273,360 |

$ |

- |

||||

Note 9 – Principal Risks

As with all ETFs, shareholders of the Fund are subject to the risk that their investment could lose money. The Fund is subject to the principal risks, any of which may adversely affect a Fund's NAV, trading price, yield, total return and ability to meet its investment objective. A description of the principal risks is included in the prospectus under the heading "Principal Risks".

Note 10 – Recent Market Events

U.S. and international markets have experienced significant periods of volatility in recent years due to a number of economic, political and global macro factors including the impact of the novel coronavirus (COVID-19) as a global pandemic, which has resulted in related public health issues, growth concerns in the U.S.

13

NOTES TO THE FINANCIAL STATEMENTS (unaudited) (continued) June 30, 2021

Note 10 – Recent Market Events (continued)

and overseas, temporary and permanent layoffs in the private sector and rising unemployment claims and reduced consumer spending. The recovery from the lasting effects of COVID-19 is uncertain and may last for an extended period of time. These developments as well as other events could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets. As a result, the risk environment remains elevated. The Adviser will monitor developments and seek to manage the Fund in a manner consistent with achieving the Fund's investment objective, but there can be no assurance that it will be successful in doing so.

Note 11 – Subsequent Events

Distributions

The Fund paid distributions to shareholders as follows:

|

Record Date |

Ex-Date |

Reinvestment Date/Payable Date |

Ordinary Income Rate |

Ordinary Income Distribution Paid |

|||||||||||||||

|

July 26, 2021 |

July 23, 2021 |

July 30, 2021 |

0.02096922 |

$ |

10,485 |

||||||||||||||

|

August 25, 2021 |

August 24, 2021 |

August 31, 2021 |

0.01802800 |

$ |

10,276 |

||||||||||||||

Foreside Acquisition

On June 30, 2021, Foreside Fund Services, LLC ("Foreside"), the Fund's distributor, and Lovell Minnick Partners, LLC ("LMP") announced they had entered into a definitive purchase and sale agreement with Genstar Capital ("Genstar"), a private equity firm specializing in financial and related business services companies. Genstar will acquire a majority stake in Foreside, and LMP will exit its investment in Foreside. The transaction is anticipated to close, subject to any necessary governmental and regulatory approvals, in the third quarter of 2021. Foreside will remain the Fund's distributor at the close of the transaction, subject to Board approval received on August 4, 2021.

Other than as disclosed, there were no other subsequent events requiring recognition or disclosure through the date the financial statements were issued.

14

Mairs & Power Minnesota Municipal Bond ETF

FINANCIAL HIGHLIGHTS

SELECTED DATA AND RATIOS

(for a share outstanding throughout the period)

|

Period Ended June 30, 2021 (1) |

|||||||

|

(unaudited) |

|||||||

|

Per Share |

|||||||

|

Net asset value, beginning of period |

$ |

25.00 |

|||||

|

Income from investment operations: |

|||||||

|

Net investment income (2) |

0.05 |

||||||

|

Net realized and unrealized gain (loss) |

0.19 |

||||||

|

Total from investment operations |

0.24 |

||||||

|

Distributions to shareholders from: |

|||||||

|

Net investment income |

(0.03 |

) |

|||||

|

Total distributions |

(0.03 |

) |

|||||

|

Net asset value, end of period |

$ |

25.21 |

|||||

|

Total investment return, at NAV (3) |

0.98 |

%(4) |

|||||

|

Total investment return, at Market (3) |

1.09 |

%(4) |

|||||

|

Net assets, end of period, in thousands |

$ |

12,606 |

|||||

|

Ratios/supplemental data: |

|||||||

|

Ratio of expenses to average net assets |

0.39 |

%(5) |

|||||

|

Ratio of net investment income to average net assets |

0.64 |

%(5) |

|||||

|

Portfolio turnover rate (6) |

0 |

%(4) |

|||||

(1) The Fund commenced investment operations on March 11, 2021.

(2) Per share net investment income was calculated using average shares outstanding.

(3) Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends.

(4) Not annualized for periods less than one year.

(5) Annualized for periods less than one year.

(6) Excludes in-kind transations associated with creations and redemptions of the Fund.

See accompanying Notes to Financial Statements.

15

FUND EXPENSES (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of the Fund's shares and (2) ongoing expenses for the operation of the Fund (e.g., asset-based charges, such as investment management fees).

This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The table below reports the Fund's expenses during the period March 11, 2021 (commencement of operations) through June 30, 2021 and includes the costs associated with a $1,000 investment.

Actual Expenses

The first line in the table below may be used to estimate the actual expenses you paid over the reporting period. You can do this by dividing your account value by $1,000 and multiplying the result by the expense shown in the table below. For example, if your account value is $8,600, divided by $1,000 = $8.60. Multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period." By doing this you can estimate the expenses you paid on your account during this period.

Hypothetical Example

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expenses and assumed returns of 5% per year before expenses, which is not the Fund's actual return. The results may be used to provide you with a basis for comparing the ongoing costs of investing in the Funds with the ongoing costs of investing in other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that these hypothetical examples highlight ongoing costs only and do not reflect any transactional fees, such as brokerage commissions paid on purchases and sales of exchange-traded fund shares. In addition, if these transactional fees were included, your costs would have been higher. These hypothetical expense examples may not be used to estimate the actual ending account balances or expenses you paid during the period and will not help you determine the relative total costs of owning different funds.

Mairs & Power Minnesota Municipal Bond ETF

|

Beginning Account Value 03/11/2021 1 |

Ending Account Value 06/30/2021 |

Expenses Paid During Period 2 |

|||||||||||||

|

Actual return |

$ |

1,000.00 |

$ |

1,009.80 |

$ |

1.19 |

|||||||||

|

Hypothetical assumed 5% return |

$ |

1,000.00 |

$ |

1,014.02 |

$ |

1.19 |

|||||||||

1 Commencement of operations.

2 The Fund's expenses are equal to the Fund's annualized expense ratio for the period of 0.39%, multiplied by the average account value over the period, multiplied by the number of days in the period (111 days), divided by 365 days to reflect the period of March 11, 2021 through June 30, 2021.

16

BASIS FOR TRUSTEES' APPROVAL OF INVESTMENT ADVISORY AGREEMENT

The Board of Trustees (the "Trustees") of Trust for Professional Managers (the "Trust") met on August 18, 2020 to consider the initial approval of the Investment Advisory Agreement (the "Agreement") between the Trust, on behalf of the Mairs & Power Minnesota Municipal Bond ETF (the "Fund"), a series of the Trust, and Mairs & Power, Inc., the Fund's investment adviser (the "Adviser"). In advance of the meeting, the Trustees requested and received materials to assist them in considering the approval of the Agreement, including a memorandum provided by the Fund's legal counsel, which outlined the Trustees' responsibilities in considering the Agreement. The materials provided contained information with respect to the factors enumerated below, including a copy of the Agreement, detailed comparative information relating to the Fund's management fees and other expenses of the Fund, due diligence materials relating to the Adviser (including a due diligence questionnaire completed on behalf of the Fund by the Adviser, the Adviser's Form ADV, select financial statements of the Adviser, bibliographic information of the Adviser's key management and compliance personnel, and a summary detailing key provisions of the Adviser's written compliance program, including its code of ethics) and other pertinent information.

Based on their evaluation of information provided by the Adviser, in conjunction with the Fund's other service providers, the Trustees, by a unanimous vote (including a separate vote of the Trustees who are not "interested persons," as that term is defined in the Investment Company Act of 1940, as amended (the "Independent Trustees")), approved the Agreement for an initial term ending two years following the Fund's commencement of operations pursuant to an effective registration statement.

DISCUSSION OF FACTORS CONSIDERED

In considering the approval of the Agreement and reaching their conclusions, the Trustees reviewed and analyzed various factors that they determined were relevant, including the factors enumerated below.

1. NATURE, EXTENT AND QUALITY OF SERVICES TO BE PROVIDED TO THE FUND

The Trustees considered the nature, extent and quality of services that would be provided by the Adviser to the Fund and the amount of time to be devoted by the Adviser's staff to the Fund's operations. The Trustees considered the Adviser's specific responsibilities in all aspects of day-to-day management of the Fund, as well as the qualifications, experience and responsibilities of Brent S. Miller and Robert W. Thompson, who will serve as the Fund's portfolio managers, and other key personnel at the Adviser who would be involved in the day-to-day activities of the Fund. The Trustees reviewed information provided by the Adviser in a due diligence questionnaire, including the structure of the Adviser's compliance program and discussed the Adviser's marketing activities and its commitment to the growth of Fund assets. The Trustees also noted any services that extended beyond portfolio management, and they considered the overall capability of the Adviser. The Trustees noted that the Trust's chief compliance officer concluded that the Adviser's written compliance policies and procedures, as required by Rule 206(4)-7 under the Investment Advisers Act of 1940, as amended, are reasonably designed to prevent violations of federal securities laws. They noted that the Trust's chief compliance officer further concluded that the Adviser's compliance program appears to adequately address the major areas of risk associated with its current advisory business. The Trustees also considered the Adviser's overall financial condition, as well as the implementation and operational effectiveness of the Adviser's business continuity plan in response to the novel coronavirus (COVID-19) pandemic and challenges to day-to-day operations in a predominately work-from-home environment. The Trustees concluded that the Adviser had sufficient quality and depth of personnel, resources, investment methods and compliance policies and procedures essential to performing its duties under the Agreement and that the nature, overall quality and extent of the management services to be provided to the Fund, as well as the Adviser's compliance program, were satisfactory and reliable.

2. INVESTMENT PERFORMANCE OF THE FUND AND THE ADVISER

The Trustees noted that the Fund had not yet commenced operations and, therefore, that performance of the Fund was not a relevant factor for consideration. In assessing the portfolio management services to be

17

BASIS FOR TRUSTEES' APPROVAL OF INVESTMENT ADVISORY AGREEMENT (continued)

provided by the Adviser, the Trustees considered the investment management experience of Messrs. Miller and Thompson, who will serve as the Fund's portfolio managers. The Trustees noted that the Adviser did not manage any other accounts with the same or similar investment strategies as the Fund.

After considering all of the information, the Trustees determined that the Fund and its shareholders were likely to benefit from the Adviser's management.

3. COSTS OF SERVICES PROVIDED AND PROFITS TO BE REALIZED BY THE ADVISER

The Trustees considered the cost of services and the structure of the Adviser's proposed management fee, including a review of the expense analyses and other pertinent material with respect to the Fund. The Trustees took into consideration that the management fee was a "unitary management fee" whereby the Adviser agrees to pay all expenses incurred by the Fund, except the unitary management fee payable to the Adviser and certain other costs of the Fund, specifically interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses and any Rule 12b-1 plan fees. The Trustees reviewed the related statistical information and other materials provided, including the comparative expenses, expense components and peer group selection. The Trustees also considered the cost structure of the Fund relative to a peer group of U.S. open-end national municipal bond exchange-traded funds in the Fund's proposed Morningstar category as constructed by data presented by Morningstar Direct (the "Morningstar National Peer Group"), as well as a peer group of U.S. open-end state-specific municipal bond funds in the Fund's proposed Morningstar category ("Morningstar State-Specific Peer Group").

The Trustees noted that the Fund's proposed contractual management fee of 0.39% was below the Morningstar National Peer Group average of 0.47%. The Trustees further noted that the Fund's proposed unitary fee structure will limit the Fund's total annual fund operating expenses to 0.39% of the Fund's average annual assets and was above the Morningstar National Peer Group average (which excludes Rule 12b-1 fees) of 0.34%. The Trustees noted that the Fund's proposed contractual management fee of 0.39% was below the Morningstar State-Specific Peer Group average of 0.46%. The Trustees further noted that the Fund's proposed unitary fee structure will limit the Fund's total annual fund operating expenses to 0.39% of the Fund's average annual assets and was below the Morningstar State-Specific Peer Group average (which excludes Rule 12b-1 fees) of 0.60%.

The Trustees also considered the overall profitability that may result from the Adviser's management of the Fund and reviewed the Adviser's financial information. The Trustees also examined the level of profits that could be realized by the Adviser from the fees payable under the Agreement anticipated by the Adviser.

The Trustees concluded that the Fund's estimated expenses and the proposed management fee to be paid to the Adviser were fair and reasonable in light of the comparative expense information and the investment management services to be provided to the Fund by the Adviser. The Trustees further concluded, based on a pro forma profitability analysis prepared by the Adviser, that while the Fund would not be profitable to the Adviser in the short-term after accounting for marketing and distribution expenses, the Adviser had adequate financial resources to support its services to the Fund, despite the anticipated subsidization of the Fund's operations.

4. EXTENT OF ECONOMIES OF SCALE AS THE FUND GROWS

The Trustees compared the Fund's estimated expenses relative to its Morningstar Peer Groups and discussed economies of scale. The Trustees noted that the Fund's management fee structure did not contain any breakpoint reductions as the Fund's assets grow in size, but that the feasibility of incorporating breakpoints would be reviewed on a regular basis. With respect to the Adviser's fee structure, the Trustees concluded that the potential economies of scale with respect to the Fund were acceptable.

18

BASIS FOR TRUSTEES' APPROVAL OF INVESTMENT ADVISORY AGREEMENT (continued)

5. BENEFITS TO BE DERIVED FROM THE RELATIONSHIP WITH THE FUND

The Trustees considered the direct and indirect benefits that could be realized by the Adviser from its association with the Fund. The Trustees concluded that the benefits the Adviser may receive, such as greater name recognition or the ability to attract additional investor assets, appear to be reasonable, and in many cases may benefit the Fund.

CONCLUSIONS

The Trustees considered all of the foregoing factors. In considering the approval of the Agreement, the Trustees did not identify any one factor as all-important, but rather considered these factors collectively in light of the Fund's surrounding circumstances. Based on this review, the Trustees, including a majority of the Independent Trustees, approved the proposed Agreement for an initial two-year term as being in the best interests of the Fund and its shareholders.

19

ADDITIONAL INFORMATION (unaudited)

INDEMNIFICATIONS

Under the Trust's organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts that provide general indemnifications to other parties. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

20

INFORMATION ABOUT TRUSTEES

The business and affairs of the Trust are managed under the direction of the Board of Trustees. Information pertaining to the Trustees of the Trust is set forth below. The Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request by calling 1-855-839-2800.

|

Name, Address and Year of Birth |

Position(s) Held with the Trust |

Term of Office and Length of Time Served |

Number of Portfolios in Trust Overseen by Trustee |

Principal Occupation(s) During the Past Five Years |

Other Directorships Held by Trustee During the Past Five Years |

||||||||||||||||||

|

INDEPENDENT TRUSTEES |

|||||||||||||||||||||||

|

Michael D. Akers, Ph.D. 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1955 |

Trustee |

Indefinite Term; Since August 22, 2001 |

24 |

• Professor Emeritus, Department of Accounting (June 2019-present), Professor, Department of Accounting (2004-May 2019), Chair, Department of Accounting (2004-2017), Marquette University. |

Independent Trustee, USA MUTUALS (an open-end investment company) (2001-2021). |

||||||||||||||||||

|

Gary A. Drska 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1956 |

Trustee |

Indefinite Term; Since August 22, 2001 |

24 |

• Pilot, Frontier/Midwest Airlines, Inc. (airline company) (1986-present). |

Independent Trustee, USA MUTUALS (an open-end investment company) (2001-2021). |

||||||||||||||||||

|

INTERESTED TRUSTEE AND OFFICERS |

|||||||||||||||||||||||

|

Joseph C. Neuberger* 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1962 |

Chairperson and Trustee |

Indefinite Term; Since August 22, 2001 |

24 |

• President (2017-present), Chief Operating Officer (2016-2020), Executive Vice President (1994-2017), U.S. Bancorp Fund Services, LLC. |

Trustee, Buffalo Funds (an open-end investment company) (2003-2017); Trustee, USA MUTUALS (an open-end investment company) (2001-2018). |

||||||||||||||||||

|

John P. Buckel 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1957 |

President and Principal Executive Officer |

Indefinite Term; Since January 24, 2013 |

N/A |

• Vice President, U.S. Bancorp Fund Services, LLC (2004-present). |

N/A |

||||||||||||||||||

|

Jennifer A. Lima 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1974 |

Vice President, Treasurer and Principal Financial and Accounting Officer |

Indefinite Term; Since January 24, 2013 |

N/A |

• Vice President, U.S. Bancorp Fund Services, LLC (2002-present). |

N/A |

||||||||||||||||||

21

INFORMATION ABOUT TRUSTEES (continued)

|

Name, Address and Year of Birth |

Position(s) Held with the Trust |

Term of Office and Length of Time Served |

Number of Portfolios in Trust Overseen by Trustee |

Principal Occupation(s) During the Past Five Years |

Other Directorships Held by Trustee During the Past Five Years |

||||||||||||||||||

|

INTERESTED TRUSTEE AND OFFICERS (continued) |

|||||||||||||||||||||||

|

Elizabeth B. Scalf 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1985 |

Chief Compliance Officer, Vice President and Anti-Money Laundering Officer |

Indefinite Term; Since July 1, 2017 |

N/A |

• Senior Vice President, U.S. Bancorp Fund Services, LLC (February 2017-present); Vice President and Assistant CCO, Heartland Advisors, Inc. (December 2016-January 2017); Vice President and CCO, Heartland Group, Inc. (May 2016-November 2016); Vice President, CCO and Senior Legal Counsel (May 2016-November 2016), Heartland Advisors, Inc. |

N/A |

||||||||||||||||||

|

Jay S. Fitton 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1970 |

Secretary |

Indefinite Term; Since July 22, 2019 |

N/A |

• Assistant Vice President, U.S. Bancorp Fund Services, LLC (2019-present); Partner, Practus, LLP (2018-2019); Counsel, Drinker Biddle & Reath LLP (2016-2018). |

N/A |

||||||||||||||||||

|

Kelly A. Burns 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1987 |

Assistant Treasurer |

Indefinite Term; Since April 23, 2015 |

N/A |

• Assistant Vice President, U.S. Bancorp Fund Services, LLC (2011-present). |

N/A |

||||||||||||||||||

|

Melissa Aguinaga 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1987 |

Assistant Treasurer |

Indefinite Term; Since July 1, 2015 |

N/A |

• Assistant Vice President, U.S. Bancorp Fund Services, LLC (2010-present). |

N/A |

||||||||||||||||||

|

Laura A. Caroll 615 E. Michigan St. Milwaukee, WI 53202 Year of Birth: 1985 |

Assistant Treasurer |

Indefinite Term; Since August 20, 2018 |

N/A |

• Assistant Vice President, U.S. Bancorp Fund Services, LLC (2007-present). |

N/A |

||||||||||||||||||

* Mr. Neuberger is an "interested person" of the Trust as defined by the 1940 Act due to his position and material business relationship with the Trust.

22

A NOTE ON FORWARD LOOKING STATEMENTS (unaudited)

Except for historical information contained in this report for the Fund, the matters discussed in this report may constitute forward-looking statements made pursuant to the safe-harbor provisions of the Securities Litigation Reform Act of 1995. These include any adviser or portfolio manager predictions, assessments, analyses or outlooks for individual securities, industries, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for the Fund in the current Prospectus, other factors bearing on this report include the accuracy of the Adviser's or portfolio managers' forecasts and predictions, and the appropriateness of the investment programs designed by the Adviser or portfolio managers to implement their strategies efficiently and effectively. Any one or more of these factors, as well as other risks affecting the securities markets and investment instruments generally, could cause the actual results of the Fund to differ materially as compared to benchmarks associated with the Fund.

ADDITIONAL INFORMATION (unaudited)

The Fund has adopted proxy voting policies and procedures that delegate to the Adviser the authority to vote proxies. A description of the Fund's proxy voting policies and procedures is available without charge, upon request, by calling the Fund toll free at 1-855-839-2800. A description of these policies and procedures is also included in the Fund's Statement of Additional Information, which is available on the SEC's website at http://www.sec.gov.

The Fund's proxy voting record for the most recent 12-month period ended June 30, is available without charge, either upon request by calling the Fund toll free at 1-855-839-2800 or by accessing the SEC's website at http://www.sec.gov.

The Fund files a complete schedule of its portfolio holdings with the SEC for the first and third quarter of each fiscal year on Part F of Form N-PORT. Shareholders may view the Part F of Form N-PORT reports on the SEC's website at http://www.sec.gov.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS (unaudited)

Information regarding how often shares of the Fund trade on an exchange at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund is available without charge, on the Fund's website at www.mairsandpower.com.

HOUSEHOLDING (unaudited)

In an effort to decrease costs, the Fund intends to reduce the number of duplicate prospectuses, supplements and certain other shareholder reports you receive by sending only one copy of each to those addresses shared by two or more accounts and to shareholders the Fund reasonably believes are from the same family or household. Once implemented, if you would like to discontinue householding for your accounts, please call toll-free at 1-855-839-2800 to request individual copies of these documents. Once the Fund receives notice to stop householding, the Fund will begin sending individual copies 30 days after receiving your request. This policy does not apply to account statements.

23

NOTICE OF PRIVACY POLICY & PRACTICES

We collect non-public personal information about you from the following sources:

• information we receive about you on applications or other forms;

• information you give us orally; and

• information about your transactions with us or others.

We do not disclose any non-public personal information about our shareholders or former shareholders without the shareholder's authorization, except as permitted by law or in response to inquiries from governmental authorities. We may share information with affiliated parties and unaffiliated third parties with whom we have contracts for servicing the Fund. We will provide unaffiliated third parties with only the information necessary to carry out their assigned responsibility. All shareholder records will be disposed of in accordance with applicable law. We maintain physical, electronic and procedural safeguards to protect your non-public personal information and require third parties to treat your non-public personal information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank or trust company, the privacy policy of your financial intermediary would govern how your non-public personal information would be shared with unaffiliated third parties.

24

MAIRS & POWER MINNESOTA MUNICIPAL BOND ETF (MINN)

For Shareholder Services

Call 1-855-839-2800

Or write to:

|

(via Regular Mail) c/o U.S. Bancorp Fund Services, LLC 615 East Michigan Street P. O. Box 701 Milwaukee, WI 53201-0701 |

(via Overnight or Express Mail) c/o U.S. Bancorp Fund Services, LLC 3rd Floor 615 East Michigan Street Milwaukee, WI 53202-0701 |

||||||

For Fund literature and information, visit the Fund's website at:

www.mairsandpower.com

Investment Manager

Mairs & Power, Inc.

W1520 First National Bank Building

332 Minnesota Street

Saint Paul, MN 55101

Custodian

U.S. Bank, N.A.

Custody Operations

1555 North River Center Drive, Suite 302

Milwaukee, WI 53212

Distributor

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, ME 04101

Independent Registered Public Accounting Firm

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

This report is intended for shareholders of the Fund and may not be used as sales literature unless preceded or accompanied by a current prospectus.

Mairs & Power, Inc.

c/o U.S. Bancorp Fund Services, LLC

3rd Floor

615 East Michigan Street

Milwaukee, WI 53202-0701

| (b) | Not applicable. |

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

| (a) | Not applicable for semi-annual reports. |

| (b) | Not Applicable. |

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

| (b) | Not Applicable. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the last fiscal half-year covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 13. Exhibits.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. There was no change in the registrant’s independent public accountant for the period covered by this report.

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) Trust for Professional Managers | |||

| By (Signature and Title)* | /s/ John Buckel | ||

| John Buckel, President | |||

| Date 8/31/21 | |||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ John Buckel | ||

| John Buckel, President | |||

| Date 8/31/21 | |||

| By (Signature and Title)* | |||

| /s/ Jennifer Lima, | |||

| Jennifer Lima, Treasurer | |||

| Date 8/31/21 | |||

* Print the name and title of each signing officer under his or her signature.