UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(513) 629-8104

Registrant's telephone number, including area code

Date of fiscal year end: February 28, 2023

Date of reporting period: February 28, 2023

Item 1. Reports to Stockholders.

(a)

Annual Report

Dearborn Partners Rising Dividend Fund

Class A Shares

DRDAX

Class C Shares

DRDCX

Class I Shares

DRDIX

February 28, 2023

Investment Adviser

Dearborn Partners, L.L.C.

200 West Madison Street

Suite 1950

Chicago, IL 60606

Phone: (888) 983-3380

Table of Contents

|

LETTER TO SHAREHOLDERS

|

3

|

||

|

EXPENSE EXAMPLE

|

6

|

||

|

INVESTMENT HIGHLIGHTS

|

8

|

||

|

SCHEDULE OF INVESTMENTS

|

10

|

||

|

STATEMENT OF ASSETS AND LIABILITIES

|

14

|

||

|

STATEMENT OF OPERATIONS

|

15

|

||

|

STATEMENTS OF CHANGES IN NET ASSETS

|

16

|

||

|

FINANCIAL HIGHLIGHTS

|

17

|

||

|

NOTES TO FINANCIAL STATEMENTS

|

20

|

||

|

REPORT OF INDEPENDENT REGISTERED

|

|||

|

PUBLIC ACCOUNTING FIRM

|

28

|

||

|

NOTICE OF PRIVACY POLICY & PRACTICES

|

29

|

||

|

ADDITIONAL INFORMATION

|

30

|

Greetings from Dearborn Partners, LLC,

Adviser to the Dearborn Partners Rising Dividend Fund (the “Fund”).

On April 10th, 2013 the Dearborn Partners Rising Dividend Fund was launched to provide investors with a generally high quality, relatively defensive equity investment diversified across a multitude of sectors in

companies that are anticipated to consistently increase their dividends over time. Patient investors looking to outpace inflation should benefit from participating in what we believe is the long-term wealth-building potential offered by what we

consider to be great businesses, while receiving an income stream with potential growth over time.

For the year ended February 28th, 2023 (the Dearborn Partners Rising Dividend Fund’s fiscal year), 45 companies in our Fund announced 49 dividend increases. The average of these increases was about 9.7% more than those

particular companies paid as dividends a year earlier. The dividend increases generated by the companies in our Fund helped investors stay well ahead of the rising costs of living, a primary objective of our strategy. During these 12 months, the Core

Consumer Price Index* averaged 5.2%. We continue to maintain the valuation and stock selection disciplines that formed the genesis of our strategy, as we believe that over time, such disciplines can offer attractive total return potential when equity

market risk is considered.

The total returns of the Fund’s Class I shares and S&P 500 benchmark for the latest fiscal year were -1.23% and -7.69%, respectively. Four of the 11 sectors in our Fund generated positive returns during the fiscal

year whereas three of the benchmark’s 11 sectors generated positive returns. A more volatile market backdrop provided a favorable performance environment for the Fund.

Nine sectors in our portfolio outperformed the commensurate sectors in the S&P 500: Communication Services, Consumer Discretionary, Energy, Financials, Health Care, Industrials, Information Technology, Real Estate

and Utilities. A few specific companies in our Fund stand out as worth mentioning for the year. Some of our best performing stocks were Exxon Mobil Corporation (XOM), Merck & Co, Inc. (MRK) and Gilead Sciences, Inc. (GILD). Strong commodity

markets have helped Exxon Mobil over the past year, given inflation’s impact across the globe. In uncertain times, investors frequently view pharmaceuticals and health care as “needs” rather than “wants.” Merck & Co. and Gilead Sciences became

safe havens in this fiscal year’s volatile market climate.

Some of our poorest performing stocks for the fiscal year period were QUALCOMM Incorporated (QCOM), Fidelity National Information Services Inc. (FIS), and T. Rowe Price Group (TROW). An oversupplied semiconductor

market and fears of losing Apple-related revenue hurt QUALCOMM. Fidelity National Information Services suffered from slower than expected recovery in their Merchant business and fears of competitive disruption. We ultimately sold the position during

the fiscal year. T. Rowe Price’s bias towards Growth stocks in their equity portfolios pressured the shares as many Growth stocks in the broader equity market underperformed over the period. We sold the position during the fiscal year.

Drama in Banking

Wednesday March 8, 2023, eight days after the end of our Fund’s fiscal year, news started to drip out about serious problems at three banks whose names begin with the letter “S”, none of which we had heard of before.

The rest of that week, share prices sold off far more than usual for just about every bank and some other stocks in the Financials sector. Nervousness spread throughout the broad market, as well. We consider three domestic

3

and one international bank failures, and other banks in questionable condition, as significant enough that we want to add a coda to the usual format of this annual letter.

In our portfolio, we care about only one bank: Glacier Bancorp, Inc. (GBCI). Until August 2021, we held three conservative, high-quality banks in our Dearborn Rising Dividend mutual fund portfolio. The Federal Reserve

still maintained its Fed Funds Rate at 0%-0.25%. We were concerned, however, that if the Fed ever started to raise interest rates, given the interest rate sensitivity of banks, we didn’t want that much exposure. We sold two banks and retained

Glacier. With headquarters in Kalispell, Montana, Glacier is the holding company for 17 community banks up and down the Rocky Mountains area of the western United States from our border with Canada to our border with Mexico. Glacier’s bankers provide

a high level of personal service to their customers. Glacier considers its deposits to be very “sticky,” i.e., unlikely to leave Glacier and move to money center banks where a human being never answers the phone. We consider its balance sheet to be

very conservative. As of December 31, 2022, 50% percent of Glacier’s investment portfolio consisted of residential mortgage-backed securities (MBS), 37% in federal, state, and local government MBS, and 13% commercial MBS. More than 88% of these

securities mature in less than five years.

On Friday March 10, 2023, a news release reported that Glacier’s Chairman of the Board had purchased 5,000 GBCI shares and the following Monday March 13, a news release reported that the CEO purchased 2,500 shares.

These executives know if deposits are leaving or not. We consider this insider buying to be a strong vote of confidence.

We are very glad that only one of the 49 stocks in this portfolio is a bank. We view this as an example of the risk control and diversification we exert as active portfolio managers. If history can be a guide, however,

nervousness in the banking industry and the market in general is not likely to fully resolve overnight. It will likely take time and patience. In times such as these, it’s a good idea to remember that when we own stock, we own a piece of a company.

Over time, stock prices move as the earnings of companies move. The long-term trend of stocks of good quality companies has been up and we believe that over time the trend will be up in the future. We believe that our portfolio of stocks of companies

that pay us dividends with the potential to increase over time provides a sensible strategy for patiently participating in the market at all times.

We continue to believe that the companies in our Dearborn Partners Rising Dividend Fund are generally financially strong, well-managed, defensive businesses with products or services that people patronize regardless of

the economic or financial environment. It is our opinion that each company in our portfolio is capable of consistently increasing annual dividends over time. History has shown that rising dividends have tended to cushion the fall of stock prices in

challenging markets and enhance total returns over time.

A primary goal of our strategy is to help investors keep ahead of the rising costs of living by providing a portfolio of companies that we believe can increase their annual dividends. We maintain our conviction that a

path to long-term wealth building can be accomplished through properly diversified portfolios of stocks of companies that offer the potential to increase dividends consistently over time. We believe our Fund exemplifies those characteristics and,

over the long term, offers the potential to provide attractive returns with modified risk.

Thank you for your continued interest in the Dearborn Partners Rising Dividend Fund. Please feel free to contact us at any time.

Sincerely,

The Dearborn Partners Rising Dividend Fund Investment Team

4

|

*

|

Core Consumer Price Index defined as U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items Less Food and Energy in U.S. City Average.

|

Past performance does not guarantee future results.

Opinions expressed are those of Dearborn Partners, LLC and are subject to change, are not guaranteed, and should not be considered investment advice.

There is no guarantee that a company will pay or continue to increase dividends.

Mutual fund investing involves risk. Principal loss is possible. The Fund’s strategy of investing in dividend-paying stocks involves the risk that such stocks may fall out of favor with investors and

underperform the market. In addition, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future or the anticipated acceleration of dividends could not occur. The Fund may invest in foreign

securities and ADRs, which involve political, economic and currency risks, greater volatility and differences in accounting methods. Medium- and small-capitalization companies tend to have limited liquidity and greater price volatility than

large-capitalization companies. Investments in REIT securities involve risks such as declines in the value of real estate and increased susceptibility to adverse economic regulatory expenses. The Fund may invest in MLPs, which can be negatively

influenced when interest rates rise. These investments also entail many of the general tax risks of investing in a partnership. There is always the risk that an MLP will fail to qualify for favorable tax treatments.

Diversification does not guarantee a profit or protect from loss in a declining market.

The S&P 500 Index is a stock market index based on the market capitalizations of 500 leading companies publicly traded in the U.S. stock market, as determined by Standard

& Poor’s. It is not possible to invest directly in an index.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of Fund holdings please refer to the Schedule of Investments

included in this report.

This report is intended for shareholders in the Dearborn Partners Rising Dividend Fund and may not be used as literature unless preceded or accompanied by the Fund’s current Prospectus.

Dearborn Partners is the adviser of the Dearborn Partners Rising Dividend Fund, which is distributed by Quasar Distributors, LLC.

5

Dearborn Partners Rising Dividend Fund

Expense Example

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and (2) ongoing costs, including management fees, distribution (12b-1) and service

fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an

investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2022 – February 28, 2023).

Actual Expenses

The first lines of the following tables provide information about actual account values and actual expenses. If you purchase Class A shares of the Fund you will pay an initial sales charge of up to 5.00% when you

invest. Class A shares are also subject to a 1.00% contingent deferred sales charge for purchases made at the $500,000 breakpoint which are redeemed within twelve months of purchase. A 1.00% contingent deferred sales charge is imposed on Class C

shares redeemed within twelve months of purchase. In addition, you will be assessed fees for outgoing wire transfers, returned checks and stop payment for all share classes, at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s

transfer agent (“Transfer Agent”). If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Transfer Agent. Individual retirement accounts (“IRAs”) will be charged a $15.00 annual maintenance fee. To the

extent the Fund invests in shares of exchange-traded funds (“ETFs”) or other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which

the Fund invests in addition to the direct expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the Example. The Example includes, but is not limited

to, management fees, fund administration and accounting, custody and transfer agent fees. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your

account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period” to estimate the expenses you paid on your account

during this period.

Hypothetical Example for Comparison Purposes

The second lines of the following tables provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before

expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs

of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the

6

Dearborn Partners Rising Dividend Fund

Expense Example (Continued)

(Unaudited)

table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second lines of the tables are useful in

comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

Class A

|

|||

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

September 1, 2022 -

|

|

|

September 1, 2022

|

February 28, 2023

|

February 28, 2023*

|

|

|

Actual

|

$1,000.00

|

$ 998.60

|

$5.95

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

$1,000.00

|

$1,018.84

|

$6.01

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.20%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

|

|

Class C

|

|||

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

September 1, 2022 -

|

|

|

September 1, 2022

|

February 28, 2023

|

February 28, 2023*

|

|

|

Actual

|

$1,000.00

|

$ 995.10

|

$9.65

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

$1,000.00

|

$1,015.12

|

$9.74

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.95%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

|

|

Class I

|

|||

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

September 1, 2022 -

|

|

|

September 1, 2022

|

February 28, 2023

|

February 28, 2023*

|

|

|

Actual

|

$1,000.00

|

$ 999.90

|

$4.71

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

$1,000.00

|

$1,020.08

|

$4.76

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 0.95%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

|

7

Dearborn Partners Rising Dividend Fund

Investment Highlights

(Unaudited)

The Fund seeks current income, rising income over time, and long-term capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in the equity securities of companies that

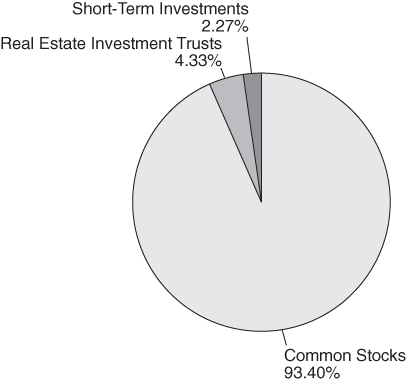

pay current dividends and that the Fund’s portfolio managers believe have the potential to increase their dividends with regularity. The Fund’s allocation of portfolio holdings as of February 28, 2023 was as follows:

Portfolio Allocation

(% of Investments)

Average Annual Returns as of February 28, 2023(1)

|

One

|

Five

|

Since Inception

|

|

|

Year

|

Year

|

(April 10, 2013)

|

|

|

Dearborn Partners Rising Dividend Fund

|

|||

|

Class A (with sales charge)

|

-6.43%

|

8.58%

|

8.56%

|

|

Class A (without sales charge)

|

-1.49%

|

9.70%

|

9.13%

|

|

Class C (with sales charge)

|

-3.17%

|

8.89%

|

8.31%

|

|

Class C (without sales charge)

|

-2.20%

|

8.89%

|

8.31%

|

|

Class I

|

-1.23%

|

9.98%

|

9.40%

|

|

S&P 500 Total Return Index

|

-7.69%

|

9.82%

|

11.84%

|

|

(1)

|

With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.00% for Class A and the applicable contingent deferred sales charge for Class C. Returns without sales charges do

not reflect the current maximum sales charges. Had the sales charges been included, the returns would have been lower.

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when

redeemed, may be worth more or less

Continued

8

Dearborn Partners Rising Dividend Fund

Investment Highlights (Continued)

(Unaudited)

than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (888)

983-3380.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graph illustrates

performance of a hypothetical investment made in the Fund and a broad-based securities index on the Fund’s inception date. The graph does not reflect any future performance.

The S&P 500 Total Return Index is a stock market index based on the market capitalization of 500 leading companies publicly traded in the U.S. stock market, as determined by Standard & Poor’s. You cannot invest

directly in an index.

Growth of $10,000 Investment(1)

|

(1)

|

The minimum investment for Class I is $500,000.

|

|

(2)

|

The Fund commenced operations on April 10, 2013.

|

9

Dearborn Partners Rising Dividend Fund

|

Schedule of Investments

|

February 28, 2023

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS – 93.23%

|

||||||||

|

Air Freight & Logistics – 1.82%

|

||||||||

|

United Parcel Service, Inc. – Class B

|

46,240

|

$

|

8,438,338

|

|||||

|

Banks – 1.74%

|

||||||||

|

Glacier Bancorp, Inc.

|

170,555

|

8,080,896

|

||||||

|

Biotechnology – 3.75%

|

||||||||

|

AbbVie, Inc.

|

65,100

|

10,018,890

|

||||||

|

Gilead Sciences, Inc.

|

92,000

|

7,408,760

|

||||||

|

17,427,650

|

||||||||

|

Building Products – 2.09%

|

||||||||

|

Carrier Global Corp.

|

215,200

|

9,690,456

|

||||||

|

Capital Markets – 5.52%

|

||||||||

|

BlackRock, Inc.

|

13,800

|

9,514,134

|

||||||

|

Nasdaq, Inc.

|

137,490

|

7,707,689

|

||||||

|

S&P Global, Inc.

|

24,688

|

8,423,546

|

||||||

|

25,645,369

|

||||||||

|

Chemicals – 3.62%

|

||||||||

|

Air Products and Chemicals, Inc.

|

29,786

|

8,518,200

|

||||||

|

The Sherwin-Williams Co.

|

37,500

|

8,300,625

|

||||||

|

16,818,825

|

||||||||

|

Commercial Services & Supplies – 2.32%

|

||||||||

|

Republic Services, Inc.

|

83,500

|

10,765,655

|

||||||

|

Consumer Staples Distribution & Retail – 5.64%

|

||||||||

|

Casey’s General Stores, Inc.

|

45,500

|

9,461,725

|

||||||

|

Costco Wholesale Corp.

|

18,450

|

8,933,121

|

||||||

|

Dollar General Corp.

|

36,000

|

7,786,800

|

||||||

|

26,181,646

|

||||||||

|

Distributors – 1.75%

|

||||||||

|

Pool Corp.

|

22,800

|

8,136,408

|

||||||

|

Diversified Telecommunication Services – 0.98%

|

||||||||

|

Verizon Communications, Inc.

|

117,100

|

4,544,651

|

||||||

|

Electric Utilities – 2.37%

|

||||||||

|

NextEra Energy, Inc.

|

155,116

|

11,017,889

|

||||||

The accompanying notes are an integral part of these financial statements.

10

Dearborn Partners Rising Dividend Fund

|

Schedule of Investments (Continued)

|

February 28, 2023

|

Shares

|

Value

|

|||||||

|

Food Products – 3.33%

|

||||||||

|

McCormick & Co., Inc.

|

84,419

|

$

|

6,274,020

|

|||||

|

Mondelez International, Inc.

|

141,000

|

9,190,380

|

||||||

|

15,464,400

|

||||||||

|

Gas Utilities – 2.48%

|

||||||||

|

Atmos Energy Corp.

|

102,300

|

11,540,463

|

||||||

|

Ground Transportation – 1.78%

|

||||||||

|

Union Pacific Corp.

|

39,990

|

8,289,127

|

||||||

|

Health Care Equipment & Supplies – 4.89%

|

||||||||

|

Abbott Laboratories

|

72,500

|

7,374,700

|

||||||

|

Becton Dickinson and Co.

|

26,708

|

6,264,361

|

||||||

|

STERIS plc (a)

|

48,327

|

9,086,926

|

||||||

|

22,725,987

|

||||||||

|

Hotels, Restaurants & Leisure – 1.86%

|

||||||||

|

McDonald’s Corp.

|

32,793

|

8,654,401

|

||||||

|

Household Products – 1.28%

|

||||||||

|

Kimberly-Clark Corp.

|

47,500

|

5,939,875

|

||||||

|

Insurance – 3.00%

|

||||||||

|

Arthur J. Gallagher & Co.

|

74,470

|

13,951,955

|

||||||

|

IT Services – 7.52%

|

||||||||

|

Accenture plc (a)

|

30,454

|

8,087,060

|

||||||

|

Automatic Data Processing, Inc.

|

48,500

|

10,661,270

|

||||||

|

Jack Henry & Associates, Inc.

|

41,235

|

6,772,436

|

||||||

|

MasterCard, Inc. – Class A

|

26,510

|

9,418,738

|

||||||

|

34,939,504

|

||||||||

|

Machinery – 4.21%

|

||||||||

|

Illinois Tool Works, Inc.

|

37,598

|

8,766,349

|

||||||

|

Snap-on, Inc.

|

43,510

|

10,820,067

|

||||||

|

19,586,416

|

||||||||

|

Multi-Utilities – 1.70%

|

||||||||

|

WEC Energy Group, Inc.

|

89,357

|

7,922,392

|

||||||

The accompanying notes are an integral part of these financial statements.

11

Dearborn Partners Rising Dividend Fund

|

Schedule of Investments (Continued)

|

February 28, 2023

|

Shares

|

Value

|

|||||||

|

Oil, Gas & Consumable Fuels – 4.80%

|

||||||||

|

EOG Resources, Inc.

|

77,230

|

$

|

8,728,535

|

|||||

|

Exxon Mobil Corp.

|

123,356

|

13,558,058

|

||||||

|

22,286,593

|

||||||||

|

Pharmaceuticals – 1.78%

|

||||||||

|

Merck & Co., Inc.

|

77,920

|

8,278,221

|

||||||

|

Semiconductors & Semiconductor Equipment – 4.99%

|

||||||||

|

Analog Devices, Inc.

|

72,499

|

13,301,391

|

||||||

|

QUALCOMM, Inc.

|

79,909

|

9,871,159

|

||||||

|

23,172,550

|

||||||||

|

Software – 3.75%

|

||||||||

|

Intuit, Inc.

|

21,500

|

8,754,370

|

||||||

|

Microsoft Corp.

|

34,700

|

8,654,874

|

||||||

|

17,409,244

|

||||||||

|

Specialty Retail – 4.57%

|

||||||||

|

Home Depot, Inc.

|

30,000

|

8,896,200

|

||||||

|

Tractor Supply Co.

|

53,000

|

12,362,780

|

||||||

|

21,258,980

|

||||||||

|

Technology Hardware, Storage & Peripherals – 4.98%

|

||||||||

|

Apple, Inc.

|

156,888

|

23,126,860

|

||||||

|

Trading Companies & Distributors – 4.71%

|

||||||||

|

Fastenal Co.

|

188,270

|

9,707,201

|

||||||

|

Watsco, Inc.

|

40,000

|

12,188,400

|

||||||

|

21,895,601

|

||||||||

|

TOTAL COMMON STOCKS (Cost $283,547,871)

|

433,190,352

|

|||||||

|

REAL ESTATE INVESTMENT TRUSTS – 4.32%

|

||||||||

|

American Tower Corp.

|

36,300

|

7,187,763

|

||||||

|

Digital Realty Trust, Inc.

|

48,000

|

5,003,040

|

||||||

|

Equinix, Inc.

|

11,460

|

7,887,574

|

||||||

|

TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $18,225,579)

|

20,078,377

|

|||||||

The accompanying notes are an integral part of these financial statements.

12

Dearborn Partners Rising Dividend Fund

|

Schedule of Investments (Continued)

|

February 28, 2023

|

Shares

|

Value

|

|||||||

|

SHORT-TERM INVESTMENTS – 2.27%

|

||||||||

|

Fidelity Investments Money Market Funds –

|

||||||||

|

Government Portfolio – Class I, 4.460% (b)

|

10,536,967

|

$

|

10,536,967

|

|||||

|

TOTAL SHORT-TERM INVESTMENTS (Cost $10,536,967)

|

10,536,967

|

|||||||

|

Total Investments (Cost $312,310,417) – 99.82%

|

463,805,696

|

|||||||

|

Other Assets in Excess of Liabilities – 0.18%

|

817,862

|

|||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

464,623,558

|

||||||

Percentages are stated as a percent of net assets.

|

(a)

|

Foreign issued security.

|

|

(b)

|

Seven day yield as of February 28, 2023.

|

Abbreviations:

plc – public limited company is a publicly traded company which signifies that shareholders have limited liability.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard &

Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

13

Dearborn Partners Rising Dividend Fund

|

Statement of Assets and Liabilities

|

February 28, 2023

|

Assets

|

||||

|

Investments, at value (cost $312,310,417)

|

$

|

463,805,696

|

||

|

Dividends, interest and reclaim receivable

|

889,947

|

|||

|

Receivable for Fund shares sold

|

567,493

|

|||

|

Other assets

|

28,803

|

|||

|

Total assets

|

465,291,939

|

|||

|

Liabilities

|

||||

|

Payable to Adviser

|

264,397

|

|||

|

Payable for distribution fees

|

193,935

|

|||

|

Payable to affiliates

|

100,567

|

|||

|

Payable for Fund shares redeemed

|

74,178

|

|||

|

Accrued expenses and other liabilities

|

35,304

|

|||

|

Total liabilities

|

668,381

|

|||

|

Net Assets

|

$

|

464,623,558

|

||

|

Net assets consist of:

|

||||

|

Paid-in capital

|

$

|

313,007,248

|

||

|

Total distributable earnings

|

151,616,310

|

|||

|

Net assets

|

$

|

464,623,558

|

||

|

Class A Shares:

|

||||

|

Net assets

|

$

|

165,615,976

|

||

|

Shares of beneficial interest issued and outstanding

|

||||

|

(unlimited number of shares authorized $0.001 par value)

|

7,987,475

|

|||

|

Net asset value and redemption price per share(1)

|

$

|

20.73

|

||

|

Maximum offering price per share ($20.73/0.95)(2)

|

$

|

21.82

|

||

|

Class C Shares:

|

||||

|

Net assets

|

$

|

92,623,709

|

||

|

Shares of beneficial interest issued and outstanding

|

||||

|

(unlimited number of shares authorized $0.001 par value)

|

4,512,048

|

|||

|

Net asset value, offering price and redemption price per share(1)

|

$

|

20.53

|

||

|

Class I Shares:

|

||||

|

Net assets

|

$

|

206,383,873

|

||

|

Shares of beneficial interest issued and outstanding

|

||||

|

(unlimited number of shares authorized $0.001 par value)

|

9,933,430

|

|||

|

Net asset value, offering price and redemption price per share

|

$

|

20.78

|

||

|

(1)

|

A contingent deferred sales charge (“CDSC”) of 1.00% may be charged on shares redeemed within one year of purchase. The CDSC on Class A Shares is applied only to purchases of $500,000 that are redeemed within

12 months of purchase. Redemption price per share is equal to net asset value less any redemption or CDSC fees.

|

|

(2)

|

Reflects a maximum sales charge of 5.00%.

|

The accompanying notes are an integral part of these financial statements.

14

Dearborn Partners Rising Dividend Fund

|

Statement of Operations

|

For the Year Ended February 28, 2023

|

Investment Income

|

||||

|

Dividend income

|

$

|

9,786,974

|

||

|

Interest

|

188,515

|

|||

|

Total Investment Income

|

9,975,489

|

|||

|

Expenses

|

||||

|

Management fees

|

3,952,749

|

|||

|

Distribution fees – Class C

|

995,660

|

|||

|

Distribution fees – Class A

|

397,970

|

|||

|

Administration fees

|

354,050

|

|||

|

Transfer agent fees and expenses

|

197,108

|

|||

|

Federal and state registration fees

|

59,066

|

|||

|

Custody fees

|

51,112

|

|||

|

Reports to shareholders

|

39,609

|

|||

|

Legal fees

|

23,522

|

|||

|

Trustees’ fees and related expenses

|

22,520

|

|||

|

Audit and tax fees

|

17,982

|

|||

|

Chief Compliance Officer fees

|

15,055

|

|||

|

Insurance expense

|

7,327

|

|||

|

Pricing fees

|

1,662

|

|||

|

Other expenses

|

9,206

|

|||

|

Total Expenses

|

6,144,598

|

|||

|

Less: Waivers by Adviser (Note 4)

|

(333,189

|

)

|

||

|

Net Expenses

|

5,811,409

|

|||

|

Net Investment Income

|

4,164,080

|

|||

|

Realized and Unrealized Gain on Investments

|

||||

|

Net realized loss on:

|

||||

|

Investments

|

(470,990

|

)

|

||

|

Net change in unrealized appreciation on:

|

||||

|

Investments

|

(10,784,966

|

)

|

||

|

Net Realized and Unrealized Loss on Investments

|

(11,255,956

|

)

|

||

|

Net Decrease in Net Assets from Operations

|

$

|

(7,091,876

|

)

|

|

The accompanying notes are an integral part of these financial statements.

15

Dearborn Partners Rising Dividend Fund

|

Statements of Changes in Net Assets

|

|

Year Ended

|

Year Ended

|

|||||||

|

February 28, 2023

|

February 28, 2022

|

|||||||

|

From Operations

|

||||||||

|

Net investment income

|

$

|

4,164,080

|

$

|

2,185,007

|

||||

|

Net realized gain (loss) on:

|

||||||||

|

Investments

|

(470,990

|

)

|

9,828,009

|

|||||

|

Net change in unrealized appreciation on:

|

||||||||

|

Investments

|

(10,784,966

|

)

|

38,747,706

|

|||||

|

Net increase (decrease) in

|

||||||||

|

net assets from operations

|

(7,091,876

|

)

|

50,760,722

|

|||||

|

From Dividend and Distributions to Shareholders

|

||||||||

|

Net dividend and distributions – Class A

|

(2,652,019

|

)

|

(3,427,049

|

)

|

||||

|

Net dividend and distributions – Class C

|

(984,199

|

)

|

(1,842,442

|

)

|

||||

|

Net dividend and distributions – Class I

|

(3,842,270

|

)

|

(5,531,789

|

)

|

||||

|

Net decrease in net assets resulting

|

||||||||

|

from dividend and distributions paid

|

(7,478,488

|

)

|

(10,801,280

|

)

|

||||

|

From Capital Share Transactions

|

||||||||

|

Proceeds from shares sold – Class A

|

34,619,876

|

38,668,064

|

||||||

|

Proceeds from shares sold – Class C

|

10,270,308

|

13,599,799

|

||||||

|

Proceeds from shares sold – Class I

|

44,302,633

|

54,511,789

|

||||||

|

Net asset value of shares issued to shareholders

|

||||||||

|

in payment of distributions declared – Class A

|

2,487,927

|

3,224,538

|

||||||

|

Net asset value of shares issued to shareholders

|

||||||||

|

in payment of distributions declared – Class C

|

946,200

|

1,777,039

|

||||||

|

Net asset value of shares issued to shareholders

|

||||||||

|

in payment of distributions declared – Class I

|

3,579,655

|

5,178,057

|

||||||

|

Payments for shares redeemed – Class A

|

(17,011,108

|

)

|

(14,605,053

|

)

|

||||

|

Payments for shares redeemed – Class C

|

(24,596,221

|

)

|

(28,949,800

|

)

|

||||

|

Payments for shares redeemed – Class I

|

(43,312,809

|

)

|

(34,523,386

|

)

|

||||

|

Net increase in net assets

|

||||||||

|

from capital share transactions

|

11,286,461

|

38,881,047

|

||||||

|

Total Increase (Decrease) in Net Assets

|

(3,283,903

|

)

|

78,840,489

|

|||||

|

Net Assets

|

||||||||

|

Beginning of year

|

$

|

467,907,461

|

$

|

389,066,972

|

||||

|

End of year

|

$

|

464,623,558

|

$

|

467,907,461

|

||||

The accompanying notes are an integral part of these financial statements.

16

Dearborn Partners Rising Dividend Fund – Class A

|

Financial Highlights

|

Per share Data for a Share Outstanding Throughout Each Year

|

Year

|

Year

|

Year

|

Year

|

Year

|

||||||||||||||||

|

Ended

|

Ended

|

Ended

|

Ended

|

Ended

|

||||||||||||||||

|

February

|

February

|

February

|

February

|

February

|

||||||||||||||||

|

28,

|

28,

|

28,

|

29,

|

28,

|

||||||||||||||||

|

2023

|

2022

|

2021

|

2020

|

2019

|

||||||||||||||||

|

Net Asset Value, Beginning of Year

|

$

|

21.40

|

$

|

19.35

|

$

|

16.91

|

$

|

15.63

|

$

|

14.09

|

||||||||||

|

Income from investment operations:

|

||||||||||||||||||||

|

Net investment income(1)

|

0.20

|

0.12

|

0.16

|

0.13

|

0.19

|

|||||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||

|

gain (loss) on investments(2)

|

(0.52

|

)

|

2.46

|

2.48

|

1.38

|

1.53

|

||||||||||||||

|

Total from investment operations

|

(0.32

|

)

|

2.58

|

2.64

|

1.51

|

1.72

|

||||||||||||||

|

Less distributions paid:

|

||||||||||||||||||||

|

From net investment income

|

(0.17

|

)

|

(0.20

|

)

|

(0.10

|

)

|

(0.13

|

)

|

(0.18

|

)

|

||||||||||

|

From net realized

|

||||||||||||||||||||

|

gain on investments

|

(0.18

|

)

|

(0.33

|

)

|

(0.10

|

)

|

(0.10

|

)

|

—

|

|||||||||||

|

Total distributions paid

|

(0.35

|

)

|

(0.53

|

)

|

(0.20

|

)

|

(0.23

|

)

|

(0.18

|

)

|

||||||||||

|

Net Asset Value, End of Year

|

$

|

20.73

|

$

|

21.40

|

$

|

19.35

|

$

|

16.91

|

$

|

15.63

|

||||||||||

|

Total Return(3)

|

(1.49

|

%)

|

13.18

|

%

|

15.73

|

%

|

9.58

|

%

|

12.33

|

%

|

||||||||||

|

Supplemental Data and Ratios:

|

||||||||||||||||||||

|

Net assets, end of year (000’s)

|

$

|

165,616

|

$

|

150,440

|

$

|

112,208

|

$

|

88,097

|

$

|

68,240

|

||||||||||

|

Ratio of expenses to average net assets:

|

||||||||||||||||||||

|

Before waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

1.27

|

%

|

1.27

|

%

|

1.30

|

%

|

1.31

|

%

|

1.33

|

%

|

||||||||||

|

After waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

1.20

|

%

|

1.22

|

%(5)

|

1.25

|

%

|

1.27

|

%(4)

|

1.34

|

%

|

||||||||||

|

Ratio of net investment income

|

||||||||||||||||||||

|

to average net assets:

|

||||||||||||||||||||

|

Before waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

0.87

|

%

|

0.50

|

%

|

0.84

|

%

|

0.70

|

%

|

1.30

|

%

|

||||||||||

|

After waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

0.94

|

%

|

0.55

|

%(5)

|

0.89

|

%

|

0.74

|

%(4)

|

1.29

|

%

|

||||||||||

|

Portfolio turnover rate

|

12.32

|

%

|

9.03

|

%

|

14.46

|

%

|

4.13

|

%

|

13.69

|

%

|

||||||||||

|

(1)

|

Per share net investment income was calculated using average shares outstanding method.

|

|

(2)

|

Realized and unrealized gain (loss) per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains

and losses in the Statements of Operations due to share transactions for the period.

|

|

(3)

|

Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Excludes the effect of applicable sales charges.

|

|

(4)

|

Effective June 28, 2019 the expense cap for Class A shares was decreased from 1.10% to 1.00% excluding Rule 12b-1 fees of 0.25%.

|

|

(5)

|

Effective June 28, 2021 the expense cap for Class A shares was decreased from 1.00% to 0.95% excluding Rule 12b-1 fees of 0.25%.

|

The accompanying notes are an integral part of these financial statements.

17

Dearborn Partners Rising Dividend Fund – Class C

|

Financial Highlights

|

Per share Data for a Share Outstanding Throughout Each Year

|

Year

|

Year

|

Year

|

Year

|

Year

|

||||||||||||||||

|

Ended

|

Ended

|

Ended

|

Ended

|

Ended

|

||||||||||||||||

|

February

|

February

|

February

|

February

|

February

|

||||||||||||||||

|

28,

|

28,

|

28,

|

29,

|

28,

|

||||||||||||||||

|

2023

|

2022

|

2021

|

2020

|

2019

|

||||||||||||||||

|

Net Asset Value, Beginning of Year

|

$

|

21.21

|

$

|

19.17

|

$

|

16.82

|

$

|

15.56

|

$

|

14.02

|

||||||||||

|

Income from investment operations:

|

||||||||||||||||||||

|

Net investment income (loss)(1)

|

0.04

|

(0.04

|

)

|

0.03

|

(0.00

|

)(6)

|

0.08

|

|||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||

|

gain (loss) on investments(2)

|

(0.50

|

)

|

2.43

|

2.46

|

1.38

|

1.53

|

||||||||||||||

|

Total from investment operations

|

(0.46

|

)

|

2.39

|

2.49

|

1.38

|

1.61

|

||||||||||||||

|

Less distributions paid:

|

||||||||||||||||||||

|

From net investment income

|

(0.04

|

)

|

(0.02

|

)

|

(0.04

|

)

|

(0.02

|

)

|

(0.07

|

)

|

||||||||||

|

From net realized

|

||||||||||||||||||||

|

gain on investments

|

(0.18

|

)

|

(0.33

|

)

|

(0.10

|

)

|

(0.10

|

)

|

—

|

|||||||||||

|

Total distributions paid

|

(0.22

|

)

|

(0.35

|

)

|

(0.14

|

)

|

(0.12

|

)

|

(0.07

|

)

|

||||||||||

|

Net Asset Value, End of Year

|

$

|

20.53

|

$

|

21.21

|

$

|

19.17

|

$

|

16.82

|

$

|

15.56

|

||||||||||

|

Total Return(3)

|

(2.20

|

%)

|

12.31

|

%

|

14.85

|

%

|

8.81

|

%

|

11.51

|

%

|

||||||||||

|

Supplemental Data and Ratios:

|

||||||||||||||||||||

|

Net assets, end of year (000’s)

|

$

|

92,624

|

$

|

109,239

|

$

|

110,863

|

$

|

96,800

|

$

|

76,881

|

||||||||||

|

Ratio of expenses to average net assets:

|

||||||||||||||||||||

|

Before waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

2.02

|

%

|

2.02

|

%

|

2.05

|

%

|

2.06

|

%

|

2.08

|

%

|

||||||||||

|

After waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

1.95

|

%

|

1.97

|

%(5)

|

2.00

|

%

|

2.02

|

%(4)

|

2.09

|

%

|

||||||||||

|

Ratio of net investment income (loss)

|

||||||||||||||||||||

|

to average net assets:

|

||||||||||||||||||||

|

Before waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

0.12

|

%

|

(0.24

|

%)

|

0.09

|

%

|

(0.05

|

%)

|

0.55

|

%

|

||||||||||

|

After waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

0.19

|

%

|

(0.19

|

%)(5)

|

0.14

|

%

|

(0.01

|

%)(4)

|

0.54

|

%

|

||||||||||

|

Portfolio turnover rate

|

12.32

|

%

|

9.03

|

%

|

14.46

|

%

|

4.13

|

%

|

13.69

|

%

|

||||||||||

|

(1)

|

Per share net investment income (loss) was calculated using average shares outstanding method.

|

|

(2)

|

Realized and unrealized gain (loss) per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains

and losses in the Statements of Operations due to share transactions for the period.

|

|

(3)

|

Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Excludes the effect of applicable sales charges.

|

|

(4)

|

Effective June 28, 2019 the expense cap for Class C shares was decreased from 1.10% to 1.00% excluding Rule 12b-1 fees of 1.00%.

|

|

(5)

|

Effective June 28, 2021 the expense cap for Class C shares was decreased from 1.00% to 0.95% excluding Rule 12b-1 fees of 1.00%.

|

|

(6)

|

Amount is between $(0.005) and $0.00.

|

The accompanying notes are an integral part of these financial statements.

18

Dearborn Partners Rising Dividend Fund – Class I

|

Financial Highlights

|

Per share Data for a Share Outstanding Throughout Each Year

|

Year

|

Year

|

Year

|

Year

|

Year

|

||||||||||||||||

|

Ended

|

Ended

|

Ended

|

Ended

|

Ended

|

||||||||||||||||

|

February

|

February

|

February

|

February

|

February

|

||||||||||||||||

|

28,

|

28,

|

28,

|

29,

|

28,

|

||||||||||||||||

|

2023

|

2022

|

2021

|

2020

|

2019

|

||||||||||||||||

|

Net Asset Value, Beginning of Year

|

$

|

21.44

|

$

|

19.39

|

$

|

16.94

|

$

|

15.65

|

$

|

14.11

|

||||||||||

|

Income from investment operations:

|

||||||||||||||||||||

|

Net investment income(1)

|

0.25

|

0.18

|

0.21

|

0.17

|

0.23

|

|||||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||

|

gain (loss) on investments(2)

|

(0.52

|

)

|

2.46

|

2.48

|

1.38

|

1.53

|

||||||||||||||

|

Total from investment operations

|

(0.27

|

)

|

2.64

|

2.69

|

1.55

|

1.76

|

||||||||||||||

|

Less distributions paid:

|

||||||||||||||||||||

|

From net investment income

|

(0.21

|

)

|

(0.26

|

)

|

(0.14

|

)

|

(0.16

|

)

|

(0.22

|

)

|

||||||||||

|

From net realized

|

||||||||||||||||||||

|

gain on investments

|

(0.18

|

)

|

(0.33

|

)

|

(0.10

|

)

|

(0.10

|

)

|

—

|

|||||||||||

|

Total distributions paid

|

(0.39

|

)

|

(0.59

|

)

|

(0.24

|

)

|

(0.26

|

)

|

(0.22

|

)

|

||||||||||

|

Net Asset Value, End of Year

|

$

|

20.78

|

$

|

21.44

|

$

|

19.39

|

$

|

16.94

|

$

|

15.65

|

||||||||||

|

Total Return(3)

|

(1.23

|

%)

|

13.49

|

%

|

16.00

|

%

|

9.89

|

%

|

12.61

|

%

|

||||||||||

|

Supplemental Data and Ratios:

|

||||||||||||||||||||

|

Net assets, end of year (000’s)

|

$

|

206,384

|

$

|

208,228

|

$

|

165,995

|

$

|

118,700

|

$

|

86,233

|

||||||||||

|

Ratio of expenses to average net assets:

|

||||||||||||||||||||

|

Before waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

1.02

|

%

|

1.02

|

%

|

1.05

|

%

|

1.06

|

%

|

1.08

|

%

|

||||||||||

|

After waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

0.95

|

%

|

0.97

|

%(5)

|

1.00

|

%

|

1.02

|

%(4)

|

1.09

|

%

|

||||||||||

|

Ratio of net investment income

|

||||||||||||||||||||

|

to average net assets:

|

||||||||||||||||||||

|

Before waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

1.12

|

%

|

0.75

|

%

|

1.08

|

%

|

0.96

|

%

|

1.56

|

%

|

||||||||||

|

After waivers, reimbursements

|

||||||||||||||||||||

|

of expenses and recoupments

|

1.19

|

%

|

0.80

|

%(5)

|

1.13

|

%

|

1.00

|

%(4)

|

1.55

|

%

|

||||||||||

|

Portfolio turnover rate

|

12.32

|

%

|

9.03

|

%

|

14.46

|

%

|

4.13

|

%

|

13.69

|

%

|

||||||||||

|

(1)

|

Per share net investment income was calculated using average shares outstanding method.

|

|

(2)

|

Realized and unrealized gain (loss) per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains

and losses in the Statements of Operations due to share transactions for the period.

|

|

(3)

|

Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends.

|

|

(4)

|

Effective June 28, 2019 the expense cap for Class I shares was decreased from 1.10% to 1.00%.

|

|

(5)

|

Effective June 28, 2021 the expense cap for Class I shares was decreased from 1.00% to 0.95%.

|

The accompanying notes are an integral part of these financial statements.

19

Dearborn Partners Rising Dividend Fund

Notes to Financial Statements

February 28, 2023

|

(1)

|

Organization

|

|

Trust for Professional Managers (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust dated May 29, 2001. The Trust is registered under the Investment Company Act of 1940, as

amended (the “1940 Act”), as an open-end management investment company. The Dearborn Partners Rising Dividend Fund (the “Fund”) represents a distinct, diversified series with its own investment objective and policies within the Trust. The

investment objective of the Fund is to seek current income, rising income over time, and long-term capital appreciation. The Trust may issue an unlimited number of shares of beneficial interest at $0.001 par value. The assets of the Fund are

segregated, and a shareholder’s interest is limited to the class in which shares are held. The Fund currently offers three classes of shares, Class A, Class C and Class I. Each class of shares has identical rights and privileges except with

respect to class-specific expenses and voting rights on matters affecting a single class of shares. The classes differ principally in their respective expenses. Class A shares are subject to an initial maximum sales charge of 5.00% imposed

at the time of purchase. The sales charge declines as the amount purchased increases in accordance with the Fund’s prospectus. Class A shares are subject to a contingent deferred sales charge of 1.00% for purchases made at the $500,000

breakpoint that are redeemed within twelve months of purchase. Class C shares are subject to a 1.00% contingent deferred sales charge for redemptions made within twelve months of purchase, in accordance with the Fund’s prospectus. The

contingent deferred sales charge for Class C Shares is 1.00% of the lesser of the original cost or the current market value of shares being redeemed. Class I shares are no-load shares. Class A and Class C shares are subject to a 0.25% and

1.00% distribution fee, respectively. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification

Topic 946 “Financial Services—Investment Companies”. The Fund commenced operations on April 10, 2013.

|

|

|

(2)

|

Significant Accounting Policies

|

|

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies are in conformity with generally accepted

accounting principles in the United States of America (“GAAP”).

|

|

(a) Investment Valuation

|

|

|

Each security owned by the Fund that is listed on a securities exchange is valued at its last sale price on that exchange on the date as of which assets are valued. When the security is listed on more than one

exchange, the Fund will use the price of the exchange that the Fund generally considers to be the principal exchange on which the security is traded.

|

|

|

Portfolio securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”) will be valued at the NASDAQ Official Closing Price (“NOCP”), which may not necessarily represent the last sale price. If there has been

no sale on such exchange or on

|

20

Dearborn Partners Rising Dividend Fund

Notes to Financial Statements (Continued)

February 28, 2023

|

NASDAQ on such day, the security is valued at the mean between the most recent bid and asked prices on such day or the security shall be valued at the latest sales price on the “composite market” for the day

such security is being valued. The composite market is defined as a consolidation of the trade information provided by national securities and foreign exchanges and over-the-counter markets as published by an approved pricing service

(“Pricing Service”).

|

|

|

Debt securities, including short-term debt instruments having a maturity of 60 days or less, are valued at the mean in accordance with prices supplied by an approved Pricing Service. Pricing Services may use

various valuation methodologies such as the mean between the bid and the asked prices, matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. If a price is not available from a Pricing

Service, the most recent quotation obtained from one or more broker-dealers known to follow the issue will be obtained. Quotations will be valued at the mean between the bid and the offer. Any discount or premium is accreted or amortized

using the constant yield to maturity method. Constant yield amortization takes into account the income that is produced on a debt security. This accretion/amortization type utilizes the discount rate used in computing the present value of

all future principal and interest payments made by a debt instrument and produces an amount equal to the cost of the debt instrument.

|

|

|

Demand notes and repurchase agreements are valued at cost. If cost does not represent current market value the securities will be priced at fair value.

|

|

|

Redeemable securities issued by open-end, registered investment companies, including money market funds, are valued at the net asset values (“NAVs”) of such companies for purchase and/or redemption orders

placed on that day. All ETFs are valued at the last reported sale price on the exchange on which the security is principally traded.

|

|

|

Foreign securities will be priced in their local currencies as of the close of their primary exchange or market or as of the time the Fund calculates its NAV, whichever is earlier. Foreign securities,

currencies and other assets denominated in foreign currencies are then translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar, as provided by an approved Pricing Service or reporting agency. All assets

denominated in foreign currencies will be converted into U.S. dollars using the applicable currency exchange rates as of the close of the NYSE, generally 4:00 p.m. Eastern Time.

|

|

|

If market quotations are not readily available, a security or other asset will be valued at its fair value in accordance with Rule 2a-5 of the 1940 Act as determined under the Adviser’s fair value pricing

procedures, subject to oversight by the Board of Trustees. These fair value pricing procedures will also be used to price a security when corporate events, events in the securities market and/or world events cause the Adviser to believe that

a security’s last sale price may not reflect its actual fair value. The intended effect of using fair value pricing procedures is to ensure that the Fund is accurately priced. The Adviser will regularly evaluate whether the Fund’s fair

value pricing procedures continue to be appropriate in light of the specific circumstances of the Fund and the quality of prices obtained through the application of such procedures.

|

21

Dearborn Partners Rising Dividend Fund

Notes to Financial Statements (Continued)

February 28, 2023

|

FASB Accounting Standards Codification, “Fair Value Measurement” Topic 820 (“ASC 820”), establishes an authoritative definition of fair value and sets out a hierarchy for measuring fair value. ASC 820 requires

an entity to evaluate certain factors to determine whether there has been a significant decrease in volume and level of activity for the security such that recent transactions and quoted prices may not be determinative of fair value and

further analysis and adjustment may be necessary to estimate fair value. ASC 820 also requires enhanced disclosures regarding the inputs and valuation techniques used to measure fair value in those instances as well as expanded disclosure of

valuation levels for each class of investments. These inputs are summarized in the three broad levels listed below:

|

|

Level 1—

|

Quoted prices in active markets for identical securities.

|

|

|

Level 2—

|

Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

|

|

|

Level 3—

|

Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

|

|

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the

Fund’s investments carried at fair value as of February 28, 2023:

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||||

|

Assets

|

|||||||||||||||||

|

Common Stocks(1)

|

$

|

433,190,352

|

$

|

—

|

$

|

—

|

$

|

433,190,352

|

|||||||||

|

Real Estate

|

|||||||||||||||||

|

Investment Trusts

|

20,078,377

|

—

|

—

|

20,078,377

|

|||||||||||||

|

Short-Term Investments

|

10,536,967

|

—

|

—

|

10,536,967

|

|||||||||||||

|

Total Investments

|

$

|

463,805,696

|

$

|

—

|

$

|

—

|

$

|

463,805,696

|

|||||||||

|

(1)

|

See the Schedule of Investments for industry classifications.

|

|

The Fund measures Level 3 activity as of the end of the period. For the year ended February 28, 2023, the Fund did not hold any Level 3 securities.

|

|

|

The Fund did not hold financial derivative instruments during the reporting period.

|

|

(b) Federal Income Taxes

|

|

|

The Fund complies with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), necessary to qualify as a regulated investment company and makes the requisite

distributions of income and capital gains to its shareholders sufficient to relieve it of all or substantially all federal income taxes. Therefore, no federal income tax provision has been provided.

|

|

|

As of and during the year ended February 28, 2023, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits

as income tax expense in the Statement of Operations. During the year ended February 28, 2023, the Fund did not incur any interest or penalties. At February 28, 2023, the fiscal years 2020 through 2023 remained open to examination in the

Fund’s major tax jurisdictions.

|

22

Dearborn Partners Rising Dividend Fund

Notes to Financial Statements (Continued)

February 28, 2023

|

(c) Distributions to Shareholders

|

|

|

The Fund will distribute any net investment income and any net realized long- or short-term capital gains at least annually, and as frequently as quarterly. Distributions from net realized gains for book

purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. Distributions to shareholders are recorded on the ex-dividend date. The Fund may also pay a special distribution at

the end of the calendar year to comply with federal tax requirements. Income and capital gains distributions may differ from GAAP, primarily due to timing differences in the recognition of income, gains and losses by the Fund. GAAP requires

that certain components of net assets relating to permanent differences be reclassified between the components of net assets. These reclassifications have no effect on net assets or NAV per share.

|

|

|

(d) Use of Estimates

|

|

|

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

|

|

|

(e) Share Valuation

|

|

|

The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the

total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the NYSE is closed for trading.

|

|

|

(f) Allocation of Income, Expenses and Gains/Losses

|

|

|

Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by

each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. Distribution fees

are expensed at 0.25% and 1.00% of average daily net assets of the Class A and Class C shares, respectively. Expenses associated with a specific fund in the Trust are charged to that fund. Common Trust expenses are typically allocated evenly

between the funds of the Trust, or by other equitable means

|

|

|

.

|

|

|

(g) Other

|

|

|

Investment transactions are recorded on the trade date. The Fund determines the gain or loss from investment transactions on the identified cost basis by comparing the original cost of the security lot sold