UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jay Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(513) 629-8104

Registrant's telephone number, including area code

Date of fiscal year end: May 31, 2023

Date of reporting period: November 30, 2022

Item 1. Reports to Stockholders.

|

(a)

|

BARRETT GROWTH FUND

Semi-Annual Report

November 30, 2022

BARRETT

GROWTH FUND

|

Letter to

|

Dear Shareholders,

|

| Shareholders | |

|

November 30, 2022

|

The Six-Month Period in Review

|

|

|

Financial markets continue to be upended by historically high inflation, disruptions in global trade and persistent conflict between Russia and Ukraine. What tops the list has been soaring interest rates, driven by the Federal Reserve’s

objective to aggressively curb the recent surge in prices of goods and services.

|

|

Over the past year and as of November month-end, the central bank has lifted the Fed funds rate from near-zero to 3.75 -4.00%. Market participants are now collectively questioning the trajectory of future rate hikes. Continued stock market

volatility has stemmed from conflicting expectations on the Fed’s next steps. Investors have been focused on each subsequent economic data point and commentary from various Fed officials in hopes of gaining visibility into 2023. It appears

stronger economic signals have driven equity prices down, implying the economy might still be sturdy enough to withstand higher rates, if needed.

|

|

|

Investment Outlook

|

|

|

Higher inflation should continue to weigh on the U.S. economy and financial markets as we enter the New Year. We anticipate consumer spending to remain constrained given higher food and energy prices. On the brighter side, wage inflation

and pandemic savings have helped to partially offset higher expenses. We are mindful these two metrics have moderated more recently and bears watching in the coming months.

|

|

|

Corporate profits have remained stable thus far. The latest set of earnings reports suggest U.S. businesses have been able to manage rising labor and other input costs through price increases and keeping tight control over operating

expenses. While managements have mostly provided near-term guidance, investors are anxiously looking for greater earnings visibility for 2023 and beyond. Until then, we expect market volatility to stay elevated.

|

|

|

We expect to remain invested in stocks, although we understand the risk/reward ratio is less compelling considering bond yields have moved higher. The path to recovery will depend on inflation data, which seems to have ‘peaked’ but remains

far higher than the Fed’s target of 2%. Our focus continues to be on identifying sustainable companies that can prosper through economic cycles trading at reasonable valuations. We remain keen on management teams that have successfully raised

their dividend through time. Investors have shown a preference for shorter term cash flow, as in dividends, when faced with higher prices for goods and services.

|

|

|

Performance and Portfolio Positioning

|

|

|

The Barrett Growth Fund (the “Fund”) generated a total return of -0.76% for the six-month period ended November 30, 2022. In comparison, the S&P 500 Index (“S&P 500”) declined -0.40% and the Lipper Large Cap Growth Index (“Lipper”)

was down -2.91%. For the quarter ended November 30, 2022, the Fund was up +2.31% versus the S&P 500 and Lipper at +3.63% and +0.12%, respectively.

|

1

BARRETT

GROWTH FUND

|

The Fund’s overall performance for the two quarters ending November 30, 2022 has been flat. The sectors that most contributed to performance were Consumer Discretionary and Communication Services. On the flip side, the sectors that

detracted from performance were Technology and Energy (as the Fund does not own any energy companies).

|

|

|

In our view, the Fund consists of high-quality names. There is reasonable diversification across sectors and geographies. Compared to the S&P 500, the Fund was relatively overweight in the following areas: Information Technology,

Healthcare, and Consumer Discretionary. Conversely, the portfolio was underweight Financials, Consumer Staples and Energy.

|

|

|

Thank you for your continued interest in the Barrett Growth Fund.

|

|

|

|

|

Amy Kong

|

E. Wells Beck, CFA

|

|

|

Portfolio Manager

|

Portfolio Manager

|

|

|

The outlook, views, and opinions presented are those of the Adviser as of 11/30/2022. These are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

|

|

|

Past performance does not guarantee future results.

|

|

|

Earnings growth is not representative of the Fund’s future performance.

|

|

|

Must be preceded or accompanied by a prospectus.

|

|

|

Mutual fund investing involves risk. Principal loss is possible. Foreign investments are subject to special risks not ordinarily associated with U.S. securities including currency fluctuations and social,

economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. The Fund may also invest in smaller and mid-capitalization companies, which involve a higher degree of risk and volatility

than investments in larger, more established companies. The Fund may also invest in derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund

performance.

|

|

|

The S&P 500 Index is a capitalization-weighted index of five hundred large capitalization stocks, which is designed to measure broad domestic securities markets. The performance of the S&P 500 Index reflects the reinvestment of

dividends and capital gains, but does not reflect the deduction of any investment advisory fees. An index is unmanaged. Investors cannot invest directly in an index.

|

|

|

The Lipper Large Cap Growth Fund Index is an equally weighted performance index, adjusted for capital gain distributions and income dividends, of the 30 largest mutual funds within the Lipper Growth Funds category.

|

|

|

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of portfolio holdings, please refer to the Schedule of Investments provided in this

report.

|

|

|

The Barrett Growth Fund is distributed by Quasar Distributors, LLC.

|

2

BARRETT

GROWTH FUND

Fund at a Glance (Unaudited)

Top Ten Holdings – as of 11/30/2022

(Percent of Net Assets)*

|

Visa, Inc. - Class A

|

5.62

|

%

|

|||

|

Microsoft Corp.

|

5.39

|

%

|

|||

|

Apple, Inc.

|

4.60

|

%

|

|||

|

Costco Wholesale Corp.

|

4.53

|

%

|

|||

|

Tetra Tech, Inc.

|

4.10

|

%

|

|||

|

TJX Cos., Inc.

|

3.98

|

%

|

|||

|

Ares Management Corp.

|

3.90

|

%

|

|||

|

NVIDIA Corp.

|

3.86

|

%

|

|||

|

Accenture PLC - Class A

|

3.74

|

%

|

|||

|

Amazon.com, Inc.

|

3.60

|

%

|

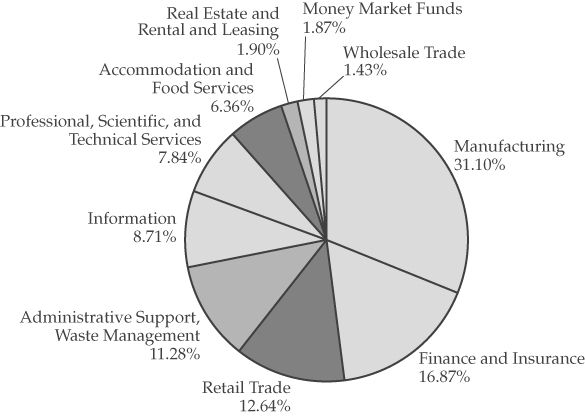

Sector Weightings – as of 11/30/2022

(Percent of Total Investments)*

|

*

|

Portfolio characteristics are as of November 30, 2022, and are subject to change at any time.

|

3

BARRETT

GROWTH FUND

Expense Example – November 30, 2022 (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including: investment advisory fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of

investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period (June 1, 2022 – November 30, 2022).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees such as the $15.00 fee charged for wire redemptions. The table also does not

include portfolio trading commissions and related trading costs, which are included in the Fund’s net asset value. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the

period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the

expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual net expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s

actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with

other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees, which, although not charged by the Fund,

may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds.

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During the Period*

|

|

|

Account Value

|

Account Value

|

June 1, 2022 to

|

|

|

June 1, 2022

|

November 30, 2022

|

November 30, 2022

|

|

|

Actual

|

$1,000.00

|

$ 992.40

|

$5.79

|

|

Hypothetical

|

|||

|

(5% return before expenses)

|

$1,000.00

|

$1,019.25

|

$5.87

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.16% (which reflects the effect of the Adviser’s fee waiver and expense limitation agreement), multiplied by the average account value over the period, multiplied by 183/365 (to

reflect the one-half year period).

|

4

BARRETT

GROWTH FUND

Performance Highlights (Unaudited)

This chart assumes an initial gross investment of $10,000 made on November 30, 2012.

The S&P 500® Index is a capitalization-weighted index of five hundred large capitalization stocks, which is designed to measure broad

domestic securities markets.

The Lipper Large-Cap Growth Funds Index® (“Lipper”) is an equally-weighted performance index, adjusted for capital gains distributions and

income dividends, of the 30 largest mutual funds within the Lipper Growth Funds category.

|

Average Annual Total Returns as of November 30, 2022

|

|||||||

|

One Year

|

Three Year

|

Five Year

|

Ten Year

|

||||

|

–●–

|

Barrett Growth Fund

|

-16.90%

|

8.97%

|

10.62%

|

12.36%

|

||

|

--■--

|

S&P 500® Index

|

-9.21%

|

10.91%

|

10.98%

|

13.34%

|

||

|

–◆–

|

Lipper Large-Cap

|

||||||

|

Growth Funds Index®

|

-26.11%

|

8.43%

|

10.62%

|

13.24%

|

|||

RETURNS SHOWN INCLUDE THE REINVESTMENT OF ALL DIVIDENDS AND DISTRIBUTIONS. RETURNS SHOWN DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. IN THE

ABSENCE OF FEE WAIVERS AND REIMBURSEMENTS, TOTAL RETURN WOULD BE REDUCED. PAST PERFORMANCE IS NOT PREDICTIVE OF FUTURE PERFORMANCE. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE, SO THAT YOUR SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS

THAN THEIR ORIGINAL COST.

5

BARRETT

GROWTH FUND

Schedule of Investments

November 30, 2022 (Unaudited)

|

Shares

|

Value

|

||||||

|

COMMON STOCKS - 96.25%

|

|||||||

|

Administrative and

|

|||||||

|

Support Services - 11.29%

|

|||||||

|

500

|

Fair Isaac Corp. (a)

|

$

|

309,860

|

||||

|

4,000

|

Fidelity National Information

|

||||||

|

Services, Inc.

|

290,320

|

||||||

|

5,750

|

PayPal Holdings, Inc. (a)

|

450,858

|

|||||

|

5,000

|

TransUnion

|

315,400

|

|||||

|

6,250

|

Visa, Inc. - Class A

|

1,356,250

|

|||||

|

2,722,688

|

|||||||

|

Broadcasting (except

|

|||||||

|

Internet) - 2.03%

|

|||||||

|

5,000

|

Walt Disney Co. (a)

|

489,350

|

|||||

|

Chemical

|

|||||||

|

Manufacturing - 9.09%

|

|||||||

|

3,000

|

Ecolab, Inc.

|

449,490

|

|||||

|

4,000

|

Merck & Co., Inc.

|

440,480

|

|||||

|

875

|

Regeneron

|

||||||

|

Pharmaceuticals, Inc. (a)

|

657,738

|

||||||

|

4,200

|

Zoetis, Inc.

|

647,388

|

|||||

|

2,195,096

|

|||||||

|

Clothing and Clothing

|

|||||||

|

Accessories Stores - 3.98%

|

|||||||

|

12,000

|

TJX Cos., Inc.

|

960,600

|

|||||

|

Computer and

|

|||||||

|

Electronic Product

|

|||||||

|

Manufacturing - 18.33%

|

|||||||

|

8,500

|

Alphabet, Inc. - Class C (a)

|

|

862,325

|

||||

|

7,500

|

Apple, Inc.

|

1,110,225

|

|||||

|

2,750

|

Danaher Corp.

|

751,877

|

|||||

|

5,500

|

NVIDIA Corp.

|

930,765

|

|||||

|

600

|

Roper Technologies, Inc.

|

263,334

|

|||||

|

900

|

Thermo Fisher Scientific, Inc.

|

504,198

|

|||||

|

4,422,724

|

|||||||

|

Credit Intermediation and

|

|||||||

|

Related Activities - 5.42%

|

|||||||

|

4,500

|

First Republic Bank/CA

|

574,245

|

|||||

|

5,300

|

JPMorgan Chase & Co.

|

732,354

|

|||||

|

1,306,599

|

|||||||

|

Electrical Equipment,

|

|||||||

|

Appliance, and

|

|||||||

|

Component - 1.25%

|

|||||||

|

4,000

|

EnerSys

|

302,320

|

|||||

|

Food Services and

|

|||||||

|

Drinking Places - 6.36%

|

|||||||

|

3,000

|

McDonald’s Corp.

|

818,370

|

|||||

|

7,000

|

Starbucks Corp.

|

715,400

|

|||||

|

1,533,770

|

|||||||

|

General Merchandise

|

|||||||

|

Stores - 4.53%

|

|||||||

|

2,025

|

Costco Wholesale Corp.

|

1,091,981

|

|||||

|

Insurance Carriers and

|

|||||||

|

Related Activities - 6.97%

|

|||||||

|

6,500

|

Progressive Corp.

|

858,975

|

|||||

|

1,500

|

UnitedHealth Group, Inc.

|

821,640

|

|||||

|

1,680,615

|

|||||||

The accompanying notes are an integral part of these financial statements.

6

BARRETT

GROWTH FUND

Schedule of Investments (Cont’d)

November 30, 2022 (Unaudited)

|

Shares

|

Value

|

||||||

|

Merchant Wholesalers,

|

|||||||

|

Nondurable Goods - 1.43%

|

|||||||

|

4,000

|

Sysco Corp.

|

$

|

346,040

|

||||

|

Miscellaneous

|

|||||||

|

Manufacturing - 2.42%

|

|||||||

|

2,500

|

Stryker Corp.

|

584,725

|

|||||

|

Motor Vehicle and

|

|||||||

|

Parts Dealers - 0.54%

|

|||||||

|

50

|

AutoZone, Inc. (a)

|

128,950

|

|||||

|

Nonstore Retailers - 3.60%

|

|||||||

|

9,000

|

Amazon.com, Inc. (a)

|

868,860

|

|||||

|

Professional, Scientific, and

|

|||||||

|

Technical Services - 7.84%

|

|||||||

|

3,000

|

Accenture PLC – Class A (b)

|

902,790

|

|||||

|

6,400

|

Tetra Tech, Inc.

|

989,376

|

|||||

|

1,892,166

|

|||||||

|

Publishing Industries

|

|||||||

|

(Except Internet) - 6.68%

|

|||||||

|

900

|

Adobe, Inc. (a)

|

310,437

|

|||||

|

5,100

|

Microsoft Corp.

|

1,301,214

|

|||||

|

1,611,651

|

|||||||

|

Securities, Commodity

|

|||||||

|

Contracts, and Other

|

|||||||

|

Financial Investments and

|

|||||||

|

Related Activities - 4.49%

|

|||||||

|

12,000

|

Ares Management Corp.

|

940,680

|

|||||

|

200

|

BlackRock, Inc.

|

143,200

|

|||||

|

1,083,880

|

|||||||

|

Total Common Stocks

|

|||||||

|

(Cost $8,583,046)

|

23,222,015

|

||||||

|

REAL ESTATE

|

|||||||

|

INVESTMENT

|

|||||||

|

TRUSTS - 1.91%

|

|||||||

|

Lessors of Real

|

|||||||

|

Estate - 1.91%

|

|||||||

|

3,250

|

Crown Castle, Inc.

|

459,647

|

|||||

|

Total Real Estate

|

|||||||

|

Investment Trusts

|

|||||||

|

(Cost $589,507)

|

459,647

|

||||||

|

SHORT-TERM

|

|||||||

|

INVESTMENTS - 1.87%

|

|||||||

|

Money Market Funds - 1.87%

|

|||||||

|

451,387

|

Fidelity Investments

|

||||||

|

Government Portfolio -

|

|||||||

|

Class I, 3.560% (c)

|

451,387

|

||||||

|

Total Short-Term Investments

|

|||||||

|

(Cost $451,387)

|

451,387

|

||||||

|

Total Investments

|

|||||||

|

(Cost $9,623,940) - 100.03%

|

24,133,049

|

||||||

|

Liabilities in Excess

|

|||||||

|

of Other Assets - (0.03)%

|

(7,878

|

)

|

|||||

|

Total Net Assets - 100.00%

|

$

|

24,125,171

|

|||||

Percentages are stated as a percent of net assets.

|

PLC

|

Public Limited Company

|

|

(a)

|

Non-income producing security.

|

|

(b)

|

Foreign issued security.

|

|

(c)

|

The rate shown represents the seven-day yield as of November 30, 2022.

|

The accompanying notes are an integral part of these financial statements.

7

BARRETT

GROWTH FUND

Statement of Assets and Liabilities

November 30, 2022 (Unaudited)

|

ASSETS

|

||||

|

Investments, at value (cost $9,623,940)

|

$

|

24,133,049

|

||

|

Dividends and interest receivable

|

19,288

|

|||

|

Receivable from Adviser

|

1,042

|

|||

|

Prepaid expenses and other assets

|

18,935

|

|||

|

Total assets

|

24,172,314

|

|||

|

LIABILITIES

|

||||

|

Payable for distribution fees

|

3,720

|

|||

|

Payable to affiliates

|

27,342

|

|||

|

Accrued expenses and other liabilities

|

16,081

|

|||

|

Total liabilities

|

47,143

|

|||

|

NET ASSETS

|

$

|

24,125,171

|

||

|

NET ASSETS CONSIST OF:

|

||||

|

Paid-in capital

|

$

|

5,344,052

|

||

|

Total distributable earnings

|

18,781,119

|

|||

|

Net Assets

|

$

|

24,125,171

|

||

|

Shares of beneficial interest outstanding

|

||||

|

(unlimited number of shares authorized, $0.001 par value)

|

972,573

|

|||

|

Net asset value, redemption price and offering price per share

|

$

|

24.81

|

||

The accompanying notes are an integral part of these financial statements.

8

BARRETT

GROWTH FUND

Statement of Operations

For the Six Months Ended November 30, 2022 (Unaudited)

|

INVESTMENT INCOME

|

||||

|

Dividend income

|

$

|

123,827

|

||

|

Interest income

|

4,231

|

|||

|

Total Investment Income

|

128,058

|

|||

|

EXPENSES

|

||||

|

Advisory fees

|

119,695

|

|||

|

Administration fees

|

23,836

|

|||

|

Distribution fees

|

18,656

|

|||

|

Fund accounting fees

|

13,906

|

|||

|

Legal fees

|

12,627

|

|||

|

Trustees’ fees and related expenses

|

11,249

|

|||

|

Federal and state registration fees

|

11,113

|

|||

|

Transfer agent fees and expenses

|

10,491

|

|||

|

Audit and tax fees

|

8,969

|

|||

|

Chief Compliance Officer fees and expenses

|

7,801

|

|||

|

Reports to shareholders

|

4,564

|

|||

|

Custody fees

|

2,650

|

|||

|

Insurance fees

|

1,007

|

|||

|

Other expenses

|

1,755

|

|||

|

Total expenses

|

248,319

|

|||

|

Less waivers and reimbursement by Adviser (Note 4)

|

(109,968

|

)

|

||

|

Net expenses

|

138,351

|

|||

|

Net Investment Loss

|

(10,293

|

)

|

||

|

REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS

|

||||

|

Net realized gain from investments

|

256,010

|

|||

|

Change in net unrealized depreciation on investments

|

(480,830

|

)

|

||

|

Net realized and unrealized loss on investments

|

(224,820

|

)

|

||

|

Net decrease in net assets from operations

|

$

|

(235,113

|

)

|

|

The accompanying notes are an integral part of these financial statements.

9

BARRETT

GROWTH FUND

Statements of Changes in Net Assets

|

Six Months Ended

|

||||||||

|

November 30, 2022

|

Year Ended

|

|||||||

|

(Unaudited)

|

May 31, 2022

|

|||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment loss

|

$

|

(10,293

|

)

|

$

|

(125,241

|

)

|

||

|

Net realized gain on investments

|

256,010

|

4,933,291

|

||||||

|

Net change in unrealized depreciation on investments

|

(480,830

|

)

|

(6,336,676

|

)

|

||||

|

Net decrease in net assets from operations

|

(235,113

|

)

|

(1,528,626

|

)

|

||||

|

FROM DISTRIBUTIONS

|

||||||||

|

Net distributions to shareholders

|

—

|

(3,831,341

|

)

|

|||||

|

Net decrease in net assets resulting from distributions paid

|

—

|

(3,831,341

|

)

|

|||||

|

FROM CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold

|

22,046

|

600,581

|

||||||

|

Net asset value of shares issued to shareholders

|

||||||||

|

in payment of distributions declared

|

—

|

3,831,341

|

||||||

|

Cost of shares redeemed

|

(1,025,991

|

)

|

(8,551,451

|

)

|

||||

|

Net decrease in net assets resulting

|

||||||||

|

from capital share transactions

|

(1,003,945

|

)

|

(4,119,529

|

)

|

||||

|

TOTAL DECREASE IN NET ASSETS

|

(1,239,058

|

)

|

(9,479,496

|

)

|

||||

|

NET ASSETS

|

||||||||

|

Beginning of period

|

25,364,229

|

34,843,725

|

||||||

|

End of period

|

$

|

24,125,171

|

$

|

25,364,229

|

||||

The accompanying notes are an integral part of these financial statements.

10

BARRETT

GROWTH FUND

Financial Highlights

Per share data for a share of capital stock outstanding for the entire period and selected information for each period are as follows:

|

Six Months

|

||||||||||||||||||||||||

|

Ended

|

||||||||||||||||||||||||

|

November 30,

|

||||||||||||||||||||||||

|

2022

|

Years Ended May 31,

|

|||||||||||||||||||||||

|

(Unaudited)

|

2022

|

2021

|

2020

|

2019

|

2018

|

|||||||||||||||||||

|

NET ASSET VALUE

|

||||||||||||||||||||||||

|

Beginning of period

|

$

|

25.00

|

$

|

30.29

|

$

|

24.34

|

$

|

20.81

|

$

|

20.30

|

$

|

18.10

|

||||||||||||

|

OPERATIONS

|

||||||||||||||||||||||||

|

Net investment income (loss)(1)

|

(0.01

|

)

|

(0.11

|

)

|

(0.10

|

)

|

(0.05

|

)

|

(0.02

|

)

|

(0.01

|

)

|

||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||||||

|

gains (losses) on securities

|

(0.18

|

)

|

(1.49

|

)

|

7.99

|

4.15

|

1.17

|

3.12

|

||||||||||||||||

|

Total from investment operations

|

(0.19

|

)

|

(1.60

|

)

|

7.89

|

4.10

|

1.15

|

3.11

|

||||||||||||||||

|

LESS DISTRIBUTIONS

|

||||||||||||||||||||||||

|

Distributions from

|

||||||||||||||||||||||||

|

net investment income

|

—

|

—

|

—

|

—

|

—

|

(0.05

|

)

|

|||||||||||||||||

|

Distributions from net

|

||||||||||||||||||||||||

|

realized gains on investments

|

—

|

(3.69

|

)

|

(1.94

|

)

|

(0.57

|

)

|

(0.64

|

)

|

(0.86

|

)

|

|||||||||||||

|

Total distributions paid

|

—

|

(3.69

|

)

|

(1.94

|

)

|

(0.57

|

)

|

(0.64

|

)

|

(0.91

|

)

|

|||||||||||||

|

NET ASSET VALUE

|

||||||||||||||||||||||||

|

End of period

|

$

|

24.81

|

$

|

25.00

|

$

|

30.29

|

$

|

24.34

|

$

|

20.81

|

$

|

20.30

|

||||||||||||

|

Total return(3)

|

-0.76

|

%

|

-7.25

|

%

|

32.96

|

%

|

19.82

|

%

|

6.17

|

%

|

17.51

|

%

|

||||||||||||

|

Net assets at end of period

|

||||||||||||||||||||||||

|

(000s omitted)

|

$

|

24,125

|

$

|

25,364

|

$

|

34,844

|

$

|

30,565

|

$

|

26,179

|

$

|

25,753

|

||||||||||||

|

RATIO OF EXPENSES TO

|

||||||||||||||||||||||||

|

AVERAGE NET ASSETS

|

||||||||||||||||||||||||

|

Before expense reimbursement(4)

|

2.08

|

%

|

1.76

|

%

|

1.78

|

%

|

1.81

|

%

|

1.81

|

%

|

1.90

|

%

|

||||||||||||

|

After expense reimbursement(4)

|

1.16

|

%

|

1.13

|

%

|

1.24

|

%(2)

|

1.25

|

%

|

1.25

|

%

|

1.25

|

%

|

||||||||||||

|

RATIO OF NET INVESTMENT

|

||||||||||||||||||||||||

|

INCOME (LOSS) TO

|

||||||||||||||||||||||||

|

AVERAGE NET ASSETS

|

||||||||||||||||||||||||

|

Before expense reimbursement(4)

|

(1.01

|

)%

|

(0.99

|

)%

|

(0.89

|

)%

|

(0.77

|

)%

|

(0.64

|

)%

|

(0.71

|

)%

|

||||||||||||

|

After expense reimbursement(4)

|

(0.09

|

)%

|

(0.36

|

)%

|

(0.35

|

)%

|

(0.21

|

)%

|

(0.08

|

)%

|

(0.06

|

)%

|

||||||||||||

|

Portfolio turnover rate(3)

|

2

|

%

|

5

|

%

|

6

|

%

|

20

|

%

|

16

|

%

|

20

|

%

|

||||||||||||

|

(1)

|

Net investment income (loss) per share represents net investment income (loss) divided by the daily average shares of beneficial interest outstanding throughout each period.

|

|

(2)

|

Effective April 30, 2021, the expense cap was decreased from 1.25% to 1.00%, excluding 12b-1 fees.

|

|

(3)

|

Not annualized for periods less than one year.

|

|

(4)

|

Annualized for periods less than one year.

|

The accompanying notes are an integral part of these financial statements.

11

BARRETT

GROWTH FUND

Notes to the Financial Statements

November 30, 2022 (Unaudited)

|

1.

|

Organization

|

Trust for Professional Managers (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust dated May 29, 2001. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as

an open-end, management investment company. The Barrett Growth Fund (the “Fund”) represents a distinct diversified series with its own investment objective and policies within the Trust. The investment objective of the Fund is to seek to

achieve long-term capital appreciation and to maximize after-tax returns. The Trust may issue an unlimited number of shares of beneficial interest at $0.001 par value. The assets of the Fund are segregated, and a shareholder’s interest is

limited to the fund in which shares are held. The Fund commenced operations on December 29, 1998 as a series of The Barrett Funds. On March 30, 2010, the Fund reorganized as a series of the Trust and changed its fiscal year end from June

30th to May 31st. Effective April 29, 2011, Barrett Asset Management, LLC (the “Adviser”) began serving as the investment adviser to the Fund. Prior to April 29, 2011, Barrett Associates, Inc., a wholly-owned subsidiary of Legg Mason, Inc.,

a financial services holding company, served as the investment adviser to the Fund.

|

|

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 “Financial Services

— Investment Companies”.

|

||

|

2.

|

Significant

Accounting

Policies

|

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies are in conformity with generally accepted accounting principles in the United

States of America (“GAAP”).

|

|

a) Investment Valuation

|

||

|

Each security owned by the Fund that is listed on a securities exchange, except for securities listed on the NASDAQ Stock Market LLC (“NASDAQ”), is valued at its last sale price on the exchange on the date as of which assets are valued.

When the security is listed on more than one exchange, the Fund will use the price of the exchange that the Fund generally considers to be the principal exchange on which the security is traded.

|

||

|

Fund securities listed on NASDAQ will be valued at the NASDAQ Official Closing Price (“NOCP”), which may not necessarily represent the last sale price. If the NOCP is not available, such securities shall be valued at the last sale price

on the day of valuation. If there has been no sale on such exchange or on NASDAQ on such day, the security is valued at (i) the mean between the most recent quoted bid and asked prices at the close of the exchange on such day or (ii) the

latest sales

|

12

BARRETT

GROWTH FUND

|

price on the Composite Market for the day such security is being valued. “Composite Market” means a consolidation of the trade information provided by national securities and foreign exchanges and over-the-counter markets as published by

a pricing service. When market quotations are not readily available, any security or other asset is valued at its fair value in accordance with Rule 2a-5 of the 1940 Act as determined under the Adviser’s procedures, subject to oversight by

the Trust’s Board of Trustees. These fair value procedures will also be used to price a security when corporate events, events in the securities market or world events cause the Adviser to believe that a security’s last sale price may not

reflect its actual fair market value. The intended effect of using fair value pricing procedures is to ensure that the Fund is accurately priced. The Adviser will regularly evaluate whether the Fund’s fair value pricing procedures continue

to be appropriate in light of the specific circumstances of the Fund and the quality of prices obtained through their application of such procedures.

|

||

|

In the case of foreign securities, the occurrence of certain events after the close of foreign markets, but prior to the time the Fund’s net asset value (“NAV”) is calculated (such as a significant surge or decline in the U.S. or other

markets) often will result in an adjustment to the trading prices of foreign securities when foreign markets open on the following business day. If such events occur, the Fund will value foreign securities at fair value, taking into account

such events, in calculating the NAV. In such cases, use of fair valuation can reduce an investor’s ability to seek to profit by estimating the Fund’s NAV in advance of the time the NAV is calculated.

|

||

|

Exchange traded options are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which an option is quoted, thus

providing a view across the entire U.S. options marketplace. Specifically, composite pricing looks at the last trades on the exchanges where the options are traded. If there are no trades for the option on a given business day, composite

option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. Option contracts on securities, currencies and other financial instruments traded in the OTC market with less

than 180 days remaining until their expiration are valued at the evaluated price provided by the broker-dealer with which the option was traded. Option contracts on securities, currencies and other financial instruments traded in the OTC

market with 180 days or more remaining until their expiration are valued at the prices provided by a recognized independent broker-dealer.

|

||

|

Redeemable securities issued by open-end, registered investment companies, including money market mutual funds, are valued at the NAVs of such companies for purchase and/or redemption orders placed on that day. If, on a particular day, a

share of an investment company is not listed on NASDAQ, such security’s fair value, in accordance with Rule 2a-5 of the 1940 Act, will be determined.

|

13

BARRETT

GROWTH FUND

|

FASB ASC Topic 820, “Fair Value Measurements and Disclosures” (“ASC 820”), establishes an authoritative definition of fair value and sets out a hierarchy for measuring fair value. ASC 820 requires an entity to evaluate certain factors to

determine whether there has been a significant decrease in volume and level of activity for the security such that recent transactions and quoted prices may not be determinative of fair value and further analysis and adjustment may be

necessary to estimate fair value. ASC 820 also requires enhanced disclosure regarding the inputs and valuation techniques used to measure fair value in those instances as well as expanded disclosure of valuation levels for each class of

investments. These inputs are summarized in the three broad levels listed below:

|

|

Level 1 –

|

Quoted prices in active markets for identical securities.

|

||

|

Level 2 –

|

Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

|

||

|

Level 3 –

|

Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

|

|

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s investments carried at

fair value as of November 30, 2022:

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||||

|

Assets:

|

||||||||||||||||||

|

Equity

|

||||||||||||||||||

|

Common Stocks(1)

|

$

|

23,222,015

|

$

|

—

|

$

|

—

|

$

|

23,222,015

|

||||||||||

|

Real Estate Investment Trusts

|

459,647

|

—

|

—

|

459,647

|

||||||||||||||

|

Short-Term Investments

|

451,387

|

—

|

—

|

451,387

|

||||||||||||||

|

Total Investments in Securities

|

$

|

24,133,049

|

$

|

—

|

$

|

—

|

$

|

24,133,049

|

||||||||||

|

(1)

|

See the Schedule of Investments for industry classifications. |

|

The Fund measures Level 3 activity as of the end of the period. For the period ended November 30, 2022, the Fund did not have any significant unobservable inputs (Level 3 securities) used in determining fair value. Therefore, a

reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable.

|

||

|

b) Federal Income Taxes

|

||

|

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986 (the “Code”), as amended, necessary to qualify as a regulated investment company and to make the requisite distributions of income and

capital gains to its shareholders sufficient to relieve it from all or substantially all federal income taxes. Therefore, no federal income tax provision has been provided.

|

14

BARRETT

GROWTH FUND

|

As of and during the year ended May 31, 2022, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to

uncertain tax benefits as income tax expense in the Statement of Operations. During the fiscal year, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. taxing authorities for tax periods prior

to the year ended May 31, 2019.

|

||

|

c) Distributions to Shareholders

|

||

|

The Fund will distribute any net investment income and any net capital gains, if any, at least annually typically during the month of December. Distributions from net realized gains

for book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. Distributions to shareholders are recorded on the ex-dividend date. The Fund may also pay a special

distribution at the end of the calendar year to comply with federal tax requirements. The Fund may make additional distributions if it deems it desirable at another time during the year.

|

||

|

d) Use of Estimates

|

||

|

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

|

||

|

e) Share Valuation

|

||

|

The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated

accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the New York Stock Exchange (“NYSE”) is closed for trading.

|

||

|

f) Expenses

|

||

|

Expenses associated with a specific series in the Trust are charged to that series. Common expenses are typically allocated evenly between the series of the Trust, or by other

equitable means.

|

||

|

g) Other

|

||

|

Investment transactions are recorded on the trade date. The Fund determines the gain or loss from investment transactions on the identified cost basis by comparing the cost of the

security lot sold with the net sales proceeds. Dividend income, less foreign withholding tax, is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Withholding taxes on foreign dividends and interest,

net of any reclaims, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

|

15

BARRETT

GROWTH FUND

|

3.

|

Federal Tax

|

The tax character of distributions paid by the Fund during the years ended May 31, 2022 and May 31, 2021 was as follows:

|

|

Matters

|

|

May 31, 2022

|

May 31, 2021

|

|||||||||

|

Ordinary Income

|

$

|

—

|

$

|

—

|

||||||

|

Long-Term Capital Gain

|

3,831,341

|

2,195,275

|

||||||||

|

The components of distributable earnings on a tax basis as of May 31, 2022 were as follows:

|

|

Cost basis of investments for federal

|

||||||

|

income tax purposes

|

$

|

10,398,324

|

||||

|

Gross tax unrealized appreciation

|

$

|

14,992,436

|

||||

|

Gross tax unrealized depreciation

|

(2,497

|

)

|

||||

|

Net tax unrealized appreciation

|

14,989,939

|

|||||

|

Undistributed ordinary income

|

—

|

|||||

|

Undistributed long-term capital gain

|

4,071,915

|

|||||

|

Distributable earnings

|

4,071,915

|

|||||

|

Other accumulated losses

|

(45,622

|

)

|

||||

|

Total distributable earnings

|

$

|

19,016,232

|

||||

|

At May 31, 2022, the Fund deferred, on a tax basis, late year losses of $45,622.

|

||

|

GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. The permanent tax

differences relate to net operating losses. For the year ended May 31, 2022, the following reclassifications were made for permanent tax differences on the Statement of Assets and Liabilities:

|

|

Total Distributable Earnings

|

$

|

123,683

|

||||

|

Paid-In Capital

|

$

|

(123,683

|

)

|

|

4.

|

Investment

Adviser

|

The Trust has an Investment Advisory Agreement (the “Agreement”) with the Adviser to furnish investment advisory services to the Fund. Under the terms of the Agreement, the Trust, on behalf of the Fund, compensates the Adviser for its

management services at the annual rate of 1.00% of the Fund’s average daily net assets.

|

|

The Adviser has contractually agreed to waive its management fee and/or reimburse the Fund’s other expenses at least through September 30, 2023, at the discretion of the Adviser and the Board of Trustees, to the extent necessary to ensure

that the Fund’s Total Annual Operating Expenses (exclusive of front-end or contingent deferred sales loads, Rule 12b-1 plan fees, shareholder servicing plan fees, taxes, leverage (i.e., any expenses incurred in connection with borrowings made

by the Fund), interest (including interest incurred in

|

16

BARRETT

GROWTH FUND

|

connection with bank and custody overdrafts), brokerage commissions and other transactional expenses, expenses incurred in connection with any merger or reorganization, dividends or interest on short positions, acquired fund fees and

expenses and extraordinary expenses such as litigation) (collectively, “Excluded Expenses”) do not exceed 1.00% (the “Expense Limitation Cap”) of the Fund’s average daily net assets. Prior to April 30, 2021, the Adviser had agreed to waive

its management fees and/or reimburse the Fund’s other expenses to the extent necessary to ensure that the Fund’s Total Annual Operating Expenses (exclusive of Excluded Expenses, Rule 12b-1 plan fees and shareholder servicing plan fees), did

not exceed 1.25% of the Fund’s average daily net assets. For the six months ended November 30, 2022, the Fund waived expenses of $109,968 which were reimbursed by the Adviser. Any such waiver or reimbursement is subject to later adjustment

to allow the Adviser to recoup amounts waived or reimbursed; provided, however, that the Adviser shall only be entitled to recoup such amounts for up to three years from the date such fees and expenses were waived or reimbursed, if such

recoupment will not cause the Fund to exceed the lesser of: (1) the expense limitation in place at the time of the waiver and/or expense payment; or (2) the expense limitation in place at the time of the recoupment. During the six months

ended November 30, 2022, $61,580 of previously waived expenses subject to recovery expired.

|

||

|

The following table shows the remaining waived or reimbursed expenses subject to potential recovery expiring during the period ending:

|

|

May 31, 2023

|

$

|

163,293

|

||||

|

May 31, 2024

|

$

|

179,335

|

||||

|

May 31, 2025

|

$

|

212,078

|

||||

|

November 30, 2025

|

$

|

109,968

|

|

5.

|

Distribution

Plan

|

The Trust adopted a plan pursuant to Rule 12b-1 (the “12b-1 Plan”), on behalf of the Fund, which authorizes it to pay Quasar Distributors, LLC (“Quasar “ or the “Distributor”) a distribution fee of up to 0.25% of the Fund’s average daily

net assets for services to prospective Fund shareholders and distribution of Fund shares. During the six months ended November 30, 2022, the Fund incurred expenses of $18,656 pursuant to the 12b-1 Plan. As of November 30, 2022, the Fund

owed the Distributor $3,720 in fees. The Distributor acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares.

|

|

|

17

BARRETT

GROWTH FUND

|

6.

|

Related Party

Transactions

|

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services” or the “Administrator”), acts as the Fund’s administrator under an Administration Agreement. The Administrator prepares various federal and

state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian, transfer agent and fund accountant; coordinates the preparation and

payment of the Fund’s expenses; and reviews the Fund’s expense accruals. Fund Services also serves as the fund accountant and transfer agent to the Fund. U.S. Bank, an affiliate of Fund Services, serves as the Fund’s custodian. Fees and

expenses incurred for the six months ended November 30, 2022, and owed as of November 30, 2022 were as follows:

|

|

Incurred

|

Owed

|

|||||||||

|

Administration

|

$

|

23,836

|

$

|

10,605

|

||||||

|

Fund accounting

|

$

|

13,906

|

$

|

6,959

|

||||||

|

Transfer agency

|

$

|

10,491

|

$

|

4,891

|

||||||

|

Custody

|

$

|

2,650

|

$

|

826

|

||||||

|

Certain officers of the Fund are also employees of Fund Services.

|

||

|

The Trust’s Chief Compliance Officer is also an employee of Fund Services. For the six months ended November 30, 2022, the Fund was allocated $7,801 of the Trust’s Chief Compliance Officer fee. At November 30, 2022, the Fund owed fees of

$4,061 for the Chief Compliance Officer’s services.

|

|

7.

|

Capital Share

|

Transactions in shares of the Fund were as follows:

|

|

Transactions

|

| Six Months Ended |

||||||||||

|

November 30, 2022

|

Year Ended

|

|||||||||

|

(Unaudited)

|

May 31, 2022

|

|||||||||

|

Shares Sold

|

902

|

18,776

|

||||||||

|

Shares Reinvested

|

—

|

128,353

|

||||||||

|

Shares Redeemed

|

(42,855

|

)

|

(282,764

|

)

|

||||||

|

Net Decrease

|

(41,953

|

)

|

(135,635

|

)

|

||||||

|

8.

|

Investment

Transactions

|

The aggregate purchases and sales of securities, excluding short-term investments, for the Fund for the six months ended November 30, 2022, were $511,697 and $1,156,682, respectively. For the six months ended November 30, 2022, there were

no purchases or sales of U.S. government securities for the Fund.

|

|

9.

|

Beneficial

Ownership

|

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. At November 30, 2022, Charles Schwab &

Co., Inc., held 49.37% of the Barrett Growth Fund’s outstanding shares.

|

18

BARRETT

GROWTH FUND

|

10.

|

Recent Market

Events

|

U.S. and international markets have experienced and may continue to experience significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including rising inflation,

uncertainty regarding central banks’ interest rate increases, the possibility of a national or global recession, trade tensions, political events, the war between Russia and Ukraine and the impact of the coronavirus (COVID-19) global

pandemic. The global recovery from COVID-19 may last for an extended period of time. As a result of continuing political tensions and armed conflicts, including the war between Ukraine and Russia, the U.S. and the European Union imposed

sanctions on certain Russian individuals and companies, including certain financial institutions, and have limited certain exports and imports to and from Russia. The war has contributed to recent market volatility and may continue to do so.

These developments, as well as other events, could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets,

despite government efforts to address market disruptions. Continuing market volatility as a result of recent market conditions or other events may have adverse effects on your account.

|

|

|

||

|

11.

|

Subsequent

|

On December 19, 2022, the Fund declared and paid distributions to shareholders of record as of December 16, 2022, as follows:

|

|

Event

|

|

Ordinary

|

Short-Term

|

Long-Term

|

||

|

Income

|

Capital Gains

|

Capital Gains

|

||

|

$—

|

$—

|

$4,071,920

|

||

19

BARRETT

GROWTH FUND

BASIS FOR TRUSTEES’ APPROVAL OF INVESTMENT ADVISORY AGREEMENT

The Board of Trustees (the “Trustees”) of Trust for Professional Managers (the “Trust”) met on August 26, 2022 to consider the renewal of the Investment Advisory Agreement (the “Agreement”) between the Trust, on behalf of the Barrett Growth Fund

(the “Fund”), a series of the Trust, and Barrett Asset Management, LLC, the Fund’s investment adviser (the “Adviser”). The Trustees also met at a prior meeting held on June 13, 2022 (the “June 13, 2022 Meeting”) to review materials related to the

renewal of the Agreement. Prior to these meetings, the Trustees requested and received materials to assist them in considering the renewal of the Agreement. The materials provided contained information with respect to the factors enumerated below,

including a copy of the Agreement, a memorandum prepared by the Trust’s outside legal counsel discussing in detail the Trustees’ fiduciary obligations and the factors they should assess in considering the renewal of the Agreement, detailed

comparative information relating to the Fund’s performance, as well as the management fees and other expenses of the Funds, due diligence materials relating to the Adviser (including a due diligence questionnaire completed on behalf of the Fund by

the Adviser, the Adviser’s Form ADV, select financial statements of the Adviser, bibliographic information of the Adviser’s key management and compliance personnel, comparative fee information for the Fund and a summary detailing key provisions of

the Adviser’s written compliance program, including its code of ethics) and other pertinent information. The Trustees also received information periodically throughout the year that was relevant to the Agreement renewal process, including

performance, management fee and other expense information. Based on their evaluation of the information provided by the Adviser, in conjunction with the Fund’s other service providers, the Trustees, by a unanimous vote (including a separate vote of

the Trustees who are not “interested persons,” as that term is defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”)), approved the continuation of the Agreement for an additional one-year term ending August 31, 2023.

DISCUSSION OF FACTORS CONSIDERED

In considering the renewal of the Agreement and reaching their conclusions, the Trustees reviewed and analyzed various factors that they determined were relevant, including the factors enumerated below.

|

1.

|

NATURE, EXTENT AND QUALITY OF SERVICES PROVIDED TO THE FUND

|

The Trustees considered the nature, extent and quality of services provided by the Adviser to the Fund and the amount of time devoted to the Fund’s operation by the Adviser’s staff. The Trustees considered the Adviser’s specific responsibilities

in all aspects of day-to-day management of the Fund, including the investment strategies implemented by the Adviser, as well as the qualifications, experience and responsibilities of E. Wells Beck, Owen W. Gilmore, and Amy Kong, the Fund’s portfolio

managers, and other key personnel at the Adviser involved in the day-to-day activities of the Fund. The Trustees reviewed information provided by the Adviser in a due diligence questionnaire, including the structure of the Adviser’s compliance

program and its continuing commitment to the Fund. The Trustees noted that during the course of the prior year the Adviser had participated in a Trust board meeting to discuss the Fund’s performance and outlook, along with the compliance efforts made

by the Adviser. The Trustees also noted any services that extended beyond portfolio management, and they considered the brokerage practices of the Adviser. The Trustees discussed the Adviser’s handling of compliance matters, including the reports of

the Trust’s chief compliance officer to the Trustees on the effectiveness of the Adviser’s compliance program. The Trustees also considered the Adviser’s overall financial condition, as well as the implementation and

20

BARRETT

GROWTH FUND

operational effectiveness of the Adviser’s business continuity plan in response to the COVID-19 pandemic. The Trustees concluded that the Adviser had sufficient quality and depth of personnel, resources, investment methods and compliance policies

and procedures essential to performing its duties under the Advisory Agreement and that the nature, overall quality and extent of the management services provided to the Fund, as well as the Adviser’s compliance program, were satisfactory and

reliable.

|

2.

|

INVESTMENT PERFORMANCE OF THE FUND AND THE ADVISER

|

The Trustees discussed the performance of the Fund for the quarter, one-year, three-year, five-year, ten-year and since inception periods ended March 31, 2022. In assessing the quality of the portfolio management services delivered by the Adviser,

the Trustees also compared the short-term and longer-term performance of the Fund on both an absolute basis and in comparison to a benchmark index (the S&P 500 Total Return Index) and in comparison to a peer group of funds as constructed using

publicly-available data provided by Morningstar, Inc. and presented by Barrington Financial Group, LLC d/b/a Barrington Partners, an independent third-party benchmarking firm, through its cohort selection process (a peer group of U.S. open-end

large-cap growth and large-cap blend funds) (the “Barrington Cohort”). The Trustees also reviewed information on the historical performance of a composite of other separately-managed equity only accounts of the Adviser that are the same or similar to

the Fund in terms of investment strategy.

The Trustees noted the Fund’s performance for each of the one-year, three-year, five-year, and ten-year periods ended March 31, 2022 was below the Barrington Cohort average. The Trustees noted that for the five-year period ended March 31, 2022,

the Fund had outperformed the S&P 500 Total Return Index. The Trustees noted that for the quarter, one-year, three-year, ten-year and since inception periods ended March 31, 2022, the Fund had underperformed the S&P 500 Total Return Index.

The Trustees also reviewed the Fund’s performance relative to the Adviser’s composite of other separately-managed equity only accounts managed with investment strategies substantially similar to the Fund and noted the Adviser attributed any

differences in performance for the periods reviewed to the Fund’s more growth-oriented investment strategy, specific stock selection and higher concentration of holdings in the Fund’s portfolio.

After considering all of the information, the Trustees concluded that the performance obtained by the Adviser for the Fund was satisfactory under current market conditions. Although past performance is not a guarantee or indication of future

results, the Trustees determined that the Fund and its shareholders were likely to benefit from the Adviser’s continued management.

|

3.

|

COSTS OF SERVICES PROVIDED AND PROFITS REALIZED BY THE ADVISER

|

The Trustees considered the cost of services and the structure of the Adviser’s fees, including a review of the expense analyses and other pertinent material with respect to the Fund. The Trustees reviewed the related statistical information and

other materials provided, including the comparative expenses and Barrington Cohort comparisons. The Trustees considered the cost structure of the Fund relative to the Barrington Cohort, the Adviser’s separately-managed accounts, and another

registered mutual fund managed by the Adviser, as well as any fee waivers and expense reimbursements of the Adviser.

The Trustees also considered the overall profitability of the Adviser and reviewed the Adviser’s financial information and noted that the Adviser has subsidized the Fund’s operations since the Fund’s inception. The Trustees also examined the level

of profits that could be expected to accrue to the Adviser from the fees payable under the Agreement, as well as the Fund’s brokerage practices, noting that the Adviser had

21

BARRETT

GROWTH FUND

discontinued all soft dollar arrangements in 2021. These considerations were based on materials requested by the Trustees and the Fund’s administrator specifically for the June 13, 2022 meeting and the August 26, 2022 meeting at which the

Agreement was formally considered, as well as the reports prepared by the Adviser over the course of the year.

The Trustees noted that the Fund’s contractual management fee of 1.00% was above the Barrington Cohort average of 0.59%. The Trustees noted that the Fund was operating above its expense cap of 1.00%. The Trustees observed that the Fund’s total

expense ratio (net of fee waivers and expense reimbursements and including Rule 12b-1 plan fees) of 1.24% was above the Barrington Cohort average of 0.99%. The Trustees also compared the fees paid by the Fund to the fees paid by other

separately-managed accounts of the Adviser and another registered mutual fund managed by the Adviser.

The Trustees concluded that the Fund’s expenses and the management fees paid to the Adviser were fair and reasonable in light of the comparative performance, expense and management fee information. The Trustees noted, based on a profitability

analysis prepared by the Adviser, that the Adviser’s profits from sponsoring the Fund were not excessive, and the Trustees further concluded that the Adviser maintained adequate profit levels to support its services to the Fund from the revenues of

its overall investment advisory business, despite subsidizing the Fund’s operations.

|

4.

|

EXTENT OF ECONOMIES OF SCALE AS THE FUND GROWS

|

The Trustees compared the Fund’s expenses relative to its peer group and discussed realized and potential economies of scale. The Trustees also reviewed the structure of the Fund’s management fee and whether the Fund was large enough to generate

economies of scale for shareholders or whether economies of scale would be expected to be realized as Fund assets grow (and if so, how those economies of scale were being or would be shared with shareholders). The Trustees reviewed all fee waivers,

expense reimbursements and potential recoupments by the Adviser with respect to the Fund. The Trustees noted that the Fund’s management fee structure did not contain any breakpoint reductions as the Fund’s assets grow in size, but that the

feasibility of incorporating breakpoints would continue to be reviewed on a regular basis. With respect to the Adviser’s fee structure, the Trustees concluded that the current fee structure was reasonable and reflected a sharing of economies of scale

between the Adviser and the Fund at the Fund’s current asset level.

|

5.

|

BENEFITS DERIVED FROM THE RELATIONSHIP WITH THE FUND

|

The Trustees considered the direct and indirect benefits that could be received by the Adviser from its association with the Fund. The Trustees examined the brokerage practices of the Adviser with respect to the Fund. The Trustees concluded that

the benefits the Adviser may receive, such as greater name recognition and increased ability to attract additional investor assets, appear to be reasonable, and in many cases may benefit the Fund.

CONCLUSIONS

The Trustees considered all of the foregoing factors. In considering the renewal of the Advisory Agreement, the Trustees did not identify any one factor as all-important, but rather considered these factors collectively in light of the Fund’s

surrounding circumstances. Based on this review, the Trustees, including a majority of the Independent Trustees, approved the continuation of the Agreement for an additional term ending August 31, 2023 as being in the best interests of the Fund and

its shareholders.

22

BARRETT

GROWTH FUND

NOTICE OF PRIVACY POLICY & PRACTICES (Unaudited)

We collect non-public personal information about you from the following sources:

|

•

|

information we receive about you on applications or other forms;

|

|

|

•

|

information you give us orally; and

|

|

|

•

|

information about your transactions with us or others.

|

The types of non-public personal information we collect and share can include:

|

•

|

social security numbers;

|

|

|

•

|

account balances;

|

|

|

•

|

account transactions;

|

|

|

•

|

transaction history;

|

|

|

•

|

wire transfer instructions; and

|

|

|

•

|

checking account information.

|

What Information We Disclose

We do not disclose any non-public personal information about our shareholders or former shareholders without the shareholder’s authorization, except as permitted by law or in response to inquiries from governmental authorities. We may share

information with affiliated parties and unaffiliated third parties with whom we have contracts for servicing the Fund. We will provide unaffiliated third parties with only the information necessary to carry out their assigned responsibility.

How We Protect Your Information

All shareholder records will be disposed of in accordance with applicable law. We maintain physical, electronic and procedural safeguards to protect your non-public personal information and require third parties to treat your non-public personal

information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank or trust company, the privacy policy of your financial intermediary would govern how your non-public personal

information would be shared with unaffiliated third parties.

23

BARRETT

GROWTH FUND

Additional Information

(Unaudited)

TAX INFORMATION

The Fund designated 0.00% of its ordinary income distribution for the year ended May 31, 2022, as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

For the year ended May 31, 2022, 0.00% of dividends paid from net ordinary income qualified for the dividends received deduction available to corporate shareholders.

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Section 871(k)(2)(C) of the Code for the Fund was 0.00%.

INDEMNIFICATIONS

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into

contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has

not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

INFORMATION ABOUT TRUSTEES

The business and affairs of the Trust are managed under the direction of the Board of Trustees. Information pertaining to the Trustees of the Trust is set forth below. The Statement of Additional Information includes additional information about

the Trustees and is available, without charge, upon request by calling 1-877-363-6333.

|

Number of

|

Other

|

||||

|

Term of

|

Portfolios

|

Principal

|

Directorships

|

||

|

Name,

|

Position(s)

|

Office and

|

in Trust

|

Occupation(s)

|

Held by Trustee

|

|

Address and

|

Held with

|

Length of

|

Overseen

|

During the Past

|

During the Past

|

|

Year of Birth

|

the Trust

|

Time Served

|

by Trustee

|

Five Years

|

Five Years

|

|

INDEPENDENT TRUSTEES

|

|||||

|

Michael D. Akers, Ph.D.

|

Trustee

|

Indefinite

|

22

|

Professor Emeritus,

|

Independent

|

|

615 E. Michigan St.

|

Term; Since

|

Department of Accounting

|

Trustee, USA

|

||

|

Milwaukee, WI 53202

|