SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

November 30, 2019

|

LETTERS TO SHAREHOLDERS

|

3

|

||

|

EXPENSE EXAMPLES

|

5

|

||

|

INVESTMENT HIGHLIGHTS

|

7

|

||

|

SCHEDULES OF INVESTMENTS

|

12

|

||

|

SCHEDULE OF WRITTEN OPTIONS

|

15

|

||

|

STATEMENTS OF ASSETS AND LIABILITIES

|

21

|

||

|

STATEMENTS OF OPERATIONS

|

22

|

||

|

STATEMENTS OF CHANGES IN NET ASSETS

|

23

|

||

|

FINANCIAL HIGHLIGHTS

|

25

|

||

|

NOTES TO FINANCIAL STATEMENTS

|

28

|

||

|

BASIS FOR TRUSTEES’ APPROVAL OF INVESTMENT ADVISORY AGREEMENTS

|

39

|

||

|

NOTICE OF PRIVACY POLICY & PRACTICES

|

45

|

||

|

ADDITIONAL INFORMATION

|

46

|

|

Beginning

|

Ending

|

Expenses Paid

|

|

|

Account Value

|

Account Value

|

During Period(1)(2)

|

|

|

Institutional Class

|

|||

|

Actual

|

$1,000.00

|

$1,066.00

|

$3.87

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,021.25

|

$3.79

|

|

Investor Class

|

|||

|

Actual

|

$1,000.00

|

$1,065.50

|

$5.16

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,020.00

|

$5.05

|

|

(1)

|

The period is June 1, 2019 – November 30, 2019.

|

|

(2)

|

Expenses for the Institutional Class and Investor Class are equal to the annualized expense ratio of 0.75% and 1.00%, respectively, multiplied by the average account value over the period, multiplied by

183/366.

|

|

Beginning

|

Ending

|

Expenses Paid

|

|

|

Account Value

|

Account Value

|

During Period(1)(2)

|

|

|

Institutional Class

|

|||

|

Actual

|

$1,000.00

|

$1,016.20

|

$2.77

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,022.25

|

$2.78

|

|

(1)

|

The period is June 1, 2019 – November 30, 2019.

|

|

(2)

|

Expenses for the Institutional Class are equal to the annualized expense ratio of 0.55%, multiplied by the average account value over the period, multiplied by 183/366.

|

|

*

|

Written Options (6.62)%

|

|

Annualized

|

|||||

|

Since

|

|||||

|

Six

|

One

|

Three

|

Five

|

Inception

|

|

|

Months

|

Year

|

Year

|

Year

|

(6/28/13)

|

|

|

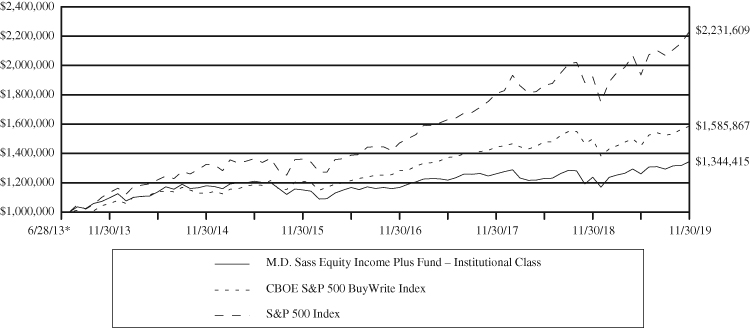

M.D. Sass Equity Income Plus Fund –

|

|||||

|

Institutional Class

|

6.60%

|

8.56%

|

4.79%

|

2.65%

|

4.71%

|

|

CBOE S&P 500 BuyWrite Index

|

9.21%

|

5.77%

|

7.29%

|

7.05%

|

7.44%

|

|

S&P 500 Index

|

15.26%

|

16.11%

|

14.88%

|

10.98%

|

13.31%

|

|

|

| Growth of $1,000,000 Investment |

|

|

|

|

|

|

*

|

Inception Date

|

|

Annualized

|

|||||

|

Since

|

|||||

|

Six

|

One

|

Three

|

Five

|

Inception

|

|

|

Months

|

Year

|

Year

|

Year

|

(6/28/13)

|

|

|

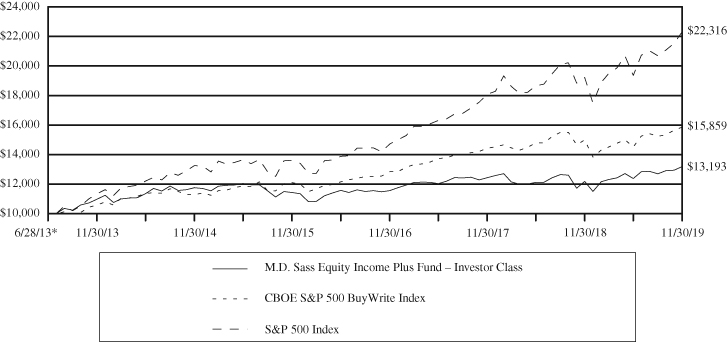

M.D. Sass Equity Income Plus Fund – Investor Class

|

6.55%

|

8.27%

|

4.50%

|

2.33%

|

4.41%

|

|

CBOE S&P 500 BuyWrite Index

|

9.21%

|

5.77%

|

7.29%

|

7.05%

|

7.44%

|

|

S&P 500 Index

|

15.26%

|

16.11%

|

14.88%

|

10.98%

|

13.31%

|

|

|

| Growth of $10,000 Investment |

|

|

|

|

|

|

*

|

Inception Date

|

|

Annualized

|

|||||

|

Since

|

|||||

|

Six

|

One

|

Three

|

Five

|

Inception

|

|

|

Months

|

Year

|

Year

|

Year

|

(6/30/11)

|

|

|

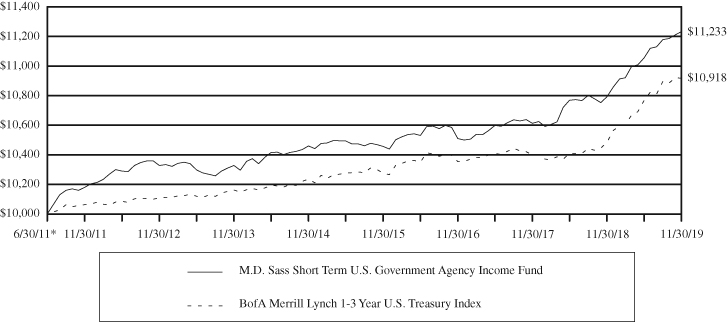

M.D. Sass Short Term U.S. Government

|

|||||

|

Agency Income Fund

|

1.62%

|

4.09%

|

2.24%

|

1.44%

|

1.39%

|

|

BofA Merrill Lynch 1-3 Year U.S. Treasury Index

|

1.40%

|

4.15%

|

1.78%

|

1.30%

|

1.05%

|

|

|

| Growth of $10,000 Investment |

|

|

|

|

|

|

*

|

Inception Date

|

|

Schedule of Investments

|

|

Shares

|

Value

|

|||||||

|

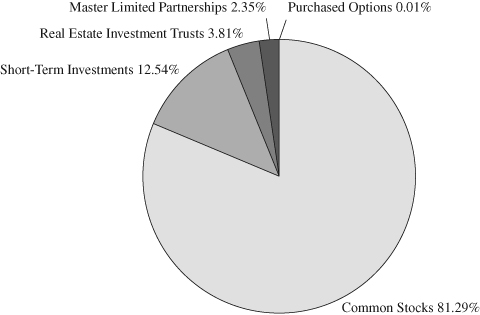

COMMON STOCKS* – 85.86%

|

||||||||

|

Aerospace & Defense – 3.25%

|

||||||||

|

Raytheon Co.

|

4,400

|

$

|

956,648

|

|||||

|

Banks – 4.60%

|

||||||||

|

Webster Financial Corp.

|

27,800

|

1,353,582

|

||||||

|

Building Products – 0.15%

|

||||||||

|

Fortune Brands Home & Security, Inc.

|

700

|

44,282

|

||||||

|

Capital Markets – 5.34%

|

||||||||

|

Apollo Global Management, Inc.

|

400

|

17,520

|

||||||

|

Northern Trust Corp.

|

14,500

|

1,554,980

|

||||||

|

1,572,500

|

||||||||

|

Chemicals – 4.09%

|

||||||||

|

Air Products & Chemicals, Inc.

|

5,100

|

1,205,283

|

||||||

|

Construction Materials – 2.60%

|

||||||||

|

Vulcan Materials Co.

|

5,400

|

766,098

|

||||||

|

Containers & Packaging – 3.48%

|

||||||||

|

Ball Corp.

|

15,500

|

1,023,930

|

||||||

|

Electrical Equipment – 3.55%

|

||||||||

|

Acuity Brands, Inc.

|

8,000

|

1,046,240

|

||||||

|

Entertainment – 3.76%

|

||||||||

|

Walt Disney Co.

|

7,300

|

1,106,534

|

||||||

|

Health Care Providers & Services – 2.93%

|

||||||||

|

Quest Diagnostics, Inc.

|

8,100

|

863,055

|

||||||

|

Hotels, Restaurants & Leisure – 6.85%

|

||||||||

|

Carnival Corp. (a)

|

19,200

|

865,536

|

||||||

|

Royal Caribbean Cruises Ltd. (a)

|

9,600

|

1,152,192

|

||||||

|

2,017,728

|

||||||||

|

Household Durables – 3.34%

|

||||||||

|

Lennar Corp.

|

16,500

|

984,225

|

||||||

|

Independent Power and Renewable Electricity Producers – 3.16%

|

||||||||

|

NRG Energy, Inc.

|

23,400

|

929,682

|

||||||

|

Insurance – 7.84%

|

||||||||

|

Chubb Ltd. (a)

|

6,400

|

969,472

|

||||||

|

MetLife, Inc.

|

26,800

|

1,337,588

|

||||||

|

2,307,060

|

||||||||

|

IT Services – 4.49%

|

||||||||

|

Sabre Corp.

|

58,900

|

1,321,127

|

||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS* – 85.86% (Continued)

|

||||||||

|

Media – 3.90%

|

||||||||

|

Comcast Corp.

|

26,000

|

$

|

1,147,900

|

|||||

|

Multiline Retail – 5.14%

|

||||||||

|

Target Corp.

|

12,100

|

1,512,621

|

||||||

|

Pharmaceuticals – 4.03%

|

||||||||

|

Pfizer, Inc.

|

30,800

|

1,186,416

|

||||||

|

Semiconductors & Semiconductor Equipment – 2.87%

|

||||||||

|

NXP Semiconductors NV (a)

|

7,300

|

843,734

|

||||||

|

Software – 4.47%

|

||||||||

|

Microsoft Corp.

|

8,700

|

1,317,006

|

||||||

|

Textiles, Apparel & Luxury Goods – 2.47%

|

||||||||

|

Gildan Activewear, Inc. (a)

|

25,000

|

727,750

|

||||||

|

Tobacco – 3.55%

|

||||||||

|

Altria Group, Inc.

|

21,000

|

1,043,700

|

||||||

|

TOTAL COMMON STOCKS (Cost $22,365,105)

|

25,277,101

|

|||||||

|

MASTER LIMITED PARTNERSHIPS* – 2.48%

|

||||||||

|

Oil, Gas & Consumable Fuels – 2.48%

|

||||||||

|

EQM Midstream Partners LP

|

31,500

|

729,855

|

||||||

|

TOTAL MASTER LIMITED PARTNERSHIPS (Cost $1,777,894)

|

729,855

|

|||||||

|

REAL ESTATE INVESTMENT TRUSTS* – 4.02%

|

||||||||

|

VICI Properties, Inc.

|

47,900

|

1,184,567

|

||||||

|

TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $989,580)

|

1,184,567

|

|||||||

|

Notional

|

|||||||||||

|

Contracts

|

Value

|

||||||||||

|

PURCHASED OPTIONS – 0.01%

|

|||||||||||

|

EXCHANGE TRADED OR CENTRALLY CLEARED PUT OPTIONS

|

|||||||||||

|

SPDR S&P 500 ETF Trust

|

|||||||||||

|

Expiration: December 2019, Exercise Price: $283.00

|

150

|

$

|

4,714,650

|

3,450

|

|||||||

|

TOTAL PURCHASED OPTIONS (Cost $74,785)

|

3,450

|

||||||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

SHORT-TERM INVESTMENTS – 13.24%

|

||||||||

|

First American Government Obligations Fund, Class X, 1.559% (b)

|

3,898,470

|

$

|

3,898,470

|

|||||

|

TOTAL SHORT-TERM INVESTMENTS (Cost $3,898,470)

|

3,898,470

|

|||||||

|

Total Investments (Cost $29,105,834) – 105.61%

|

31,093,443

|

|||||||

|

Liabilities in Excess of Other Assets – (5.61)%

|

(1,652,142

|

)

|

||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

29,441,301

|

||||||

|

*

|

All or a portion of these securities may be subject to call options written.

|

|

(a)

|

Foreign issued security.

|

|

(b)

|

Seven day yield as of November 30, 2019.

|

|

Schedule of Written Options

|

|

Notional

|

||||||||||||

|

Contracts

|

Amount

|

Value

|

||||||||||

|

EXCHANGE TRADED OR CENTRALLY CLEARED CALL OPTIONS

|

||||||||||||

|

Acuity Brands, Inc.

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $120.00

|

(80

|

)

|

$

|

(1,046,240

|

)

|

$

|

(96,800

|

)

|

||||

|

Air Products & Chemicals, Inc.

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $220.00

|

(51

|

)

|

(1,205,283

|

)

|

(87,720

|

)

|

||||||

|

Altria Group, Inc.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $50.00

|

(210

|

)

|

(1,043,700

|

)

|

(22,890

|

)

|

||||||

|

Apollo Global Management, Inc.

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $40.00

|

(4

|

)

|

(17,520

|

)

|

(1,580

|

)

|

||||||

|

Ball Corp.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $62.50

|

(155

|

)

|

(1,023,930

|

)

|

(71,300

|

)

|

||||||

|

Carnival Corp. (a)

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $47.50

|

(192

|

)

|

(865,536

|

)

|

(15,360

|

)

|

||||||

|

Chubb Ltd. (a)

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $145.00

|

(64

|

)

|

(969,472

|

)

|

(48,320

|

)

|

||||||

|

Comcast Corp.

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $47.50

|

(260

|

)

|

(1,147,900

|

)

|

(520

|

)

|

||||||

|

EQM Midstream Partners LP

|

||||||||||||

|

Expiration: April 2020, Exercise Price: $30.00

|

(315

|

)

|

(729,855

|

)

|

(14,175

|

)

|

||||||

|

Fortune Brands Home & Security, Inc.

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $55.00

|

(7

|

)

|

(44,282

|

)

|

(5,950

|

)

|

||||||

|

Gildan Activewear, Inc. (a)

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $35.00

|

(250

|

)

|

(727,750

|

)

|

(500

|

)

|

||||||

|

Lennar Corp.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $55.00

|

(165

|

)

|

(984,225

|

)

|

(95,040

|

)

|

||||||

|

MetLife, Inc.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $47.50

|

(268

|

)

|

(1,337,588

|

)

|

(83,080

|

)

|

||||||

|

Microsoft Corp.

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $140.00

|

(87

|

)

|

(1,317,006

|

)

|

(104,487

|

)

|

||||||

|

Northern Trust Corp.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $100.00

|

(145

|

)

|

(1,554,980

|

)

|

(115,275

|

)

|

||||||

|

NRG Energy, Inc.

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $40.00

|

(234

|

)

|

(929,682

|

)

|

(17,550

|

)

|

||||||

|

NXP Semiconductors NV (a)

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $105.00

|

(73

|

)

|

(843,734

|

)

|

(88,148

|

)

|

||||||

|

Pfizer, Inc.

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $40.00

|

(308

|

)

|

(1,186,416

|

)

|

(4,004

|

)

|

||||||

|

Quest Diagnostics, Inc.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $95.00

|

(81

|

)

|

(863,055

|

)

|

(90,720

|

)

|

||||||

|

Raytheon Co.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $180.00

|

(44

|

)

|

(956,648

|

)

|

(166,760

|

)

|

||||||

|

Royal Caribbean Cruises Ltd. (a)

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $105.00

|

(96

|

)

|

(1,152,192

|

)

|

(147,360

|

)

|

||||||

|

Sabre Corp.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $20.00

|

(589

|

)

|

(1,321,127

|

)

|

(159,030

|

)

|

||||||

|

Target Corp.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $105.00

|

(121

|

)

|

(1,512,621

|

)

|

(250,470

|

)

|

||||||

|

VICI Properties, Inc.

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $22.50

|

(479

|

)

|

(1,184,567

|

)

|

(107,775

|

)

|

||||||

|

Schedule of Written Options (Continued)

|

|

Notional

|

||||||||||||

|

Contracts

|

Amount

|

Value

|

||||||||||

|

EXCHANGE TRADED OR CENTRALLY CLEARED CALL OPTIONS (Continued)

|

||||||||||||

|

Vulcan Materials Co.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $130.00

|

(54

|

)

|

$

|

(766,098

|

)

|

$

|

(70,470

|

)

|

||||

|

Walt Disney Co.

|

||||||||||||

|

Expiration: December 2019, Exercise Price: $130.00

|

(73

|

)

|

(1,106,534

|

)

|

(160,381

|

)

|

||||||

|

Webster Financial Corp.

|

||||||||||||

|

Expiration: January 2020, Exercise Price: $50.00

|

(278

|

)

|

(1,353,582

|

)

|

(34,055

|

)

|

||||||

|

TOTAL WRITTEN OPTIONS (Premiums received $1,582,318)

|

$ | (2,059,720 | ) | |||||||||

|

(a)

|

Foreign issued security.

|

|

Schedule of Investments

|

|

Principal

|

||||||||

|

Amount

|

Value

|

|||||||

|

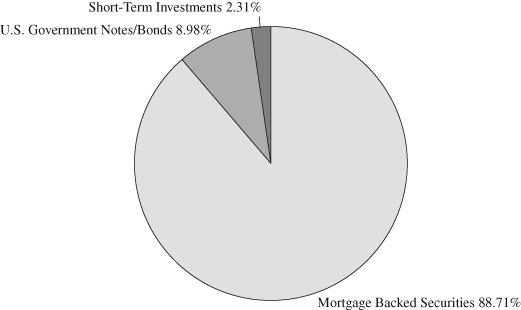

MORTGAGE BACKED SECURITIES – 88.92%

|

||||||||

|

Fannie Mae Pool

|

||||||||

|

890156, 5.000%, 05/01/2023

|

$

|

4,818

|

$

|

4,987

|

||||

|

995865, 4.500%, 07/01/2024

|

72,722

|

75,937

|

||||||

|

AL9541, 3.500%, 12/01/2026

|

177,913

|

184,378

|

||||||

|

47935, 4.844% (11th District Cost of Funds Index + 1.250%), 05/01/2027 (a)

|

1,209

|

1,239

|

||||||

|

AL8046, 3.500%, 01/01/2028

|

706,763

|

732,409

|

||||||

|

AL6206, 3.500%, 06/01/2028

|

355,419

|

370,657

|

||||||

|

252284, 6.500%, 01/01/2029

|

71,161

|

80,561

|

||||||

|

323591, 6.500%, 03/01/2029

|

16,949

|

18,880

|

||||||

|

AL5259, 3.500%, 05/01/2029

|

265,261

|

276,045

|

||||||

|

BM4202, 3.500%, 12/01/2029

|

173,610

|

180,634

|

||||||

|

AL9858, 3.000%, 03/01/2030

|

286,024

|

294,237

|

||||||

|

BM1231, 3.500%, 11/01/2031

|

421,053

|

436,441

|

||||||

|

MA0949, 3.500%, 01/01/2032

|

110,657

|

115,540

|

||||||

|

555326, 5.500%, 04/01/2033

|

153,133

|

172,651

|

||||||

|

555531, 5.500%, 06/01/2033

|

135,310

|

151,175

|

||||||

|

555592, 5.500%, 07/01/2033

|

36,789

|

41,284

|

||||||

|

748375, 3.789% (12 Month LIBOR USD + 1.117%), 08/01/2033 (a)

|

1,542

|

1,621

|

||||||

|

888073, 5.500%, 02/01/2035

|

26,397

|

29,496

|

||||||

|

745751, 5.500%, 09/01/2035

|

33,839

|

38,145

|

||||||

|

FM1487, 4.000%, 09/01/2039

|

88,499

|

92,656

|

||||||

|

MA3027, 4.000%, 06/01/2047

|

468,882

|

492,022

|

||||||

|

Fannie Mae REMICS

|

||||||||

|

2005-62, 4.750%, 07/25/2035

|

3,782

|

3,833

|

||||||

|

Fannie Mae-Aces

|

||||||||

|

2013-M13, 2.447%, 09/25/2020 (b)

|

437,791

|

437,563

|

||||||

|

2011-M4, 3.726%, 06/25/2021

|

237,088

|

241,645

|

||||||

|

2011-M8, 2.922%, 08/25/2021

|

222,942

|

225,147

|

||||||

|

FHLMC-GNMA

|

||||||||

|

G023, 2.158% (1 Month LIBOR USD + 0.450%), 11/25/2023 (a)

|

62,830

|

63,136

|

||||||

|

Freddie Mac Gold Pool

|

||||||||

|

G1-3272, 4.500%, 08/01/2020

|

316

|

327

|

||||||

|

G1-1838, 6.000%, 08/01/2020

|

187

|

187

|

||||||

|

G1-4904, 4.500%, 12/01/2021

|

3,789

|

3,917

|

||||||

|

G1-3007, 5.000%, 03/01/2023

|

28,431

|

29,565

|

||||||

|

G1-3390, 6.000%, 01/01/2024

|

21,557

|

22,327

|

||||||

|

G1-4160, 6.000%, 01/01/2024

|

1,031

|

1,038

|

||||||

|

G1-3610, 5.500%, 02/01/2024

|

19,648

|

20,428

|

||||||

|

G1-3692, 5.500%, 02/01/2024

|

10,719

|

11,108

|

||||||

|

J1-2635, 4.000%, 07/01/2025

|

48,907

|

51,063

|

||||||

|

G3-0289, 7.000%, 09/01/2025

|

73,193

|

75,742

|

||||||

|

J1-3273, 3.500%, 10/01/2025

|

78,399

|

81,288

|

||||||

|

G1-4350, 4.000%, 12/01/2026

|

78,165

|

81,825

|

||||||

|

G1-4441, 4.000%, 03/01/2027

|

184,664

|

194,482

|

||||||

|

Schedule of Investments (Continued)

|

|

Principal

|

||||||||

|

Amount

|

Value

|

|||||||

|

MORTGAGE BACKED SECURITIES – 88.92% (Continued)

|

||||||||

|

Freddie Mac Gold Pool (Continued)

|

||||||||

|

G1-6406, 3.000%, 01/01/2028

|

$

|

195,500

|

$

|

201,259

|

||||

|

G1-8601, 3.000%, 05/01/2031

|

458,744

|

472,237

|

||||||

|

G1-8702, 3.500%, 08/01/2033

|

157,251

|

163,259

|

||||||

|

G0-1584, 5.000%, 08/01/2033

|

66,146

|

73,119

|

||||||

|

G0-4913, 5.000%, 03/01/2038

|

60,564

|

66,960

|

||||||

|

H0-9207, 6.500%, 08/01/2038

|

23,099

|

26,167

|

||||||

|

Freddie Mac Multifamily Structured Pass Through Certificates

|

||||||||

|

K-714, 0.793%, 10/25/2020 (b)(c)

|

10,708,586

|

29,514

|

||||||

|

Q-001, 1.701%, 04/25/2021

|

260,035

|

259,118

|

||||||

|

K-J18, 2.455%, 03/25/2022

|

156,839

|

157,989

|

||||||

|

K-720, 0.640%, 06/25/2022 (b)(c)

|

9,156,901

|

98,473

|

||||||

|

K-023, 1.368%, 08/25/2022 (b)(c)

|

4,439,012

|

128,881

|

||||||

|

KI01, 1.945% (1 Month LIBOR USD + 0.160%), 09/25/2022 (a)

|

102,038

|

101,901

|

||||||

|

K-724, 0.382%, 11/25/2023 (b)(c)

|

4,972,991

|

47,517

|

||||||

|

K-J27, 2.092%, 07/25/2024

|

150,000

|

149,871

|

||||||

|

K-057, 1.325%, 07/25/2026 (b)(c)

|

2,669,612

|

172,902

|

||||||

|

Q-004, 2.957%, 01/25/2046 (b)

|

726,995

|

732,270

|

||||||

|

Q-007, 2.984%, 10/25/2047 (b)

|

178,041

|

181,667

|

||||||

|

Freddie Mac Pool

|

||||||||

|

ZS-8598, 3.000%, 02/01/2031

|

190,038

|

195,525

|

||||||

|

ZS-8686, 3.000%, 02/01/2033

|

336,332

|

345,442

|

||||||

|

RB-5012, 3.500%, 10/01/2039

|

99,362

|

102,998

|

||||||

|

Freddie Mac REMICS

|

||||||||

|

3414, 4.000%, 12/15/2019

|

0

|

0

|

||||||

|

3033, 4.500%, 09/15/2020

|

993

|

996

|

||||||

|

2649, 3.500%, 07/15/2023

|

6,696

|

6,714

|

||||||

|

2824, 5.000%, 07/15/2024

|

3,365

|

3,525

|

||||||

|

3784, 4.000%, 01/15/2026

|

21,770

|

22,428

|

||||||

|

2344, 6.500%, 08/15/2031

|

18,581

|

21,878

|

||||||

|

Freddie Mac Structured Pass-Through Certificates

|

||||||||

|

2017-SR01, 2.750%, 11/25/2022

|

250,000

|

254,012

|

||||||

|

FRESB Mortgage Trust

|

||||||||

|

2015-SB2, 2.086% (1 Month LIBOR USD + 2.086%), 07/25/2035 (a)

|

422,202

|

421,651

|

||||||

|

2015-SB7, 2.370% (1 Month LIBOR USD + 2.370%), 09/25/2035 (a)

|

502,463

|

502,673

|

||||||

|

2016-SB13, 2.060% (1 Month LIBOR USD + 2.060%), 01/25/2036 (a)

|

359,238

|

359,275

|

||||||

|

2016-SB16, 2.130% (1 Month LIBOR USD + 2.130%), 05/25/2036 (a)

|

372,631

|

373,243

|

||||||

|

2019-SB60, 3.070% (1 Month LIBOR USD + 3.070%), 01/25/2039 (b)

|

498,789

|

510,788

|

||||||

|

2015-SB3, 2.012% (1 Month LIBOR USD + 2.012%), 08/25/2042 (a)

|

36,236

|

36,199

|

||||||

|

Ginnie Mae I Pool

|

||||||||

|

782618X, 4.500%, 04/15/2024

|

179,959

|

185,607

|

||||||

|

741854X, 4.000%, 05/15/2025

|

96,052

|

100,086

|

||||||

|

Schedule of Investments (Continued)

|

|

Principal

|

||||||||

|

Amount

|

Value

|

|||||||

|

MORTGAGE BACKED SECURITIES – 88.92% (Continued)

|

||||||||

|

Government National Mortgage Association

|

||||||||

|

2013-101, 0.514%, 05/16/2035

|

$

|

208,387

|

$

|

206,081

|

||||

|

2013-55, 1.579%, 12/16/2042

|

363,040

|

358,931

|

||||||

|

2015-97, 2.400%, 04/16/2043

|

516,075

|

516,186

|

||||||

|

2011-6, 3.474%, 10/16/2044 (b)

|

30,850

|

30,832

|

||||||

|

2013-107, 0.422%, 11/16/2047 (b)(c)

|

4,144,043

|

66,559

|

||||||

|

2013-15, 0.584%, 08/16/2051 (b)(c)

|

5,204,610

|

204,221

|

||||||

|

2013-07, 0.351%, 05/16/2053 (b)(c)

|

7,267,035

|

160,273

|

||||||

|

2013-01, 0.656%, 02/16/2054 (b)(c)

|

4,577,938

|

148,756

|

||||||

|

2013-105, 0.454%, 06/16/2054 (b)(c)

|

3,435,897

|

53,915

|

||||||

|

2013-17, 0.750%, 06/16/2054 (b)(c)

|

6,197,043

|

177,920

|

||||||

|

2013-40, 0.764%, 06/16/2054 (b)(c)

|

4,141,692

|

150,211

|

||||||

|

2013-101, 0.541%, 10/16/2054 (b)(c)

|

4,782,144

|

130,990

|

||||||

|

2013-156, 0.707%, 06/16/2055 (b)(c)

|

5,202,149

|

158,131

|

||||||

|

2014-155, 1.123%, 08/16/2055 (b)(c)

|

1,501,850

|

81,588

|

||||||

|

2014-01, 0.349%, 09/16/2055 (b)(c)

|

6,463,868

|

140,576

|

||||||

|

2014-54, 0.435%, 09/16/2055 (b)(c)

|

5,327,742

|

146,294

|

||||||

|

2014-73, 0.610%, 04/16/2056 (b)(c)

|

5,495,168

|

170,492

|

||||||

|

2014-120, 0.690%, 04/16/2056 (b)(c)

|

2,322,967

|

80,731

|

||||||

|

2014-138, 0.741%, 04/16/2056 (b)(c)

|

1,870,202

|

89,357

|

||||||

|

2015-130, 0.863%, 07/16/2057 (b)(c)

|

2,788,466

|

127,728

|

||||||

|

Seasoned Credit Risk Transfer Trust Series

|

||||||||

|

2018-3, 3.500%, 08/27/2057

|

126,700

|

131,747

|

||||||

|

TOTAL MORTGAGE BACKED SECURITIES (Cost $17,337,586)

|

15,173,279

|

|||||||

|

U.S. GOVERNMENT NOTES/BONDS – 9.00%

|

||||||||

|

United States Treasury Inflation Indexed Bonds

|

||||||||

|

0.125%, 04/15/2020

|

361,815

|

360,803

|

||||||

|

0.625%, 04/15/2023

|

1,064,701

|

1,075,166

|

||||||

|

United States Treasury Notes/Bonds

|

||||||||

|

2.000%, 01/31/2020

|

100,000

|

100,054

|

||||||

|

TOTAL U.S. GOVERNMENT NOTES/BONDS (Cost $1,534,894)

|

1,536,023

|

|||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

SHORT-TERM INVESTMENTS – 2.31%

|

||||||||

|

First American U.S. Treasury Money Market Fund, Class Z, 1.494% (d)

|

394,672

|

$

|

394,672

|

|||||

|

TOTAL SHORT-TERM INVESTMENTS (Cost $394,672)

|

394,672

|

|||||||

|

Total Investments (Cost $19,267,152) – 100.23%

|

17,103,974

|

|||||||

|

Liabilities in Excess of Other Assets – (0.23)%

|

(38,926

|

)

|

||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

17,065,048

|

||||||

|

(a)

|

Variable rate security; the rate shown represents the rate at November 30, 2019.

|

|

(b)

|

Variable rate security; the rate shown represents the rate at November 30, 2019. The coupon is based on an underlying pool of loans.

|

|

(c)

|

Represents an interest-only security that entitles holders to receive only interest payments on underlying mortgages.

|

|

(d)

|

Seven day yield as of November 30, 2019.

|

|

Statements of Assets and Liabilities

|

|

Short Term

|

||||||||

|

Equity

|

U.S. Government

|

|||||||

|

Income

|

Agency

|

|||||||

|

Plus Fund

|

Income Fund

|

|||||||

|

ASSETS

|

||||||||

|

Investments, at value (cost $29,105,834 and $19,267,152, respectively)

|

$

|

31,093,443

|

$

|

17,103,974

|

||||

|

Cash

|

1,326,774

|

—

|

||||||

|

Dividend receivable

|

54,354

|

—

|

||||||

|

Interest receivable

|

3,167

|

89,826

|

||||||

|

Receivable for fund shares sold

|

112,498

|

—

|

||||||

|

Receivable from Adviser

|

3,298

|

7,919

|

||||||

|

Other assets

|

17,140

|

12,816

|

||||||

|

TOTAL ASSETS

|

32,610,674

|

17,214,535

|

||||||

|

LIABILITIES

|

||||||||

|

Written options, at value (premiums received of $1,582,318 and $—, respectively)

|

2,059,720

|

—

|

||||||

|

Payable for investments purchased

|

1,044,643

|

100,741

|

||||||

|

Payable to affiliates

|

39,951

|

30,150

|

||||||

|

Payable for distribution (Rule 12b-1) fees

|

1,334

|

—

|

||||||

|

Payable for shareholder servicing fees

|

2,054

|

—

|

||||||

|

Accrued expenses and other liabilities

|

21,671

|

18,596

|

||||||

|

TOTAL LIABILITIES

|

3,169,373

|

149,487

|

||||||

|

NET ASSETS

|

$

|

29,441,301

|

$

|

17,065,048

|

||||

|

Net Assets Consist Of:

|

||||||||

|

Paid-in capital

|

$

|

35,482,403

|

$

|

24,007,459

|

||||

|

Accumulated deficit

|

(6,041,102

|

)

|

(6,942,411

|

)

|

||||

|

Net Assets

|

$

|

29,441,301

|

$

|

17,065,048

|

||||

|

Institutional Class Shares

|

||||||||

|

Net assets

|

29,297,525

|

17,065,048

|

||||||

|

Shares of beneficial interest outstanding

|

||||||||

|

(unlimited number of shares authorized, $0.001 par value)

|

2,588,284

|

1,843,804

|

||||||

|

Net asset value, offering price and redemption price per share

|

$

|

11.32

|

$

|

9.26

|

||||

|

Investor Class Shares

|

||||||||

|

Net assets

|

143,776

|

N/A

|

||||||

|

Shares of beneficial interest outstanding

|

||||||||

|

(unlimited number of shares authorized, $0.001 par value)

|

12,733

|

N/A

|

||||||

|

Net asset value, offering price and redemption price per share

|

$

|

11.29

|

$

|

N/A

|

||||

|

Statements of Operations

|

|

Short Term

|

||||||||

|

Equity

|

U.S. Government

|

|||||||

|

Income

|

Agency

|

|||||||

|

Plus Fund

|

Income Fund

|

|||||||

|

INVESTMENT INCOME

|

||||||||

|

Dividend income

|

$

|

296,414

|

(1)

|

$

|

—

|

|||

|

Interest income (net of amortization and paydown gains and losses)

|

12,507

|

373,693

|

||||||

|

TOTAL INVESTMENT INCOME

|

308,921

|

373,693

|

||||||

|

EXPENSES

|

||||||||

|

Management fees

|

118,152

|

25,749

|

||||||

|

Administration and accounting fees

|

48,217

|

27,459

|

||||||

|

Transfer agent fees and expenses

|

24,971

|

10,756

|

||||||

|

Federal and state registration fees

|

16,120

|

10,349

|

||||||

|

Audit and tax fees

|

10,056

|

9,239

|

||||||

|

Legal fees

|

8,498

|

8,498

|

||||||

|

Chief Compliance Officer fees

|

6,039

|

6,039

|

||||||

|

Custody fees

|

4,525

|

4,312

|

||||||

|

Trustees’ fees

|

4,430

|

4,430

|

||||||

|

Reports to shareholders

|

2,867

|

967

|

||||||

|

Pricing expenses

|

1,201

|

7,123

|

||||||

|

Distribution (Rule 12b-1) fees – Investor Class

|

256

|

—

|

||||||

|

Other expenses

|

3,589

|

3,152

|

||||||

|

TOTAL EXPENSES

|

248,921

|

118,073

|

||||||

|

Less waivers and reimbursement by Adviser (Note 4)

|

(130,513

|

)

|

(70,866

|

)

|

||||

|

NET EXPENSES

|

118,408

|

47,207

|

||||||

|

NET INVESTMENT INCOME

|

190,513

|

326,486

|

||||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS

|

||||||||

|

Net realized gain (loss) from:

|

||||||||

|

Investments and purchased options

|

1,709,023

|

(14,759

|

)

|

|||||

|

Written options

|

(93,270

|

)

|

—

|

|||||

|

Change in net unrealized appreciation (depreciation) on:

|

||||||||

|

Investments and purchased options

|

1,349,283

|

(46,148

|

)

|

|||||

|

Written options

|

(1,067,945

|

)

|

—

|

|||||

|

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS

|

1,897,091

|

(60,907

|

)

|

|||||

|

NET INCREASE IN NET ASSETS FROM OPERATIONS

|

$

|

2,087,604

|

$

|

265,579

|

||||

|

(1)

|

Net of $1,416 in foreign withholding tax.

|

|

Statements of Changes in Net Assets

|

|

Six Months Ended

|

||||||||

|

November 30, 2019

|

Year Ended

|

|||||||

|

(Unaudited)

|

May 31, 2019

|

|||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income

|

$

|

190,513

|

$

|

764,079

|

||||

|

Net realized gain (loss) from:

|

||||||||

|

Investments and purchased options

|

1,709,023

|

858,614

|

||||||

|

Written options

|

(93,270

|

)

|

111,402

|

|||||

|

Change in net unrealized appreciation (depreciation) on:

|

||||||||

|

Investments and purchased options

|

1,349,283

|

(789,831

|

)

|

|||||

|

Written options

|

(1,067,945

|

)

|

62,456

|

|||||

|

Net increase in net assets from operations

|

2,087,604

|

1,006,720

|

||||||

|

FROM DISTRIBUTIONS

|

||||||||

|

Net dividends and distributions – Institutional Class

|

(361,014

|

)

|

(1,036,314

|

)

|

||||

|

Net dividends and distributions – Investor Class

|

(2,787

|

)

|

(8,297

|

)

|

||||

|

Net decrease in net assets resulting from dividends and distributions paid

|

(363,801

|

)

|

(1,044,611

|

)

|

||||

|

FROM CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold – Institutional Class

|

778,734

|

2,928,349

|

||||||

|

Proceeds from shares sold – Investor Class

|

—

|

400

|

||||||

|

Shares issued in reinvestment of distributions – Institutional Class

|

357,545

|

977,399

|

||||||

|

Shares issued in reinvestment of distributions – Investor Class

|

2,582

|

8,060

|

||||||

|

Payments for shares redeemed – Institutional Class

|

(7,841,566

|

)

|

(24,759,105

|

)

|

||||

|

Payments for shares redeemed – Investor Class

|

(148,315

|

)

|

(560,581

|

)

|

||||

|

Net decrease in net assets from capital share transactions

|

(6,851,020

|

)

|

(21,405,478

|

)

|

||||

|

TOTAL DECREASE IN NET ASSETS

|

(5,127,217

|

)

|

(21,443,369

|

)

|

||||

|

NET ASSETS:

|

||||||||

|

Beginning of period

|

34,568,518

|

56,011,887

|

||||||

|

End of period

|

$

|

29,441,301

|

$

|

34,568,518

|

||||

|

Statements of Changes in Net Assets

|

|

Six Months Ended

|

||||||||

|

November 30, 2019

|

Year Ended

|

|||||||

|

(Unaudited)

|

May 31, 2019

|

|||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income

|

$

|

326,486

|

$

|

606,470

|

||||

|

Net realized gain (loss) from investments

|

(14,759

|

)

|

5,547

|

|||||

|

Change in net unrealized depreciation on investments

|

(46,148

|

)

|

(123,497

|

)

|

||||

|

Net increase in net assets from operations

|

265,579

|

488,520

|

||||||

|

FROM DISTRIBUTIONS

|

||||||||

|

Net dividends and distributions

|

(344,191

|

)

|

(646,655

|

)

|

||||

|

Net decrease in net assets resulting from dividends and distributions paid

|

(344,191

|

)

|

(646,655

|

)

|

||||

|

FROM CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold

|

2,083,556

|

403,802

|

||||||

|

Shares issued in reinvestment of distributions

|

330,931

|

581,346

|

||||||

|

Payments for shares redeemed

|

(2,688,469

|

)

|

(6,838,074

|

)

|

||||

|

Net decrease in net assets from capital share transactions

|

(273,982

|

)

|

(5,852,926

|

)

|

||||

|

TOTAL DECREASE IN NET ASSETS

|

(352,594

|

)

|

(6,011,061

|

)

|

||||

|

NET ASSETS:

|

||||||||

|

Beginning of period

|

17,417,642

|

23,428,703

|

||||||

|

End of period

|

$

|

17,065,048

|

$

|

17,417,642

|

||||

|

Financial Highlights

|

|

Six Months

|

||||||||||||||||||||||||

|

Ended

|

||||||||||||||||||||||||

|

November 30,

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

|||||||||||||||||||

|

2019

|

May 31,

|

May 31,

|

May 31,

|

May 31,

|

May 31,

|

|||||||||||||||||||

|

(Unaudited)

|

2019

|

2018

|

2017

|

2016

|

2015

|

|||||||||||||||||||

|

Net Asset Value,

|

||||||||||||||||||||||||

|

Beginning of Year/Period

|

$

|

10.73

|

$

|

10.70

|

$

|

10.72

|

$

|

10.45

|

$

|

11.54

|

$

|

11.15

|

||||||||||||

|

Income (loss) from

|

||||||||||||||||||||||||

|

investment operations:

|

||||||||||||||||||||||||

|

Net investment income(1)(2)

|

0.07

|

0.18

|

0.11

|

0.14

|

0.16

|

0.22

|

||||||||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||||||

|

gain (loss) on investments(6)

|

0.64

|

0.09

|

(0.01

|

)

|

0.31

|

(0.58

|

)

|

0.48

|

||||||||||||||||

|

Total from investment operations

|

0.71

|

0.27

|

0.10

|

0.45

|

(0.42

|

)

|

0.70

|

|||||||||||||||||

|

Less distributions paid:

|

||||||||||||||||||||||||

|

From net investment income

|

(0.12

|

)

|

(0.24

|

)

|

(0.12

|

)

|

(0.18

|

)

|

(0.22

|

)

|

(0.22

|

)

|

||||||||||||

|

From realized gain

|

—

|

—

|

—

|

—

|

(0.45

|

)

|

(0.09

|

)

|

||||||||||||||||

|

Total distributions paid

|

(0.12

|

)

|

(0.24

|

)

|

(0.12

|

)

|

(0.18

|

)

|

(0.67

|

)

|

(0.31

|

)

|

||||||||||||

|

Net Asset Value, End of Year/Period

|

$

|

11.32

|

$

|

10.73

|

$

|

10.70

|

$

|

10.72

|

$

|

10.45

|

$

|

11.54

|

||||||||||||

|

Total Return(3)(5)

|

6.60

|

%

|

2.55

|

%

|

0.95

|

%

|

4.29

|

%

|

-3.52

|

%

|

6.37

|

%

|

||||||||||||

|

Supplemental Data and Ratios:

|

||||||||||||||||||||||||

|

Net assets at end of year/period (000’s)

|

$

|

29,297

|

$

|

34,289

|

$

|

55,188

|

$

|

64,908

|

$

|

132,523

|

$

|

159,725

|

||||||||||||

|

Ratio of expenses to average net assets(4)

|

||||||||||||||||||||||||

|

Before waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

1.58

|

%

|

1.35

|

%

|

1.17

|

%

|

1.09

|

%

|

1.03

|

%

|

1.05

|

%

|

||||||||||||

|

After waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

0.75

|

%

|

0.75

|

%

|

0.75

|

%

|

0.75

|

%

|

0.75

|

%

|

0.75

|

%

|

||||||||||||

|

Ratio of net investment income

|

||||||||||||||||||||||||

|

to average net assets(4)

|

||||||||||||||||||||||||

|

Before waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

0.38

|

%

|

1.11

|

%

|

0.57

|

%

|

0.95

|

%

|

1.95

|

%

|

1.61

|

%

|

||||||||||||

|

After waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

1.21

|

%

|

1.71

|

%

|

0.99

|

%

|

1.29

|

%

|

2.23

|

%

|

1.91

|

%

|

||||||||||||

|

Portfolio turnover rate(3)

|

17.72

|

%

|

71.47

|

%

|

93.98

|

%

|

77.33

|

%

|

63.55

|

%

|

87.20

|

%

|

||||||||||||

|

(1)

|

Per share net investment income has been calculated using the daily average shares outstanding method.

|

|

(2)

|

Net investment income per share is calculated using the ending balances prior to consideration or adjustment for permanent book to tax differences.

|

|

(3)

|

Not annualized for periods less than one year.

|

|

(4)

|

Annualized for periods less than one year.

|

|

(5)

|

Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends.

|

|

(6)

|

Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate

gains and losses in the Statements of Operations due to share transactions for the period.

|

|

Financial Highlights

|

|

Six Months

|

||||||||||||||||||||||||

|

Ended

|

||||||||||||||||||||||||

|

November 30,

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

|||||||||||||||||||

|

2019

|

May 31,

|

May 31,

|

May 31,

|

May 31,

|

May 31,

|

|||||||||||||||||||

|

(Unaudited)

|

2019

|

2018

|

2017

|

2016

|

2015

|

|||||||||||||||||||

|

Net Asset Value,

|

||||||||||||||||||||||||

|

Beginning of Year/Period

|

$

|

10.71

|

$

|

10.68

|

$

|

10.69

|

$

|

10.43

|

$

|

11.53

|

$

|

11.14

|

||||||||||||

|

Income (loss) from

|

||||||||||||||||||||||||

|

investment operations:

|

||||||||||||||||||||||||

|

Net investment income(1)(2)

|

0.05

|

0.15

|

0.08

|

0.11

|

0.12

|

0.18

|

||||||||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||||||

|

gain (loss) on investments(8)

|

0.64

|

0.09

|

(0.00

|

)(6)

|

0.30

|

(0.58

|

)

|

0.49

|

||||||||||||||||

|

Total from investment operations

|

0.69

|

0.23

|

0.08

|

0.41

|

(0.46

|

)

|

0.67

|

|||||||||||||||||

|

Less distributions paid:

|

||||||||||||||||||||||||

|

From net investment income

|

(0.11

|

)

|

(0.21

|

)

|

(0.09

|

)

|

(0.15

|

)

|

(0.19

|

)

|

(0.19

|

)

|

||||||||||||

|

From realized gain

|

—

|

—

|

—

|

—

|

(0.45

|

)

|

(0.09

|

)

|

||||||||||||||||

|

Total distributions paid

|

(0.11

|

)

|

(0.21

|

)

|

(0.09

|

)

|

(0.15

|

)

|

(0.64

|

)

|

(0.28

|

)

|

||||||||||||

|

Net Asset Value, End of Year/Period

|

$

|

11.29

|

$

|

10.71

|

$

|

10.68

|

$

|

10.69

|

$

|

10.43

|

$

|

11.53

|

||||||||||||

|

Total Return(3)(5)

|

6.55

|

%

|

2.15

|

%

|

0.71

|

%

|

3.92

|

%

|

-3.88

|

%

|

6.09

|

%

|

||||||||||||

|

Supplemental Data and Ratios:

|

||||||||||||||||||||||||

|

Net assets at end of year/period (000’s)

|

$

|

144

|

$

|

280

|

$

|

824

|

$

|

1,114

|

$

|

2,348

|

$

|

2,330

|

||||||||||||

|

Ratio of expenses to average net assets(4)

|

||||||||||||||||||||||||

|

Before waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

1.81

|

%

|

1.59

|

%

|

1.42

|

%

|

1.44

|

%

|

1.38

|

%

|

1.40

|

%

|

||||||||||||

|

After waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

1.00

|

%(7)

|

1.00

|

%(7)

|

1.00

|

%(7)

|

1.10

|

%

|

1.10

|

%

|

1.10

|

%

|

||||||||||||

|

Ratio of net investment income

|

||||||||||||||||||||||||

|

to average net assets(4)

|

||||||||||||||||||||||||

|

Before waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

0.14

|

%

|

0.84

|

%

|

0.33

|

%

|

0.69

|

%

|

1.60

|

%

|

1.31

|

%

|

||||||||||||

|

After waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

0.95

|

%

|

1.43

|

%

|

0.75

|

%

|

1.03

|

%

|

1.88

|

%

|

1.61

|

%

|

||||||||||||

|

Portfolio turnover rate(3)

|

17.72

|

%

|

71.47

|

%

|

93.98

|

%

|

77.33

|

%

|

63.55

|

%

|

87.20

|

%

|

||||||||||||

|

(1)

|

Per share net investment income has been calculated using the daily average shares outstanding method.

|

|

(2)

|

Net investment income per share is calculated using the ending balances prior to consideration or adjustment for permanent book to tax differences.

|

|

(3)

|

Not annualized for periods less than one year.

|

|

(4)

|

Annualized for periods less than one year.

|

|

(5)

|

Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Excludes the effect of applicable sales charges.

|

|

(6)

|

Less than 0.05 cents per share.

|

|

(7)

|

Reflects expense cap of 0.75% plus Rule 12b-1 fees of 0.25%. The Fund did not accrue 0.10% allowable under the shareholder servicing plan for the years ended May 31, 2018 or May 31, 2019 or the six months ended

November 30, 2019.

|

|

(8)

|

Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate

gains and losses in the Statements of Operations due to share transactions for the period.

|

|

Financial Highlights

|

|

Six Months

|

||||||||||||||||||||||||

|

Ended

|

||||||||||||||||||||||||

|

November 30,

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

|||||||||||||||||||

|

2019

|

May 31,

|

May 31,

|

May 31,

|

May 31,

|

May 31,

|

|||||||||||||||||||

|

(Unaudited)

|

2019

|

2018

|

2017

|

2016

|

2015

|

|||||||||||||||||||

|

Net Asset Value,

|

||||||||||||||||||||||||

|

Beginning of Year/Period

|

$

|

9.30

|

$

|

9.36

|

$

|

9.51

|

$

|

9.75

|

$

|

9.91

|

$

|

10.06

|

||||||||||||

|

Income (loss) from

|

||||||||||||||||||||||||

|

investment operations:

|

||||||||||||||||||||||||

|

Net investment income(1)(2)

|

0.18

|

0.29

|

0.26

|

0.25

|

0.15

|

0.15

|

||||||||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||||||

|

loss on investments

|

(0.03

|

)

|

(0.05

|

)

|

(0.11

|

)

|

(0.19

|

)

|

(0.11

|

)

|

(0.08

|

)

|

||||||||||||

|

Total from investment operations

|

0.15

|

0.24

|

0.15

|

0.06

|

0.04

|

0.07

|

||||||||||||||||||

|

Less distributions paid:

|

||||||||||||||||||||||||

|

From net investment income

|

(0.19

|

)

|

(0.30

|

)

|

(0.30

|

)

|

(0.30

|

)

|

(0.20

|

)

|

(0.22

|

)

|

||||||||||||

|

Total distributions paid

|

(0.19

|

)

|

(0.30

|

)

|

(0.30

|

)

|

(0.30

|

)

|

(0.20

|

)

|

(0.22

|

)

|

||||||||||||

|

Net Asset Value, End of Year/Period

|

$

|

9.26

|

$

|

9.30

|

$

|

9.36

|

$

|

9.51

|

$

|

9.75

|

$

|

9.91

|

||||||||||||

|

Total Return(3)(4)

|

1.62

|

%

|

2.66

|

%

|

1.60

|

%

|

0.64

|

%

|

0.35

|

%

|

0.75

|

%

|

||||||||||||

|

Supplemental Data and Ratios:

|

||||||||||||||||||||||||

|

Net assets at end of year/period (000’s)

|

$

|

17,065

|

$

|

17,418

|

$

|

23,429

|

$

|

36,394

|

$

|

97,164

|

$

|

83,678

|

||||||||||||

|

Ratio of expenses to average net assets(5)

|

||||||||||||||||||||||||

|

Before waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

1.38

|

%

|

1.24

|

%

|

0.90

|

%

|

0.64

|

%

|

0.59

|

%

|

0.65

|

%

|

||||||||||||

|

After waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

0.55

|

%

|

0.55

|

%

|

0.55

|

%

|

0.55

|

%

|

0.58

|

%

|

0.66

|

%

|

||||||||||||

|

Ratio of net investment income

|

||||||||||||||||||||||||

|

to average net assets(5)

|

||||||||||||||||||||||||

|

Before waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

2.98

|

%

|

2.42

|

%

|

2.36

|

%

|

2.50

|

%

|

1.50

|

%

|

1.52

|

%

|

||||||||||||

|

After waivers and

|

||||||||||||||||||||||||

|

reimbursements of expenses

|

3.81

|

%

|

3.11

|

%

|

2.71

|

%

|

2.59

|

%

|

1.51

|

%

|

1.51

|

%

|

||||||||||||

|

Portfolio turnover rate(4)

|

20.84

|

%

|

15.24

|

%

|

98.95

|

%

|

164.31

|

%

|

182.08

|

%

|

99.63

|

%

|

||||||||||||

|

(1)

|

Per share net investment income has been calculated using the daily average shares outstanding method.

|

|

(2)

|

Net investment income per share is calculated using the ending balances prior to consideration or adjustment for permanent book to tax differences.

|

|

(3)

|

Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends.

|

|

(4)

|

Not annualized for periods less than one year.

|

|

(5)

|

Annualized for periods less than one year.

|

|

(1)

|

Organization

|

|

Trust for Professional Managers (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust dated May 29, 2001. The Trust is registered under the Investment Company Act of 1940, as

amended (the “1940 Act”), as an open-end management investment company. The M.D. Sass Funds (the “Funds”) each represent a distinct diversified series with their own investment objectives and policies within the Trust. The investment

objective of the M.D. Sass Short Term U.S. Government Agency Income Fund (the “Short Term U.S. Government Agency Income Fund”) is to achieve a high and stable rate of total return, when and as opportunities are available in the context of

preserving capital in adverse markets. The investment objective of the M.D. Sass Equity Income Plus Fund (the “Equity Income Plus Fund”) is to generate income as well as capital appreciation, while emphasizing downside protection. The Trust

may issue an unlimited number of shares of beneficial interest at $0.001 par value. The assets of the Funds are segregated, and a shareholder’s interest is limited to the Fund in which shares are held. The Short Term U.S. Government Agency

Income Fund currently offers one class of shares, the Institutional Class. Effective February 20, 2014, the Short Term U.S. Government Agency Income Fund ceased offering its StoneCastle Treasurer Class. Effective September 1, 2015, the

Short Term U.S. Government Agency Income Fund converted its Retail Class shares to Institutional Class shares and ceased offering its Retail Class. The Equity Income Plus Fund currently offers two classes of shares, the Institutional Class

and the Investor Class. Effective February 29, 2016, the Equity Income Plus Fund converted its Class C shares to Retail Class shares and ceased offering its Class C shares, and the Retail Class was renamed to the Investor Class. The Investor

Class shares are subject to a 0.25% distribution (Rule 12b-1) fee and a shareholder servicing fee not to exceed 0.10%. Each class of shares in both Funds have identical rights and privileges except with respect to the Rule 12b-1 and

shareholder servicing fees and voting rights on matters affecting a single class of shares. The Short Term U.S. Government Agency Income Fund’s registration statement became effective on June 22, 2011. The Institutional Class shares

commenced operations on June 30, 2011. The Equity Income Plus Fund’s registration statement became effective on June 28, 2013 at which time the Institutional and Investor Classes commenced operations. Costs incurred by the Funds in

connection with the organization, registration and the initial public offering of shares were paid by M.D. Sass Investors Services, Inc. and M.D. Sass, LLC (the “Advisers”), investment advisers to the Short Term U.S. Government Agency Income

Fund and Equity Income Plus Fund, respectively. The Funds are each an investment company and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard

Codification Topic 946 “Financial Services — Investment Companies”.

|

|

|

(2)

|

Significant Accounting Policies

|

|

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of the financial statements. These policies are in conformity with generally accepted

accounting principles in the United States of America (“GAAP”).

|

|

(a)

|

Investment Valuation

|

|

Each security owned by the Funds that is listed on a securities exchange is valued at its last sale price on that exchange on the date as of which assets are valued. When the security is listed on more than

one exchange, the Funds will use the price of the exchange that the Funds generally consider to be the principal exchange on which the security is traded.

|

|

|

Fund securities listed on the NASDAQ Stock Market, LLC (“NASDAQ”) will be valued at the NASDAQ Official Closing Price (“NOCP”), which may not necessarily represent the last sale price. If the NOCP is not

available, such securities shall be valued at the last sale price on the day of valuation. If there has been no sale on such exchange or on NASDAQ on such day, the security is valued at the mean between the bid and asked prices on such day

or will be valued at the later sale price on the composite market (defined as a consolidation of the trade information provided by national securities and foreign exchanges and over-the-counter markets as published by a pricing service).

When market quotations are not readily available, any security or other asset is valued at its fair value as determined under procedures approved by the Trust’s Board of Trustees. These fair value procedures will also be used to price a

|

|

security when corporate events, events in the securities market and/or world events cause the Advisers to believe that a security’s last sale price may not reflect its actual fair value. The intended effect of

using fair value pricing procedures is to ensure that the Funds are accurately priced.

|

|

|

Debt securities, including U.S. Government and Agency Securities, corporate securities, municipal securities, mortgage- and asset-backed securities, commercial paper, banker’s acceptances, certificates of

deposit, time deposits and U.S. Treasury Bills, including short-term debt instruments having a maturity of 60 days or less, are valued at the mean by pricing service providers. Pricing services may use various valuation methodologies such as

broker-dealer quotations or valuation estimates from their internal pricing models. The pricing models for these securities usually consider tranche-level attributes, estimated cash flows and market-based yield spreads for each tranche,

current market data and incorporate deal collateral performance, as available. Pricing Services generally value debt securities assuming orderly transactions of an institutional round lot size, but such securities may be held or transactions

may be conducted in such securities in smaller, odd lot sizes. Odd lots often trade at lower prices than institutional round lots. If a price is not available from a pricing service, the most recent quotation obtained from one or more

brokers known to follow the issue will be obtained. Quotations will be valued at the mean between the bid and the offer. Debt securities that use similar valuation techniques and inputs as described above are typically categorized as Level 2

of the fair value hierarchy. Debt securities purchased on a delayed delivery basis are typically marked to market daily until settlement at the forward settlement date. Any discount or premium is accreted or amortized using the constant

yield method until maturity.

|

|

|

Exchange-traded options are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which

an option is quoted, thus providing a view across the entire U.S. options marketplace. Specifically, composite pricing looks at the last trades on the exchanges where the options are traded. If there are no trades for the option on a given

business day, composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded and the option will generally be classified as Level 2.

|

|

|

Money market funds, demand notes and repurchase agreements are valued at cost. If cost does not represent current market value the securities will be priced at fair value.

|

|

|

Redeemable securities issued by open-end, registered investment companies are valued at the net asset value (“NAV”) of such companies for purchase and/or redemption orders placed on that day.

|

|

|