SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

|

LETTER TO SHAREHOLDERS

|

3

|

|

EXPENSE EXAMPLES

|

7

|

|

INVESTMENT HIGHLIGHTS

|

9

|

|

SCHEDULES OF INVESTMENTS

|

15

|

|

STATEMENTS OF ASSETS AND LIABILITIES

|

44

|

|

STATEMENTS OF OPERATIONS

|

46

|

|

STATEMENTS OF CHANGES IN NET ASSETS

|

48

|

|

FINANCIAL HIGHLIGHTS

|

52

|

|

NOTES TO FINANCIAL STATEMENTS

|

58

|

|

NOTICE OF PRIVACY POLICY & PRACTICES

|

74

|

|

ADDITIONAL INFORMATION

|

75

|

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

December 1, 2018 -

|

|

|

December 1, 2018

|

May 31, 2019

|

May 31, 2019*

|

|

|

Actual

|

$1,000.00

|

$ 975.90

|

$4.88

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

$1,000.00

|

$1,020.00

|

$4.99

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 0.99%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

|

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

December 1, 2018 -

|

|

|

December 1, 2018

|

May 31, 2019

|

May 31, 2019*

|

|

|

Actual

|

$1,000.00

|

$1,043.30

|

$5.65

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

$1,000.00

|

$1,019.40

|

$5.59

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.11%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

|

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

December 1, 2018 -

|

|

|

December 1, 2018

|

May 31, 2019

|

May 31, 2019*

|

|

|

Actual

|

$1,000.00

|

$1,076.60

|

$4.87

|

|

Hypothetical (5% return

|

|||

|

before expenses)

|

$1,000.00

|

$1,020.24

|

$4.73

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 0.94%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

|

|

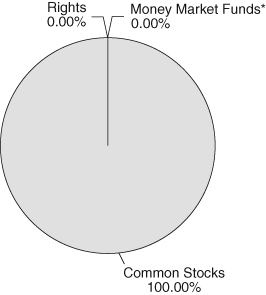

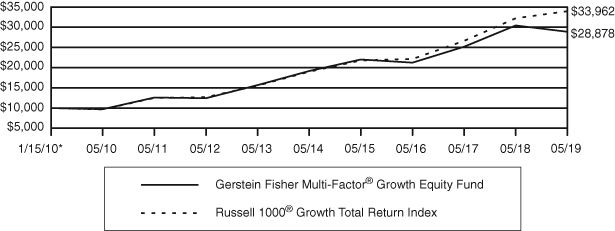

Gerstein Fisher

|

Russell 1000®

|

|

|

Multi-Factor®

|

Growth Total

|

|

|

Growth Equity

|

Return Index

|

|

|

One Year

|

-5.13%

|

5.39%

|

|

Three Year

|

10.79%

|

15.33%

|

|

Five Year

|

8.54%

|

12.33%

|

|

Since Inception (1/15/10)(1)

|

11.98%

|

13.93%

|

|

(1)

|

While the Fund commenced operations on December 31, 2009, the Fund began investing consistent with its investment objective on January 15, 2010.

|

|

*

|

While the Fund commenced operations on December 31, 2009, the Fund began investing consistent with its investment objective on January 15, 2010.

|

|

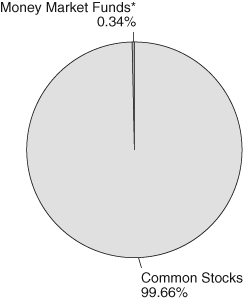

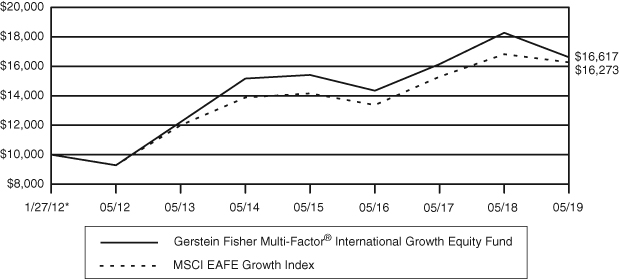

Gerstein Fisher

|

||

|

Multi-Factor®

|

||

|

International

|

MSCI EAFE

|

|

|

Growth Equity

|

Growth Index

|

|

|

One Year

|

-9.10%

|

-3.27%

|

|

Three Year

|

5.02%

|

6.77%

|

|

Five Year

|

1.84%

|

3.23%

|

|

Since Inception (1/27/12)

|

7.16%

|

6.86%

|

|

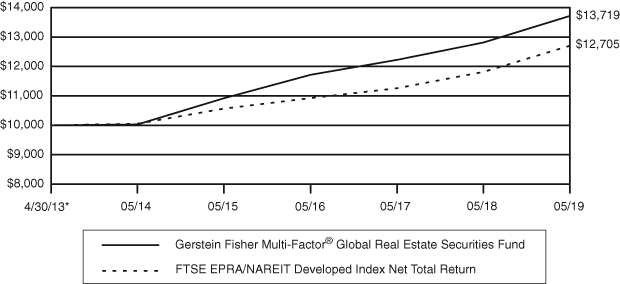

Gerstein Fisher

|

FTSE EPRA/

|

|

|

Multi-Factor®

|

NAREIT

|

|

|

Global Real

|

Developed Index

|

|

|

Estate Securities

|

Net Total Return

|

|

|

One Year

|

7.06%

|

7.53%

|

|

Three Year

|

5.40%

|

5.16%

|

|

Five Year

|

6.47%

|

4.79%

|

|

Since Inception (4/30/13)

|

5.33%

|

4.01%

|

|

Schedule of Investments

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS – 100.08%

|

||||||||

|

Administrative and Support Services – 4.00%

|

||||||||

|

AECOM (a)

|

700

|

$

|

22,330

|

|||||

|

Booking Holdings, Inc. (a)

|

48

|

79,499

|

||||||

|

Kforce, Inc.

|

7,123

|

247,524

|

||||||

|

MasterCard, Inc.

|

38,857

|

9,772,147

|

||||||

|

PayPal Holdings, Inc. (a)

|

3,190

|

350,103

|

||||||

|

Perspecta, Inc.

|

524

|

11,376

|

||||||

|

Robert Half International, Inc.

|

446

|

23,932

|

||||||

|

10,506,911

|

||||||||

|

Air Transportation – 2.93%

|

||||||||

|

American Airlines Group, Inc.

|

293

|

7,978

|

||||||

|

Delta Air Lines, Inc.

|

41,349

|

2,129,473

|

||||||

|

Mesa Air Group, Inc. (a)

|

18,816

|

171,602

|

||||||

|

Southwest Airlines Co.

|

82,478

|

3,925,953

|

||||||

|

United Continental Holdings, Inc. (a)

|

18,841

|

1,463,004

|

||||||

|

7,698,010

|

||||||||

|

Ambulatory Health Care Services – 3.78%

|

||||||||

|

Amedisys, Inc. (a)

|

73,670

|

8,273,878

|

||||||

|

Chemed Corp.

|

208

|

68,211

|

||||||

|

Genomic Health, Inc. (a)

|

14,729

|

769,590

|

||||||

|

Novocure Ltd. (a)(b)

|

15,388

|

817,411

|

||||||

|

Tivity Health, Inc. (a)

|

79

|

1,446

|

||||||

|

9,930,536

|

||||||||

|

Apparel Manufacturing – 1.00%

|

||||||||

|

Capri Holdings Ltd. (a)(b)

|

236

|

7,665

|

||||||

|

Columbia Sportswear Co.

|

2,293

|

215,037

|

||||||

|

Lululemon Athletica, Inc. (a)

|

2,449

|

405,530

|

||||||

|

VF Corp.

|

13,000

|

1,064,440

|

||||||

|

Zumiez, Inc. (a)

|

47,501

|

939,570

|

||||||

|

2,632,242

|

||||||||

|

Automobiles & Components – 0.00%

|

||||||||

|

Garrett Motion, Inc. (a)

|

49

|

754

|

||||||

|

Beverage and Tobacco Product Manufacturing – 2.97%

|

||||||||

|

Altria Group, Inc.

|

680

|

33,361

|

||||||

|

Boston Beer Co., Inc. (a)

|

848

|

266,526

|

||||||

|

Coca-Cola Consolidated, Inc.

|

129

|

38,959

|

||||||

|

Keurig Dr Pepper, Inc.

|

137,787

|

3,884,216

|

||||||

|

National Beverage Corp. (a)

|

122

|

5,508

|

||||||

|

NMI Holdings, Inc. (a)

|

24,537

|

668,879

|

||||||

|

PepsiCo, Inc.

|

22,578

|

2,889,984

|

||||||

|

7,787,433

|

||||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Broadcasting (except Internet) – 1.14%

|

||||||||

|

CBS Corp.

|

559

|

$

|

26,989

|

|||||

|

Comcast Corp.

|

12,847

|

526,727

|

||||||

|

Discovery Communications, Inc. – Class A (a)

|

23,775

|

648,107

|

||||||

|

Discovery Communications, Inc. – Class C (a)

|

14,742

|

377,985

|

||||||

|

Fox Corp.

|

1,302

|

45,192

|

||||||

|

Walt Disney Co.

|

10,307

|

1,360,936

|

||||||

|

2,985,936

|

||||||||

|

Building Material and Garden Equipment and Supplies Dealers – 3.49%

|

||||||||

|

Fastenal Co.

|

728

|

22,270

|

||||||

|

Home Depot, Inc.

|

42,020

|

7,977,497

|

||||||

|

Lowe’s Cos, Inc.

|

12,472

|

1,163,388

|

||||||

|

9,163,155

|

||||||||

|

Chemical Manufacturing – 5.97%

|

||||||||

|

Abbott Laboratories

|

149

|

11,343

|

||||||

|

AbbVie, Inc.

|

31,369

|

2,406,316

|

||||||

|

Allergan PLC (b)

|

80

|

9,753

|

||||||

|

Celgene Corp. (a)

|

116

|

10,880

|

||||||

|

Chemours Co.

|

286

|

6,032

|

||||||

|

Eli Lilly & Co.

|

8,874

|

1,028,852

|

||||||

|

Horizon Therapeutics PLC (a)(b)

|

78,581

|

1,872,585

|

||||||

|

Innophos Holdings, Inc.

|

493

|

13,109

|

||||||

|

Innoviva, Inc. (a)

|

237,533

|

3,247,076

|

||||||

|

Johnson & Johnson

|

20,281

|

2,659,853

|

||||||

|

LyondellBasell Industries NV (b)

|

15,131

|

1,123,477

|

||||||

|

Medifast, Inc.

|

1,851

|

238,686

|

||||||

|

Merck & Co, Inc.

|

11,522

|

912,658

|

||||||

|

Myriad Genetics, Inc. (a)

|

337

|

8,347

|

||||||

|

SIGA Technologies, Inc. (a)

|

88,527

|

472,734

|

||||||

|

Supernus Pharmaceuticals, Inc. (a)

|

549

|

16,486

|

||||||

|

Trex Co., Inc. (a)

|

5,552

|

332,121

|

||||||

|

Trinseo SA (b)

|

3,000

|

110,520

|

||||||

|

USANA Health Sciences, Inc. (a)

|

238

|

16,846

|

||||||

|

Vertex Pharmaceuticals, Inc. (a)

|

6,985

|

1,160,767

|

||||||

|

15,658,441

|

||||||||

|

Clothing and Clothing Accessories Stores – 1.49%

|

||||||||

|

American Eagle Outfitters, Inc.

|

9,342

|

162,551

|

||||||

|

Gap, Inc.

|

1,059

|

19,782

|

||||||

|

Ross Stores, Inc.

|

15,963

|

1,484,399

|

||||||

|

TJX Companies, Inc.

|

38,144

|

1,918,262

|

||||||

|

Urban Outfitters, Inc. (a)

|

14,927

|

335,410

|

||||||

|

3,920,404

|

||||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Computer and Electronic Product Manufacturing – 13.59%

|

||||||||

|

Alphabet, Inc. (a)

|

5,772

|

$

|

6,370,913

|

|||||

|

Apple, Inc.

|

75,665

|

13,246,672

|

||||||

|

Broadcom, Inc.

|

83

|

20,886

|

||||||

|

Ciena Corp. (a)

|

971

|

33,927

|

||||||

|

Cirrus Logic, Inc. (a)

|

243

|

9,081

|

||||||

|

Dell Technologies, Inc. (a)

|

4,751

|

282,922

|

||||||

|

Harris Corp.

|

6,496

|

1,215,986

|

||||||

|

Harvard Bioscience, Inc. (a)

|

6,087

|

13,817

|

||||||

|

Intel Corp.

|

62,048

|

2,732,594

|

||||||

|

Lam Research Corp.

|

7,500

|

1,309,575

|

||||||

|

Medtronic PLC (b)

|

113

|

10,461

|

||||||

|

Micron Technology, Inc. (a)

|

211,262

|

6,889,254

|

||||||

|

ON Semiconductor Corp. (a)

|

65,000

|

1,154,400

|

||||||

|

QUALCOMM, Inc.

|

190

|

12,696

|

||||||

|

Roper Technologies, Inc.

|

213

|

73,255

|

||||||

|

Rubicon Technology, Inc. (a)

|

610

|

4,929

|

||||||

|

SMART Global Holdings, Inc. (a)(b)

|

13,146

|

223,876

|

||||||

|

Teradyne, Inc.

|

310

|

13,063

|

||||||

|

Thermo Fisher Scientific, Inc.

|

112

|

29,902

|

||||||

|

Turtle Beach Corp. (a)(c)

|

51,848

|

431,375

|

||||||

|

Western Digital Corp.

|

244

|

9,082

|

||||||

|

Zebra Technologies Corp. (a)

|

9,145

|

1,567,819

|

||||||

|

35,656,485

|

||||||||

|

Construction of Buildings – 0.03%

|

||||||||

|

KB Home

|

1,575

|

39,580

|

||||||

|

TRI Pointe Group, Inc. (a)

|

3,361

|

41,340

|

||||||

|

80,920

|

||||||||

|

Consumer Durables & Apparel – 0.02%

|

||||||||

|

Kontoor Brands, Inc. (a)

|

1,857

|

54,414

|

||||||

|

Credit Intermediation and Related Activities – 2.88%

|

||||||||

|

Altisource Portfolio Solutions SA (a)(b)(c)

|

11,971

|

240,976

|

||||||

|

Amalgamated Bank

|

1,448

|

23,892

|

||||||

|

Capital One Financial Corp.

|

22,404

|

1,923,831

|

||||||

|

OneMain Holdings, Inc.

|

33,240

|

992,879

|

||||||

|

Regional Management Corp. (a)

|

2,511

|

61,946

|

||||||

|

Santander Consumer USA Holdings, Inc.

|

157,753

|

3,532,090

|

||||||

|

USA Technologies, Inc. (a)

|

3,367

|

22,593

|

||||||

|

Wells Fargo & Co.

|

16,844

|

747,368

|

||||||

|

7,545,575

|

||||||||

|

Data Processing, Hosting and Related Services – 2.32%

|

||||||||

|

Limelight Networks, Inc. (a)

|

3,360

|

10,349

|

||||||

|

Match Group, Inc. (a)

|

519

|

35,629

|

||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Data Processing, Hosting and Related Services – 2.32% (Continued)

|

||||||||

|

Visa, Inc.

|

37,492

|

$

|

6,048,584

|

|||||

|

6,094,562

|

||||||||

|

Educational Services – 0.00%

|

||||||||

|

ITT Educational Services, Inc. (a)

|

3,750

|

4

|

||||||

|

Electrical Equipment, Appliance, and Component Manufacturing – 0.01%

|

||||||||

|

AO Smith Corp.

|

414

|

16,767

|

||||||

|

Resideo Technologies, Inc. (a)

|

81

|

1,594

|

||||||

|

18,361

|

||||||||

|

Electronics and Appliance Stores – 0.24%

|

||||||||

|

Aaron’s, Inc.

|

9,884

|

526,422

|

||||||

|

Best Buy Co., Inc.

|

1,500

|

94,005

|

||||||

|

620,427

|

||||||||

|

Fabricated Metal Product Manufacturing – 0.00%

|

||||||||

|

General Finance Corp. (a)

|

1,408

|

10,743

|

||||||

|

Food Services and Drinking Places – 0.60%

|

||||||||

|

Chipotle Mexican Grill, Inc. (a)

|

100

|

65,997

|

||||||

|

Darden Restaurants, Inc.

|

10,620

|

1,235,318

|

||||||

|

Domino’s Pizza, Inc.

|

96

|

26,832

|

||||||

|

McDonald’s Corp.

|

151

|

29,939

|

||||||

|

Wendy’s Co.

|

10,000

|

183,900

|

||||||

|

Yum! Brands, Inc.

|

234

|

23,950

|

||||||

|

1,565,936

|

||||||||

|

Furniture and Home Furnishings Stores – 0.40%

|

||||||||

|

RH (a)

|

12,402

|

1,056,030

|

||||||

|

Furniture and Related Product Manufacturing – 0.28%

|

||||||||

|

Herman Miller, Inc.

|

7,630

|

270,789

|

||||||

|

Kimball International, Inc.

|

10,491

|

161,981

|

||||||

|

Sleep Number Corp. (a)

|

8,688

|

302,429

|

||||||

|

735,199

|

||||||||

|

Gasoline Stations – 0.14%

|

||||||||

|

Delek US Holdings, Inc.

|

11,813

|

361,596

|

||||||

|

General Merchandise Stores – 4.26%

|

||||||||

|

Burlington Stores, Inc. (a)

|

30,000

|

4,697,400

|

||||||

|

Dollar General Corp.

|

26,783

|

3,408,940

|

||||||

|

Tractor Supply Co.

|

304

|

30,637

|

||||||

|

WalMart, Inc.

|

30,000

|

3,043,200

|

||||||

|

11,180,177

|

||||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Health and Personal Care Stores – 0.13%

|

||||||||

|

Ulta Beauty, Inc. (a)

|

1,000

|

$

|

333,380

|

|||||

|

Heavy and Civil Engineering Construction – 0.00%

|

||||||||

|

Century Communities, Inc. (a)

|

478

|

12,763

|

||||||

|

Insurance Carriers and Related Activities – 6.37%

|

||||||||

|

American International Group, Inc.

|

490

|

25,024

|

||||||

|

Anthem, Inc.

|

29,812

|

8,287,140

|

||||||

|

Berkshire Hathaway, Inc. (a)

|

5,771

|

1,139,311

|

||||||

|

Essent Group Ltd. (a)(b)

|

5,544

|

260,291

|

||||||

|

Everest Re Group Ltd. (b)

|

100

|

24,766

|

||||||

|

Humana, Inc.

|

38

|

9,305

|

||||||

|

Lincoln National Corp.

|

23,256

|

1,382,569

|

||||||

|

Molina Healthcare, Inc. (a)

|

22,163

|

3,152,908

|

||||||

|

Prudential Financial, Inc.

|

7,525

|

695,159

|

||||||

|

Travelers Companies, Inc.

|

72

|

10,481

|

||||||

|

Voya Financial, Inc.

|

33,992

|

1,731,213

|

||||||

|

16,718,167

|

||||||||

|

Leather and Allied Product Manufacturing – 1.15%

|

||||||||

|

Crocs, Inc. (a)

|

67,639

|

1,306,786

|

||||||

|

Deckers Outdoor Corp. (a)

|

182

|

27,682

|

||||||

|

NIKE, Inc.

|

21,592

|

1,665,607

|

||||||

|

Tapestry, Inc.

|

208

|

5,940

|

||||||

|

3,006,015

|

||||||||

|

Machinery Manufacturing – 0.38%

|

||||||||

|

Applied Materials, Inc.

|

280

|

10,833

|

||||||

|

Caterpillar, Inc.

|

1,008

|

120,769

|

||||||

|

Cummins, Inc.

|

4,156

|

626,559

|

||||||

|

Deere & Co.

|

261

|

36,584

|

||||||

|

Ingersoll-Rand PLC (b)

|

1,641

|

194,196

|

||||||

|

988,941

|

||||||||

|

Management of Companies and Enterprises – 0.01%

|

||||||||

|

EchoStar Corp. (a)

|

470

|

20,107

|

||||||

|

Merchant Wholesalers, Durable Goods – 1.58%

|

||||||||

|

3M Co.

|

6,653

|

1,062,817

|

||||||

|

Arrow Electronics, Inc. (a)

|

17,635

|

1,105,009

|

||||||

|

Honeywell International, Inc.

|

491

|

80,676

|

||||||

|

Paycom Software, Inc. (a)

|

9,000

|

1,908,900

|

||||||

|

4,157,402

|

||||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Merchant Wholesalers, Nondurable Goods – 0.67%

|

||||||||

|

Freshpet, Inc. (a)

|

9,463

|

$

|

439,745

|

|||||

|

Herbalife Nutrition Ltd. (a)(b)

|

30,701

|

1,282,688

|

||||||

|

Sysco Corp.

|

439

|

30,212

|

||||||

|

US Foods Holding Corp. (a)

|

430

|

14,861

|

||||||

|

1,767,506

|

||||||||

|

Miscellaneous Manufacturing – 0.87%

|

||||||||

|

ABIOMED, Inc. (a)

|

30

|

7,858

|

||||||

|

Brady Corp.

|

201

|

9,306

|

||||||

|

Estee Lauder Companies, Inc.

|

3,000

|

483,090

|

||||||

|

Intuitive Surgical, Inc. (a)

|

55

|

25,567

|

||||||

|

YETI Holdings, Inc. (a)

|

72,970

|

1,745,442

|

||||||

|

2,271,263

|

||||||||

|

Motion Picture and Sound Recording Industries – 2.37%

|

||||||||

|

Netflix, Inc. (a)

|

9,360

|

3,213,101

|

||||||

|

World Wrestling Entertainment, Inc.

|

41,463

|

3,016,018

|

||||||

|

6,229,119

|

||||||||

|

Motor Vehicle and Parts Dealers – 0.00%

|

||||||||

|

Lithia Motors, Inc.

|

115

|

13,127

|

||||||

|

Nonstore Retailers – 4.24%

|

||||||||

|

Amazon.com, Inc. (a)

|

6,054

|

10,746,274

|

||||||

|

Natural Health Trends Corp.

|

1,673

|

17,031

|

||||||

|

Systemax, Inc.

|

16,729

|

344,450

|

||||||

|

WW Grainger, Inc.

|

90

|

23,552

|

||||||

|

11,131,307

|

||||||||

|

Oil and Gas Extraction – 1.16%

|

||||||||

|

Evolution Petroleum Corp.

|

40,540

|

247,699

|

||||||

|

Renewable Energy Group, Inc. (a)

|

178,748

|

2,795,619

|

||||||

|

3,043,318

|

||||||||

|

Other Information Services – 3.77%

|

||||||||

|

Chegg, Inc. (a)

|

71,560

|

2,680,638

|

||||||

|

Facebook, Inc. (a)

|

24,916

|

4,421,843

|

||||||

|

QuinStreet, Inc. (a)

|

130,686

|

2,003,416

|

||||||

|

Travelzoo (a)

|

798

|

13,574

|

||||||

|

Twitter, Inc. (a)

|

17,121

|

623,889

|

||||||

|

VeriSign, Inc. (a)

|

750

|

146,235

|

||||||

|

Yelp, Inc. (a)

|

276

|

8,481

|

||||||

|

9,898,076

|

||||||||

|

Paper Manufacturing – 0.76%

|

||||||||

|

Veritiv Corp. (a)

|

113

|

1,996

|

||||||

|

Verso Corp. (a)

|

115,468

|

1,988,359

|

||||||

|

1,990,355

|

||||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Primary Metal Manufacturing – 0.05%

|

||||||||

|

Global Brass & Copper Holdings, Inc.

|

350

|

$

|

15,270

|

|||||

|

Olympic Steel, Inc.

|

9,542

|

118,130

|

||||||

|

133,400

|

||||||||

|

Professional, Scientific, and Technical Services – 6.50%

|

||||||||

|

Amgen, Inc.

|

3,682

|

613,789

|

||||||

|

Arrowhead Pharmaceuticals, Inc. (a)

|

4,374

|

103,708

|

||||||

|

Cadence Design Systems, Inc. (a)

|

4,307

|

273,796

|

||||||

|

eBay, Inc.

|

370

|

13,294

|

||||||

|

Hackett Group, Inc.

|

2,561

|

41,206

|

||||||

|

Insperity, Inc.

|

29,758

|

3,389,436

|

||||||

|

Itron, Inc. (a)

|

363

|

20,564

|

||||||

|

LivePerson, Inc. (a)

|

22,491

|

625,925

|

||||||

|

Okta, Inc. (a)

|

8,323

|

942,330

|

||||||

|

salesforce.com, Inc. (a)

|

12,556

|

1,901,104

|

||||||

|

SecureWorks Corp. (a)(c)

|

20,416

|

298,278

|

||||||

|

Trade Desk, Inc. (a)

|

224

|

44,533

|

||||||

|

VMware, Inc. (a)

|

49,650

|

8,787,057

|

||||||

|

17,055,020

|

||||||||

|

Publishing Industries (except Internet) – 11.99%

|

||||||||

|

Adobe, Inc. (a)

|

11,597

|

3,141,627

|

||||||

|

DXC Technology Co.

|

445

|

21,155

|

||||||

|

eGain Corp. (a)

|

21,500

|

169,420

|

||||||

|

EPAM Systems, Inc. (a)

|

1,225

|

211,423

|

||||||

|

ePlus, Inc. (a)

|

4,572

|

323,058

|

||||||

|

Fair Isaac Corp. (a)

|

1,000

|

295,900

|

||||||

|

InterActiveCorp (a)

|

22,322

|

4,929,814

|

||||||

|

Intuit, Inc.

|

25,000

|

6,121,250

|

||||||

|

Microsoft Corp.

|

115,806

|

14,322,886

|

||||||

|

News Corp.

|

852

|

9,704

|

||||||

|

Oracle Corp.

|

20,000

|

1,012,000

|

||||||

|

Red Hat, Inc. (a)

|

123

|

22,669

|

||||||

|

Synopsys, Inc. (a)

|

1,000

|

116,440

|

||||||

|

Twilio, Inc. (a)

|

1,279

|

168,815

|

||||||

|

Workday, Inc. (a)

|

160

|

32,659

|

||||||

|

Workiva, Inc. (a)

|

10,000

|

556,400

|

||||||

|

31,455,220

|

||||||||

|

Rail Transportation – 0.02%

|

||||||||

|

CSX Corp.

|

321

|

23,905

|

||||||

|

Union Pacific Corp.

|

173

|

28,853

|

||||||

|

52,758

|

||||||||

|

Rental and Leasing Services – 1.27%

|

||||||||

|

Air Lease Corp.

|

16,515

|

594,540

|

||||||

|

Aircastle Ltd. (b)

|

22,939

|

445,475

|

||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Rental and Leasing Services – 1.27% (Continued)

|

||||||||

|

CAI International, Inc. (a)

|

41,913

|

$

|

943,881

|

|||||

|

Triton International Ltd. (b)

|

12,826

|

379,008

|

||||||

|

United Rentals, Inc. (a)

|

8,718

|

959,852

|

||||||

|

3,322,756

|

||||||||

|

Securities, Commodity Contracts, and Other

|

||||||||

|

Financial Investments and Related Activities – 1.07%

|

||||||||

|

CME Group, Inc.

|

145

|

27,857

|

||||||

|

MSCI, Inc.

|

678

|

149,167

|

||||||

|

S&P Global, Inc.

|

5,994

|

1,281,997

|

||||||

|

Yum China Holdings, Inc.

|

33,790

|

1,351,938

|

||||||

|

2,810,959

|

||||||||

|

Specialty Trade Contractors – 0.72%

|

||||||||

|

Armstrong Flooring, Inc. (a)

|

2,076

|

21,881

|

||||||

|

Comfort Systems USA, Inc.

|

763

|

35,998

|

||||||

|

Quanta Services, Inc.

|

52,756

|

1,833,799

|

||||||

|

1,891,678

|

||||||||

|

Support Activities for Mining – 0.00%

|

||||||||

|

Antero Resources Corp. (a)

|

924

|

6,071

|

||||||

|

Support Activities for Transportation – 0.01%

|

||||||||

|

Willis Lease Finance Corp. (a)

|

300

|

14,940

|

||||||

|

Telecommunications – 0.83%

|

||||||||

|

ARC Group Worldwide, Inc. (a)

|

1,500

|

728

|

||||||

|

AT&T, Inc.

|

8,113

|

248,096

|

||||||

|

T-Mobile US, Inc. (a)

|

6,578

|

483,088

|

||||||

|

Ubiquiti Networks, Inc. (c)

|

11,853

|

1,426,034

|

||||||

|

Vonage Holdings Corp. (a)

|

1,644

|

19,465

|

||||||

|

2,177,411

|

||||||||

|

Transportation Equipment Manufacturing – 2.62%

|

||||||||

|

Allison Transmission Holdings, Inc.

|

552

|

22,847

|

||||||

|

Boeing Co.

|

16,291

|

5,565,169

|

||||||

|

Commercial Vehicle Group, Inc. (a)

|

20,815

|

129,261

|

||||||

|

Lawson Products, Inc. (a)

|

3,160

|

115,909

|

||||||

|

Lear Corp.

|

7,500

|

892,725

|

||||||

|

Marine Products Corp.

|

7,973

|

110,346

|

||||||

|

Meritor, Inc. (a)

|

2,416

|

48,707

|

||||||

|

6,884,964

|

||||||||

|

Total Common Stocks (Cost $174,014,069)

|

262,650,274

|

|||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

RIGHTS – 0.00%

|

||||||||

|

Newstar Financial, Inc. CVR (a)(d)(e)

|

4,036

|

$

|

2,341

|

|||||

|

Total Rights (Cost $0)

|

2,341

|

|||||||

|

INVESTMENTS PURCHASED WITH PROCEEDS

|

||||||||

|

FROM SECURITIES LENDING – 0.57%

|

||||||||

|

Money Market Fund – 0.57%

|

||||||||

|

First American Government Obligations Fund, Class Y, 2.000% (f)

|

1,489,918

|

1,489,918

|

||||||

|

Total Investments Purchased with Proceeds

|

||||||||

|

from Securities Lending (Cost 1,489,918)

|

1,489,918

|

|||||||

|

SHORT-TERM INVESTMENTS – 0.00%

|

||||||||

|

Money Market Fund – 0.00%

|

||||||||

|

First American Treasury Obligations Fund, Class X, 2.297% (f)

|

681

|

681

|

||||||

|

Total Short-Term Investments (Cost $681)

|

681

|

|||||||

|

Total Investments (Cost $175,504,668) – 100.65%

|

264,143,214

|

|||||||

|

Liabilities in Excess of Other Assets – (0.65)%

|

(1,693,875

|

)

|

||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

262,449,339

|

||||||

|

(a)

|

Non-income producing security.

|

|

(b)

|

Foreign issued security.

|

|

(c)

|

All or a portion of this security is out on loan as of May 31, 2019. Total value of securities out on loan is $1,393,836.

|

|

(d)

|

Illiquid security. The total market value of this security was $2,341, representing 0.00% of net assets.

|

|

(e)

|

Fair valued security. Value determined using significant unobservable inputs.

|

|

(f)

|

Seven day yield as of May 31, 2019.

|

|

Abbreviations:

|

|

|

Ltd.

|

Limited is a term indicating a company is incorporated and shareholder have limited liability.

|

|

NV

|

Naamloze Vennootschap is a Dutch term for publicly traded companies.

|

|

PLC

|

Public Limited Company is a publicly traded company which signifies that shareholders have limited liability.

|

|

SA

|

An abbreviation used by many countries to signify a stock company whereby shareholders have limited liability.

|

|

Schedule of Investments

|

|

Shares

|

Value

|

|||||||

|

COMMON STOCKS – 98.98%

|

||||||||

|

Australia – 10.36%

|

||||||||

|

BHP Billiton Ltd.

|

327,628

|

$

|

8,513,404

|

|||||

|

BlueScope Steel Ltd.

|

113,865

|

829,964

|

||||||

|

Caltex Australia Ltd.

|

1,202

|

21,962

|

||||||

|

CIMIC Group Ltd.

|

27,868

|

872,609

|

||||||

|

Coca-Cola Amatil Ltd.

|

154,205

|

1,017,430

|

||||||

|

Cochlear Ltd.

|

162

|

22,395

|

||||||

|

Coles Group Ltd. (a)

|

608

|

5,232

|

||||||

|

CSL Ltd.

|

77

|

10,940

|

||||||

|

Insurance Australia Group Ltd.

|

117,465

|

621,461

|

||||||

|

Macquarie Group Ltd.

|

264

|

21,965

|

||||||

|

Medibank Private Ltd.

|

923,732

|

2,113,846

|

||||||

|

Qantas Airways Ltd.

|

153,654

|

590,827

|

||||||

|

QBE Insurance Group Ltd.

|

2,590

|

20,891

|

||||||

|

Rio Tinto Ltd.

|

87,852

|

6,097,276

|

||||||

|

Santos Ltd.

|

4,571

|

21,257

|

||||||

|

Sonic Healthcare Ltd.

|

1,211

|

21,921

|

||||||

|

South32 Ltd.

|

435,897

|

999,763

|

||||||

|

Washington H Soul Pattinson & Co. Ltd.

|

41,302

|

636,231

|

||||||

|

Wesfarmers Ltd.

|

608

|

15,586

|

||||||

|

Woolworths Group Ltd.

|

7,887

|

171,108

|

||||||

|

22,626,068

|

||||||||

|

Austria – 0.23%

|

||||||||

|

ANDRITZ AG

|

594

|

21,360

|

||||||

|

Verbund AG

|

9,600

|

479,940

|

||||||

|

501,300

|

||||||||

|

Belgium – 3.64%

|

||||||||

|

Colruyt SA

|

82,841

|

6,168,106

|

||||||

|

UCB SA

|

23,264

|

1,778,536

|

||||||

|

7,946,642

|

||||||||

|

Bermuda – 1.82%

|

||||||||

|

Jardine Strategic Holdings Ltd.

|

43,265

|

1,619,317

|

||||||

|

NWS Holdings Ltd.

|

1,197,863

|

2,360,380

|

||||||

|

3,979,697

|

||||||||

|

Cayman Islands – 0.54%

|

||||||||

|

WH Group Ltd. (b)

|

1,304,314

|

1,174,056

|

||||||

|

Denmark – 3.99%

|

||||||||

|

Coloplast A/S

|

16,733

|

1,777,711

|

||||||

|

H Lundbeck A/S

|

38,826

|

1,557,685

|

||||||

|

Novo Nordisk A/S

|

113,660

|

5,348,651

|

||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Denmark – 3.99% (Continued)

|

||||||||

|

Vestas Wind System A/S

|

185

|

$

|

15,061

|

|||||

|

Demant A/S (a)

|

340

|

11,355

|

||||||

|

8,710,463

|

||||||||

|

Finland – 1.43%

|

||||||||

|

Elisa OYJ

|

237

|

10,569

|

||||||

|

Metso OYJ

|

757

|

24,425

|

||||||

|

Neste OYJ

|

87,345

|

2,948,665

|

||||||

|

Orion OYJ

|

3,742

|

122,394

|

||||||

|

Stora Enso OYJ

|

2,458

|

25,948

|

||||||

|

3,132,001

|

||||||||

|

France – 10.28%

|

||||||||

|

Aeroports de Paris

|

55

|

9,418

|

||||||

|

Alstom SA

|

156,133

|

7,125,486

|

||||||

|

Arkema SA

|

111

|

9,308

|

||||||

|

Atos SE

|

6,067

|

461,481

|

||||||

|

Bouygues SA

|

14,753

|

515,769

|

||||||

|

Dassault Systemes SE

|

8,374

|

1,242,500

|

||||||

|

Edenred

|

14,389

|

656,414

|

||||||

|

Eiffage SA

|

3,500

|

334,588

|

||||||

|

Eurazeo SA

|

9,556

|

668,665

|

||||||

|

Hermes International

|

1,348

|

895,698

|

||||||

|

Ingenico Group SA

|

270

|

21,542

|

||||||

|

Ipsen SA

|

86

|

10,274

|

||||||

|

Kering SA

|

1,433

|

745,877

|

||||||

|

Legrand SA

|

1,384

|

93,039

|

||||||

|

L’Oreal SA

|

3,638

|

976,009

|

||||||

|

LVMH Moet Hennessy Louis Vuitton SE

|

5,928

|

2,236,908

|

||||||

|

Pernod Ricard SA

|

2,332

|

411,152

|

||||||

|

Peugeot SA

|

90,096

|

2,010,961

|

||||||

|

Remy Cointreau SA

|

5,147

|

707,250

|

||||||

|

Rexel SA

|

58,174

|

627,805

|

||||||

|

Safran SA

|

3,830

|

502,517

|

||||||

|

Sartorius Stedim Biotech

|

2,277

|

315,464

|

||||||

|

SCOR SE

|

29,216

|

1,201,978

|

||||||

|

Societe BIC SA

|

5,722

|

447,750

|

||||||

|

Sodexo SA

|

193

|

22,208

|

||||||

|

Thales SA

|

200

|

22,017

|

||||||

|

Ubisoft Entertainment SA (a)

|

227

|

18,550

|

||||||

|

Veolia Environnement SA

|

984

|

22,775

|

||||||

|

Worldline SA (a)(b)

|

2,426

|

145,564

|

||||||

|

22,458,967

|

||||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Germany – 8.56%

|

||||||||

|

Adidas AG

|

10,126

|

$

|

2,890,766

|

|||||

|

Beiersdorf AG

|

190

|

21,863

|

||||||

|

Commerzbank AG

|

68,274

|

478,457

|

||||||

|

Continental AG

|

136

|

18,496

|

||||||

|

Daimler AG

|

564

|

29,231

|

||||||

|

Deutsche Boerse AG

|

938

|

129,097

|

||||||

|

Deutsche Lufthansa AG

|

71,132

|

1,348,794

|

||||||

|

Deutsche Post AG

|

26,669

|

784,620

|

||||||

|

E.ON SE

|

50,000

|

522,775

|

||||||

|

Fresenius Medical Care AG & Co. KGaA

|

1,091

|

79,503

|

||||||

|

Henkel AG & Co. KGaA

|

4,143

|

358,905

|

||||||

|

HUGO BOSS AG

|

13,395

|

777,109

|

||||||

|

Infineon Technologies AG

|

9,849

|

175,412

|

||||||

|

Kabel Deutschland Holding AG

|

7,275

|

870,065

|

||||||

|

MTU Aero Engines AG

|

5,806

|

1,252,518

|

||||||

|

Porsche Automobil Holding SE – Preference Shares

|

12,051

|

747,784

|

||||||

|

Puma SE

|

5,232

|

3,042,302

|

||||||

|

RWE AG

|

80,223

|

2,007,048

|

||||||

|

SAP SE

|

20,000

|

2,463,736

|

||||||

|

Siemens AG

|

2,400

|

271,562

|

||||||

|

Wirecard AG

|

2,764

|

431,969

|

||||||

|

18,702,012

|

||||||||

|

Hong Kong – 2.24%

|

||||||||

|

AIA Group Ltd.

|

164,754

|

1,547,734

|

||||||

|

HKT Trust & HKT Ltd.

|

489,275

|

771,401

|

||||||

|

SJM Holdings Ltd.

|

1,261,087

|

1,398,010

|

||||||

|

Swire Pacific Ltd.

|

15,000

|

177,488

|

||||||

|

Techtronic Industries Co. Ltd.

|

157,215

|

1,003,607

|

||||||

|

4,898,240

|

||||||||

|

Ireland – 0.74%

|

||||||||

|

Kerry Group PLC

|

2,339

|

270,139

|

||||||

|

Kingspan Group PLC

|

25,703

|

1,339,808

|

||||||

|

1,609,947

|

||||||||

|

Israel – 0.89%

|

||||||||

|

Bank Leumi Le-Israel BM

|

4,909

|

32,892

|

||||||

|

Check Point Software Technologies Ltd. (a)

|

1,558

|

171,816

|

||||||

|

Israel Chemicals Ltd.

|

83,061

|

416,110

|

||||||

|

Mizrahi Tefahot Bank Ltd. (a)

|

56,633

|

1,238,680

|

||||||

|

Nice Ltd. (a)

|

179

|

24,993

|

||||||

|

Taro Pharmaceutical Industries Ltd. (a)

|

707

|

65,737

|

||||||

|

1,950,228

|

||||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Italy – 0.63%

|

||||||||

|

Leonardo SpA

|

67,579

|

$

|

747,615

|

|||||

|

Moncler SpA

|

16,518

|

606,894

|

||||||

|

Rizzoli Corriere Della Sera Mediagroup SpA

|

14,241

|

14,063

|

||||||

|

Saipem SpA (a)

|

131

|

558

|

||||||

|

1,369,130

|

||||||||

|

Japan – 14.63%

|

||||||||

|

Alfresa Holdings Corp.

|

104,941

|

2,624,119

|

||||||

|

Astellas Pharma, Inc.

|

1,586

|

21,254

|

||||||

|

Bandai Namco Holdings, Inc.

|

10,000

|

489,590

|

||||||

|

Calbee, Inc.

|

341

|

9,670

|

||||||

|

Daifuku Co Ltd.

|

3,398

|

169,032

|

||||||

|

Daiichi Sankyo Co Ltd.

|

38,192

|

1,842,199

|

||||||

|

FUJIFILM Holdings Corp.

|

2,360

|

112,454

|

||||||

|

Fujitsu Ltd.

|

23,922

|

1,612,695

|

||||||

|

Hitachi Chemical Co. Ltd.

|

819

|

21,750

|

||||||

|

Hitachi Construction Machinery Co. Ltd.

|

761

|

17,570

|

||||||

|

Hitachi High-Technologies Corp.

|

6,000

|

253,008

|

||||||

|

Hitachi Ltd.

|

30,296

|

1,020,155

|

||||||

|

Hoya Corp.

|

7,488

|

518,311

|

||||||

|

ITOCHU Corp.

|

110,730

|

2,032,820

|

||||||

|

Kakaku.com, Inc.

|

44,182

|

891,014

|

||||||

|

Kaneka Corp.

|

500

|

17,156

|

||||||

|

Keio Corp.

|

313

|

20,841

|

||||||

|

Keisei Electric Railway Co. Ltd.

|

593

|

22,107

|

||||||

|

Kikkoman Corp.

|

22,607

|

934,528

|

||||||

|

Kose Corp.

|

12,518

|

1,967,906

|

||||||

|

Marui Group Co Ltd.

|

25,000

|

519,862

|

||||||

|

Mitsui Chemicals, Inc.

|

394

|

8,597

|

||||||

|

MonotaRO Co Ltd.

|

6,395

|

135,073

|

||||||

|

Nabtesco Corp.

|

577

|

14,371

|

||||||

|

Nagoya Railroad Co. Ltd.

|

707

|

19,464

|

||||||

|

Nexon Co. Ltd. (a)

|

1,342

|

19,905

|

||||||

|

NGK Insulators Ltd.

|

6,093

|

82,284

|

||||||

|

NGK Spark Plug Co. Ltd.

|

931

|

16,250

|

||||||

|

Nisshin Seifun Group, Inc.

|

30,000

|

696,668

|

||||||

|

NSK Ltd.

|

2,274

|

18,145

|

||||||

|

Omron Corp.

|

11,015

|

518,382

|

||||||

|

Pan Pacific International Holdings Corp.

|

2,944

|

181,564

|

||||||

|

Pola Orbis Holdings, Inc.

|

23,695

|

649,841

|

||||||

|

Rakuten, Inc.

|

67,955

|

702,623

|

||||||

|

Ryohin Keikaku Co. Ltd.

|

68

|

12,265

|

||||||

|

SBI Holdings, Inc.

|

8,349

|

191,585

|

||||||

|

SG Holdings Co Ltd.

|

43,801

|

1,182,953

|

||||||

|

Shimizu Corp.

|

11,544

|

93,738

|

||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Japan – 14.63% (Continued)

|

||||||||

|

Shionogi & Co. Ltd.

|

6,447

|

$

|

351,525

|

|||||

|

Shiseido Co. Ltd.

|

37,576

|

2,695,880

|

||||||

|

Showa Denko KK

|

39,284

|

1,065,326

|

||||||

|

SMC Corp/Japan

|

66

|

21,513

|

||||||

|

SoftBank Group Corp.

|

12,116

|

1,124,153

|

||||||

|

Subaru Corp.

|

38

|

878

|

||||||

|

Sumitomo Dainippon Pharma Co. Ltd.

|

143,323

|

2,928,496

|

||||||

|

Suzuken Co. Ltd.

|

43,551

|

2,678,216

|

||||||

|

Toho Co. Ltd.

|

513

|

21,986

|

||||||

|

Toho Gas Co Ltd.

|

553

|

21,543

|

||||||

|

Unicharm Corp.

|

15,955

|

475,945

|

||||||

|

Yamaha Corp.

|

919

|

41,126

|

||||||

|

Yamazaki Baking Co. Ltd.

|

1,392

|

20,852

|

||||||

|

Yokogawa Electric Corp.

|

42,853

|

827,408

|

||||||

|

ZOZO, Inc.

|

1,013

|

17,316

|

||||||

|

31,953,912

|

||||||||

|

Jersey – 0.31%

|

||||||||

|

Experian PLC

|

4,542

|

136,875

|

||||||

|

Ferguson PLC

|

5,524

|

357,037

|

||||||

|

Glencore PLC

|

58,027

|

185,668

|

||||||

|

679,580

|

||||||||

|

Luxembourg – 0.00%

|

||||||||

|

Tenaris SA

|

636

|

7,448

|

||||||

|

Netherlands – 8.59%

|

||||||||

|

Airbus SE

|

3,828

|

490,114

|

||||||

|

ASML Holding NV

|

8,000

|

1,506,043

|

||||||

|

Ferrari NV

|

72

|

10,236

|

||||||

|

Fiat Chrysler Automobiles NV

|

31,810

|

405,105

|

||||||

|

Heineken Holding NV

|

16,716

|

1,653,934

|

||||||

|

Heineken NV

|

287

|

30,125

|

||||||

|

ING Groep NV

|

180

|

1,944

|

||||||

|

Koninklijke DSM NV

|

4,688

|

525,921

|

||||||

|

Koninklijke KPN NV

|

844,730

|

2,578,920

|

||||||

|

Koninklijke Philips NV

|

46,015

|

1,823,572

|

||||||

|

Koninklijke Vopak NV

|

19,115

|

782,985

|

||||||

|

NN Group NV (c)

|

74,158

|

2,815,113

|

||||||

|

Randstad NV (a)

|

1,208

|

62,185

|

||||||

|

STMicroelectronics NV

|

818

|

12,369

|

||||||

|

Unilever NV

|

25,005

|

1,505,146

|

||||||

|

Wolters Kluwer NV

|

65,278

|

4,554,022

|

||||||

|

18,757,734

|

||||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

New Zealand – 0.41%

|

||||||||

|

a2 Milk Co. Ltd. (a)

|

82,400

|

$

|

849,036

|

|||||

|

Mercury NZ Ltd.

|

10,033

|

25,247

|

||||||

|

Spark New Zealand Ltd.

|

8,874

|

22,114

|

||||||

|

896,397

|

||||||||

|

Norway – 0.95%

|

||||||||

|

Equinor ASA

|

21,276

|

406,411

|

||||||

|

Marine Harvest ASA

|

26,016

|

603,713

|

||||||

|

Norsk Hydro ASA

|

31,302

|

109,413

|

||||||

|

Orkla ASA

|

109,452

|

947,843

|

||||||

|

2,067,380

|

||||||||

|

Portugal – 0.01%

|

||||||||

|

Galp Energia SGPS SA

|

1,378

|

20,700

|

||||||

|

Singapore – 1.47%

|

||||||||

|

ComfortDelGro Corp. Ltd.

|

528,170

|

946,472

|

||||||

|

Fraser & Neave Ltd.

|

14,289

|

17,976

|

||||||

|

Genting Singapore Ltd.

|

28,527

|

18,043

|

||||||

|

Sembcorp Industries Ltd.

|

337,143

|

590,900

|

||||||

|

United Overseas Bank Ltd.

|

23,900

|

409,415

|

||||||

|

Wilmar International Ltd.

|

511,058

|

1,223,774

|

||||||

|

3,206,580

|

||||||||

|

Spain – 1.47%

|

||||||||

|

Aena SME SA (b)

|

2,076

|

381,208

|

||||||

|

Amadeus IT Group SA (a)

|

15,921

|

1,214,455

|

||||||

|

CaixaBank SA

|

156,566

|

481,005

|

||||||

|

Ferrovial SA

|

8,751

|

208,584

|

||||||

|

Industria de Diseno Textil SA

|

367

|

9,801

|

||||||

|

Red Electrica Corp. SA

|

43,045

|

912,357

|

||||||

|

3,207,410

|

||||||||

|

Sweden – 4.83%

|

||||||||

|

Atlas Copco AB – Class A

|

556

|

14,922

|

||||||

|

Atlas Copco AB – Class B

|

623

|

15,059

|

||||||

|

Boliden AB

|

46,738

|

1,063,515

|

||||||

|

Epiroc AB – Class A

|

556

|

5,171

|

||||||

|

Epiroc AB – Class B

|

623

|

5,632

|

||||||

|

Essity AB

|

5,840

|

171,349

|

||||||

|

Holmen AB

|

606

|

11,752

|

||||||

|

Industrivarden AB

|

517

|

10,429

|

||||||

|

Investor AB

|

41,904

|

1,809,784

|

||||||

|

Kinnevik AB

|

835

|

21,267

|

||||||

|

Lundin Petroleum AB

|

37,711

|

1,023,088

|

||||||

|

Sandvik AB

|

31,528

|

486,688

|

||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Sweden – 4.83% (Continued)

|

||||||||

|

Swedish Match AB

|

102,895

|

$

|

4,644,658

|

|||||

|

Telefonaktiebolaget LM Ericsson

|

130,941

|

1,259,874

|

||||||

|

10,543,188

|

||||||||

|

Switzerland – 10.35%

|

||||||||

|

Adecco Group AG

|

26,696

|

1,441,057

|

||||||

|

Alcon, Inc. (a)

|

16,422

|

955,059

|

||||||

|

Cie Financiere Richemont SA

|

296

|

21,774

|

||||||

|

Coca-Cola HBC AG (a)

|

4,221

|

151,951

|

||||||

|

Credit Suisse Group AG (a)

|

18,424

|

208,466

|

||||||

|

Kuehne + Nagel International AG

|

5,000

|

665,029

|

||||||

|

Nestle SA

|

39,128

|

3,881,449

|

||||||

|

Novartis AG

|

82,111

|

7,056,452

|

||||||

|

Roche Holding AG

|

21,277

|

5,588,449

|

||||||

|

SGS SA

|

369

|

930,705

|

||||||

|

Sika AG

|

600

|

88,964

|

||||||

|

Sonova Holding AG

|

267

|

59,452

|

||||||

|

Swatch Group AG

|

281

|

13,576

|

||||||

|

Temenos AG (a)

|

8,444

|

1,469,134

|

||||||

|

UBS Group AG (a)

|

3,540

|

40,738

|

||||||

|

Vifor Pharma AG

|

159

|

21,997

|

||||||

|

22,594,252

|

||||||||

|

United Kingdom – 10.59%

|

||||||||

|

3i Group PLC

|

227,186

|

3,015,912

|

||||||

|

Anglo American PLC

|

42,959

|

1,027,737

|

||||||

|

Ashtead Group PLC

|

353

|

8,287

|

||||||

|

AstraZeneca PLC

|

1,797

|

132,426

|

||||||

|

Auto Trader Group PLC (b)

|

317,889

|

2,403,205

|

||||||

|

Berkeley Group Holdings PLC

|

45,540

|

2,013,146

|

||||||

|

BP PLC

|

75,000

|

508,184

|

||||||

|

Burberry Group PLC

|

72,780

|

1,557,775

|

||||||

|

Carnival PLC

|

114,435

|

5,699,110

|

||||||

|

Croda International PLC

|

339

|

21,694

|

||||||

|

Hargreaves Lansdown PLC

|

1,004

|

28,655

|

||||||

|

InterContinental Hotels Group PLC

|

180

|

11,595

|

||||||

|

ITV PLC

|

11,855

|

16,052

|

||||||

|

Kingfisher PLC

|

2,816

|

7,593

|

||||||

|

London Stock Exchange Group PLC

|

178

|

11,885

|

||||||

|

Next PLC

|

35,402

|

2,580,652

|

||||||

|

Pearson PLC

|

60,345

|

600,654

|

||||||

|

Persimmon PLC

|

26,733

|

664,992

|

||||||

|

RELX PLC – London Stock Exchange

|

951

|

22,126

|

||||||

|

Rio Tinto PLC

|

1,017

|

58,318

|

||||||

|

Sage Group PLC

|

64,982

|

612,658

|

||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

United Kingdom – 10.59% (Continued)

|

||||||||

|

Smith & Nephew PLC

|

8,263

|

$

|

173,596

|

|||||

|

Smiths Group PLC

|

496

|

9,012

|

||||||

|

Tate & Lyle PLC

|

5,289

|

48,278

|

||||||

|

Unilever PLC

|

30,951

|

1,888,197

|

||||||

|

23,121,739

|

||||||||

|

United States – 0.02%

|

||||||||

|

Ball Corp.

|

540

|

33,240

|

||||||

|

Total Common Stocks (Cost $196,164,001)

|

216,148,311

|

|||||||

|

INVESTMENTS PURCHASED WITH PROCEEDS

|

||||||||

|

FROM SECURITIES LENDING – 1.42%

|

||||||||

|

Money Market Fund – 1.42%

|

||||||||

|

First American Government Obligations Fund, Class Y, 2.000% (d)

|

3,101,826

|

3,101,826

|

||||||

|

Total Investments Purchased with Proceeds

|

||||||||

|

from Securities Lending (Cost 3,101,826)

|

3,101,826

|

|||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

SHORT-TERM INVESTMENTS – 0.34%

|

||||||||

|

Money Market Fund – 0.34%

|

||||||||

|

First American Treasury Obligations Fund, Class X, 2.297% (d)

|

737,888

|

$

|

737,888

|

|||||

|

Total Short-Term Investments (Cost $737,888)

|

737,888

|

|||||||

|

Total Investments (Cost $200,003,715) – 100.74%

|

219,988,025

|

|||||||

|

Liabilities in Excess of Other Assets – (0.74)%

|

(1,615,293

|

)

|

||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

218,372,732

|

||||||

|

(a)

|

Non-income producing security.

|

|

(b)

|

Securities issued pursuant to Rule 144A under the Securities Act of 1933. Such securities are deemed to be liquid and the aggregate value, $4,104,033, represents 1.18% of net assets.

|

|

(c)

|

All or a portion of this security is out on loan as of May 31, 2019. Total value of securities out on loan is $2,783,215.

|

|

(d)

|

Seven day yield as of May 31, 2019.

|

|

Abbreviations:

|

|

|

A/S

|

Aktieselskap is the Danish term for a stock company, which signifies that shareholders have limited liability.

|

|

AB

|

Aktiebolag is the Swedish term for stock company.

|

|

AG

|

Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e. owned by shareholders.

|

|

ASA

|

Allmennaksjeselskap is a Norwegian term which signifies that the company is listed in the stock-exchange.

|

|

BM

|

An abbreviation that refers to a limited liability company.

|

|

KGaA

|

Kommanditgesellschaft auf Aktien is a German term that refers to a Limited Partnership that has shares.

|

|

Ltd.

|

Limited is a term indicating a company is incorporated and shareholders have limited liability.

|

|

NV

|

Naamloze Vennootschap is a Dutch term for publicly traded companies.

|

|

OYJ

|

Julkinen osakeyhtiö is the Finnish term for publicly-traded companies.

|

|

PLC

|

Public Limited Company is a publicly traded company which signifies that shareholders have limited liability.

|

|

SA

|

An abbreviation used by many countries to signify a stock company whereby shareholders have limited liability.

|

|

SE

|

Societas Europaea is a term for a European Public Limited Liability Company.

|

|

SGPS

|

Sociedade gestora de participacoes socialis is a Portugese term for a holding enterprise.

|

|

SpA

|

Società per Azioni is the Italian term for a limited share company.

|

|

Schedule of Investments

|

|

Shares

|

Value

|

|||||||

|

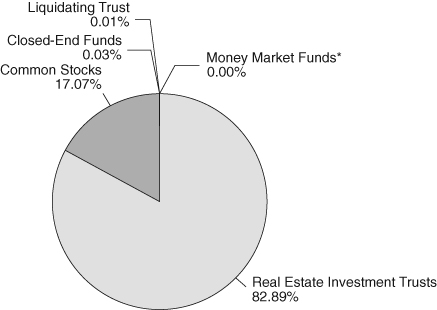

COMMON STOCKS – 17.08%

|

||||||||

|

Australia – 0.00%

|

||||||||

|

OneMarket Ltd. (a)

|

3,750

|

$

|

2,068

|

|||||

|

Bermuda – 0.66%

|

||||||||

|

Hongkong Land Holdings Ltd.

|

131,973

|

861,142

|

||||||

|

Sinolink Worldwide Holdings Ltd. (a)

|

1,250,000

|

94,158

|

||||||

|

955,300

|

||||||||

|

Brazil – 0.31%

|

||||||||

|

BR Malls Participacoes SA

|

51,271

|

168,293

|

||||||

|

Construtora Tenda SA

|

39,630

|

203,909

|

||||||

|

Direcional Engenharia SA

|

27,778

|

70,437

|

||||||

|

442,639

|

||||||||

|

Canada – 0.15%

|

||||||||

|

Brookfield Property Partners LP

|

11,933

|

220,808

|

||||||

|

Cayman Islands – 0.19%

|

||||||||

|

Aoyuan Healthy Life Group Co. Ltd. (a)

|

4,888

|

2,481

|

||||||

|

Powerlong Real Estate Holdings Ltd.

|

595,061

|

270,002

|

||||||

|

272,483

|

||||||||

|

China – 0.10%

|

||||||||

|

Yuzhou Properties Co. Ltd.

|

325,480

|

148,305

|

||||||

|

Germany – 1.62%

|

||||||||

|

Deutsche Wohnen SE

|

12,775

|

603,071

|

||||||

|

DIC Asset AG

|

9,867

|

103,246

|

||||||

|

TAG Immobilien AG

|

23,056

|

541,105

|

||||||

|

TLG Immobilien AG

|

16,263

|

476,918

|

||||||

|

Vonovia SE

|

11,678

|

611,862

|

||||||

|

2,336,202

|

||||||||

|

Hong Kong – 5.91%

|

||||||||

|

China Aoyuan Group Ltd.

|

415,543

|

449,481

|

||||||

|

China Resources Land Ltd.

|

282,000

|

1,147,169

|

||||||

|

Gemdale Properties & Investment Corp Ltd.

|

6,650,633

|

798,150

|

||||||

|

Henderson Land Development Co. Ltd.

|

2,213

|

11,436

|

||||||

|

HKC Holdings Ltd.

|

26,889

|

18,390

|

||||||

|

Hopson Development Holdings Ltd.

|

256,232

|

256,175

|

||||||

|

Hysan Development Co. Ltd.

|

153,514

|

799,520

|

||||||

|

Kerry Properties Ltd.

|

181,270

|

689,018

|

||||||

|

Liu Chong Hing Investment Ltd.

|

13,337

|

20,328

|

||||||

|

Longfor Group Holdings Ltd.

|

112,216

|

413,381

|

||||||

|

New World Development Co. Ltd.

|

269,855

|

398,963

|

||||||

|

Poly Property Group Co. Ltd.

|

204,152

|

70,225

|

||||||

|

Schedule of Investments (Continued)

|

|

Shares

|

Value

|

|||||||

|

Hong Kong – 5.91% (Continued)

|

||||||||

|

Road King Infrastructure Ltd.

|

176,807

|

$

|

358,592

|

|||||

|

Shanghai Industrial Urban Development Group Ltd.

|

326,585

|

60,414

|

||||||

|

Shui On Land Ltd.

|

866,903

|

196,541

|

||||||

|

Sino Land Co. Ltd.

|

591,923

|

947,223

|

||||||

|

Swire Properties Ltd.

|

113,902

|

469,736

|

||||||

|

Times China Holdings Ltd.

|

343,307

|

568,600

|

||||||

|

Wheelock & Co. Ltd.

|

129,609

|

855,587

|

||||||

|

8,528,929

|

||||||||

|

Indonesia – 0.07%

|

||||||||

|

Bumi Serpong Damai Tbk PT (a)

|

384,000

|

36,458

|

||||||

|

Ciputra Development Tbk PT

|

387,000

|

26,573

|

||||||

|

Pakuwon Jati Tbk PT

|

900,000

|

44,422