Table of Contents

Index to Financial Statements

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

For the fiscal year ended December 31, 2014

of

ARRIS GROUP, INC.

A Delaware Corporation

IRS Employer Identification No. 46-1965727

SEC File Number 000-31254

3871 Lakefield Drive

Suwanee, GA 30024

(678) 473-2000

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.01 par value — NASDAQ Global Market System

ARRIS Group, Inc. is a well-known seasoned issuer.

ARRIS Group, Inc. (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

Except as set forth in Item 10, ARRIS Group, Inc. is unaware of any delinquent filers pursuant to Item 405 of Regulation S-K.

ARRIS Group, Inc. is a large accelerated filer and is not a shell company.

ARRIS Group, Inc. is required to submit electronically and post on its corporate web site interactive data files required to be submitted and posted pursuant to Rule 405 of Regulation S-T.

The aggregate market value of ARRIS Group, Inc.’s Common Stock held by non-affiliates as of June 30, 2014 was approximately $4.6 billion (computed on the basis of the last reported sales price per share of such stock of $32.53 on the NASDAQ Global Market System). For these purposes, directors, officers and 10% shareholders have been assumed to be affiliates.

As of January 31, 2015, 145,161,490 shares of ARRIS Group, Inc.’s Common Stock were outstanding.

Portions of ARRIS Group, Inc.’s Proxy Statement for its 2015 Annual Meeting of Stockholders are incorporated by reference into Part III.

Table of Contents

Index to Financial Statements

i

Table of Contents

Index to Financial Statements

PART I

| Item 1. | Business |

As used in this Annual Report, unless the context requires otherwise, “we,” “our,” “us,” “the Company,” and “ARRIS” refer to ARRIS Group, Inc. (and its predecessors) and our consolidated subsidiaries.

General

Our principal executive offices are located at 3871 Lakefield Drive, Suwanee, Georgia 30024, and our telephone number is (678) 473-2000. We maintain a website at www.arris.com. The information contained on our website is not part of, and is not incorporated by reference into, this Form 10-K. On our website, we provide links to copies of the annual, quarterly and current reports that we file with the Securities and Exchange Commission (“SEC”), Section 16 reports that our officers and directors file with the SEC, any amendments to those reports, proxy materials for meetings of our shareholders, and all Company news releases. Investor presentations are also frequently posted on our website. Copies of our code of ethics and the charters of our standing board committees also are available on our website. We will provide investors copies of these documents in electronic or paper form upon request, free of charge. We will disclose on our website or on a Current Report on Form 8-K any waivers or amendments to our code of ethics made with respect to our directors and executive officers.

Glossary of Terms

Below are commonly used acronyms in our industry and their meanings:

| Acronym |

Terminology | |

| AdVOD |

Linear and Demand Oriented Advertising | |

| ARPU |

Average Revenue Per User | |

| BEQ |

Broadband Edge QAM | |

| BSR |

Broadband Services Router | |

| Cable VoIP |

Cable Voice over Internet Protocol | |

| CAM |

Cable Access Module | |

| CBR |

Constant Bit Rate | |

| CCAP |

Converged Cable Access Platform | |

| CE |

Consumer Electronics | |

| CMS |

Content Management System | |

| CMTS |

Cable Modem Termination System | |

| COTS |

Commercial Off the Shelf | |

| CPE |

Customer Premises Equipment | |

| CVeX |

Converged Video Exchange | |

| CWDM |

Coarse Wave Division Multiplexing | |

| DBS |

Digital Broadcast Satellite | |

| DCT |

Digital Consumer Terminal | |

|

DOCSIS® |

Data Over Cable Service Interface Specification | |

| DPI |

Digital Program Insertion | |

| DRM |

Digital Rights Management | |

| DSL |

Digital Subscriber Line | |

| DTA |

Digital Television Adapter | |

| DVB |

Digital Video Broadcasting | |

| DVR DWDM |

Digital Video Recorder Dense Wave Division Multiplexing | |

| EMTA |

Embedded Multimedia Terminal Adapter | |

| EPON |

Ethernet over Passive Optical Network | |

| eQAM |

Edge Quadrature Amplitude Modulator | |

| FPGA |

Field Programmable Gate Arrays | |

| FTTH |

Fiber to the Home | |

| FTTP |

Fiber to the Premises | |

| GAAP |

Generally Accepted Accounting Principles | |

| GHZ |

Gigahertz | |

| GPA |

General Purchase Agreements | |

| HD |

High Definition |

1

Table of Contents

Index to Financial Statements

| Acronym |

Terminology | |

| HD-DVR |

High Definition Digital Video Recorder | |

| HDTV |

High Definition Television | |

| HDR |

High Dynamic Range | |

| HEVC |

High Efficiency Video Coding | |

| HFC |

Hybrid Fiber-Coaxial | |

| IFRS |

International Financial Reporting Standards | |

| ILEC |

Incumbent Local Exchange Carrier | |

| IoT |

Internet of Things | |

| IP |

Internet Protocol | |

| IPR |

Intellectual Property Rights | |

| IPTV |

Internet Protocol Television | |

| IRD |

Integrated Receiver / Decoder | |

| LAN |

Local Area Network | |

| Mbps |

Megabits per Second | |

| MPEG |

Moving Picture Experts Group | |

| MPEG-2 |

Moving Picture Experts Group, Standard No. 2 | |

| MPEG-4 |

Moving Picture Experts Group, Standard No. 4 | |

| M-CMTS |

Modular CMTS | |

| MSO |

Multiple Systems Operator | |

| MSP |

Media Services Platform | |

| MTA |

Multimedia Terminal Adapter | |

| MVPD |

Multichannel Video Programming Distributors | |

| NGNA |

Next Generation Network Architecture | |

| NDVR |

Network Digital Video Recorder | |

| NPVR |

Network Personal Video Recorder | |

| NSM |

Network Service Manager | |

| NIU |

Network Interface Unit | |

| OLT |

Optical Line Termination | |

| ONU |

Optical Network Unit | |

| OEM |

Original Equipment manufacturer | |

| OSS |

Operations Support System | |

| OTT |

Over-the-Top | |

| PC |

Personal Computer | |

| PCS |

Post Contract Support | |

| PCT |

Patent Convention Treaty | |

| PON PSTN |

Passive Optical Network Public-Switched Telephone Network | |

| PVR QAM |

Personal Video Recorder Quadrature Amplitude Modulation | |

| QoS |

Quality of Service | |

| RDK |

Reference Design Kit | |

| RF |

Radio Frequency | |

| RFOG |

Radio Frequency over Glass | |

| RGU |

Revenue Generating Unit | |

| SCTE |

Society of Cable Telecommunication Engineers | |

| SD |

Standard Definition | |

| SDV |

Switched Digital Video | |

| SLA |

Service Level Agreement | |

| TVE |

TV Everywhere | |

| UHD |

Ultra High Definition | |

| Triple Play |

Bundled Offering of Internet, Telephone and TV | |

| VAR |

Value-Added Reseller | |

| VOD |

Video on Demand | |

| VoIP |

Voice over Internet Protocol | |

| VPN |

Virtual Private Network | |

| VSP |

Video Services Platform / Video Service Provider | |

| VSOE |

Vendor-Specific Objective Evidence |

2

Table of Contents

Index to Financial Statements

Overview

ARRIS is a global provider of entertainment and communications solutions. We are headquartered in Suwanee, Georgia. We operate in two business segments: Customer Premises Equipment (“CPE”) and Network & Cloud (“N&C”). We enable service providers including cable, telephone, and digital broadcast satellite operators and media programmers to deliver media, voice, and IP data services to their subscribers. We are a leader in set-tops, digital video and Internet Protocol Television (“IPTV”) distribution systems, broadband access infrastructure platforms, and associated data and voice CPE, which we also sell directly to consumers through retail channels. Our solutions are complemented by a broad array of services including technical support, repair and refurbishment, and system design and integration.

Industry Overview

Entertainment and communications delivery is evolving rapidly as a result of a convergence of trends — including increased competition among service providers, industry consolidation, advances in technology, and shifts in global content consumption behaviors.

Consumers have embraced new forms of content as well as new vehicles for consumption. Across the board, consumers are watching more content, more often, and on more devices. Both content and content delivery are evolving to address the demand. User-generated, streaming, and on-demand content continues to grow in popularity, facilitated by a burgeoning ecosystem of connected devices, including tablets, smartphones, media players, gaming consoles, IP set-tops, and smart TVs. The intersection of consumer demand for personalized content, growing libraries of media, and a broadening device ecosystem has yielded a ripe environment for popular new services like Over-the-Top (“OTT”), TV Everywhere (“TVE”), and multiscreen.

On the technology front, Internet Protocol (“IP”) video distribution is further transforming how content is managed and consumed. IP is not only facilitating new forms of video — like Ultra High-Definition (“UHD”) TV — and the ways in which video is delivered, but it is also accelerating the evolution of communications services, like interactive media and broadband. As a result, service providers are compelled to continually invest in and upgrade their network and expand their video, voice, data, and mobile services. Additional, a recent focus on delivering gigabit broadband speeds increases the need to scale networks to the growing demand for bandwidth as new video services like multiscreen video and always-on services like Internet of Things (“IoT”) continue to increase in popularity.

Providing these advanced services to consumers is a highly competitive business. This environment is driving service providers to enhance and expand their offerings by adding more high-definition (“HD”) channels, and now UHD content (also referred to as 4K or 8K), increasing data speeds and expanding mobile services to provide converged media experiences that bridge conventional TV and Internet services. This, in turn, is creating a market for regular video and broadband network upgrades as well as technology investment cycles in CPE, such as set-tops, data modems, and gateways.

Service providers continue to advance their capabilities to differentiate and gain market share. U.S. Cable operators and telcos are investing extensively to deploy enhanced user interfaces, higher broadband speeds, additional programming, integrated home networking and monitoring services, all with higher reliability. These cycles, combined with associated consumer trends and innovation in entertainment and communications delivery continues to accelerate industry growth.

Motorola Home Integration

Following our acquisition of the Motorola Home business from General Instrument Holdings, Inc., a subsidiary of Google, Inc. in 2013, ARRIS experienced significant growth in global scale and customer base and benefitted from an augmented engineering capability and product portfolio. As a result of the acquisition, ARRIS more than doubled in size and capitalized on many of the synergies between the two companies. Since then, we’ve focused on streamlining the combined businesses and assets, recently completing the major tasks of integrating order management, supply chain, IT, and finance. Today the overall process is nearly complete. We have phased out our Transition Service Agreements with Google and are moving forward as a single, unified company.

3

Table of Contents

Index to Financial Statements

Current Operating Segments

The completion of the Motorola Home acquisition changed the way that we manage and review the performance of our business. As a result, beginning with the periods ended June 30, 2013, we report two operating segments, (1) Network & Cloud and (2) Customer Premises Equipment. Corporate and other expenses not included in the measure of segment contribution will be reported in an “All Other” category. See Note 10 to our financial statements for additional information.

Our Strategy

Our long-term business strategy is aimed at growth and expansion with the goal of transforming the future of consumer entertainment and connectivity. ARRIS is achieving that by:

| • | Investing in global research and development |

| • | Advancing tomorrow’s consumer services and experiences |

| • | Deepening relationships with our customers |

| • | Gaining market share with new and existing service provider customers worldwide |

| • | Expanding the ARRIS product and solutions portfolio to serve satellite operators and grow retail channel sales |

| • | Enhancing the ARRIS brand |

Specific aspects of our strategy include:

| • | Leveraging ARRIS’ scale to drive profitable worldwide growth. With the integration of the Motorola Home business, ARRIS has achieved a new level of scale to drive efficiencies. Our expanded portfolio, broader customer base, and larger sales team, expose us to a greater portion of worldwide spending on products in our markets. |

| • | Capitalizing on the evolution toward network convergence and all IP platforms to drive business growth. New digital video services require IP-based infrastructure to reach consumers on their screen of choice. Service providers face a two-pronged challenge: meeting demand for these new services on legacy equipment, today, while transitioning equipment for tomorrow’s services to an all-IP model. ARRIS uniquely combines an end-to-end approach to the IP transition with an established footprint in the home and entrenched expertise in content delivery from the cloud to the home. Our end-to-end solutions give service providers a variety of choices for customizing their approach to the IP transition. They encompass network-based video transcoding, packaging, and compression technologies required to deliver new IP video formats; the cloud-based platforms to deliver robust and personalized user experiences; and a portfolio of video gateways that serve as the new hub for delivering IP-based entertainment to connected devices inside and outside the home. |

| • | Enabling differentiated and personalized multiscreen experiences through a holistic approach to content delivery. The growth of connected consumer devices has created an opportunity for service providers to deliver new, more personalized content experiences to consumers across multiple screens. These experiences require control over content distribution as well as seamless integration into multiple touchpoints in the consumer experience. The challenge of supporting these differentiated experiences and monetizing them is the focus of ARRIS’ end-to-end content delivery strategy which leverages our expertise across hardware and software solutions in the cloud, network, and home to provide a holistic approach to personalization that can transform the entertainment experience. |

| • | Investing in our product and service portfolios through organic development, partnership and acquisition. ARRIS has a comprehensive and robust development program designed to deliver new products to enhance our competitiveness and growth potential. We regularly evaluate opportunities to acquire capabilities that complement our internal research and development. We plan to continue targeting acquisition candidates that have complementary technology, products and talent. |

4

Table of Contents

Index to Financial Statements

| • | Expanding our international business and exploring adjacent market opportunities. ARRIS continuously seeks and analyzes investments in opportunities that allow us to capitalize on the growth of video and data services in global markets. Some examples include the growth of digital video and HDTV in Latin America, Europe, the Middle East and Africa (“EMEA”) and Asia as well as the demand for increased data speeds that are driving infrastructure investment. We also are pursuing opportunities in new and adjacent markets, including satellite and Telco. |

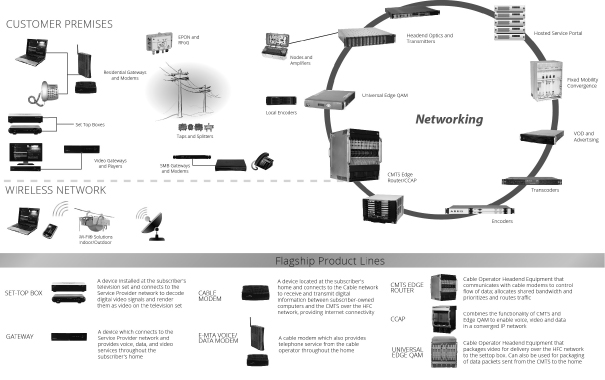

Our Principal Products

We provide cable network operators, telco service providers, content programmers and retailers with components of our broad product portfolio ranging from the cloud and headend solutions to CPE and global support services. A cross-section of our products in each of our two business segments Network & Cloud and Customer Premises Equipment are depicted below:

Network & Cloud

| • | CMTS/CCAP |

| • | The Cable Modem Termination System (“CMTS”) is cable operator headend equipment that communicates with cable modems to control the flow of data; allocates shared bandwidth and prioritizes and routes traffic. The Converged Cable Access Platform (“CCAP”) combines the functionality of a CMTS and an Edge QAM to enable voice, video and data in a converged IP network |

| • | Video Infrastructure |

| • | Multichannel Video Programming Distributors (“MVPD”) and Programmer Equipment that process and package video content for delivery over the service provider network to be received by a set-top or gateway. Includes encoding, compression, transcoding, storage, policy management, security and encryption, and signal modulation for HFC, DSL and/or fiber networks. |

| • | Ad Insertion Technologies supporting linear and on demand ad placement and substitution in MPEG and IP delivery environments. |

5

Table of Contents

Index to Financial Statements

| • | Access & Transport |

| • | Equipment in the ground or on transmission poles between service providers’ headend and subscribers’ premises, as well as equipment used to initiate the distribution of content-carrying signals. Includes optical transmission equipment, Fiber Nodes, RF Amplifiers and metro Wi-Fi wireless products. |

| • | Global Services |

| • | Technical support, professional services, and system integration offerings to enable solutions sales of our end-to-end product portfolio. |

| • | Cloud Solutions |

| • | Software products that enable providers to securely deliver rich user experiences; multiscreen recommendation, offer management, and advertising services. |

| • | Workforce management solutions enabling Service Providers to efficiently manage and dispatch field technicians. Network surveillance and issue correlation software and services. |

Customer Premises Equipment

| • | Set-Top |

| • | A device installed at the subscriber’s television set and connects to the service provider network to decode secure digital video signals and render them as video on the television set. |

| • | Gateway |

| • | A device that connects to the service provider network and delivers video, voice, and data services throughout the subscriber’s home. |

| • | DSL and Cable Modem |

| • | A device located at the subscriber’s home that connects to the cable or telco network to receive and transmit digital information between subscriber-owned devices (e.g. PC or tablet) and the service provider’s headend or central office, providing Internet connectivity. |

| • | E-MTA and Voice / Data Modem |

| • | A modem that also provides both data and telephone service from the service provider throughout the home. |

Sales and Marketing

Our sales, sales engineering and technical services team serve our global customers through offices in the U.S. and many of our global markets. Our sales engineering team assists customers in system design and specification. Our technical services team provides professional services to help network operators to design and keep their networks operating at peak performance. Additionally, we provide 24x7 technical support, directly and through channel partners, as well as training, both at our facilities and at our customers’ sites.

We work with value added resellers (“VARs”), sales representatives and channel partners that extend our sales presence into operator markets where we do not have established sales offices. We also maintain an inside sales group that is responsible for regular phone contact with the customer, prompt order entry, timely and accurate delivery, and effective sales administration.

We achieve superior customer service through advanced customer relationship management programs combined with information systems that allow us to provide personalized and timely customer support on a range of subjects and to continually refine operations management.

6

Table of Contents

Index to Financial Statements

Our marketing organization promotes both the ARRIS brand and our solutions to customers, consumers, and partners throughout the world. It is complemented by a product management team, which works with our engineering bench to develop and market new products and product enhancements. These teams are responsible for inventory levels, pricing, delivery requirements, market demand analysis, as well as product positioning, communications and advertising.

Customers

The majority of our sales are to facilities-based cable and telco multi-channel video service providers worldwide. As the U.S. cable and telecommunications industries continues a trend toward consolidation, our sales to the largest service providers continues to be crucial to our success. Our sales are substantially dependent upon a system operator’s selection of ARRIS’ network equipment, demand for increased broadband services by subscribers, and general capital expenditure levels by system operators. Our three largest customers (including their affiliates, as applicable) are Comcast, Time Warner Cable and AT&T. From time to time, the affiliates included in our revenues from these customers have changed as a result of mergers and acquisitions. Therefore, the revenue for our customers for prior periods has been adjusted to include, on a comparable basis for all periods presented, the affiliates currently understood to be under common control. Our sales to these customers for the last three years were (in thousands, except percentages):

| Years ended December 31, | ||||||||||||

| 2014 | 2013 | 2012 | ||||||||||

| Comcast and affiliates |

$ | 1,012,367 | $ | 674,977 | $ | 421,177 | ||||||

| % of sales |

19.0 | % | 18.6 | % | 31.1 | % | ||||||

| Time Warner Cable and affiliates |

$ | 693,736 | $ | 359,516 | $ | 243,157 | ||||||

| % of sales |

13.0 | % | 9.9 | % | 18.0 | % | ||||||

| AT&T and affiliates |

$ | 614,601 | $ | 280,225 | $ | 1,661 | ||||||

| % of sales |

11.5 | % | 7.7 | % | 0.1 | % | ||||||

ARRIS utilizes standard terms of sale. These standard terms of sale apply to all purchases except those to a few of our large customers with whom we have executed general purchase agreements (“GPAs”). These GPAs do not obligate the customer to a specific volume of business. The vast majority of our sales, whether to customers with GPAs or otherwise, result from periodic purchase orders. We have multiple agreements with our largest customers, including Comcast and Time Warner Cable, based upon their needs or as a result of prior acquisitions. We maintain these agreements in the normal course of our business.

International Operations

Our international revenue is generated primarily from Asia-Pacific, Europe, Middle East and Africa (“EMEA”) and Americas. The Asia-Pacific market includes Australia, China, Hong Kong, India, Japan, Korea, Singapore, and Taiwan. The EMEA market includes Austria, Belgium, France, Germany, Great Britain, Hungary, Ireland, Israel, Netherlands, Norway, Poland, Portugal, Romania, Russia, Spain, Sweden, Switzerland and Turkey. The Americas market includes Argentina, Bahamas, Brazil, Canada, Chile, Colombia, Costa Rica, Ecuador, Honduras, Jamaica, Mexico, Panama, Peru and Puerto Rico. Revenues from international customers were approximately 25.7%, 32.1%, and 24.6% of total revenues for 2014, 2013 and 2012, respectively.

We continue to strategically invest in worldwide marketing and sales efforts. We currently maintain international sales offices in Argentina, Brazil, Chile, China, Great Britain, Japan, Korea, Mexico, Netherlands and Spain.

7

Table of Contents

Index to Financial Statements

Research and Development

We operate in an industry that is subject to rapid changes in technology and our success is largely contingent upon anticipating such changes. Accordingly, we invest significantly in research and development. This commitment to innovation has resulted in the development of many instrumental next-generation consumer solutions like HD-DVR, WholeHome DVR/media server, in-home and metro Wi-Fi, IoT, 4K/UHD, and more. We continue to innovate in response to both our customers’ needs and developing industry trends, including:

| • | Transforming the Entertainment Experience — solving the complexity of delivering content to the burgeoning connected device ecosystem through scalable networking and connectivity solutions in the home. |

| • | Delivering Your Media, Your Way — anticipating demand for more personalized, relevant, and mobile experiences with end-to-end multiscreen solutions to personalize and monetize tomorrow’s content experiences. |

| • | Powering Smarter Networks — realizing the potential of today’s entertainment technology, enabling future services like UHD and multiscreen monetization, and transitioning to all-IP networks through powerful transcoding, bandwidth optimization, and video compression technologies. |

| • | Broadband Access — employing state-of-the-art computing and packet processing technologies to solve the last-mile bottleneck, providing ever higher residential speeds and bandwidth. |

| • | Cloud — the enablement of complex function to be performed in the “cloud” to simplify and streamline the in home network and the service providers’ network operations. |

We have a significant engineering resources and employees in the U.S. dedicated to research and development through laboratories in Beaverton, Oregon; Horsham, Pennsylvania; Kirkland, Washington; Lisle, Illinois; San Diego, California; Santa Clara, California; Suwanee, Georgia; Wallingford, Connecticut; and Westborough and Lowell, Massachusetts, as well as internationally in Bangalore, India; Cordoba, Argentina; Cork, Ireland; Linkoping, Sweden; Shenzhen, China; and Tel Aviv, Israel.

Research and development expenses in 2014, 2013 and 2012 were approximately $556.6 million, $425.8 million and $170.7 million, respectively. Research and development expenses as a percent of sales in 2014, 2013 and 2012 were approximately 10.5%, 11.8% and 12.6%, respectively. These costs include allocated common costs associated with information technology and facilities.

Intellectual Property

We have an active patenting program for protecting our innovations. During 2014, we continued to enhance our patent portfolio. We were awarded 141 patents and filed 323 utility patent applications and 65 provisional patent applications. As of January 31, 2015, the patenting program consisted of maintaining our portfolio of approximately 1,482 issued patents (both U.S. and foreign) and pursuing patent protection on new inventions (currently approximately 955 U.S. and foreign patent applications). In our effort to pursue new patents, we have created a process whereby employees may submit ideas of inventions for review by management. The review process evaluates each submission based on criteria that includes: novelty, potential commercial value of the invention, and detectability of infringement. Patent applications are filed on the inventions that meet the criteria.

Although patents generally have a 20 year legal life, the relevant technologies to which the patents apply often have much shorter lives. As such, the economic useful life of the patents is often the same as that of the associated developed technology.

Our patents and patent applications generally are in the areas of telecommunications hardware, software and related technologies. For technology that is not owned by us, we have a program for obtaining appropriate licenses to ensure that we have the necessary license coverage for our products. In addition, we have formed strategic relationships with leading technology companies to provide us with early access to technology that we believe will help keep us at the forefront of our industry.

We also have a program for protecting and developing trademarks. As of January 31, 2015, ARRIS had 469 registered or pending trademark registrations. Our trademark program includes procedures for the use of current trademarks and for the development of new trademarks. This program is designed to ensure that our employees

8

Table of Contents

Index to Financial Statements

properly use our registered trademarks and any new trademarks that are expected to develop strong brand loyalty and name recognition. The design of our trademark program is intended to protect our trademarks from dilution or cancellation.

From time to time there are significant disputes with respect to the ownership of the technology used in our industry and patent infringements. See Part I, Item 3, “Legal Proceedings.”

Product Sourcing and Distribution

We maintain a balance of internal and external manufacturing providers to continue offering our customers a competitive combination of quality, cost and flexibility in meeting their needs. We operate manufacturing facilities in Taipei, Taiwan and Tijuana, Mexico. We also use contract manufacturers located in China, Thailand, Mexico, and the United States.

We provide our contract manufacturers with rolling, non-binding forecasts, and we typically have a minimum of 60 days of purchase orders placed with them for products. Purchase orders for delivery within 60 days generally are not cancelable. Purchase orders with delivery past 60 days generally may be cancelled with penalties in accordance with each vendor’s terms. Each contract manufacturer provides a minimum 15-month warranty.

We manufacture a significant portion of our video set-tops and gateways in our manufacturing facility in Taipei, Taiwan. The factory is 209,600 square feet, and, as of December 31, 2014, the facility employed approximately 1,100 people. Current outsourcing arrangements include set-tops, modems, DTAs and IP set-tops.

We manufacture a portion of our Network & Cloud products in our manufacturing facility in Tijuana, Mexico. The factory is 83,124 square feet, and, as of December 31, 2014, the facility employed approximately 410 people. Current outsourcing arrangements include CMTS, amplifiers, certain power supplies, accessories, optical modules, digital return modules, circuit boards, repair services, and video infrastructure equipment.

We distribute a substantial number of products that are not produced by us in order to provide our customers with a comprehensive portfolio offering. Domestically, we distribute hardware and installation products through regional warehouses in California, North Carolina, and Washington. Internationally, we distribute through regional warehouses in Japan, Germany and Netherlands, and through drop shipments from our contract manufacturers located throughout the world.

We obtain key components from numerous third-party suppliers. Our supply agreements include technology licensing and component purchase contracts. Several of our competitors have similar supply agreements for these components. In addition, we license software for operating network and security systems or sub-systems, and a variety of routing protocols from different suppliers.

Backlog

Our backlog consists of unfilled customer orders (believed to be firm and long-term contracts) that have not been completed. With respect to long-term contracts, we include in our backlog only amounts representing orders currently released for production or, in specific instances, the amount we expect to be released in the succeeding 12 months. The amount contained in backlog for any contract or order may not be the total amount of the contract or order. The amount of our backlog at any given time does not reflect expected revenues for any fiscal period.

Our backlog at December 31, 2014 was approximately $631.0 million, at December 31, 2013 was approximately $538.6 million, and at December 31, 2012 was approximately $222.6 million. We believe that all of the backlog existing at December 31, 2014 will be shipped in 2015.

Anticipated orders from customers may fail to materialize and delivery schedules may be deferred or cancelled for a number of reasons, including reductions in capital spending by network operators, shipping disruptions, customer financial difficulties, annual capital spending budget cycles, and construction delays.

9

Table of Contents

Index to Financial Statements

Competition

The markets in which we participate are dynamic and highly competitive, requiring companies to react quickly to capitalize on opportunity. We retain skilled and experienced personnel, and deploy substantial resources to meet the changing demands of the industry and to capitalize on change. We compete with international, national and regional manufacturers, distributors and wholesalers including companies that are larger than we are. Our major competitors include:

| • | ADB Global; |

| • | Casa Systems, Inc.; |

| • | Cisco Systems, Inc.; |

| • | Commscope, Inc.; |

| • | Concurrent Computer Corporation; |

| • | Emcore Corporation; |

| • | Ericsson; |

| • | Harmonic, Inc.; |

| • | Hitron Technologies Americas Inc.; |

| • | Huawei; |

| • | Humax Co.; |

| • | Netgear; |

| • | Netgem; |

| • | Pace Plc; |

| • | RGB Networks; |

| • | Sagemcom; |

| • | Samsung; |

| • | SeaChange, Inc.; |

| • | SMC Networks; |

| • | Technicolor, Inc.; |

| • | Tivo Inc.; |

| • | Thomson Video Networks; |

| • | TOA Technologies (Oracle); |

| • | TVC Communications, Inc.; |

| • | Ubee Interactive, Inc.; |

| • | Vecima Networks, Inc.; and |

| • | ZTE |

We distinguish our products on the basis of reliability and performance, differentiated features, flexibility, breadth, customer service, and availability of business solutions, while pricing our solutions competitively with those of other manufacturers.

The consumer demand for more broadband bandwidth is a fundamental driver behind the continued growth in CMTS and CCAP Edge Routing capacity deployed by cable operators worldwide. The CMTS/CCAP supplier

10

Table of Contents

Index to Financial Statements

space is highly competitive with strong historical players such as Cisco and announcements of new products from manufacturers such as Casa, Commscope and Harmonic. In the third quarter of 2014, according to Infonetics Research, CMTS, CCAP and Edge QAM Hardware and Subscribers Quarterly Worldwide and Regional Market Share, Size, and Forecasts, Third Quarter 2014, ARRIS secured 48% worldwide CMTS/CCAP share by revenue.

Through the acquisition of the Motorola Home business, ARRIS became a world leader in the supply of set-tops and video gateways. According to Infonetics Research, Set-Tops and Pay TV Subscribers Quarterly Worldwide Market Share and Forecasts for Third Quarter 2014, ARRIS was the leading provider of all cable video set-tops, gateways, and media players in the third quarter of 2014 with approximately 32% worldwide share of revenue. Infonetics tracks market share for 38 competitors in the very competitive set-tops market.

ARRIS has been a leader in the DOCSIS EMTA product category since its inception, and through the acquisition of the Motorola Home business, ARRIS is now a leader in the supply of all types of broadband CPE including DOCSIS, DSL, and FTTH. According to Infonetics Research, Broadband CPE Quarterly Worldwide Market Share and Forecasts for Third Quarter 2014, ARRIS was the leading worldwide provider of cable broadband CPE products in the third quarter of 2014 with approximately 36% worldwide share of revenues.

Our multi-screen content management and protection products compete with many vendors offering on-demand video and digital advertising insertion hardware and software, including Adobe, Cisco, Concurrent Computer Corporation, Ericsson Irdeto, SeaChange International Inc., Tivo, Verimatrix, and others. Our operations management systems compete with vendors offering network management, mobile workforce management, network configuration management, and network capacity management systems such as TOA Technologies, Click Software and others, some of which may currently have greater sales in these areas than ARRIS. In some instances, our customers internally develop their own software for these functions. However, we believe that we offer a more integrated solution that gives us a competitive advantage in supporting the requirements of both today’s distribution networks and the emerging all-digital, packet-based networks.

We also compete with companies such as Cisco, Harmonic, Huawei, Pace and ZTE for network distribution and access equipment. In recent periods, competition in this market has also increased from aftermarket suppliers, whose primary focus is on the refurbishment of OEM equipment, resulting in additional competition for new sales opportunities. In addition, because of the convergence of the cable and telecommunications and rapid technological development, new competitors may enter this space.

Lastly, some of our competitors are larger companies with greater financial resources and product breadth than us. This may enable them to bundle products or be able to market and price products more aggressively than we can.

Regulation and Corporate Responsibility

Our products and operations are subject to numerous U.S. and international regulations and requirements in the areas of labor, environmental compliance including energy efficiency standards, health and safety and ethics. Historically compliance with such regulations has not had a material impact on our business or results of operations.

We are committed to strong corporate responsibility and in 2014 took a number of steps to enhance this commitment. As part of this commitment, we became a member of the Electronic Industry Citizenship Coalition® (EICC®), a non-profit coalition of electronics companies committed to supporting the rights and wellbeing of workers and communities affected by the global electronics supply chain. In connection with joining the EICC, we adopted a number of new policies and initiated new programs relating to corporate responsibility. These included, among others, a Corporate Responsibility Policy and Corporate Responsibility Business Principles, a Supplier Code of Conduct and the establishment of sustainability goals. Additional information regarding these policies and programs is available under the “Investors” tab of our corporate website (www.arris.com).

With respect to energy efficiency, we are a signatory to both the Voluntary Agreement for Ongoing Improvement to the Energy Efficiency of Set-Top Boxes in the U.S. and the Voluntary Industry Agreement to Improve

11

Table of Contents

Index to Financial Statements

the Energy Consumption of Complex Set-Top Boxes in the European Union. As signatories to these agreements, we are committed to reducing our environmental impact through increasing the energy efficiency of our set-top boxes while still protecting our need to adapt to rapidly changing technology and the introduction of new features.

Employees

As of January 31, 2015, we had approximately 6,660 employees. ARRIS has no employees represented by unions within the United States. We believe that we have a strong relationship with our employees. Our future success depends, in part, on our ability to attract and retain key personnel. Competition for qualified personnel in the cable industry is intense, and the loss of certain key personnel could have a material adverse effect on us. We have entered into employment contracts with our key executive officers and have confidentiality agreements with substantially all of our employees. We also have long-term incentive programs that are intended to provide substantial incentives for our key employees to remain with us.

| Item 1A. | Risk Factors |

Our business is dependent on customers’ capital spending on broadband communication systems, and reductions by customers in capital spending would adversely affect our business.

Our performance is primarily dependent on customers’ capital spending for constructing, rebuilding, maintaining or upgrading broadband communications systems. Capital spending in the broadband communications industry is cyclical and can be curtailed or deferred on short notice. A variety of factors affect capital spending, and, therefore, our sales and profits, including:

| • | general economic conditions; |

| • | customer specific financial or stock market conditions; |

| • | availability and cost of capital; |

| • | foreign currency fluctuations; |

| • | governmental regulation; |

| • | demands for network services; |

| • | competition from other providers of broadband and high-speed services; |

| • | acceptance of new services offered by our customers; and |

| • | real or perceived trends or uncertainties in these factors. |

Several of our customers have accumulated significant levels of debt. These high debt levels, coupled with the volatility in the capital markets, may impact their access to capital in the future. Even if the financial health of our customers remains intact, these customers may not purchase new equipment at levels we have seen in the past or expect in the future. While there has been improvement in the U.S. and global economy over the past year, we cannot predict the impact, if any, of any softening of the national of global economy or of specific customer financial challenges on our customer’s expansion and maintenance expenditures.

In addition, the Federal Communications Commission has publicly announced that it is considering adopting new regulations to mandate “net neutrality” by broadband Internet service providers and subjecting broadband providers to regulation as traditional telephone companies under Title II of the Communications Act. These and other changes in regulatory requirements with which many of our U.S. customers are required to comply could result in such customers reducing their investment in their broadband communications networks. A significant reduction in their capital expenditures as a result of any such regulations could adversely affect our business, operating results, and financial condition.

12

Table of Contents

Index to Financial Statements

The markets in which we operate are intensely competitive, and competitive pressures may adversely affect our results of operations.

The markets in which we participate are dynamic, highly competitive and require companies to react quickly and capitalize on change. We must retain skilled and experienced personnel, as well as deploy substantial resources to meet the changing demands of the industry and must be nimble to be able to capitalize on change. We compete with international, national and regional manufacturers, distributors and wholesalers including some companies that are larger than we are. We list our major competitors in Part I, Item 1, “Business”.

In some instances, our customers themselves may be our competition as they may develop their own software requiring support within our products or their own product design produced directly by the customer with a contract manufacturer. The rapid technological changes occurring in broadband may lead to the entry of new competitors, including those with substantially greater resources than our own. Because the markets in which we compete are characterized by rapid growth and, in some cases, low barriers to entry, smaller niche market companies and start-up ventures also may become principal competitors in the future. Actions by existing competitors and the entry of new competitors may have an adverse effect on our sales and profitability. In the future, technological advances could lead to the obsolescence of some of our current products, which could have a material adverse effect on our business.

Further, several of our larger competitors may be in a better position to withstand any significant, sustained reduction in capital spending by customers. They often have broader product lines and market focus and therefore are not as susceptible to downturns in a particular market. In addition, several of our competitors have been in operation longer than we have, and therefore have more established relationships with domestic and foreign broadband service providers.

Consolidations in the broadband communication systems industry could result in delays or reductions in purchases of products, which would have a material adverse effect on our business.

The broadband communication systems industry has historically experienced, and continues to experience, the consolidation of many industry participants. For example, in the first half of 2014 Comcast announced its proposed acquisition of Time Warner Cable and AT&T announced its proposed acquisition of DIRECTV and in February 2015, Verizon Communications Inc. announced that it is selling certain wireline businesses to Frontier Communications Corp. When consolidations occur, it is possible that the acquirer will not continue using the same suppliers, possibly resulting in an immediate or future elimination of sales opportunities for us or our competitors. Even if sales are not reduced, consolidation can also result in pressure from customers for lower prices or better terms, reflecting the increase in the total volume of products purchased or the elimination of a price differential between the acquiring customer and the company acquired. Consolidations also could result in delays in purchasing decisions by the affected companies prior to completion of the transaction and by the merged businesses. The purchasing decisions of the merged companies could have a material adverse effect on our business.

We may have difficulty in forecasting our sales.

Because a significant portion of the purchases by our customers are discretionary, accurately forecasting sales is difficult. In addition, in recent years our customers have submitted their purchase orders less evenly over the course of each quarter and year and with shorter lead times than they have historically. This, coupled with the size of our operations makes it difficult for us to forecast sales and other financial measures, which can result in us maintaining inventory levels that are too high or too low for our ultimate needs.

The broadband communications industry on which our business is focused is significantly impacted by technological change and open architecture solutions.

The broadband communication systems industry has gone through dramatic technological change resulting in service providers rapidly migrating their business from a one-way television service to a two-way communications network enabling multiple services, such as high-speed Internet access, residential telephony services, business telephony services and Internet access, digital television, video on demand and advertising services. New services, such as home security, power monitoring and control, HD television, 3-D television and 4K

13

Table of Contents

Index to Financial Statements

(UHD) television that are or may be offered by service providers, are also based on, and will be characterized by, rapidly evolving technology. The development of increasing transmission speed, density and bandwidth for Internet traffic has also enabled the provision of high quality, feature length video over the Internet. This so called over-the-top IP video service enables content providers such as Netflix and Hulu, programmers such as HBO and ESPN and portals like Google to provide video services on-demand, by-passing traditional video service providers. The Federal Communications Commission is also considering changes to its rules to facilitate the ability of over-the-top services to compete against traditional multichannel video programming providers. As these service providers enhance their quality and scalability, traditional providers are moving to match them and provide even more competitive services over their existing networks, as well as over-the-top IP video for delivery not only to televisions but to computers, tablets, and telephones in order to remain competitive. Our business is dependent on our ability to develop products that enable current and new customers to exploit these rapid technological changes. We believe the continued growth of over-the-top IP video represents a shift from the traditional video delivery paradigm. To the extent that we are unable to adapt our technologies to serve this emerging demand our business may be adversely affected.

The continued industry move to open standards may impact our future result.

The broadband communication systems industry has and will continue to demand products based on open standards. The move toward open standards is expected to increase the number of service providers that will offer new services. This trend is expected to increase the number of competitors and drive down the capital costs per subscriber deployed. These factors may adversely impact both our future revenues and margins. In addition, many of our customers participate in “technology pools” and increasingly request that we donate a portion of our source code used by the customer to these pools which may impact our ability to recapture the R&D investment made in developing such code.

We believe that we will be increasingly required to work with third party technology providers. As a result, we expect the shift to more open standards may require us to license software and other components from third parties, which licenses may not be available or may not continue to be available to us on commercially reasonable terms. In some circumstances, such technology may include technology or protocols developed by standards settings bodies or other industry forums. The terms of the licenses granted by such parties may limit our ability to commercialize products that utilize such technology, which could have a material adverse effect on our results.

The completion of the Motorola Home acquisition will continue to have a significant impact on our operations and financial statements going forward.

In April 2013, we completed our acquisition of the Motorola Home business, which was significantly larger than our business prior to the Acquisition. For the year ended December 31, 2012, Motorola Home had net sales of approximately $3.3 billion and total assets of approximately $2.5 billion, compared with our net sales of approximately $1.4 billion and total assets of $1.4 billion for the year ended December 31, 2012. In addition, we significantly increased our long-term debt in connection with the Acquisition. Given the significant increase in the size of our business as a result of the acquisition and the increase in our long-term debt, our historical results are not indicative of our combined operations going forward.

The anticipated benefits from acquisitions may not be realized.

Our growth strategy has historically included acquisitions, including our acquisition of the Motorola Home business, and we expect that we will continue to grow through additional strategic acquisitions in the future. We pursue acquisitions with the expectation that the transaction would result in various benefits, including, among other things, enhancing our current and future product offerings, strengthening our ability to capitalize on and manage changing industry trends and broadening our customer base.

An acquisition involves the combination of two companies that previously operated independently. The difficulties of combining the acquired company’s operations with ours include:

| • | combining the best practices of two companies, including research and development and sales functions; |

14

Table of Contents

Index to Financial Statements

| • | the necessity of coordinating geographically separated organizations, systems and facilities; |

| • | integrating personnel with diverse business backgrounds and organizational cultures; |

| • | reducing the costs associated with each company’s operations; and |

| • | preserving important relationships of both ARRIS and the acquired company and resolving potential conflicts that may arise. |

Integration of the operations of an acquired company could cause an interruption of, or loss of momentum in, our business and the possible loss of key personnel. The diversion of management’s attention and any delays or difficulties encountered in connection with the acquisition and the integration of the two companies’ operations could have an adverse effect on the business, results of operations, financial condition or prospects of the combined company after the acquisition. In addition, we may experience unexpected difficulties and/or delays in combining the acquired company’s systems with including the subsequent testing related to applicable internal controls, or the discovery of material weaknesses with such internal controls, in a timely fashion which could have an adverse effect on our operations. The integration process can be complex and take significant time to complete which may result in difficulties that could impact our operations or financial results not being discovered until well after the closing date of the acquisition. For example, while we completed the acquisition of the Motorola Home business in April 2013, we do not expect to complete the accounting system integration until the first quarter of 2015.

In addition, our ability to achieve the anticipated benefits of an acquisition is subject to a number of uncertainties discussed elsewhere, including:

| • | our ability to take advantage of expected growth opportunities; |

| • | general market and economic conditions; |

| • | general competitive factors in the industry and marketplace; and |

| • | higher than expected costs required to achieve the anticipated benefits of the acquisition. |

No assurance can be given that these benefits will be achieved or, if achieved, the timing of their achievement. Failure to achieve these anticipated benefits could result in increased costs and decreases in expected revenues and/or net income following an acquisition.

Our use of the “Motorola” brand name is limited.

In connection with our acquisition of Motorola Home, we were granted the right, as extended, subject to certain conditions, to continue to use the Motorola brand name on certain products for a period of two years after the acquisition. We sell those products in geographic regions and through distribution channels, especially retail, under the Motorola brand where the “ARRIS” brand is not as recognized.

Shelf space in retail outlets can also be impacted by how recognizable a brand is by customers. If we are unable to successfully rebrand those products, our sales in those regions and channels may decrease. Further, the loss of the use of the “Motorola” brand may result in a lower amount of shelf space, or space in less desirable areas, which may impact our sales.

Our business is concentrated in a few key customers. The loss of one of these customers or a significant reduction in sales to one of these customers would have a material adverse effect on our business.

For the year ended December 31, 2014, sales to our three largest customers (including their affiliates, as applicable) accounted for approximately 19.0%, 13.0% and 11.5%, respectively, of our total revenue. The loss of one of our large customers, or a significant reduction in the products or services provided to any of them would have a material adverse impact on our business. For many of these customers, we also are one of their largest suppliers. As a result, if from time-to-time customers elect to purchase products from our competitors in order to diversify their supplier base and to dual-source key products or to curtail purchasing due to budgetary or market

15

Table of Contents

Index to Financial Statements

conditions, such decisions could have material consequences to our business. In addition, because of the magnitude of our sales to these customers the terms and timing of our sales are heavily negotiated, and even minor changes can have a significant impact upon our business.

We may face higher costs associated with protecting our intellectual property or obtaining necessary access to the intellectual property of others.

Our future success depends in part upon our proprietary technology, product development, technological expertise and distribution channels. We cannot predict whether we can protect our technology or whether competitors can develop similar technology independently. Given the dependence within our industry on published specifications and technology, there are frequent claims and related litigation regarding patent and other intellectual property rights. We have received, directly or indirectly, and expect to continue to receive, from third parties, including some of our competitors, notices claiming that we, or our customers using our products, have infringed upon third-party patents or other proprietary rights. We are involved in several proceedings (and other proceedings have been threatened) in which our customers were sued for patent infringement. (See Item 3, “Legal Proceedings”) In these cases our customers have made claims against, us and other suppliers for indemnification. We may become involved in similar litigation involving these and other customers in the future. These claims, regardless of their merit, could result in costly litigation, divert the time, attention and resources of our management, delay our product shipments, and, in some cases, require us to enter into royalty or licensing agreements. If a claim of patent infringement against us or our customer is successful and we fail to obtain a license or develop non-infringing technology, we or our customer may be prohibited from marketing or selling products containing the infringing technology which could materially affect our business and operating results. In addition, the payment of any damages or any necessary licensing fees or indemnification costs associated with a patent infringement claim could be material and could also materially adversely affect our operating results.

We have significant indebtedness which could limit our operations and opportunities, make it more difficult for us to pay or refinance our debts and/or may cause us to issue additional equity in the future, which would increase the dilution of our stockholders or reduce earnings.

As of December 31, 2014, we had approximately $1.5 billion in total indebtedness. In addition, we have a $247.5 million available under our revolving line of credit to support our working capital needs. Our debt service obligations with respect to this indebtedness could have an adverse impact on our earnings and cash flows for as long as the indebtedness is outstanding.

This significant indebtedness could also have important consequences to stockholders. For example, it could:

| • | make it more difficult for us to pay or refinance our debts as they become due during adverse economic and industry conditions because any decrease in revenues could cause us to not have sufficient cash flows from operations to make our scheduled debt payments; |

| • | limit our flexibility to pursue other strategic opportunities or react to changes in our business and the industry in which we operate and, consequently, place us at a competitive disadvantage to competitors with less debt; |

| • | require a substantial portion of our cash flows from operations to be used for debt service payments, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes; and |

| • | result in higher interest expense in the event of increases in interest rates since the majority of our debt is subject to variable rates. |

Based upon current levels of operations, we expect to be able to generate sufficient cash on a consolidated basis to make all of the principal and interest payments when such payments are due under our senior secured credit facilities; but there can be no assurance that we will be able to repay or refinance such borrowings and obligations.

16

Table of Contents

Index to Financial Statements

We may consider it appropriate to reduce the amount of indebtedness currently outstanding. This may be accomplished in several ways, including issuing additional shares of common stock or securities convertible into shares of common stock, reducing discretionary uses of cash or a combination of these and other measures. Issuances of additional shares of common stock or securities convertible into shares of common stock would have the effect of diluting the ownership percentage that stockholders will hold in the company and may reduce our reported earnings per share.

We have substantial goodwill and amortizable intangible assets.

Our financial statements reflect substantial goodwill and intangible assets, approximately $936.1 million and $943.4 million, respectively, as of December 31, 2014, that was recognized in connection with acquisitions.

We annually (and more frequently if changes in circumstances indicate that the asset may be impaired) review the carrying amount of our goodwill in order to determine whether it has been impaired for accounting purposes. In general, if the fair value of the corresponding reporting unit is less that the carrying amount of the reporting unit, we record an impairment. The determination of fair value is dependent upon a number of factors, including assumptions about future cash flows and growth rates that are based on our current and long-term business plans. With respect to the amortizable intangible assets, we test recoverability when events or changes in circumstances indicate that their carrying amounts may not be recoverable. Examples of such circumstances include, but are not limited to, operating or cash flow losses from the use of such assets or changes in our intended uses of such assets. If we determine that an asset or asset group is not recoverable, then we would record an impairment charge if the carrying amount of the asset or asset group exceeds its fair value. Fair value is based on estimated discounted future cash flows expected to be generated by the asset or asset group. The assumptions underlying cash flow projections would represent management’s best estimates at the time of the impairment review.

While no goodwill or intangible asset impairments were recorded in 2014 and 2013, as the ongoing expected cash flows and carrying amounts of our remaining goodwill and intangible assets are assessed, changes in the economic conditions, changes to our business strategy, changes in operating performance or other indicators of impairment could cause us to realize impairment charges in the future. For additional information, see the discussion under “Critical Accounting Policies” in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Products currently under development may fail to realize anticipated benefits.

Rapidly changing technologies, evolving industry standards, frequent new product introductions and relatively short product life cycles characterize the markets for our products. The technology applications that we currently are developing may not ultimately be successful. Even if the products in development are successfully brought to market, they may not be widely used or we may not be able to capitalize successfully on their technology. To compete successfully, we must quickly design, develop, manufacture and sell new or enhanced products that provide increasingly higher levels of performance and reliability. However, we may not be able to develop or introduce these products successfully if they:

| • | are not cost-effective; |

| • | are not brought to market in a timely manner; |

| • | fail to achieve market acceptance; or |

| • | fail to meet industry certification standards. |

Furthermore, our competitors may develop similar or alternative technologies that, if successful, could have a material adverse effect on us. Our strategic alliances are based on business relationships that have not been the subject of written agreements expressly providing for the alliance to continue for a significant period of time. The loss of a strategic relationship could have a material adverse effect on the progress of new products under development with that third party.

17

Table of Contents

Index to Financial Statements

Defects within our products could have a material impact on our results.

Many of our products are complex technology that include both hardware and software components. It is not unusual for software, especially in earlier versions, to contain bugs that can unexpectedly interfere with expected operations. While we employ rigorous testing prior to the shipment of our products, defects, including those resulting from components we purchase, may still occur from time to time. Product defects could impact our reputation with our customers which may result in fewer sales. In addition, depending on the number of products affected, the cost of fixing or replacing such products could have a material impact on our operating results.

We offer warranties of various lengths to our customers on many of our products and have established warranty reserves based on, among other things, our historic experience, failure rates and cost to repair. In the event of a significant non-recurring product failure, the amount of the warranty reserve may not be sufficient. From time to time we may also make repairs on defects that occur outside of the provided warranty period. Such costs would not be covered by the established reserves and, depending on the volume of any such repairs, may have a material adverse effect on our results from operations or financial condition.

Our success depends on our ability to attract and retain qualified personnel in all facets of our operations.

Competition for qualified personnel is intense, and we may not be successful in attracting and retaining key personnel, which could impact our ability to maintain and grow our operations. Our future success will depend, to a significant extent, on the ability of our management to operate effectively. In the past, competitors and others have attempted to recruit our employees and their attempts may continue. The loss of services of any key personnel, the inability to attract and retain qualified personnel in the future or delays in hiring required personnel, particularly engineers and other technical professionals, could negatively affect our business.

We are dependent on contract manufacturers, and an inability to obtain adequate and timely delivery of supplies could adversely affect our business.

Many components, subassemblies and modules necessary for the manufacture or integration of our products are obtained from a sole supplier or a limited group of suppliers. Our reliance on sole or limited suppliers, particularly foreign suppliers, and our reliance on subcontractors involves several risks including a potential inability to obtain an adequate supply of required components, subassemblies or modules and reduced control over pricing, quality and timely delivery of components, subassemblies or modules. An inability to obtain adequate deliveries or any other circumstance that would require us to seek alternative sources of supply could affect our ability to ship products on a timely basis. Any inability to reliably ship our products on time could damage relationships with current and prospective customers and harm our business. Our ability to ship could be impacted by country laws and/or union labor disruptions. For example the recent labor dispute involving union dock workers at certain U.S. west coast port facilities has, in many cases, greatly increased the shipping times for our products arriving through the affected ports and has also increased our shipping costs as we have had to increase the number of products shipped using air freight which is significantly more expensive. Disputes of this nature may have a material impact on our financial results.

We are subject to the economic, political and social instability risks associated with doing business in certain foreign countries.

For the year ended December 31, 2014, approximately 25.7% of our sales were made outside of the United States. In addition, a significant portion of our products are manufactured or assembled in China, Mexico and Taiwan. As a result, we are exposed to risk of international operations, including:

| • | the imposition of government controls; |

| • | compliance with United States and foreign laws concerning trade and employment practices; |

| • | difficulties in obtaining or complying with export license requirements; |

| • | labor unrest, including strikes, and difficulties in staffing; |

18

Table of Contents

Index to Financial Statements

| • | security concerns; |

| • | economic boycott for doing business in certain countries; |

| • | inflexible employee contracts or labor laws in the event of business downturns; |

| • | coordinating communications among and managing international operations; |

| • | fluctuations in currency exchange rates; |

| • | currency controls; |

| • | changes in tax and trade laws that increase our local costs; |

| • | exposure to heightened corruption risks; and |

| • | reduced protection for intellectual property rights. |

Political instability and military and terrorist activities, including the continued unrest between the Ukraine and Russia and in Israel, may have significant impacts on our customers’ spending in these regions and can further enhance many of the risks identified above. In addition, a portion of our research and development operations and a portion of our contract manufacturing occur in Israel and we also have customer service, marketing and general and administrative employees at our Israeli facility. Most of our employees in Israel are obligated to perform annual reserve duty in the Israeli Defense Forces. In the past, several of these employees have been called for active military duty and, if hostilities increase again, we expect some will be called to active military duty.

Any of these risks could impact our sales, interfere with the operation of our facilities and result in reduced production, increased costs, or both, which could have an adverse effect on our financial results.

We face risks relating to currency fluctuations and currency exchange.

On an ongoing basis we are exposed to various changes in foreign currency rates because significant sales are denominated in foreign currencies. Additionally, certain intercompany transactions are denominated in foreign currencies and subject to revaluation. These changes can impact our results of operations, cash flows and financial position. We manage these risks through regular operating and financing activities and periodically use derivative financial instruments such as foreign exchange forward and option contracts. There can be no assurance that our risk management strategies will be effective.

In addition, many of our international customers make purchases from us that are denominated in U.S dollars. To the extent that the U.S. dollar strengthens, it may impact their ability to purchase products.

We also may encounter difficulties in converting our earnings from international operations to U.S. dollars for use in the United States. These obstacles may include problems moving funds out of the countries in which the funds were earned and difficulties in collecting accounts receivable in foreign countries where the usual accounts receivable payment cycle is longer.

We depend on channel partners to sell our products in certain regions and are subject to risks associated with these arrangements.

We utilize distributors, value-added resellers, system integrators, and manufacturers’ representatives to sell our products to certain customers and in certain geographic regions to improve our access to these customers and regions and to lower our overall cost of sales and post-sales support. Our sales through channel partners are subject to a number of risks, including:

| • | ability of our selected channel partners to effectively sell our products to end customers; |

| • | our ability to continue channel partner arrangements into the future since most are for a limited term and subject to mutual agreement to extend; |

| • | a reduction in gross margins realized on sale of our products; and |

| • | a diminution of contact with end customers which, over time, could adversely impact our ability to develop new products that meet customers’ evolving requirements. |

19

Table of Contents

Index to Financial Statements

Our stock price has been and may continue to be volatile.

Our common stock is currently traded on The NASDAQ Global Select Market. The trading price of our common stock has been and may continue to be subject to large fluctuations. Our stock price may increase or decrease in response to a number of events and factors including:

| • | future announcements concerning us, key customers or competitors; |

| • | quarterly variations in operating results; |

| • | changes in financial estimates and recommendations by securities analysts; |

| • | developments with respect to technology or litigation; |

| • | the operating and stock price performance of our competitors; and |

| • | acquisitions and financings. |

Fluctuations in the stock market, generally, also impact the volatility of our stock price. General stock market movements may adversely affect the price of our common stock, regardless of our operating performance.

Cyber-security incidents, including data security breaches or computer viruses, could harm our business by disrupting our delivery of services, damaging our reputation or exposing us to liability.

We receive, process, store and transmit, often electronically, the confidential data of our clients and others. Unauthorized access to our computer systems or stored data could result in the theft or improper disclosure of confidential information, the deletion or modification of records or could cause interruptions in our operations. These cyber-security risks increase when we transmit information from one location to another, including transmissions over the Internet or other electronic networks. Despite implemented security measures, our facilities, systems and procedures, and those of our third-party service providers, may be vulnerable to security breaches, acts of vandalism, software viruses, misplaced or lost data, programming and/or human errors or other similar events which may disrupt our delivery of services or expose the confidential information of our clients and others. Any security breach involving the misappropriation, loss or other unauthorized disclosure or use of confidential information of our clients or others, whether by us or a third party, could (i) subject us to civil and criminal penalties, (ii) have a negative impact on our reputation, or (iii) expose us to liability to our clients, third parties or government authorities. Any of these developments could have a material adverse effect on our business, results of operations and financial condition. We have not experienced any such incidents that have had material consequences to date. Congress also is considering cyber-security legislation that, if enacted, could impose additional obligations upon us.

New regulations related to conflict minerals may adversely affect us

We are subject to recently adopted SEC disclosure obligations relating to our use of so-called “conflict minerals” — columbite-tantalite, cassiterite (tin), wolframite (tungsten) and gold. These minerals are present in a significant number of our products. We are required to file a report with the SEC annually covering our use of these materials and their source.

In preparing these reports, we are dependent upon information supplied by suppliers of products that contain, or potentially contain, conflict minerals. To the extent that the information that we receive from our suppliers is inaccurate or inadequate or our processes in obtaining that information do not fulfill the SEC’s requirements, we could face reputational risks. Further, if in the future we are unable to certify that our products are conflict mineral free, we may face challenges with our customers, which could place us at a competitive disadvantage.

20

Table of Contents

Index to Financial Statements

We do not intend to pay cash dividends in the foreseeable future.