Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Willis Group Holdings Public Limited Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

WILLIS GROUP HOLDINGS PUBLIC LIMITED COMPANY

Notice of 2014 Annual General Meeting

of Shareholders and Proxy Statement

Table of Contents

Willis Group Holdings Public Limited Company

Grand Mill Quay, Barrow Street

Dublin 4, Ireland

June 6, 2014

Dear Willis Shareholder,

You are cordially invited to attend our Annual General Meeting of Shareholders at 9:00 a.m. GMT on Wednesday, July 23, 2014, to be held at the Four Seasons Hotel, Simmonscourt Road, Dublin 4, Ireland.

In addition to the matters described in the attached Notice of Annual General Meeting and Proxy Statement, you will have an opportunity to meet your directors and executive officers. Your representation and vote are important and your ordinary shares should be voted whether or not you plan to come to the Annual General Meeting. Please complete, sign, date, and return your proxy card promptly.

In reviewing the Proxy Statement you will find detailed information about the director nominees’ qualifications and why we believe they are the right people to represent you. You will also see that changes to the compensation program that we told you about last year, after an extensive engagement with shareholders, were fully implemented in 2013. These changes reflect the Board’s and Compensation Committee’s commitment to respond to shareholder feedback and create appropriate incentives for executives to improve individual and Company performance to enhance shareholder value. We hope you recognize the value of our approach to executive compensation and will provide your endorsement when voting. A summary of the key features of our compensation program is provided in the “2014 Proxy Statement Highlights” on page 1 and in the “Executive Compensation — Compensation Discussion and Analysis” section on page 33.

Yours sincerely,

James F. McCann

Chairman of the Board

Table of Contents

WILLIS GROUP HOLDINGS PUBLIC LIMITED COMPANY

Grand Mill Quay

Barrow Street, Dublin 4, Ireland

NOTICE OF 2014 ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be held on Wednesday, July 23, 2014

NOTICE IS HEREBY GIVEN that the 2014 Annual General Meeting of Willis Group Holdings Public Limited Company (“Willis” or the “Company”), a company incorporated under the laws of Ireland, will be held at 9:00 a.m. GMT on Wednesday, July 23, 2014 at the Four Seasons Hotel, Simmonscourt Road, Dublin 4, Ireland for the following purposes:

| 1. | To elect 12 directors; |

| 2. | To ratify the reappointment of Deloitte LLP as independent auditors until the close of the next Annual General Meeting of Shareholders and to authorize the Board of Directors, acting through the Audit Committee, to fix the auditor’s remuneration; |

| 3. | To cast an advisory vote to approve named executive officer compensation; |

| 4. | To approve an amendment to the Company’s Willis Group Holdings Public Limited Company 2012 Equity Incentive Plan (the “2012 Plan”) to increase the number of shares authorized for issuance under the 2012 Plan; |

| 5. | To renew the directors’ authority to issue shares under Irish law; |

| 6. | To renew the directors’ authority to opt-out of statutory pre-emption rights under Irish law; |

| 7. | To authorize holding the 2015 Annual General Meeting of Shareholders at a location outside of Ireland; and |

| 8. | To consider and vote on such other business as may properly come before the meeting or any adjournment thereof. |

During the Annual General Meeting, the directors will present the Company’s financial statements for the period ended December 31, 2013 prepared in accordance with Irish law (“Irish Statutory Accounts”) and the reports of the directors and auditors. Shareholders present at the meeting will have an opportunity to ask any relevant and appropriate questions regarding the Irish Statutory Accounts and related reports to the representatives of our independent auditor who will be in attendance at the meeting.

Only shareholders of record on May 30, 2014 are entitled to receive notice of, and to attend and vote, in person or by proxy, at the meeting and any adjournment or postponement of the meeting. A shareholder who is entitled to attend the meeting and vote is entitled to appoint one or more proxies to attend, speak and vote. A proxy need not be a member of the Company. Company shareholders of record who attend the meeting may vote their ordinary shares personally at the meeting, even if they have sent in proxies. This Notice and Proxy Statement are being mailed or made available on the Internet to shareholders on or around June 6, 2014, together with a copy of the Company’s 2013 Annual Report and Irish Statutory Accounts, which includes financial statements for the year ended December 31, 2013.

Your vote is important. Whether you own one share or many, we greatly appreciate your prompt cooperation in voting your proxy. Please follow the instructions on the proxy card you receive. If you received this Proxy Statement by regular mail, you may cast your vote by mail, by telephone, or over the Internet by following the instructions on the enclosed proxy card. If you are accessing this Proxy

Table of Contents

Statement through the Internet after receiving a Notice of Internet Availability, you may cast your vote by telephone or over the Internet by following the instructions set out in that notice.

On Behalf of the Board of Directors,

Nicole Napolitano

Group Company Secretary

June 6, 2014

Important Notice Regarding the Availability of Proxy Materials for the Company’s Annual General Meeting of Shareholders to be held on July 23, 2014. This Proxy Statement, the Company’s 2013 Annual Report and the Irish Statutory Accounts are available, at www.proxyvote.com.

Table of Contents

Table of Contents

2014 PROXY STATEMENT HIGHLIGHTS

For more complete information about the topics discussed below, please review the entire Proxy Statement.

2014 Annual General Meeting of Shareholders

| • Date and Time: |

July 23, 2014 at 9:00 a.m. GMT. Registration begins at 8:30 a.m. GMT. | |

| • Place: |

Four Seasons Hotel, Simmonscourt Road, Dublin 4 Ireland | |

| • Record Date: |

May 30, 2014 | |

| • Voting: |

Shareholders as of the record date are entitled to vote. Each share is entitled to one vote for each director nominee and each of the other proposals. | |

| • Attendance: |

All shareholders may attend the meeting. | |

Meeting Agenda and Voting Recommendations

| Proposals |

Board Recommendation | |

| 1. Election of directors |

For Each Nominee | |

| 2. Ratification of the reappointment of Deloitte LLP as our independent auditors |

For | |

| 3. Advisory vote on our named executive officers’ compensation |

For | |

| 4. To approve an amendment to the 2012 Plan to increase the number of shares authorized for issuance under the 2012 Plan |

For | |

| 5. To renew the directors’ authority to issues shares under Irish law |

For | |

| 6. To renew the directors’ authority to opt-out of statutory pre-emption rights under Irish law |

For | |

| 7. To authorize holding the 2015 Annual General Meeting of Shareholders at a location outside of Ireland |

For | |

| 1. | Election of Directors |

We are asking you to vote “FOR” each of the director nominees listed below. All incumbent directors attended at least 75% of Board and relevant committee meetings in 2013. Set forth below is summary information about each nominee at the 2014 Annual General Meeting of Shareholders and the Committees they sit on. Other than our Group Chief Executive Officer, Dominic Casserley, each director nominee qualifies as independent under applicable standards.

| Nominee |

Age | Director Since |

Summary |

Committee | ||||||||

| Dominic Casserley |

56 | 2013 | CEO of Willis Group Holdings plc | • Executive | ||||||||

| Anna C. Catalano |

54 | 2006 | Former Group Vice President, Marketing for BP plc |

• Compensation

• Governance | ||||||||

| Sir Roy Gardner |

68 | 2006 | Former Chairman of Compass Group, PLC |

• Executive

• Risk (Chairman) | ||||||||

| The Rt. Hon. Sir Jeremy Hanley, KCMG |

68 | 2006 | Former Member of Parliament for Richmond and Barnes | • Audit | ||||||||

| Robyn S. Kravit |

62 | 2008 | Chief Executive Officer of Tethys Research, LLC | • Risk | ||||||||

Table of Contents

| Nominee |

Age |

Director |

Summary |

Committee | ||||||||

| Wendy E. Lane |

63 | 2004 | Chairman of Lane Holdings, Inc. | • Audit

• Compensation (Chairman) | ||||||||

| • Executive | ||||||||||||

| Francisco Luzón |

66 | 2013 | Former Executive Board Member and General Manager of the Latin American Division of Banco Santander, S.A. | • Governance | ||||||||

| James F. McCann |

62 | 2004 | Chairman and CEO of 1-800-Flowers | • Executive

• Governance (Chairman) | ||||||||

| Jaymin Patel |

46 | 2013 | President and CEO of GTECH Americas | • Compensation | ||||||||

| Douglas B. Roberts |

66 | 2003 | Professor and the Director for Institute of Public Policy and Social Research — Michigan State University | • Audit (Chairman)

• Executive | ||||||||

| Dr. Michael J. Somers |

71 | 2010 | Former CEO of Irish National Treasury Management Agency | • Audit | ||||||||

| Jeffrey W. Ubben |

52 | 2013 | Founder, CEO and the Chief Investment Officer of ValueAct Capital | • Risk | ||||||||

In considering whether to vote for the above director nominees, you should also consider the highlights of our corporate governance practices which our directors follow and may be relevant to your evaluation of the director nominees.

Corporate Governance Highlights

2

Table of Contents

| 2. | Ratification of the Reappointment of Independent Auditors |

The Audit Committee recommended that the Board ratify the reappointment of Deloitte LLP as the Company’s independent auditor for the fiscal year ending December 31, 2014, and the Board did so in February 2014. We are asking you to ratify the reappointment of Deloitte LLP as the Company’s independent auditors and to authorize the Board, acting through the Audit Committee, to fix the auditor’s remuneration.

| 3. | Advisory Vote on Named Executive Officer Compensation |

We are asking for your support for our named executive officer compensation as described in this Proxy Statement. While your vote is advisory, and not binding on the Compensation Committee or the Board of Directors, they will consider the outcome of the vote and any concerns raised by shareholders when determining future compensation arrangements. In deciding how to vote, we encourage you to consider key features of our 2013 compensation program discussed below.

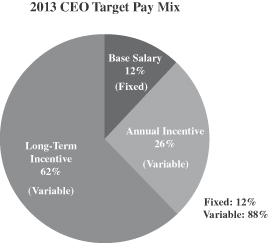

Compensation Philosophy

The Company’s objective is to attract and retain highly qualified and talented executives and professionals. We also aim to create appropriate incentives for our executives to improve their individual performance with the objective of improving the Company’s long-term performance, and as a result, to create value and wealth for our shareholders. These objectives form the basis of the Company’s compensation philosophy. The key components of our compensation philosophy are:

| • | Base salary, which is designed to provide a fixed level of remuneration to fairly compensate executives for their time and effort based on the individual’s role, experience and skill; |

| • | Annual incentive compensation, which is designed to incent and reward our named executive officers for their contribution in generating strong financial performance at the Company, and strong financial or strategic performance, at their business or functional unit; and |

| • | Long-term incentive compensation with both performance-based and time-based components, which is designed to both incent and reward performance and to help ensure retention. |

Through these elements we seek to align the compensation of our named executive officers with the Company’s performance.

The Company’s 2013 Financial Performance and Named Executive Officer Compensation

The macroeconomic environment in 2013, while better than 2012, remained challenging globally but especially in three of our key geographic markets, the United Kingdom, Western Europe and North America. Adjusted EBITDA, a key financial metric in calculating named executive officer compensation in 2013, was $874 million in 2013. That is down $16 million from $890 million in 2012. However, on a like-for-like basis, assuming we expensed bonuses in 2012 the way we did in 2013, adjusted EBITDA in 2012 would have been $48 million lower, or $842 million. On that basis, adjusted EBITDA improved $32 million, or 3.8%, in 2013.1

On the top line, Willis saw solid improvement in its revenues, with reported commissions and fees growth of 5.1% over 2012 and organic commissions and fees growth of 4.9%. That revenue growth breaks out by segment as follows:

| • | North America reported commissions and fees growth of 5.4% and organic commissions and fees growth of 4.9%; |

| • | International reported commissions and fees growth of 3.9% and organic commissions and fees growth of 4.1%; and |

| 1 | Organic commissions and fees growth and Adjusted EBITDA figures are Non-GAAP figures. A reconciliation of the Non-GAAP to GAAP figures are located on Exhibit A. |

3

Table of Contents

| • | Global reported commissions and fees growth of 5.7% and organic commissions and fees growth of 5.6%. |

Additionally, in 2013, the Company:

| • | Generated 2013 cash flow from operating activities of $561 million, up $36 million from the prior year; |

| • | Maintained cash on hand of $796 million at December 31, 2013, up almost $300 million from year end 2012; |

| • | Refinanced over $500 million of debt, pushing out maturities 10 and 30 years, effectively increasing the weighted average maturity of our debt while mildly decreasing the overall cost of debt; and |

| • | Made substantive progress on key strategic initiatives centered around how and where we will compete, including executing and announcing a number of organizational structure changes, invested in markets where we see growth opportunities and divesting in markets where we don’t see the strategic advantage or growth opportunities. |

The annual incentive compensation awards for our named executive officers (other than Joseph Plumeri) were based on a combination of the Company’s performance (80% for Dominic Casserley and 60% for Michael Neborak, Stephen Hearn, Timothy Wright, Todd Jones and Victor Krauze) and individual and business unit or corporate function performance (20% for Dominic Casserley and 40% for Michael Neborak, Stephen Hearn, Timothy Wright, Todd Jones and Victor Krauze). The Company performance portion was calculated measuring organic commissions and fees growth against a target of 5.8% and adjusted EBITDA against a target of $902 million. The Compensation Committee set challenging targets to incent the Company and the named executive officers to deliver strong financial performance. Because the Company’s actual performance was close to but did not reach these targets, the portion of the annual incentive compensation awards based on Company performance produced a blended payout percentage of 89.5% of the targets. The Compensation Committee similarly set demanding individual and business unit performance goals.

After taking into account both Company performance and individual and business unit performance based on the formula above, the annual incentive compensation awards to our named executive officers were as follows:

| • | Dominic Casserley was awarded $2,061,000 representing approximately 92% of his target payout. |

| • | Michael Neborak was awarded $540,000, representing 90% of his target payout. |

| • | Stephen Hearn was awarded £975,200 (or $1,525,213), representing 92% of his target payout. |

| • | Timothy Wright was awarded £810,950 (or $1,268,326), representing approximately 93% of his target payout. |

| • | Todd Jones was awarded $708,600, representing approximately 94% of his target payout. |

| • | Victor Krauze was awarded $826,875, representing 90% of his target payout (pro-rated to reflect change in job responsibilities). |

Joseph Plumeri’s 2013 pro-rated annual incentive compensation award was based 100% on Group financial performance. As a result, he was awarded $1,678,125, representing approximately 90% of his target payout. Mr. Plumeri resigned as Group CEO on January 6, 2013 and as Chairman of the Board on July 7, 2013.

Our current named executive officers also received time-based restricted share units (“RSUs”), performance-based RSUs and time-based options as long-term incentive awards. The performance-based RSUs are based on three-year performance period targets in lieu of the previous one-year performance targets, designed to encourage sustained financial performance. The value of these awards cannot be fully calculated until the requisite time periods are reached, the three-year performance period has ended and performance against the

4

Table of Contents

targets is calculated. The grant date fair value of the awards are below, however, the named executive officers will not realize the full value of such awards if the three-year performance targets are not reached:

| • | Dominic Casserley: $5,250,000; |

| • | Michael Neborak: $1,000,000; |

| • | Stephen Hearn: $2,200,000; |

| • | Timothy Wright: $1,200,000; and |

| • | Todd Jones: $750,000. |

Redesign of our Named Executive Officer Compensation for 2013

In 2012 and 2013, the Compensation Committee redesigned our named executive officer compensation after members of the Committee and management engaged in extensive shareholder engagement. As a result, shareholder support at our 2013 Annual General Meeting of Shareholders of our compensation program was sharply up at approximately 89% from approximately 54% the year before. However, not all of the changes could be implemented before 2013 and the Compensation Discussion and Analysis and compensation tables still focused on the compensation of our former CEO, Joseph J. Plumeri, who resigned effective January 6, 2013 but remained on as Chairman until July 7, 2013 to effect an orderly transition of knowledge and relationships. For 2013, all of the changes are fully implemented, as reflected throughout this proxy and summarized below. Specifically, the Board and Compensation Committee:

| • | Sought advice from its independent compensation consultant, Towers Watson, regarding the design of the Company’s new CEO compensation package, including the level of pay relative to the market in which we compete for talent, the mix of fixed to variable pay components and the relationship of the CEO’s pay level compared to the other named executive officers’ compensation. |

| • | Revised financial metrics for the Company’s annual incentive compensation awards and performance-based long-term incentive awards to differentiate between and to emphasize both short-term and long-term financial performance. |

| • | Replaced adjusted earnings per share (“EPS”) and adjusted operating margin with organic commissions and fees growth and adjusted EBITDA as metrics for our annual incentive compensation awards because they believe they are key drivers of increasing cash flow and, therefore, important constituents of shareholder value creation. Additionally, adjusted EBITDA is an appropriate short-term metric because it measures cash-based operating income and ensures that appropriate investment in the Company is encouraged. |

| • | Eliminated the one-year performance period targets for the long-term incentive compensation awards and adopted three-year performance period targets to encourage sustained financial performance. They also replaced previously used metrics, adjusted EPS and adjusted operating margin, with organic commissions and fees growth and adjusted EBIT (modified by a cost of capital charge for acquisitions or a cost of capital credit for dispositions made during the performance period). Adjusted EBIT (modified as described above) is an appropriate long-term metric because it provides management accountability for investment decisions (mergers and acquisitions and capital expenditures) over time. |

| • | Adopted a strict policy prohibiting directors and executive officers from entering into margin accounts or pledging shares. |

| • | Confirmed our philosophy that incentive pay should be performance driven and not guaranteed. Accordingly, unless there are material and compelling circumstances (i.e., on a limited basis, in connection with new hires), the Compensation Committee will not approve guaranteed incentive awards. As discussed further below, our new Chief Executive Officer’s compensation does not include any guaranteed annual incentive compensation awards. |

5

Table of Contents

| • | Revised our executive officer share ownership guidelines to require each executive officer to own shares equivalent in value to a multiple of his or her base salary, as set forth below: |

| Position |

Multiple | |

| Group CEO |

6.0x base salary | |

| Executive Officers Leading Major Business Units and Group CFO |

3.0x base salary | |

| Other Executive Officers |

2.0x base salary |

| • | Required our executives to retain at least 50% of the net shares received under equity award programs until the ownership guidelines are met. |

The Board and the Compensation Committee will continue to review the Company’s executive compensation programs and make improvements as appropriate.

Compensation Highlights for Our New CEO

In January 2013, the Board appointed Dominic Casserley as the Company’s CEO. The Company recruited Mr. Casserley from McKinsey & Company, where he led McKinsey’s Greater China Practice and its UK and Ireland Practice and served as a senior partner and member of the firm’s global board. At the same time, the Board promoted Mr. Stephen Hearn to the new role of Deputy CEO. This was a successful partnership in 2013 and the Board continues to believe the combination of Mr. Casserley’s external perspective and broad global financial experience and Mr. Hearn’s internal perspective and deep industry experience is a powerful partnership to drive the Company’s strategic direction.

Consistent with the Compensation Committee’s and Board’s compensation philosophy for 2013 and beyond, we structured Mr. Casserley’s compensation as follows:

| • | Lowered the CEO’s total target pay package by over 25% compared to Mr. Plumeri resulting in less disparity between the compensation of the CEO and other named executive officers. |

| • | Lowered the CEO’s amount of fixed pay by almost 45% and added a cap on his annual incentive compensation awards. |

| • | Provided the CEO, as a transition payment, with a one-time sign-on cash award of $1,500,000, which was not paid until January 2014, the start of his second year of service. We believed this payment was reasonable and necessary to recruit our CEO given that he was moving from McKinsey & Company’s all-cash based compensation system to a system that combines cash and equity. Mr. Casserley is required to repay 50% of the award if he resigns without “good reason” (as such term is defined in his employment agreement) prior to the completion of two years of service. |

| • | Provided that the CEO’s 2013 annual incentive compensation awards, if any, would be paid partially in equity as a means to building share ownership. |

| • | Revised the CEO’s 2013 annual incentive award to be based 80% on the Company’s financial metrics and 20% on individual performance, with no guaranteed payment. |

| • | Continued the practice of providing a double trigger for accelerating vesting of the CEO’s equity upon a change of control. |

6

Table of Contents

Other Compensation Highlights

Other relevant parts of our compensation program are as follows:

| 4. | Amendment to 2012 Plan to Increase the Number of Shares Available for Issuance Under the 2012 Plan |

At the Annual General Meeting of Shareholders, our shareholders are being asked to approve an amendment to the 2012 Plan to increase by 10,000,000 the number of ordinary shares reserved for issuance under the 2012 Plan to an aggregate of 23,000,000 shares. As of March 31, 2014, 544,700 ordinary shares were reserved for issuance and available for future awards under the 2012 Plan. As a result of the limited number of shares remaining available for issuance under the Company’s stock plans, and in order to have an appropriate supply of shares available for equity awards under the 2012 Plan to recruit, hire, and retain the talent necessary to achieve strong performance in the future, we are requesting the additional 10,000,000 shares for which shareholder approval is being sought. If the amendment is approved by the shareholders, approximately 10,544,700 shares would be available for the grant of new awards under the 2012 Plan (including shares available for issuance as of March 31, 2014). Upon the recommendation of the Compensation Committee, our Board of Directors unanimously approved the amendment to the 2012 Plan subject to shareholder approval. Until the amendment is approved by our shareholders, no awards may be granted under the 2012 Plan with respect to the additional shares reserved for issuance under the amendment.

| 5. | Renewal of the Directors’ Authority to Issue Shares under Irish Law |

As a matter of Irish company law, the directors of a company may not issue new ordinary or preferred shares unless approved by shareholders and such authority can only be conferred for a maximum of five years. Shareholders previously conferred such authority on our Board but the authority is due to expire on December 30, 2014. It is now proposed to renew the directors’ authority for a five-year period to expire on July 23, 2019. Please note, we are not asking you to approve an increase to our authorized share capital. You are only being asked to renew the directors’ existing authority to issue shares for an additional five years. Your approval of this proposal will simply provide directors with continued flexibility to issue shares up to the maximum of our existing authorized but unissued share capital, subject to the requirements of the New York Stock Exchange (“NYSE”) to obtain further shareholder approval under certain conditions described in more detail in our proposal below.

7

Table of Contents

| 6. | Renewal of the Directors’ Authority to Issue Shares for Cash Without First Offering Shares to Existing Shareholders |

In general, unless otherwise authorized, before an Irish public limited company can issue shares for cash to any new shareholders, it must first offer the shares to existing shareholders of the company on a pro-rata basis (commonly referred to as the statutory pre-emption right). The Company’s articles of association currently authorize directors to issue new shares for cash, up to a maximum of the Company’s authorized but unissued share capital, without first offering them to existing shareholders, thereby opting out of the statutory pre-emption right (the “opt-out authority”). The opt-out authority has been in place since the Company’s redomiciliation to Ireland and reflects the authorizations in place prior to the redomiciliation. Under Irish law, the opt-out authority can be granted for a maximum period of five years, at which point it will lapse unless renewed by the shareholders of the Company by a special resolution. The current opt-out authority is due to expire on December 30, 2014. It is now proposed to renew the opt-out authority for a further five-year period to expire on July 23, 2019.

Similar to the authorization sought for Proposal Five, this authority is fundamental to our business and enables us to issue shares under our equity compensation plans and if applicable, will facilitate our ability to fund acquisitions and otherwise raise capital. We are not asking you to approve an increase in our authorized share capital. Instead, approval of this proposal will only grant the Board the authority to issue shares in the manner already permitted under our articles of association and merely place us on par with other NYSE-listed companies with whom we compete.

| 7. | Authorization to Hold the 2015 Annual General Meeting of Shareholders at a Location Outside of Ireland |

Under Irish law, the Company’s shareholders must authorize holding any Annual General Meeting of Shareholders at a location outside of Ireland. The Board may desire to hold the 2015 Annual General Meeting of Shareholders in the United States, and is therefore asking our shareholders to authorize holding the 2015 Annual General Meeting of Shareholders at a location outside of Ireland.

| 8. | 2015 Annual General Meeting Shareholder Submission Dates |

8

Table of Contents

GENERAL INFORMATION ABOUT THE PROXY MATERIALS

AND THE 2014 ANNUAL GENERAL MEETING OF SHAREHOLDERS

References to “shares” in this Proxy Statement are to the ordinary shares, nominal value $0.000115 per share.

Why am I receiving these materials?

We are making this Proxy Statement available to you on or around June 6, 2014 because the Board of Directors is soliciting your proxy to vote at the Company’s 2014 Annual General Meeting of Shareholders on July 23, 2014. The information provided in this Proxy Statement is for your use in deciding how to vote on the proposals described below.

The Proxy Statement and the following documents are available on the website at www.proxyvote.com and the Company’s website at www.willis.com:

| • | Our Notice of Annual General Meeting of Shareholders and Notice of Internet Availability of Proxy Materials; |

| • | Our Annual Report, which includes financial statements for the fiscal year ended December 31, 2013; and |

| • | Our Irish Statutory Accounts for the period ended December 31, 2013, and the reports of the directors and auditors thereon. |

If you request, we will deliver to you a printed version of these materials.

How will the proxy materials be distributed and are they available on the Internet?

The instructions for accessing proxy materials and voting can be found in the information you received.

For shareholders who received a notice by mail about the Internet availability of proxy materials: You may access the proxy materials and voting instructions over the Internet via the web address provided in the Notice of Internet Availability. In order to access this material and vote, you will need the control number provided on the notice you received in the mail. You may vote by following the instructions on the notice or on the website.

For shareholders who received the proxy materials by mail: You may vote your shares by following the instructions provided on the proxy card or voting instruction form. If you vote by Internet or telephone, you will need the control number provided on the proxy card or voting instruction form. If you vote by mail, please complete, sign and date the proxy card or voting instruction form and mail it in the accompanying pre-addressed envelope.

You have the right to request paper copies of the proxy materials, free of charge, regardless of whether you are a record or beneficial owner of shares. Shareholders of record may request paper copies by contacting the Company Secretary or by following the instructions contained in the notice. If you hold shares through brokers, banks or other nominees, you should receive written instructions on how to request paper copies of the proxy materials if you so desire. We recommend that you contact your broker, bank or other nominee if you do not receive these instructions along with the Company’s proxy documents.

Why are there two sets of financial statements covering the same period?

Under applicable U.S. securities laws, we are required to send to you our financial statements for the fiscal year ended December 31, 2013. These financial statements, included in our Annual Report, are available on the website at www.proxyvote.com and the Company’s website at www.willis.com and, if you request, will be delivered in a printed version to you. Under Irish company law, we are also required to provide you with our Irish Statutory Accounts, including the reports of our directors and auditors thereon, which accounts have been

9

Table of Contents

prepared in accordance with Irish law. The Irish Statutory Accounts are available on the website at www.proxyvote.com and the Company’s website at www.willis.com, will be presented at the Annual General Meeting of Shareholders to be held on July 23, 2014 and, if you request, will be delivered in a printed version to you.

What is the recommendation of the Board of Directors on each proposal scheduled to be voted on at the meeting? How do the Board of Directors and executive officers intend to vote with respect to the agenda items?

The Company’s Board of Directors recommends that you vote FOR the election of each of the directors; FOR the ratification of the reappointment of Deloitte LLP as the Company’s independent auditors and the authorization of the Board of Directors, acting through the Audit Committee, to fix the independent auditor’s remuneration; FOR the approval, on an advisory basis, of the compensation of our named executive officers; FOR an amendment to the 2012 Plan to increase the number of shares authorized for issuance under the 2012 Plan; FOR the renewal of the directors’ authority to issue shares under Irish law; FOR the renewal of the directors’ authority to opt-out of statutory pre-emption rights under Irish law; and FOR the 2015 Annual General Meeting of Shareholders to be held at a location outside of Ireland.

Our directors and executive officers have indicated that they intend to vote their shares in favor of each of the proposals in accordance with the Board’s recommendations. As of May 30, 2014, our current directors, director nominees and executive officers and their affiliates beneficially owned in the aggregate approximately —% of our outstanding shares.

How do I attend the Annual General Meeting?

All shareholders of record on May 30, 2014 are invited to attend the Annual General Meeting in person. For admission to the meeting, shareholders of record should bring proof of identification and address. Those who have beneficial ownership of shares held by a bank, brokerage firm or other nominee should bring account statements or letters from their banks, brokers or other nominee showing that they owned Willis shares as of May 30, 2014. Registration will begin at 8:30 a.m. GMT on July 23, 2014 and the meeting will begin at 9:00 a.m. GMT.

Who is entitled to vote?

Holders of our shares, as recorded in our share register on May 30, 2014, may vote at the meeting. As of May 30, 2014, the latest practicable date, there were — shares outstanding. Holders are entitled to one vote per share. A list of shareholders will be available for inspection for at least 10 days prior to the meeting at our offices at 200 Liberty Street, New York, NY 10281-1003.

How do I vote?

You may vote in person at the meeting or by proxy. We recommend that you vote by proxy even if you expect to attend the meeting. You are entitled to appoint one or more proxies to attend, speak and vote instead of you. A proxy need not be a member of the Company. You will be able to change your vote at the meeting if you attend in person.

Please refer to your proxy card or the information forwarded by your bank, broker or other holder of record to see how you should complete your proxy card and deliver it to the Company.

How do proxies work?

The Company’s Board of Directors is asking for your proxy. Giving us your proxy means you authorize us to vote your shares at the meeting, or at any adjournment of the meeting, in the manner you direct. You may vote for or against the proposals or abstain from voting. You may also vote for all, some or none of the directors seeking election.

10

Table of Contents

If you sign and return the enclosed proxy card but do not specify how to vote, we will vote your shares for all proposals in accordance with the recommendations made by the Board.

If your shares are held in an account with a broker, bank or other nominee, this institution is considered the shareholder of record and you are considered the “beneficial owner” or “street name holder” of those shares. In this case, your broker or bank (or its agent) or other nominee has forwarded the proxy materials, and separate voting instructions, to you. Because you are not the shareholder of record, you may not vote your shares in person at the Annual General Meeting unless you obtain a valid proxy from the broker, bank or other nominee that holds your shares, giving you the right to vote the shares in person at the meeting. As the beneficial owner of the shares, you have the right to direct your broker, bank or other nominee how to vote your shares by following the voting instructions provided to you with the proxy materials.

Under relevant NYSE rules, if you do not instruct your broker how to vote, your broker will only be able to vote your shares with respect to “routine” matters. The only routine matter is the ratification of the reappointment of Deloitte LLP as the Company’s independent auditors (Proposal 2). Broker discretionary voting is not permitted for any of the other proposals because they are “non-routine” matters.

As of the date hereof, we do not know of any other business that will be presented at the meeting. If other business shall properly come before the meeting or any adjournment or postponement thereof, your proxy gives the person or persons named in the proxy the authority to vote on the matter in accordance with the recommendation of our Board of Directors.

Who is paying the costs of soliciting this proxy?

In addition to this mailing, our employees may solicit proxies personally, electronically or by telephone. We pay the costs of soliciting this proxy. MacKenzie Partners has been retained to assist in the proxy solicitation at a base fee of approximately $15,000 plus expenses. We also reimburse brokers and other nominees for their expenses in sending these materials to you and getting your voting instructions. For further information on these arrangements, please refer to “Solicitation of Proxies.”

If I vote and then want to change or revoke my vote, may I?

If you are a shareholder of record, you may revoke your proxy at any time before the meeting by submitting a new proxy with a later date, by a later telephone or Internet vote, by voting in person at the meeting, or by notifying our Company Secretary. Written revocations to the Company Secretary should be directed to:

Company Secretary

c/o Office of the General Counsel

Willis Group Holdings Public Limited Company

200 Liberty Street

New York, NY 10281-1003

If your shares are held in a stock brokerage account or by a bank or other nominee on your behalf, follow the voting instructions provided to you with this Proxy Statement to determine how you may change your vote.

What is the quorum required for the Annual General Meeting?

In order to carry on the business of the meeting, we must have a quorum. Under our articles of association, a quorum is reached when shareholders holding at least 50% of our issued and outstanding shares are present in person or by proxy and entitled to vote.

Only the Company’s shareholders, their proxy holders, the Company’s directors, the Company’s auditors and the Company’s guests may attend the meeting.

11

Table of Contents

What vote is required for approval of each proposal and what is the effect of broker non-votes and abstentions?

All proposals to be acted on at the meeting other than Proposal Six require the affirmative vote of a majority of the votes cast at a meeting at which a quorum is present. Proposal Six requires the affirmative vote of not less than 75% of the votes of the shareholders cast at a general meeting. Abstentions and broker non-votes, though counted for the purposes of determining that a quorum is present, will not be counted as votes cast and therefore will have no effect. A broker non-vote is a proxy submitted by a broker where the broker fails to vote on behalf of a client on a particular matter because the broker was not instructed by the beneficial owner when such instruction is required by the NYSE with respect to such matter.

Who will count the votes and certify the results?

Computershare has been appointed as the independent Inspector of Election and will count the votes, determine whether a quorum is present, evaluate the validity of proxies and ballots, and certify the results of the voting.

Who is your transfer agent?

Our transfer agent is Computershare. All communications concerning accounts of shareholders of record, including address changes, name changes, inquiries as to requirements to transfer shares and similar issues, can be handled by calling toll-free (866) 259-7716 (U.S.) or (201) 680-6578 (outside the U.S.) or (800) 231-5469 (hearing impaired) or by accessing the web site at www.computershare.com/investor.

12

Table of Contents

ELECTION OF DIRECTORS

The Company’s directors are elected by the affirmative vote of a majority of the votes cast by shareholders at the Annual General Meeting and hold office only until the next Annual General Meeting of Shareholders unless they are earlier removed or resign before that meeting. Any nominee for director who does not receive a majority of the votes cast is not elected to the Board. The Nominating and Corporate Governance Committee (the “Governance Committee”) has reviewed the needs of the Board and the qualities, experience and performance of each director and director nominee. At the Governance Committee’s recommendation, the Board has nominated all current directors to hold office until the next Annual General Meeting of Shareholders unless they are earlier removed or resign before that meeting.

The Board unanimously recommends you vote “FOR” the election of each of the directors.

Nominees for Election

Willis Group Holdings plc is a leading global risk advisor, insurance and reinsurance broker. Through its subsidiaries, Willis develops and delivers professional insurance, reinsurance, risk management, financial and human resources consulting and actuarial services to corporations, public entities and institutions around the world. We have approximately 21,700 employees around the world (including approximately 3,700 at our associate companies) and a network of in excess of 400 offices in approximately 120 countries.

Directors are responsible for overseeing the Company’s business around the globe consistent with their fiduciary duties. This requires highly-skilled individuals with various qualities, attributes and professional experience. The Governance Committee believes that the slate of nominees as a whole reflects the collective knowledge, integrity, reputation, and leadership abilities, and, as discussed more below, the diversity of skills and experience with respect to accounting and financial services, government and regulation, marketing and operations and global markets that the governance of the Company requires.

Qualifications

When recommending a person for new or continued membership on the Board, the Governance Committee considers each nominee’s individual qualifications in light of the overall mix of attributes represented on the Board and the Company’s current and future needs. In its assessment of each nominee, the Governance Committee considers the person’s integrity, experience, reputation, independence and when the person is a current director of the Company, his or her performance as a director. The Governance Committee considers each director’s ability to devote the time and effort necessary to fulfill responsibilities to the Company and, for current directors, whether each director has attended at least 75% of the aggregate of the total number of meetings held by the Board and any committee on which he or she served. In 2013, each director satisfied this requirement. The Governance Committee believes service on other public or private boards (including international companies) also enhances a director’s knowledge and board experience. It considers the experience of a director on other boards and board committees in both this nomination decision and in recommending the membership slate for each of the Company’s Board Committees.

The Governance Committee believes that including directors having current and previous leadership positions is important to the Board’s ability to oversee management. Extensive knowledge of the Company’s business and the industry is an important quality for directors. Additionally, because of the Company’s global reach, international experience or knowledge of a key geographic area is also important. As the Company’s business also requires continuous compliance with regulatory requirements and agencies, it is imperative for some directors to have legal, governmental, political or diplomatic expertise. If a person has served or currently serves in the public arena (whether through political service, employment as a CEO of a public company or membership on a board of a public company), then his or her integrity and reputation is also a matter of public

13

Table of Contents

record on which Company and its shareholders may rely. The Governance Committee also believes that the Company distinguishes itself from its competitors through marketing and, as a result, a strong marketing perspective should be represented. In light of its public and global nature (including conducting business in different countries and currencies), the Company also seeks international experience and a high level of financial literacy and experience on the Board and Audit Committee.

Diversity

The Company is committed to maintaining diversity on the Board as provided in the Company’s Corporate Governance Guidelines. The Board and the Governance Committee believe that diversity on the Board is important to ensuring a rounded perspective. Diversity is broadly interpreted by the Board to include viewpoints, background, experience, industry knowledge, and geography, as well as more traditional characteristics of diversity, such as race and gender. We believe that our commitment is demonstrated by the current structure of our Board and the varied backgrounds and skill sets of our current directors and nominees, which include three women, two persons of Asian descent and a mix of American, British, Irish and Spanish citizens.

Set forth below each biographical information is a summary of some of the key qualifications, attributes, skills and experiences discussed above that were considered by the Governance Committee for each person nominated for election at our 2014 Annual General Meeting of Shareholders. (The absence of a particular bullet-point for a director does not mean that the director does not possess other qualifications or skills in that area).

Biographical Information

Dominic Casserley — Mr. Casserley, age 56, joined the Company, as CEO and as a director on January 7, 2013 and currently serves as a member of the Company’s Executive Committee. Before joining the Company, he served as a senior partner of McKinsey & Company, which he joined in New York in 1983. During his 29 years at McKinsey & Company, Mr. Casserley was based in the U.S. for 12 years, Asia for five years, and, from 2000 until 2012, he worked across Europe while based in the London office. During his time at McKinsey & Company, Mr. Casserley led McKinsey’s Greater China Practice and its UK and Ireland Practice. Mr. Casserley was a member of McKinsey’s Shareholder Council, the firm’s global board, from 1999 to 2012 and for four years served as the Chairman of its Finance Committee. Mr. Casserley is a graduate of Cambridge University.

| • | International Business Experience — Mr. Casserley’s expertise in the global financial services industry, including experience with insurance companies, and the skill of capitalizing on the opportunities of expanding into new markets, was obtained during his 29-year tenure at McKinsey where he spent 17 years working in Asia, Europe and London and, during which time, he led the firm’s Greater China Practice and its UK and Ireland Practice. |

| • | CEO/Management Experience — Mr. Casserley has served as the Company’s current Chief Executive Officer since January 7, 2013. In addition to serving as a senior partner at McKinsey & Company he served on the company’s global board for over 10 years and served as Chairman of the Finance Committee of that board for four years. |

Anna C. Catalano — Ms. Catalano, age 54, joined the Board on July 21, 2006 and currently serves as a member of the Company’s Governance Committee and Compensation Committee. She was Group Vice President, Marketing for BP plc from 2001 to 2003. Prior to that she held various executive positions at BP and Amoco, including Group Vice President, Emerging Markets at BP; Senior Vice President, Sales and Operations at Amoco; and President of Amoco Orient Oil Company. She currently serves on the Board and the Governance Committee of Mead Johnson Nutrition and Chemtura Corporation and the Compensation Committees of Mead Johnson Nutrition, Chemtura Corporation and Kraton Performance Polymers. She serves on the Executive Committee of the Houston Chapter of the Alzheimer’s Association and serves as a director on the National Board of the Alzheimer’s Association. Ms. Catalano formerly served on the boards of SSL International plc, Hercules

14

Table of Contents

Incorporated, Aviva plc and U.S. Dataworks and as an advisory board member of BT Global Services. Ms. Catalano holds a BS degree in Business Administration from the University of Illinois, Champaign-Urbana.

| • | International Business — Ms. Catalano has significant executive experience in international business operations through her roles as: Group Vice President, Marketing at BP plc; Group Vice President, Emerging Markets at BP; Senior Vice President, Sales and Operations at Amoco; and President of Amoco Orient Oil Company. In 2001, Ms. Catalano was recognized by Fortune Magazine as being among the “Most Powerful Women in International Business.” |

| • | Marketing Experience — Ms. Catalano has over 25 years of experience in global marketing and operations. During her tenure as the head of marketing for BP plc, she was instrumental in the internal and external repositioning of the BP brand and was a primary voice behind the campaign to establish BP’s “Beyond Petroleum” positioning. She is also a frequent speaker on strategic and global branding. |

| • | Board and Committee Experience — Ms. Catalano has significant experience as a director and committee member from her service on other public company boards including her current service as a member of the Governance Committee of Mead Johnson Nutrition and Chemtura Corporation, the Compensation Committees of Mead Johnson Nutrition, Chemtura Corporation and Kraton Performance Polymers as well as her former service on the international company boards of SSL International plc and Aviva plc. |

Sir Roy Gardner — Sir Roy Gardner, age 68, joined the Board on April 26, 2006 and currently serves as the Chairman of the Company’s Risk Committee and a member of the Executive Committee. He is a Chartered Certified Accountant and served as Chairman of Compass Group PLC, a food and support services company, until his retirement from the position in February 2014. He also served as Chairman of the Nominating Committee of Compass Group PLC. He is a Senior Advisor to Credit Suisse and also a Director and Chairman of the Nominating Committee of Mainstream Renewable Power Limited, Chairman of the Advisory Board of the Energy Futures Lab of Imperial College London, President of Carers UK, Chairman of the Apprenticeship Ambassadors Network and Chairman and member of several board committees of Enserve Group Ltd. In addition, he was Chairman of Connaught plc between May and September 2010. He previously held positions as Chief Executive of Centrica plc, Chairman of Manchester United plc, Chairman of Plymouth Argyle Football Club, Finance Director of British Gas plc, Managing Director of GEC-Marconi Ltd, Director of GEC plc and Director of Laporte plc.

| • | International Business and Board Experience — The United Kingdom is an important market for the Company. Sir Roy Gardner is a well-respected British businessman who began his career in 1963 and has held leadership positions at or held director positions on the boards of a number of UK and other European companies. |

| • | CEO/Management Experience — Sir Roy Gardner’s senior leadership roles include his position as former Chief Executive of Centrica plc for 9 1/2 years. Centrica plc is a large multinational utility company that is based in the United Kingdom but also has interests in North America. It is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. |

| • | Extensive Knowledge of the Company’s Business — Sir Roy Gardner’s experience on the Board, his financial background as a UK-Chartered Certified Accountant and his former service as the Chairman of the Company’s Compensation Committee provides him with an extensive knowledge of the Company’s business and allows him to serve as an effective Chairman of the Company’s Risk Committee. |

The Rt. Hon. Sir Jeremy Hanley, KCMG — Sir Jeremy Hanley, age 68, joined the Board on April 26, 2006 and currently serves as a member of the Company’s Audit Committee. He is a Chartered Accountant and a director of Willis Limited, a subsidiary of the Company, and a director and member of the Audit and Remuneration Committees of Langbar International Limited and of London Asia Capital plc. He also serves on the International Advisory Committee for GTECH S.p.A Sir Jeremy was a Member of Parliament for Richmond

15

Table of Contents

and Barnes from 1983 to 1997 and held a number of ministerial position in the U.K. government, including Under Secretary of State for Northern Ireland, Minister of State for the Armed Forces, Cabinet Minister without Portfolio at the same time as being Chairman of the Conservative Party and Minister of State for Foreign & Commonwealth Affairs. He retired from politics in 1998. He also served on the Boards of Lottomatica S.p.A., Onslow Suffolk Limited, Mountfield Group Limited, Nymex London Limited and ITE Group plc. and the Audit Committee of the Joint Arab British Chamber of Commerce.

| • | Legal, Governmental, Political or Diplomatic Expertise — Sir Jeremy Hanley has a deep understanding of UK governmental and regulatory affairs and public policy based on his 14 years as a member of Parliament and significant ministerial positions in the UK government. Sir Jeremy Hanley’s background is important for his role as a director of Willis Limited, a subsidiary of the Company regulated by the Financial Control Authority, the regulator of the financial services industry in the UK. |

| • | Financial Background — Sir Jeremy Hanley, a member of the Company’s Audit Committee, is a UK-Chartered accountant which qualifies him as an audit committee financial expert. |

| • | International Board and Committee Experience — Sir Jeremy Hanley also brings experience from his service on numerous international boards, including his former service on the Board and Audit Committee of Lottomatica S.p.A., an Italian company. |

Robyn S. Kravit — Ms. Kravit, age 62, joined the Board on April 23, 2008 and currently serves as a member of the Company’s Risk Committee. She is an international business executive with almost 30 years of experience in establishing and directing significant China-based operations engaged in the international trading of industrial raw materials. Ms. Kravit co-founded Tethys Research LLC, a biotechnology company, and has acted as its Chief Executive Officer since 2000. From 2001 through 2010, Ms. Kravit was a Director of FONZ, the organization which manages commercial and educational activities for Smithsonian’s National Zoological Park, serving two terms as President and later chairing its Audit Committee. On January 1, 2012, she was appointed to a two-year term on the Standing Advisory Group of the Public Company Accounting Oversight Board (PCAOB), established by Congress to oversee the audits of public companies. She currently serves on the Advisory Council of Johns Hopkins University’s Whiting School of Engineering and the Board of Governors of the Washington Foreign Law Society. She previously served on the Board of InovaChem Inc. Ms. Kravit holds a BA in East Asian Studies from Vassar College, and a MA in East Asian Studies from Harvard University.

| • | International Experience — China is an emerging market for the Company and Ms. Kravit’s almost 30 years of experience in international business, focusing on the Far East markets, provides the Company with an extensive knowledge base. She is fluent in Mandarin Chinese. She has established and directed significant China-based operations engaged in the international trading of industrial raw materials and has experience in devising marketing plans that adapt to evolving political and economic environments. She also has extensive experience in the management of foreign trade transactions and international risk management. |

| • | CEO/Management Experience — Ms. Kravit founded and since 2000 has been the Chief Executive Officer of Tethys Research LLC, a biotechnology company, and is responsible for contract, administrative and financial operations. Prior to Tethys, as Managing Director for Asian operations, Ms. Kravit functioned as CEO of a major business unit within a complex multinational corporation. |

| • | Financial Background — Ms. Kravit previously served on the Company’s Audit Committee and was appointed to a two-year term on the Standing Advisory Group of the PCAOB. The Standing Advisory Group advises the PCAOB on issues relating to the development of auditing standards. |

Wendy E. Lane — Ms. Lane, age 63, joined the Board on April 21, 2004 and currently serves as the Chairman of the Company’s Compensation Committee and as a member of the Audit Committee and Executive Committee. She was a member of the CEO Search Committee as well as other ad hoc Board Committees convened from time to time. She has been Chairman of Lane Holdings, Inc., an investment firm, since 1992. Prior to forming Lane Holdings, Inc., Ms. Lane was a Principal and Managing Director of Donaldson, Lufkin and

16

Table of Contents

Jenrette Securities Corporation, an investment banking firm, serving in these and other positions from 1981 to 1992. Ms. Lane is also a director and Audit Committee member of UPM-Kymmene Corporation, a Finnish publicly-held corporation and, until May 13, 2014, will serve as a member of the board, Nominating and Corporate Governance and Audit Committees of Laboratory Corporation of America. Ms. Lane holds a BA from Wellesley College and a MBA from Harvard Business School.

| • | Financial Background — Ms. Lane has more than 15 years of experience in investment banking, including financings, mergers and acquisitions and advisory projects. Prior to forming her own investment firm in 1992, Ms. Lane was a Principal and Managing Director of Donaldson, Lufkin and Jenrette Securities Corporation, an investment banking firm, serving in these and other positions from 1981 to 1992. From 1977 to 1980, she was an investment banker at Goldman Sachs. Ms. Lane’s financial background qualifies her as an audit committee financial expert. |

| • | Extensive Knowledge of the Company’s Business — Ms. Lane’s service as a director, financial expertise, current dual service as the Chairman of the Company’s Compensation Committee and member of the Audit Committee and former service as a member of the Company’s Nominating and Corporate Governance Committee have provided Ms. Lane with an invaluable knowledge base of the Company and a deep understanding of the interrelationships of issues and decisions between the Committees. She was also part of the Search Committee formed by the Board in connection with appointing a new CEO. |

| • | International Board Experience — Ms. Lane has served for seven years on the board of UPM-Kymmene Corporation, a Finnish publicly held corporation with worldwide operations and revenues exceeding $11.5 billion. |

| • | Board and Committee Experience — As well as serving on almost all of Willis’ Committees, Ms. Lane serves on the Audit Committee of UPM-Kymmene Corporation, has chaired the Audit and Compensation Committees of Laboratory Corporation of America and has extensive committee experience on all of her current and past boards. |

Francisco Luzón — Mr. Luzón, age 66, joined the Board on July 23, 2013 and currently serves as a member of the Governance Committee. From 1996 until January 2012, Mr. Luzón served in several capacities at Banco Santander, S.A. (a public company organized under the laws of Spain), most recently as Executive Board Member and General Manager of the Latin American Division, from 1996 until 1998, as Executive Director and Deputy to the Chairman and Head of Strategy, Communication and Investor Relations, and in 1998, as Head of Human Resources and Information Technology. Prior to that, Mr. Luzón held executive positions at several other banks, including Argentaria, S.A., Banco Exterior de Espana, S.A., Banco Bilbao Vizcaya and Banco Vizcaya. Within the last five years, Mr. Luzón has served as a Director of Banco Santander, S.A. and Inditex-Zara, the international fashion retail company. Mr. Luzón currently is a director of Latam Airlines Group, the international airline, and Member of its Finance Committee and its Strategy Committee. He also serves on the boards and advisory councils of numerous academic institutions, non-profit organizations and think tanks. He is also a consultant of the Interamerican Development Bank. Mr. Luzón has a Degree in business and economics from Bilbao University and, in 2010, received an Honorary Degree in economics from University Castilla La Mancha.

| • | International Business and Management Experience — Mr. Luzón has significant international financial services experience, having served in executive roles most recently at Banco Santander, the Spanish financial institution, and other international banks over the last 30 years, and having worked in London, New York, Tokyo, the Middle East, North Africa and 12 countries in Latin America. |

| • | Financial Background — Mr. Luzón has over 40 years of experience working in mergers and acquisitions, the restructuring of numerous private and state-owned banks, insurance companies and financial institutions in Spain and throughout numerous countries in Latin America. |

| • | International Board Experience — Mr. Luzón also brings experience from his service on international boards, including his former service as a director of Banco Santander and Inditex-Zara, the international fashion retailer, and his current service as a director of Latam Airlines Group, the |

17

Table of Contents

| international airline. He has also served on the boards and advisory councils of numerous companies, academic institutions, not-for-profit organizations and think tanks. |

James F. McCann — Mr. McCann, age 62, joined the Board on April 21, 2004 and currently serves as the Board’s non-executive Chairman of the Board, the Chairman of the Company’s Governance Committee, and as a member of the Executive Committee. Prior to serving as the non-executive Chairman of the Board, Mr. McCann served as the Company’s Presiding Independent Director. Mr. McCann was a member of the CEO Search Committee as well as other ad hoc Board Committees convened from time to time. He has served since 1976 as Chairman and Chief Executive Officer of 1-800-Flowers.Com, Inc., a florist and gift shop company. He also serves as a director for Scott’s Miracle-Gro, Dearborn National and JPMorgan Chase Regional Advisory Board. He previously served as a director and Compensation Committee member of Lottomatica S.p.A. and a director of Gateway, Inc. and The Boyds Collection, Ltd.

| • | CEO/Management Experience — Mr. McCann has substantial management, strategic and operational experience as Chairman and CEO of 1-800-Flowers.com, Inc. The knowledge and experience he has gained through his leadership of a consumer-product and service-based public company for over 30 years continues to benefit the Company both in his role as a director, Chairman of the Board, the Chairman of the Governance Committee, Presiding Independent Director, and a member of the Executive Committee. |

| • | Extensive Knowledge of the Company’s Business — Mr. McCann’s service as a director of the Company, service as the Board’s non-executive Chairman of the Board, Presiding Independent Director, Chairman of the Governance Committee, member of the Executive Committee and former member of the Company’s Compensation Committee has provided him with an in-depth knowledge of the Company’s business and structure. He was also part of the Search Committee formed by the Board in connection with appointing a new CEO. |

| • | Board and Committee Experience — Mr. McCann has benefited from his service as a former director and member of the Compensation Committee of Lottomatica S.p.A., an Italian headquartered company and his experience as Chairman of 1-800-Flowers.com. |

Jaymin Patel — Mr. Patel, age 46, joined the Board on July 23, 2013 and currently serves as a member of the Compensation Committee. Mr. Patel is currently the President and Chief Executive Officer of GTECH Americas, a division of GTECH S.p.A. (formerly named Lottomatica S.p.A.), a leading commercial operator and provider of technology in regulated worldwide gaming markets. Before becoming CEO of GTECH Corporation, then a subsidiary of Lottomatica Group S.p.A. in 2008, Mr. Patel held various executive positions at GTECH, including President and Chief Operating Officer (2007), Senior Vice President and Chief Financial Officer (2000-2007), Vice President, Financial Planning and Business Evaluation (1998-2000) and Finance Director, European and African Operations (1995-1997). From August 2006 until April 2007, Mr. Patel also served as Chief Financial Officer of Lottomatica S.p.A. (now GTECH S.p.A.). Prior to joining GTECH, Mr. Patel worked at PricewaterhouseCoopers in London. Mr. Patel serves as a member of the Board and the Executive Management Committee of GTECH S.p.A. Mr. Patel holds a B.A. with honors from Birmingham Polytechnic in the United Kingdom and qualified as a Chartered Accountant with PricewaterhouseCoopers in London.

| • | CEO/Management Experience —Mr. Patel has approximately twenty years of experience as an executive of GTECH and is currently the President and Chief Executive Officer of GTECH Americas. |

| • | International Experience — As CEO of GTECH Americas, an international business that operates in over 55 countries, Mr. Patel has international business experience, especially growing GTECH in developing countries, including Latin America, Eastern Europe and Asia Pacific regions. |

| • | International Board Experience —Mr. Patel has served for six years on the Board and Executive Management Committee of Lottomatica Group S.p.A. (now GTECH S.p.A.), an Italian publicly held corporation with worldwide operations. |

18

Table of Contents

Douglas B. Roberts — Mr. Roberts, age 66, joined the Board on February 13, 2003 and currently serves as the Chairman of the Company’s Audit Committee and a member of the Executive Committee. He is the former Treasurer for the State of Michigan, a position held from April 2001 to December 2002 and from January 1991 to November 1998. From January 1999 to March 2001 he was Vice President of Business Development and Best Practices at Lockheed Martin IMS. Prior to January 1991, Mr. Roberts worked in the Michigan Senate as Director, Senate Fiscal Agency from April 1988 to December 1990 and as Deputy Superintendent of Public Instruction for the Department of Education. Mr. Roberts holds a doctorate in Economics from Michigan State University. Currently, Mr. Roberts is both a Professor and the Director for the Institute for Public Policy and Social Research at Michigan State University.

| • | Legal, Governmental, Political or Diplomatic Experience — Mr. Roberts has a deep understanding of public finance and other public policy matters from his 28-year tenure in state government, including his years as a Michigan state treasurer and his current academic position. As Michigan state treasurer, he oversaw the state’s revenue and cash positions during a period of rebirth in Michigan’s finances and economy which included five ratings upgrades. In addition, the state Treasurer is the sole fiduciary of the state’s pension systems valued at approximately $50 billion. |

| • | Financial Background and Extensive Knowledge of the Company’s Business — Mr. Roberts’ business experience and education also qualify him as an audit committee financial expert and have positioned him well to serve as a Company’s director and as the Chairman of our Audit Committee. |

Dr. Michael J. Somers — Dr. Somers, age 71, joined the Board on April 21, 2010 and currently serves as a member of the Company’s Audit Committee. He was Chief Executive Officer of the Irish National Treasury Management Agency from 1990, when it was established, until the end of 2009. The Agency, which is a commercial entity outside the civil service, was initially set up to arrange Ireland’s borrowing and manage its national debt. Its remit was extended to establish and manage the National Pensions Reserve Fund, of which Dr. Somers was a Commissioner, and the National Development Agency, of which he was Chairman. It also incorporated the State Claims Agency, which handles claims against the State and against hospitals and other medical institutions. Dr. Somers previously worked in the Irish Department of Finance and the Central Bank and served as Secretary General of the Department of Defense from 1985 to 1987. He was the Irish member of the EU Monetary Committee from 1987 to 1990 and chaired the EU group that established the European Bank for Reconstruction and Development. He served on the board of the Irish Stock Exchange until the end of 2009. He was the Irish Director on the Board of the European Investment Bank up to May 2013. He serves on the Boards of Allied Irish Banks plc, St. Vincent’s Healthcare Group Ltd., the Institute of Directors, Hewlett Packard International Bank plc, Fexco Holdings Ltd., and as Chairman of Goodbody Stockbrokers, a subsidiary of Fexco. He also serves as Chairman of the Audit Committees of Hewlett Packard International Bank plc and St. Vincent’s Healthcare Group and Chairman of the Risk Committee of the AIB Bank. He was awarded the honor of Chevalier of the Légion d’Honneur by the President of France. He previously served as a Council Member of the Dublin Chamber of Commerce and Ulysses Securitization plc, a government established special purpose entity whose purpose has expired and assets have been liquidated. He holds various degrees, including a master’s degree in economic science and a doctorate from University College Dublin. He is President of the Ireland Chapter of the Ireland-U.S. Council.

| • | Financial Background — Dr. Somers has an extensive finance background as a result of his experience relating to Ireland’s borrowing and managing its national debt as well as his experience as the Irish member of the EU Monetary Committee. |

| • | International Business and Board Experience — Dr. Somers has extensive knowledge and experience in serving the Irish and European financial, business and governmental communities, including through his service on a number of Irish Boards. The Irish market is important to the Company which completed its redomicile to Ireland, in part, to facilitate business expansion. Dr. Somers also brings his experience on the Audit Committee and Risk Committee of various entities. |

Jeffrey W. Ubben — Mr. Ubben, age 52, joined the Board on July 23, 2013 and is a member of the Company’s Risk Committee. Mr. Ubben is a Founder, Chief Executive Officer and the Chief Investment Officer

19

Table of Contents

of ValueAct Capital. Prior to founding ValueAct Capital in 2000, Mr. Ubben was a Managing Partner at Blum Capital Partners for more than five years. Previously, Mr. Ubben spent eight years at Fidelity Investments where he managed the Fidelity Value Fund. Mr. Ubben is a former director and member of the Compensation Committee of Acxiom Corp., a former director and member of the Compensation Committee of Gartner Group, Inc., a former director and member of the Audit and Finance Committee of Misys, plc, a former director and member of the Nomination and Governance Committee of Omnicare, Inc., a former director and member of the Audit and Finance Committee of Sara Lee Corp. and a former director of several other public and private companies. In addition, Mr. Ubben serves as chairman of the national board of the Posse Foundation, is on the board of trustees of Northwestern University, and is also on the board of the American Conservatory Theater. He has a B.A. from Duke University and an M.B.A. from the J. L. Kellogg Graduate School of Management at Northwestern University.

| • | Financial Background — Mr. Ubben has more than 20 years of experience in the investment management business. |

| • | CEO/Management Experience — Mr. Ubben’s leadership roles include serving as Chief Executive Officer and Chief Investment Officer of ValueAct Capital since 2000 and as Managing Partner at Blum Capital Partners for more than five years prior to joining ValueAct. |

| • | Board and Committee Experience — Mr. Ubben also brings experience from his prior service as a director and board committee member of numerous global public companies. |

On April 25, 2013, the Company entered into a Nomination Agreement with ValueAct pursuant to which the Company’s Board of Directors agreed to nominate Mr. Ubben for election at the 2013 Annual General Meeting of Shareholders. In addition, ValueAct agreed, subject to exceptions, not to engage in certain transactions regarding the Company and its securities until a date specified in the Nomination Agreement. This agreement expires at the 2014 Annual General Meeting of Shareholders.

In connection with consideration of Proposal 1 (Election of Directors), below is a summary of the Company’s corporate governance practices, guidelines and procedures.

Board and Committee Member Independence

Based on the recommendation of the Governance Committee, the Board has determined that, with the exception of Mr. Casserley, (i) all of the current directors and director nominees shown above and (ii) the members of the Audit Committee, Compensation Committee, Governance Committee and the Risk Committee are independent under the relevant Securities and Exchange Commission (“SEC”) rules, NYSE listing standards and the Board’s Director Independence Standards. The Board’s Director Independence Standards are part of the Company’s Corporate Governance Guidelines adopted by the Board and which comply and meet the requirements of the NYSE’s listing standards.