Item 1. |

Reports to Shareholders. |

| Page | ||||||||

| 2 | ||||||||

| 15 | ||||||||

| 16 | ||||||||

| 22 | ||||||||

| 23 | ||||||||

| 24 | ||||||||

| 25 | ||||||||

| 26 | ||||||||

| 28 | ||||||||

| 29 | ||||||||

| 30 | ||||||||

| 71 | ||||||||

| 96 | ||||||||

| 97 | ||||||||

| 99 | ||||||||

| 100 | ||||||||

| Fund | Fund Summary |

Schedule of Investments |

||||||

| 6 | 31 | |||||||

| 7 | 35 | |||||||

| 8 | 39 | |||||||

| 9 | 43 | |||||||

| 10 | 46 | |||||||

| 11 | 49 | |||||||

| 12 | 52 | |||||||

| 13 | 58 | |||||||

| 14 | 65 | |||||||

(1) |

Consolidated Schedule of Investments |

Important Information About the Funds |

2 |

PIMCO CLOSED-END FUNDS |

SEMIANNUAL REPORT |

| | JUNE 30, 2024 | 3 |

Important Information About the Funds |

(Cont.) |

Fund Name |

Inception Date |

Diversification Status | ||||||||

PIMCO Municipal Income Fund |

06/29/01 |

Diversified | ||||||||

PIMCO Municipal Income Fund II |

06/28/02 |

Diversified | ||||||||

PIMCO Municipal Income Fund III |

10/31/02 |

Diversified | ||||||||

PIMCO California Municipal Income Fund |

06/29/01 |

Diversified | ||||||||

PIMCO California Municipal Income Fund II |

06/28/02 |

Diversified | ||||||||

PIMCO California Municipal Income Fund III |

10/31/02 |

Diversified | ||||||||

PIMCO New York Municipal Income Fund |

06/29/01 |

Non-diversified | ||||||||

PIMCO New York Municipal Income Fund II |

06/28/02 |

Diversified | ||||||||

PIMCO New York Municipal Income Fund III |

10/31/02 |

Non-diversified | ||||||||

4 |

PIMCO CLOSED-END FUNDS |

SEMIANNUAL REPORT |

| | JUNE 30, 2024 | 5 |

Symbol on NYSE - PCQ |

Municipal Bonds & Notes |

||||

Ad Valorem Property Tax |

29.0% |

|||

Health, Hospital & Nursing Home Revenue |

12.2% |

|||

Local or Guaranteed Housing |

9.4% |

|||

College & University Revenue |

7.5% |

|||

Lease (Abatement) |

5.4% |

|||

Port, Airport & Marina Revenue |

4.9% |

|||

General Fund |

4.4% |

|||

Tobacco Settlement Funded |

4.3% |

|||

Natural Gas Revenue |

4.2% |

|||

Sales Tax Revenue |

3.8% |

|||

Special Tax |

2.3% |

|||

Electric Power & Light Revenue |

2.3% |

|||

Highway Revenue Tolls |

2.2% |

|||

Sewer Revenue |

2.1% |

|||

Water Revenue |

1.4% |

|||

Lease (Non-Terminable) |

1.2% |

|||

Other |

2.3% |

|||

U.S. Government Agencies |

1.1% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Market Price |

$9.42 |

|||

NAV |

$10.48 |

|||

Premium/(Discount) to NAV |

(10.11)% |

|||

Market Price Distribution Rate (2) |

4.59% |

|||

NAV Distribution Rate (2) |

4.12% |

|||

Total Effective Leverage (3) |

40.79% |

|||

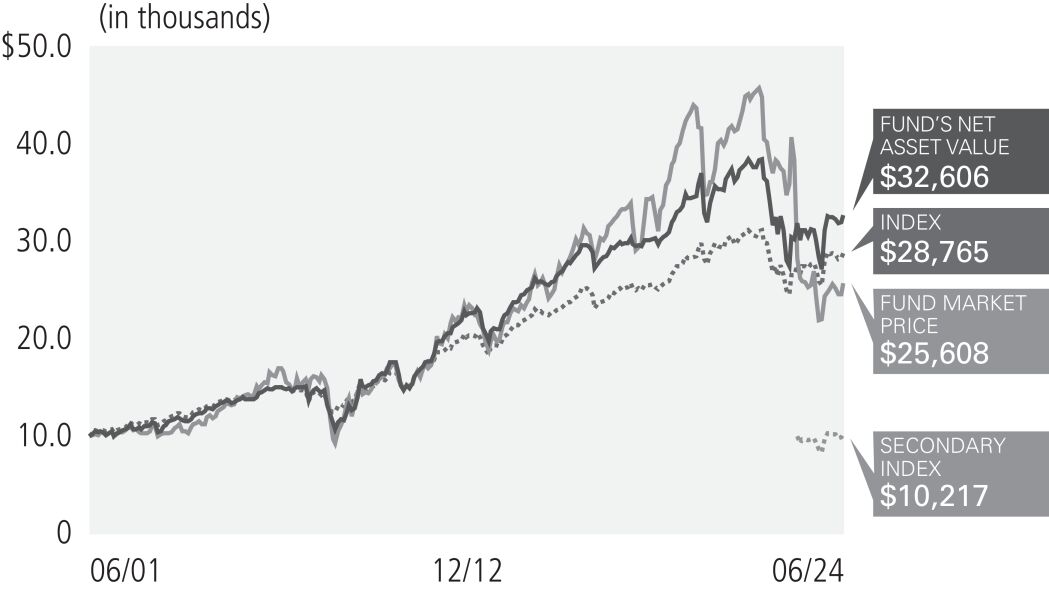

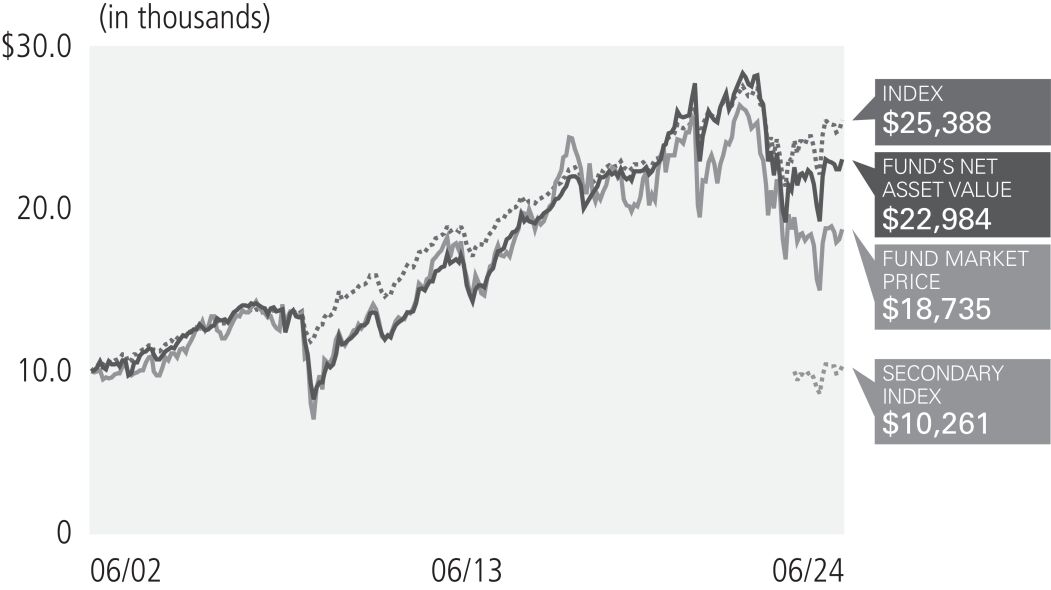

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||||||||||

6 Month* |

1 Year |

5 Year |

10 Year |

Since launch of Secondary Index 01/25/23 |

Commencement of Operations (06/29/01) |

|||||||||||||||||||||

|

Market Price |

3.42% |

0.68% |

(8.51)% |

1.12% |

(8.08)% |

4.17% |

|||||||||||||||||||

|

NAV |

0.35% |

4.71% |

(0.31)% |

3.24% |

1.54% |

5.28% |

|||||||||||||||||||

|

Bloomberg CA Muni 22+ Year Index |

(0.27)% |

4.27% |

0.96% |

3.05% |

3.06% |

4.70% |

¨ | ||||||||||||||||||

|

ICE California Long Duration Municipal Securities Index** |

(0.97)% |

5.22% |

— |

— |

1.47% |

— |

|||||||||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The indexes are not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

| » | Exposure to the housing sector contributed to performance, as the sector posted positive returns. |

| » | Security selection within the education sector contributed to performance, as select securities held within the Fund posted positive returns. |

| » | Security selection within taxable municipals contributed to performance, as select taxable municipals held within the Fund posted positive performance. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Exposure to the electric utility sector detracted from performance, as the sector posted negative returns. |

| » | Exposure to the lease-backed sector detracted from performance, as the sector posted negative returns. |

6 |

PIMCO CLOSED-END FUNDS |

Symbol on NYSE - PCK |

Municipal Bonds & Notes |

||||

Ad Valorem Property Tax |

31.3 |

% | ||

Health, Hospital & Nursing Home Revenue |

11.0 |

% | ||

Local or Guaranteed Housing |

9.6 |

% | ||

College & University Revenue |

5.9 |

% | ||

Natural Gas Revenue |

5.4 |

% | ||

Port, Airport & Marina Revenue |

4.9 |

% | ||

Tobacco Settlement Funded |

4.4 |

% | ||

General Fund |

4.2 |

% | ||

Sales Tax Revenue |

3.3 |

% | ||

Lease (Abatement) |

3.2 |

% | ||

Highway Revenue Tolls |

3.1 |

% | ||

Special Tax |

2.5 |

% | ||

Electric Power & Light Revenue |

2.3 |

% | ||

Sewer Revenue |

1.9 |

% | ||

Water Revenue |

1.3 |

% | ||

Lease (Non-Terminable) |

1.0 |

% | ||

Other |

3.3 |

% | ||

U.S. Government Agencies |

1.1 |

% | ||

Short-Term Instruments |

0.3 |

% | ||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Market Price |

$5.85 |

|||

NAV |

$6.68 |

|||

Premium/(Discount) to NAV |

(12.43)% |

|||

Market Price Distribution Rate (2) |

4.41% |

|||

NAV Distribution Rate (2) |

3.86% |

|||

Total Effective Leverage (3) |

40.70% |

|||

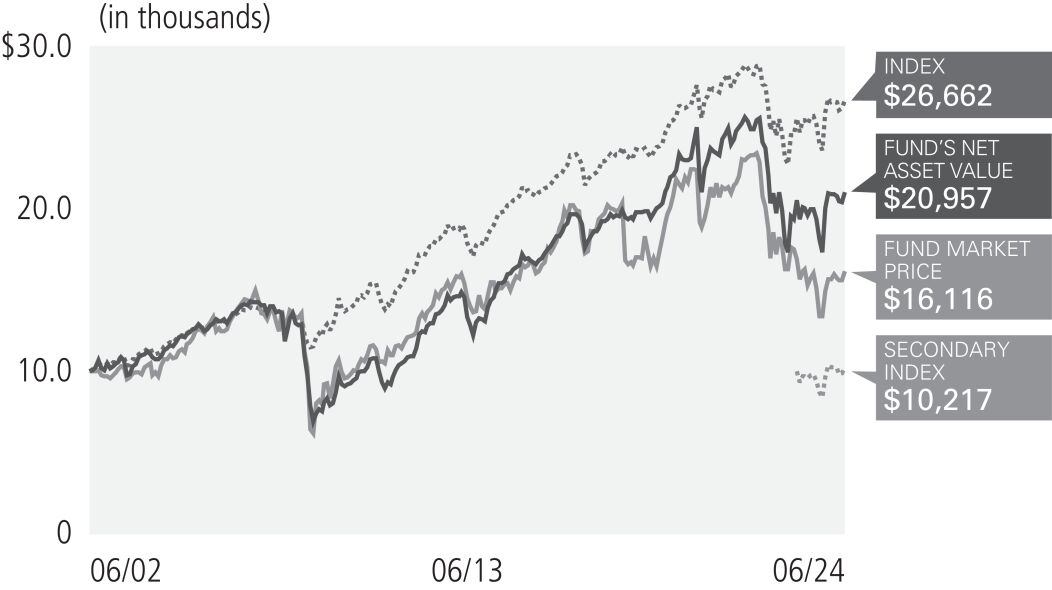

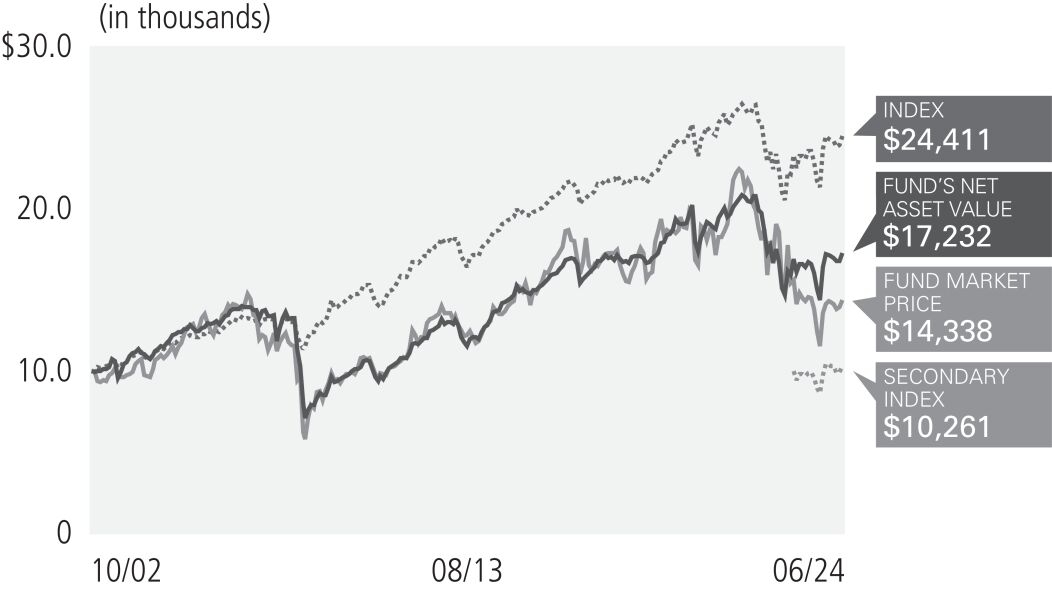

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||||||||||

6 Month* |

1 Year |

5 Year |

10 Year |

Since launch of Secondary Index 01/25/23 |

Commencement of Operations (06/28/02) |

|||||||||||||||||||||

|

Market Price |

3.12% |

2.88% |

(4.96)% |

0.65% |

(2.71)% |

2.25% |

|||||||||||||||||||

|

NAV |

0.15% |

4.99% |

(0.98)% |

3.12% |

1.44% |

3.42% |

|||||||||||||||||||

|

Bloomberg CA Muni 22+ Year Index |

(0.27)% |

4.27% |

0.96% |

3.05% |

3.06% |

4.55% |

¨ | ||||||||||||||||||

|

ICE California Long Duration Municipal Securities Index** |

(0.97)% |

5.22% |

— |

— |

1.47% |

— |

|||||||||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The indexes are not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

| » | Exposure to the housing sector contributed to performance, as the sector posted positive returns. |

| » | Security selection within the education sector contributed to performance, as select securities held within the Fund posted positive returns. |

| » | Security selection within the special tax sector contributed to performance, as select securities held within the Fund posted positive returns. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Exposure to the lease-backed sector detracted from performance, as the sector posted negative returns. |

| » | Exposure to the electric utility sector detracted from performance, as the sector posted negative returns. |

SEMIANNUAL REPORT |

| | JUNE 30, 2024 | 7 |

Symbol on NYSE - PZC |

Municipal Bonds & Notes |

||||

Ad Valorem Property Tax |

28.6% |

|||

Health, Hospital & Nursing Home Revenue |

12.8% |

|||

Local or Guaranteed Housing |

9.8% |

|||

Tobacco Settlement Funded |

6.4% |

|||

College & University Revenue |

6.1% |

|||

Port, Airport & Marina Revenue |

4.8% |

|||

Lease (Abatement) |

4.0% |

|||

General Fund |

3.6% |

|||

Sales Tax Revenue |

3.3% |

|||

Special Tax |

3.1% |

|||

Electric Power & Light Revenue |

2.3% |

|||

Natural Gas Revenue |

2.1% |

|||

Water Revenue |

1.9% |

|||

Sewer Revenue |

1.8% |

|||

Highway Revenue Tolls |

1.5% |

|||

Lease (Non-Terminable) |

1.4% |

|||

Other |

3.1% |

|||

U.S. Government Agencies |

1.7% |

|||

Short-Term Instruments |

1.7% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Market Price |

$7.18 |

|||

NAV |

$7.75 |

|||

Premium/(Discount) to NAV |

(7.35)% |

|||

Market Price Distribution Rate (2) |

4.93% |

|||

NAV Distribution Rate (2) |

4.57% |

|||

Total Effective Leverage (3) |

40.66% |

|||

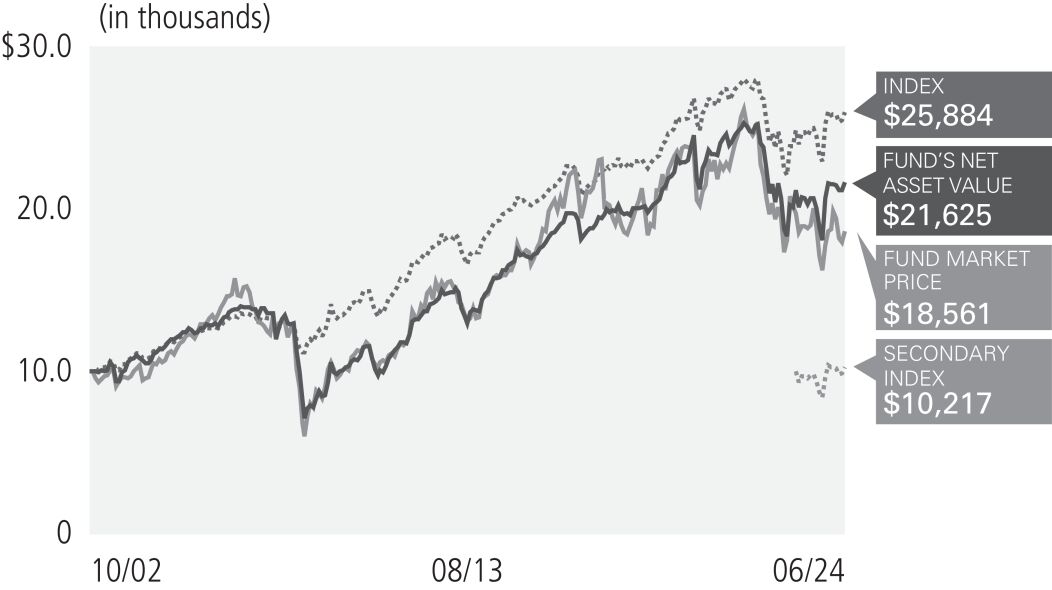

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||||||||||

6 Month* |

1 Year |

5 Year |

10 Year |

Since launch of Secondary Index 01/25/23 |

Commencement of Operations (10/31/02) |

|||||||||||||||||||||

|

Market Price |

(0.22)% |

(2.12)% |

(3.99)% |

1.58% |

(3.56)% |

2.90% |

|||||||||||||||||||

|

NAV |

0.49% |

4.78% |

(0.33)% |

3.26% |

1.59% |

3.62% |

|||||||||||||||||||

|

Bloomberg CA Muni 22+ Year Index |

(0.27)% |

4.27% |

0.96% |

3.05% |

3.06% |

4.48% |

|||||||||||||||||||

|

ICE California Long Duration Municipal Securities Index** |

(0.97)% |

5.22% |

— |

— |

1.47% |

— |

|||||||||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The indexes are not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

| » | Exposure to the housing sector contributed to performance, as the sector posted positive returns. |

| » | Select exposure within the education sector contributed to performance, as select securities held within the Fund posted positive returns. |

| » | Select exposure within the special tax sector contributed to performance, as select securities held within the Fund posted positive returns. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Select exposure within the industrial revenue sector detracted from performance, as select securities held within the Fund posted negative returns. |

| » | Exposure to the electric utility sector detracted from performance, as the sector posted negative returns. |

8 |

PIMCO CLOSED-END FUNDS |

Symbol on NYSE - PNF |

Municipal Bonds & Notes |

||||

College & University Revenue |

10.8% |

|||

Income Tax Revenue |

10.7% |

|||

Water Revenue |

8.8% |

|||

Tobacco Settlement Funded |

8.8% |

|||

Health, Hospital & Nursing Home Revenue |

8.6% |

|||

Port, Airport & Marina Revenue |

7.5% |

|||

Transit Revenue |

7.4% |

|||

Ad Valorem Property Tax |

7.2% |

|||

Local or Guaranteed Housing |

7.0% |

|||

Electric Power & Light Revenue |

6.7% |

|||

Industrial Revenue |

5.3% |

|||

Sales Tax Revenue |

2.7% |

|||

Highway Revenue Tolls |

2.3% |

|||

Miscellaneous Taxes |

1.6% |

|||

Charter School Aid |

1.1% |

|||

Other |

3.4% |

|||

Short-Term Instruments |

0.1% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Marke t Price |

$ |

|||

NAV |

$ |

|||

Premium/(Discount) to NAV |

( |

|||

Market Price Distribution Rate (2) |

5.13% |

|||

NAV Distribution Rate (2) |

4.57% |

|||

Total Effective Leverage (3) |

37.45% |

|||

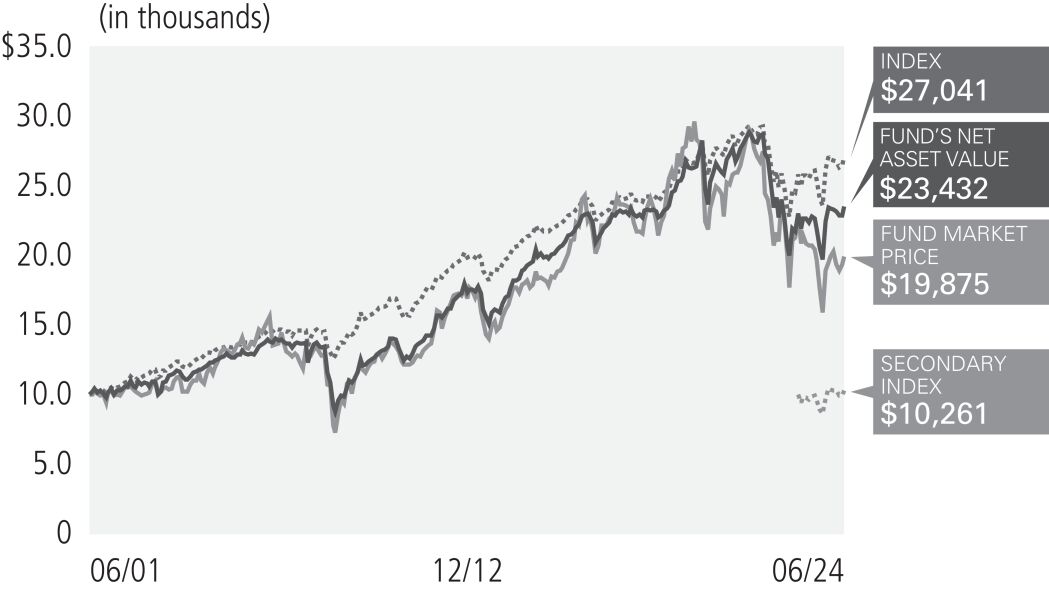

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||||||||||

6 Month* |

1 Year |

5 Year |

10 Year |

Since launch of Secondary Index 01/25/23 |

Commencement of Operations (06/29/01) |

|||||||||||||||||||||

|

Market Price |

2.20% |

(3.90)% |

(5.45)% |

1.21% |

(10.40)% |

3.03% |

|||||||||||||||||||

|

NAV |

0.14% |

3.12% |

(1.56)% |

2.57% |

1.31% |

3.77% |

|||||||||||||||||||

|

Bloomberg NY Muni 22+ Year Index |

(0.13)% |

3.98% |

0.80% |

2.77% |

3.36% |

4.42% |

¨ | ||||||||||||||||||

|

ICE New York Long Duration Municipal Securities Index** |

(1.18)% |

3.89% |

— |

— |

1.79% |

— |

|||||||||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The indexes are not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

| » | Security selection within the transportation sector contributed to performance, as select securities held within the Fund posted positive performance. |

| » | Exposure to the healthcare sector contributed to performance, as the sector posted positive returns. |

| » | Select exposure within taxable municipals contributed to performance, as select securities held within the Fund posted positive returns. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Exposure to the special tax sector detracted from performance, as the sector posted negative returns. |

| » | Exposure to the electric utility sector detracted from performance, as the sector posted negative returns. |

SEMIANNUAL REPORT |

| | JUNE 30, 2024 | 9 |

Symbol on NYSE - PNI |

Municipal Bonds & Notes |

||||

College & University Revenue |

12.0% |

|||

Tobacco Settlement Funded |

12.0% |

|||

Electric Power & Light Revenue |

8.8% |

|||

Water Revenue |

8.6% |

|||

Port, Airport & Marina Revenue |

7.9% |

|||

Health, Hospital & Nursing Home Revenue |

7.2% |

|||

Ad Valorem Property Tax |

6.8% |

|||

Local or Guaranteed Housing |

6.7% |

|||

Income Tax Revenue |

6.7% |

|||

Industrial Revenue |

4.1% |

|||

Highway Revenue Tolls |

4.1% |

|||

Transit Revenue |

4.0% |

|||

Sales Tax Revenue |

3.0% |

|||

Miscellaneous Revenue |

2.3% |

|||

Lease (Appropriation) |

2.0% |

|||

Miscellaneous Taxes |

1.2% |

|||

Charter School Aid |

1.2% |

|||

Other |

0.1% |

|||

Short-Term Instruments |

1.3% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Market Price |

$7.41 |

|||

NAV |

$8.48 |

|||

Premium/(Discount) to NAV |

(12.62)% |

|||

Market Price Distribution Rate (2) |

4.78% |

|||

NAV Distribution Rate (2) |

4.17% |

|||

Total Effective Leverage (3) |

40.74% |

|||

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||||||||||

6 Month* |

1 Year |

5 Year |

10 Year |

Since launch of Secondary Index 01/25/23 |

Commencement of Operations (06/28/02) |

|||||||||||||||||||||

|

Market Price |

(0.03)% |

2.50% |

(4.23)% |

0.90% |

(2.56)% |

2.94% |

|||||||||||||||||||

|

NAV |

(0.02)% |

3.02% |

(1.42)% |

2.81% |

1.28% |

3.85% |

|||||||||||||||||||

|

Bloomberg NY Muni 22+ Year Index |

(0.13)% |

3.98% |

0.80% |

2.77% |

3.36% |

4.32% |

¨ | ||||||||||||||||||

|

ICE New York Long Duration Municipal Securities Index** |

(1.18)% |

3.89% |

— |

— |

1.79% |

— |

|||||||||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The indexes are not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

| » | Security selection within the transportation sector contributed to performance, as select securities held within the Fund posted positive returns. |

| » | Exposure to the healthcare sector contributed to performance, as the sector posted positive returns. |

| » | Exposure to the tobacco sector contributed to performance, as the sector posted positive returns. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Exposure to the special tax sector detracted from performance, as the sector posted negative returns. |

| » | Exposure to the lease-backed sector detracted from performance, as the sector posted negative returns. |

10 |

PIMCO CLOSED-END FUNDS |

Symbol on NYSE - PYN |

Municipal Bonds & Notes |

||||

Tobacco Settlement Funded |

10.4% |

|||

College & University Revenue |

10.2% |

|||

Water Revenue |

8.3% |

|||

Local or Guaranteed Housing |

8.1% |

|||

Income Tax Revenue |

8.1% |

|||

Port, Airport & Marina Revenue |

7.5% |

|||

Industrial Revenue |

7.5% |

|||

Electric Power & Light Revenue |

6.9% |

|||

Ad Valorem Property Tax |

6.6% |

|||

Health, Hospital & Nursing Home Revenue |

6.5% |

|||

Transit Revenue |

6.4% |

|||

Highway Revenue Tolls |

2.9% |

|||

Sales Tax Revenue |

2.6% |

|||

Lease (Appropriation) |

2.6% |

|||

Fuel Sales Tax Revenue |

1.3% |

|||

Miscellaneous Taxes |

1.2% |

|||

Charter School Aid |

1.1% |

|||

Other |

0.8% |

|||

Short-Term Instruments |

1.0% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Market Price |

$5.90 |

|||

NAV |

$6.75 |

|||

Premium/(Discount) to NAV |

(12.59)% |

|||

Market Price Distribution Rate (2) |

5.04% |

|||

NAV Distribution Rate (2) |

4.41% |

|||

Total Effective Leverage (3) |

40.13% |

|||

| Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||||||||||

| 6 Month* | 1 Year | 5 Year | 10 Year | Since launch of Secondary Index 01/25/23 |

Commencement of Operations (10/31/02) |

|||||||||||||||||||||

|

Market Price | 1.51% | (1.29)% | (4.98)% | 0.49% | (5.94)% | 1.68% | |||||||||||||||||||

|

NAV | 0.30% | 3.23% | (1.31)% | 2.36% | 1.39% | 2.54% | |||||||||||||||||||

|

Bloomberg NY Muni 22+ Year Index | (0.13)% | 3.98% | 0.80% | 2.77% | 3.36% | 4.20% | |||||||||||||||||||

|

ICE New York Long Duration Municipal Securities Index** | (1.18)% | 3.89% | — | — | 1.79% | — | |||||||||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The indexes are not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

| » | Security selection within the transportation sector contributed to performance, as select securities held within the Fund posted positive returns. |

| » | Exposure to the healthcare sector contributed to performance, as the sector posted positive returns. |

| » | Exposure to the industrial revenue sector contributed to performance, as the sector posted positive returns. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Exposure to the lease-backed sector detracted from performance, as the sector posted negative returns. |

| » | Exposure to the electric utility sector detracted from performance, as the sector posted negative returns. |

SEMIANNUAL REPORT |

| | JUNE 30, 2024 | 11 |

Symbol on NYSE - PMF |

Municipal Bonds & Notes |

||||

Health, Hospital & Nursing Home Revenue |

16.0% | |||

Ad Valorem Property Tax |

11.4% | |||

Local or Guaranteed Housing |

6.5% | |||

Sales Tax Revenue |

6.5% | |||

Miscellaneous Revenue |

5.3% | |||

Tobacco Settlement Funded |

4.9% | |||

Lease (Appropriation) |

4.8% | |||

Industrial Revenue |

4.7% | |||

Highway Revenue Tolls |

4.4% | |||

Electric Power & Light Revenue |

4.4% | |||

Water Revenue |

4.0% | |||

College & University Revenue |

3.2% | |||

Income Tax Revenue |

2.6% | |||

Appropriations |

2.6% | |||

Port, Airport & Marina Revenue |

2.5% | |||

Nuclear Revenue |

1.7% | |||

Fuel Sales Tax Revenue |

1.5% | |||

General Fund |

1.4% | |||

Natural Gas Revenue |

1.2% | |||

Economic Development Revenue |

1.1% | |||

Miscellaneous Taxes |

1.0% | |||

Other |

5.4% | |||

U.S. Government Agencies |

1.7% | |||

Loan Participations and Assignments |

0.7% | |||

Short-Term Instruments |

0.5% | |||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Market Price |

$9.17 |

|||

NAV |

$9.46 |

|||

Premium/(Discount) to NAV |

(3.07)% |

|||

Market Price Distribution Rate (2) |

5.50% |

|||

NAV Distribution Rate (2) |

5.33% |

|||

Total Effective Leverage (3) |

41.31% |

|||

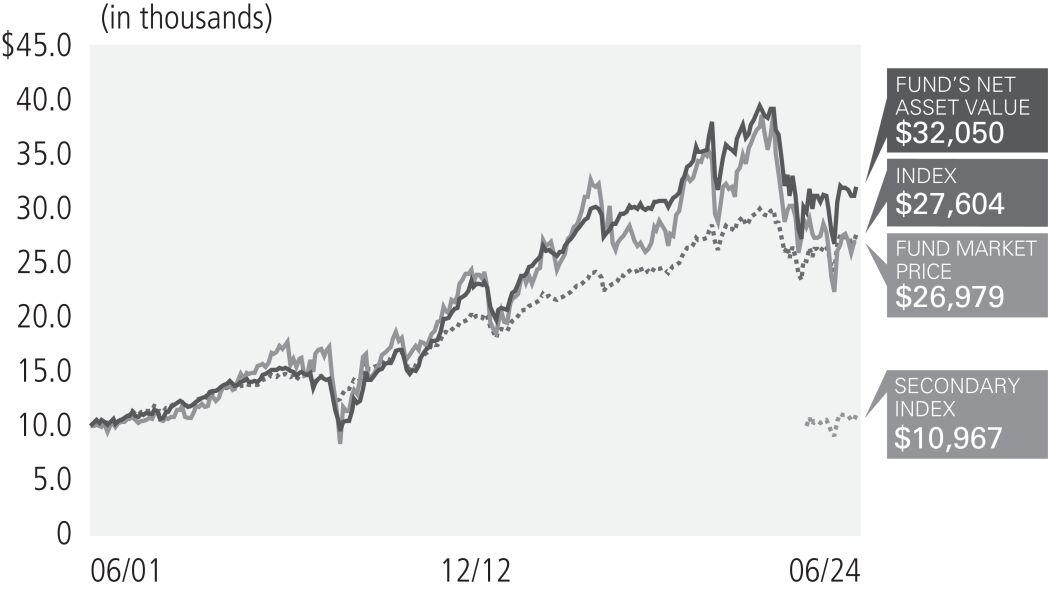

| Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||||||||||

| 6 Month* | 1 Year | 5 Year | 10 Year | Since launch of Secondary Index 12/09/2022 |

Commencement of Operations (06/29/01) |

|||||||||||||||||||||

|

Market Price | 0.96% | (5.78)% | (3.67)% | 1.26% | (4.00)% | 4.41% | |||||||||||||||||||

|

NAV | (0.17)% | 2.51% | (1.19)% | 3.01% | 2.74% | 5.19% | |||||||||||||||||||

|

Bloomberg Municipal Long 22+ Bond Index |

0.08% | 4.26% | 0.89% | 2.96% | 5.04% | 4.51% | ¨ | ||||||||||||||||||

|

ICE Long Duration National Municipal Securities Index** | (1.22)% | 4.53% | — | — | 4.28% | — | |||||||||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broadbased securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The indexes are not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

| » | Exposure to the healthcare sector contributed to performance, as the sector posted positive returns. |

| » | Exposure to the industrial revenue sector contributed to performance, as the sector posted positive returns. |

| » | Exposure to the housing sector contributed to performance, as the sector posted positive returns. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Security selection within the tobacco sector detracted from performance, as select securities held within the fund posted negative returns. |

| » | Exposure to the lease-backed sector detracted from performance, as the sector posted negative returns. |

12 |

PIMCO CLOSED-END FUNDS |

Symbol on NYSE - PML |

Municipal Bonds & Notes |

||||

Health, Hospital & Nursing Home Revenue |

16.1% |

|||

Ad Valorem Property Tax |

10.4% |

|||

Highway Revenue Tolls |

6.2% |

|||

Sales Tax Revenue |

5.5% |

|||

Local or Guaranteed Housing |

5.5% |

|||

Lease (Appropriation) |

5.0% |

|||

Tobacco Settlement Funded |

4.9% |

|||

Industrial Revenue |

4.7% |

|||

Natural Gas Revenue |

4.3% |

|||

Electric Power & Light Revenue |

4.1% |

|||

Miscellaneous Revenue |

3.8% |

|||

College & University Revenue |

2.9% |

|||

Appropriations |

2.8% |

|||

Water Revenue |

2.7% |

|||

Port, Airport & Marina Revenue |

2.7% |

|||

Income Tax Revenue |

2.6% |

|||

Sewer Revenue |

1.4% |

|||

General Fund |

1.3% |

|||

Fuel Sales Tax Revenue |

1.3% |

|||

Economic Development Revenue |

1.3% |

|||

Hotel Occupancy Tax |

1.2% |

|||

Nuclear Revenue |

1.1% |

|||

Miscellaneous Taxes |

1.1% |

|||

Other |

4.2% |

|||

U.S. Government Agencies |

1.6% |

|||

Loan Participations and Assignments |

0.7% |

|||

Short-Term Instruments |

0.6% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Market Price |

$8.53 |

|||

NAV |

$8.78 |

|||

Premium/(Discount) to NAV |

(2.85)% |

|||

Market Price Distribution Rate (2) |

5.56% |

|||

NAV Distribution Rate (2) |

5.40% |

|||

Total Effective Leverage (3) |

39.64% |

|||

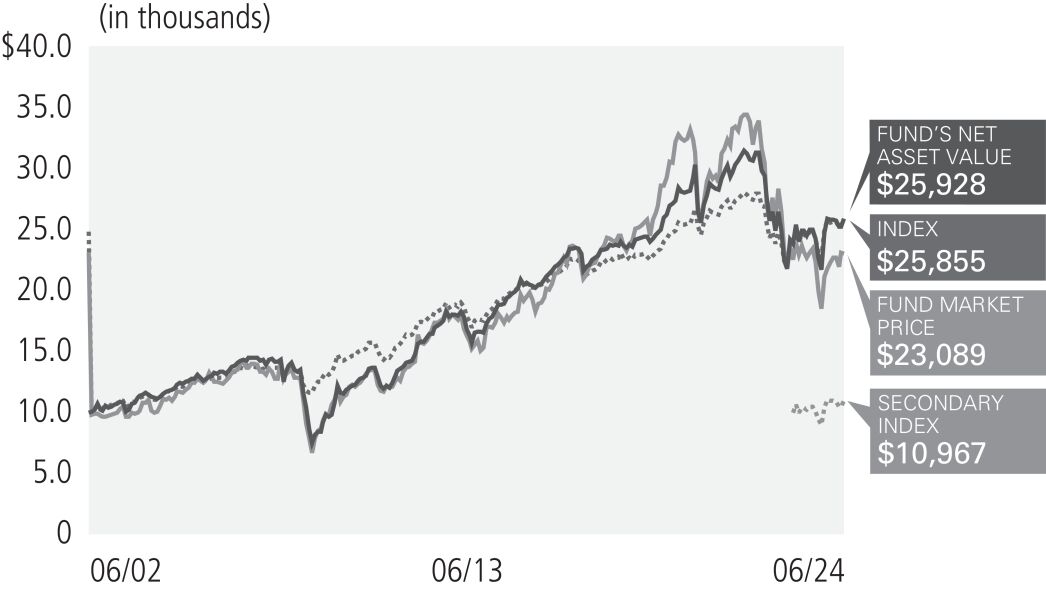

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||||||||||

6 Month* |

1 Year |

5 Year |

10 Year |

Since launch of Secondary Index 12/09/2022 |

Commencement of Operations (06/28/02) |

|||||||||||||||||||||

|

Market Price |

5.67% |

(0.14)% |

(5.42)% |

2.62% |

(1.44)% |

3.94% |

|||||||||||||||||||

|

NAV |

0.09% |

3.50% |

(0.89)% |

3.23% |

3.30% |

4.42% |

|||||||||||||||||||

|

Bloomberg Municipal Long 22+ Bond Index |

0.08% |

4.26% |

0.89% |

2.96% |

5.04% |

4.41% |

¨ | ||||||||||||||||||

|

ICE Long Duration National Municipal Securities Index** |

(1.22)% |

4.53% |

— |

— |

4.28% |

— |

|||||||||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The indexes are not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

| » | Exposure to the healthcare sector contributed to performance, as the sector posted positive returns. |

| » | Exposure to the industrial revenue sector contributed to performance as the sector posted positive returns. |

| » | Security selection within taxable municipals contributed to performance, as select taxable municipals held within the Fund posted positive performance. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Exposure to the lease-backed sector detracted from performance, as the sector posted negative returns. |

| » | Security selection within the tobacco sector detracted from performance, as select securities held within the fund posted negative returns. |

SEMIANNUAL REPORT |

| | JUNE 30, 2024 | 13 |

Symbol on NYSE - PMX |

Municipal Bonds & Notes |

||||

Health, Hospital & Nursing Home Revenue |

13.4% |

|||

Ad Valorem Property Tax |

11.6% |

|||

Local or Guaranteed Housing |

7.6% |

|||

Sales Tax Revenue |

6.3% |

|||

Highway Revenue Tolls |

5.1% |

|||

Electric Power & Light Revenue |

4.9% |

|||

Natural Gas Revenue |

4.5% |

|||

Industrial Revenue |

4.2% |

|||

Tobacco Settlement Funded |

4.0% |

|||

Lease (Appropriation) |

3.9% |

|||

Water Revenue |

3.8% |

|||

Port, Airport & Marina Revenue |

3.4% |

|||

Income Tax Revenue |

3.3% |

|||

Appropriations |

2.9% |

|||

College & University Revenue |

2.8% |

|||

Fuel Sales Tax Revenue |

2.5% |

|||

Miscellaneous Revenue |

2.1% |

|||

Nuclear Revenue |

1.5% |

|||

Sewer Revenue |

1.5% |

|||

Economic Development Revenue |

1.3% |

|||

General Fund |

1.1% |

|||

Charter School Aid |

1.0% |

|||

Other |

4.8% |

|||

U.S. Government Agencies |

1.6% |

|||

Loan Participations and Assignments |

0.7% |

|||

Short-Term Instruments |

0.2% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

Market Price |

$7.88 |

|||

NAV |

$8.10 |

|||

Premium/(Discount) to NAV |

(2.72)% |

|||

Market Price Distribution Rate (2) |

5.03% |

|||

NAV Distribution Rate (2) |

4.89% |

|||

Total Effective Leverage (3) |

40.33% |

|||

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||||||||||

6 Month* |

1 Year |

5 Year |

10 Year |

Since launch of Secondary Index 12/09/2022 |

Commencement of Operations (10/31/02) |

|||||||||||||||||||||

|

Market Price |

9.45% |

3.28% |

(3.70)% |

2.48% |

(4.22)% |

3.67% |

|||||||||||||||||||

|

NAV |

(0.01)% |

3.31% |

(1.24)% |

3.32% |

3.28% |

4.20% |

|||||||||||||||||||

|

Bloomberg Municipal Long 22+ Bond Index |

0.08% |

4.26% |

0.89% |

2.96% |

5.04% |

4.30% |

|||||||||||||||||||

|

ICE Long Duration National Municipal Securities Index** |

(1.22)% |

4.53% |

— |

— |

4.28% |

— |

|||||||||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The indexes are not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (“ROC”) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

| » | Exposure to the industrial revenue sector contributed to performance, as the sector posted positive performance. |

| » | Exposure to the healthcare sector contributed to performance, as the sector posted positive performance. |

| » | Exposure to the housing sector contributed to performance, as the sector posted positive performance. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Exposure to the lease-backed sector detracted from performance, as the sector posted negative returns. |

| » | Security selection within the tobacco sector detracted from performance, as select securities held posted negative returns. |

14 |

PIMCO CLOSED-END FUNDS |

Index Descriptions |

Index* |

Index Description | |

| Bloomberg CA Muni 22+ Year Index | The Bloomberg CA Muni 22+ Year Index is the long maturity California component of the Bloomberg Municipal Bond Index, which consists of a broad selection of investment grade general obligation and revenue bonds. It is an unmanaged index representative of the tax-exempt bond market. | |

| Bloomberg Municipal Long 22+ Bond Index | Bloomberg Municipal Long 22+ Bond Index is a rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market. | |

| Bloomberg NY Muni 22+ Year Index | The Bloomberg NY Muni 22+ Year Index is the long maturity New York component of the Bloomberg Municipal Bond Index, which consists of a broad selection of investment grade general obligation and revenue bonds. It is an unmanaged index representative of the tax-exempt bond market. | |

| ICE California Long Duration Municipal Securities Index | ICE California Long Duration Municipal Securities Index is a subset of the ICE Long Duration National Municipal Securities Index including only securities issued within the State of California. The ICE Long Duration National Municipal Securities Index tracks the performance of long duration rated and unrated US dollar denominated tax-exempt debt publicly issued by US states and territories, and their political subdivisions, in the US domestic market. | |

| ICE Long Duration National Municipal Securities Index | ICE Long Duration National Municipal Securities Index tracks the performance of long duration rated and unrated US dollar denominated tax-exempt debt publicly issued by US states and territories, and their political subdivisions, in the US domestic market. | |

| ICE New York Long Duration Municipal Securities Index | ICE New York Long Duration Municipal Securities Index is a subset of the ICE Long Duration National Municipal Securities Index including only securities issued within the State of New York. The ICE Long Duration National Municipal Securities Index tracks the performance of long duration rated and unrated US dollar denominated tax-exempt debt publicly issued by US states and territories, and their political subdivisions, in the US domestic market. | |

SEMIANNUAL REPORT |

| | JUNE 30, 2024 | 15 |

Financial Highlights |

Investment Operations |

Less Distributions to Preferred Shareholders (c) |

Less Distributions to Common Shareholders (d) |

||||||||||||||||||||||||||||||||||||||||||||||||||

Selected Per Share Data for the Year or Period Ended^: |

Net Asset Value Beginning of Year or Period (a) |

Net Investment Income (Loss) (b) |

Net Realized/ Unrealized Gain (Loss) |

From Net Investment Income |

From Net Realized Capital Gains |

Net Increase (Decrease) in Net Assets Applicable to Common Shareholders Resulting from Operations |

From Net Investment Income |

From Net Realized Capital Gains |

Tax Basis Return of Capital |

Total |

Increase Resulting from Tender of ARPS (c) |

Increase Resulting from Common Share Offering |

Offering Cost Charged to Paid in Capital |

|||||||||||||||||||||||||||||||||||||||

PIMCO California Municipal Income Fund |

||||||||||||||||||||||||||||||||||||||||||||||||||||

01/01/2024 - 06/30/2024+ |

$ | 10.66 | $ | 0.21 | $ | (0.20 | ) | $ | (0.10 | ) | $ | 0.00 | $ | (0.09 | ) | $ | (0.22 | ) | $ | 0.00 | $ | 0.00 | $ | (0.22 | ) | $ | 0.12 | $ | N/A | $ | N/A | |||||||||||||||||||||

12/31/2023 |

10.31 | 0.55 | 0.57 | (0.37 | ) | 0.00 | 0.75 | (0.24 | ) | 0.00 | (0.19 | ) | (0.43 | ) | 0.03 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2022 |

14.08 | 0.65 | (3.48 | ) | (0.14 | ) | 0.00 | (2.97 | ) | (0.59 | ) | (0.02 | ) | (0.19 | ) | (0.80 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||

12/31/2021 |

14.28 | 0.71 | (0.12 | ) | (0.01 | ) | 0.00 | 0.58 | (0.78 | ) | 0.00 | 0.00 | (0.78 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2020 |

14.20 | 0.74 | 0.20 | (0.07 | ) | 0.00 | 0.87 | (0.78 | ) | (0.01 | ) | 0.00 | (0.79 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2019 |

13.32 | 0.80 | 1.16 | (0.16 | ) | 0.00 | 1.80 | (0.92 | ) | 0.00 | 0.00 | (0.92 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||||

PIMCO California Municipal Income Fund II |

||||||||||||||||||||||||||||||||||||||||||||||||||||

01/01/2024 - 06/30/2024+ |

$ | 6.81 | $ | 0.13 | $ | (0.15 | ) | $ | (0.05 | ) | $ | 0.00 | $ | (0.07 | ) | $ | (0.13 | ) | $ | 0.00 | $ | 0.00 | $ | (0.13 | ) | $ | 0.06 | $ | N/A | $ | N/A | |||||||||||||||||||||

12/31/2023 |

6.53 | 0.33 | 0.38 | (0.22 | ) | 0.00 | 0.49 | (0.16 | ) | 0.00 | (0.10 | ) | (0.26 | ) | 0.05 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2022 |

9.11 | 0.39 | (2.50 | ) | (0.09 | ) | 0.00 | (2.20 | ) | (0.36 | ) | 0.00 | (0.02 | ) | (0.38 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||

12/31/2021 |

9.13 | 0.40 | (0.04 | ) | 0.00 | 0.00 | 0.36 | (0.38 | ) | 0.00 | 0.00 | (0.38 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||||

12/31/2020 |

8.98 | 0.41 | 0.17 | (0.04 | ) | 0.00 | 0.54 | (0.38 | ) | (0.01 | ) | 0.00 | (0.39 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2019 |

8.29 | 0.50 | 0.87 | (0.10 | ) | 0.00 | 1.27 | (0.42 | ) | (0.16 | ) | 0.00 | (0.58 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||||

PIMCO California Municipal Income Fund III |

||||||||||||||||||||||||||||||||||||||||||||||||||||

01/01/2024 - 06/30/2024+ |

$ | 7.89 | $ | 0.16 | $ | (0.13 | ) | $ | (0.07 | ) | $ | 0.00 | $ | (0.04 | ) | $ | (0.18 | ) | $ | 0.00 | $ | 0.00 | $ | (0.18 | ) | $ | 0.08 | $ | N/A | $ | N/A | |||||||||||||||||||||

12/31/2023 |

7.70 | 0.39 | 0.37 | (0.25 | ) | 0.00 | 0.51 | (0.27 | ) | 0.00 | (0.08 | ) | (0.35 | ) | 0.03 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2022 |

10.20 | 0.48 | (2.43 | ) | (0.09 | ) | 0.00 | (2.04 | ) | (0.46 | ) | 0.00 | 0.00 | (0.46 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||

12/31/2021 |

10.29 | 0.52 | (0.15 | ) | 0.00 | 0.00 | 0.37 | (0.46 | ) | 0.00 | 0.00 | (0.46 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||||

12/31/2020 |

10.20 | 0.52 | 0.09 | (0.05 | ) | 0.00 | 0.56 | (0.46 | ) | (0.01 | ) | 0.00 | (0.47 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2019 |

9.46 | 0.56 | 0.80 | (0.11 | ) | 0.00 | 1.25 | (0.51 | ) | 0.00 | 0.00 | (0.51 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||||

PIMCO New York Municipal Income Fund |

||||||||||||||||||||||||||||||||||||||||||||||||||||

01/01/2024 - 06/30/2024+ |

$ | 8.98 | $ | 0.18 | $ | (0.19 | ) | $ | (0.07 | ) | $ | 0.00 | $ | (0.08 | ) | $ | (0.20 | ) | $ | 0.00 | $ | 0.00 | $ | (0.20 | ) | $ | 0.08 | $ | N/A | $ | N/A | |||||||||||||||||||||

12/31/2023 |

8.70 | 0.45 | 0.47 | (0.29 | ) | 0.00 | 0.63 | (0.15 | ) | 0.00 | (0.25 | ) | (0.40 | ) | 0.05 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2022 |

12.13 | 0.48 | (3.30 | ) | (0.11 | ) | 0.00 | (2.93 | ) | (0.40 | ) | 0.00 | (0.10 | ) | (0.50 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||

12/31/2021 |

12.01 | 0.54 | 0.09 | (0.01 | ) | 0.00 | 0.62 | (0.50 | ) | 0.00 | 0.00 | (0.50 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||||

12/31/2020 |

12.15 | 0.60 | (0.17 | ) | (0.06 | ) | 0.00 | 0.37 | (0.50 | ) | (0.01 | ) | 0.00 | (0.51 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||

12/31/2019 |

11.29 | 0.68 | 0.96 | (0.13 | ) | 0.00 | 1.51 | (0.65 | ) | 0.00 | 0.00 | (0.65 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||||

PIMCO New York Municipal Income Fund II |

||||||||||||||||||||||||||||||||||||||||||||||||||||

01/01/2024 - 06/30/2024+ |

$ | 8.66 | $ | 0.18 | $ | (0.20 | ) | $ | (0.08 | ) | $ | 0.00 | $ | (0.10 | ) | $ | (0.18 | ) | $ | 0.00 | $ | 0.00 | $ | (0.18 | ) | $ | 0.09 | $ | N/A | $ | N/A | |||||||||||||||||||||

12/31/2023 |

8.29 | 0.44 | 0.55 | (0.30 | ) | 0.00 | 0.69 | (0.23 | ) | 0.00 | (0.12 | ) | (0.35 | ) | 0.03 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2022 |

11.66 | 0.47 | (3.25 | ) | (0.11 | ) | 0.00 | (2.89 | ) | (0.48 | ) | 0.00 | 0.00 | (0.48 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||

12/31/2021 |

11.50 | 0.48 | 0.17 | (0.01 | ) | 0.00 | 0.64 | (0.48 | ) | 0.00 | 0.00 | (0.48 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||||

12/31/2020 |

11.59 | 0.56 | (0.12 | ) | (0.05 | ) | 0.00 | 0.39 | (0.48 | ) | 0.00 | 0.00 | (0.48 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2019 |

10.67 | 0.63 | 0.93 | (0.13 | ) | 0.00 | 1.43 | (0.51 | ) | 0.00 | 0.00 | (0.51 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||||

PIMCO New York Municipal Income Fund III |

||||||||||||||||||||||||||||||||||||||||||||||||||||

01/01/2024 - 06/30/2024+ |

$ | 6.88 | $ | 0.15 | $ | (0.14 | ) | $ | (0.08 | ) | $ | 0.00 | $ | (0.07 | ) | $ | (0.15 | ) | $ | 0.00 | $ | 0.00 | $ | (0.15 | ) | $ | 0.09 | $ | N/A | $ | N/A | |||||||||||||||||||||

12/31/2023 |

6.66 | 0.39 | 0.40 | (0.30 | ) | 0.00 | 0.49 | (0.10 | ) | 0.00 | (0.20 | ) | (0.30 | ) | 0.03 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2022 |

9.20 | 0.42 | (2.42 | ) | (0.11 | ) | 0.00 | (2.11 | ) | (0.33 | ) | 0.00 | (0.10 | ) | (0.43 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||

12/31/2021 |

9.15 | 0.44 | 0.05 | (0.01 | ) | 0.00 | 0.48 | (0.43 | ) | 0.00 | 0.00 | (0.43 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||||

12/31/2020 |

9.29 | 0.48 | (0.14 | ) | (0.05 | ) | 0.00 | 0.29 | (0.42 | ) | 0.00 | (0.01 | ) | (0.43 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||

12/31/2019 |

8.66 | 0.55 | 0.66 | (0.13 | ) | 0.00 | 1.08 | (0.41 | ) | 0.00 | (0.04 | ) | (0.45 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||||

PIMCO Municipal Income Fund (Consolidated) |

||||||||||||||||||||||||||||||||||||||||||||||||||||

01/01/2024 - 06/30/2024+ |

$ | 9.73 | $ | 0.23 | $ | (0.26 | ) | $ | (0.10 | ) | $ | 0.00 | $ | (0.13 | ) | $ | (0.25 | ) | $ | 0.00 | $ | 0.00 | $ | (0.25 | ) | $ | 0.11 | $ | N/A | $ | N/A | |||||||||||||||||||||

12/31/2023 |

9.51 | 0.61 | 0.43 | (0.37 | ) | 0.00 | 0.67 | (0.37 | ) | 0.00 | (0.13 | ) | (0.50 | ) | 0.05 | N/A | N/A | |||||||||||||||||||||||||||||||||||

12/31/2022 |

13.33 | 0.68 | (3.71 | ) | (0.14 | ) | 0.00 | (3.17 | ) | (0.65 | ) | 0.00 | 0.00 | (0.65 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||

12/31/2021 |

13.22 | 0.71 | 0.06 | (0.01 | ) | 0.00 | 0.76 | (0.65 | ) | 0.00 | 0.00 | (0.65 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||||

12/31/2020 |

13.35 | 0.74 | (0.07 | ) | (0.07 | ) | 0.00 | 0.60 | (0.65 | ) | (0.08 | ) | 0.00 | (0.73 | ) | 0.00 | N/A | N/A | ||||||||||||||||||||||||||||||||||

12/31/2019 |

12.36 | 0.81 | 1.07 | (0.16 | ) | 0.00 | 1.72 | (0.72 | ) | (0.01 | ) | 0.00 | (0.73 | ) | 0.00 | N/A | N/A | |||||||||||||||||||||||||||||||||||

16 |

PIMCO CLOSED-END FUNDS |

See Accompanying Notes |

Common Share |

Ratios/Supplemental Data |

|||||||||||||||||||||||||||||||||||||

Ratios to Average Net Assets Applicable to Common Shareholders |

||||||||||||||||||||||||||||||||||||||

Net Asset Value End of Year or Period (a) |

Market Price End of Year or Period |

Total Investment Return (e) |

Net Assets Applicable to Common Shareholders End of Year or Period (000s) |

Expenses (f)(g) |

Expenses Excluding Waivers (f)(g) |

Expenses Excluding Interest Expense (f) |

Expenses Excluding Interest Expense and Waivers (f) |

Net Investment Income (Loss) (f) |

Portfolio Turnover Rate |

|||||||||||||||||||||||||||||

| $ | 10.47 | $ | 9.42 | 3.42 | % | $ | 198,690 | 3.24 | %* | 3.24 | %* | 1.38 | %* | 1.38 | %* | 4.14 | %* | 14 | % | |||||||||||||||||||

| 10.66 | 9.32 | (35.33 | ) | 202,306 | 2.16 | 2.16 | 1.34 | 1.34 | 5.43 | 28 | ||||||||||||||||||||||||||||

| 10.31 | 15.07 | (14.34 | ) | 195,462 | 1.78 | 1.78 | 1.26 | 1.26 | 5.73 | 28 | ||||||||||||||||||||||||||||

| 14.08 | 18.58 | 7.99 | 266,321 | 1.44 | 1.44 | 1.20 | 1.20 | 5.05 | 11 | |||||||||||||||||||||||||||||

| 14.28 | 17.98 | (4.94 | ) | 269,561 | 1.67 | 1.67 | 1.22 | 1.22 | 5.28 | 15 | ||||||||||||||||||||||||||||

| 14.20 | 19.86 | 29.47 | 267,390 | 2.09 | 2.09 | 1.18 | 1.18 | 5.75 | 16 | |||||||||||||||||||||||||||||

| |

|

|

||||||||||||||||||||||||||||||||||||

| $ | 6.67 | $ | 5.85 | 3.12 | % | $ | 215,277 | 3.44 | %* | 3.44 | %* | 1.37 | %* | 1.37 | %* | 3.09 | %* | 12 | % | |||||||||||||||||||

| 6.81 | 5.80 | (10.74 | ) | 219,490 | 2.29 | 2.29 | 1.37 | 1.37 | 5.12 | 25 | ||||||||||||||||||||||||||||

| 6.53 | 6.79 | (23.32 | ) | 210,581 | 1.77 | 1.77 | 1.29 | 1.29 | 5.49 | 27 | ||||||||||||||||||||||||||||

| 9.11 | 9.35 | 7.99 | 293,165 | 1.41 | 1.41 | 1.21 | 1.21 | 4.44 | 11 | |||||||||||||||||||||||||||||

| 9.13 | 9.03 | (5.58 | ) | 293,591 | 1.62 | 1.62 | 1.23 | 1.23 | 4.68 | 19 | ||||||||||||||||||||||||||||

| 8.98 | 10.00 | 36.01 | 288,138 | 1.99 | 1.99 | 1.18 | 1.18 | 5.61 | 16 | |||||||||||||||||||||||||||||

| $ | 7.75 | $ | 7.18 | (0.22 | )% | $ | 174,244 | 3.29 | %* | 3.29 | %* | 1.35 | %* | 1.35 | %* | 4.06 | %* | 14 | % | |||||||||||||||||||

| 7.89 | 7.37 | (7.46 | ) | 177,348 | 2.33 | 2.33 | 1.36 | 1.36 | 5.20 | 30 | ||||||||||||||||||||||||||||

| 7.70 | 8.35 | (20.55 | ) | 172,972 | 1.80 | 1.80 | 1.27 | 1.27 | 5.71 | 28 | ||||||||||||||||||||||||||||

| 10.20 | 11.10 | 13.11 | 228,733 | 1.45 | 1.45 | 1.21 | 1.21 | 5.06 | 13 | |||||||||||||||||||||||||||||

| 10.29 | 10.25 | (5.89 | ) | 230,271 | 1.68 | 1.68 | 1.23 | 1.23 | 5.13 | 13 | ||||||||||||||||||||||||||||

| 10.20 | 11.41 | 25.66 | 227,745 | 2.12 | 2.12 | 1.20 | 1.20 | 5.59 | 16 | |||||||||||||||||||||||||||||