UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 10-K

__________________________________________________

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2015

Commission File Number: 001-33540

__________________________________________________

EnSync, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________________

|

Wisconsin

|

39-1987014

|

|

(State or other jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

|

N93 W14475 Whittaker Way

Menomonee Falls, Wisconsin

|

53051

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(262) 253-9800

(Registrant’s telephone number, including area code)

__________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

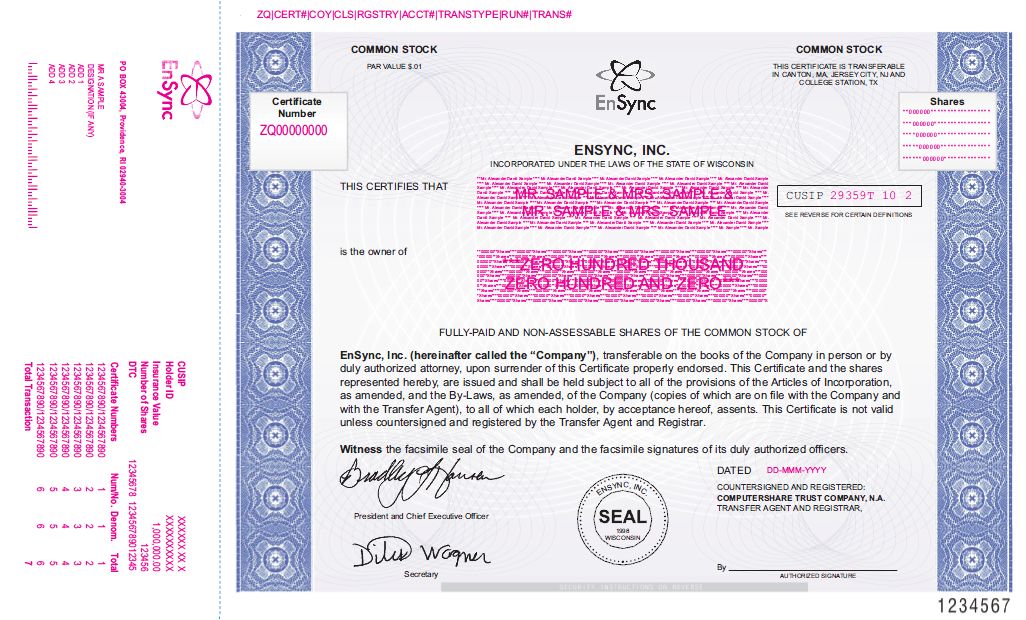

Common Stock, $0.01 Par Value

|

NYSE MKT

|

Securities registered pursuant to Section 12(g) of the Act: None

__________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

(Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

Indicate by check whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes þ No o

The aggregate market value of the voting stock held by non-affiliates, computed by reference to the last sales price on December 31, 2014, which was the last business day of the registrant's most recently completed second fiscal quarter, was $14,843,314.

The number of shares of the registrant’s Common Stock outstanding as of September 28, 2015 was 47,129,334.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after the end of the fiscal year ended June 30, 2015. Portions of such proxy statement are incorporated by reference into Part III of this Form 10-K.

ENSYNC, INC.

2015 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

|

PART I

|

Page

|

||

|

Item 1.

|

Business

|

1

|

|

|

Item 1A.

|

Risk Factors

|

8

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

19

|

|

|

Item 2.

|

Properties

|

19

|

|

|

Item 3.

|

Legal Proceedings

|

19

|

|

|

Item 4.

|

Mine Safety Disclosures

|

19

|

|

|

PART II

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

20

|

|

|

Item 6.

|

Selected Financial Data

|

20

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

20

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

25

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

26

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

54

|

|

|

Item 9A.

|

Controls and Procedures

|

54

|

|

|

Item 9B.

|

Other Information

|

55

|

|

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

56

|

|

|

Item 11.

|

Executive Compensation

|

56

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

56

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

56

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

||

|

PART IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

57

|

|

|

Signatures

|

58

|

Forward-Looking Statements

The following discussion should be read in conjunction with our accompanying Consolidated Financial Statements and Notes thereto included within this Annual Report on Form 10-K. In addition to historical information, this Annual Report on Form 10-K and the following discussion contain statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements contain projections of our future results of operations or of our financial position or state other forward-looking information. In some cases you can identify these statements by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will” and “would” or similar words. We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control and that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Investors are cautioned not to rely on forward-looking statements because they involve risks and uncertainties, and actual results may differ materially from those discussed as a result of various factors, including, but not limited to: our historical and anticipated future operation losses; our ability to raise the necessary capital to fund our operations and the risk of dilution to shareholders from capital raising transactions; our stock price volatility and trading volume; the competiveness of the industry in which we compete; our ability to successfully commercialize new products, including our Matrix TM Energy Management and Agile TM Hybrid Storage Systems; our ability to lower our costs and increase our margins; the failure of our products to perform as planned; our ability to build quality and reliable products and market perception of our products; our ability to grow rapidly while successfully managing our growth; our ability to maintain our current and establish new strategic partnerships; our dependence on sole source and limited source suppliers; our product and customer concentration and lack of revenue diversification; SPI’s ability to influence key decision making and potential to acquire complete control; our ability to enforce our agreements in Asia; our ability to retain our managerial personnel and to attract additional personnel; our ability to manage our international operations; the length and variability of our sales cycle; our increased emphasis on larger and more complex system solutions; our lack of experience in the power purchase agreement business; our reliance of third-party suppliers and contractors when developing and constructing systems for our PPA business; our ability to protect our intellectual property and the risk we may infringe on the intellectual property of others; future acquisitions could disrupt our business and dilute our stockholders; and other risks and uncertainties discussed under Item 1A. Risk Factors. Readers should not place undue reliance on our forward-looking statements. These forward-looking statements speak only as of the date on which the statements were made and are not guarantees of future performance. Except as may be required by applicable law, we do not undertake or intend to update any forward-looking statements after the date of this Annual Report on Form 10-K.

Item 1. BUSINESS

EnSync, Inc. and its subsidiaries (“EnSync,” “we,” “us,” “our,” or the “Company”) develop, license, and manufacture innovative energy management systems solutions serving the utility, commercial and industrial (“C&I”) building, utility, and off-grid markets. Incorporated in 1998, EnSync is headquartered in Menomonee Falls, Wisconsin, USA, with offices in San Francisco, California, Honolulu, Hawaii, Shanghai, China and Perth, Western Australia. In August 2015, we changed our corporate name from ZBB Energy Corporation to EnSync, Inc., and we regularly use the name EnSync Energy Systems for marketing and branding purposes.

EnSync develops and commercializes application solutions for advanced energy management systems critical to the transition from a “coal-centric economy” to one reliant on renewable energy sources. EnSync synchronizes conventional utility, distributed generation and storage assets to seamlessly ensure the least expensive and most reliable electricity available, thus enabling the future of energy networks.

Today there are generally three sources of electricity, particularly for behind-the-meter applications: conventional generation, generation from renewables and energy storage.

On their own, each of these sources can be limiting due to various factors such as cost, availability, resiliency and environmental impact. In a model environment, these disparate sources work in a synchronized manner, all three continually prioritized and optimized to always deliver the least expensive and most reliable electricity.

However, the conventional approach of power electronics provides limited capability in terms of optimization, efficiency, scalability, and the ability to accommodate ever-changing and evolving applications and policies. Essentially with a “stick-built” environment, the conventional inverter approach is inherently inflexible in what is now a dynamic world of electricity generation and load management.

1

Further complicating the realization of the model environment is that a “one size fits all” approach to energy storage has been the norm, relying on single-storage technology for both power and energy applications. The perfect battery does not exist, and forcing one type of storage technology to attempt a variety of both power and energy applications is limiting and costly.

EnSync’s energy management systems enable comprehensive functionality and provide for numerous applications that do away with limitations of conventional power electronics. EnSync’s energy management systems are being developed to provide:

|

|

·

|

active energy synchronization for any or all DC and AC inputs and outputs;

|

|

|

·

|

prioritization and optimization of all generating assets without system controllers and complex algorithms;

|

|

|

·

|

management of every power and energy storage application and asset in simultaneous operation; and

|

|

|

·

|

modular, scalable, efficient and “future proof” energy management as a 20-year asset.

|

Our energy storage system expertise enables us to design and deploy customized systems using whatever storage technology is most effective and economical for the specific needs of the customer and application, including applications where the optimum solution utilizes multiple storage technologies in a hybrid configuration. EnSync recently released the Matrix™ Energy Management System, a technology that makes it very easy to create hybrid systems by effectively “auto-segregating” power and energy applications, and pulling from the optimal battery technology to do the job without the complexity of a central control system; a highly complicated task accomplished simply and cost-effectively.

These capabilities provide the opportunity to rethink how we source electricity and monetize distributed generation and storage assets.

The macro ability to leverage the optimal use of electricity from the grid, renewables and storage is itself powerful; the ability to monetize numerous applications behind the meter provides the micro level ability to leverage almost any combination of known applications, including supply response, time-of-use, frequency regulation and back-up power.

Hybrid power and energy storage is the best way to optimize both power and energy applications, and an enabling energy management system distills all of the complexity to a simple means of creating cash behind the meter.

There is definitive movement towards the increasing complexity of applications and greater integration of functionality in order to solve more issues, while providing even higher value. We believe this trend will accelerate over the next four to five years.

We believe our energy management solutions are a significant improvement over conventional, static, 20-year asset that cannot accommodate the dynamic evolution of rate structures, programs and capabilities. We believe our solution will allow our customers to future-proof a building with an energy management system that is flexible and scalable by simply adding drawers to a cabinet, and each drawer designated as photovoltaics (“PV”), DC lighting, a diesel generator or storage, to list a few options. Hot swappable, drawer-based architecture similar to that of a rack mount server, should allow optimal uptime and reliability.

In some environments, such as remote micro grids, diesel generators could play the role of conventional generation. All of the aforementioned synchronization capabilities apply here as well, and even allow for the optimization of the diesel generation by eliminating inefficient load following by simply running the generators only at optimal efficiency to charge the batteries.

EnSync is excited about the industry shift to comprehensive energy management for behind-the-meter applications. We believe firmly that synchronization of disparate generating assets for the purpose of power and energy through state-of-the-art energy management systems is opening up numerous possibilities, as well as markets, for owners and operators of buildings, utilities, and micro grids.

2

Our goal at EnSync is to deliver the ability to lower the cost of electricity, create a more resilient grid infrastructure, prompt economic markets to leverage distributed assets and bring power to remote locales not served by traditional grid power.

Target Markets

EnSync’s energy management systems, storage technologies and power quality products target a variety of applications in three primary markets: (1) Commercial & Industrial (“C&I”) Buildings, Multi-tenant Buildings and Communities; (2) Utility Grid Power Distribution; and (3) Microgrids. We believe our solutions will enable utilities to reduce construction of under-utilized “peak” power generating plants and incorporate more renewable energy generating assets into the grid. EnSync’s ability to provide modular and configurable power control and storage solutions can be tailored to meet a variety of needs, whether it be shifting energy from low rate to high rate periods, or enabling complete grid independence.

Commercial & Industrial Buildings, Multi-Tenant Structures and Communities

EnSync offers a revolutionary energy synchronization system which we believe enables a dramatic reduction in the cost of electricity and increases the financial returns of distributed generation systems in the C&I market. Commercial and industrial buildings have become a major opportunity for distributed generation assets to create "net zero" buildings, and provide utilities with sources of energy in critical peak or critical load situations. We believe we are the only company today that can provide complete C&I building energy storage and energy management systems that unlock opportunities to generate income today, as well as "future proof" the building for any additional applications and requirements that are realized throughout the life of the asset. This includes energy management and hybrid energy storage systems.

For the C&I market, EnSync has introduced Matrix and Agile Hybrid systems engineered to:

|

|

·

|

enable distributed intelligence and active control of inputs and outputs inside buildings;

|

|

|

·

|

allow a building to be connected to others in a micro grid;

|

|

|

·

|

provide seamless connectivity to the utility for smart export on demand and “Internet of Energy” capability; and

|

|

|

·

|

create a net-zero building and deliver cash generation opportunities.

|

We recently began addressing the C&I market through power purchase agreements (“PPAs”) under which we agree to provide, and the customer agrees to purchase, electricity from us at a fixed rate for a 20-year period. Under this structure we develop and supply a system that uses our and other companies’ products and the customer receives the benefit of a low and fixed price for electricity without any upfront costs. Because this business model requires significant capital outlays, we intend to develop a monetization strategy under which we sell the PPAs we generate to investors.

Utility Grid Power Distribution

Utilities are faced with providing cheaper, cleaner and more reliable power as we transition away from a coal-centric economy which requires increased use of renewables. EnSync utility-scale energy storage systems are designed to improve power quality, smooth output from intermittent generating assets, help reduce emissions, defer transmission, distribution and substation upgrades, and reduce costs associated with traditional generating plants.

An integrated system that features Zinc Bromide flow battery technology can be partnered with Matrix power controls to provide for longer energy discharge applications prevalent in utility scale applications.

EnSync’s utility-scale flow batteries offer high energy density, are environmentally friendly, and are manufactured as 20-year assets. Multiple container units can be modularly interconnected and configured with EnSync’s inverter technology to deliver an end-to-end system for quick and simple installation. EnSync’s designs are easily transferable and portable with simple site permitting in places that can be constructed not always accessible by traditional generating sources.

Microgrids

Microgrids are localized grids that can disconnect from the traditional grid to operate autonomously and help mitigate grid disturbances to strengthen grid resilience, and can play an important role in transforming the nation’s electric grid.

Remote microgrids, in locations where utility power is not available, often use a combination of renewables, diesel generators and storage for their electricity requirements.

Resiliency, independence, environmentally friendly and cost-effective operation are key requirements for today’s microgrid environments, and we believe that EnSync is well-positioned to become the “go-to” microgrid enabling technology to deliver on these objectives.

3

Our Products

These are disruptive times for the power industry, and the industry must adapt to meet the challenges of a grid built on old technology and inefficient transmission and distribution. With an abundance of renewable energy generation being realized in various domestic and international locations, problems utilizing power from renewables persist because the grid network cannot effectively utilize the additional and inherently variable generation propensity of renewables. The grid today simply is not designed to accommodate such influxes and its intrinsic variability. Additionally, peak demand is often not realized during periods of maximum wind or sun, leading to a condition where overbuilding of heavily under-utilized generation capacity is required to meet the load during the highest usage periods of the day. Energy storage systems that are capable of long discharge can shift significant amounts of energy from relatively lower demand to higher demand periods, reducing the need for build-out of low utilization “peak power” generation.

EnSync products are designed to address the increasingly overtaxed grid networks throughout the world by enabling variable power generation from renewable sources to be introduced in large amounts in an economical, clean and reliable manner, improving the quality of life for an energy hungry population.

EnSync products have also been instrumental in enabling breakthroughs in distributed energy and micro-grid deployment in grid interactive or completely off-grid applications. From island power installations in the Pacific region to remote off-grid power for military use and diesel displacement for back-up power for buildings and facilities in Hawaii, EnSync’s advanced energy storage and power control systems deliver highly effective solutions for a variety of needs.

Matrix™ Energy Management System

The Matrix Energy Management System is breakthrough technology as a “behind the meter” energy control system targeted specifically at the commercial, industrial and multi-tenant building markets. Matrix utilizes EnSync’s patented “Auto-Sync” DC-Bus Modular Controls that enable simple integration of all AC and DC system inputs, and automatically routes the generated electricity in the most efficient and cost-effective manner, in or out of the building. Matrix is modular and configurable, designed to meet the building owner’s needs today, as well as providing a “future proof” solution for potential applications tomorrow. Matrix enables complete distributed generation asset-to-utility communication for “smart export” and is able to be clustered in a secure network as a set of assets that enable real-time spot market electricity sales. Serviceability is simple with “hot swappable” drawers that can be replaced without taking the entire distributed generation system off line. DC-DC, DC-AC, and AC-DC transformers and communications drawers are all configurable to the same universal architecture in either single or multiple Matrix cabinets.

The full UL certification process of the Matrix system is well underway. This includes all individual medium power modules in the Matrix portfolio as well as the comprehensive modular integration for any combination of modularity, making the Matrix a fully configurable UL certified system for the commercial and industrial markets as well as distributed assets in the Electrical Utility market. As the Matrix is considered a “platform”, it has a roadmap for incorporation of features, functionality, capabilities and higher power ratings, whether created organically or from third parties. With basic DC-DC and DC-AC power conversion capability complete, the efforts ahead are on execution of the platform roadmap.

4

Advanced Energy Storage Products

The Agile Hybrid Storage System is forward-looking technology that seamlessly combines a variety of storage units to meet a breadth of applications. EnSync’s Agile Hybrid Series is an energy storage system optimized specifically for high performance, safety, longevity and ability to deliver both power and energy for all available behind-the-meter applications in commercial, industrial, multi-tenant and resort buildings.

The Agile Hybrid Series features EnSync’s flow battery which recently achieved third-party certification from a leading, globally-recognized test facility in China that validated the battery achieved performance at or beyond design and company specifications. Along with our flow battery, the Agile Hybrid integrates complementary storage technology best suited for the balance of applications, which is often Lithium-ion batteries because it marries well with renewable firming and other short-discharge, high-power applications. Highlights of the Agile Hybrid Storage System include:

|

|

·

|

Power and energy applications in one integrated platform - power applications: PV ramp, frequency regulation, power quality - energy applications: demand response, rate shifting, critical back-up power;

|

|

|

·

|

Configurable for any building, any application requiring discharge time from seconds to greater than 8 hours;

|

|

|

·

|

Controlled via a patented “Auto-Sync” DC-Bus;

|

|

|

·

|

High power, frequent cycling applications served by best-in-class Li-ion chemistry;

|

|

|

·

|

Li-ion is managed within its optimum operating range for extended life;

|

|

|

·

|

Hybridized solution with the potential to unlock additional value streams;

|

|

|

·

|

Long duration, deep discharge applications met with 4th generation zinc bromide flow chemistry;

|

|

|

·

|

System optimized for high performance, safety and longevity;

|

|

|

·

|

Modular and scalable to meet requirements for a wide variety of applications and locations; and

|

|

|

·

|

Field proven ability to perform in diverse operating environments.

|

Agile Hybrid Large-Format Storage

The Agile Hybrid Large-Format Storage System delivers all of the advantages of the smaller format described above, but in a larger format for larger scale applications. Highlights of the large-format system include:

|

|

·

|

Operates as a self-contained, 480VAC interconnected container, designed for drop and deploy in larger scale C&I installations;

|

|

|

·

|

Modular and can be interconnected on the AC for larger installations;

|

|

|

·

|

The system includes a 450 kWh zinc bromide flow battery, 160kWh Li-ion battery, 250kW 480VAC inverter and inputs for PV, wind or alternate power inputs;

|

|

|

·

|

The communications and control interface is designed for easy integration into C&I level Building Management Systems or utility integrated control through SCADA;

|

|

|

·

|

Internally, all components are interconnected on a 725-820VDC bus using the patented EnSync integration platform to provide real-time control and millisecond level electrical response to variable loads and intermittent renewable power; and

|

|

|

·

|

The on-board module controller is capable of hybrid battery control logic, which instantly dispatches rapid power response to the Li-ions and energy response to the flow battery providing maximum system efficiency, reliability and monetization options.

|

EnSync Utility Scale Flow Battery

Primarily for utility scale applications, EnSync offers a 945kWh, 0-465kW zinc bromide flow battery module, designed for interconnection via a 725-820 VDC bus to other system containers that provide options to include additional flow batteries, Li-ion or other battery types for hybridization, power electronics for integration of PV or other generating assets and inverter modules that lead to the desired VAC interconnection.

This product is designed to be more flexible than the basic large format in its configuration and engineered to be deployed in larger applications. The communications and control are facilitated at the utility level, and the EnSync patented hybrid control and DC integration logic is incorporated just as it is in the large format hybrid.

5

Power Quality - GridStrong™ Distribution Grid Control

As a natural extension of our proven EnSync power electronics platform, we have engineered GridStrong technology to improve power quality, integrate Conservation Voltage Reduction (“CVR”) and improve Volt/Var Optimization (“VVO”) at “edge of the grid” distribution networks. With the ever-increasing deployment of smart meters, and penetration of distributed renewables, utilities require better control of their distribution system.

GridStrong technology supplies the aforementioned benefits, and offers a smart meter function to provide the utility with real time feedback, insight and high resolution of local events. This capability can be integrated into the existing customer supervisory control and data acquisition (“SCADA”) telemetry, or as a stand-alone software solution such as VVO or CVR. The GridStrong technology can be controlled by a central command in various operation modes and with a local autonomous control, allowing multiple systems to be deployed in a common area without issue.

Strategic Partners

We continue to utilize strategic partners to maximize our speed to market with solutions, augment our capabilities and expand our global presence. EnSync has formalized and is executing on joint development and joint venture agreements in South Korea and China, and we will continue to evolve strategic relationships in geographic markets that offer rapid and substantial growth opportunities. These strategic partners offer numerous benefits, such as market entry and penetration, low-cost manufacturing, financial consideration, technical complement, government relationships and integration as well as support services.

Our product licensing and development agreements with Lotte Chemical in South Korea have enabled us to fund development programs and significantly reduce our development cycle time. Meineng Energy, our China joint venture, has enabled us to expand our production in a low cost region, in addition to significantly increasing our post-prototype test and characterization capability. Both partners have spread the EnSync brand to their respective regions. Additionally, in July 2015 we entered into a strategic partnership with Solar Power, Inc. In addition to receiving significant investment capital from Solar Power, Inc. (“SPI”), we also entered into a Supply Agreement under which we expect to sell products and related services with an aggregated total of at least 40 megawatt of energy storage over the course of the next four years.

Competition

As discussed elsewhere in this Business section of this Annual Report on Form 10-K, we believe our technologies and products provide us with certain competitive advantages in the markets we serve. However, even with these advantages, the market for renewable energy products and services is intensely competitive and continually impacted by evolving industry standards, rapid price changes and product obsolescence. Our competitors include many domestic and foreign companies, most of which have substantially greater financial, marketing, personnel and other resources than we do. Although we believe that the advantages described above and elsewhere in this Business section of this Annual Report on Form 10-K position us well to be competitive in our industry, as a small company, we are and will continue to be at a competitive disadvantage to most of our competitors, particularly for large utility contracts.

6

Intellectual Property

Our market position, in part, depends on our Intellectual Property (“IP”) portfolio and our ability to obtain and maintain intellectual property protection for our products, processes, technology and know-how. We seek to protect our IP by, among other methods, filing United States and foreign patent applications related to our proprietary technology, inventions and improvements that are important to the development and conduct of our business. We also rely on trademarks, trade secrets, know-how and continuing technological innovation to evolve and secure our proprietary position. When it is determined that a trade secret is the most prudent approach to IP protection, we employ confidentiality agreements with our employees, customers, prospective customers, consultants, advisors, contractors or any other entity requiring knowledge of our IP for technology development or business development reasons.

We continue to have domestic and international patents issued on our power and energy control architecture known as the “Auto-Sync” modular DC-Bus, which is utilized in our new Matrix Energy Management System and our legacy EnerSection family of products. Most recently, the original patent was issued in the European Union. We have received an additional patent, the original “Auto-Sync” patent, in the US, with patents pending internationally. Additionally, we have multiple patents pending on power conversion control concepts domestically and internationally related to renewable energy optimization. We have filed for multiple patents in areas of energy storage technology and applications and control technologies, both domestically and internationally. Our filings are intended to further our differentiation, as our ability to control complex functions in simple and economical ways is unique. Areas such as hybridized storage technologies and concurrent control of multiple applications without the requirement for complicated control schemes are breakthroughs for the commercial and industrial building market, and are foundational to our Agile Hybrid Energy Storage and Matrix Energy Management System products that were introduced at the end of fiscal year 2015. EnSync also continues to do basic research on materials and chemistries for energy storage. This is an area where know-how, in addition to IP, is critical.

EnSync views the “Internet of Energy” as a key developing market. We have critical building blocks that can enable efficient and economic deployment and control of distributed generation and storage assets throughout the grid network, delivering high value to both utility as well as distributed generation asset owners. EnSync’s control expertise and ability to leverage third-party data will be an enabling capability for a future where spot market buying and selling of electricity between asset owners and the utility is realized. We will continue to invest in the development of our control and communication technologies to that end, which we believe will allow EnSync to be the “hub” through which electricity and communication between the generating assets and the utility passes.

We use trademarks on some of our products and systems, and have added registration of our “Auto-Sync” DC-Bus, Matrix, Agile, GridStrong and other roadmap products this year in the United States and internationally.

Advanced Engineering and Development

Our key advanced engineering initiatives and achievements are:

|

|

·

|

Completion of the next generation zinc bromide flow battery product – Agile Flow, with successful 3rd party validation at the top grid product test and certification facility in China.

|

|

|

·

|

Completion of zinc bromide/Li-ion Hybrid energy storage platform – Agile Hybrid.

|

|

|

·

|

Completion of the next generation of power electronics platform – Matrix Energy Management System.

|

|

|

·

|

Completion of the next generation of dynamic var compensator – GridStrong.

|

|

|

·

|

Design and development our utility scale flow battery products, including the Lotte 500kWh product.

|

|

|

·

|

Development of a control and communication platform to link the distributed generation assets to the utility, a key enabler of the “Internet of Energy”.

|

|

|

·

|

Design and development of the High Power version of the Matrix Energy Management System targeted for utility scale markets.

|

|

|

·

|

Design and development of a high power, zinc bromide/Li-ion/Matrix integrated system incorporating PV and other renewable and advanced energy generation capability into a single large format modular system.

|

The goal of these initiatives is to deliver differentiated product and service solutions that enable the massive expansion of renewable energy generation.

Our advanced engineering and development expense and cost of engineering and development revenues totaled approximately $6.7 million and $5.5 million in the years ended June 30, 2015 and June 30, 2014, respectively. We also had engineering and development revenues of approximately $771,000 and $1.3 million in the years ended June 30, 2015 and June 30, 2014, respectively.

7

Employees

EnSync currently has a total of 59 full-time employees in the United States and China. We expect staffing numbers to increase as our business grows in accordance with our business expansion plans.

Available Information

Our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and any Current Reports on Form 8-K that we may file or furnish to the SEC pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934 as well as any amendments to any of those reports are available free of charge on or through our website as soon as reasonably practicable after we file them with or furnish them to the SEC electronically. Our website is located at www.ensync.com. In addition, you may receive a copy of any of our reports free of charge by contacting our Investor Relations department at our corporate headquarters.

Item 1A. RISK FACTORS

We operate in a rapidly changing environment that involves a number of risks, some of which are beyond our control. This discussion highlights some of the risks which may affect future operating results. These are the risks and uncertainties we believe are most important for you to consider. We cannot be certain that we will successfully address these risks. If we are unable to address these risks, our business may not grow, our stock price may suffer and we may be unable to stay in business. Additional risks and uncertainties not presently known to us, which we currently deem immaterial or which are similar to those faced by other companies in our industry or business in general, may also impair our business operations.

We have incurred losses since our inception in 1998 and anticipate incurring continuing losses.

For the fiscal year ended June 30, 2015, we had revenues of $1,763,510. During this period, we had a net loss of $12,885,807 after deducting the net loss attributable to the noncontrolling interest. There can be no assurance that we will have income from operations or net income in the future. As of June 30, 2015 we had an accumulated deficit of $102,674,048. As discussed in our financial statements our significant operating losses and operating cash flow deficits raise doubt about our ability to continue as a going concern. We anticipate that we will continue to incur losses and operating cash flow deficits until we can produce and sell, if ever, a sufficient number of our systems to be profitable. However, we cannot predict when we will operate profitably, if ever. Even if we do achieve profitability, we may be unable to sustain or increase our profitability in the future.

We may require a substantial amount of additional funds to finance our capital requirements and the growth of our business, and we may not be able to raise a sufficient amount of funds, or be able to do so on terms favorable to us and our stockholders, or at all.

We have incurred losses since our inception in 1998 and expect to continue to incur losses until we are able to significantly grow our revenues. Accordingly we may need additional financing to remain in operation and to maintain and expand our business, and such financing may not be available on favorable terms, if at all. In the event that we issue any additional equity securities, investors’ interests in the Company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. Further, any such issuance may result in a change in control.

If we are unable to obtain the necessary funds on acceptable terms, we may not be able to:

|

|

·

|

execute our growth plan;

|

|

|

·

|

take advantage of future opportunities;

|

|

|

·

|

respond to customers and competition; or

|

|

|

·

|

remain in operation.

|

We may issue debt and/or senior equity securities in the future which would be senior to our common stock upon liquidation. Upon liquidation, holders of our debt securities, senior equity securities and lenders with respect to other borrowings will receive distributions of our available assets prior to the holders of our common stock. As a result of the significant number of convertible preferred shares outstanding, our common stockholders may receive nothing in the case of a liquidation event.

8

Our stock price could be volatile and our trading volume may fluctuate substantially.

The price of our common stock has been and may in the future continue to be extremely volatile, with the sale price fluctuating from a low of $0.40 to a high of $30.00 since June 18, 2007, the first day our stock was traded on the NYSE MKT. Many factors could have a significant impact on the future price of our common stock, including:

|

|

·

|

the various risks and uncertainties discussed herein;

|

|

|

·

|

general domestic and international economic conditions and other external factors;

|

|

|

·

|

general market conditions; and

|

|

|

·

|

the degree of trading liquidity in our common stock.

|

In addition, the stock market has from time to time experienced extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies which may be unrelated to the operating performance of those particular companies. These broad market fluctuations may adversely affect our share price, notwithstanding our operating results.

For the three-month period ended June 30, 2015, the daily trading volume for shares of our common stock ranged from 59,000 to 4,224,300 shares traded per day, and the average daily trading volume during such three-month period was 446,018 shares traded per day. Accordingly, our investors who wish to dispose of their shares of common stock on any given trading day may not be able to do so or may be able to dispose of only a portion of their shares of common stock.

SPI could sell or transfer a substantial number of shares of our common stock, which could depress the price of our securities or result in a change in control of the Company.

SPI currently holds 8,000,000 shares of our common stock and convertible preferred stock and a warrant that, assuming full conversion and exercise, would result in the ownership by SPI of an additional 92,000,600 shares of our common stock. SPI has no contractual restrictions on its ability to sell or transfer our common stock on the open market, in privately negotiated transactions or otherwise, and these sales or transfers could create substantial declines in the price of our securities or, if these sales or transfers were made to a single buyer or group of buyers, could contribute to a transfer of control of the Company to a third party. Sales by SPI of a substantial number of shares, or the expectation of such sales, could cause a significant reduction in the market price of our common stock.

Our industry is highly competitive and we may be unable to successfully compete.

We compete in the market for renewable energy products and services which is intensely competitive. Evolving industry standards, rapid price changes and product obsolescence also impact the market. Our competitors include many domestic and foreign companies, most of which have substantially greater financial, marketing, personnel and other resources than we do. Our current competitors or new market entrants could introduce new or enhanced technologies, products or services with features that render our technologies, products or services obsolete or less marketable. Our success will be dependent upon our ability to develop products that are superior to existing products and products introduced in the future, and which are cost effective. In addition, we may be required to continually enhance any products that are developed as well as introduce new products that keep pace with technological change and address the increasingly sophisticated needs of the marketplace. Even if our current technologies prove to be commercially feasible, there is extensive research and development being conducted on alternative energy sources that may render our technologies and protocols obsolete or otherwise non-competitive.

There can be no assurance that we will be able to keep pace with the technological demands of the marketplace or successfully develop products that will succeed in the marketplace. As a small company, we will be at a competitive disadvantage to most of our competitors, which include larger, established companies that have substantially greater financial, technical, manufacturing, marketing, distribution and other resources than us. There can be no assurance that we will have the capital resources available to undertake the research which may be necessary to upgrade our equipment or develop new devices to meet the efficiencies of changing technologies. Our inability to adapt to technological change could have a materially adverse effect on our results of operations.

9

Our ability to achieve significant revenue growth will be dependent on the successful commercialization of our new products, including our Agile Hybrid Storage System and Matrix Energy Management System.

We anticipate that a substantial majority of our revenue in fiscal year 2016 will come from new products, including our Agile Hybrid Storage System and Matrix Energy Management System. If these new products do not meet with market acceptance, our business, financial condition and results of operations will be adversely affected. A number of factors may affect the market acceptance of our new products, including, among others:

|

|

·

|

the price of our products relative to other products either currently available or subsequently introduced;

|

|

|

·

|

the perception by potential customers and strategic partners of the effectiveness of our products for their intended purposes;

|

|

|

·

|

our ability to fund our manufacturing, sales and marketing efforts; and

|

|

|

·

|

the effectiveness of our sales and marketing efforts.

|

Our products are and will be sold in new and rapidly evolving markets. As such, we cannot accurately predict the extent to which demand for these products will increase, if at all. We do not know whether our targeted customers will accept our technology or will purchase our products in sufficient quantities to allow our business to grow. To succeed, demand for our products must increase significantly in existing markets, and there must be strong demand for products that we introduce in the future. The commercial success of our new products is also dependent on the design and development of an efficient and cost effective means to integrate such products into existing electrical systems.

To achieve profitability, we will need to lower our costs and increase our margins, which we may not be able to do.

To achieve profitability we will need to lower our costs and increase our margins. These efforts may fail due to unforeseen factors. Our failure to lower our costs could make our products less competitive and harm our ability to grow our revenues. Our inability to lower our costs and increase our margins could have a materially adverse effect on our results of operations.

If our products do not perform as planned, we could experience increased costs, lower margins and harm to our reputation.

We have developed a portfolio of new products. The failure of our products to perform as planned could result in increased costs, lower margins and harm to our reputation which could have a material adverse effect on our business and financial results. For example a substantial majority of our revenue in recent periods came from our third generation ZBB EnerStore zinc bromide flow battery and ZBB EnerSection power and energy control center; as we initially reported in August, 2014, subsequent to commercialization, installation and commissioning of units in the field we garnered meaningful insights that resulted in system design modifications and other general upgrades that improved performance, efficiency, and reliability. In the interest of enhancing customer satisfaction and market reputation, in the fourth quarter of fiscal 2014 we launched an initiative to implement these improvements at certain locations of our installed base over fiscal 2015. As a result of this initiative, results of operations for the quarter ended June 30, 2014 included a charge of $1.8 million.

We need to continue to improve the performance of our products to meet future requirements and competitive pressures.

We need to continue to improve various aspects of our technology as we move forward with larger scale production and new applications of our products. For example, through our collaboration with Lotte Chemical Corporation we are currently working to develop a 500kWh version of our zinc bromide battery. Our products are complex and there can be no assurance our development efforts will be successful. Future developments and competition may reveal additional technical issues that are not currently recognized as obstacles. If we cannot continue to improve the performance of our products in a timely manner, we may be forced to redesign or delay large scale production or possibly abandon our product development efforts altogether.

We must build quality products to ensure acceptance of our products.

The market perception of our products and related acceptance of such products is highly dependent upon the quality and reliability of the products we build. Any quality problems attributable to our product lines may substantially impair our revenue and operating results. Moreover, quality problems for our product lines could cause us to delay or cease shipments of products or have to recall or field upgrade products, thus adversely affecting our ability to meet revenue or cost targets. In addition, while we seek to limit our liability as a result of product failure or defects through warranty and other limitations, if one of our products fails, a customer could suffer a significant loss and seek to hold us responsible for that loss and our reputation with other current or potential customers would likely suffer.

10

To succeed, we will need to rapidly grow and we may not be successful in managing this rapid growth.

In order to successfully grow our revenues and become profitable as well as meet the target set forth in our Supply Agreement with SPI, we will need to grow rapidly. If we fail to effectively manage this growth, our business could be adversely affected. Rapid growth will place significant demands on our management, operational and financial infrastructure. If we do not effectively manage our growth, we may fail to timely deliver products to our customers in sufficient volume or the quality of our products could suffer, which could negatively affect our operating results. To effectively manage this growth, we will need to hire additional personnel, and we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. As we move forward in commercializing our new products, we will also need to effectively manage our manufacturing and marketing needs, which represent new areas of oversight for us. These additional employees, systems enhancements and improvements will require significant capital expenditures and management resources. Failure to successfully implement these improvements could hurt our ability to manage our growth and our financial position.

Our relationships with our strategic partners may not be successful, and we may not be successful in establishing additional partnerships, which could adversely affect our ability to commercialize our products and services.

An important element of our business strategy is to enter into strategic partnerships with partners who can assist us in achieving our business goals. We are currently a party to several strategic partnership arrangements and any disruption in these collaborations could be detrimental to our business. The most significant of these strategic partnerships is our partnership with SPI. We expect to seek additional collaborators or strategic partners due to the expense, effort and expertise required to develop market and commercialize our products and our limited resources, but we may not be successful in our efforts to establish additional strategic partnerships and arrangements. If our strategic partners do not satisfy their obligations to us, we are unable to meet our strategic partners’ expectations and demands or we are unable to reach agreements with additional suitable strategic partners, we may fail to meet our business objectives for the commercialization of our products. The terms of any additional strategic partnerships or other arrangements that we establish may not be favorable to us. Our inability to successfully implement strategic partnerships and arrangements could adversely affect our business, financial condition and results of operations.

We expect that a significant portion of our sales will be to a single customer.

On July 13, 2015, in connection with the closing of the transaction between the Company and SPI, we entered into a Supply Agreement with SPI pursuant to which we agreed to provide SPI with Products and related Services (each as defined in the Supply Agreement) that have an aggregated total of at least 40 megawatt of energy storage rated power output prior to the 48-month anniversary of the date of the Supply Agreement with certain lower megawatt thresholds being required to be met at the 12-month, 24-month and 36-month anniversaries of the Supply Agreement. While we are continually seeking to expand our customer base, we anticipate that orders under the Supply Agreement will comprise a very significant portion of our sales through at least fiscal 2019. This arrangement makes us significantly dependent on SPI. Any decline in the anticipated orders from SPI or the failure of SPI to satisfy its obligations under the Supply Agreement could have an adverse impact on our business, financial condition and results of operations. Our future success is dependent upon the anticipated purchases by SPI. In addition, our dependence on our strategic partnership with SPI exposes us to numerous other risks, including: (i) a slowdown or delay in SPI’s deployment of our products could significantly reduce demand for our products; (ii) current or future economic conditions could negatively affect SPI and cause them to significantly reduce operations, or file for bankruptcy; and (iii) concentration of accounts receivable credit risk, which could have a material adverse effect on our liquidity and financial condition if SPI declared bankruptcy or delayed payments due under the Supply Agreement. Finally, if we are unable to meet our obligations to SPI under the Supply Agreement, SPI may terminate the agreement which would have a material adverse impact on our business, financial condition and results of operations.

We depend on sole and limited source suppliers and outsource selected component manufacturing, and shortages or delay of supplies of component parts may adversely affect our operating results until alternate sources can be developed.

Our operations are dependent on the ability of suppliers to deliver quality components, devices and subassemblies in time to meet critical manufacturing and distribution schedules. If we experience any constrained supply of any such component parts, such constraints, if persistent, may adversely affect operating results until alternate sourcing can be developed. There may be an increased risk of supplier constraints in periods where we are increasing production volume to meet customer demands. Volatility in the prices of component parts, an inability to secure enough components at reasonable prices to build new products in a timely manner in the quantities and configurations demanded or, conversely, a temporary oversupply of these parts, could adversely affect our future operating results.

11

We purchase several component parts from sole source and limited source suppliers. As a result of our current production volumes, we lack significant leverage with these and other suppliers especially when compared to some of our larger competitors. If our suppliers receive excess demand for their products, we may receive a low priority for order fulfillment as large volume customers may receive priority that may result in delays in our acquiring components. If we are delayed in acquiring components for our products, the manufacture and shipment of our products could be delayed. Lead times for ordering materials and components vary significantly and depend on factors such as specific supplier requirements, contract terms, the extensive production time required and current market demand for such components. Some of these delays may be substantial. As a result, we sometimes purchase critical, long lead time or single sourced components in large quantities to help protect our ability to deliver finished products. If we overestimate our component requirements, we may have excess inventory, which will increase our costs. If we underestimate our component requirements, we will have inadequate inventory, which will delay our manufacturing and render us unable to deliver products to customers on scheduled delivery dates. Manufacturing delays could negatively impact our ability to sell our products and could damage our customer relationships.

To assure the availability of our products to our customers, we outsource the manufacturing of selected components prior to the receipt of purchase orders from customers. However, we do not recognize revenue for such products until we receive an order from a customer and the product is shipped. As demand for our products may not materialize, this product delivery method subjects us to increased risks of high inventory carrying costs, obsolescence and excess, and may increase our operating costs. In addition, we may from time to time make design changes to our products, which could lead to obsolescence of inventory.

We have no experience manufacturing our products on a large-scale basis and may be unable to do so at our manufacturing facilities.

To date, we have achieved only very limited production of our energy storage systems and have no experience manufacturing our products on a large-scale basis. In connection with our strategic partnership with SPI, we will have to increase our production of products significantly and rapidly. We believe our current facilities in Menomonee Falls, Wisconsin, are sufficient to allow us to significantly increase production of our products. However, there can be no assurance that our current facilities, even if operating at full capacity, will be adequate to enable us to produce the energy storage systems in sufficient quantities to meet potential future orders, including orders we anticipate receiving under the Supply Agreement with SPI. Our inability to manufacture a sufficient number of units on a timely basis would have a material adverse effect on our business prospects, strategic partner relationships, financial condition and results of operations. In addition, even if we are able to meet production requirements, we may not be able to achieve margins that enable us to become profitable.

We are subject to risks relating to product concentration and lack of revenue diversification.

We derive a substantial portion of our revenue from a limited number of products. These products are also an integral component of many of our other products. We expect these products to continue to account for a large percentage of our revenues in the near term. Continued market acceptance of these products is therefore critical to our future success. Our future success will also depend on our ability to reduce our dependence on these few products by developing and introducing new products and product or feature enhancements in a timely manner. Specifically, our ability to capture significant market share depends on our ability to develop and market extensions to our existing product lines at higher and lower power range offerings and as containerized solutions. We are currently investing significant amounts in our products to broaden our product portfolio. Even if we are able to develop and commercially introduce new products and enhancements, they may not achieve market acceptance and the revenue generated from these new products and enhancements may not offset the costs, which would substantially impair our revenue, profitability and overall financial prospects. Successful product development and market acceptance of our existing and future products depend on a number of factors, including:

|

|

·

|

changing requirements of customers;

|

|

|

·

|

accurate prediction of market and technical requirements;

|

|

|

·

|

timely completion and introduction of new designs;

|

|

|

·

|

quality, price and performance of our products;

|

|

|

·

|

availability, quality, price and performance of competing products and technologies;

|

|

|

·

|

our customer service and support capabilities and responsiveness;

|

|

|

·

|

successful development of our relationships with existing and potential customers; and

|

|

|

·

|

changes in technology, industry standards or end-user preferences.

|

12

SPI has significant influence over key decision making and may ultimately acquire complete control of the Company.

On July 13, 2015, in connection with the closing of the transaction between the Company and SPI, we issued SPI 8,000,000 shares of our common stock and convertible preferred stock and a warrant that, assuming full conversion and exercise, would result in the ownership by SPI of an additional 92,000,600 shares of our common stock. SPI’s 8,000,000 common shares represent approximately 17% of the outstanding common stock of the Company and, as a result, it may have the ability to exert influence over the outcome of matters submitted to our shareholders for approval. Additionally, the certificate designations, preferences, rights and limitations of SPI’s convertible preferred stock allow it to vote on an as-converted basis on amendments to the Company’s Articles of Incorporation and Bylaws. Assuming the full conversion of SPI’s convertible preferred stock (and that no other shares of common stock are issued pursuant to the exercise or conversion of outstanding derivative securities or otherwise), it would own greater than a majority of the outstanding common stock and would have the ability to exert complete control of the Company. As a shareholder, SPI is entitled to vote its shares in its own interest, which may not always be in the interests of our shareholders generally.

Additionally, the Company is party to a Governance Agreement with SPI (the “Governance Agreement”). Under the Governance Agreement, SPI is entitled to nominate one director to our board of directors for so long as SPI holds at least 10,000 convertible preferred shares or 25 million shares of common stock or common stock equivalents (the “Requisite Shares”). Additionally, for so long as SPI holds the Requisite Shares (1) following the time at which the Series C-2 Preferred Stock shall have become convertible in full, SPI shall be entitled to nominate a total of two directors and (2) following the time at which the Series C-3 Preferred Stock shall have become convertible in full, SPI shall be entitled to nominate a total of three directors. The more representation that SPI gets on our board of directors, the more it will be able to influence the direction of the Company.

The Governance Agreement also provides that for so long as SPI holds the Requisite Shares, we will not take certain actions without the affirmative vote of SPI, including the following: (a) change the number or manner of appointment of the directors on the board; (b) other than in the ordinary course of conducting the Company’s business, cause the incurrence, issuance, assumption, guarantee or refinancing of any debt if the aggregate amount of such debt and all other outstanding debt of the Company exceeds $10 million; (c) cause the acquisition of an interest in any entity or the acquisition of a substantial portion of the assets or business of any entity or any division or line of business thereof or any other acquisition of material assets, in any such case where the consideration paid exceeds $2 million, or cause the Company to engage in certain other Fundamental Transactions (as defined in the certificate of designation of preferences, rights and limitations of the Series C Convertible Preferred Stock); (d) cause the entering into by the Company of any agreement, arrangement or transaction with an affiliate that calls for aggregate payments (other than payment of salary, bonus or reimbursement of reasonable expenses) in excess of $120,000; (e) cause the commitment to capital expenditures in excess of $7 million during any fiscal year; (f) cause the selection or replacement of our auditors; (g) enter into of any partnership, consortium, joint venture or other similar enterprise involving the payment, contribution, or assignment by the Company or to the Company of money or assets greater than $5 million; (h) amend or otherwise change our Articles of Incorporation or by-laws or equivalent organizational documents of the Company or any subsidiary in any manner that materially and adversely affects any rights of SPI; or (i) grant, issue or sell any equity securities (with certain limited exceptions). These veto rights provide SPI with significant influence over the Company’s operations and strategy. SPI may choose to exert its influence in a manner that is not in the best interests of our general shareholders.

Our China joint venture could be adversely affected by the laws and regulations of the Chinese government, our lack of decision-making authority and disputes between us and the Joint Venture.

The China market has a large inherent need for advanced energy storage and power electronics and is likely to become the world’s largest market for energy storage. To take advantage of this opportunity, in November 2011, we established a joint venture to develop, produce, sell, distribute and service advanced storage batteries and power electronics in China (the “Joint Venture”).

However, achieving the anticipated benefits of the Joint Venture is subject to a number of risks and uncertainties.

The Joint Venture has (1) an exclusive royalty-free license to manufacture and distribute our third generation ZBB EnerStore zinc bromide flow battery and any other zinc bromide flow battery product developed internally by us based on the V3 EnerStore, ranging from 50kWh – 500kWh module design, and ZBB EnerSection power and energy control center (up to 250KW) (the “Products”) in mainland China in the power supply management industry and (2) a non-exclusive royalty-free license to manufacture and distribute the Products in Hong Kong and Taiwan in the power supply management industry. Although the Joint Venture partners are contractually restricted from using our intellectual property outside of the Joint Venture, there is always a general risk associated with sharing intellectual property with third parties and the possibility that such information may be used and shared without our consent. Moreover, China laws that protect intellectual property rights are not as developed and favorable to the owner of such rights as are U.S. laws. If any of our intellectual property rights are used or shared without our approval in China, we may have difficulty in prosecuting our claim in an expeditious and effective manner. Difficulties or delays in enforcing our intellectual property rights could have a material adverse effect on our business and prospects.

13

As a general matter, there are substantial uncertainties regarding the interpretation and application of China laws and regulations, including, but not limited to, the laws and regulations governing the anticipated business of the Joint Venture and the protection of intellectual property rights. These laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. The unpredictability of the interpretation and application of existing and new China laws and regulations will pose additional challenges for us as we seek to develop and grow the Joint Venture’s business in China. Our failure to understand these laws or an unforeseen change in a law or the application thereof could have an adverse effect on the Joint Venture.

The success of the Joint Venture will depend in part on continued support of “new energy” initiatives by the government of China that includes requirements for products like ours. Should the government change its policies in an unfavorable manner the anticipated demand for the Joint Venture’s products in China may fail to materialize.

The Joint Venture may have economic, tax or other business interests or goals which are inconsistent with our business interests or goals, and may be in a position to take actions contrary to our policies or objectives. Disputes between us and the Joint Venture partners may result in litigation or arbitration that could be costly and divert the attention of our management and key personnel from focusing their time and effort on our day to day business. In addition, we may, in certain circumstances, be liable for the actions of the Joint Venture.

The Joint Venture is a new business in China. As with any new business, there will be many challenges facing the Joint Venture, including establishing successful manufacturing capabilities, developing a market for the Joint Venture’s products, obtaining requisite governmental approvals and permits, implementation of an untested business plan, and securing adequate funding for working capital and growth. Failure to overcome any of these or any other challenges facing the Joint Venture could result in its failure.

Business practices in Asia may entail greater risk and dependence upon the personal relationships of senior management than is common in North America, and therefore some of our agreements with other parties in China and South Korea could be difficult or impossible to enforce.

We are increasing our business activities in Asia. The business culture in parts of Asia is, in some respects, different from the business cultures in Western countries. Personal relationships among business principals of companies and business entities in Asia are very significant in their business cultures. In some cases, because so much reliance is based upon personal relationships, written contracts among businesses in Asia may be less detailed and specific than is commonly accepted for similar written agreements in Western countries. In some cases, material terms of an understanding are not contained in the written agreement but exist only as oral agreements. In other cases, the terms of transactions which may involve material amounts of money are not documented at all. In addition, in contrast to the Western business environment where a written agreement specifically defines the terms, rights and obligations of the parties in a legally-binding and enforceable manner, the parties to a written agreement in Asia may view that agreement more as a starting point for an ongoing business relationship which will evolve and undergo ongoing modification over time. As a result, any contractual arrangements we enter into with a counterparty in Asia may be more difficult to review, understand and/or enforce.

Our success depends on our ability to retain our managerial personnel and to attract additional personnel.

Our success depends largely on our ability to attract and retain managerial personnel. Competition for desirable personnel is intense, and there can be no assurance that we will be able to attract and retain the necessary staff. The loss of members of managerial staff could have a material adverse effect on our future operations and on successful development of products for our target markets. The failure to maintain management and to attract additional key personnel could materially adversely affect our business, financial condition and results of operations.

14

We market and sell, and plan to market and sell, our products in numerous international markets. If we are unable to manage our international operations effectively, our business, financial condition and results of operations could be adversely affected.

We market and sell, and plan to market and sell, our products in a number of foreign countries, including China, Australia, South Africa, Canada, European Union countries, the United Kingdom, Italy, Chile, Brazil, India, Mexico as well as Puerto Rico, various Caribbean island nations and various southeast Asia countries, and we are therefore subject to risks associated with having international operations. Risks inherent in international operations include, but are not limited to, the following:

|

|

·

|

changes in general economic and political conditions in the countries in which we operate;

|

|

|

·

|

unexpected adverse changes in foreign laws or regulatory requirements, including those with respect to renewable energy, environmental protection, permitting, export duties and quotas;

|

|

|

·

|

trade barriers such as export requirements, tariffs, taxes and other restrictions and expenses, which could increase the prices of our products and make us less competitive in some countries;

|

|

|

·

|

fluctuations in exchange rates may affect demand for our products and may adversely affect our profitability;

|

|

|

·

|

difficulty of, and costs relating to compliance with, the different commercial and legal requirements of the overseas markets in which we offer and sell our products;

|

|

|

·

|

inability to obtain, maintain or enforce intellectual property rights; and

|

|

|

·

|

difficulty in enforcing agreements in foreign legal systems.

|

Our business in foreign markets requires us to respond to rapid changes in market conditions in these countries. Our overall success as a global business depends, in part, on our ability to succeed in differing legal, regulatory, economic, social and political conditions. We may not be able to develop and implement policies and strategies that will be effective in each location where we do business, which in turn could adversely affect our business, financial condition and results of operations.

Our sales cycle is lengthy and variable, which makes it difficult for us to forecast revenue and other operating results.