MERRITT 7 VENTURE L.L.C.

c/o Marcus Partners Management

301 Merritt 7 Corporate Park

Norwalk, CT 06854

September 11, 2018

GE Capital US Holdings, Inc.

901 Main Avenue

Norwalk, CT 06851

Reed’s Inc.

13000 South Spring Street

Los Angeles, CA 90061

| Re: | Sublease dated as of September 1, 2018 (the “Sublease”) between GE Capital US Holdings, Inc. (“Sublessor”) and Reed’s Inc. (“Sublessee”) for a portion of the UL level (also known as the Upper Lobby Floor) of 201 Merritt 7 Corporate Park, Norwalk, CT (the “Sublet Premises”) |

Ladies and Gentlemen:

Reference is made to that certain Lease dated October 25, 2012, as amended by First Amendment of Lease dated December I, 2012 and Second Amendment of Lease dated October 2014 (collectively, the “Lease”) between Merritt 7 Venture L.L.C. (“Landlord”), as landlord, and Sublessor, as assignee of General Electric Capital LLC (fonnerly General Electric Capital Corporation), as tenant, for the entire premises (the “Premises”) in the building known as 201 Merritt 7 Corporate Park, Norwalk, Connecticut 06851 (the “Building”).

Sublessor has requested Landlord’s consent to the Sublease. Landlord hereby consents to the subletting of the Sublet Premises by Sublessor to Sublessee, subject to the following terms and conditions:

I. Landlord’s granting of the within consent shall not be deemed a waiver of Landlord’s rights under and in accordance with the Lease to consent or refuse to consent to any (a) assignment of the Lease or the Sublease or (b) any further subletting of the Premises, the Sublet Premises or any portion thereof.

2. Nothing contained herein shall be deemed to constitute a release of Sublessor as tenant under the Lease from any of its obligations as tenant under the Lease, and Sublessor shall remain fully liable for the performance of all of the obligations of tenant under the Lease and shall be fully responsible and liable to Landlord for all acts or omissions of anyone claiming under or through Sublessor of the obligations of tenant under the Lease.

| 1 |

3. Sublessor and Sublessee each hereby represents and warrants that (a) the Sublease constitutes the complete agreement between the parties with respect to the Sublet Premises, (b) a true and complete copy thereof is attached hereto as Exhibit A and (c) no rent or other consideration is being paid to Sublessor by Sublessee for the Sublease, or for the right to use or occupy the Sublet Premises, except as set forth in the Sublease. Any modification or amendment to the Sublease (except for a termination of the Sublease, a decrease in the length of the term thereof, or a de minimis modification or amendment not altering any of the material terms of the Sublease) without the prior written consent of Landlord in each instance shall be deemed to be a default by Sublessor as tenant under the Lease.

4. Nothing contained herein or in the Sublease shall be deemed to (a) increase, amend, modify or extend any of Landlord’s obligations under the Lease in any way whatsoever, and/or (b) diminish, restrict, limit, forfeit or waive any of Landlord’s rights under the Lease in any way whatsoever or (c) constitute a consent to any assignment of the Lease or the Sublease or further subletting of the Premises, the Sublet Premises or any portion thereof.

5. The Sublease shall be subject and subordinate at all times to all of the covenants, agreements, terms, provisions and conditions of the Lease and to the matters to which the Lease is or shall be subordinate.

6. Sublessee shall use and occupy the Sublet Premises for the uses permitted under the Lease and the Sublease and for no other purpose.

7. Although a copy of the Sublease is annexed hereto, Sublessor and Sublessee acknowledge and agree that Landlord is not a party thereto and is not bound by its provisions. Nothing contained herein shall be construed as a consent to. or approval or ratification by Landlord of, any of the particular provisions of the Sublease, or as a representation or warranty by Landlord, provided that this sentence shall not be construed as invalidating the consent by Landlord to the Sublease to Sublessee generally, as reflected herein.

8. Except as expressly set forth herein, no alterations, improvements or additions to the Sublet Premises, or any portion thereof, shall be made except in accordance with the provisions of the Lease.

9. Should Sublessee request that Landlord provide any building service for which Landlord imposes a separate charge, and should such service be provided by Landlord, such request for, and provision of, such services shall not serve to create any relationship of landlord and tenant between Landlord and Sublessee, and Sublessor shall remain primarily liable for payment of such charges. As an administrative convenience to Sublessee, Landlord may (but shall not obligated to) directly bill to Sublessor and/or Sublessee any charge respecting the provision of services by Landlord under the Lease or this consent with respect to the Sublet Premises, including, without limitation, charges for condenser water (if any), after hours HVAC or freight elevator usage, and other extra services requested by Sublessee (or by Sublessor on Sublessee’s behalf) and/or furnished to Sublessee. Sublessor authorizes such direct billing and understands and acknowledges that (a) Sublessor, as tenant under the Lease, shall remain primarily liable for all such charges and billings. Landlord shall notify Sublessor of any default by Sublessor or Sublessee in the payment of any such charges and billings and (b) despite such authorization from Sublessor. Landlord may choose to seek authorization from or bill Sublessor for, all such services requested by Sublessee.

| 2 |

10. Upon the expiration or any earlier termination of the term of the Lease, or in case Landlord accepts surrender of the Lease by Sublessor, except as provided in the next sentence, tbe Sublease and its term shall expire and come to an end as of the effective date of such expiration, termination, or surrender and Sublessee shall vacate the Sublet Premises on or before such date. If the Lease shall expire or terminate during the term of the Sublease for any reason other than condemnation or destruction by fire or other cause, or if Sublessor shall surrender the Lease to Landlord during the term of the Sublease, Landlord, in its sole discretion, upon written notice given to Sublessor and Sublessee on or before the effective date of such expiration, termination or surrender, without any additional or further agreement of any kind on the part of Sublessee, may elect to continue the Sublease as a direct lease between Landlord and Sublessee (provided that the terms and provisions of the Lease shall be deemed incorporated in the Sublease to the same extent as if the Lease had not expired or terminated). ln that event, Sublessee shall attorn to Landlord and Landlord and Sublessee shall have the same rights, obligations and remedies under the Sublease as Sublessor and Sublessee, respectively, had thereunder prior to such effective date, except that Landlord shall not be (1) liable for any act, omission, or default of Sublessor under the Sublease, or (2) subject to any offsets, claims, or defenses that Sublessee had or might have against Sublessor, or (3) bound by any rent or additional rent or other payment paid by Sublessee to Sublessor for more than one month in advance, or (4) bound by any modification, amendment, or abridgment of the Sublease made without Landlord’s prior written consent. Upon expiration of the Sublease pursuant to the provisions of the first sentence of this Paragraph 10, if Sublessee shall fail to vacate the Sublet Premises as provided in the Lease, Landlord shall have against Sublessee all of the rights and remedies available against Sublessor under the Lease as well as the rights and remedies available generally to a landlord against a tenant holding over after the expiration of a lease term.

11. Sublessor and Sublessee each represents and warrants to Landlord that it has not dealt with any broker in connection with the Sublease or this consent, other than CBRE Inc. and Newmark of Connecticut, LLC (collectively, “Broker”). Sublessor and Sublessee shall each indemnify, defend and hold Landlord harmless from and against any and all claims, losses, liabilities, damages, judgments, fines, suits, demands, costs, interest and expenses of any kind or nature (including reasonable attorneys’ fees and disbursements) incurred in connection with any claim, proceeding or judgment and the defense thereof which Landlord may incur by reason of any claim of or liability to any broker (including, without limitation, Broker), finder or like agent arising out of any dealings claimed to have occurred between the indemnifying party and the claimant in connection with the Sublease or this consent, or the above representation being false.

12. Nothing contained in the Sublease shall be construed to create privity of estate or (except as expressly provided herein) of contract between Sublessee and Landlord.

13. This consent is further conditioned upon payment by Sublessor of Landlord’s legal fees and expenses incurred in connection with the review of the Sublease and the preparation and negotiation of this consent.

| 3 |

14. This consent will for all purposes be construed in accordance with and governed by the laws of the State of Connecticut applicable to agreements made and to be perfonned wholly therein.

15. This consent shall not be effective until executed by all the parties hereto and may be executed in several counterparts, each of which will constitute an original instrument and all of which will together constitute one and the same instrument.

16. The terms and provisions of this consent shall bind and inure to the benefit of the parties hereto and their respective successors and assigns.

[REMAINDER OF PAGE INTENTIONALLY BLANK;

SIGNATURES FOLLOW ON NEXT PAGE]

| 4 |

Please acknowledge your agreement with the foregoing by signing this consent where indicated below.

| LANDLORD: | |

|

ACKNOWLEDGED AND AGREED:

SUBLESSOR:

GE CAPITAL US HOLDINGS, INC.

| By: | ||

| Name: | ||

| Title: |

| SUBLESSEE: | ||

| REED’S INC. | ||

| By: | ||

| Name: | Valentin Stalowir | |

| Title: | CEO | |

| 5 |

SUBLEASE

THIS SUBLEASE is made and entered into as of September 1, 2018 (“Effective Date”), by and between GE Capital US Holdings, Inc., a Delaware corporation, having an office and place of business at 901 Main Avenue, Norwalk, Connecticut 06851, hereinafter called “Sublessor”, and Reed’s Inc., a Delaware corporation, having an office and principal place of business at 13000 South Spring Street, Los Angeles, CA 90061, hereinafter called “Sublessee”. Sublessor and Sublessee are collectively referred to herein as the “Parties” and individually as a “Party”.

WITNESSETH:

WHEREAS, by a certain written Amended and Restated Lease between Merritt 7 Venture L.L.C., a Delaware limited liability company, as landlord (hereinafter called “Owner”), and Sublessor, as assignee of General Electric Capital LLC (formerly General Electric Capital Corporation), as tenant, dated as of October 25, 2012, as amended by that certain First Amendment of Lease, dated December 1, 2013 and that certain Second Amendment of Lease dated October 2014 (said lease, as same has been so amended, supplemented and/ or extended, being hereinafter called the “Master Lease”) (a redacted copy of which Master Lease is attached hereto and made a part hereof as Exhibit “A”), Owner leased to Sublessor those certain premises consisting of the entire building (“Building”) with the right to use, in common with others, the walkways, driveways, and parking areas located on the land (“Property”) commonly known as 20 1 Merritt 7 Corporate Park, Norwalk, Connecticut which, together with such other improvements and appurtenances therein mentioned, are more particularly described in the Master Lease, which are located in the office park known as Merritt 7 Corporate Park (the “Park”); and

| 6 |

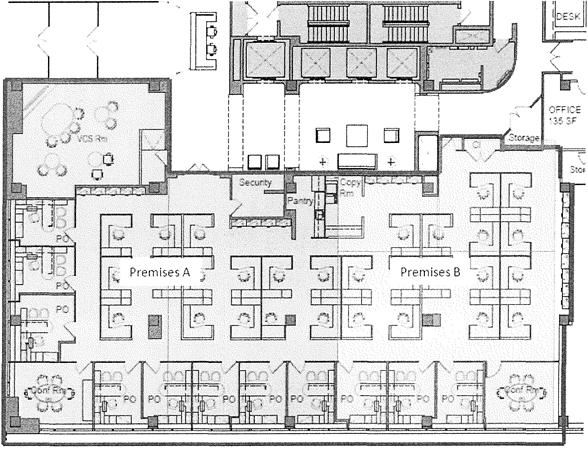

WHEREAS, Sublessee desires to sublease and hire from Sublessor, and Sublessor is willing to sublet to Sublessee, a portion of the UL level of the Building, all of which are shown on the plan attached hereto and made a part hereof as Exhibit “B” (hereinafter called the “Sublease Premises”) on the terms and conditions more particularly hereinafter set forth.

NOW, THEREFORE, in consideration of the mutual covenants, conditions and agreements herein contained, Sublessor and Sublessee agree as follows:

1. Demise and Use. Sublessor, for and in consideration of the rents and covenants specified to be paid, performed and observed by Sublessee, does hereby let, sublet, lease and demise to Sublessee the Sublease Premises and Sublessee hereby subleases the Sublease Premises from Sublessor for the Term (as hereinafter defined) and according to the covenants and conditions contained herein. The Sublease Premises is deemed and agreed by the Parties to contain the following rentable square feet: (i) a portion of the UL level of the Building containing approximately Four Thousand Six Hundred Twenty (4,620) rentable square feet of space (sometimes referred to herein as “Sublease Premises A”) and (ii) a portion of the UL level of the Building containing approximately Four Thousand (4,000) rentable square feet of space (sometimes referred to herein as “Sublease Premises B”). Accordingly, the parties agree that the Sublease Premises shall be deemed to consist of Eight Thousand Six Hundred Twenty (8,620) rentable square feet. Sublessee shall use and occupy the Sublease Premises as permitted under the Master Lease and for no other purpose whatsoever. As used herein, the term “Sublease Premises” shall include such appurtenant rights to use the common areas of the Building, the Property and the Park, as applicable (including, without limitation, the fitness center, restrooms, elevators, outdoor plazas, parking areas and cafeteria), in common with the other tenants and occupants thereof as granted to Sublessor under the Master Lease to the extent required by Sublessee in connection with (i) the use of and access to the Sublease Premises and (ii) Sublessee’s business operations, all as contemplated hereby, including the Plaza area located outside the Sublease Premises for outdoor collaboration and meetings as may be permitted under the Master Lease. Sublessor represents and warrants that, as of the date on which Sublessor delivers possession of the Premises to Sublessee, the Building structure and Building systems serving the Premises shall be in good working order.

| 7 |

Notwithstanding anything to the contrary contained in Section 5.01 of the Master Lease, but subject to the terms of Section 29 below (Pantry Space), Sublessee shall not be allowed to use any portion of the Sublease Premises as a fitness center or cafeteria; provided, however, notwithstanding anything in this Sublease to the contrary, Sublessee and it employees shall have the right to use any fitness center and cafeteria in the common areas of the Building as reasonably desired, subject to Sublessor’s reasonable rules and regulations related to management and operation of such facilities, which rules and regulations shall be applied to all users of such facilities in a non discriminatory manner (provided that with respect to the fitness center, each such employee who desires to use the fitness center (i) provides a waiver in the form attached hereto as Exhibit “H” or such other form as Sublessor may reasonably request from time to time for use by all fitness center members, and (ii) pays directly to the Sublessor (or fitness center manager, if so directed by Sublessor) the reasonable monthly fee charged for usage of said fitness center). Notwithstanding anything contained in this Sublease to the contrary, Sublessee shall not be required to pay Sublessor any fee or other amount in connection the use of the fitness center by Sublessee’s employees.

Sodexo is the current Cafeteria operator. In the event that annual Cafeteria and catering target sales reach a certain level at the Building (“Target Sales”) then Sodexo does not charge Sublessor for Cafeteria services. Sublessor represents to Sublesee that Sublessee’s share of the Target Sales amount for calendar year 2018 would have been Twelve Thousand Nine Hundred Fifty-Nine and No/ 100 Dollars ($12,959) for Sublease Premises A and Eleven Thousand Two Hundred Twenty and No/ 100 Dollars ($11,220) for Sublease Premises B. Target Sales for 2019 and future calendar years will be established at a later date. In the event that the annual Target Sales amount is not achieved then Sublessor is required to pay Sodexo Fifty-Two Cents ($0.52) for each dollar of any such shortfall (“Shortfall Amount”), e.g., a maximum of Six Thousand Seven Hundred Thirty-Nine and NojlOO Dollars ($6,739) for 2018 Target Sales applicable to Sublease Premises A and Five Thousand Eight Hundred Thirty-Four and Noj 100 Dollars ($5,834) for 2018 Target Sales applicable to Sublease Premises B. So long as Sublessee remains a user of the Cafeteria, Sublessee shall be responsible to Sublessor for (i) its Target Sales amount, and (ii) any Shortfall Amount resulting from Sublessee’s failure to reach its Target Sales amount. For avoidance of doubt, Sublease Premises B’s Target Sales requirement will be established in 2021 and commence on April 1, 2021. Until then, Sublessee is only responsible for the shortfall for Target Sales applicable to Sublease Premises A (beginning on the Sublease Premises A Commencement Date).

Sublessor shall have the right at any time to cease the operation of a Cafeteria without any liability to Sublessee and Sublessee shall have the right at any time with thirty (30) days’ prior written notice to Sublessor to cease using the Cafeteria and thereafter Sublessee shall not be obligated for any Target Sales or shortfall amounts so long as Sublessee’s employees do not use the Cafeteria.

| 8 |

2. Term. Subject to Owner’s Consent described in Section 23 below, the term of this Sublease (the “Term”) shall commence on the date on which Sublessor delivers possession of the Sublease Premises to Sublessee in the condition required under this Sublease (the “Commencement Date”), which is estimated to occur on or about September 1, 20 18 for Sublease Premises A and April 1, 2021 for Sublease Premises B. This Sublease shall terminate and the Term shall end on December 15, 2024 (“Expiration Date”), unless the Term shall be sooner terminated in accordance with the provisions hereof. Any rights or options of Sublessor under the Master Lease to terminate the Master Lease, to extend the term of the Master Lease, to expand the Premises, or any rights offirst offer or refusal are hereby specifically excluded from this Sublease.

3. Early Access; Delivery of Possession. (a) Sublessor shall allow Sublessee access to the Sublease Premises at least fifteen (15) days prior to the Commencement Date to allow Sublessee to perform Sublessee’s Work and to install its fixtures, furniture, telephones, data lines and other telecommunications/IT equipment and cabling (the “Early Access Period”). Sublessee shall not be required to pay Base Rent or Additional Rent during the Early Access Period. However, during the Early Access Period, Sublessee shall comply with all of Sublessee’s indemnity obligations and insurance requirements set forth herein. The parties agree to comply with the following terms and conditions during the Early Access Period: (i) Sublessor shall continue to have control of the Sublease Premises for all purposes provided the same does not interfere with Sublessee’s performance of Sublessee’s Work, (ii) Sublessee shall provide Sublessor with a schedule relating to Sublessee’s Work prior to the time when any such work is to be performed in the Sublease Premises, and (iii) Sublessor shall reasonably cooperate with Sublessee in connection with Sublessee’s exercise of the foregoing rights. Sublessor shall deliver possession of the Sublease Premises to Sublessee on the Commencement Date in the condition required under this Sublease. Sublessor is not obligated to provide or pay for any improvement work related to the improvement of the Sublease Premises for Sublessee’s occupancy. Sublessee shall have access to the Sublease Premises seven (7) days per week, twenty-four (24) hours per day, 365 days per year and may install a card key or other security system to restrict access to the Sublease Premises.

| 9 |

4. Rent. Commencing upon the applicable Commencement Date, Sublessee shall pay to Sublessor (at the address designated by prior written notice to Sublessee), in lawful money of the United States without any prior notice or demand therefor, a fixed monthly rent (the “Base Rent”) for the Sublease Premises as set forth on Exhibit “C” attached hereto and made a part hereof (subject to abatement as provided therein), in advance on the first day of each calendar month during the Term.

(b) In addition to the Base Rent due hereunder during the Term, Sublessee shall promptly pay to Sublessor its proportionate share of all additional rents payable to Owner pursuant to Section 2.02 of the Master Lease (“Proportionate Share”), except (i) those payments specifically excluded by the terms of this Sublease (including any penalties, costs and/ or fees in connection with Sublessor’s default under the Master Lease), and (ii) those payments which cover a period prior to the Commencement Date. provided, however, that Sublessee shall only be responsible for increases over the 2018 calendar base year for OpEx Additional Rent and increases over the 2018/2019 fiscal year for Tax Additional Rent (“Additional Rent”). The Proportionate Share for Sublease Premises A is One and Seventy-One One Hundredths percent (1.71%) and the Proportionate Share for Sublease Premises B is One and Forty-Eight One Hundredths percent ( 1.48%). Any such payments which Sublessee is herein required to make which cover a period of time both before and after the Commencement Date shall be prorated between the Parties as of the Commencement Date. Notwithstanding anything to the contrary contained in this Sublease or the Master Lease, the Proportionate Share shall not be increased during the Term of this Sublease. In addition, if the Master Lease requires the tenant to make payments of real estate taxes and/or utilities which are applicable to the Sublease Premises directly to the taxing authorities and/ or utility companies, as the case may be, Sublessee shall make such payments in a timely manner and promptly supply Sublessor with evidence thereof, and such shall be deemed to be Additional Rent hereunder. Sublessee shall pay the Additional Rent to Sublessor five (5) business days prior to when it is due under the Master Lease. Notwithstanding the foregoing, Sublessee hereby acknowledges and agrees that in the event Sublessee wishes to use any utility or service, the cost of which is not included in the base services provided by Owner under the terms of the Master Lease (e.g., HVAC use outside of Business Hours, as defined below, and other costs described in Section 3.02 of the Master Lease), Sublessee shall be solely responsible for the cost of any such utility or service utilized by Sublessee and the cost thereof shall be deemed Additional Rent. Sublessee agrees that Sublessor is not responsible for providing such services or utilities, and that Sublessee shall be solely responsible for requesting such services or utilities directly from Owner and for paying Owner for the same. Base Rent and all Additional Rent are hereinafter collectively called “Rent”. Sublessor’s right to recoup any expenses under this Sublease shall not be duplicative. Sublessor warrants and represents that the Building contains two hundred forty-one thousand five hundred eighty-nine (241,589) rentable square feet and based solely on Owner’s assertions the Building constitutes nineteen percent ( 19%) of the rentable square feet in the Park. For purposes of this Sublease, the term “Business Hours” shall mean Monday-Friday, from 8:00am to 8:00pm, and Saturday, from 9:00am to 1:00pm. The current after Business Hours HVAC rate is Two Hundred and NojlOO Dollars ($200) per hour.

| 10 |

(c) All amounts due from Sublessee to Sublessor under this Sublease shall be paid by wire transfer of immediately available funds to an account designated in writing by Sublessor, or to such other place as Sublessor may designate in writing at least thirty (30) days prior to the due date, without any offset or deduction whatsoever except as provided elsewhere in this Sublease. The monthly Base Rent and Additional Rent payable on account of any partial calendar month during the Term, if any, shall be prorated on a per diem basis based on the number of actual days in such partial calendar month. Sublessee’s obligation to pay Rent owing and due for any period during the Term shall survive the expiration of the Term.

(d) The Parties hereto agree and acknowledge that no statement or letter accompanying any payment shall be deemed to be an accord and satisfaction and Sublessor may accept any such payment without prejudice to Sublessor’s right to recover the balance or pursue any other remedy provided in this Sublease or at law, and (ii) Sublessee shall be required to pay to Sublessor interest on any sum of money which Sublessee is required to pay to Sublessor pursuant to the terms of this Sublease that is not paid to Sublessor within five (5) days of the due date and that such interest shall be calculated at an annual rate of three percent (3%) above the so-called “prime rate” of Citibank, N.A. (or its successor), as announced from time to time, (or the maximum percent permitted by law, whichever is less) (“Interest Rate”) from the date that such sum becomes due until the date it is paid.

| 11 |

5. Incorporation of Master Lease Terms. (a) The provisions, terms, covenants and conditions of the Master Lease are, except as otherwise herein specifically provided, hereby incorporated in this Sublease with the same effect as if entirely rewritten herein,except for the prov1s1ons as to base rent, additional rent and such other terms, covenants and conditions that are specifically inconsistent with the terms hereof. Words or terms which are capitalized but not defined herein shall have the meanings ascribed thereto in the Master Lease unless the context clearly requires otherwise. Sublessee acknowledges that it has read and examined the Master Lease attached hereto as Exhibit “A” and is fully familiar with the terms, provisions, covenants and conditions contained therein. Sublessee hereby covenants to perform the terms, provisions, covenants and conditions of Sublessor as tenant under the Master Lease to the extent the same are applicable to the Sublease Premises during the Term and are not otherwise expressly modified by the terms of this Sublease , and agrees not to do or permit to be done any act which shall result in a violation of any of the terms and conditions of the Master Lease. Except as otherwise specifically provided herein, Sublessee is to have the benefit of the covenants and undertakings of Owner as landlord in the Master Lease to the extent the same are applicable to the Sublease Premises during the Term. Sublessor does not assume any obligation to perform the terms, covenants and conditions contained in the Master Lease on the part of Owner to be performed as the same relates to providing Building services and utilities, and performing maintenance, repair, replacement, rebuilding, and restoration. It is further understood and agreed, therefore, that notwithstanding anything to the contrary contained in this Sublease, Sublessor shall not be in default under this Sublease for failure to render any of the services or perform any of the maintenance, repair, replacement, rebuilding, and restoration obligations required of Sublessor by the terms of this Sublease which are the responsibility of Owner as landlord under the Master Lease, but Sublessor agrees to timely take all commercially reasonable measures to insure that Owner performs such services and obligations. In addition to the foregoing, upon the request of Sublessee, Sublessor shall be obligated to exercise its self-help rights under Section 7.05 of the Master Lease on Sublessee’s behalf and if successful in doing so, then pass through to Sublessee its proportionate share of any benefits thereof. The term “commercially reasonable measures” shall not include legal action against Owner for its failure to so perform unless Sublessee agrees to pay all costs and expenses in connection therewith which shall be payable as Additional Rent. In addition to the foregoing, no such failure or default on the part of Owner shall constitute an actual or constructive total or partial eviction of Sublessee or entitle Sublessee to a reduction or abatement of Base Rent or Additional Rent hereunder, unless such failure or default would constitute an actual or constructive total or partial eviction of Sublessor or would entitle Sublessor to a reduction or abatement of Base Rent or Additional Rent (as such terms are used in the Master Lease) under the terms of the Master Lease or applicable law, if this Sublease did not exist. Notwithstanding the foregoing, if any utility, HVAC or elevator service (i.e. no elevators are functioning) is interrupted for a period of three (3) days or longer, and such interruption is not caused by Sublessee’s negligence or willful misconduct or a fire or other casualty, then the Rent payable under this Sublease shall be fully abated from the first day of such interruption on a per diem basis until such interruption is eliminated.

| 12 |

(b) The Parties agree that the following provisions of the Master Lease are, for the purposes of this Sublease, hereby deleted: 1.01 (first paragraph only); 1.02; 2.01; 2.02 (paragraph titled “Tenant’s Pro Rata Share” only); 2.02(e); 2.03 (third sentence only); 3.02(b); 5.03 (last paragraph only); 6.01(b) (second sentence only); 6.01(c); 7.05; 8.01(b); 10.01; 10.03; 11.01; 11.02; 12.01; 13.01 (except (c) and (e)); 13.02; 13.03; 14.04; 15.02; 16.01; 18.01; 20.10 (except last sentence); 20.12; 20.13; 20.15; Article 21; 22.0 1; 23.01; 24.01-24.02; and All Exhibits except 3.02 and 5.04. The remaining provisions of the Master Lease shall, for the purposes of this Sublease and to the extent that same are applicable, remain in full force and effect as between Sublessor and Sublessee as provided in this Section 5 of this Sublease, except as said provisions have been otherwise amended or modified by this Sublease (or as otherwise set forth in Section 5(a) above).

(c) Notwithstanding the generality of clause (b) above, and except to the extent provided in this Sublease, for the purposes of incorporation of the terms, provisions, covenants and conditions contained in the Master Lease herein, the term “Tenant” in the Master Lease shall mean and refer to Sublessee hereunder; the term “Landlord” in the Master Lease shall mean and refer to Sublessor hereunder; the term “the Demised Premises” in the Master Lease shall mean and refer to the Sublease Premises hereunder; the term “Base Rent” in the Master Lease shall mean and refer to the Base Rent hereunder; the term “Additional Rent” in the Master Lease shall mean and refer to the Additional Rent hereunder; the term “this Lease” in the Master Lease shall mean and refer to this Sublease; the term “Commencement Date” in the Master Lease shall mean and refer to the Commencement Date hereunder; and the term “Expiration Date” in the Master Lease shall mean and refer to the Expiration Date hereunder.

(d) It is further understood and agreed that some of the provisions of the Master Lease incorporated herein by reference are hereby amended as follows:

(i) The word “Landlord” shall refer to both Owner and Sublessor in Section 5.03 of the Master Lease.

(ii) Sublessor shall have an additional five (5) business days for purposes of Sublessor’s delivery to Sublessee of the Reconciliation Notice and items related to the same as set forth in Section 2.02 of the Master Lease. If an excluded provision contains the definition of a defined term used in an incorporated provision or is specifically referenced in this Sublease, such definition in the excluded provision shall be deemed incorporated solely for such purpose.

| 13 |

6. Holding Over. If Sublessee retains all or any portion of the Sublease Premises after the expiration or termination of the Term, then during such period Sublessee shall pay Sublessor the greater of: (i) two hundred percent (200%) of the Base Rent; and (ii) any amount charged to Sublessor under the terms of the Master Lease on account of such holdover. Sublessee shall also pay all damages, consequential as well as direct, sustained by Sublessor by reason of such retention (including, without limitation, any such damages payable to Owner under the terms of the Master Lease). Nothing in this Section 6 contained shall be construed or operate as a waiver of Sublessor’s right of re-entry or any other right of Sublessor.

7. Notices. All notices, requests, demands and other communications with respect to this Sublease, whether or not herein expressly provided for, shall be in writing and shall be deemed to have been duly given the next business day after being deposited (in time for delivery by such service on such business day) with Federal Express or another national courier service, for delivery to the Parties at the addresses listed below, or to such other address or addresses as may hereafter be designated by either party in writing for such purpose:

| Sublessor: | GE Capital US Holdings, Inc. |

| 901 Main Avenue | |

| Norwalk, CT 06851 | |

| Attn: Real Estate Leader | |

| With a copy to: | GE Global Operations- Properties |

| 191 Rosa Parks Street | |

| Cincinnati, OH 45202 | |

| Attn: Steve Copsinis | |

| Sublessee: | Reeds’s Inc. |

| 20 1 Merritt 7 | |

| Norwalk, CT 06851 | |

| Attn: Iris Synder, CFO | |

| With a copy to: | Libertas Law Group |

| 225 Santa Monica Blvd, 5th Floor | |

| Attn: Ruba Qashu |

| 14 |

8. Sublease Subject to Master Lease. (a) This Sublease is expressly made subject to all the terms and conditions of the Master Lease, except as specifically provided to the contrary in this Sublease or in the Owner’s Consent (as hereinafter defined). Sublessee hereby assumes, and covenants that it shall, throughout the Term, observe all of the terms, provisions, covenants and conditions of the Master Lease on the part of Sublessor to be performed as the tenant thereunder (except the provisions which are not incorporated herein), and that Sublessee will not do any act, matter or thing which will be, result in, or constitute a violation or breach of or a default under the Master Lease; any such violation, breach or default shall constitute the breach by Sublessee of a substantial obligation under this Sublease. Sublessee shall indemnify and hold Sublessor harmless from and against all claims, penalties and expenses, including reasonable out-of-pocket attorneys’ fees and disbursements, based upon any default by Sublessee, during the Term, in Sublessee’s performance of those terms, provisions, covenants and conditions of the Master Lease which are or shall be applicable to Sublessee, as above provided, and Sublessee shall pay to Sublessor as Additional Rent hereunder any and all sums which Sublessor is required to pay to Owner, which requirement is caused in whole or in part by Sublessee’s failure to perform or observe any of the terms, provisions, covenants and conditions of the Master Lease or by any act or omission described in the preceding sentence. In any case where the consent or approval of Owner shall be required pursuant to the Master Lease, Sublessor’s consent shall also be required hereunder.

(b) Except as specifically set forth in this Sublease, to the extent that any duty, requirement or obligation of Sublessee which is covered or addressed by any of the terms or provisions of this Sublease is also covered and/ or addressed by any of the terms or provisions of the Master Lease with respect to the Sublease Premises: (i) Sublessee shall comply with the terms and provisions of both this Sublease and the Master Lease, to the extent that such terms and provisions of this Sublease and those of the Master Lease are not in conflict, and (ii) to the extent that such terms and provisions of this Sublease and those ofthe Master Lease are in conflict, Sublessee shall (as between the terms and provisions of this Sublease and the terms and provisions of the Master Lease) comply with the terms and provisions of the Sublease.

(c) This Sublease is subject and subordinate to the Master Lease and to the matters to which the Master Lease is or shall be subordinate, and in the event of termination, re-entry or dispossess by Owner under the Master Lease, Sublessee shall, at Owner’s option, attorn to Owner pursuant to the then executory provisions of this Sublease, except that Owner shall not (i) be liable for any previous act or omission of Sublessor under this Sublease, (ii) be subject to any offset not expressly provided in this Sublease which shall have theretofore accrued to Sublessee against Sublessor, or (iii) be bound by any previous modification of this Sublease or by any previous prepayment of more than one (1) month’s Base Rent or Additional Rent.

(d) If any termination of the Master Lease is the result of a voluntary termination of the Master Lease by Sublessor or a default by Sublessor under the Master Lease and such default of Sublessor was not due to default by Sublessee of its obligations hereunder, Sublessor shall be liable to Sublessee for any and all damages (except for consequential and punitive damages) incurred by Sublessee as a result of such termination. In the event of any other expiration or earlier termination of the Master Lease, for any reason whatsoever, this Sublease shall automatically terminate on the date of the expiration or termination of the Master Lease; provided, however, that those terms and conditions of this Sublease which expressly survive expiration or termination of this Sublease, including, but not limited to, indemnity obligations, shall survive any such expiration or termination of this Sublease. Further, in the event of any damage to or destruction of the Premises or the Building or in the event that the Premises or the Building (or any portion thereof, including, any parking spaces allocated to Sublessor under the Master Lease) are taken for any public or quasi-public use in condemnation proceedings or by any right of eminent domain or sale in lieu of condemnation and if Sublessor or Owner elect to terminate the Master Lease as a result of such damage, destruction or condemnation, then this Sublease shall automatically terminate (provided, however, that if the damage, destruction or taking solely affects the Sublease Premises, Sublessor will not elect to terminate the Master Lease unless Sublessee has given its prior written consent to such termination). Upon any termination of this Sublease pursuant to the foregoing provisions of this Section 8(d) of this Sublease, Sublessee shall not have any right or claim against Sublessor on account of such termination other than as specifically provided herein.

9. Performance of Master Lease. (a) The respective terms, covenants, provisions and conditions of the Master Lease on the part of Owner to be performed, which have been incorporated herein by reference, are to be performed by Owner or its successors and assigns, and, subject to Section S(a) hereof, Sublessee shall look solely to Owner for such performance. Sublessor shall not be liable or responsible to Sublessee for any failure or default on the part of Owner, its successors or assigns, with respect to any of the terms, covenants, provisions and conditions of the Master Lease.

| 15 |

(b) If Sublessee shall default in the payment of Rent hereunder or in the performance or observance of any of the terms, covenants or conditions of this Sublease on the part of Sublessee to be performed or observed, Sublessor shall have the right (but not the obligation) to exercise all of the same rights and remedies provided to or reserved by Owner in the Master Lease with respect to such default and at law and in equity; provided, however, the foregoing shall in no way be deemed to limit or impair the rights and privileges of Owner under the Master Lease, or to impose any obligations on the part of Sublessor by reason of the exercise by Owner of any of such rights or privileges with respect to the Sublease Premises or to the use and occupation thereof by Sublessee. Without limiting the foregoing, Sublessor shall have the same rights and remedies in the event of non-payment by Sublessee of Rent hereunder as are available to Owner under the Master Lease and at law and in equity for the non-payment of Rent and/ or of any installment thereof.

(c) Sublessee or Sublessor, as applicable, shall, within three (3) days after receipt thereof, notify the other Party of any notice applicable to the Sublease Premises served by Owner upon such Party. Wherever Owner requires Sublessor, as tenant under the Master Lease (except in respect of any provision which has not been incorporated herein), to take any action or to cure any default (other than a default in the payment of Base Rent or Additional Rent) applicable to the Sublease Premises within a period of time stated therein or in the Master Lease, Sublessee shall complete such action or cure such default not later than three (3) days prior to the expiration of such period and shall promptly furnish notice of compliance to Sublessor, unless the nature of such cure cannot reasonably be completed within five (5) business days, in which case, Sublessee shall have an additional time period to complete such cure (which shall not exceed a total of thirty (30) days), and Sublessee shall not be deemed to be in default or breach of its obligations under this Sublease unless Sublessee fails to cure such default within such thirty (30) day period.

| 16 |

10. Subleases, Assignments, etc.

(a) Sublessee shall not by operation of law or otherwise, assign this Sublease or any interest therein or sublet any portion or all of the Sublease Premises (each, a “Transfer”) without Owner’s prior written consent as set forth in the Master Lease, and Sublessor’s prior written consent which may be granted or withheld in Sublessor’s sole discretion; provided, however, that commencing on the earlier of (i) the date upon which Sublessor has sublet the entire Premises or assigned the Master Lease, each to an unaffiliated third party for the remainder of the Term (as defined in the Master Lease) and (ii) the date that is twelve (12) months after the Commencement Date, Sublessor shall not unreasonably withhold its consent to any Transfer. Notwithstanding the foregoing, Sublessee shall not offer to make or enter into negotiations with respect to a Transfer to any of the following: (x) a tenant in the Building; (y) any party with whom Sublessor or any affiliate of Sublessor is then negotiating or has been negotiating in the then-prior six (6) months with respect to space in the Building; (z) any entity owned by, owning, or affiliated with, directly or indirectly, any tenant or party described in clauses (x) and (y) hereof, and it shall not be unreasonable for Sublessor to disapprove any proposed Transfer to such entities. Any Transfer in violation of the provisions of this Sublease shall, at the option of Sublessor, be void and of no force or effect, and, at the option of Sublessor, terminate this Sublease.

(b) No consent by Sublessor or Owner to any Transfer shall in any manner be considered to relieve Sublessee from obtaining Sublessor or Owner’s express written consent to any further Transfer.

(c) Without limitation of the foregoing, if this Sublease is assigned, or if the Sublease Premises or any part thereof is sublet or occupied by anyone other than Sublessee, Sublessor may, after default by Sublessee, collect Base Rent and Additional Rent from the assignee, subtenant or occupant, and apply the amount collected to the Base Rent and Additional Rent herein reserved, but no such assignment, subletting, occupancy or collection of Base Rent and Additional Rent shall be deemed a waiver of the covenants in this Section 10, nor shall it be deemed acceptance of the assignee, subtenant or occupant as a tenant, or a release of Sublessee from the full performance of all the terms, conditions and covenants of this Sublease.

| 17 |

11. “As Is” Condition. Without limiting any representation or warranty or any other obligation of Sublessor under this Sublease, Sublessor warrants and represents that the Building systems that serve the Sublease Premises shall be in good working order and condition and to Sublessor’s actual knowledge all such Building systems are and shall be in compliance with all applicable laws and regulations, with the Sublease Premises being broom clean and vacant on the Commencement Date (exclusive of the Personal Property, as such term is hereinafter defined). Sublessee acknowledges that it has inspected the Sublease Premises demised hereunder, and, agrees to accept the Sublease Premises in “AS IS” “WHERE IS CONDITION” in reliance upon Sublessor’s warranty and representation set forth above in this Section, and without any obligation on Sublessor’s part to alter or reconfigure the Sublease Premises and subject to all applicable zoning, federal, state and local laws, ordinances and regulations governing and regulating the Sublease Premises, including but not limited to the Americans with Disabilities Act, and any covenants and restrictions of record and all matters disclosed thereby and by any exhibits attached to this Sublease; provided, however, Sublessee shall not be responsible for performing any improvements to cure any non-compliance with such laws except to the extent caused by its specific (and not general office) use of the Sublease Premises or any alteration made by Sublessee. Except as set forth above in this Section or elsewhere in this Sublease, Sublessee further acknowledges that neither Sublessor nor Owner has made any representations or warranties whatsoever with respect to the physical condition of the Sublease Premises or Personal Property, expressed and/ or implied, or arising by operation of law, including, but not limited to, any warranty of condition, habitability, merchantability or fitness for a particular purpose and Sublessee agrees that neither Sublessor or Owner have any obligation to alter or repair the Sublease Premises or to prepare the same in any way prior to the Commencement Date for Sublessee’s occupancy or use.

| 18 |

12. Alterations. All alterations, changes, additions, improvements, repairs or replacements in, to, or about the Sublease Premises (collectively, “Sublessee Changes”), including, without limitation, Sublessee’s Work, shall be made in accordance with the provisions of the Master Lease applicable thereto. No Sublessee Changes shall be affected by Sublessee to the Sublease Premises without Sublessor’s prior written consent, which consent shall not be unreasonably withheld, delayed or conditioned. All Sublessee Changes shall be subject to Owner’s consent if required by the terms of the Master Lease, and Sublessor makes no representations or warranties, and expresses no opinion, with respect to Owner’s consent to any Sublessee Changes. Sublessee shall reimburse: (i) Owner in accordance with the provisions in the Master Lease with respect to Sublessee Changes, and (ii) Sublessor for all actual, reasonable out-of-pocket costs and expenses incurred in connection with the review of proposed Sublessee Changes, including the plans with respect thereto, which shall not exceed $2,000 per request. Sublessee shall not be required to remove any such alteration from the Sublease Premises unless Owner or Sublessor requires such removal in writing at the time of granting its consent to Sublessee’s proposed alteration.

| 19 |

13. Sublessee’s Work. Subject to the consent of Sublessor and Owner (i) to the Sublessee’s Preliminary Work described on Exhibit “E” attached hereto, and (ii) the Sublessee’s Final Work Plans (as hereinafter defined), Sublessee shall have the right to perform and complete at its sole cost and expense the work (“Sublessee’s Work”) as described in the Sublessee’s Final Work Plans, which when approved by Sublessor and Owner shall be made a part hereof and shall constitute Exhibit “E”; provided, however, by its execution of this Sublease, Sublessor shall be deemed to have consented to all of the work described in Exhibit “E”, except as may be otherwise expressly noted in said Exhibit. At its sole cost and expense, Sublessee shall remove Sublessee’s Work and restore the Sublease Premises to its pre-Sublessee’s Work condition on the Commencement Date at the expiration of the Term, normal wear and tear and casualty excepted; provided, however, Sublessor specifically agrees that if at the time Owner consents to Sublessee’s Work, Owner does not require the removal of Sublessee’s Work and restoration of the Sublease Premises to its pre-Sublessee’s Work condition on the Commencement Date by either Sublessor or Sublessee, Sublessee shall not be obligated to remove Sublessee’s Work nor to restore the Sublease Premises at the expiration of the Term. Sublessee shall construct all Sublessee’s Work in a good and workmanlike manner and in compliance with all federal, state and local laws, rules, regulations and ordinances, including, but not limited to, the Americans with Disabilities Act. Further, Sublessee shall comply with all terms and conditions of the Master Lease relating to alterations or changes to be made to the Sublease Premises and shall comply with Owner’s reasonable health, safety and security policies and procedures in so constructing the Sublessee’s Work, a copy of which shall be delivered to Sublessee prior to the execution of this Sublease. In addition, Sublessee shall indemnify, defend and hold harmless Sublessor and Owner against liability, loss, cost, damage, liens and expense imposed upon Sublessor or Owner arising out of the performance of such Sublessee’s Work by Sublessee, excluding, however, any such liability, loss, cost, damage, or lien resulting from the acts or omissions of Sublessor or Owner.

| 20 |

14. Brokers. Sublessor and Sublessee each represent and warrant to the other that it has had no dealings with any real estate broker, finder or agent in connection with the negotiation of this Sublease or bringing about or consummating this Sublease, except CBRE, Inc. (“Sublessor’s Broker”) and Newmark of Connecticut, LLC (“Sublessee’s Broker”). Sublessor shall pay Sublessor’s Broker a commission pursuant to a separate written agreement and Sublessor’s Broker shall thereafter be solely responsible for any commissions owning to Sublessee’s Broker in connection with this Sublease. Other than Sublessor’s Broker and Sublessee’s Broker, the Parties know of no other real estate broker or agent who is or might be entitled to a commission in connection with this Sublease. Sublessor and Sublessee each agree to indemnify, defend and hold the other harmless from all costs and liabilities, including reasonable attorneys’ fees and costs, arising out of or in connection with claims made by any broker or individual who alleges that it is entitled to commissions or fees with regard to this Sublease as a result of dealings it had with the indemnifying party.

15. Indemnification.

(a) Sublessee shall indemnify and save harmless Sublessor and its officers, directors, agents and employees, against and from any and all liability, damage, expense, cause of action, suits, claims or judgments for injury or death to persons or damage to property sustained by anyone in and about the Sublease Premises or any part thereof, arising out of or in any way connected with Sublessee’s or its agents’, employees’, contractors’ or invitees’, use or occupation of the Sublease Premises or any breach of this Sublease or the Master Lease. Furthermore, all furnishings, fixtures, equipment, and property of every kind and description of Sublessee and of persons claiming by or through Sublessee which may be on the Sublease Premises shall be at the sole risk and hazard of Sublessee and no part or loss or damage thereto from whatever cause is to be charged to or borne by Sublessor.

| 21 |

(b) Sublessor shall indemnify and save harmless Sublessee and its officers, directors, agents and employees, against and from any and all liability, damage, expense, cause of action, suits, claims or judgments for injury or death to persons or damage to property sustained by anyone in and about the Premises other than the Sublease Premises or any part thereof, arising out of or in any way connected with Sublessor’s or its agents’, employees’, contractors’ or invitees’, use or occupation of the Premises other than the Sublease Premises or any breach of this Sublease or the Master Lease. Furthermore, all furnishings, fixtures, equipment, and property of every kind and description of Sublessor and of persons claiming by or through Sublessor which may be on the Premises other than the Sublease Premises shall be at the sole risk and hazard of Sublessor and no part or loss or damage thereto from whatever cause is to be charged to or borne by Sublessee. In no event shall Sublessee be liable in any way for, and Sublessor and Owner each forever releases Sublessee from, any claim, loss, liability, damages and costs in connection with or arising out of or resulting from Sublessor’s default or breach under the Master Lease.

16. Damage, Destruction and Condemnation. If the Sublease Premises or any portion thereof shall be damaged by fire or other casualty or be condemned or taken in any manner for a public or quasi-public use, Sublessee agrees that it shall be the obligation of Owner and not of Sublessor to repair, restore or rebuild the Sublease Premises in accordance with the terms of the Master Lease. In the event of a casualty or condemnation in connection with all or any portion of the Building or Sublease Premises, this Sublease shall continue in full force and effect, unless in connection therewith Owner or Sublessor terminates the Master Lease pursuant to the provisions thereof. Base Rent and Additional Rent payable hereunder shall be abated in full pending the complete restoration of any damage caused by such casualty or taking of the Sublease Premises to the extent that such rents are abated pursuant to the Master Lease .. In the event of a condemnation or taking of the Sublease Premises, the Parties hereby agree that Sublessee shall be entitled to any award received by Sublessor pursuant to the Master Lease with respect to the Sublease Premises, less the reasonable costs of collection borne by Sublessor. Notwithstanding the foregoing, Sublessee shall have the right to terminate this Sublease if (i) the repair or restoration work cannot be completed within one hundred eighty (180) days following the date of casualty or condemnation, or (ii) if fewer than twelve ( 12) months remain in the Term of this Sublease. The Parties agree that this Section 16 constitutes an express agreement governing any case of damage, destruction or taking of the Sublease Premises or the Building by fire or other casualty or condemnation.

| 22 |

17. Right of Sublessor to Perform Sublessee’s Covenants. If Sublessee shall have defaulted in the observance or performance of any term or covenant on Sublessee’s part to be observed or performed under or by virtue of any of the terms or provisions of this Sublease beyond applicable notice and cure periods, then, unless otherwise provided elsewhere in this Sublease, Sublessor may, after giving at least three (3) business days’ prior written notice to Sublessee (unless Sublessee’s failure to perform such obligation has created an emergency, which means an imminent threat to personal safety or property damage, in which event Sublessor shall give at least twenty four (24) hours’ prior written notice to Sublessee), perform the same for the account of Sublessee, and if Sublessor makes any expenditures or incurs any obligations for the payment of money in connection therewith, including, but not limited to, reasonable out-of-pocket attorneys’ fees and disbursements in instituting, prosecuting or defending any action or proceeding and any late charge to the extent Sublessor is charged by Owner as a result of such default by Sublessee, such sums paid or obligations incurred with interest at the Interest Rate, and such costs shall be deemed to be Additional Rent hereunder and shall be paid by Sublessee to Sublessor within thirty (30) days after Sublessee’s receipt of a reasonably detailed invoice or statement therefor, in addition to any documentation reasonably requested by Sublessee.

| 23 |

18. Insurance. Sublessee shall maintain and keep in full force and effect during the Term, at its own cost and expense, the insurance policies required to be held by “Tenant” under the applicable provisions of Section 4.02 of the Master Lease and such policies shall comply with the requirements of Section 4.02 of the Master Lease but only to the extent of Sublessee’s interest in and to the the Sublease Premises. The foregoing shall in no way limit or otherwise diminish Sublessor’s obligations under the Master Lease, including the obligation to maintain insurance under Section 4.02 of the Master Lease with respect to the entire Premises. All commercial general liability insurance procured by Sublessee under this Section 18 shall name Owner, Sublessor, any superior lessor and any superior mortgagee, as their respective interests may appear as additional insureds (so long as Sublessor provides Sublessee prior written notice of the names and addresses of such superior mortgagees and/ or superior lessors). Sublessee shall include in each of its insurance policies (and, with respect to any equipment in the Sublease Premises owned by Sublessee, in the insurance policies covering such equipment carried by Sublessee or the lessors of such equipment) against loss, damage or destruction by fire or other insured casualty (except for earthquake and sprinkler coverage) a waiver of all of the insurer’s rights of subrogation against Sublessor, Owner, any superior lessor, mortgagee, managing agent and property manager.

19. End of Term. Upon the expiration or sooner termination of the Term, Sublessee shall vacate and surrender the Sublease Premises in accordance with Section 15.01 of the Master Lease; provided, however, that Sublessee shall not be required to remove any alterations installed by Sublessor at any time or alterations which existed and/ or were commenced prior to the Commencement Date, but shall reasonably cooperate with Sublessor to the extent that Sublessor is required to timely remove such alterations pursuant to the Master Lease. Removal of all furniture, trade fixtures, and moveable equipment and other personal items owned by Sublessee shall be the responsibility of Sublessee. Sublessor shall cooperate with Sublessee in Sublessee’s performance of its obligations under this Section.

| 24 |

20. Signage. Sublessee shall be entitled to directory signage in the Building lobby and on the entrances to the Sublease Premises subject to Sublessor’s (and Owner’s if required) prior written consent, which shall not be unreasonably withheld, conditioned or delayed. Sublessor shall pay the costs and expenses of removing Sublessor’s signage and Sublessee shall pay the costs and expenses of installing, maintaining and repairing its signage.

21. Parking. During the Term, Sublessee shall be entitled to use 3 parking spaces per 1,000 rentable square feet of the Sublease Premises at no additional charge of Sublessor’s non-designated parking spaces in accordance with the terms of Section 20.10 of the Master Lease.

22. Miscellaneous. This Sublease and any Exhibits attached hereto:

(a) Contain the entire agreement among the Parties hereto with respect to the subject matter covered hereby;

(b) May not be amended or rescinded except by an instrument m writing executed by each of the Parties hereto;

(c) Shall inure to the benefit of and be binding upon the successors and assigns of the Parties hereto (to the extent permitted under this Sublease); and

| 25 |

(d) May be executed in one or more counterparts, each of which, when so executed and delivered shall be deemed an original and all of which taken together shall constitute one and the same instrument;

(e) In the event that any covenant, condition or other provision herein contained is held to be invalid, void or illegal by any court of competent jurisdiction, the same shall be deemed severable from the remainder of this Sublease and shall in no way affect, impair or invalidate any other covenant, condition or other provision herein contained. If such condition, covenant or other provision shall be deemed invalid due to its scope or breadth, such covenant, condition or other provisions shall be deemed valid to the extent of the scope or breadth permitted by law;

(f) intentionally omitted;

(g) The waiver by Sublessor or Sublessee of any breach of any term, condition or covenant of this Sublease shall not be deemed to be a waiver of such provision or any subsequent breach of the same or any other term, condition or covenant of this Sublease. No covenant, term or condition of this Sublease shall be deemed to have been waived by Sublessor or Sublessee unless such waiver is in writing and signed by the waiving party;

(h) Sublessor may transfer the Sublease Premises and any of its rights under this Sublease or Master Lease without the consent of Sublessee. In the event that Sublessor, or any successor to the Sublessor’s interest in the Sublease Premises, shall sell, convey, transfer or assign the Sublease Premises, all liabilities and obligations on the part of Sublessor, or such successor, under this Sublease, shall thereupon and thereby be released, and thereupon all such liabilities and obligations shall be binding upon the new sublessor and Sublessee shall look solely to such new sublessor for the performance of any of Sublessor’s obligations hereunder; provided, however, to the extent such liabilities and obligations are of a continuing nature and have not been expressly assumed by the successor, Sublessor or such successor, as the case may be, shall remain liable therefor. This Sublease and Sublessee’s rights and obligations hereunder shall not otherwise be affected by any such sale, conveyance, transfer or assignment and Sublessee agrees to attorn to such new owner and execute any such documents evidencing such attornment;

| 26 |

(i) The submission of this Sublease for examination or the negotiation of the transaction described herein or the execution of this Sublease by only one of the Parties shall not in any way constitute an offer to sublease on behalf of either Sublessor or Sublessee, and this Sublease shall not be binding on either Party until duplicate originals thereof, duly executed on behalf of both Parties, have been delivered to each of the Parties hereto;

U) This Sublease is made the state of Connecticut and shall be governed by and construed by the laws thereof;

U) Except with respect to Sublessee’s failure to vacate and surrender the Sublease Premises on or before the Expiration Date as provided in Section 6 of this Sublease, Sublessor and Sublessee agree that as to the other, Sublessor and Sublessee shall not have any right to sue for or collect, and Sublessor and Sublessee shall never have any liability or responsibility whatsoever for any consequential or indirect damages, whether proximately or remotely related to any default of the other under this Sublease or any act, omission or negligence of Sublessee or Sublessor or their respective agents, contractors or employees, as the case may be, and Sublessor and Sublessee hereby waive any all such rights; and

| 27 |

(1) Both Parties hereto will maintain in confidence and not disclose to any third-party the existence of this Sublease and/or the specific terms of this Sublease, except (i) to said party’s corporate affiliates, legal counsel, auditors, lenders or contractors, (ii) to prospective assignees of the Sublease or subtenants of all or any portion of the Sublease Premises, (iii) as required in connection with any financing or proposed sale or transfer of any interest in the Sublease Premises by Sublessor, (iv) as required in connection with the sale of equity interests, or the merger or consolidation of either party hereto, (v) in order to enforce a party’s rights under this Sublease or the Master Lease, (vi) as specifically authorized to do so in writing by the other party, or (vii) as otherwise required by any applicable laws or pursuant to any litigation, arbitration or regulatory proceeding.

23. Owner’s Consent. This Sublease is subject to and conditioned upon the written consent of Owner to (i) this subletting as described in this Sublease, and to Sublessor’s Work, and (ii) the Sublessee’s Work and signage (if required), such consent to be given by Owner, per separate written agreement (“Owner’s Consent”). Sublessor shall (i) use commercially reasonable efforts to procure Owner’s Consent and (ii) promptly notify Sublessee of the receipt of Owner’s Consent and provide Sublessee with a copy thereof. In the event that Owner’s Consent as it relates to (i) above shall not have been obtained on or prior to the date that is two (2) months from the Effective Date, then Sublessor and Sublessee shall each have the right to terminate this Sublease effective upon notice to the other given in writing within five (5) days from the Effective Date, in which event this Sublease shall be of no further force or effect and the Parties will have no further obligations or liability hereunder.

24. Personal Property. Sublessor shall deliver the furniture, equipment and other personal property located at the Sublease Premises as of the Effective Date and listed on Exhibit “F” attached hereto and made a part hereof (“Personal Property”) to Sublessee on the Commencement Date for the purchase price of One Dollar ($1.00), subject to the provisions of this Section 24. On the Commencement Date, Sublessor shall deliver to Sublessee a Bill of Sale for the Personal Property in the form attached as Exhibit “G” hereto. During the Term, Sublessee shall have the right to use, remove or discard any or all Personal Property in any manner Sublessee desires.

| 28 |

(a) Sublessee has inspected the Personal Property and determined that it is acceptable to Sublessee. Sublessor has not made, and shall not be bound by, any statements, agreement, or representations regarding the Personal Property not specifically set forth herein, unless the same are reduced to writing and signed by Sublessor.

(b) SUBLESSEE AGREES THAT EXCEPT AS EXPRESSLY PROVIDED ELSEWHERE IN THIS SUBLEASE, SUBLESSOR MAKES NO WARRANTIES, EXPRESSED AND IMPLIED AND ALL WARRANTIES OF ANY KIND, INCLUDING ANY EXPRESSED OR IMPLIED WARRANTY OF MERCHANTABILITY OR FITNESS FOR PURPOSE, ARE HEREBY EXCLUDED BOTH AS TO THE PERSONAL PROPERTY AND AS TO MAINTENANCE OR REPAIR WORK PERFORMED BY SUBLESSOR ON THE PERSONAL PROPERTY.

25. Representations and Warranties. (a) Sublessee warrants and represents, for the benefit of Sublessor only, that (i) Sublessee is duly organized and existing under the laws of the State of Delaware, (ii) subject to obtaining the Owner’s Consent, Sublessee has full right and authority to execute, deliver and perform under this Sublease, (iii) the persons executing this Sublease on behalf of Sublessee were authorized to do so, (iv) to Sublessee’s actual knowledge, the execution, delivery and performance by Sublessee of this Sublease will not violate any provision of law or any order of any court or agency of government, or any agreement or other instrument to which Sublessee is a party or by which it or any of its property is bound and (v) this Sublease shall be a valid and binding obligation of Sublessee enforceable in accordance with its terms.

| 29 |

(b) Sublessor warrants and represents, for the benefit of Sublessee only, that (i) Sublessor is duly organized and existing under the laws of the State of Delaware, (ii) subject to obtaining the Owner’s Consent, Sublessor has full right and authority to execute, deliver and perform under this Sublease, (iii) the persons executing this Sublease on behalf of Sublessor were authorized to do so, (iv) to Sublessor’s actual knowledge, the execution, delivery and performance by Sublessor of this Sublease will not violate any provision of law or any order of any court or agency of government, or any agreement or other instrument to which Sublessor is a party or by which it or any of its property is bound and (v) this Sublease shall be a valid and binding obligation of Sublessor enforceable in accordance with its terms.

26. Anti-Terrorism Representations. (a) Sublessor represents and warrants to Sublessee that (1) neither Sublessor, nor to the knowledge of Sublessor, any director, officer, employee or affiliate of the Sublessor (collectively, “Sublessor Parties”) are in violation of any law relating to terrorism or money laundering, including but not limited to, Executive Order No. 13224 on Terrorist Financing, the U.S. Bank Secrecy Act, as amended by the Patriot Act, the Trading with the Enemy Act, the International Emergency Economic Powers Act and all regulations promulgated thereunder, all as amended from time to time (collectively, “Anti-Terrorism Law”); (2) no action, proceeding, investigation, charge, claim, report, or notice has been filed, commenced, or threatened against Sublessor, or to the knowledge of Sublessor, any ofthe Sublessor Parties alleging any violation of any Anti-Terrorism Law; and (3) neither Sublessor nor, to the knowledge of Sublessor, any of the Sublessor Parties is a “Prohibited Person”. As used in this Sublease, “Prohibited Person” shall mean any (1) person or entity who is on the OFAC List or any “designated national,” “specially designated national,” “specially designated terrorist,” “specially designated global terrorist,” “foreign terrorist organization,” “blocked person,” or “specially designated narcotics trafficker,” within the definitions set forth in the Foreign Assets Control Regulations of the United States Treasury Department, 31 C.F.R., Subtitle B, Chapter V, as amended; (2) any government or entity against whom the United States maintains economic or other sanctions or embargoes under the Regulations of the United States Treasury Department, 31 C.F.R., Subtitle B, Chapter V, or the Export Administration Regulations of the United States Department of Commerce, 15 C.F.R. Subtitle B, Chapter VII, Subchapter C, each as amended, including, but not limited to, the “Government of Burma,” the “Government of Sudan,” the “Taliban,” and the “Government of Iran,” and person acting on behalf of such government or entity; (3) person or entity who is listed in the Annex to or is otherwise within the scope of Executive Order 13224- Blocking Property and Prohibiting Transactions with Persons who Commit, Threaten to Commit, or Support Terrorism, effective September 24, 2001; or (4) person or entity subject to additional restrictions imposed by any of the following statutes or Regulations and Executive Orders issued thereunder: the Trading with the Enemy Act, 50 U.S.C. Appendix,§§ 1 et seq.; the Iraq Sanctions Act, §§ 586 et seq. of Pub. L. 101-513, 104 Stat. 2047; the National Emergencies Act, 50 U.S.C. §§ 160 1 et seq.; the Anti-Terrorism and Effective Death Penalty Act of 1996, Pub. L. 104-132, 110 Stat. 1214; the International Emergency Economic Powers Act, 50 U.S. C. §§ 1701 et seq.; the United Nations Participation Act, 22 U.S.C. § 287c; the International Security and Development Cooperation Act, 22 U.S.C. § 2349aa-9; the Nuclear Proliferation Prevention Act of 1994, Pub. L. 103-236, 108 Stat. 507; the Foreign Narcotics Kingpin Designation Act, 21 U.S. C.§§ 1901 et seq.; the Iran and Libya Sanctions Act of 1996, Pub. L. 104-172, 110 Stat. 1541; the Cuban Democracy Act, 22 U.S.C. §§ 6001 et seq.; the Cuban Liberty and Democratic Solidarity Act, Pub. L. 104-114, 22 U.S.C. §§ 6021 et seq.; the Clean Diamonds Trade Act, Pub. L.108-19, 117 Stat. 631; the Burmese Freedom and Democracy Act, Pub. L. 108-61, 117 Stat. 864; the Foreign Operations, Export Financing and Related Programs Appropriations Act of 1997, § 570 of Pub. L. 104-208, 110 Stat. 3009; the Trade Sanctions Reform and Enhancement Act of 2000, Title IX of Pub. L. 106-387, 114 Stat. 1549; the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of2001, Pub. L. 107-56, 115 Stat. 272; or any other law of similar import as to any non-U.S. country, as each such Act or law has been or may be amended, adjusted, modified, or reviewed from time to time. Sublessor covenants that Sublessor shall not knowingly conduct any business or transaction or make or receive any contribution of funds, goods or services in violation of any Anti Terrorism Law or engage in or conspire to engage in any transaction that evades or avoids, has the purpose of evading or avoiding or attempts to violate any of the prohibitions of any Anti-Terrorism Law.

| 30 |

(b) Sublessee represents and warrants to Sublessor that, as of the date hereof, (1) neither Sublessee, nor to the knowledge of Sublessee, any director, officer, employee or affiliate of the Sublessee (collectively, “Sublessee Parties”) are in violation of any Anti-Terrorism Law; (2) no action, proceeding, investigation, charge, claim, report, or notice has been filed, commenced, or threatened against Sublessee, or to the knowledge of Sublessee, any of the Sublessee Parties alleging any violation of any Anti-Terrorism Law; and (3) neither Sublessee nor, to the knowledge of Sublessee, any of the Sublessee Parties is a “Prohibited Person”. Sublessee covenants that Sublessee shall not knowingly conduct any business or transaction or make or receive any contribution of funds, goods or services in violation of any Anti-Terrorism Law or engage in or conspire to engage in any transaction that evades or avoids, has the purpose of evading or avoiding or attempts to violate any of the prohibitions of any Anti-Terrorism Law.

27. Quiet Enjoyment. Upon paying the Base Rent, Additional Rent and performing the terms, covenants, conditions and provisions of this Sublease, Sublessee may lawfully and quietly hold and enjoy the Sublease Premises during the Term, subject, however, to the terms, covenants, conditions, and provisions of this Sublease.

28. White Noise. The following provision relates to the system that provides white noise to the Premises (the “White Noise System”). The parties hereby agree that the Sublessor shall adjust the levels and settings of the White Noise System at the reasonable request of Sublessee (to the extent that White Noise System affects the Sublease Premises). Sublessor shall keep and maintain the White Noise System in good repair and working order and perform any and all required maintenance on the same (subject to reimbursement through Sublessee’s payment of Additional Rent). Sublessor shall reasonably consider Sublessee’s request for upgrades and alterations to the White Noise System to enhance service to the Sublease Premises. Any elective upgrades and/ or alterations to the White Noise System shall be borne by the party requesting the same. Sublessor’s obligation to provide the White Noise System in the Sublease Premises shall terminate if and when Sublessor no longer occupies the Building, however, Sublessor shall make reasonable efforts to cause another occupant of the Building to provide the same.

| 31 |

29. Pantry Space. Notwithstanding anything contained in this Sublease to the contrary, Sublessee may, if Sublessee so elects, and for Sublessee’s sole use, install and operate within the Sublease Premises a pantry or lunch room containing microwave ovens, refrigerators, vending machines to dispense hot and cold beverages, ice cream, candy and food; provided, however, each such pantry or lunchroom shall be located in the existing pantry space designated as such on the floor plans constituting part of Exhibit “B” hereto, and the aforementioned machines and equipment shall be maintained in a neat and sanitary condition and shall comply with applicable laws and ordinances.

30. Sublessor’s Default. As between Sublessor and Sublessee, if Sublessor fails in the performance of any of its obligations under this Sublease and such failure continues for five (5) days after Sublessor’s receipt of written notice thereof from Sublessee (and an additional reasonable time after such receipt if (A) such failure cannot be cured within such five (5) day period, and (B) Sublessor commences curing such failure within such five (5) day period and thereafter diligently pursues the curing of such failure), then Sublessee shall be entitled to exercise any remedies that Sublessee may have at law or in equity.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

| 32 |

List of Exhibits

| Exhibit A | Master lease |

| Exhibit B | Sublease Premises |

| Exhibit C | Rent |

| Exhibit D | Reserved |

| Exhibit E | Sublessee’s Work |

| Exhibit F | Personal Property |

| Exhibit G | Bill of Sale |

| Exhibit H | Fitness Center Waiver Form |

| 33 |

IN WITNESS WHEREOF, the Parties have duly executed this Sublease as of the Effective Date.

| GE

CAPITAL US HOLDINGS, INC., a Delaware corporation |

||

| By: | ||

| Name: | Ana M. Chadwick | |

| Title: | Finance Leader | |

| REED’S INC., | ||

| a Delaware corporation | ||

| By: | ||

| Name: | Val Stalowir |

|

| Title: | CEO | |

| 34 |

EXHIBIT “A”

MASTER LEASE

(Attached)

| 35 |

EXHIBIT

“B”

SUBLEASE PREMISES

| 36 |

EXHIBIT “C”

BASE RENT SCHEDULE

Sublease Premises A

| Period | Rent per RSF | Monthly Base Rent | Annual Base Rent | |||||||||

| 9/1/2018 - 8/31/2019 | $ | 24.00 | $ | 9,240.00 | $ | 92,400 | * | |||||

| * Prorated for 10 months | ||||||||||||

| 9/1/2019 - 8/31/2020 | $ | 24.50 | $ | 9,432.50 | $ | 113,190 | ||||||

| 9/1/2020 - 8/31/2021 | $ | 25.00 | $ | 9,625.00 | $ | 115,500 | ||||||

| 9/1/2021 - 8/31/2022 | $ | 25.50 | $ | 9,817.50 | $ | 117,810 | ||||||

| 9/1/2022 - 8/31/2023 | $ | 26.00 | $ | 10,010.00 | $ | 120,120 | ||||||