UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

For the year ended

or

| Commission File Number |

HIREQUEST, INC.

(Exact name of registrant as specified in its charter)

| | | |

| (State of incorporation or organization) | (I.R.S. employer identification no.) |

| | ||

| (Address of principal executive offices) (Zip Code) |

| Registrant’s telephone number, including area code: ( |

Securities registered pursuant to Section 12(b) of the Act:

| | | The | ||

| Title of each class | Trading Symbol | Name of each exchange on which registered |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer ☐, an accelerated filer ☐, a

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $

Number of shares of registrant’s common stock outstanding at March 14, 2022 was

Portions of the registrant’s definitive proxy statement for the annual meeting of stockholders to be filed pursuant to Regulation 14A or an amendment to this Annual Report on Form 10-K are incorporated by reference into Items 10, 11, 12, 13, and 14 of Part III of this report. The Registrant will file its definitive proxy statement or an amendment to this Annual Report on Form 10-K with the Securities and Exchange Commission within 120 days of December 31, 2021.

Table of Contents

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K for the year ended December 31, 2021 and other documents incorporated herein by reference include, and our officers and other representatives may sometimes make or provide certain estimates and other forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act, including, among others, statements with respect to future revenue, franchise sales, system-wide sales, net income and Adjusted EBITDA (a non-GAAP Financial Measure); the impact of any global pandemic including COVID-19; operating results; dividends and shareholder returns; anticipated benefits of any merger or acquisitions including those we have completed in 2021 and 2022; intended office openings or closings; expectations of the effect on our financial condition of claims and litigation; strategies for customer retention and growth; strategies for risk management; and all other statements that are not purely historical and that may constitute statements of future expectations. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will,” and similar references to future periods.

While we believe these statements are accurate, forward-looking statements are not historical facts and are inherently uncertain. They are based only on our current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. We cannot assure you that these expectations will occur, and our actual results may be significantly different. Therefore, you should not place undue reliance on these forward-looking statements. Important factors that may cause actual results to differ materially from those contemplated in any forward-looking statements made by us include the following: the level of demand and financial performance of the temporary staffing industry; the financial performance of our franchisees; the impacts of COVID-19 or other diseases or pandemics; changes in customer demand; the extent to which we are successful in gaining new long-term relationships with customers or retaining existing ones, and the level of service failures that could lead customers to use competitors’ services; significant investigative or legal proceedings including, without limitation, those brought about by the existing regulatory environment or changes in the regulations governing the temporary staffing industry and those arising from the action or inaction of our franchisees and temporary employees; strategic actions, including acquisitions and dispositions and our success in integrating acquired businesses including, without limitation, successful integration following the acquisitions of Snelling Staffing, LINK, Recruit Media, and Dental Power, and subsequent acquisitions; disruptions to our technology network including computer systems and software whether resulting from a cyber attack or otherwise; natural events such as severe weather, fires, floods, and earthquakes, or man-made or other disruptions of our operating systems or the economy including by war; and the factors discussed in the “Risk Factors” section and elsewhere in this Annual Report on Form 10-K.

Any forward-looking statement made by us in this Annual Report on Form 10-K is based only on information currently available to us and speaks only as of the date on which it is made. The Company disclaims any obligation to update or revise any forward-looking statement, whether written or oral, that may be made from time to time, based on the occurrence of future events, the receipt of new information, or otherwise, except as required by law.

PART I

Development of our Business

HireQuest, Inc. (collectively with its subsidiaries, the “Company,” “we,” “us,” or “our”) is a Delaware corporation originally organized in Washington as Command Staffing, LLC in 2002. In 2005, Temporary Financial Services, Inc., a public company, acquired the assets of Command Staffing, LLC, and the combined entity changed its name to Command Center, Inc. On September 11, 2019, Command Center, Inc. reincorporated in Delaware and changed its name to HireQuest, Inc. following its acquisition of Hire Quest Holdings, LLC (“Hire Quest Holdings,” and together with its subsidiary, Hire Quest, LLC, “Legacy HQ”). This acquisition is sometimes referred to as the “Merger.” Hire Quest, LLC was formed as a Florida limited liability company in 2002. Hire Quest Holdings, LLC was formed as a Florida limited liability company in 2017. Since the Merger, we have made a number of acquisitions which are discussed in more detail below.

The COVID-19 pandemic significantly impacted our business and operations in 2020, and to a lesser degree in 2021. Please see “Management's Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K for a description of the effects COVID-19 has had on the Company.

Our common stock trades on the Nasdaq Market under the symbol “HQI.” All references to “common stock” means the common stock of HireQuest, Inc., par value $0.001 per share.

Our principal executive office is located at 111 Springhall Drive, Goose Creek, SC, 29445 and the telephone number is (843) 723-7400. More information about us may be found at www.hirequest.com. The information on our website is not incorporated by reference in this Annual Report on Form 10-K.

The Snelling Acquisition

On March 1, 2021, we completed our acquisition of certain assets of Snelling Staffing in accordance with the terms of the Asset Purchase Agreement dated January 29, 2021 (the “Snelling Agreement”). At the time of acquisition, Snelling Staffing was a 67-year-old staffing company headquartered in Richardson, TX. Pursuant to the Snelling Agreement, HQ Snelling Corporation (“HQ Snelling”), our wholly-owned subsidiary, acquired approximately 47 offices, and acquired substantially all of the operating assets, and assumed certain liabilities of the sellers for a purchase price of $17.9 million, subject to customary adjustments for net working capital plus further adjustment of $7.2 million of collateral released to the sellers by their workers' compensation insurer (the "Snelling Acquisition"). Also on March 1, 2021, HQ Snelling entered into the First Amendment to the Purchase Agreement, pursuant to which HireQuest, Inc. agreed to advance $2.1 million to be paid to the sellers at closing to be used to pay accrued payroll liabilities that HQ Snelling assumed pursuant to the Snelling Agreement. We funded this acquisition with existing cash on hand and a draw on our existing line of credit with Truist Bank ("Truist").

The Link Acquisition

On March 22, 2021, we completed our acquisition of the franchise relationships and certain other assets of LINK Staffing (“Link”) in accordance with the terms of the Asset Purchase Agreement dated February 12, 2021 (the "Link Agreement"). At the time of acquisition Link was a family-owned staffing company headquartered in Houston, TX. Pursuant to the Link Agreement, HQ Link Corporation ("HQ Link"), our wholly-owned subsidiary, acquired approximately 35 franchised offices, customer lists and contracts, and other assets of Link for a purchase price of $11.1 million (the "Link Acquisition"). We funded this acquisition with existing cash on hand.

The Recruit Media Acquisition

On October 1, 2021 we completed our acquisition of Recruit Media, Inc. (“Recruit Media”) in accordance with the Stock Purchase Agreement dated October 1, 2021 (the “Recruit Agreement”). Pursuant to the Recruit Agreement, we purchased all of the outstanding shares of common stock of Recruit Media for approximately $4.4 million. Recruit Media is a tuck-in acquisition whose intellectual property compliments our technological structure, allowing us to accelerate improvements to our platform.

The Dental Power Acquisition

On December 6, 2021 we completed our acquisition of the Dental Power Staffing division (“DPS”) of Dental Power International, Inc. (“Dental Power”) in accordance with the terms of a definitive agreement, dated November 2, 2021, with Dental Power, for $1.9 million. Dental Power is a 46-year-old dental staffing company headquartered in Carrboro, North Carolina with long-standing client relationships in the dental industry. providing temporary, long-term contract, and direct-hire staffing services to dental practices across the U.S. As of December 31, 2021, all of the operations acquired from Dental Power remain company owned.

Together, the Snelling Acquisition, the Link Acquisition, the Recruit Acquisition and the Dental Acquisition are sometimes referred to as the "2021 Acquisitions."

Our Model

We are a nationwide franchisor of temporary staffing offices providing direct-dispatch and commercial staffing solutions in the light industrial and blue-collar industries. With the Snelling Acquisition and the Link Acquisition, we significantly expanded our traditional commercial staffing solutions. Following the December acquisition of DPS, we have a platform to build a customer base in the dental-oriented sector of the staffing industry, which will benefit our entire system by increasing revenue opportunities under the HireQuest Health brand.

Our franchises provide customers with seamless access to a contingent workforce whenever they need it. Flexible staffing solutions permit customers to focus on their underlying operations and to expand or contract their workforce quickly to meet fluctuating demands. We pay the majority of our temporary employees daily or weekly which attracts workers who cannot wait up to three weeks for their first paycheck under a traditional employment model.

In 2021, our franchisees operated under the trade names “HireQuest Direct,” “Snelling,” “HireQuest,” “LINK Staffing,” “DriverQuest,” and “HireQuest Health.” HireQuest Direct focuses on daily-work/daily-pay jobs primarily for construction and light industrial customers. Snelling, HireQuest, and LINK Staffing focuses on longer-term staffing positions in the light industrial and administrative arenas. DriverQuest specializes in commercial drivers serving a variety of industries and applications. HireQuest Health specializes in skilled personnel in the healthcare and dental industries.

Our revenue, which is primarily comprised of royalty fees generated by the operations of our franchised offices, license fees, and interest charged to our franchisees on overdue accounts receivable, was $22.8 million in 2021. Our system-wide sales, which we define as sales at all offices, whether owned and operated by us or by our franchisees, were $354.5 million in 2021. Nearly all system-wide-sales originated from franchisee-owned offices. We employed approximately 73,000 temporary employees during 2021. At December 31, 2021, we had 217 franchisee-owned offices operating in 36 states and the District of Columbia. On a net basis, we opened 78 offices in 2021 (acquiring 65, opening 14 and closing 1).

We provide incentives to our existing franchisees, including assistance with start-up funding and acquisition costs, to encourage them to expand into new markets. While staffing industry growth has outpaced overall economic and employment growth, the industry still employs only a small percentage of the United States’ non-farm workforce. We believe that the low percentage of the total workforce that is currently contingent, when combined with potential shifts towards a more contingent workforce in the overall economy, provides meaningful opportunities for future organic growth.

Our differentiated services are driven by two key elements:

| ● |

Local ownership and dedicated responsiveness. Our offices are franchisee-owned. We believe that ownership at the local level, where the vast majority of customer interactions occur, allows our organization to be agile and responsive to customer needs. Since our franchisees have a personal financial interest in the success of their offices, our customers interact with a representative who is incentivized to deliver excellent customer service and resolve issues efficiently. In addition, franchise owners are able to develop long-term relationships due to the lack of turnover. We believe the combination of local ownership coupled with properly-aligned incentives results in enhanced customer satisfaction and greater customer retention. |

| ● |

Direct dispatch from our offices. The majority of our employees in our construction and light industrial segment are dispatched from our offices every day. This allows our franchisees and their staff to qualify the employees for work, provide them with any necessary personal protective equipment, assist them in arranging transportation amongst themselves, and ensure the right number of qualified individuals are dispatched at the right time. We believe that employee dispatch from franchise offices increases consistency as our employees are sent to a particular jobsite without having to rely on less reliable means of verification, such as telephone calls. Once we and our customers have developed a rapport with particular employees, we will sometimes dispatch these employees directly to a customer location. |

Our Industry

Temporary Staffing

According to the American Staffing Association (ASA), the staffing and recruiting industry in the United States generated annual revenue of $161 billion in 2019 (prior to the pandemic). Approximately 85% of industry revenue is generated by temporary and contract employee placement services, with the remainder coming from executive search and permanent placement. According to ASA, industry revenue dipped by 13% in 2020 due to the economic impact of the pandemic. Staffing Industry Analysts (SIA) estimates that industry revenue rebounded by 16% in 2021. Following our 2021 Acquisitions, we expect to expand into several of the remaining segments of the staffing industry including health care, clerical and administrative, and professional.

The direct-dispatch staffing industry has developed based on business need for flexible staffing solutions. The industry provides contingent workforce solutions as an alternative to the costs and efforts that are required for recruiting, hiring, and managing permanent employees. Many of the customers we target operate in a cyclical production environment and find it difficult to staff according to their changing business requirements. Companies also desire a way to maintain consistent staffing levels when full-time employees are absent due to illness, vacation, or unplanned terminations. Direct-dispatch staffing offers customers the opportunity to respond immediately to changes in staffing needs, to reduce the costs associated with recruiting and interviewing, to eliminate unemployment and workers’ compensation exposure, and to draw from a larger pool of potential employees. We have found that staffing firms provide particular value in assisting customers with filling mundane or repetitive jobs, high turnover positions, staffing for project specific needs, and filling other short duration positions such as special events, disaster recovery, and seasonal jobs.

Historically, our business has been bolstered by declining unemployment rates as our customers find it more difficult and more expensive to recruit, interview, hire, and train qualified staff. As employers look for alternatives to combat these increasing costs and administrative burdens, opportunities arise for the temporary staffing industry. In addition, worker attitudes have changed from one which idealized extended tenure with a single employer to one which is more open to temporary or transient employment. This shift has increased the availability of temporary workers in the economy as a whole. Conversely, periods of declining unemployment are a challenge for our industry.

Government Regulation

While the offices under our brands are operated by franchisees, our wholly-owned subsidiary is the employer of record of the temporary employees. As a large employer, we are subject to a significant number of employment laws at the state, federal, and local levels. We are required to comply with all applicable federal and state laws and regulations relating to employment, including verification of eligibility for employment, occupational safety and health provisions, wage and hour requirements, employment insurance, and laws relating to equal opportunity employment. In addition to federal and state laws and regulations, many counties and cities have become active in regulating various aspects of employment, including minimum wages, living wages, paid sick leave, retirement savings programs, transportation benefits, application forms and background checks, mandatory training, and required notices to employees, among others.

In addition, fourteen states and the Federal Trade Commission impose pre-sale franchise registration or disclosure requirements on franchisors. A number of states also regulate substantive aspects of our relationship with our franchisees such as termination, nonrenewal, transfer, no-poach and non-competition provisions, discrimination among franchisees, and other aspects of the relationships between and with franchisees. Additional legislation, which we cannot predict, could expand these requirements imposed on us. Significant expansion could lead to a significant increase in compliance costs, which could have a material adverse effect on our business, financial position and results of operations.

Our Competitive Strengths

We attribute our success to the following strengths:

| ● |

Nationwide footprint with differentiated business model. We believe we are one of the largest providers of direct-dispatch temporary staffing solutions in the light industrial and blue-collar segments of the staffing industry measured by number of offices. Our nationwide footprint allows us to compete for national account relationships not available to many of our local or regional competitors. Our size also allows us to obtain favorable terms on our workers’ compensation insurance program. Our franchise model has many advantages as well. Most of our competitors utilize a company-owned office model in which management of day-to-day interactions with customers is handled by individuals who do not have the same incentive to succeed as franchisees have as owners of their businesses. The company-owned model typically requires significant investment in middle management to overcome this lack of incentive. We largely avoid this expense because our franchisees are independent business owners responsible for their own financial well-being, and in doing so increase our store level economics. |

| ● |

A franchise system with expansion capabilities. We incentivize our franchisees to expand their own businesses through our Franchise Expansion Incentive Program. Under this program, we offer assistance overcoming the startup costs of an office in a new metropolitan area by providing our existing franchisees with credits on the royalty fees they pay in their existing offices. In addition, under certain circumstances, we will provide assistance in acquisition funding or financing. We also maintain a Risk Management Incentive Program which allows us to reward franchisees who are successful in keeping their workers' compensation loss ratios below certain thresholds by providing them a credit. We believe that this incentivizes our franchisees to encourage workplace safety, while also providing franchisees with capital to reinvest in, or expand, their businesses. |

| ● |

Responsible capital allocation with very little debt. Financing our day-to-day needs largely with cash produced from operations allows us to continue building cash reserves which we can use, in addition to our line of credit with Truist, to finance significant transactions such as major reinvestments in our business, strategic acquisitions, share buybacks, or stockholder dividends, depending on the opportunities that present themselves. Compared to company-owned offices, our franchise model allows us to employ relatively fewer full-time staff at our corporate headquarters decreasing the working capital needed for operations. |

Our Growth Strategy

We believe there are considerable opportunities to grow our business and brands. The following are key components of our growth strategy:

| ● |

Make strategic acquisitions. We are continuously evaluating acquisition opportunities that will allow us to expand our franchisee base, expand the number of industries our franchisees service, and diversify our national footprint. |

| ● |

Continue to grow the number of offices our franchisees operate. We believe attractive returns at the franchisee level position us to continue to attract new franchisees and encourage our existing franchisees to open new offices. In addition, we encourage our existing franchisees to explore new potential markets through our Franchise Expansion Incentive Program. When combined with the back-office support that we provide franchisees, we believe we are poised to expand into unserved or underserved markets. |

| ● |

Capitalize on our national footprint to grow same store and system-wide sales. We anticipate that our enhanced scale combined with our royalty-driven business model will contribute to growth in our access to and profitability from national accounts. Traditionally, these larger national accounts have the leverage to impose lower margins on their temporary staffing providers. Our royalty-driven business model, in which we earn a percentage of gross billings or funded payroll regardless of margins, partially insulates stockholders from short-term margin volatility inherent in the ownership of the traditional company-owned model for temporary staffing. |

| ● |

Increase our brand awareness. As we continue to develop new markets and to serve our existing markets, we expect our brands to become more recognizable and a greater asset to us in driving repeat customers, encouraging customers to expand their use of our services across multiple markets, and increasing new customer development. |

Our Offices

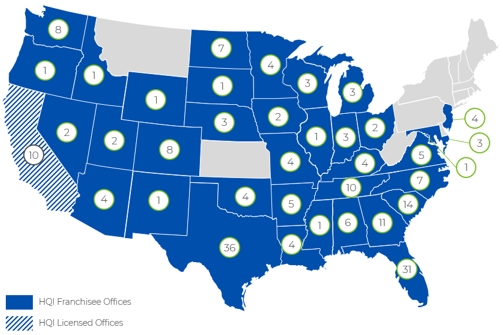

We had 217 offices located in 36 states and the District of Columbia as of December 31, 2021. All offices were franchised, with the only exceptions being the recently acquired Dental Power office. The map below provides the number of offices we had in each state.

Number of Offices By State

December 31, 2021

In the first two months of 2022, we added franchises in Pennsylvania, New York, Texas and New Mexico. We have a strong concentration of offices in established and emerging regions such as the Southeast, Florida, Texas, Colorado, and Washington. These regional office concentrations contribute to greater brand recognition while we continue to add offices in unserved and underserved regions. These concentrations also allow us to better recognize local and regional market trends. Most of our franchisee offices are located near areas of concentrated construction or major manufacturing and industrial sites.

Our Franchise Program

Our franchised offices are a key component of our success. We urge our franchisees to customize their services according to the unique opportunities and assets available at each of their offices, while also leveraging the overall size of the organization whenever possible. This approach allows for each office to have a unique blend of customers and emphasis while also reducing overhead costs, improving economies of scale, establishing procedural uniformity and controls, and creating a predictable internal environment for temporary employees.

A typical franchised office is managed by an owner with the assistance of in-office personnel. Many offices hire business development staff to help drive business to the offices. We provide advice and guidance from our corporate headquarters.

Franchising Strategy

As of December 31, 2021, there were 217 franchised Snelling, HireQuest, and HireQuest Direct offices operated by 107 franchisees. Approximately one-third of our franchisees owned multiple offices. Our largest franchisee owned 14 offices, and about one-eighth of our franchisees owned 4 or more offices. One individual owned significant interest in 6 franchisees that operated 24 offices. We also had 23 franchisees that share common ownership with significant stockholders, directors, and officers of the Company. We refer to these as the "Worlds Franchisees." These 23 Worlds Franchisees operated 60 offices as of December 31, 2021.

Our approach to the franchise model creates what we believe to be superior office-level economics. We finance many of the initial working capital needs of our franchisees, including costs of new office openings, through our ownership of franchisee accounts receivable which we acquire through our franchise agreements. This is a relatively inexpensive source of capital for our franchisees and allows them to expand more freely. In addition, our Risk Management Incentive Program lowers the effective cost of workers’ compensation insurance at the franchisee level – a significant expense for many of our competitors. We thereby eliminate for our franchisees two of the largest barriers to entry, financing and workers’ compensation, and enable potentially higher operating margins at the office level.

Franchise Agreements

Our franchise agreements contain standard terms and conditions. In most cases, our franchisees are granted the exclusive right to operate their chosen brand, either Snelling, HireQuest or HireQuest Direct, in their protected territory. Typically, a protected territory corresponds with the metropolitan statistical area where the office is located. In a small number of densely populated cities, the protected territories are smaller.

As of December 31, 2021, our franchisees operated under 146 executed franchise agreements. For our HireQuest Direct brand we charge a royalty fee of between 6% and 8% of gross sales, depending on sales volume. For our Snelling and HireQuest brands, including HireQuest franchisees, Snelling franchisees, Link Franchisees, DriverQuest franchisees, and HireQuest Health franchisees, we charge a royalty fee of 4.5% of the payroll we fund plus 18% of the gross margin for the territory. For the Snelling franchise agreements assumed where the franchise owner did not execute new HireQuest or HireQuest Direct business line franchise agreements, the royalty fee ranges from 5% to 8%.

Our typical franchise agreement has a term of five years. Our franchise agreement is designed to remove some of the most significant barriers to entry in our industry – access to working capital, access to affordable workers’ compensation insurance, and dedicated software. By entering into a franchisee agreement with us, our franchisees gain access to our proprietary software, HQ WebConnect©, which we update regularly through a dedicated staff of developers, and gain access to working capital by factoring their accounts receivable through us. Additionally, in states that do not require participation in a state-run program, our franchisees gain access to our "A++" rated workers’ compensation insurance coverage.

Franchisees receive initial and ongoing training in our technology and methods of operation. We provide support personnel on an as-needed basis to our franchisees. We have a comprehensive brand standards manual which explains our policies on key operational, financial, and regulatory compliance issues. Under the franchise agreement, beneficial owners of our franchisees guaranty all debts and obligations of the franchise to us. Still, we have substantially less control over a franchisee’s operations than we would if we owned and operated an office ourselves. Franchisees are not required to provide full financial statements or other information that is outside of the royalty base.

The table below displays the number of franchise agreements scheduled to renew at the end of each year:

| Year |

Renewals |

|

| 2022 | 13 | |

| 2023 | 11 | |

| 2024 |

36 |

|

| 2025 |

12 |

|

| 2026 |

41 |

|

| 2027(1) |

1 |

|

| 2028(2) | 4 | |

| 2029(3) | 9 | |

| 2030(4) | 4 | |

| 2031(5) | 1 |

| 1. |

Excludes franchise agreements that renew at the end of 2022 which will renew again in 2027. |

| 2. |

Excludes franchise agreements that renew at the end of 2023 which will renew again in 2028. |

| 3. |

Excludes franchise agreements that renew at the end of 2024 which will renew again in 2029. |

| 4. |

Excludes franchise agreements that renew at the end of 2025 which will renew again in 2030. |

| 5. |

Excludes franchise agreements that renew at the end of 2026 which will renew again in 2031. |

The large number of renewals in 2024 resulted from the significant number of new franchisees we added in 2019 after the Merger with Command Center. The large number of renewals in 2026 resulted from the significant number of new franchisees we added in 2021 after the 2021 Acquisitions.

Our Human Capital Resources

Temporary Employees

Our temporary employees are a key component of our success. We consider them one of our most valuable assets as they perform the services our franchises provide. Hire Quest, LLC, our wholly-owned subsidiary, is the employer of record of all temporary employees of the HireQuest Direct, Snelling, HireQuest, and Link brands. We have separate wholly-owned subsidiaries that employ the temporary employees of DriverQuest and HireQuest Health services. In 2021, we employed approximately 73,000 temporary employees and issued approximately 1.1 million paychecks. The vast majority of these payments were made via electronic transfer or paycard. Given the nature of temporary employment, it is difficult for us to determine the exact number of full-time employees on a given day, however, approximately 670 temporary employees worked at least 1,800 hours in 2021.

These temporary employees served thousands of customers, primarily in the construction, industrial/manufacturing, warehousing, hospitality, recycling/waste management, and disaster recovery industries. Our customers range in size from small, local businesses to large, multi-national corporations. Most of our work assignments are short-term, and many are filled with little advance notice from customers.

We continuously recruit temporary staff so we can respond to customer needs quickly. We attract our employees through various means, including in-person recruitment, online resources, cell phone texting services, our large and ever-growing internal database, job fairs, word-of-mouth, digital and print advertisements, and a number of other methods. Our success depends, in part, on our ability to attract and retain temporary employees. To that end, we have implemented a robust health insurance program giving qualifying temporary employees a list of plans to choose from, including Affordable Care Act (ACA) compliant coverage.

The safety of our temporary employees remains one of our highest priorities. We regularly provide safety and skills training. We also aggressively manage our workers' compensation program to identify trends in injuries and limit our losses and exposure. Through our Risk Management Incentive Program, our franchisees are incentivized to ensure safe working environments and to achieve quick resolutions of workers' compensation claims when they do arise.

Corporate Employees

We believe our success also depends on our ability to attract, develop, and retain talented employees at our corporate headquarters. The skills, experience, and industry knowledge of our employees significantly benefit our operations and performance. We believe a strong, positive corporate culture and employee engagement is key to attracting and retaining talented employees. Executives of the company set this tone at the top, and we routinely have Company functions designed to engage and integrate our employees into our culture. We employ approximately seventy corporate employees through HQ LTS Corporation, our wholly-owned subsidiary. Most of these individuals are employed at our corporate headquarters in Goose Creek, South Carolina. The vast majority of these employees are full-time. These employees provide back-office support, including financing, insurance, accounting, operations, national sales, information technology, legal, and human resources services to our franchisees and temporary employees. As of December 31, 2021 we had approximately 70 corporate employees in total, most of which were full time employees.

Executive Officers

Information about our executive officers follows:

| Name |

Age |

Position |

||

| Richard Hermanns |

58 |

President, Chief Executive Officer, and Chairman of the Board |

||

| David S. Burnett |

55 |

Chief Financial Officer |

||

| John D. McAnnar |

39 |

Chief Legal Officer, Vice President, and Secretary |

Richard Hermanns is the President and Chief Executive Officer, as well as Chairman of the Board of Directors, of HireQuest, Inc. Mr. Hermanns has thirty-one years of experience in the temporary staffing industry. Previously, he served as chief executive officer and secretary of HireQuest, LLC, after the company’s founding in 2002, and similar capacities for predecessor entities since July 1991. Prior to founding HireQuest, Mr. Hermanns was the chief financial officer of Outsource International, formerly known as Labor World USA, Inc., and an assistant vice president at NCNB National Bank, now Bank of America. He graduated summa cum laude with a Bachelor of Science in economics and finance from Barry University and holds a Masters of Business Administration in finance from the University of Southern California. In addition to his business ventures, Mr. Hermanns is also involved in a number of charitable pursuits. One of them is the Higher Quest Foundation, a non-profit organization dedicated to fighting global hunger in a sustainable way.

David S. Burnett is the Chief Financial Officer of HireQuest, Inc. He has served as the Chief Financial Officer since December 2021. Prior to joining HQI, Mr. Burnett was Chief Financial Officer for Ivy Asset Group, an alternative credit provider and investment bank. Prior to Ivy, Mr. Burnett served as Chief Financial Officer for a series of publicly-traded companies under the umbrella of BKF Capital Group, including Interlink Electronics, Inc. (Nasdaq:LINK), BKF Capital Group, Inc. (OTC:BKFG) and Ridgefield Acquisition Corp (OTC:RDGA). Before that, Mr. Burnett served in various management positions with EnPro Industries, Inc. (NYSE:NPO), most recently as Vice President and Treasurer. EnPro is a diversified industrial technology company with $1.5 billion in global revenue. Prior to EnPro he was a Director at PricewaterhouseCoopers LLP and Senior Manager at Grant Thornton LLP. Mr. Burnett received his Bachelor of Science degree in Business Administration (Accounting) from Old Dominion University, and a Master of Science degree in Taxation from Golden Gate University. He is both a Certified Public Accountant and a Certified Treasury Professional.

John D. McAnnar is the Chief Legal Officer, Vice President, and Secretary of HireQuest, Inc. He has fulfilled the former two roles for both HQI, and its predecessor, HireQuest, LLC, since 2014. His work with HireQuest involves a range of legal, operational, and risk management affairs in different realms, including mergers and acquisitions, securities, employment, insurance and finance, workers’ compensation, and intellectual property. Previously, Mr. McAnnar served in the litigation departments of Carmody MacDonald, P.C., and Armstrong Teasdale, LLP, an Am Law 200 firm, where he focused on complex commercial litigation, corporate, and employment law. He is the co-founder of ArchCity Defenders, a non-profit organization in St. Louis, Mo., that led the push for change in Missouri’s municipal court system following the Ferguson unrest. For this work, Mr. McAnnar has received multiple awards, including the National Legal Aid & Defenders Association New Leaders in Advocacy Award and the Ina M. Boon Social Justice Award from the St. Louis City NAACP. Mr. McAnnar graduated cum laude with a Bachelor of Arts degree from the University of Pittsburgh. He achieved his juris doctorate, magna cum laude, from St. Louis University School of Law, where he was inducted into the Alpha Sigma Nu Jesuit Honor Society and the Order of the Woolsack. He is also an adjunct professor at the Charleston School of Law.

Our Competition

The staffing industry is highly fragmented and highly competitive, with relatively low barriers to entry aside from payroll funding, workers’ compensation premiums, and startup costs. No single staffing company dominates the industry. Our competitors range in size from small, local or regional operators with five or fewer offices to large, multi-national companies with hundreds or thousands of offices around the world. Some of our competitors are publicly traded corporations that have the same access to capital as we do. Our strongest competition in any market comes from companies that have established long-lasting relationships with their clients. Competition in the industry tends to track the overall strength of the economy and trends in workforce flexibility. As the economy grows, the number of competitors generally increases.

The primary competitive factors in our market includes price, the ability to provide the requested workers on a timely basis, and success in meeting customer expectations. Secondary factors include customer relationships, name recognition, and established reputation. Businesses operating in these areas of the staffing industry require access to significant working capital to pay temporary employees, particularly in the spring and summer when seasonal staffing requirements are highest, and to fund workers' compensation premiums and claims. Lack of working capital can be a significant impediment to growth for small, local, and regional staffing service providers. A second barrier to entry is an affordable workers’ compensation policy. Small entrants usually do not have the scale necessary to secure a policy on terms similar to ours. Regulatory compliance is becoming more burdensome, particularly for smaller firms that cannot profitably comply with the increasing number of federal, state, and local employment laws and regulations.

We also face increasing competition from gig-economy companies who are attempting to monetize the temporary staffing industry through smartphone applications. We believe these apps, however, will not be a major source of successful competition in the commoditized section of the labor markets where we have significant operations. The apps, which operate on a broad-blast, first-come-first-served basis, often result in too many or too few workers arriving at a jobsite, workers arriving without the necessary required personal protective equipment, or employees arriving at a jobsite unwilling or unable to perform the assigned tasks. In contrast, our direct dispatch model allows us to screen employees’ readiness for work every day, assist with arranging transportation to and from jobsites, and match employees with company-provided personal protective equipment before they leave the office. Our proprietary software does utilize bulk text messaging, but on a targeted basis specific to a particular job in a particular geography.

Our Cyclicality and Seasonality

The temporary staffing industry has historically been cyclical. Success tends to track the economy. When our franchisees’ customers expect to have long-term permanent needs, they tend to increase their use of temporary employees. Our revenue tends to increase as the economy expands, and conversely, our revenue tends to decrease when the economy contracts.

Some of the industries in which we operate are subject to seasonal fluctuation. Many of the jobs filled by temporary employees are outdoors and generally performed during the warmer months of the year. As a result, activity increases in the spring and continues at higher levels through the summer, then begins to taper off during fall and through winter. In addition, demand by industrial customers tends to slow after the holiday season and pick up again in the third and fourth quarters – peaking in the third quarter. Our exposure to seasonality is mitigated, in part, by our strong presence in the Southern United States where seasonal fluctuations are typically less pronounced.

Our Intellectual Property

We own the rights to all of our key trademarks including “HireQuest,” “HireQuest Direct,” “Snelling,” “DriverQuest,” “HireQuest Health,” “Recruit,” “VETSQuest,” “The Right People at the Right Time”, and all of our stylized logos. We also own the rights to trademarks we have utilized in the past. We license the use of our marks to our franchisees via the franchise agreements. Following our March 2021 Acquisitions, we have a license to use the Link-associated trademarks with franchisees acquired in the Link Acquisition. In California, we license the use of the Snelling and Link names to an independent third-party.

We have developed and own our proprietary software to handle most aspects of operations, including temporary employee dispatch and payroll, invoicing, and accounts receivable. Our software system also allows us to produce internal reports necessary to track and manage financial performance of franchisees, customer trends, detect potential fraud, and to examine other key performance indicators. We believe that our software facilitates efficient customer interaction, allowing for online bill payment, invoice review, and other important functions. Because WebConnect is a proprietary system, we maintain a dedicated IT development staff, who continually refine our software in response to feedback from franchisees, customers, and employees. We license the use of our software to franchisees via our franchise agreements. The system is not patented. We have invested in off-site back-up and storage systems that we believe provide reasonable protections for our electronic information systems against breakdowns as well as other disruptions and unauthorized intrusions.

We rely on common law protection of our copyrighted works. These works include advertising and marketing materials and other items that are not material to our business. We license some intellectual property from third parties for use in our corporate headquarters, but such licenses are not material to our business.

Our Organizational Structure

HireQuest, Inc. is a holding company. As of December 31, 2021, HireQuest, Inc. was the corporate parent of a series of wholly-owned subsidiaries including: (1) HQ LTS Corporation, which employs the staff of our corporate headquarters; (2) HQ Financial Corporation, which provides financing and related services to our franchisees; (3) Hire Quest, LLC, which is the employer of record of the temporary employees of our HireQuest Direct, HireQuest, and Snelling operations; (4) DriverQuest 2, LLC, which employs the temporary employees of our DriverQuest operations; (5) HQ Medical, LLC, which employs the temporary employees of our HireQuest Health operations; (6) HQ Franchising Corporation, which is the franchisor of our franchised relationships; and (7) HQ Real Property Corporation, which owns our corporate headquarters buildings. HireQuest Inc. was also the corporate parent to a series of additional wholly-owned subsidiaries which had no operations in 2021 (all of which are listed on Exhibit 21.1 filed herewith and incorporated herein by reference).

Our Securities Exchange Act Reports

We maintain a website at the following address: www.hirequest.com. The information on our website is not incorporated by reference in this Annual Report on Form 10-K.

We make available on our website certain reports and amendments to those reports that we file with or furnish to the Securities and Exchange Commission (the “SEC”) in accordance with the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These include our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, Section 13 filings by our 5% shareholders and Section 16 filings by our officers, directors and 10% stockholders. We make this information available on our website free of charge as soon as reasonably practicable after we or they electronically file the information with, or furnish it to, the SEC.

Our common stock value and our business, results of operations, cash flows, and financial condition are subject to various risks, including, but not limited to, those set forth below. If any of these risks actually occur, the value of our common stock, business, results of operations, cash flows, and financial condition could be materially adversely affected. In such case, the value of your investment could decline, and you may lose all or part of the money you paid to buy our common stock. These risk factors should be carefully considered together with the other information in this Form 10-K, including the risks and uncertainties described under the heading “Special Note Regarding Forward-Looking Statements.”

Risks Related to Our Business and Industry

Acquisitions may have an adverse effect on our business.

We intend to continue making acquisitions a part of our growth initiative. This strategy may be impeded, and we may not achieve our long-term growth goals if acquisition candidates are not available under acceptable terms. Additionally, we may have difficulty integrating acquired companies into our business, including our operational software and financial reporting systems, and may not effectively manage or (if deemed necessary) divest acquired companies to achieve expected growth.

Future acquisitions may cause us to incur additional debt and contingent liabilities, and result in an increase in interest expense, amortization expense, and non-recurring charges related to integration efforts. Acquisitions financed through equity offerings may cause dilution to our existing shareholders. Acquisitions we announce could be viewed negatively by investors, which may adversely affect the price of our common stock. Acquisitions can also result in the addition of goodwill and intangible assets to our financial statements, and we may be required to record a significant charge in our financial statements during the period in which we determine an impairment of our acquired goodwill and intangible assets has occurred, which would negatively impact our financial results. The potential loss of key executives, franchisees, clients, and other business partners of businesses we acquire may adversely impact the value of the assets, operations, or business we acquire. Any combination of these events or consequences could cause material harm to our business, and adversely affect our operations and financial condition.

New business initiatives will cause us to incur additional expenditures and may have an adverse effect on our core business.

We expect to expand our business by entering new business initiatives as part of our growth strategy. New business initiatives, strategic business partners, or changes in the composition of our business can be distracting to our management and disruptive to our operations, causing our core business and results of operations to suffer materially. New business initiatives and entering new markets could involve significant unanticipated challenges and risks and divert management’s attention away from our core business.

The COVID-19 pandemic has been unpredictable and could continue to negatively impact our financial condition and results of operations.

The COVID-19 pandemic adversely affected our business and financial results in 2020 and, to a lesser extent in 2021, and we expect that it may continue to negatively impact our business and financial results going forward. The extent to which it does so depends on the length of the pandemic and its economic repercussions. Since March 13, 2020, state and local authorities have taken dramatic action including, without limitation, ordering the workforce to stay home, banning all non-essential businesses from operating, implementing shelter in place orders, refusing to issue new building permits, and invalidating current building permits causing work to stop. There has been widespread infection in the United States and abroad, with a resulting catastrophic impact on human lives, including those of our franchisees and employees, and the economy as a whole, including our customers. In addition to the actions described above, national, state, and local authorities have recommended social distancing and imposed quarantine and isolation measures on large portions of the population and additional mandatory business closures. These measures, while intended to protect human life, had serious adverse impacts on our business and domestic and foreign economies. They caused our system-wide sales and resulting revenue to decline in 2020 and into early 2021.

The sweeping and evolving nature of the COVID-19 pandemic makes it extremely difficult to predict how our business operations will be affected in the long term by the COVID-19 outbreak, variants of COVID-19, and any virus that spreads in a similar fashion. Our operations were disrupted by customers decreasing the amount of orders they placed for temporary employees, safety measures we and our franchisees put in place to prevent spread of the virus, inability to locate temporary employees willing to work, and in other ways. In 2020, 13 of our franchised offices closed or consolidated into other existing offices at least, in part, due to the impact of COVID-19. A small number of franchisees, as well as the purchaser of our California offices, have experienced difficulty in repaying their financing obligations to us, causing us to set aside a reserve of $1.9 million as of December 31, 2021.

A repeat of the cascading effects of the COVID-19 pandemic could materially increase our costs, severely negatively impact our revenue, net income, and other results of operations, reduce system-wide sales, cause additional office closings or cause us to lose franchisees, and impact our liquidity position, possibly significantly. The extent and duration of any such impacts on our business, financial condition, and results of operations cannot be predicted.

Price increases and supply shortages may negatively affect our results of operations.

Supply chain challenges related to the COVID-19 pandemic and the impact of Russia’s invasion of Ukraine on oil and gas delivery have contributed and continue to contribute to price increases and supply shortages in a variety of industries, including construction, industrial/manufacturing and consumer goods. If these impacts continue to affect our industrial/manufacturing, construction or other clients, demand for our labor may decrease, which would decrease gross billings and therefore our royalty revenue. Furthermore, sustained increases in the consumer price index will likely put upward pressure on wages. If we are unable to match or exceed wages offered by other potential employers to our temporary employees, we may suffer from employee attrition.

We have been and may continue to be unable to attract sufficient qualified candidates to meet all of the needs of our clients.

We compete to meet our clients’ needs for workforce solutions and, therefore, we must continually attract qualified candidates to fill positions. Attracting qualified candidates depends on factors such as the number of candidates available in the relevant location, desirability of the assignment, the health of our workforce, and the associated wages and other benefits. We have experienced shortages of qualified candidates and we may experience such shortages in the future due to a number of factors beyond our control, such as the COVID-19 pandemic, demographic shifts in the workforce, benefits received by our candidates from other sources including government benefits, and the overall desire of workforce aged employees to fulfill the types of jobs our customers need. If there is a shortage of candidates, the cost to employ or recruit qualified individuals could increase. If we are unable to pass those increases through to our clients, it could materially and adversely affect our business.

We are vulnerable to seasonal fluctuations with lower demand in the winter months.

Royalty fees generated from office sales in markets subject to seasonal fluctuations are less stable and may be lower than in other markets. Locating offices in highly seasonal markets involves higher risks. Individual franchisee revenue can fluctuate significantly on both a quarter over quarter and year over year basis thereby impacting our royalty and service revenue, depending on the local economic conditions and need for temporary staffing services in the local economy. Weather can also have a significant impact on our operations as there is typically lower demand for staffing services during adverse weather conditions in the winter months. To the extent that seasonal fluctuations become more pronounced, our royalty fees could fluctuate materially from period to period.

We are critically dependent on workers’ compensation insurance coverage at commercially reasonable rates, and unexpected changes in claim trends on our workers’ compensation may negatively impact our financial condition.

We employ workers for whom we provide workers’ compensation insurance. Our workers’ compensation insurance policies are renewed annually. The majority of our insurance policies are with Chubb/Ace American. Our insurance carriers require us to collateralize a significant portion of our workers’ compensation obligation. We currently collateralize our policies largely with a letter of credit from Truist. If we no longer had access to that collateral, we could not be certain we would be able to obtain appropriate types or levels of insurance in the future or that adequate replacement policies would be available on acceptable terms. As our business grows or if our financial results deteriorate, the amount of collateral required could increase and the timing of providing collateral could be accelerated. Resources to meet these requirements may not be available to us in a timely manner or at all. The loss of our workers’ compensation insurance coverage would prevent us from operating as a staffing services business in the majority of our markets. Further, we cannot be certain that our current and former insurance carriers will be able to pay claims we make under such policies.

We are responsible for a significant portion of expected losses under our workers’ compensation program. Unexpected changes in claim trends, including the severity and frequency of claims, changes in state laws regarding benefit levels and allowable claims, actuarial estimates, or medical cost inflation, could result in costs that are significantly higher. There can be no assurance that we will be able to increase the fees charged to our clients in a timely manner and in a sufficient amount to cover increased costs as a result of any changes in claims-related liabilities.

Our efforts to actively manage the safety of our temporary workers and actively control costs with internal staff and our network of workers’ compensation related service providers may not be sufficient to prevent material increases to our workers’ compensation costs.

We are dependent on a small number of individuals who constitute our current management.

We are highly dependent on the services of our senior management team and other key employees at our corporate headquarters and on our franchisees’ ability to recruit, retain, and motivate key operations related employees. Competition for such employees can be intense, and the inability to attract and retain the additional qualified employees required to expand our activities, or the loss of current key employees could adversely affect our operating efficiency and financial condition. In addition, our growth strategy may place strains on our management who may become distracted from day-to-day duties.

We may incur employment related claims or other types of claims and costs that could materially harm our business.

We are in the business of employing people in the workplaces of our clients. We incur a risk of liability for claims for personal injury, wage and hour violations, immigration, discrimination, harassment, and other liabilities arising from the actions of our clients and/or temporary workers. Some or all of these claims may give rise to negative publicity, litigation, settlements, or investigations. As a result, we may incur costs, charges or other material adverse impacts on our financial statements.

We maintain insurance with respect to some potential claims and costs with deductibles. We cannot be certain that our insurance will be available, or if available, will be of a sufficient amount or scope to cover claims that may be asserted against us. Should the ultimate judgments or settlements exceed our insurance coverage, they could have a material effect on our business. We cannot be certain we will be able to obtain appropriate types or levels of insurance in the future, that adequate replacement policies will be available on acceptable terms, or at all, or that our insurance providers will be able to pay claims we make under such policies.

We offer our qualifying temporary workers government-mandated health insurance in compliance with the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 (collectively, the “ACA”). We cannot be certain that compliant insurance coverage will remain available to us on reasonable terms, and we could face additional risks arising from future changes to or repeal of the ACA or changed interpretations of our obligations under the ACA.

If we fail successfully to implement our growth strategy, which includes new office development by existing and new franchisees, our ability to increase our revenue and operating profits could be adversely affected.

Portions of our growth strategy rely on new office development by existing and new franchisees. Our franchisees may face many challenges in opening new offices including:

| ● |

Availability and cost of financing; |

| ● |

Negotiation of acceptable lease and financing terms; |

| ● |

Trends in the overall and local economy of the target market; |

| ● |

Recruitment, training, and retention of qualified core staff and temporary personnel; and |

| ● |

General economic and business conditions |

These factors are outside of our control and could hinder our franchisees from opening new offices or expanding existing ones. This could prevent us from successfully implementing our growth strategy.

Changes in our industry could place strains on our management, employees, information systems, and internal controls, which may adversely impact our business.

Changes in the temporary staffing industry and how our customers utilize, order, and pay for temporary staffing services, particularly through new and innovative uses of technology, may place significant demands on our administrative, operational, financial, and other resources or require us to obtain different or additional resources. Any failure to respond to or manage such changes effectively could adversely affect our business. To be successful, we will need to continue to implement management information systems and improve our operating, administrative, financial, and accounting systems and controls in order to adapt quickly to such changes. These changes may be time-consuming and expensive, increase management responsibilities, and divert management attention, and we may not realize a return on our investment in these changes due to the high obsolescence rate of current technology.

Proposed vaccination mandate, if implemented, is likely to adversely impact our business, results of operations, cash flows and financial position.

On November 5, 2021, the Occupational Safety and Health Administration announced an emergency temporary standard mandating the COVID-19 vaccine or weekly testing for most U.S. employees, which includes our employees. That standard was struck down by the U.S. Supreme Court on January 13, 2022. However, the Biden Administration has indicated that it may seek to impose alternative vaccine mandates and other governmental authorities have imposed more targeted vaccine and testing orders and regulations, and may continue to do so in the future. If a mandate is ultimately issued and implemented in some form, we expect there would be further disruptions to our operations and increased compliance burdens, including financial costs, diversion of administrative resources, and increased downtimes to accommodate for any required ongoing COVID-19 testing.

Shifts in attitudes towards contingent workforces could negatively impact our results of operations and financial condition.

Attitudes and beliefs about contingent workforces could change such that our customers no longer desire to utilize our services. If this occurs, it could negatively impact our financial condition and results of operations. Such a shift could also make it challenging or impossible for us to successfully implement our growth strategies.

Difficult political or market conditions, wars, natural disasters, global pandemics, or other unpredictable matters could affect our business in many ways including by reducing the amount of available temporary employees, reducing the amount of customer projects, or harming the overall economy which could materially reduce our revenue, earnings and cash flow and adversely affect our financial condition.

Our business is linked to conditions in the overall economy, such as those impacting the ability of our customers to obtain financing, the availability of temporary employees, changes in laws, and catastrophic events such as fires, floods, earthquakes, tornadoes, hurricanes, pandemics, and the ripple effects on the economy from wars and other geopolitical events. For example, the outbreak of COVID-19 materially affected our business in 2020 by decreasing activity in the economy overall and negatively impacting the industries our customers are in, especially hospitality, event staffing, auto auctioneering, and similar industries. While the impact on our business in 2021 was lessened, we believe COVID-19 still depressed our results. These factors are unpredictable and outside of our control. They may affect the level and volatility of securities prices and the liquidity and value of investments, including investments in our common stock.

Risks Related to our Credit Facility and Liquidity

Our level of debt and restrictions in our credit agreement could negatively affect our operations and limit our liquidity and our ability to react to changes in the economy.

Our revolving line of credit with Truist Bank (“Truist”) contains restrictive covenants that require us to maintain certain financial conditions, which we may fail to meet if there is a material decrease in our profitability or liquidity. Our failure to comply with these covenants could result in an event of default, which, if not cured or waived, would require us to repay these borrowings before their due date. We may not have sufficient funds on hand to repay these loans, and if we are forced to refinance these borrowings on less favorable terms, or are unable to refinance at all, our results of operations and financial condition could be materially adversely affected by increased costs and rates.

If our debt level significantly increases in the future, it could have significant consequences on our ongoing operations including requiring us to dedicate a significant portion of our cash flow from operations to servicing debt rather than using it to execute our strategic initiatives, such as acquisitions; limiting our ability to obtain additional debt financing for future working capital, capital expenditures, or other worthwhile endeavors; and limiting our ability to react to changes in the market.

In addition, the line of credit agreement limits, among other things, our ability to:

| ● |

Sell, lease, license, or otherwise dispose of assets; |

| ● |

Undergo a change in control; |

| ● |

Consolidate and merge with other entities; or |

| ● |

Create, incur, or assume liens, debt, and other encumbrances. |

A breach of any of the restrictions and covenants could result in a default under our agreements which could cause any outstanding indebtedness under the agreements or under any future financing arrangements to become immediately due and payable, and result in the termination of commitments to extend further credit.

Without sufficient liquidity, we may not be able to pursue accretive business opportunities.

Our major source of liquidity and capital is cash generated from our ongoing operations. We also receive principal and interest payments on notes receivable. We must have sufficient sources of liquidity to meet our working capital requirements, fund our workers’ compensation collateral requirements, service our outstanding term loan, and finance growth opportunities. Without sufficient liquidity, we may not be able to pursue accretive business opportunities.

We may be unable to obtain financing of our working capital, acquisition, capital, dividend, and other needs on favorable terms.

Our success and growth is largely dependent upon meeting and covering our working capital and other financial needs on favorable terms. If we need to expand our current line of credit in the future, or lose our existing line of credit, it is possible we would be unable to secure a replacement line of credit on favorable terms or at all which would have a negative impact on our financial condition and results of operations.

Risks Related to Our Franchisees and Business Model

Converting company-owned offices to franchises has multiple risks.

We believe that the franchise model is superior to the company-owned store model. To that end, we have historically converted all company-owned offices of any entities we acquire to franchises. However, we have less control over the day-to-day operations of the offices and the franchisees may operate in a manner that is counter to our interests or introduce risks to our business by departing from our operating norms. Further, franchises are generally regulated at both the federal and the state level, so operating as franchises will introduce additional regulatory risk. We have added a significant number of new franchisees through the 2021 Acquisitions, and other transactions. Acquired franchisees need to adapt to a new operating model, a new IT system, and new business processes. Their failure to do so could negatively impact our financial condition and results of operations.

Our operating and financial results and growth strategies are closely tied to the success of our franchisees.

With all of our offices being operated by franchisees, we are dependent on the financial success and cooperation of our franchisees. We have limited control over how our franchisees’ businesses are run, and the inability of franchisees to operate successfully could adversely affect our operating and financial results through decreased royalty payments or otherwise. If our franchisees incur too much debt, if their operating expenses increase, or if economic or sales trends deteriorate such that they are unable to operate profitably or repay existing debt, it could result in their financial distress, including insolvency or bankruptcy. To date, a small number of franchisees had difficulty in servicing the debts they owe to us as a result of the financial impacts of COVID-19. We have placed a reserve on the notes receivable from those franchisees in the amount of approximately $405,000 at December 31, 2021. If a significant franchisee or a significant number of franchisees become financially distressed, our operating and financial results could be impacted through reduced or delayed royalty payments. A franchisee bankruptcy could have a substantial negative impact on our ability to collect payments due under such franchisee’s franchise agreement. Our success also depends on the willingness and ability of our franchisees to be incentivized to deliver excellent customer service, resolve any issues efficiently, and ensure customer retention. In addition, our success depends on the willingness and ability of our franchisees to implement major initiatives, which may include financial investment. Our franchisees may be unable to successfully implement strategies that we believe are necessary for their further growth, which in turn may harm our growth prospects and financial condition.

Our franchisees could take action that could harm our business.

Our franchisees are contractually obligated to operate their offices in accordance with the operations standards set forth in our agreements with them and applicable laws. However, although we attempt to properly train and support all our franchisees, they are independent third parties whom we do not control. The franchisees own, operate, and oversee the daily operations of their offices, and their core office employees are not our employees. While we have the ability to enforce our franchise agreements, many of our franchisees’ actions are outside of our control. Although we have developed criteria to evaluate and screen prospective franchisees, we cannot be certain that our franchisees will have the business acumen or financial resources necessary to operate successful franchises at their approved offices, and state franchise laws may limit our ability to terminate or not renew these franchise agreements. Moreover, despite our training, support, and monitoring, franchisees may not successfully operate offices in a manner consistent with our standards and requirements or may not hire and adequately train qualified office personnel. The failure of our franchisees to operate their franchises in accordance with our standards or applicable law, actions taken by their employees or a negative publicity event at one of our franchisees’ offices or involving one of our franchisees could have a material adverse effect on our reputation, our brands, our ability to attract prospective franchisees, and our business, financial condition, or results of operations.

If we fail to identify, recruit, and contract with a sufficient number of qualified franchisees, our ability to open new offices and increase our revenue could be materially adversely affected.

The opening of additional offices and expansion into new markets depends, in part, upon the availability of prospective franchisees who meet our selection criteria. Many of our franchisees open and operate multiple offices, and part of our growth strategy requires us to identify, recruit and contract with new franchisees or rely on our existing franchisees to expand. We may not be able to identify, recruit or contract with suitable franchisees in our target markets on a timely basis or at all. If we are unable to recruit suitable franchisees or if franchisees are unable or unwilling to open new offices, our growth may be slower than anticipated, which could materially adversely affect our ability to increase our revenue and materially adversely affect our business, financial condition and results of operations.

Opening new offices in existing markets and aggressive development could cannibalize existing sales and may negatively affect sales at existing offices and relationships with existing franchisees.

We intend to continue opening new franchised offices in our existing markets as a part of our growth strategy. Expansion in existing markets may be affected by local economic and market conditions. Further, the customer target area of our offices varies by location, depending on a number of factors, including population density, area demographics and geography. As a result, the opening of a new office in or near markets in which our franchisees’ offices already exist could adversely affect the sales of these existing franchised offices. Sales cannibalization between offices may become significant in the future as we continue to expand our operations and could affect sales growth, which could, in turn, materially adversely affect our business, financial condition or results of operations. There can be no assurance that sales cannibalization will not occur or become more significant in the future as we increase our presence in existing markets.

A large number of our franchises are controlled by a small number of individuals.

A significant number of our franchises are controlled or beneficially owned by a small number of individuals. Mr. Jackson and immediate family members of Mr. Hermanns have ownership interests in certain of our franchisees, which we label the “Worlds Franchisees.” There were 23 Worlds Franchisees at December 31, 2021 that operated 60 of our 217 franchised offices. Mr. Hermanns’ three children and son-in-law own in the aggregate between 26.8% and 62.8% of each of the Worlds Franchisees. Mr. Jackson owns between 10.7% and 25.4% of each of the Worlds Franchisees.

Approximately one-third of our franchisees owned multiple offices. If any of our relatively large ownership groups were to experience financial difficulty, reduced sales volume, or close, we may experience a negative impact on our results of operations, liquidity, or financial condition.

Our results of operations may be significantly affected by the ability of certain franchisees and the purchaser of our California offices to repay their loans to us.

We occasionally lend money to our franchisees to facilitate a franchise conversion or expansion into a new market. While most of our franchisees have historically repaid their loans to us, for various reasons, a small number have not, and there is no guarantee that our franchisees will continue to repay their loans in the future. We extended purchase financing loans in 2019 in connection with the Command Center Merger and subsequent sales and conversions of company-owned offices to franchises. In addition, the purchaser of our California office assets (the "California Purchaser") financed the transaction by providing us a note for $1.8 million. As a result of the negative impacts of COVID-19, a small number of our franchisees and the California Purchaser had difficulty in repaying their debts to us. To that end, we placed a reserve of approximately $1.9 million on our notes receivable at December 31, 2021. The risk of non-payment is affected, among other things, by:

| ● |

The overall condition and results of operations of the particular franchise or operating entity; |

| ● |