Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10385

Pacific Funds Series Trust

(Exact name of registrant as specified in charter)

700 Newport Center Drive, P.O. Box 7500

Newport Beach, CA 92660

(Address of principal executive offices) (Zip code)

Robin S. Yonis

Vice President, General Counsel and Assistant Secretary of Pacific Funds Series Trust

700 Newport Center Drive, P.O. Box 9000

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Anthony H. Zacharski, Esq.

Dechert LLP

90 State House Square

Hartford, CT 06103

Registrant’s telephone number, including area code: 949-219-6767

Date of fiscal year end: March 31

Date of reporting period: April 1, 2020 - March 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

March 31, 2021

ANNUAL REPORT

Table of Contents

PACIFIC FUNDS

ANNUAL REPORT

AS OF MARCH 31, 2021

| A-1 | ||||

| A-3 | ||||

| B-1 | ||||

| Financial Statements: |

||||

| C-1 | ||||

| C-6 | ||||

| C-11 | ||||

| C-19 | ||||

| C-20 | ||||

| D-1 | ||||

| E-1 | ||||

| F-1 | ||||

| F-2 | ||||

| F-5 | ||||

| F-8 | ||||

| F-9 | ||||

| F-25 | ||||

Pacific Funds Series Trust, which is a Delaware statutory trust, may be referred to as “Pacific Funds” or the “Trust”.

Table of Contents

PACIFIC FUNDS

We are pleased to share with you the Pacific Funds Series Trust (“Pacific Funds” or the “Trust”) Annual Report for the fiscal year ended March 31, 2021, including performance data, management’s discussion of fund performance, and a complete list of investments as of the close of this reporting period. Pacific Funds is comprised of twenty-nine funds (each individually, a “Fund” and collectively, the “Funds”), fifteen of which are available for direct investment. Pacific Life Fund Advisors LLC (PLFA) is the Adviser to the Trust and supervises the management of all of the Trust’s Funds. PLFA directly manages Pacific FundsSM Portfolio Optimization Conservative, Pacific FundsSM Portfolio Optimization Moderate-Conservative, Pacific FundsSM Portfolio Optimization Moderate, Pacific FundsSM Portfolio Optimization Growth and Pacific FundsSM Portfolio Optimization Aggressive-Growth (together, the “Portfolio Optimization Funds”) as well as the PF Multi-Asset Fund.

Each of the Portfolio Optimization Funds is an asset allocation “Fund of Funds” that invests in Class P shares of certain other Funds of the Trust (the “PF Underlying Funds”). PLFA supervises the management of those PF Underlying Funds which are only available for investment by the Portfolio Optimization Funds. The Portfolio Optimization Funds also invest in Class P shares of Pacific FundsSM Core Income, Pacific FundsSM High Income and Pacific FundsSM Floating Rate Income.

The Adviser has retained other firms to serve as sub-advisers under its supervision. The sub-advisers, the Adviser and the Funds of the Trust that they manage as of March 31, 2021 are listed below:

| Sub-Adviser or Adviser | Funds Available for Direct Investment |

Page Number | ||

| Pacific Life Fund Advisors LLC (PLFA) | Pacific FundsSM Portfolio Optimization Conservative | A-5 | ||

| Pacific FundsSM Portfolio Optimization Moderate-Conservative | A-6 | |||

| Pacific FundsSM Portfolio Optimization Moderate | A-8 | |||

| Pacific FundsSM Portfolio Optimization Growth | A-9 | |||

| Pacific FundsSM Portfolio Optimization Aggressive-Growth | A-10 | |||

| Pacific Asset Management LLC (Pacific Asset Management) | Pacific FundsSM Ultra Short Income | A-11 | ||

| Pacific FundsSM Short Duration Income | A-12 | |||

| Pacific FundsSM Core Income | A-13 | |||

| Pacific FundsSM Strategic Income | A-14 | |||

| Pacific FundsSM Floating Rate Income | A-15 | |||

| Pacific FundsSM High Income | A-16 | |||

| Pacific FundsSM ESG Core Bond | A-17 | |||

| Rothschild & Co Asset Management US Inc. (Rothschild & Co) | Pacific FundsSM Small/Mid-Cap | A-18 | ||

| Pacific FundsSM Small-Cap | A-19 | |||

| Pacific FundsSM Small-Cap Value | A-20 | |||

| Sub-Adviser or Adviser | PF Underlying Funds | Page Number | ||

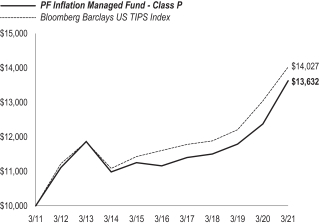

| Pacific Investment Management Company LLC (PIMCO) | PF Inflation Managed Fund | A-21 | ||

| J.P. Morgan Investment Management Inc. (JPMorgan) / Pacific Investment Management Company LLC (PIMCO) / Western Asset Management Company, LLC (Western Asset) | PF Managed Bond Fund | A-22 | ||

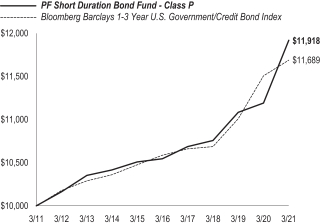

| T. Rowe Price Associates, Inc. (T. Rowe Price) | PF Short Duration Bond Fund | A-24 | ||

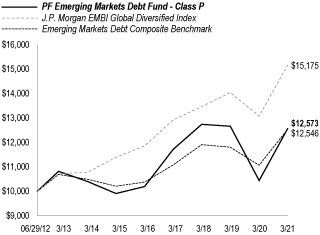

| Ashmore Investment Management Limited (Ashmore) | PF Emerging Markets Debt Fund | A-25 | ||

| MFS Investment Management (MFS) | PF Growth Fund | A-26 | ||

| ClearBridge Investments, LLC (ClearBridge) | PF Large-Cap Value Fund | A-27 | ||

| MFS Investment Management (MFS) | PF Small-Cap Growth Fund (formerly named PF Developing Growth Fund) | A-28 | ||

| Alliance Bernstein L.P. (AB) | PF Small-Cap Value Fund | A-30 | ||

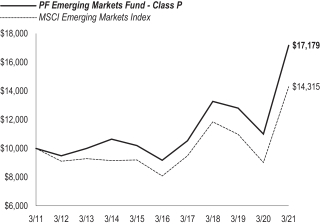

| Invesco Advisers Inc. (Invesco) | PF Emerging Markets Fund | A-31 | ||

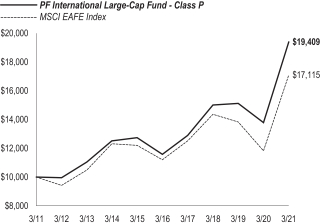

| MFS Investment Management (MFS) | PF International Large-Cap Fund | A-32 | ||

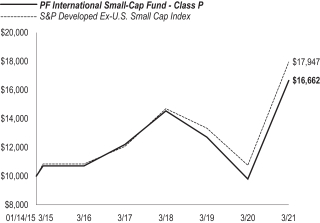

| QS Investors, LLC (QS Investors) | PF International Small-Cap Fund | A-33 | ||

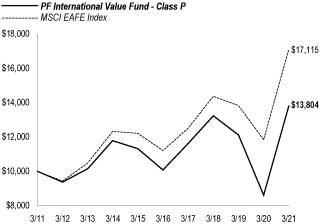

| Wellington Management Company LLP (Wellington) | PF International Value Fund | A-34 | ||

| Pacific Life Fund Advisors LLC (PLFA) / portion sub-advised by Pacific Asset Management LLC | PF Multi-Asset Fund | A-35 | ||

| Principal Real Estate Investors, LLC (Principal REI) | PF Real Estate Fund | A-36 | ||

A-1

Table of Contents

PACIFIC FUNDS

Each of the sub-advisers and the Adviser has prepared a discussion regarding the performance of the Funds of the Trust that they manage, including commentary discussing positive and negative factors affecting performance for the past twelve months.

We appreciate your confidence in Pacific Funds and look forward to serving your financial needs in the years to come.

Sincerely,

|

| |

| James T. Morris Chairman of the Board |

Adrian S. Griggs Chief Executive Officer | |

| Pacific Funds Series Trust | Pacific Funds Series Trust | |

A-2

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION

This Annual Report is provided for the general information of investors with beneficial interests in the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus, as supplemented, which contains information about the Trust and each of its Funds, including their investment objectives, risks, charges and expenses. You should read the prospectus carefully before investing. There is no assurance that a Fund will achieve its investment objective. Each Fund is subject to market risk. The value of a Fund changes as its asset values go up or down. The value of a Fund’s shares will fluctuate, and when redeemed, may be worth more or less than their original cost. The total return for each share class of each Fund is net of fees and includes reinvestment of all dividends and capital gain distributions, if any, and does not include deductions of any applicable share class sales charges. Past performance is not predictive of future performance. This report shows you the performance of each Fund compared to its benchmark index. Index performance is provided for illustrative and comparative purposes only and does not predict or depict the performance of the Funds. Indices are unmanaged, do not incur transaction costs, do not include fees and expenses, and cannot be purchased directly by investors. Index returns include reinvested dividends.

The composite benchmarks for the Portfolio Optimization Funds are composed of up to four broad-based indices. The percentage amounts of each broad-based index within each composite benchmark are based on each Fund’s target asset class allocations in effect during the reporting period. The percentages attributed to a broad-based index within a composite benchmark will change if a Fund’s target asset class allocations change.

PLFA supervises the management of the Funds contained in this report, subject to the oversight of the Trust’s Board of Trustees (Board). PLFA directly manages the Portfolio Optimization Funds as well as the PF Multi-Asset Fund. PLFA has written the general market conditions commentary which expresses PLFA’s opinions and views on how the market generally performed for the fiscal year ended March 31, 2021 (the reporting period) as well as separate commentary specific to those Funds that it directly manages that is based on its opinion of how these Funds performed during this reporting period.

For the other Funds, PLFA has retained other firms to serve as sub-advisers under its supervision. Each of these sub-advisers has written a separate commentary specific to the Fund(s) that they manage that is based on their opinions of how their Fund(s) performed during the reporting period. The views expressed in those commentaries reflect those of the respective sub-advisers for the fiscal year ended March 31, 2021.

All views and opinions expressed in the management discussion of fund performance are subject to change at any time based upon market, economic or other conditions, and the Trust, its Adviser and the sub-advisers disclaim any responsibility to update such views. These views and options may not be relied upon as investment advice or recommendations, or as an offer for any particular security. Any references to “we”, “I”, or “ours” are references to the sub-adviser or Adviser, as applicable. Any sectors referenced are provided by the applicable sub-adviser and could be different from the sectors listed in the Schedules of Investments if obtained from another source. The Adviser and sub-advisers may include statements that constitute “forward-looking statements” under the United States (U.S.) securities laws. Forward-looking statements include information concerning possible or assumed future results of the Trust’s investment operations, asset levels, earnings, expenses, industry or market conditions, regulatory developments and other aspects of the Trust’s operations or general economic conditions. In addition, when used in this report, words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “projects” and future or conditional verbs such as “will”, “may”, “could”, “should”, and “would”, or any other statement that necessarily depends on future events, are intended to identify forward- looking statements. Forward-looking statements are not guarantees of performance or economic results. They involve risks, uncertainties and assumptions. Although such statements are based on expectations that the Adviser or a sub-adviser believes to be reasonable, actual results may differ materially from expectations. Investors must not rely on any forward-looking statements. Statements of facts and performance data are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy.

In connection with any forward-looking statements and any investment in the Trust, investors should carefully consider the investment objectives, policies and risks described in the Trust’s current prospectus, as supplemented, and Statement of Additional Information, as supplemented, as filed with the United States (U.S.) Securities and Exchange Commission (SEC), which may be obtained from the SEC or by contacting the Trust as noted in the Where to Go for More Information section of this Annual Report.

Market Conditions (for the fiscal year ended March 31, 2021)

Executive Summary

Small capitalization stocks, particularly small-capitalization value, rallied towards the end of the reporting period. Both monetary and fiscal stimulus packages helped fuel a rally in cyclical sectors that tend to outperform in the early phase of an economic recovery. This kept the growth-to-value rotation in motion. Over the reporting period, domestic markets outpaced international markets, as manufacturing activity in the U.S. bounced back strongly after the market correction earlier in the reporting period.

The yield on 10-year Treasuries spiked as concerns of loose fiscal policy potentially overheating the economy weighed on bond investors. Rising rates were headwinds for long-term bonds, as exposure to duration (or sensitivity to changes in interest rates) detracted from bond returns over the reporting period. On the other hand, the contraction in high-yield spreads helped buffer the impact from rising interest rates, which benefitted high yield and bank loans. In general, the on-going vaccine efforts around the globe improved sentiments, as economies around the world seek to emerge from COVID-19 restrictions.

Outlook

The positive sentiment will likely continue to drive equity markets higher, as the wellspring of U.S. government stimulus helps absorb most of the remaining pandemic-related economic headwinds. While bipartisanship is a rare sight in Washington, the Democrats’ unified government as a result of the 2020 U.S. elections should allow them to use the budget reconciliation process to pass further stimulus measures, provided they don’t have infighting within the party between progressive and moderate factions. One of those few areas where there seems to be bipartisan agreement is that China has become a formidable competitor as it seeks to become the next global leader

| See benchmark definitions on A-37 – A-39 |

A-3

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

and influencer. How Congress decides to address this issue remains unclear, but it appears likely that they will continue with the hawkish approach that was started by the Trump administration.

Stimulus

Since the pandemic broke out, the U.S. government injected over $10 trillion in monetary and fiscal support into the United States economy. This amount of money equates to roughly half the annual Gross Domestic Product of the U.S.

The Biden Administration’s next proposed stimulus plan, focusing on infrastructure, targets various industries that range from technology-related sectors to construction. In general, the goal seems to address both supply-chain bottlenecks and areas of growth. This includes everything from improving highways to installing 5G networks. Furthermore, research and development incentives will likely boost semiconductor manufacturers, which will seed the next technological progress.

Supply Chains

The ongoing trade dispute between China and Western nations has forced manufacturers to diversify their supply chains. Countries such as Vietnam and other Southeast Asian nations are likely to benefit from this supply chain shift. Additionally, the U.S. will likely look to boost domestic activity by improving its own domestic-supply chains.

In the U.S., manufacturing activity experienced a strong rebound from its sharp deterioration last year, as indicated by the Purchasing Managers Index (PMI) for March of 2021 coming in at 64.7, the highest level since 1983. (PMI levels above 50 indicates expansionary conditions.). This elevated manufacturing activity also means more manufacturing jobs for those seeking work, which is crucial given that there is still significant slack in the labor market. Manufacturing positions are in higher demand than they have been in decades.

Building out supply-chain capacity is both a domestic and an international initiative that should support global growth and thus be broadly positive for risk assets such as equities and credit.

Infrastructure

The Biden Administration’s massive $2.25 trillion infrastructure push joins a broader global effort to improve supply-chain networks, as competition for international influence has only raised tensions with China. President Biden laid out his “Build Back Better” plan to improve roads and bridges as well as upgrade the digital- and technology-related infrastructure over the next several years. By some estimates, the process to get the plan approved may take up to six months, and its implementation could bump Gross Domestic Product growth in the U.S. by 0.5%.

The major challenge of the infrastructure bill will be determining how to finance the initiatives. The Biden Administration seeks to raise corporate taxes from 21% to 28% and may also need to resort to deficit financing. Any effort to hike taxes will draw opposition from Republicans and even moderate Democrats during the negotiations, which may bring the corporate tax increase closer to 25%. Nonetheless, infrastructure spending, especially because it will help the U.S. compete with China, should receive support from Congress.

Commodities vs. the U.S. Dollar

This global competition for influence will likely support international growth and demand for commodities. Historically, commodity prices have moved inversely with the U.S. dollar. Therefore, rising commodity prices could add downward pressure on the dollar.

Much of this demand for commodities will come from China, as it pushes for more self-reliance. Chinese demand for oil has been positive since the second quarter of 2020 and surged over the first quarter of 2021, while demand in the U.S. and Eurozone may have finally bottomed.

Raw material such as industrial metals could see upward pressure from a rise in demand. This could be positive for emerging market equities, as China’s equity market has generally moved in tandem with industrial metals.

Resurging global competition will likely bring a push for infrastructure spending internationally. This environment could boost global markets, including emerging markets.

Emerging Markets

The Asian region represents approximately 80% of the MSCI Emerging Markets Index. Therefore, the early recovery in China should have positive economic spillover effects throughout the region. We can already see China’s consumer confidence has recovered relatively quickly since the pandemic broke out.

The recovery in China is also consistent with accelerating wage growth in the country. While rising wages in China is consistent with consumer confidence, labor cost pressures in China are further persuading foreign companies to seek alternative supply chains to control costs. However, this should serve to further strengthen the markets of other emerging nations.

Concluding Remarks

The economic recovery and increased competition have the potential to drive global trade higher. Disruptions in supply chains, including the recent incident with the cargo ship blockage in the Suez Canal, will only accelerate a global push for making supply chains more efficient and diverse. This is particularly important in order to meet the pent-up demand that has been built up since the pandemic, which will likewise be released as the world’s population gets inoculated.

In the meantime, the reshuffling of supply chains may improve domestic economic activity as manufacturers scramble to meet demand. The competition between the U.S. and China for global influence will continue intensifying, but this does not necessarily mean that decades of globalization will reverse. Instead, nations will look to broaden alliances and partnerships in order to compete on a global scale. This may encourage Western companies to seek opportunities in emerging countries such as India, which is expected to be one of the largest contributors to global growth over the next several years.

While challenges around the world, including the pandemic, upended the lives of individuals, companies have generally been able to adapt. Unsettled differences between the U.S. and China regarding trade and other geopolitical issues will likely worsen in the

| See benchmark definitions on A-37 – A-39 |

A-4

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

foreseeable future. Furthermore, trade wars and accidents revealed how easily supply chains can be disrupted. This should continue to drive investments in supply chains as global competition continues to increase, which should favor risk assets.

Performance of the Portfolio Optimization Funds

The performance of the Portfolio Optimization Funds are composites of the performance of each of the Funds in which each invests (which may include domestic and/or international equities and bonds). The Portfolio Optimization Funds are compared to two broad-based indices; however, to further assist in performance comparisons, composite benchmarks were constructed for the Portfolio Optimization Funds. Each composite benchmark is comprised of up to four of the broad-based indices shown below. The composite benchmarks were constructed with allocations to each asset class that correspond to the target allocations for Portfolio Optimization Funds. However, the actual allocations of any Portfolio Optimization Fund will naturally vary from these targets as a result of market performance over time. The one-year performance for these broad-based indices for the fiscal year ended March 31, 2021 is shown in the following table:

| Broad-Based Indices |

||||

| S&P 500 Index (representing U.S. Stocks) |

56.35% | |||

| Morgan Stanley Capital International (MSCI) EAFE Index (International Stocks) |

44.57% | |||

| Bloomberg Barclays US Aggregate Bond Index (Fixed Income) |

0.71% | |||

| ICE BofA U.S. 3-Month T-Bill Index (Cash) |

0.12% | |||

Pacific Funds Portfolio Optimization Conservative (managed by Pacific Life Fund Advisors LLC)

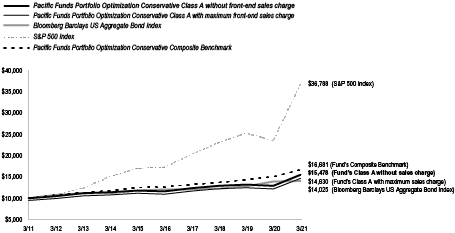

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Portfolio Optimization Conservative’s Class A (without sales charge) returned 19.96%, compared to a return of 0.71% for the Bloomberg Barclays US Aggregate Bond Index, a return of 56.35% for the S&P 500 Index, and a return of 10.82% for the Pacific Funds Portfolio Optimization Conservative Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| See benchmark definitions on A-37 – A-39 |

A-5

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A outperformed the Pacific Funds Portfolio Optimization Conservative Composite Benchmark. The Pacific Funds Portfolio Optimization Conservative Composite Benchmark is comprised of the Bloomberg Barclays US Aggregate Bond, S&P 500, ICE BofA U.S. 3-Month Treasury Bill, and MSCI EAFE Indices in a weighting that is fixed and specific to the Fund. The Fund was primarily invested in various fixed income strategies, with a smaller allocation to equity, during the reporting period. Fixed income investments included allocations to intermediate-term bond, short duration bond, inflation-indexed bond, emerging markets bond, and floating rate strategies. The equity segment consisted mainly of allocations to domestic and foreign large-capitalization strategies.

Among the fixed income lineup, high yield and emerging market bonds contributed to performance over the reporting period as riskier asset classes recovered after an abrupt market correction. Additionally, the PF Managed Bond Fund, which represented the largest weight in the Fund, outperformed the Bloomberg Barclays US Aggregate Bond Index and contributed to performance over the reporting period. On the other hand, Pacific Funds Floating Rate Income underperformed its benchmark, which held back performance.

As for domestic equities, exposures to small-capitalization, particularly value-oriented, stocks contributed to performance over the reporting period as the market rally favored cyclical sectors that tend to outperform in the early phase of an economic recovery. On the other hand, the exposure to real estate detracted from performance as work-from-home arrangements amid the pandemic lowered demand for office space. Additionally, PF Growth and PF Large-Cap Value underperformed their respective benchmarks, which detracted from performance. International equities as a group outperformed the MSCI EAFE Index over the reporting period. An overweight to emerging markets had a positive impact on performance.

Pacific Funds Portfolio Optimization Moderate-Conservative (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Portfolio Optimization Moderate-Conservative’s Class A (without sales charge) returned 29.06%, compared to a return of 0.71% for the Bloomberg Barclays US Aggregate Bond Index, a return of 56.35% for the S&P 500 Index, and a return of 19.65% for the Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| See benchmark definitions on A-37 – A-39 |

A-6

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A outperformed the Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark. The Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark is comprised of the Bloomberg Barclays US Aggregate Bond, S&P 500, MSCI EAFE, and ICE BofA U.S. 3-Month Treasury Bill Indices in a weighting that is fixed and specific to the Fund. The Fund had a diversified allocation mix that was modestly tilted to fixed income during the reporting period. Fixed income investments included intermediate-term bond strategies as well as short duration bond, inflation-indexed bond, high yield bond, emerging markets bond, and floating rate strategies. The Fund’s equity exposure was diversified across style (growth and value), market capitalization and region (including an allocation to foreign small-capitalization and emerging markets strategies).

Among the fixed income lineup, high yield and emerging market bonds contributed to performance over the reporting period as riskier asset classes recovered after an abrupt market correction. Additionally, the PF Managed Bond Fund, which represented the largest weight in the Fund, outperformed the Bloomberg Barclays US Aggregate Bond Index and contributed to performance over the reporting period. On the other hand, Pacific Funds Floating Rate Income underperformed its benchmark, which held back performance.

As for domestic equities, exposures to small-capitalization, particularly value-oriented, stocks contributed to performance over the reporting period as the market rally favored cyclical sectors that tend to outperform in the early phase of an economic recovery. On the other hand, the exposure to real estate detracted from performance as work-from-home arrangements amid the pandemic lowered demand for office space. Additionally, PF Growth and PF Large-Cap Value underperformed their respective benchmarks, which detracted from performance. International equities as a group outperformed the MSCI EAFE Index over the reporting period. An overweight to emerging markets had a positive impact on performance.

| See benchmark definitions on A-37 – A-39 |

A-7

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Portfolio Optimization Moderate (managed by Pacific Life Fund Advisors LLC)

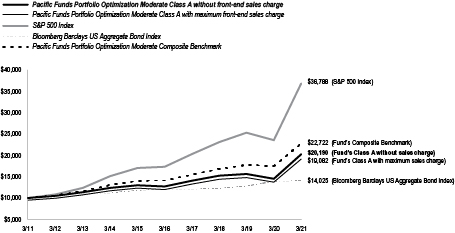

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Portfolio Optimization Moderate’s Class A (without sales charge) returned 39.61%, compared to a return of 56.35% for the S&P 500 Index, a return of 0.71% for the Bloomberg Barclays US Aggregate Bond Index, and a return of 30.17% for the Pacific Funds Portfolio Optimization Moderate Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A outperformed the Pacific Funds Portfolio Optimization Moderate Composite Benchmark. The Pacific Funds Portfolio Optimization Moderate Composite Benchmark is comprised of the S&P 500, Bloomberg Barclays US Aggregate Bond, MSCI EAFE, and ICE BofA U.S. 3-Month Treasury Bill Indices in a weighting that is fixed and specific to the Fund. The Fund allocated to a mix of equity and fixed income strategies during the reporting period, with a larger allocation toward equity investments. The equity exposure was diversified across style (growth and value), market capitalization and region (including allocations to foreign small-capitalization and emerging markets stocks). The Fund also maintained exposure to select market sectors such as publicly-traded real estate investment trusts (REITs). Fixed income investments included intermediate-term bond, short duration bond, inflation-indexed bond, emerging markets bond, and floating rate loan strategies.

Among domestic equities, exposures to small-capitalization, particularly value-oriented, stocks contributed to performance over the reporting period as the market rally favored cyclical sectors that tend to outperform in the early phase of an economic recovery. On the other hand, the exposure to real estate detracted from performance as work-from-home arrangements amid the pandemic lowered demand for office space. Additionally, PF Growth and PF Large-Cap Value underperformed their respective benchmarks, which detracted from performance.

| See benchmark definitions on A-37 – A-39 |

A-8

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

International equities as a group outperformed the MSCI EAFE Index over the reporting period. An overweight to emerging markets had a positive impact on performance. Exposure to international small-capitalization stocks also contributed to performance.

Among the fixed income lineup, high yield and emerging market bonds contributed to performance over the reporting period as riskier asset classes recovered after an abrupt market correction. Additionally, the PF Managed Bond Fund outperformed the Bloomberg Barclays US Aggregate Bond Index and contributed to performance over the reporting period. On the other hand, Pacific Funds Floating Rate Income underperformed its benchmark, which held back performance.

Pacific Funds Portfolio Optimization Growth (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2021?

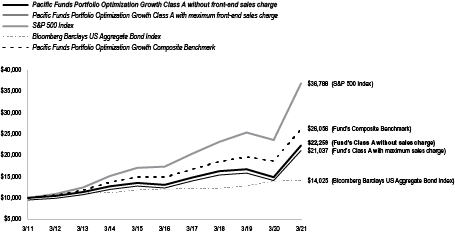

A. For the year ended March 31, 2021, Pacific Funds Portfolio Optimization Growth’s Class A (without sales charge) returned 50.27%, compared to a return of 56.35% for the S&P 500 Index, a return of 0.71% for the Bloomberg Barclays US Aggregate Bond Index, and a return of 39.72% for the Pacific Funds Portfolio Optimization Growth Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A outperformed the Pacific Funds Portfolio Optimization Growth Composite Benchmark. The Pacific Funds Portfolio Optimization Growth Composite Benchmark is comprised of the S&P 500, Bloomberg Barclays US Aggregate Bond, and MSCI EAFE Indices in a weighting that is fixed and specific to the Fund. The Fund had a diversified allocation mix during the reporting period with majority allocated to equity. The equity exposure was diversified across style (growth and value), market capitalization and region (including

| See benchmark definitions on A-37 – A-39 |

A-9

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

allocations to foreign small capitalization and emerging markets stocks). The Fund also maintained exposure to select market sectors such as publicly-traded REITs. Fixed income investments included intermediate-term bond strategies as well as specific strategies such as short duration bond, inflation-indexed bond and emerging markets bond strategies.

Among domestic equities, exposures to small-capitalization, particularly value-oriented, stocks contributed to performance over the reporting period as the market rally favored cyclical sectors that tend to outperform in the early phase of an economic recovery. On the other hand, the exposure to real estate detracted from performance as work-from-home arrangements amid the pandemic lowered demand for office space. Additionally, PF Growth and PF Large-Cap Value underperformed their respective benchmarks, which detracted from performance. International equities as a group outperformed the MSCI EAFE Index over the reporting period. An overweight to emerging markets had a positive impact on performance. Exposure to international small-capitalization stocks also contributed to performance.

Among the fixed income lineup, high yield and emerging market bonds contributed to performance over the reporting period as riskier asset classes recovered after an abrupt market correction. Additionally, the PF Managed Bond Fund outperformed the Bloomberg Barclays US Aggregate Bond Index and contributed to performance over the reporting period.

Pacific Funds Portfolio Optimization Aggressive-Growth (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Portfolio Optimization Aggressive-Growth’s Class A (without sales charge) returned 60.05%, compared to a return of 56.35% for the S&P 500 Index, a return of 0.71% for the Bloomberg Barclays US Aggregate Bond Index, and a return of 50.09% for the Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| See benchmark definitions on A-37 – A-39 |

A-10

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A outperformed the Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark. The Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark is comprised of the S&P 500, MSCI EAFE, and Bloomberg Barclays US Aggregate Bond Indices in a weighting that is fixed and specific to the Fund. The Fund primarily allocated to domestic and international equity funds that are diversified across style (growth and value), market capitalization and region (which included allocations to foreign small-capitalization and emerging markets stocks) during the reporting period. The Fund also maintained exposure to select sectors, such as publicly-traded REITs, as well as a small allocation to intermediate-term fixed income securities.

Among domestic equities, exposures to small-capitalization, particularly value-oriented, stocks contributed to performance over the reporting period as the market rally favored cyclical sectors that tend to outperform in the early phase of an economic recovery. On the other hand, the exposure to real estate detracted from performance as work-from-home arrangements amid the pandemic lowered demand for office space. Additionally, PF Growth and PF Large-Cap Value underperformed their respective benchmarks, which detracted from performance. International equities as a group outperformed the MSCI EAFE Index over the reporting period. An overweight to emerging markets had a positive impact on performance. Exposure to international small-capitalization stocks also contributed to performance.

Among the fixed income lineup, high yield and emerging market bonds contributed to performance over the reporting period as riskier asset classes recovered after an abrupt market correction.

Pacific Funds Ultra Short Income (managed by Pacific Asset Management LLC)

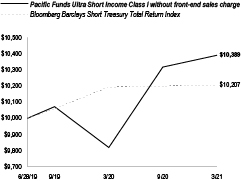

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Ultra-Short Income’s Class I (without sales charge) returned 5.81%, compared to a return of 0.15% for its benchmark, the Bloomberg Barclays Short Treasury Total Return Index

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2021. For comparison purposes, the performance of all classes for the period ended March 31, 2021 are also shown in the table below. Performance data for Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period the Fund’s Class I outperformed the benchmark. The Fund primarily invests in investment grade short-term fixed and floating rate debt securities. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

| See benchmark definitions on A-37 – A-39 |

A-11

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

The Fund’s focus on corporate debt versus government securities was the primary contributor to performance. The Fund’s overweight relative to the benchmark to corporate bonds, notably BBB rated corporate bonds, benefited performance. The Fund’s overweight to the non-investment grade bank loans and the high yield bonds benefited performance. The Fund’s exposure to treasuries that have longer maturities than the benchmark detracted from performance. At the sector level, overweights to Banking, AAA Collateralized Loan Obligations / Asset Backed Securities, and Independent Energy benefited performance while an overweight to the Paper sector detracted.

Pacific Funds Short Duration Income (managed by Pacific Asset Management LLC)

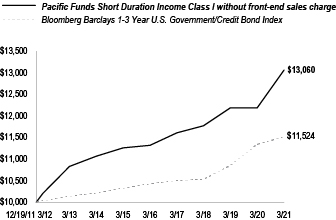

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Short Duration Income’s Class I (without sales charge) returned 7.16%, compared to a return of 1.57% for its benchmark, the Bloomberg Barclays 1-3 Year U.S. Government/Credit Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class A, C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund uses a short maturity corporate debt focused strategy. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

The Fund’s asset allocation and focus on corporate debt were the primary contributors to relative performance. The Fund’s reporting period, which began only a few days after the market bottom of late March 2020, saw significant total returns for credit related risk assets including corporate bonds. The Fund’s overweight relative to the benchmark to corporate bonds, notably BBB rated corporate bonds, contributed to performance. The Fund’s overweight to the non-investment grade bank loan sector and the high yield bond sector also contributed to performance. The Fund’s duration was above benchmark, which detracted from performance. The Fund’s overweight to Technology, Banking, and Electric Utilities benefited performance while the Fund’s underweights to Sovereign, Integrated Energy, and Retail REITS detracted. At the issuer level, oil and gas producers Ovintiv, Diamondback Energy and Oneok were the top contributors while Southwest Airlines (Transportation and Logistics), Marubeni (Consumer Staples) and AES (Utilities) were the top detractors.

| See benchmark definitions on A-37 – A-39 |

A-12

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Core Income (managed by Pacific Asset Management LLC)

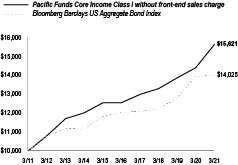

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Core Income’s Class I (without sales charge) returned 8.61%, compared to a return of 0.71% for its benchmark, the Bloomberg Barclays US Aggregate Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the ten-year period ended March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class A, C, P and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund uses an intermediate term corporate debt focused strategy. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

The Fund benefited from asset allocation and the focus on corporate debt versus government securities as the primary contributors to relative performance. The Fund’s overweight (relative to its benchmark) to corporate bonds, notably BBB rated corporate bonds, benefited performance. The Fund’s overweight to the non-investment grade bank loan sector and the high yield bond sector benefited performance. The Fund’s duration was below that of its benchmark, which benefited performance. At the security level, General Motors (Automotive), Clubcorp (Leisure Facilities and Services), and Beazer Homes (Home Construction) were the top contributors while Liberty Mutual (Insurance), Activision (Entertainment Content), and Charter Communications (Cable and Satellite) were the top detractors. Sector overweights to Technology, Electric Utility, and Midstream Energy contributed to performance while underweights to Airlines, Tobacco, and Sovereigns detracted.

| See benchmark definitions on A-37 – A-39 |

A-13

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Strategic Income (managed by Pacific Asset Management LLC)

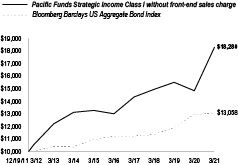

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Strategic Income’s Class I (without sales charge) returned 23.23%, compared to a return of 0.71% for its benchmark, the Bloomberg Barclays US Aggregate Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class A, C and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund focuses on USD credit focused fixed income asset classes, notably non-investment grade securities. Based on our view of the market conditions during the reporting period, we positioned the Fund towards non-investment grade securities. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

The Fund outperformed its benchmark for the reporting period due to asset allocation and the focus on credit related fixed income sectors including corporate bonds, bank loans, and high yield securities. The reporting period, which began just a few days after the late March 2020 market bottom, led to significant total returns across risk assets. The Fund’s overweight (relative to its benchmark) in corporate bonds, notably BBB rated corporate bonds, benefited performance. The Fund’s overweight to the non-investment grade bank loan sector and the high yield bond sector contributed to performance. The Fund’s duration was below benchmark, contributing to relative performance. At the sector level, overweights to Midstream, Independent, and Gaming benefited performance while underweights to Sovereign, Chemicals, and Health Insurance detracted. At the issuer level, overweights to Golden Nugget (Leisure Facilities and Services), Energy Transfer (Oil and Gas Producers), and Boeing (Aerospace and Defense) contributed to performance while Sinclair Broadcasting (Publishing and Broadcasting), TNT Crane (Industrials), Liberty Mutual (Insurance) detracted.

| See benchmark definitions on A-37 – A-39 |

A-14

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Floating Rate Income (managed by Pacific Asset Management LLC)

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Floating Rate Income’s Class I (without sales charge) returned 14.87%, compared to a return of 20.77% for its benchmark, the Credit Suisse Leveraged Loan Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class A, C, P and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I underperformed the benchmark. Using a fundamental approach with a top down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look for investment opportunities in floating rate loans and floating rate debt securities.

For the reporting period, the Fund underperformed the benchmark primarily due to its focus on performing loans. During the reporting period, lower quality substantially outperformed. The Fund focused on the performing part of the bank loan market. The Fund’s underweights (relative to its benchmark) to issuers in the energy and gaming/leisure sectors detracted from performance. Credit quality allocations were mixed in regard to relative performance. The Fund’s overweight to B vs. BB rated issuers contributed to relative performance, and the Fund’s underweight to CCC-rated issuers detracted. The Fund focused during the reporting period on performing second lien CCC rated issuers. The Fund’s focus on larger and more liquid issuers, generally those with facility sizes greater than $1billion U.S. dollars detracted from performance as smaller issuers outperformed.

| See benchmark definitions on A-37 – A-39 |

A-15

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds High Income (managed by Pacific Asset Management LLC)

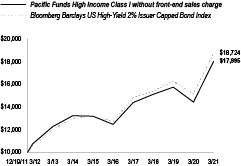

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds High Income’s Class I (without sales charge) returned 24.76%, compared to a return of 23.65% for its benchmark, the Bloomberg Barclays US. High-Yield 2% Issuer Capped Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class A, C, P and Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund seeks a high level of current income by investing in non-investment grade debt instruments or in instruments with characteristics of non-investment grade instruments. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts.

During the reporting period, the Fund outperformed the benchmark primarily due to sector allocations and an overweight (relative to the benchmark) to lower quality securities. The Fund’s underweight to BB rated securities and overweight to CCC rated securities benefited performance given the rally in lower quality issuers. At the sector level, underweights to Cable & Satellite and Technology benefited performance along with the overweight to Midstream Energy companies. The Fund’s underweight to Independent Energy and Airlines detracted from performance. Top issue level contributors included Golden Nugget (Leisure Facilities and Services), Ahern Rentals (Industrial), and Ford (Automotive) while largest issuer level detractors were Occidental Petroleum (Oil and Gas), Sinclair Broadcasting (Publishing and Broadcasting), and Altice (Cable and Satellite). The Fund’s duration was shorter than the benchmark during the reporting period, benefiting relative performance.

| See benchmark definitions on A-37 – A-39 |

A-16

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

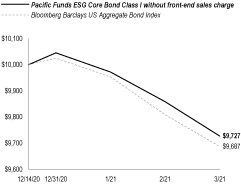

Pacific Funds ESG Core Bond (managed by Pacific Asset Management LLC)

Q. How did the Fund perform for the period ended March 31, 2021?

A. Pacific Funds ESG Core Bond commenced operations on December 14, 2020. For the period from inception through March 31, 2021, the Fund’s Class I (without sales charge) returned -2.73% compared to a return of -3.13% for its benchmark, the Bloomberg Barclays US Aggregate Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2021. For comparison purposes, the performance of all classes for the period ended March 31, 2021 are also shown in the table below. Performance data for Advisor Class shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the period, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the period from inception through March 31, 2021, the Fund’s Class I outperformed the benchmark. The Fund uses an intermediate term corporate debt focused strategy. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection. The Fund also incorporates sustainable investment goals into the investment process by use of ESG Exclusions and ESG metrics. The sub-adviser created the following ESG Exclusions to seek to screen out investment in issuers with direct involvement in: (i) the production, distribution, sale or use of thermal coal exceeding the sub-adviser’s revenue threshold; (ii) the production of tobacco; (iii) the production or sale of controversial military weapons; and (iv) serious human rights violations or severe environmental damage. Individual investment selection was also based on the sub-adviser’s analysis of ESG metrics provided by independent third-party ESG service providers. That is, the sub-adviser relies on ESG ratings and other information provided by various independent third-party ESG service providers to help construct a portfolio that rates highly on ESG factors.

The Fund benefited from asset allocation, security selection, and the underweight to duration during the period we managed the Fund. The Fund’s duration was below that of the benchmark, contributing to relative performance. The Fund’s overweight (relative to its benchmark) to longer maturity corporate bonds detracted from performance though the underweight to long maturity Treasuries contributed. At the issuer level, Oracle, Verizon, and Delta Airlines contributed to performance while CVS and PNC Bank detracted.

| See benchmark definitions on A-37 – A-39 |

A-17

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

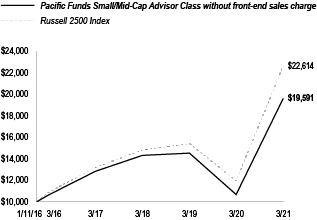

Pacific Funds Small/Mid-Cap (managed by Rothschild & Co Asset Management US Inc.)

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Small/Mid-Cap’s Advisor Class (without sales charge) returned 84.04%, compared to a return of 89.40% for its benchmark, the Russell 2500 Index.

The following graph compares the performance of a hypothetical $10,000 investment in Advisor Class shares of the Fund to its benchmark for the period from inception through March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class A, C, and R6 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Advisor Class underperformed the benchmark. We at Rothschild & Co implement the Fund’s strategy by investing in common stocks and other equity securities of small and medium capitalization U.S. companies. We analyze a variety of quantitative and fundamental inputs in making stock decisions and seek to build a portfolio that is well diversified at the issuer level and by economic sector. Our focus remains on identifying stocks with attractive relative valuations and the ability to exceed investors’ expectations.

Leading sectors contributing to the Fund’s performance included consumer discretionary, industrials, and health care. Conversely, the utilities, communication services, and energy sectors were the least impactful to the Fund’s absolute performance, with the utilities sector partially detracting from overall returns. Sector allocation was positive, with tailwinds from underweights to the real estate and utilities sectors along with an overweight to the information technology sector exceeding the headwinds from the Fund’s small cash position along with an underweight to the energy sector and an overweight to the industrials sector. Stock selection was the primary driver of the Fund’s relative underperformance, with the effects of contributors in the consumer discretionary, financials, and industrials sectors falling short of those of the detractors in information technology, health care, and real estate sectors.

Turning to individual stocks, the most severe detractors from the Fund’s performance included Intercept Pharmaceuticals Inc, a biotech developing therapies to treat chronic liver diseases, which reeled from the complete response letter (CRL) it received from Food and Drug Administration (FDA) regarding its Nonalcoholic Steatohepatitis (NASH) (fatty-liver disease) New Drug Application (NDA) filing. Subsequently, absent FDA guidance, the Fund’s management lacked clarity on a regulatory pathway forward and sold the stock. Another detractor from the Fund’s performance was FTI Consulting Inc, a business consulting firm, which was under modest pressure as the company’s litigation related business was impacted by COVID-19 delays which were partially offset by initial significant demand in its bankruptcy restructuring practice. That being said, the expected bankruptcy upcycle stopped relatively quickly as the market was flush with liquidity, removing near-term bankruptcy risks for a number of industries and companies. Lastly, Portland General Electric Co (POR), modestly underperformed its regulated utility peer group, the benchmark’s worst performing sector during the reporting period. POR underperformed after lowering its 2020 earnings guidance due to concerns over customer non-payment due to COVID-19 related job losses, and then again, after unfounded reports that the company was responsible for igniting the Riverside wildfire in Oregon.

Top individual stock contributors to the Fund’s performance included RH (formerly Restoration Hardware), a furniture retailer, reported better-than-expected results and guidance as consumer demand trends towards home spending continued. The company appears very well positioned at the high-end as there are increases in second and third home ownership and a movement toward suburban living from smaller dwellings in urban locations. Such trends likely create a strong sustainable demand trend for home furnishings. Another contributor to the Fund’s performance, Lithia Motors Inc ‘A’, an auto retailer, reported better-than-expected results driven by a resurgence in demand and much

| See benchmark definitions on A-37 – A-39 |

A-18

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

stronger margins. In addition, the company officially introduced its omni channel offering “Driveway” which is expected to generate sizable earnings contribution over the next 5 years. This initiative along with an aggressive acquisition strategy and improving core growth, the company provided a $50 earnings per share goal within 5 years, which is higher than current profit levels.

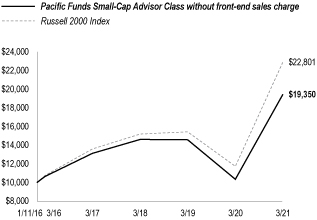

Pacific Funds Small-Cap (managed by Rothschild & Co Asset Management US Inc.)

Q. How did the Fund perform for the year ended March 31, 2021?

A. For the year ended March 31, 2021, Pacific Funds Small-Cap’s Advisor Class (without sales charge) returned 87.51%, compared to a return of 94.85% for its benchmark, the Russell 2000 Index.

The following graph compares the performance of a hypothetical $10,000 investment in Advisor Class shares of the Fund to its benchmark for the period from inception through March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class A, C, and R6 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Advisor Class underperformed the benchmark. We at Rothschild & Co implement the Fund’s strategy by investing in common stocks and other equity securities of small capitalization U.S. companies. We analyze a variety of quantitative and fundamental inputs in making stock decisions and seek to build a portfolio that is well diversified at the issuer level and by economic sector. Our focus remains on identifying stocks with attractive relative valuations and the ability to exceed investors’ expectations.

Leading sectors contributing to the Fund’s performance included consumer discretionary, industrials, and health care. Conversely, the utilities, energy, and communication services sectors were the least impactful to the Fund’s absolute performance, with the utilities sector partially detracting from overall returns. Sector allocation was positive, with tailwinds from an overweight to the consumer discretionary sector and an underweight to the utilities and financials sectors exceeding the headwinds from the Fund’s small cash position along with underweights to the materials and energy sectors. Stock selection was the primary driver of the Fund’s relative under performance, with the effects of contributors in the consumer discretionary, financials, and consumer staples sectors falling short of those of the detractors in the health care, information technology, and real estate sectors.

Turning to individual stocks, the most severe detractors from the Fund’s performance included Intercept Pharmaceuticals Inc, a biotech developing therapies to treat chronic liver diseases, which reeled from the complete response letter (CRL) it received from FDA regarding its NASH (fatty-liver disease) NDA filing. Subsequently, absent FDA guidance, the Fund’s management lacked clarity on a regulatory pathway forward and sold the stock. Another detractor from the Fund’s performance was FTI Consulting Inc, a business consulting firm, which was under modest pressure as the company’s litigation related business was impacted by COVID-19 delays which were partially offset by initial significant demand in its bankruptcy restructuring practice. That being said, the expected bankruptcy upcycle stopped relatively quickly as the market was flush with liquidity, removing near-term bankruptcy risks for a number of industries and companies. Lastly, Novavax, a vaccine drug company, reported best-in-class COVID-19 vaccine safety and efficacy in both the original wild-type virus and variants in its United Kingdom (U.K.) clinical study back in January 2021. Following these positive results the stock was purchased in the Fund however, it weakened after the company disclosed a slight delay to the read-out of its important U.S./Mexico clinical study required for FDA approval from March 2021 to April 2021. The other driving force of the stock’s pullback was that the stock possessed a tremendous amount of momentum, a factor which fell out of favor in the last two weeks of February 2021.

| See benchmark definitions on A-37 – A-39 |

A-19

Table of Contents

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Top individual stock contributors to the Fund’s performance included Lithia Motors Inc ‘A’, an auto retailer, which reported better-than-expected results driven by a resurgence in demand and much stronger margins. In addition, the company officially introduced its omni channel offering “Driveway” which is expected to generate sizable earnings contribution over the next 5 years. This initiative along with an aggressive acquisition strategy and improving core growth, the company provided a $50 earnings per share goal within 5 years, which is higher than current profit levels. Another contributor to the Fund’s performance, Horizon Therapeutics PLC, successfully launched Tepezza, an orphan thyroid eye disease drug, that became one of the best all-time orphan drug launches. The company launched the drug in February 2020 and raised sales guidance consecutively in its first four quarters following launch, from an initial expectation of $60 million to finish the fiscal fear 2020 with sales over $800 million.

Pacific Funds Small-Cap Value (managed by Rothschild & Co Asset Management US Inc.)

Q. How did the Fund perform for the year ended March 31, 2021?

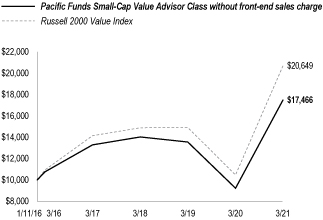

A. For the year ended March 31, 2021, Pacific Funds Small-Cap Value’s Advisor Class (without sales charge) returned 89.25%, compared to a return of 97.05% for its benchmark, the Russell 2000 Value Index.

The following graph compares the performance of a hypothetical $10,000 investment in Advisor Class shares of the Fund to its benchmark for the period from inception through March 31, 2021. For comparison purposes, the performance of all classes for the periods ended March 31, 2021 are also shown in the table below. Performance data for Class A, C, and R6 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

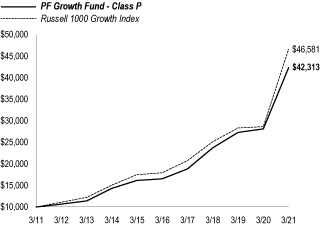

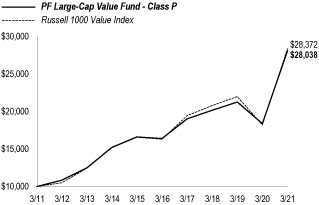

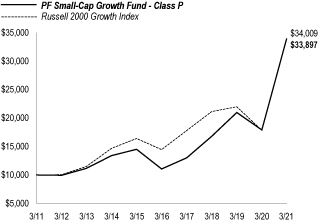

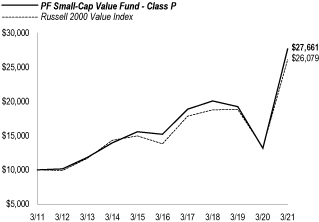

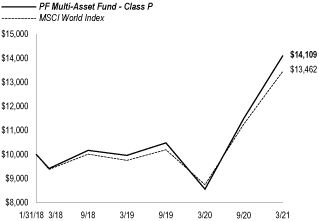

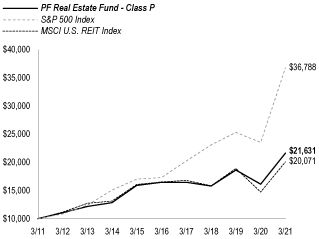

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.