UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10385

Pacific Funds Series Trust (formerly called Pacific Life Funds)

(Exact name of registrant as specified in charter)

700 Newport Center Drive, P.O. Box 7500

Newport Beach, CA 92660

(Address of principal executive offices) (Zip code)

Robin S. Yonis

Vice President and General Counsel of Pacific Funds Series Trust

700 Newport Center Drive, P.O. Box 9000

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Anthony H. Zacharski, Esq.

Dechert LLP

90 State House Square

Hartford, CT 06103

Registrant’s telephone number, including area code: 949-219-6767

Date of fiscal year end: March 31

Date of reporting period: March 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270 30e-1).

ANNUAL REPORT

AS OF MARCH 31, 2015

| TABLE OF CONTENTS |

||

| A-1 | ||

| A-2 | ||

| B-1 | ||

| C-1 | ||

| C-3 | ||

| C-5 | ||

| C-9 | ||

| D-1 | ||

| E-1 | ||

| F-1 | ||

| F-2 | ||

| F-4 | ||

| Approval of Investment Advisory Agreement and Sub-Advisory Agreements |

F-7 | |

| F-19 |

Pacific Funds Series Trust, which is a Delaware statutory trust, may be referred to as “Pacific Funds”

(formerly named Pacific Life Funds) or the “Trust”.

PACIFIC FUNDS

We are pleased to share with you the Annual Report dated March 31, 2015 for Pacific Funds Series Trust (“Pacific Funds” or the “Trust”). Pacific Funds is comprised of 34 funds, 12 of which are included in this report (each individually, a “fund” and collectively, the “funds”) and are available for direct investment. Pacific Life Fund Advisors LLC (PLFA), as Adviser to the funds, manages Pacific FundsSM Portfolio Optimization Conservative, Pacific FundsSM Portfolio Optimization Moderate-Conservative, Pacific FundsSM Portfolio Optimization Moderate, Pacific FundsSM Portfolio Optimization Growth, Pacific FundsSM Portfolio Optimization Aggressive-Growth funds (Portfolio Optimization Funds) and Pacific FundsSM Diversified Alternatives. Each of the Portfolio Optimization Funds and Pacific Funds Diversified Alternatives is an asset allocation “fund of funds” and invests in certain other funds (PF Underlying Funds) of the Trust. PLFA supervises the management of the PF Underlying Funds which are only available for investment by the Portfolio Optimization Funds and Pacific Funds Diversified Alternatives and are included in a separate PF Underlying Funds Annual Report. Please see “Where to Go for More Information” for instructions on how to obtain the PF Underlying Funds’ Annual Report. PLFA also does business under the name “Pacific Asset Management” and manages Pacific FundsSM Short Duration Income, Pacific FundsSM Core Income, Pacific FundsSM Strategic Income, Pacific FundsSM Floating Rate Income, Pacific FundsSM Limited Duration High Income, and Pacific FundsSM High Income under that name. The Adviser and Pacific Asset Management and their funds as of March 31, 2015 are listed below:

| Manager | Fund | Page Number | ||

| Pacific Life Fund Advisors LLC (PLFA) | Pacific FundsSM Portfolio Optimization Conservative (formerly named PL Portfolio Optimization Conservative) | A-5 | ||

| Pacific FundsSM Portfolio Optimization Moderate-Conservative (formerly named PL Portfolio Optimization Moderate-Conservative) | A-7 | |||

| Pacific FundsSM Portfolio Optimization Moderate (formerly named PL Portfolio Optimization Moderate) | A-9 | |||

| Pacific FundsSM Portfolio Optimization Growth (formerly named PL Portfolio Optimization Moderate-Aggressive) | A-11 | |||

| Pacific FundsSM Portfolio Optimization Aggressive-Growth (formerly named PL Portfolio Optimization Aggressive) | A-13 | |||

| Pacific FundsSM Diversified Alternatives (formerly named PL Diversified Alternatives) | A-14 | |||

| Pacific Asset Management | Pacific FundsSM Short Duration Income (formerly named PL Short Duration Bond) | A-15 | ||

| Pacific FundsSM Core Income (formerly named PL Income) | A-16 | |||

| Pacific FundsSM Strategic Income (formerly named PL Strategic Income) | A-17 | |||

| Pacific FundsSM Floating Rate Income (formerly named PL Floating Rate Income) | A-18 | |||

| Pacific FundsSM Limited Duration High Income (formerly named PL Limited Duration High Income) | A-19 | |||

| Pacific FundsSM High Income (formerly named PL High Income) | A-20 |

We appreciate your confidence in the Trust and look forward to serving your financial needs in the years to come.

Sincerely,

|

| |

| James T. Morris | Mary Ann Brown | |

| Chairman of the Board | Chief Executive Officer | |

| Pacific Funds Series Trust | Pacific Funds Series Trust |

A-1

PACIFIC FUNDS PERFORMANCE DISCUSSION

This Annual Report is provided for the general information of investors with beneficial interests in the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus, as supplemented, which contains information about the Trust and each of its funds, including their investment objectives, risks, charges and expenses. You should read the prospectus carefully before investing. There is no assurance that a fund will achieve its investment objective. Each fund is subject to market risk. The net asset value (NAV) of a fund changes as the value of its assets go up or down. The value of a fund’s shares will fluctuate, and when redeemed, may be worth more or less than their original cost. The total return for each fund includes reinvestment of all dividends and capital gain distributions, if any, and does not include deductions of any applicable sales charges. Past performance is not predictive of future performance.

This report shows you the performance of the funds compared to benchmark indices. Index performance is provided for illustrative and comparative purposes only and does not predict or depict the performance of the funds. Indices are unmanaged, do not incur transaction costs and cannot be purchased directly by investors. Index returns include reinvested dividends.

The composite benchmarks for the Portfolio Optimization Funds are composed of up to four broad-based indices. The percentage amounts of each broad-based index within each composite benchmark are based on each fund’s target asset class allocations in effect during the reporting period. The percentages attributed to a broad-based index within a composite benchmark will change if a fund’s target asset class allocations change.

PLFA has written the general market conditions commentary which expresses PLFA’s opinions and views on how the market generally performed for the year ended March 31, 2015. PLFA does business under the name “Pacific Asset Management” and manages the Pacific Funds Short Duration Income, Pacific Funds Core Income, Pacific Funds Strategic Income, Pacific Funds Floating Rate Income, Pacific Funds Limited Duration High Income, Pacific Funds High Income funds under that name.

All views are subject to change at any time based upon market or other conditions, and the Trust, its Adviser and Pacific Asset Management disclaim any responsibility to update such views. Any references to “we”, “I”, or “ours” are references to the Adviser or Pacific Asset Management. The Adviser and Pacific Asset Management may include statements that constitute “forward-looking statements” under the United States (U.S.) securities laws. Forward-looking statements include information concerning possible or assumed future results of the Trust’s investment operations, asset levels, earnings, expenses, industry or market conditions, regulatory developments and other aspects of the Trust’s operations or general economic conditions. In addition, when used in this report, predictive verbs such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “projects” and future or conditional verbs such as “will”, “may”, “could”, “should”, and “would”, or any other statement that necessarily depends on future events, are intended to identify forward-looking statements. Forward-looking statements are not guarantees of performance or economic results. They involve risks, uncertainties and assumptions. Although such statements are based on expectations that the Adviser or Pacific Asset Management believe to be reasonable, actual results may differ materially from expectations. Investors must not rely on any forward-looking statements.

In connection with any forward-looking statements and any investment in the Trust, investors should carefully consider the investment objectives, policies and risks described in the Trust’s current prospectus, as supplemented, and Statement of Additional Information, as supplemented, as filed with the Securities and Exchange Commission (SEC), which may be obtained from the SEC’s website at www.sec.gov.

Market Conditions (for the year ended March 31, 2015)

Executive Summary

Over the reporting period, markets around the world began to diverge as major central banks veered in different paths. The Federal Reserve (Fed) led by the newly appointed Chairperson, Janet Yellen, continued to unwind its third quantitative easing program (QE3) and finally ended the bond-buying stimulus program in the fourth quarter of 2014. The Fed opted to end QE3 based on signs of stabilizing economic growth, improving employment conditions, and contained inflation expectations.

While economic fundamentals seemed relatively upbeat in the U.S., many other nations did not share in America’s good fortunes. The European Central Bank (ECB) and the Bank of Japan (BoJ) continued to aggressively provide stimulus to boost the recovery of their struggling economies. Over the summer of 2014, the ECB lowered the deposit rate for banks into negative territory for the first time. This effectively penalized banks for keeping funds with the ECB and thus, incentivized them to lend to each other so that capital would eventually flow throughout the economy. The BoJ also stepped up its commitment to boost the economy through Japanese bond and stock purchases to channel cash into the markets. Additional Japanese policies sought to further depreciate the yen in an attempt to boost exports.

Emerging market countries faced numerous challenges throughout the reporting period. Several Asian countries felt the squeeze from the weakening yen, which gave an advantage to Japanese exporters at the expense of other Asian exporters. Looking eastward, Russia felt the most pressure throughout the reporting period, starting with its altercations with Ukraine that led to increased international sanctions. Subsequently, oil prices plunged as supply started outstripping demand in large part due to the shale boom in the U.S. Since Russia’s economy depends on energy revenue, tumbling oil prices had devastating effects and led to the collapse of the ruble. Low oil prices also affected other emerging market economies. Net energy exporting countries in Latin America suffered heavily as oil lost approximately half its value over the second half of 2014.

In general, these global developments fueled the supranormal U.S. dollar rally over the second half of 2014. Tensions and negative economic developments outside the U.S. led to further downward pressure on foreign investments, while domestic assets appreciated due to a healthier U.S. economy. Improving economic growth and hiring activity in the U.S. helped shelter domestic markets from problems around the world. The following sections highlight how specific market segments responded to the events that unfolded over the reporting period.

See benchmark definitions on page A-21

A-2

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Fixed Income

Bond yields fell despite the Fed reducing its bond purchases, which would typically be expected to have downward pressure on bond prices and push up interest rates. The yield on the 10-year Treasury started the reporting period at 2.72% and finished at 1.97%. Low inflationary expectations contributed to falling yields as inflation remained tame in the U.S. while Europe and Japan confronted deflationary conditions. Furthermore, nominal yields on German bunds and Japanese bonds remained well below those of comparable Treasury bonds. This made Treasuries more attractive on a relative basis, which further contributed to falling interest rates. Other factors that further reduced Treasury yields included geopolitical tensions in Ukraine and the Middle East that led investors to seek safe haven assets like U.S. Treasury bonds.

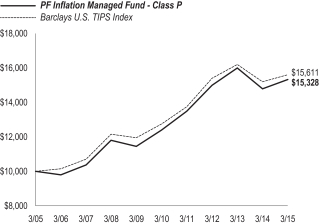

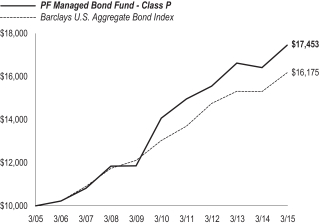

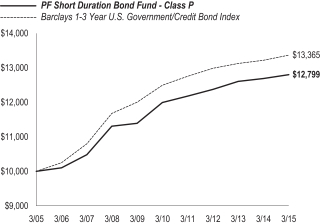

For the reporting period, the broad fixed income market (as measured by the Barclays U.S. Aggregate Bond Index) gained 5.72%. Long-term Treasuries were among the top performers within the fixed income market as they benefited from investors seeking safety and yield. The investment-grade credit category also delivered solid gains and outperformed the high yield group over the reporting period. A sizable portion of high yield issuers is in energy-related industries; and thus, they were negatively affected by the slump in oil prices. The emerging markets debt category had mixed results. U.S. dollar-denominated emerging markets debt performed well. On the other hand, local currency-denominated instruments were negatively affected by the surge in the U.S. dollar and faced losses over the reporting period. The Treasury Inflation-Protected Securities (TIPS) category earned modest gains but underperformed the broad fixed income market due to low inflation expectations. Short duration bonds (e.g. short-term credit and bank loans) have less sensitivity to interest rates; therefore, they did not benefit from falling yields and lagged the broad fixed income market.

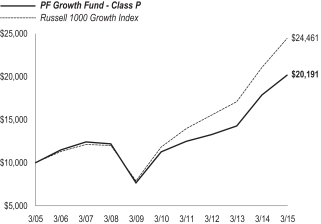

Domestic Equity

The U.S. equity market had its sixth consecutive positive calendar year performance, and the S&P 500 Index returned 12.73% over the reporting period. The broad domestic equity market generally maintained its upward momentum. Large- and mid-capitalization stocks outperformed small-capitalization stocks. From a valuation perspective, small-capitalization stocks were relatively overvalued compared to their larger counterparts. With respect to style, growth outpaced value. Over the reporting period, healthy mergers & acquisitions (M&A) activity helped several sectors, particularly health care. Responses to the Affordable Care Act primarily fueled the M&A activity in the sector as industry participants resorted to consolidation to help offset the expense of covering and treating the increase in insured patients. Real estate investment trusts (REITs), which tend to have relatively high dividend payouts, also performed very well. The Financial Times Stock Exchange National Association of Real Estate Investment Trust (FTSE NAREIT) Equity REITs Index surged 23.95% over the reporting period. On the other end of the spectrum, the energy sector was the only sector to have losses over the reporting period, which was driven by plunging oil prices.

International Equity

The foreign equity market struggled over the reporting period as several key central banks tried to stave off further economic woes while other nations struggled with geopolitical issues and/or crashing oil prices. The Morgan Stanley Capital International Europe, Australasia, and Far East (MSCI EAFE) Index and the MSCI Emerging Markets Index returned -0.92% and 0.44%, respectively. Actions by the BoJ helped lift Japanese stocks higher, which primarily contributed to the performance of the MSCI EAFE Index. However, the United Kingdom (U.K.) offset much of that contribution. Regarding the U.K., approximately one-quarter of its companies represented in the MSCI EAFE Index are linked to commodities. Commodities, especially energy, experienced a sharp decline over the reporting period. A slowdown in China and other parts of the world, as well as an excess supply of oil, contributed to falling commodity prices. Among the countries represented in the MSCI Emerging Markets Index, Russia, South Korea and Brazil were the top detractors from performance. Russia and Brazil felt the pain caused by the impact of falling commodities; whereas, South Korea was hurt by the softer demand from China and a weaker yen, which made Japanese goods relatively cheaper than Korean goods. While the Chinese economy has been decelerating, a flood of credit jolted its equity market higher, which offset some of the detractors.

Commodities

The global slowdown created a challenging condition for commodities over the reporting period. Among the various commodity groups, the energy category experienced the deepest hardship, losing nearly half its value over the reporting period. A global reduction in demand in conjunction with an oversupply of oil contributed to slumping energy prices. Although the metals category (which includes precious and industrial metals) had moderately negative returns, they fared better than other major commodity categories. Nevertheless, precious metals fell as the U.S. dollar rallied sharply over the second half of 2014.

Concluding Remarks

The Fed is expected to begin hiking rates in the second half of 2015, as the U.S. economy remains relatively healthy. It should be noted that equity markets typically have not experienced a correction during the earlier stage of monetary tightening. This is generally due to central banks raising rates when their respective economies are doing well. Sound economic conditions and a revival in M&A activity should help the domestic equity market stay afloat. Valuations of domestic equities may appear relatively elevated, but they are not at bubble levels as seen during the “tech boom” period. Current valuations may be justified by solid earnings as well as low inflation and interest rates (i.e. cost of capital). Stable economic conditions should also keep default levels benign, which justify tighter bond spreads. However, energy and related sectors may continue to face challenges if oil prices fall further or remain stagnant.

Overseas, the ECB and BoJ are anticipated to either continue or expand their quantitative easing programs. These efforts may improve their respective economic growth potential and boost their equity markets. Reviving economic growth should translate into improvements in earnings, which have lagged in recent periods. The divergence in monetary policies between the U.S. and many other major nations may also keep the U.S. dollar at elevated levels. This may benefit those that export to the U.S. since their goods and services will be relatively cheaper.

| See benchmark definitions on page A-21 |

A-3

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Continued deceleration of growth in China will likely affect several developing nations that have depended on its rapid expansion. In the past, Chinese regulators have responded to signs of a slowdown by implementing various stimulus plans to rejuvenate the economy. Recently, China has been the driving force behind the Asian Infrastructure Investment Bank (AIIB). While this entity could stimulate infrastructure development and complement China’s New Silk Road initiative, much of these efforts are still in very early stages with many challenges ahead, and are unlikely to have an immediate impact on economic activity. China’s New Silk Road envisions a region where currency exchanges are fluid and easy, a kind of economic trade route that will represent China’s visions for an interdependent economic and political community stretching from East Asia to Western Europe.

Global financial markets will continue to face hurdles and deal with uncertainties of geopolitical risks. Europe continues to deal with a potential ousting of Greece from the European Union, which could elevate short-term volatility. Additionally, the energy sector continues to deal with a supply glut that has suppressed oil prices. This helps oil consumers but hurts producers. Despite many of these risks, there are potential opportunities to monitor and seek to capitalize down the road.

Performance of the Portfolio Optimization Funds and Pacific Funds Diversified Alternatives

The performance of the Portfolio Optimization Funds and Pacific Funds Diversified Alternatives are composites of the performance of each of the PF Underlying Funds in which each invests (which may include bonds, domestic and/or international equities). The Portfolio Optimization Funds and Pacific Funds Diversified Alternatives are compared to a single broad-based industry index; however, because these funds are a composite of various asset classes, there is no one broad-based industry index to use as a complete comparison with these funds. To assist in performance comparisons, composite benchmarks were constructed for the Portfolio Optimization Funds. Each composite benchmark is comprised of up to four broad-based indices shown below. The composite benchmarks were constructed with allocations to each asset class that correspond to the target allocations for Portfolio Optimization Funds. However, the actual allocations of any Portfolio Optimization Fund will naturally vary from these targets as a result of market performance over time. Pacific Funds Diversified Alternatives does not have a composite benchmark. The one-year performance for these broad-based indices is shown in the following table.

| Broad Based Indices |

One Year (as of 3-31-15) |

|||

| S&P 500 Index (U.S. Stocks) |

12.73% | |||

| Morgan Stanley Capital International (MSCI) EAFE Index (Net) (International Stocks) |

(0.92% | ) | ||

| Barclays U.S. Aggregate Bond Index (Fixed Income) |

5.72% | |||

| BofA Merrill Lynch U.S. 3-Month T-Bill Index (Cash) |

0.03% | |||

| See benchmark definitions on page A-21 |

A-4

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Portfolio Optimization Conservative (managed by Pacific Life Fund Advisors LLC)

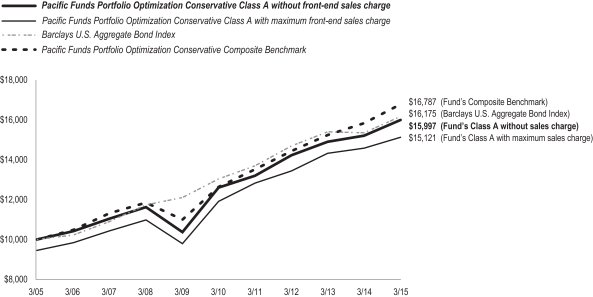

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Portfolio Optimization Conservative’s Class A (without sales charge) returned 3.71%, compared to a 5.72% return for the Barclays U.S. Aggregate Bond Index, and a 6.07% return for the Pacific Funds Portfolio Optimization Conservative Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the fund to its benchmarks for the ten-year period ended March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class B, C, R and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| See benchmark definitions on page A-21 |

A-5

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class A underperformed the Pacific Funds Portfolio Optimization Conservative Composite Benchmark. The fund was primarily comprised of various fixed income strategies, with a small allocation to equity and alternative funds, during the reporting period. Fixed income investments included PF Underlying Funds comprised of intermediate-term bonds, short duration securities, inflation-protected bonds, emerging markets bonds, and floating rate loans. The equity segment mainly encompassed domestic and foreign large-capitalization funds. Alternatives included two absolute return strategies and a precious metals fund.

From the broad asset class perspective, the fund’s fixed income group underperformed the Barclays U.S. Aggregate Bond Index and was the primary detractor from performance. The domestic equity group underperformed the S&P 500 Index, while the international equity group was in-line with MSCI EAFE Index. The alternative funds had mixed results and detracted from performance as a group.

With interest rates falling, short duration bonds struggled over the reporting period. Among the underlying fixed income holdings of the fund, the PF Short Duration Bond Fund was one of the largest detractors. The PF Emerging Markets Debt Fund also dragged performance. Its allocation and security selection in Russia and Ukraine was unfavorable as the conflict between the two countries continued. The surging U.S. dollar also negatively affected the fund’s local currency-denominated holdings. On the other hand, the PF Managed Bond Fund contributed positively to performance. The co-sub-advised fund benefited from duration positioning in Western Asset Management Company’s (“Western Asset”) portion of the fund.

Among the fund’s domestic equities group, growth strategies generally fared better than their value counterparts. Exposure to large-capitalization value funds (i.e. PF Comstock and PF Large-Cap Value Funds) were among the primary detractors within the domestic equity group. Within the foreign equity group, the PF International Large-Cap Fund outperformed the MSCI EAFE Index, but its contribution was offset by the underperformance that stemmed from the PF International Value Fund.

The underlying alternative funds, which generally have a low correlation to the broad equity and fixed income markets, had varying impacts on performance. The PF Global Absolute Return Fund contributed to performance as several of the strategy’s short and long positions benefited from geopolitical events as well as divergent actions taken by various central banks around the globe. The PF Currency Strategies Fund also earned positive returns over the reporting period. However, the PF Precious Metals Fund struggled as the U.S. dollar rallied and inflationary expectations fell.

| See benchmark definitions on page A-21 |

A-6

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Portfolio Optimization Moderate-Conservative (managed by Pacific Life Fund Advisors LLC)

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Portfolio Optimization Moderate-Conservative’s Class A (without sales charge) returned 4.69%, compared to a 5.72% return for the Barclays U.S. Aggregate Bond Index, and a 6.91% return for the Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the fund to its benchmarks for the ten-year period ended March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class B, C, R and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| See benchmark definitions on page A-21 |

A-7

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class A underperformed the Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark. The fund maintained a diversified allocation mix that was modestly tilted toward fixed income during the reporting period. Fixed income investments included PF Underlying Funds that consisted of intermediate-term bonds as well as short duration securities, inflation-protected bonds, emerging markets bonds, and floating rate loans. The equity exposure was diversified across style (growth/value), market capitalization and region (including an allocation to foreign small-capitalization and emerging markets strategies). Alternatives included two absolute return strategies and a precious metals fund.

From the broad asset class perspective, the fund’s fixed income group underperformed the Barclays U.S. Aggregate Bond Index and was the primary detractor from performance. The domestic equity group underperformed the S&P 500 Index, while the international equity group contributed to performance. The alternative funds had mixed results over the reporting period.

With interest rates falling, short duration bonds struggled over the reporting period. Among the underlying fixed income holdings of the fund, the PF Short Duration Bond Fund was one of the largest detractors. The PF Emerging Markets Debt Fund also dragged performance. Its allocation and security selection in Russia and Ukraine was unfavorable as the conflict between the two countries continued. The surging U.S. dollar also negatively affected the fund’s local currency-denominated holdings. On the other hand, the PF Managed Bond Fund contributed positively to performance. The co-sub-advised fund benefited from duration positioning in Western Asset’s portion of the fund.

Among the fund’s domestic equities group, growth strategies generally fared better than their value counterparts. Exposure to large-capitalization value funds (i.e. PF Comstock and PF Large-Cap Value Funds) were among the primary detractors within the domestic equity group. Within the foreign equity group, the PF International Large-Cap Fund outperformed the MSCI EAFE Index, but its contribution was offset by the underperformance that stemmed from the PF International Value Fund. The PF International Small-Cap Fund performed well and helped returns.

The underlying alternative funds, which generally have a low correlation to the broad equity and fixed income markets, had varying impacts on performance. The PF Global Absolute Return Fund contributed to performance as several of the strategy’s short and long positions benefited from geopolitical events as well as divergent actions taken by various central banks around the globe. The PF Currency Strategies Fund also earned positive returns over the reporting period. However, the PF Precious Metals Fund struggled as the U.S. dollar rallied and inflationary expectations fell.

| See benchmark definitions on page A-21 |

A-8

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Portfolio Optimization Moderate (managed by Pacific Life Fund Advisors LLC)

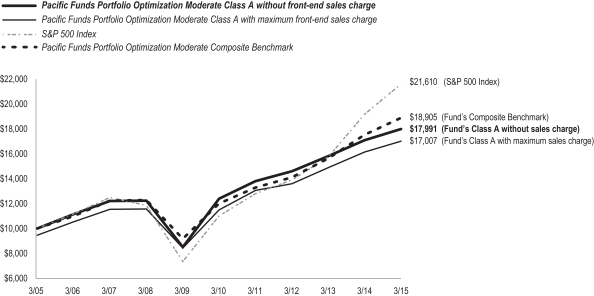

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Portfolio Optimization Moderate’s Class A (without sales charge) returned 5.30%, compared to a 12.73% return for the S&P 500 Index, and a 7.79% return for the Pacific Funds Portfolio Optimization Moderate Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the fund to its benchmarks for the ten-year period ended March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class B, C, R and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| See benchmark definitions on page A-21 |

A-9

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class A underperformed the Pacific Funds Portfolio Optimization Moderate Composite Benchmark. The fund maintained a mix of equity and fixed income funds. The equity exposure was diversified across style (growth/value), market capitalization and region (including allocations to foreign small-capitalization and emerging markets stocks). The fund also maintained exposure to select market sectors such as publicly traded REITs. Fixed income investments included intermediate-term bonds, short duration securities, inflation-protected bonds, emerging markets bonds, and floating rate loans. Alternatives consisted of two absolute return strategies and a precious metals fund.

From the broad asset class perspective, the domestic equity group underperformed the S&P 500 Index, while the international equity group was roughly in-line with the MSCI EAFE Index. The fund’s fixed income group underperformed the Barclays U.S. Aggregate Bond Index and detracted from performance. The alternative funds had mixed results but detracted from the performance overall.

Among the fund’s domestic equities group, growth strategies generally fared better than their value counterparts. Exposure to large-capitalization value funds (i.e. PF Comstock and PF Large-Cap Value Funds) were among the primary detractors within the domestic equity group. Within the foreign equity group, the PF International Large-Cap Fund outperformed the MSCI EAFE Index, but its contribution was offset by the underperformance that stemmed from the PF International Value and PF Emerging Markets Funds. The PF International Small-Cap Fund performed well and helped returns.

With interest rates falling, short duration bonds struggled over the reporting period. Among the underlying fixed income holdings of the fund, the PF Short Duration Bond Fund was among the top detractors. The PF Emerging Markets Debt Fund also dragged performance. Its allocation and security selection in Russia and Ukraine was unfavorable as the conflict between the two countries continued. The surging U.S. dollar also negatively affected the fund’s local currency-denominated holdings. On the other hand, the PF Managed Bond Fund contributed positively to performance. The co-sub-advised fund benefited from duration positioning in Western Asset’s portion of the fund.

The underlying alternative funds, which generally have a low correlation to the broad equity and fixed income markets, had varying impacts on performance. The PF Global Absolute Return Fund contributed to performance as several of the strategy’s short and long positions benefited from geopolitical events as well as divergent actions taken by various central banks around the globe. The PF Currency Strategies Fund also earned positive returns over the reporting period. However, the PF Precious Metals Fund struggled as the U.S. dollar rallied and inflationary expectations fell.

| See benchmark definitions on page A-21 |

A-10

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

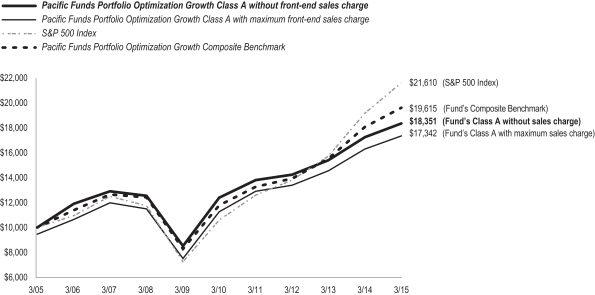

Pacific Funds Portfolio Optimization Growth (managed by Pacific Life Fund Advisors LLC)

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Portfolio Optimization Growth’s Class A (without sales charge) returned 6.36%, compared to a 12.73% return for the S&P 500 Index, and a 8.58% return for the Pacific Funds Portfolio Optimization Growth Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the fund to its benchmarks for the ten-year period ended March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class B, C, R and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| See benchmark definitions on page A-21 |

A-11

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class A underperformed the Pacific Funds Portfolio Optimization Growth Composite Benchmark. The fund maintained a diversified allocation mix that was tilted toward equity. The equity exposure was diversified across style (growth/value), market capitalization and region (including allocations to foreign small-capitalization and emerging markets stocks). The fund also maintained exposure to select market sectors such as publicly traded REITs. Fixed income investments included intermediate-term bonds as well as specific strategies such as short duration, inflation-protected bonds and emerging markets bonds. Alternatives included two absolute return strategies and a precious metals fund.

From the broad asset class perspective, the domestic equity group underperformed the S&P 500 Index, while the international equity group was roughly in-line with the MSCI EAFE Index. The fund’s fixed income group underperformed the Barclays U.S. Aggregate Bond Index and modestly detracted from performance. The alternative funds had mixed results and modestly detracted from performance as a group.

Among the fund’s domestic equities group, growth strategies generally fared better than their value counterparts. Exposure to large-capitalization value funds (i.e. PF Comstock and PF Large-Cap Value Funds) were among the primary detractors within the domestic equity group. Within the foreign equity group, the PF International Large-Cap Fund outperformed the MSCI EAFE Index, but its contribution was offset by the underperformance that stemmed from the PF International Value and PF Emerging Markets Funds. The PF International Small-Cap Fund performed well and helped returns.

With interest rates falling, short duration bonds struggled over the reporting period and the PF Short Duration Bond Fund detracted from performance. The PF Emerging Markets Debt Fund also dragged performance. Its allocation and security selection in Russia and Ukraine was unfavorable as the conflict between the two countries continued. The surging U.S. dollar also negatively affected the fund’s local currency-denominated holdings. On the other hand, the PF Managed Bond Fund contributed positively to performance. The co-sub-advised fund benefited from duration positioning in Western Asset’s portion of the fund.

The underlying alternative funds, which generally have a low correlation to the broad equity and fixed income markets, had varying impacts on performance. The PF Global Absolute Return Fund contributed to performance as several of the strategy’s short and long positions benefited from geopolitical events as well as divergent actions taken by various central banks around the globe. The PF Currency Strategies Fund also earned positive returns over the reporting period. However, the PF Precious Metals Fund struggled as the U.S. dollar rallied and inflationary expectations fell.

| See benchmark definitions on page A-21 |

A-12

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Portfolio Optimization Aggressive-Growth (managed by Pacific Life Fund Advisors LLC)

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Portfolio Optimization Aggressive-Growth’s Class A (without sales charge) returned 6.18%, compared to a 12.73% return for the S&P 500 Index, and a 8.56% return for the Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the fund to its benchmarks for the ten-year period ended March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class B, C, R and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

| See benchmark definitions on page A-21 |

A-13

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class A underperformed the Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark. The fund was primarily allocated to domestic and international equity funds that are diversified across style (growth/value), market capitalization and region (which included allocations to foreign small-capitalization and emerging markets stocks). The fund also maintained exposure to select sectors, such as publicly traded REITs, as well as a small allocation to intermediate-term fixed income securities. Alternatives included two absolute return strategies and a precious metals fund.

From the broad asset class perspective, the domestic equity group underperformed the S&P 500 Index, while the international equity group was relatively mixed. The fund’s fixed income group underperformed the Barclays U.S. Aggregate Bond Index and modestly detracted from performance. The alternative funds had mixed results and detracted from performance as a group.

Among the fund’s domestic equities group, growth strategies generally fared better than their value counterparts. Exposure to large-capitalization value funds (i.e. PF Comstock and PF Large-Cap Value Funds) were among the primary detractors within the domestic equity group. The PF Mid-Cap Equity Fund lagged behind its respective benchmark and hurt performance. On the other hand, the allocation to the PF Real Estate Fund added to performance. Within the foreign equity group, the PF International Large-Cap Fund outperformed the MSCI EAFE Index, but its contribution was offset by the underperformance that stemmed from the PF International Value and PF Emerging Markets Funds. The PF International Small-Cap Fund performed well and helped returns.

Among the fixed income funds, the PF Emerging Markets Debt Fund primarily dragged performance. Its allocation and security selection in Russia and Ukraine was unfavorable as the conflict between the two countries continued. The surging U.S. dollar also negatively affected the fund’s local currency-denominated holdings. On the other hand, the PF Managed Bond Fund contributed positively to performance. The co-sub-advised fund benefited from duration positioning in Western Asset’s portion of the fund.

The underlying alternative funds, which generally have a low correlation to the broad equity and fixed income markets, had varying impacts on performance. The PF Global Absolute Return Fund contributed to performance as several of the strategy’s short and long positions benefited from geopolitical events as well as divergent actions taken by various central banks around the globe. The PF Currency Strategies Fund also earned positive returns over the reporting period. However, the PF Precious Metals Fund struggled as the U.S. dollar rallied and inflationary expectations fell.

Pacific Funds Diversified Alternatives (managed by Pacific Life Fund Advisors LLC)

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Diversified Alternatives’ Class A (without sales charge) returned 3.19%, compared to a 0.02% return for its benchmark, the Citigroup 1-Month U.S. T-Bill Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the fund to its benchmark for the period from inception through March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class C and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

| Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. | ||

| See benchmark definitions on page A-21 |

A-14

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class A outperformed the benchmark. The fund was primarily comprised of PF Underlying Funds that invest in various non-traditional asset classes and investment strategies. The allocations include precious metals equities, currencies, and global absolute return strategies. The fund also maintained exposure to inflation-protected bonds, floating rate loan, real estate, emerging markets equity and emerging markets debt strategies.

The fund’s allocations to the PF Global Absolute Return, PF Currency Strategies, and PF Real Estate Fund were the top contributors to the fund’s performance. The PF Global Absolute Return and the PF Currency Strategies Funds’ short and long positions benefited from geopolitical events as well as divergent actions taken by various central banks around the globe. REITs continued to perform well as investors sought yields in the falling interest rate environment.

Among the detractors over the reporting period, the PF Precious Metals Fund primarily held back performance. The PF Precious Metals Fund invests primarily in gold mining stocks, which tend to be sensitive to movements in gold prices. Over the reporting period, gold prices fell as the U.S. dollar continued to appreciate and inflationary expectations were contained. Both PF Emerging Markets and PF Emerging Markets Debt Funds also suppressed fund performance as many developing regions were hurt by the sharp decline in oil prices and a slowdown in China.

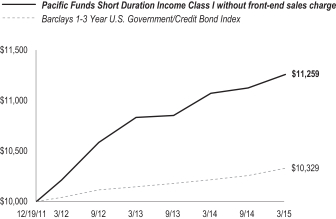

Pacific Funds Short Duration Income (managed by Pacific Asset Management)

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Short Duration Income’s Class I (without sales charge) returned 1.70%, compared to a 1.12% return for its benchmark, the Barclays 1-3 Year U.S. Government/Credit Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the fund to its benchmark for the period from inception through March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class A, C and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class I outperformed the benchmark. We at Pacific Asset Management managed the fund by focusing on short maturity investment grade corporate bonds. The fund maintained a flexibility to incorporate floating rate loans and high yield bonds. Individual investment selection was based on our fundamental research process. Sector allocations were determined based on our assessment of risk/return opportunities relative to the fund’s investment goal and benchmark weightings. We also performed a credit analysis on each potential issuer and a relative value analysis on each potential investment and invest in instruments that we believe to have the potential for capital appreciation.

The fund’s outperformance relative to the benchmark was primarily due to the fund’s focus on corporate debt securities versus government bonds. The outperformance was primarily driven by the income advantages of short duration corporate bonds versus the government bonds. The fund’s allocation to high yield and floating rate loans also benefited to its performance due to high income advantages versus the benchmark. The duration of the fund was generally in-line with the benchmark and neutral to performance. However, the fund’s underweighting in Treasuries versus the benchmark contributed to underperformance.

| See benchmark definitions on page A-21 |

A-15

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

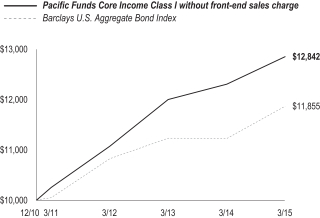

Pacific Funds Core Income (managed by Pacific Asset Management)

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Core Income’s Class I (without sales charge) returned 4.46%, compared to a 5.72% return for its benchmark, the Barclays U.S. Aggregate Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the fund to its benchmark for the period from inception through March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class A, C and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class I underperformed the benchmark. We at Pacific Asset Management managed the fund as an investment grade corporate bond fund invested principally in income producing debt instruments. Individual investment selection was based on our fundamental research process. Sector allocations were determined based on our assessment of risk/return opportunities. We performed a credit analysis on each potential issuer and a relative value analysis on each potential investment and invested in instruments that we believed to have the potential for capital appreciation.

For the reporting period, the fund’s underperformance compared to the benchmark was due to the fund’s structural focus on investment grade corporate debt versus other areas of the bond market, notably low quality investment grade and high yield. We pared back overweights to higher yielding assets in favor of higher quality names and cash. During the reporting period, the Treasury yields decreased significantly which led to the outperformance of duration risk versus credit risk. As a result, the fund’s focus on BBB-rated corporate bonds led to the fund’s underperformance as higher-quality bonds outperformed lower-quality bonds.

Overall risk was reduced during the reporting period given the sharp decline in commodity prices — led by oil — and a reduction in bid side liquidity. The fund’s asset allocation on corporate debt was the primary detractor from fund performance. The fund held a relatively consistent mix of investment grade securities and high yield and bank loan instruments during the reporting period. The asset allocation to high yield and bank loan instruments was a negative to fund performance as those sectors lack of duration risk led to underperformance versus higher-quality, more interest rate-sensitive instruments. The fund’s duration was below the benchmark for the reporting period, also a negative to relative fund performance. While the fund benefited from security selection and a higher average yield than the benchmark, the decrease in Treasury yields led to government bond outperformance.

| See benchmark definitions on page A-21 |

A-16

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Strategic Income (managed by Pacific Asset Management)

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Strategic Income’s Class I (without sales charge) returned 1.13%, compared to a 5.72% return for its benchmark, the Barclays U.S. Aggregate Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the fund to its benchmark for the period from inception through March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class A, C and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class I underperformed the benchmark. We at Pacific Asset Management managed the fund with a non-investment grade credit-focused strategy, with the flexibility to invest across various asset classes, including high yield bonds, bank loans, and investment grade corporate bonds. Individual investment selection is based on our fundamental research process. Sector allocations were determined based on our assessment of risk/return opportunities relative to the fund’s investment goal and benchmark weightings. We also performed a credit analysis on each potential issuer and a relative value analysis on each potential investment and invest in instruments that we believed to have the potential for capital appreciation.

The fund’s underperformance relative to the benchmark was due to the fund’s structural focus on non-investment grade corporate debt versus other areas of the bond market, notably government bonds. During the reporting period, Treasury yields decreased significantly, which led to the outperformance of duration risk versus credit risk. As a result, the fund’s focus on high yield bonds led to the fund’s underperformance as high quality bonds outperformed lower quality bonds.

The fund’s asset allocation varied during the reporting period as the fund has broad flexibility to invest across credit markets. The fund held between 42-51% in high yield bonds, which provided the core allocation of the fund. Bank loans accounted for between 14-25% of the allocation and investment grade corporate bonds accounted for a steady 24% of the allocation during the reporting period. The fund’s duration was below the benchmark during the reporting period, a negative to relative performance given the strong drop in Treasury yields. While the fund benefited from a higher average yield than the benchmark, the decrease in Treasury yields as seen in the U.S. Treasury Index, which underperformed the benchmark during the reporting period, led to government bond outperformance and thus, fund underperformance.

| See benchmark definitions on page A-21 |

A-17

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

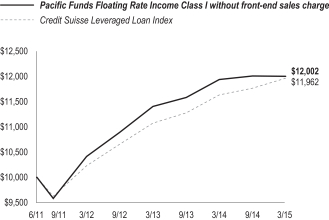

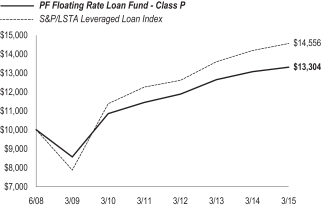

Pacific Funds Floating Rate Income (managed by Pacific Asset Management)

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Floating Rate Income’s Class I (without sales charge) returned 0.55%, compared to a 2.83% return for its benchmark, the Credit Suisse Leveraged Loan Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the fund to its benchmark for the period from inception through March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class A, C, P and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class I underperformed the benchmark. We at Pacific Asset Management managed the fund by investing primarily in non-investment grade floating rate loans and debt securities. We managed the strategy in a selective approach, focusing on the larger issuers. Individual investment selection was based on our fundamental research process and an assessment of the investment’s relative value. We also performed a credit analysis on each potential investment.

The fund’s underperformance relative to the benchmark for the reporting period was due to three factors: focus on large-capitalization issuers, overweight to B- versus BB-rated loans, and the fund’s security selection in metals/mining and energy. During the reporting period, large-capitalization issuers, which we define as greater than $300 million in loan/facility size, underperformed smaller-capitalization issuers. While delivering lower overall credit risk compared to the benchmark, the fund’s quality bias delivered lower coupon income compared to the benchmark. The benchmark’s yield advantage thus served as a headwind in terms of the fund’s relative performance. For the reporting period, the significant drop in base metal and oil prices contributed to sharp drops in the valuations for energy and mining companies, which hurt performance. The fund’s overweight positions in retail, food and drug, housing, and forest products/containers and its underweight positions in media/telecommunications and utility sectors benefited performance. The fund’s overweighting in energy and underweighting in information technology detracted from performance. Overall, credit selection was a detractor from performance.

| See benchmark definitions on page A-21 |

A-18

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Limited Duration High Income (managed by Pacific Asset Management)

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds Limited Duration High Income’s Class I (without sales charge) returned -0.89%, compared to a 0.49% return for its benchmark, the Barclays U.S. 1–5 Year High-Yield Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the fund to its benchmark for the period from inception through March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class A, C and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class I underperformed the benchmark. We at Pacific Asset Management managed the fund by focusing on non-investment grade high yield bonds and floating rate loans. The fund is designed to provide a flexible approach to investing in non-investment grade credit focused sectors. Individual investment selection was based on our fundamental research process. Sector allocations were determined based on our assessment of risk/return opportunities relative to the fund’s investment goal and benchmark weightings. We also performed a credit analysis on each potential issuer and a relative value analysis on each potential investment and invest in instruments that we believed to have the potential for capital appreciation.

The fund underperformed the benchmark for the reporting period due to security selection and overweights to energy related issuers. During the reporting period, BB-rated bonds outperformed lower-quality bonds given the sharp drop in Treasury yields which led to outperformance of duration risk versus credit risk. As a result, the fund’s overweight to CCC- and B-rated issuers detracted from performance. During the reporting period, the sharp drop in oil prices led to selling pressure, weakened valuations, and negative performance for energy related companies. The fund’s overweight to packaging benefited performance. Overall, credit selection was a detractor from performance.

| See benchmark definitions on page A-21 |

A-19

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds High Income (managed by Pacific Asset Management)

Q. How did the fund perform for the year ended March 31, 2015?

A. For the year ended March 31, 2015, Pacific Funds High Income’s Class I (without sales charge) returned -0.30%, compared to a 2.00% return for its benchmark, the Barclays U.S. High-Yield 2% Issuer Capped Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the fund to its benchmark for the period from inception through March 31, 2015. For comparison purposes, the performance of all classes for the periods ended March 31, 2015 are also shown in the table below. Performance data for Class A, C, P and Advisor Class shares will vary due to differences in fees and sales charges. The fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

|

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Q. Discuss both positive and negative factors that materially affected the fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the fund’s Class I underperformed the benchmark. We at Pacific Asset Management managed the fund by focusing on non-investment grade securities, primarily high yield bonds. Individual investment selection was based on our fundamental research process. Sector allocations were determined based on our assessment of risk/return opportunities relative to the fund’s investment goal and benchmark weightings. We also performed a credit analysis on each potential issuer and a relative value analysis on each potential investment.

The fund underperformed the benchmark due to security selection and credit quality allocation. During the reporting period, BB-rated bonds outperformed lower-quality bonds given the sharp drop in Treasury yields, which led to outperformance of duration risk versus credit risk. As a result, credit quality allocation negatively contributed to performance as the fund was overweight B-rated and CCC-rated securities. A sizable overweight in bonds with zero- to two-year durations detracted from performance, as this was the weakest duration segment in the benchmark. Underweights in bonds with durations of five- to ten-years and ten or more years also hurt, as longer-duration bonds outperformed. The fund’s security selection in energy detracted from performance. Additionally, the significant drop in oil prices during the reporting period led to selling pressure and negative returns from energy related companies, and was a detractor from fund performance. The fund’s overweight to building materials and gaming contributed to performance.

| See benchmark definitions on page A-21 |

A-20

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Benchmark Definitions

Barclays 1-3 Year U.S. Government/Credit Bond Index measures performance of U.S. dollar-denominated U.S. Treasuries, government-related, and investment grade U.S. corporate securities with maturities of one to three years.

Barclays U.S. 1-5 Year High-Yield Index is an index that covers the universe of fixed-rate, non-investment-grade debt with maturities between one and five years.

Barclays U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bonds market, which includes investment grade U.S. government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the index must have at least 1 year remaining to maturity. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, non-convertible, and taxable.

Barclays U.S. High-Yield 2% Issuer Capped Bond Index is an index that is an issuer-constrained version for the U.S. Corporate High-Yield Index that covers the U.S. dollar-denominated, non-investment grade fixed-rate taxable corporate bond market and limits issuer exposures to a maximum of 2% and redistributes the excess market value index-wide on a pro-rata basis. The total return is equal to the change in price plus the coupon return.

BofA Merrill Lynch U.S. 3-Month Treasury Bill (T-Bill) Index is an index comprised of a single Treasury bill issue purchased at the beginning of the month and held for a full month, then sold and rolled into a newly selected Treasury bill issue. Results include the reinvestment of all distributions.

Citigroup 1-Month U.S. Treasury Bill (T-Bill) Index is a market value-weighted index of public obligations of the U.S. Treasury with maturities of one month.

Credit Suisse Leveraged Loan Index tracks the investable market of the U.S. dollar-denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries.

Morgan Stanley Capital International (MSCI) Europe, Australasia and Far East (EAFE) Index (Net) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. As of March 31, 2015, the MSCI EAFE Index (Net) consists of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The word “(Net)” in the index name means the net total return for the index, which includes the reinvestment of dividends after the deduction of withholding tax, applying the tax rate to non-resident individuals who do not benefit from double taxation treaties.

Pacific Funds Portfolio Optimization Conservative Composite Benchmark (formerly named PL Portfolio Optimization Conservative Composite Benchmark) is 73% Barclays U.S. Aggregate Bond; 15% S&P 500; 7% BofA Merrill Lynch U.S. 3-Month Treasury Bill; and 5% MSCI EAFE (Net) Indices as of March 31, 2015.

Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark (formerly named PL Portfolio Optimization Moderate-Conservative Composite Benchmark) is 55% Barclays U.S. Aggregate Bond; 30% S&P 500; 10% MSCI EAFE (Net), and 5% BofA Merrill Lynch U.S. 3-Month Treasury Bill Indices as of March 31, 2015.

Pacific Funds Portfolio Optimization Moderate Composite Benchmark (formerly named PL Portfolio Optimization Moderate Composite Benchmark) is 45% S&P 500; 38% Barclays U.S. Aggregate Bond; 15% MSCI EAFE (Net), and 2% BofA Merrill Lynch U.S. 3-Month Treasury Bill Indices as of March 31, 2015.

Pacific Funds Portfolio Optimization Growth Composite Benchmark (formerly named PL Portfolio Optimization Moderate-Aggressive Composite Benchmark) is 60% S&P 500; 20% Barclays U.S. Aggregate Bond; and 20% MSCI EAFE (Net) Indices as of March 31, 2015.

Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark (formerly named PL Portfolio Optimization Aggressive Composite Benchmark) is 65% S&P 500; 25% MSCI EAFE (Net); and 10% Barclays U.S. Aggregate Bond Indices as of March 31, 2015.

S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

A-21

| (b) | The funds’ investments are affiliated mutual funds (See Note 7C in Notes to Financial Statements). |

| (c) | Fair Value Measurements |

The following is a summary of the funds’ investments as categorized under the three-tier hierarchy of inputs used in valuing the funds’ assets and liabilities (See Note 3D in Notes to Financial Statements) as of March 31, 2015:

| Total Value at March 31, 2015 |

Level 1 Quoted Price |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||||

| Pacific Funds Portfolio Optimization Conservative |

||||||||||||||||||

| Assets |

Affiliated Mutual Funds | $419,876,334 | $419,876,334 | $— | $— | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Pacific Funds Portfolio Optimization Moderate-Conservative |

||||||||||||||||||

| Assets |

Affiliated Mutual Funds | $581,512,326 | $581,512,326 | $— | $— | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| See Notes to Financial Statements | See explanation of symbols and terms, if any, on page B-27 |

B-1

| (b) | The funds’ investments are affiliated mutual funds (See Note 7C in Notes to Financial Statements). |

| (c) | Fair Value Measurements |

The following is a summary of the funds’ investments as categorized under the three-tier hierarchy of inputs used in valuing the funds’ assets and liabilities (See Note 3D in Notes to Financial Statements) as of March 31, 2015:

| Total Value at March 31, 2015 |

Level 1 Quoted Price |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||

| Pacific Funds Portfolio Optimization Moderate |

||||||||||||||||

| Assets |

Affiliated Mutual Funds | $1,657,571,301 | $1,657,571,301 | $— | $— | |||||||||||

|

|

|

|

|

|

|

|

||||||||||

| Pacific Funds Portfolio Optimization Growth |

||||||||||||||||

| Assets |

Affiliated Mutual Funds | $1,157,876,266 | $1,157,876,266 | $— | $— | |||||||||||

|

|

|

|

|

|

|

|

||||||||||

| See Notes to Financial Statements | See explanation of symbols and terms, if any, on page B-27 |

B-2

| (b) | The funds’ investments are affiliated mutual funds (See Note 7C in Notes to Financial Statements). |

| (c) | Fair Value Measurements |

The following is a summary of the funds’ investments as categorized under the three-tier hierarchy of inputs used in valuing the funds’ assets and liabilities (See Note 3D in Notes to Financial Statements) as of March 31, 2015:

| Total Value at March 31, 2015 |

Level 1 Quoted Price |

Level 2 Significant Observable Inputs |

Level 3 Significant Unobservable Inputs |

|||||||||||||||

| Pacific Funds Portfolio Optimization Aggressive-Growth |

||||||||||||||||||

| Assets |

Affiliated Mutual Funds | $339,201,859 | $339,201,859 | $— | $— | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Pacific Funds Diversified Alternatives |

||||||||||||||||||

| Assets |

Affiliated Mutual Funds | $5,775,468 | $5,775,468 | $— | $— | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| See Notes to Financial Statements | See explanation of symbols and terms, if any, on page B-27 |

B-3

PACIFIC FUNDS **

PACIFIC FUNDSSM SHORT DURATION INCOME **

Schedule of Investments

March 31, 2015

| See Notes to Financial Statements | See explanation of symbols and terms, if any, on page B-27 |

B-4

PACIFIC FUNDS **