UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017 | |

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

(Exact name of registrant as specified in its charter) | Commission file number | State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

Crestwood Equity Partners LP | 001-34664 | Delaware | 43-1918951 |

Crestwood Midstream Partners LP | 001-35377 | Delaware | 20-1647837 |

811 Main Street, Suite 3400 Houston, Texas | 77002 | |

(Address of principal executive offices) | (Zip code) | |

(832) 519-2200

(Registrant’s telephone number, including area code)

___________________________________________

Securities registered pursuant to Section 12(b) of the Act:

Crestwood Equity Partners LP | Common Units representing limited partnership interests, listed on the New York Stock Exchange | |

Crestwood Midstream Partners LP | None | |

Securities registered pursuant to Section 12(g) of the Act:

Crestwood Equity Partners LP | None | |

Crestwood Midstream Partners LP | None | |

Indicate by check mark if registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Crestwood Equity Partners LP | Yes x No ¨ | |

Crestwood Midstream Partners LP | Yes ¨ No x | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Crestwood Equity Partners LP | Yes ¨ No x | |

Crestwood Midstream Partners LP | Yes ¨ No x | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Crestwood Equity Partners LP | Yes x No ¨ | |

Crestwood Midstream Partners LP | Yes x No ¨ | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Crestwood Equity Partners LP | Yes x No ¨ | |

Crestwood Midstream Partners LP | Yes x No ¨ | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Crestwood Equity Partners LP | x | |

Crestwood Midstream Partners LP | x | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Crestwood Equity Partners LP | Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | Emerging growth company ¨ |

Crestwood Midstream Partners LP | Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange act.

Crestwood Equity Partners LP | o | |

Crestwood Midstream Partners LP | o | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Crestwood Equity Partners LP | Yes ¨ No x | |

Crestwood Midstream Partners LP | Yes ¨ No x | |

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2017).

Crestwood Equity Partners LP | $1.1 billion | |

Crestwood Midstream Partners LP | None | |

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date (February 12, 2018).

Crestwood Equity Partners LP | $26.95 per common unit | 71,231,599 | |

Crestwood Midstream Partners LP | None | None | |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated by reference into the indicated parts of this report:

Crestwood Equity Partners LP | None | |

Crestwood Midstream Partners LP | None | |

Crestwood Midstream Partners LP, as a wholly-owned subsidiary of a reporting company, meets the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K and is therefore filing this report with the reduced disclosure format as permitted by such instruction.

FILING FORMAT

This Annual Report on Form 10-K is a combined report being filed by two separate registrants: Crestwood Equity Partners LP and Crestwood Midstream Partners LP. Crestwood Midstream Partners LP is a wholly-owned subsidiary of Crestwood Equity Partners LP. Information contained herein related to any individual registrant is filed by such registrant solely on its own behalf. Each registrant makes no representation as to information relating exclusively to the other registrant.

Item 15 of Part IV of this Annual Report includes separate financial statements (i.e., balance sheets, statements of operations, statements of comprehensive income, statements of partners’ capital and statements of cash flows, as applicable) for Crestwood Equity Partners LP and Crestwood Midstream Partners LP. The notes accompanying the financial statements are presented on a combined basis for each registrant. Management’s Discussion and Analysis of Financial Condition and Results of Operations included under Item 7 of Part II is presented for each registrant.

3

CRESTWOOD EQUITY PARTNERS LP

CRESTWOOD MIDSTREAM PARTNERS LP

INDEX TO ANNUAL REPORT ON FORM 10-K

Page | ||

Mine Safety Disclosures | ||

4

GLOSSARY

The terms below are common to our industry and used throughout this report.

/d | per day |

AOD | Area of dedication, which means the acreage dedicated to a company by an oil and/or natural gas producer under one or more contracts. |

ASC | Accounting Standards Codification. |

ASU | Accounting Standards Update. |

Barrels (Bbls) | One barrel of petroleum products equal to 42 U.S. gallons. |

Base gas | A quantity of natural gas held within the confines of the natural gas storage facility and used for pressure support and to maintain a minimum facility pressure. May consist of injected base gas or native base gas. Also known as cushion gas. |

Bcf | One billion cubic feet of natural gas. A standard volume measure of natural gas products. |

Cycle | A complete withdrawal and injection of working gas. Cycling refers to the process of completing one cycle. |

EPA | Environmental Protection Agency. |

FASB | Financial Accounting Standards Board. |

FERC | Federal Energy Regulatory Commission. |

Firm service | Services pursuant to which customers receive an assured or firm right to (i) in the context of storage service, store product in the storage facility or (ii) in the context of transportation service, transport product through a pipeline, over a defined period of time. |

GAAP | Generally Accepted Accounting Principles. |

Gas storage capacity | The maximum volume of natural gas that can be cost-effectively injected into a storage facility and extracted during the normal operation of the storage facility. Gas storage capacity excludes base gas. |

HP | Horsepower. |

Hub | Geographic location of a storage facility and multiple pipeline interconnections. |

Hub services | With respect to our natural gas storage and transportation operations, the following services: (i) interruptible storage services, (ii) firm and interruptible park and loan services, (iii) interruptible wheeling services, and (iv) balancing services. |

Injection rate | The rate at which a customer is permitted to inject natural gas into a natural gas storage facility. |

Interruptible service | Services pursuant to which customers receive only limited assurances regarding the availability of (i) with respect to storage services, capacity and deliverability in storage facilities or (ii) with respect to transportation services, capacity and deliverability from receipt points to delivery points. Customers pay fees for interruptible services based on their actual utilization of the storage or transportation assets. |

MMBbls | One million barrels. |

MMcf | One million cubic feet of natural gas. |

Natural gas | A gaseous mixture of hydrocarbon compounds, primarily methane together with varying quantities of ethane, propane, butane and other gases. |

Natural Gas Act | Federal law enacted in 1938 that established the FERC’s authority to regulate interstate pipelines. |

Natural gas liquids (NGLs) | Those hydrocarbons in natural gas that are separated from the natural gas as liquids through the process of absorption, condensation, adsorption or other methods in natural gas processing or cycling plants. NGLs include natural gas plant liquids (primarily ethane, propane, butane and isobutane) and lease condensate (primarily pentanes produced from natural gas at lease separators and field facilities). |

NYPSC | New York State Public Service Commission. |

NYSE | New York Stock Exchange. |

Salt cavern | A man-made cavern developed in a salt dome or salt beds by leaching or mining of the salt. |

SEC | Securities and Exchange Commission. |

Withdrawal rate | The rate at which a customer is permitted to withdraw gas from a natural gas storage facility. |

Working gas | Natural gas in a storage facility in excess of base gas. Working gas may or may not be completely withdrawn during any particular withdrawal season. |

Working gas storage capacity | See gas storage capacity (above). |

5

PART I

Item 1. Business

Unless the context requires otherwise, references to (i) “we,” “us,” “our,” “ours,” “our company,” the “Company,” the “Partnership,” “Crestwood Equity,” “CEQP,” and similar terms refer to either Crestwood Equity Partners LP itself or Crestwood Equity Partners LP and its consolidated subsidiaries, as the context requires, and (ii) “Crestwood Midstream” and “CMLP” refers to Crestwood Midstream Partners LP and its consolidated subsidiaries Unless otherwise indicated, information contained herein is reported as of December 31, 2017.

Introduction

Crestwood Equity, a Delaware limited partnership formed in March 2001, is a master limited partnership (MLP) that develops, acquires, owns or controls, and operates primarily fee-based assets and operations within the energy midstream sector. Headquartered in Houston, Texas, we provide broad-ranging infrastructure solutions across the value chain to service premier liquids-rich natural gas and crude oil shale plays across the United States. We own and operate a diversified portfolio of crude oil and natural gas gathering, processing, storage and transportation assets that connect fundamental energy supply with energy demand across North America. Crestwood Equity’s common units representing limited partner interests are listed on the NYSE under the symbol “CEQP.”

Crestwood Equity is a holding company. All of our consolidated operating assets are owned by or through our wholly-owned subsidiary, Crestwood Midstream, a Delaware limited partnership. Our consolidated operating assets primarily include:

• | natural gas facilities with approximately 2.4 Bcf/d of gathering capacity and 0.5 Bcf/d of processing capacity; |

• | NGL facilities with approximately 20,000 Bbls/d of fractionation capacity and 3.1 MMBbls of storage capacity, as well as our portfolio of transportation assets (consisting of truck and rail terminals, truck/trailer units and rail cars) capable of transporting approximately 195,000 Bbls/d of NGLs; and |

• | crude oil facilities with approximately 125,000 Bbls/d of gathering capacity, 1.5 MMBbls of storage capacity, 20,000 Bbls/d of transportation capacity and 160,000 Bbls/d of rail loading capacity. |

In addition, through our equity investments in joint ventures, we have ownership interests in:

• | natural gas facilities with approximately 0.3 Bcf/d of gathering capacity, 0.2 Bcf/d of processing capacity, 75.8 Bcf of certificated working storage capacity, and 1.5 Bcf/d of transportation capacity; and |

• | crude oil facilities with approximately 20,000 Bbls/d of rail loading capacity and 380,000 Bbls of working storage capacity. |

Our primary business objective is to maximize the value of Crestwood for our unitholders.

6

Ownership Structure

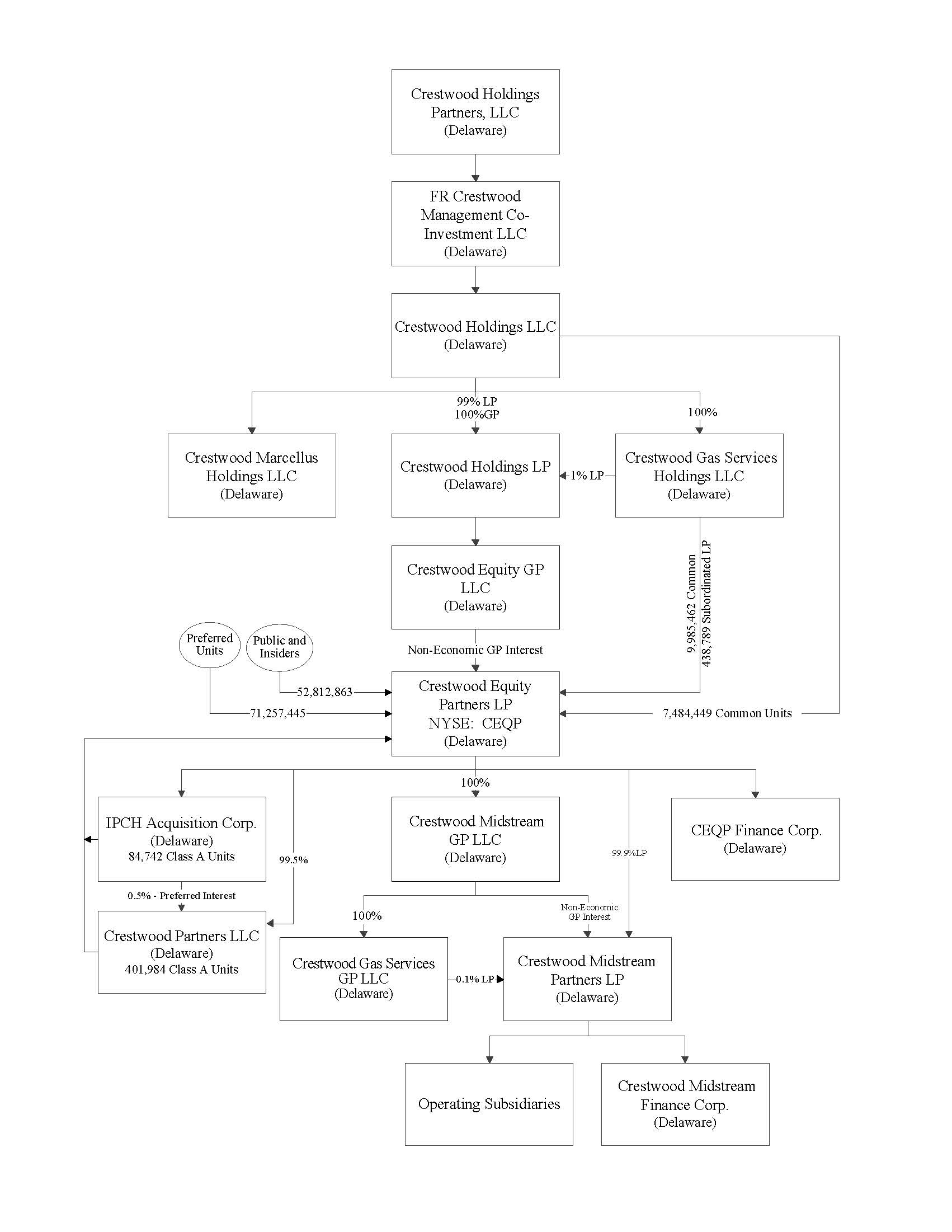

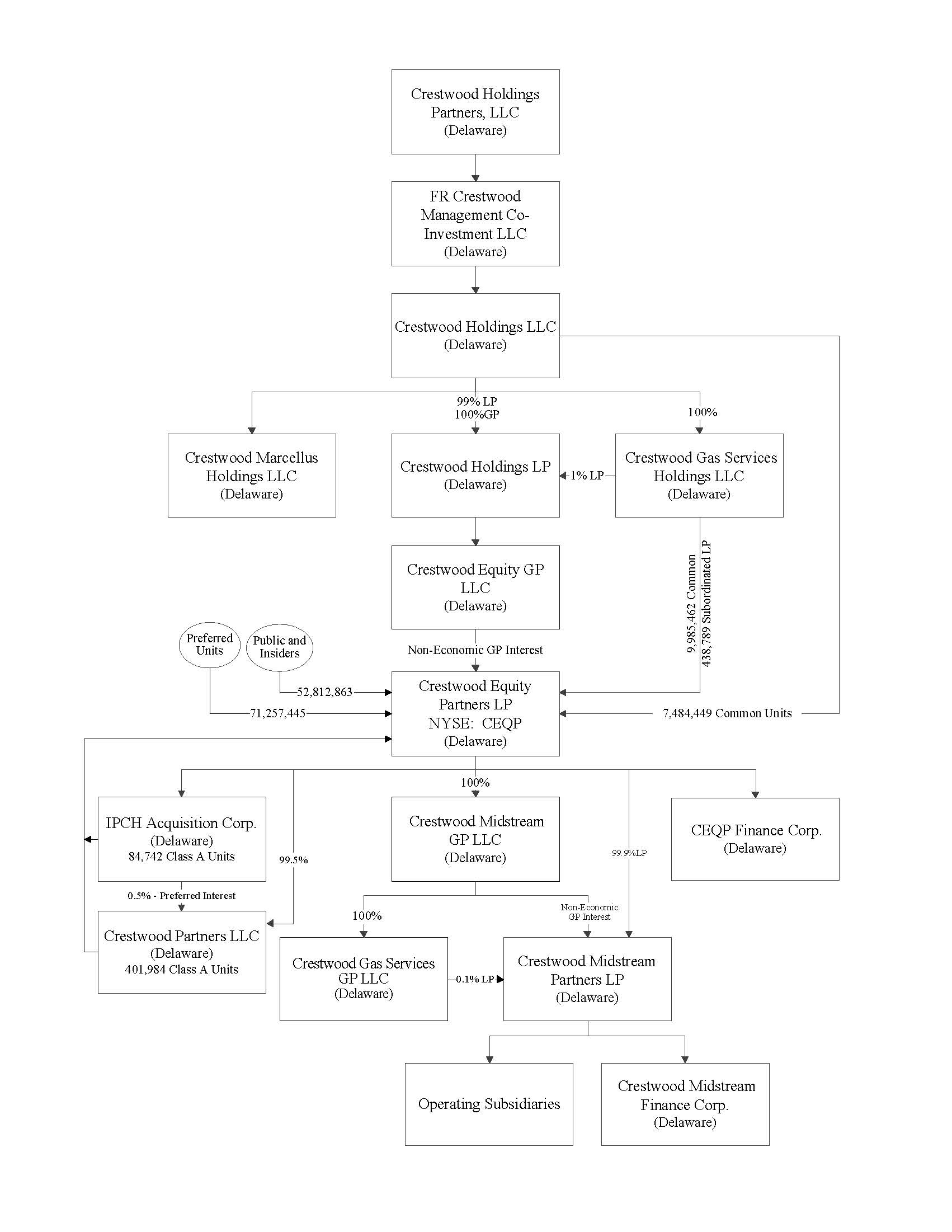

The diagram below reflects a simplified version of our ownership structure as of December 31, 2017:

Crestwood Equity. Crestwood Equity GP LLC, which is indirectly owned by Crestwood Holdings LLC (Crestwood Holdings), owns our non-economic general partnership interest. Crestwood Holdings, which is substantially owned and controlled by First Reserve Management, L.P. (First Reserve), also owns approximately 25% of Crestwood Equity’s common units and all of its subordinated units as of December 31, 2017.

Crestwood Midstream. Crestwood Equity owns a 99.9% limited partnership interest in Crestwood Midstream and Crestwood Gas Services GP LLC (CGS GP), a wholly-owned subsidiary of Crestwood Equity, owns a 0.1% limited partnership interest in

7

Crestwood Midstream. Crestwood Midstream GP LLC, a wholly-owned subsidiary of Crestwood Equity, owns the non-economic general partnership interest of Crestwood Midstream.

Simplification Merger (2015). On September 30, 2015, Crestwood Midstream merged with a wholly-owned subsidiary of Crestwood Equity, with Crestwood Midstream surviving as a wholly-owned subsidiary of Crestwood Equity (the Simplification Merger). Prior to the Simplification Merger, Crestwood Equity indirectly owned a non-economic general partnership interest in Crestwood Midstream and 100% of its incentive distribution rights (IDRs), which entitled Crestwood Equity to receive 50% of all distributions paid to Crestwood Midstream’s common unit holders in excess of its initial quarterly distribution of $0.37 per common unit. Crestwood Midstream’s common units were also listed on the NYSE under the listing symbol “CMLP”. Upon becoming a wholly-owned subsidiary of Crestwood Equity as a result of the Simplification Merger, Crestwood Midstream’s IDRs were eliminated and its common units ceased to be listed on the NYSE.

Prior to the Simplification Merger, Crestwood Midstream owned all of our operating assets other than the assets comprising our NGL marketing business. Crestwood Operations LLC (Crestwood Operations), a wholly-owned subsidiary of Crestwood Equity, owned and operated the assets comprising our NGL marketing business, consisting mainly of our West Coast NGL assets, our Seymour NGL storage facility, and our NGL transportation terminals and fleet. Upon the closing of the Simplification Merger, Crestwood Equity contributed 100% of its interests in Crestwood Operations to Crestwood Midstream. As a result of this contribution, all of the Company’s assets are owned by or through Crestwood Midstream. See Part IV, Item 15. Exhibits, Financial Statement Schedules, Note 2 for a further discussion of the Simplification Merger.

Our Assets

Our financial statements reflect three operating and reporting segments: (i) gathering and processing (G&P) operations; (ii) storage and transportation (S&T) operations; and (iii) marketing, supply and logistics (MS&L) operations. Below is a description of our operating and reporting segments.

Gathering and Processing

Our G&P operations provide gathering and transportation services (natural gas, crude oil and produced water) and processing, treating and compression services (natural gas) to producers in unconventional shale plays and tight-gas plays in North Dakota, West Virginia, Texas, New Mexico, Wyoming and Arkansas. This segment primarily includes our operations and investments that own (i) our crude oil, gas and produced water gathering systems in the Bakken Shale play; (ii) rich gas gathering systems and processing plants in the Bakken, Marcellus, Barnett, Delaware Permian and Powder River Basin Shale plays; and (iii) dry gas gathering systems in the Barnett, Fayetteville and Delaware Permian Shale plays.

8

The table below summarizes certain information about our G&P systems (including our equity investments) as of December 31, 2017:

Shale Play (State) | Counties / Parishes | Pipeline (Miles) | Gathering Capacity | 2017 Average Gathering Volumes | Compression (HP) | Number of In-Service Processing Plants | Processing Capacity (MMcf/d) | Gross Acreage Dedication |

Bakken North Dakota | McKenzie and Dunn | 640 (1) | 100 MMcf/d - natural gas gathering 125 MBbls/d - crude oil gathering 40 MBbls/d - water gathering | 48 MMcf/d - natural gas gathering 80 MBbls/d - crude oil gathering 35 MBbls/d - water gathering | 18,000 | 1 | 30 | 150,000 |

Marcellus West Virginia | Harrison, Barbour and Doddridge | 80 | 875 MMcf/d | 423 MMcf/d | 131,380 | — | — | 140,000 |

Barnett Texas | Hood, Somervell, Tarrant, Johnson and Denton | 507 | 925 MMcf/d | 319 MMcf/d | 153,465 | 1 | 425 | 140,000 |

Fayetteville Arkansas | Conway, Faulkner, Van Buren, and White | 173 | 510 MMcf/d | 46 MMcf/d | 18,670 | — | — | 143,000 |

Granite Wash Texas | Roberts | 36 | 36 MMcf/d | 10 MMcf/d | 10,400 | 1 | 36 | 22,000 |

Delaware Permian(2) New Mexico/Texas | Eddy (New Mexico) Loving, Reeves, Ward, Culberson (Texas) | 189 | 165 MMcf/d | 74 MMcf/d | 33,310 (3) | 2 | 75 | 214,000 |

Powder River Basin (3) Wyoming | Converse | 211 | 140 MMcf/d | 60 MMcf/d | 50,895 | 1 | 120 | 358,000 |

(1) | Consists of 262 miles of natural gas gathering pipeline, 183 miles of crude oil gathering pipeline, and 195 miles of produced water gathering pipeline. |

(2) | Our Delaware Permian assets in New Mexico and Texas are owned by Crestwood Permian Basin Holdings LLC (Crestwood Permian), our 50% equity method investment. |

(3) | Includes 16,800 HP that is owned and operated by a third party under a compression services agreement. |

(4) | Our Powder River Basin assets are owned by Jackalope Gas Gathering Services, L.L.C. (Jackalope), our 50% equity method investment. |

We generate G&P revenues predominantly under fee-based contracts, which minimizes our commodity price exposure and provides less volatile operating performance and cash flows. Our principal G&P systems are described below.

Bakken

Our Arrow system gathers crude oil, rich gas and produced water from wells operating on the Fort Berthold Indian Reservation in the core of the Bakken Shale in McKenzie and Dunn Counties, North Dakota. Located approximately 60 miles southeast of the COLT Hub, the Arrow system connects to our COLT Hub through Hiland Partners, LP (Hiland) and Andeavor crude oil pipeline systems. The Arrow system includes approximately 640 miles of gathering lines, a 23-acre central delivery point with 266,000 Bbls of crude oil working storage capacity and multiple pipeline take-away outlets, and salt water disposal wells. We are completing construction of a 30 MMcf/d natural gas processing facility (Bear Den) and associated pipelines that began receiving gas in late 2017. Our operations are anchored by long-term gathering contracts with producers who have dedicated over 150,000 acres to the Arrow system, and our underlying contracts largely provide for fixed-fee gathering services with annual escalators for crude oil, natural gas and produced water gathering services.

Marcellus

We own and operate natural gas gathering and compression systems in Harrison, Doddridge and Barbour Counties, West Virginia. These systems consist of 80 miles of low pressure gathering lines and nine compression and dehydrations stations with 131,380 horsepower. Through these systems, we provide midstream services, primarily to Antero Resources Corporation (Antero), under long-term, fixed-fee contracts across two operating areas: our eastern area of operation (East AOD), where we are the exclusive gatherer, and our western area of operation (Western Area), where we provide compression services.

9

In the East AOD, we provide gathering, dehydration and compression services, on a fixed-fee basis, to Antero on approximately 140,000 gross acres dedicated pursuant to a 20-year gathering and compression agreement. Under the gathering agreement, Antero provides for an annual minimum volume commitment of 450 MMcf/d in 2018. We gather and ultimately redeliver Antero’s production to MarkWest Energy Partners, L.P.’s Sherwood gas processing plant and various regional pipeline systems.

In the Western Area, we provide compression and dehydration services, on a fixed-fee basis, to Antero’s gathering facilities predominantly with our West Union and Victoria compressor stations, each with a maximum capacity of 120 MMcf/d. The agreement runs through 2021, subject to Antero’s right to extend the contract term for an additional three years, and provides for a minimum volume commitment of approximately 50% of the throughput capacity of each compressor station.

Barnett

We own and operate three systems in the Barnett Shale, including the Cowtown, Lake Arlington and the Alliance systems.

Our Cowtown system, which is located principally in the southern portion of the Fort Worth Basin, consists of pipelines that gather rich gas produced by customers and deliver the volumes to our plants for processing and the Cowtown plant, which includes two natural gas processing units that extract NGLs from the natural gas stream and deliver customers’ residue gas and extracted NGLs to unaffiliated pipelines for sale downstream. For the year ended December 31, 2017, our processing plant had a total average throughput of 114 MMcf/d of natural gas with an average NGL recovery of 9,541 Bbls/d. In June 2015, we diverted processing volumes from our Corvette plant to the Cowtown plant but we continue to use the compression facilities at the Corvette plant.

Our Lake Arlington system, which is located in eastern Tarrant County, Texas, consists of a dry gas gathering system and related dehydration and compression facilities. Our Alliance system, which is located in northern Tarrant and southern Denton Counties, Texas, consists of a dry gas gathering system and a related dehydration, compression and amine treating facility.

Fayetteville

We own and operate five systems in the Fayetteville Shale, including the Twin Groves, Prairie Creek, Woolly Hollow, Wilson Creek, and Rose Bud systems. Our Twin Groves, Prairie Creek, and Woolly Hollow systems (Conway and Faulkner Counties) consist of three gas gathering, compression, dehydration and treating facilities. Our Wilson Creek system (Van Buren County) consists of a gas gathering system and related dehydration and compression facilities. Our Rose Bud system (White County) consists of a gas gathering system. All of our systems gather natural gas produced by customers and deliver customers’ gas to unaffiliated pipelines for sale downstream.

Equity Investments

Delaware Permian

In October 2016, Crestwood Infrastructure Holdings LLC (Crestwood Infrastructure), our wholly-owned subsidiary, and an affiliate of First Reserve formed a joint venture, Crestwood Permian, to fund and own a natural gas gathering system (the Nautilus gathering system) and other potential investments in the Delaware Permian. As part of this transaction, we transferred to the Crestwood Permian joint venture 100% of the equity interest of Crestwood Permian Basin LLC (Crestwood Permian Basin), which owns the Nautilus gathering system. We manage the joint venture under a long-term management agreement and we account for our 50% ownership interest in Crestwood Permian under the equity method of accounting.

Crestwood Permian Basin has a long-term agreement with SWEPI LP (SWEPI), a subsidiary of Royal Dutch Shell plc, to construct, own and operate the Nautilus gathering system in SWEPI’s operated position in the Delaware Permian. SWEPI has dedicated to Crestwood Permian Basin approximately 100,000 acres and gathering rights for SWEPI’s gas production across a large acreage position in Loving, Reeves and Ward Counties, Texas. The initial build-out of the Nautilus gathering system was completed on June 6, 2017, and includes 20 receipt point meters, 60 miles of pipeline, a 24-mile high pressure header system, 10,080 horsepower of compression and a high pressure delivery point. From the date it was placed into service to December 31, 2017, the Nautilus gathering system had an average throughput of 35 MMcf/d. Crestwood Permian Basin provides gathering, dehydration, compression and liquids handling services to SWEPI under a 20-year fixed-fee gathering agreement. In October 2017, Shell Midstream Partners L.P. (Shell Midstream), a subsidiary of Royal Dutch Shell plc, purchased a 50% equity interest in Crestwood Permian Basin.

10

On June 21, 2017, we contributed to Crestwood Permian 100% of the equity interest of Crestwood New Mexico Pipeline LLC

(Crestwood New Mexico), our wholly-owned subsidiary that owns our Delaware Basin assets located in Eddy County, New

Mexico. These assets consist of two dry gas gathering systems (Las Animas systems) and one rich gas gathering system and processing plant (Willow Lake system). Our Willow Lake system includes two plants with a combined capacity of 75MMcf/d processing plant, which are supported by a 10-year fixed-fee agreement with Concho Resources Inc. (Concho) and a seven year contract with Mewbourne Oil Co. (Mewbourne). We deconsolidated Crestwood New Mexico as a result of the contribution. In conjunction with this contribution, First Reserve has agreed to contribute to Crestwood Permian the first $151 million of capital cost required to fund the expansion of the Delaware Basin assets, which includes a new processing plant located in Orla, Texas and associated pipelines (Orla processing plant). See Part IV, Item 15. Exhibits, Financial Statement Schedules, Note 6 for a further discussion of our investment in Crestwood Permian.

Powder River Basin

Our G&P segment includes our 50% equity interest in the Jackalope joint venture with Williams Partners LP (Williams), which we account for under the equity method of accounting. The joint venture, operated by Williams, owns the Jackalope gas gathering system, which serves a 358,000 gross acre dedication operated by Chesapeake Energy Corporation (Chesapeake) in Converse County, Wyoming. The Jackalope system consists of approximately 211 miles of gathering pipelines, 50,895 horsepower of compression and a 120 MMcf/d processing plant (Bucking Horse). The system connects to 100 well pads and is supported by a 10-year gathering and processing agreement with Chesapeake that includes minimum revenue guarantees for a five to seven year period. See Part IV, Item 15. Exhibits, Financial Statement Schedules, Note 6 for a further discussion of our investment in Jackalope.

The table below summarizes certain contract information of our G&P operations (including our equity investments) as of December 31, 2017:

Shale Play | Type of Services | Type of Contracts(1) | Gross Acreage Dedication | Major Customers | Weighted Average Remaining Contract Terms (in years) |

Bakken | Gathering - crude oil, natural gas and water | Mixed | 150,000 | WPX, Bruin E&P Partners, LLC, Rimrock Energy Partners, LLC, XTO Energy, QEP Resources, Inc., Enerplus | 8 |

Marcellus | Gathering | Fixed-fee | 140,000 | Antero | 14 |

Compression | Fixed-fee | — | Antero | 2 | |

Barnett | Gathering | Mixed | 140,000 | BlueStone, Devon Energy, Tokyo Gas America Ltd. (Tokyo Gas) | 7 |

Processing | Mixed | — | BlueStone, Devon Energy, Tokyo Gas | 9 | |

Compression | Mixed | — | BlueStone, Devon Energy, Tokyo Gas | 7 | |

Fayetteville | Gathering | Fixed-fee | 143,000 | BHP Billiton Petroleum (BHP) | 7 |

Treating | Fixed-fee | — | BHP | 7 | |

Granite Wash | Gathering | Fixed-fee | 22,000 | Sabine Oil and Gas | 7 |

Processing | Mixed | — | Sabine Oil and Gas | 7 | |

Permian | Gathering | Fixed-fee | 214,000 | Mewbourne, Concho, Marathon Oil Corp, SWEPI | 7 |

Processing | Mixed | — | Mewbourne, Matador | 4 | |

Powder River Basin | Gathering | Fixed-fee | 358,000 | Chesapeake | 10 |

Processing | Fixed-fee | — | Chesapeake | 10 | |

(1) | Fixed-fee contracts represent contracts in which our customers agree to pay a flat rate based on the amount of gas delivered. Mixed contracts include percent-of-proceeds and fixed-fee arrangements. |

Storage and Transportation

Our S&T operations include our COLT Hub, one of the largest crude-by-rail terminals serving Bakken crude oil production, and our equity investments in three joint ventures that own five high-performance natural gas storage facilities with an aggregate certificated working gas storage capacity of approximately 75.8 Bcf, three natural gas pipeline systems with an aggregate firm transportation capacity of 1.5 Bcf/d, and crude oil facilities with approximately 380,000 Bbls of crude oil working storage capacity and 20,000 Bbls/d of rail loading capacity.

11

COLT Hub

The COLT Hub consists of our integrated crude oil loading, storage and pipeline terminal located in the heart of the Bakken and Three Forks Shale oil-producing areas in Williams County, North Dakota. It has approximately 1.2 MMBbls of crude oil storage capacity and is capable of loading up to 160,000 Bbls/d. Customers can source crude oil for rail loading through interconnected gathering systems, a twelve-bay truck unloading rack and the COLT Connector, a 21-mile 10-inch bi-directional proprietary pipeline that connects the COLT terminal to our storage tank at Dry Fork (Beaver Lodge/Ramberg junction). The COLT Hub is connected to the Meadowlark Midstream Company, LLC and Hiland crude oil gathering systems and the Dakota Access Pipeline (DAPL) interstate pipeline system at the COLT terminal, and the Enbridge Energy Partners, L.P. and Andeavor interstate pipeline systems at Dry Fork. The gathering systems connected to the COLT Hub can deliver up to approximately 350,000 Bbls/d of crude oil to our terminal.

Equity Investments

Below is a description of the S&T assets owned by our joint ventures.

Northeast Storage Facilities. Our storage and transportation segment includes our 50% equity interest in Stagecoach Gas Services LLC (Stagecoach Gas), which we account for under the equity method of accounting. On June 3, 2016, our wholly-owned subsidiary, Crestwood Pipeline and Storage Northeast LLC (Crestwood Northeast) and Con Edison Gas Pipeline and Storage Northeast, LLC (CEGP), a wholly-owned subsidiary of Consolidated Edison, Inc. (Consolidated Edison), formed Stagecoach Gas to own and further develop our natural gas natural gas storage and transportation business located in the Northeast (the NE S&T assets). During 2016, we contributed to the joint venture the entities owning the NE S&T assets, CEGP contributed to the joint venture $975 million in exchange for a 50% equity interest in Stagecoach Gas, and Stagecoach Gas distributed to us the net cash proceeds received from CEGP. We manage the joint venture’s operations under a long-term management agreement. We deconsolidated the NE S&T assets as a result of the contribution of these assets to Stagecoach Gas as described above. See Part IV, Item 15. Exhibits, Financial Statement Schedules, Note 6 for a further discussion of our investment in Stagecoach Gas.

The Stagecoach Gas joint venture owns and operates four natural gas storage facilities located in New York and Pennsylvania. The facilities are located near major shale plays and demand markets, have low maintenance costs and long useful lives. They have comparatively high cycling capabilities, and their interconnectivity with interstate pipelines offers significant flexibility to customers. These natural gas storage facilities, each of which generates fee-based revenues as of December 31, 2017, include:

• | Stagecoach - a FERC certificated 26.2 Bcf multi-cycle, depleted reservoir storage facility owned and operated by a subsidiary of Stagecoach Gas. A 21-mile, 30-inch diameter south pipeline lateral connects the storage facility to Tennessee Gas Pipeline Company, LLC’s (TGP) 300 Line, and a 10-mile, 20-inch diameter north pipeline lateral connects to Millennium Pipeline Company’s (Millennium) system. |

• | Thomas Corners - a FERC-certificated 7.0 Bcf multi-cycle, depleted reservoir storage facility owned and operated by a subsidiary of Stagecoach Gas. An 8-mile, 12-inch diameter pipeline lateral connects the storage facility to TGP’s 200 Line, and an 8-mile, 8-inch diameter pipeline lateral connects to Millennium. Thomas Corners is also connected to Dominion Transmission Inc.’s (Dominion) system through the Steuben facility discussed below. |

• | Seneca Lake - a FERC-certificated 1.5 Bcf multi-cycle, bedded salt storage facility owned and operated by a subsidiary of Stagecoach Gas. A 20-mile, 16-inch diameter pipeline lateral connects the storage facility to the Millennium and Dominion systems. |

• | Steuben - a FERC-certificated 6.2 Bcf single-cycle, depleted reservoir storage facility owned and operated by a subsidiary of Stagecoach Gas. A 15-mile, 12-inch diameter pipeline lateral connects the storage facility to the Dominion system, and a 6-inch diameter pipeline measuring less than one mile connects the Steuben and Thomas Corners storage facilities. |

Tres Palacios Storage Facility. Our storage and transportation segment includes our 50.01% equity interest in Tres Palacios Holdings LLC (Tres Holdings), which we account for under the equity method of accounting. Tres Palacios Gas Storage LLC (Tres Palacios), a wholly-owned subsidiary of Tres Holdings, owns a FERC-certificated 34.9 Bcf multi-cycle salt dome natural gas storage facility located in Texas. We manage the joint venture’s operations under a long-term management agreement.

12

The Tres Palacios natural gas storage facility’s 63-mile, dual 24-inch diameter header system (including a 52-mile north pipeline lateral and an approximate 11-mile south pipeline lateral) interconnects with 11 pipeline systems and can receive residue gas from the tailgate of Kinder Morgan Inc.’s (Kinder Morgan) Houston Central processing plant. The certificated maximum injection rate of the Tres Palacios storage facility is 1,000 MMcf/d and the certificated maximum withdrawal rate is 2,500 MMcf/d. See Part IV, Item 15. Exhibits, Financial Statement Schedules, Note 6 for a further discussion of our ownership interest in Tres Palacios.

The following provides additional information about the natural gas storage facilities of our S&T equity investments as of December 31, 2017:

Storage Facility / Location | Certificated Working Gas Storage Capacity (Bcf) | Certificated Maximum Injection Rate (MMcf/d) | Certificated Maximum Withdrawal Rate (MMcf/d) | Pipeline Connections | ||||||

Stagecoach Tioga County, NY; Bradford County, PA | 26.2 | 250 | 500 | TGP’s 300 Line; Millennium; UGI’s Sunbury Pipeline,(1) Transco’s Leidy Line(1) | ||||||

Thomas Corners Steuben County, NY | 7.0 | 70 | 140 | TGP’s 200 Line; Millennium; Dominion | ||||||

Seneca Lake Schuyler County, NY | 1.5 | (2) | 73 | 145 | Dominion; Millennium | |||||

Steuben Steuben County, NY | 6.2 | 30 | 60 | TGP’s 200 Line; Millennium; Dominion | ||||||

Northeast Storage Total | 40.9 | 423 | 845 | |||||||

Tres Palacios | 34.9 | 1,000 | 2,500 | Multiple(3) | ||||||

Total | 75.8 | 1,423 | 3,345 | |||||||

(1) | Stagecoach is connected to UGI Energy Services, LLC’s (UGI) Sunbury Pipeline and Transcontinental Gas Pipe Line Corporation’s (Transco) Leidy Line through the MARC I Pipeline. |

(2) | Stagecoach Gas has been authorized by the FERC to expand the facility’s working gas storage capacity to 2 Bcf. |

(3) | Tres Palacios is interconnected to Florida Gas Transmission Company, LLC, Kinder Morgan Tejas Pipeline, L.P., Houston Pipe Line Company LP, Central Texas Gathering System, Natural Gas Pipeline Company of America, Transco, TGP, Gulf South Pipeline, Valero Natural Gas Pipeline Company, Channel Pipeline Company, and Texas Eastern Transmission, L.P. |

Transportation Facilities. Stagecoach Gas owns three natural gas pipeline systems located in New York and Pennsylvania. These natural gas transportation facilities include:

• | North-South Facilities - include compression and appurtenant facilities installed to expand transportation capacity on the Stagecoach north and south pipeline laterals. The bi-directional interstate facilities provide more than 538 MMcf/d of firm interstate transportation capacity to shippers. The North-South Facilities generate fee-based revenues under a negotiated rate structure authorized by the FERC. |

• | MARC I Pipeline - a 39-mile, 30-inch diameter interstate natural gas pipeline that connects the North-South Facilities and TGP’s 300 Line in Bradford County, Pennsylvania, with UGI’s Sunbury Pipeline and Transco’s Leidy Line, both in Lycoming County, Pennsylvania. The bi-directional pipeline provides more than 925 MMcf/d of firm interstate transportation capacity to shippers. The MARC I Pipeline generates fee-based revenues under a negotiated rate structure authorized by the FERC. |

• | East Pipeline - a 37.5 mile, 12-inch diameter intrastate natural gas pipeline located in New York, which transports 30 MMcf/d of natural gas from Dominion to the Binghamton, New York city gate. The pipeline runs within three miles of the North-South Facilities’ point of interconnection with Millennium. The East Pipeline generates fee-based revenues under a negotiated rate structure authorized by the NYPSC. |

Rail Loading Facility. Crestwood Crude Logistics LLC, our wholly-owned subsidiary, has a 50.01% equity interest in Powder River Basin Industrial Complex, LLC (PRBIC), which owns an integrated crude oil loading, storage and pipeline terminal located in Douglas County, Wyoming. PRBIC provides a market for crude oil production from the Powder River Basin. The joint venture, which is operated by our joint venture partner, Twin Eagle Resource Management, LLC (Twin Eagle), sources crude oil production from Chesapeake and other Powder River Basin producers. PRBIC includes 20,000 Bbls/d of rail loading capacity and 380,000 Bbls of crude oil working storage capacity. PRBIC expanded its pipeline terminal to include connections to Kinder Morgan’s Double H Pipeline system in July 2015 and Plains All American Pipeline’s Rocky Mountain Pipeline system in March 2016. See Part IV, Item 15. Exhibits, Financial Statement Schedules, Note 6 for a further discussion of our investment in PRBIC.

13

The table below summarizes certain contract information associated with the COLT Hub and the assets of our S&T equity investments as of December 31, 2017:

Facility | Type of Services | Type of Contracts(1)(2) | Contract Volumes | Major Customers | Weighted Average Remaining Contract Terms (in years) |

COLT | Rail Loading and Transportation | Mixed | 31 MBbl/d | U.S. Oil, Flint Hills Resources, Sunoco Logistics | 2 |

NE S&T Joint Venture: | |||||

North-South Facilities | Transportation | Firm | 538 MMcf/d | Southwestern Energy, Consolidated Edison, Anadarko Energy Services Company (Anadarko) | 2 |

MARC I Pipeline | Transportation | Firm | 925 MMcf/d | Chesapeake, Anadarko, Chief Oil and Gas | 3 |

East Pipeline | Transportation | Firm | 30 MMcf/d | NY State Electric & Gas Corp | 3 |

Stagecoach | Storage | Firm | 26.3 Bcf | Consolidated Edison, Merrill Lynch Commodities Inc (Merrill Lynch), New Jersey Natural Gas, Repsol Energy North America Corporation (Repsol), Sequent Energy Management | 2 |

Thomas Corners | Storage | Firm | 13.0 Bcf | Repsol, Tenaska Gas Storage, LLC | 1 |

Seneca Lake | Storage | Firm | 1.5 Bcf | Dominion, NY State Electric & Gas Corp, DTE Energy Trading | 2 |

Steuben | Storage | Firm | 9.3 Bcf | PSEG Energy Resources & Trade LLC, Repsol, Pivotal Utility Holdings | 1 |

Tres Palacios Joint Venture | Storage | Firm | 28.5 Bcf | Brookfield Infrastructure Group, Anadarko, Exelon, Merrill Lynch, NJR Energy, Repsol | 1 |

PRBIC Joint Venture | Rail Loading | Fixed-fee | 10 MBbl/d | Chesapeake | 1 |

(1) | Firm contracts represent take-or-pay contracts whereby our customers agree to pay for a specified amount of storage or transportation capacity, whether or not the capacity is utilized. Fixed-fee contracts represent contracts in which our customers agree to pay a flat rate based on the amount of commodity delivered. |

(2) | Mixed contracts include both firm and fixed-fee arrangements. |

Marketing, Supply and Logistics

Our MS&L segment includes our supply and logistics business, our storage and terminals business, our West Coast operations and our crude oil, NGL and produced water trucking operations.

Supply and Logistics. Our Supply and Logistics operations are supported by (i) our fleet of rail and rolling stock with 75,000 Bbls/d of NGL transportation capacity, which also includes our rail-to-truck terminals located in Florida, New Jersey, New York, Rhode Island and North Carolina; and (ii) NGL pipeline and storage capacity leased from third parties, including more than 500,000 Bbls of NGL working storage capacity at major hubs in Mt. Belvieu, Texas and Conway, Kansas.

Storage and Terminals. Our NGL Storage and Terminals operations include our Seymour and Bath storage facilities. The Seymour storage facility is located in Seymour, Indiana, and has 500,000 Bbls of underground NGL storage capacity and 29,000 Bbls of aboveground “bullet” storage capacity. The Seymour facility’s receipts and deliveries are supported by Enterprise’s TEPPCO pipeline, allowing pipeline and truck access. The Bath storage facility is located in Bath, New York and has approximately 2.0 MMBbls of underground NGL storage capacity and is supported by rail and truck terminal facilities capable of loading and unloading 23 rail cars per day and approximately 100 truck transports per day.

West Coast. Our West Coast NGL operations provide processing, fractionation, storage, transportation and marketing services to producers, refiners and other customers. Our facilities located near Bakersfield, California include 24 million gallons of aboveground NGL storage capacity, 25 MMcf/d of natural gas processing capacity, 12,000 Bbls/d of NGL fractionation capacity, 8,000 Bbls/d of butane isomerization capacity, and NGL rail and truck receipt and take-away options. We separate NGLs from natural gas, deliver to local natural gas pipelines, retain NGLs for further processing at our fractionation facility, provide butane isomerization and refrigerated storage services, as well as provide to Western US refineries for motor fuel production. Our isomerization facility chemically changes normal butane to isobutane, which we provide to refineries for motor fuel production. Our operations also consist of wholesale propane assets, primarily including three rail-to-truck terminals located in Hazen, Nevada, Carlin, Nevada, and Shoshoni, Wyoming and a truck terminal located in Salt Lake City, Utah. These terminals are used to provide supply, transportation and storage services to wholesale customers in the western and north central regions of the United States.

14

Trucking. Our Trucking operations consist of a fleet of owned and leased trucks with 20,000 Bbls/d of crude oil and produced water transportation capacity and 120,000 Bbls/d of NGL transportation capacity. We provide hauling services to customers in North Dakota, Montana, Wyoming, Texas, New Mexico, Indiana, Mississippi, New Jersey, Ohio, Utah and California.

Customers

For the years ended December 31, 2017, 2016 and 2015, no customer accounted for more than 10% of our total consolidated revenues.

Industry Background

The midstream sector of the energy industry provides the link between exploration and production and the delivery of crude oil, natural gas and their components to end-use markets. The midstream sector consists generally of gathering, processing, storage, and transportation activities. We, through our consolidated operations and our equity investments, gather crude oil and natural gas; process natural gas; fractionate NGLs; store crude oil, NGLs and natural gas; and transport crude oil, NGLs and natural gas.

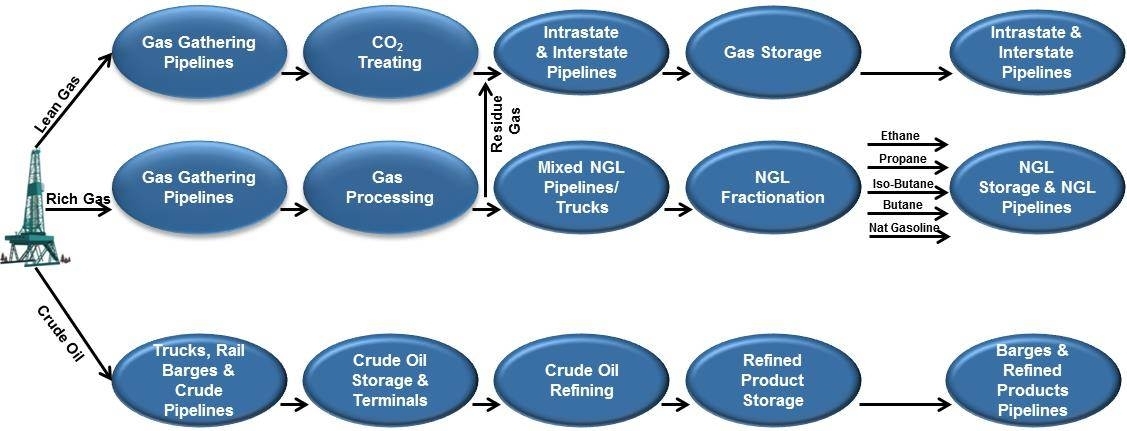

The diagram below depicts the main segments of the midstream sector value chain:

Crude Oil

Pipelines typically provide the most cost-effective option for shipping crude oil. Crude oil gathering systems normally comprise a network of small-diameter pipelines connected directly to the well head that transport crude oil to central receipt points or interconnecting pipelines through larger diameter trunk lines. Common carrier pipelines frequently transport crude oil from central delivery points to logistics hubs or refineries under tariffs regulated by the FERC or state authorities. Logistic hubs provide storage and connections to other pipeline systems and modes of transportation, such as railroads and trucks. Pipelines not engaged in the interstate transportation of crude may also be proprietary or leased entirely to a single customer.

Trucking complements pipeline gathering systems by gathering crude oil from operators at remote wellhead locations not served by pipeline gathering systems. Trucking is generally limited to low volume, short haul movements because trucking costs escalate sharply with distance, making trucking the most expensive mode of crude oil transportation. Railroads provide additional transportation capabilities for shipping crude oil between gathering storage systems, pipelines, terminals and storage centers and end-users.

Natural Gas

Midstream companies within the natural gas industry create value at various stages along the value chain by gathering natural gas from producers at the wellhead, processing and separating the hydrocarbons from impurities and into lean gas (primarily methane) and NGLs, and then routing the separated lean gas and NGL streams for delivery to end-markets or to the next stage of the value chain.

15

A significant portion of natural gas produced at the wellhead contains NGLs. Natural gas produced in association with crude oil typically contains higher concentrations of NGLs than natural gas produced from gas wells. This rich natural gas is generally not acceptable for transportation in the nation’s transmission pipeline system or for residential or commercial use. Processing plants extract the NGLs, leaving residual lean gas that meets transmission pipeline quality specifications for ultimate consumption. Processing plants also produce marketable NGLs, which, on an energy equivalent basis, typically have a greater economic value as a raw material for petrochemicals and motor gasolines than as a component of the natural gas stream.

Gathering. At the earliest stage of the midstream value chain, a network of typically small diameter pipelines known as gathering systems directly connect to wellheads or pad sites in the production area. Gathering systems transport gas from the wellhead to downstream pipelines or a central location for treating and processing. Gathering systems are often designed to be highly flexible to allow gathering of natural gas at different pressures and scalable to allow for additional production and well connections without significant incremental capital expenditures. A byproduct of the gathering process is the recovery of condensate liquids, which are sold on the open market.

Compression. Gathering systems are operated at pressures intended to enable the maximum amount of production to be gathered from connected wells. Through a mechanical process known as compression, volumes of natural gas at a given pressure are compressed to a sufficiently higher pressure, thereby allowing those volumes to be delivered into a higher pressure downstream pipeline to be shipped to market. Because wells produce at progressively lower field pressures as they age, it becomes necessary to add additional compression over time to maintain throughput across the gathering system.

Treating and Dehydration. Treating and dehydration involves the removal of impurities such as water, carbon dioxide, nitrogen and hydrogen sulfide that may be present when natural gas is produced at the wellhead. Impurities must be removed for the natural gas to meet the quality specifications for pipeline transportation, and end users normally cannot consume (and will not purchase) natural gas with a high level of impurities. Therefore, to meet downstream pipeline and end user natural gas quality standards, the natural gas is dehydrated to remove water and is chemically treated to separate the impurities from the natural gas stream.

Processing. Once impurities are removed, pipeline-quality residue gas is separated from NGLs. Most rich natural gas is not suitable for long-haul pipeline transportation or commercial use and must be processed to remove the heavier hydrocarbon components. The removal and separation of hydrocarbons during processing is possible because of the differences in physical properties between the components of the raw gas stream. There are four basic types of natural gas processing methods: cryogenic expansion, lean oil absorption, straight refrigeration and dry bed absorption. Cryogenic expansion represents the latest generation of processing, incorporating extremely low temperatures and high pressures to provide the best processing and most economical extraction.

Natural gas is processed not only to remove heavier hydrocarbon components that would interfere with pipeline transportation or the end use of the natural gas, but also to separate from the natural gas those hydrocarbon liquids that could have a higher value as NGLs than as natural gas. The principal component of residue gas is methane, although some lesser amount of entrained ethane typically remains. In some cases, processors have the option to leave ethane in the gas stream or to recover ethane from the gas stream, depending on ethane’s value relative to natural gas. The processor’s ability to “reject” ethane varies depending on the downstream pipeline’s quality specifications. The residue gas is sold to industrial, commercial and residential customers and electric utilities.

Fractionation. Once NGLs have been removed from the natural gas stream, they can be broken down into their base components to be useful to commercial customers. Mixed NGL streams can be further separated into purity NGL products, including ethane, propane, normal butane, isobutane, and natural gasoline. Fractionation works based on the different boiling points of the different hydrocarbons in the NGL stream, and essentially occurs in stages consisting of the boiling off of hydrocarbons one by one. The entire fractionation process is broken down into steps, starting with the removal of the lighter NGLs from the stream. In general, fractionators are used in the following order: (i) deethanizer, which separates ethane from the NGL stream, (ii) depropanizer, which separates propane, (iii) debutanizer, which boils off the butanes and leaves the pentanes and heavier hydrocarbons in the NGL stream, and (iv) butane splitter (or deisobutanizer), which separates isobutanes and normal butanes.

Transportation and Storage. Once raw natural gas has been treated or processed and the raw NGL mix fractionated into individual NGL components, the natural gas and NGL components are stored, transported and marketed to end-use markets. The natural gas pipeline grid in the United States transports natural gas from producing regions to customers, such as LDCs, industrial users and electric generation facilities.

16

Historically, the concentration of natural gas production in a few regions of the United States generally required transportation pipelines to transport gas not only within a state but also across state borders to meet national demand. However, a recent shift in supply sources, from conventional to unconventional, has affected the supply patterns, the flows and the rates that can be charged on pipeline systems. The impacts vary among pipelines according to the location and the number of competitors attached to these new supply sources. These changing market dynamics are prompting midstream companies to evaluate the construction of short-haul pipelines as a means of providing demand markets with cost-effective access to newly-developed production regions, as compared to relying on higher-cost, long-haul pipelines that were originally designed to transport natural gas greater distances across the country.

Natural gas storage plays a vital role in maintaining the reliability of gas available for deliveries. Natural gas is typically stored in underground storage facilities, including salt dome caverns, bedded salt caverns and depleted reservoirs. Storage facilities are most often utilized by pipeline companies to manage temporary imbalances in operations; natural gas end-users, such as LDCs, to manage the seasonality and variability of demand and to satisfy future natural gas needs; and, independent natural gas marketing and trading companies in connection with the execution of their trading strategies.

Competition

Our G&P operations compete for customers based on reputation, operating reliability and flexibility, price, creditworthiness, and service offerings, including interconnectivity to producer-desired takeaway options (i.e., processing facilities and pipelines). We face strong competition in acquiring new supplies in the production basins in which we operate, and competition customarily is impacted by the level of drilling activity in a particular geographic region and fluctuations in commodity prices. Our primary competitors include other midstream companies with G&P operations and producer-owned systems, and certain competitors enjoy first-mover advantages over us and may offer producers greater gathering and processing efficiencies, lower operating costs and more flexible commercial terms.

Our NGL supply and logistics business competes primarily with integrated major oil companies, refiners and processors, and other energy companies that own or control transportation and storage assets that can be optimized for supply, marketing and logistics services.

Natural gas storage and pipeline operators compete for customers primarily based on geographic location, which determines connectivity and proximity to supply sources and end-users, as well as price, operating reliability and flexibility, available capacity and service offerings. Our primary competitors in our natural gas storage market include other independent storage providers and major natural gas pipelines with storage capabilities embedded within their transmission systems. Our primary competitors in the natural gas transportation market include major natural gas pipelines and intrastate pipelines that can transport natural gas volumes between interstate systems. Long-haul pipelines often enjoy cost advantages over new pipeline projects with respect to options for delivering greater volumes to existing demand centers, and new projects and expansions proposed from time to time may serve the markets we serve and effectively displace the service we provide to customers.

Our crude oil rail terminals primarily compete with crude oil pipelines and other midstream companies that own and operate rail terminals in the markets we serve. The crude oil logistics business is characterized by strong competition for supplies, and competition is based largely on customer service quality, pricing, and geographic proximity to customers and other market hubs.

Regulation

Our operations and investments are subject to extensive regulation by federal, state and local authorities. The regulatory burden on our operations increases our cost of doing business and, in turn, impacts our profitability. In general, midstream companies have experienced increased regulatory oversight over the past few years. We cannot predict the extent to which this trend will continue in the foreseeable future or in the long term.

Pipeline and Underground Storage Safety

We are subject to pipeline safety regulations imposed by the U.S. Department of Transportation Pipeline and Hazardous Materials Safety Administration (PHMSA). PHMSA regulates safety requirements in the design, construction, operation and maintenance of jurisdictional natural gas and hazardous liquid pipeline and storage facilities. All of our natural gas pipelines used in gathering, storage and transportation activities are subject to regulation by PHMSA under the Natural Gas Pipeline Safety Act of 1968, as amended (NGPSA), and all of our NGL and crude oil pipelines used in gathering, storage and

17

transportation activities are subject to regulation by PHMSA as hazardous liquids pipelines under the Hazardous Liquid Pipeline Safety Act of 1979, as amended (HLPSA).

These federal statutes and PHMSA implementing regulations collectively impose numerous safety requirements on pipeline operators, such as the development of a written qualification program for individuals performing covered tasks on pipeline facilities and the implementation of pipeline integrity management programs. For example, pursuant to the authority under the NGPSA and HLPSA, PHMSA has promulgated regulations requiring pipeline operators to develop and implement integrity management programs for certain gas and hazardous liquid pipelines. The integrity management programs govern pipeline operators’ actions in high-consequence areas, such as areas of high population and areas unusually sensitive to environmental damage. Specifically, integrity management programs require more frequent inspections and other preventative measures to ensure pipeline safety in high consequence areas.

We plan to continue testing under our pipeline integrity management programs to assess and maintain the integrity of our pipelines in accordance with PHMSA regulations. Notwithstanding our preventive and investigatory maintenance efforts, we may incur significant expenses if anomalous pipeline conditions are discovered or due to the implementation of more stringent pipeline safety standards resulting from new or amended legislation. For example, the NGPSA and HLPSA were amended by the Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011 (2011 Pipeline Safety Act), which requires increased safety measures for gas and hazardous liquids transportation pipelines. Among other things, the 2011 Pipeline Safety Act increased the penalties for safety violations, established additional safety requirements for newly constructed pipelines and required studies of safety issues that could result in the adoption of new regulatory requirements by PHMSA for existing pipelines. More recently, in June 2016, the Protecting Our Infrastructure of Pipelines and Enhancing Safety Act of 2016 (2016 Pipeline Safety Act) was passed, extending PHMSA’s statutory mandate through 2019 and, among other things, requiring PHMSA to complete certain of its outstanding mandates under the 2011 Pipeline Safety Act and developing new safety standards for natural gas storage facilities by June 2018. The 2016 Pipeline Safety Act also empowers PHMSA to address imminent hazards by imposing emergency restrictions, prohibitions and safety measures on owners and operators of gas or hazardous liquid pipeline facilities without prior notice or an opportunity for a hearing. PHMSA issued interim regulations in October 2016, to implement the agency's expanded authority to address unsafe pipeline conditions or practices that pose an imminent hazard to life, property, or the environment. The safety enhancement requirements and other provisions of the 2011 Pipeline Safety Act and the 2016 Pipeline Safety Act, as well as any implementation of PHMSA regulations thereunder, or any issuance or reinterpretation of guidance by PHMSA or any state agencies with respect thereto, could require us to install new or modified safety controls, pursue additional capital projects or conduct maintenance programs on an accelerated basis, any or all of which tasks could result in our incurring increased operating costs that could have a material adverse effect on our results of operations or financial position.

Furthermore, PHMSA is considering changes to its natural gas pipeline regulations to, among other things: (i) expand the scope of high consequence areas; (ii) strengthen integrity management requirements applicable to existing operators; (iii) strengthen or expand non-integrity pipeline management standards relating to such matters as valve spacing, automatic or remotely-controlled valves, corrosion protection, and gathering lines; and (iv) add new regulations to govern underground facilities that are not currently subject to federal regulation. See “We may incur higher costs as a result of pipeline integrity management program testing and additional safety legislation,” under Item 1A. Risk Factors for further discussion on PHMSA rulemaking. We cannot predict the final outcome of these legislative or regulatory efforts or the precise impact that compliance with any resulting new safety requirements may have on our business and investments.

Future environmental regulatory developments, such as more strict environmental laws or regulations, or more stringent enforcement of the existing regulatory requirements could also directly affect our operations and investments. For example, in June 2016, the EPA published a final rule establishing new emissions standards for methane and additional standards for volatile organic compounds from certain new, modified, and reconstructed equipment and processes in the oil and natural gas source category, including production, processing, transmission and storage facilities. These standards will require the use of certain specific emissions control practices, thereby requiring additional controls for pneumatic controllers and pumps, as well as compressors, and imposing leak detection and repair requirements for natural gas compressor and booster stations. However, in June 2017, the EPA published a proposed rule to stay certain portions of these 2016 standards for two years and reconsider the entirety of the 2016 standards but has not yet published a final rule and, as a result, the 2016 standards are currently in effect.

States are also expected to implement their own rules, which could be more stringent than federal requirements. In matters that could have an indirect adverse effect on our business by decreasing demand for the services that we offer, the EPA has completed a study of potential adverse impacts that certain drilling methods (including hydraulic fracturing) may have on water quality and public health, concluding that “water cycle” activities associated with hydraulic fracturing may impact drinking water resources under certain circumstances. Congress has also considered but not adopted, and several states have

18

proposed or enacted, legislation or regulations imposing more stringent or costly requirements for exploration and production companies to develop and produce hydrocarbons.

States are largely preempted by federal law from regulating pipeline safety for interstate pipelines, but most states are certified by the Department of Transportation to assume responsibility for enforcing federal intrastate pipeline regulations and inspection of intrastate pipelines. In practice, because states can adopt stricter standards for intrastate pipelines than those imposed by the federal government for interstate pipelines, states vary considerably in their authority and capacity to address pipeline safety. Our pipelines have operations and maintenance plans designed to keep the facilities in compliance with pipeline safety requirements, and we do not anticipate any significant difficulty in complying with applicable state laws and regulations.

Natural Gas Gathering

Natural gas gathering facilities are exempt from FERC jurisdiction under Section 1(b) of the Natural Gas Act. Although the FERC has not made formal determinations with respect to all of our facilities we consider to be gathering facilities, we believe that our natural gas pipelines meet the traditional tests that the FERC has used to determine whether a pipeline is a gathering pipeline, and not subject to FERC jurisdiction. The distinction between FERC-regulated transmission services and federally unregulated gathering services, however, has been the subject of substantial litigation. The FERC determines whether facilities are gathering facilities on a case-by-case basis, so the classification and regulation of our gathering facilities is subject to change based on future determinations by the FERC, the courts or Congress. If the FERC were to consider the status of an individual facility and determine that the facility and/or services provided are not exempt from FERC regulation under the Natural Gas Act and the facility provides interstate service, the rates for, and terms and conditions of, the services provided by such facility would be subject to FERC. Such regulation could decrease revenue, increase operating costs, and, depending upon the facility in question, adversely affect our results of operations and cash flows. In addition, if any of our facilities were found to have provided services or otherwise operated in violation of the Natural Gas Act or the Natural Gas Policy Act, this could result in the imposition of civil penalties, as well as a requirement to disgorge charges collected for such service in excess of the rate established by the FERC.

States may regulate gathering pipelines. State regulation of gathering facilities generally includes various safety, environmental and, in some circumstances, requirements prohibiting undue discrimination, and complaint-based rate regulation. Our natural gas gathering operations may be subject to ratable take and common purchaser statutes in the states in which we operate. These statutes are designed to prohibit discrimination in favor of one producer over another producer, or one source of supply over another source of supply, and generally require our gathering pipelines to take natural gas without undue discrimination as to source of supply or producer. These statutes have the effect of restricting our right as an owner of gathering facilities to decide with whom we contract to purchase or transport natural gas.

The states in which we operate gathering systems have adopted a form of complaint-based regulation, which allows natural gas producers and shippers to file complaints with state regulators in an effort to resolve grievances relating to gathering access and rate discrimination. To date, these regulations have not had an adverse effect on our systems. We cannot predict whether such a complaint will be filed against us in the future, however, a failure to comply with state regulations can result in the imposition of administrative, civil and criminal remedies.

In Texas, we have filed with the Texas Railroad Commission (TRRC) to establish rates and terms of service for certain of our pipelines. Our assets in Texas include intrastate common carrier NGL pipelines subject to the regulation of the TRRC, which requires that our NGL pipelines file tariff publications containing all the rules and the regulations governing the rates and charges for services we perform. NGL pipeline rates may be limited to provide no more than a fair return on the aggregate value of the pipeline property used to render services.

NGL Storage

Our NGL storage terminals are subject primarily to state and local regulation. For example, the Indiana Department of Natural Resources (INDNR) and the New York State Department of Environmental Conservation (NYSDEC) have jurisdiction over the underground storage of NGLs and NGL related well drilling, well conversions and well plugging in Indiana and New York, respectively. Thus, the INDNR regulates aspects of our Seymour facility, and the NYSDEC regulates aspects of the Bath facility, as well as our proposed storage facility near Watkins Glen.

19

We filed an application with the NYSDEC in October 2009, for an underground storage permit for our Watkins Glen NGL storage development project. The agency issued a Positive Declaration for the project in November 2010, and determined in August 2011 that the Draft Supplemental Environmental Impact Statement we submitted for the project was complete. In 2012, we modified our brine pond designs in response to local concerns and submitted to the NYSDEC final drawings and plans for our revised project design. The NYSDEC published a draft storage permit in October 2014, and held an issues conference in February 2015, to determine if any significant issues remained that would require an adjudicatory hearing. In September 2016, we further modified our project design (i.e., reduced storage capacity, eliminated truck and rail transportation options, and eliminated brine pond capacity) in response to local concerns and perceptions. In September 2017, the Chief Administrative Law Judge ruled that the opponents of the project failed to raise any issues requiring adjudication. This ruling has been appealed to the NYSDEC Commissioner. As part of the US Salt divestiture, we retained all surface and sub-surface rights necessary to place the Watkins Glen NGL storage development project into service once we receive all required regulatory approvals. We cannot predict with certainty if and when the permitting process will be concluded.

Crude Oil Transportation

The transportation of crude oil by common carrier pipelines on an interstate basis is subject to regulation by the FERC under the Interstate Commerce Act (ICA), the Energy Policy Act of 1992, and the rules and regulations promulgated under those laws. FERC regulations require interstate common carrier petroleum pipelines to file with the FERC and publicly post tariffs stating their interstate transportation rates and terms and conditions of service. The ICA and FERC regulations also require that such rates be just and reasonable, and to be applied in a non-discriminatory manner so as to not confer undue preference upon any shipper. The transportation of crude oil by common carrier pipelines on an intrastate basis is subject to regulation by state regulatory commissions. The basis for intrastate crude oil pipeline regulation, and the degree of regulatory oversight and scrutiny given to intrastate crude oil pipeline rates, varies from state to state. Intrastate common carriers must also offer service to all shippers requesting service on the same terms and under the same rates. Our crude oil pipelines in North Dakota are not common carrier pipelines and, therefore, are not subject to rate regulation by the FERC or any state regulatory commission. We cannot, however, provide assurance that the FERC will not, at some point, either at the request of other entities or on its own initiative, assert that some or all of our crude oil pipelines are subject to FERC requirements for common carrier pipelines, or are otherwise not exempt from the FERC’s filing or reporting requirements, or that such an assertion would not adversely affect our results of operations. In the event the FERC were to determine that these crude oil pipelines are subject to FERC requirements for common carrier pipelines, or otherwise would not qualify for a waiver from the FERC’s applicable regulatory requirements, we would likely be required to (i) file a tariff with the FERC; (ii) provide a cost justification for the transportation charge; (iii) provide service to all potential shippers without undue discrimination; and (iv) potentially be subject to fines, penalties or other sanctions.

Certain of our crude oil operations located in North Dakota are subject to state regulation by the North Dakota Industrial Commission (NDIC). For example, gas conditioning requirements established by the NDIC recently will require operators of crude by rail terminals to report to the NDIC any crude volumes received for loading that exceed federal vapor pressure limits. State legislation has been proposed that, if passed, would authorize and require the NDIC to promulgate regulations under which produced water pipelines would be required to, among other things, install leak detection facilities and post bonds to cover potential remediation costs associated with releases. Moreover, the regulation of our customers’ production activities by the NDIC impacts our operations. For example, during 2016, the NDIC approved additional requirements relating to site construction, underground gathering pipelines and spill containment that became effective on October 1, 2016, while other requirements relating to bonding for underground gathering pipelines, and construction of berms around facilities became effective on January 1, 2017. Additionally, on July 1, 2014, the NDIC issued an order pursuant to which the agency adopted legally enforceable “gas capture percentage goals” targeting the capture of certain percentages of natural gas produced in the state by specified dates, and subsequently modified that order in late 2015. Exploration and production operators in the state may be required to install new equipment to satisfy these goals, and any failure by operators to meet these gas capture percentage goals would subject those operators to production restrictions, which could reduce the amount of commodities we gather on the Arrow system from our customers, and have a corresponding adverse impact on our business and results of operations.

Portions of our Arrow gathering system, which is located on the Fort Berthold Indian Reservation, may be subject to applicable regulation by the Mandan, Hidatsa & Arikara Nation (MHA Nation). An entirely separate and distinct set of laws and regulations may apply to operators and other parties within the boundaries of the Fort Berthold Indian Reservation. Various federal agencies within the U.S. Department of the Interior, particularly the Bureau of Indian Affairs, the Office of Natural Resources Revenue and the Bureau of Land Management (BLM) promulgate and enforce regulations pertaining to oil and gas operations on Native American lands. These regulations include lease provisions, environmental standards, tribal employment preferences and numerous other matters.

20

Native American tribes are subject to various federal statutes and oversight by the Bureau of Indian Affairs and BLM. However, Native American tribes possess certain inherent authorities to enact and enforce their own internal laws and regulations as long as such laws and regulations do not supersede or conflict with such federal statutes. These tribal laws and regulations may include various fees, taxes, and requirements to extend preference in employment to tribal members or Indian owned businesses. Further, lessees and operators within a Native American reservation may be subject to the pertinent Native American judiciary system, or barred from litigating matters adverse to the pertinent tribe unless there is a specific waiver of the tribe’s sovereign immunity. Therefore, we may be subject to various applicable laws and regulations pertaining to Native American oil and gas leases, fees, taxes and other burdens, obligations and issues unique to oil and gas operations within Native American reservations. One or more of these applicable regulatory requirements, or delays in obtaining necessary approvals or permits necessary to operate on tribal lands, may increase our costs of doing business on Native American tribal lands and have an impact on the economic viability of any well or project with a Native American reservation. Additionally, we cannot guarantee that we will always be able to renew existing rights-of-way or obtain new rights-of-way in Native American lands without experiencing significant costs. For example, following a recent decision issued in May 2017 by the Federal Tenth Circuit Court of Appeals that relied, in part, on a previous Federal Eighth Circuit Court of Appeals decision, tribal ownership of even a very small fractional interest in an allotted land, that is, tribal land owned or at one time owned by an individual Native American landowner, bars condemnation of any interest in the allotment. Consequently, the inability to condemn such allotted lands under circumstances where an existing pipeline rights-of-way may soon lapse or terminate serves as an additional impediment for pipeline operators.