International Tower Hill Mines Ltd.: Exhibit 99.2 - Filed by newsfilecorp.com

| INTERNATIONAL TOWER HILL MINES LTD. |

| (An Exploration Stage Company) |

| |

| FORM 51-102F1 |

| MANAGEMENT DISCUSSION & ANALYSIS |

| |

| May 10, 2012 |

| |

| Introduction |

During 2011, International Tower Hill Mines Ltd. (the “Company”

or “ITH”) changed its fiscal year end to December 31. This Management Discussion

& Analysis (“MD&A”) covers the three month period ended March 31, 2012

and has been prepared by management, in accordance with the requirements of

National Instrument 51-102, as of May 10, 2012 and should be read in conjunction

with the Company’s audited consolidated financial statements for the seven month

period ended December 31, 2011. Due to the change in year end, the three month

period ended February 28, 2011 has been used as the comparative period to the

three month period ended March 31, 2012. The Company’s audited consolidated

financial statements for the seven month period ending December 31, 2011 were

the first annual financial statements that have been prepared in accordance with

International Financial Reporting Standards (“IFRS”). The Company adopted IFRS

on June 1, 2011 with a transition date of June 1, 2010. Except where otherwise

noted, all dollar amounts are stated in Canadian dollars.

Caution Regarding Forward Looking Statements

This MD&A contains forward-looking statements and

forward-looking information (collectively, “forward-looking statements”) within

the meaning of applicable Canadian and US securities legislation. These

statements relate to future events or the future activities or performance of

the Company. All statements, other than statements of historical fact are

forward-looking statements. Information concerning mineral resource estimates

also may be deemed to be forward-looking statements in that it reflects a

prediction of the mineralization that would be encountered if a mineral deposit

were developed and mined. Forward-looking statements are typically identified by

words such as: believe, expect, anticipate, intend, estimate, postulate, plans

and similar expressions, or which by their nature refer to future events. These

forward looking statements include, but are not limited to, statements

concerning:

-

the Company’s strategies and objectives, both generally and specifically in

respect of the Livengood project;

-

the potential for the expansion of the estimated resources at Livengood;

-

the potential for a production decision concerning, and any production at,

the Livengood project;

-

the completion of a Pre-feasibility Study for the Livengood project;

-

the potential for higher grade mineralization to form the basis for a

starter surface mine shell in any production scenario at Livengood;

-

the potential overburden geometry of the Livengood deposit being amenable

for a low cost surface mine that could support a high production rate and

economies of scale;

-

the potential for cost savings due to the high gravity gold concentration

component of some of the Livengood mineralization;

-

the sequence of decisions regarding the timing and costs of development

programs with respect to, and the issuance of the necessary permits and

authorizations required for the Livengood project;

-

the Company’s estimates of the quality and quantity of the resources at

Livengood;

-

the timing and cost of the planned future exploration programs at

Livengood, and the timing of the receipt of results therefrom;

-

the Company’s future cash requirements;

-

general business and economic conditions;

-

the Company’s ability to meet its financial obligations as they come due,

and to be able to raise the necessary funds to continue operations on

acceptable terms, if at all;

-

the use of the proceeds from the financing which closed November 10, 2010;

and

-

the ability of the Company to continue to refine the project economics for

the Livengood project.

Although the Company believes that such statements are

reasonable, it can give no assurance that such expectations will prove to be

correct. Inherent in forward looking statements are risks and uncertainties

beyond the Company’s ability to predict or control, including, but not limited

to, risks related to the Company’s inability to identify one or more economic

deposits on its property, variations in the nature, quality and quantity of any

mineral deposits that may be located, variations in the market price of any

mineral products the Company may produce or plan to produce, the Company’s

inability to obtain any necessary permits, consents or authorizations required

for its activities, to produce minerals from its property successfully or

profitably, to continue its projected growth, to raise the necessary capital or

to be fully able to implement its business strategies, and other risks

identified herein under “Risk Factors”.

The Company cautions investors that any forward-looking

statements by the Company are not guarantees of future performance, and that

actual results are likely to differ, and may differ materially, from those

expressed or implied by forward looking statements contained in this MD&A.

Such statements are based on a number of assumptions which may prove incorrect,

including, but not limited to, assumptions about:

-

the demand for, and level and volatility of the price of, gold;

-

general business and economic conditions;

-

the timing of the receipt of regulatory and governmental approvals, permits

and authorizations necessary to implement and carry on the Company’s planned

exploration and potential development program at Livengood;

-

conditions in the financial markets generally;

2

-

the Company’s ability to secure the necessary consulting, drilling and

related services and supplies on favourable terms in connection with not only

its ongoing exploration program at Livengood but also in connection with the

completion of its pre-feasibility study and in connection with any feasibility

study that may be commissioned;

-

the Company’s ability to attract and retain key staff, particularly in

connection with the carrying out of a feasibility study and the development of

any mine at Livengood;

-

the accuracy of the Company’s resource estimates (including with respect to

size and grade) and the geological, operational and price assumptions on which

these are based;

-

the timing of the ability to commence and complete the planned work at

Livengood;

-

the anticipated terms of the consents, permits and authorizations necessary

to carry out the planned exploration and development programs at Livengood and

the Company’s ability to comply with such terms on a safe and cost-effective

basis;

-

the ongoing relations of the Company with its underlying lessors and the

applicable regulatory agencies;

-

that the metallurgy and recovery characteristics of samples from certain of

the Company’s mineral properties are reflective of the deposit as a whole;

-

the continued development of and potential construction of any mine at the

Livengood property not requiring consents, approvals, authorizations or

permits that are materially different from those identified to date by the

Company;

-

the ability of the Company to predict how the net proceeds of the financing

which closed on November 10, 2010 will be used; and

-

the timetables for the completion of a pre-feasibility study at Livengood

and for any feasibility study that may be commissioned.

These forward looking statements are made as of the date hereof

and the Company does not intend and does not assume any obligation, to update

these forward looking statements, except as required by applicable law. For the

reasons set forth above, investors should not attribute undue certainty to or

place undue reliance on forward-looking statements.

Historical results of operations and trends that may be

inferred from the following discussion and analysis may not necessarily indicate

future results from operations. In particular, the current state of the global

securities markets may cause significant reductions in the price of the

Company’s securities and render it difficult or impossible for the Company to

raise the funds necessary to continue operations. See “Risk Factors –

Insufficient Financial Resources/Share Price Volatility”.

Caution Regarding Adjacent or Similar Mineral

Properties

This MD&A contains information with respect to adjacent or

similar mineral properties in respect of which the Company has no interest or

rights to explore or mine. The Company advises US investors that the mining

guidelines of the US Securities and Exchange Commission (the “SEC”) set forth in

the SEC’s Industry Guide 7 (“SEC Industry Guide 7”) strictly prohibit

information of this type in documents filed with the SEC. As a foreign private

issuer preparing this MD&A pursuant to Canadian disclosure requirements

under the Canada-U.S. Multi-Jurisdictional Disclosure System, this MD&A is

not subject to the requirements of SEC Industry Guide 7.

Readers are cautioned that the Company has no interest in or right to acquire

any interest in any such properties, and that mineral deposits on adjacent or

similar properties, and any production therefore or economics with respect

thereto, are not indicative of mineral deposits on the Company’s properties or

the potential production from, or cost or economics of, any future mining of any

of the Company’s mineral properties.

3

Cautionary Note to US Investors Concerning Reserve and

Resource Estimates

The terms “mineral reserve”, “proven mineral reserve” and

“probable mineral reserve” are Canadian mining terms as defined in accordance

with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and

Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and

Mineral Reserves, adopted by the CIM Council, as amended (“CIM Standards”).

These definitions differ from the definitions in SEC Industry Guide 7 under the

United States Securities Act of 1933, as amended (the “Securities Act”). Under

SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is

required to report reserves, the three-year historical average price is used in

any reserve or cash flow analysis to designate reserves and the primary

environmental analysis or report must be filed with the appropriate governmental

authority.

In addition, the terms “mineral resource”, “measured mineral

resource”, “indicated mineral resource” and “inferred mineral resource” are

defined in and required to be disclosed by NI 43-101 and the CIM Standards;

however, these terms are not defined terms under SEC Industry Guide 7 and are

normally not permitted to be used in reports and registration statements filed

with the SEC. Investors are cautioned not to assume that all or part of a

mineral deposit in these categories will ever be converted into reserves.

“Inferred mineral resources” have a great amount of uncertainty as to their

existence, and great uncertainty as to their economic and legal feasibility. It

cannot be assumed that all or any part of an inferred mineral resource will ever

be upgraded to a higher category. Under Canadian rules, estimates of inferred

mineral resources may not form the basis of feasibility or pre-feasibility

studies, except in rare cases. Investors are cautioned not to assume that all or

any part of an inferred mineral resource exists or is economically or legally

mineable. Disclosure of “contained ounces” in a resource is permitted disclosure

under Canadian regulations; however, the SEC normally only permits issuers to

report mineralization that does not constitute “reserves” by SEC Industry Guide

7 standards as in place tonnage and grade without reference to unit

measures.

Accordingly, information contained in this MD&A and the

documents incorporated by reference herein contain descriptions of the Company’s

mineral deposits that may not be comparable to similar information made public

by U.S. companies subject to the reporting and disclosure requirements under the

United States federal securities laws and the rules and regulations

thereunder.

| Current

Business Activities |

General

During the three month period ended March 31, 2012, and to the

date of this MD&A, the Company advanced its Livengood Gold Project in Alaska

with the continuation of activities in support of the Pre-feasibility Study

(“PFS”) as well as its Feasibility Study (“FS”). This included completion of

drill programs, analyzing results thereof, the advancement of engineering and

environmental studies, and the build-up of its team in Fairbanks, Alaska and

Englewood, Colorado.

Highlights of activities during and subsequent to the period

include:

- The PFS work proceeded as planned with substantial progress, including

that the majority of engineering studies have been completed on time. A

detailed metallurgical review of the flow-sheet utilized in the Company’s Preliminary

Economic Assessment (“PEA”) of the Livengood Project as contained in the

August 25, 2011 NI 43-101 technical report entitled “August 2011 Summary

Report on the Livengood Project, Tolovana District, Alaska” (“August 2011

Report”) indicated further optimization is possible. The PFS is anticipated to

be completed in the third quarter of 2012 and will include results of these

optimization studies.

4

-

Ongoing environmental baseline data gathering for Livengood permitting

activities continued with samples developed for large scale field testing of

material geochemical characteristics.

-

In January 2012, two major contracts were awarded: process engineering

services and geotechnical infrastructure engineering services for the FS.

Feasibility level work commenced in February 2012.

-

On May 1, 2012 the Company commenced three major field drill programs

consisting of district-wide exploration, condemnation and geotechnical

drilling at Livengood.

Livengood Project

Pre-feasibility Study

A PFS for the Livengood Project is currently underway and

scheduled to be released in the third quarter of 2012. The PFS work continued as

planned during the quarter. With the majority of engineering studies having been

completed in November 2011, the Company is currently carrying out detailed and

extensive metallurgical testing after a review of the Preliminary Economic

Assessment flow sheet indicated that further optimization is possible. The

Livengood PFS will provide an update of the anticipated project configuration

and an overview of the geological, exploration, surface mine planning,

metallurgical test work, process plant and infrastructure engineering, and

environmental baseline studies that have been completed to date. The PFS will

update the PEA, which was based on a surface mining operation supplying

mineralized material to a processing plant with average throughput of 91,000

tonnes per day. The processing plant would produce gravity and flotation

concentrates with gold recovered by Carbon-in-Leach processing of the

concentrates.

Environmental baseline data gathering for Livengood permitting

activities continues for air quality, cultural resources, groundwater, surface

water, fisheries, wildlife, and wetlands and includes additional drilling and

samples during the 2012 field season for geochemical testing.

During the quarter, the Company selected Samuel Engineering,

Inc. of Greenwood Village, Colorado, to provide process engineering services for

its FS. The Company has also engaged AMEC Environment & Infrastructure, Inc.

of Denver, Colorado, to provide geotechnical infrastructure engineering services

for the FS. Feasibility level work commenced in February 2012.

The Company will continue its investigations and studies at the

Livengood Project. In order to support the completion of these work programs as

well as drilling programs (see Drilling below) the Company anticipates spending

approximately $68 million for the 2012 fiscal year ending December 31, 2012,

subject to raising the necessary additional financing. For the three months

ended March 31, 2012, total expenditures on the Livengood Project were

$14,242,782 which includes land acquisitions, drilling related to exploration

activities (see Drilling below) and field costs and other investigations and

studies.

5

Drilling

In March 2012 the Company received the results for 73 in-fill

drill holes completed late in 2011 which confirm the integrity of the May 2011

resource estimate reported in the August 2011 Report. Based on the latest

results, new internal resource estimates calculated for three areas of the

deposit have been verified within 1% to contain the same tonnage, grade and

contained ounces of gold as those calculated from the nominal 50-metre-spaced

grid drilling used to calculate the May 2011 resource. This positive outcome

marks the conclusion of confirmation drilling at the Livengood Project as the

Company focuses on district-wide exploration within its 145 km2 land

package as well as condemnation/geotechnical drilling in support of permitting

activities in 2012.

In May 2012, the Company commenced three major field drill

programs consisting of district-wide exploration, condemnation and geotechnical

drilling. Results from the drill programs are expected throughout the summer and

fall of 2012.

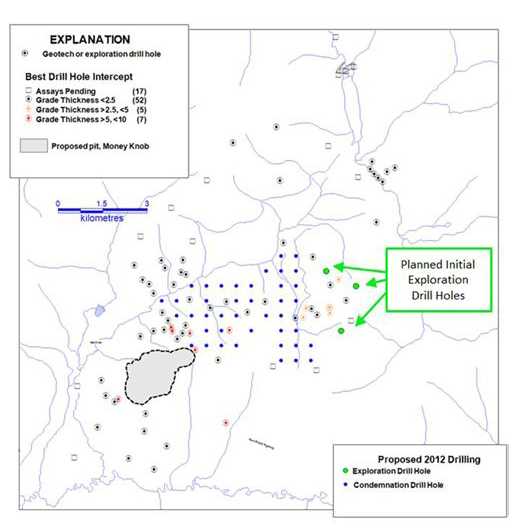

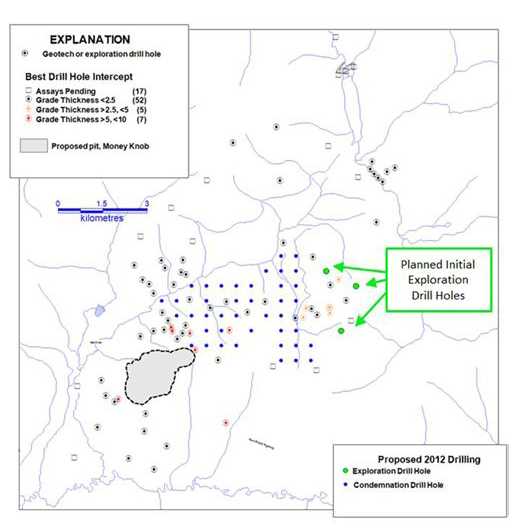

The Company plans to drill 3,000 metres in 10 core holes as

part of its initial district-wide exploration program. Prior drilling, mapping

and surface geochemical sampling conducted in 2010 had identified an area

northeast of the Money Knob deposit where faults, dikes and anomalous gold

coincide, indicating an area of potentially significant mineralization. An

initial three holes are planned to target the area to assess the extent of the

mineralization (see Figure 1 below). Subsequent exploration drill sites are

contingent on the results of the initial holes. With the Money Knob deposit

containing over 16.5 million gold ounces in the Measured and Indicated (933

million tonnes at an average grade of 0.55 grams per tonne (“g/t”) using a 0.22

g/t cutoff), and 4.1 million ounces in the Inferred (257 million tonnes at an

average grade of 0.50 g/t using a 0.22 g/t cutoff), resource categories, the

Company will focus on new areas of our land package for potential additional

gold deposits.

In addition, a 40-hole, 6,000-metre program of condemnation

drilling will be carried out to either sterilize or establish the presence of

significant mineralization in the area surrounding the Money Knob deposit and

extending northeast towards existing mineralized exploration drill holes. The

purpose of the condemnation drilling program is to determine appropriate areas

for infrastructure development.

6

Figure 1: Map showing distribution of regional

geotechnical and exploration holes at Livengood, whether

they intersect gold

mineralization, and the locations of proposed condemnation and exploration core

holes for the 2012 program.

In addition, a 3,000-metre program of geotechnical drilling is

planned for 2012, this program will assist in the development of baseline data

as the Livengood project progresses toward permitting. The data will enable the

Company to prepare the requisite analysis to support permit applications in the

first half of 2013.

Use of Financing Proceeds

The Company closed a bought deal short form prospectus and a

private placement financing on November 10, 2010. The Company disclosed that it

intended to use the net proceeds from the two financings for continued work on

the Livengood Project and for general working capital purposes. The “Use of

Proceeds” plan contained in the Company’s short form prospectus dated November

5, 2010, projected total Livengood project expenditures dating from September 1,

2010 (beginning of Q2 for the Fiscal Year ending May 31, 2011) to May 31, 2014.

The use of proceeds plan totalled $136,575,000 for the period ending May 31,

2014. Table 1 shows the expenditures to March 31, 2012 compared with the

intended use of proceeds.

7

| Table 1: Comparison of Proposed Use of Proceeds

with Actual Use of Proceeds to March 31, 2012 |

| |

| |

|

|

|

|

Total Plan |

|

|

|

|

|

|

|

| |

|

Total Budget |

|

|

(Year Ended |

|

|

|

|

|

|

|

| |

|

Year ended |

|

|

May 31, 2011 |

|

|

Actual |

|

|

Variance |

|

| |

|

May 2011 to |

|

|

and Period |

|

|

Sept 1, 2010 |

|

|

(Total Plan – |

|

| Project Cost |

|

Period ended |

|

|

ended May 31, |

|

|

through March |

|

|

Actual through |

|

| Center |

|

May 2014 |

(2) |

|

2012)(2) |

|

|

31, 2012(1) |

|

|

March 31, 2012) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Project administration |

$ |

31,101,700 |

|

$ |

13,813,500 |

|

$ |

7,265,806 |

|

$ |

6,547,694 |

|

| Geological and field operations |

|

67,136,000 |

|

|

37,748,800 |

|

|

59,752,930 |

|

|

(22,004,130 |

) |

| Metallurgical studies |

|

6,883,400 |

|

|

5,369,500 |

|

|

4,111,098 |

|

|

1,258,402 |

|

| Infrastructure and engineering |

|

8,887,400 |

|

|

4,721,900 |

|

|

8,922,999 |

|

|

(4,201,099 |

) |

| Environmental and community engagement |

|

14,431,300 |

|

|

5,352,100 |

|

|

6,806,596 |

|

|

(1,454,496 |

) |

| Mining studies |

|

2,415,400 |

|

|

1,094,200 |

|

|

506,224 |

|

|

587,976 |

|

| Project integration |

|

1,882,300 |

|

|

600,000 |

|

|

617,425 |

|

|

(17,425 |

) |

| Land purchases(3) |

|

- |

|

|

- |

|

|

27,135,546 |

|

|

(27,135,546 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Subtotal |

|

132,737,500 |

|

|

68,700,000 |

|

|

115,118,624 |

|

|

(46,418,624 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Offering costs |

|

3,837,500 |

|

|

- |

|

|

502,208 |

|

|

(502,208 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

$ |

136,575,000 |

|

$ |

68,700,000 |

|

$ |

115,620,832 |

|

$ |

(46,920,832 |

) |

(1)Unaudited Livengood Project

Reporting

(2)As disclosed in the prospectus dated

November 5, 2010

(3)The amount does not include the

value of the Company’s derivative liability.

Table 1 shows a variance of approximately $46.9M from the

$68.7M for the total plan period ending May 31, 2012, and total spending of

$115.6M is approximately 85% of the total budget to mid-2014.

The activities planned for the total plan period are generally

on schedule and the completion of the PFS is expected in the third quarter of

2012, including additional optimization opportunities that have been identified

to date. Project administration expenditures are below the plan rate but are

adequate for the needs of the project. Geological and field operations have been

accelerated to support detailed evaluation and increased confidence in the

resource as well as for geotechnical studies. Metallurgical studies were

nominally below plan and have advanced as necessary to support the PFS. Field

programs in support of infrastructure geotechnical investigations have been

expanded and accelerated. The acceleration has added confidence in the

infrastructure characterization, which is a critical path item in the PFS.

Engineering expenditures were nominally on plan. Environmental and community

engagement is on schedule, and has required more expenditure than planned as

additional drilling and environmental sampling were incurred for baseline data

analysis. Expenditure for mining studies was nominally on plan requiring less

expenditures for the period. Project integration is nominally above plan, as the

technical components of the PFS were being compiled during the period. The land

purchases were not originally budgeted for the period prior to

May, 2014, but were accelerated to facilitate infrastructure engineering and

permitting. Offering costs were higher than expected due to the length of time

in filing the short form prospectus incurred in the quarter ended February

2011.

8

Livengood Placer Land

The land acquired in December 2011 enabled the Company to

pursue additional site facility locations and to investigate other land use

opportunities including the potential for placer gold extraction. During the

quarter, the Company undertook a comprehensive review and internal financial

analysis of these placer properties. As a result of the investigations, the

Company determined to postpone all further studies for placer gold extraction.

The review indicated the greatest benefits would be to optimize site facility

locations for the larger Livengood Project rather than focus on short-term

production.

Qualified Person and Quality Control/Quality

Assurance

Development work at the Livengood Project site was directed by

Thomas E. Irwin, Alaska General Manager.

The geologic work program at Livengood was designed and is

supervised by Chris Puchner, Chief Geologist (CPG 07048) of the Company who is a

qualified person as defined by National Instrument 43-101. Mr. Puchner is

responsible for all aspects of the work, including the quality control/quality

assurance program. On-site project personnel photograph the core from each

individual borehole prior to preparing the split core. Duplicate reverse

circulation drill samples are collected with one split sent for analysis.

Representative chips are retained for geological logging. On-site personnel at

the project log and track all samples prior to sealing and shipping. All sample

shipments are sealed and shipped to ALS Chemex in Fairbanks, Alaska, for

preparation and then on to ALS Chemex in Reno, Nevada, or Vancouver, B.C., for

assay. ALS Chemex’s quality system complies with the requirements for the

International Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy

and precision are monitored by the analysis of reagent blanks, reference

material and replicate samples. Quality control is further assured by the use of

international and in-house standards. Finally, representative blind duplicate

samples are forwarded to ALS Chemex and an ISO compliant third party laboratory

for additional quality control.

Due to the nature of the Company’s proposed business and the

present stage of exploration of its Livengood property interests (which is an

advanced stage exploration project, but with no known reserves), the following

risk factors, among others, will apply:

Resource Exploration and

Development is Generally a Speculative Business: Resource exploration and

development is a speculative business and involves a high degree of risk,

including, among other things, unprofitable efforts resulting both from the

failure to discover mineral deposits and from finding mineral deposits which,

though present, are insufficient in size and grade at the then prevailing market

conditions to return a profit from production. The marketability of natural

resources which may be acquired or discovered by the Company will be affected by

numerous factors beyond the control of the Company. These factors include market

fluctuations, the proximity and capacity of natural resource markets, government

regulations, including regulations relating to prices, taxes, royalties, land

use, importing and exporting of minerals and environmental protection. The exact

effect of these factors cannot be accurately predicted, but the combination of

these factors may result in the Company not receiving an adequate return on

invested capital.

9

While the Livengood project

has estimated measured, inferred and indicated resources identified, there are

no known reserves on any of the Company’s properties. The majority of

exploration projects do not result in the discovery of commercially mineable

deposits of ore. Substantial expenditures are required to; establish ore

reserves through drilling and metallurgical and other testing techniques,

determine metal content and metallurgical recovery processes to extract metal

from the ore, and construct, renovate or expand mining and processing

facilities. No assurance can be given that any level of recovery of ore reserves

will be realized or that any identified mineral deposit will ever qualify as a

commercial mineable ore body which can be legally and economically

exploited.

Fluctuation of Metal

Prices: Even if commercial quantities of mineral deposits are discovered by

the Company, there is no guarantee that a profitable market will exist for the

sale of the metals produced. The Company’s long-term viability and profitability

depend, in large part, upon the market price of metals which have experienced

significant movement over short periods of time, and are affected by numerous

factors beyond the control of the Company, including international economic and

political trends, expectations of inflation, currency exchange fluctuations,

interest rates and global or regional consumption patterns, speculative

activities and increased production due to improved mining and production

methods. The supply of and demand for metals are affected by various factors,

including political events, economic conditions and production costs in major

producing regions. There can be no assurance that the price of any minerals

produced from the Company’s properties will be such that any such deposits can

be mined at a profit.

Permits and Licenses: The

operations of the Company will require licenses and permits from various

governmental authorities. There can be no assurance that the Company will be

able to obtain all necessary licenses and permits that may be required to carry

out exploration, development and mining operations at its projects, on

reasonable terms or at all. Delays in obtaining, or a failure to obtain, any

such licenses and permits, or a failure to comply with the terms of any such

licenses and permits that the Company does obtain, could have a material adverse

effect on the Company.

Acquisition of Mineral Claims

under Agreements: The agreements pursuant to which the Company has the right

to acquire interests in a number of its properties at Livengood provide that the

Company must make a series of cash payments over certain time periods and/or

expend certain minimum amounts on the exploration of the properties. Failure by

the Company to make such payments or make such expenditures in a timely fashion

may result in the Company losing its interest in such properties. There can be

no assurance that the Company will have, or be able to obtain, the necessary

financial resources to be able to maintain all of its property agreements in

good standing, or to be able to comply with all of its obligations thereunder,

with the result that the Company could forfeit its interest in one or more of

its mineral properties.

Proposed Amendments to the

United States General Mining Law of 1872: In recent years, the United States

Congress has considered a number of proposed amendments to the U.S. General

Mining Law of 1872 (“Mining Law”). If adopted, such legislation, among other

things, could impose royalties on mineral production from unpatented mining

claims located on United States federal lands (which includes certain of the

mining claims at Livengood), result in the denial of permits to mine after the

expenditure of significant funds for exploration and development, reduce

estimates of mineral reserves and reduce the amount of future exploration and

development activity on United States federal lands, all of which could have a

material and adverse effect on the Company’s cash flow, results of operations

and financial condition.

Uncertainties Relating to

Unpatented Mining Claims: Some of the mining claims at the Livengood

property are federal or Alaska State unpatented mining claims. There is a risk

that a portion of such unpatented mining claims could be determined to be

invalid, in which case the Company could lose the right to mine any minerals

contained within those mining claims. Unpatented mining claims are created and

maintained in accordance with the applicable US federal and Alaska state mining

laws.

10

Unpatented mining claims are unique to United States property

interests, and are generally considered to be subject to greater title risk than

other real property interests due to the validity of unpatented mining claims

often being uncertain. This uncertainty arises, in part, out of the complex

federal and state laws and regulations under the Mining Law. Unpatented mining

claims are always subject to possible challenges of third parties or contests by

the United States federal or Alaska State governments. The validity of an

unpatented mining claim, in terms of both its location and its maintenance, is

dependent on strict compliance with a complex body of federal and state

statutory and decisional law. Title to the unpatented mining claims may also be

affected by undetected defects such as unregistered agreements or transfers. The

Company has not obtained full title opinions for the majority of its mineral

properties. Not all the mineral properties in which the Company has an interest

have been surveyed, and their actual extent and location may be in doubt.

Surface Rights and Access:

Although the Company acquires the rights to some or all of the minerals in

the ground subject to the mineral tenures that it acquires, or has a right to

acquire, in most cases it does not thereby acquire any rights to, or ownership

of, the surface to the areas covered by its mineral tenures. In such cases,

applicable mining laws usually provide for rights of access to the surface for

the purpose of carrying on mining activities, however, the enforcement of such

rights through the courts can be costly and time consuming. It is necessary to

negotiate surface access or to purchase the surface rights if long-term access

is required. There can be no guarantee that, despite having the right at law to

access the surface and carry on mining activities, the Company will be able to

negotiate satisfactory agreements with any such existing landowners/occupiers

for such access or purchase of such surface rights, and therefore it may be

unable to carry out planned mining activities. In addition, in circumstances

where such access is denied, or no agreement can be reached, the Company may

need to rely on the assistance of local officials or the courts in such

jurisdiction the outcomes of which cannot be predicted with any certainty. The

inability of the Company to secure surface access or purchase required surface

rights could materially and adversely affect the timing, cost or overall ability

of the Company to develop any mineral deposits it may locate.

No Assurance of

Profitability: The Company has no history of production or earnings and due

to the nature of its business there can be no assurance that the Company will be

profitable. The Company has not paid dividends on its shares since incorporation

and does not anticipate doing so in the foreseeable future. The Company’s

property is in the exploration stage and the Company has not defined or

delineated any proven or probable reserves on its property. The Company’s

property is not currently under development. Continued exploration of its

existing property and the future development of any properties found to be

economically feasible, will require significant funds. The only present source

of funds available to the Company is through the sale of its equity shares,

short-term, high-cost borrowing or the sale or optioning of a portion of its

interest in its mineral properties. Even if the results of exploration are

encouraging, the Company may not have sufficient funds to conduct the further

exploration that may be necessary to determine whether or not a commercially

mineable deposit exists. While the Company may generate additional working

capital through further equity offerings, short-term borrowing or through the

sale or possible syndication of its property, there is no assurance that any

such funds will be available on favourable terms, or at all. At present, it is

impossible to determine what amounts of additional funds, if any, may be

required. Failure to raise such additional capital could put the continued

viability of the Company at risk.

Uninsured or Uninsurable

Risks: Exploration, development and mining operations involve various

hazards, including environmental hazards, industrial accidents, metallurgical

and other processing problems, unusual or unexpected rock formations, structural

cave-ins or slides, flooding, fires, metal losses and periodic interruptions due

to inclement or hazardous weather conditions. These risks could result in damage

to or destruction of mineral properties, facilities or other property, personal

injury, environmental damage, delays in operations, increased cost of

operations, monetary losses and possible legal liability. The Company may not be

able to obtain insurance to cover these risks at economically feasible premiums

or at all. The Company may elect not to insure where premium costs are disproportionate to the Company’s perception

of the relevant risks. The payment of such insurance premiums and of such

liabilities would reduce the funds available for exploration and production

activities.

11

Government Regulation: Any

exploration, development or mining operations carried on by the Company will be

subject to government legislation, policies and controls relating to

prospecting, development, production, environmental protection, mining taxes and

labour standards. The Company cannot predict whether or not such legislation,

policies or controls, as presently in effect, will remain so, and any changes

therein (for example, significant new royalties or taxes), which are completely

outside the control of the Company, may materially adversely affect to ability

of the Company to continue its planned business within any such

jurisdictions.

Market events and

conditions: Since 2008, the U.S. credit markets have experienced serious

disruption due to a deterioration in residential property values, defaults and

delinquencies in the residential mortgage market (particularly, sub-prime and

non-prime mortgages) and a decline in the credit quality of mortgage backed

securities. These problems have led to a slow-down in residential housing market

transactions, declining housing prices, delinquencies in non-mortgage consumer

credit and a general decline in consumer confidence. These conditions caused a

loss of confidence in the broader U.S. and global credit and financial markets

and resulting in the collapse of, and government intervention in, major banks,

financial institutions and insurers and creating a climate of greater

volatility, less liquidity, widening of credit spreads, a lack of price

transparency, increased credit losses and tighter credit conditions.

Notwithstanding various actions by the U.S. and foreign governments, concerns

about the general condition of the capital markets, financial instruments,

banks, investment banks, insurers and other financial institutions caused the

broader credit markets to further deteriorate and stock markets to decline

substantially. In addition, general economic indicators have deteriorated,

including declining consumer sentiment, increased unemployment and declining

economic growth and uncertainty about corporate earnings.

While these conditions appear to

have improved slightly in 2011 and into 2012, unprecedented disruptions in the

credit and financial markets have had a significant material adverse impact on a

number of financial institutions and have limited access to capital and credit

for many companies. These disruptions could, among other things, make it more

difficult for the Company to obtain, or increase its cost of obtaining, capital

and financing for its operations. The Company’s access to additional capital may

not be available on terms acceptable to it or at all.

General economic conditions:

The recent unprecedented events in global financial markets have had a

profound impact on the global economy. Many industries, including the gold and

base metal mining industry, are impacted by these market conditions. Some of the

key impacts of the current financial market turmoil include contraction in

credit markets resulting in a widening of credit risk, devaluations and high

volatility in global equity, commodity, foreign exchange and precious metal

markets, and a lack of market liquidity. A continued or worsened slowdown in the

financial markets or other economic conditions, including but not limited to,

consumer spending, employment rates, business conditions, inflation, fuel and

energy costs, consumer debt levels, lack of available credit, the state of the

financial markets, interest rates, and tax rates may adversely affect our growth

and profitability. Specifically:

-

The global credit/liquidity crisis could impact the cost and availability

of financing and the Company’s overall liquidity;

-

the volatility of gold and other base metal prices may impact the Company’s

future revenues, profits and cash flow;

12

-

volatile energy prices, commodity and consumables prices and currency

exchange rates impact potential production costs;

-

the devaluation and volatility of global stock markets impacts the

valuation of the common shares, which may impact the Company’s ability to

raise funds through the issuance of common shares.

These factors could have a material adverse effect on the

Company’s financial condition and results of operations.

Insufficient Financial

Resources: The Company does not presently have sufficient financial

resources to undertake by itself the preparation of a feasibility study and, if

a production decision is made, the construction of a mine at Livengood. The

completion of a feasibility study, and any construction of a mine at Livengood

following the making of a production decision, will therefore depend upon the

Company’s ability to obtain financing through the sale of its equity securities,

a possible joint venturing of the project or the securing of significant debt

financing. There is no assurance that the Company will be successful in

obtaining the required financing to complete a feasibility study or construct

and operate a mine at Livengood (should a production decision be made). Failure

to raise the required funds could result in the interest of the Company in the

Livengood project being significantly diluted or lost altogether or the Company

being unable to complete a feasibility study or construct a mine at Livengood

(following any production decision that may be made).

Financing Risks: The

Company has limited financial resources, has no source of operating cash flow

and has no assurance that additional funding will be available to it for further

exploration and development of the Livengood project or to fulfil its

obligations under any applicable agreements. Although the Company has been

successful in the past in obtaining financing through the sale of equity

securities, there can be no assurance that it will be able to obtain adequate

financing in the future or that the terms of such financing will be favourable.

Failure to obtain such additional financing could result in delay or indefinite

postponement of further exploration and development of Livengood with the

possible loss of its interest in such property.

Dilution to the Company’s

existing shareholders: The Company may require additional equity financing

be raised in the future. The Company may issue securities on less than

favourable terms to raise sufficient capital to fund its business plan. Any

transaction involving the issuance of equity securities or securities

convertible into Common Shares would result in dilution, possibly substantial,

to present and prospective holders of Common Shares.

Increased costs:

Management anticipates that costs at the Company’s projects will frequently

be subject to variation from one year to the next due to a number of factors,

such as changing ore grade, metallurgy and revisions to mine plans, if any, in

response to the physical shape and location of the ore body. In addition, costs

are affected by the price of commodities such as fuel, rubber and electricity.

Such commodities are at times subject to volatile price movements, including

increases that could make production at certain operations less profitable. A

material increase in costs at any significant location could have a significant

effect on the Company’s profitability.

Dependence Upon Others and Key

Personnel: The success of the Company’s operations will depend upon numerous

factors, many of which are beyond the Company’s control, including (i) the

ability of the Company to enter into strategic alliances through a combination

of one or more joint ventures, mergers or acquisition transactions; and (ii) the

ability to attract and retain additional key personnel in exploration, mine

development, sales, marketing, technical support and finance. These and other

factors will require the use of outside suppliers as well as the talents and

efforts of the Company. There can be no assurance of success with any or all of

these factors on which the Company’s operations will depend. The Company has relied and

may continue to rely upon consultants and others for operating expertise.

13

Currency Fluctuations: The

Company maintains its accounts in Canadian and U.S. dollars, making it subject

to foreign currency fluctuations. Such fluctuations may materially affect the

Company’s financial position and results.

Share Price Volatility: In

recent years, the securities markets in the United States and Canada have

experienced a high level of price and volume volatility, and the market price of

securities of many companies, particularly those considered exploration or

development stage companies, have experienced wide fluctuations in price which

have not necessarily been related to the operating performance, underlying asset

values or prospects of such companies. There can be no assurance that

significant fluctuations in the trading price of the Company’s common shares

will not occur, or that such fluctuations will not materially adversely impact

on the Company’s ability to raise equity funding without significant dilution to

its existing shareholders, or at all.

Exploration and Mining

Risks: Fires, power outages, labour disruptions, flooding, explosions,

cave-ins, landslides and the inability to obtain suitable or adequate machinery,

equipment or labour are other risks involved in the operation of mines and the

conduct of exploration programs. Substantial expenditures are required to

establish reserves through drilling, to develop metallurgical processes, to

develop the mining and processing facilities and infrastructure at any site

chosen for mining. Although substantial benefits may be derived from the

discovery of a major mineralized deposit, no assurance can be given that

minerals will be discovered in sufficient quantities to justify commercial

operations or that funds required for development can be obtained on a timely

basis. The economics of developing mineral properties is affected by many

factors including the cost of operations, variations of the grade of ore mined,

fluctuations in the price of gold or other minerals produced, costs of

processing equipment and such other factors as government regulations, including

regulations relating to royalties, allowable production, importing and exporting

of minerals and environmental protection. In addition, the grade of

mineralization ultimately mined may differ from that indicated by drilling

results and such differences could be material. Short term factors, such as the

need for orderly development of ore bodies or the processing of new or different

grades, may have an adverse effect on mining operations and on the results of

operations. There can be no assurance that minerals recovered in small scale

laboratory tests will be duplicated in large scale tests under on-site

conditions or in production scale operations. Material changes in geological

resources, grades, stripping ratios or recovery rates may affect the economic

viability of projects.

Environmental

Restrictions: The activities of the Company are subject to environmental

regulations promulgated by government agencies in different countries from time

to time. Environmental legislation generally provides for restrictions and

prohibitions on spills, releases or emissions into the air, discharges into

water, management of waste, management of hazardous substances, protection of

natural resources, antiquities and endangered species and reclamation of lands

disturbed by mining operations. Certain types of operations require the

submission and approval of environmental impact assessments. Environmental

legislation is evolving in a manner which means stricter standards, and

enforcement, fines and penalties for non-compliance are more stringent.

Environmental assessments of proposed projects carry a heightened degree of

responsibility for companies and directors, officers and employees. The cost of

compliance with changes in governmental regulations has a potential to reduce

the profitability of operations.

Regulatory Requirements:

The activities of the Company are subject to extensive regulations governing

various matters, including environmental protection, management and use of toxic

substances and explosives, management of natural resources, exploration,

development of mines, production and post-closure reclamation, exports, price

controls, taxation, regulations concerning business dealings with indigenous

peoples, labour standards on occupational health and safety, including mine safety, and historic and cultural preservation.

Failure to comply with applicable laws and regulations may result in civil or

criminal fines or penalties, enforcement actions thereunder, including orders

issued by regulatory or judicial authorities causing operations to cease or be

curtailed, and may include corrective measures requiring capital expenditures,

installation of additional equipment, or remedial actions, any of which could

result in the Company incurring significant expenditures. The Company may also

be required to compensate those suffering loss or damage by reason of a breach

of such laws, regulations or permitting requirements. It is also possible that

future laws and regulations, or more stringent enforcement of current laws and

regulations by governmental authorities, could cause additional expense, capital

expenditures, restrictions on or suspension of the Company’s operations and

delays in the exploration and development of the Company’s property.

14

Limited Experience with

Development-Stage Mining Operations: The Company has limited experience in

placing resource properties into production, and its ability to do so will be

dependent upon using the services of appropriately experienced personnel or

entering into agreements with other major resource companies that can provide

such expertise. There can be no assurance that the Company will have available

to it the necessary expertise when and if it places the Livengood project into

production.

Estimates of Mineral Reserves

and Resources and Production Risks: The mineral resource estimates included

in this MD&A are estimates only and no assurance can be given that any

particular level of recovery of minerals will in fact be realized or that an

identified reserve or resource will ever qualify as a commercially mineable (or

viable) deposit which can be legally and economically exploited. The estimating

of mineral resources and mineral reserves is a subjective process and the

accuracy of mineral resource and mineral reserve estimates is a function of the

quantity and quality of available data, the accuracy of statistical

computations, and the assumptions used and judgments made in interpreting

available engineering and geological information. There is significant

uncertainty in any mineral resource or mineral reserve estimate and the actual

deposits encountered and the economic viability of a deposit may differ

materially from the Company’s estimates. In addition, the grade of

mineralization ultimately mined may differ from that indicated by drilling

results and such differences could be material. Production can be affected by

such factors as permitting regulations and requirements, weather, environmental

factors, unforeseen technical difficulties, unusual or unexpected geological

formations and work interruptions. Short term factors, such as the need for

orderly development of deposits or the processing of new or different grades,

may have a material adverse effect on mining operations and on the results of

operations. There can be no assurance that minerals recovered in small scale

laboratory tests will be duplicated in large scale tests under on-site

conditions or in production scale operations. Material changes in reserves or

resources, grades, stripping ratios or recovery rates may affect the economic

viability of projects. The estimated resources described in this MD&A should

not be interpreted as assurances of mine life or of the profitability of future

operations. Estimated mineral resources and mineral reserves may have to be

re-estimated based on changes in applicable commodity prices, further

exploration or development activity or actual production experience. This could

materially and adversely affect estimates of the volume or grade of

mineralization, estimated recovery rates or other important factors that

influence mineral resource or mineral reserve estimates. Market price

fluctuations for gold, silver or base metals, increased production costs or

reduced recovery rates or other factors may render any particular reserves

uneconomical or unprofitable to develop at a particular site or sites. A

reduction in estimated reserves could require material write downs in investment

in the affected mining property and increased amortization, reclamation and

closure charges.

Mineral resources are not

mineral reserves and there is no assurance that any mineral resources will

ultimately be reclassified as proven or probable reserves. Mineral resources

which are not mineral reserves do not have demonstrated economic

viability.

15

Enforcement of Civil

Liabilities: As substantially all of the assets of the Company and its

subsidiaries are located outside of Canada, and certain of the directors and

officers of the Company are resident outside of Canada, it may be difficult or

impossible to enforce judgements granted by a court in Canada against the assets

of the Company or the directors and officers of the Company residing outside of

Canada.

Mining Industry is Intensely

Competitive: The Company’s business of the acquisition, exploration and

development of mineral properties is intensely competitive. The Company may be

at a competitive disadvantage in acquiring additional mining properties because

it must compete with other individuals and companies, many of which have greater

financial resources, operational experience and technical capabilities than the

Company. The Company may also encounter increasing competition from other mining

companies in efforts to hire experienced mining professionals. Competition for

exploration resources at all levels is currently very intense, particularly

affecting the availability of manpower, drill rigs and helicopters. Increased

competition could adversely affect the Company’s ability to attract necessary

capital funding or acquire suitable producing properties or prospects for

mineral exploration in the future.

ITH may be a “passive foreign

investment company” under the U.S. Internal Revenue Code, which may result in

material adverse U.S. federal income tax consequences to investors in Common

Shares that are U.S. taxpayers: Investors in Common Shares that are U.S.

taxpayers should be aware that ITH believes that it has been in prior years, and

expects it will be in the current year, a “passive foreign investment company”

under Section 1297(a) of the U.S. Internal Revenue Code (a “PFIC”). If ITH is or

becomes a PFIC, generally any gain recognized on the sale of the Common Shares

and any “excess distributions” (as specifically defined) paid on the Common

Shares must be rateably allocated to each day in a U.S. taxpayer’s holding

period for the Common Shares. The amount of any such gain or excess distribution

allocated to prior years of such U.S. taxpayer’s holding period for the Common

Shares generally will be subject to U.S. federal income tax at the highest tax

applicable to ordinary income in each such prior year, and the U.S. taxpayer

will be required to pay interest on the resulting tax liability for each such

prior year, calculated as if such tax liability had been due in each such prior

year.

Alternatively, a U.S. taxpayer

that makes a “qualified electing fund” (a “QEF”) election with respect to ITH

generally will be subject to U.S. federal income tax on such U.S. taxpayer’s pro

rata share of ITH’s “net capital gain” and “ordinary earnings” (as specifically

defined and calculated under U.S. federal income tax rules), regardless of

whether such amounts are actually distributed by ITH. U.S. taxpayers should be

aware, however, that there can be no assurance that ITH will satisfy record

keeping requirements under the QEF rules or that ITH will supply U.S. taxpayers

with required information under the QEF rules, in event that ITH is a PFIC and a

U.S. taxpayer wishes to make a QEF election. As a second alternative, a U.S.

taxpayer may make a “mark-to-market election” if ITH is a PFIC and the Common

Shares are “marketable stock” (as specifically defined). A U.S. taxpayer that

makes a mark-to-market election generally will include in gross income, for each

taxable year in which ITH is a PFIC, an amount equal to the excess, if any, of

(a) the fair market value of the Common Shares as of the close of such taxable

year over (b) such U.S. taxpayer’s adjusted tax basis in the Common Shares.

16

| Selected

Financial Information |

The Company’s unaudited condensed consolidated interim

financial statements for the three month period ended March 31, 2012 (the

“Interim Financial Statements”) have been prepared in accordance with

International Accounting Standard (“IAS”) 34, “Interim Financial Reporting”. The

following selected financial information is taken from the Company’s Interim

Financial Statements and should be read in conjunction with those statements

along with the Company’s audited consolidated financial statements for the

period ended December 31, 2011 and for the year ended May 31, 2011. The Company

changed its fiscal year end to December 31 from May 31 effective December 31,

2011. Selected financial information appears below.

| |

|

|

|

|

|

|

| |

|

March 31, 2012 |

|

|

February 28, 2011 |

|

| |

|

$ |

|

|

$ |

|

| Description

|

|

(three months) |

|

|

(three months) |

|

| Operations: |

|

|

|

|

|

|

| Interest Income |

$ |

84,723 |

|

$ |

269,602 |

|

| Consulting fees (including share-based payments) |

|

261,861 |

|

|

122,710 |

|

| Wages and benefits (including share-based

payments) |

|

3,266,172 |

|

|

688,685 |

|

| Investor relations (including share-based payments) |

|

113,511 |

|

|

208,791 |

|

| Foreign exchange loss |

|

(20,445 |

) |

|

(154,418 |

) |

| Unrealized loss

on derivative liability |

$ |

(2,385,360 |

) |

$ |

- |

|

| |

|

|

|

|

|

|

| Net loss |

$ |

(6,331,596 |

) |

$ |

(1,424,785 |

) |

| Exchange difference on translating foreign

operations |

|

(2,178,764 |

) |

|

(3,234,484 |

) |

| |

|

|

|

|

|

|

| Comprehensive loss |

$ |

(8,510,360 |

) |

$ |

(4,659,269 |

) |

| |

|

|

|

|

|

|

| Basic and fully diluted loss per share from continuing

operations |

$ |

(0.07 |

) |

$ |

(0.02 |

) |

| |

|

|

|

|

|

|

| |

|

March 31, 2012 |

|

|

December 31, 2011 |

|

| Statement of Financial Position: |

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

39,722,163 |

|

$ |

55,642,179 |

|

| Total Current Assets |

|

40,311,258 |

|

|

56,599,339 |

|

| Exploration and Evaluation Assets |

|

163,086,344 |

|

|

158,041,441 |

|

| Long term financial liabilities |

|

23,179,120 |

|

|

21,153,600 |

|

| Cash dividends |

$ |

- |

|

$ |

- |

|

Three Months Ended March 31, 2012

The Company ended the period with $39,722,163 of cash and cash

equivalents. The Company spent $14,242,742 on exploration and evaluation assets

and used $1,607,077 in operating activities. Share-based payment charges of

$1,967,740 in the quarter was due to the granting of options and recognizing the

expense associated with the vesting of certain stock options granted in the

quarter and in the prior year to employees and consultants. The Company also

recognized a loss of $2,385,360 due to the increase in the estimated fair value

of its derivative liability.

Three Months Ended March 31, 2012 compared to Three Months

Ended February 28, 2011

Due to the Company changing its fiscal year end to December 31

from May 31 during 2011, the Company’s results and activity for the three months

ended March 31, 2012 are compared to the three month period ended February 28, 2011. The following discussion

highlights certain selected financial information and changes in operations

between the three month periods ended March 31, 2012 and February 28, 2011.

17

The Company incurred a net loss of $6,331,596 for the period

ended March 31, 2012, compared to a net loss of $1,424,785 for the period ended

February 28, 2011. Share-based payment charges were $1,967,740 (February 28,

2011 - $nil). The increase in share-based payment charges during the period was

the result of stock option grants to new employees and vesting of prior stock

option grants. The Company granted 680,000 options during the three months ended

March 31, 2012 compared to 265,000 during the period ended February 28,

2011.

Excluding share-based payment charges of $1,928,876 and $nil

(February 28, 2011), wages and benefits for the period increased to $1,337,296

from $688,685 (February 28, 2011) as a result of increased personnel and hiring

of new officers during the period.

Investor relations expense decreased to $113,511 (February 28,

2011 - $208,791) due to decreased personnel and additional costs incurred during

the three months ended February 28, 2011 related to informing the investment

community about the transfer of assets to Corvus Gold Inc (“Corvus”).

Excluding share-based payment charges of $36,989 and $nil

(February 28, 2011), consulting fees increased to $224,872 (February 28, 2011 -

$122,710) due to additional fees incurred in the current period primarily for

general corporate matters and compensation benefits design and

implementation.

Regulatory expenses increased to $87,310 (February 28, 2011 –

9,966) due to the timing of payments for annual listing fees paid to the Toronto

Stock Exchange (“TSX”) and the NYSE – Amex LLC (“NYSE-A”).

Other expense categories reflected only moderate change period

over period.

Other items amounted to a loss of $2,200,252 during the current

period compared to a gain of $51,029 during the period ended February 28, 2011.

The loss in the current period resulted mainly from an unrealized loss of

$2,385,360 on the revaluation of the derivative liability at March 31, 2012. In

addition to the unrealized loss on the derivative liability, the Company had

unrealized losses on marketable securities of $22,500 (February 28, 2011 -

$9,500) and foreign exchange loss of $20,445 (February 28, 2011 – $154,418).

Offsetting these losses, the Company recognized interest income of $84,723

(February 28, 2011 – $269,602) and income from mineral property earn-in of

$143,330 related to the Terra and Chisna properties transferred to Corvus in

2010 (February 28, 2011 - $nil). During the period ended February 28, 2011 the

Company incurred spin-out costs of $54,655 related to the transfer of assets to

Corvus.

Share-based payment charges

Share-based payment charges for the period ended March 31, 2012

of $1,967,740 (February 28, 2011 -$nil) were allocated as follows:

| |

|

|

|

|

|

|

|

|

|

| |

|

Before allocation |

|

|

Share-based |

|

|

After Allocation |

|

| |

|

of share-based |

|

|

payment |

|

|

of share-based |

|

| Three months

ended March 31, 2012 |

|

payment charges |

|

|

charges |

|

|

payment charges |

|

| Consulting fees |

$ |

224,872 |

|

$ |

36,989 |

|

$ |

261,861 |

|

| Investor relations |

|

112,031 |

|

|

1,480 |

|

|

113,511 |

|

| Professional fees |

|

126,856 |

|

|

395 |

|

|

127,251 |

|

| Wages and benefits |

|

1,337,296 |

|

|

1,928,876 |

|

|

3,266,172 |

|

| |

|

|

|

$ |

1,967,740 |

|

|

|

|

18

Supplemental Information:

Comparison to Prior Quarterly

Periods

The following selected financial information is a summary of

quarterly results taken from the Company’s unaudited condensed consolidated

interim financial statements:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

4 months |

|

|

|

|

|

|

|

| |

|

March 31, |

|

|

December 31, |

|

|

August 31, |

|

|

May 31, |

|

| Description

|

|

2012 |

|

|

2011 |

|

|

2011 |

|

|

2011 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest Income |

$ |

84,723 |

|

$ |

270,350 |

|

$ |

320,563 |

|

$ |

317,865 |

|

| Net loss |

|

(6,331,596 |

) |

|

(2,675,646 |

) |

|

(8,364,241 |

) |

|

(1,904,306 |

) |

| Basic and diluted loss per common share |

$ |

(0.07 |

) |

$ |

(0.03 |

) |

$ |

(0.10 |

) |

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

May 31, |

|

| |

|

|

|

|

|

|

|

|

|

|

2010 |

|

| |

|

February 28, |

|

|

November 30, |

|

|

August 31, |

|

|

(Canadian |

|

| Description

|

|

2011 |

|

|

2010 |

|

|

2010 |

|

|

GAAP) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest Income |

$ |

269,602 |

|

$ |

27,142 |

|

$ |

60,537 |

|

$ |

29,643 |

|

| Net loss – continuing operations |

|

(1,424,785 |

) |

|

(2,134,304 |

) |

|

(4,094,290 |

) |

|

(7,762,533 |

) |

| Net loss – discontinued operations |

|

- |

|

|

- |

|

|

(934,157 |

) |

|

(2,153,063 |

) |

| Net loss |

|

(1,424,785 |

) |

|

(2,134,304 |

) |

|

(5,028,447 |

) |

|

(9,915,596 |

) |

| Basic and diluted loss per common share |

$ |

(0.02 |

) |

$ |

(0.03 |

) |

$ |

(0.06 |

) |

$ |

(0.16 |

) |

The discussion above provides certain reasons for some of the

variations in the quarterly numbers but, as with most junior mineral exploration

companies, the results of operations (including interest income and net losses)

are not the main factor in establishing the financial health of the Company. Of

far greater significance are the mineral properties in which the Company has, or

may earn, an interest, its working capital and its number of shares outstanding.

The results over quarters are primarily dependent upon the success of the

Company’s ongoing property evaluation program and the timing and results of the

Company’s exploration activities on its mineral properties. There are no general

trends regarding the Company’s quarterly results, and the Company’s business of

mineral exploration is not seasonal. Quarterly results can vary significantly

depending on whether the Company has abandoned any properties or granted any

stock options or paid any employee bonuses. These are factors that account for

material variations in the Company’s quarterly net losses, none of which are

predictable. The write-off of mineral properties can have a material effect on

quarterly results as and when they occur. Another factor which can cause a

material variation in net loss on a quarterly basis is the grant of stock

options due to the resulting share based payment charges which can be

significant, such as during the quarters ended March 31, 2012, August 31, 2011,

August 31, 2010 and May 31, 2010. The payment of employee bonuses (which have

tended to be awarded in November/December), being once-yearly charges, can also

materially affect operating losses. During the three month period ended March

31, 2012 and the four month period ended December 31, 2011, net loss was

significantly impacted by the change in value of the Company’s derivative

liability. General operating costs other than the specific items noted above

tend to be quite similar from period to period, although they will increase

quarter over quarter as the Company increases the number of employees as

necessary to meet the requirements of its increased work at the Livengood

project. The variation in interest income is related solely to the interest

earned on funds held by the Company, which is dependent upon the success of the

Company in raising the required financing for its activities which will vary

with overall market conditions, and is therefore difficult to predict.

19

Liquidity and Capital Resources

The Company has no revenue generating operations from which it

can internally generate funds. To date, the Company’s ongoing operations have

been predominantly financed through sale of its equity securities by way of

private placements and the subsequent exercise of share purchase and broker

warrants and options issued in connection with such private placements. However,

the exercise of warrants and options is dependent primarily on the market price