UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

OR

For the transition period from to

Commission file number

(Exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction of incorporation | (I.R.S. Employer Identification No.) | |

or organization) | ||

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ◻

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ◻ | Accelerated filer ◻ |

Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

As of March 6, 2024, there were

DOCUMENTS INCORPORATED BY REFERENCE: NONE

TABLE OF CONTENTS

Unless the context requires otherwise, references in this Annual Report on Form 10-K to “we,” “our,” “us,” “the Company” and “Bio-Path” refer to Bio-Path Holdings, Inc. and its subsidiary. Bio-Path Holdings, Inc.’s wholly-owned subsidiary, Bio-Path, Inc., is sometimes referred to herein as “Bio-Path Subsidiary.”

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements can be identified by words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “project,” “goal,” “strategy,” “future,” “likely,” “may,” “should,” “will” and variations of these words and similar references to future periods, although not all forward-looking statements contain these identifying words. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances, including those discussed in “Item 1A. Risk Factors” of this Annual Report on Form 10-K and in other reports or documents we file with the U.S. Securities and Exchange Commission (“SEC”). As a result, our actual results and financial condition may differ materially from those expressed or forecasted in the forward-looking statements, and you should not rely on such forward-looking statements. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

| ● | our lack of significant revenue to date, our history of recurring operating losses and our expectation of future operating losses; |

| ● | our need for substantial additional capital and our need to delay, reduce or eliminate our drug development and commercialization efforts if we are unable to raise additional capital; |

| ● | the highly-competitive nature of the pharmaceutical and biotechnology industry and our ability to compete effectively; |

| ● | the success of our plans to use collaboration arrangements to leverage our capabilities; |

| ● | our ability to retain and attract key personnel; |

| ● | the risk of misconduct of our employees, agents, consultants and commercial partners; |

| ● | disruptions to our operations due to expansions of our operations; |

| ● | the costs we would incur if we acquire or license technologies, resources or drug candidates; |

| ● | risks associated with product liability claims; |

| ● | our reliance on information technology systems and the liability or interruption associated with cyber-attacks or other breaches of our systems; |

| ● | our ability to use net operating loss carryforwards; |

| ● | provisions in our charter documents and state law that may prevent a change in control; |

| ● | work slowdown or stoppage at government agencies could negatively impact our business; |

| ● | the impact, risks and uncertainties related to global pandemics, including the COVID-19 pandemic, and actions taken by governmental authorities or others in connection therewith; |

| ● | our need to complete extensive clinical trials and the risk that we may not be able to demonstrate the safety and efficacy of our drug candidates; |

| ● | risks that our clinical trials may be delayed or terminated; |

| ● | our ability to obtain domestic and/or foreign regulatory approval for our drug candidates; |

| ● | changes in existing laws and regulations affecting the healthcare industry; |

| ● | our reliance on third parties to conduct clinical trials for our drug candidates; |

| ● | our ability to maintain orphan drug exclusivity for our drug candidates; |

| ● | our reliance on third parties for manufacturing our clinical drug supplies; |

| ● | risks associated with the manufacture of our drug candidates; |

| ● | our ability to establish sales and marketing capabilities relating to our drug candidates; |

| ● | market acceptance of our drug candidates; |

| ● | third-party payor reimbursement practices; |

| ● | our ability to adequately protect the intellectual property of our drug candidates; |

| ● | infringement on the intellectual property rights of third parties; |

| ● | costs and time relating to litigation regarding intellectual property rights; |

| ● | our ability to adequately prevent disclosure by our employees or others of trade secrets and other proprietary information; |

| ● | our need to raise additional capital; |

| ● | the volatility of the trading price of our common stock; |

| ● | our common stock being thinly traded; |

| ● | our ability to issue shares of common or preferred stock without approval from our stockholders; |

| ● | our ability to pay cash dividends; |

| ● | costs and expenses associated with being a public company; |

| ● | our ability to maintain effective internal controls over financial reporting; and |

| ● | our ability to maintain compliance with the listing standards of the Nasdaq Capital Market. |

Please also refer to “Item 1A. Risk Factors” of this Annual Report on Form 10-K and other reports or documents we file with the SEC for a discussion of risks and factors that could cause our actual results and financial condition to differ materially from those expressed or forecasted in this Annual Report on Form 10-K.

Any forward-looking statement made by us in this Annual Report on Form 10-K is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future developments or otherwise. However, you should carefully review the risk factors set forth in other reports or documents we file from time to time with the SEC.

PART I

ITEM 1. BUSINESS

Overview

We are a clinical and preclinical stage oncology-focused RNAi nanoparticle drug development company utilizing a novel technology that achieves systemic delivery for target-specific protein inhibition for any gene product that is over-expressed in disease. Our drug delivery and antisense technology, called DNAbilize®, is a platform that uses P-ethoxy, which is a deoxyribonucleic acid (DNA) backbone modification that is intended to protect the DNA from destruction by the body’s enzymes when circulating in vivo, incorporated inside of a lipid bilayer having neutral charge. We believe this combination allows for high efficiency loading of antisense DNA into non-toxic, cell-membrane-like structures for delivery of the antisense drug substance into cells. In vivo, the DNAbilize® delivered antisense drug substances are systemically distributed throughout the body to allow for reduction or elimination of target proteins in blood diseases and solid tumors. Through testing in numerous animal studies and dosing in clinical trials, our DNAbilize® drug candidates have demonstrated an excellent safety profile. DNAbilize® is a registered trademark of the Company.

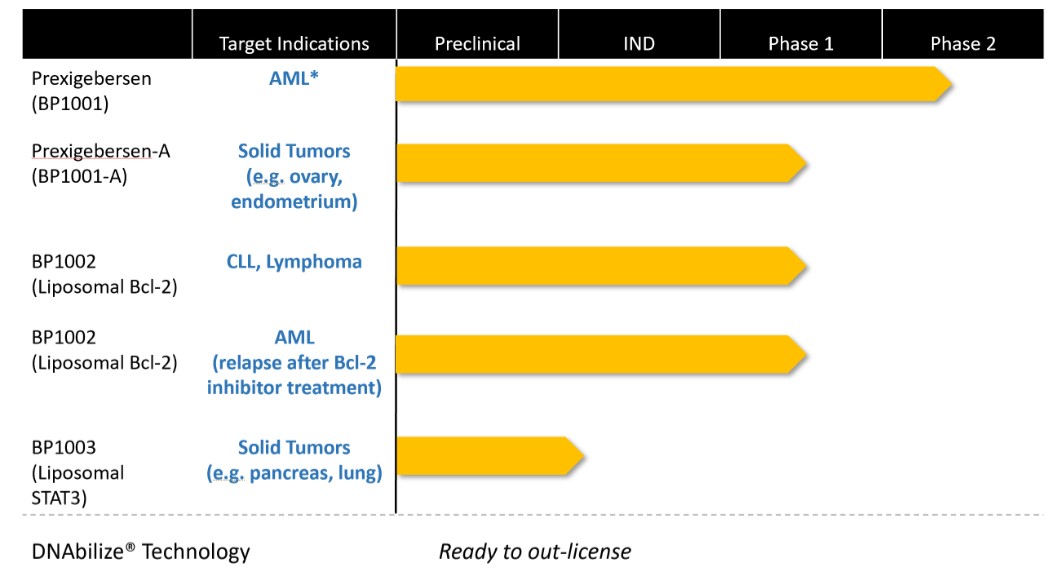

Using DNAbilize® as a platform for drug development and manufacturing, we currently have four drug candidates in development to treat at least five different cancer disease indications (Figure 1). Our lead drug candidate, prexigebersen (pronounced prex” i je ber’ sen), which targets growth factor receptor-bound protein 2 (“Grb2”), initially started the efficacy portion of a Phase 2 clinical trial for untreated acute myeloid leukemia (“AML”) patients in combination with low-dose cytarabine (“LDAC”). The interim data presented in the 2018 American Society of Hematology (“ASH”) Annual Meeting showed that 11 (65%) of the 17 evaluable patients had a response, including five (29%) who achieved complete remission (“CR”), inclusive of one CR with incomplete hematologic recovery (“CRi”) and one morphologic leukemia-free state, and six (35%) stable disease responses, including two patients who had greater than a 50% reduction in bone marrow blasts. However, DNA hypomethylating agents are now the most frequently used agents in the treatment of elderly AML patients in the U.S. and Europe. As a result, Stage 2 of the Phase 2 trial in AML was amended to remove the combination treatment of prexigebersen and LDAC and replace it with the combination treatment of prexigebersen and decitabine, a DNA hypomethylating agent, for treatment of a second cohort of untreated AML patients. Since decitabine is also used as a treatment for relapsed/refractory AML patients, a cohort of relapsed/refractory AML patients was also added to the study.

The U.S. Food and Drug Administration (“FDA”) granted approval of venetoclax in combination with LDAC, decitabine or azacytidine (the latter two drugs are DNA hypomethylating agents) as frontline therapy for newly diagnosed AML in adults who are 75 years or older, or who have comorbidities precluding intensive induction chemotherapy. We believe this approval of the frontline venetoclax and decitabine combination therapy provides an opportunity for combining prexigebersen with the combination therapy for the treatment of newly diagnosed AML patients. Preclinical efficacy studies for the triple combination treatment of prexigebersen, decitabine and venetoclax in AML have been successfully completed. In the preclinical efficacy studies, four AML cancer cell lines were treated with three different combinations of decitabine, venetoclax and prexigebersen. Decrease in AML cell viability was the primary measure of efficacy. The triple combination of decitabine, venetoclax and prexigebersen showed significant improvement in efficacy in three of the four AML cell lines. Based on these results, we believe that adding prexigebersen to the treatment combination of decitabine and venetoclax could lead to improved efficacy in AML patients. Accordingly, we further amended Stage 2 of this Phase 2 clinical trial to add the triple combination treatment comprised of prexigebersen, decitabine and venetoclax.

Our approved amended Stage 2 for this Phase 2 clinical trial currently has three cohorts of patients. The first two cohorts will treat patients with the triple combination of prexigebersen, decitabine and venetoclax. The first cohort will include untreated AML patients, and the second cohort will include relapsed/refractory AML patients. Finally, the third cohort will treat relapsed/refractory AML patients, who are venetoclax-resistant or -intolerant, with the two-drug combination of prexigebersen and decitabine. The full trial design plans have approximately 98 evaluable patients for the first cohort having untreated AML patients with a preliminary review performed after 19 evaluable patients and a formal interim analysis after 38 evaluable patients. The full trial design plans have approximately 54 evaluable patients for each of the second cohort, having relapsed/refractory AML patients, and the third cohort, having AML patients who are venetoclax-resistant or -intolerant, in each case with a review performed after 19 evaluable patients. The study is anticipated to be conducted at up to ten clinical sites in the U.S., and Gail J. Roboz, MD, is the national coordinating Principal Investigator for the Phase 2 trial. Dr. Roboz is a professor of medicine and director of the Clinical and Translational Leukemia Program at the Weill Medical College of Cornell University (the “Weill Medical College”) and the New York-Presbyterian Hospital in New York City. On August 13, 2020, we announced the enrollment and dosing of the first patient in this approved amended Stage 2 of the Phase 2 clinical trial.

2

The safety run-in of Stage 2 of the Phase 2 clinical study was successfully completed, and the preliminary data was presented at the 2021 ASH Annual Meeting. In the safety run-in of the triple combination, six evaluable patients were treated with the combination of prexigebersen, decitabine and venetoclax. These patients included four relapsed/refractory AML patients, and two newly diagnosed AML patients. Five patients (83%) responded to treatment, including four (67%) achieving CR and one (17%) achieving CRi. Recent publications provide that response (CR + CRi) rates to combination treatment with decitabine and venetoclax (but without prexigebersen) are 42 to 52% for relapsed/refractory AML patients and 0 to 39% for relapsed/refractory secondary AML patients. Response rates to frontline treatment with decitabine and venetoclax (but without prexigebersen) are 62 to 71% for newly diagnosed AML patients. These preliminary data showed the treatment was well-tolerated and there were no dose limiting toxicities attributed to prexigebersen. Three patients remained on treatment for more than one cycle.

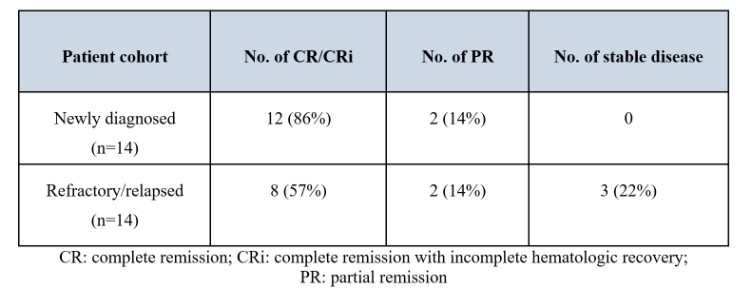

On August 1, 2023, we announced interim data for the first two cohorts of the amended Stage 2 of the Phase 2 clinical trial. Fourteen newly diagnosed patients were evaluable in the first cohort and treated with at least one cycle of the prexigebersen, decitabine and venetoclax combination therapy. All patients in the first cohort (median age 75) were adverse risk by 2017 European LeukemiaNet (“ELN”) guidelines (n=10) or secondary AML (n=4). Prexigebersen was well-tolerated, and adverse events (“AEs”) were generally consistent with decitabine and venetoclax treatment and/or for AML. Twelve of the 14 evaluable patients (86%) achieved CR/CRi and two (14%) achieved partial remission (“PR”). In total, 100% of the evaluable patients had a response to treatment. The CR/CRi rates of 86% for the evaluable patients in the first cohort is significantly higher than the CR/CRi rates of 62% for newly diagnosed patients treated with the frontline combination treatment of decitabine and venetoclax. Fourteen refractory/relapsed evaluable AML patients in the second cohort were treated with at least one cycle of the prexigebersen, decitabine and venetoclax combination therapy. Substantially all of the patients in the second cohort (median age 56.5) were adverse risk by 2017 ELN guidelines (n=11) or secondary AML (n=2). Prexigebersen was well-tolerated, and AEs were generally consistent with decitabine and venetoclax treatment and/or for AML. Eight of the 14 evaluable refractory/relapsed patients (57%) achieved CR/CRi, two (14%) achieved PR and two (22%) achieved stable disease. In total, 93% of the evaluable patients in the second cohort had a response to treatment. The CR/CRi rates of 57% for the evaluable refractory and relapsed patients in the second cohort is significantly higher than the CR/CRi rates of 21% for refractory/relapsed patients treated with the combination treatment of decitabine and venetoclax. Based on this interim data, we currently plan to pursue FDA expedited programs for Fast Track designation, and we are evaluating whether to seek to expand Stage 2 of the Phase 2 clinical trial in Europe.

Our second drug candidate, Liposomal Bcl-2 (“BP1002”), targets the protein Bcl-2, which is responsible for driving cell survival in up to 60% of all cancers. A Phase 1 clinical trial to evaluate the ability of BP1002 to treat refractory/relapsed lymphoma and refractory/relapsed chronic lymphocytic leukemia (“CLL”) patients has been initiated. The Phase 1 clinical trial is being conducted at the Georgia Cancer Center while two additional clinical trial sites are currently being activated for inclusion in the study, The University of Texas Southwestern and New York Medical College. On January 10, 2024, we announced the successful completion of the first dose cohort in the Phase 1 clinical trial. A total of six evaluable patients are scheduled to be treated with BP1002 monotherapy in a standard 3+3 design, unless there is a dose limiting toxicity which would require an additional three patients to be tested. There were no dose limiting toxicities in the first dose cohort (20 mg/m2). Enrollment is now open for patients for the second BP1002 dose cohort of 40 mg/m2.

Additionally, preclinical studies suggest that the combination of BP1002 with decitabine is efficacious in venetoclax-resistant leukemia and lymphoma cells. An abstract of the preclinical study was presented at the 2021 American Association for Cancer Research (“AACR”) Annual Meeting. A Phase 1/1b clinical trial to investigate the ability of BP1002 to treat refractory/relapsed AML patients, including venetoclax-resistant patients, is being studied. A recent study1 found that AML patients who had relapsed from frontline venetoclax-based treatment had a very poor prognosis, with a median survival of less than three months. Since venetoclax and BP1002 utilize different mechanisms of action, we believe that BP1002 may be a potential treatment for venetoclax-relapsed AML patients. The Phase 1/1b clinical trial is being conducted at several leading cancer centers in the United States, including the Weill Medical College, The University of Texas MD Anderson Cancer Center (“MD Anderson”), Scripps Health and The University of California at Los Angeles Cancer Center. On December 14, 2023, we announced the successful completion of the first dose cohort of the dose escalation portion of the Phase 1/1b clinical trial of BP1002. A total of three evaluable patients per dosing cohort are scheduled to be treated with BP1002 monotherapy in a standard 3+3 design. The first dose cohort consisted of a starting dose of 20 mg/m2, and there were no dose limiting toxicities. Enrollment is now open for patients for the second BP1002 dose cohort of 40

1 (Maiti A, Ruasch C, Cortes JE, et.al. Outcomes of relapsed or refractory acute myeloid leukemia after frontline hypomethylating agent and venetoclax regimens. Haematologica 2021; 106: 894-898.)

3

mg/m2. The Phase 1b portion of the study is expected to commence after completion of BP1002 monotherapy cohorts and is intended to assess the safety and efficacy of BP1002 in combination with decitabine in refractory/relapsed AML patients.

Our third drug candidate, Liposomal STAT3 (“BP1003”), targets the STAT3 protein and is currently in IND enabling studies as a potential treatment of pancreatic cancer, non-small cell lung cancer (“NSCLC”) and AML. Preclinical models have shown BP1003 to inhibit cell viability and STAT3 protein expression in NSCLC and AML cell lines. Further, BP1003 successfully penetrated pancreatic tumors ex vivo and significantly enhanced the efficacy of gemcitabine, a treatment for patients with advanced pancreatic cancer, in a pancreatic cancer patient derived tumor model. An abstract of the preclinical study was presented at the 2019 AACR Annual Meeting. Our lead indication for BP1003 is pancreatic cancer due to the severity of this disease and the lack of effective, life-extending treatments. For example, pancreatic adenocarcinoma is projected to be the second most lethal cancer behind lung cancer by 2030. Typical survival for a metastatic pancreatic cancer patient is about three to six months from diagnosis. Additionally, an abstract of the preclinical study demonstrating that BP1003 enhanced the sensitivity of breast and ovarian cancer cells to chemotherapy was presented at the 2022 AACR Annual Meeting. We have successfully completed several IND enabling studies of BP1003 and have one additional IND enabling study to complete. Once the additional study is successfully completed, our goal is to file an IND application and initiate the first-in-humans Phase 1 study of BP1003 in patients with refractory, metastatic solid tumors, including pancreatic cancer and NSCLC.

In addition, a modified product named BP1001-A, our fourth drug candidate, has shown to enhance chemotherapy efficacy in preclinical solid tumor models. Results of the preclinical study were published in the scientific journal Oncotarget in July 2020. BP1001-A incorporates the same drug substance as prexigebersen but has a slightly modified formulation designed to enhance nanoparticle properties. A BP1001-A Phase 1/1b clinical trial in patients with advanced or recurrent solid tumors has been initiated. The Phase 1/1b clinical trial is being conducted at several leading cancer centers in the United States, including MD Anderson, Karmanos Cancer Institute, Mary Crowley Cancer Research and Holy Cross Hospital, Maryland. On July 17, 2023, we announced completion of the first cohort of the dose escalation portion of the Phase 1/1b clinical trial. A total of nine evaluable patients are scheduled to be treated with BP1001-A monotherapy in a standard 3+3 dose escalation design. The first dose cohort consisted of a starting dose of 60 mg/m2, and there were no dose limiting toxicities. Enrollment is now open for patients for the second dose cohort of 90 mg/m2. The Phase 1b portion of the study is expected to commence after successful completion of BP1001-A monotherapy cohorts and is intended to assess the safety and efficacy of BP1001-A in combination with paclitaxel in patients with recurrent ovarian or endometrial tumors.

Our DNAbilize® technology-based products are available for out-licensing or partnering. We intend to apply our drug technology template to new disease-causing protein targets to develop new liposomal antisense drug candidates for inclusion in our pipeline that meet scientific, preclinical and commercial criteria and file new patents on these targets. We expect that these efforts will include collaboration with key scientific opinion leaders in the field of study and include developing drug candidates for diseases other than cancer. As we expand our drug development programs, we will look at indications where a systemic delivery is needed and antisense RNAi nanoparticles can be used to slow, reverse or cure a disease, either alone or in combination with another drug.

We have certain intellectual property as the basis for our current drug products in clinical development, prexigebersen, BP1002, BP1003 and BP1001-A. We are developing RNAi antisense nanoparticle drug candidates based on our own patented technology to treat cancer and autoimmune disorders where targeting a single protein may be advantageous and result in reduced patient adverse effects as compared to small molecule inhibitors with off-target and non-specific effects. We have composition of matter and method of use intellectual property for the design and manufacture of antisense RNAi nanoparticle drug products.

4

Our pipeline for development of antisense therapeutics is set forth in Figure 1 below:

Figure 1. Bio-Path Pipeline for Development of Therapeutics

* Received orphan drug designation from the U.S. FDA and from the European Medicines Agency (“EMA”) for AML

Our basic drug development concept is to block expression of proteins associated with disease. Messenger RNA (“mRNA”) is essential in the process of creating proteins. We have developed DNAbilize® nanoparticle drug delivery systems to deliver short strands of antisense DNA drugs to cells and block the production of proteins associated with disease progression.

Antisense DNA therapeutics is the field of designing short DNA sequences that are complementary to a mRNA for a protein of interest with the intention of inhibiting the production of the targeted protein. The DNA will find the matching RNA and form a complex. The complexed RNA will not have access to the protein-making machinery, which prevents the cell from translating it into a protein. Thus, protein production is turned off and levels of the targeted protein are reduced in the cell. This gene-specific process of controlling protein expression has led to great interest in using antisense DNA to shut off the production of proteins involved in disease. Antisense therapeutics have been in development for over 20 years. However, challenges to antisense therapeutics, such as instability of antisense drugs inside of the body and inefficient delivery of antisense to disease cells, have thawed antisense therapeutic potential.

We believe our DNAbilize® technology, which is the combination of the protected P-ethoxy antisense DNA backbone with the neutral liposome nanoparticle, is the ideal approach for antisense DNA therapeutics because it overcomes the challenges associated with both antisense stability and intracellular delivery. The P-ethoxy modification used in our DNAbilize® technology is completely sulfur free. We avoid using sulfur-containing antisense because it has been associated with causing liver toxicity and life-threatening bleeding and clotting complications. We prefer neutral lipids to cationic lipids for intracellular delivery because encapsulating the antisense DNA inside a neutral charged lipid bilayer facilitates the delivery and transfer of DNA into the cell to be fluid and gentle. While many companies have focused research on either the DNA stabilization problem or the lipid delivery problem,

5

we are not aware of any company that has developed improvements in both areas. DNAbilize® is truly a stand-alone platform because, as demonstrated by our published preclinical studies, it allows for high doses of drug products to be delivered throughout the entire body while minimizing toxicity. This allows our research and development efforts to focus on drug targets rather than on indications because the DNAbilize® system should not be limited in what types of indications it can treat. As such, we believe that DNAbilize® represents the first ever antisense therapeutic approach that can successfully treat hematological and systemic diseases.

Strategy

Because of our unique ability to address unmet needs in hematological malignancies, our lead drug candidates focus on cancers of the blood and lymph. Our strategy is to develop prexigebersen, BP1002, BP1003 and BP1001-A for multiple indications where the pathways involving Grb2, Bcl-2 and STAT3, respectively, are utilized to promote cancer growth, survival, angiogenesis and tumor surveillance evasion. Using DNAbilize® technology, we plan to develop therapeutics to a wide range of diseases and disorders independently and in partnership with others. Our strategy includes:

| ● | Developing prexigebersen for treatment of AML in combination therapies. |

| ● | Developing BP1002 for treatment of lymphoma and CLL. |

| ● | Developing BP1002 for refractory/relapsed AML patients, including venetoclax-resistant patients. |

| ● | Developing BP1003 for pancreatic cancer, NSCLC and AML. |

| ● | Developing BP1001-A for treatment of solid tumors. |

| ● | Expanding DNAbilize® to evaluate targets beyond cancer. |

| ● | Establishing DNAbilize® as the antisense drug delivery method of choice by forming partnerships with pharmaceutical and academic clinical research labs. |

Overview of Drug Candidates

The historical perspective of cancer treatments has been the use of drugs that affect the entire body. Advances in the past decades have shifted to treating the tumor tissue itself. One of the main strategies in these developments has been targeted therapy, involving drugs that are targeted to block the expression of specific disease-causing proteins while having little or no effect on other healthy tissues. We believe that nucleic acid drug products, specifically antisense, are a promising field of targeted therapy. Development of antisense as cancer drugs, however, has been limited by the lack of a suitable method to deliver antisense drugs to cancer cells with high uptake into the cancer cells without causing toxicity to non-cancer cells. Our patented DNAbilize® neutral-lipid based liposome technology is designed to overcome these limitations. We have published preclinical studies demonstrating that our DNAbilize® technology could efficiently deliver antisense therapeutics to mouse models of hematological malignancies and solid tumors, decrease target proteins production and suppress tumor progression. In addition, to date, no adverse effects attributed to the study drugs have been observed in our leukemia and lymphoma clinical trials.

PREXIGEBERSEN

Prexigebersen is targeted at the protein Grb2, a bridging protein between activated and mutated cellular kinases and the proteins involved in cell propagation, and in particular, a well-known cancer associated switch called Ras protein. When mutations occur that activate these kinases, the cell propagates uncontrollably, via Grb2, and this results in disease progression. Antisense inhibition of Grb2 interrupts the signals between mutated and activated receptors that connect to the Ras protein. This inhibition suppresses cancer cell propagation and does not result in adverse events typically observed with receptor inhibitors or Ras pathway inhibitors. We believe that prexigebersen has the potential to be an ideal combination for any number of cancer therapeutics where the Ras pathway is aberrantly activated and patient fitness is a major concern, such as in AML.

6

Indications for Acute Myeloid Leukemia (AML)

AML - Background and Common Treatments. AML is the rapid accumulation of immature myeloid cells in the blood, resulting in a drop of the other cell types such as red blood cells and platelets. AML incidence increases with age, with more than 50% of the cases in people aged 60 or older. AML is the most common acute leukemia in adults, and the National Cancer Institute estimated that approximately 20,380 new cases occurred in 2023 (Table 1). The five-year survival rate is approximately 11% in older adults (ages 65+). Prior to venetoclax approval, the frontline low-intensity therapies for elderly AML patients were LDAC, decitabine or azacytidine. The Bcl-2 inhibitor venetoclax is approved for newly diagnosed AML patients aged 75 years and older or adults who cannot be treated with intensive induction chemotherapy. Venetoclax is used in combination with LDAC, decitabine or azacytidine. Mutation in the Bcl-2 binding domain, which reduces venetoclax’s ability to bind to Bcl-2, has been linked with venetoclax resistance in CLL patients. Such venetoclax resistance may also occur in AML patients. AML remains an area of high unmet need for both the relapsed and the newly diagnosed elderly population who are typically ineligible for induction therapy.

Table 1. Basic Statistics for AML

Prexigebersen Development and Treatment for Leukemia. The safety, pharmacokinetics and efficacy of our lead DNAbilize® antisense drug candidate, prexigebersen, was assessed in patients having AML, CML, myelodysplastic syndrome (MDS) or acute lymphoblastic leukemia (“ALL”) in a Phase 1 trial. The Phase 1 clinical trial was a dose-escalating study to determine the safety and tolerability of escalating doses of prexigebersen. After completion of dose-escalation monotherapy, the safety and toxicity of prexigebersen in combination with LDAC was assessed in patients with refractory/relapsed AML. Additionally, the pharmacokinetics and anti-leukemic effects, including down-regulation of the target Grb2 protein in patient samples, of the drug candidate were determined. Results of the clinical study were published in the scientific journal Lancet Haematology in 2018.

Phase 1 Clinical Trial

Among the 39 patients enrolled in the study, 12 patients were removed from study before the end of cycle 1 because of disease progression or death, without dose-limiting toxicity, and were replaced per protocol guidelines. The approved prexigebersen treatment cycle is two doses per week over four weeks, resulting in eight doses administered over 28 days. Among the 27 evaluable patients, 21 patients were treated with escalating doses of prexigebersen monotherapy and six patients were treated with prexigebersen plus LDAC (Figure 2). The dose-limiting toxicity was not reached in the prexigebersen monotherapy cohorts, up to the maximum dose of 90 mg/m2. The prexigebersen plus LDAC combination was also well tolerated, with a toxicity profile similar to that of prexigebersen monotherapy, including the absence of identifiable dose-limiting toxicity. Lack of toxicity is a major advantage for the drug candidate prexigebersen since it allows higher levels of drug to be administered to the patient, increasing the potential therapeutic benefit.

Patients could receive additional cycles of prexigebersen if they exhibited stable disease or had improvement of their disease. In the prexigebersen monotherapy cohorts, four patients completed two cycles of treatment and three patients completed five cycles of treatment. Among the six patients who received prexigebersen plus LDAC combination therapy, three received three cycles of treatment and one received five cycles of treatment. Furthermore, five patients receiving prexigebersen plus LDAC combination experienced at least a 50% reduction in bone marrow blasts; two patients achieved a CR, one achieved CRi, and two had stable disease. These results demonstrate the potential anti-leukemic activity of prexigebersen and its potential to stabilize patients for extended treatments.

One of the assays developed in the Phase 1 clinical trial was the flow cytometry scientific assay which was used to provide critical proof that DNAbilize® neutral liposome delivery technology delivered the drug substance to the cell and was able to transport it across the cell membrane into the interior to block cellular production of the Grb2 protein. The extent by which prexigebersen inhibited the expression of the target Grb2 protein and the expression of phosphorylated extracellular signal related kinase (pERK), a

7

protein downstream of the Ras protein, in patient samples was investigated. By the end of the treatment, prexigebersen decreased Grb2 protein levels in 10 out of 12 samples (83%) tested (average reduction 50%) compared to the baseline Grb2 levels prior to treatment. Similarly, by the end of the treatment, prexigebersen decreased pERK levels in seven out of 12 samples (58%) tested (average reduction 52%) compared to the baseline pERK levels prior to treatment. These results are potentially a significant breakthrough for antisense therapeutics, whose development, to date, as a class of therapeutics has been severely limited by a lack of a systemic delivery mechanism that can safely distribute the drug throughout the body and deliver the antisense drug substance across the cell membrane into the interior of the cell. Further, we expect that scientific proof of principle for DNAbilize® may lead to licensing and business development opportunities, supporting our business model.

An important outcome of the Phase1b clinical trial was a novel method which was developed to assess the pharmacokinetics of the drug, i.e., to detect the prexigebersen drug substance in patients’ peripheral blood samples. Pharmacokinetics of prexigebersen demonstrated a half-life at 60 mg/m2 of 30 hours, significantly better than the 90 mg/m2 dose. The final analysis of these data, along with the demonstrated reductions in bone marrow blasts, suggested that 60 mg/m2 is the appropriate dose for use in the Phase 2 trial.

A summary of the clinical trial results for the Phase 1 monotherapy for indications of AML, CML, MDS and ALL, and Phase 1b combination therapy for prexigebersen for indications of AML is shown in Figure 2 below. The first six cohorts, patients 001 to 034, were treated in the Phase 1 clinical trial using prexigebersen as a monotherapy. The seventh cohort, patients 035, 037 and 038, were treated in our Phase 1b clinical trial evaluating the combination therapy of 60 mg/m2 prexigebersen. The eighth cohort, patients 039, 040 and 041, were treated with combination therapy of 90 mg/m2.

Figure 2. Summary Cohorts 1-8 Prexigebersen Clinical Trial Phase 1 and 1b

Peripheral or bone |

| |||||||||||

marrow blast % |

| |||||||||||

Off- | Reason | Cycles | ||||||||||

Patients |

| Diagnosis |

| Baseline |

| Nadir |

| Tx |

| Discontinued |

| Completed |

1 |

| CML |

| 51 |

| No |

| 97 |

| DLT |

| <1 |

6 |

| AML |

| 15 |

| 2 |

| 5 |

| PD |

| 5 |

7 |

| MDS |

| 8 |

| 4 |

| 6 |

| PD |

| 5 |

10 |

| AML |

| 23 |

| 10 |

| 10 |

| PD |

| 1 |

11 |

| CML |

| 7 |

| No |

| 50 |

| PD |

| 1 |

14 |

| AML |

| 48 |

| 5 |

| 21 |

| PD |

| 1 |

15 |

| AML |

| 54 |

| 31 |

| 72 |

| PD |

| 1 |

20 |

| AML |

| 76 |

| 5 |

| 63 |

| PD |

| 1 |

21 |

| AML |

| 71 |

| 43 |

| 74 |

| PD |

| 2 |

22 |

| AML |

| 1 |

| — |

| 1 |

| PD |

| 2 |

23 |

| MDS |

| NE |

| NE |

| NE |

| PD |

| 1 |

24 |

| MDS |

| — |

| — |

| — |

| PD |

| 5 |

25 |

| AML |

| 10 |

| 3 |

| 19 |

| PD |

| 2 |

26 |

| AML |

| 11 |

| No |

| 80 |

| PD |

| 1 |

27 |

| AML |

| 93 |

| No |

| 97 |

| PD |

| 1 |

28 |

| AML |

| 96 |

| 93 |

| 98 |

| PD |

| 1 |

29 |

| AML |

| 35 |

| 7 |

| 24 |

| PD |

| 1 |

30 |

| AML |

| 51 |

| 17 |

| 82 |

| PD |

| 1 |

31 |

| AML |

| 17 |

| No |

| 17 |

| PD |

| 1 |

32 |

| AML |

| 24 |

| 22 |

| 22 |

| PD |

| 2 |

34 |

| AML |

| 66 |

| ND |

| ND |

| PD |

| 1 |

35 |

| AML |

| 17 |

| 2 |

| 2 |

| CRi |

| 1 |

37 |

| AML |

| 25 |

| 33 |

| ND |

| PD |

| 1 |

38 |

| AML |

| 23 |

| 2 |

| 3 |

| CR |

| 5 |

39 |

| AML |

| 36 |

| 16 |

| 58 |

| SD |

| 3 |

40 |

| AML |

| 31 |

| 2 |

| 2 |

| CR |

| 3 |

41 |

| AML |

| 18 |

| 9 |

| 14 |

| SD |

| 3 |

Nadir: the lowest point, Off-TX: off treatment, No: no reduction in blasts, DLT: dose limiting toxicity, PD: progressive disease, NE: not enough sample to evaluate, ND: not done, CRi: complete remission with incomplete hematologic recovery, CR: complete remission, SD: stable disease

8

Phase 2 Clinical Trials

Results from the Phase 1b clinical trial demonstrated it is safe to add prexigebersen to LDAC, which appears to yield better response rates in this AML patient population. A Phase 2 study was initiated to assess the efficacy of prexigebersen plus LDAC in newly diagnosed AML patients. Thirty patients were enrolled and 17 patients were deemed evaluable (Table 2). The interim data showed that 11 (65%) of the 17 evaluable patients had a response, including five (29%) who achieved CR, including one CRi and one morphologic leukemia free state, and six (35%) stable disease responses, including two patients who had greater than a 50% reduction in bone marrow blasts. The efficacy data from the 17 evaluable patients was very favorable compared to the reported CR, CRp and CRi rates of 7 to 13% with LDAC treatment alone. Importantly, through investigation by the principal investigators, it was observed that 68% of patients were secondary AML patients, a difficult class to treat.

Table 2. Outcome of evaluable patients who were treated with prexigebersen + LDAC

Results to date have shown prexigebersen, with its efficacy and excellent safety profile, to be an effective combination candidate with frontline therapy. However, DNA hypomethylating agents are now the most frequently used agents in the treatment of elderly AML patients in the U.S. and Europe. As a result, we amended Stage 2 of the Phase 2 trial in AML to remove the combination treatment of prexigebersen and LDAC and replace it with the combination treatment of prexigebersen and decitabine. Since decitabine is also used as a treatment for relapsed/refractory AML patients, a cohort of relapsed/refractory AML patients was also added to the study.

We believe the approval of the frontline venetoclax and decitabine combination therapy provides an opportunity for combining prexigebersen with the combination therapy for the treatment of newly diagnosed AML patients. Preclinical testing of prexigebersen with venetoclax and decitabine demonstrated the potential to enhance efficacy of the frontline treatment combination. The triple combination of prexigebersen, venetoclax and decitabine showed significant improvement in decreasing the viability of three of the four AML cell lines tested. Bio-Path’s approved amended Stage 2 for this Phase 2 clinical trial has three cohorts of patients. The first two cohorts will treat patients with the triple combination of prexigebersen, decitabine and venetoclax with the first cohort including untreated AML patients and the second cohort including relapsed/refractory AML patients. Finally, the third cohort will treat relapsed/refractory AML patients who are venetoclax-resistant or -intolerant with the two-drug combination of prexigebersen and decitabine.

The first step in establishing the amended Stage 2 of the Phase 2 trial in AML was demonstrating the safety of treating patients with the two-drug combination of prexigebersen and decitabine. Results of the six evaluable patients, who were treated with the combination of prexigebersen and decitabine, in Stage 2 of the Phase 2 clinical trial were presented in the 2021 ASH Annual Meeting (Table 3). Although the treatment combination of prexigebersen and decitabine was not the treatment planned for the efficacy evaluation of Stage 2 of the Phase 2 clinical trial, the efficacy profile in this safety segment of the study was encouraging with 50% of patients having a response, including two complete responses (33%) with incomplete hematologic recovery and one patient (17%)

9

showing partial response. For reference, in this class of AML patients, the complete response rate to treatment with decitabine alone is approximately 20%.

Additionally, results of the six evaluable patients, who were treated with the triple combination of prexigebersen, decitabine and venetoclax, in Stage 2 of the Phase 2 clinical trial were also presented in the 2021 ASH Annual Meeting (Table 3). These patients included four relapsed/refractory AML patients, and two newly diagnosed AML patients. In the preliminary safety data review, five of the patients (83%) responded to treatment, including four (67%) achieving CR and one (17%) achieving CRi. Recent publications provide that CR rates to combination treatment with decitabine and venetoclax (but without prexigebersen) are 42 to 52% for relapsed/refractory AML patients and 0 to 39% for relapsed/refractory secondary AML patients. Response rates to frontline treatment with decitabine and venetoclax (but without prexigebersen) are 62 to 71% for newly diagnosed AML patients. These preliminary data showed the treatment was well-tolerated and there were no dose limiting toxicities attributed to prexigebersen. Three patients remained on treatment for more than one cycle.

Table 3. Outcome of evaluable patients who were treated with the two-drug prexigebersen + decitabine combination or the triple prexigebersen + decitabine + venetoclax combination

On August 1, 2023, we announced interim data for the first two cohorts of the amended Stage 2 of the Phase 2 clinical trial (Table 4). Fourteen newly diagnosed patients were evaluable in the first cohort and treated with at least one cycle of the prexigebersen, decitabine and venetoclax combination therapy. All patients in the first cohort (median age 75) were adverse risk by 2017 ELN guidelines (n=10) or secondary AML (n=4). Prexigebersen was well-tolerated, and AEs were generally consistent with decitabine and venetoclax treatment and/or for AML. Twelve of the 14 evaluable patients (86%) achieved CR/CRi and two (14%) achieved PR. In total, 100% of the evaluable patients had a response to treatment. The CR/CRi rates of 86% for the evaluable patients in the first cohort is significantly higher than the CR/CRi rates of 62% for newly diagnosed patients treated with the frontline combination treatment of decitabine and venetoclax. Fourteen refractory/relapsed evaluable AML patients in the second cohort were treated with at least one cycle of the prexigebersen, decitabine and venetoclax combination therapy. Substantially all of the patients in the second cohort (median age 56.5) were adverse risk by 2017 ELN guidelines (n=11) or secondary AML (n=2). Prexigebersen was well-tolerated, and AEs were generally consistent with decitabine and venetoclax treatment and/or for AML. Eight of the 14 evaluable refractory/relapsed patients (57%) achieved CR/CRi, two (14%) achieved PR and two (22%) achieved stable disease. In total, 93% of the evaluable patients in the second cohort had a response to treatment. The CR/CRi rates of 57% for the evaluable refractory and relapsed patients in the second cohort is significantly higher than the CR/CRi rates of 21% for refractory/relapsed patients treated with the combination treatment of decitabine and venetoclax. Based on this interim data, we currently plan to pursue FDA expedited programs for Fast Track designation, and we are evaluating whether to seek to expand Stage 2 of the Phase 2 clinical trial in Europe.

10

Table 4. Interim data of evaluable patients who were treated with the triple prexigebersen + decitabine + venetoclax combination

Development of new therapeutics for AML can meet currently unmet needs for patients who have very few treatment options due to age, fitness or treatment-resistance of advanced genetically unstable cells. Elderly patients unfit to receive a stem cell transplant or induction therapy face a likelihood of relapse to a more resistant leukemia. Prexigebersen and DNAbilize® technology offer new hope for achieving remission for fragile populations. We believe that the combination of prexigebersen with frontline chemotherapy can provide a way to treat cancer without added toxicity so that the patient can remain under treatment long enough to reach complete remission.

BP1002

BP1002, also known by its scientific name as Liposomal Bcl-2, is our second liposome delivered antisense drug candidate. BP1002 is intended to target lymphoma, CLL, AML and certain solid tumor markets. We believe that BP1002 has the potential to treat 40 to 60% of solid tumors.

Bcl-2 is a protein that is involved in regulating apoptosis, or programmed cell death. Apoptosis is a physiologic mechanism of cell turnover by which cells actively commit suicide in response to aberrant external signals. Over-expression of Bcl-2 prevents the induction of apoptosis in response to cellular insults such as treatment with chemotherapeutic agents. Bcl-2, initially discovered in transformed follicular lymphoma (“FL”) was found to contribute to the pathophysiology of various subtypes of non-Hodgkin’s lymphoma (“NHL”).

Non-Hodgkin’s Lymphoma - Background and Common Treatments. Lymphoma can start anywhere in the body where lymph tissue is found. The major sites of lymph tissue are lymph nodes, bone marrow, spleen, thymus, adenoids and tonsils and the digestive tract. NHL is a term used for many different types of lymphoma that share some common characteristics. In the U.S., approximately 86,550 new cases of and 20,180 deaths from NHL were expected in 2023 (Table 5). Approximately 60% of NHLs are aggressive lymphomas which usually need to be treated right away, as they grow and can spread quickly to other parts of the lymph system or to other parts of the body, such as the liver, brain or bone marrow.

Table 5. Basic statistics of Non-Hodgkin’s Lymphoma

11

BP1002 - Development and Treatment for lymphoma

Therapies that directly and specifically block or inhibit protein synthesis of Bcl-2 could be transformative for NHL. The Bcl-2 inhibitor venetoclax was approved by the FDA for the treatment of patients with CLL and small lymphocytic leukemia (“SLL”). However, treatment with venetoclax can lead to the development of drug resistance, resulting in disease recurrence. One of the proposed mechanisms of venetoclax resistance is acquired mutations in Bcl-2, which reduce venetoclax’s ability to bind and inhibit Bcl-2. Because BP1002 activity is based on blocking the Bcl-2 messenger RNA and BP1002 targets Bcl-2 at a site different from venetoclax, we expect BP1002 to overcome such venetoclax resistance mechanism and be an effective approach for patients who have relapsed from venetoclax. Preclinical studies suggest that the combination of BP1002 with decitabine is efficacious in venetoclax-resistant lymphoma cells. An abstract of the preclinical study was presented at the 2021 American Association for Cancer Research Annual Meeting. We believe BP1002 provides a new tool for cancer treatment for not just lymphomas, but also many cancers for which Bcl-2 expression is driving cell survival. The introduction of a new, non-toxic, and specific Bcl-2 inhibitor could be a major advance in cancer therapeutics.

On January 10, 2024, we announced the successful completion of the first dose cohort in the Phase 1 clinical trial evaluating the ability of BP1002 to treat refractory/relapsed lymphoma and refractory/relapsed CLL patients. The Phase 1 clinical trial is being conducted at the Georgia Cancer Center while two additional clinical trial sites are currently being processed for inclusion in the study, The University of Texas Southwestern and New York Medical College. Initially, a total of six evaluable patients are scheduled to be treated with BP1002 monotherapy in a standard 3+3 design, with a starting dose of 20 mg/m2. The approved treatment cycle is two doses per week over four weeks, resulting in eight doses administered over twenty-eight days. Enrollment is now open for patients for the second dose cohort of 40 mg/m2.

BP1002 - Development and Treatment for AML

The Bcl-2 inhibitor venetoclax is used in frontline combination therapies to treat elderly AML patients; however, venetoclax resistance has been observed. A recent study2 found that AML patients who had relapsed from frontline venetoclax-based treatment had a very poor prognosis, with a median survival of less than three months. Since venetoclax and BP1002 utilize different mechanisms of action, we believe that BP1002 may be a potential treatment for venetoclax-relapsed AML patients. Preclinical studies, presented as an abstract at the 2021 American Association for Cancer Research Annual Meeting, suggest that the combination of BP1002 with decitabine is efficacious in venetoclax-resistant AML cells. A Phase 1/1b clinical trial to investigate the ability of BP1002 to treat refractory/relapsed AML patients, including venetoclax-resistant patients, is being studied. The Phase 1/1b clinical trial is being conducted at several leading cancer centers in the United States, including the Weill Medical College, MD Anderson Cancer Center, Scripps Cancer Center and The University of California at Los Angeles Cancer Center. Gail J. Roboz, M.D., is serving as the national coordinating Principal Investigator for the Phase 1/1b trial. Gary Schiller, M.D., The University of California at Los Angeles Cancer Center, Maro Ohanian, D.O., Department of Leukemia, University of Texas MD Anderson Cancer Center, and David Hermel, M.D., Scripps Health, will each serve as Principal Investigators.

On December 14, 2023, we announced the successful completion of the first dose cohort of the dose escalation portion of the Phase 1/1b clinical trial of BP1002 which evaluates the ability of BP1002 to treat refractory/relapsed AML patients, including venetoclax-resistant patients. A total of three evaluable patients per dosing cohort are scheduled to be treated with BP1002 monotherapy in a standard 3+3 design, unless there is a dose limiting toxicity which would require an additional three patients tested. The first dose cohort consisted of a starting dose of 20 mg/m2, and there were no dose limiting toxicities. The approved treatment cycle is two doses per week over four weeks for a total of eight doses administered over 28 days. Enrollment is now open for patients for the second dose cohort of 40 mg/m2. The Phase 1b portion of the study is expected to commence after completion of BP1002 monotherapy cohorts and will assess the safety and efficacy of BP1002 in combination with decitabine in refractory/relapsed AML patients.

BP1003

BP1003 is our third liposome delivered antisense drug candidate. BP1003 is a DNAbilize® RNAi nanoparticle containing antisense DNA targeting STAT3, whose elevated expression/activity is associated with a poorer survival outcome for patients with

2 (Maiti A, Ruasch C, Cortes JE, et.al. Outcomes of relapsed or refractory acute myeloid leukemia after frontline hypomethylating agent and venetoclax regimens. Haematologica 2021; 106: 894-898.)

12

solid tumors, including those of gastric cancer, lung cancer, hepatic cancer, osteosarcoma, prostate cancer and pancreatic adenocarcinoma (PDAC). We believe that a therapeutic that shuts down the STAT3 protein can have significant clinical impact for solid tumors that have elevated expression/activity of STAT3.

Our lead indication for BP1003 is pancreatic cancer due to the severity of this disease and the lack of effective, life-extending treatments. PDAC is a cancer of the exocrine cells of the pancreas. In the U.S. in 2022, approximately 62,210 people were diagnosed with PDAC, and approximately 49,830 died from the disease. It is estimated that less than 11% of PDAC patients survive beyond five years, and it is projected that by 2030, PDAC will become the second most lethal cancer behind lung cancer. Treatment of the disease is hampered by the location of the pancreas, which is difficult to reach with conventional therapies and the fibrotic nature of the tumors, which protects them from penetration by chemotherapeutics. We believe a novel and unconventional therapeutic is needed to overcome these barriers to treatment.

While competition for therapeutics that target the STAT3 pathway exists, the competition for specific STAT3 inhibitors is very small. Many peptides designed to bind to STAT3 suffered from poor intrinsic pharmacokinetic properties, including poor cellular permeability and lack of stability in vivo, which curtailed their further development. Even second-generation peptidomimetics have failed to overcome these limitations. Most compounds under development target the pathway upstream of STAT3, such as the JAK2 kinase. However, lack of efficacy of the JAK2 kinase inhibitors was observed in PDAC clinical studies. Ionis Pharmaceuticals, Inc. has developed an antisense DNA-based STAT3 inhibitor called IONIS-STAT3-2.5Rx. It is being evaluated in clinical trials by AstraZeneca under the name AZD9150 for solid tumors and NHL. However, due to the toxicity of the DNA chemistry, thrombocytopenia continues to limit the systemic delivery and efficacy of such compounds for the treatment of cancer. We believe BP1003 avoids these complications.

We hypothesized that the natural lipid delivery vesicle would have unique characteristics that would allow for penetration of the fibrotic stroma to reach the PDAC cells. An abstract of the preclinical study was presented in the 2019 American Association for Cancer Research Annual Meeting. Our preclinical work demonstrated that BP1003 was successful in crossing the scar tissue matrix and delivering antisense drug into the tumor tissue. Subsequent studies evaluating the combination of BP1003 with gemcitabine, a standard of care for PDAC patients with metastatic disease, suggest that the regimen has synergistic anti-tumor effects. Additionally, an abstract of the preclinical study demonstrating that BP1003 enhanced the sensitivity of breast and ovarian cancer cells to chemotherapy was presented at the 2022 AACR Annual Meeting. We have successfully completed several IND enabling studies of BP1003, including safety. Body weight was used as an indicator of BP1003 safety in rodents. Mice received saline or twice weekly injections of BP1003 for four weeks. There was no difference in body weight between control mice and BP1003-treated mice (Figure 3). We have one additional IND enabling study to complete. Once the additional study is successfully completed, our goal is to file an IND and initiate the first-in-humans Phase 1 study of BP1003 in patients with refractory, metastatic solid tumors, including pancreatic cancer and NSCLC.

Figure 3. No difference in mean body weight was observed between control groups and BP1003-treated groups

We believe that the excellent safety profile of the DNAbilize® chemistry, the novel lipid formula that allows for penetration of the tumor stroma, and the ability to target a single protein with precision, makes BP1003 an ideal candidate for combination with approved treatments to extend survival while maintaining quality of life for the patient.

13

BP1001-A

Data supports a prominent role of Grb2 in the progression of solid tumors, and overexpression of Grb2 has been associated with chemosensitivity, poor prognosis and advanced disease in several malignancies including gynecologic malignancies.

Indications for Solid Tumors (e.g., Ovary, Endometrium)

Ovarian cancer is one of the most common types of gynecologic malignancy. In the U.S., 19,710 new cases of and 13,270 deaths from ovarian cancer were expected in 2023 (Table 6). According to the Ovarian Cancer Research Alliance, approximately 70% of patients diagnosed with ovarian cancer will have a recurrence. Recurrent ovarian cancer is treatable but rarely curable. The response rates to second-line chemotherapy are low and differ by platinum-sensitivity status: 20 to 25% for platinum-sensitive cases and 10 to 20% for platinum-resistant cases3. Given the poor outcomes of treatment for ovarian cancer, novel drug treatments are urgently needed.

Table 6. Basic Statistics for Ovarian Cancer

Endometrial cancer is the most common gynecologic malignancy in the U.S. In the U.S., 66,200 new cases of and 13,030 deaths from endometrial cancer were expected in 2023 (Table 7). The majority of cases are diagnosed at an early stage and are amenable to treatment with surgery alone. However, approximately 38 to 67% of advanced stage endometrial cancers will recur 4. Recurrent endometrial cancer is incurable with currently available standard therapies. The median survival for patients with recurrent endometrial carcinoma is approximately 12 to 15 months 5. Novel drug treatments for recurrent endometrial carcinoma are urgently needed.

Table 7. Basic Statistics for Endometrial Cancer

Development and Treatment for ovarian and endometrial cancer

Grb2 may be a novel potential therapeutic target for ovarian and endometrial cancer, and BP1001-A may provide clinical benefit against these gynecologic malignancies. BP1001-A is a modified drug product with the same drug substance as prexigebersen but includes formulation enhancements to produce smaller drug nanoparticles. The goal of this product enhancement is to produce smaller drug nanoparticles that can pass through vasculature pore spaces, thereby enabling release of the drug product into the interior of the tumor to enhance drug effectiveness. Preclinical experiments were conducted in collaboration with leaders in the field of ovarian cancer at MD Anderson Cancer Center. Results of the preclinical study were published in the scientific journal Oncotarget in

3 (Soyama H, Takano M, Miyamoto M, et al. Factors favouring long-term survival following recurrence in ovarian cancer. Mol Clin Oncol. 2017: 7: 42-46.)

4 (Huijgens ANJ, Merten HJMM. Factors predicting recurrent endometrial cancer. Facts Views Vis Obgyn. 2013; 5: 179-186.)

5 (Brooks RA, Fleming GF, Lastra RR, et al. Current recommendations and progress in endometrial cancer. CA Cancer J Clin 2019; 69: 258-279.)

14

July 2020. BP1001-A effectively penetrated ovarian tumors and decreased target Grb2 protein level in preclinical ovarian and endometrial tumor models. BP1001-A was demonstrated to reduce tumor burden both as a monotherapy and in combination with paclitaxel, a therapy commonly used to treat patients with advanced ovarian or endometrial cancer.

A Phase 1/1b clinical trial of BP1001-A in patients with advanced or recurrent solid tumors has been initiated. The dose escalation portion of the Phase 1/1b clinical trial is ongoing at more than eight leading cancer centers in the United States, including MD Anderson, The Mary Crowley Cancer Research Center, and Karmanos Cancer Center. Initially, a total of nine evaluable patients are scheduled to be treated with BP1001-A monotherapy in a standard 3+3 design, with a starting dose of 60 mg/m2 and continuing with 90 mg/m2 and 135 mg/m2. The approved treatment cycle is two doses per week over four weeks, resulting in eight doses administered over 28 days. The Phase 1b portion of the study is expected to commence after successful completion of BP1001-A monotherapy cohorts and is intended to assess the safety and efficacy of BP1001-A in combination with paclitaxel in patients with recurrent ovarian or endometrial tumors.

On July 17, 2023, we announced successful completion of the first dose cohort of BP1001-A in the Phase 1/1b study. Three patients were enrolled into the first dose cohort of BP1001-A at three different centers in the study, including one patient with hepatic lesions (and lung metastases) and two with advanced gynecologic lesions. All three patients had undergone extensive previous chemotherapies and/or surgeries for their disease prior to enrollment in this study. No patient experienced any treatment related adverse events or any adverse events deemed related to the study drug. Enrollment is now open for patients for the second dose cohort.

Indications for Triple Negative Breast Cancer (TNBC) and Inflammatory Breast Cancer (IBC)

TNBC and IBC - Background and Common Treatments. Approximately 15 to 20% of breast cancers fall into the category of triple-negative. TNBC tumors do not express estrogen receptors, progesterone receptors, and low human epidermal growth factor receptor 2 (“HER2”). These negative indicators mean that the growth of the cancer is not supported by the hormones estrogen and progesterone, or by the presence of HER2 receptors. Therefore, TNBC does not respond to hormonal therapy or therapies that target HER2 receptors. In addition, TNBC tumors are very aggressive. IBC is a rare and very aggressive type of breast cancer that accounts for 2 to 5% of all breast cancers. A lack of targeted treatments for these types of breast cancer has led to development of new therapeutics currently in clinical trials. Overexpression of receptor tyrosine kinases has been reported for TNBC and IBC. Since Grb2 is vital in the cancer signaling of receptor tyrosine kinases, the Company and collaborators at MD Anderson Cancer Center are interested in developing BP1001-A as a potential treatment for TNBC and IBC.

DNABILIZE®

DNAbilize® technology is available for out-licensing. We intend to apply our drug delivery technology template to new disease-causing protein targets to develop new liposomal antisense drug candidates for inclusion in our pipeline that meet scientific, preclinical and commercial criteria and file new patents on these targets. We expect that these efforts will include collaboration with scientific key opinion leaders in the field of study and include developing drug candidates for diseases other than cancer. A significant amount of capital is expected to be allocated to in-license promising protein targets that can be developed as new liposomal antisense drug candidates. As we expand, we will look at indications where a systemic delivery is needed and antisense can be used to slow, reverse or cure a disease, either alone or in combination with another drug. Our patent portfolio currently includes three issued patents in the U.S. that protect the platform technology for DNAbilize®, the Company’s novel RNAi nanoparticle drugs. We plan to continue our efforts to build protection around our technology as it safeguards our platform technology and target-specific technology, is a deterrent to would-be competitors and creates value around our core competencies.

We are interested in pursuing a wide-ranging, proactive licensing program to include co-development of specific liposomal antisense drug candidates, sub-licensing our delivery template for outside development of liposomal antisense drug candidates or out-licensing a partially-developed drug candidate for final development and marketing.

Research and Development

Our research and development expense primarily consists of third-party clinical, preclinical and manufacturing development activities, salaries and benefits expense and stock-based compensation. As we advance and expand our pipeline of drug candidates, we anticipate our research and development expenses will continue to increase in conjunction with these activities. Research and

15

development expenses incurred during the years ended December 31, 2023 and 2022 were $11.6 million and $9.2 million, respectively.

Manufacturing

We do not own or operate, and currently have no plans to establish, any manufacturing facilities. Accordingly, we have no ability to internally manufacture the drug candidates that we need to conduct our clinical trials. For the foreseeable future, we expect to continue to rely on third-party manufacturers and other third parties to produce, package and store sufficient quantities of our drug candidates and any future drug candidates for use in our clinical trials. We have entered into agreements with third-party manufacturers for the manufacture of our drug requirements, including agreements for the manufacture of prexigebersen for use in our Phase 2 clinical trial in AML, as well as agreements for the manufacture of BP1002, BP1003 and BP1001-A for use in our Phase 1 clinical trials. However, we may face various risks and uncertainties in connection with our reliance on third-party manufacturers, as discussed in “Item 1A. Risk Factors” of this Annual Report on Form 10-K under the heading “Risks Related to Manufacturing Our Drug Candidates.” If the FDA or other regulatory agencies approve any of our drug candidates for commercial sale, we expect that we would continue to rely, at least initially, on third-party manufacturers to produce commercial quantities of such approved drug candidates. However, we may in the future elect to manufacture certain of our drug candidates in our own manufacturing facilities. If we do so, we will require substantial additional funds and need to recruit qualified personnel in order to build or lease and operate any manufacturing facilities.

Sales and Marketing

We currently do not have any commercial drug products or an organization for the sales and marketing of pharmaceutical products. In order to successfully commercialize any drug candidates that may be approved in the future by the FDA or comparable foreign regulatory authorities, we must build our sales and marketing capabilities or make arrangements with third parties to perform these services. For certain drug candidates in selected indications where we believe that an approved product could be commercialized by a specialty sales force that calls on a limited but focused group of physicians, we may commercialize these products ourselves. However, in therapeutic indications that require a large sales force selling to a large and diverse prescribing population, we may enter into arrangements with other companies for commercialization. If we are unable to establish adequate sales, marketing and distribution capabilities, whether independently or with third parties, we may not be able to generate product revenue and may not become profitable.

Intellectual Property

Patents, trademarks, trade secrets, technology, know-how and other proprietary rights are important to our business. Our success depends in large part on our ability to obtain and maintain patent protection both in the U.S. and in other countries for our drug candidates and on our ability to operate without infringing the proprietary rights of third parties. Our ability to protect our drug candidates from unauthorized or infringing use by third parties depends in substantial part on our ability to obtain and maintain valid and enforceable patents.

We rely on trade secrets to protect our technology, especially where we do not believe patent protection is appropriate or obtainable. However, trade secrets are difficult to protect. In order to protect our proprietary technology and processes, we also rely in part on confidentiality and intellectual property assignment agreements with our corporate partners, employees, consultants, outside scientific collaborators, sponsored researchers and other advisors. These agreements may not effectively prevent disclosure of confidential information nor result in the effective assignment to us of intellectual property, and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information or other breaches of the agreements. In addition, others may independently discover our trade secrets and proprietary information, and in such case we could not assert any trade secret rights against such party. To the extent that we enter into out-license and in-license agreements in the future, our success will depend in part on the ability of our licensors to obtain, maintain and enforce patent protection for their intellectual property, in particular, any patents to which we secure exclusive rights.

We have expanded our intellectual property portfolio by filing patent applications that are applicable to our technology and business strategy. Our patent portfolio currently includes five issued patents in the U.S. and 17 issued patents in foreign jurisdictions:

16

Claims Related to DNAbilize®

Patent No. |

| Title |

| Date Issued |

US 9,744,187 |

| P-ethoxy nucleic acids for liposomal formulation | August 29, 2017 | |

US 10,335,428 |

| P-ethoxy nucleic acids for liposomal formulation | July 2, 2019 | |

US 10,898,506 |

| P-ethoxy nucleic acids for liposomal formulation | January 26, 2021 | |

SG 11201802718P |

| P-ethoxy nucleic acids for liposomal formulation | May 12, 2021 | |

EA 038277 (in force in AM, AZ, BY, KG, KZ, RU, TJ, TM) |

| P-ethoxy nucleic acids for liposomal formulation | August 4, 2021 | |

AU 2016340123 | P-ethoxy nucleic acids for liposomal formulation | January 5, 2023 | ||

MX 403603 | P-ethoxy nucleic acids for liposomal formulation | June 20, 2023 | ||

IN 472686 | P-ethoxy nucleic acids for liposomal formulation | November 24, 2023 |

Compositions and Methods of Use for Specific Drug Targets

Patent No. |

| Title |

| Date Issued |

US 10,927,379 |

| Combination therapy with liposomal antisense oligonucleotides | February 23, 2021 | |

US 11,041,153 |

| P-ethoxy nucleic acids for STAT3 inhibition | June 22, 2021 | |

EP 3 512 525 (in force in DE, ES, FR, GB, and NL) | Combination therapy with liposomal antisense oligonucleotides | July 27, 2022 | ||

JP 7132911 | Combination therapy with liposomal antisense oligonucleotides | August 30, 2022 | ||

JP 7186721 | P-ethoxy nucleic acids for IGF-1R inhibition | December 1, 2022 | ||

CN ZL 201880033244.6 | P-ethoxy nucleic acids for STAT3 inhibition | December 16, 2022 | ||

EA 041953 (in force in AM, AZ, BY, KG, KZ, RU, TJ, TM) | Combination therapy with liposomal antisense oligonucleotides | December 19, 2022 | ||

JP 7237009 | P-ethoxy nucleic acids for STAT3 inhibition | March 2, 2023 | ||

EA 042663 (in force in AM, AZ, BY, KG, KZ, RU, TJ, TM) | P-ethoxy nucleic acids for STAT3 inhibition | March 9, 2023 | ||

HK 400 11951 | Combination therapy with liposomal antisense oligonucleotides | April 6, 2023 | ||

JP 7284709 | P-ethoxy nucleic acids for BCL2 inhibition | May 23, 2023 |

17

EA 044637 | P-ethoxy nucleic acids for BCL2 inhibition | September 19, 2023 | ||

MX 408790 | P-ethoxy nucleic acids for STAT3 inhibition | December 7, 2023 | ||

MX 408785 | P-ethoxy nucleic acids for BCL2 inhibition | December 7, 2023 |

We have six additional pending patent applications in the U.S. and seven additional allowed patent application in a foreign jurisdiction. Further, we have pending patent applications in key foreign jurisdictions across our six families of applications. We continue our efforts to build protection around our technology as it safeguards our platform technology and target-specific technology, is a deterrent to would-be competitors and creates value around our core competencies.

There can be no assurances that patents related to our existing patent applications or applications we may file in the future will be issued or that any issued patents will provide meaningful protection for our drug candidates, which could materially and adversely affect our competitive business position, business prospects and financial condition.

In the U.S., individual patents extend for varying periods of time depending on the date of filing of the patent application or the date of patent issuance. Generally, patents issued in the U.S. are effective for 20 years from the earliest non-provisional filing date. In addition, a patent term can sometimes be extended to recapture a portion of the term effectively lost during the FDA’s regulatory review period; however, the restoration period cannot be longer than five years, and the total patent term cannot exceed 14 years following FDA approval.

Employees

We currently employ ten full-time employees. We also have contractual relationships with additional professionals who perform certain medical officer, regulatory, drug development and administrative duties. We believe relations with such professionals and employees are good.

Competition