Table of Contents

As filed with the Securities and Exchange Commission on November 3, 2021

Registration No. 333-__________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SF-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CAPITAL ONE AUTO RECEIVABLES, LLC

as depositor to the issuing entities described herein

(Exact name of registrant as specified in its charter)

| Delaware | 31-1750007 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

Commission File Number of depositor: 333-_______

Central Index Key Number of depositor: 0001133438

Central Index Key Number of sponsor: 0000047288

Capital One, National Association

(Exact name of sponsor as specified in its charter)

1680 Capital One Drive

McLean, Virginia 22102

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Matthew W. Cooper

General Counsel

Capital One Financial Corporation

1680 Capital One Drive

McLean, Virginia 22102

(703) 720-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

| Juan E. Yrausquin | Angela M. Ulum | |

| Senior Director, Associate General Counsel | Mayer Brown LLP | |

| Capital One Financial Corporation | 71 South Wacker Drive | |

| 1680 Capital One Drive | Chicago, Illinois 60606 | |

| McLean, Virginia 22102 | (312) 782-0600 |

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective, as determined by market conditions.

If any of the securities being registered on this Form SF-3 are to be offered pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form SF-3 is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form SF-3 is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per unit(1) |

Proposed maximum aggregate offering price |

Amount of registration fee(2) | ||||

| Asset-Backed Notes |

$1,000,000 | 100% | $1,000,000 | $92.70 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated for purposes of calculating the registration fee. |

| (2) | Calculated pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not deliver the notes described in this preliminary prospectus until we deliver a final prospectus. This preliminary prospectus is not an offer to sell these notes nor is it seeking an offer to buy these notes in any state where the offer or sale is not permitted.

Subject to Completion, dated [_______] [ ], 20[ ]

PROSPECTUS

$[ ](1)

Capital One Prime Auto Receivables Trust 20[ ]-[ ]

Issuing Entity

Central Index Key Number: [ ]

| Capital One Auto Receivables, LLC Depositor Central Index Key Number: 0001133438 |

Capital One, National Association Sponsor and Servicer Central Index Key Number: 0000047288 |

You should carefully read the risk factors set forth under “Risk Factors” beginning on page [ ] of this prospectus.

The notes are asset-backed securities. The notes will be the obligation of the issuing entity solely and will not be obligations of or guaranteed by any other person or entity.

Capital One Prime Auto Receivables Trust 20[ ] – [ ] will issue the following asset-backed notes:

| Initial Note Balance(1) |

Offered Amount |

Interest Rate | Final Scheduled Payment Date |

Price to Public(2) |

Underwriting Discount |

Proceeds to the Depositor |

||||||||||||||||||||||

| Class A-1 Notes |

$ | $ | % | % | % | % | ||||||||||||||||||||||

|

Class A-2[-A] Notes(3) |

} | $ | $ | % | % | % | % | |||||||||||||||||||||

|

[Class A-2-B Notes(3)] |

$ | $ | |

[Benchmark + [ ]%](3) |

|

% | % | % | ||||||||||||||||||||

| Class A-3 Notes(4) |

} | $ | $ | % | % | % | % | |||||||||||||||||||||

| Class A-4 Notes(4) |

$ | $ | % | % | % | % | ||||||||||||||||||||||

| Class B Notes(5) |

$ | $ | % | |||||||||||||||||||||||||

| Class C Notes(5) |

$ | $ | % | |||||||||||||||||||||||||

| [Class D Notes](5) |

$ | $ | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

$ | $ | $ | $ | $ | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| (1) | [Not less than 5% of each class of notes will be retained by the sponsor or one or more majority-owned affiliates of the sponsor (which for EU risk retention purposes and UK risk retention purposes will be a wholly-owned special purpose subsidiary of CONA) to satisfy the credit risk retention obligations of the sponsor as described under “The Sponsor—U.S. Credit Risk Retention” and “The Sponsor—Securitization Regulations” in this prospectus.] |

| (2) | Plus accrued interest, if any, from the closing date. |

| (3) | [The interest rate for each class of notes will be a fixed rate, a floating rate or a combination of a fixed rate and a floating rate if that class has both a fixed rate tranche and a floating rate tranche. The Class A-2-B notes will accrue interest at a floating rate based on a benchmark, which initially will be [insert applicable floating rate benchmark]. For more information on how the benchmark is determined, you should read “The Notes—Payments of Interest” in this prospectus.] [NOTE: If floating rate notes are offered, the applicable prospectus will disclose the terms of the specific index, which will be an index other than LIBOR, that will be used to determine interest payments for such floating rate tranches.]] |

| (4) | [The initial note balance of the Class A-3 notes and the Class A-4 notes may change, but will be determined on or prior to the day of pricing of those classes of notes. The initial note balance of the issued Class A-3 notes is expected to be within the range of $[ ]—$[ ], and the initial note balance of the issued Class A-4 notes is expected to be within the range of $[ ]—$[ ]. The offered amount of each of the Class A-3 notes and the Class A-4 notes will be 95% of the related initial note balance of such class. See “Risk Factors—Risks related to the issuance of multiple classes of notes, an unknown allocation of notes or retention of notes— There are risks associated with the unknown initial note balance of the Class A-3 notes and the Class A-4 notes”.] |

| (5) | [The Class B notes, the Class C notes and the Class D notes are not being offered hereby and will be retained by the sponsor or another majority-owned affiliate of the sponsor, but will be entitled to certain payments as described herein.] |

| • | The notes are payable [solely][principally] from the assets of the issuing entity, which consist primarily of receivables which are motor vehicle retail installment sale contracts that are secured by new and used automobiles, light-duty trucks, SUVs and vans, [payments due under an interest rate [swap] [cap] agreement] [and funds on deposit in the reserve account]. [A portion of the receivables may be acquired by the issuing entity subsequent to the closing date during the funding period described in this prospectus using amounts deposited in a pre-funding account on the closing date.] [[ ] will be the counterparty to the interest rate swap agreement]. [[ ] will be the cap provider under the interest rate cap agreement.] |

| • | The issuing entity will pay interest on and principal of the notes on the [ ] day of each month, or, if the [ ] is not a business day, the next business day, starting on [ ]. |

| • | [The issuing entity will not pay principal during the revolving period, which is scheduled to terminate after the payment date occurring on [ ]. However, if the revolving period terminates early as a result of an early amortization event, principal payments may commence prior to that date.] |

| • | Credit enhancement for the notes will consist of a reserve account with an initial deposit of approximately $[ ], [excess interest on the receivables,] [overcollateralization,] and [the yield supplement overcollateralization amount], and, in the case of the Class A notes, Class B notes [and Class C notes], the subordination of certain payments to the noteholders of less senior classes of notes. |

| • | The issuing entity will also issue non-interest bearing certificates representing the equity interest in the issuing entity, which initially will be issued to the depositor and are not being offered hereby. [The depositor intends to sell [a portion][the majority] of the certificates on or after the closing date.] |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The issuing entity is being structured so as not to constitute a “covered fund” as defined in the regulations implementing Section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly known as the “Volcker Rule”.

| [______________] |

[_________________ | ] |

The date of this prospectus is [ ]

Table of Contents

Prospectus

| vi | ||||

| vii | ||||

| viii | ||||

| ix | ||||

| x | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 14 | ||||

| CERTAIN CONSIDERATIONS FOR ERISA AND OTHER U.S. BENEFIT PLANS |

14 | |||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 19 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

i

Table of Contents

| 47 | ||||

| 48 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 58 | ||||

| 58 | ||||

| 63 | ||||

| 67 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

| 69 | ||||

| 79 | ||||

| 79 | ||||

| 79 | ||||

| 79 | ||||

| 81 | ||||

| 81 | ||||

| 81 | ||||

| 82 | ||||

| 83 | ||||

| 85 | ||||

| 86 | ||||

| 87 | ||||

| 90 | ||||

| Sale and Assignment of Receivables and Related Security Interests |

90 | |||

| 90 | ||||

| 91 | ||||

| 94 | ||||

| 97 | ||||

| 97 | ||||

| 98 | ||||

| 98 | ||||

| 99 | ||||

| 99 | ||||

| 99 | ||||

ii

Table of Contents

| [Acquisition of Subsequent Receivables During Funding Period] |

100 | |||

| 101 | ||||

| 102 | ||||

| 102 | ||||

| 105 | ||||

| 105 | ||||

| 105 | ||||

| 105 | ||||

| 106 | ||||

| 107 | ||||

| 107 | ||||

| Indemnification of the Indenture Trustee and the Owner Trustee |

107 | |||

| 108 | ||||

| 108 | ||||

| Modifications of Receivables and Extensions of Receivables Final Payment Dates |

108 | |||

| 111 | ||||

| 111 | ||||

| 112 | ||||

| 113 | ||||

| 113 | ||||

| 114 | ||||

| 114 | ||||

| 115 | ||||

| 115 | ||||

| 115 | ||||

| 116 | ||||

| 116 | ||||

| 116 | ||||

| 116 | ||||

| 117 | ||||

| Priority of Payments Will Change Upon Events of Default that Result in Acceleration |

118 | |||

| 119 | ||||

| 120 | ||||

| 121 | ||||

| 121 | ||||

| 122 | ||||

| 124 | ||||

| 124 | ||||

| 125 | ||||

| 125 | ||||

| 126 | ||||

| 127 | ||||

| 128 | ||||

| 130 | ||||

| 131 | ||||

| 133 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| Requirements for Certain EU and UK Regulated Persons and Affiliates |

135 | |||

| 140 | ||||

iii

Table of Contents

iv

Table of Contents

WHERE TO FIND INFORMATION IN THIS PROSPECTUS

This prospectus provides information about the issuing entity, Capital One Prime Auto Receivables Trust 20[ ]-[ ], including terms and conditions that apply to the notes to be offered by this prospectus.

In this prospectus, the terms “we,” “us,” and “our” refer to Capital One Auto Receivables, LLC, the depositor.

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. If you receive any other information, you should not rely on it. We are not offering the notes in any jurisdiction where the offer is not permitted. We do not claim that the information in this prospectus is accurate on any date other than the date stated on the cover.

We have started with two introductory sections in this prospectus describing the notes and the issuing entity in abbreviated form, followed by a more complete description of the terms of the offering of the notes. The introductory sections are:

| • | Summary of Terms—provides important information concerning the amounts and the payment terms of each class of notes and gives a brief introduction to the key structural features of the issuing entity; and |

| • | Risk Factors—describes briefly some of the risks to investors in the notes. |

We include cross-references in this prospectus to captions in these materials where you can find additional related information. You can find the page numbers on which these captions are located under the Table of Contents in this prospectus. You can also find a listing of the pages where the principal terms are defined under “Index” beginning on page [__] of this prospectus.

If you have received a copy of this prospectus in electronic format, and if the legal prospectus delivery period has not expired, you may obtain at no cost a paper copy of this prospectus from the depositor or from the underwriters upon request.

vi

Table of Contents

After the notes are issued, unaudited monthly reports containing information concerning the issuing entity, the notes and the receivables will be prepared by Capital One, National Association (“CONA”), as the servicer, and sent on behalf of the issuing entity to the indenture trustee, which will forward the same to Cede & Co. (“Cede”), as nominee of The Depository Trust Company (“DTC”).

The indenture trustee will also make such reports (and, at its option, any additional files containing the same information in an alternative format) available to noteholders each month via its website, which is presently located at [ ]. Assistance in using this website may be obtained by calling the indenture trustee’s customer service desk at [ ]. The indenture trustee will notify the noteholders in writing of any changes in the address or means of access to the website where the reports are accessible.

The reports do not constitute financial statements prepared in accordance with generally accepted accounting principles. CONA, the depositor and the issuing entity do not intend to send any of their financial reports to the beneficial owners of the notes. The issuing entity will file with the Securities and Exchange Commission (the “SEC”) all required annual reports on Form 10-K, distribution reports on Form 10-D and current reports on Form 8-K. Those reports will be filed with the SEC under the name “Capital One Prime Auto Receivables Trust 20[ ]-[ ]” and file number 333-[ ]. The issuing entity incorporates by reference any current reports on Form 8-K filed after the date of this prospectus by or on behalf of the issuing entity before the termination of the offering of the notes, but not any information that is furnished but that is not deemed filed. The issuing entity’s annual reports on Form 10-K, distribution reports on Form 10-D and current reports on Form 8-K, and amendments to those reports filed with, or otherwise furnished to, the SEC will not be made available on CONA’s website because those reports are made available to the public on the SEC website as described below.

The depositor has filed with the SEC a Registration Statement (333-[ ]) on Form SF-3 that includes this prospectus and certain amendments and exhibits under the Securities Act of 1933, as amended, relating to the offering of the notes described herein. This prospectus does not contain all of the information in the Registration Statement. The SEC maintains a website (http://www.sec.gov) that contains reports, registration statements, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

vii

Table of Contents

NOTICE TO INVESTORS: THE UNITED KINGDOM

PROHIBITION ON SALES TO UK RETAIL INVESTORS

THE NOTES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY UK RETAIL INVESTOR IN THE UNITED KINGDOM (“UK”). FOR THESE PURPOSES, A “UK RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT, AS DEFINED IN POINT (8) OF ARTICLE 2 OF COMMISSION DELEGATED REGULATION (EU) 2017/565 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (AS AMENDED, THE “EUWA”); OR (II) A CUSTOMER WITHIN THE MEANING OF THE PROVISIONS OF THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS AMENDED (THE “FSMA”) AND ANY RULES OR REGULATIONS MADE UNDER THE FSMA (SUCH RULES AND REGULATIONS AS AMENDED) TO IMPLEMENT DIRECTIVE (EU) 2016/97 (AS AMENDED), WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT, AS DEFINED IN POINT (8) OF ARTICLE 2(1) OF REGULATION (EU) NO 600/2014 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA, AND AS AMENDED; OR (III) NOT A QUALIFIED INVESTOR (A “UK QUALIFIED INVESTOR”) AS DEFINED IN ARTICLE 2 OF REGULATION (EU) 2017/1129 (AS AMENDED), AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA, AND AS AMENDED (THE “UK PROSPECTUS REGULATION”). CONSEQUENTLY NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 (AS AMENDED), AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA, AND AS AMENDED (THE “UK PRIIPS REGULATION”) FOR OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO UK RETAIL INVESTORS IN THE UK HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO ANY UK RETAIL INVESTOR IN THE UK MAY BE UNLAWFUL UNDER THE UK PRIIPS REGULATION.

OTHER UK OFFERING RESTRICTIONS

THIS PROSPECTUS IS NOT A PROSPECTUS FOR THE PURPOSE OF THE UK PROSPECTUS REGULATION. THIS PROSPECTUS HAS BEEN PREPARED ON THE BASIS THAT ANY OFFERS OF NOTES IN THE UK WILL BE MADE ONLY TO A UK QUALIFIED INVESTOR. ACCORDINGLY, ANY PERSON MAKING OR INTENDING TO MAKE AN OFFER IN THE UK OF NOTES WHICH ARE THE SUBJECT OF THE OFFERING CONTEMPLATED IN THIS PROSPECTUS MAY ONLY DO SO TO ONE OR MORE UK QUALIFIED INVESTORS. NONE OF THE ISSUING ENTITY, THE DEPOSITOR OR ANY OF THE UNDERWRITERS HAS AUTHORIZED, NOR DO THEY AUTHORIZE, THE MAKING OF ANY OFFER OF NOTES IN THE UK OTHER THAN TO UK QUALIFIED INVESTORS.

[THE CLASS A-1 NOTES HAVE NOT BEEN AND WILL NOT BE OFFERED IN THE UK OR TO UK PERSONS AND NO PROCEEDS OF ANY CLASS A-1 NOTES WILL BE RECEIVED IN THE UK.]

OTHER UK REGULATORY RESTRICTIONS

THE NOTES MUST NOT BE OFFERED OR SOLD AND THIS PROSPECTUS AND ANY OTHER DOCUMENT IN CONNECTION WITH THIS PROSPECTUS AND ISSUANCE OF THE NOTES MUST NOT BE COMMUNICATED OR CAUSED TO BE COMMUNICATED IN THE UK EXCEPT TO PERSONS HAVING PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND QUALIFYING AS INVESTMENT PROFESSIONALS UNDER ARTICLE 19 (INVESTMENT PROFESSIONALS) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS AMENDED (THE “ORDER”), OR TO PERSONS WHO FALL WITHIN ARTICLE 49(2)(A)-(D) (HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.) OF THE ORDER OR WHO OTHERWISE FALL WITHIN AN EXEMPTION SET FORTH IN SUCH ORDER SUCH THAT SECTION 21(1) OF THE FSMA DOES NOT APPLY TO THE ISSUING ENTITY OR ARE PERSONS TO WHOM THIS PROSPECTUS OR ANY OTHER SUCH DOCUMENT MAY OTHERWISE LAWFULLY BE COMMUNICATED OR CAUSED TO BE COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING

viii

Table of Contents

REFERRED TO AS “RELEVANT PERSONS”). IN THE UK, ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS PROSPECTUS RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. NEITHER THIS PROSPECTUS NOR THE NOTES ARE OR WILL BE AVAILABLE IN THE UK TO PERSONS WHO ARE NOT RELEVANT PERSONS AND THIS PROSPECTUS MUST NOT BE ACTED ON OR RELIED ON BY PERSONS IN THE UK WHO ARE NOT RELEVANT PERSONS. THE COMMUNICATION OF THIS PROSPECTUS TO ANY PERSON IN THE UK WHO IS NOT A RELEVANT PERSON IS UNAUTHORIZED AND MAY CONTRAVENE THE FSMA.

NOTICE TO INVESTORS: EUROPEAN ECONOMIC AREA

PROHIBITION ON SALES TO EU RETAIL INVESTORS

THE NOTES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY EU RETAIL INVESTOR IN THE EUROPEAN ECONOMIC AREA (THE “EEA”). FOR THESE PURPOSES, AN “EU RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF DIRECTIVE 2014/65/EU (AS AMENDED, “MIFID II”); OR (II) A CUSTOMER WITHIN THE MEANING OF DIRECTIVE (EU) 2016/97 (AS AMENDED), WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED IN POINT (10) OF ARTICLE 4(1) OF MIFID II; OR (III) NOT A QUALIFIED INVESTOR (AN “EU QUALIFIED INVESTOR”) AS DEFINED IN ARTICLE 2 OF REGULATION (EU) 2017/1129 (AS AMENDED) (THE “EU PROSPECTUS REGULATION”). CONSEQUENTLY, NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 (AS AMENDED, THE “EU PRIIPS REGULATION”) FOR OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO EU RETAIL INVESTORS IN THE EEA HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO ANY EU RETAIL INVESTOR IN THE EEA MAY BE UNLAWFUL UNDER THE EU PRIIPS REGULATION.

OTHER EEA OFFERING RESTRICTIONS

THIS PROSPECTUS IS NOT A PROSPECTUS FOR THE PURPOSE OF THE EU PROSPECTUS REGULATION. THIS PROSPECTUS HAS BEEN PREPARED ON THE BASIS THAT ANY OFFERS OF NOTES IN THE EEA WILL BE MADE ONLY TO AN EU QUALIFIED INVESTOR. ACCORDINGLY, ANY PERSON MAKING OR INTENDING TO MAKE AN OFFER IN THE EEA OF NOTES WHICH ARE THE SUBJECT OF THE OFFERING CONTEMPLATED IN THIS PROSPECTUS MAY ONLY DO SO TO ONE OR MORE EU QUALIFIED INVESTORS. NONE OF THE ISSUING ENTITY, THE DEPOSITOR OR ANY OF THE UNDERWRITERS HAS AUTHORIZED, NOR DO THEY AUTHORIZE, THE MAKING OF ANY OFFER OF NOTES IN THE EEA OTHER THAN TO EU QUALIFIED INVESTORS.

ix

Table of Contents

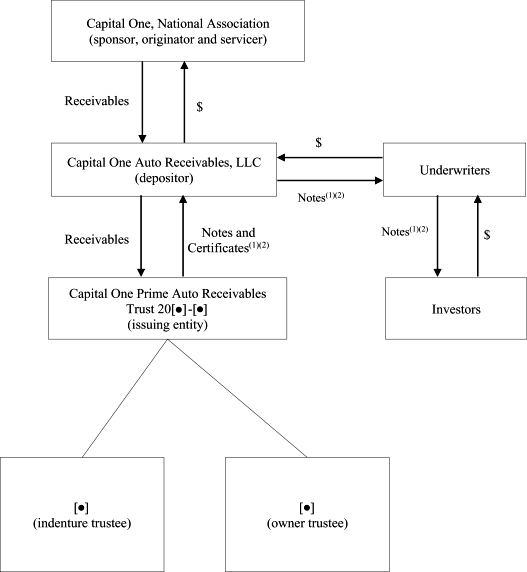

SUMMARY OF STRUCTURE AND FLOW OF FUNDS

This structural summary briefly describes certain major structural components, the relationship among the parties, the flow of funds prior to an acceleration after an event of default and certain other material features of the transaction. This structural summary does not contain all of the information that you need to consider in making your investment decision. You should carefully read this entire prospectus to understand all the terms of this offering.

Structural Diagram

| (1) | [Neither the certificates, which represent an equity interest in the issuing entity, nor the Class B notes, the Class C notes [or the Class D notes] are being offered hereby.] [The depositor intends to sell [a portion][the majority] of the certificates on or after the closing date.] |

x

Table of Contents

| (2) | [Not less than 5% of each class of notes and the certificates will be retained by CONA (which for EU risk retention purposes and UK risk retention purposes will be a wholly-owned special purpose subsidiary of CONA) or one or more majority-owned affiliates of CONA to satisfy the credit risk retention obligations of CONA described under “The Sponsor—U.S. Credit Risk Retention” and “ —Securitization Regulations” in this prospectus.] |

xi

Table of Contents

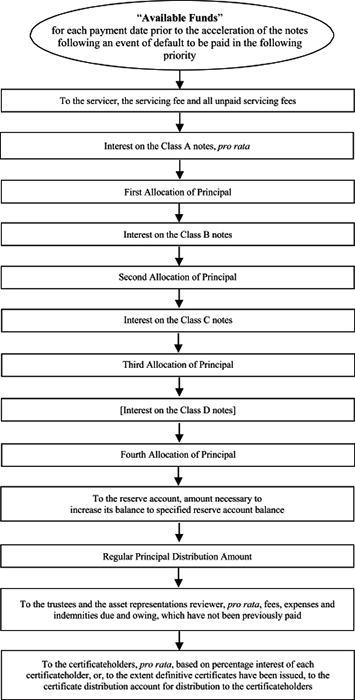

Flow of Funds

xii

Table of Contents

This summary provides an overview of selected information from this prospectus and does not contain all of the information that you need to consider in making your investment decision. This summary provides an overview of certain information to aid your understanding. You should carefully read this entire prospectus to understand all of the terms of this offering.

Issuing Entity

Capital One Prime Auto Receivables Trust 20[ ]—[ ], a Delaware statutory trust, will be the “issuing entity” of the notes and the certificates. The primary assets of the issuing entity will be a pool of receivables, which are motor vehicle retail installment sale contracts that are secured by new and used automobiles, light-duty trucks, SUVs and vans.

Depositor

Capital One Auto Receivables, LLC, a Delaware limited liability company and a wholly-owned special purpose subsidiary of Capital One, National Association, is the “depositor.” The depositor will sell the receivables to the issuing entity. The depositor will be the initial holder of the issuing entity’s certificates[, although the depositor intends to sell [a portion of][the majority of] the certificates on or after the closing date.] The certificates are not being offered by this prospectus.

You may contact the depositor by mail at [1600 Capital One Drive, Room 27907B, McLean, Virginia 22102].

Sponsor

Capital One, National Association, a national banking association, known as “CONA” will be the “sponsor” of the transaction described in this prospectus.

Servicer

CONA, operating through its Capital One Auto Finance division and in its capacity as the “servicer,” will service the receivables held by the issuing entity.

| * | NOTE: Disclose transactions that are not arm’s length or transactions that are outside the ordinary course between sponsor, depositor or issuing entity and any other transaction party. |

The servicer will be entitled to receive a servicing fee for each collection period. The “servicing fee” for any payment date will be an amount equal to the product of (1) [ ]%; (2) one-twelfth [(or, in the case of the first payment date, [a fraction equal to the number of days from but not including the initial cut-off date to and including the last day of the first collection period over 360][one-sixth])], and (3) the net pool balance of the receivables as of the first day of the related collection period (or, for the first payment date, as of the cut-off date). As additional compensation, the servicer will be entitled to retain all supplemental servicing fees [and reimbursements and investment earnings (net of investment losses and expenses) from amounts on deposit in the collection account [and the reserve account]]. The servicing fee, together with any portion of the servicing fee that remains unpaid from prior payment dates, will be payable on each payment date from funds on deposit in the collection account with respect to the collection period preceding such payment date, including funds, if any, deposited into the collection account from the reserve account.

Originator

CONA, operating through its Capital One Auto Finance division, acquired the receivables from motor vehicle dealers. We refer to CONA as the “originator.” [Each of the receivables to be transferred to the issuing entity during the funding period will have been acquired by CONA from a motor vehicle dealer.]

CONA will sell all of the receivables to be included in the receivables pool to the depositor and the depositor will sell those receivables to the issuing entity.

Administrator

CONA will be the “administrator” of the issuing entity, and in such capacity will provide administrative and ministerial services for the issuing entity.

1

Table of Contents

Trustees

[ ], a [ ], will be the “indenture trustee.”

[ ], a [ ], will be the “owner trustee.”

Asset Representations Reviewer

[ ], a [ ], will be the “asset representations reviewer.”

[Swap Counterparty]

[[ ], a [ ], will be the “swap counterparty”] [insert disclosure required by Item 1115 of Regulation AB].

[Cap Provider]

[[ ], a [ ], will be the “cap provider.”] [insert disclosure required by Item 1115 of Regulation AB.]

The issuing entity will offer the following notes:

| Class |

Offered Amount(1) |

Interest Rate(2) |

Final Scheduled Payment Date | |||||

| Class A-1 Notes |

$[•] | [•]% | [•] | |||||

| Class A-2[-A] Notes |

} | [•]% | ||||||

| [Class A-2-B Notes] |

$[•] | [Benchmark] + [•]%(2) | [•] | |||||

| Class A-3 Notes(3) |

} | $[•] | [•]% | [•] | ||||

| Class A-4 Notes(3) |

$[•] | [•]% | [•] |

(1) [Not less than 5% of each class of notes will be retained by CONA or one or more majority-owned affiliates of CONA (which for EU risk retention purposes and UK risk retention purposes will be a wholly-owned special purpose subsidiary of CONA) to satisfy the credit risk retention obligations of CONA described under “The Sponsor—U.S. Credit Risk Retention” and “ —Securitization Regulations” in this prospectus. $[•] of the Class A-1 notes, $[•] of the Class A-2 notes and the Class A-3 notes in the aggregate, and $[•] of the Class A-4 notes are not being offered hereunder.]

(2) [The interest rate for each class of notes will be a fixed rate, a floating rate or a combination of a fixed rate and a floating rate if that class has both a fixed rate tranche and a floating rate tranche. The Class A-2-B notes will accrue interest at a floating rate based on a benchmark, which initially will be [insert applicable floating rate benchmark]. For more information on how the benchmark is determined, you should read “The Notes—Payments of Interest” in this prospectus.] [NOTE: If floating rate notes are offered, the applicable prospectus will disclose the terms of the specific index, which will be an index other than LIBOR, that will be used to determine interest payments for such floating rate tranches.]] (3) [The initial note balance of the Class A-3 notes and the Class A-4 notes may change, but will be determined on or prior to the day of pricing of those classes of notes. The initial note balance of the issued Class A-3 notes is expected to be within the range of $[ ]—$[ ], and the initial note balance of the issued Class A-4 notes is expected to be within the range of $[ ]—$[ ]. The offered amount of each of the Class A-3 notes and the

Class A-4 notes will be 95% of the related initial note balance of such class. See “Risk Factors—Risks related to the issuance of multiple classes of notes, an unknown allocation of notes or retention of notes— There are risks associated with the unknown initial note balance of the Class A-3 notes and the Class A-4 notes”.]

[The Class A-2-A notes and the Class A-2-B notes are sometimes together referred to as the “Class A-2 notes.” The Class A-2-A notes rank pari passu with the Class A-2-B notes.]

[The allocation of the principal balance between the Class A-2-A notes and Class A-2-B notes will be determined no later than the day of pricing and may result in any number of possible allocation scenarios, including a scenario in which the entire principal balance of the Class A-2 notes is allocated to the floating rate Class A-2-B notes and none of the principal balance is allocated to the fixed rate Class A-2-A notes.]

[The interest rate for each class of notes will be a fixed rate or a combination of a fixed and floating rate if that class has both a fixed rate tranche and a floating rate tranche. For example, the Class [A-2] notes are divided into fixed and floating rate tranches, and the Class [A-2-A] notes are the fixed rate notes and the Class [A-2-B] notes are the floating rate notes. We refer in this prospectus to notes that bear interest at a floating rate as “floating rate notes,” and to notes that bear interest at a fixed rate as “fixed rate notes.”

For a description of how interest will be calculated on the floating rate notes, see “The Notes—Payments of Interest” in this prospectus.]

[The issuing entity will also issue $[•] of Class B [•]% asset-backed notes, $[•] of Class C [•]% asset-backed notes and $[•] of Class D [•]% asset-backed notes, which are not being offered by this prospectus. The final scheduled payment date for the Class B notes is [ ]. The final scheduled payment date for the Class C notes is [ ]. The final scheduled payment date for the Class D notes is [ ]. The Class B notes, Class C notes and the Class D notes [are not being publicly registered and will be retained by the sponsor or another majority-owned affiliate of the sponsor]. Information about the Class B notes, Class C notes and the Class D notes is set forth herein solely to provide a better understanding of the Class A notes.]

We refer to the Class A-1 notes, the Class A-2 notes, the Class A-3 notes and the Class A-4 notes as the “Class A notes.” We refer to the Class A notes, the Class B notes, the Class C notes [and the Class D notes,] collectively as the “notes.” The Class A notes, which we refer to as the “offered notes,” are the only securities that are being offered by this prospectus.

2

Table of Contents

The notes are issuable in a minimum denomination of $[1,000] and integral multiples of $[1,000] in excess thereof.

So long as the Class A notes are outstanding, the Class A notes will be the “controlling class.” After the Class A notes have been paid in full, the Class B notes will be the controlling class, after the Class B notes have been paid in full, the Class C notes will be the controlling class [and after the Class C notes have been paid in full, the Class D notes will be the controlling class].

The issuing entity expects to issue the notes on or about [ ], which we refer to as the “closing date.”

On the closing date, the issuing entity will issue subordinated and non-interest bearing “certificates” in a nominal aggregate principal amount of $[100,000], which represent the equity interest in the issuing entity and are not offered hereby. The “certificateholders” will be entitled on each payment date only to amounts remaining after payments on the notes and payments of issuing entity expenses and other required amounts on such payment date. The certificates will initially be held by the depositor, but the depositor may transfer all or a portion of the certificates to one of its affiliates [or sell [all or] a portion of the certificates][or sell the portion of the certificates not required to be retained] on or after the closing date. [The depositor intends to sell [a portion of] [the majority of] the certificates on or after the closing date.] [However, the portion of the certificates retained by the depositor to satisfy U.S. credit risk retention rules and for purposes of the SR Rules will not be sold, transferred or hedged except as permitted under, or in accordance with, those rules. See “The Sponsor—U.S. Credit Risk Retention,” “ —Securitization Regulations” and “Legal Investments—Regulations for Certain EU and UK Regulated Persons and Affiliates.”]

To the extent of funds available therefor and prior to an acceleration of the notes following an event of default, after payment of certain amounts to the servicer, the issuing entity will pay interest and principal on the notes monthly, on the [__] day of each month (or, if the [ ] day is not a business day, on the next business day), which we refer to as the “payment date.” The first payment date is [ ][ ], 20[ ]. On each payment date, payments on the

notes will be made to holders of record as of the close of business on the business day immediately preceding that payment date (except in limited circumstances where definitive notes are issued), which we refer to as the “record date.”

Interest Payments

The issuing entity will pay interest on the Class [A-1] notes [and the Class [A-2-B] notes] on the basis of the actual number of days elapsed during the period for which interest is payable and a 360-day year. This means that the interest due on each payment date for the Class [A-1] notes [and the Class A-2-B notes, as applicable] will be the product of (i) the outstanding note balance of the related class of notes, (ii) the applicable interest rate and (iii) the actual number of days from and including the previous payment date (or, in the case of the first payment date, from and including the closing date) to but excluding the current payment date divided by 360.

The issuing entity will pay interest on the Class [A-2-A] notes, the Class [A-3] notes, the Class [A-4] notes, the Class [B] notes, the Class [C] notes [and the Class D notes] on the basis of a 360-day year consisting of twelve 30-day months. This means that the interest due on each payment date for the Class [A-2-A] notes, the Class [A-3] notes, the Class [A-4] notes, the Class [B] notes, the Class [C] notes [and the Class D notes] will be the product of (i) the outstanding note balance of the related class of notes, (ii) the applicable interest rate and (iii) 30 [(or, in the case of the first payment date, the number of days from and including the closing date to but excluding [ ][ ], 20[ ] (assuming a 30-day calendar month))], divided by 360. Interest payments on all Class A notes will have the same priority. Interest payments on the Class B notes will be subordinated to interest payments and, in specified circumstances, principal payments on the Class A notes. Interest payments on the Class C notes will be subordinated to interest payments and, in specified circumstances, principal payments on the Class A notes and the Class B notes. [Interest payments on the Class D notes will be subordinated to interest payments and, in specified circumstances, principal payments on the Class A notes, the Class B notes and the Class C notes.]

A failure to pay the interest due on the notes of the controlling class on any payment date that continues for a period of five (5) business days or more will result in an event of default under the indenture.

3

Table of Contents

Principal Payments

[The issuing entity will not pay principal on the notes on any payment date during the revolving period.]

The issuing entity will generally pay principal sequentially to the earliest maturing class of notes monthly on each payment date [related to the amortization period] in accordance with the payment priorities described below under “ —Priority of Payments.”

The issuing entity will make principal payments of the notes based on the amount of collections and defaults on the receivables during the prior collection period. This prospectus describes how available funds and amounts on deposit in the reserve account are allocated to principal payments of the notes.

On each payment date, prior to the acceleration of the notes following an event of default, which is described below under “ —Interest and Principal Payments after an Event of Default,” the issuing entity will distribute funds available to pay principal of the notes in the following order of priority:

| • | first, to the Class A-1 noteholders, until the Class A-1 notes are paid in full; |

| • | second, to the Class A-2[-A] noteholders and [Class A-2-B noteholders, ratably,] until the Class A-2[-A] notes [and the Class A-2-B notes] are paid in full; |

| • | third, to the Class A-3 noteholders, until the Class A-3 notes are paid in full; |

| • | fourth, to the Class A-4 noteholders, until the Class A-4 notes are paid in full; |

| • | fifth, to the Class B noteholders, until the Class B notes are paid in full; [and] |

| • | sixth, to the Class C noteholders, until the Class C notes are paid in full; [and] |

| • | [seventh, to the Class D noteholders, until the Class [D] notes are paid in full]. |

[In addition, the issuing entity may make principal payments on the notes from funds on deposit in the pre-funding account, as described below under “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset

Representations Review Agreement – Acquisition of Subsequent Receivables During Funding Period.”]

All unpaid principal of a class of notes will be due on the final scheduled payment date for that class.

Interest and Principal Payments after an Event of Default

If an event of default under the indenture were to occur and the maturity of the notes were to be accelerated, the priority of payments of principal and interest will change from the description in “ —Interest Payments” above, “ —Principal Payments” above and “ —Priority of Payments” below. The priority of payments of principal and interest after an event of default under the indenture and acceleration of the notes will depend on the nature of the event of default.

On each payment date after an event of default under the indenture occurs as a result of a payment default or a bankruptcy event relating to the issuing entity and the notes are accelerated, after payment of certain amounts to the trustees, the asset representations reviewer and the servicer [and the swap counterparty], interest on the Class A notes will be paid ratably to each class of Class A notes and then principal payments will be made first to Class A-1 noteholders until the Class A-1 notes are paid in full. Next, the noteholders of [each class of] the Class A-2 notes, the Class A-3 notes and the Class A-4 notes will receive principal payments, ratably, based on the outstanding note balance of each remaining class of Class A notes until each such class of notes is paid in full. After interest on and principal of all of the Class A notes are paid in full, interest and principal payments will be made to noteholders of the Class B notes. After interest on and principal of all of the Class B notes are paid in full, interest and principal payments will be made to noteholders of the Class C notes. [After interest on and principal of all of the Class C notes are paid in full, interest and principal payments will be made to noteholders of the Class D notes.]

On each payment date after an event of default under the indenture occurs as a result of the issuing entity’s breach of a covenant (other than a payment default), representation or warranty and the maturity of the notes is accelerated, after payment of certain amounts to the trustees, the asset representations reviewer and the servicer [and the swap counterparty], interest on the Class A notes will be paid ratably to each class of Class A notes followed by interest on the Class B notes, then followed by interest on the Class C notes

4

Table of Contents

[and then followed by interest on the Class D notes]. After the payments described in the previous sentence, principal payments of each class of notes will then be made first to the Class A-1 noteholders until the Class A-1 notes are paid in full. Next, the noteholders of all other classes of Class A notes will receive principal payments, ratably, based on the outstanding note balance of each remaining class of Class A notes until those other classes of Class A notes are paid in full. Next, the Class B noteholders will receive principal payments until the Class B notes are paid in full. Next, the Class C noteholders will receive principal payments until the Class C notes are paid in full. [Finally, the Class D noteholders will receive principal payments until the Class D notes are paid in full.]

See “The Indenture —Rights Upon Event of Default” in this prospectus.

If an event of default has occurred but the notes have not been accelerated, then interest and principal payments will be made in the priority set forth below under “ —Priority of Payments.”

Optional Redemption of the Notes

The servicer will have the right at its option to exercise a “clean-up call” to purchase (and/or designate one or more persons to purchase) the receivables and the other issuing entity property (other than the reserve account) from the issuing entity on any payment date if both of the following conditions are satisfied: (a) as of the last day of the related collection period, the net pool balance has declined to [10]% or less of the net pool balance as of the [initial] cut-off date [plus the principal balance of the subsequent receivables as of the related cut-off date] and (b) the purchase price (as defined below) and the available funds for such payment date would be sufficient to pay (i) the amounts required to be paid under clauses [first through twelfth] in accordance with “—Priority of Payments” below (assuming that such payment date is not a redemption date) and (ii) the aggregate unpaid note balance of all of the outstanding notes (after giving effect to the payments described in the preceding clause (i)). We use the term “net pool balance” to mean, as of any date, the aggregate outstanding principal balance of all receivables (other than defaulted receivables) owned by the issuing entity on that date. If the servicer (or its designee) purchases the receivables and other issuing entity property (other than the reserve account), the

“purchase price” will equal the net pool balance plus accrued and unpaid interest on the receivables as of the last day of the collection period immediately preceding the redemption date, which amount (net of any collections deposited into the collection account after the last day of the collection period immediately preceding the redemption date) will be deposited by the servicer (or its designee) into the collection account on or prior to noon, New York City time, on the redemption date.

It is expected that at the time this option becomes available to the servicer, only the [Class C notes][and Class D notes] will be outstanding.

Additionally, each of the notes is subject to redemption in whole, but not in part, on any payment date on which the sum of the amounts on deposit in the reserve account and remaining available funds after the payments under clauses [first through twelfth] set forth in “—Priority of Payments” below would be sufficient to pay in full the aggregate unpaid note balance of all of the outstanding notes as determined by the servicer. On such payment date, the outstanding notes shall be redeemed in whole, but not in part.

Notice of redemption under the indenture must be given by the indenture trustee prior to the applicable redemption date to each holder of notes as of the close of business on the record date preceding the applicable redemption date. All notices of redemption will state: (i) the redemption date; (ii) the redemption price; (iii) that the record date otherwise applicable to that redemption date is not applicable and that payments will be made only upon presentation and surrender of those notes, and the place where those notes are to be surrendered for payment of the redemption price; (iv) that interest on the notes will cease to accrue on the redemption date; and (v) the CUSIP numbers (if applicable) for the notes. Notice of redemption of the notes shall be given by the indenture trustee in the name and at the expense of the issuing entity.

The occurrence of any one of the following events will be an “event of default” under the indenture:

| • | a default in the payment of any interest on any note of the controlling class when the same becomes due and payable, and such default continues for a period of five (5) business days or more; |

5

Table of Contents

| • | default in the payment of the principal of any note at the related final scheduled payment date or the redemption date; |

| • | any failure by the issuing entity to duly observe or perform in any material respect any of its covenants or agreements in the indenture (other than (i) a covenant or agreement, a default in the observance or performance of which is elsewhere specifically addressed or (ii) a covenant or agreement pursuant to the FDIC Rule Covenant (as defined below under “The Indenture—FDIC Rule Covenant”)), which failure materially and adversely affects the interests of the noteholders, and which continues unremedied for ninety (90) days after receipt by the issuing entity of written notice thereof from the indenture trustee or noteholders evidencing at least a majority of the outstanding principal amount of the notes of the controlling class; |

| • | any representation or warranty of the issuing entity made in the indenture proves to be incorrect in any material respect when made, which failure materially and adversely affects the interests of the noteholders, and which failure continues unremedied for ninety (90) days after receipt by the issuing entity of written notice thereof from the indenture trustee or noteholders evidencing at least a majority of the outstanding principal amount of the notes of the controlling class; or |

| • | the occurrence of certain events (which, if involuntary, remain unstayed for more than ninety (90) days) of bankruptcy, insolvency, receivership or liquidation of the issuing entity. |

Notwithstanding the foregoing, a delay in or failure of performance referred to under the first four bullet points above for a period of one-hundred twenty (120) days will not constitute an event of default if that delay or failure was caused by force majeure or other similar occurrence.

The amount of principal required to be paid to noteholders under the indenture generally will be limited to amounts available to make such payments in accordance with the priority of payments. Thus, the failure to pay principal on a class of notes due to a lack of amounts available to make such payments

will not result in the occurrence of an event of default until the final scheduled payment date or redemption date for that class of notes.

The primary assets of the issuing entity will be a pool of motor vehicle retail installment sale contracts secured by new and used automobiles, light-duty trucks, SUVs and vans. We refer to these contracts as “receivables,” to the pool of those receivables as the “receivables pool” and to the persons who financed their purchases with these contracts as “obligors.”

The receivables identified on the schedule of receivables delivered by CONA on the closing date [and on any funding date] will be transferred by CONA to the depositor and then transferred by the depositor to the issuing entity. The issuing entity will grant a security interest in the receivables and the other issuing entity property to the indenture trustee on behalf of the noteholders [and the swap counterparty].

The “issuing entity property” will include the following:

| • | the receivables, including collections on the receivables after [the applicable cut-off date (which, for the receivables sold to the issuing entity on the closing date is] [ ], 20[ ] which we refer to as the “[initial] cut-off date,” [and for the receivables sold to the issuing entity on a funding date, is the date specified in the notice relating to that funding date, which we refer to as the “subsequent cut-off date”)]; |

| • | security interests in the vehicles financed by the receivables, which we refer to as the “financed vehicles”; |

| • | all receivable files relating to the original motor vehicle retail installment sale contracts evidencing the receivables; |

| • | [rights under the interest rate swap agreement and payments made by the swap counterparty under the interest rate swap agreement;] |

| • | [rights under the interest rate cap agreement and payments made by the cap provider under the interest rate cap agreement;] |

6

Table of Contents

| • | rights to proceeds under insurance policies that cover the obligors under the receivables or the financed vehicles and refunds in connection with extended service agreements relating to receivables which became defaulted receivables after the applicable cut-off date; |

| • | any other property securing the receivables; |

| • | rights to amounts on deposit in the collection account, the principal distribution account, the reserve account and any other accounts owned by the issuing entity (other than the certificate distribution account), and permitted investments of those accounts; |

| • | rights under the administration agreement, the sale agreement, the servicing agreement and the purchase agreement; and |

| • | the proceeds of any and all of the above. |

Receivable Representations and Warranties

CONA will make certain representations and warranties regarding the characteristics of the receivables as of the [applicable] cut-off date. Breach of these representations may, subject to certain conditions, result in CONA being obligated to repurchase the related receivable. See “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Representations and Warranties.” This repurchase obligation will constitute the sole remedy available to the noteholders or the issuing entity for any uncured breach by CONA of those representations and warranties.

If an investor in the notes requests that CONA repurchase any receivable due to a breach of a representation or warranty as described above, and the repurchase request has not been fulfilled or otherwise resolved to the reasonable satisfaction of the requesting party within one-hundred eighty (180) days of the receipt of notice of the request by CONA, the requesting party will have the right to refer the matter, at its discretion, to either mediation (including nonbinding arbitration) or third-party arbitration. The terms of the mediation or arbitration, as applicable, are described under “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Dispute Resolution” in this prospectus.

Review of Asset Representations

As more fully described in “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Asset Representations Review” in this prospectus, if the aggregate amount of delinquent receivables exceeds a specified threshold, then investors holding at least 5% of the aggregate outstanding principal amount of the notes may elect to initiate a vote to determine whether the asset representations reviewer will conduct a review. If investors representing at least a majority of the voting investors vote in favor of directing a review, then the asset representations reviewer will perform a review of specified delinquent receivables for compliance with the representations and warranties made by CONA. See “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Asset Representations Review” in this prospectus.

The statistical information in this prospectus is based on the pool of receivables as of the [statistical] cut-off date. [The receivables sold to the issuing entity on the closing date will be the same receivables included in the pool described in this prospectus as of the statistical cut-off date except for those receivables [(i) that no longer satisfy the eligibility criteria specified in the transaction documents or (ii) for which payment in full has been received in the ordinary course, in each case, as of the cut-off date.] [The characteristics of the subsequent receivables sold to the issuing entity on each funding date may vary somewhat from the characteristics of the receivables as of the initial cut-off date.]

As of the close of business on the [statistical] cut-off date, the receivables in the pool had an aggregate initial principal balance of $[ ] and had:

| • | an average original principal balance of $[ ]; |

| • | a weighted average contract rate of approximately [ ]%;(1) |

| • | a weighted average original term of approximately [ ] months; (1) |

7

Table of Contents

| • | a weighted average remaining term of approximately [ ] months; (1) |

| • | a minimum FICO® score at origination of [ ]; |

| • | a maximum FICO® score at origination of [ ]; and |

| • | a weighted average FICO® score at origination of approximately [ ]; (1) and |

| • | a weighted average loan-to-value ratio at origination of approximately [ ]%.(1) |

For more information about the characteristics of the receivables in the pool, see “The Receivables Pool” in this prospectus. In connection with the offering of the notes, the depositor has performed a review of the receivables in the pool [as of the initial cut-off date] and certain disclosure in this prospectus relating to the receivables, as described under “The Receivables Pool—Review of the Receivables Pool” in this prospectus.

As described under “The Originator—Underwriting” in this prospectus, in limited circumstances, some contracts may be approved by CONA under an exception to CONA’s underwriting criteria based on a judgmental evaluation. The originator’s credit risk management monitors exceptions to the underwriting criteria continuously using an automated tracking tool.

[Insert data regarding the number of pool assets that would be exceptions to the underwriting criteria and a description of the nature of the exceptions.] [None of the receivables were approved as an exception to CONA’s underwriting criteria.]

In addition to the purchase of receivables from the issuing entity in connection with the servicer’s exercise of its “clean-up call” option as described above under “Interest and Principal—Optional Redemption of the Notes,” receivables may be purchased from the issuing entity by the sponsor, in connection with the breach of certain representations and warranties concerning the characteristics of the receivables, and by the servicer, in connection with certain specified modifications to the receivables or the breach of certain servicing covenants, as described under “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Representations and Warranties” in this prospectus.

| (1) | Weighted by outstanding principal balance as of the [statistical] cut-off date. |

[On the closing date, $[ ] of the proceeds from the sale of the notes by the issuing entity will be deposited in an account, which we refer to as the “pre-funding account.” The amount deposited in the pre-funding account on the closing date represents [ ]% of the initial pool balance (including the expected principal balance of the subsequent receivables). During the funding period (defined below), the issuing entity will use the amounts on deposit in the pre-funding account to acquire additional receivables from the depositor, which we refer to as “subsequent receivables,” for an amount equal to [ ]% of the aggregate principal balance of the subsequent receivables as of the applicable subsequent cut-off date. The issuing entity may acquire subsequent receivables on any business day during the funding period (but no more than once a week) each of which we refer to as a “funding date.” Subsequent receivables must meet certain eligibility criteria as described in “The Receivables Pool—Criteria Applicable to Selection of Receivables” in this prospectus. Assuming that substantially all of the pre-funded amount is used for the purchase of subsequent receivables, the aggregate principal balance of the subsequent receivables as of their respective subsequent cut-off dates will equal approximately [__]% of the aggregate principal balance of all receivables as of their respective cut-off dates.

The “funding period” will begin on the closing date and will end on the earliest to occur of:

| • | [ ], 20[ ]; |

| • | the date on which the amount in the pre-funding account is $[ ] or less; or |

| • | the occurrence of an event of default under the indenture. |

On the first payment date following the termination of the funding period, the indenture trustee will withdraw any funds remaining on deposit in the pre-funding account (excluding investment earnings) and distribute those funds to the noteholders as payment of principal. Such payments will be made either on a sequential or a pro rata basis as described under “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Acquisition of Subsequent Receivables During Funding Period.”]

8

Table of Contents

[The issuing entity will not make payments of principal on the notes on payment dates occurring during the revolving period.

The “revolving period” consists of the collection periods from the closing date through [ ], and the related payment dates. We refer to the collection periods and the related payment dates following the revolving period as the “amortization period.”

If an early amortization event occurs, the revolving period will terminate early, and the amortization period will begin. See “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Revolving Period” in this prospectus.

On each payment date related to the revolving period, amounts otherwise available to make principal payments on the notes will be applied to purchase additional receivables from the depositor for the purpose of maintaining the initial aggregate principal balance of the receivables. Such additional receivables must meet certain eligibility criteria as described in “The Receivables Pool—Criteria Applicable to Selection of Receivables” in this prospectus.

The amount of additional receivables and percentage of asset pool will be determined by the amount of cash available from payments and prepayments on existing receivables. There are no stated limits on the amount of additional receivables allowed to be purchased during the revolving period in terms of either dollars or percentage of the initial aggregate principal balance of the receivables. [Insert the maximum amount of additional assets that may be acquired during the revolving period and the percentage of the asset pool that may be acquired during the revolving period, to the extent applicable, in accordance with Item 1103(a)(5) of Regulation AB.] See “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Revolving Period” in this prospectus.

To the extent that amounts allocated for the purchase of additional receivables are not so used on any payment date occurring during the revolving period, they will be deposited into the accumulation account and applied on subsequent payment dates occurring during the revolving period to purchase additional receivables from the depositor.]

[Revolving Period

During the revolving period, the issuing entity will distribute available funds in the following order of priority:

| • | first, to the servicer, the servicing fee (including servicing fees not previously paid); |

| • | second, to the indenture trustee, the owner trustee and the asset representations reviewer, the amount of any fees, expenses and indemnification amounts due to each such party, pro rata, based on amounts due to each such party, in an aggregate amount not to exceed $[ ] in any calendar year; |

| • | [third, to the swap counterparty, the net swap payment;] |

| • | [fourth,] pro rata, (1) to the Class A noteholders, interest on the Class A notes and [(2) to the swap counterparty any senior swap termination payments payable to the swap counterparty]; |

| • | [fifth], to the Class B noteholders, interest on the Class B notes; |

| • | [sixth], to the Class C noteholders, interest on the Class C notes; |

| • | [seventh], to the Class D noteholders, interest on the Class D notes;] |

| • | [eighth] reinvestments in additional receivables and deposits into the accumulation account, as applicable, in the amount by which the aggregate principal balance of the notes exceeds the aggregate receivables principal balance, |

| • | [ninth], to the indenture trustee, the owner trustee [and the asset representations reviewer], fees, reasonable expenses and indemnification amounts not previously paid by the servicer; |

| • | [tenth] to the reserve account, an amount required to cause the amount of cash on deposit in the reserve account to equal the specified reserve account balance; |

| • | [eleventh] reinvestments in additional receivables and deposits into the accumulation account, as applicable, in the amount by which |

9

Table of Contents

| the aggregate principal balance of the notes plus the overcollateralization target amount exceeds the aggregate receivables principal balance, as increased above, plus the amounts deposited in the accumulation account above; |

| • | [twelfth], to the swap counterparty, any subordinate swap termination payment]; and |

| • | [thirteenth], any remaining funds will be distributed to the certificate distribution account for distribution to the certificateholders. |

[Amortization Period]

[During the amortization period] On each payment date, except after the acceleration of the notes following an event of default, the paying agent will make the following payments and deposits from available funds in the collection account (including funds, if any, deposited into the collection account from the reserve account [and amounts, if any, paid by the swap counterparty] to the extent described in “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Reserve Account” in this prospectus) in the following amounts and order of priority:

| • | first, to the servicer, the servicing fee (including servicing fees not previously paid); |

| • | [second, to the swap counterparty, the net swap payment;] |

| • | [third,] pro rata, (1) to the Class A noteholders, accrued interest on the Class A notes; provided, that if there are not sufficient funds available to pay the entire amount of the accrued Class A note interest, the amount available will be applied to the payment of interest on the Class A notes on a pro rata basis based on the amount of interest payable to each class of Class A notes and [(2) to the swap counterparty any senior swap termination payments payable to the swap counterparty;]; |

| • | [fourth], to the principal distribution account for distribution to the noteholders, the First Allocation of Principal; |

| • | [fifth], to the Class B noteholders, interest on the Class B notes; |

| • | [sixth], to the principal distribution account for distribution to the noteholders, the Second Allocation of Principal; |

| • | [seventh], to the Class C noteholders, interest on the Class C notes; |

| • | [eighth], to the principal distribution account for distribution to the noteholders, the Third Allocation of Principal; |

| • | [[ninth], to the Class D noteholders, interest on the Class D notes;] |

| • | [[tenth], to the principal distribution account for distribution to the noteholders, the Fourth Allocation of Principal;] |

| • | [eleventh], to the reserve account, any additional amounts required to cause the amount of cash on deposit in the reserve account to equal the specified reserve account balance; |

| • | [twelfth], to the principal distribution account for distribution to the noteholders, the Regular Principal Distribution Amount; |

| • | [thirteenth], to the indenture trustee, the owner trustee [and the asset representations reviewer], pro rata, fees, expenses and indemnification amounts due and owing which have not been previously paid; and |

| • | [fourteenth, to the swap counterparty, any subordinate swap termination payment]; and |

| • | [fifteenth], any funds remaining, to the certificateholders, pro rata based on the percentage interest of each certificateholder, or, to the extent definitive certificates have been issued, to the certificate distribution account for distribution to the certificateholders. |

Amounts deposited in the principal distribution account will be paid to the noteholders of the notes as described under “The Notes—Payment of Principal.”

Credit enhancement provides protection for the notes against losses and delays in payment on the receivables or other shortfalls of cash flow. The credit enhancement for the notes will be the reserve

10

Table of Contents

account, [overcollateralization [(in addition to the yield supplement overcollateralization amount) and the yield supplement overcollateralization amount]] the excess interest on the receivables and, in the case of the Class A notes, the Class B notes and the Class C notes, subordination of certain payments as described below. If the credit enhancement is not sufficient to cover all amounts payable on the notes, notes having a later final scheduled payment date generally will bear a greater risk of loss than notes having an earlier final scheduled payment date. See also “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Overcollateralization” and “ —Excess Interest” in this prospectus.

The credit enhancement for the notes will be as follows:

| Class A notes: | Subordination of payments on the Class B notes, the Class C notes [and the Class D notes], overcollateralization, the reserve account and excess interest on the receivables. | |

| Class B notes: | Subordination of payments on the Class C notes [and the Class D notes], overcollateralization, the reserve account and excess interest on the receivables. | |

| Class C notes: | [Subordination of payments on the Class D notes,] overcollateralization, the reserve account and excess interest on the receivables. | |

| [Class D notes:] | [Overcollateralization, the reserve account and excess interest on the receivables.] | |

Subordination of Payments on the Class B Notes

As long as the Class A notes remain outstanding, payments of interest on any payment date on the Class B notes will be subordinated to payments of interest on the Class A notes and certain other payments on that payment date (including principal payments of the Class A notes in specified circumstances), and payments of principal of the Class B notes will be subordinated to all payments of principal of and interest on the Class A notes and certain other payments on that payment date. If the notes have been accelerated after an event of default under the indenture, the priority of payments will change. For a description of these changes in priority, see “ —Interest and Principal— Interest and Principal Payments after an Event of Default” above and “The Indenture—Priority of Payments Will Change Upon Events of Default That Result in Acceleration.”

Subordination of Payments on the Class C Notes

As long as the Class A notes and the Class B notes remain outstanding, payments of interest on any payment date on the Class C notes will be subordinated to payments of interest on the Class A notes and the Class B notes and certain other payments on that payment date (including principal payments of the Class A notes and the Class B notes in specified circumstances), and payments of principal of the Class C notes will be subordinated to all payments of principal of and interest on the Class A notes and the Class B notes and certain other payments on that payment date. If the notes have been accelerated after an event of default under the indenture, the priority of payments will change. For a description of these changes in priority, see “ —Interest and Principal—Interest and Principal Payments after an Event of Default” above and “The Indenture—Priority of Payments Will Change Upon Events of Default That Result in Acceleration.”

[Subordination of Payments on the Class D Notes]

[As long as the Class A notes, the Class B notes and the Class C notes remain outstanding, payments of interest on any payment date on the Class D notes will be subordinated to payments of interest on the Class A notes, the Class B notes and the Class C notes and certain other payments on that payment date (including principal payments of the Class A notes, the Class B notes and the Class C notes in specified circumstances), and payments of principal of the Class D notes will be subordinated to all payments of principal of and interest on the Class A notes, the Class B notes and the Class C notes and certain other payments on that payment date. If the notes have been accelerated after an event of default under the indenture, the priority of payments will change. For a description of these changes in priority, see “ —Interest and Principal— Interest and Principal Payments after an Event of Default” above and “The Indenture—Priority of Payments Will Change Upon Events of Default That Result in Acceleration.”]

Overcollateralization

Overcollateralization is the amount by which the net pool balance [(plus, during the funding period, the amount on deposit in the pre-funding account)] exceeds the outstanding note balance of the notes.

11

Table of Contents

The initial overcollateralization level on the closing date will be approximately [ ]% of the net pool balance as of the [initial] cut-off date and is expected to build to a target overcollateralization level on each payment date equal to the greater of (a) [ ]% of the net pool balance as of the last day of the related collection period and (b) [ ]% of the [sum of (i) the] pool balance as of the [initial cut-off date plus (ii) the aggregate principal balance of all subsequent receivables as of the applicable subsequent] cut-off date; provided, however, that after the Class [ ] notes have been paid in full, the target overcollateralization level will decrease to a target overcollateralization level on each payment date equal to the greater of (a) [ ]% of the pool balance as of the last day of the related collection period and (b) [ ]% of the [sum of (i) the] pool balance as of the [initial cut-off date plus (ii) the aggregate principal balance of all subsequent receivables as of the applicable subsequent] cut-off date. See “The Transfer Agreements, the Servicing Agreement, the Administration Agreement and the Asset Representations Review Agreement —Overcollateralization” in this prospectus.

Reserve Account

On the closing date, the reserve account will initially be funded by a deposit of proceeds from the sale of the notes in an amount not less than [ ]% of the initial [adjusted] net pool balance as of the cut-off date) [, plus an amount expected to cover the negative carry with respect to the accrued interest on that portion of the note balance equal to amounts on deposit in the pre-funding account and earnings on funds, if any, on deposit in the pre-funding account]. [(We use the term “adjusted pool balance” to mean, as of any date, the net pool balance at that time, minus the yield supplement overcollateralization amount (as described below) as of that date.)]

On each payment date, after giving effect to any withdrawals from the reserve account, if the amount of cash on deposit in the reserve account is less than the specified reserve account balance, the deficiency will be funded by the deposit of available funds to the reserve account in accordance with the priority of payments described above. The “specified reserve account balance” will be, on any payment date while the notes are outstanding, [ ]% of the net pool balance as of the cut-off date. [The specified reserve account balance will be determined after the pricing of the notes but before the closing date and will be an amount not less than [ ]% of the Pool Balance as of the cut-off date.]

On each payment date, the indenture trustee will withdraw funds from the reserve account to cover any shortfall in the amounts required to be paid on that payment date with respect to clauses first through [eleventh] under “Priority of Payments” above.