Exhibit 99.2

Chunghwa Telecom Co., Ltd. and Subsidiaries

Consolidated Financial Statements for the

Six Months Ended June 30, 2014 and 2013 and

Independent Auditors’ Review Report

- 1 -

INDEPENDENT AUDITORS’ REVIEW REPORT

The Board of Directors and Stockholders

Chunghwa Telecom Co., Ltd.

We have reviewed the accompanying consolidated balance sheets of Chunghwa Telecom Co., Ltd. and subsidiaries (“the Company”) as of June 30, 2014, and 2013, the related consolidated statements of comprehensive income for the three months ended June 30, 2014 and 2013 and for the six months ended June 30, 2014 and 2013, as well as the consolidated statements of changes in equity and cash flows for the six months ended June 30, 2014 and 2013. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to issue a report on these consolidated financial statements based on our review.

We conducted our reviews in accordance with the Statement of Auditing Standards No. 36, “Review of Financial Statements”, issued by the Auditing Committee of the Accounting Research and Development Foundation of the Republic of China. A review consists principally of applying analytical procedures to financial data and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with auditing standards generally accepted in the Republic of China, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an audit opinion.

Based on our reviews, we are not aware of any material modifications that should be made to the consolidated financial statements referred to above for them to be in conformity with the Guidelines Governing the Preparation of Financial Reports by Securities Issuers and International Accounting Standard 34, “Interim Financial Reporting” endorsed by the Financial Supervisory Commission of the Republic of China.

| /s/ DELOITTE & TOUCHE |

| Deloitte & Touche |

| Taipei, Taiwan |

| The Republic of China |

August 12, 2014

Notice to Readers

The accompanying consolidated financial statements are intended only to present the consolidated financial position, financial performance and cash flows in accordance with accounting principles and practices generally accepted in the Republic of China and not those of any other jurisdictions. The standards, procedures and practices to review such consolidated financial statements are those generally accepted and applied in the Republic of China.

For the convenience of readers, the independent auditors’ review report and the accompanying consolidated financial statements have been translated into English from the original Chinese version prepared and used in the Republic of China. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese-language independent auditors’ review report and consolidated financial statements shall prevail.

- 2 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In Thousands of New Taiwan Dollars)

| June 30, 2014 (Reviewed) | December 31, 2013 (Audited) | June 30, 2013 (Reviewed) | ||||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

| ASSETS |

||||||||||||||||||||||||

| CURRENT ASSETS |

||||||||||||||||||||||||

| Cash and cash equivalents (Note 6) |

$ | 28,141,343 | 6 | $ | 14,585,105 | 3 | $ | 58,987,872 | 13 | |||||||||||||||

| Financial assets at fair value through profit or loss (Note 7) |

— | — | 337 | — | 944 | — | ||||||||||||||||||

| Available-for-sale financial assets (Note 8) |

— | — | 24,267 | — | 2,667,257 | — | ||||||||||||||||||

| Held-to-maturity financial assets (Note 9) |

4,467,343 | 1 | 4,264,104 | 1 | 4,242,690 | 1 | ||||||||||||||||||

| Hedging derivative assets (Notes 3 and 10) |

24 | — | — | — | 193 | — | ||||||||||||||||||

| Trade notes and accounts receivable, net (Note 11) |

23,610,397 | 5 | 22,900,902 | 5 | 23,655,430 | 5 | ||||||||||||||||||

| Accounts receivable from related parties (Note 38) |

69,680 | — | 69,304 | — | 51,438 | — | ||||||||||||||||||

| Inventories (Notes 12 and 39) |

8,193,599 | 2 | 7,848,087 | 2 | 7,656,753 | 2 | ||||||||||||||||||

| Prepayments (Notes 13 and 38) |

5,594,815 | 2 | 2,224,130 | 1 | 5,395,517 | 1 | ||||||||||||||||||

| Other current monetary assets (Note 14) |

5,183,291 | 1 | 4,636,305 | 1 | 8,974,135 | 2 | ||||||||||||||||||

| Other current assets (Note 20) |

5,266,805 | 1 | 3,960,798 | 1 | 3,734,357 | 1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total current assets |

80,527,297 | 18 | 60,513,339 | 14 | 115,366,586 | 25 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| NONCURRENT ASSETS |

||||||||||||||||||||||||

| Available-for-sale financial assets (Note 8) |

2,802,406 | 1 | 3,046,182 | 1 | 3,074,721 | 1 | ||||||||||||||||||

| Financial assets carried at cost (Note 15) |

2,412,507 | — | 2,423,646 | — | 2,458,874 | 1 | ||||||||||||||||||

| Held-to-maturity financial assets (Note 9) |

5,715,227 | 1 | 7,501,743 | 2 | 10,207,126 | 2 | ||||||||||||||||||

| Investments accounted for using equity method (Note 16) |

2,506,021 | — | 2,562,293 | — | 2,153,828 | 1 | ||||||||||||||||||

| Property, plant and equipment (Notes 17, 38 and 39) |

298,533,250 | 66 | 302,714,116 | 69 | 296,563,757 | 65 | ||||||||||||||||||

| Investment properties (Note 18) |

8,009,747 | 2 | 8,018,031 | 2 | 7,780,608 | 2 | ||||||||||||||||||

| Intangible assets (Note 19) |

43,763,380 | 10 | 44,398,888 | 10 | 5,481,211 | 1 | ||||||||||||||||||

| Deferred income tax assets |

1,787,114 | — | 1,515,408 | — | 1,346,605 | — | ||||||||||||||||||

| Prepayments (Notes 13 and 38) |

3,409,603 | 1 | 3,608,487 | 1 | 3,554,406 | 1 | ||||||||||||||||||

| Other noncurrent assets (Notes 20 and 39) |

5,212,094 | 1 | 4,882,974 | 1 | 6,049,843 | 1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total noncurrent assets |

374,151,349 | 82 | 380,671,768 | 86 | 338,670,979 | 75 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| TOTAL |

$ | 454,678,646 | 100 | $ | 441,185,107 | 100 | $ | 454,037,565 | 100 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| LIABILITIES AND EQUITY |

||||||||||||||||||||||||

| CURRENT LIABILITIES |

||||||||||||||||||||||||

| Short-term loans (Note 21) |

$ | 1,085,000 | — | $ | 254,357 | — | $ | 194,865 | — | |||||||||||||||

| Financial liabilities at fair value through profit or loss (Note 7) |

456 | — | 246 | — | 120 | — | ||||||||||||||||||

| Hedging derivative liabilities (Notes 3 and 10) |

287 | — | — | — | 29,060 | — | ||||||||||||||||||

| Trade notes and accounts payable (Note 23) |

12,386,753 | 3 | 15,589,108 | 4 | 11,717,243 | 3 | ||||||||||||||||||

| Payables to related parties (Note 38) |

639,736 | — | 556,809 | — | 539,472 | — | ||||||||||||||||||

| Current tax liabilities |

4,448,390 | 1 | 4,144,076 | 1 | 4,134,530 | 1 | ||||||||||||||||||

| Dividends payables (Note 28) |

18,525,558 | 4 | — | — | 35,913,099 | 8 | ||||||||||||||||||

| Other payables (Note 24) |

38,862,229 | 9 | 26,791,769 | 6 | 27,875,023 | 6 | ||||||||||||||||||

| Provisions (Notes 25) |

118,904 | — | 129,341 | — | 135,793 | — | ||||||||||||||||||

| Advance receipts (Note 26) |

9,060,245 | 2 | 9,463,535 | 2 | 10,013,855 | 2 | ||||||||||||||||||

| Current portion of long-term loans (Note 22) |

300,000 | — | 300,000 | — | — | — | ||||||||||||||||||

| Other current liabilities |

1,606,491 | — | 1,598,017 | — | 1,570,243 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total current liabilities |

87,034,049 | 19 | 58,827,258 | 13 | 92,123,303 | 20 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| NONCURRENT LIABILITIES |

||||||||||||||||||||||||

| Long-term loans (Notes 22 and 39) |

1,748,000 | 1 | 1,400,000 | 1 | 1,700,000 | 1 | ||||||||||||||||||

| Deferred income taxes liabilities |

110,501 | — | 101,379 | — | 104,407 | — | ||||||||||||||||||

| Provisions (Note 25) |

120,935 | — | 123,464 | — | 149,213 | — | ||||||||||||||||||

| Customers’ deposits (Note 38) |

4,774,790 | 1 | 4,834,580 | 1 | 4,811,041 | 1 | ||||||||||||||||||

| Accrued pension liabilities |

5,713,227 | 1 | 5,519,103 | 1 | 4,744,825 | 1 | ||||||||||||||||||

| Deferred revenue |

3,566,075 | 1 | 3,700,949 | 1 | 3,797,237 | 1 | ||||||||||||||||||

| Other noncurrent liabilities |

1,329,481 | — | 1,334,220 | — | 1,318,571 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total noncurrent liabilities |

17,363,009 | 4 | 17,013,695 | 4 | 16,625,294 | 4 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities |

104,397,058 | 23 | 75,840,953 | 17 | 108,748,597 | 24 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EQUITY ATTRIBUTABLE TO STOCKHOLDERS OF THE PARENT (Note 28) |

||||||||||||||||||||||||

| Common stock |

77,574,465 | 17 | 77,574,465 | 18 | 77,574,465 | 17 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Additional paid-in capital |

168,040,721 | 37 | 184,620,065 | 42 | 184,578,623 | 41 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Retained earnings |

||||||||||||||||||||||||

| Legal reserve |

76,893,722 | 17 | 74,819,380 | 17 | 74,819,380 | 16 | ||||||||||||||||||

| Special reserve |

2,819,899 | 1 | 2,675,894 | — | 2,675,894 | 1 | ||||||||||||||||||

| Unappropriated earnings |

20,818,527 | 4 | 20,744,024 | 5 | 1,376,826 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total retained earnings |

100,532,148 | 22 | 98,239,298 | 22 | 78,872,100 | 17 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other adjustments |

(412,430 | ) | — | (144,005 | ) | — | (102,998 | ) | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total equity attributable to stockholders of the parent |

345,734,904 | 76 | 360,289,823 | 82 | 340,922,190 | 75 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| NONCONTROLLING INTERESTS |

4,546,684 | 1 | 5,054,331 | 1 | 4,366,778 | 1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total equity |

350,281,588 | 77 | 365,344,154 | 83 | 345,288,968 | 76 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| TOTAL |

$ | 454,678,646 | 100 | $ | 441,185,107 | 100 | $ | 454,037,565 | 100 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The accompanying notes are an integral part of the consolidated financial statements.

- 3 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In Thousands of New Taiwan Dollars, Except Earnings Per Share)

(Reviewed, Not Audited)

| For the Three Months Ended June 30 | For the Six Months Ended June 30 | |||||||||||||||||||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | Amount | % | |||||||||||||||||||||||||

| REVENUES (Notes 29 and 38) |

$ | 55,784,235 | 100 | $ | 55,837,956 | 100 | $ | 110,834,147 | 100 | $ | 112,454,949 | 100 | ||||||||||||||||||||

| OPERATING COSTS (Notes 12 and 38) |

35,036,373 | 63 | 35,279,063 | 64 | 70,036,540 | 63 | 72,729,744 | 65 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| GROSS PROFIT |

20,747,862 | 37 | 20,558,893 | 36 | 40,797,607 | 37 | 39,725,205 | 35 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| OPERATING EXPENSES (Note 38) |

||||||||||||||||||||||||||||||||

| Marketing |

6,427,683 | 11 | 5,961,812 | 11 | 12,594,540 | 11 | 11,949,971 | 11 | ||||||||||||||||||||||||

| General and administrative |

1,083,515 | 2 | 1,011,692 | 2 | 2,166,827 | 2 | 2,059,983 | 2 | ||||||||||||||||||||||||

| Research and development |

897,016 | 2 | 931,773 | 1 | 1,790,928 | 2 | 1,802,796 | 1 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total operating expenses |

8,408,214 | 15 | 7,905,277 | 14 | 16,552,295 | 15 | 15,812,750 | 14 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| OTHER INCOME AND EXPENSE (Note 30) |

(10,995 | ) | — | (5,728 | ) | — | (19,505 | ) | — | (30,226 | ) | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| INCOME FROM OPERATIONS |

12,328,653 | 22 | 12,647,888 | 22 | 24,225,807 | 22 | 23,882,229 | 21 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| NON-OPERATING INCOME AND EXPENSES |

||||||||||||||||||||||||||||||||

| Interest income |

83,609 | — | 172,939 | — | 142,732 | — | 324,410 | 1 | ||||||||||||||||||||||||

| Other income (Notes 30 and 38) |

142,342 | — | 69,403 | — | 395,409 | 1 | 138,875 | — | ||||||||||||||||||||||||

| Other gains and losses (Notes 30 and 38) |

24,654 | — | (42,464 | ) | — | (6,368 | ) | — | (30,656 | ) | — | |||||||||||||||||||||

| Finance costs (Note 30) |

(10,559 | ) | — | (6,373 | ) | — | (19,285 | ) | — | (14,347 | ) | — | ||||||||||||||||||||

| Share of the profit of associates and jointly controlled entities accounted for using equity method (Note 16) |

219,616 | 1 | 202,653 | 1 | 391,722 | — | 302,359 | — | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total non-operating income and expenses |

459,662 | 1 | 396,158 | 1 | 904,210 | 1 | 720,641 | 1 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| INCOME BEFORE INCOME TAX |

12,788,315 | 23 | 13,044,046 | 23 | 25,130,017 | 23 | 24,602,870 | 22 | ||||||||||||||||||||||||

| INCOME TAX EXPENSE (Notes 3 and 31) |

2,091,946 | 4 | 2,157,517 | 4 | 4,047,979 | 4 | 4,102,241 | 4 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| NET INCOME |

10,696,369 | 19 | 10,886,529 | 19 | 21,082,038 | 19 | 20,500,629 | 18 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| OTHER COMPREHENSIVE INCOME (LOSS), Net |

||||||||||||||||||||||||||||||||

| Exchange differences arising from the translation of the foreign operations |

(51,248 | ) | — | 15,694 | — | (36,731 | ) | — | 89,812 | — | ||||||||||||||||||||||

| Unrealized gain (loss) on available-for-sale financial assets |

26,162 | — | (244,797 | ) | — | (233,805 | ) | — | (333,317 | ) | — | |||||||||||||||||||||

(Continued)

- 4 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In Thousands of New Taiwan Dollars, Except Earnings Per Share)

(Reviewed, Not Audited)

| For the Three Months Ended June 30 | For the Six Months Ended June 30 | |||||||||||||||||||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | Amount | % | |||||||||||||||||||||||||

| Cash flow hedges (Note 10) |

$ | (263 | ) | — | $ | — | — | $ | (263 | ) | — | $ | — | — | ||||||||||||||||||

| Share of other comprehensive loss of associates and jointly controlled entities accounted for using equity method |

(32,245 | ) | — | (8,260 | ) | — | (24,641 | ) | — | (36,300 | ) | — | ||||||||||||||||||||

| Income tax relating to each component of other comprehensive income (Note 31) |

846 | — | (379 | ) | — | 1,882 | — | 111 | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total other comprehensive loss, net of income tax |

(56,748 | ) | — | (237,742 | ) | — | (293,558 | ) | — | (279,694 | ) | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| TOTAL COMPREHENSIVE INCOME |

$ | 10,639,621 | 19 | $ | 10,648,787 | 19 | $ | 20,788,480 | 19 | $ | 20,220,935 | 18 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| NET INCOME ATTRIBUTABLE TO |

||||||||||||||||||||||||||||||||

| Stockholders of the parent |

$ | 10,582,991 | 19 | $ | 10,634,960 | 19 | $ | 20,818,408 | 19 | $ | 19,836,066 | 18 | ||||||||||||||||||||

| Noncontrolling interests |

113,378 | — | 251,569 | 1 | 263,630 | — | 664,563 | — | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | 10,696,369 | 19 | $ | 10,886,529 | 20 | $ | 21,082,038 | 19 | $ | 20,500,629 | 18 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| COMPREHENSIVE INCOME ATTRIBUTABLE TO |

||||||||||||||||||||||||||||||||

| Stockholders of the parent |

$ | 10,542,310 | 19 | $ | 10,386,347 | 19 | $ | 20,549,983 | 19 | $ | 19,532,409 | 17 | ||||||||||||||||||||

| Noncontrolling interests |

97,311 | — | 262,440 | — | 238,497 | — | 688,526 | 1 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | 10,639,621 | 19 | $ | 10,648,787 | 19 | $ | 20,788,480 | 19 | $ | 20,220,935 | 18 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| EARNINGS PER SHARE (Note 32) |

||||||||||||||||||||||||||||||||

| Basic |

$ | 1.36 | $ | 1.37 | $ | 2.68 | $ | 2.56 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Diluted |

$ | 1.36 | $ | 1.37 | $ | 2.68 | $ | 2.56 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| The accompanying notes are an integral part of the consolidated financial statements. |

(Concluded) |

- 5 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(In Thousands of New Taiwan Dollars)

(Reviewed, Not Audited)

| Equity Attributable to Owner of the Company (Notes 10 and 28) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retained Earnings | Exchange Differences Arising from the Translation |

Unrealized Gain (Loss) on Available- |

Total equity | |||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock |

Additional Paid-in Capital |

Legal Reserve |

Special Reserve |

Unappropriated Earnings |

Total Retained Earnings |

of the Foreign |

for-sale Financial Assets |

Cash flow Hedges |

Total Other Adjustments |

Attributable to Stockholders of the Parent |

Noncontrolling Interests |

Total Equity | ||||||||||||||||||||||||||||||||||||||||

| BALANCE, JANUARY 1, 2013 |

$ | 77,574,465 | $ | 190,162,430 | $ | 70,828,983 | $ | 2,675,894 | $ | 21,483,854 | $ | 94,988,731 | $ | (96,930 | ) | $ | 257,991 | $ | — | $ | 161,061 | $ | 362,886,687 | $ | 4,441,849 | $ | 367,328,536 | |||||||||||||||||||||||||

| Appropriation of 2012 earnings |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Legal reserve |

— | — | 3,990,397 | — | (3,990,397 | ) | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Cash dividends distributed by Chunghwa |

— | — | — | — | (35,913,099 | ) | (35,913,099 | ) | — | — | — | — | (35,913,099 | ) | — | (35,913,099 | ) | |||||||||||||||||||||||||||||||||||

| Cash dividends distributed by subsidiaries |

— | — | — | — | — | — | — | — | — | — | — | (810,789 | ) | (810,789 | ) | |||||||||||||||||||||||||||||||||||||

| Other changes in additional paid-in capital |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash distributed from additional paid-in capital |

— | (5,589,240 | ) | — | — | — | — | — | — | — | — | (5,589,240 | ) | — | (5,589,240 | ) | ||||||||||||||||||||||||||||||||||||

| Change in additional paid-in capital from investments in associates accounted for using equity method |

— | 1,630 | — | — | — | — | — | — | — | — | 1,630 | 4,223 | 5,853 | |||||||||||||||||||||||||||||||||||||||

| Net income for the six months ended June 30, 2013 |

— | — | — | — | 19,836,066 | 19,836,066 | — | — | — | — | 19,836,066 | 664,563 | 20,500,629 | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive income for the six months ended June 30, 2013 |

— | — | — | — | (39,598 | ) | (39,598 | ) | 67,687 | (331,746 | ) | — | (264,059 | ) | (303,657 | ) | 23,963 | (279,694 | ) | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Total comprehensive income for the six months ended June 30, 2013 |

— | — | — | — | 19,796,468 | 19,796,468 | 67,687 | (331,746 | ) | — | (264,059 | ) | 19,532,409 | 688,526 | 20,220,935 | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Exercise of employee stock option of subsidiaries |

— | 3,803 | — | — | — | — | — | — | — | — | 3,803 | 26,269 | 30,072 | |||||||||||||||||||||||||||||||||||||||

| Compensation cost of employee stock option of a subsidiary |

— | — | — | — | — | — | — | — | — | — | — | 16,950 | 16,950 | |||||||||||||||||||||||||||||||||||||||

| Decrease in noncontrolling interests |

— | — | — | — | — | — | — | — | — | — | — | (250 | ) | (250 | ) | |||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| BALANCE, JUNE 30, 2013 |

$ | 77,574,465 | $ | 184,578,623 | $ | 74,819,380 | $ | 2,675,894 | $ | 1,376,826 | $ | 78,872,100 | $ | (29,243 | ) | $ | (73,755 | ) | $ | — | $ | (102,998 | ) | $ | 340,922,190 | $ | 4,366,778 | $ | 345,288,968 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| BALANCE, JANUARY 1, 2014 |

$ | 77,574,465 | $ | 184,620,065 | $ | 74,819,380 | $ | 2,675,894 | $ | 20,744,024 | $ | 98,239,298 | $ | 5,742 | $ | (149,747 | ) | $ | — | $ | (144,005 | ) | $ | 360,289,823 | $ | 5,054,331 | $ | 365,344,154 | ||||||||||||||||||||||||

| Appropriation of 2013 earnings |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Legal reserve |

— | — | 2,074,342 | — | (2,074,342 | ) | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Special reserve |

— | — | — | 144,005 | (144,005 | ) | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Cash dividends distributed by Chunghwa |

— | — | — | — | (18,525,558 | ) | (18,525,558 | ) | — | — | — | — | (18,525,558 | ) | — | (18,525,558 | ) | |||||||||||||||||||||||||||||||||||

| Cash dividends distributed by subsidiaries |

— | — | — | — | — | — | — | — | — | — | — | (796,789 | ) | (796,789 | ) | |||||||||||||||||||||||||||||||||||||

| Other changes in additional paid-in capital |

||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash dividends from additional paid-in capital |

— | (16,577,663 | ) | — | — | — | — | — | — | — | — | (16,577,663 | ) | — | (16,577,663 | ) | ||||||||||||||||||||||||||||||||||||

| Change in additional paid-in capital from investments in associates and jointly controlled entities accounted for using equity method |

— | (1,681 | ) | — | — | — | — | — | — | — | — | (1,681 | ) | (2,486 | ) | (4,167 | ) | |||||||||||||||||||||||||||||||||||

| Net income for the six months ended June 30, 2014 |

— | — | — | — | 20,818,408 | 20,818,408 | — | — | — | — | 20,818,408 | 263,630 | 21,082,038 | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive income for the six months ended June 30, 2014 |

— | — | — | — | — | — | (43,791 | ) | (224,371 | ) | (263 | ) | (268,425 | ) | (268,425 | ) | (25,133 | ) | (293,558 | ) | ||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Total comprehensive income for the six months ended June 30, 2014 |

— | — | — | — | 20,818,408 | 20,818,408 | (43,791 | ) | (224,371 | ) | (263 | ) | (268,425 | ) | 20,549,983 | 238,497 | 20,788,480 | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| Compensation cost of employee stock option of a subsidiary |

— | — | — | — | — | — | — | — | — | — | — | 53,131 | 53,131 | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| BALANCE, JUNE 30, 2014 |

$ | 77,574,465 | $ | 168,040,721 | $ | 76,893,722 | $ | 2,819,899 | $ | 20,818,527 | $ | 100,532,148 | $ | (38,049 | ) | $ | (374,118 | ) | $ | (263 | ) | $ | (412,430 | ) | $ | 345,734,904 | $ | 4,546,684 | $ | 350,281,588 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

The accompanying notes are an integral part of the consolidated financial statements.

- 6 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands of New Taiwan Dollars)

(Reviewed, Not Audited)

| Six Months Ended June 30 | ||||||||

| 2014 | 2013 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||

| Income before income tax |

$ | 25,130,017 | $ | 24,602,870 | ||||

| Adjustments to reconcile income before income tax to net cash provided by operating activities: |

||||||||

| Depreciation |

16,105,591 | 15,360,856 | ||||||

| Amortization |

784,700 | 601,967 | ||||||

| Provision for doubtful accounts |

148,370 | 138,262 | ||||||

| Interest expenses |

19,285 | 14,347 | ||||||

| Interest income |

(142,732 | ) | (324,410 | ) | ||||

| Dividend income |

(76,998 | ) | (34,451 | ) | ||||

| Compensation cost of employee stock options |

53,131 | 16,950 | ||||||

| Share of the profit of associates and jointly controlled entities accounted for using equity method |

(391,722 | ) | (302,359 | ) | ||||

| Impairment loss on financial assets carried at cost |

8,976 | 26,772 | ||||||

| Impairment loss on intangible assets |

— | 18,055 | ||||||

| Provision for inventory and obsolescence |

247,684 | 137,965 | ||||||

| Impairment loss on property, plant and equipment |

— | 2,262 | ||||||

| Loss (gain) on disposal of financial instruments |

(44,377 | ) | 6,951 | |||||

| Loss on disposal of property, plant and equipment |

19,505 | 9,909 | ||||||

| Valuation loss (gain) on financial assets and liabilities at fair value through profit or loss, net |

456 | (34,756 | ) | |||||

| Gain arising on adjustments for hedged available-for-sale financial assets |

— | (63,566 | ) | |||||

| Valuation loss on hedging derivative liabilities, net |

— | 57,806 | ||||||

| Valuation loss on hedging derivative assets, net |

— | 5,760 | ||||||

| Loss (gain) on foreign exchange |

107,722 | (68,631 | ) | |||||

| Changes in operating assets and liabilities: |

||||||||

| Decrease (increase) in: |

||||||||

| Financial assets held for trading |

91 | 4,603 | ||||||

| Trade notes and accounts receivable |

(855,279 | ) | 674,216 | |||||

| Receivables from related parties |

(376 | ) | (7,501 | ) | ||||

| Inventories |

(593,196 | ) | (598,617 | ) | ||||

| Other current monetary assets |

(274,231 | ) | (527,227 | ) | ||||

| Prepayment |

(3,171,800 | ) | (3,409,982 | ) | ||||

| Other current assets |

(1,306,006 | ) | 740,238 | |||||

| Increase (decrease) in: |

||||||||

| Trade notes and accounts payable |

(3,255,927 | ) | (1,875,442 | ) | ||||

| Payables to related parties |

82,927 | (300,594 | ) | |||||

| Other payables |

(4,187,853 | ) | (3,622,071 | ) | ||||

| Provisions |

(12,966 | ) | 18,852 | |||||

| Advance receipts |

(403,290 | ) | (88,206 | ) | ||||

| Other current liabilities |

6,328 | (32,697 | ) | |||||

(Continued)

- 7 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands of New Taiwan Dollars)

(Reviewed, Not Audited)

| Six Months Ended June 30 | ||||||||

| 2014 | 2013 | |||||||

| Deferred revenue |

$ | (134,874 | ) | $ | (41,617 | ) | ||

| Accrued pension liabilities |

194,124 | 128,022 | ||||||

|

|

|

|

|

|||||

| Cash generated from operations |

28,057,280 | 31,234,536 | ||||||

| Interest paid |

(19,270 | ) | (22,264 | ) | ||||

| Income tax paid |

(4,005,213 | ) | (3,312,033 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

24,032,797 | 27,900,239 | ||||||

|

|

|

|

|

|||||

| CASH FLOWS FROM INVESTING ACTIVITIES |

||||||||

| Acquisition of available-for-sale financial assets |

— | (1,761,867 | ) | |||||

| Proceeds from disposal of available-for-sale financial assets |

81,229 | 1,341,910 | ||||||

| Acquisition of time deposits and negotiable certificate of deposit with maturities of more than three months |

(411,000 | ) | (17,729,546 | ) | ||||

| Proceeds from disposal of time deposits and negotiable certificate of deposit with maturities of more than three months |

434,607 | 33,820,230 | ||||||

| Proceeds from disposal of held-to-maturity financial assets |

1,570,000 | 1,570,692 | ||||||

| Acquisition of financial assets carried at cost |

(47,078 | ) | (35,785 | ) | ||||

| Proceeds from disposal of financial assets carried at cost |

3,489 | — | ||||||

| Capital reduction of financial assets carried at cost |

43,740 | 18,000 | ||||||

| Proceeds from disposal of hedging derivative assets |

— | 9,635 | ||||||

| Derecognition of hedging derivative liabilities |

— | (84,133 | ) | |||||

| Acquisition of investments accounted for using equity method |

(133,485 | ) | (60,000 | ) | ||||

| Capital reduction of associates |

— | 16,387 | ||||||

| Acquisition of property, plant and equipment |

(13,089,921 | ) | (15,586,069 | ) | ||||

| Proceeds from disposal of property, plant and equipment |

3,808 | 35,847 | ||||||

| Acquisition of intangible assets |

(149,163 | ) | (321,109 | ) | ||||

| Increase in noncurrent assets |

(340,956 | ) | (1,451,126 | ) | ||||

| Interest received |

21,857 | 334,297 | ||||||

| Cash dividends received |

451,807 | 361,115 | ||||||

|

|

|

|

|

|||||

| Net cash provided by (used in) investing activities |

(11,561,066 | ) | 478,478 | |||||

|

|

|

|

|

|||||

| CASH FLOWS FROM FINANCING ACTIVITIES |

||||||||

| Proceeds from short-term loans |

830,643 | 227,292 | ||||||

| Repayment of short-term loans |

— | (143,900 | ) | |||||

| Proceeds from long-term loans |

348,000 | — | ||||||

| Repayment of long-term loans |

— | (358,372 | ) | |||||

| Customers’ deposits refunded |

(58,707 | ) | (95,308 | ) | ||||

| Decrease in other liabilities |

(4,739 | ) | (84,389 | ) | ||||

| Proceeds from exercise of employee stock option granted by subsidiaries |

— | 30,072 | ||||||

|

|

|

|

|

|||||

| Net cash provided by (used in) financing activities |

1,115,197 | (424,605 | ) | |||||

|

|

|

|

|

|||||

(Continued)

- 8 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands of New Taiwan Dollars)

(Reviewed, Not Audited)

| Six Months Ended June 30 | ||||||||

| 2014 | 2013 | |||||||

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS |

$ | (30,690 | ) | $ | 95,288 | |||

|

|

|

|

|

|||||

| NET INCREASE IN CASH AND CASH EQUIVALENTS |

13,556,238 | 28,049,400 | ||||||

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD |

14,585,105 | 30,938,472 | ||||||

|

|

|

|

|

|||||

| CASH AND CASH EQUIVALENTS, END OF PERIOD |

$ | 28,141,343 | $ | 58,987,872 | ||||

|

|

|

|

|

|||||

| The accompanying notes are an integral part of the consolidated financial statements. |

(Concluded) |

- 9 -

CHUNGHWA TELECOM CO., LTD. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS ENDED JUNE 30, 2014 AND 2013

(In Thousands of New Taiwan Dollars, Unless Stated Otherwise)

(Reviewed, Not Audited)

| 1. | GENERAL |

Chunghwa Telecom Co., Ltd. (“Chunghwa”) was incorporated on July 1, 1996 in the Republic of China (“ROC”) pursuant to the Article 30 of the Telecommunications Act. Chunghwa is a company limited by shares and, prior to August 2000, was wholly owned by the Ministry of Transportation and Communications (“MOTC”). Prior to July 1, 1996, the current operations of Chunghwa were carried out under the Directorate General of Telecommunications (“DGT”). The DGT was established by the MOTC in June 1943 to take primary responsibility in the development of telecommunications infrastructure and to formulate policies related to telecommunications. On July 1, 1996, the telecom operations of the DGT were spun-off to as Chunghwa which continues to carry out the business and the DGT continues to be the industry regulator.

As the dominate telecommunications service provider of domestic and international fixed-line, Global System for Mobile Communications (“GSM”), and Third Generation (“3G”) mobile service in the ROC, Chunghwa is subject to additional regulations imposed by ROC.

Effective August 12, 2005, the MOTC had completed the process of privatizing Chunghwa by reducing the government ownership to below 50% in various stages. In July 2000, Chunghwa received approval from the Securities and Futures Commission (the “SFC”) for a domestic initial public offering and its common shares were listed and traded on the Taiwan Stock Exchange (the “TWSE”) on October 27, 2000. Certain of Chunghwa’s common shares had been sold, in connection with the foregoing privatization plan, in domestic public offerings at various dates from August 2000 to July 2003. Certain of Chunghwa’s common shares had also been sold in an international offering of securities in the form of American Depository Shares (“ADS”) on July 17, 2003 and were listed and traded on the New York Stock Exchange (the “NYSE”). The MOTC sold common shares of Chunghwa by auction in the ROC on August 9, 2005 and completed the second international offering on August 10, 2005. Upon completion of the share transfers associated with these offerings on August 12, 2005, the MOTC owned less than 50% of the outstanding shares of Chunghwa and completed the privatization plan.

Chunghwa together with its subsidiaries are hereinafter referred to collectively as “the Company”.

The consolidated financial statements are presented in Chunghwa’s functional currency, New Taiwan dollars.

| 2. | APPROVAL OF FINANCIAL STATEMENTS |

The consolidated financial statements were approved and authorized by the Board of Directors on August 12, 2014.

- 10 -

| 3. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Statement of Compliance

The accompany consolidated financial statements have been prepared in conformity with the Guidelines Governing the Preparation of Financial Reports by Securities Issuers and International Accounting Standard 34, “Interim Financial Reporting,” endorsed by the Financial Supervisory Commission (the “FSC”). The consolidated financial statements do not present full disclosures required for a complete set of the International Financial Reporting Standards (IFRS), International Accounting Standards (IAS), and the Interpretations as well as related guidance translated by Accounting Research and Development Foundation (ARDF) endorsed by the FSC (collectively, “Taiwan-IFRSs”) annual consolidated financial statements.

Basis of Consolidation

The detailed information of subsidiaries included in the consolidated financial statements was as follows:

| Percentage of Ownership | ||||||||||||||||||||

| Name of Investor | Name of Investee | Main Businesses and Products | June 30, 2014 |

December 31, 2013 |

June 30, 2013 |

Note | ||||||||||||||

| Chunghwa Telecom Co., Ltd. |

Senao International Co., Ltd. (“SENAO”) |

Selling and maintaining mobile phones and its peripheral products |

28 | 28 | 28 | a. | ||||||||||||||

| Light Era Development Co., Ltd. (“LED”) |

Housing, office building development, rent and sale services |

100 | 100 | 100 | ||||||||||||||||

| Donghwa Telecom Co., Ltd. (“DHT”) |

International telecommunications IP fictitious internet and internet transfer services |

100 | 100 | 100 | ||||||||||||||||

| Chunghwa Telecom Singapore Pte., Ltd. (“CHTS”) |

Telecommunication wholesale, internet transfer services international data and long distance call wholesales to carriers |

100 | 100 | 100 | ||||||||||||||||

| Chunghwa System Integration Co., Ltd. (“CHSI”) |

Providing communication and information aggregative services |

100 | 100 | 100 | ||||||||||||||||

| Chunghwa Investment Co., Ltd. (“CHI”) |

Investment |

89 | 89 | 89 | ||||||||||||||||

| CHIEF Telecom Inc. (“CHIEF”) |

Internet communication and internet data center (“IDC”) service |

69 | 69 | 69 | ||||||||||||||||

| Chunghwa International Yellow Pages Co., Ltd. (“CHYP”) |

Yellow pages sales and advertisement services |

100 | 100 | 100 | ||||||||||||||||

| Prime Asia Investments Group Ltd. (B.V.I.) (“Prime Asia”) |

Investment |

100 | 100 | 100 | ||||||||||||||||

| Spring House Entertainment Tech. Inc. (“SHE”) |

Network services, producing digital entertainment contents and broadband visual sound terrace development |

56 | 56 | 56 | ||||||||||||||||

| Chunghwa Telecom Global, Inc. (“CHTG”) |

International data and internet services and long distance call wholesales to carriers |

100 | 100 | 100 | ||||||||||||||||

| Chunghwa Telecom Vietnam Co., Ltd. (“CHTV”) |

Information and communications technology, international circuit, and intelligent energy network service |

100 | 100 | 100 | ||||||||||||||||

| Smartfun Digital Co., Ltd. (“SFD”) |

Software retail |

65 | 65 | 65 | ||||||||||||||||

| Chunghwa Telecom Japan Co., Ltd. (“CHTJ”) |

Telecom business, information process and information provide service, development and sale of software and consulting services in telecommunication |

100 | 100 | 100 | ||||||||||||||||

| Chunghwa Sochamp Technology Inc. (“CHST”) |

License plate recognition system |

51 | 51 | 51 | ||||||||||||||||

| Honghwa International Co., Ltd. (“HHI”) |

Telecommunication constructions, telecommunication service agencies and other service. |

100 | 100 | 100 | b. | |||||||||||||||

| New Prospect Investments Holdings Ltd. (B.V.I.) (“New Prospect”) |

Investment |

100 | 100 | 100 | ||||||||||||||||

| Senao International Co., Ltd. |

Senao International (Samoa) Holding Ltd. (“SIS”) |

International investment |

100 | 100 | 100 | |||||||||||||||

| CHIEF Telecom Inc. |

Unigate Telecom Inc. (“Unigate”) |

Telecommunication and internet service |

100 | 100 | 100 | |||||||||||||||

| Chief International Corp. (“CIC”) |

Investment |

100 | 100 | 100 | ||||||||||||||||

| Chunghwa System Integrated Co., Ltd. |

Concord Technology Co., Ltd. (“Concord”) |

Investment |

100 | 100 | 100 | |||||||||||||||

| Spring House Entertainment Tech. Inc. |

Ceylon Innovation Ltd. (“CEI”) |

International trading, general advertisement and book publishment service |

100 | 100 | 100 | |||||||||||||||

| Light Era Development Co., Ltd. |

Yao Yong Real Property Co., Ltd. (“YYRP”) |

Real estate management and leasing business |

100 | 100 | 100 | |||||||||||||||

| Chunghwa Investment Co., Ltd. |

Chunghwa Precision Test Tech Co., Ltd. (“CHPT”) |

Semiconductor testing components and printed circuit board industry production and marketing of electronic products |

51 | 51 | 51 | c. | ||||||||||||||

| Chunghwa Investment Holding Co., Ltd. (“CIHC”) |

Investment |

100 | 100 | 100 | ||||||||||||||||

(Continued)

- 11 -

| Percentage of Ownership | ||||||||||||||||||||

| Name of Investor | Name of Investee | Main Businesses and Products | June 30, 2014 |

December 31, 2013 |

June 30, 2013 |

Note | ||||||||||||||

| Concord Technology Co., Ltd. |

Glory Network System Service (Shanghai) Co., Ltd. (“GNSS (Shanghai)”) |

Planning and design of software and hardware system services and integration of information system |

100 | 100 | 100 | |||||||||||||||

| Chunghwa Precision Test Tech. Co., Ltd. |

Chunghwa Precision Test Tech. USA Corporation (“CHPT (US)”) |

Semiconductor testing components and printed circuit board industry production and marketing of electronic products |

100 | 100 | 100 | |||||||||||||||

| CHPT Japan Co., Ltd. (“CHPT (JP)”) |

Sale and maintenance of electronic parts and machinery processed products, and design of printed circuit board |

100 | 100 | 100 | d. | |||||||||||||||

| Chunghwa Precision Test Tech. International, Ltd. (“CHPT (International)”) |

Electronic materials wholesale and retail and investment |

100 | 100 | — | e. | |||||||||||||||

| Senao International (Samoa) Holding Ltd. |

Senao International HK Limited (“SIHK”) |

International investment |

100 | 100 | 100 | |||||||||||||||

| Chunghwa Investment Holding Co., Ltd. |

CHI One Investment Co., Limited (“COI”) |

Investment |

100 | 100 | 100 | |||||||||||||||

| Senao International HK Limited |

Senao Trading (Fujian) Co., Ltd. (“STF”) |

Information technology services and sale of communication products |

100 | 100 | 100 | |||||||||||||||

| Senao International Trading (Shanghai) Co., Ltd. (“SITS”) |

Information technology services and sale of communication products |

100 | 100 | 100 | ||||||||||||||||

| Senao International Trading (Shanghai) Co., Ltd. (“SEITS”) |

Information technology services and maintenance of communication products |

100 | 100 | 100 | ||||||||||||||||

| Senao International Trading (Jiangsu) Co., Ltd. (“SITJ”) |

Information technology services and sale of communication products |

100 | 100 | 100 | ||||||||||||||||

| Prime Asia Investments Group, Ltd. (B.V.I.) |

Chunghwa Hsingta Co., Ltd. (“CHC”) |

Investment |

100 | 100 | 100 | |||||||||||||||

| Chunghwa Hsingta Company Ltd. |

Chunghwa Telecom (China) Co., Ltd. (“CTC”) |

Planning and design of energy conservation and software and hardware system services, and integration of information system |

100 | 100 | 100 | |||||||||||||||

| Jiangsu Zhenhua Information Technology Company, LLC. (“JZIT”) |

Intelligent energy conserving and intelligent building services |

75 | 75 | 75 | ||||||||||||||||

| Hua-Xiong Information Technology Co., Ltd. (“HXIT”) |

Intelligent system and energy saving system services in buildings |

51 | 51 | 51 | ||||||||||||||||

| Chunghwa Precision Test Tech. International, Ltd. |

Shanghai Taihua Electronic Technology Limited (“STET”) |

Design of printed circuit board and related consultation service |

100 | — | — | f. | ||||||||||||||

(Concluded)

| a. | The Company owns 28% equity shares of SENAO. However, the Company has four out of seven seats of the board of directors of SENAO through the support of large beneficial shareholders. Therefore, the Company has control over SENAO and the accounts of SENAO are included in the consolidated financial statements. The decrease of the Company’s equity ownership of SENAO was due to the exercise of options by SENAO’s employees. The Company owned 28.23%, 28.18% and 28.18% equity shares of SENAO as of June 30, 2013, December 31, 2013 and June 30, 2014, respectively. |

| b. | Chunghwa established 100% owned subsidiary of HHI in January 2013. Honghwa Human Resources changed its name to Honghwa International from July 4, 2014. |

| c. | The decrease of the Company’s equity ownership of CHPT was due to the exercise of options by CHPT’s employees and CHPT issued employee stock bonus. The Company owned 51.06%, 50.62% and 50.62% equity shares of CHPT as of June 30, 2013, December 31, 2013 and June 30, 2014, respectively. |

| d. | CHPT established 100% owned subsidiary of CHPT (JP) in January 2013. |

| e. | CHPT established 100% owned subsidiary of CHPT (International) in July 2013. |

| f. | CHPT (International) established 100% owned subsidiary of STET in January 2014. |

- 12 -

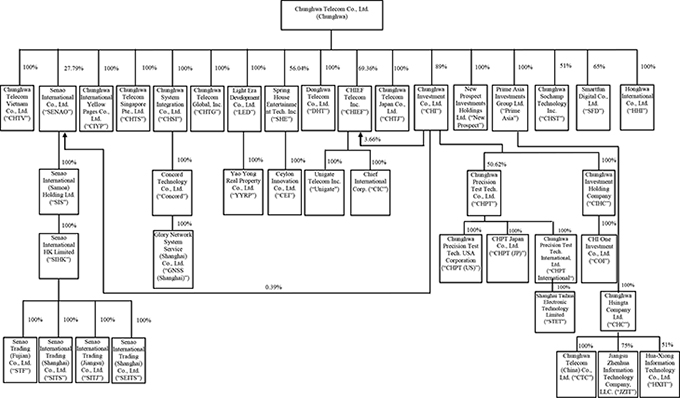

The following diagram presents information regarding the relationship and ownership percentages between Chunghwa and its subsidiaries as of June 30, 2014:

Other Significant Accounting Policies

The accounting policies applied in these consolidated financial statements are consistent with those applied in the consolidated financial statements for the year ended December 31, 2013, except for those described below:

| a. | Retirement benefit costs |

For defined benefit retirement plans, the cost of providing retirement benefit in the interim period is determined using the pension cost rate derived from the actuarial valuation at the end of prior year, adjusted for significant market fluctuation, curtailment, settlement or other one-time events.

| b. | Taxation |

Income tax expense represents the sum of the tax currently payable and deferred tax. Interim period income taxes are assessed on an annual basis. Interim period income tax expense is calculated by applying to an interim period’s pre-tax income and the tax rate that would be applicable to expected total annual earnings.

| c. | Hedge accounting |

The Company designates certain derivatives as cash flow hedges.

The effective portion of changes in the fair value of derivatives that are designated and qualify as cash flow hedges is recognized in other comprehensive income. The gain or loss relating to the ineffective portion is recognized immediately in profit or loss.

- 13 -

The associated gains or losses that were recognized in other comprehensive income are reclassified from equity to profit or loss as a reclassification adjustment in the line item relating to the hedged item in the same period when the hedged item affects profit or loss. However, when the hedged forecast transaction subsequently results in the recognition of a non-financial asset or a non-financial liability, the associated gains and losses previously recognized in other comprehensive income are transferred from equity and are included in the initial cost of the non-financial asset or non-financial liability.

Hedge accounting is discontinued prospectively when the Company revokes the designated hedging relationship, or when the hedging instrument expires or is sold, terminated, or exercised, or when it no longer meets the criteria for hedge accounting. The cumulative gain or loss on the hedging instrument previously recognized in other comprehensive income remains in equity until the forecast transaction occurs. When a forecast transaction is no longer expected to occur, the gain or loss accumulated in equity is recognized immediately in profit or loss.

| 4. | CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION UNCERTAINTY |

In the application of the Company’s accounting policies, the managements are required to make judgments, estimates and assumptions which are based on historical experience and other factors that are not readily apparent from other sources. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimate is revised if the revision affects only that period, or in the period of the revision and future periods if the revision affects both current and future periods.

The same critical accounting judgments and key sources of estimation uncertainty of consolidated financial statements have been followed in these consolidated financial statements as were applied in the preparation of the consolidated financial statements for the year ended December 31, 2013.

| 5. | APPLICATION OF NEW AND REVISED STANDARDS AND INTERPRETATIONS |

| a. | The 2013 Taiwan-IFRSs version in issue but not yet effective |

On April 3, 2014, according to Rule No. 1030010325 issued by the FSC, the following 2013 IFRS version endorsed by the FSC (collectively, “2013 Taiwan-IFRSs version”) should be adopted by the Company starting 2015.

| New, Revised or Amended Standards and Interpretations |

Effective Date Issued by IASB (Note) | |||

| Amendments to IFRSs |

Improvement to IFRSs 2009—amendment to IAS 39 |

January 1, 2009 and January 1, 2010, as appropriate | ||

| Amendment to IAS 39 |

Embedded Derivative |

Effective for annual periods ending on or after June 30, 2009 | ||

| Amendments to IFRSs |

Improvements to IFRSs 2010 |

July 1, 2010 or January 1, 2011, as appropriate | ||

| Amendments to IFRSs |

Annual Improvements to IFRSs 2009-2011 Cycle |

January 1, 2013 | ||

(Continued)

- 14 -

| New, Revised or Amended Standards and Interpretations |

Effective Date Issued by IASB (Note) | |||

| Amendment to IFRS 1 |

Limited Exemption from Comparative IFRS 7 Disclosures of First-time Adopters |

July 1, 2010 | ||

| Amendment to IFRS 1 |

Severe Hyperinflation and Removal of Fixed Dates for First-time Adopters |

July 1, 2011 | ||

| Amendment to IFRS 1 |

Government Loans |

January 1, 2013 | ||

| Amendment to IFRS 7 |

Disclosures—Offsetting Financial Assets and Financial Liabilities |

January 1, 2013 | ||

| Amendment to IFRS 7 |

Disclosures—Transfers of Financial Assets |

July 1, 2011 | ||

| Amendment to IFRS 10 |

Consolidated Financial Statements |

January 1, 2013 | ||

| Amendment to IFRS 11 |

Joint Arrangements |

January 1, 2013 | ||

| Amendment to IFRS 12 |

Disclosure of Interests in Other Entities |

January 1, 2013 | ||

| Amendments to IFRS 10, 11 and 12 |

Consolidated Financial Statements, Joint Arrangements and Disclosure of Interests in Other Entities: Transition Guidance |

January 1, 2013 | ||

| Amendments to IFRS 10, IFRS 12 and IAS 27 |

Investment Entities |

January 1, 2014 | ||

| IFRS 13 |

Fair Value Measurement |

January 1, 2013 | ||

| Amendment to IAS 1 |

Presentation of Items of Other Comprehensive Income |

July 1, 2012 | ||

| Amendment to IAS 12 |

Deferred Tax: Recovery of Underlying Assets |

January 1, 2012 | ||

| Amendment to IAS 19 (Revised 2011) |

Employee Benefits |

January 1, 2013 | ||

| Amendment to IAS 27 (Revised 2011) |

Separate Financial Statements |

January 1, 2013 | ||

| Amendment to IAS 28 (Revised 2011) |

Investments in Associates and Joint Ventures |

January 1, 2013 | ||

| Amendment to IAS 32 |

Offsetting of Financial Assets and Financial Liabilities |

January 1, 2014 | ||

| IFRIC 20 |

Stripping Costs in Production Phase of a Surface Mine |

January 1, 2013 | ||

(Concluded)

| Note: | Unless stated otherwise, the above new, revised or amended standards or interpretations are effective for annual periods beginning on or after the respective effective dates. |

Except for the following, the application of aforementioned 2013 Taiwan-IFRSs version has not had any material impact on the Company’s consolidated financial statements:

| 1) | IFRS 12 “Disclosure of Interests in Other Entities” |

IFRS 12 is a new disclosure standard and is applicable to entities that have interests in subsidiaries, joint arrangements, associates and/or unconsolidated structured entities. In general, the disclosure requirements in IFRS 12 are more extensive than in the current standards. The Company will apply the new disclosure requirements of IFRS 12 in 2015.

- 15 -

| 2) | IFRS 13 “Fair Value Measurement” |

IFRS 13 establishes a single source of guidance for fair value measurements and related disclosures. It defines fair value, establishes a framework for measuring fair value, and requires disclosures about fair value measurements. The disclosure requirements in IFRS 13 are more extensive than those required in the current standards. For example, quantitative and qualitative disclosures based on the three-level fair value hierarchy currently required for financial instruments only will be extended by IFRS 13 to cover all assets and liabilities within its scope.

The Company will apply IFRS 13 prospectively in 2015.

| 3) | Amendments to IAS 1 “Presentation of Items of Other Comprehensive Income” |

The amendments to IAS 1 require items of other comprehensive income to be grouped into those that (1) will not be reclassified to profit or loss; and (2) will be reclassified subsequently to profit or loss when specific conditions are met. Income taxes on related items of other comprehensive income are grouped on the same basis. Previously, there were no such requirements.

The Company will apply the amendments to IAS 1 in 2015. The items that will not be reclassified subsequently to profit or loss are expected to include actuarial gains or losses from defined benefit plans, the share of actuarial gains or losses from defined benefit plans of associates and jointly controlled entities as well as the related income tax on such items. Items that will be reclassified subsequently to profit or loss are expected to include exchange differences arising on translation of foreign operations, changes in fair value of available-for-sale financial assets, cash flow hedges, the share of other comprehensive income of associates and jointly controlled entities as well as the related income tax on items of other comprehensive income (except for the share of actuarial gains or losses from defined benefit plans of associates and jointly controlled entities).

| 4) | Amendments to IAS 19 “Employee Benefits” |

The amendments to IAS 19 change the accounting for defined benefit plans, which require the Company to recognize changes in defined benefit obligations or assets and to disclose the components of the defined benefit costs. According to the amendments, the past service cost, will be expensed immediately when it incurs and no longer be amortized over the average period before vested on a straight-line basis. In addition, the amendment also requires a broader disclosure in defined benefit plans.

When the Company applies the amendments to IAS 19 in 2015, employee benefits will be recognized based on actuarial calculations in accordance with IAS 19. The Company anticipates that as of June 30, 2014 and January 1, 2014, deferred tax assets will be retrospectively restated to decrease by $8,534 thousand and $9,082 thousand, respectively; accrued pension liabilities will be retrospectively restated to decrease by $33,731 thousand and $35,898 thousand, respectively; retained earnings will be retrospectively restated to increase by $21,937 thousand and $23,472 thousand, respectively; noncontrolling interests will be retrospectively restated to increase by $3,260 thousand and $3,344 thousand, respectively. For the three months ended June 30, 2014, pension cost will increase by $1,083 thousand which increase in operating expenses, and income tax expenses will decrease by $274 thousand. For the six months ended June 30, 2014 pension cost will increase by $2,167 thousand which increase in operating expenses, and income tax expenses will decrease by $548 thousand.

- 16 -

Except for the abovementioned impact, as of the date the consolidated financial statements were authorized for issue, the Company is continuingly assessing the possible impact that the application of the 2013 Taiwan-IFRSs version will have on the Company’s financial position and operating result, and will disclose the relevant impact when the assessment is complete.

| b. | The IFRSs issued by IASB but not endorsed by FSC |

The Company has not applied the following IFRSs issued by the IASB but not endorsed by the FSC. As of the date that the consolidated financial statements were authorized for issue, the initial adoption to the following standards and interpretations is still subject to the effective date to be published by the FSC.

| New, Revised or Amended Standards and Interpretations |

Effective Date Issued by IASB (Note 1) | |||

| Amendments to IFRSs |

Annual Improvements to IFRSs 2010-2012 Cycle |

July 1, 2014 (Note 2) | ||

| Amendments to IFRSs |

Annual Improvements to IFRSs 2011-2013 Cycle |

July 1, 2014 | ||

| IFRS 9 |

Financial Instruments |

January 1, 2018 | ||

| Amendments to IFRS 9 and IFRS 7 |

Mandatory Effective Date of IFRS 9 and Transition Disclosures |

January 1, 2018 | ||

| Amendment to IFRS 11 |

Acquisitions of Interests in Joint Operations |

January 1, 2016 | ||

| IFRS 14 |

Regulatory Deferral Accounts |

January 1, 2016 | ||

| IFRS 15 |

Revenue from Contracts with Customers |

January 1, 2017 | ||

| Amendments to IAS 16 and IAS 38 |

Clarification of Acceptable Methods of Depreciation and Amortization |

January 1, 2016 | ||

| Amendments to IAS 16 and IAS 41 |

Agriculture: Bearer Plants |

January 1, 2016 | ||

| Amendment to IAS 19 |

Defined Benefit Plans: Employee Contributions |

July 1, 2014 | ||

| Amendment to IAS 36 |

Impairment of Assets: Recoverable Amount Disclosures for Non-financial Assets |

January 1, 2014 | ||

| Amendment to IAS 39 |

Novation of Derivatives and Continuation of Hedge Accounting |

January 1, 2014 | ||

| IFRIC 21 |

Levies |

January 1, 2014 | ||

| Note 1: | Unless stated otherwise, the above new standards and interpretations are effective for annual periods beginning on or after the respective effective dates. |

| Note 2: | The amendment to IFRS 2 applies to share-based payment transactions for which the grant date is on or after July 1, 2014; the amendment to IFRS 3 applies to business combinations for which the acquisition date is on or after July 1, 2014; the amendment to IFRS 13 is effective immediately; the remaining amendments are effective for annual periods beginning on or after July 1, 2014. |

- 17 -

Except for the following, the initial application of the above new standards and interpretations have not had any material impact on the Company’s consolidated financial statements:

| 1) | IFRS 9 “Financial Instruments” |

Recognition and measurement of financial assets

With regards to financial assets, all recognized financial assets that are within the scope of IAS 39 “Financial Instruments: Recognition and Measurement” are subsequently measured at amortized cost or fair value. Under IFRS 9, the requirements for the classification and measurement of financial assets are stated as follows:

| a) | For debt instruments, if their contractual terms give rise on specified dates to cash flows that are solely payments of principal and interest on the principal outstanding, and they are held within a business model whose objective is to collect the contractual cash flows, the financial assets are measured at amortized cost and are assessed for impairment continuously with impairment loss recognized in profit or loss, if any. Interest revenue is recognized in profit or loss by using the effective interest method; |

| b) | For debt instruments, if the objective of the Company’s business model is achieved by both collecting the contractual cash flows and selling financial assets, the financial assets are measured at fair value through other comprehensive income (FVTOCI) and are assessed for impairment continuously. Interest revenue is recognized in profit or loss by using the effective interest method, and other gain or loss shall be recognized in other comprehensive income, except for impairment gains or losses and foreign exchange gains and losses. |

| c) | Except for a) and b), all other financial assets are measured at fair value through profit or loss. However, the Company may make an irrevocable election to present subsequent changes in the fair value of an equity investment (that is not held for trading) in other comprehensive income, with only dividend income generally recognized in profit or loss. No subsequent impairment assessment is required. |

The impairment of financial assets

IFRS 9 requires that an entity recognize impairment loss on financial assets by using the “expected credit losses model”. The credit loss allowance is required for financial assets measured at amortized cost, financial assets mandatorily measured at FVTOCI, lease receivables, contract assets arising from IFRS 15 “Revenue from Contracts with Customers”, loan commitments and financial guarantee contracts. A loss allowance for the 12-month expected credit losses is required for a financial asset if its credit risk has not increased significantly since initial recognition. However, a loss allowance for full lifetime expected credit losses is required for (1) a financial asset if its credit risk has increased significantly since initial recognition and (2) trade receivables.

For purchased or originated credit-impaired financial assets, the estimated cash flows used to calculate the credit-adjusted effective interest rate incorporate expected credit losses at initial recognition. Subsequently, any changes in expected losses are recognized as changes in loss allowance with a corresponding gain or loss recognized in profit or loss.

- 18 -

Hedge accounting

The main changes in hedge accounting amended the application requirements for hedge accounting to better reflect the entity’s risk management activities. Compared with IAS 39, the main changes include: (1) enhancing types of transactions eligible for hedge accounting, specifically broadening the risk eligible for hedge accounting of non-financial items; (2) changing the way hedging derivative instruments are accounted for to reduce profit or loss volatility; and (3) replacing retrospective effectiveness assessment with the principle of economic relationship between the hedging instrument and the hedged item.

| 2) | Amendments to IAS 36 “Recoverable Amount Disclosures for Non-financial Assets” |

In issuing IFRS 13 “Fair Value Measurement”, the IASB made some consequential amendments to the disclosure requirements in IAS 36 “Impairment of Assets”, introducing a requirement to disclose in every reporting period the recoverable amount of an asset or each cash-generating unit. The amendment clarifies that the disclosure of such recoverable amount is required during the period when an impairment loss has been recognized or reversed. Furthermore, the Company is required to disclose the discount rate used in current and previous measurements of the recoverable amount based on fair value less costs of disposal measured using a present value technique.

| 3) | Amendments to IAS 39 “Novation of Derivatives and Continuation of Hedge Accounting” |

The amendments to IAS 39 provide an exception to the requirement for the discontinuation of hedge accounting. The amendment states that the novation of a hedging instrument should not be considered an expiration or termination giving rise to the discontinuation of hedge accounting when a hedging derivative is novated:

As a consequence of laws and regulations, or the introduction of laws and regulations, one or more clearing counterparties replace the original counterparty; and

Any changes in terms of the novated derivative are limited to those necessary to effect the replacement of the counterparty.

Any changes to the derivative’s fair value arising from the novation would be reflected in its measurement and therefore in the measurement and assessment of hedge effectiveness. The Company does not anticipate that the application of these amendments to IAS 39 will have a significant impact on the Company’s consolidated financial statements as the Company does not have any novation of derivatives.

| 4) | IFRS 15 “Revenue from Contracts with Customers” |

IFRS 15 establishes principles for recognizing revenue that apply to all contracts with customers, and will supersedes IAS 18 “Revenue”, IAS 11 “Construction Contracts” and a number of revenue-related interpretations from January 1, 2017.

When applying IFRS 15, the Company shall recognize revenue by applying the following steps:

a) Identify the contract with the customer;

b) Identify the performance obligations in the contract;

c) Determine the transaction price;

d) Allocate the transaction price to the performance obligations in the contract; and

e) Recognize revenue when the entity satisfies a performance obligation.

When IFRS 15 is effective, the Company may elect to apply IFRS 15 either retrospectively to each prior reporting period presented or retrospectively with the cumulative effect of initially applying IFRS 15 recognized at the date of initial application.

- 19 -

Except for the abovementioned impact, as of the date the consolidated financial statements were authorized for issue, the Company is continuingly assessing the possible impact that the application other standards and interpretations will have on the Company’s financial position and operating result, and will disclose the relevant impact when the assessment is complete.

| 6. | CASH AND CASH EQUIVALENTS |

| June 30, 2014 | December 31, 2013 |

June 30, 2013 | ||||||||||

| Cash |

||||||||||||

| Cash on hand |

$ | 302,808 | $ | 235,955 | $ | 311,389 | ||||||

| Bank deposits |

6,495,599 | 10,591,681 | 5,125,359 | |||||||||

|

|

|

|

|

|

|

|||||||

| 6,798,407 | 10,827,636 | 5,436,748 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Cash equivalents |

||||||||||||

| Commercial paper |

12,887,906 | 2,375,419 | 36,301,572 | |||||||||

| Negotiable certificate of deposit with maturities of less than three months |

8,062,195 | — | 15,800,000 | |||||||||

| Time deposits with maturities of less than three months |

392,835 | 1,382,050 | 1,449,552 | |||||||||

|

|

|

|

|

|

|

|||||||

| 21,342,936 | 3,757,469 | 53,551,124 | ||||||||||

|

|

|

|

|

|

|

|||||||

| $ | 28,141,343 | $ | 14,585,105 | $ | 58,987,872 | |||||||

|

|

|

|

|

|

|

|||||||

The annual yield rates of bank deposits, commercial paper, negotiable certificate of deposit with maturities of less than three months and time deposits with maturities of less than three months were as follows:

| June 30, 2014 | December 31, 2013 |

June 30, 2013 | ||||

| Bank deposits |

0.00%-0.39% | 0.00%-0.76% | 0.00%-0.94% | |||

| Commercial paper |

0.56%-0.63% | 0.60%-0.65% | 0.68%-0.70% | |||

| Negotiable certificate of deposit with maturities of less than three months |

0.60%-1.35% | — | 0.84%-0.87% | |||

| Time deposits with maturities of less than three months |

0.30%-5.55% | 0.05%-5.10% | 0.30%-5.50% |

| 7. | FINANCIAL INSTRUMENTS AT FAIR VALUE THROUGH PROFIT OR LOSS |

| June 30, 2014 |

December 31, 2013 |

June 30, 2013 |

||||||||||

| Financial assets held for trading |

||||||||||||

| Derivatives (not designated for hedge) |

||||||||||||

| Forward exchange contracts |

$ | — | $ | 337 | $ | 944 | ||||||

|

|

|

|

|

|

|

|||||||

| Financial liabilities held for trading |

||||||||||||

| Derivatives (not designated for hedge) |

||||||||||||

| Forward exchange contracts |

$ | 456 | $ | 246 | $ | 120 | ||||||

|

|

|

|

|

|

|

|||||||

The Company did not apply hedge accounting on the aforementioned contracts at the balance sheet dates.

- 20 -

Outstanding forward exchange contracts as of balance sheet dates were as follows:

| Contract Amount | ||||||||||

| Currency | Maturity Period | (In Thousands) | ||||||||

| June 30, 2014 |

||||||||||

| Forward exchange contracts—buy |

NT$/US$ | 2014.07 | NT$ | 122,962/US$4,100 | ||||||

| December 31, 2013 |

||||||||||

| Forward exchange contracts—buy |

NT$/US$ | 2014.01 | NT$ | 90,092/US$3,021 | ||||||

| June 30, 2013 |

||||||||||

| Forward exchange contracts—buy |

NT$/US$ | 2013.07 | NT$ | 218,679/US$7,300 | ||||||

The Company entered into above forward exchange contracts to manage its exposure to foreign currency risk and impacts in operating results due to fluctuations in exchange rates. However, the aforementioned derivatives did not meet the criteria for hedge accounting and were classified as financial assets or financial liabilities held for trading.

| 8. | AVAILABLE-FOR-SALE FINANCIAL ASSETS |

| June 30, 2014 | December 31, 2013 |

June 30, 2013 | ||||||||||

| Equity securities |

||||||||||||

| Domestic listed stocks and emerging stocks |

$ | 2,802,406 | $ | 3,046,182 | $ | 3,074,721 | ||||||

| Foreign listed stocks |

— | 24,267 | 11,767 | |||||||||

| Domestic and foreign open-end mutual funds |

— | — | 2,655,490 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 2,802,406 | $ | 3,070,449 | $ | 5,741,978 | |||||||

|

|

|

|

|

|

|

|||||||

| Current |

$ | — | $ | 24,267 | $ | 2,667,257 | ||||||

| Non-current |

2,802,406 | 3,046,182 | 3,074,721 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 2,802,406 | $ | 3,070,449 | $ | 5,741,978 | |||||||

|

|

|

|

|

|

|

|||||||

| 9. | HELD-TO-MATURITY FINANCIAL ASSETS |

| June 30, 2014 | December 31, 2013 |

June 30, 2013 | ||||||||||

| Corporate bonds |

$ | 8,930,702 | $ | 10,512,893 | $ | 13,195,749 | ||||||

| Bank debentures |

1,251,868 | 1,252,954 | 1,254,067 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 10,182,570 | $ | 11,765,847 | $ | 14,449,816 | |||||||

|

|

|

|

|

|

|

|||||||

| Current |

$ | 4,467,343 | $ | 4,264,104 | $ | 4,242,690 | ||||||

| Non-current |

5,715,227 | 7,501,743 | 10,207,126 | |||||||||

|

|

|

|

|

|

|

|||||||

| $ | 10,182,570 | $ | 11,765,847 | $ | 14,449,816 | |||||||

|

|

|

|

|

|

|

|||||||

- 21 -