TABLE OF CONTENTS

Page

CERTAIN TERMS AND CONVENTIONS

|

1 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

2 |

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

|

4 |

SELECTED FINANCIAL DATA

|

5 |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

7 |

REGULATORY RECENT DEVELOPMENTS

|

24 |

SIGNATURES

|

35 |

| FINANCIAL STATEMENTS | 36 |

CERTAIN TERMS AND CONVENTIONS

All references in this Form 6-K to (i) “Itaú Unibanco Holding,” “Itaú Unibanco Group,” “we,” “us” or “our” are references to Itaú Unibanco Holding S.A. and its consolidated subsidiaries, except where specified or differently required by the context; (ii) the “Brazilian government” are references to the federal government of the Federative Republic of Brazil, or Brazil; (iii) “preferred shares” are references to our authorized and outstanding preferred shares with no par value; and (iv) “common shares” are references to our authorized and outstanding common shares with no par value. All references to “ADSs” are to American Depositary Shares, each representing one preferred share, without par value. The ADSs are evidenced by American Depositary Receipts, or “ADRs,” issued by The Bank of New York Mellon, or BNY Mellon. All references herein to the “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to “US$,” “dollars” or “U.S. dollars” are to United States dollars.

Additionally, unless specified or the context indicates otherwise, the following definitions apply throughout this Form 6-K:

| · | “Itaú Unibanco” means Itaú Unibanco S.A., together with its consolidated subsidiaries; |

| · | “Itaú BBA” means Banco Itaú BBA S.A., together with its consolidated subsidiaries; |

| · | “Itaú Corpbanca” means Itaú Corpbanca, together with its consolidated subsidiaries; and |

| · | “Central Bank” means the Central Bank of Brazil. |

Additionally, acronyms used repeatedly, defined and technical terms, specific market expressions and the full names of our main subsidiaries and other entities referenced in this report on Form 6-K are explained or detailed in the glossary of terms beginning on page 253 to our annual report on Form 20-F for the year ended December 31, 2021 filed with the SEC on April 28, 2022, or our 2021 Form 20-F.

| 1 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report on Form 6-K contains statements that are or may constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends affecting our business. These forward-looking statements are subject to risks, uncertainties and assumptions including, among other risks:

· Political instability in Brazil, including developments and the perception of risks in connection with the recently elected government in Brazil, as well as ongoing corruption and other investigations and increasing fractious relations and infighting within the administration of former president Jair Bolsonaro, as well as policies and potential changes to address these matters or otherwise, including economic and fiscal reforms and in response to any ongoing effects of the COVID-19 pandemic, any of which may negatively affect growth prospects in the Brazilian economy as a whole;

· General economic, political, and business conditions in Brazil and variations in inflation indexes, interest rates, foreign exchange rates, and the performance of financial markets in Brazil and the other markets in which we operate;

· Global economic and political conditions, as well as geopolitical instability, in particular in the countries where we operate, including in relation to the United States or the Russian invasion of Ukraine;

· Changes in laws or regulations, including in respect of tax matters, compulsory deposits and reserve requirements, that adversely affect our business;

· Developments in high-profile investigations currently in progress and their impact on customers or on our tax exposures;

· Disruptions and volatility in the global financial markets;

· Costs and availability of funding;

· Failure or hacking of our security and operational infrastructure or systems;

· Our ability to protect personal data;

· Our level of capitalization;

· Increases in defaults by borrowers and other loan delinquencies, which result in increases in loan loss allowances;

· Competition in our industry;

· Changes in our loan portfolio and changes in the value of our securities and derivatives;

· Customer losses or losses of other sources of revenues;

· Our ability to execute our strategies and capital expenditure plans and to maintain and improve our operating performance;

· Our exposure to Brazilian public debt;

· Incorrect pricing methodologies for insurance, pension plan and premium bond products and inadequate reserves

| 2 |

· The effectiveness of our risk management policies;

· Our ability to successfully integrate acquired or merged businesses;

· Adverse legal or regulatory disputes or proceedings;

· Environmental damage and climate change and effects from socio-environmental issues, including new and/or more stringent regulations relating to these issues;

· The economic, financial, political and social effects of, and our ability to efficiently respond to, the COVID-19 pandemic (or other pandemics, epidemics and similar crises), including new strains, particularly in Brazil and to the extent that they continue to cause serious negative macroeconomic effects, thus enhancing the risks described in the “Risk Factors” section of our 2021 Form 20-F; and

· Other risk factors as set forth in our 2021 Form 20-F.

The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar words are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. We undertake no obligation to update publicly or revise any forward-looking statements because of new information, future events or otherwise. Considering these risks and uncertainties, the forward-looking information, events and circumstances discussed in this Form 6-K might not occur. Our actual results and performance could differ substantially from those anticipated in such forward-looking statements. Given the uncertainties of forward-looking statements, we cannot assure you that projected results or events will be achieved and we caution you not to place undue reliance on these statements.

| 3 |

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

The information found in this Form 6-K is accurate only as of the date of such information or as of the date of this Form 6-K, as applicable. Our activities, our financial position and assets, the results of transactions and our prospects may have changed since that date.

Information contained in or accessible through our website or any other websites referenced herein does not form part of this Form 6-K unless we specifically state that it is incorporated by reference and forms part of this Form 6-K. All references in this Form 6-K to websites are inactive textual references and are for information only.

Effect of Rounding

Certain amounts and percentages included in this Form 6-K, including in the section of this Form 6-K entitled “Operating and Financial Review and Prospects” have been rounded for ease of presentation. Percentage figures included in this Form 6-K have not been calculated in all cases on the basis of the rounded figures but on the basis of the original amounts prior to rounding. For this reason, certain percentage amounts in this Form 6-K may vary from those obtained by performing the same calculations using the figures in our audited consolidated financial statements. Certain other amounts that appear in this Form 6-K may vary slightly and figures shown as totals in certain tables may not be an arithmetical aggregation of the figures preceding them.

About our Financial Information

The reference date for the quantitative information derived from our balance sheet included in this Form 6-K is as of December 31, 2022 and December 31, 2021 and the reference dates for information derived from our statement of income are the years ended December 31, 2022 and 2021, except where otherwise indicated.

Our audited consolidated financial statements as of December 31, 2022 and 2021 and for the three years ended December 31, 2022, 2021 and 2020, included at the end of this Form 6-K, are prepared in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board, or IASB.

Our audited consolidated financial statements as of December 31, 2022 and 2021 and for the three years ended December 31, 2022, 2021 and 2020 were audited in accordance with International Standards on Auditing by PricewaterhouseCoopers Auditores Independentes Ltda., or PwC, our independent auditors. Such financial statements are referred to herein as our audited consolidated financial statements.

Please see “Note 30 – Segment Information” to our audited consolidated financial statements for further details about the main differences between our management reporting systems and our audited consolidated financial statements prepared in accordance with IFRS issued by the IASB.

| 4 |

SELECTED FINANCIAL DATA

We present below our selected financial data derived from our audited consolidated financial statements included in this Form 6-K. Our audited consolidated financial statements are presented as of and for the years ended December 31, 2022 and 2021 and have been prepared in accordance with IFRS issued by the IASB.

Additionally, we present a summarized version of our Consolidated Statement of Income, Balance Sheet and Statement of Cash Flows in the section “Operating and Financial Review and Prospects.”

The following selected financial data should be read together with “Presentation of Financial and Other Information” and “Operating and Financial Review and Prospects.”

| 5 |

| Income Information | For the years ended December 31, | Variation | |

| 2022 | 2021 | ||

| (In millions of R$, except percentages and basis points) | % | ||

| Operating Revenues | 144,857 | 126,374 | 14.6 |

| Net interest income(1) | 87,211 | 75,209 | 16.0 |

| Non-interest income(2) | 57,646 | 51,165 | 12.7 |

| Expected Loss from Financial Assets and Claims | (29,287) | (14,379) | 103.7 |

| Other operating income (expenses) | (78,037) | (69,764) | 11.9 |

| Net income attributable to owners of the parent company | 29,702 | 26,760 | 11.0 |

| Recurring Managerial Return on Average Equity - Annualized - Consolidated (3) | 19.0% | 18.8% | 20 bps |

| Return on Average Equity – Annualized - Consolidated(4) | 18.7% | 18.2% | 50 bps |

| (1)

Includes: (i) interest and similar income; (ii) interest and similar expenses; (iii) income of financial assets and liabilities at

fair value through profit or loss; and (iv) foreign exchange results and exchange variations in foreign transactions. (2) Includes commissions and banking fees, income related to insurance and private pension operations before claim and selling expenses and other income. | |||

| (3) The Recurring Managerial Return on Average Equity is obtained by dividing the Recurring Managerial Result (R$30,267 million and R$27,662 million in the years ended December 31, 2022 and 2021, respectively) by the Average Stockholders’ Equity adjusted by the dividends proposed (R$159,156 million and R$146,814 million in the years ended December 31, 2022 and 2021, respectively). The resulting amount is multiplied by the number of periods in the year to derive the annualized rate. The calculation bases of returns were adjusted by the dividends proposed after the balance sheet closing dates, which have not yet been approved at annual Stockholders' or Board meetings. | |||

| (4)

The return on average equity is calculated by dividing the Net Income (R$29,702 million and R$26,760 million in the years ended December

31, 2022 and 2021, respectively) by the Average Stockholders’ Equity adjusted by the dividends proposed (R$159,156 million

and R$146,814 million in the years ended December 31, 2022 and 2021, respectively). This average considers the Stockholders’

Equity from the four previous quarters. The quotient of this division was multiplied by the number of periods in the year to arrive

at the annual ratio. The calculation bases of returns were adjusted by the proposed dividend amounts after the balance sheet dates

not yet approved at the annual shareholders 'meeting or at the Board of Directors' meetings. | |||

| Balance Sheet Information | As of December 31, | As of December 31, | Variation |

| 2022 | 2021 | ||

| (In millions of R$, except percentages and basis points) | % | ||

| Total assets | 2,323,440 | 2,069,206 | 12.3 |

| Total loans and finance lease operations | 909,422 | 822,590 | 10.6 |

| (-) Provision for expected loss(1) | (52,324) | (44,316) | 18.1 |

| Common Equity Tier I Ratio - in % | 11.9% | 11.3% | 60 bps |

| Tier I Ratio - in % | 13.5% | 13.0% | 50 bps |

| Total Capital Ratio - in % | 15.0% | 14.7% | 30 bps |

| (1) Comprises Expected Credit Loss for Financial Guarantees Pledged R$ (810) (R$ (767) at 12/31/2021) and Loan Commitments R$ (2,874) (R$ (4,433) at 12/31 /2021). Please see “Note 10 — Loan and Lease operations” to our audited consolidated financial statements for further details. | |||

| Other Information | For the years ended, December 31, | Variation | |

| 2022 | 2021 | % | |

| Net income per share – R$ (1) | 3.03 | 2.74 | 10.6 |

| Weighted average number of outstanding shares - basic | 9,798,994,231 | 9,777,031,938 | 0.2 |

| Total Number of Employees | 101,094 | 99,598 | 1.5 |

| Brazil | 89,147 | 87,341 | 2.1 |

| Abroad | 11,947 | 12,257 | (2.5) |

| Total Branches and CSBs – Client Service Branches | 4,231 | 4,335 | (2.4) |

| ATM – Automated Teller Machines (2) | 43,790 | 45,329 | (3.4) |

| (1) Calculated based on the weighted average number of outstanding shares for the period. | |||

| (2) Includes ESBs (electronic service branches) and service points at third-party locations and Banco24Horas ATMs. | |||

| 6 |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The following discussion should be read in conjunction with our audited consolidated financial statements and accompanying notes and other financial information included elsewhere in this Form 6-K and the description of our business in “Item 4. Information on the Company” in our 2021 Form 20-F. The following discussion contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those discussed in forward-looking statements as a result of various factors, including those set forth in “Forward-Looking Statements” herein and in our 2021 Form 20-F.

Results of Operations

The table below presents our summarized consolidated statement of income for the years ended December 31, 2022 and 2021. The interest rates cited are expressed in Brazilian reais and include the effect of the variation of the real against foreign currencies. For more information on the products and services we offer, see “Item 4. Information on the Company” in our 2021 Form 20-F.

Please see our audited consolidated financial statements for further details about our Consolidated Statement of Income.

| Summarized Consolidated Statement of Income | For the years ended December 31, |

Variation | ||

| 2022 | 2021 | R$ million | % | |

| (In millions of R$) | ||||

| Operating revenues | 144,857 | 126,374 | 18,483 | 14.6 |

| Net interest income(1) | 87,211 | 75,209 | 12,002 | 16.0 |

| Non-interest income(2) | 57,646 | 51,165 | 6,481 | 12.7 |

| Expected loss from financial assets and claims | (29,287) | (14,379) | (14,908) | 103.7 |

| Other operating income (expenses) | (78,037) | (69,764) | (8,273) | 11.9 |

| Net income before income tax and social contribution | 37,533 | 42,231 | (4,698) | (11.1) |

| Current and deferred income and social contribution taxes | (6,796) | (13,847) | 7,051 | (50.9) |

| Net income | 30,737 | 28,384 | 2,353 | 8.3 |

| Net income attributable to owners of the parent company | 29,702 | 26,760 | 2,942 | 11.0 |

| (1) Includes: | ||||

| (i) interest and similar income (R$190,273 million and R$129,253 million in the years ended December 31, 2022 and 2021, respectively); (ii) interest and similar expenses (R$(138,515) million and R$(69,305) million in the years ended December 31, 2022 and 2021, respectively); (iii)income of financial assets and liabilities at fair value through profit or loss (R$34,173 million and R$16,678 million in the years ended December 31, 2022 and 2021, respectively); and (iv) foreign exchange results and exchange variations in foreign transactions (R$1,280 million and R$(1,417) million in the years ended December 31, 2022 and 2021, respectively). | ||||

| (2) Includes commissions and banking fees, Income from insurance and private pension operations before claim and selling expenses and other income. | ||||

Year ended December 31, 2022, compared to year ended December 31, 2021.

Net income attributable to owners of the parent company increased by 11.0% to R$29,702 million for the year ended December 31, 2022, from R$26,760 million for the same period of 2021. This is mainly due to a 14.6%, or R$18,483 million, increase in operating revenues, offset by a 103.7%, or R$14,908 million, increase in expected loss from financial assets and claims. These line items are further described below:

Net interest income increased by R$12,002 million, or 16.0%, for the year ended December 31, 2022, compared to the same period of 2021, mainly due to increases in the following line items (i) R$61,020 million in interest and similar income, mainly due to increases of R$24,055 million in loan operations income and R$15,655 million in income from securities purchased under agreements to resell; and (ii) R$17,495 million in income of financial assets and liabilities at fair value through profit or loss. These increases were largely offset by (i) an increase of R$69,210 million in interest and similar expenses, mainly due to an increase of R$31,866 million in deposits; (ii) an increase of R$19,764 million in securities sold under repurchase agreements; and (iii) R$16,635 million in financial expense from technical provisions for insurance and private pension.

| 7 |

Brazilian tax legislation provides for gains and losses arising from exchange rate variations on permanent foreign investments to be included in the tax calculation basis, based on their nature, as well as foreign-exchange variations on the hedged portions of foreign investments which, according to Law No. 14,031 of July 28, 2020, must be included in the proportion of 50% in 2021 and 100% from 2022 onwards. Our investments abroad with risk coverage had their hedges 100% adjusted on December 31, 2021, in accordance with Law No. 14,031 of July 28, 2020. Accordingly, the depreciation of the real against foreign currencies, especially the U.S. dollar, generates losses on our hedging instruments abroad. Conversely, the appreciation of the real against foreign currencies, generates gains on our hedging instruments abroad. This affected our tax expenses recorded in the line items “current and deferred income and social contribution taxes” and “other operating income (expenses).” The nominal appreciation of the real against the U.S. dollar was 6.5% comparing December 31, 2022 with December 31, 2021, and the nominal depreciation of the real against the U.S. dollar was 7.4% comparing December 31, 2021 with December 31, 2020.

The fiscal effect on the hedging instruments for our investments abroad and other resulted in a gain of R$3,257 million for the year ended December 31, 2022, compared to a gain of R$2,838 million for the same period of 2021.

Considering the fiscal effect on the hedging instruments for our investments abroad mentioned above in current and deferred income and social contribution taxes and tax expenses, net interest income increased by R$12,421 million for the year ended December 31, 2022, compared to the same period of 2021.

| o | Interest and similar income increased by 47.2% for the year ended December 31, 2022, compared to the same period of 2021, due to the positive effect of the growth of our loan portfolio, associated with the gradual change in the mix of products to loans to the Retail Business segment. As of December 31, 2022, the SELIC rate was 13.75% per annum compared to 9.25% per annum as of December 31, 2021. |

| o | Interest and similar expenses increased by 99.9% for the year ended December 31, 2022 compared to the same period of 2021, due to increases in the following items: (i) R$31,866 million in expenses from deposits, especially in time deposits; (ii) R$19,764 million in expenses from securities sold under repurchase agreements; and (iii) R$16,635 million in expenses from technical provisions for insurance and private pension, due to an increase in private pension plan liabilities and a change in investment funds linked to pension plans, from multimarket to fixed-income, both indexed to the SELIC rate which increased during the period. The increases mentioned above are a result of the increase in interest rates and the increase in the volume of our operations. |

Please see “Note 21 – Interest and similar income and expenses and income of financial assets and liabilities at fair value through profit or loss” to our audited consolidated financial statements for further details on interest and similar expenses.

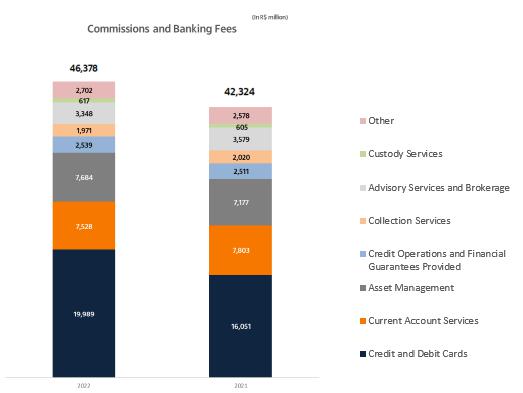

Non-interest income increased by 12.7% to R$6,481 million for the year ended December 31, 2022 compared to the same period of 2021. This increase was mainly due to (i) a 9.6%, or R$4,054 million, increase in commissions and banking fees, due to the higher transaction volume from credit and debit cards, both in the issuance and in the acquiring segment; and (ii) a 52.9%, or R$1,843 million, increase in other income, due to the corporate reorganization of Câmara Interbancária de Pagamentos, or CIP, to a new company, CIP S.A.

The following chart shows the main components of our banking service fees for the years ended December 31, 2022, and 2021:

| 8 |

Please see “Note 22 – Commissions and Banking Fees” to our audited consolidated financial statements for further details on banking service fees.

Expected Loss from Financial Assets and Claims

Our expected loss from financial assets and claims increased by R$14,908 million, or 103.7%, for the year ended December 31, 2022, compared to the same period of 2021, mainly due to an increase in expected loss with loan and lease operations of R$14,149 million for the year ended December 31, 2022, compared to the same period of 2021. This increase was due to (i) the growth of our credit portfolio, and (ii) a subsequent event related to a specific case in the large companies segment, for which we recorded a provision for loan losses to cover 100% of the exposure of R$1.3 billion (R$719 million, net of taxes) as of December 31, 2022.

Please see “Note 10 — Loan and Lease operations” to our audited consolidated financial statements for further details on our loan and lease operations portfolio.

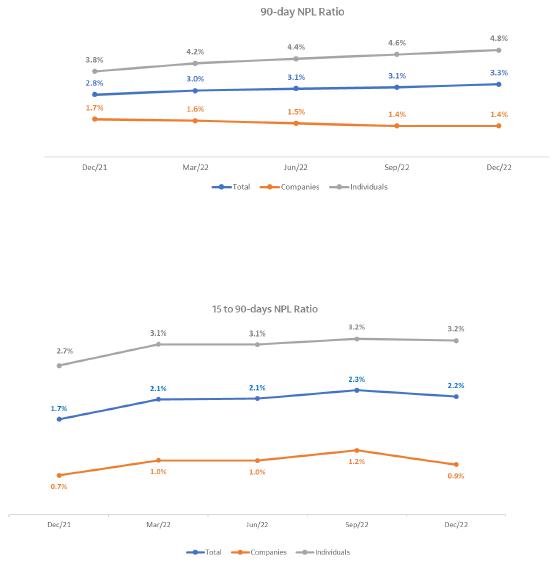

| o | Non-performing loans: We calculate our 90-day non-performing loan or NPL ratio as the value of our 90-days non-performing loans to our loan portfolio. |

As of December 31, 2022, our 90-day NPL ratio was 3.3%, an increase of 50 basis points compared to December 31, 2021. This increase was due to the increase of 100 basis points in the 90-day NPL ratio in respect of our individuals loan portfolio, with higher delinquency rates for individuals in Brazil, especially in our credit card, personal loan and vehicle financing portfolios, which were partially offset by a decrease of 30 basis points in our companies loan portfolio. In the fourth quarter of 2022, we recorded sales of active portfolios with no risk retention to non-related companies. From these sales, R$278 million refer to active loans that were more than 90 days overdue, of which R$158 million would still be an active portfolio at the end of 2022 if not sold. Additionally, we sold R$296 million which refer to active portfolios non-overdue or with short delinquency that did not have a material impact on delinquency ratios. In addition, we sold an active and not overdue portfolio of R$773 million from a specific client of the corporate segment with no impact on our delinquency ratios.

We calculate our 15 to 90 days non-performing loan ratio as the value of our 15 to 90 days non-performing loans to our loan portfolio. The 15 to 90 days NPL ratio is an indicator of early delinquency.

| 9 |

As of December 31, 2022, our 15 to 90 days NPL ratio was 2.2%, an increase of 50 basis points when compared to December 31, 2021. During this period our 15 to 90-day NPL ratio increased by 50 basis points in the 15 to 90-day NPL ratio of our individuals loan portfolio, which is returning to its pre-pandemic levels, mainly due to higher delinquency rates in the credit card, personal loan and vehicle financing portfolios, and increased by 20 basis points in respect of our companies loan portfolio, as of December 31, 2022 compared to December 31, 2021.

The chart below shows a comparison of both NPL ratios for each quarter as of December 31, 2021, through December 31, 2022:

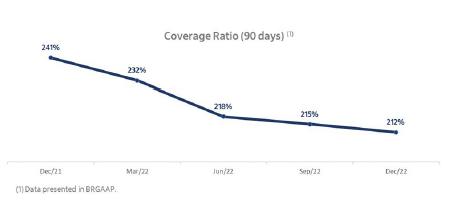

| o | Coverage ratio (90 days): We calculate our coverage ratio as provisions for expected losses to 90-day non-performing loans. As of December 31, 2022, our coverage ratio in accordance with accounting practices adopted in Brazil applicable to institutions authorized to operate by the Central Bank, or BRGAAP, was 212% compared to a ratio of 241% as of December 31, 2021. This decrease was mainly due to an increase in NPL 90-day loans, concentrated in the individual’s segment in Brazil and driven by the expansion of our loan portfolio, especially in the Retail Business segment. |

The chart below shows a comparison in the coverage ratios for each quarter as of December 31, 2021, through December 31, 2022:

| 10 |

Other Operating Income (Expenses) increased by 11.9% to an expense of R$78,037 million for the year ended December 31, 2022, from an expense of R$69,764 million for the same period of 2021. This increase was mainly due to the R$6,615 million, or 10.6%, increase in our general and administrative expenses for the year ended December 31, 2022. This increase was due to: (i) the effects of the annual collective wage agreement, the growth in the number of employees, in addition to the increase in profit sharing expenses; (ii) higher expenses with credit card reward programs; (iii) expenses with tax and social security provisions, and media marketing campaigns.

Please see “Note 23 – General and Administrative Expenses” to our audited consolidated financial statements for further details.

Current and deferred income and social contribution taxes amounted to an expense of R$6,796 million for the year ended December 31, 2022, from an expense of R$13,847 million in the year ended December 31, 2021.

This was partially due to the fiscal effect on the hedging instruments for our investments abroad, as mentioned in “Net interest income,” which amounted to a gain of R$3,215 million for the year ended December 31, 2022, compared to a gain of R$2,549 million for the same period of 2021. Disregarding this fiscal effect, current and deferred income and social contribution taxes decreased by R$6,385 million during this period.

Please see “Note 24 – Taxes” to our audited consolidated financial statements for further details.

Basis for Presentation of Segment Information

We maintain segment information based on reports used by senior management to assess the financial performance of our businesses and to make decisions regarding the allocation of funds for investment and other purposes.

Segment information is not prepared in accordance with IFRS issued by the IASB but based on BRGAAP. It also includes the following adjustments: (i) the recognition of the impact of capital allocation using a proprietary model; (ii) the use of funding and cost of capital at market prices, using certain managerial criteria; (iii) the exclusion or inclusion of extraordinary items from our results; and (iv) the reclassification of the tax effects from hedging transactions we enter into for our investments abroad.

Extraordinary items correspond to relevant events (with a positive or negative accounting effect) identified in our results of operations for each relevant period. We apply a historically consistent methodology (approved by our governance procedures) pursuant to which relevant events are either not related to our core operations or are related to previous fiscal years. The provisions for restructuring are extraordinary items and, as such, do not impact the results and analysis regarding our segment information below.

| 11 |

For more information on our segments, see “Item 4. Information on the Company” in our 2021 Form 20-F and “Note 30 – Segment Information” to our audited consolidated financial statements.

The table below sets forth the summarized results from our operating segments for the year ended December 31, 2022:

| Summarized

Consolidated Statement of Income from January 1, 2022 to December 31, 2022(1) |

Retail Business (a) |

Wholesale

Business (b) |

Activities

with the Market + Corporation (c) |

Total (a)+(b)+(c) |

Adjustments | IFRS consolidated(2) |

| (In millions of R$) | ||||||

| Operating revenues | 90,509 | 49,229 | 2,983 | 142,721 | 2,136 | 144,857 |

| Cost of Credit | (29,908) | (2,392) | - | (32,300) | 4,563 | (27,737) |

| Claims | (1,538) | (11) | - | (1,549) | (1) | (1,550) |

| Other operating income (expenses) | (43,512) | (19,482) | (374) | (63,368) | (14,669) | (78,037) |

| Income tax and social contribution | (4,594) | (9,076) | (14) | (13,684) | 6,888 | (6,796) |

| Non-controlling interest in subsidiaries | 45 | (825) | (254) | (1,034) | (1) | (1,035) |

| Net income | 11,002 | 17,443 | 2,341 | 30,786 | (1,084) | 29,702 |

| (1)

The first three columns are our business segments. Additional information about each of our business segments can be found below

under the headings "(a) Retail Business", "(b) Wholesale Business" and "(c) Activities with the Market +

Corporation". The adjustments column includes the following pro forma adjustments: (i) the recognition of the impact of capital allocation using a proprietary model; (ii) the use of funding and cost of capital at market prices, using certain managerial criteria; (iii) the exclusion of non-recurring events from our results; and (iv) the reclassification of the tax effects from hedging transactions we enter into for our investments abroad. The IFRS consolidated column is the total result of our three segments plus adjustments. (2) The IFRS Consolidated figures do not represent the sum of the parties because there are intercompany transactions that were eliminated only in the consolidated statements. Segments are assessed by top management, net of income and expenses between related parties. | ||||||

The following discussion should be read in conjunction with our audited consolidated financial statements, especially “Note 30 – Segment Information.” The adjustments column shown in this note shows the effects of the differences between the segmented results (substantially in accordance with BRGAAP) and those calculated according to the principles adopted in our audited consolidated financial statements in IFRS as issued by the IASB.

Year ended December 31, 2022, compared to the year ended December 31, 2021:

| (a) | Retail Business |

This segment consists of business with retail customers, account holders and non-account holders, individuals and legal entities, high income clients (Itaú Uniclass and Personnalité) and the companies segment (microenterprises and small companies). It includes financing and credit assignments made outside the branch network, in addition to credit cards and payroll loans.

The following table sets forth our summarized consolidated statement of income with respect to our Retail Business segment for the years ended December 31, 2022, and 2021:

| 12 |

| Summarized Consolidated Statement of Income - Retail Business | For the years ended December 31, |

Variation | ||

| 2022 | 2021 | R$ million | % | |

| (In millions of R$) | ||||

| Operating revenues | 90,509 | 75,443 | 15,066 | 20.0 |

| Interest margin | 54,881 | 43,042 | 11,839 | 27.5 |

| Non-interest income (1) | 35,628 | 32,401 | 3,227 | 10.0 |

| Cost of credit and claims | (31,446) | (19,869) | (11,577) | 58.3 |

| Other operating income (expenses) | (43,512) | (40,116) | (3,396) | 8.5 |

| Income tax and social contribution | (4,594) | (5,593) | 999 | (17.9) |

| Non-controlling interest in subsidiaries | 45 | (330) | 375 | (113.6) |

| Net income | 11,002 | 9,535 | 1,467 | 15.4 |

| (1) Non-interest income include: commissions and banking fees; income from insurance and private pension operations before claim and selling expenses and other revenues. | ||||

Net income from our Retail Business segment increased by 15.4%, to R$11,002 million for the year ended December 31, 2022, from R$9,535 million for the same period of 2021. These results are explained as follows:

Operating revenues: increased by R$15,066 million for the year ended December 31, 2022, compared to the same period of 2021, due to an increase of 27.5% in interest margin, as a result of a higher volume of credit lines and the effect of the mix of products. Moreover, non-interest income increased by 10.0% in the year ended December 31, 2022, compared to the same period of 2021, driven by the increase in commissions and fees, mainly driven by the increase in card-issuing activities due to the higher transaction volume in credit cards and the increase in acquiring revenues, due to the higher transaction volume from credit cards and higher gains from “flex” products offered as part of our merchant services (advance payment of card receivables by the acquirer). Revenues from insurance also increased, driven by the increase in earned premiums and revenues from premium bonds.

Cost of credit and claims increased by R$11,577 million for the year ended December 31, 2022, compared to the same period of 2021, due to an increase in provisions for loan losses, driven by the increased origination in consumer credit and unsecured credit products.

Other operating income (expenses) increased by R$3,396 million for the year ended December 31, 2022, compared to the same period of 2021, mainly due to (i) higher personnel expenses, as a result of the annual collective wage agreement and the increase in the number of employees in the period; and (ii) higher administrative expenses, due to the increase in expenses with facilities, materials, marketing campaigns in the media, third-party services, depreciation and amortization.

Income tax and social contribution for the Retail Business segment, as well as for the Wholesale Business segment and Activities with the Market + Corporation segment, is calculated by adopting the full income tax rate, net of the tax effect of any payment of interest on capital. The difference between the income tax amount determined for each business segment and the effective income tax amount, as stated in our audited consolidated financial statements, is recorded under the Activities with the Market + Corporation segment. As discussed above under “Net income attributable to owners of the parent company - Current and deferred income and social contribution taxes,” our current and deferred income and social contribution taxes increased mainly as a result of an increase in income before tax and social contribution.

| 13 |

(b) Wholesale Business

This business segment consists of products and services offered to middle-market companies, high net worth clients (Private Banking), and the operation of Latin American units and Itaú BBA, which is the unit responsible for business with large companies and investment banking operations.

The following table sets forth our summarized consolidated statement of income with respect to our Wholesale Business segment for the years ended December 31, 2022, and 2021:

| Summarized Consolidated Statement of Income - Wholesale Business | For the years ended December 31, |

Variation | ||

| 2022 | 2021 | R$ million | % | |

| (In millions of R$) | ||||

| Operating revenues | 49,229 | 38,228 | 11,001 | 28.8 |

| Interest margin | 34,701 | 24,005 | 10,696 | 44.6 |

| Non-interest income (1) | 14,528 | 14,223 | 305 | 2.1 |

| Cost of credit and claims | (2,403) | (1,965) | (438) | 22.3 |

| Other operating income (expenses) | (19,482) | (17,743) | (1,739) | 9.8 |

| Income tax and social contribution | (9,076) | (6,799) | (2,277) | 33.5 |

| Non-controlling interest in subsidiaries | (825) | (591) | (234) | 39.6 |

| Net income | 17,443 | 11,130 | 6,313 | 56.7 |

| (1) Non-interest income include: commissions and banking fees; income from insurance and private pension operations before claim and selling expenses and other revenues. | ||||

Net income from the Wholesale Business segment increased by 56.7%, to R$17,443 million for the year ended December 31, 2022 from R$11,130 million for the same period of 2021. These results are explained as follows:

Operating revenues: increased by R$11,002 million, or 28.8%, for the year ended December 31, 2022 compared to the same period of 2021, due to an increase of 44.6% in the interest margin, driven by the higher volume of credit operations and the higher margin of liabilities recorded during the period. As of December 31, 2022, we participated in 340 local operations, which included debentures, promissory notes and securitization transactions, totaling R$106.2 billion, ranking first in volume and in number of operations pursuant to a ranking published by ANBIMA – Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais, or the Brazilian Financial and Capital Markets Association. In international fixed income, we ranked first in operations as of December 31, 2022, totaling 8 operations and over R$3.0 billion in volume by Dealogic’s ranking. In the equity markets, we ranked first in operations, participated in 19 operations (including Block Trades) with a volume of R$8.5 billion, ranking second in Dealogic´s ranking, as of December 31, 2022. We also provided financial advisory services for 45 M&A transactions in Brazil, totaling R$84.0 billion and were ranked second place in number of M&A deals and first place in volume by Dealogic’s ranking, as of December 31, 2022.

Cost of credit and claims increased by R$438 million for the year ended December 31, 2022 compared to the same period of 2021, due to a subsequent event to the date of the report related to the provision for a specific case in the corporate segment that filed for judicial reorganization.

Income tax and social contribution for this business segment, as well as for the Retail Business and Activities with the Market + Corporation segments, is calculated by adopting the full income tax rate, net of the tax effect of any payment of interest on capital. The difference between the income tax amount determined for each segment and the effective income tax amount, as stated in our audited consolidated financial statements, is recorded under the Activities with the Market + Corporation segment. As discussed above, our current and deferred income and social contribution taxes increased mainly due to an increase in income before tax and social contribution.

| 14 |

(c) Activities with the Market + Corporation

This segment consists of results from capital surplus, subordinated debt surplus and the net balance of tax credits and debits. It also includes the financial margin on market trading, treasury operating costs, and equity in earnings of companies not included in either of the other segments.

The following table sets forth our summarized consolidated statement of income with respect to our Activities with the Market + Corporation segment for the years ended December 31, 2022, and 2021:

| Summarized Consolidated Statement of Income - Activities with the Market + Corporation | For the years ended December 31, |

Variation | ||

| 2022 | 2021 | R$ million | % | |

| (In millions of R$) | ||||

| Operating revenues | 2,983 | 11,930 | (8,947) | (75.0) |

| Interest margin | 2,979 | 11,099 | (8,120) | (73.2) |

| Non-interest income (1) | 4 | 831 | (827) | (99.5) |

| Other operating income (expenses) | (374) | (1,055) | 681 | (64.5) |

| Income tax and social contribution | (14) | (3,997) | 3,983 | (99.6) |

| Non-controlling interest in subsidiaries | (254) | (664) | 410 | (61.7) |

| Net income | 2,341 | 6,214 | (3,874) | (62.3) |

| (1) Non-interest income include: commissions and banking fees; income from insurance and private pension operations before claim and selling expenses and other revenues. | ||||

Net income from the Activities with the Market + Corporation segment decreased by R$3,874 million, or 62.3%, for the year ended December 31, 2022, compared to the same period of 2021. We recorded a decrease in interest margin, mainly due to the negative effects of the hedge transactions during the period. In addition, our net income was affected by the spin-off of our equity interest held in XP, Inc. at the end of May 2021.

Income tax and social contribution for this segment, as well as for the Retail Business and Wholesale Business segments, is calculated by adopting the full income tax rate, net of the tax effect of any payment of interest on capital. The difference between the income tax amount determined for each segment and the effective income tax amount, as stated in our audited consolidated financial statements, is recorded under the Activities with the Market + Corporation segment. As discussed above, our current and deferred income and social contribution taxes increased mainly due to an increase in income before tax and social contribution.

Balance Sheet

The table below sets forth our summarized balance sheet as of December 31, 2022 and December 31, 2021. Please see our audited consolidated financial statements for further details about our Consolidated Balance Sheet.

| 15 |

| Summarized Balance Sheet - Assets | As of | Variation | ||||

| December 31, 2022 | December 31, 2021 | R$ million | % | |||

| (In millions of R$) | ||||||

| Cash | 35,381 | 44,512 | (9,131) | (20.5) | ||

| Financial assets at amortized cost | 1,586,992 | 1,375,782 | 211,210 | 15.4 | ||

| Compulsory deposits in the Central Bank of Brazil | 115,748 | 110,392 | 5,356 | 4.9 | ||

| Interbank deposits, securities purchased under agreements to resell and securities at amortized cost | 500,686 | 387,406 | 113,280 | 29.2 | ||

| Loan and lease operations portfolio | 909,422 | 822,590 | 86,832 | 10.6 | ||

| Other financial assets | 111,823 | 96,473 | 15,350 | 15.9 | ||

| (-) Provision for Expected Loss | (50,687) | (41,079) | (9,608) | 23.4 | ||

| Financial assets at fair value through other comprehensive income | 121,052 | 105,622 | 15,430 | 14.6 | ||

| Financial assets at fair value through profit or loss | 464,682 | 434,169 | 30,513 | 7.0 | ||

| Investments in associates and join ventures, Fixed assets, Goodwill and Intangible assets, assets held for sale and other assets | 55,853 | 50,688 | 5,165 | 10.2 | ||

| Tax assets | 59,480 | 58,433 | 1,047 | 1.8 | ||

| Total assets | 2,323,440 | 2,069,206 | 254,234 | 12.3 | ||

December 31, 2022, compared to December 31, 2021.

Total assets increased by R$254,234 million, as of December 31, 2022, compared to December 31, 2021, mainly due to an increase in financial assets at amortized cost. This result is further described below:

Financial assets at amortized cost increased by R$211,210 million, or 15.4%, as of December 31, 2022, compared to December 31, 2021, mainly due to an increase in interbank deposits, securities purchased under agreements to resell and securities at amortized cost and loan and lease operations portfolio.

Interbank deposits, securities purchased under agreements to resell, securities at amortized cost increased by R$113,280 million, or 29.2%, as of December 31, 2022 compared to December 31, 2021, mainly due to increases of: (i) R$71,569 million in securities, mainly in Brazilian government securities, rural product note (Cédula do Produtor Rural) and debentures; and (ii) R$52,061 million in securities purchased under agreements to resell.

Please see “Note 4 - Interbank Deposits and Securities Purchased Under Agreements to Resell” and “Note 9 - Financial assets at amortized cost – Securities” to our audited consolidated financial statements for further details.

Loan and lease operations portfolio increased by R$86,832 million, or 10.6%, as of December 31, 2022, compared to December 31, 2021. The increase of R$67,567 million in our individuals loan portfolio, mainly driven by increases of 20.4%, or R$23,046 million in credit cards, and 24.4%, or R$20,609 million in mortgage loans.

| 16 |

| Loan and Lease Operations, by asset type | As of | Variation | ||

| December 31, 2022 | December 31, 2021 | R$ million | % | |

| (In millions of R$) | ||||

| Individuals | 400,103 | 332,536 | 67,567 | 20.3 |

| Credit card | 135,855 | 112,809 | 23,046 | 20.4 |

| Personal loan | 53,945 | 42,235 | 11,710 | 27.7 |

| Payroll loans | 73,633 | 63,416 | 10,217 | 16.1 |

| Vehicles | 31,606 | 29,621 | 1,985 | 6.7 |

| Mortgage loans | 105,064 | 84,455 | 20,609 | 24.4 |

| Corporate | 139,268 | 135,034 | 4,234 | 3.1 |

| Micro/Small and Medium Businesses | 164,896 | 149,970 | 14,926 | 10.0 |

| Foreign Loans Latin America | 205,155 | 205,050 | 105 | 0.1 |

| Total Loan operations and lease operations portfolio | 909,422 | 822,590 | 86,832 | 10.6 |

Please see “Note 10 – Loan and Lease Operations” to our audited consolidated financial statements for further details.

The table below sets forth our summarized balance sheet – liabilities and stockholders’ equity as of December 31, 2022 and December 31, 2021. Please see our audited consolidated financial statements for further details about our Consolidated Balance Sheet.

| Summarized Balance Sheet - Liabilities and Stockholders' Equity | As of | Variation | |||||

| December 31, 2022 | December 31, 2021 | R$ million | % | ||||

| (In millions of R$) | |||||||

| Financial Liabilities | 1,836,690 | 1,621,786 | 214,904 | 13.3 | |||

| At Amortized Cost | 1,755,498 | 1,553,107 | 202,391 | 13.0 | |||

| Deposits | 871,438 | 850,372 | 21,066 | 2.5 | |||

| Securities sold under repurchase agreements | 293,440 | 252,848 | 40,592 | 16.1 | |||

| Interbank market funds, Institutional market funds and other financial liabilities | 590,620 | 449,887 | 140,733 | 31.3 | |||

| At Fair Value Through Profit or Loss | 77,508 | 63,479 | 14,029 | 22.1 | |||

| Provision for Expected Loss | 3,684 | 5,200 | (1,516) | (29.2) | |||

| Provision for insurance and private pensions | 235,150 | 214,976 | 20,174 | 9.4 | |||

| Provisions | 19,475 | 19,592 | (117) | (0.6) | |||

| Tax liabilities | 6,738 | 6,246 | 492 | 7.9 | |||

| Other liabilities | 48,044 | 42,130 | 5,914 | 14.0 | |||

| Total liabilities | 2,146,097 | 1,904,730 | 241,367 | 12.7 | |||

| Total stockholders’ equity attributed to the owners of the parent company | 167,953 | 152,864 | 15,089 | 9.9 | |||

| Non-controlling interests | 9,390 | 11,612 | (2,222) | (19.1) | |||

| Total stockholders’ equity | 177,343 | 164,476 | 12,867 | 7.8 | |||

| Total liabilities and stockholders' equity | 2,323,440 | 2,069,206 | 254,234 | 12.3 | |||

Total liabilities and stockholders’ equity increased by R$254,234 million, as of December 31, 2022, compared to December 31, 2021, mainly due to an increase in interbank market funds, institutional market funds and other financial liabilities, securities sold under repurchase agreements, and deposits. These results are detailed as follows:

| 17 |

Deposits increased by R$21,066 million as of December 31, 2022, compared to December 31, 2021, mainly due to an increase of R$67,164 million in time deposits, partially offset by a decrease of R$40,529 million in demand deposits.

Please see “Note 15 – Deposits” to our audited consolidated financial statements for further details.

Securities sold under repurchase agreements increased by R$40,592 million, or 16.1%, as of December 31, 2022, compared to December 31, 2021, mainly due to an increase of R$22,414 million in right to sell or repledge the collateral, and an increase of R$22,339 million in assets received as collateral.

Interbank market funds, institutional market funds and other financial liabilities increased by R$140,733 million, or 31.3%, as of December 31, 2022 compared to December 31, 2021, mainly due to an increase of R$117,442 million in interbank market funds, as a result of the following increases: (i) R$42,546 million in financial bills; (ii) R$37,031 million in real estate bills; and (iii) R$22,582 million in rural credit bills.

Please see “Note 17 – Securities Sold Under Repurchase Agreements and Interbank and Institutional Market Funds” to our audited consolidated financial statements for further details.

Capital Management

Capital Adequacy

Through our ICAAP, we assess the adequacy of our capital to face the risks to which we are subject. For ICAAP, capital is composed of regulatory capital for credit, market and operational risks, and by the necessary capital to cover other risks.

In order to ensure our capital soundness and availability to support business growth, we maintain capital levels above the minimum requirements, according to the Common Equity Tier I, Additional Tier I Capital, and Tier II minimum ratios.

Our Total Capital, Tier I Capital and Common Equity Tier I Capital ratios are calculated on a consolidated basis, applied to institutions included in our Prudential Conglomerate which comprises not only financial institutions but also consortia (consórcios), payment entities, factoring companies or companies that directly or indirectly assume credit risk, and investment funds in which our Itaú Unibanco Group retains substantially all risks and rewards.

| 18 |

| As of December 31, | As of December 31, | |

| 2022 | 2021 | |

| (In R$ million, except percentages) | ||

| Available capital (amounts) | ||

| Common Equity Tier I (CET I) | 147,781 | 130,716 |

| Tier I | 166,868 | 149,912 |

| Total capital | 185,415 | 169,797 |

| Risk-weighted assets (amounts) | ||

| Total risk-weighted assets (RWA) | 1,238,582 | 1,153,841 |

| Risk-based capital ratios as a percentage of RWA | ||

| Common Equity Tier I ratio (%) | 11.9% | 11.3% |

| Tier I ratio (%) | 13.5% | 13.0% |

| Total capital ratio (%) | 15.0% | 14.7% |

| Additional CET I buffer requirements as a percentage of RWA | ||

| Capital conservation buffer requirement (%) (1) | 2.5% | 2.0% |

| Countercyclical buffer requirement (%)² | 0.0% | 0.0% |

| Bank G-SIB and/or D-SIB additional requirements (%) | 1.0% | 1.0% |

| Total of bank CET I specific buffer requirements (%) | 3.5% | 3.0% |

| 1) For purposes of calculating the Conservation capital buffer, BACEN Resolution 4,783 establishes, for defined periods, percentages to be applied to the RWA value with a gradual increase until April/22, when it reaches 2.5%. | ||

| 2) The countercyclical capital buffer is fixed by the Financial Stability Committee and currently is set to zero. | ||

As of December 31, 2022, our Total Capital reached R$185,415 million, an increase of R$15,618 million compared to December 31, 2021. Our Basel Ratio (calculated as the ratio between our Total Capital and the total amount of RWA) reached 15.0%, as of December 31, 2022, an increase of 30 basis points compared to 14.7% as of December 31, 2021, mainly due to the income for the period offset by the increase in credit risk-weighted assets and the prudential and equity adjustments.

Additionally, the Fixed Assets Ratio (Índice de Imobilização) indicates the level of total capital committed to adjusted permanent assets. Itaú Unibanco Holding is within the maximum limit of 50% of the adjusted total capital, as established by the Central Bank. As of December 31, 2022, our Fixed Assets Ratio reached 19.9%, which presents a buffer of R$55,748 million.

Our Tier I ratio increased 30 basis points in relation to September 30, 2022 driven by the net income for the period, and the prudential and equity adjustments, partially offset by the higher volume of credit risk-weighted assets.

Please see “Note 32 – Risk and Capital Management” of our audited consolidated financial statements for further details about regulatory capital.

| 19 |

Liquidity Ratios

The Basel III Framework introduced global liquidity standards, providing for minimum liquidity requirements and aims to ensure that banks can rely on their own sources of liquidity, leaving central banks as a lender of last resort. Basel III provides for two liquidity ratios to ensure that financial institutions have sufficient liquidity to meet their short-term and long-term obligations: (i) the liquidity coverage ratio, or LCR, and (ii) the net stable funding ratio, or NSFR.

We believe that the LCR and NSFR provide more relevant information than an analysis of summarized cash flows.

We present below a discussion of our LCR for the average of the three-month period ended on December 31, 2022, and NSFR as of December 31, 2022.

Liquidity Coverage Ratio

The LCR measures the short-term resistance of a bank’s liquidity risk profile. It is the ratio of the stock of high-quality liquid assets to expected net cash outflows over the next 30 days, assuming a scenario of idiosyncratic or systemic liquidity stress.

We calculate our LCR according to the methodology established in Central Bank Circular No. 3,749, of March 5, 2015. We measure our total high liquidity assets for the end of each period to cash outflows and inflows as the daily average value for each period. Pursuant to Central Bank regulations, effective as of January 1, 2019, the minimum LCR is 100%.

| Three-months period ended, | ||

| Liquidity Coverage Ratio | December 31, 2022 | December 31,2021 |

| Total Weighted Value (average) | ||

| (In millions of R$) | ||

| Total High Liquidity Assets (HQLA)1 | 325,269 | 307,280 |

| Cash Outflows2 | 361,902 | 341,053 |

| Cash Inflows3 | 164,104 | 147,960 |

| Total Net Cash Outflows | 197,797 | 193,093 |

| LCR% | 164.4% | 159.1% |

| (1) High Quality Liquidity Assets correspond to inventories, in some cases weighted by a discount factor, of assets that remain liquid in the market even in periods of stress, that can easily be converted into cash and that are classified as low risk. | ||

| (2) Outflows — total potential cash outflows for a 30-day horizon, calculated for a standard stress scenario as defined by BACEN Circular 3,749. | ||

| (3) Inflows — total potential cash inflows for a 30-day horizon, calculated for a standard stress scenario as defined by BACEN Circular 3,749. | ||

Our average LCR as of December 31, 2022, was 164.4% and, accordingly, above the Central Bank requirements.

Net Stable Funding Ratio

The NSFR measures long-term liquidity risk. It is the ratio of available stable funding to required stable funding over a one-year time period, assuming a stressed scenario.

We calculate our NSFR according to the methodology established in Central Bank Circular No. 3,869, of December 19, 2017. The NSFR corresponds to the ratio of our available stable funds, or ASF, for the end of each period to our required stable funds, or RSF for the end of each period.

| 20 |

Pursuant to Central Bank regulations, effective as of October 1, 2018, the minimum NSFR is 100%.

| As of December 31, | As of December 31, | |

| Net Stable Funding Ratio | 2022 | 2021 |

| Total Ajusted Value | ||

| (In millions of R$) | ||

| Total Available Stable Funding (ASF)¹ | 1,151,750 | 1,016,989 |

| Total Required Stable Funding (RSF)² | 922,395 | 839,830 |

| NSFR (%) | 124.9% | 121.1% |

| (1) ASF – Available Stable Funding – refers to liabilities and equity weighted by a discount factor according to their stability, pursuant to Central Bank Circular 3,869/2017. | ||

(2) RSF – Required Stable Funding – refers to assets and off-balance exposures weighted by a discount factor to their necessity, pursuant to Central Bank Circular 3,869/2017.

| ||

As of December 31, 2022, our ASF totaled R$1,151.8 billion, mainly due to capital and Retail Business and Wholesale Business funding, and our RSF totaled R$922.4 billion, particularly due to loans and financings with wholesale business and retail business customers, central governments and transactions with central banks.

As of December 31, 2022, our NSFR was 124.9% and, accordingly, above Central Bank requirements.

Liquidity and Capital Resources

We define our consolidated group operational liquidity reserve as the total amount of assets that can be rapidly turned into cash, based on local market practices and legal restrictions. The operational liquidity reserve generally includes: (i) cash and deposits on demand, (ii) funded positions of securities purchased under agreements to resell and (iii) unencumbered government securities.

The following table presents our operational liquidity reserve as of December 31, 2022 and 2021:

| Operational Liquidity Reserve | As of December 31, | 2022 Average Balance(1) | |

| 2022 | 2021 | ||

| (In millions of R$) | |||

| Cash | 35,381 | 44,512 | 38,371 |

| Securities purchased under agreements to resell – Funded position (2) | 34,373 | 32,436 | 43,954 |

| Unencumbered government securities (3) | 189,279 | 152,099 | 164,887 |

| Operational reserve | 259,033 | 229,047 | 247,212 |

| (1) Average calculated based on audited financial statements. | |||

| (2) Net of R$ 14.576 (R$ 9.266 at 12/31/2021), which securities are restricted to guarantee transactions at B3 S.A.—Brasil, Bolsa Balcão (B3) and the Central Bank. | |||

| (3) Present values are included as a result of the change in the reporting of future flows of assets that are now reported as future value as of September 2016. | |||

Our main sources of funding are interest-bearing deposits, deposits received under repurchase agreements, on lending from government financial institutions, lines of credit with foreign banks and the issuance of securities abroad.

Please see “Note 15 – Deposits” to our audited consolidated financial statements for further details about funding.

Capital Expenditures

| 21 |

According to our practice over the last few years, our capital expenditures in the year ended December 31, 2022, were funded with internal resources. We cannot provide assurance that we will make capital expenditures in the future and, if made, that the amounts will correspond to the current estimates. The table below presents our capital expenditures for the years ended December 31, 2022 and 2021:

| For the year ended | Variation | |||

| Capital Expenditures | December 31, 2022 | December 31, 2021 | 2022 - 2021 | |

| (In millions of R$, except percentages) | ||||

| Fixed Assets | 2,727 | 1,414 | 1,313.0 | 92.9% |

| Fixed assets under construction | 905 | 710 | 195 | 27.5% |

| Land and buildings | 8 | 25 | (17) | -68.0% |

| Leasehold improvements | 56 | 106 | (50) | -47.2% |

| Furniture and equipment, installations and data processing systems | 1,710 | 532 | 1,178 | 221.4% |

| Other | 48 | 41 | 7 | 17.1% |

| Intangible Assets | 5,768 | 7,667 | (1,899) | -24.8% |

| Association for the promotion and offer of financial products and services | 0 | 5 | (5) | -100.0% |

| Software acquired and internally developed software | 4,727 | 4,249 | 478 | 11.2% |

| Other intangibles | 1,041 | 3,413 | (2,372) | -69.5% |

| Total | 8,495 | 9,081 | (586) | -6.5% |

Please see “Note 14 – Goodwill and Intangible Assets” to our audited consolidated financial statements for details about our capital expenditures.

Capitalization

The table below presents our capitalization as of December 31, 2022. The information described is derived from our audited consolidated financial statements as of and for the year ended December 31, 2022. As of the date of this Form 6-K, there has been no material change in our capitalization since December 31, 2022.

| 22 |

| Capitalization | As of December 31, 2022 | |

| R$ | US$ (1) | |

| (In millions, except percentages) | ||

| Current liabilities | ||

| Deposits | 498,803 | 95,598 |

| Securities sold under repurchase agreements | 270,798 | 51,900 |

| Structured notes | 2 | 0 |

| Derivatives | 42,116 | 8,072 |

| Interbank market funds | 137,428 | 26,339 |

| Institutional market funds | 20,731 | 3,973 |

| Other financial liabilities | 162,426 | 31,130 |

| Provision for insurance and private pension | 3,747 | 718 |

| Provisions | 4,715 | 904 |

| Tax liabilities | 2,950 | 565 |

| Other Non-financial liabilities | 43,603 | 8,357 |

| Total | 1,187,319 | 227,556 |

| Non-current liabilities | ||

| Deposits | 372,635 | 71,417 |

| Securities sold under repurchase agreements | 22,642 | 4,339 |

| Structured notes | 62 | 12 |

| Derivatives | 34,745 | 6,659 |

| Interbank market funds | 157,159 | 30,120 |

| Institutional market funds | 108,651 | 20,824 |

| Other financial liabilities | 4,808 | 921 |

| Provision for insurance and private pension | 231,403 | 44,350 |

| Provision for Expected Loss | 3,684 | 706 |

| Provisions | 14,760 | 2,829 |

| Tax liabilities | 3,443 | 660 |

| Other Non-financial liabilities | 4,441 | 851 |

| Total | 958,433 | 183,689 |

| Income tax and social contribution - deferred | 345 | 66 |

| Non-controlling interests | 9,390 | 1,800 |

| Stockholders’ equity attributed to the owners of the parent company (2) | 167,953 | 32,189 |

| Total capitalization (3) | 2,323,440 | 445,300 |

| BIS ratio (4) | 15.0% | |

| (1) Convenience translation at 5.2177 reais per U.S. dollar, the exchange rate in effect on December 31, 2022. | 5 | |

| (2) Itaú Unibanco Holding’s authorized and outstanding share capital consists of 4,958,290,359 common shares and 4,842,576,301 preferred shares, all of which are fully paid. For more information regarding our share capital see Note 19 to our audited consolidated financial statements as of and for the period ended December 31, 2022. | ||

| (3) Total capitalization corresponds to the sum of total current liabilities, long-term liabilities, deferred income, minority interest in subsidiaries and stockholders’ equity. | ||

| (4) Calculated by dividing total regulatory capital by risk weight assets. | ||

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements, other than the guarantees, financial guarantees, commitments to be released, letters of credit to be released and contractual commitments that are described in “Note 13 - Fixed assets,” “Note 14 - Goodwill and Intangible assets,” “Note 32 – Risk and Capital Management, I.I – Collateral and policies for mitigating credit risk” and “Note 32 – Risk and Capital Management – I.IV – Maximum Exposure of Financial Assets to Credit Risk” to our audited consolidated financial statements.

| 23 |

REGULATORY RECENT DEVELOPMENTS

We are subject to the regulation and supervision of various regulatory entities in the segments we operate. The supervision of these entities is essential to the structure of our business and directly impacts our growth strategies. Below we describe the main public consultations, resolutions, rules, or laws that are currently in force in the Brazilian legal system, with which we are required to comply. In addition, we are also subject to the regulations described in “Item 4B. Business Overview - Supervision and Regulation” of our 2021 Form 20-F.

We describe below the material regulatory developments applicable to us since the filing of our 2021 Form 20-F.

The National Monetary Council, or CMN, improves rules for special-purpose accounts

On January 27, 2022, issued Resolution No. 4,981, which amends CMN Resolution No. 3,844, of March 23, 2022, to simplify the procedures for opening special accounts denominated in foreign currency exclusively to receive foreign credit transactions granted by international organizations. As of the date of publication of CMN Resolution No. 4,981 (January 31, 2022), direct and indirect administration entities of Brazilian States, the Federal District, and Municipalities will no longer be required to have a specific authorization to be holders of these special accounts in financial institutions authorized to operate in the foreign exchange market (such as us). This measure aims to make this authorization process more efficient.

CMN Resolution No. 4,981 entered into effect on January 31, 2022.

The Brazilian Securities and Exchange Commission simplifies the registration process of non-resident investors that are individuals

On February 7, 2022, the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários, or CVM) issued CVM Resolution No. 64, or Resolution No. 64, which exempts non-resident investors that are individuals of specific registration requirement with the CVM, as previously prescribed by CVM Resolution No. 13, of November 18, 2020, which was amended by the new rule.

With the new rule, non-resident investors that are individuals will be exempted from specific registration with the CVM, provided that their representatives (which must register with the CVM before the non-resident investor begins operating in Brazil, through the filing of an application) send information about the investor, as required by the CVM, through CVM’s electronic systems.

Resolution No. 64 entered into effect on May 2, 2022.

The Central Bank enhances prudential rules applicable to payment institutions

On March 11, 2022, the Central Bank published Resolutions Nos. 197, 198, 199, 200, 201 and 202, a set of rules aimed at improving the prudential rules applicable to payment services. The new rules are the result of Public Consultation No. 78/2020 and, in general terms, extend to prudential conglomerates led by payment institutions the prudential requirements already applicable to conglomerates led by financial institutions.

According to the Central Bank, this extension has become necessary in view of the diversification and sophistication of activities carried out by payment institutions since the publication of the legal and regulatory framework for payment services, in 2013. Since then, certain payment institutions have constituted financial subsidiaries and started to assume new risks, without being required to have prudential requirements proportionate to these new risks.

One of the principles of the new rules is that this extension of prudential requirements to payment institution-led conglomerates to be carried out in a proportional manner. In other words, smaller institutions, which are exposed to lower risks, will have simplified prudential requirements, while larger institutions, which carry out activities subject to higher risks, will have to rely on more sophisticated prudential requirements. As a result, the Central Bank expects that the new regulation will preserve the stimulus for the entry of new competitors in the payments segment, in order to increase competition in the financial and payments system, as well as stimulate greater financial inclusion.

| 24 |

In order to facilitate the application of the respective prudential frameworks, prudential conglomerates have been classified into three types. Pursuant to the new prudential framework, the concept of regulatory capital applicable to payment institutions has been modified to ensure a greater capacity to absorb unexpected losses. These new prudential regulations will be implemented gradually, starting from July 2023 (as per Central Bank Resolution No. 258, which delayed the entry into effect of these regulations from January 2023 to July 2023). This ensures sufficient time for institutions to adapt their internal controls and adjust their ownership structure. This gradual introduction was inspired by the introduction of Basel III for financial institutions.

Regarding such new rules, on February 8, 2023, the Central Bank issued Resolution No. 290, which amends Resolution No. 200, in order to incorporate recommendations from the Basel Committee on Banking Supervision, or BCBS, set out in the Basel III framework. Thus, the capital required for the Credit Valuation Adjustment, or CVA, ceases to be calculated in the scope of the portions related to the exposures to credit risk and starts to be considered as a new component related to the exposures to market risk.

Resolution No. 290 will enter into effect on July 1, 2023.

The Brazilian Federal Government’s Decree alters tax rate applicable to external loans with a term of up to 180 days to zero

On March 15, 2022, the Brazilian Federal Government issued Decree No. 10,997, which amended Decree No. 6,306, of December 14, 2007. The main modification brought was to the tax rate on financial transactions (Imposto sobre Operações Financeiras or IOF) related to external loans with a term of up to 180 days, which was reduced from 6% to 0%, with immediate effects.

The Central Bank launches Open Finance

On March 24, 2022, the CMN and the Central Bank issued Joint Resolution No. 4, amending Joint Resolution No. 1, of 2020, to officially launch the Open Finance project. This measure reinforces the evolution of the Brazilian Open Financial System model, which will go from a traditional Open Banking initiative purely focused on data and services related to traditional banking products to a broader strategy, encompassing data on other financial services such as accreditation, foreign exchange, investments, insurance and pension plans.

To consolidate the migration from Open Banking to Open Finance, the Central Bank and the CMN are updating the regulatory treatment for this new nomenclature in Joint Resolution No. 1 of 2020, and later in other related regulations as they are amended.

This change occurs together with the advancement of discussions with the National Council of Private Insurance, or CNSP, and the Superintendence of Private Insurance, or SUSEP, aiming at a future interoperability between participants of Open Finance and Open Insurance.

Another change made to improve the Open Finance implementation process refers to the definitive governance structure, whose model will be submitted to the Central Bank for approval by June 30, 2022. Considering the experience acquired with the implementation of the initiative so far, it was necessary to clarify some attributions and duties of this structure for the monitoring and resolution of problems arising from non-compliance by the institutions with their obligations within the Open Finance ecosystem.

Joint Resolution No. 4 entered into effect on May 2, 2022.

On February 23, 2023, the Central Bank issued Resolution No. 294, which amends Central Bank Resolution No. 32, of October 29, 2020. Such rule sets forth technical requirements and operational procedures to implement Open Finance in Brazil. The amendments are mainly to provide more clarity regarding the supervisory role assigned to the Open Finance Governance Structure, the body responsible for implementing and governing Open Finance. Resolution No. 32 is expected to undergo periodic reviews to reflect the evolution of the ecosystem itself. Additionally, Resolution No. 294 (i) reviews the definition on the mandatory participants and the responsibility of the management of their information and (ii) establishes the need for prior consent from the Central Bank in case of exclusion of a participating institution from the ecosystem or exclusion of a participation modality.

| 25 |

Resolution No. 294 will enter into effect on April 1, 2023.

New law increases tax burden applicable to financial institutions

On April 28, 2022, the President of Brazil published Provisional Measure No. 1,115, or MP 1,115/22, which amends Law No. 7,689, of 1988, to increase by 1%the rates of the social contribution over net income (Contribuição Social sobre o Lucro Líquido, or CSLL) applicable to financial institutions, other institutions authorized to operate by the Central Bank, and insurance and capitalization companies.

As of the entry into effect of MP 1,115/22 and until December 31, 2022, (i) banking institutions (such as us) will have the CSLL levied on their taxable income at a total 21% rate (as opposed to the prior rate of 20%); and (ii) other institutions authorized to operate by the Central Bank and insurance and capitalization companies will have the CSLL levied on their taxable income at a total 16% rate (as opposed to the prior rate of 15%).

MP 1,115/22 entered into effect on August 1, 2022 (90 days as of the date of its publication) and was converted into Law No. 14,446 on September 2, 2022, remaining in force until December 31, 2022. As of January 1, 2023, the CSLL rates levied on the taxable income of financial institutions and other institutions authorized to operate by the Central Bank and insurance and capitalization companies reverted back to the prior rates of 20% and 15%, respectively.

The Central Bank introduces changes to the capital requirements for credit risk provided in Basel III

On May 12, 2022, the Central Bank issued Resolution No. 229, which improves and consolidates the procedures for the calculation of capital requirements in respect of exposures to credit risk through a standardized approach, or RWACPAD. These procedures are the result of an extensive discussion based on Public Consultation No. 80, published on December 11, 2020.

The new prudential framework is more sensitive to credit risk as Resolution No. 229 increases the granularity of the weights associated with the exposures to credit risk and refines the differentiation of the credit risk of each transaction. For example, in relation to residential real estate financing, instead of using a single risk weighting factor, the risk weighting factors under Resolution No. 229 vary based on objective parameters, allowing less risky exposures to credit risk to have lower capital requirements.

These changes align the Brazilian banking and finance regulations with the international best practice recommendations of the BCBS, and integrate in the framework known as "Basel III" into the Brazilian banking and finance regulations. The recommendations of the BCBS aim to harmonize the prudential regulation adopted by its members.

Resolution No. 229 will enter into effect on July 1, 2023 and will repeal Central Bank Circular No. 3,644, of March 4, 2013.

Financial System Regulators issue Joint Resolution on Interoperability on Open Finance

On May 20, 2022, the Central Bank, the CMN, the CNSP, and the SUSEP, issued Joint Resolution No. 5, which establishes more clarity and rules for interoperability within the scope of Open Finance.

Such interoperability will allow the standardized sharing of data, with the client's consent, in a secure, agile and accurate manner, between banks, payment institutions, credit cooperatives, insurance companies, open complementary pension funds, capitalization companies and other institutions authorized to operate by the Central Bank and SUSEP.

| 26 |

The participants of the ecosystem are responsible for proposing and implementing technical standards and operational procedures that ensure interoperability. These proposals must be sent to SUSEP and the Central Bank by November 30, 2023.

Joint Resolution No. 5 entered into effect on January 2, 2023.

The CVM issues new rules on public offerings of securities

On July 13, 2022, the CVM issued Resolution No. 160, which (i) establishes new rules regarding public offerings for primary or secondary distribution of securities and the trading of securities offered in regulated markets, and (ii) revokes CVM Instructions No. 400, of December 29, 2003, No. 471, of August 8, 2008, No. 476 of January 16, 2009, No. 530, of November 22, 2012, and CVM Deliberations No. 476, of January 25, 2005, No. 533, of January 29, 2008, No. 809, of February 19, 2019, No. 818, of April 30, 2019, and No. 850, of April 7, 2020.