January 5, 2015

VIA EDGAR

Mr. Kevin W. Vaughn

Accounting Branch Chief

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington D.C. 20549

| Re: | Itaú Unibanco Holding S.A. |

| Form 20-F for the Fiscal Year Ended December 31, 2013 | |

| Filed April 2, 2014 | |

| File No. 001-15276 |

Dear Mr. Vaughn:

This letter sets forth the responses of Itaú Unibanco Holding S.A. (the “Company”) to the comments contained in your letter, dated December 17, 2014, relating to the Annual Report on Form 20-F of the Company for the year ended December 31, 2013 filed with the Securities and Exchange Commission (the “Commission”) on April 2, 2014 (the “Annual Report”). The comments of the staff of the Commission (the “Staff”) are set forth in bold/italics and the Company’s responses are set forth in plain text immediately following each comment. The Company has responded to all of the Staff’s comments. As explained below, in accordance with the Staff’s request, the Company will undertake to include revised disclosures in response to each of the Staff’s comments in the Company’s future filings, beginning with the Company’s annual report on Form 20-F for the fiscal year ended December 31, 2014. Marked changes below indicate proposed revisions to the disclosures to be included in such future filings. Although the revisions are presented as changes to the Annual Report, appropriate changes to future filings based on the proposed revisions will reflect the results presented in the applicable report.

Form 20-F for the Fiscal Year Ended December 31, 2013

Market Risk, page A-172

VaR – Institutional Treasury Trading Portfolio, page A-178

1. You state in your discussion of VaR - institutional treasury trading portfolio that the unit segregates its risk management from the Banking and Trading Portfolios. In your future filings please revise this section or the disclosure on page A-174 to more clearly explain the purpose and composition of the institutional treasury trading portfolio and how it differs from the global trading portfolio.

Response to Comment No. 1

In response to the Staff´s comment, the Company proposes to revise in future filings its disclosure regarding the VaR – institutional treasury trading portfolio (beginning on page A-178 of our Annual Report) in the manner set forth below (marked changes indicate revisions to the disclosure in our Annual Report). The disclosure below is based on information as of December 31, 2013.

It is important to note that the proposed change eliminates any distinction between “Institutional Treasury Trading Portfolio” and “Trading Portfolio”, due to an enhancement of our disclosure made with respect to the 1st quarter of 2014. “Institutional Treasury Trading Portfolio” was used to reflect trading positions taken under the “Trading Book Directorate”, which was comprised of trading positions with likely trading intention characteristics, as we define in our qualitative disclosure1. The purpose of such change is to report the entire trading portfolio without reference to our internal classifications. This change in presentation described herein does not materially impact the reported trading VaR. With the change in scope, the reported trading VaR fully reflects the definition of the trading portfolio.

Market Risk

Market risk is the possibility of losses resulting from fluctuations in the market value of positions held by a financial institution, most typically caused by variations in foreign exchange rates, interest rates, Brazilian inflation indexes, equity and commodity prices, along with various indexes for these risk factors. Market risk management is the process by which our management monitors and controls risk of variations in the value of financial instruments due to market movements, while aiming to optimize the risk-return ratio through an adequate limits structure, effective risk management models and related management tools.

Our policies and general market risk management framework are consistent with the principles of National Monetary Council (“CMN”) regulations. These principles guide our approach to market risk control and management across all business units and legal entities of the Itaú Unibanco Group.

Our market risk management strategy is aimed at balancing corporate business goals, taking into account, among other things:

| • | Political, economic and market conditions; |

| • | The market risk profile of the portfolio; and |

| • | Expertise within the group to support operations in specific markets. |

1The Trading Portfolio is composed of all transactions with financial and commodity instruments (including derivatives) held with the intention of trading, to benefit from arbitrage opportunities, or using such transactions to hedge risk within this portfolio, and that have no restriction on trading. Profits are based on changes in actual or expected prices in the short term.

| 2 |

Our market risk management framework is subject to the governance and hierarchy of committees, with specific limits assigned to different portfolios and levels (for example, Banking Portfolio, Trading Portfolio, Equities Desk), as well as classes of market risk (such as interest rate risk and foreign exchange risk). Daily risk reports, used by the business and control units, are also sent to senior management. In addition, our market risk management and control process is subject to periodic reviews. The key principles underlying our market risk control are as follows:

| • | All market risks assumed must be in line with our risk-return objectives; |

| • | Through disciplined dialogue, senior management is to be kept informed of the overall market risk profile and its evolution over time; |

| • | There must be transparency as to how the business works to optimize results; |

| • | The market risk control structure must provide early warning mechanisms to facilitate effective risk management, without obstructing the business objectives; and |

| • | Concentration of risks must be avoided. |

Market risk is controlled by an unit that is independent from our “risk originating” business units and is responsible for performing the daily activities of: (i) risk measurement, and assessment, (ii) monitoring of stress scenarios, limits and alerts; (iii) application of stress scenarios, analysis and tests; (iv) reporting of risk findings to responsible individuals within the relevant business unit, in accordance with our governance requirements; (v) monitoring the necessary actions to readjust positions and/or levels of risk to make them viable; and (vi) providing support for the launch of new financial products. To this end, we have a structured process of communication and information flow that provides information to our Superior Committees and monitors compliance with the requirements of Brazilian and relevant foreign regulatory agencies.

Our structure of limits and alerts follows the guidelines of the Board of Directors and is approved by the Superior Risk Policies Committee (CSRisc) after endorsement by the Superior Institutional Treasury Committee (CSTI). The limits range from aggregated risk indicators at the portfolio level to more granular limits at the individual desk level. The market risk limits framework extends to the risk factor level, with specific limits that aim to improve the process of risk monitoring and understanding as well as prevent risk concentration. This structure of limits and alerts promotes the effectiveness and coverage of control and is reviewed at least annually. Limits and alerts are calibrated based on projections of future balance sheets, stockholders’ equity available to support trading activities and the risk profile of each organizational entity, defined in terms of risk measurement as used within the risk management process. The process of setting these limit levels and breach reporting follows the governance approved by our financial conglomerate’s internal policies. Market risk limits are monitored on a daily basis by our independent Market Risk Control Unit, which reports breaches of limits and discusses them with the relevant committees in accordance with the following procedure:

| • | Within one business day, to the management of the relevant business unit; |

| • | On a weekly basis, to the Risk and Positions Committee, which is composed of our Institutional Treasury Executive Vice President, our Institutional Treasury Executive Officer, the heads of the Trading and Banking units, our Chief Risk Officer and our Director of the Market Risk Control Unit; and |

| • | On a monthly basis, to the Superior Institutional Treasury Committee (CSTI), which is chaired by our Chief Executive Officer. |

| 3 |

Additionally, our Board of Directors members have established certain limits of tolerance to high-level risks that are specifically applicable to treasury activities. These limits of tolerance are monitored on a daily basis by our independent risk unit, and any breach is reported to the Committees, to the Board of Officers and the Board of Directors in accordance with the procedure mentioned above. Potential breaches are also reported to executive officers through the CSRisc, which meets every two months, and to the Board of Directors members through the CGRC, which meets every two months and reports its activities to all Board of Directors members.

We hedge transactions with clients and proprietary positions, including foreign investments, in order to mitigate risks arising from fluctuations in market risk factors (e.g., prices) and to prevent positions from breaching limits. Derivatives are commonly used for these hedging activities. When these transactions are classified as hedges for accounting purposes, specific supporting documentation is reviewed, allowing for an ongoing follow up of the hedge effectiveness (retrospectively and prospectively) and of any changes in the accounting process. The accounting and managerial hedging procedures are governed by our internal institutional polices. Our market risk framework categorizes transactions as part of either the Banking Portfolio or the Trading Portfolio, in accordance with general criteria established by the Basel Capital Accords.

The Trading Portfolio is composed of all transactions with financial and commodity instruments (including derivatives) held with the intention of trading, to benefit from arbitrage opportunities, or using such transactions to hedge risk within this portfolio, and that have no restriction on trading. Profits are based on changes in actual or expected prices in the short term.

The Banking Portfolio is predominantly characterized by trades originated from the banking business that are not classified in the trading portfolio and related to the management of our balance sheet. Treasury transactions in the banking portfolio are executed in conjunction with active management of financial risks inherent in our overall balance sheet, and are held without intent to trade in the short term. The banking portfolio may include derivatives. As a general rule, this desk’s portfolios are held without intent of resale and time horizon of medium and long term.

Market risk exposures that are inherent to many financial instruments, including derivatives, are composed of various risk factors. A risk factor refers to a market parameter whose variation impacts the evaluation of a certain position. The main risk factors measured by us are:

| • | Interest rates: the risk of losses from transactions that are subject to interest rate variations; |

| • | Other foreign interest rates: the risk of losses from transactions subject to foreign interest rate variations; |

| • | FX rates: the risk of losses from positions subject to foreign exchange rate variation (e.g., foreign currency positions); |

| • | Brazilian inflation indexes: the risk of losses from transactions subject to variations in inflation linked indexes; and |

| • | Equities and commodities: the risk of losses from transactions that are subject to equity and commodity price variations. |

| 4 |

The CMN has regulations establishing the segregation of market risk exposure at a minimum into the following categories: interest rates, FX rates, equities and commodities. Brazilian inflation indexes are treated as a group of risk factor and receive the same treatment as the other risk factors, such as interest rates and FX rates, and follow the governance and risk limits framework adopted by our organization for market risk management.

Market risk is analyzed based on the following key metrics:

| • | Value at Risk (VaR): a statistical metric that quantifies potential economic losses based on normal market conditions, considering a defined holding period and confidence level; |

| • | Losses in Stress Scenarios (Stress Testing): a simulation technique to evaluate the impact on assets, liabilities and derivatives portfolios of various risk factors in extreme market situations (based on prospective scenarios); |

| • | Stop Loss Alert: a mechanism that triggers a management review of positions, if the accumulated losses in a given period reach specified levels; |

| • | Concentration: cumulative exposure of certain assets or risk factors calculated at market value (MtM - Mark to Market); and |

| • | Stressed VaR: a statistical metric derived from VaR, aimed at capturing the largest risk in simulations of the current portfolio, taking into consideration observable returns in historical scenarios. |

In addition to the risk metrics described above, sensitivity and loss control measures are also analyzed. They include:

| • | Gap Analysis: accumulated exposure of cash flows by risk factor, which are marked-to-market and positioned by settlement dates; |

| • | Sensitivity (DV01 – Delta Variation Risk): impact on the market value of cash flows when a one annual basis point change is applied to current interest rates or index rates; and |

| • | Sensitivities to Various Risk Factors (Greek): partial derivatives of a portfolio of options in connection with the prices of the underlying assets, implied volatilities, interest rates and time. |

Please refer to our Consolidated Financial Statements (IFRS), Note 36 – Management of Financial Risks for further details about Market Risk.

VaR - Consolidated Itaú Unibanco Holding

The internal VaR model we use assumes a one-day holding period and a 99.0% confidence level. Volatilities and correlations are estimated based on a volatility-weighing methodology that confers greater weight to the most recent information.

The table below shows the Consolidated Global VaR, comprising our Trading and Banking portfolios, and our subsidiaries abroad Itaú BBA International, Banco Itaú Argentina, Banco Itaú Chile, Banco Itaú Uruguay, Banco Itaú Paraguay and Itaú BBA Colombia showing where there are higher concentrations of market risk. We adhered to our policy of operating within low limits in relation to capital and maintained our conservative management and portfolio diversification approach through the period.

| 5 |

| (in millions of R$) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Global VaR (*) | Average | Minimum | Maximum | December 31, 2013 | Average | Minimum | Maximum | December 31, 2012 | Average | Minimum | Maximum | December 31, 2011 | ||||||||||||||||||||||||||||||||||||

| Group of Risk Factor | ||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate | 172.4 | 65.6 | 416.9 | 69.1 | 191.2 | 71.8 | 427.6 | 348.7 | 100.9 | 24.6 | 222.6 | 104.8 | ||||||||||||||||||||||||||||||||||||

| Other Interest rate | 26.2 | 8.6 | 76.7 | 45.2 | 20.4 | 7.3 | 49.6 | 11.4 | 29.5 | 12.6 | 59.0 | 23.6 | ||||||||||||||||||||||||||||||||||||

| FX rate | 34.5 | 4.4 | 70.2 | 10.4 | 25.7 | 4.6 | 53.9 | 8.8 | 19.1 | 5.2 | 38.8 | 18.0 | ||||||||||||||||||||||||||||||||||||

| Brazilian Inflation Indexes | 76.1 | 37.3 | 155.5 | 65.7 | 110.3 | 14.8 | 325.0 | 51.2 | 17.7 | 2.5 | 41.6 | 21.1 | ||||||||||||||||||||||||||||||||||||

| Equities and commodities | 29.6 | 14.0 | 60.1 | 20.4 | 24.2 | 13.6 | 43.5 | 16.8 | 36.9 | 17.4 | 57.1 | 25.2 | ||||||||||||||||||||||||||||||||||||

| Foreign Units | ||||||||||||||||||||||||||||||||||||||||||||||||

| Banco Itaú BBA International | 2.4 | 1.6 | 4.1 | 1.9 | 1.7 | 0.7 | 5.1 | 1.1 | 2.9 | 0.4 | 6.5 | 1.5 | ||||||||||||||||||||||||||||||||||||

| Banco Itaú Argentina | 4.0 | 2.2 | 7.4 | 5.7 | 3.0 | 1.7 | 5.6 | 5.5 | 4.0 | 1.6 | 9.4 | 3.7 | ||||||||||||||||||||||||||||||||||||

| Banco Itaú Chile | 5.6 | 2.1 | 13.6 | 2.1 | 5.5 | 3.2 | 9.6 | 4.4 | 5.3 | 1.9 | 10.3 | 5.3 | ||||||||||||||||||||||||||||||||||||

| Banco Itaú Uruguai | 2.8 | 1.5 | 8.9 | 1.7 | 1.7 | 0.3 | 3.4 | 2.0 | 0.5 | 0.2 | 1.1 | 0.7 | ||||||||||||||||||||||||||||||||||||

| Banco Itaú Paraguai | 0.9 | 0.4 | 1.8 | 0.9 | 0.4 | 0.2 | 1.4 | 1.0 | 0.6 | 0.2 | 1.7 | 0.2 | ||||||||||||||||||||||||||||||||||||

| Banco Itaú BBA Colombia | 0.4 | 0.0 | 1.3 | 0.2 | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||

| Diversification effect (*) | (113.0 | ) | (77.1 | ) | (53.4 | ) | ||||||||||||||||||||||||||||||||||||||||||

| Total | 224.5 | 97.9 | 443.4 | 110.4 | 289.7 | 118.0 | 601.4 | 373.7 | 142.0 | 74.0 | 278.5 | 150.9 | ||||||||||||||||||||||||||||||||||||

(*) Reduction of risk due to the combination of all risk factors

On December 31, 2013, our average global VaR was R$224.5 million, or 0.27% of our consolidated stockholders’ equity on December 31, 2013, compared to our average global VaR of R$289.7 million on December 31, 2012 or 0.38% of our consolidated stockholders’ equity on December 31, 2012, and to R$142.0 million on December 31, 2011, or 0.19% of our consolidated stockholders’ equity on December 31, 2011. The Total VaR of our foreign units represented less than 1% of our stockholders’ equity on December 31, 2013.

VaR

- Institutional Treasury Trading Portfolio

The table below presents risks arising from transactions with financial and commodity instruments (including derivatives) with the intention of trading, following the criteria defined above for the Trading Portfolio.

The

Institutional Treasury unit segregates its risk management from the Banking and Trading Portfolios.

[Please

note that the following text will change for the next quarterly report] We recently enhanced the internal VaR methodology used

for the Trading Book Portfolio, migrating from the “parametric” approach to a “historical

simulation” approach. This new approach uses four years of historical market data, performs a full revaluation of all positions,

considers both one-day and ten-day holding periods, and reports risk at various confidence levels, including the 99.0% confidence

level. used under the parametric methodology. The historical simulation methodology is generally recognized

to improve risk measurement for nonlinear financial products (such as options), and to more effectively capture both basis risk

and statistically unusual (or “fat tail”) events. This new approach calculates VaR on both an unweighted “simple

returns” basis and on a “volatility weighted” basis. We are in the process of extending the use of the historical

simulation methodology beyond the Trading Book Portfolio to include all other relevant portfolios that

give rise to market risks.

| 6 |

The

Trading Portfolio takes positions aiming to optimize risk-weighted results. The Trading Portfolio seeks the best domestic and foreign

market opportunities within the pre-established limits and strives to create a well-diversified risk exposure.

| (in millions of R$) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Trading VaR (*) | Average | Minimum | Maximum | December 31, 2013 | Average | Minimum | Maximum | December 31, 2012 | Average | Minimum | Maximum | December 31, 2011 | ||||||||||||||||||||||||||||||||||||

| Group of Risk Factor | ||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate | 38.2 | 15.7 | 104.9 | 20.1 | 38.3 | 12.8 | 95.4 | 25.2 | 31.2 | 9.5 | 79.0 | 18.4 | ||||||||||||||||||||||||||||||||||||

| Other Interest rate | 13.7 | 4.5 | 31.7 | 21.7 | 10.7 | 4.2 | 27.2 | 6.4 | 11.5 | 5.5 | 27.1 | 7.5 | ||||||||||||||||||||||||||||||||||||

| FX rate | 31.8 | 6.2 | 68.1 | 9.4 | 25.1 | 4.9 | 55.6 | 9.9 | 20.9 | 7.7 | 37.8 | 22.0 | ||||||||||||||||||||||||||||||||||||

| Brazilian Inflation Indexes | 12.0 | 3.1 | 30.4 | 21.4 | 9.4 | 1.8 | 22.2 | 7.1 | 6.9 | 0.9 | 24.5 | 4.7 | ||||||||||||||||||||||||||||||||||||

| Equities and commodities | 19.2 | 5.8 | 38.2 | 13.7 | 23.3 | 13.8 | 41.5 | 14.8 | 7.5 | 1.5 | 15.1 | 24.0 | ||||||||||||||||||||||||||||||||||||

| Diversification effect (*) | (56.0 | ) | (38.6 | ) | (22.6 | ) | ||||||||||||||||||||||||||||||||||||||||||

| Total | 40.2 | 17.7 | 71.7 | 30.3 | 54.3 | 21.3 | 112.3 | 24.7 | 69.1 | 38.4 | 125.0 | 53.9 | ||||||||||||||||||||||||||||||||||||

(*) Reduction of risk due to the combination of all risk factors

Our total average Trading Portfolio VaR was R$40.2 million on December 31, 2013, compared to R$54.3 million on December 31, 2012 and to R$69.1 million on December 31, 2011.

Sensitivity Analyses (Trading and Banking Portfolios)

As required by Brazilian regulation, we conduct sensitivity analysis for market risk factors considered important. The highest resulting losses are presented below, by risk factor, in each such scenario and are calculated net of tax effects, providing a view of our exposure under circumstances.

The sensitivity analyses of the Trading and Banking Portfolios presented here are based on a static assessment of the portfolio exposure. Therefore, such analyses do not consider the dynamic response capacity of management (e.g., treasury and market risk control unit) to initiate mitigating measures and minimize the possibility of significant losses. In addition, the profit or loss presented does not reflect accounting profit or losses since the analysis is intended to assess risk exposure based on the fair value of financial instruments, regardless of whether financial instruments are accounted for on an accrual basis or not.

(in thousands of R$) | ||||||||||||||||||||||||||

| Exposures | Trading

Portfolio (1) December 31, 2013 | Trading

and Banking Portfolios (1) December 31, 2013 | ||||||||||||||||||||||||

| Risk Factors | Risk of change | Scenario I | Scenario II | Scenario III | Scenario I | Scenario II | Scenario III | |||||||||||||||||||

| Interest Rate | Fixed Income Interest Rates | (387 | ) | (9,632 | ) | (19,187 | ) | (2,107 | ) | (52,469 | ) | (104,507 | ) | |||||||||||||

| Foreign Exchange Linked | Foreign Exchange Linked Interest Rates | 122 | (3,079 | ) | (6,188 | ) | 375 | (9,336 | ) | (18,593 | ) | |||||||||||||||

| Foreign Exchange Rates | Prices of Foreign Currencies | 3,994 | (99,844 | ) | (199,688 | ) | 3,183 | (79,568 | ) | (159,136 | ) | |||||||||||||||

| Price Index Linked | Price Indexes Linked Interest Rates | (758 | ) | (18,600 | ) | (36,489 | ) | (4,237 | ) | (103,960 | ) | (203,958 | ) | |||||||||||||

| TR | TR Linked Interest Rates | 5 | (119 | ) | (238 | ) | 257 | (6,428 | ) | (12,885 | ) | |||||||||||||||

| Equities | Prices of Equities | 3,597 | (89,920 | ) | (179,839 | ) | 2,867 | (71,679 | ) | (143,358 | ) | |||||||||||||||

| Total without correlation | 6,573 | (221,193 | ) | (441,628 | ) | 337 | (323,439 | ) | (642,438 | ) | ||||||||||||||||

| Total with correlation | 6,336 | (213,234 | ) | (425,738 | ) | 325 | (311,801 | ) | (619,322 | ) | ||||||||||||||||

(1) Amounts net of tax effects.

| 7 |

In order to measure these sensitivities, the following scenarios are used:

| • | Scenario I: Addition of one basis point to interest rates and associated indexes and one percentage point to currency and equity prices; |

| • | Scenario II: Shocks of 25 basis points to interest rates and associated indexes and 25 percentage points to currency and equity prices, increasing and decreasing the market data at closing, considering the highest losses per risk factor; and |

| • | Scenario III: Shocks of 50 basis points to interest rates and associated indexes and 50 percentage points to currency and equity prices, increasing and decreasing the market data at closing, considering the highest losses per risk factor. |

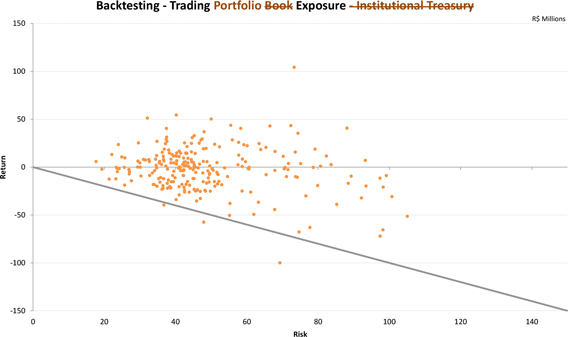

Backtesting

The effectiveness of the VaR model is validated by the use of backtesting techniques that compare hypothetical daily results with the estimated daily VaR. The number of exceptions (i.e. deviations) with respect to the pre-established VaR limits should be consistent, within an acceptable margin, with the hypothesis of 99.0% confidence intervals (i.e., there is a 1.0% probability that the financial losses are higher than the losses estimated by the model), considering a period of 250 business days (ending on December 31, 2013). The backtesting analysis presented below takes into consideration the ranges suggested by the Basel document “Supervisory Framework for the use of backtesting in conjunction with the internal models approach to market risk capital requirements.”

The ranges are divided into:

| · | Green (0 to 4 exceptions): corresponds to backtesting results that do not suggest any problems with the quality or accuracy of the models adopted; |

| · | Yellow (5 to 9 exceptions): refers to an intermediate range group, which indicates the need to pay attention and/or monitor and may indicate the need for improvement actions; and |

| · | Red (10 or more exceptions): demonstrates the need for an improvement action. |

The

exposure graph below illustrates the reliability of risk measures generated by the models we use in the Institutional Treasury

Trading Portfolio (foreign units are not included in the graph below given the immateriality of amounts involved). The graph shows

the adequacy level of the market risk models used by us, presenting the risk (absolute value) vs. return pairs for the period considered.

Since the diagonal line represents the threshold where risk equals return, all the dots below this line indicate exceptions to

the estimated risk. For the exposure of the Institutional Treasury Trading Portfolio, the hypothetical losses

exceeded the VaR estimated by the model on 3 days in the period.

| 8 |

Source: Itaú Unibanco Holding

Financial Performance, page A-237

2. Footnotes 1 and 2 to your overdue and non-overdue tables on pages A-261 to A-266 currently quantify the aggregate amount of non-accrual loans that are presented in the total of overdue and non-overdue loans. For example, your disclosure appears to indicate that an unknown amount of nonaccrual loans within the total of R$18,065 million are split between the total of R$12,991 million overdue loans on page A-263 and the R$398,711 million non-overdue loans on page A-264. In your future filings, please revise footnote 1 to present the amount of nonaccrual loans presented in the respective table so the reader can ascertain the amount of nonaccrual loans that are included in the total of the R$12,991 million loans.

Response to Comment No. 2

In response to the Staff’s comment, the Company advises the Staff that the “Non-Overdue” tables on pages A-261, A-262, A-264 and A-265 set out the Non-Overdue amounts of all credit operations. The Company proposes to revise in future filings its disclosure with respect to the “Loan and Lease Operations” on pages A-261 through A-266 of its Annual Report in the manner set forth below (marked changes indicate revisions to the disclosure in our Annual Report). The disclosure below is based on information as of December 31, 2013. In future filings the Company will:

| · | Change the titles of the relevant tables from “Non-Overdue” to “Non-Overdue Installments” and the name of each column from “Total Non-Overdue Loans” to “Total Non-Overdue Installments”; and |

| 9 |

| · | Segregate the non-accrual amount between Non-Overdue and Overdue and describe such amount in the footnotes to each relevant table. |

Classification of the credit portfolio into fixed and variable rates – Non-Overdue Installments

| Non-Overdue Installments | ||||||||||||||||||||||||||||

| 12/31/2013 | ||||||||||||||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||||||||||

| Due

in 30 days or less | Due

in 31- 90 days | Due

in 91- 180 days | Due

in 181-360 days | Due

in one year to five years | Due

after five years | Total

Non- Overdue Installments | ||||||||||||||||||||||

| Interest rate of loans to customers by maturity: | ||||||||||||||||||||||||||||

| Variable rates | 11,263 | 19,553 | 12,867 | 22,402 | 55,621 | 40,443 | 162,149 | |||||||||||||||||||||

| Fixed rates | 45,758 | 38,947 | 30,763 | 37,237 | 81,229 | 2,628 | 236,562 | |||||||||||||||||||||

| Total (1) | 57,021 | 58,500 | 43,630 | 59,639 | 136,850 | 43,071 | 398,711 | |||||||||||||||||||||

(1) Includes non-accrual loans of R$18,065 million, which reflects all loans and leases more than 60 days overdue. Of such amount of non-accrual loans, R$9,045 million represents installments not yet overdue and R$9,020 million represents overdue installments. With respect to loans payable in installments, non-accrual loans include both current and past due installments.

| Non-Overdue Installments | ||||||||||||||||||||||||||||

| 12/31/2012 | ||||||||||||||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||||||||||

| Due

in 30 days or less | Due

in 31- 90 days | Due

in 91- 180 days | Due

in 181-360 days | Due

in one year to five years | Due

after five years | Total

Non- Overdue Installments | ||||||||||||||||||||||

| Interest rate of loans to customers by maturity: | ||||||||||||||||||||||||||||

| Variable rates | 10,007 | 16,207 | 12,713 | 16,379 | 48,581 | 29,569 | 133,456 | |||||||||||||||||||||

| Fixed rates | 42,403 | 32,957 | 29,994 | 35,264 | 78,311 | 1,365 | 220,294 | |||||||||||||||||||||

| Total (1) | 52,410 | 49,164 | 42,707 | 51,643 | 126,892 | 30,934 | 353,750 | |||||||||||||||||||||

(1) Includes non-accrual loans of R$20,791 million, which reflects all loans and leases more than 60 days overdue. Of such amount of non-accrual loans,R$11,611 million represents installments not yet overdue and R$9,180 million represents overdue Installments. With respect to loans payable in installments, non-accrual loans include both current and past due installments.

| 10 |

| Non-Overdue Installments | ||||||||||||||||||||||||||||

| 12/31/2011 | ||||||||||||||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||||||||||

| Due

in 30 days or less | Due

in 31- 90 days | Due

in 91- 180 days | Due

in 181-360 days | Due

in one year to five years | Due

after five years | Total

Non- Overdue Installments | ||||||||||||||||||||||

| Interest rate of loans to customers by maturity: | ||||||||||||||||||||||||||||

| Variable rates | 6,384 | 14,270 | 10,093 | 12,056 | 45,072 | 21,175 | 109,050 | |||||||||||||||||||||

| Fixed rates | 43,376 | 31,742 | 26,772 | 36,517 | 82,432 | 1,496 | 222,335 | |||||||||||||||||||||

| Total (1) | 49,760 | 46,012 | 36,865 | 48,573 | 127,504 | 22,671 | 331,385 | |||||||||||||||||||||

(1) Includes non-accrual loans of R$20,439 million, which reflects all loans and leases more than 60 days overdue. Of such amount of non-accrual loans,R$10,843 million represents installments not yet overdue and R$10,196 million represents overdue installments. With respect to loans payable in installments, non-accrual loans include both current and past due installments.

3. Please tell us and revise your future filings to clearly explain how the “loans overdue not impaired” of R$18,586 million on page A-267 relate to total of overdue loans and leases of R$12,991 million on page A-263.

Response to Comment No. 3

In response to the Staff’s comment, the Company advises the Staff that the “Overdue” tables on pages A-263, A-264, A-265 and A-266 set out only the overdue installments of the credit operations. With respect to the R$18,586 million reflected in the "Loans Overdue Not Impaired" column listed on page A-267 of the Annual Report, such value includes loans and leases that are past due between 1 day and 90 days. Loans and leases that are past due for over 90 days are reported in the "Loans Impaired" column on page A-267 of the Annual Report. The Company proposes to revise in future filings its disclosure with respect to the “Loans Overdue Not Impaired” on page A-267 of its Annual Report in the manner set forth below (marked changes indicate revisions to the disclosure in our Annual Report). The disclosure below is based on information as of December 31, 2013. In future filings the Company will:

Make the following changes with respect to the disclosure on pages A-265 and A-266:

| · | Change the title of these tables from “Overdue” to “Overdue Installments”; |

| · | Segregate the non-accrual amount between Non-Overdue and Overdue and describe such amount in the footnotes to each relevant table; and |

| · | Include a “Total overdue installments” column. |

| 11 |

Classification of the credit portfolio into fixed and variable rates – Overdue Installments

| Overdue Installments (1) | ||||||||||||||||||||||||||||||||

| 12/31/2013 | ||||||||||||||||||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||||||||||||||

| 01-30 days | 31-60

days | 61-90

days | 91- 180 days | 181- 360 days | One

year or more | Total overdue installments | Total gross loans | |||||||||||||||||||||||||

| Interest rate of loans to customers by maturity: | ||||||||||||||||||||||||||||||||

| Variable rates | 755 | 195 | 165 | 258 | 185 | 12 | 1,570 | 163,717 | ||||||||||||||||||||||||

| Fixed rates | 2,608 | 1,226 | 1,076 | 2,617 | 3,772 | 122 | 11,421 | 247,985 | ||||||||||||||||||||||||

| Total (2) | 3,363 | 1,421 | 1,241 | 2,875 | 3,957 | 134 | 12,991 | 411,702 | ||||||||||||||||||||||||

(1) Defined as loans and leases contractually past due as to payment of interest or principal.

(2) Includes non-accrual loans of R$18,065 million, which reflects all loans and leases more than 60 days overdue.Of such amount of non-accrual loans,R$9,045 million represents installments not yet overdue and R$9,020 million represents overdue installments. With respect to loans payable in installments,non-accrual loans includes both current and past due installments.

| Overdue Installments (1) | ||||||||||||||||||||||||||||||||

| 12/31/2012 | ||||||||||||||||||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||||||||||||||

| 01-30

days | 31-60

days | 61-90

days | 91- 180 days | 181- 360 days | One

year or more | Total overdue installments | Total gross loans | |||||||||||||||||||||||||

| Interest rate of loans to customers by maturity: | ||||||||||||||||||||||||||||||||

| Variable rates | 714 | 263 | 39 | 119 | 153 | 7 | 1,295 | 134,751 | ||||||||||||||||||||||||

| Fixed rates | 2,811 | 1,269 | 1,106 | 2,850 | 3,814 | 89 | 11,939 | 232,233 | ||||||||||||||||||||||||

| Total (2) | 3,525 | 1,532 | 1,145 | 2,969 | 3,967 | 96 | 13,234 | 366,984 | ||||||||||||||||||||||||

(1) Defined as loans and leases contractually past due as to payment of interest or principal.

(2) Includes non-accrual loans of R$20,791 million, which reflects all loans and leases more than 60 days overdue.Of such amount of non-accrual loans,R$11,611 million represents installments not yet overdue and R$9,180 million represents overdue installments. With respect to loans payable in installments,non-accrual loans includes both current and past due installments.

| 12 |

| Overdue Installments (1) | ||||||||||||||||||||||||||||||||

| 12/31/2011 | ||||||||||||||||||||||||||||||||

| (in millions of R$) | ||||||||||||||||||||||||||||||||

| 01-30 days | 31-60 days | 61-90 days | 91- 180 days | 181- 360 days | One year or more | Total overdue installments | Total gross loans | |||||||||||||||||||||||||

| Interest rate of loans to customers by maturity: | ||||||||||||||||||||||||||||||||

| Variable rates | 1,266 | 120 | 75 | 73 | 91 | 6 | 1,631 | 110,681 | ||||||||||||||||||||||||

| Fixed rates | 2,923 | 1,350 | 1,326 | 3,167 | 4,282 | 200 | 13,248 | 235,583 | ||||||||||||||||||||||||

| Total (2) | 4,189 | 1,470 | 1,401 | 3,240 | 4,373 | 206 | 14,879 | 346,264 | ||||||||||||||||||||||||

| (1) Defined as loans and leases contractually past due as to payment of interest or principal. |

| (2) Includes non-accrual loans of R$20,439 million, which reflects all loans and leases more than 60 days overdue.Of such amount of non-accrual loans,R$10,843 million represents installments not yet overdue and R$10,196 million represents overdue installments. With respect to loans payable in installments, non-accrual loans includes both current and past due installments. |

Make the following changes with respect to the disclosure on page A-267:

| · | Include a footnote disclosing: “the operations classified as “Loans Overdue Not Impaired” are past due between 1 day and 90 days and the balance is the total of the outstanding principal amount (Overdue and Non-Overdue)”. |

| (in millions of R$, except percentages) | ||||||||||||||||

| 12/31/2013 | ||||||||||||||||

| Internal Rating | Loans neither overdue nor impaired | Loans overdue not impaired (1) | Loans impaired | Total loans | ||||||||||||

| Lower Risk | 300,816 | 4,354 | - | 305,170 | ||||||||||||

| Satisfactory | 64,722 | 7,676 | - | 72,398 | ||||||||||||

| Higher Risk | 11,273 | 6,556 | - | 17,829 | ||||||||||||

| Impaired (2) | - | - | 16,305 | 16,305 | ||||||||||||

| Total | 376,811 | 18,586 | 16,305 | 411,702 | ||||||||||||

| % | 91.5 | % | 4.5 | % | 4.0 | % | 100.0 | % | ||||||||

| 13 |

| (in millions of R$, except percentages) | ||||||||||||||||

| 12/31/2012 | ||||||||||||||||

| Internal Rating | Loans neither overdue nor impaired | Loans overdue not impaired (1) | Loans impaired | Total loans | ||||||||||||

| Lower Risk | 249,282 | 5,438 | - | 254,720 | ||||||||||||

| Satisfactory | 61,075 | 9,436 | - | 70,511 | ||||||||||||

| Higher Risk | 14,190 | 8,052 | - | 22,242 | ||||||||||||

| Impaired (2) | - | - | 19,511 | 19,511 | ||||||||||||

| Total | 324,547 | 22,926 | 19,511 | 366,984 | ||||||||||||

| % | 88.5 | % | 6.2 | % | 5.3 | % | 100.0 | % | ||||||||

| (in millions of R$, except percentages) | ||||||||||||||||

| 12/31/2011 | ||||||||||||||||

| Internal Rating | Loans neither overdue nor impaired | Loans overdue not impaired (1) | Loans impaired | Total loans | ||||||||||||

| Lower Risk | 221,315 | 5,800 | - | 227,115 | ||||||||||||

| Satisfactory | 63,762 | 10,956 | - | 74,719 | ||||||||||||

| Higher Risk | 16,911 | 9,134 | - | 26,045 | ||||||||||||

| Impaired (2) | - | - | 18,385 | 18,385 | ||||||||||||

| Total | 301,988 | 25,890 | 18,385 | 346,264 | ||||||||||||

| % | 87.2 | % | 7.5 | % | 5.3 | % | 100.0 | % | ||||||||

(1) The operations classified as Loans Overdue Not Impaired are past due between 1 day and 90 days and the balance is the total of the outstanding principal amount (Overdue and Non-Overdue).

(2) We consider loans as impaired when (i) corporate transactions have a probability of default higher than 31.84%; (ii) transactions are overdue for more than 90 days; or (iii) renegotiated transactions are overdue for more than 60 days.

4. You disclose on page A-253 that you consider all loans and leases more than 60 days overdue as nonaccrual. Please tell us the reasons that nonaccrual loans would be reflected in your non-overdue loan tables. Specifically explain the extent to which such loans have been renegotiated.

Response to Comment No. 4

In response to the Staff’s comment, the Company advises the Staff that the “Non-Overdue” tables on pages A-261, A-262, A-264 and A-265 set out the Non-Overdue amounts of all credit operations. Amounts classified as non-accrual loans include both the Overdue installments and Non-Overdue installments. Non-Overdue installments are reflected in the tables on pages A-261, A-262, A-264 and A-265 of the Annual Report labeled “Non-Overdue.” The Company proposes to revise in future filings its disclosure with respect to the “Loan and Lease Operations” on page A-253 of the Annual Report with the inclusion of a footnote reflecting the total of renegotiated loans in the balance of non-accrual loans. Also, on pages A-276 through A-282 we provided disclosure regarding renegotiated loans. The disclosure below is based on information as of December 31, 2013. In future filings the Company will:

| 14 |

| · | Change the title of these tables on pages A-261, A-262, A-264 and A-265 from “Non-Overdue” to “Non-Overdue Installments” and the name of each column from “Total Non-Overdue Loans” to “Total Non-Overdue Installments”; and |

| · | Include a footnote reflecting the total of renegotiated loans in the balance of non-accrual loans on page A-253, which would read as follows (marked changes indicate revisions to the disclosure in our Annual Report): |

| (in millions of R$) | ||||||||||||||||||||||||||||||||

| Loan and Lease | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||

| Operations, by type (1) | Loan | Allowance | Loan | Allowance | Loan | Allowance | Loan | Allowance | ||||||||||||||||||||||||

| Individuals | 167,431 | 13,853 | 150,921 | 14,844 | 149,391 | 13,684 | 126,805 | 11,146 | ||||||||||||||||||||||||

| Credit card | 53,149 | 2,952 | 40,531 | 2,863 | 38,961 | 3,825 | 33,041 | 3,306 | ||||||||||||||||||||||||

| Personal loans | 26,635 | 6,488 | 26,749 | 6,841 | 25,876 | 4.842 | 17,144 | 3,590 | ||||||||||||||||||||||||

| Payroll Loans | 22,571 | 1,133 | 13,550 | 867 | 10,107 | 556 | 8,402 | 429 | ||||||||||||||||||||||||

| Vehicles | 40,584 | 3,245 | 51,646 | 4,227 | 60,463 | 4,415 | 60,151 | 3,709 | ||||||||||||||||||||||||

| Mortgage loans | 24,492 | 35 | 18,445 | 46 | 13,984 | 46 | 8,067 | 112 | ||||||||||||||||||||||||

| Corporate | 126,413 | 1,783 | 103,729 | 1,362 | 91,965 | 703 | 74,565 | 544 | ||||||||||||||||||||||||

| Small and Medium Businesses | 81,601 | 6,085 | 85,185 | 9,091 | 85,649 | 9,197 | 79,950 | 8,041 | ||||||||||||||||||||||||

| Foreign Loans Latin America | 36,257 | 514 | 27,149 | 416 | 19,259 | 289 | 13,517 | 263 | ||||||||||||||||||||||||

| Total loans and advances to clients | 411,702 | 22,235 | 366,984 | 25,713 | 346,264 | 23,873 | 294,837 | 19,994 | ||||||||||||||||||||||||

| (1)We classify all loans and leases more than 60 days overdue as non-accrual loans and we discontinue accruing financial income related to them. The contractual amounts of non-accrual loans were R$18,065 million, R$20,791 million, R$20,439 million and R$14,736 million as of December 31, 2013, 2012, 2011 and 2010, respectively. The total of renegotiated loans in the balance of non-accrual loans reflected herein was R$4,628 million, R$5,733 million and R$4,364 million as of December 31, 2013, 2012 and 2011, respectively. Non-accrual loans are presented herein in the appropriate category of loan and lease operations. The interest income foregone on our non-accrual loans net of allowance for loan losses for 2013, 2012, 2011 and 2010 was R$1,681 million, R$1,852 million, R$1,914 million and R$1,548 million, respectively. |

| - The Individuals portfolio consists primarily of vehicle financing to individuals, credit card, personal loans (including mainly consumer finance and overdrafts), payroll loans and residential mortgage loans. |

| - The Corporate portfolio consists primarily of loans made to large corporate clients. |

| - The Small and Medium Businesses portfolio consists primarily of loans to small and medium-sized companies. |

| - The Foreign Loans Latin America portfolio consists primarily of loans granted by our operations in Argentina, Chile, Paraguay and Uruguay, primarily to individuals. |

| The contractual amount of non-accrual loans was R$18,065 million, of which R$4,628 million consisted of the total of renegotiated loans in the balance of non-accrual of December 31,2013. |

| 15 |

Tabular Disclosure of Contractual Obligations, page A-288

5. Your disclosure in footnote 1 to your Contractual Obligations table states that Interbank and Institutional Market Debt amounting to R$111,376 million and R$72,055 million, respectively, includes total estimated interest payments (including for derivatives). Please tell us and revise your future filings to clarify how the amounts in the Contractual Obligations table include total estimated interest when such amounts agree to the carrying amount at amortized cost for Interbank and Institutional market debt presented on page F-5.

Response to Comment No. 5

In response to the Staff’s comment, the Company has reviewed its disclosure under the heading “Tabular disclosure of contractual obligations” on page A-288 of the Annual Report and proposes to revise in future filings this disclosure, since the Contractual Obligations table did not include expected future interest payments. Such revised disclosure would read as follows (marked changes indicate revisions to the disclosure in our Annual Report) based on information as of December 31, 2013:

| (in millions of R$) | ||||||||||||||||||||

| Payments due by period | ||||||||||||||||||||

| Contractual Obligations | Total | Less than 1 year | 1-3 years | 3-5 years | More than 5 years | |||||||||||||||

| Interbank market debt (1)(*) | 119,154 | 57,763 | 38,572 | 10,847 | 11,973 | |||||||||||||||

| Institutional market debt (2)(*) | 95,203 | 14,682 | 23,275 | 28,431 | 28,816 | |||||||||||||||

| Operating and capital (finance) lease obligations (*) | 5,069 | 1,255 | 1,683 | 1,272 | 859 | |||||||||||||||

| Endorsements and sureties | 71,162 | 16,143 | 7,217 | 4,363 | 43,439 | |||||||||||||||

| Letters of credit to be released | 11,431 | 11,431 | - | - | - | |||||||||||||||

| Pension Obligations | 579 | 40 | 36 | 33 | 470 | |||||||||||||||

| Health Benefits | 146 | 7 | 17 | 19 | 103 | |||||||||||||||

| Total | 302,744 | 101,321 | 70,799 | 44,964 | 85,660 | |||||||||||||||

| (*) Includes total estimated interest payments (including for derivatives). These estimated interest payments were calculated substantially based on the interbank forward rates at the specific periods. |

| (1) Includes mortgage notes, real estate credit bills, agribusiness credit bills, financial credit bills, import and export financing and on-lending - domestic. |

| (2) Includes subordinated debt, debentures and foreign borrowings through securities. |

6. Given that the endorsements and sureties of R$71,162 million on F-164 agrees to the amount of guarantees and standby letters of credit, please tell us how your table on A-238 reflects your letters of credit of R$11,431 million on page F-164.

Response to Comment No. 6

In response to the Staff’s comment, the Company advises the Staff that “Guarantees and Stand by Letters of Credit” refers only to Endorsements and Sureties balance operations. The Company proposes to revise in future filings its disclosure under the heading “Tabular disclosure of contractual obligations” on page A-288 of the Annual Report. The proposed changes are as follows:

| 16 |

| · | Change references from “Guarantees and Stand by Letters of Credit” to “Endorsements and Sureties”; and |

| · | Include “Letters of credit to be released” in the “Tabular disclosure of contractual obligations.” |

Results, page A-294

7. We note from your discussion on page A-307 that in 2013 income from insurance private pension and capitalization transactions before claim and selling expenses increased mainly due to lower expenses as a result of change in reserves for insurance and private pension, partially offset by the decrease in income from insurance and private pension. Given the significance of your insurance, pension plan, and capitalization business to net income, please revise your future filings to more fully discuss the underlying activity reflected in these amounts, including the reasons for and nature of the change in the reserves. Provide quantification of the impact of the reasons cited for the changes in the balances, and discuss the interaction between the change in reserves with the changes in claims expense.

Response to Comment No. 7

In response to the Staff’s comment, the Company reviewed the disclosure beginning on page A-307 of the Annual Report and proposes to expand in future filings the disclosure regarding our insurance, pension plan, and capitalization business. Such revised disclosure would read as follows (marked changes indicate revisions to the disclosure in our Annual Report) based on information as of December 31, 2013:

“In 2013, income from insurance, private pension and capitalization transactions before claim and selling expenses increased, mainly due to lower expenses as a result of changes in reserves for insurance and private pension, partially offset by the decrease in income from insurance and private pension. The negative variation of R$1,421 million from income from insurance and private pension and a positive variation of R$2,342 million from change in reserves for insurance and private pension are mainly due to the impact of the change in a Brazilian government resolution (CMN No. 4,176) which lengthens the duration of fixed-income portfolios. This change, along with the increase in future interest rates, increased the volatility of long term fixed-income securities of the private pension funds market. Another result of such changes to the private pension funds market is that customers moved funds to other investments, thereby resulting in a lower increase in pension plan assets, and thus, a smaller increase in revenues when compared to the previous year. During the period discussed, there was no interaction between the changes in reserves with the changes in claims expense, because only changes in the private pension product influenced the changes in reserves. The claims expenses are recorded as a separate line item of our income statement. ”

| 17 |

2.4 Summary of Main Accounting Practices, page F-17

a) Consolidation, page F-17

8. You disclose that the effects arising from adopting IFRS 10 resulted in an increase of R$489 million in non-controlling stockholders equity and represent amounts related to your investments that were previously not consolidated under IAS 27 and SIC 12. Please tell us and revise your future filings to more clearly explain the types of entities that were reflected in this adjustment and the basis for the change in accounting treatment. Clarify the extent to which that increase in non-controlling stockholders’ equity and amounts presented in the table on page F-18 relate to joint ventures previously proportionately consolidated and are now fully consolidated as of January 1, 2013.

Response to Comment No. 8

In response to the Staff’s comment, the Company reviewed its disclosure on page F-17 of the Annual Report and advises that the effects arising from adopting IFRS 10 resulted in an increase of R$ 520 million in non-controlling stockholders equity instead of R$ 489 million. The R$ 31 million difference refers to an immaterial error in the amount disclosed in the note to the financial statements which has no impact on the presentation of the statement of financial position, comprehensive income or cash flows of the Company. For a better understanding, we present the information in the table below. Such revised information would read as follows (marked changes indicate revisions to the disclosure in our Annual Report) based on information as of December 31, 2013:

The effects arising from adopting the IFRS 10, which gave rise to the change in the accounting policy, resulted in an increase of R$520 million in the non-controlling stockholders’ equity. We present below the overall amounts related to our investments fully consolidated in according to IFRS 10:

| (in millions of R$) | ||||||

| As

at December 31, 2012 |

Impact

of change in accounting policy |

As at December 31, 2012, after the adoption of IFRS 10 | ||||

| Assets | 3,583 | 3,583 | 7,166 | |||

| Loans & Lease Operation | 3,089 | 3,089 | 6,178 | |||

| Other assets | 494 | 494 | 988 | |||

| Liabilities | 3,063 | 3,063 | 6,126 | |||

| Deposits | 1,604 | 1,604 | 3,208 | |||

| Other financial liabilities | 1,309 | 1,309 | 2,618 | |||

| Other liabilities | 150 | 150 | 300 | |||

| Total stockholders’ equity | 520 | 520 | 1,040 | |||

| Stockholders’ equity | 520 | - | 520 | |||

| Non-controlling interests | - | 520 | 520 | |||

| Net Interest Income | 739 | 739 | 1,478 | |||

| Other operating income (expenses) | -690 | -690 | -1,380 | |||

| Income Tax expense | -21 | -21 | -42 | |||

| Net income attributable to owners of the parent company | 28 | - | 28 | |||

| Net income attributable to non-controlling interests | - | 28 | 28 | |||

The table above does not include the effects of elimination of the intercompany transactions upon the consolidation process.

| 18 |

The impacts addressed above are from the result of the full consolidation of interests held by the Company in joint ventures. Until December 31, 2012, Itaú Unibanco Holding consolidated proportionally its interest held in joint ventures, in conformity with the requirements of IAS 31 – “Interests in joint ventures”.

Under IFRS 10, Itaú Unibanco Holding was deemed to have control of these joint ventures and exposed to, or entitled to, the variable returns derived from its involvement.

Note 36 – Management of Financial Risks, page F-162

9. We note that you identify Brazilian inflation indexes as a risk factor that you measure and analyze in your key market risk metrics, specifically, VaR, and sensitivity analyses. In your future filings, please enhance your related market risk discussion to discuss the strategies used by management in managing this market risk exposure, including related objectives and policies. Refer to paragraph 33(b) of IFRS 7 for further guidance.

Response to Comment No. 9

In response to the Staff’s comment, the Company proposes to revise in future filings the disclosure in Note 36 - Management of Financial Risks. Such revised disclosure would read as follows (marked changes indicate revisions to the disclosure in our Annual Report) based on information as of December 31, 2013:

Market risk

Market risk is the possibility of losses resulting from fluctuations in the market values of positions held by a financial institution, including risks of transactions subject to variations in foreign exchange and interest rates, share, of prices indexes and commodity prices among other indexes on these risk factors.

The market risk management is the process through which the institution plans, monitors and controls the risks of variations in financial instruments market values due market changes, aiming at optimizing the risk-return ratio, by using an appropriate structure of Adequate management limits, models and tools.

| 19 |

The policy of risk management is in line with the principles of CMN Resolution No. 3,464, and posterior amendments, comprising a set of principles that drive the institution’s strategy of control and management of market risks in all business units and legal entities of ITAÚ UNIBANCO HOLDING.

The document set forth by the corporate guidelines on market risk management, that is not part of the financial statements, may be viewed on the website www.itau-unibanco.com.br/ri, in the section Corporate Governance/Rules and Policies/Public Access Report - Market Risk.

The risk management strategy of ITAÚ UNIBANCO HOLDING tries to achieving a balance between business objectives, considering among others:

| · | Political, economic and market context; |

| · | Market risk portfolio of ITAÚ UNIBANCO HOLDING; |

| · | Capacity to operate in specific markets. |

The

process for managing market risk of ITAÚ UNIBANCO HOLDING occurs within the governance and hierarchy of committees and

limits approved specifically for this purpose, sensitizing different levels and classes of market risk. This framework

limits that covers from the monitoring of aggregate indicators of risk (portfolio level) to the monitoring of granular limits

(individual desks level), assuring effectiveness and coverage of control.This market risk framework includes

limits that involve the monitoring of aggregate risk indicators (at the portfolio level) and extends its coverage to more granular

levels (the individual desk level) with specific limits aiming to improve the process of risk monitoring and understanding and

also to prevent risk concentration. These limits are dimensioned considering the projected results

of the balance sheet, expected performance and risk appetite of the institution, the level of equity and the profile of risk of

each organization unit, which are defined in terms of risk measures used by management. The process of setting these limit

levels and breach reporting follows the governance approved by our financial conglomerate’s internal policies. Limits

are monitored and controlled daily and excesses are reported and discussed in the corresponding committees. Additionally, daily

risk reports used by the business and control areas, are issued to the top management.

The limit structure and warnings follow the guidelines of the Board of Directors and is established and approved by the Superior Risk Committee (CSRisc) after discussions and resolutions of the Superior Institutional Treasury Committee (CSTI) on metrics and market risk limits. The review of this structure of limits is performed at least annually.

The purpose of this structure is:

| · | Providing more assurance to all executive levels that the assumption of market risks is in line with the ITAÚ UNIBANCO HOLDING and the risk-return objective; |

| 20 |

| · | Promoting the disciplined and educated discussion on the global risk profile and its evolution over time; |

| · | Increasing transparency on the way the business seeks the optimization of results; |

| · | Providing early warning mechanisms in order to make the effective risk management easier, without jeopardizing the business purposes; and |

| · | Avoiding risk concentration. |

The market risk control and management process is periodically reviewed with the purpose of keeping the process aligned with best market practices and complies with continuous improvement processes at ITAÚ UNIBANCO HOLDING.

The market risk is controlled by an area independent from the business units and is responsible for carrying out daily measurement, assessment, analysis and reporting activities to the areas and relevant people, in accordance with the governance established and following up the actions required for adjusting the position and/or risk level, when necessary. For that purpose, the ITAÚ UNIBANCO HOLDING has a structured reporting and information flow with the objective of providing input for the follow-up by senior-level committees and complying with the requirements of Brazilian and foreign regulatory agents.

ITAÚ UNIBANCO HOLDING hedges transactions with clients and proprietary positions, including foreign investments, aiming at mitigating risks arising from fluctuations in significant market factors and adjusting the transactions into the current exposure limits. Derivatives are the most frequently used instruments for these hedges. When these transactions are designed for as hedge accounting, specific supporting documentation is prepared, including continuous review of the hedge effectiveness and other changes in the accounting process. Accounting and managerial hedge are governed by corporate guidelines of ITAÚ UNIBANCO HOLDING.

The market risk framework categorizes transactions as part of either the banking portfolio or the trading portfolio, in accordance with general criteria established by the Capital Accord and subsequent amendments.

The trading portfolio consists of all qualifying transactions (including derivatives) held with intent to trade or to hedge risk within this portfolio, and that have no restriction.

The banking portfolio is basically characterized by transactions from the banking business, such as funding and loans, and also includes derivatives with eligible clients and transactions related to the management of the balance sheet of the institution, including by way of derivatives. It has the no-intention of resale and medium- and long-term time horizons as general guidelines.

The exposures to market risks inherent in the various products, including derivatives, are broken down into a number of risk factors. Market factors are primary components of pricing. The main risk factors measured by ITAÚ UNIBANCO HOLDING are:

| 21 |

| · | Interest rates risk: risk of financial losses on operations subject to interest rates variations; |

| · | Foreign exchange-linked: the risk of losses arising from positions in transactions which are subject to a foreign exchange-linked interest rate; |

| · | Foreign exchange rates: risk of losses on positions in foreign currency in operations subject to foreign exchange variation; |

| · | Price index-linked: risk of financial losses on operations subject to changes in price index coupon rates; |

| · | Variable income: risk of losses in operations subject to variation in goods prices and commodities. |

The CMN has regulations establishing the segregation of market risk exposure at a minimum into the following categories: interest rates, foreign exchange rates and variable income. Brazilian inflation indexes are treated as a group of risk factors and receive the same treatment as the other risk factors, such as interest rates and FX rates, and follow the governance and risk limits framework adopted by our organization for market risk management.

Market risk for interest rate in the Trading and Banking Portfolio is managed by a combination of processes, including marking-to-market positions, calculating sensitivity to interest rate variations, Value at Risk (VaR) and running stress tests across the portfólio, these processes are consistent with ITAÚ UNIBANCO HOLDING’s institutional policies incorporated into the market risk framework.

To evaluate the share position of the banking and trading portfolios, Value at Risk (VaR) is applied, in addition to stress tests, as presented below in the paragraph about metrics.

Market risk is analyzed based on the following metrics:

| · | Value at risk (VaR): statistical metric that estimates the expected maximum potential economic loss under normal market conditions, taking into consideration a certain time horizon and confidence level; |

| · | Losses in stress scenarios (Stress test): simulation technique to assess the behavior of assets, liabilities and derivatives of a portfolio when several risk factors are taken to extreme market situations (based on prospective scenarios) in the portfolio; |

| · | Stop loss: metrics which purpose is to review positions, should losses accumulated in a certain period reach a certain amount; |

| · | Concentration: cumulative exposure of a certain asset or risk factor calculated at market value (“MtM – Mark to Market”); |

| 22 |

| · | Stressed VaR: statistical metric resulting from the VaR calculation, with the purpose of capturing the highest risk in simulations for the current portfolio, considering the returns that can be observed in historic scenarios. |

In addition to the risk measures, sensitivity and loss control measures are also analyzed. They comprise:

| · | Gap analysis: accumulated exposure, by risk factor, of cash flows expressed at market value, allocated at the maturity dates; |

| · | Sensitivity (DV01 – Delta Variation): the impact on the cash flows market value when submitted to an one annual basis point increase in the current interest rates or index rate; |

| · | Sensitivity to the Several Risk Factors (Greeks): partial derivatives of an options portfolio in relation to the underlying assets price, implicit volatility, interest rate and timing. |

ITAÚ UNIBANCO HOLDING uses proprietary systems to measure the consolidated market risk. The processing of these systems mainly takes place in São Paulo, in an access-controlled, of high availability, environment, with data safekeeping and recovery processes, and counts on such an infrastructure to ensure the continuity of business in contingency (disaster recovery) situations.

* * * *

The Company acknowledges that (i) the Company is responsible for the adequacy and accuracy of the disclosure in its filings; (ii) Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and (iii) the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

[Remainder of this page intentionally left blank.]

| 23 |

If you have any questions regarding this letter, please do not hesitate to call the undersigned at + (55) (11) 5019-1792 or to send an e-mail to caio.david@itau-unibanco.com.br.

| Sincerely, | ||

| /s/ | ||

| Caio Ibrahim David, Chief Financial Officer | ||

| cc Roberto Egydio Setubal, Chief Executive Officer | ||

| Alfredo Egydio Setubal, Investor Relations Officer |

| 24 |