UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☐ | Definitive Information Statement |

| NEW MOMENTUM CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

3823 44th Ave. NE

Seattle, Washington 98105

Telephone No.: (206) 522-2256

Payment of Filing Fee (Check the appropriate box)

| ☒ | No fee required. |

|

|

|

| ☐ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

|

|

|

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

|

|

|

| ☐ | Fee paid previously with preliminary materials. |

|

|

|

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

NEW MOMENTUM CORPORATION

150 Cecil Street, #08-01

Singapore 069543

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This Information Statement is first being furnished on or about June ___, 2022 to the holders of record as of the close of business on June ___, 2022 of the common stock of New Momentum Corporation, a Nevada corporation (the “New Momentum”).

Effective May 30, 2022, the Board of Directors of New Momentum and 1 stockholder holding an aggregate of 70,813,213 shares of common stock and 150,000,000 shares of Series A Preferred Stock issued and outstanding as of May 30, 2022, have approved and consented in writing to the following action:

|

| ● | The approval of an amendment to our Articles of Incorporation to increase the number of shares of common stock authorized for issuance from 500,000,000 to 1,000,000,000. |

Such approval and consent constitute the approval and consent of a majority of the total number of shares of outstanding common stock and are sufficient under the Nevada Revised Statutes (“NRS”) and New Momentum’s Articles of Incorporation, as amended, and Bylaws to approve the actions. Accordingly, the actions will not be submitted to the other stockholders of New Momentum for a vote, and this Information Statement is being furnished to stockholders to provide them with certain information concerning the action in accordance with the requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the regulations promulgated thereunder, including Regulation 14C.

ACTIONS BY BOARD OF DIRECTORS

AND

CONSENTING STOCKHOLDER

GENERAL

New Momentum will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. New Momentum will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending this Information Statement to the beneficial owners of New Momentum’s common stock.

New Momentum will only deliver one Information Statement to multiple security holders sharing an address unless New Momentum has received contrary instructions from one or more of the security holders. Upon written or oral request, New Momentum will promptly deliver a separate copy of this Information Statement and any future annual reports and information statements to any security holder at a shared address to which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information statements to any security holder or holders sharing an address to which multiple copies are now delivered. You should direct any such requests to the following address: New Momentum Corporation, 150 Cecil Street, #08-01, Singapore 069543 Attn: Leung Tin Lung David, Chief Executive Officer. Mr. Leung may also be reached by telephone at +65 3105 1428.

INFORMATION ON CONSENTING STOCKHOLDER

Pursuant to New Momentum’s Bylaws and the Nevada Revised Statutes (“NRS”), a vote by the holders of at least a majority of New Momentum’s outstanding capital stock is required to effect the action described herein. New Momentum’s Articles of Incorporation, as amended, does not authorize cumulative voting. As of the record date, New Momentum had 176,168,548 shares of common stock issued and outstanding. The voting power representing not less than 88,084,275 shares of common stock is required to pass any stockholder resolutions. The consenting stockholders are the record and beneficial owner of 70,813,213 shares of common stock and 1 share of Series A Preferred Stock, which represents approximately 40.1% of the issued and outstanding shares of common stock and 100% of Series Preferred Stock of New Momentum. Each share of Series A Preferred Stock has voting rights equal to 110% of the number of issued and outstanding shares of common stock of the Company. Accordingly, the 1 share of Series A Preferred Stock has voting power equal to 193,785,402 shares of common stock. Pursuant to Chapter 78.320 of the NRS, the consenting stockholders voted, with the Board of Directors, in favor of the actions described herein in a joint written consent, dated May 30, 2022. No consideration was paid for any consent. The consenting stockholders’ names, affiliation with New Momentum, and their beneficial holdings are as follows:

| 2 |

|

Name |

Affiliation | Shares of Common Stock Beneficially Held | Shares of Series A Preferred Stock Held | Total Voting Power |

|

Leung Tin Lung David (1) |

President, Chief Executive Officer, Director, and greater than 10% holder of common stock |

70,813,213 (1) |

1 (2) |

264,598,615shares (3) |

|

| (1) | Such 70,813,213 shares equal to 40.1% of the 176,168,548 issued and outstanding shares of common stock on May 30, 2022. |

|

| (2) | Such 1 share of Series A Preferred Stock equals 100% of the issued and outstanding shares of Series A Preferred Stock on May 30, 2022. Voting power equal to 193,785,402 shares of common stock. |

|

| (3) | Comprised of 70,813,213 shares of common stock and 1 share of Series A Preferred Stock, which has voting power equal to 193,785,402 shares of common stock. |

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

None.

PROPOSALS BY SECURITY HOLDERS

None.

DISSENTERS RIGHTS OF APPRAISAL

None.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of May 30, 2022, certain information regarding the ownership of New Momentum’s capital stock by each director and executive officer of New Momentum, each person who is known to New Momentum to be a beneficial owner of more than 5% of any class of New Momentum’s voting stock, and by all officers and directors of New Momentum as a group. Unless otherwise indicated below, to New Momentum’s knowledge, all persons listed below have sole voting and investing power with respect to their shares of capital stock, except to the extent authority is shared by spouses under applicable community property laws.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (“SEC”) and generally includes voting or investment power with respect to securities. Shares of common stock subject to options, warrants or convertible securities exercisable or convertible within 60 days of May 30, 2022 are deemed outstanding for computing the percentage of the person or entity holding such options, warrants or convertible securities but are not deemed outstanding for computing the percentage of any other person, and is based on 176,168,548 shares of common stock issued and outstanding on a fully diluted basis, as of May 30, 2022.

| 3 |

| Name and Address of Beneficial Owner |

| Amount and Nature of Beneficial Ownership |

|

| Percentage of Class (1) |

| ||

| Leung Tin Lung David (2) |

|

| 70,813,213 |

|

|

| 40.1 | % |

| Directors and Executive Officers as a Group (1 person) |

|

| 70,813,213 |

|

|

| 40.1 | % |

|

|

|

|

|

|

|

|

|

|

| 5% or greater shareholders |

|

|

|

|

|

|

|

|

| Chak Wan Ling Margaret (3) |

|

| 27,763,000 |

|

|

| 15.8 |

|

| Leung Yin Yu Janice (4) |

|

| 25,000,000 |

|

|

| 14.2 | % |

| Leung Suk Man (5) |

|

| 25,000,000 |

|

|

| 14.2 | % |

____________

| * | Less than 1%. |

| (1) | Percentages are calculated based on 176,168,548 shares of the Company’s common stock issued and outstanding on March 30, 2020. |

| (2) | Address at c/o New Momentum Corporation, 150 Cecil Street, #08-01, Singapore 069543. |

| (3) | Address at c/o New Momentum Corporation, 150 Cecil Street, #08-01, Singapore 069543. |

| (4) | Address at c/o New Momentum Corporation, 150 Cecil Street, #08-01, Singapore 069543. |

| (5) | Address at c/o New Momentum Corporation, 150 Cecil Street, #08-01, Singapore 069543. |

The following table lists, as of May 30, 2022, the number of shares of Series A Preferred Stock of our Company that are beneficially owned by each person or entity known to our Company to be the beneficial owner of more than 5% of the outstanding Series A Preferred Stock.

| Name and Address of Beneficial Owner |

| Amount and Nature of Beneficial Ownership of Series A Preferred Stock |

| Percentage of Class (1) |

| |

| Leung Tin Lung David (2) |

| 1 share directly held (3) |

|

| 100 | % |

(1) Percentages are calculated based on 1 share of the Company’s Series A Preferred Stock issued and outstanding on May 30, 2022. Each share of Series A Preferred Stock has voting rights equal to 110% of the issued and outstanding shares of common stock. Accordingly, on May 30, 2022, such 1 share of Series A Preferred Stock has voting power equal to 264,598,615 share of common stock.

(2) Address at c/o New Momentum Corporation, 150 Cecil Street, #08-01, Singapore 069543.

| 4 |

EXECUTIVE COMPENSATION

The following table sets forth information regarding each element of compensation that we paid or awarded to our named executive officers for fiscal years ended December 31, 2021 and 2020:

Summary Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-Equity |

|

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Incentive |

|

| Nonqualified |

|

|

|

|

|

|

| ||||||||

| Name and |

|

|

|

|

|

|

|

|

| Stock |

|

| Option |

|

| Plan |

|

| Deferred |

|

| All Other |

|

|

|

| ||||||||

| Principal Position |

| Year |

| Salary ($) |

|

| Bonus ($) |

|

| Awards ($) |

|

| Awards ($) |

|

| Compensation ($) |

|

| Compensation ($) |

|

| Compensation ($) |

|

| Total ($) |

| ||||||||

| Law Wai |

| 2021 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

| Fan (1) |

| 2020 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cheng Kin |

| 2021 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

| Ning (2) |

| 2020 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Marie Huen |

| 2021 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

| Lai Chun (3) |

| 2020 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Leung Tin |

| 2021 |

|

| 10,785 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 10,785 |

|

| Lung David (4) |

| 2020 |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

___________

| (1) | Appointed Chief Executive Officer and President on February 13, 2015; resigned from all such positions on May 27, 2020. |

| (2) | Appointed Chief Financial Officer, Secretary and Treasurer on February 13, 2015; resigned from all such positions on May 27, 2020. |

| (3) | Appointed Chief Operating Officer on February 13, 2015; resigned from such position on May 27, 2020. |

| (4) | Appointed President, Secretary, Treasurer and director on May 27, 2020. |

Employment Contracts, Termination of Employment, Change-in-Control Arrangements

On April 16, 2021, the Company entered into an Employment Agreement (the “Employment Agreement”) with Leung Tin Lung David, our President and Chief Executive Officer, and sole director.

The Employment Agreement provides that Mr. Leung shall act as the Company’s Chief Executive Officer at an initial annual base salary of $240,000. Mr. Leung’s monthly base salary shall increase by $30,000 per month, which is equivalent to $360,000 on an annualized basis, at the time that the Company closes on a Qualified Financing. For the purposes of the Employment Agreement, a “Qualified Financing” shall mean an equity or debt financing in which the Company offers and sells equity or debt securities for an aggregate purchase price of, and obtains gross cash proceeds in an amount of, not less than $1,000,000. Mr. Leung may, in his sole discretion, elect to receive any monthly base salary due to him, in whole or in part, in the form of a restricted stock grant, or a warrant or an option with no or a an exercise price of $0.00001 per share, with a future vesting date to be determined by Mr. Leung, and a term of 10 years. Mr. Leung’s base salary shall increase by 7% on April 1 of each year, based on the salary due to Mr. Leung in the year prior to each such increase.

In addition to new hire option grants and any other outstanding options that Mr. Leung may currently hold, Mr. Leung is eligible to participate in the Company’s 2020 Stock Incentive Program, and any employee benefit plan of the Company (the “Program”) whereby each year Mr. Leung may receive an option for up to 5,000,000 shares of Company Common Stock (the “Option”) per year. The Option, if granted, will vest and become exercisable over a four (4) year vesting period such that 1/48 of the total number of Option shares will vest and become exercisable on each monthly anniversary. Vesting is contingent upon Mr. Leung’s continued employment with the Company.

Mr. Leung is eligible for a cash bonus(es) equal to 10% of first $1,000,000 of earnings before interest, tax, depreciation and amortization (“EBITDA”) of the Company, 8% of the second $1,000,000 of EBITDA of the Company, 6% of the third $1,000,000 of EBITDA of the Company, 4% of the fourth $1,000,000 of EBITDA of the Company, and 2% of all EBITDA of the Company in excess of $4,000,000. All such bonus payments are due to Mr. Leung when the Company earns its EBITDA. In lieu of any cash payment due to Mr. Leung as a bonus, Mr. Leung, may in his sole discretion, elect to receive shares of common stock of the Company at a rate of $0.27805 per share (the closing price per share of common stock of the Company on the OTC Markets on April 15, 2021). In lieu of any issuance of shares common stock by the Company to Mr. Leung as a bonus, Mr. Leung may, in his sole discretion, elect to receive any monthly base salary due to him, in whole or in part, in the form of a restricted stock grant, or a warrant or an option with no or a an exercise price of $0.27805 per share, with a future vesting date to be determined by Mr. Leung, and a term of 10 years.

| 5 |

Mr. Leung is also eligible for a cash bonus in the event of any sale (whether in one or a series of transactions) of all or a substantial amount of the assets or the capital stock of the Company, any sale, merger, consolidation or other event which results in the transfer of control of or a material interest in the Company or of all or a substantial amount of the assets thereof, as well as any recapitalization, restructuring or liquidation of the Company by the current owners, a third party or any combination thereof, or any other form of transaction or disposition which results in the effective sale of the principal business and operations of the Company by the current owners (a “Transaction”).

In the event a Transaction is consummated or if the Company enters into an agreement providing for a Transaction, the Company will pay Mr. Leung a “Transaction Fee,” payable in cash or other immediately available funds at the closing of the Transaction. The Transaction Fee shall be equal to 3% of the aggregate value (as defined below) of the Transaction; however, in no event shall the Transaction Fee be less than $750,000.

In the event a licensing transaction is consummated by the Company for a licensing aggregate value of greater than $5,000,000, the Company will pay Mr. Leung a cash fee (the “Licensing Transaction Fee”), payable in cash or other immediately available funds at the closing of the Licensing Transaction, equal to 6.0% of the Licensing Aggregate Value; provided, however, that in no event shall the License Transaction Fee be less than $750,000.

1,000,000 shares of common stock shall be issued to Mr. Leung when the Company’s securities are listed on an exchange or the OTCQX tier of the OTC Markets Group, Inc. In lieu of such an issuance of 1,000,000 shares common stock, Mr. Leung may, in his sole discretion, elect to receive such shares, in the form of a restricted stock grant, or a warrant or an option with no or a an exercise price of $0.00001 per share, with a future vesting date to be determined by Mr. Leung, and a term of 10 years.

The Company will pay for Mr. Leung’s costs related to his (i) reasonable monthly cell phone and other mobile Internet costs, home office Internet costs, (iii) car and commuting costs, not to exceed $1,000 per month, and (iii) club membership costs, payable not later than 10 days after the end of each month.

Mr. Leung is also entitled a severance payment for his then current annual base salary rate upon the termination of his employment by the Company without cause or by him for good reason or in the event of a change in control.

Option Exercises and Fiscal Year-End Option Value Table

There were no stock options exercised by the named executive officers as of the end of the fiscal year ended December 31, 2021.

Long-Term Incentive Plans and Awards

There were no awards made to a named executive officer, under any long-term incentive plan, as of the end of the fiscal year ended December 31, 2021.

We currently do not pay any compensation to our directors serving on our Board of Directors.

Other Compensation

There are no annuity, pension or retirement benefits proposed to be paid to officers, directors, or employees of our company in the event of retirement at normal retirement date as there was no existing plan as of December 31, 2021, provided for or contributed to by our company.

Director Compensation

The following table sets forth director compensation for fiscal year ended December 31, 2021:

| Name |

| Fees Earned or Paid in Cash ($) |

|

| Stock Awards ($) |

|

| Option Awards ($) |

|

| Non-Equity Incentive Plan Compensation ($) |

|

| Nonqualified Deferred Compensation Earnings ($) |

|

| All Other Compensation ($) |

|

| Total ($) |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

| Leung Tin Lung David (1) |

|

| -0- |

|

|

| -0- |

|

|

| -0- |

|

|

| -0- |

|

|

| -0- |

|

|

| -0- |

|

|

| -0- |

|

_______________

| (1) | Appointed President, Secretary, Treasurer and director on May 27, 2020. |

| 6 |

Narrative to Director Compensation Table

The following is a narrative discussion of the material information that we believe is necessary to understand the information disclosed in the previous table.

Leung Tin Leung David receives no compensation solely in his capacity as a director of the Company. All travel and lodging expenses associated with corporate matters are reimbursed by us, if and when incurred.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth stock option grants and compensation or the fiscal year ended December 31, 2021:

|

|

| Option Awards |

|

| Stock Awards |

| |||||||||||||||

| Name |

| Number of Securities Underlying Unexercised Options (#) Exercisable |

| Number of Securities Underlying Unexercised Options (#) Unexercisable |

| Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

| Option Exercise Price ($) |

| Option Expiration Date |

|

| Number of Shares or Units of Stock That Have Not Vested (#) |

| Market Value of Shares or Units of Stock That Have Not Vested ($) |

| Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

| Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) |

| |

| Law Wai Fan (1) |

| -0- |

| -0- |

| -0- |

| $-0- |

|

| N/A |

|

| -0- |

| -0- |

| -0- |

| -0- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cheng Kin Ning (2) |

| -0- |

| -0- |

| -0- |

| $-0- |

|

| N/A |

|

| -0- |

| -0- |

| -0- |

| -0- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Marie Huen Lai Chun (3) |

| -0- |

| -0- |

| -0- |

| $-0- |

|

| N/A |

|

| -0- |

| -0- |

| -0- |

| -0- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Chu Kin Hon (4) |

| -0- |

| -0- |

| -0- |

| $-0- |

|

| N/A |

|

| -0- |

| -0- |

| -0- |

| -0- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Leung Tin Lung David (5) |

| -0- |

| -0- |

| -0- |

| $-0- |

|

| N/A |

|

| -0- |

| -0- |

| -0- |

| -0- |

|

_____________

| (1) | Appointed Chief Executive Officer on February 13, 2015; resigned from such position on May 27, 2020. |

| (2) | Appointed Chief Financial Officer on February 13, 2015; resigned from such position on May 27, 2020. |

| (3) | Appointed Chief Operating Officer on February 13, 2015; resigned from such position on May 27, 2020. |

| (4) | Appointed a director on February 13, 2015; resigned from such position on May 27, 2020. |

| (5) | Appointed President, Secretary, Treasurer and director on May 27, 2020. |

| 7 |

Option Exercises and Fiscal Year-End Option Value Table.

There were no stock options exercised by the named executive officers as of the end of the fiscal period ended December 31, 2021.

Long-Term Incentive Plans and Awards

There were no awards made to a named executive officer, under any long-term incentive plan, as of the end of the fiscal year ended December 31, 2021.

We currently do not pay any compensation to our directors serving on our Board of Directors.

Equity Compensation Plan Information

On October 14, 2020, the Board of Directors of the Company approved and adopted the terms and provisions of a 2020 Stock Incentive Plan for the Company. Pursuant to the terms of the Plan, the maximum number of shares of Common Stock available for the grant of awards under the Plan shall not exceed 20,000,000. During the year ended December 31, 2020, the Company granted 19,400,000 shares of common stock to directors, officers, and consultants. During the year ended December 31, 2021, the Company granted 250,000 shares of common stock to consultants.

Other Compensation

There are no annuity, pension or retirement benefits proposed to be paid to officers, directors, or employees of our company in the event of retirement at normal retirement date as there was no existing plan as of the end of the fiscal year ended December 31, 2021.

CHANGE IN CONTROL

To the knowledge of management, there are no present arrangements or pledges of securities of New Momentum which may result in a change in control of New Momentum.

NOTICE TO STOCKHOLDERS OF ACTION APPROVED BY CONSENTING STOCKHOLDER

The following action was taken based upon the unanimous recommendation of the Board of Directors and the written consent of the consenting stockholders:

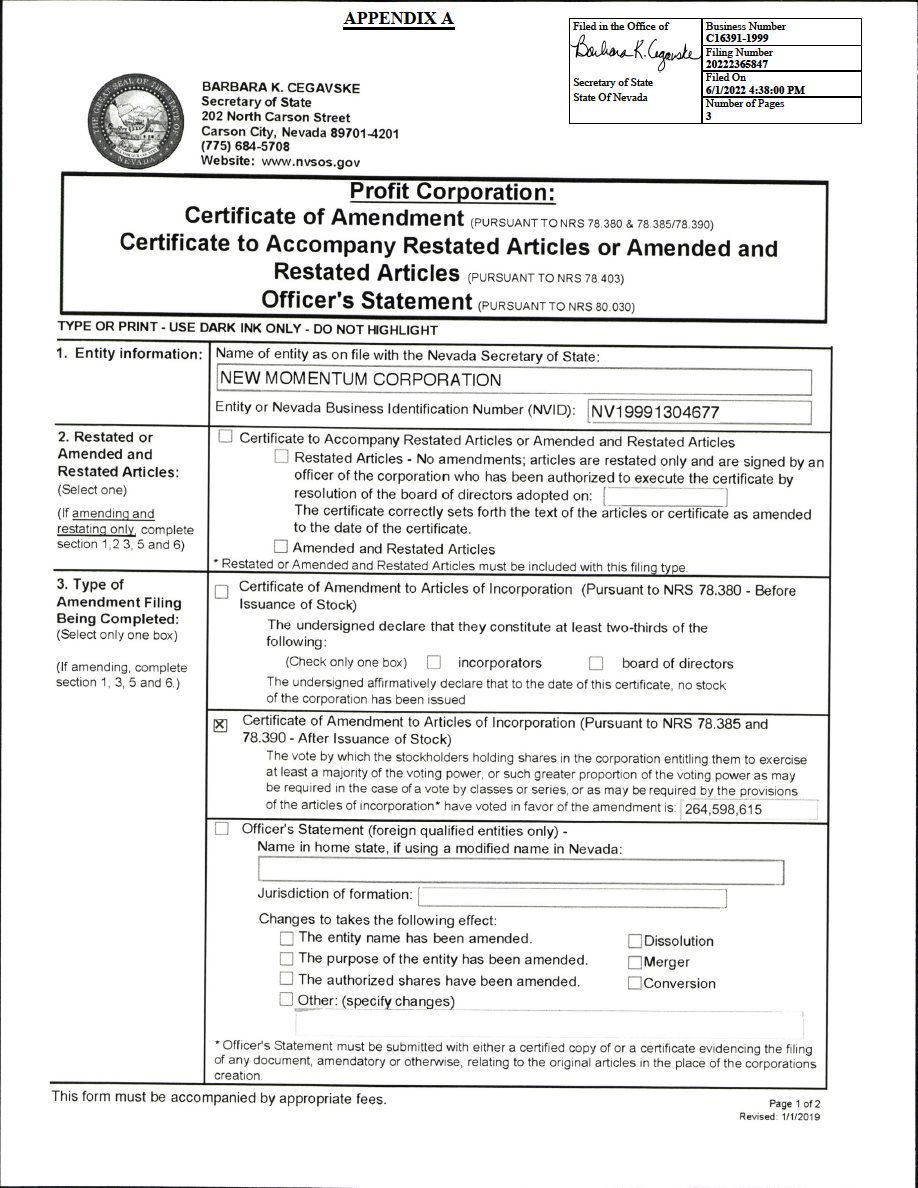

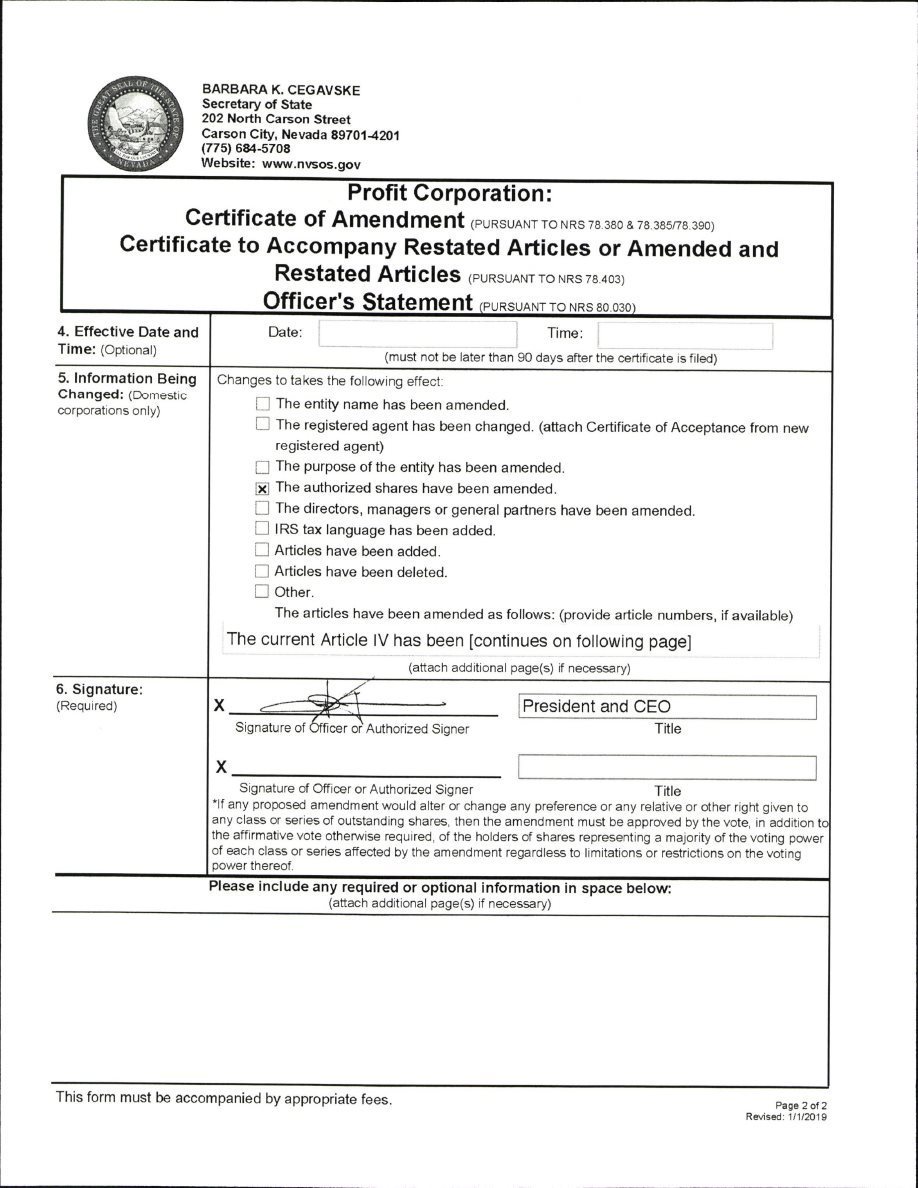

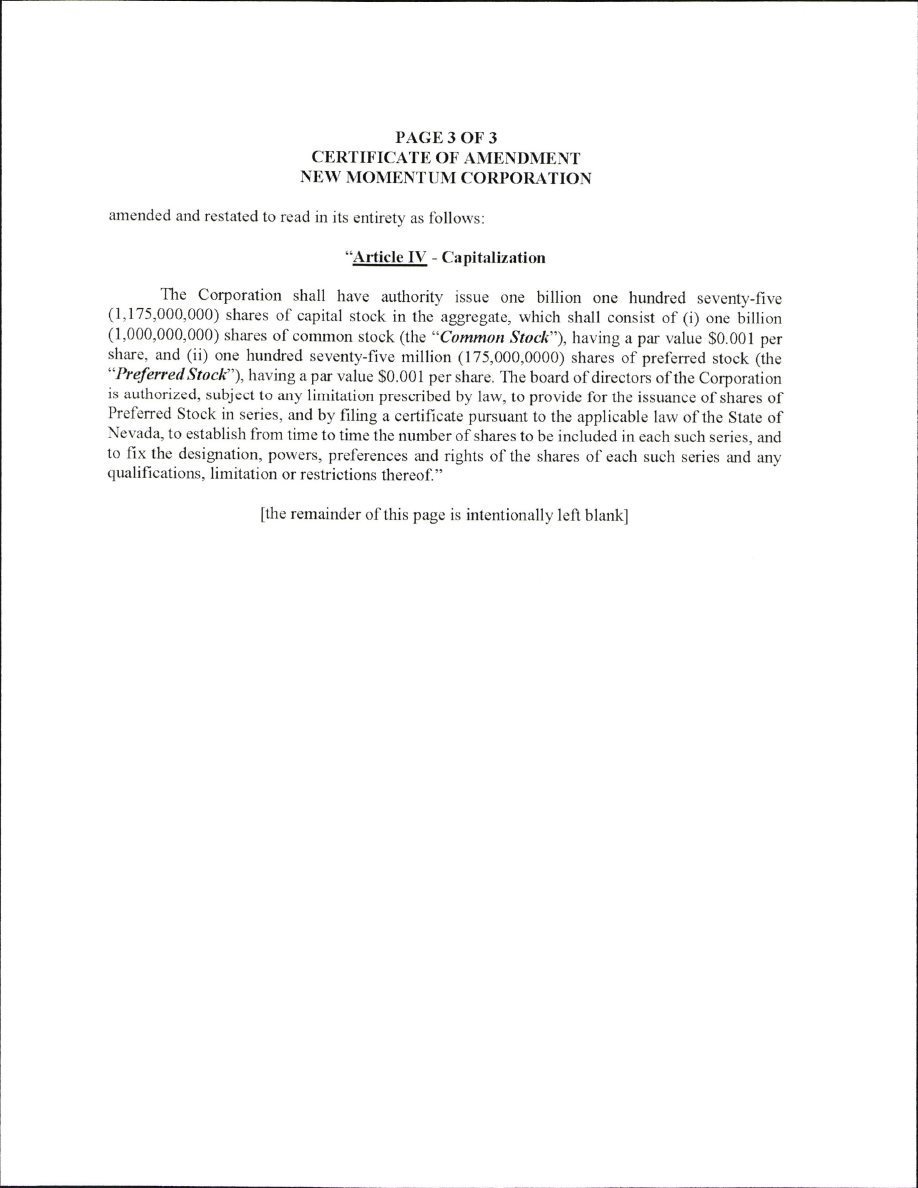

I. AMENDMENT TO THE ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF SHARES OF AUTHORIZED COMMON STOCK

On May 30, 2022, the Board of Directors the consenting stockholders adopted and approved a resolution to effect an amendment to our Articles of Incorporation to increase the number of shares of authorized common stock from 500,000,000 to 1,000,000,000. The number of authorized shares of preferred stock of 175,000,000 remains unchanged. Such amendment is referred to herein as the “Authorized Shares Amendment.”

Currently, New Momentum has 500,000,000 shares of common stock authorized, of which 176,168,548 shares were issued and outstanding on May 30, 2022. As a result of the Authorized Shares Amendment, New Momentum will have 1,000,000,000 shares of shares of common stock authorized for issuance, of which 7,830,872,701 will be available for issuance.

| 8 |

A table illustrating the Authorized Shares Amendment (discussed below) is as follows:

|

|

| Number of shares of common stock issued and outstanding |

|

| Number of shares of common stock authorized in Articles of Incorporation (1) |

|

| Number of shares of common stock authorized and reserved for issuance |

| Number of shares of common stock authorized but unreserved for issuance |

| |||

| Before Authorized Shares Amendment |

|

| 176,168,548 |

|

|

| 500,000,000 |

|

| -0- |

|

| 323,831,452 |

|

| After Authorized Shares Amendment |

|

| 176,168,548 |

|

|

| 1,000,000,000 |

|

| -0- |

|

| 823,831,452 |

|

|

| (1) | Does not include 175,000,000 shares of Preferred Stock, 1 share of which has been designated as Series A Preferred Stock and all of which are issued and outstanding. |

Giving effect to the Authorized Shares Amendment, New Momentum will still have 7,830,872,701 shares of common stock, all of which will be unreserved, but authorized for issuance. Any additional issuance of common stock could, under certain circumstances, have the effect of delaying or preventing a change in control of New Momentum by increasing the number of outstanding shares entitled to vote and by increasing the number of votes required to approve a change in control of New Momentum. Shares of common stock could be issued, or rights to purchase such shares could be issued, to render more difficult or discourage an attempt to obtain control of New Momentum by means of a tender offer, proxy contest, merger or otherwise. The ability of the Board of the Directors to issue such additional shares of common stock could discourage an attempt by a party to acquire control of New Momentum by tender offer or other means. Such issuances could therefore deprive stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price that such an attempt could cause. Moreover, the issuance of such additional shares of common stock to certain persons’ interests aligned with that of the Board of Directors could make it more difficult to remove incumbent managers and directors from office even if such change were to be favorable to stockholders generally.

While the increase in the number of shares of common stock authorized may have anti-takeover ramifications, the Board of Directors believes that the financial flexibility offered by the amendment outweighs any disadvantages. To the extent that the increase in the number of shares of common stock authorized may have anti-takeover effects, the amendment may encourage persons seeking to acquire New Momentum to negotiate directly with the Board of Directors, enabling the Board of Directors to consider a proposed transaction in a manner that best serves the stockholders’ interests.

The Board of Directors believes that it is advisable and in the best interests of New Momentum to have available additional authorized but unissued shares of common stock in an amount adequate to provide for New Momentum’s future needs. The unissued shares of common stock will be available for issuance from time to time as may be deemed advisable or required for various purposes, including the issuance of shares in connection with financing or acquisition transactions. New Momentum has no present plans or commitments for the issuance or use of the proposed additional shares of common stock in connection with any financing.

The Authorized Shares Amendment is not intended to have any anti-takeover effect and is not part of any series of anti-takeover measures contained in any debt instruments or the Articles of Incorporation or the Bylaws of New Momentum in effect on the date of this Information Statement. However, New Momentum stockholders should note that the availability of additional authorized and unissued shares of common stock could make any attempt to gain control of New Momentum or the Board of Directors more difficult or time consuming and that the availability of additional authorized and unissued shares might make it more difficult to remove management. New Momentum is not aware of any proposed attempt to take over New Momentum or of any attempt to acquire a large block of New Momentum’s stock. New Momentum has no present intention to use the increased number of authorized common stock for anti-takeover purposes.

| 9 |

Effective Date

Under Rule 14c-2, promulgated pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Authorized Shares Amendment shall be effective twenty (20) days after this Information Statement is mailed to stockholders of New Momentum. We anticipate the effective date to be on or about June 24, 2022.

ADDITIONAL INFORMATION

We are subject to the informational requirements of the Exchange Act, and in accordance therewith file reports, proxy statements and other information including annual and quarterly reports on Form 10-K and 10-Q with the SEC. Copies of these documents can be obtained upon written request addressed to the SEC, Public Reference Section, 100 F Street, N.E., Washington, D.C., 20549, at prescribed rates. The SEC also maintains a web site on the Internet (http://www.sec.gov) where reports, proxy and information statements and other information regarding issuers that file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval System may be obtained free of charge.

STATEMENT OF ADDITIONAL INFORMATION

New Momentum’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, and filed with the SEC on May 16, 2022; Annual Report on Form 10-K for the year ended December 31, 2021, and filed with the SEC on April 18, 2022; and Registration Statement on Form 8-A, filed with the SEC on October 23, 2006, have been incorporated herein by this reference.

New Momentum will provide without charge to each person, including any beneficial owner of such person, to whom a copy of this Information Statement has been delivered, on written or oral request, a copy of any and all of the documents referred to above that have been or may be incorporated by reference herein other than exhibits to such documents (unless such exhibits are specifically incorporated by reference herein).

All documents filed by New Momentum pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of this Information Statement shall be deemed to be incorporated by reference herein and to be a part hereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Information Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Information Statement.

COMPANY CONTACT INFORMATION

All inquiries regarding New Momentum should be addressed to Leung Tin Lung David, Chief Executive Officer, at New Momentum’s principal executive offices, at: New Momentum Corporation, 150 Cecil Street, #08-01, Singapore 069543. Mr. Leung may also be reached by telephone at +65 3105 1428.

| 10 |

APPENDICES

The following documents are appended to this information statement:

Appendix A: Certificate of Amendment to Articles of Incorporation