UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 28, 2017

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36401

SPORTSMAN’S WAREHOUSE HOLDINGS, INC.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

|

39-1975614 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer |

|

7035 South High Tech Drive Midvale, Utah |

|

84047 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (801) 566-6681

Securities registered pursuant to Section 12(b) of the Act: Common Stock, Par Value $0.01 Per Share; Common stock traded on the NASDAQ stock market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

Accelerated filer |

|||||

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of July 29, 2016, the last business day of the registrant’s most recently completed second quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The NASDAQ Stock Market on such date, was $325,173,327. Shares held by each executive officer, director and by each person who owns 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of Registrant’s Common Stock outstanding as of March 24, 2017 was 42,269,940.

Portions of the Registrant’s Definitive Proxy Statement relating to the 2017 Annual Meeting of Shareholders, which will be filed with the Securities and Exchange Commission within 120 days after the end of the 2016 fiscal year, are incorporated by reference into Part III of this Report.

Table of Contents

ii

References throughout this document to “Sportsman’s Warehouse,” “we,” “us,” and “our” refer to Sportsman’s Warehouse Holdings, Inc. and its subsidiaries, and references to “Holdings” refer to Sportsman’s Warehouse Holdings, Inc. excluding its subsidiaries.

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “10-K”) contains statements that constitute forward-looking statements as that term is defined by the Private Securities Litigation Reform Act of 1995. These statements concern our business, operations and financial performance and condition as well as our plans, objectives and expectations for our business operations and financial performance and condition, which are subject to risks and uncertainties. All statements other than statements of historical fact included in this 10-K are forward-looking statements. These statements may include words such as “aim,” “anticipate,” “assume,” “believe,” “can have,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “likely,” “may,” “objective,” “plan,” “potential,” “positioned,” “predict,” “should,” “target,” “will,” “would” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events or trends. For example, all statements we make relating to our plans and objectives for future operations, growth or initiatives and strategies are forward-looking statements.

These forward-looking statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate and our management’s beliefs and assumptions. We derive many of our forward-looking statements from our own operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution predicting the impact of known factors is very difficult, and we cannot anticipate all factors that could affect our actual results.

All of our forward-looking statements are subject to risks and uncertainties that may cause our actual results to differ materially from our expectations. Important factors that could cause actual results to differ materially from our expectations include, but are not limited to:

|

· |

our retail-based business model is impacted by general economic conditions and economic and financial uncertainties may cause a decline in consumer spending; |

|

· |

our concentration of stores in the Western United States makes us susceptible to adverse conditions in this region, which could affect our sales and cause our operating results to suffer; |

|

· |

we operate in a highly fragmented and competitive industry and may face increased competition; |

|

· |

we may not be able to anticipate, identify and respond to changes in consumer demands, including regional preferences, in a timely manner; |

|

· |

we may not be successful in operating our stores in any existing or new markets into which we expand; and |

|

· |

current and future government regulations, in particular regulations relating to the sale of firearms and ammunition, may impact the demand for our products and our ability to conduct our business. |

The above is not a complete list of factors or events that could cause actual results to differ from our expectations, and we cannot predict all of them. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements disclosed under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this 10-K, as such disclosures may be amended, supplemented or superseded from time to time by other reports we file with the Securities and Exchange Commission (the “SEC”), including subsequent Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and public communications. You should evaluate all forward-looking statements made in this 10-K and otherwise in the context of these risks and uncertainties.

Potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on any forward-looking statements we make. These forward-looking statements speak only as of the date of this 10-K and are not guarantees of future performance or developments and involve known and unknown risks, uncertainties and other factors that are in many cases beyond our control. Except as required by law, we undertake no obligation to update or revise any forward-looking statements publicly, whether as a result of new information, future developments or otherwise.

iii

Overview

Sportsman’s Warehouse is a high-growth outdoor sporting goods retailer focused on meeting the everyday needs of the seasoned outdoor veteran, the first-time participant and every enthusiast in between. Our mission is to provide a one-stop shopping experience that equips our customers with the right hunting, shooting, fishing and camping gear to maximize their enjoyment of the outdoors. We strive to accomplish this goal by tailoring our broad and deep merchandise assortment to meet local conditions and demand, offering everyday low prices, providing friendly support from our knowledgeable, highly trained staff and offering extensive in-store events and educational programming. These core strategies help position Sportsman’s Warehouse as the “local outdoor experts” and the preferred place to both shop and share outdoor-based experiences in the communities we serve. As a result, we are expanding our loyal customer base in existing markets and increasing our store footprint in new markets, which we believe will further drive our growth and profitability.

Sportsman’s Warehouse was founded in 1986 as a single retail store in Midvale, Utah and has grown to 75 stores across 20 states. Today, we have the largest outdoor specialty store base in the Western United States and Alaska. Our stores range from 15,000 to 65,000 gross square feet, with an average size of approximately 42,000 gross square feet. Our store layout is adaptable to both standalone locations and strip centers. Based on publicly available information, we believe it is less capital-intensive for us to open new stores compared to our principal competitors because our “no frills” store layout requires less initial cash investment to build out and our stores generally require less square footage than the stores of our competitors. Together, these features enable us to effectively serve markets of multiple sizes, from Metropolitan Statistical Areas, or MSAs, with populations of less than 75,000 to major metropolitan areas with populations in excess of 1,000,000, while generating consistent four-wall Adjusted EBITDA margins and returns on invested capital across a range of store sales volumes. We may post information that is important to investors on our website from time to time. The information provided on our website is not part of this report and is, therefore, not incorporated herein by reference.

Our Competitive Strengths

We believe the following competitive strengths allow us to capitalize on the growth opportunity within the outdoor activities and sporting goods market:

Differentiated Shopping Experience for the Seasoned Outdoor Veteran, the First-Time Participant and Every Enthusiast in Between. We place great emphasis on creating an inviting and engaging store experience for customers of all experience levels. For the seasoned outdoor veteran, we offer a one-stop, convenient store layout that promotes “easy-in, easy-out” access to replenish supplies, learn about local conditions and test products. We also serve first-time participants and casual users who are interested in enjoying the outdoors but enter our store without a clear sense for what equipment they need for their chosen activity. Our highly trained employees, who often are outdoor enthusiasts themselves and users of the products we sell, engage and interact with our customers in order to educate them and equip them with the right gear. Our sales associates draw upon both formal vendor sales training as well as first-hand experiences from using our products in local conditions. This selling approach allows us to offer a broad range of products and to deliver a shopping experience centered on the customer’s needs, which we believe results in increased customer loyalty, repeat visits and frequent referrals to other potential customers.

A customer’s shopping experience in our stores is further enhanced by a variety of helpful in-store offerings and features, including the issuance of hunting and fishing licenses, local fishing reports, availability of Sportsman’s News (our proprietary in-store newspaper), access to the Braggin’ Board (where customers can post photos of their outdoor adventures), indoor test ranges for archery equipment and displays of customer-owned taxidermy. In addition, we host a variety of in-store programs (such as “ladies night”), contests (such as Bucks & Bulls, a free-to-enter, big-game trophy contest) and a wide range of instructional seminars, from turkey frying to firearm operation and safety. These programs are all designed to help our customers connect with the outdoors and build the skill sets necessary to maximize enjoyment of their chosen activities. As a result, we believe our stores often serve as gathering spots where local enthusiasts can share stories, product knowledge and advice on outdoor recreation activities, which both drives traffic and fosters customer loyalty.

4

Locally Relevant Merchandise Serving the Comprehensive Needs of Outdoor Enthusiasts at a Compelling Value. We offer our customers an extensive and carefully selected assortment of branded, high-quality outdoor products at competitive prices. We accomplish this in three principal ways:

|

· |

Locally Relevant Merchandise: We carry over 72,000 SKUs on average in each store, out of a pool of approximately 140,000 total SKUs. Each store’s merchandise is tailored to meet local conditions and consumer demand, taking into account seasonal requirements, regional game and fishing species, geographic diversity, weather patterns and key demographic factors, so that our customers have the right product, at the right time, for the right location. |

|

· |

Breadth and Mix of Product Assortment: Our merchandise strategy is designed to serve a variety of purchasing occasions, from big-ticket items to replenishment activity, as well as to meet the wide-ranging needs of customers from first-time participants to seasoned outdoor veterans. We pride ourselves on carrying an extensive selection of branded, “good, better and best” hard goods at everyday low prices, including a broad array of in-stock consumable items. Approximately 36.0% of our unit sales and 20.0% of our dollar sales during fiscal year 2016 were consumable goods, such as ammunition, bait, cleaning supplies, food, lures, propane and reloading supplies. We believe this pairing of product breadth and consumable goods appeals to a broad range of customers and drives both repeat traffic and increased average ticket value. |

|

· |

Strong Vendor Relationships: We believe our vendors find our “brand-centric”, high-service store concept to be unique among national specialty outdoor retailers. Our attractive store locations, consistent presentation of merchandise and thorough product training present a compelling opportunity for our vendors to offer their brands to local markets that historically have been served primarily by “mom & pop” retailers. As a result, we believe we are able to negotiate terms with our vendors that are similar to those offered to our principal competitors that are larger in size. We share the benefits of these strategic vendor relationships with our customers through better pricing and enhanced access to certain products that are limited in production. |

Flexible and Adaptable Real Estate Strategy. We believe that our store model, combined with our rigorous site selection process, is uniquely customizable to address the needs of the different markets we serve. Our stores can vary in size from approximately 15,000 to 65,000 gross square feet. We have had success with leasing existing sites as well as constructing new build-to-suit sites. Our flexible store model permits us to serve both large metropolitan areas, like Phoenix, Arizona, and smaller MSAs, like Soldotna, Alaska, while generating consistent four-wall Adjusted EBITDA margins and returns on invested capital across a range of store sales volumes. In small- to medium-sized markets, we are often able to establish ourselves as a standalone destination for our customers; in larger markets, we have successfully leveraged existing infrastructure to open stores in shopping plazas near complementary retailers, drawing upon existing foot traffic. We believe our low-cost, flexible model allows us to access both large and small markets more economically than many of our peers.

We maintain a disciplined approach to new store development and perform comprehensive market research before selecting a new site, including partnering with specialized, third-party local real estate firms. We select sites based on criteria such as local demographics, traffic patterns, density of hunting and fishing license holders in the area, abundance of hunting and fishing game and outdoor recreation activities, store visibility and accessibility, purchase data from our existing customer database and availability of attractive lease terms. We have established productive relationships with well-regarded commercial real estate firms and believe that we are a sought-after tenant, given the strength of the Sportsman’s Warehouse brand, the high volume of customers that visit our stores and our flexible approach to site locations. As a result, we continue to have access to desirable retail sites on attractive terms.

Low Cost Operating Structure with Attractive and Replicable Store Economics. We strive to maintain a lower operating cost structure than our principal competitors, which allows us to serve small- to medium-sized markets as well as larger MSAs. We achieve this by exercising tight control over store-level expenses, real estate costs and corporate overhead. In addition, our growing store base, efficient, localized marketing spend and “no frills” warehouse store layout help us maintain comparatively low operating costs and provide us with the opportunity to achieve four-wall Adjusted EBITDA margins of 10% or more for stores in most new markets. Our typical new store requires an average net investment of approximately $2.0 million, which includes store build-out (net of contributions from landlords) and pre-opening cash expenditures. In addition, we stock each new store with initial inventory at an average cost of approximately $2.3 million. We target a pre-tax return on invested capital within one year after opening of over 50% excluding initial inventory cost (or over 20% including initial inventory cost), although our historical returns have often

5

exceeded these thresholds. As of the end of fiscal year 2016, all of our stores that had been open for more than twelve months were profitable and those stores had an average Adjusted EBITDA margin of 13.5%. We believe this low-cost, capital-efficient approach also allows us to successfully serve markets that are not well-suited for the more capital-intensive store models of our principal competitors. Approximately 62% of our markets currently lack another nationally recognized outdoor specialty retailer, which we believe is a result of these dynamics.

Significant New Store Growth Opportunity within Existing and New Markets. We operate 75 stores across 20 states, primarily in the Western United States and Alaska, with a presence in these markets that is nearly three times that of the next largest outdoor retailer. We believe our leadership position in the Western United States, combined with our existing scalable infrastructure, provides a strong foundation for continued expansion within our core markets. Over the longer term, we believe our distinct retail concept has the potential to expand to more than 300 locations throughout the United States based on research conducted for us by Buxton Company, an independent consumer research and analytics firm.

Passionate and Experienced Management Team with Proven Track Record. We are focused on delivering an unsurpassed shopping experience to anyone who enjoys the excitement of the outdoors. This passion and commitment is shared by team members throughout our entire organization, from senior management to the employees in our stores. Our senior management team has an average of 20 years of retail experience, with extensive capabilities across a broad range of disciplines, including merchandising, real estate, finance, compliance, store operations, supply chain management and information technology. We also pride ourselves on the long tenure of our more than 200 store managers and corporate employees, who have been with us for an average of approximately nine years.

Our Growth Strategy

We are pursuing a number of strategies designed to continue our growth and strong financial performance, including:

Expanding Our Store Base. We believe that our compelling new store economics and our track record of opening successful new stores provide a strong foundation for continued growth through new store openings in existing, adjacent and new markets. Over the last three fiscal years, we have opened an average of nine stores per year. We have opened two new stores to date in fiscal year 2017 and currently plan to open an additional ten new stores in the remainder of fiscal year 2017. For the next several years thereafter, we intend to grow our square footage at a rate of greater than 10 percent annually and expect that most of our near-term growth will occur within the Western United States with our growth also focusing on expansion to the eastern United States. Our longer-term plans include expanding our store base to serve the outdoor needs of enthusiasts in markets across the United States. We believe our existing infrastructure, including distribution, information technology, loss prevention and employee training, is capable of sustaining 100 or more stores without significant additional capital investment.

Increasing Same Store Sales Growth. We are committed to increasing same store sales through a number of ongoing and new initiatives, including: addition of the ability to purchase firearms using our website and pick up the firearm in the store, expansion of our clothing offerings and private label program (such as our proprietary Rustic RidgeTM and KillikTM clothing lines), our loyalty program, the implementation of kiosks and mobile point-of-sale in our stores and expansion of our “store-within-a-store” programs with major brands such as Carhartt, Columbia Sportswear and Under Armour. Each of these initiatives is designed to foster additional shopping convenience, add deeper merchandise selection and provide more product information to the customer. We believe these initiatives will drive additional traffic, improve conversion and increase average ticket value.

Continuing to Enhance Our Operating Margins. We believe that our planned expansion of our store base and growth in same store sales will result in improved Adjusted EBITDA margins as we take advantage of economies of scale in product sourcing and leverage our existing infrastructure, supply chain, corporate overhead and other fixed costs. Furthermore, we expect to increase our gross profit margin by expanding product offerings in our private label program, including our proprietary Rustic RidgeTM and KillikTM clothing lines, and continuing marketing initiatives in our higher-margin clothing and footwear departments.

Growing the Sportsman’s Warehouse Brand. We are committed to supporting our stores, product offerings and brand through a variety of marketing programs, private label offerings and corporate partnerships. Our marketing and promotional strategy includes coordinated print, digital and social media platforms. In-store, we offer a wide range of

6

outdoor-themed activities and seminars, from turkey frying to firearm operation and safety. In addition, we sponsor community outreach and charity programs to more broadly connect with our local communities with the aim of promoting our brand and educating consumers. Finally, we are committed to local chapters of national, regional and local wildlife federations and other outdoor-focused organizations, such as Ducks Unlimited and the Rocky Mountain Elk Foundation. Many of our store managers and employees serve in senior positions in these organizations, which further strengthens our place as leaders in the local outdoor community. We believe all of these programs promote our mission of engaging with our customers and serving outdoor enthusiasts.

Our Stores

We operate 75 stores across 20 states as of January 28, 2017. Most of our stores are located in power, neighborhood and lifestyle centers. Power centers are large, unenclosed shopping centers that are usually anchored by three or more national supercenters, such as Target, Wal-Mart and Costco. Neighborhood centers are shopping centers anchored by a supermarket or drugstore that provide convenience goods and services to a neighborhood. Lifestyle centers are shopping centers that combine the traditional functions of a shopping mall with leisure amenities such as pedestrian friendly areas, open air seating and inviting meeting spaces. We also operate several single-unit, stand-alone locations. Our stores average approximately 42,000 gross square feet.

The following table lists the location by state of our 77 stores open as of March 24, 2017:

|

|

|

Number of Stores |

|

|

|

Number of Stores |

|

Utah |

|

9 |

|

Nevada |

|

3 |

|

Washington |

|

9 |

|

New Mexico |

|

3 |

|

Oregon |

|

8 |

|

Iowa |

|

1 |

|

Arizona |

|

7 |

|

Kentucky |

|

1 |

|

California |

|

7 |

|

Louisiana |

|

1 |

|

Idaho |

|

6 |

|

Mississippi |

|

1 |

|

Alaska |

|

5 |

|

North Dakota |

|

1 |

|

Colorado |

|

5 |

|

South Carolina |

|

1 |

|

Wyoming |

|

4 |

|

Tennessee |

|

1 |

|

Montana |

|

3 |

|

Virginia |

|

1 |

|

|

|

|

|

|

|

|

Store Design and Layout

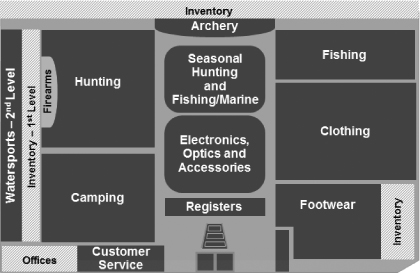

We present our broad and deep array of products in a convenient and engaging atmosphere to meet the everyday needs of all outdoor enthusiasts, from the seasoned veteran to the first-time participant. We maintain a consistent floor layout across our store base that we believe promotes an “easy-in, easy-out” shopping experience. All of our stores feature wide aisles, high ceilings, visible signage and central checkouts with multiple registers. Sportsman’s Warehouse stores, true to their name, are designed in a “no frills” warehouse format that welcomes customers directly from or on the way to an outdoor activity. All of our stores also feature “store-within-a-store” concepts for certain popular brand partners, such as Carhartt, Columbia Sportswear and Under Armour, through which we dedicate a portion of our floor

7

space to these brands to help increase visibility and drive additional sales. The diagram below demonstrates our typical store layout.

Our stores include locally relevant features such as a large fishing board at the entrance that displays current fishing conditions in local lakes and rivers with coordinating gear in end-cap displays in the fishing aisles. We actively engage our customers through in-store features such as the Braggin’ Board, various contests (such as Bucks & Bulls and Fish Alaska), and customer-owned taxidermy displays on the walls. We also host in-store programs such as “ladies night” and a wide range of instructional seminars, from Dutch oven cooking to choosing the right binocular. Annually, we organize approximately 3,000 programs across our stores for the benefit of our customers. We believe these programs help us connect with the communities in which we operate and encourage first time participants to build the skills necessary to become outdoor enthusiasts and loyal customers.

Expansion Opportunities and Site Selection

We have developed a rigorous and flexible process for site selection. We select sites for new store openings based on criteria such as local demographics, traffic patterns, density of hunting and fishing license holders in the area, abundance of hunting and fishing game and outdoor recreation activities, store visibility and accessibility, purchase data from our existing customer database and availability of attractive lease terms. Our store model is adaptable to markets of multiple sizes, from MSAs with populations of less than 75,000 to major metropolitan areas with populations in excess of 1,000,000. We have been successful both in remodeling existing buildings and in constructing new build-to-suit locations.

Our store model is designed to be profitable in a variety of real estate venues, including power, neighborhood and lifestyle centers as well as single-unit, stand-alone locations. In small- to medium-sized markets, we generally seek anchor locations within high-traffic, easily accessible shopping centers. In larger metropolitan areas, we generally seek locations in retail areas with major discount retailers (such as Wal-Mart), wholesale retailers (such as Costco), other specialty hardline retailers (such as The Home Depot) or supermarkets. As we continue to expand our store base, we believe that small- to medium-sized markets offer a significant opportunity. In these markets, we believe our store size, which is smaller than many of our national competitors but larger than many independent retailers, enables us to find convenient, easily accessible store locations while still offering the broad and deep selection of merchandise that our customers desire. In addition, our store format and size allow us to open multiple stores in local areas within major MSAs, which gives our customers convenient, easy access to our products without having to travel long distances.

Members of our real estate team spend considerable time evaluating prospective sites before bringing a proposal to our real estate committee. Our real estate committee, which is comprised of senior management including our Chief Executive Officer, Chief Financial Officer, Vice President of Real Estate, and Senior Vice President of Stores, approves all prospective locations before a lease is signed.

8

We believe there is a significant opportunity to expand our store base in the United States. Based on research conducted for us by Buxton Company, we believe that we can grow our store base from 77 locations to more than 300 locations in the United States.

We opened eleven new stores in fiscal year 2016. We have opened two new stores to date in fiscal year 2017 and currently plan to open an additional ten new stores in the remainder of fiscal year 2017. For the next several years thereafter, we intend to grow our square footage at a rate of greater than 10 percent annually. Our new store openings are planned in existing, adjacent and new markets.

Our new store growth plan is supported by our target new unit economics, which we believe to be compelling. A typical store location ranges in size from 30,000 to 50,000 gross square feet. Our net investment to open a new store is approximately $2.0 million, consisting of pre-opening expenses and capital investments, net of tenant allowances. In addition, we stock each new store with initial inventory at an average cost of approximately $2.3 million. For the first twelve month period after opening a new store, we target net sales of $8.0 million to $11.0 million, a four-wall Adjusted EBITDA margin of more than 10% and a pre-tax return on invested capital of over 50% excluding initial inventory cost (or over 20% including initial inventory cost). Our new stores typically reach a mature sales growth rate within three to four years after opening, with net sales increasing approximately 25% in the aggregate during this time period. For the 29 stores opened since 2010 that have been open for a full twelve months, we achieved an average four-wall Adjusted EBITDA margin of 13.5% and an average ROIC of 81.7% excluding initial inventory cost (and 30.1% including initial inventory cost) during the first twelve months of operations. In addition, we achieved an average pre-tax payback period of less than one year (excluding initial inventory cost) and expect to achieve an average pre-tax payback period of approximately 2.5 years (including initial inventory cost).

E-Commerce Platform and Digital Strategy

We believe our website is an extension of our brand and our retail stores. Our website, www.sportsmanswarehouse.com, serves as both a sales channel and a platform for marketing and product education, and allows us to engage more fully with the local outdoor community. Our website features a similar merchandise assortment as offered in our stores as well as certain products found exclusively online. Regulatory restrictions create certain structural barriers to the online sale of approximately 33% of our revenue, such as firearms, ammunition, certain cutlery, propane and reloading powder. As a result, this portion of our business is currently more protected from online-only retailers, such as Amazon.

We also provide our online customers with convenient multi-channel services. To ensure that our customers have access to our entire assortment of products available on the e-commerce website, our retail stores feature kiosks that allow customers to place orders for items that are available only on our website or that are out of stock or not regularly stocked. We view our kiosk offering as an important complement to our larger format stores, as well as a key differentiator and extension of our smaller format stores. Our in-store pickup offering allows customers to order products through our e-commerce website and pick up the products in our retail stores without incurring shipping costs. We believe our ship-to-store functionality is a valuable service offering to customers, as well as a means to generate additional foot traffic to our retail stores.

Our website also features an online version of our Braggin’ Board, which complements our retail store Braggin’ Board forum. In addition, our website features local area content, including fishing reports and event schedules, as well as online educational resources, including tips, advice and links to video demonstrations on our dedicated YouTube channel. In fiscal year 2014, we launched enhanced department and product pages, detailed buyer’s guides, and additional instructional product videos. We have also rolled out our social media strategy through our Facebook page and Instagram feed. These platforms allow us to reach our customers more directly with targeted postings of advertisements and in-store events. We believe our online educational resources and community outreach drive traffic to our website and retail stores, while improving user engagement as shoppers move from single-purchase users to loyal customers. We provide online customer service support and fulfill all orders in-house through our distribution center. During fiscal year 2016, our e-commerce platform generated total sales of $9.3 million, or 1.2% of our total sales. Over the same period, our website received greater than 17.0 million visits, which we believe demonstrates our position as a leading resource for outdoor products and product education.

9

Our Products and Services

Merchandise Strategy

We offer a broad range of products at a variety of price points and carry a deep selection of branded merchandise from well-known manufacturers, such as Browning, Carhartt, Coleman, Columbia Sportswear, Federal Premium Ammunition, Honda, Johnson Outdoors, Remington, Shakespeare, Shimano, Smith & Wesson and Under Armour. To reinforce our convenient shopping experience, we offer our products at competitive, everyday low prices. We believe our competitive pricing strategy supports our strong value proposition, instills price confidence in both our customers and our sales associates and is a critical element of our competitive position.

We believe we offer a wider selection of hard goods than many of our principal competitors. We employ a “good, better, and best” merchandise strategy, with an emphasis on “better” products that meet the needs of customers of all experience levels. We strive to keep our merchandise mix fresh and exciting by continuously searching for new, innovative products and introducing them to our customers. Our hunting and shooting department, which is strategically located at the back of the store, is a key driver of store traffic and one of the reasons for our high frequency of customer visits. We carry a large array of consumable goods, which includes ammunition, bait, cleaning supplies, food, lures, propane and reloading supplies. During fiscal year 2016, sales of consumable goods accounted for approximately 36.0% of our unit sales and 20.0% of our dollar sales. We believe the sale of consumables and replenishment items drives repeat traffic, with approximately 67% of our customers visiting our stores seven or more times per year (according to our internal surveys). During such visits, our customers frequently browse and purchase other items, including additional gear and accessories.

We also carry a variety of private label offerings under the Rustic RidgeTM, KillikTM, Vital ImpactTM, Yukon Gold, Lost River and Sportsman’s Warehouse brands. These products are designed and priced to complement our branded assortment, by offering our customers a quality alternative at all price points. We believe the clothing, footwear and camping categories present a compelling near-term opportunity to expand our private label offering. In order to address these segments, we introduced our proprietary Rustic RidgeTM and KillikTM clothing lines. During fiscal year 2016, private label offerings accounted for approximately 4.0% of our total sales, compared to more than 20% for many of our sporting goods retail peers. We believe our private label products are an important opportunity to drive sales and increase margins alongside our branded merchandise.

In addition to outfitting our customers with the correct gear, we provide our customers with various in-store, value-added, technical support services. All of our stores offer full-service archery technician services, fishing-reel line winding, gun bore sighting and scope mounting, among other services. We also help first-time participants enjoy the outdoors responsibly by issuing hunting and fishing licenses. We believe the support services provided by our highly trained staff technicians differentiate us from our competitors and drive customer loyalty and repeat traffic to our stores.

Products

Our stores are organized into six departments. The table below summarizes the key product lines and brands by department:

|

Department |

|

Product Offerings |

|

Camping |

|

Backpacks, camp essentials, canoes and kayaks, coolers, outdoor cooking equipment, sleeping bags, tents and tools |

|

Clothing |

|

Camouflage, jackets, hats, outerwear, sportswear, technical gear and work wear |

|

Fishing |

|

Bait, electronics, fishing rods, flotation items, fly fishing, lines, lures, reels, tackle and small boats |

|

Footwear |

|

Hiking boots, socks, sport sandals, technical footwear, trail shoes, casual shoes, waders and work boots |

|

Hunting and Shooting |

|

Ammunition, archery items, ATV accessories, blinds and tree stands, decoys, firearms, reloading equipment and shooting gear |

|

Optics, Electronics and Accessories |

|

Gift items, GPS devices, knives, lighting, optics -e.g., binoculars and two-way radios |

Each department has buying and planning teams that are responsible for monitoring product availability from vendors and sales volume within the department and across all stores. We actively monitor the profitability of each

10

product category within each department and adjust our assortment and selling space accordingly. This flexibility enables us to provide customers with more preferred product choices and to enhance the profit potential of each store.

Hunting and shooting has historically been the largest contributor to our sales. Hunting and shooting department products are generally sold at significantly higher price points than other merchandise but often have lower margins. Camping is our second largest department, and family-oriented camping equipment in particular continues to be a high growth product category. Although clothing sales decreased as a percentage of total sales during fiscal year 2016, overall clothing sales have grown as we have introduced new brands and styles, including our selections for women and children. We view clothing sales as an important opportunity, given this department’s high gross margins and appeal to a broad, growing demographic.

The following table shows our sales during the past three fiscal years presented by department:

|

|

|

Fiscal Year Ended |

|

||||

|

|

|

January 28, |

|

January 30, |

|

January 31, |

|

|

Department |

|

2017 |

|

2016 |

|

2015 |

|

|

Camping |

|

14.6% |

|

14.6% |

|

13.9% |

|

|

Clothing |

|

8.7% |

|

8.9% |

|

9.8% |

|

|

Fishing |

|

10.0% |

|

9.9% |

|

9.8% |

|

|

Footwear |

|

7.1% |

|

7.3% |

|

7.7% |

|

|

Hunting and Shooting |

|

50.9% |

|

50.2% |

|

49.4% |

|

|

Optics, Electronics and Accessories (Giftbar) |

|

9.0% |

|

9.6% |

|

9.8% |

|

|

Other |

|

(0.3%) |

|

(0.5%) |

|

(0.4%) |

|

|

Total |

|

100.0% |

|

100.0% |

|

100.0% |

|

Camping. Camping represented approximately 14.6% of our net sales during fiscal year 2016. Our camping assortment addresses both the technical requirements of the heavy-use camper, including gear for long-duration or deep-woods excursions, as well as the needs of the casual camper. We offer a broad selection of tents and shelters for both multi-day back country use and weekend outings, sleeping bags for the most extreme conditions as well as the summer overnight trip, backpacks and backpacking gear, including camouflaged styles for hunting, generators for home and camp use, cooking and food preparation equipment, including stoves and extended-use coolers, as well as dehydrated foods. Our camping department also includes canoes, kayaks and a selection of recreational family camping equipment, including basic automotive accessories, camp chairs and canopies. Our camping department includes brands such as Alps Mountaineering, Camp Chef, Coleman, Honda, Teton Sports, and Yeti Coolers.

Clothing. Clothing represented approximately 8.7% of our net sales during fiscal year 2016 and includes camouflage, outerwear, sportswear, technical gear, work-wear, jackets and hats. We primarily offer well-known brands in our clothing department, such as Carhartt, Columbia, Kings Mountain Shadow, Sitka, and Under Armour. We also intend to grow our proprietary clothing lines, Rustic RidgeTM and KillikTM. Our clothing selection offers technical performance capabilities for a variety of hunting activities, including upland game, waterfowl, archery, big game hunting, turkey hunting and shooting sports. Performance attributes include waterproofing, temperature control, scent control features and visual capabilities, such as blaze orange and camouflage in a wide range of patterns. Outerwear, particularly performance rainwear, is an important product category for customers who are fishing, hiking, hunting or marine enthusiasts. We furthermore complement our technical clothing with an assortment of casual clothing that fits our customers’ lifestyles, including a variety of branded graphic t-shirts, and private label motto t-shirts.

Fishing . Fishing represented approximately 10.0% of our net sales during fiscal year 2016 and includes products for fresh-water fishing, salt-water fishing, fly-fishing, ice-fishing and boating. Our broad assortment appeals to the beginning and weekend angler, as well as avid and tournament anglers. In addition to lures, rods and reels, our fishing assortment features a wide selection of products in tackle management and organization, electronics, fly-fishing, ice-fishing and marine accessories sub-categories. We also provide fishing-reel line winding services in all of our stores and live bait in most of our stores. We offer products for boat care and maintenance, as well as safety equipment and aquatic products such as float tubes and pontoons. All of our stores also sell fishing licenses. Our fishing department includes brands such as Johnson Outdoors, Normark, Plano, Pure Fishing, Rivers Wild Flies, and Shimano.

Footwear . Footwear represented approximately 7.1% of our net sales during fiscal year 2016 and includes work boots, technical footwear, hiking boots, trail shoes, socks, sport sandals and waders. As with clothing, our footwear selection offers a variety of technical performance capabilities, such as different levels of support and types of tread,

11

waterproofing, temperature control and visual attributes. Our footwear department includes brands such as Danner, Keen, Merrell, Red Wing, and Under Armour.

Hunting and Shooting. Hunting and shooting is our largest merchandise department, representing approximately 50.9% of our net sales during fiscal year 2016. Products such as ammunition, cleaning supplies, firearms and reloading selections are typically key drivers of traffic in our stores. Our hunting and shooting merchandise assortment provides equipment, accessories and consumable supplies for virtually every type of hunting and shooting sport. A backroom shop staffed with technicians allows us to support our hunting assortments for the benefit of the hunter, shooter, and archery enthusiast.

Our merchandise selection includes a wide variety of firearms designed for hunting, shooting sports and home and personal defense, including air guns, black powder muzzle loaders, handguns, rifles and shotguns. We carry a wide selection of ammunition, archery equipment, dog training products, hunting equipment, reloading equipment and shooting accessories. Our hunting and shooting department includes brands such as Federal Premium Ammunition, Hornady, Remington Arms, Ruger, Smith & Wesson, and Winchester.

Optics, Electronics and Accessories. Our optics, electronics and accessories department represented approximately 9.0% of our net sales during fiscal year 2016. This department supplements our other equipment departments with complementary products, such as optics (including binoculars, spotting scopes and rangefinders), GPS devices and other navigation gear, GoPro video cameras, two-way radios, specialized and basic cutlery and tools, including hunting and other knives, lighting, bear spray and other accessories. Our optics, electronics and accessories department includes brands such as Garmin, Leica, Nikon, Swarovski Optik and Vortex Optics.

Other. Our other department represented approximately (0.3)% of our net sales during fiscal year 2016 and includes hunting and fishing licenses and background check revenue, net of revenue discounts. See Note 2 to our Consolidated Financial Statements for a discussion how, in fiscal year 2016, we changed the way revenue from state fish and game licenses, duck stamps, and state government-mandated firearm backgroud checks is recorded (Gross vs. Net).

Loyalty Programs

We launched a loyalty program in the fall of 2013, through which our consumers are able to earn “points” towards Sportsman’s Warehouse gift cards on most of their purchases. The program is free to join and accepted through all channels for both purchases and the use of redemption cards. As of January 28, 2017, we had approximately 1.2 million participants in our loyalty program.

Customers may obtain a loyalty program card when making a purchase in-store or online. After obtaining a card, the customer must register on our website in order to redeem loyalty rewards. Customers earn one point for each dollar spent, with the exception of certain items, such as gift cards and fish and game licenses. For every 100 points accumulated, the customer is entitled to a $1.00 credit in loyalty rewards, which may be redeemed by logging into our website to request a redemption card for any whole dollar amount (subject to the customer’s available point balance). The redemption card is then mailed to the customer and operates as a gift card to be used for both in-store and online purchasing. The rewards points expire after 18 months of dormancy.

In addition, we offer our customers the multi-use Sportsman’s Warehouse Rewards VISA Platinum credit card issued by US Bank. US Bank extends credit directly to cardholders and provides all servicing for the credit card accounts, funds the rewards and bears all credit and fraud losses. This card allows customers to earn points whenever and wherever they use their card. Customers may redeem earned points for products and services just as they would redeem loyalty card points.

Sourcing and Distribution

Sourcing

We maintain central purchasing, replenishment and distribution functions to manage inventory planning, allocate merchandise to stores and oversee the replenishment of basic merchandise to the distribution center. We have no long-term purchase commitments. During fiscal year 2016, we purchased merchandise from approximately 1,500 vendors

12

with no vendor accounting for more than approximately 6% of total merchandise purchased. We have established long-standing, continuous relationships with our largest vendors.

Our sourcing organization is currently managed by our merchant team in our corporate headquarters. We also have field merchants that coordinate certain merchandising functions at the store level to provide a more localized merchandising model. To ensure that our product offerings are tailored to local market conditions and demand, our merchant teams regularly meet one-on-one with our vendors, and attend trade shows, review trade periodicals and evaluate merchandise offered by other retail and online merchants. We also frequently gather feedback and new product reviews from our store management and employees, as well as from reviews submitted by our customers. We believe this feedback is valuable to our vendor-partners and improves our access to new models and technologies.

Distribution and Fulfillment

We distribute all of our merchandise from our efficient 507,000 square foot distribution center in Salt Lake City, Utah. We opened this facility in July 2013, more than doubling the available space from our prior facility, in order to accommodate our growing store base and e-commerce platform. The distribution center supports replenishment for all 75 stores and manages the fulfillment of direct-to-consumer e-commerce orders. We use preferred carriers for replenishment of our retail stores. We ship merchandise to our e-commerce customers via courier service. An experienced distribution management team leads a staff of 435 employees at peak inventory levels heading into the fourth quarter.

The distribution center has dynamic systems and processes that we believe can accommodate continued new store growth for 100 or more stores. We use the HighJump warehouse management system, or WMS, to manage all activities. The system is highly adaptable and can be easily changed to accommodate new business requirements. For example, our WMS enabled us to support full omni channel distribution under one roof by allowing us to comingle inventory to optimize space requirements and labor. Additionally, we have developed customized Radio Frequency and Voice Directed processes to handle the specific requirements of our operations. We have the capability to both case pick and item pick, which is designed to ensure that our stores have sufficient quantities of product while also allowing us to maintain in inventory slow moving but necessary items. This balance allows us to stock the right products at the necessary locations, all at the right time and in the correct quantity.

Marketing and Advertising

We believe, based on internal surveys, that the majority of our customers are male, between the ages of 35 and 65, and have an annual household income between $40,000 and $100,000. We also actively market to women and children and have expanded our product offerings of women’s and children’s outerwear, clothing and footwear to address rising participation rates in hunting and shooting sports, as well as overall outdoor activity.

Our primary marketing efforts are focused on driving additional consumers to the stores and increasing the frequency and profitability of visits by customers of all types. We employ a two-pronged marketing approach:

|

· |

regional advertising programs; and |

|

· |

local grass roots efforts to build brand awareness and customer loyalty. |

Our regional advertising programs emphasize seasonal requirements for hunting, fishing and camping in our various store geographies. Our advertising medium is typically newspaper inserts (primarily multi-page color inserts during key shopping periods such as the Christmas season and Father’s Day), supplemented with modest amounts of direct mail, seasonal use of local and national television ads and a variety of out-of-home media buys. We proactively modify the timing and content of our message to match local and regional preferences, changing seasons, weather patterns and topography of a given region. In addition, the use of co-op funding with select vendors to supplement our out-of-pocket media expenses allows us to improve brand exposure through various advertising vehicles, while partnering with national brands in relevant media channels. This program also reinforces the general consumer’s impression of Sportsman’s Warehouse as a preferred retailer for those brands. Finally, we sponsor regional and national television programming, including sponsoring the, Angler’s Channel, Fishful Thinking, Hooked on Utah and Eastman’s Hunting TV. Our total marketing expenses for fiscal year 2016 were approximately $9.4 million, excluding co-op reimbursement of $1.9 million.

13

The second prong of our marketing effort is the time and resources devoted to fostering grass roots relationships in the local community. Each Sportsman’s Warehouse store employs a variety of outreach tools to build local awareness. One key component to a successful store is hosting events throughout the year, targeting a variety of end user customer profiles (such as hunters, campers, anglers, women and children). In total, our store base hosts or facilitates approximately 3,000 in-store and offsite seminars and events per year, such as “ladies night,” Eastman’s Deer Tour, Waterfowl Weekend, Conservation Days contest and Bucks & Bulls. We are also active in supporting a variety of conservation groups, such as Ducks Unlimited, Rocky Mountain Elk Foundation, Mule Deer Foundation and the National Wild Turkey Federation, both at the corporate level and through store employee local memberships and participation. Company representatives attend more than 600 events annually in the aggregate, both to provide support for these organizations and to solidify ties between their members and the Sportsman’s brand. Furthermore, we believe that the Sportsman’s News newspaper, offered in-store, provides a unique point of contact with our customers by offering outdoor stories, product reviews, how-to articles and new product introductions to keep all of our customers up to date on the latest trends and technology. Finally, such grass roots campaigns enable us to reduce our initial marketing spend in connection with new store openings. We believe that these initiatives are highly cost-effective tools to create brand awareness and engender a loyal community of local customers, as well as a key differentiator versus other national retailers.

Hiring, Training and Motivating our Employees

We believe that the recruitment, training and knowledge of our employees and the consistency and quality of the service they deliver are central to our success. We emphasize deep product knowledge for store managers and sales associates at both the hiring and training stages. We hire most of our sales associates for a specific department or product category. As part of the interview process, we test each prospective employee for knowledge specific to the department or category in which he or she is applying to work. All of our managers and sales associates undergo focused sales training, consisting of both sales techniques and specialized product instruction, both immediately upon hiring (approximately 20 hours) and continuing throughout their career (approximately 16 hours annually). In addition, our sales associates receive loss prevention instruction and departmental training upon hiring. For example, in our hunting department, all employees receive an additional nine hours of training on ATF and company policies initially upon hire, with continuing education throughout the year. Our store managers complete two to six months of on-the-job training at another store with an existing district manager, as part of which they receive approximately 80 hours of dedicated managerial training and instruction. Our department heads receive extensive online training as well as on-site instruction, totaling approximately 40 hours. As a result of these programs, our employees are highly trained to provide friendly and non-intimidating education, guidance and support to address our customers’ needs.

Our employees are often outdoor enthusiasts themselves, participating in outdoor activities alongside our customers in the local community. Our employees spend a portion of their gross wages in-store, underscoring their passion for both our company and the outdoor lifestyle. We believe our level of employee store patronage is unique among our competitors in this industry and enhances our differentiated shopping experience.

One of our unique assets is a specially designed training room located at our headquarters. Our training room is used frequently for firm-wide training programs and by vendors to stage training demonstrations for new products. Training room sessions are broadcast real-time in high definition to each store location and are recorded for future viewing. Vendor training is especially interactive, permitting vendor representatives to present a uniform message simultaneously to all employees, while allowing managers and sales staff in individual stores to ask questions of the vendors and provide real-time feedback on products. This system decreases the vendor’s promotion and education costs and provides more meaningful training to our employees. Training room sessions are particularly important for technical products, especially those with numerous features and a high unit price, because they enable our sales associates to better educate customers and provide additional assurance that a given product fits the customer’s needs. Given its utility as a cost-effective sales tool, our training room is reserved well in advance by vendors. Our training program has been a critical factor in increasing conversion, which has led to average ticket growth of approximately 10% since the end of fiscal year 2010.

Information Technology

Business critical information technology, or IT, systems include our supply chain systems, merchandise system, point-of-sale (POS) system, warehouse management system, e-commerce system, loss prevention system and financial and payroll systems. Our IT infrastructure is robustly designed to be able to access real-time data from any store or

14

channel. The network infrastructure allows us to quickly and cost effectively add new stores to the wide area network, or WAN. The private WAN is built on a CenturyLink (formerly Qwest) backbone with all of its resources and support. Additionally, we have implemented a redundant wireless WAN on Verizon’s infrastructure. All key systems will continue to run in the event of a power or network outage. All data is backed up daily from one storage array to another storage array.

We have implemented what we believe to be best-of-class software for all of our major business critical systems. Key operating systems include Oracle Applications for ERP, Oracle Commerce for our e-commerce channel, Salesforce’s (formally Tomax’s) Retail.net and JPOS for in-store functionality and HighJump for WMS. Our physical infrastructure is also built on products from best-in-class vendors Cisco, Dell, Oracle Sun and VMWare. Originally designed with the goal of being able to run a significantly larger retail business, our IT systems are scalable to support our growth.

The retail stores and the distribution center have loss prevention employees who monitor an average of 60 cameras at each store and 200 at the distribution center. These cameras are connected to digital video recorders (DVR) that record at least 30 days of video. Cameras are monitored locally during store hours. In addition, all cameras are monitored centrally at our headquarters in our dedicated surveillance room, which has capacity to monitor over 120 stores. This room is staffed continuously and provides off-hours monitoring and backup for all stores. Digital recorded video can be searched by pixel movement, which can quickly identify any loss prevention issue. Our sophisticated systems are a key factor in our shrink rates of less than 1% and an important component of our comprehensive compliance program.

We furthermore have incorporated enhanced reporting tools that have allowed for more comprehensive monitoring of business performance, which has been critical to management’s ability to drive strong store level performance. Management has access to a reporting dashboard that shows key performance indicators, or KPIs, on a company, store, department and category level. KPIs include sales, margin, budget, conversions, payroll, shrinkage and average order value all on a daily, weekly, monthly and yearly basis. All KPIs are compared to comparable prior year periods. District, store and department managers have access to the data relevant to their area of responsibility. Real-time, up to the second, sales data is available on demand. The system allows for custom-created reports as required.

Intellectual Property

Sportsman’s Warehouse®, Sportsman’s Warehouse America’s Premier Outfitter®, Lost Creek®, LC Lost Creek Fishing Gear and Accessories®, Rustic RidgeTM, KillikTM, K Killik & DesignTM, LC & DesignTM, and Vital ImpactTM are among our service marks or trademarks registered with the United States Patent and Trademark Office. In addition, we own several other registered and unregistered trademarks and service marks involving advertising slogans and other names and phrases used in our business. We also own numerous domain names, including www.sportsmanswarehouse.com, among others. The information on, or that can be accessed through, our websites is not a part of this filing.

We believe that our trademarks are valid and valuable and intend to maintain our trademarks and any related registrations. We do not know of any material pending claims of infringement or other challenges to our right to use our marks in the United States or elsewhere. We have no franchises or other concessions that are material to our operations.

Our Market and Competition

Our Market

We compete in the large, growing and fragmented outdoor activities and sporting goods market, which we believe is currently underserved by full-line multi-activity retailers. We believe, based on reports by the National Sporting Goods Association, or NSGA, and other industry sources, that U.S. outdoor activities and sporting goods retail sales totaled over $60 billion in 2015. The U.S. outdoor activities and sporting goods sector is comprised of three primary categories—equipment, clothing and footwear—with each category containing distinct product sets to support a variety of activities, including hunting, fishing, camping and shooting, as well as other sporting goods activities.

We believe growth in the U.S. outdoor activities and sporting goods market is driven by several key trends, including: an expanding demographic focused on healthy and active lifestyles; successful new product introductions centered around enhancing performance and enjoyment while participating in sporting and outdoor activities; and the resilience of consumer demand for purchases in these categories versus other discretionary categories. We believe these factors will continue to foster growth in the outdoor activities and sporting goods market in the future.

15

Within the retail sporting goods sector, we operate primarily in the outdoor equipment, clothing and footwear segment, which includes hunting and shooting, fishing, camping and boating. This segment is growing at a faster rate than the sporting goods industry at large. The 2011 U.S. Fish and Wildlife national survey, published once every five years, found that hunting and shooting and fishing participation increased 9% and 11%, respectively, for Americans aged 16 and older from 2006 to 2011. This survey also found that fishing participation among women increased by 17% over the same time period.

A 2015 NSGA report indicated that, from 2013 to 2015, there was a 4% increase in hunting with firearms participation, a 4% increase in target shooting (live ammunition) participation, and a 5% increase in fishing (fresh water) participation. From 2011 to 2015 the report indicated a 12% increase in female participation in target shooing (live ammo), and an 25% increase in female participation in hunting with firearms in the United States.

Furthermore, we believe that specialty retailers have generated additional sales volume by expanding their presence, especially in smaller communities, which has increased customers’ access to products that formerly were less available. The nature of the outdoor activities to which we cater requires recurring purchases throughout the year, resulting in high rates of conversion among customers. For example, active anglers typically purchase various fishing tackle throughout the year based on seasons and changing conditions. Hunting with firearms typically is accompanied by recurring purchases of ammunition and cleaning supplies throughout the year and multiple firearm styles for different hunted game.

Competition

We believe that the principal competitive factors in our industry are breadth and depth of product selection, including locally relevant offerings, value pricing, convenient locations, technical services and customer service. A few of our competitors have a larger number of stores, and some of them have a greater market presence, name recognition and financial, distribution, marketing and other resources than we have. We believe that we compete effectively with our competitors with our distinctive branded selection and superior customer service, as well as our commitment to understanding and providing merchandise that is relevant to our targeted customer base. We cater to the outdoor enthusiast and believe that we have both an in-depth knowledge of the technical outdoor customer and a “grab and go” store environment that is uniquely conducive to their need for value and convenience. We believe that our flexible box size, combined with our low-cost, high-service model, also allows us to enter into and serve smaller markets that our larger competitors cannot penetrate as effectively. Finally, certain barriers, including legal restrictions, exist on the sale of our product offerings that comprise approximately 33% of our revenue, such as firearms, ammunition, certain cutlery, propane and reloading powder, create a structural barrier to competition from many online retailers, such as Amazon.

Our principal competitors include the following:

|

· |

independent, local specialty stores, often referred to as “mom & pops”; |

|

· |

other specialty retailers that compete with us across a significant portion of our merchandising categories through retail store, catalog or e-commerce businesses, such as Bass Pro Shops, Cabela’s and Gander Mountain; |

|

· |

large-format sporting goods stores and chains, such as Academy Sports + Outdoors and Dick’s Sporting Goods; and |

|

· |

mass merchandisers, warehouse clubs, discount stores, department stores and online retailers, such as Amazon, Target and Wal-Mart. |

Independent, Local Specialty Stores. These stores generally range in size from approximately 2,000 to 10,000 square feet, and typically focus on one or two specific product categories, such as hunting, fishing or camping, and usually lack a broad selection of product.

Other Specialty Retailers. Some of the other specialty retailers that compete with us across a significant portion of our merchandising categories are large-format retailers that generally range in size from 40,000 to 250,000 square feet. These retailers seek to offer a broad selection of merchandise focused on hunting, fishing, camping and other outdoor product categories. Some of these stores combine the characteristics of an outdoor retailer with outdoor entertainment

16

and theme attractions. We believe that the number of these stores that can be supported in any single market area is limited because of their large size and significant per-store cost.

Other specialty retailers are smaller chains that typically focus on offering a broad selection of merchandise in one or more of the following product categories—hunting, fishing, camping or other outdoor product categories. We believe that these other outdoor-focused chains generally do not offer a similar depth and breadth of merchandise or specialized services in all of our product categories.

Large-Format Sporting Goods Stores And Chains. These stores generally range from 20,000 to 80,000 square feet and offer a broad selection of sporting goods merchandise covering a variety of sporting goods categories, including baseball, basketball, football and home gyms, as well as hunting, fishing and camping. However, we believe that the amount of space at these stores devoted to our outdoor product categories limits the extent of their offerings in these areas.

Mass Merchandisers, Warehouse Clubs, Discount Stores, Department Stores and Online Retailers. With respect to retailers in this category with physical stores, these stores generally range in size from approximately 50,000 to over 200,000 square feet and are primarily located in shopping centers, free-standing sites or regional malls. Hunting, fishing and camping merchandise and clothing represent a small portion of the stores’ assortment, and of their total sales. We believe that less than 10% of our product offering, and less than 5% of our hunting and shooting product offering, overlap with these stores.

Over the past decade, specialty retailers, such as us, have gained market share of equipment sales at the expense of mass merchants, discount stores and independent retailers, or “mom & pop” shops, which we believe comprise approximately 65% of the market. In addition, while there are over 80,000 Type 01 Federal Firearms Licenses, or FFLs, in the United States today, only 4,300 are currently held by national or regional specialty stores. Since FFLs are issued at the store level, these statistics imply that the remaining 95% of the market is fragmented among mom & pop stores. We believe this fragmentation within the total addressable market presents an attractive opportunity for us to continue to expand our market share, as customers increasingly prefer a broad and appealing selection of merchandise, competitive prices, high levels of service and one-stop shopping convenience.

Seasonality

We experience moderate seasonal fluctuations in our net sales and operating results as a result of holiday spending and the opening of hunting seasons. While our sales are more level throughout the year than many retailers, our sales are still traditionally somewhat higher in the third and fourth fiscal quarters than in the other quarterly periods. On average over the last three fiscal years, we have generated 27.3% and 28.9% of our net sales in the third and fourth fiscal quarters, respectively, which includes the holiday selling season as well as the opening of the fall hunting season. However, Spring hunting, Father’s Day and the availability of hunting and fishing throughout the year in many of our markets counterbalance this seasonality to a certain degree. For additional information, see Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operation."

Regulation and Compliance

Regulation and Legislation

We operate in highly regulated industries. There are a number of federal, state and local laws and regulations that affect our business. In every state in which we operate, we must obtain various licenses or permits in order to operate our business.

Because we sell firearms at all of our retail stores, we are subject to regulation by the Bureau of Alcohol, Tobacco, Firearms and Explosives, or the “ATF”. Each store has a federal firearms license permitting the sale of firearms, and our distribution center has obtained a federal firearms license to store and distribute firearms. Certain states require a state license to sell firearms, and we have obtained these licenses for the states in which we operate that have such a requirement.

We must comply with federal, state and local laws and regulations, including the National Firearms Act of 1934, or NFA, the Gun Control Act of 1968, or GCA, the Arms Export Control Act of 1976 and Internal Revenue Code

17

provisions applicable to the Firearms and Ammunition Excise Tax, all of which have been amended from time to time. The NFA and the GCA require our business to, among other things, maintain federal firearms licenses for our locations and perform a pre-transfer background check in connection with all firearms purchases. We perform this background check using either the FBI-managed National Instant Criminal Background Check System, or NICS, or a comparable state government-managed system that relies on NICS and any additional information collected by the state, a state point of contact. These background check systems either confirm that a transfer can be made, deny the transfer or require that the transfer be delayed for further review, and provide us with a transaction number for the proposed transfer. We are required to record the transaction number on an ATF Form 4473 and retain this form in our records for auditing purposes for 20 years for each approved transfer and five years for each denied or delayed transaction.

The federal categories of prohibited purchasers are the prevailing minimum for all states. States (and, in some cases, local governments) on occasion enact laws that further restrict permissible purchasers of firearms. We are also subject to numerous other federal, state and local laws and regulations regarding firearm sale procedures, record keeping, inspection and reporting, including adhering to minimum age restrictions regarding the purchase or possession of firearms or ammunition, residency requirements, applicable waiting periods, importation regulations and regulations pertaining to the shipment and transportation of firearms.

Over the past several years, bills have been introduced in the United States Congress that would restrict or prohibit the manufacture, transfer, importation or sale of certain calibers of handgun ammunition, impose a tax and import controls on bullets designed to penetrate bullet-proof vests, impose a special occupational tax and registration requirements on manufacturers of handgun ammunition and increase the tax on handgun ammunition in certain calibers. Recently, Congress has debated certain gun control measures that were supported by the prior administration.