| ||

(Address of principal executive offices) |

| (Zip Code) |

|

|

|

Registrant’s telephone number, including area code: |

| ( |

N/A |

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

TABLE OF CONTENTS

|

| Page |

|

| |

|

| |

Item 1.01 |

| |

Item 2.01 |

| |

|

| |

|

| |

|

| |

|

| |

| Security Ownership of Certain Beneficial Owners and Management |

|

| Directors, Executive Officers, Promoters and Control Persons |

|

|

| |

|

| |

|

| |

| Market Price of and Dividends on Common Equity and Related Stockholder Matters |

|

|

| |

|

| |

|

| |

Item 3.02 |

| |

Item 5.01 |

| |

Item 5.02 |

| |

Item 9.01 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for development and commercialization of our planned technologies (ii) our limited financial resources, and (iii) need for additional capital to fund our operations.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, lack of revenue and/or future insufficient cash flows and resulting illiquidity, our inability to develop our business, significant government regulation, or inability to protect our intellectual property, existing or increased competition, penny stock risks, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Report appears in the section captioned “Risk Factors” and elsewhere in this Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the SEC.

EXPLANATORY NOTE

Special Capital Corporation, a Nevada Corporation, is referred to herein as “we”, “our”, “us”, or the “Company”.

On August 29, 2024, we completed the acquisition of 100% of Node Nexus Network Co LLC, a limited liability company formed under the laws of the Emirate of Dubai on April 30, 2024 (“Target” or “Node Nexus”) and Sean Michael Brehm, also known as Sean Michael Obrien (the “Target Shareholder”).

In accordance with the requirements of Item 9.01 of Form 8-K, the Company hereby provides notice that the financial statements of the acquired target company will be filed within the 71-day period specified by the Securities and Exchange Commission (SEC) rules. This time frame allows the Company to ensure that all relevant financial information is accurately prepared, reviewed, and presented in compliance with applicable accounting standards and regulatory requirements.

The Company is committed to providing a comprehensive and transparent disclosure, and the financial statements will include all necessary details to enable investors and stakeholders to assess the financial position and results of operations of the acquired target company. The Company will file these financial statements as an amendment to this Form 8-K within the stipulated period.

3

This Current Report is being filed in connection with a series of transactions consummated by the Company and certain related events and actions taken by the Company.

This Current Report responds to the following Items in Form 8-K:

Item 1.01. Entry into a Material Definitive Agreement

Item 2.01. Completion of Acquisition or Disposition of Assets

Item 3.02. Unregistered Sales of Equity Securities

Item 5.01. Changes in Control of Registrant

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Item 1.01. Entry into a Material Definitive Agreement.

The Exchange

As we previously disclosed in Forms 8-K:

·On May 13, 2024, we disclosed that that the Target Shareholder was appointed as our director on May 13, 2024.

·On June 6, 2024, the Target Shareholder was appointed as our Chairman of the Board of Directors as of that same date.

·On June 7, 2024, the Company entered into a Share Exchange Agreement (the “Exchange Agreement”) with the Target and the Target Shareholder, whereby (i) the Company agreed to acquire from the Target, and Target agreed to sell to the Company, 150 shares of capital stock, representing 100% of the Target’s outstanding shares, in exchange for 40,000,000 newly issued shares (the “Exchange Shares”) of our common stock, $.0001 par value (the “Common Stock”) and (ii) the Target Shareholder agreed to purchase 5,000,000 shares of the Company’s restricted Common Stock at a per share price of $0.20 or an aggregate of $1,000,000 (the “Purchase Price”) concurrently with or prior to the Closing (“Financing Shares”).

·On June 23, 2024, the Parties entered into a licensing agreement (“Licensing Agreement”) for the Intellectual Property as defined in the Exchange Agreement which consists of:

oDistributed Quantum Ledger Database Technology (DQ-LDB) technologies involved with data processing, storage and security as embodied in the Vogon Quantum Ledger Product.

oDecentralized Infrastructure software associated with data collection, processing and security of data as provided to the Licensee.

oDecentralized Cloud and Distributed Cloud Solutions as provided to the Licensee.

oArtificial Intelligence technologies involved with data integrity and security as provided to the Licensee.

·On July 23, 2024, the Parties entered into an amendment to the Exchange Agreement (the “Amendment”) to extend the Closing date to on or before August 31, 2024 (the “Closing Date”).

4

On July 23, 2024, the Parties entered into an amendment to the Exchange Agreement (the “Amendment”) with the following terms:

●The Closing shall occur on or before August 31, 2024, unless extended (the “Closing”).

●The Company and its transfer agent shall enter into an escrow agreement (the “Escrow Agreement”) whereby the Financing Shares shall be held in escrow pending the Company’s receipt of the Purchase Price, and the Exchange Shares shall be held in escrow pending the losing of the transactions contemplated by the Exchange Agreement on or before August 31, 2024.

●In the event that the Closing does not occur on or prior to August 31, 2024, the Financing Shares and Exchange Shares shall be cancelled and returned to Treasury.

●Parties shall enter into a licensing agreement (“Licensing Agreement”) for the Intellectual Property as defined in the Exchange Agreement.

·On August 14, 2024, the Target Shareholder delivered $1,010,000 to the Company to complete the purchase of the Financing Shares, and on August 15, 2024, the Company issued to the Target Shareholder 5,050,000 shares of Common Stock at $.20 per share.

·On August 22, 2024. we issued 40 million shares of the Common Stock in escrow to Node Nexus under the Exchange Agreement as amended and took possession and control of the Node Nexus assets.

·On August 28, 2024, we executed a second amendment to the Exchange Agreement whereby we agreed to issue 1,000,000 shares of Series Quantum preferred stock (the “Series Quantum Preferred Stock”) in lieu of the 40,000,000 common shares provided for under the Exchange agreement as previously amended. Each one (1) share of the Series Quantum Preferred Stock is convertible into forty (40) shares of our Common Stock by the holder or the Company provided that the holder has held the Series Quantum Preferred Stock for at least 12 months and the Company has authorized common shares to effectuate such conversion.

·On August 29, 2024, the Exchange Agreement as amended was fully performed and the shares in Node Nexus were delivered to the Company.

The foregoing descriptions of the Exchange Agreement, amendments to the Exchange Agreement and Licensing Agreement are summaries, do not purport to be complete, and are qualified in their entirety by reference to the full text of the Exchange Agreement, a copy of which is attached as Exhibit 10.4 to the Current Report on Form 8-K filed with the SEC on June 7, 2024, to the Amendment a copy of which is attached as Exhibit 10.16 to the Current Report on Form 8-K filed with the SEC on July 23, 2024, to the Escrow Agreement, a copy of which is attached as Exhibit 10.17 to the Current Report on Form 8-K filed with the SEC on July 23, 2024, and to the Licensing Agreement a copy of which is attached as Exhibit 10.18 to the Current Report on Form 8-K filed with the SEC on July 23, 2024. Each is incorporated by reference herein.

Pursuant to the terms and subject to the conditions set forth in the Exchange Agreement or waiver thereof, on August 29, 2024, the share exchange was completed (the “Exchange”) , the Company became the owner of 100% of the shares of Target, the Exchange Shares were released from escrow, and the transaction was consummated (the “Closing”).

Item 2.01 referenced immediately below, the Exchange and the entry into agreements relating thereto is hereby incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On August 29 2024, the parties consummated the Exchange, which resulted in the Target becoming the Company’s wholly owned subsidiary. Pursuant to the Exchange, the Company issued 1,000,000 shares of Series Quantum Preferred Stock to Sean Michael Brehm and the Company became the owner of 100% of the Target’s outstanding securities. After giving effect to the Exchange, the Company has 100,000,000 shares of Common Stock, par value $.0001, authorized, of which 67,699,516 shares are issued and outstanding, and 5,000,000 shares of preferred stock, par value $.0001, authorized, of which 1,000,000 shares are issued and outstanding.

5

The Company’s Common Stock is quoted on the OTC Markets OTCQB under the symbol “FCCN.”

BUSINESS

We plan to develop and commercialize cloud computing solutions that integrate quantum computing technology to offer secure, scalable, decentralized digital services that are cost-effective and environmentally-friendly.

For the six months ended June 30, 2024, prior to our acquisition of Node Nexus, our revenues were $0 and we had an operating loss of $ (143,093), and Node Nexus had revenue of $0 and an operating loss of $0. As of August 25, 2024, we had cash on hand of $491,657.97, which represents a portion of the proceeds we received from the sale to the Target Shareholder of 5,050,000 shares of Common Stock at $.20 per share.

Our principal offices are located at 701 Fifth Avenue, Suite 4200, Seattle Washington 98104 and our telephone number is (206) 262-7799. Our website is located at www.spectralcapital.com.

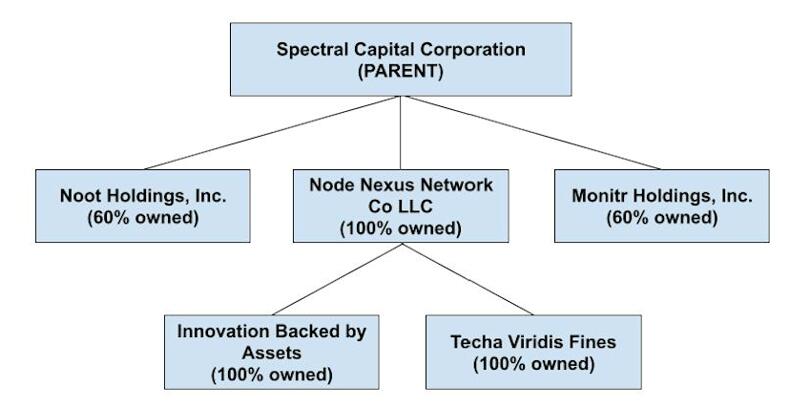

We plan to conduct our future operations through our five subsidiaries none of which presently generate revenue:

As described above, we acquired Node Nexus Network Co LLC (“Node Nexus”) on August 29, 2024 which plans to develop quantum computing technologies. We intend to commercialize products and services using quantum computing within the following submarkets:

·Vogon Cloud-Superior Quantum Hosting. We have licensed Distributed Quantum ledger technology from crwdunit, inc., a Delaware corporation and related party via our acquisition of Node Nexus on August 29, 2024. This product provides immutable, fast, decentralized, cost-effective and environmentally friendly storage for enterprise-level data and for critical transactions.

·QuantumVM-Critical Middleware. Our subsidiary, Node Nexus built QuantumVM-Critical Middleware, which is a hyper-efficient virtual machine that allows companies to use and integrate their legacy data in a quantum environment, optimizing the mix of classical cloud and quantum systems for maximum efficiency.

·Decentralized Green Quantum Data Center. Our subsidiary, Techa Viridis Fines (TVF), began development of a portfolio of low-carbon data centers through our partnerships with SKY Data. As part of our acquisition of Node Nexus, we acquired the development plans fromTVF, along with Memoranda of Understanding, to develop 16 decentralized regional hybrid data centers around the world.

·Quantum Commodity Exchange. In July 2024, we developed the ability to provide a robust quantum commodity exchange capability for resource-rich countries. Our solution is transparent, decentralized, hyper-secure, faster and less expensive than traditional solutions which are hosted by large technology companies.

6

On July 31, 2024, Innovation Backed by Assets (“IBA”) was incorporated in the country of San Marino as a wholly-owned subsidiary of Node Nexus. We plan to develop IBA to offer sustainable global infrastructure financing using our QaaS products contingent upon the receipt of financing.

On April 30, 2024, Techa Viridus Fines (“TFV”) was incorporated in the country of United Arab Emirates as a wholly-owned subsidiary of Node Nexus. Through TFV, we plan to develop 16 regional data centers in Austin TX; Panama City, Panama; Buenos Aires, Argentina; Florianopolis, Brazil; St John;s Caribbean; Lima, Peru; Port Louis, Mauritius; Dakar, Senegal; Libreville, Gabon; Gaborone, Botswana; Mysore, India; Hong Kong; Tashkent, Uzbekistan; Abu Dhabi, UAE; Zurich, Switzerland; and London, UK using green technologies (sun and wind power).

We presently have no revenue sources and plan to generate our initial revenues from the sale of quantum cloud computing services embodied in the Vogon Cloud and QuantumVM solutions.

On February 26, 2013, we signed a Technology Acquisition Agreement to acquire mobile search engine and mobile sharing technology from Fiveseas Securities Ltd. (“Fiveseas”). Under the agreement, we issued Fiveseas 5,000,000 shares of the Common Stock. The agreement called for the technology to reside within a newly formed Delaware corporation called Noot Holdings, Inc. (“Noot”), which we formed on February 28, 2013 and are a 60% owner of and Fiveseas is a 40% owner of. Fiveseas was granted a right of first refusal for any subsequent sale of the technology. Noot has been inactive since 2015 and, as such, we generated $0 and $0 of revenue from Noot for the year ended December 31, 2023 and six months ended June 30, 2024. To date, we have been unable successfully commercialize our Noot technologies.

The terns for the right of first refusal provide the company with the first right to purchase the remaining 40% from Fiveseas.

On December 1, 2013, we signed a Technology Acquisition Agreement to acquire a technology application and service that enhances the way people find, consume, analyze, share and discuss financial news and topics, equities, commodities and currencies on the web from TL Global Inc (“TL Global”). Under the agreement, we issued TL Global 5,000,000 shares of the Common Stock, par value $0.0001. The agreement called for the technology to reside within a newly formed Delaware corporation, Monitr Holdings, Inc. (“Monitr”), which we formed on December 1, 2013 and are a 60% owner of and TL Global is a 40% owner of. TL Global was granted a right of first refusal for any subsequent sale of the technology. Monitr has been inactive since 2015 and, as such, we generated $0 and $0 of revenue from Monitr for the year ended December 31, 2023 and six months ended June 30, 2023. To date, we have been unable to successfully commercialize our Monitr technologies.

The terns for the right of first refusal provide the company with the first right to purchase the remaining 40% from TL Global.

On January 3, 2022, we entered into a telecommunications services agreement with Sky Data PLL OU (Estonia) (“Sky Data”) to provide long distance switching services. We provided services under this agreement to 3 customers and generated $98,323 of revenue from the contract during 2022. We have paused this line of business and plan to resume our telecommunications reselling services through our partnership with SKY within the 2024 fiscal year and without third-party intervention.

We are also in negotiations to acquire the Crowd Point family of companies which consist of the following: 100% of the issued and outstanding stock of crwdunit, inc., a Delaware corporation, along with affiliated and subsidiary companies which have not yet been fully disclosed to us (“crwdunit”) which will help us continue to develop our quantum offering. These companies are also controlled by Mr. Brehm. One of the assets we acquired in the Node Nexus acquisition was the right to acquire crwdunit for $10,000,000 in cash or shares of Common Stock or any combination thereof as further described in the Affiliate Acquisition Agreement attached hereto as Exhibit 10.19. There are no assurances we will be successful in such acquisition.

7

Intellectual Property and Proprietary Rights

We do not currently have any patents or trademarks.

Revenues

We generated revenue of $0, $0 and $98,323 for the six months ended June 30, 2024 and years ended December 31, 2023 and 2022.

Facilities

We rent a virtual office located at 701 Fifth Avenue, Suite 4200, Seattle, Washington, 98104, under a month-to-month basis. We pay monthly rent of $375.00 for this location.

We occupy an office at The Iridium Building, Umm-Suqeim St, Al Barsha-1 P.O. Box #342044, Dubai, UEA and pay 1,667 United Arab Emirates Dirhams ($454 USD) monthly for this facility pursuant to a lease agreement with Smart Place Business Center that expires on April 8, 2025.

We believe that our current facilities are sufficient to meet our current and near-term needs and that, should it be needed, suitable additional space will be available.

Products

We plan to develop and commercialize an innovative cloud solution integrating our QuantumVM with standard cloud stack technologies such as Docker, Kubernetes, and NHost. This integration leverages QuantumVM's Just-In-Time (JIT) compiler, polyglot capabilities, and advanced cryptographic functions to significantly enhance performance, flexibility, security, and scalability.

·Quantum VM’s JIT Compiler: Optimizes code execution at runtime, improving performance and reducing latency.

·Polyglot Capabilities: Supports multiple programming languages, enhancing development flexibility and reducing time-to-market.

·Advanced Cryptographic Techniques: Utilizes SPHINCS+ and BLS 12-381 for robust data security, essential for compliance and data integrity.

·Deterministic Concurrency: Ensures consistent and real-time data processing, which is critical for edge computing and IoT applications.

Vogon Cloud

The Vogon Cloud is a distributed quantum database ledger technology solution that allows for immutable, secure, rapid access to critical data across enterprises

The Vogon cloud is a No-SQL (Semi-SQL & Semi-NoSQL) Append-only database that provides an immutable, transparent, and cryptographically verifiable transaction log owned by a central authority. Since it is a No-SQL database. It has the ability to store a lot of semi-unstructured data using a document-oriented data model. Moreover, it uses SQL-like data structure (Tables and Rows) and a language (PartiQL). So, it can leverage current SQL developers to offer robust ways to query and manage data.

8

QLDB vs SQL, NoSQL Databases

Traditional Databases

Any other traditional databases (SQL and No-SQL) store data in the form of a table or JSON document model. Within these traditional databases, data can be modified by anyone who is in control of the database itself results in data conflicts and manipulations. These databases don't keep track of document history and only store the current state of the document. Therefore, these databases cannot provide audit trials that are out of the box as they do not have automatic data encryption, so the data files are at risk of being read or modified by hackers directly. While most of these databases cannot work with cryptography, so it is not possible to impute the data and cannot prove who modified what.

1.Immutability & Transparency

2.Audit Logs

3.Verifiable

4.Data History

Vogon Cloud

Vogon Cloud is a fully managed ledger database that provides a transparent, immutable, and cryptographically verifiable transaction log owned by a central trusted authority. Vogon Cloud tracks each and every application data change and maintains a complete and verifiable history of changes over time.

Features of Vogon Cloud

1. Immutability & Transparency

Vogon Cloud has a built-in immutable journal that stores an accurate and sequenced entry of every data change. The journal is append-only, meaning that data can only be added to a journal and it cannot be overwritten or deleted. This ensures that your stored change history cannot be deleted or modified. Even if you delete the data from your ledger, the change history of that data can still be accessed by reading from the immutable journal.

2. Audit Logs & History

With Vogon Cloud, you can access the entire change history of your application’s data. You can query a summary of historical changes and specific details related to transaction history. So, QLDB can provide audit trails out of the box without any further implementation.

3. Verifiable

Vogon Cloud uses cryptography to create a concise summary of your change in history. This secure summary, commonly known as a digest, is generated using a cryptographic hash function (SHA-256). The digest acts as proof of your data’s change history, allowing you to look back and verify the integrity of your data changes.

4. Highly Scalable

With Vogon Cloud, you don’t have to worry about provisioning capacity or configuring read and write limits. You create a ledger and define your tables, and Vogon Cloud automatically scales to support the demands of your application. Vogon Cloud also allows you to monitor operational metrics for your data.

Architecture of Vogon Cloud

QLDB Application Architecture

QLDB vs Blockchain:

If you’re familiar with blockchain already, you might conclude from the definition, QLDB is somewhat related to blockchain; yes, it is. It offers all the key features of a blockchain ledger database including immutability, transparency, and cryptographically verifiable transaction log. However, the most important difference between QLDB and Blockchain is that QLDB is a centralized ledger, whereas Blockchain is a distributed ledger.

9

Blockchain has shown the potential to change every sector out there. Blockchain is also useful when it comes to storing data. After all, it is a distributed ledger. Also, the fact that traditional databases will soon make their way out for the more robust blockchain-based database. However, some businesses just cannot use a decentralized database for their business as they have to run a number of blockchain nodes and a lot of complexity involved in building a blockchain network. Also, other organizations that are involved with the business consortium should need to participate in the network.

There are certain use cases where an organization (like a bank) doesn’t want to share a ledger with any other party and wants to keep track of data on a centralized ledger where they want data to be immutable, verifiable, and secure. This type of use case doesn’t need the complexity of Blockchain network architecture; QLDB is a perfect fit.

Is QLDB going to kill Blockchain? The answer is No. Blockchains have their own unique features — i.e., Smart contracts that run on the blockchain network take application logic to the next level by running separately from the server. With QLDBs (or any traditional databases), you will end up writing application logic in your server code.

Applications of QLDB

QLDB is used for applications that need a scalable centralized ledger database to record all the transaction history over time with added cryptographic security. Blockchain can be applied to many challenges in supply chains, finance, and healthcare, such as complicated record-keeping and tracking of products, as a less corruptible and better-automated alternative to centralized databases. H However, industries that don’t want to share a ledger with other participants (as in blockchain) can instead use QLDB.

Use Cases

Banking and Finance: Banks often need a centralized ledger-like application to keep track of critical data, such as credit and debit transactions across customer bank accounts. Instead of building a custom database that has complex auditing functionality, or using blockchain, banks can use QLDB to easily store an accurate and complete record of all financial transactions.

Supply chains: Manufacturing companies often need to track the full manufacturing history of a product as well as records of their movements throughout the supply chain. A ledger database can be used to record the history of each transaction and provide details of every individual batch of the product manufactured at a facility. In case of a product recall, manufacturers can use QLDB to easily trace the history of the entire production and distribution lifecycle of a product.

Insurance: Insurance applications often need a way to better track the history of claim transactions. Instead of building complex auditing functionality using relational databases, insurance companies can use QLDB to accurately maintain the history of claims over their entire lifetime, and whenever a potential conflict arises, QLDB can also help cryptographically verify the integrity of the claims data, making the application resilient against data entry errors and manipulation.

Marketing

We intend to develop our brand marketing efforts with focused and metric-driven direct response marketing to acquire new customers. We plan to use a variety of targeted online marketing programs for lead generation, including search engine marketing, search engine optimization and targeted email and social media marketing campaigns, as well as more traditional direct marketing and indirect channel partner marketing programs, to drive interest in our Vogon Cloud and QuantumVM technologies. As part of these efforts, we intend to regularly run campaigns simultaneously and constantly refine our media mix across our channels.

10

Employees

As of August 28, 2024, we have 0 employees other than our executive officers and directors.

We currently hire third-party consultants and third-party contractors to provide various development services on an as needed basis.

Dependence on a Few Customers

We are not and do not expect to be dependent on one or a few customers.

Research and Development

In the six months ended June 30, 2024 and years ended December 31, 2022 and 2023, we spent $0, $0 and $0 on research and development.

Seasonality

Our business is not affected by seasonal factors.

Competition

The market for our products and services is highly fragmented and competitive. These types of products and solutions continue to evolve, creating opportunity for new competitors to enter the market with quantum/hybrid solutions or products or address specific segments of the market. We consider the following to be a representative list of competitors we face all of which are more established companies with name recognition and greater financial and operational resources than we do: Amazon Web Services, Google, Oracle, Dell, HP, Cisco, Microsoft, Rigetti, IBM, DWave, Quantiniuum and others. We have limited capital sources and no revenue. Our marketplace is highly competitive and rapidly changing. Our ability to compete depends upon many factors within and outside our control, including the performance and reliability of our marketplace, customer service, marketing efforts and development of our technologies and brand name. Due to the relatively low barriers to entry, we expect additional competition from other emerging companies. Our existing and potential competitors are substantially larger than us and have significantly greater financial, technical and marketing resources. As a result, they may be able to respond more quickly to new or emerging technologies for our products. There can be no assurance that we will be able to compete successfully against current or future competitors or that competitive pressure will not have a material adverse effect on our business, operating results and financial condition.

Physical Infrastructure and Management

We plan to develop technology infrastructure to support our products under development. Assuming, financing is available to us, we intend to invest in our peering architecture and underlying infrastructure management to handle significant Internet traffic at low bandwidth costs. We intend to invest in the automation of common physical data center components like servers, load balancers, switches and storage, and we use open-source solutions, when possible, to automate manual processes and thereby reduce the risk of human error and lower costs.

Regulation

Advertising and promotional information presented on our websites, in our products, and in our other marketing and promotional activities are subject to federal and state consumer protection laws regulating unfair and deceptive practices. U.S. federal, state and foreign legislatures have also adopted laws and regulations regulating numerous other aspects of our business. Regulations relating to the Internet, including laws governing online content, user privacy and data protection, automatic renewal laws, taxation, and liability for third-party activities, are particularly relevant to our business. A sample of such laws and regulations is discussed below.

11

Communications Decency Act (CDA). The CDA regulates content of material on the Internet, and provides immunity to Internet service providers and providers of interactive computer services for certain claims based on content posted by third parties. The CDA and the case law interpreting it generally provide that domain name registrars and website hosting providers cannot be liable for defamatory or obscene content posted by customers on registrars' servers unless they participate in creating or developing the content. The Stop Enabling Sex Traffickers Act (SESTA) and Allow States and Victims to Fight Online Sex Trafficking Act of 2017 (FOSTA), which became effective in April 2018, amend certain portions of the CDA, which may limit the immunity previously available to us under the CDA.

Digital Millennium Copyright Act (DMCA). The DMCA provides domain name registrars and website hosting providers a safe harbor from liability for third-party copyright infringement. To qualify for the safe harbor, however, registrars and website hosting providers must satisfy numerous requirements, including adopting a user policy providing for termination of service access of users who are repeat infringers, informing users of this policy and implementing the policy in a reasonable manner. In addition, registrars and website hosting providers must expeditiously remove or disable access to content upon receiving a proper notice from a copyright owner alleging infringement of its protected works. A registrar or website hosting provider failing to comply with these safe harbor requirements may be found liable for copyright infringement.

Anti-Cybersquatting Consumer Protection Act (ACPA). The ACPA was enacted to address piracy on the Internet by curtailing a practice known as "cybersquatting," or the bad-faith registration of a domain name identical or similar to another party's trademark, or to the name of another living person, in order to profit from that name or mark. The ACPA provides that registrars may not be held liable for damages for registration or maintenance of a domain name for another person absent a showing of the registrar's bad faith intent to profit. Registrars may, however, be held liable if their activities are deemed outside the scope of basic registrar functions.

Lanham Act. The Lanham Act governs trademarks and false advertising. Case law interpreting the Lanham Act has limited liability for many Internet service providers such as search engines and domain name registrars. Nevertheless, there is no statutory safe harbor for trademark violations comparable to the provisions of the DMCA, and we may be subject to a variety of trademark claims in the future.

Privacy and Data Protection. In the areas of personal privacy and data protection, the U.S. federal and various state and foreign governments have adopted or proposed limitations on, and requirements associated with, the collection, distribution, use, storage and security of personal information of individuals. In addition, in several jurisdictions in which we operate, data protection is more highly regulated and rigidly enforced. For example, the European Union (E.U.) has enacted the General Data Protection Regulation (GDPR), which includes stringent operational requirements for processors and controllers of E.U. personal data with broad extra-territorial effect and imposes significant penalties for non-compliance. In addition, California enacted the California Consumer Privacy Act (CCPA) in 2018, effective January 1, 2020, which was further modified by the passage of the California Privacy Rights Act (CPRA). The CCPA and its associated regulations require covered companies to provide new disclosures to California consumers and afford such consumers new abilities to opt-out of certain sales and sharing of personal information for advertising and other purposes. Several other U.S. states recently have adopted or are considering laws and regulations relating to processing of personal information that apply to our business. We expect compliance with the increasing number of these laws and regulations to be more burdensome and costly for us.

Artificial Intelligence. AI is the subject of evolving review by various governmental and regulatory agencies around the globe, including the Securities and Exchange Commission (the “SEC”) and the Federal Trade Commission (“FTC”), and changes in laws, rules, directives and regulations governing the use of AI are evolving rapidly. For example, on October 30, 2023, the Biden administration issued an Executive Order to, among other things, establish extensive new standards for AI safety and security, and other jurisdictions may decide to adopt similar or more restrictive legislation that may render the use of such technologies challenging. Similarly, the intellectual property ownership and license rights, including copyright, surrounding AI technologies has not been fully addressed by U.S. courts or other federal or state laws or regulations. We will continue to monitor the development of global AI laws and regulations and evaluate the potential implications for the operation of our business.

12

Laws and regulations relating to our activities are unsettled in many jurisdictions and may prove difficult or impossible to comply with in some jurisdictions. Additionally, federal, state, local and foreign governments are also considering legislative and regulatory proposals that would regulate the Internet and our activities in more and different ways than exist today. Laws and regulations in the U.S. or in foreign jurisdictions may be applied in new or different manners in pending or future litigation. Further, other existing bodies of law, including the criminal laws of various jurisdictions, may be deemed to apply to our activities, or new statutes or regulations may be adopted in the future. It is also impossible to predict whether new taxes will be imposed on our services and, depending upon the type of such taxes, whether and how we would be affected.

RISK FACTORS

You should carefully consider the risks described below before making an investment decision in the Common Stock. Our operations and financial results are subject to various risks and uncertainties. If any of the following risks occur, our business, financial condition, reputation, operating results and growth prospects could be materially and adversely affected. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also materially adversely affect our business, operating results, financial condition, reputation and growth prospects.

Risk Factor Summary

The following is a summary of the principal risks that could materially and adversely affect our business, financial condition, operating results and growth prospects.

·We have nominal revenue and have not yet derived any revenue from our quantum computing business and may never be able to do so.

·We have limited sources of revenue and limited assets; consequently, our quantum solutions might not work.

·Our current cash balance is inadequate to execute on our business plan, and we may be unable to raise additional needed money.

·If we are unable to attract and retain customers and increase sales to new and existing customers, our business and operating results will be negatively impacted.

·If we are unable to continue to attract a diverse customer base for which we have developed more customized solutions and applications, our business, growth prospects and operating results could be adversely affected.

·Our business will suffer if the small business market for our solutions proves less lucrative than projected or if we fail to effectively acquire and service small business customers.

·We may not successfully develop and market products that meet or anticipate our customers' needs, whether organically or inorganically, or may not develop such products on a timely basis.

·The use of new and evolving technologies, such as AI, in our offerings may result in reputational harm and liability.

·Our brand is integral to our success. If we fail to protect or promote our brand, our business and competitive position may be harmed.

·We face significant competition for our products, which we expect will continue to intensify, and we may be unable to maintain or improve our competitive position or market share.

·The future growth of our business depends in part on our international sales, which subjects us to international related risks.

·We have taken actions to support profitable growth, which may not be successful; if we do not effectively manage future growth, our operating results will be adversely affected.

·We may acquire other businesses or talent, which could require significant management attention, disrupt our business, dilute stockholder value and adversely affect our operating results.

·We may enter into new lines of business that offer new products and services, which may subject us to additional risks.

·We are exposed to the risk of system failures and capacity constraints.

·We rely on third parties to perform certain key functions, and their failure to perform those functions could result in the interruption of our operations and systems and could result in significant costs and reputational damage to us.

13

·A network attack, a security breach or other cybersecurity incident could delay or interrupt service to our customers, harm our reputation, cause us to incur substantial costs, or subject us to significant liability.

·If the security of the confidential information or personal information we or our vendors or partners maintain, including that of our customers and the visitors to our customers’ websites stored in our systems, is breached or otherwise subjected to unauthorized access, our reputation may be harmed, we may be required to expend substantial resources to mitigate and remediate such breach, and we may be exposed to substantial liability.

·We maintain an enterprise-wide cybersecurity program. Our failure to properly maintain this program for the Company as a whole, or any part of the Company, could cause us to experience a cybersecurity incident that could harm our reputation, cause us to incur substantial costs, or subject us to significant liability.

·We rely on our marketing efforts and channels to promote our brand and acquire new customers. These efforts may require significant expense and may not be successful or cost-effective.

·Our ability to increase sales of our products is highly dependent on the quality of our customer care. Our failure to provide high-quality customer care would have an adverse effect on our business, brand and operating results.

·Our future performance depends in part on the services and performance of our senior management, as well as our experienced and capable employees. If we are unable to attract, motivate, and retain our employees, our business could suffer.

·Our failure to properly register or maintain our customers' domain names could subject us to additional expenses, claims of loss or negative publicity that could have a material adverse effect on our business.

·Our quarterly and annual operating results may be adversely affected due to a variety of factors, which could make our future results difficult to predict and could cause our operating results to fall below investor or analyst expectations.

·Our level of indebtedness could adversely affect our financial condition, our ability to raise additional capital to fund our operations, our ability to operate our business and our ability to react to changes in the economy or our industry, as well as divert our cash flow from operations for debt payments and prevent us from meeting our debt obligations.

·Governmental and regulatory policies or claims concerning the domain name registration system and the Internet in general, and industry reactions to those policies or claims, may cause instability in the industry and disrupt our business.

·We are subject to governmental regulation and other legal obligations, particularly related to privacy, data and information security and cybersecurity. Our failure to comply with these or any future laws, regulations or obligations could subject us to sanctions and damages and could harm our reputation and business.

·Our business depends on our customers continued and unimpeded access to the Internet and the development and maintenance of Internet infrastructure. Internet access providers may be able to block, degrade or charge for access to certain of our products, which could lead to additional expenses and the loss of customers.

·Our business could be affected by new governmental regulations regarding the Internet.

·We may face liability or become involved in disputes over registration and transfer of domain names and control over websites.

·Our business could be negatively impacted by shareholder activism.

·Our share price may be volatile, and you may lose all or part of your investment

Strategic Risks

If we are unable to attract and retain customers and generate revenue, our business and operating results would be harmed.

We do not have customers and had revenue of $0 for the six months ended June 30, 2024. Our success depends on our ability to attract and retain customers. Although our total customers and revenue could grow rapidly, this may not happen. There are no assurances that we will accomplish our goals or implement our business plan.

14

Our business will suffer if the small business market for our solutions proves less lucrative than projected or if we fail to effectively acquire and service small business customers.

We must continue to develop our technology to be competitive without knowing whether such investments will result in successful products for our customers. Our new products or product enhancements could fail to attain meaningful customer acceptance for many reasons, including:

·failure to accurately predict market demand or customer preferences;

·defects, errors or failures in product design or performance;

·negative publicity about product performance or effectiveness, including negative comments on social media;

·the perceived value of our products or product enhancements relative to their cost;

·changing regulatory requirements adversely affecting the products we offer; and

·poor business conditions for our customers or poor general macroeconomic conditions.

If our new products or enhancements to those new products do not achieve adequate acceptance by our customers, or if our new products do not result in significant sales or subsequent renewals, we will not be competitive, our anticipated revenue growth may not be achieved and the negative impact on our operating results may be particularly acute because of the upfront technology and development, marketing and advertising and other expenses we may incur in connection with new products or enhancements. In addition, we may migrate our future customers from a product that we intend to retire to another, substantially similar product. We may experience technical or other complications during such migration, which could result in a poor customer experience and which could have an adverse impact on our operating results.

The use of new and evolving technologies, such as AI, in our offerings may result in reputational harm and liability.

We are increasingly exploring new and evolving technologies, such as AI, to, among other things, develop new tools and products and additional features in our planned future products, including ongoing deployment and improvement of existing AI, and the development of new product technologies, such as generative AI. There are significant risks involved in developing and deploying AI, such as an increase in intellectual property infringement or misappropriation, data privacy, cybersecurity, operational and technological risks, harmful content, accuracy, bias and discrimination, any of which could affect our further development, adoption, and use of AI, and may cause us to incur additional research and development costs to resolve such issues. In addition, the introduction of AI technologies into new or existing products may result in new or enhanced governmental or regulatory scrutiny, litigation, privacy, confidentiality or security risks, ethical concerns or other complications that could adversely affect our business, reputation or financial results.

AI is the subject of evolving review by various governmental and regulatory agencies around the globe, including the SEC and the FTC, and changes in laws, rules, directives and regulations governing the use of AI are evolving rapidly. For example, on October 30, 2023, the Biden administration issued an Executive Order to, among other things, establish extensive new standards for AI safety and security, and other jurisdictions may decide to adopt similar or more restrictive legislation that may render the use of such technologies challenging. Similarly, the intellectual property ownership and license rights, including copyright surrounding AI technologies, have not been fully addressed by U.S. courts or other federal or state laws or regulations, and the use or adoption of AI technologies in our products and services may subject us to copyright infringement or other intellectual property misappropriation claims. We may not always be able to anticipate how to respond to these frameworks and we may have to expend resources to adjust our tools, products or other offerings in certain jurisdictions if the legal frameworks on AI are not consistent across jurisdictions. Any inability to appropriately respond to this evolving landscape could result in legal liability, regulatory action or brand and reputational harm. Our reliance on AI could also pose ethical concerns and lead to a lack of human oversight and control. If we enable or offer solutions that draw controversy, or these new offerings do not work as we describe them to our customers, we may experience brand or reputational harm, competitive harm or legal liability. The rapid evolution of AI will require the application of resources to develop, test and maintain our products and services to help ensure that AI is implemented ethically in order to minimize unintended, harmful impacts. Further, AI technologies, including generative AI, may create content that appears correct but is factually inaccurate or flawed, or contains copyrighted or other protected material, and our customers or others may rely on or use this flawed content to their detriment. In addition, we face significant competition from other companies that are developing their own AI products and technologies. Our competitors may develop AI

15

products and technologies that are similar or superior to our technologies or are more cost-effective to develop or deploy.

It is not possible to predict all of the risks related to the use of AI, and changes in laws, rules, directives and regulations governing AI may adversely affect our ability to develop and use AI or subject us to legal liability.

We will face significant competition for our Quantum/Hybrid products, which we expect will continue to intensify, and we may not be able to develop a competitive position or market share.

The market for our future products and services is highly fragmented and competitive, and we expect competition to increase in the future from our competitors. In addition, we will compete against the largest and most sophisticated companies in the world, who have nearly unlimited resources. Even though Amazon Web Services has stopped accepting new customers, this could change at any time, and there is no assurance we can compete successfully against Amazon or similar companies.

Some of our current and potential competitors have greater resources, more brand recognition and consumer awareness, more diversified product offerings, greater international scope and larger customer bases than we do. Therefore, we may not be able to effectively compete with them.

Increased competition in our industry could result in lower sales, price reductions, reduced margins, loss of market share and increased marketing expenses. Furthermore, conditions in our market could change rapidly and significantly as a result of technological advancements, partnering by our competitors or market consolidation. New or existing competitors, or groups of competitors working cooperatively, may invent similar or superior products and technologies competing with our products and technology. The continued entry of competitors into the domain name registration and web-hosting markets, and the rapid growth of some competitors already in each market, may make it difficult for us to maintain our market position. Our ability to compete will depend upon our ability to provide a better product than our competitors at a competitive price and supported by superior customer care. We may be required to make substantial additional investments in research, development, marketing and sales in order to respond to competition, and there can be no assurance that these investments will achieve any returns for us or that we will be able to compete successfully in the future.

We have taken significant actions to support profitable growth. These actions may not succeed. If we do not effectively manage future growth, our operating results will be adversely affected.

We continue to work to increase the breadth and scope of our business, operations and our product offerings. To support future growth, we must continue to improve our information technology and financial infrastructure, operating and administrative systems and our ability to effectively manage headcount, capital and processes. We are likely to recognize the costs associated with these actions earlier than some of the anticipated benefits, and the return on these actions may be lower or may develop more slowly than we expect. If we do not achieve the benefits anticipated from these actions, or if the achievement of these benefits is delayed, our operating results may be adversely affected.

We will incur expenses relating to our investments in international business and infrastructure, such as: (i) our offerings and marketing presence in India, Europe, Latin America, the Middle East and Africa, and Asia; (ii) our marketing to attract new customers in non-U.S. markets; and (iii) investments in software systems and additional data center resources to keep pace with the growth of our cloud infrastructure and cloud-based product offerings.

As we grow, our management, administrative, operational and financial infrastructure may be strained. The scalability and flexibility of our future infrastructure will depend on the functionality and bandwidth of our future data centers, peering sites and servers.

We will review and make enhancements as necessary to our future platforms and tools to support our growth. While we are engaged in this work, we may experience difficulties in managing our existing systems and processes, which could disrupt our operations, the management of our finances and the reporting of our financial results.

16

We may acquire other businesses or talent, which could require significant management attention, disrupt our business, dilute stockholder value and adversely affect our operating results.

As part of our business strategy, we may make acquisitions or investments in companies, talent, products, domain portfolios and technologies that we believe will complement or supplement our business and address the needs of our future customers, such as our acquisition of Node Nexus. We cannot ensure we will be able to successfully integrate the acquired products, talent and technology or achieve the revenue and expense synergies we expect as a result of these acquisitions. Even if we do successfully integrate acquired products, we may not successfully integrate the associated brands into our portfolio or may decide to modify, retire or change the direction of the associated brands, which could adversely affect our operating results. If we fail to properly evaluate, execute or integrate acquisitions or investments, the anticipated benefits may not be realized, we may be exposed to unknown or unanticipated liabilities and our business and growth prospects could be harmed. In addition, any future acquisitions we complete could be viewed negatively by our customers, investors or industry analysts.

We may have to pay cash, incur debt or issue equity securities to pay for future acquisitions, each of which could adversely affect our financial condition or the value of the Common Stock. Equity issuances in connection with potential future acquisitions may also result in dilution to our stockholders. In addition, our future operating results may be impacted by performance earn-outs, contingent bonuses or other deferred payments. Furthermore, acquisitions may involve contingent liabilities, adverse tax consequences, additional equity-based compensation expense, the recording and subsequent amortization of amounts related to certain purchased intangible assets and, if unsuccessful, impairment charges resulting from the write-off of goodwill or other intangible assets associated with the acquisition, any of which could negatively impact our future results of business. We may also face competition for acquisitions from larger competitors that may have more extensive financial resources, which may increase the cost or limit the availability of acquisitions.

We may fail to identify all of the problems, liabilities or other shortcomings or challenges of an acquired company, including issues related to intellectual property, solution quality or architecture, privacy, data protection, information security practices, regulatory compliance practices, employment practices, customer or sales channels and integrations of prior acquisitions. We are also required to integrate, operate and manage an acquired company's security infrastructure, which may be particularly challenging when acquired businesses utilize heavily customized or outdated systems or if we face a loss of personnel of the acquired business. Challenges with acquired systems and/or the loss of personnel familiar with and responsible for such acquired systems could increase our vulnerability to network attacks, security incidents or similar events.

We may encounter difficulties assimilating or integrating the companies, solutions, technologies, accounting systems, personnel or operations we acquire, particularly if the key personnel are geographically dispersed or choose not to work for us once they are acquired. For example, in the future, we may enter into transition services agreements with a seller for the provision of support services to assist with the orderly integration of the business. We may never realize the benefits of these transition services agreements and may be unable to manage and coordinate the performance of personnel providing services to us under these agreements. Leaders and personnel at acquired companies may focus on achieving performance earn-outs or contingent payments rather than integrating with us. Additionally, we may not integrate an acquired company into our systems as planned, requiring us to depend on their legacy systems or a transition services agreement for longer than anticipated.

We may enter into new lines of business that offer new products and/or services, which may subject us to additional risks.

From time to time, we may enter into new lines of business that offer new products and/or services. Our lack of experience with or knowledge of new lines of business we choose to enter, as well as external factors, such as competitive alternatives, potential conflicts of interest, either real or perceived, and shifting market preferences, may impact our implementation and operation of such new lines of business. Other risks of implementing new lines of business include:

·potential diversion of management's attention, available cash and other resources from our existing business;

·any determination by governmental agencies that any acquisition we undertake is anticompetitive in any relevant market;

17

·unanticipated liabilities or contingencies;

·compliance with new or increased regulatory burdens;

·potential damage to existing customer relationships, lack of customer acceptance or inability to attract new customers; and

·the inability to compete effectively in the new line of business

Failure to successfully manage these risks in the implementation or acquisition of new lines of business or the offering of new products or services could have a material adverse effect on our reputation, business, results of operations and financial condition.

Operational Risks

We are exposed to the risk of system failures and capacity constraints.

In the future, we may experience system failures and outages disrupting the operation of our websites or our products, such as hosting or the availability of our customer care operations. Our future revenue will depend in large part on the volume of hosting to our future data centers, the number of customers whose data we host on our future servers and the availability of our future customer care operations. Accordingly, the performance, reliability and availability of our websites and servers for our future corporate operations and infrastructure, as well as in the delivery of our future products to customers, will be critical to our reputation and our ability to attract and retain customers. Any such system failure or outage could generate negative publicity, which could negatively impact our reputation and financial results.

We do not maintain property and business interruption insurance coverage adequate to compensate us fully for losses that may occur.

We may be subject to product liability claims, and insurance coverage could be inadequate or unavailable to cover these claims.

We do not presently carry liability insurance. The use or misuse of our contemplated products and services could result in injury to third parties or the user. In such cases, we may be subject to liability claims arising from the design, manufacture, or sale of our products or other injuries. If these claims are decided against us, and we are found to be liable, we may be required to pay substantial damages. We have no insurance and as such, cannot assure you that our insurance coverage in the future, if obtained would be sufficient to cover the payment of any potential claim. In addition, we cannot assure you that we will be able to obtain insurance at a reasonable cost. Any material uninsured loss could have a material adverse effect on our financial condition, results of operations and cash flows. We may be subject to product liability claims arising from the design, manufacture, or sale of our products. If these claims are decided against us, and we are found to be liable, we may be required to pay substantial damages. We cannot assure you that our insurance coverage would be sufficient to cover the payment of any potential claim. In addition, we cannot assure you that this or any other insurance coverage will continue to be available or, if available, that we will be able to obtain it at a reasonable cost. Any material uninsured loss could have a material adverse effect on our financial condition, results of operations and cash flows. Our operations are subject to many hazards inherent in our industry. Our assets may experience physical damage as a result of an accident or natural disaster. These hazards can also cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage, and suspension of operations. If we have uninsured claims, or insufficient insurance in the future to cover claims, our results of operations will be materially and negatively impacted.

We rely on third parties to perform certain key functions, and their failure to perform those functions could result in the interruption of our operations and systems and could result in significant costs and reputational damage to us.

18

We rely on third parties, and other parties with which those third parties contract, to perform certain technology, processing, servicing and support functions on our behalf, and may in the future choose to transition a function previously managed by us to such third parties. While we use various methods to manage the cybersecurity risk of using third parties to perform key functions, third parties we use are vulnerable to operational and technological disruptions, including from cybersecurity incidents, which may negatively impact our ability to provide services to our customers, operate our business and fulfill our financial reporting obligations. We may have limited remedies against these third parties in the event of service disruptions. If third parties are unable to perform these functions on our behalf because of service interruptions or extended outages, or because those services are no longer available on commercially reasonable terms, our expenses could increase and our customers' use of our products could be impaired until equivalent services, if available, are identified, obtained and implemented, all of which could adversely affect our business.

A network attack, a security breach or other cybersecurity incident could delay or interrupt service to our customers, harm our reputation, cause us to incur substantial costs, or subject us to significant liability.

We maintain an enterprise-wide cybersecurity program to manage the risks to our information systems from cybersecurity threats and incidents. Our operations depend on our ability to protect our information systems against interruption, a breach of confidentiality, or other damage from unauthorized entry, computer viruses, denial of service attacks and other security threats both within and beyond our control. These cybersecurity threats may arise from human error, fraud, or malice on the part of our employees, insiders, or third parties, or they may result from accidental technological failure. Any of these parties may also attempt to fraudulently induce employees, customers, or other third-party users of our systems to disclose sensitive information, wittingly or unwittingly, to gain access to our data or that of our customers or third parties with whom we interact.

As an operator of Internet infrastructure, the company may be frequently targeted and experiences a high rate of attacks. These include the most sophisticated forms of attacks, such as advanced persistent threat attacks and zero-day threats. These forms of attacks include situations where the threat is not compiled or does not have detection signatures within our observation and threat indicators space until the moment it is launched. For example, we have experienced, and may experience in the future, distributed denial of service (DDoS) attacks aimed at disrupting service to our customers, attempts to place illegal or abusive content on our or our customers' websites, and other attacks on our systems by sophisticated threat actors. In addition, there has been an increase in the number of malicious software attacks in the technology industry generally, including newer strains of malware, ransomware and cryptocurrency mining software exploiting zero-day vulnerabilities in open-source and third-party software. Moreover, retaliatory acts by Russia in response to economic sanctions or other measures taken by the international community against Russia arising from the Russia-Ukraine military conflict could include an increased number or severity of cyber attacks from Russia or its allies. For example, we have seen an increasing number of cyber attacks from threat actor groups located in or leveraging systems, sites and infrastructure hosted in the Russian region to target attacks on our infrastructure. Our response to any such attacks may be insufficient to protect our network and systems, especially as attacks increase in size and nation-state actors use attacks against political and economic adversaries.

Social engineering efforts may compromise our personnel or those of our third-party vendors, leading to unauthorized access to information systems we have a responsibility to protect, which could lead to the unauthorized acquisition of information, the unavailability of our information systems (or information contained on those systems) or the compromise of customer accounts. Despite efforts to promote security awareness and training for our personnel and vendors, malicious actors are increasingly sophisticated and successful in their use of social engineering techniques. We have experienced, and may continue to experience, social engineering attempts, some of which have been successful, including by a persistent threat actor group, which, among other things, has attempted to transfer customer domain names and has targeted customer domains related to cryptocurrency. Recent advances in AI may increase the sophistication of these types of attacks; for example, as attackers are able to create more personalized and targeted communications using information derived from people’s relationships, online behavior and preferences. We have taken steps and continue to work to enhance our cybersecurity and resilience against social engineering, requiring additional engineering efforts and modifications to our technology architecture as well as the expenditure of time and additional cost. We cannot guarantee that our efforts will be successful or that future social engineering incidents will not cause financial, operational and/or reputational harm.

19

We cannot guarantee that our backup systems and regular data backups will be adequate to protect against the loss of our information or information of our customers and third parties. In addition, we cannot guarantee that our cybersecurity program, including our related security protocols, network protection mechanisms, cybersecurity awareness training, insider threat protection program, access controls, and other procedures and measures currently in place, or that may be in place in the future, will be adequate to prevent or remedy network and service interruptions, system failure, third-party operating systems and software vulnerabilities, damage to one or more of our systems, data loss, cybersecurity breaches or other cybersecurity incidents. Also, our products are cloud-based and we store our customers' data on our servers. Despite the implementation of cybersecurity measures, our information systems may be vulnerable to computer viruses, worms, other malicious software programs, social engineering attacks, insider threats, credential theft and related abuse, illegal or abusive content or similar disruptive problems caused by our customers, employees, consultants or other Internet users who attempt to invade or disrupt public and private data networks or to improperly access, use or obtain data.

A cybersecurity incident or any actual or perceived breach of our security could expose us to a risk of loss or litigation and possible liability and could subject us to regulatory or other government inquiries or investigations, which will require us to expend significant capital and other resources to remediate the breach, any of which would harm our business, financial condition and operating results.

Our business will involve the storage and transmission of confidential information. In addition, nearly all of our products will be cloud-based and we will process such data for our customers on our servers and servers used by our vendors and partners. We will take measures intended to protect the security, integrity and confidentiality of the personal information or other information, including payment card information, that we collect, store or transmit, but cannot guarantee that inadvertent or unauthorized use or disclosure of such information will not occur or that third parties, including nation-states and bad actors, or our personnel, or those of our vendors will not gain unauthorized or other malicious access to this information or systems where personal information is processed despite our preventative efforts or those of our vendors or partners.

If third parties succeed in penetrating our security measures or those of our vendors and partners or in otherwise accessing or obtaining without authorization the personal, sensitive or confidential information that we or our vendors and partners maintain, we could be subject to liability, loss of business, litigation, government investigations or other losses. Responding to such requests may be costly and time-consuming.

If we or our partners experience any breaches or sabotage of our security measures, or otherwise suffer unauthorized use or disclosure of, or access to, personal, sensitive or confidential information, including payment card information, we might be required to expend significant capital and resources to remediate these problems and protect against additional breaches or sabotage. We may not be able to remedy any problems caused by threat actors in a timely manner, or at all, due to, among other things, a lack of qualified personnel to handle such problems or the failure of our personnel to follow internal policies and procedures. Because techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until after they are launched against a target, we and our vendors and partners may be unable to anticipate these techniques or to implement adequate preventative measures on a timely basis. Advances in computer capabilities, discoveries of new weaknesses, increased likelihood of nation-state cyber attacks (including retaliatory cyber attacks by Russia in response to economic sanctions resulting from the Russia-Ukraine military conflict), and other developments with software generally used by the Internet community, such as the Zenbleed and Downfall vulnerabilities, which exploit security flaws in processors manufactured by both AMD and Intel, continually evolving ransomware attacks, or developments related to vendor software also increase the risk that we, or our customers using our servers and services, will suffer a security breach. We or our partners may also suffer security breaches or unauthorized access to personal, sensitive or confidential information, including payment card information, due to employee error, rogue employee activity, unauthorized access by third parties acting with malicious intent or committing an inadvertent mistake, or social engineering. If a breach of our security or other cybersecurity incident occurs or is perceived to have occurred, the perception of the effectiveness of our security measures and our reputation could be harmed and we could lose current and potential customers.

20

Security breaches or other unauthorized access to personal, sensitive or confidential information could result in mandatory customer, regulator, contractual notifications, litigation, government investigations, adverse publicity, and claims against us which could result in a material adverse effect on our business, financial condition or reputation. We do not maintain cyber liability insurance coverage sufficient to cover certain liabilities in connection with a security breach or other security incident, and we cannot be certain that if we are able to obtain such insurance coverage, it will be adequate for liabilities actually incurred, that insurance will continue to be available to us on commercially reasonable terms (if at all) or that any insurer will not deny coverage as to any future claim.

In addition, certain insurers have denied coverage if a nation-state is declared the sponsor or perpetrator of such security breach or incident. For example, following the U.S., the UK, Canadian and Australian governments' attribution of Russia for the NotPetya ransomware attack, Zurich American Insurance Co. denied Mondelez International, Inc.'s claim for damages from that attack, which resulted in litigation between Zurich and Mondelez that was eventually settled prior to trial. In January 2022, a court in New Jersey permitted Merck & Co. to recover under its cyber insurance policies for a NotPetya attack, leading to a settlement prior to trial that was publicly announced in January 2024. These examples suggest there continues to be uncertainty across the cyber insurance market regarding the availability of coverage for nation-state-led cyber attacks. The successful assertion of one or more large claims against us that exceed available insurance coverage, the occurrence of changes in our insurance policies, including premium increases or the imposition of large deductible or co-insurance requirements, or denials of coverage based on "act of war" or similar exclusions triggered by attribution of an attack to a nation-state, particularly given the heightened risk of cyber attacks due to the ongoing Russia-Ukraine military conflict, could have a material adverse effect on our business, including our financial condition, results of operations and reputation.

We plan to expend significant resources to protect against security breaches and other cybersecurity incidents. The risk that these types of events could seriously harm our business is likely to increase as we expand the number of cloud-based products we offer and as we operate or expand our business into more countries.